UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6397

Fidelity California Municipal Trust II

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 29 |

| |

Date of reporting period: | August 31, 2011 |

Item 1. Reports to Stockholders

Fidelity® California

Municipal Money Market

Fund

Semiannual Report

August 31, 2011

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | The Chairman's message to shareholders. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

(The chairman's photo appears here.)

Dear Shareholder:

U.S. equities remained in a significant midyear downturn that began in May and intensified in the final week of July and the early part of August, when Standard & Poor's announced it was lowering its long-term sovereign credit rating of the United States. The historic downgrade followed a political stalemate in which Congress struggled to address the debt ceiling issue before an early-August deadline, resulting in heightened investor anxiety and volatility across major financial markets. Financial markets are always unpredictable, of course, but there are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Abigail P. Johnson

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2011 to August 31, 2011).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Shareholder Expense Example - continued

| Annualized Expense Ratio | Beginning

Account Value

March 1, 2011 | Ending

Account Value

August 31, 2011 | Expenses Paid

During Period *

March 1, 2011 to

August 31, 2011 |

Actual | .22% | $ 1,000.00 | $ 1,000.10 | $ 1.11** |

Hypothetical (5% return per year before expenses) | | $ 1,000.00 | $ 1,024.03 | $ 1.12 ** |

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

** If certain fees were not voluntarily waived by FMR or its affiliates during the period, the annualized expense ratio would have been .51% and the expenses paid in the actual and hypothetical examples above would have been $2.56 and $2.59, respectively.

Semiannual Report

Investment Changes (Unaudited)

Effective Maturity Diversification |

Days | % of fund's

investments

8/31/11 | % of fund's investments

2/28/11 | % of fund's

investments

8/31/10 |

1 - 7 | 67.3 | 73.9 | 82.9 |

8 - 30 | 4.4 | 4.5 | 2.1 |

31 - 60 | 6.3 | 5.6 | 1.5 |

61 - 90 | 4.5 | 3.5 | 0.1 |

91 - 180 | 4.4 | 11.3 | 3.1 |

> 180 | 13.1 | 1.2 | 10.3 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity |

| 8/31/11 | 2/28/11 | 8/31/10 |

Fidelity California Municipal Money Market | 48 Days | 28 Days | 39 Days |

California Tax-Free Money Market Funds Average * | 36 Days | 26 Days | 33 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and markets changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life |

| 8/31/11 | 2/28/11 | 8/31/10 |

Fidelity California Municipal Money Market | 48 Days | 28 Days | 39 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

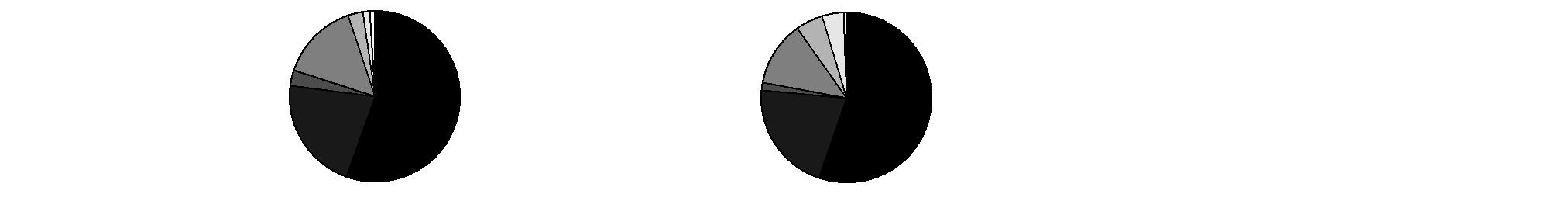

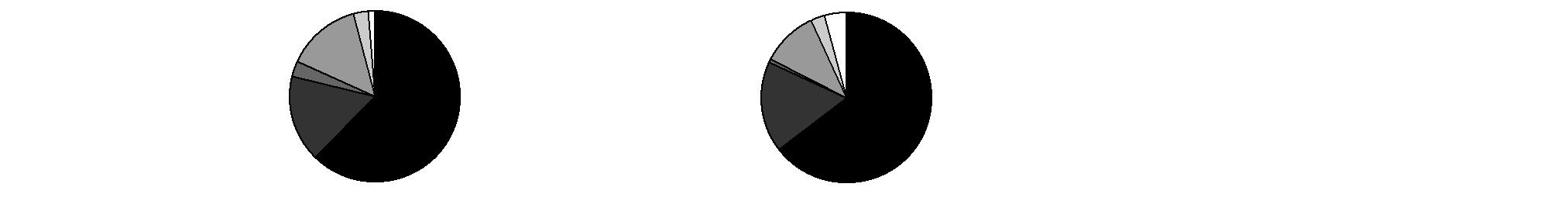

Asset Allocation (% of fund's net assets) |

As of August 31, 2011 | As of February 28, 2011 |

| Variable Rate Demand Notes (VRDNs) 62.5% | |  | Variable Rate Demand Notes (VRDNs) 64.6% | |

| Commercial Paper (including

CP Mode) 16.6% | |  | Commercial Paper (including

CP Mode) 17.3% | |

| Tender Bonds 2.9% | |  | Tender Bonds 0.7% | |

| Municipal Notes 14.2% | |  | Municipal Notes 10.7% | |

| Fidelity Municipal

Cash Central Fund 2.8% | |  | Fidelity Municipal

Cash Central Fund 2.6% | |

| Other Investments 1.3% | |  | Other Investments 4.2% | |

| Net Other Assets ** (0.3)% | |  | Net Other Assets ** (0.1)% | |

* Source: iMoneyNet, Inc.

**Net Other Assets are not included in the pie chart.

Semiannual Report

Investments August 31, 2011 (Unaudited)

Showing Percentage of Net Assets

Municipal Securities - 100.3% |

| Principal Amount (000s) | | Value (000s) |

California - 94.2% |

ABAG Fin. Auth. for Nonprofit Corps. Multi-family Hsg. Rev.: | | | |

(Acton Courtyard Apts. Proj.) Series 2010 A, 0.2% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | $ 8,620 | | $ 8,620 |

(Miramar Apts. Proj.) Series 2000 A, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 8,400 | | 8,400 |

(The Artech Bldg. Proj.) Series 2010 B, 0.2% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 3,200 | | 3,200 |

(Vintage Chateau Proj.) Series A, 0.2% 9/7/11, LOC Union Bank of California, VRDN (b)(e) | 10,900 | | 10,900 |

ABAG Fin. Auth. for Nonprofit Corps. Rev.: | | | |

(Eskaton Properties, Inc. Proj.) Series 2008 B, 0.22% 9/7/11, LOC U.S. Bank NA, Minnesota, VRDN (b) | 15,300 | | 15,300 |

(Schools of the Sacred Heart - San Francisco Proj.): | | | |

Series 2008 A, 0.23% 9/7/11, LOC Bank of America NA, VRDN (b) | 7,105 | | 7,105 |

Series 2008 B, 0.23% 9/7/11, LOC Bank of America NA, VRDN (b) | 5,315 | | 5,315 |

(Sharp HealthCare Proj.): | | | |

Series 2009 A, 0.17% 9/7/11, LOC Bank of America NA, VRDN (b) | 30,195 | | 30,195 |

Series 2009 C, 0.15% 9/7/11, LOC Citibank NA, VRDN (b) | 3,600 | | 3,600 |

(Valley Christian Schools Proj.) Series 2003, 0.18% 9/7/11, LOC Bank of America NA, VRDN (b) | 13,000 | | 13,000 |

Alameda County Joint Powers Auth. Lease Rev. Series 2010 A, 0.2% 10/5/11, LOC Fed. Home Ln. Bank, San Francisco, CP | 5,700 | | 5,700 |

Anaheim Hsg. Auth. Multi-family Hsg. Rev. (Park Vista Apt. Proj.) Series 2000 D, 0.15% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 9,000 | | 9,000 |

Anaheim Pub. Fing. Auth. Rev. Participating VRDN Series BA 08 3035X, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 6,385 | | 6,385 |

Barclays Cap. Muni. Trust Receipts Bonds Series 2011 26U, 0.19%, tender 11/22/11 (Barclays Bank PLC Guaranteed) (a) | 35,000 | | 35,000 |

Bay Area Toll Auth. San Francisco Bay Toll Bridge Rev. Participating VRDN: | | | |

Series BA 08 1058, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 2,250 | | 2,250 |

Series EGL 07 0053, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 10,395 | | 10,395 |

Series II R 11901, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 1,300 | | 1,300 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Bay Area Toll Auth. San Francisco Bay Toll Bridge Rev. Participating VRDN: - continued | | | |

Series Putters 3211, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | $ 13,320 | | $ 13,320 |

Series Putters 3293, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 2,495 | | 2,495 |

Series Putters 3434, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,195 | | 4,195 |

Bueno Park Multi-family Hsg. Rev. (Walden Glen Apts. Proj.) Series 2000 A, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 14,288 | | 14,288 |

California Cmty Fin. Auth. Tranp TRAN Series A, 2% 6/29/12 | 52,200 | | 52,887 |

California Dept. of Wtr. Resources Pwr. Supply Rev. Bonds: | | | |

Series 2002 A, 5.5% 5/1/12 | 1,750 | | 1,809 |

Series A, 5.5% 5/1/12 | 1,000 | | 1,034 |

Series L, 5% 5/1/12 | 14,200 | | 14,634 |

California Dept. of Wtr. Resources Wtr. Rev. Participating VRDN: | | | |

Series BA 08 3031X, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 3,500 | | 3,500 |

Series BBT 08 28, 0.2% 9/7/11 (Liquidity Facility Branch Banking & Trust Co.) (b)(g) | 7,205 | | 7,205 |

Series Putters 3019, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 9,785 | | 9,785 |

Series Putters 3361, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,570 | | 4,570 |

California Econ. Dev. Fing. Auth. Rev. (KQED, Inc. Proj.) Series 1996, 0.3% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b) | 1,665 | | 1,665 |

California Econ. Recovery Bonds Series 2004 A, 5.25% 7/1/12 | 7,620 | | 7,934 |

California Ed. Notes Prog. TRAN Series B, 2% 4/30/12 | 7,700 | | 7,785 |

California Edl. Facilities Auth. Rev.: | | | |

Participating VRDN: | | | |

Series BA 08 1207, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 4,450 | | 4,450 |

Series Floaters 08 38C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo & Co.) (b)(g) | 8,820 | | 8,820 |

Series ROC II R 11790PB, 0.24% 9/7/11 (Liquidity Facility Deutsche Postbank AG) (b)(g) | 11,905 | | 11,905 |

Series ROC II R 11974, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 3,500 | | 3,500 |

Series WF 10 54C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 7,150 | | 7,150 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

California Edl. Facilities Auth. Rev.: - continued | | | |

Participating VRDN: | | | |

Series WF11 59 C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | $ 4,735 | | $ 4,735 |

Series 2010 S4, 0.22% 3/22/12, CP | 42,800 | | 42,800 |

Series U, 0.1% 10/21/11, CP | 21,600 | | 21,600 |

0.35% 11/10/11, CP | 35,300 | | 35,300 |

California Enterprise Dev. Auth. (Frank-Lin Distillers Products, Ltd. Proj.) Series 2010, 0.23% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b) | 9,835 | | 9,835 |

California Gen. Oblig.: | | | |

Bonds 5% 2/1/12 (Pre-Refunded to 2/1/12 @ 100) (f) | 21,900 | | 22,322 |

Participating VRDN Series Solar 07 54E, 0.2% 9/7/11 (Liquidity Facility U.S. Bank NA, Minnesota) (b)(g) | 14,995 | | 14,995 |

Series 2003 A2, 0.08% 9/1/11, LOC Bank of Montreal, VRDN (b) | 1,375 | | 1,375 |

Series 2003 B3, 0.17% 9/7/11, LOC JPMorgan Chase Bank, LOC California Pub. Employees Retirement Sys., VRDN (b) | 31,000 | | 31,000 |

Series 2004 A7, 0.21% 9/7/11, LOC Citibank NA, LOC California Teachers Retirement Sys., VRDN (b) | 45,000 | | 45,000 |

Series 2004 A9, 0.2% 9/7/11, LOC State Street Bank & Trust Co., Boston, LOC California Teachers Retirement Sys., VRDN (b) | 16,500 | | 16,500 |

Series 2005 B2, 0.15% 9/7/11, LOC JPMorgan Chase Bank, VRDN (b) | 3,000 | | 3,000 |

Series 2005 B5, 0.17% 9/7/11, LOC Barclays Bank PLC, VRDN (b) | 14,770 | | 14,770 |

Series 2005 B6, 0.24% 9/1/11, LOC KBC Bank NV, VRDN (b) | 14,400 | | 14,400 |

0.2% 9/7/11, LOC Citibank NA, LOC California Teachers Retirement Sys., VRDN (b) | 5,000 | | 5,000 |

California Health Facilities Fing. Auth. Rev.: | | | |

(Catholic Healthcare West Proj.) Series 2004 K, 0.18% 9/7/11, LOC Bank of America NA, VRDN (b) | 10,000 | | 10,000 |

(Childrens Hosp. Los Angeles Proj.) Series 2010 B, 0.15% 9/1/11, LOC Bank of America NA, VRDN (b) | 25,800 | | 25,800 |

(Scripps Health Proj.) Series 2008 C, 0.15% 9/7/11, LOC Union Bank of California, VRDN (b) | 13,900 | | 13,900 |

(St. Joseph Health Sys. Proj.) Series 2011 A, 0.15% 9/7/11, LOC Union Bank of California, VRDN (b) | 27,300 | | 27,300 |

Bonds Series B2, 0.19% tender 10/13/11, CP mode | 14,050 | | 14,050 |

Participating VRDN: | | | |

Series MS 3239, 0.21% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 18,800 | | 18,800 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

California Health Facilities Fing. Auth. Rev.: - continued | | | |

Participating VRDN: | | | |

Series MS 3248, 0.22% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | $ 26,750 | | $ 26,750 |

Series MS 3267, 0.22% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 33,375 | | 33,375 |

Series Putters 3630, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 7,000 | | 7,000 |

Series Putters 3878 Q, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 1,000 | | 1,000 |

Series ROC II R 11952, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 3,780 | | 3,780 |

California Hsg. Fin. Agcy. Multifamily Hsg. Rev. Series 2008 C: | | | |

0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 5,900 | | 5,900 |

0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 5,430 | | 5,430 |

California Hsg. Fin. Agcy. Rev.: | | | |

(Home Mtg. Prog.): | | | |

Series 2000 N, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 22,720 | | 22,720 |

Series 2000 X2, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 11,325 | | 11,325 |

Series 2001 U, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 3,695 | | 3,695 |

Series 2002 M, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 1,100 | | 1,100 |

Series 2003 F, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 16,250 | | 16,250 |

Series 2003 M, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 3,900 | | 3,900 |

Series 2004 E, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 1,545 | | 1,545 |

Series 2005 A, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 7,740 | | 7,740 |

Series 2005 B1, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 1,400 | | 1,400 |

Series 2005 H, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 11,195 | | 11,195 |

Series 2006 C, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 1,550 | | 1,550 |

Series 2006 F1, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 6,610 | | 6,610 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

California Hsg. Fin. Agcy. Rev.: - continued | | | |

(Home Mtg. Prog.): | | | |

Series 2006 F2, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | $ 15,400 | | $ 15,400 |

Series 2007 H, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 5,700 | | 5,700 |

Series 2007 K, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 10,200 | | 10,200 |

Series 2008 C, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 7,890 | | 7,890 |

Series 2008 D: | | | |

0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 2,500 | | 2,500 |

0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 15,685 | | 15,685 |

(Multifamily Hsg. Prog.): | | | |

Series 2001 G, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 2,000 | | 2,000 |

Series 2002 E, 0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 6,055 | | 6,055 |

Series 2002 U, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 16,200 | | 16,200 |

Series 2003 D, 0.17% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 33,360 | | 33,360 |

Series 2003 K: | | | |

0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 900 | | 900 |

0.15% 9/7/11 (Liquidity Facility Fannie Mae) (Liquidity Facility Freddie Mac), VRDN (b)(e) | 1,700 | | 1,700 |

California Infrastructure & Econ. Dev. Bank Rev.: | | | |

(Betts Spring Co. Proj.) Series 2008, 0.36% 9/7/11, LOC Bank of America NA, VRDN (b)(e) | 8,895 | | 8,895 |

(Pacific Gas and Elec. Co. Proj.) Series 2009 C, 0.14% 9/1/11, LOC Sumitomo Mitsui Banking Corp., VRDN (b) | 11,000 | | 11,000 |

(RAND Corp. Proj.): | | | |

Series 2008 A, 0.22% 9/7/11, LOC Bank of America NA, VRDN (b) | 33,150 | | 33,150 |

Series 2008 B, 0.14% 9/1/11, LOC Bank of America NA, VRDN (b) | 3,170 | | 3,170 |

California Muni. Fin. Auth. Indl. Dev. Rev. (Edelbrock Permanent Mold, LLC Proj.) Series 2007, 0.34% 9/7/11, LOC PNC Bank NA, VRDN (b)(e) | 5,095 | | 5,095 |

California Poll. Cont. Fing. Auth. Ctfs. of Prtn. (Pacific Gas & Elec. Co. Proj.) Series 1997 B, 0.14% 9/1/11, LOC JPMorgan Chase Bank, VRDN (b)(e) | 4,500 | | 4,500 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

California Poll. Cont. Fing. Auth. Envir. Impt. Rev. (Air Products & Chemicals Proj.) Series 1997 B, 0.08% 9/1/11, VRDN (b) | $ 2,600 | | $ 2,600 |

California Poll. Cont. Fing. Auth. Solid Waste Disp. Rev. (Recology, Inc. Proj.) Series 2010 A, 0.28% 9/7/11, LOC Bank of America NA, VRDN (b) | 48,000 | | 48,000 |

California Pub. Works Board Lease Rev. Participating VRDN Series BA 08 1065, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 13,690 | | 13,690 |

California School Cash Reserve Prog. Auth. TRAN: | | | |

Series 2011 A, 2% 3/1/12 | 6,900 | | 6,955 |

Series 2011 C, 2% 3/1/12 | 51,400 | | 51,834 |

Series 2011 D, 2% 3/1/12 | 28,530 | | 28,742 |

Series 2011 E, 2% 6/1/12 | 20,600 | | 20,853 |

Series 2011 G, 2% 6/1/12 | 38,155 | | 38,581 |

Series 2011 H, 2% 2/1/12 | 4,800 | | 4,828 |

Series L, 2.5% 10/31/11 | 4,000 | | 4,013 |

Series R, 2.5% 12/30/11 | 8,305 | | 8,358 |

California State Univ. Rev. Series 2001 A: | | | |

0.18% 9/1/11, LOC JPMorgan Chase Bank, LOC State Street Bank & Trust Co., Boston, CP | 10,600 | | 10,600 |

0.2% 9/1/11, LOC JPMorgan Chase Bank, LOC State Street Bank & Trust Co., Boston, CP | 3,900 | | 3,900 |

California Statewide Cmnty. Dev. Auth. Rev. Bonds 5.6% 10/1/11 (Escrowed to Maturity) (f) | 11,300 | | 11,348 |

California Statewide Cmntys. Dev. Auth. Gas Supply Rev. Series 2010, 0.2% 9/7/11 (Liquidity Facility Royal Bank of Canada), VRDN (b) | 70,565 | | 70,565 |

California Statewide Cmntys. Dev. Auth. Indl. Dev. Rev. (Arthurmade Plastics, Inc. Proj.) Series 2000 A, 0.51% 9/7/11, LOC Bank of America NA, VRDN (b)(e) | 2,300 | | 2,300 |

California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev.: | | | |

(Aegis of Aptos Proj.) Series 1998-Y 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 7,350 | | 7,350 |

(Bristol Apts. Proj.) Series Z, 0.21% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 9,500 | | 9,500 |

(Crocker Oaks Apts. Proj.) Series 2001 H, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 6,750 | | 6,750 |

(Crystal View Apt. Proj.) Series A, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 27,075 | | 27,075 |

(Grove Apts. Proj.) Series X, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 6,150 | | 6,150 |

(Heritage Park Apts. Proj.) Series 2008 C, 0.2% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 10,000 | | 10,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev.: - continued | | | |

(Maple Square Apt. Proj.) Series AA, 0.21% 9/7/11, LOC Citibank NA, VRDN (b)(e) | $ 5,955 | | $ 5,955 |

(Marlin Cove Apts. Proj.) Series V, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 40,000 | | 40,000 |

(Northwest Gateway Apts. Proj.) Series 2004 C, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 23,000 | | 23,000 |

(Northwood Apts. Proj.) Series N, 0.21% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 4,800 | | 4,800 |

(Parkside Terrace Apts. Proj.) Series 2008 E, 0.2% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 17,009 | | 17,009 |

(River Run Sr. Apts. Proj.) Series LL, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 13,505 | | 13,505 |

(Salvation Army S.F. Proj.) 0.22% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 16,845 | | 16,845 |

(Sunrise Fresno Proj.) Series B, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 5,500 | | 5,500 |

(Terraces at Park Marino Proj.) Series I, 0.23% 9/7/11, LOC California Teachers Retirement Sys., VRDN (b)(e) | 6,105 | | 6,105 |

(The Crossings Sr. Apts./ Phase II Proj.) Series J, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 11,100 | | 11,100 |

(Valley Palms Apts. Proj.) Series 2002 C, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 13,500 | | 13,500 |

(Villas at Hamilton Apts. Proj.) Series 2001 HH, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 11,300 | | 11,300 |

(Vineyard Creek Apts. Proj.): | | | |

Series 2003 W, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 4,000 | | 4,000 |

Series O, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 12,452 | | 12,452 |

(Vista Del Monte Proj.) Series QQ, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 13,450 | | 13,450 |

(Vizcaya Apts. Proj.) Series B, 0.2% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 22,200 | | 22,200 |

(Wilshire Court Proj.) Series M, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 20,290 | | 20,285 |

California Statewide Cmntys. Dev. Auth. Rev.: | | | |

(JTF Enterprises LLC Proj.) Series 1996 A, 0.21% 9/7/11, LOC Bank of America NA, VRDN (b)(e) | 3,000 | | 3,000 |

(Oakmont Stockton Proj.) Series 1997 C, 0.18% 9/7/11, LOC Fed. Home Ln. Bank, San Francisco, VRDN (b)(e) | 5,960 | | 5,960 |

(Park Century School Proj.) Series 2007, 0.38% 9/7/11, LOC Bank of America NA, VRDN (b) | 7,875 | | 7,875 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

California Statewide Cmntys. Dev. Auth. Rev.: - continued | | | |

(The Archer School for Girls, Inc. Proj.) Series 2005, 0.2% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b) | $ 10,660 | | $ 10,660 |

Bonds (Cottage Health Sys. Obligated Group Proj.) Series 2010, 2% 11/1/11 | 3,735 | | 3,741 |

Participating VRDN Series Putters 3891, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,465 | | 4,465 |

TRAN Series 2011 A, 2% 5/15/12 | 11,000 | | 11,133 |

California Statewide Cmntys. Dev. Corp. Rev.: | | | |

(Merrill Packaging Proj.) 0.22% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b)(e) | 380 | | 380 |

(Rix Industries Proj.) Series 1996 I, 0.22% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b)(e) | 800 | | 800 |

Camarillo City Multi-Family Hsg. Rev. (Hacienda de Camarillo Proj.) Series 1996, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 600 | | 600 |

Chabot-Las Positas Cmnty. College District Participating VRDN Series WF 11 46C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 14,025 | | 14,025 |

Chula Vista Ind. Dev. Rev. (San Diego Gas & Elec. Co. Proj.): | | | |

Series 2004 F, 0.15% 9/7/11, VRDN (b)(e) | 75,000 | | 75,000 |

Series 2006 A, 0.14% 9/7/11, VRDN (b) | 38,450 | | 38,450 |

East Bay Muni. Util. District Wastewtr. Sys. Rev. Participating VRDN Series Putters 3772 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 11,250 | | 11,250 |

East Bay Muni. Util. District Wtr. Sys. Rev. Participating VRDN: | | | |

Series EGL 07 0069, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 48,800 | | 48,800 |

Series EGL 7 05 0045, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 39,600 | | 39,600 |

Series MS 3250, 0.22% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 7,500 | | 7,500 |

Series Putters 3759 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 6,035 | | 6,035 |

Series ROC II R 10397, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 6,500 | | 6,500 |

Elk Grove Unified School District Spl. Tax Participating VRDN Series Solar 06-80, 0.2% 9/7/11 (Liquidity Facility U.S. Bank NA, Minnesota) (b)(g) | 7,300 | | 7,300 |

Fontana Unified School District Gen. Oblig. TRAN 2% 12/30/11 | 2,500 | | 2,513 |

Foothill-De Anza Cmnty. College District Participating VRDN: | | | |

Series MS 3268 X, 0.22% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 5,000 | | 5,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Foothill-De Anza Cmnty. College District Participating VRDN: - continued | | | |

Series WF 11 68C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | $ 4,000 | | $ 4,000 |

Fremont Union High School District, Santa Clara Participating VRDN Series WF 11 34C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 17,940 | | 17,940 |

Garden Grove Multi-family Hsg. Rev. (Cal-Malabar Apts. Proj.) Series 1997 A, 0.23% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 3,200 | | 3,200 |

Grossmont Healthcare District Participating VRDN: | | | |

Series MS 3253, 0.21% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 22,575 | | 22,575 |

Series WF 11 30C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 10,190 | | 10,190 |

Grossmont Union High School District Participating VRDN: | | | |

Series Putters 3797Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 3,270 | | 3,270 |

Series ROC RR II R 11929, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 4,000 | | 4,000 |

Kern County Board of Ed. TRAN Series 2011 A, 2% 10/1/11 | 11,200 | | 11,213 |

Livermore Multi-family Mtg. Rev. (Portola Meadows Apts. Proj.) 0.22% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 11,025 | | 11,025 |

Loma Linda Hosp. Rev. (Loma Linda Univ. Med. Ctr. Proj.): | | | |

Series 2007 B1, 0.2% 9/7/11, LOC Union Bank of California, VRDN (b) | 11,315 | | 11,315 |

Series 2008 B, 0.25% 9/7/11, LOC Bank of America NA, VRDN (b) | 19,500 | | 19,500 |

Los Angeles Cmnty. College District Participating VRDN: | | | |

Putters 3609Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,995 | | 4,995 |

Series EGL 08 57, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 17,400 | | 17,400 |

Series Putters 2864, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,780 | | 4,780 |

Series Putters 3770 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 3,270 | | 3,270 |

Series Putters 3776Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 7,425 | | 7,425 |

Series ROC II R 11728, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 6,960 | | 6,960 |

Series ROC II R 11773, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 2,835 | | 2,835 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Los Angeles Cmnty. College District Participating VRDN: - continued | | | |

Series WF 09 8C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo & Co.) (b)(g) | $ 19,650 | | $ 19,650 |

Los Angeles Cmnty. Redev. Agcy. Multi-family Hsg. Rev. (Hollywood & Vine Apts. Proj.) Series A, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 58,600 | | 58,600 |

Los Angeles County Gen. Oblig.: | | | |

Series 2010 A, 0.13% 10/5/11, LOC JPMorgan Chase Bank, CP | 41,270 | | 41,270 |

Series 2010 B, 0.25% 9/2/11, LOC Bank of America NA, CP | 7,500 | | 7,500 |

Series 2010 C, 0.17% 10/5/11, LOC Wells Fargo Bank NA, CP | 7,000 | | 7,000 |

TRAN: | | | |

Series 2012 A, 2.5% 2/29/12 | 21,500 | | 21,730 |

Series 2012 B, 2.5% 3/30/12 | 42,200 | | 42,725 |

Los Angeles County Hsg. Auth. Multi-family Hsg. Rev. (Park Sierra Apts. Proj.) Series 1986 A, 0.22% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 50,900 | | 50,900 |

Los Angeles County Metropolitan Trans. Auth. Sales Tax Rev. Series A: | | | |

0.12% 9/9/11, LOC Barclays Bank PLC, CP | 7,000 | | 7,000 |

0.12% 9/9/11, LOC Barclays Bank PLC, CP | 7,406 | | 7,406 |

0.2% 10/12/11, LOC Barclays Bank PLC, CP | 15,950 | | 15,950 |

Los Angeles County Schools Pooled Fing. Prog. Ctfs. of Prtn. TRAN Series F 1, 2% 2/1/12 | 12,000 | | 12,057 |

Los Angeles Dept. Arpt. Rev.: | | | |

Participating VRDN: | | | |

Series Putters 3838, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 3,300 | | 3,300 |

Series ROC II R 11842, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 6,750 | | 6,750 |

Series WF 10 44C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 7,440 | | 7,440 |

Series A, 0.16% 9/8/11, LOC Citibank NA, LOC State Street Bank & Trust Co., Boston, CP | 17,500 | | 17,500 |

Los Angeles Dept. of Wtr. & Pwr. Rev.: | | | |

Participating VRDN: | | | |

Series Putters 3332, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 6,660 | | 6,660 |

Series Putters 3718 Z, 0.23% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 12,060 | | 12,060 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Los Angeles Dept. of Wtr. & Pwr. Rev.: - continued | | | |

Participating VRDN: | | | |

Series ROC II R 500, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | $ 20,900 | | $ 20,900 |

Series Solar 06 48, 0.19% 9/7/11 (Liquidity Facility U.S. Bank NA, Minnesota) (b)(g) | 15,370 | | 15,370 |

0.13% 11/1/11 (Liquidity Facility Wells Fargo Bank NA), CP | 54,800 | | 54,800 |

0.15% 10/5/11 (Liquidity Facility Wells Fargo Bank NA), CP | 46,300 | | 46,300 |

0.31% 10/6/11 (Liquidity Facility Wells Fargo Bank NA), CP | 15,500 | | 15,500 |

Los Angeles Dept. of Wtr. & Pwr. Wtrwks. Rev. Participating VRDN: | | | |

Series Putters 3310, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 7,245 | | 7,245 |

Series Putters 3750 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,000 | | 4,000 |

Series WF 10 43C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 12,160 | | 12,160 |

Los Angeles Gen. Oblig.: | | | |

Bonds Series Putters 3930, 0.16%, tender 10/20/11 (Liquidity Facility JPMorgan Chase & Co.) (b)(g)(h) | 52,300 | | 52,300 |

Participating VRDN Series Putters 3931, 0.14% 9/1/11 (Liquidity Facility JPMorgan Chase & Co.) (b)(g) | 40,500 | | 40,500 |

TRAN: | | | |

2.5% 2/29/12 | 16,600 | | 16,781 |

2.5% 3/30/12 | 9,600 | | 9,721 |

2.5% 4/30/12 | 27,800 | | 28,197 |

Los Angeles Hbr. Dept. Rev. Participating VRDN: | | | |

Series DB 634, 0.24% 9/7/11 (Liquidity Facility Deutsche Bank AG) (b)(e)(g) | 14,780 | | 14,780 |

Series WF 10 40C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 5,400 | | 5,400 |

Los Angeles Multi-family Hsg. Rev. (Channel Gateway Apts. Proj.) Series 1989 B, 0.22% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 67,700 | | 67,700 |

Los Angeles Muni. Impt. Corp. Lease Rev.: | | | |

Series 2004 A1: | | | |

0.13% 10/5/11, LOC Wells Fargo Bank NA, CP | 26,352 | | 26,352 |

0.15% 10/4/11, LOC Wells Fargo Bank NA, CP | 9,000 | | 9,000 |

0.15% 11/8/11, LOC Wells Fargo Bank NA, CP | 5,000 | | 5,000 |

Series 2004 A2, 0.13% 10/5/11, LOC JPMorgan Chase Bank, CP | 10,000 | | 10,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Los Angeles Wastewtr. Sys. Rev.: | | | |

Participating VRDN: | | | |

Series EGL 7 05 3003, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | $ 34,000 | | $ 34,000 |

Series Putters 3371, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 22,495 | | 22,495 |

Series Putters 3751, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,935 | | 4,935 |

Series 2008 G, 0.24% 9/7/11, LOC Bank of America NA, VRDN (b) | 25,000 | | 25,000 |

Los Rios Cmnty. College District Participating VRDN Series ROC II R 11953 X, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 6,400 | | 6,400 |

Metropolitan Wtr. District of Southern California Wtr. Rev. Participating VRDN Series Putters 3547, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 10,935 | | 10,935 |

Metropolitan Wtr. District of Southern California Wtrwks. Rev. Participating VRDN: | | | |

Series BA 08 1062, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 6,525 | | 6,525 |

Series BA 08 1087, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 5,750 | | 5,750 |

Series EGL 07 0044, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 16,430 | | 16,430 |

Series EGL 07 71, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 43,000 | | 43,000 |

Series Putters 3289, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 2,225 | | 2,225 |

Series Putters 3653 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 2,495 | | 2,495 |

Series Putters 3752 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 3,570 | | 3,570 |

Seris ROC II R 11925, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 3,585 | | 3,585 |

Modesto Pub. Fing. Auth. Lease Rev. Series 2008 B, 0.28% 9/7/11, LOC Bank of America NA, VRDN (b) | 13,200 | | 13,200 |

Newport Mesa Unified School District Participating VRDN Series WF 11 70Z, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 12,185 | | 12,185 |

Oakland Gen. Oblig. TRAN 2% 3/30/12 | 9,000 | | 9,088 |

Ohlone Cmnty. College District Participating VRDN Series Putters 3782 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 12,250 | | 12,250 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Olcese Wtr. District Bonds (Rio Bravo Wtr. Delivery Systems Proj.) Series 1986 A, 0.25% tender 10/5/11, LOC Sumitomo Mitsui Banking Corp., CP mode (e) | $ 4,100 | | $ 4,100 |

Orange County Apt. Dev. Rev.: | | | |

(Ladera Apts. Proj.) Series 2001 II B, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 23,500 | | 23,500 |

(Park Place Apts. Proj.) Series 1989 A, 0.2% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 10,500 | | 10,500 |

(Wood Canyon Villas Proj.) Series 2001 E, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 16,000 | | 16,000 |

Orange County Local Trans. Auth. Sales Tax Rev. Series A, 0.14% 10/5/11, LOC Bank of America NA, LOC JPMorgan Chase Bank, CP | 12,500 | | 12,500 |

Orange County Rfdg. Recovery TRAN: | | | |

2% 3/15/12 | 15,300 | | 15,444 |

2% 5/15/12 | 14,960 | | 15,142 |

2% 6/29/12 | 41,715 | | 42,309 |

Orange County Sanitation District Ctfs. of Prtn. Participating VRDN: | | | |

Series MS 06 2222, 0.21% 9/7/11 (Liquidity Facility Wells Fargo & Co.) (b)(g) | 15,484 | | 15,484 |

Series MS 3030, 0.21% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 10,515 | | 10,515 |

Orange County Sanitation District Rev. BAN Series 2010 B, 2% 11/23/11 | 49,000 | | 49,182 |

Orange County Spl. Fing. Auth. Teeter Plan Rev. 0.16% 12/7/11, LOC Wells Fargo Bank NA, CP | 30,900 | | 30,900 |

Orange County Wtr. District Rev. Ctfs. of Prtn. Participating VRDN Series Putters 3686Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,100 | | 4,100 |

Paramount Hsg. Auth. Multi-family Rev. (Century Place Apts. Proj.) Series 1999 A, 0.16% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 21,000 | | 21,000 |

Pleasant Hill Redev. Agcy. Multi-family Hsg. Rev. (Chateau III Proj.) Series 2001, 0.3% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 10,355 | | 10,355 |

Pleasanton Multi-family Rev. (Bernal Apts. Proj.) Series A, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 13,750 | | 13,750 |

Port of Oakland Port Rev. Series 2010 A, 0.13% 9/12/11, LOC Wells Fargo Bank NA, CP | 40,565 | | 40,565 |

Poway Unified School District Participating VRDN Series WF 11 91 Z, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 6,830 | | 6,830 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

RBC Muni. Prods, Inc. Trust Various States Bonds: | | | |

Series RBC E 21, 0.25%, tender 12/1/11 (Liquidity Facility Royal Bank of Canada) (b)(g)(h) | $ 44,050 | | $ 44,050 |

Series RBC E24, 0.25%, tender 12/1/11 (Liquidity Facility Royal Bank of Canada) (b)(g)(h) | 15,500 | | 15,500 |

Richmond Wastewtr. Rev. Series 2008 A, 0.2% 9/7/11, LOC Union Bank of California, VRDN (b) | 12,500 | | 12,500 |

Rio Hondo Cmnty. College District Participating VRDN Series WF 10 51Z, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 20,825 | | 20,825 |

Riverside County Asset Leasing Corp. Leasehold Rev. (Southwest Justice Ctr. Proj.) Series 2008 A, 0.15% 9/7/11, LOC Union Bank of California, VRDN (b) | 8,000 | | 8,000 |

Riverside County Gen. Oblig.: | | | |

Series B: | | | |

0.12% 9/9/11, LOC Bank of Nova Scotia New York Branch, CP | 35,900 | | 35,900 |

0.26% 9/15/11, LOC Bank of Nova Scotia New York Branch, CP | 18,700 | | 18,700 |

TRAN 2% 3/30/12 | 44,100 | | 44,542 |

Riverside County Ind. Dev. Auth. Ind. Dev. Rev. (Merrick Engineering, Inc. Proj.) 0.28% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b)(e) | 1,940 | | 1,940 |

Riverside Ctfs. of Prtn. (Riverside Renaissance Proj.) Series 2008, 0.24% 9/7/11, LOC Bank of America NA, VRDN (b) | 8,350 | | 8,350 |

Riverside Elec. Rev. Series 2008 A, 0.18% 9/7/11, LOC Bank of America NA, VRDN (b) | 36,815 | | 36,815 |

Riverside Indl. Dev. Auth. Indl. Dev. Rev. (Sabert Corp. Proj.) 0.25% 9/7/11, LOC PNC Bank NA, VRDN (b)(e) | 2,230 | | 2,230 |

Sacramento County Hsg. Auth. Multi-family Hsg. Rev.: | | | |

(California Place Apts. Proj.) Series B, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 4,500 | | 4,500 |

(Deer Park Apts. Proj.) Issue A, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 13,200 | | 13,200 |

(Sun Valley Proj.) Series 2001 F, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 3,750 | | 3,750 |

Sacramento Gen. Oblig. TRAN 2% 6/29/12 | 21,875 | | 22,188 |

Sacramento Hsg. Auth. Multi-family: | | | |

(Countrywood Village Apts. Proj.) Series F, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 8,225 | | 8,225 |

(Valencia Point Apts. Proj.) 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 4,900 | | 4,900 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Sacramento Muni. Util. District Elec. Rev. Series 2007 J: | | | |

0.11% 9/14/11, LOC Bank of New York, New York, LOC California Teachers Retirement Sys., CP | $ 55,200 | | $ 55,200 |

0.12% 9/15/11, LOC Bank of New York, New York, LOC California Teachers Retirement Sys., CP | 7,000 | | 7,000 |

Sacramento Redev. Agcy. Multi-family (18th & L Apts. Proj.) 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 21,075 | | 21,075 |

San Bernardino County Gen. Oblig. TRAN Series A, 2% 6/29/12 | 49,700 | | 50,403 |

San Diego Cmnty. College District: | | | |

Bonds Series 2011, 1.5% 8/1/12 | 5,000 | | 5,056 |

Participating VRDN Series Putters 3741Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 5,000 | | 5,000 |

San Diego County & School District TRAN: | | | |

Series 2011 A, 2% 6/29/12 | 11,500 | | 11,665 |

Series 2011 B1, 2% 1/31/12 | 7,600 | | 7,648 |

San Diego County Wtr. Auth. Wtr. Rev. Participating VRDN: | | | |

Series Putters 2903Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 7,380 | | 7,380 |

Series Putters 3028, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 8,715 | | 8,715 |

San Diego Hsg. Auth. Multi-family Hsg. Rev.: | | | |

(Bay Vista Apts. Proj.) Series A, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 14,500 | | 14,500 |

(Delta Village Apts. Proj.) Series A, 0.22% 9/7/11, LOC Citibank NA, VRDN (b)(e) | 6,500 | | 6,500 |

(Stratton Apts. Proj.) Series 2000 A, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 5,000 | | 5,000 |

San Diego Pub. Facilities Fing. Auth. Wtr. Rev. Participating VRDN Series MS 3229X, 0.22% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 7,500 | | 7,500 |

San Diego Unified School District Participating VRDN Series WF 11 97C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 9,800 | | 9,800 |

San Francisco Bay Area Rapid Transit District Sales Tax Rev. Participating VRDN Series BA 08 3041X, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | 6,665 | | 6,665 |

San Francisco Bay Area Rapid Transit Fing. Auth. Participating VRDN Series ROC II R 12318, 0.2% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 15,225 | | 15,225 |

San Francisco City & County Arpts. Commission Int'l. Arpt. Rev. Series 2010 A1, 0.15% 9/7/11, LOC JPMorgan Chase Bank, VRDN (b)(e) | 21,500 | | 21,500 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

San Francisco City & County Gen. Oblig.: | | | |

Participating VRDN: | | | |

Series BA 08 3318, 0.27% 9/7/11 (Liquidity Facility Bank of America NA) (b)(g) | $ 2,000 | | $ 2,000 |

Series WF 10 48C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (b)(g) | 10,040 | | 10,040 |

Series 2, 0.13% 10/5/11, LOC U.S. Bank NA, Minnesota, CP | 16,519 | | 16,519 |

San Francisco City & County Multi-family (8th & Howard Family Apts. Proj.) Series 2000 B, 0.21% 9/7/11, LOC Citibank NA, VRDN (b)(e) | 4,105 | | 4,105 |

San Francisco City & County Redev. Agcy. Multi-family Hsg. Rev.: | | | |

(Mission Creek Cmnty. Proj.) Series B, 0.21% 9/7/11, LOC Citibank NA, VRDN (b)(e) | 6,940 | | 6,940 |

(Ocean Beach Apts. Proj.) Series B, 0.17% 9/7/11, LOC Citibank NA, VRDN (b)(e) | 6,835 | | 6,835 |

San Francisco City & County Unified School District TRAN 2% 6/29/12 | 15,300 | | 15,515 |

San Francisco Redev. Agcy. Multi-family Hsg. Rev. 0.18% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 3,000 | | 3,000 |

San Jose Int'l. Arpt. Rev. Series A4 B, 0.16% 9/7/11, LOC Citibank NA, CP | 7,605 | | 7,605 |

San Jose Multi-family Hsg. Rev.: | | | |

(Alamaden Family Apts. Proj.) Series 2003 D, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 24,615 | | 24,615 |

(Betty Ann Gardens Apts. Proj.) Series 2002 A, 0.25% 9/7/11, LOC Citibank NA, VRDN (b)(e) | 6,800 | | 6,800 |

(El Paseo Apts. Proj.) Series 2002 B, 0.25% 9/7/11, LOC Citibank NA, VRDN (b)(e) | 4,745 | | 4,745 |

(Kennedy Apt. Homes Proj.) Series 2002 K, 0.21% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 9,075 | | 9,075 |

(Las Ventanas Apts. Proj.) Series 2008 B, 0.18% 9/7/11, LOC Freddie Mac, VRDN (b) | 13,300 | | 13,300 |

(Siena at Renaissance Square Proj.) Series 1996 A, 0.2% 9/7/11, LOC Key Bank NA, VRDN (b)(e) | 46,000 | | 46,000 |

(Trestles Apts. Proj.) Series 2004 A, 0.26% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 7,325 | | 7,325 |

(Turnleaf Apts. Proj.) Series 2003 A, 0.3% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 10,860 | | 10,860 |

San Marcos Calif Unified School District Participating VRDN Series Putters 3927 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 1,700 | | 1,700 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

San Mateo County Cmnty. College District Participating VRDN Series WF 11 64C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo Bank NA) (a)(b)(g) | $ 8,370 | | $ 8,370 |

San Mateo Unified School District BAN 2% 2/15/12 | 11,300 | | 11,369 |

Santa Ana Calif Unified School District TRAN 2% 12/1/11 | 10,000 | | 10,038 |

Santa Ana Hsg. Auth. (City Gardens Apts. Proj.) Series 2006 B, 0.22% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 8,140 | | 8,140 |

Santa Clara County Fing. Auth. Lease Rev. (Multiple Facilities Proj.) Series 2008 M, 0.18% 9/7/11, LOC Bank of America NA, VRDN (b) | 88,895 | | 88,895 |

Santa Clara County Hsg. Auth. Multi-family Hsg. Rev. (Timberwood Apts. Proj.) Series B, 0.27% 9/7/11, LOC Union Bank of California, VRDN (b)(e) | 11,445 | | 11,445 |

Santa Clara Elec. Rev. Series 2008 B. 0.17% 9/7/11, LOC Bank of America NA, VRDN (b) | 15,360 | | 15,360 |

Santa Clara Valley Trans. Auth. Participating VRDN Series ROC R 11967, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 4,850 | | 4,850 |

Santa Clara Valley Wtr. District Wtr. Util. Rev.: | | | |

Series 2010 A1, 0.21% 12/7/11, LOC JPMorgan Chase Bank, CP | 28,310 | | 28,310 |

Series 2010 A2: | | | |

0.17% 11/4/11, LOC JPMorgan Chase Bank, CP | 14,700 | | 14,700 |

0.18% 12/7/11, LOC JPMorgan Chase Bank, CP | 29,955 | | 29,955 |

Santa Cruz County TRAN: | | | |

2% 3/1/12 | 6,000 | | 6,052 |

2% 7/5/12 | 25,300 | | 25,661 |

Santa Cruz Redev. Agcy. Multi-family Rev.: | | | |

(1010 Pacific Ave. Apts. Proj.) Series B, 0.22% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 16,000 | | 16,000 |

(Shaffer Road Apts. Proj.) Series A, 0.2% 9/7/11, LOC Fannie Mae, VRDN (b)(e) | 6,000 | | 6,000 |

South Coast Local Ed. Agcy. TRAN: | | | |

Series 2011 A, 2% 6/29/12 | 4,000 | | 4,055 |

Series 2011 C, 2% 8/31/12 | 10,000 | | 10,149 |

Southern California Pub. Pwr. Auth. Rev. (Magnolia Pwr. Proj.) Series 2009-2, 0.17% 9/7/11, LOC Bank of America NA, VRDN (b) | 37,445 | | 37,445 |

State Ctr. Cmnty. College District Participating VRDN Series Putters 1972, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 12,780 | | 12,780 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

Univ. of California Revs.: | | | |

Participating VRDN: | | | |

Series Floaters 09 7C, 0.19% 9/7/11 (Liquidity Facility Wells Fargo & Co.) (b)(g) | $ 4,000 | | $ 4,000 |

Series MS 3066, 0.21% 9/7/11 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(g) | 9,935 | | 9,935 |

Series Putters 3365, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 5,760 | | 5,760 |

Series Putters 3367, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 1,500 | | 1,500 |

Series Putters 3368, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 9,500 | | 9,500 |

Series Putters 3754 Z, 0.21% 9/7/11 (Liquidity Facility JPMorgan Chase Bank) (b)(g) | 4,250 | | 4,250 |

Series ROC II R 11886X, 0.21% 9/7/11 (Liquidity Facility Citibank NA) (b)(g) | 4,145 | | 4,145 |

Series Solar 06 39, 0.2% 9/7/11 (Liquidity Facility U.S. Bank NA, Minnesota) (b)(g) | 10,180 | | 10,180 |

Series A: | | | |

0.11% 9/7/11, CP | 13,400 | | 13,400 |

0.11% 9/7/11, CP | 27,500 | | 27,500 |

0.15% 9/1/11, CP | 18,900 | | 18,900 |

0.17% 11/7/11, CP | 31,500 | | 31,500 |

0.34% 9/15/11, CP | 17,300 | | 17,300 |

Walnut Energy Ctr. Auth. Series 2005 B, 0.3% 10/6/11, LOC State Street Bank & Trust Co., Boston, CP | 10,000 | | 10,000 |

Woodland Fin. Auth. Rev. 0.23% 9/1/11, LOC Union Bank of California, CP | 3,100 | | 3,100 |

| | 4,891,439 |

Delaware - 0.1% |

Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1999 A, 0.43% 9/7/11, VRDN (b) | 4,630 | | 4,630 |

Georgia - 0.1% |

Putnam Dev. Auth. Swr. Facility Rev. (Oconee Crossings Wharf Proj.) 0.39% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b)(e) | 3,355 | | 3,355 |

Indiana - 0.2% |

Rockport Indl. Dev. Rev. (AK Steel Corp. Proj.) Series 1998 A, 0.19% 9/7/11, LOC PNC Bank NA, VRDN (b)(e) | 10,000 | | 10,000 |

Iowa - 0.3% |

Iowa Fin. Auth. Poll. Cont. Facility Rev. (MidAmerican Energy Proj.) Series 2008 B, 0.2% 9/7/11, VRDN (b) | 15,225 | | 15,225 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Kentucky - 0.2% |

Jefferson County Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series 2011 A, 0.28% tender 9/6/11, CP mode | $ 2,200 | | $ 2,200 |

Trimble County Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series A2, 0.55% tender 9/23/11, CP mode (e) | 8,100 | | 8,100 |

| | 10,300 |

Maryland - 0.1% |

Maryland Health & Higher Edl. Facilities Auth. Rev. (Univ. of Maryland Med. Sys. Proj.) Series 2008 A, 0.25% 9/7/11, LOC Citizens Bank of Pennsylvania, VRDN (b) | 7,000 | | 7,000 |

Massachusetts - 0.3% |

Massachusetts Indl. Fin. Agcy. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1992, 0.7% tender 9/12/11, CP mode | 6,000 | | 6,000 |

Massachusetts State Dev. Fing. Agcy. Poll. Cont. Rev. Bonds (Massachusetts Elec. Co. Proj.) 0.9% tender 9/2/11, CP mode | 7,000 | | 7,000 |

| | 13,000 |

New Hampshire - 0.2% |

New Hampshire Bus. Fin. Auth. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.): | | | |

Series 1990 A, 0.75% tender 9/6/11, CP mode (e) | 1,300 | | 1,300 |

Series 1990 B, 0.75% tender 9/9/11, CP mode | 8,600 | | 8,600 |

Series A1, 0.75% tender 9/6/11, CP mode (e) | 3,000 | | 3,000 |

| | 12,900 |

North Carolina - 0.2% |

Gaston County Indl. Facilities & Poll. Cont. Fing. Auth. Rev. (Duke Energy Corp. Proj.) Series 1999, 0.24% 9/1/11, VRDN (b)(e) | 12,000 | | 12,000 |

Ohio - 0.3% |

Ohio Hsg. Fin. Agcy. Multi-family Hsg. Rev. (Club at Spring Valley Apts. Proj.) Series 1996 A, 0.42% 9/7/11, LOC RBS Citizens NA, VRDN (b)(e) | 4,540 | | 4,540 |

Ohio Hsg. Fin. Agcy. Residential Mtg. Rev. Series 2006 I, 0.19% 9/7/11 (Liquidity Facility Citibank NA), VRDN (b)(e) | 5,600 | | 5,600 |

Westlake Health Facilities Rev. (Lutheran Home Proj.) Series 2005, 0.35% 9/7/11, LOC RBS Citizens NA, VRDN (b) | 7,400 | | 7,400 |

| | 17,540 |

Oregon - 0.2% |

Port of Portland Arpt. Rev. Series Eighteen B, 0.17% 9/7/11, LOC Wells Fargo Bank NA, VRDN (b)(e) | 10,180 | | 10,180 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Pennsylvania - 0.2% |

Chester County Indl. Dev. Auth. Student Hsg. Rev. Series 2008 A, 0.26% 9/7/11, LOC Citizens Bank of Pennsylvania, VRDN (b) | $ 5,375 | | $ 5,375 |

Delaware County Indl. Dev. Auth. Rev. (Academy of Notre Dame de Namur Proj.) Series 2007, 0.29% 9/7/11, LOC Citizens Bank of Pennsylvania, VRDN (b) | 3,955 | | 3,955 |

| | 9,330 |

South Carolina - 0.1% |

Oconee County Poll. Cont. Rev. (Duke Energy Corp. Proj.) Series 1999 A, 0.22% 9/1/11, VRDN (b) | 3,100 | | 3,100 |

Tennessee - 0.1% |

Montgomery County Pub. Bldg. Auth. Pooled Fing. Rev. (Tennessee County Ln. Pool Prog.) Series 2004, 0.18% 9/1/11, LOC Bank of America NA, VRDN (b) | 5,000 | | 5,000 |

Texas - 0.5% |

Southeast Texas Hsg. Fin. Corp. Multi-family Hsg. Rev. (Oaks of Hitchcock Apt. Proj.) Series 2000 A, 0.24% 9/7/11, LOC Gen. Elec. Cap. Corp., VRDN (b)(e) | 5,150 | | 5,150 |

Texas Dept. of Hsg. & Cmnty. Affairs Single Family Mtg. Rev. Participating VRDN Series ROC II R 11215 WF, 0.31% 9/7/11 (Liquidity Facility Wells Fargo & Co.) (b)(e)(g) | 12,120 | | 12,120 |

West Harris County Reg'l. Wtr. Auth. Wtr. Sys. Rev. Participating VRDN Series Solar 07 103, 0.19% 9/7/11 (Liquidity Facility U.S. Bank NA, Minnesota) (b)(g) | 10,255 | | 10,255 |

| | 27,525 |

Virginia - 0.2% |

Arlington County Indl. Dev. Auth. Multi-family Hsg. Rev. Series A, 0.24% 9/7/11, LOC Freddie Mac, VRDN (b)(e) | 4,000 | | 4,000 |

Virginia Hsg. Dev. Auth. Commonwealth Mtg. Rev. Participating VRDN Series BA 1046, 0.34% 9/7/11 (Liquidity Facility Bank of America NA) (b)(e)(g) | 6,200 | | 6,200 |

| | 10,200 |

Municipal Securities - continued |

| Shares | | Value (000s) |

Other - 2.8% |

Fidelity Municipal Cash Central Fund, 0.19% (c)(d) | 143,182 | | $ 143,182 |

TOTAL INVESTMENT PORTFOLIO - 100.3% (Cost $5,205,906) | | 5,205,906 |

NET OTHER ASSETS (LIABILITIES) - (0.3)% | | (13,704) |

NET ASSETS - 100% | $ 5,192,202 |

Security Type Abbreviations |

BAN | - | BOND ANTICIPATION NOTE |

CP | - | COMMERCIAL PAPER |

TRAN | - | TAX AND REVENUE ANTICIPATION NOTE |

VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

Legend |

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $43,370,000 or 0.8% of net assets. |

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(c) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund. |

(d) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(e) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

(f) Security collateralized by an amount sufficient to pay interest and principal. |

(g) Provides evidence of ownership in one or more underlying municipal bonds. |

(h) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $111,850,000 or 2.2% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Cost

(000s) |

Los Angeles Gen. Oblig. Bonds Series Putters 3930, 0.16%, tender 10/20/11 (Liquidity Facility JPMorgan Chase & Co.) | 7/20/11 | $ 52,300 |

RBC Muni. Prods, Inc. Trust Various States Bonds: Series RBC E 21, 0.25%, tender 12/1/11 (Liquidity Facility Royal Bank of Canada) | 5/6/11 - 8/30/11 | $ 44,050 |

Series RBC E24, 0.25%, tender 12/1/11 (Liquidity Facility Royal Bank of Canada) | 8/5/11 | $ 15,500 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Municipal Cash Central Fund | $ 159 |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Income Tax Information |

At February 28, 2011, the Fund had a capital loss carryforward of approximately $1,691,000 all of which will expire in fiscal 2019. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | August 31, 2011 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $5,062,724) | $ 5,062,724 | |

Fidelity Central Funds (cost $143,182) | 143,182 | |

Total Investments (cost $5,205,906) | | $ 5,205,906 |

Cash | | 120 |

Receivable for investments sold | | 19,952 |

Receivable for fund shares sold | | 59,399 |

Interest receivable | | 4,511 |

Distributions receivable from Fidelity Central Funds | | 25 |

Other receivables | | 2 |

Total assets | | 5,289,915 |

| | |

Liabilities | | |

Payable for investments purchased | $ 40,508 | |

Payable for fund shares redeemed | 55,054 | |

Distributions payable | 1 | |

Accrued management fee | 865 | |

Other affiliated payables | 1,248 | |

Other payables and accrued expenses | 37 | |

Total liabilities | | 97,713 |

| | |

Net Assets | | $ 5,192,202 |

Net Assets consist of: | | |

Paid in capital | | $ 5,193,862 |

Accumulated undistributed net realized gain (loss) on investments | | (1,660) |

Net Assets, for 5,192,238 shares outstanding | | $ 5,192,202 |

Net Asset Value, offering price and redemption price per share ($5,192,202 ÷ 5,192,238 shares) | | $ 1.00 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands Six months ended August 31, 2011 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 5,866 |

Income from Fidelity Central Funds | | 159 |

Total income | | 6,025 |

| | |

Expenses | | |

Management fee | $ 9,395 | |

Transfer agent fees | 3,371 | |

Accounting fees and expenses | 220 | |

Custodian fees and expenses | 30 | |

Independent trustees' compensation | 9 | |

Registration fees | 33 | |

Audit | 22 | |

Legal | 21 | |

Miscellaneous | 22 | |

Total expenses before reductions | 13,123 | |

Expense reductions | (7,358) | 5,765 |

Net investment income (loss) | | 260 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 20 |

Net increase in net assets resulting from operations | | $ 280 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

Amounts in thousands | Six months ended August 31, 2011 (Unaudited) | Year ended February 28,

2011 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 260 | $ 501 |

Net realized gain (loss) | 20 | (1,691) |

Net increase in net assets resulting

from operations | 280 | (1,190) |

Distributions to shareholders from net investment income | (260) | (501) |

Share transactions at net asset value of $1.00 per share

Proceeds from sales of shares | 9,653,703 | 19,668,465 |

Reinvestment of distributions | 256 | 495 |

Cost of shares redeemed | (9,574,986) | (19,598,265) |

Net increase (decrease) in net assets and shares resulting from share transactions | 78,973 | 70,695 |

Total increase (decrease) in net assets | 78,993 | 69,004 |

| | |

Net Assets | | |

Beginning of period | 5,113,209 | 5,044,205 |

End of period | $ 5,192,202 | $ 5,113,209 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

| Six months ended August 31, 2011 | Years ended February 28, |

| (Unaudited) | 2011 | 2010 | 2009 | 2008 F | 2007 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) | - G | - G | - G | .013 | .030 | .030 |

Net realized and unrealized gain (loss) G | - | - | - | - | - | - |

Total from investment operations | - G | - G | - G | .013 | .030 | .030 |

Distributions from net investment income | - G | - G | - G | (.013) | (.030) | (.030) |

Distributions from net realized gain | - | - | - | - G | - G | - |

Total distributions | - G | - G | - G | (.013) | (.030) | (.030) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return B,C | .01% | .01% | .04% | 1.32% | 3.06% | 3.09% |

Ratios to Average Net Assets D,E | | | | | |

Expenses before reductions | .51% A | .51% | .55% | .53% | .51% | .52% |

Expenses net of fee waivers, if any | .22% A | .32% | .44% | .53% | .51% | .52% |

Expenses net of all reductions | .22% A | .32% | .44% | .50% | .41% | .38% |

Net investment income (loss) | .01% A | .01% | .04% | 1.30% | 2.98% | 3.05% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 5,192 | $ 5,113 | $ 5,044 | $ 5,761 | $ 6,051 | $ 4,762 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F For the year ended February 29.

G Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended August 31, 2011 (Unaudited)

(Amounts in thousands except ratios)

1. Organization.

Fidelity California Municipal Money Market Fund (the Fund) is a fund of Fidelity California Municipal Trust II (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust. The Fund may be affected by economic and political developments in the state of California.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Semiannual Report

3. Significant Accounting Policies - continued

Security Valuation - continued

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

Investment Transactions and Income. The net asset value per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Security transactions, including the Fund's investment activity in the Fidelity Central Funds, are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company, including distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. A fund's federal tax return is subject to examination by the Internal Revenue Service (IRS) for a period of three years.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustees compensation, capital loss carryforwards and losses deferred due to excise tax regulations.

The Funds purchase municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except ratios)

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ - |

Gross unrealized depreciation | - |

Net unrealized appreciation (depreciation) on securities and other investments | $ - |

| |

Tax cost | $ 5,205,906 |

Under the recently enacted Regulated Investment Company Modernization Act of 2010 (the Act), the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to any losses incurred in pre-enactment taxable years, which generally expire after eight years from when they are incurred. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law. The Fund's first fiscal year end subject to the Act will be February 29, 2012.