To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

Yield refers to the income paid by the Fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund.

| Variable Rate Demand Note - 34.5% | | | |

| | | Principal Amount (000s) | Value (000s) |

| Alabama - 0.4% | | | |

| Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 0.98% 9/7/17, VRDN (a)(b) | | $6,661 | $6,661 |

| West Jefferson Indl. Dev. Series 2008, 1% 9/7/17, VRDN (a) | | 4,800 | 4,800 |

| | | | 11,461 |

| Arkansas - 0.4% | | | |

| Blytheville Indl. Dev. Rev. (Nucor Corp. Proj.): | | | |

| Series 1998, 0.98% 9/7/17, VRDN (a)(b) | | 2,100 | 2,100 |

| Series 2002, 1.01% 9/7/17, VRDN (a)(b) | | 1,500 | 1,500 |

| Osceola Solid Waste Disp. Rev. (Plum Point Energy Associates, LLC Proj.) Series 2006, 0.94% 9/7/17, LOC Royal Bank of Scotland PLC, VRDN (a)(b) | | 7,100 | 7,100 |

| | | | 10,700 |

| California - 32.8% | | | |

| Alameda County Indl. Dev. Auth. Rev. (Edward L. Shimmon, Inc. Proj.) Series 1996 A, 0.86% 9/7/17, LOC BNP Paribas SA, VRDN (a)(b) | | 3,900 | 3,900 |

| California Hsg. Fin. Agcy. Rev.: | | | |

| (Multifamily Hsg. Prog.): | | | |

| Series 2001 G: | | | |

| 0.86% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 2,275 | 2,275 |

| 0.86% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 1,650 | 1,650 |

| Series 2005 D, 0.86% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 2,955 | 2,955 |

| Series 2000 N, 0.87% 9/7/17, LOC Bank of America NA, VRDN (a)(b) | | 5,375 | 5,375 |

| Series 2005 A, 0.82% 9/7/17, LOC Bank of Tokyo-Mitsubishi UFJ Ltd., VRDN (a)(b) | | 14,050 | 14,050 |

| Series 2005 B, 0.87% 9/7/17, LOC Bank of America NA, VRDN (a)(b) | | 35,765 | 35,765 |

| Series 2006 C, 0.87% 9/7/17, LOC Bank of America NA, VRDN (a)(b) | | 8,900 | 8,900 |

| California Infrastructure & Econ. Dev. Bank Rev. (Betts Spring Co. Proj.) Series 2008, 0.9% 9/7/17, LOC Bank of America NA, VRDN (a)(b) | | 6,495 | 6,495 |

| California Poll. Cont. Fing. Auth. Ctfs. of Prtn. (Pacific Gas & Elec. Co. Proj.) Series 1997 B, 0.83% 9/1/17, LOC Canadian Imperial Bank of Commerce, VRDN (a)(b) | | 37,700 | 37,700 |

| California Poll. Cont. Fing. Auth. Solid Waste Disp. Rev.: | | | |

| (Metropolitan Recycling, LLC Proj.) Series 2012 A, 0.98% 9/7/17, LOC Comerica Bank, VRDN (a)(b) | | 2,320 | 2,320 |

| (Var-Waste Connections, Inc. Proj.) Series 2007, 0.87% 9/7/17, LOC Bank of America NA, VRDN (a)(b) | | 10,100 | 10,100 |

| Series 2012 A, 0.95% 9/7/17, LOC MUFG Union Bank NA, VRDN (a)(b) | | 2,335 | 2,335 |

| California Statewide Cmntys. Dev. Auth. Indl. Dev. Rev. (Arthur Made Plastics, Inc. Proj.) Series 2000 A, 0.95% 9/7/17, LOC Bank of America NA, VRDN (a)(b) | | 800 | 800 |

| California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev.: | | | |

| (Irvine Apt. Cmntys. LP Proj.) Series 2001 W2, 0.9% 9/1/17, LOC Wells Fargo Bank NA, VRDN (a)(b) | | 19,000 | 19,000 |

| (Maple Square Apt. Proj.) Series AA, 0.85% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 5,255 | 5,255 |

| (Terraces at Park Marino Proj.) Series I, 0.9% 9/7/17, LOC Bank of The West San Francisco, VRDN (a)(b) | | 4,470 | 4,470 |

| (The Crossings at Elk Grove Apts.) Series H, 0.85% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 6,830 | 6,830 |

| Garden Grove Hsg. Auth. Multi-family Hsg. Rev. (Valley View Sr. Villas Proj.) Series 1990 A, 0.89% 9/7/17, LOC MUFG Union Bank NA, VRDN (a)(b) | | 9,100 | 9,100 |

| Los Angeles Multi-family Hsg. Rev. (Colonia Corona Apts. Proj.) Series 2004 D, 0.85% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 2,400 | 2,400 |

| Riverside County Ind. Dev. Auth. Ind. Dev. Rev. (Merrick Engineering, Inc. Proj.) 0.94% 9/7/17, LOC Wells Fargo Bank NA, VRDN (a)(b) | | 1,160 | 1,160 |

| Sacramento Hsg. Auth. Multi-family Rev. (Phoenix Park II Apts. Proj.) 0.85% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 5,971 | 5,971 |

| San Bernardino County Flood Cont. District Judgment Oblig. Series 2008, 0.82% 9/7/17, LOC Bank of America NA, VRDN (a) | | 24,845 | 24,845 |

| San Diego Hsg. Auth. Multi-family Hsg. Rev. (Delta Village Apts. Proj.) Series A, 0.9% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 5,700 | 5,700 |

| San Francisco City & County Multi-family Hsg. Rev. (8th & Howard Family Apts. Proj.) Series 2000 B, 0.85% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 3,505 | 3,505 |

| San Francisco City & County Redev. Agcy. Multi-family Hsg. Rev.: | | | |

| (Antonia Manor Apts. Proj.) Series 2000 E, 1% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 1,150 | 1,150 |

| (Mission Creek Cmnty. Proj.) Series B, 0.85% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 5,160 | 5,160 |

| (Ocean Beach Apts. Proj.) Series B, 0.86% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 1,144 | 1,144 |

| San Jose Multi-family Hsg. Rev.: | | | |

| (Betty Ann Gardens Apts. Proj.) Series 2002 A, 0.94% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 5,850 | 5,850 |

| (El Paseo Apts. Proj.) Series 2002 B, 0.94% 9/7/17, LOC Citibank NA, VRDN (a)(b) | | 4,045 | 4,045 |

| Santa Clara County Hsg. Auth. Multi-family Hsg. Rev. (Timberwood Apts. Proj.) Series B, 0.91% 9/7/17, LOC MUFG Union Bank NA, VRDN (a)(b) | | 10,335 | 10,335 |

| ABAG Fin. Auth. for Nonprofit Corps. Multi-family Hsg. Rev. (La Terrazza Apts. Proj.) Series 2002 A, 0.85% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 16,880 | 16,880 |

| FHLMC: | | | |

| Anaheim Hsg. Auth. Multi-family Hsg. Rev. (Park Vista Apt. Proj.) Series 2000 D, 0.89% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 3,600 | 3,600 |

| California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev.: | | | |

| (Bristol Apts. Proj.) Series Z, 0.89% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 9,500 | 9,500 |

| (Northwood Apts. Proj.) Series N, 0.89% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 4,600 | 4,600 |

| (Vizcaya Apts. Proj.) Series B, 0.88% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 20,505 | 20,505 |

| California Statewide Cmntys. Dev. Auth. Rev. (Oakmont Stockton Proj.) Series 1997 C, 0.89% 9/7/17, LOC Fed. Home Ln. Bank, San Francisco, VRDN (a)(b) | | 5,960 | 5,960 |

| Los Angeles Cmnty. Redev. Agcy. Multi-family Hsg. Rev. (Grand Promenade Proj.) 0.84% 9/7/17, LOC Freddie Mac, VRDN (a) | | 36,500 | 36,500 |

| Los Angeles Multi-family Hsg. Rev. (Channel Gateway Apts. Proj.) Series 1989 B, 0.87% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 67,700 | 67,700 |

| Orange County Apt. Dev. Rev. (Park Place Apts. Proj.) Series 1989 A, 0.88% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 15,400 | 15,400 |

| San Diego Hsg. Auth. Multi-family Hsg. Rev. (Villa Nueva Apts. Proj.) Series 2007 F, 0.88% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 37,500 | 37,500 |

| San Francisco Redev. Agcy. Multi-family Hsg. Rev. 0.89% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 3,000 | 3,000 |

| San Jose Multi-family Hsg. Rev.: | | | |

| (Trestles Apts. Proj.) Series 2004 A, 0.83% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 7,325 | 7,325 |

| (Turnleaf Apts. Proj.) Series 2003 A, 0.89% 9/7/17, LOC Freddie Mac, VRDN (a)(b) | | 15,090 | 15,090 |

| FNMA: | | | |

| California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev.: | | | |

| (Canyon Creek Apts. Proj.) Series 1995 C, 0.89% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 38,800 | 38,800 |

| (Coventry Place Apts. Proj.) Series 2002 JJ, 0.86% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 6,035 | 6,035 |

| (River Run Sr. Apts. Proj.) Series LL, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 13,505 | 13,505 |

| (Salvation Army S.F. Proj.) 0.87% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 15,005 | 15,005 |

| (The Belmont Proj.) Series 2005 F, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 19,890 | 19,890 |

| (The Crossings Sr. Apts./ Phase II Proj.) Series J, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 11,100 | 11,100 |

| (Valley Palms Apts. Proj.) Series 2002 C, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 25,500 | 25,500 |

| (Villas at Hamilton Apts. Proj.) Series 2001 HH, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 11,300 | 11,300 |

| (Vista Del Monte Proj.) Series QQ, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 12,050 | 12,050 |

| (Wilshire Court Proj.): | | | |

| Series AAA, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 3,100 | 3,100 |

| Series M, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 20,290 | 20,290 |

| Series 2003 DD, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 14,600 | 14,600 |

| Emeryville Redev. Agcy. Multi-family Hsg. Rev. Series 2002 A, 0.9% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 30,000 | 30,000 |

| Los Angeles Cmnty. Redev. Agcy. Multi-family Hsg. Rev. (Hollywood & Vine Apts. Proj.) Series A, 0.85% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 28,700 | 28,700 |

| Orange County Apt. Dev. Rev.: | | | |

| (Ladera Apts. Proj.) Series 2001 II B, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 23,500 | 23,500 |

| (Wood Canyon Villas Proj.) Series 2001 E, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 16,000 | 16,000 |

| Pleasanton Multi-family Rev. (Bernal Apts. Proj.) Series A, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 13,750 | 13,750 |

| Richmond Multifamily Hsg. Rev. (Baycliff Apts. Proj.) Series 2004 A, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 26,490 | 26,490 |

| Sacramento County Hsg. Auth. Multi-family Hsg. Rev. (California Place Apts. Proj.) Series B, 0.86% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 3,755 | 3,755 |

| Sacramento Hsg. Auth. Multi-family Rev. (Valencia Point Apts. Proj.) Series 2006 I, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 4,900 | 4,900 |

| Sacramento Redev. Agcy. Multi-family Hsg. Rev. (18th & L Apts. Proj.) Series 2002 E, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 21,075 | 21,075 |

| San Diego Hsg. Auth. Multi-family Hsg. Rev. (Bay Vista Apts. Proj.) Series A, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 14,500 | 14,500 |

| San Jose Multi-family Hsg. Rev.: | | | |

| (Alamaden Family Apts. Proj.) Series 2003 D, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 24,615 | 24,615 |

| (Almaden Lake Village Apt. Assoc. Proj.) Series 1997 A, 0.9% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 15,000 | 15,000 |

| (Kennedy Apt. Homes Proj.) Series 2002 K, 0.89% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 7,975 | 7,975 |

| Santa Cruz Redev. Agcy. Multi-family Rev.: | | | |

| (1010 Pacific Ave. Apts. Proj.) Series B, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 21,275 | 21,275 |

| (Shaffer Road Apts. Proj.) Series A, 0.88% 9/7/17, LOC Fannie Mae, VRDN (a)(b) | | 29,925 | 29,925 |

| | | | 966,735 |

| Delaware - 0.0% | | | |

| Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1993 C, 0.97% 9/7/17, VRDN (a) | | 1,200 | 1,200 |

| Indiana - 0.2% | | | |

| Indiana Dev. Fin. Auth. Envir. Rev. (PSI Energy Proj.): | | | |

| Series 2003 A, 0.94% 9/7/17, VRDN (a)(b) | | 200 | 200 |

| Series 2003 B, 0.95% 9/7/17, VRDN (a)(b) | | 4,620 | 4,620 |

| Lawrenceburg Poll. Cont. Rev. (Indiana Michigan Pwr. Co. Proj.): | | | |

| Series H, 0.94% 9/7/17, VRDN (a) | | 1,900 | 1,900 |

| Series I, 0.94% 9/7/17, VRDN (a) | | 900 | 900 |

| | | | 7,620 |

| North Carolina - 0.0% | | | |

| Hertford County Indl. Facilities Poll. Cont. Fing. Auth. (Nucor Corp. Proj.) Series 2000 A, 1.01% 9/7/17, VRDN (a)(b) | | 1,000 | 1,000 |

| Texas - 0.2% | | | |

| Jewett Econ. Dev. Corp. Indl. Dev. Rev. (Nucor Corp. Proj.) 0.98% 9/7/17, VRDN (a)(b) | | 3,450 | 3,450 |

| Port Arthur Navigation District Jefferson County Rev. Series 2000 B, 0.95% 9/7/17 (Total SA Guaranteed), VRDN (a)(b) | | 1,300 | 1,300 |

| | | | 4,750 |

| West Virginia - 0.5% | | | |

| Marion County Solid Waste Disp. Rev. (Grant Town Cogeneration Proj.) Series 1990 D, 0.9% 9/7/17, LOC Deutsche Bank AG, VRDN (a)(b) | | 800 | 800 |

| West Virginia Econ. Dev. Auth. Solid Waste Disp. Facilities Rev.: | | | |

| (Appalachian Pwr. Co. - Amos Proj.) Series 2008 B, 1.03% 9/7/17, VRDN (a)(b) | | 6,100 | 6,100 |

| (Appalachian Pwr. Co.- Mountaineer Proj.) Series 2008 A, 1% 9/7/17, VRDN (a)(b) | | 6,800 | 6,800 |

| | | | 13,700 |

| TOTAL VARIABLE RATE DEMAND NOTE | | | |

| (Cost $1,017,166) | | | 1,017,166 |

|

| Tender Option Bond - 37.2% | | | |

| California - 36.3% | | | |

| Academy of Motion Picture Arts Participating VRDN Series 2017, 0.82% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 5,300 | 5,300 |

| Bay Area Toll Auth. San Francisco Bay Toll Bridge Rev. Participating VRDN: | | | |

| Series 16 XM 0234, 1% 9/7/17 (Liquidity Facility Bank of America NA) (a)(c) | | 6,125 | 6,125 |

| Series 16 XM 0244, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 4,995 | 4,995 |

| Series 17 XX 1045, 0.8% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 10,035 | 10,035 |

| Series 2017, 0.8% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 5,390 | 5,390 |

| Series Floaters XG 01 32, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 13,325 | 13,325 |

| Series Floaters XM 05 28, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,850 | 2,850 |

| Series XF 10 44, 0.84% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 11,950 | 11,950 |

| Burbank Unified School District Participating VRDN Series Floaters XF 22 92, 0.81% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 4,320 | 4,320 |

| California Edl. Facilities Auth. Rev. Participating VRDN: | | | |

| Series 16 XM 0146, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 12,010 | 12,010 |

| Series 16 XM0194, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 5,965 | 5,965 |

| Series Floaters XF 23 77, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 12,575 | 12,575 |

| Series MS 3346, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 9,330 | 9,330 |

| Series XF 24 00, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 2,790 | 2,790 |

| California Gen. Oblig. Participating VRDN: | | | |

| Series 15 XF 1039, 0.81% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 38,500 | 38,500 |

| Series 15 XF0129, 0.81% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 7,500 | 7,500 |

| Series 15 XF2161, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,035 | 7,035 |

| Series 15 XF2171, 0.81% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 11,240 | 11,240 |

| Series 16 ZM0201, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 5,120 | 5,120 |

| Series DB XF 1041, 0.81% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 25,490 | 25,490 |

| Series Floaters XF 23 72, 0.8% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 3,300 | 3,300 |

| Series Floaters XX 10 57, 0.8% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 2,235 | 2,235 |

| Series Floaters YX 10 30, 0.81% 9/7/17 (Liquidity Facility Barclays Bank PLC)(a)(c) | | 6,820 | 6,820 |

| California Health Facilities Fing. Auth. Participating VRDN: | | | |

| Series 16 XG 00 49, 0.81% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 26,675 | 26,675 |

| Series 16 XXF0440, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,100 | 3,100 |

| Series 2017 XF 2417, 0.81% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 11,875 | 11,875 |

| Series Floaters 013, 0.97% 10/12/17 (Liquidity Facility Barclays Bank PLC) (a)(c)(d) | | 7,800 | 7,800 |

| Series Floaters XF 24 67, 0.81% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 3,200 | 3,200 |

| Series Floaters XG 01 20, 0.8% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 12,200 | 12,200 |

| Series Floaters XG 01 25, 0.82% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 13,700 | 13,700 |

| Series Floaters XL 00 45, 0.82% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 1,600 | 1,600 |

| Series Floaters YX 10 33, 0.81% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 4,500 | 4,500 |

| Series Floaters ZM 05 43, 0.84% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 2,600 | 2,600 |

| California Health Facilities Fing. Auth. Rev. Participating VRDN: | | | |

| Series 15 XF0120, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 14,720 | 14,720 |

| Series 15 XF2119, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,995 | 7,995 |

| Series 2015 ZF0213, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 7,500 | 7,500 |

| Series DB 15 XF 0234, 0.81% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 18,480 | 18,480 |

| Series Floaters XG 01 04, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 13,867 | 13,867 |

| Series Floaters XM 03 01, 0.81% 9/7/17 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 5,100 | 5,100 |

| Series MS 3239, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 22,800 | 22,800 |

| Series MS 3267, 0.82% 9/7/17 (Liquidity Facility Cr. Suisse AG) (a)(c) | | 27,375 | 27,375 |

| Series MS 3301, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,330 | 7,330 |

| California St. Univ. Rev. Participating VRDN Series XM 0306, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,600 | 7,600 |

| California State Univ. Rev. Participating VRDN Series 16 ZM0199, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 4,000 | 4,000 |

| California Statewide Cmntys. Dev. Auth. Multi-family Hsg. Rev. Participating VRDN Series Floaters 02 144A, 0.86% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(b)(c) | | 23,910 | 23,910 |

| California Statewide Cmntys. Dev. Auth. Rev. Participating VRDN: | | | |

| Series 2017: | | | |

| 0.82% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 4,530 | 4,530 |

| 0.91% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 13,550 | 13,550 |

| Series ROC II R 14001, 0.8% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 2,375 | 2,375 |

| Series XF 23 59, 0.82% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 5,925 | 5,925 |

| Chaffey Unified High School District Participating VRDN Series Floaters XF 05 48, 0.82% 9/7/17 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 3,400 | 3,400 |

| Culver City Calif Unified School District Bonds Series Solar 17 10, SIFMA Municipal Swap Index + 0.050% 0.84%, tender 9/7/17 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(c)(e) | | 3,440 | 3,440 |

| Dept. of Arpts. of the City of LA Participating VRDN Series YX 10 01, 0.84% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(b)(c) | | 4,690 | 4,690 |

| Dept. of Wtr. and Pwr. of Los Angeles Participating VRDN Series XM 03 65, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,500 | 7,500 |

| Dignity Health Participating VRDN Series 17 04, 0.87% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 40,470 | 40,470 |

| East Bay Muni. Util. District Participating VRDN Series XM 02 94, 0.81% 9/7/17 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 6,800 | 6,800 |

| East Bay Muni. Util. District Wastewtr. Sys. Rev. Participating VRDN: | | | |

| Series 2015 XF0190, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 1,835 | 1,835 |

| Series EGL1310, 0.83% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 21,700 | 21,700 |

| Series MS 3250, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,500 | 7,500 |

| Eastern Muni. Wtr. District Fing. W Participating VRDN: | | | |

| Series Floaters XG 01 24, 0.8% 9/7/17 (Liquidity Facility Bank of America NA) (a)(c) | | 2,100 | 2,100 |

| Series Floaters ZM 05 10, 0.8% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 1,800 | 1,800 |

| El Camino Hosp. Participating VRDN Series 2017 XF 2415, 0.82% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 3,375 | 3,375 |

| Elk Grove Unified School District: | | | |

| Bonds Series Solar 17 0033, SIFMA Municipal Swap Index + 0.150% 0.94%, tender 11/30/17 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(c)(e) | | 2,100 | 2,100 |

| Participating VRDN Series Floaters XG 01 27, 0.8% 9/7/17 (Liquidity Facility Bank of America NA) (a)(c) | | 3,125 | 3,125 |

| Fillmore Calif Wastewtr. Rev. Participating VRDN Series Floaters XF 24 70, 0.82% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 3,035 | 3,035 |

| Foothill-De Anza Cmnty. College District: | | | |

| Bonds Series WF 11 68C, SIFMA Municipal Swap Index + 0.280% 1.07%, tender 2/8/18 (Liquidity Facility Wells Fargo Bank NA) (a)(c)(e)(f) | | 8,815 | 8,815 |

| Participating VRDN: | | | |

| Series 15 ZF2116, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,500 | 7,500 |

| Series MS 3268 X, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 5,000 | 5,000 |

| Series MS 3288, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 8,400 | 8,400 |

| Series ROC II R 14066, 0.82% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 3,500 | 3,500 |

| Garvey School District Participating VRDN Series Floaters XF 26 60, 0.99% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 2,900 | 2,900 |

| Grossmont Healthcare District Participating VRDN Series MS 3253, 0.82% 9/7/17 (Liquidity Facility Cr. Suisse AG) (a)(c) | | 14,375 | 14,375 |

| Grossmont Union High School District Participating VRDN Series 16 ZF0317, 0.99% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 1,000 | 1,000 |

| Huntington Beach City Bonds Series Solar 17 0029, SIFMA Municipal Swap Index + 0.150% 0.94%, tender 11/30/17 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(c)(e) | | 2,100 | 2,100 |

| Long Beach Unified School District Participating VRDN Series 2017, 0.81% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 17,360 | 17,360 |

| Los Angeles Cmnty. College District Participating VRDN: | | | |

| Series 16 ZF0315, 0.84% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 7,425 | 7,425 |

| Series 16 ZF0327, 0.84% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,885 | 5,885 |

| Series MS 3096, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 9,600 | 9,600 |

| Series ROC II R 11773, 0.8% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 19,575 | 19,575 |

| 0.81% 9/7/17 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 5,800 | 5,800 |

| Los Angeles County Pub. Works Fing. Auth. Lease Rev. Participating VRDN Series ZF 01 84, 0.89% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,645 | 3,645 |

| Los Angeles Dept. Arpt. Rev. Participating VRDN: | | | |

| Series 16 XL0005, 0.81% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 2,300 | 2,300 |

| Series ROC II R 11842, 0.81% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 6,750 | 6,750 |

| Series ZM 04 73, 0.84% 9/7/17 (Liquidity Facility Royal Bank of Canada) (a)(b)(c) | | 2,605 | 2,605 |

| Series ZM 04 87, 0.84% 9/7/17 (Liquidity Facility Royal Bank of Canada) (a)(b)(c) | | 1,470 | 1,470 |

| 0.85% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(b)(c) | | 7,645 | 7,645 |

| Los Angeles Dept. of Wtr. & Pwr. Rev. Participating VRDN: | | | |

| Series 16 XF 04 87, 0.82% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,500 | 2,500 |

| Series Floaters XM 03 79, 0.81% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,665 | 3,665 |

| Series MS 3289, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,335 | 7,335 |

| Series MS 3345, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 16,060 | 16,060 |

| Series Putters 0039, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,750 | 3,750 |

| Series XG 0110, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 4,100 | 4,100 |

| Los Angeles Dept. of Wtr. & Pwr. Wtrwks. Rev. Participating VRDN: | | | |

| Series 0018, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 7,500 | 7,500 |

| Series Floaters XG 01 21, 0.8% 9/7/17 (Liquidity Facility Bank of America NA) (a)(c) | | 2,100 | 2,100 |

| Series Floaters ZM 04 68, 0.81% 9/7/17 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 5,800 | 5,800 |

| Series MS 3397, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 9,770 | 9,770 |

| Series MS 3403, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 8,975 | 8,975 |

| Los Angeles Hbr. Dept. Rev.: | | | |

| Bonds Series WF 10 40C, SIFMA Municipal Swap Index + 0.280% 1.07%, tender 3/1/18 (Liquidity Facility Wells Fargo Bank NA) (a)(c)(e)(f) | | 5,400 | 5,400 |

| Participating VRDN Series 15 ZF0158, 0.87% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 5,280 | 5,280 |

| Los Angeles Wastewtr. Sys. Rev. Participating VRDN: | | | |

| Series 15 ZF0243, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,430 | 5,430 |

| Series ROC II R 14059, 0.81% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 6,000 | 6,000 |

| Lucia Mar Unified School District Participating VRDN Series 2017, 0.82% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 4,700 | 4,700 |

| Lucile Salter Packrd Chil Hosp. Participating VRDN Series Floaters XG 01 48, 0.84% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 3,515 | 3,515 |

| Metropolitan Wtr. District of Southern California Wtr. Rev. Participating VRDN Series Floaters XM 04 23, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 10,940 | 10,940 |

| Newport Mesa Unified School District Bonds Series WF 11 70Z, SIFMA Municipal Swap Index + 0.280% 1.07%, tender 3/1/18 (Liquidity Facility Wells Fargo Bank NA) (a)(c)(e)(f) | | 370 | 370 |

| Oakland Gen. Oblig. Bonds Series Solar 0046, SIFMA Municipal Swap Index + 0.050% 0.83%, tender 9/7/17 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(c)(e) | | 1,600 | 1,600 |

| Orange County Sanitation District Ctfs. of Prtn. Participating VRDN Series MS 3030, 0.82% 9/7/17 (Liquidity Facility Cr. Suisse AG) (a)(c) | | 9,765 | 9,765 |

| Rancho Wtr. District Fing. Auth. Rev. Participating VRDN Series Floaters XF 23 67, 0.8% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 3,200 | 3,200 |

| Sacramento Area Flood Cont. Agcy. Participating VRDN: | | | |

| Series Floaters XM 04 55, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 3,900 | 3,900 |

| Series Floaters YX 10 37, 0.81% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 3,540 | 3,540 |

| Series Floaters ZM 04 57, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 4,930 | 4,930 |

| Series Floaters ZM 04 58, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 8,500 | 8,500 |

| San Diego Cmnty. College District: | | | |

| Bonds Series WF11 87C, SIFMA Municipal Swap Index + 0.300% 0.99%, tender 9/28/17 (Liquidity Facility Wells Fargo Bank NA) (a)(c)(e)(f) | | 9,910 | 9,910 |

| Participating VRDN Series XM 0149, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 2,300 | 2,300 |

| San Diego County Wtr. Auth. Wtr. Rev. Participating VRDN Series 16 ZF0441, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 6,810 | 6,810 |

| San Diego Pub. Facilities Fing. Auth. Swr. Rev. Participating VRDN 0.89% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 1,875 | 1,875 |

| San Diego Pub. Facilities Fing. Auth. Wtr. Rev. Participating VRDN Series 15 XF0098, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,565 | 5,565 |

| San Diego Unified School District Participating VRDN Series MS 3330, 0.82% 9/7/17 (Liquidity Facility Cr. Suisse AG) (a)(c) | | 5,940 | 5,940 |

| San Francisco Bay Area Rapid Transit District Sales Tax Rev. Participating VRDN Series ROC II R 14035, 0.81% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 4,000 | 4,000 |

| San Francisco Bay Area Rapid Transit Fing. Auth. Participating VRDN Series floaters XX 10 51, 0.8% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 2,300 | 2,300 |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev. Participating VRDN: | | | |

| Series 2015 XF 1033, 0.84% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(b)(c) | | 10,340 | 10,340 |

| Series XF 10 32, 0.84% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 5,921 | 5,921 |

| Santa Monica Cmnty. College District Gen. Oblig. Participating VRDN Series 15 XF2169, 0.81% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 4,800 | 4,800 |

| South San Francisco Calif District Bonds Series 2016, SIFMA Municipal Swap Index + 0.050% 0.84%, tender 9/7/17 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(c)(e) | | 5,160 | 5,160 |

| Sunnyvale School District Bonds Series 2016 18, SIFMA Municipal Swap Index + 0.050% 0.84%, tender 9/7/17 (Liquidity Facility U.S. Bank NA, Cincinnati) (a)(c)(e) | | 7,940 | 7,940 |

| Sweetwater Union High School District Participating VRDN Series Floaters XF 24 62, 0.89% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 2,530 | 2,530 |

| The Regents of the Univ. of California Participating VRDN: | | | |

| Series XM 03 46, 0.82% 9/7/17 (Liquidity Facility Wells Fargo Bank NA) (a)(c) | | 7,500 | 7,500 |

| Series XM 03 47, 0.82% 9/7/17 (Liquidity Facility Wells Fargo Bank NA) (a)(c) | | 3,750 | 3,750 |

| Series XM 03 58, 0.81% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,000 | 2,000 |

| Series XM 03 66, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 8,925 | 8,925 |

| The Regents of the Univ. of California Gen. Rev. Participating VRDN Series Floaters XM 03 90, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,000 | 5,000 |

| Trustees of the California State Univ. Participating VRDN Series ZM 00 90, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,580 | 3,580 |

| Univ. of California Regts. Med. Ctr. Pooled Rev. Participating VRDN: | | | |

| Series Floaters XX 10 23, 0.8% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 2,935 | 2,935 |

| Series Floaters ZF 23 62, 0.8% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 14,120 | 14,120 |

| Univ. of California Revs. Participating VRDN: | | | |

| Series 16 XL0001, 0.81% 9/7/17 (Liquidity Facility Barclays Bank PLC)(a)(c) | | 10,250 | 10,250 |

| Series Floaters XM 04 13, 0.8% 9/7/17 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 12,500 | 12,500 |

| Series Floaters XM 04 34, 0.81% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 1,000 | 1,000 |

| Series MS 3066, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 8,021 | 8,021 |

| Series MS 3396, 0.82% 9/7/17 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 7,830 | 7,830 |

| Wells Fargo Stage Trs Var States Bonds Series 86C, SIFMA Municipal Swap Index + 0.270% 1.06%, tender 9/14/17 (Liquidity Facility Wells Fargo Bank NA) (a)(b)(c)(e)(f) | | 12,985 | 12,985 |

| | | | 1,069,439 |

| Colorado - 0.1% | | | |

| Colorado Health Facilities Auth. Rev. Participating VRDN Series Floaters XF 22 41, 0.99% 9/7/17 (Liquidity Facility Citibank NA) (a)(c) | | 1,550 | 1,550 |

| Connecticut - 0.2% | | | |

| Connecticut Gen. Oblig. Participating VRDN Series Floaters 014, 0.97% 10/12/17 (Liquidity Facility Barclays Bank PLC) (a)(c)(d) | | 5,600 | 5,600 |

| Illinois - 0.1% | | | |

| Chicago Transit Auth. Participating VRDN Series Floaters XM 04 50, 0.86% 9/7/17 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 2,700 | 2,700 |

| Montana - 0.3% | | | |

| Missoula Mont Wtr. Sys. Rev. Participating VRDN Series Floaters 011, 0.97% 10/12/17 (Liquidity Facility Barclays Bank PLC) (a)(c)(d) | | 9,500 | 9,500 |

| Nebraska - 0.1% | | | |

| Omaha Pub. Pwr. District Elec. Rev. Participating VRDN Series 16 XF1053, 0.86% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 2,100 | 2,100 |

| New Jersey - 0.0% | | | |

| New Jersey St. Trans. Trust Fund Auth. Participating VRDN Series Floaters 16 XF1059, 0.96% 9/7/17 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 1,400 | 1,400 |

| Ohio - 0.1% | | | |

| Ohio Higher Edl. Facility Commission Rev. Participating VRDN Series 2017, 0.97% 10/12/17 (Liquidity Facility Barclays Bank PLC) (a)(c)(d) | | 1,600 | 1,600 |

| TOTAL TENDER OPTION BOND | | | |

| (Cost $1,093,889) | | | 1,093,889 |

|

| Other Municipal Security - 25.2% | | | |

| California - 23.3% | | | |

| California Gen. Oblig.: | | | |

| Bonds Series 2016, 5% 9/1/17 | | 17,400 | 17,400 |

| Series 11A2, 0.88% 11/2/17, LOC Royal Bank of Canada, CP | | 13,000 | 13,000 |

| Series A-3, 0.87% 9/6/17, LOC MUFG Union Bank NA, CP | | 17,700 | 17,700 |

| Series A1, 0.88% 10/3/17, LOC Wells Fargo Bank NA, CP | | 9,200 | 9,200 |

| Series A3, 0.95% 9/7/17, LOC MUFG Union Bank NA, CP | | 13,500 | 13,500 |

| Series A7, 0.86% 11/15/17, LOC Mizuho Corporate Bank Ltd., CP | | 21,055 | 21,055 |

| Series A8, 0.84% 9/8/17, LOC Bank of The West San Francisco, CP | | 18,200 | 18,200 |

| 0.87% 9/6/17, LOC Royal Bank of Canada, CP | | 11,100 | 11,100 |

| California Health Facilities Fing. Auth. Rev. Bonds (Stanford Hosp. & Clinics Proj.) Series 2012 C, SIFMA Municipal Swap Index + 0.250% 1.04%, tender 3/29/18 (a)(e) | | 51,900 | 51,900 |

| California Statewide Cmntys. Dev. Auth. Gas Supply Rev. Bonds: | | | |

| Series 2010 A, SIFMA Municipal Swap Index + 0.100% 0.89%, tender 11/1/17 (Liquidity Facility Royal Bank of Canada) (a)(e) | | 167,000 | 166,999 |

| Series 2010 B, SIFMA Municipal Swap Index + 0.100% 0.89%, tender 11/1/17 (Liquidity Facility Royal Bank of Canada) (a)(e) | | 118,800 | 118,800 |

| East Bay Muni. Util. District Wastewtr. Sys. Rev.: | | | |

| Series A1: | | | |

| 0.8% 9/5/17 (Liquidity Facility Sumitomo Mitsui Banking Corp.), CP | | 8,400 | 8,400 |

| 0.85% 9/7/17 (Liquidity Facility Sumitomo Mitsui Banking Corp.), CP | | 5,800 | 5,800 |

| 0.87% 10/4/17 (Liquidity Facility Sumitomo Mitsui Banking Corp.), CP | | 6,500 | 6,500 |

| 0.89% 11/2/17 (Liquidity Facility Sumitomo Mitsui Banking Corp.), CP | | 5,800 | 5,800 |

| 0.92% 9/6/17 (Liquidity Facility Sumitomo Mitsui Banking Corp.), CP | | 6,600 | 6,600 |

| 0.92% 9/7/17 (Liquidity Facility Sumitomo Mitsui Banking Corp.), CP | | 2,700 | 2,700 |

| Series A2, 0.86% 10/4/17 (Liquidity Facility Bank of America NA), CP | | 7,800 | 7,800 |

| Los Angeles County Cap. Asset Leasing Corp. Lease Rev. Series B: | | | |

| 0.91% 9/7/17, LOC U.S. Bank NA, Cincinnati, CP | | 16,900 | 16,900 |

| 0.94% 9/6/17, LOC U.S. Bank NA, Cincinnati, CP | | 7,700 | 7,700 |

| Los Angeles County Metropolitan Trans. Auth. Sales Tax Rev. Series ATE: | | | |

| 0.82% 9/20/17, LOC Citibank NA, CP | | 2,500 | 2,500 |

| 0.83% 10/2/17, LOC Citibank NA, CP | | 5,333 | 5,333 |

| 0.84% 11/2/17, LOC Citibank NA, CP | | 5,567 | 5,567 |

| 0.91% 10/10/17, LOC MUFG Union Bank NA, CP | | 1,600 | 1,600 |

| 0.93% 9/12/17, LOC Sumitomo Mitsui Banking Corp., CP | | 11,500 | 11,500 |

| Los Angeles Dept. Arpt. Rev. Series B4, 1% 9/6/17, LOC Wells Fargo Bank NA, CP (b) | | 3,081 | 3,081 |

| Los Angeles Dept. of Wtr. & Pwr. Rev. Series 2017, 0.99% 1/23/18 (Liquidity Facility Royal Bank of Canada), CP | | 30,300 | 30,300 |

| Los Angeles Muni. Impt. Corp. Lease Rev.: | | | |

| Series 09A2, 0.91% 9/12/17, LOC Bank of America NA, CP | | 4,300 | 4,300 |

| Series 11A3: | | | |

| 0.84% 9/11/17, LOC Bank of The West San Francisco, CP | | 12,900 | 12,900 |

| 0.85% 10/4/17, LOC Bank of The West San Francisco, CP | | 3,200 | 3,200 |

| 0.88% 9/14/17, LOC Bank of The West San Francisco, CP | | 7,900 | 7,900 |

| Series 13A4: | | | |

| 0.91% 9/12/17, LOC U.S. Bank NA, Cincinnati, CP | | 4,500 | 4,500 |

| 0.91% 9/12/17, LOC U.S. Bank NA, Cincinnati, CP | | 2,000 | 2,000 |

| 0.92% 9/12/17, LOC U.S. Bank NA, Cincinnati, CP | | 4,700 | 4,700 |

| 1% 2/1/18, LOC U.S. Bank NA, Cincinnati, CP | | 4,900 | 4,900 |

| Series A1, 0.91% 9/6/17, LOC Wells Fargo Bank NA, CP | | 6,400 | 6,400 |

| Sacramento Muni. Util. District Elec. Rev. Series L1, 0.95% 9/6/17, LOC Barclays Bank PLC, CP | | 18,400 | 18,400 |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev.: | | | |

| Series A4, 0.85% 10/4/17, LOC Wells Fargo Bank NA, CP (b) | | 17,000 | 17,000 |

| Series B4, 0.89% 12/7/17, LOC Wells Fargo Bank NA, CP | | 6,400 | 6,400 |

| San Francisco City & County Gen. Oblig. Series 3, 0.9% 9/6/17, LOC State Street Bank & Trust Co., Boston, CP | | 7,986 | 7,986 |

| | | | 687,521 |

| Georgia - 0.5% | | | |

| Main Street Natural Gas, Inc. Georgia Gas Proj. Rev. Bonds Series 2010 A1, SIFMA Municipal Swap Index + 0.100% 0.89%, tender 12/1/17 (Liquidity Facility Royal Bank of Canada) (a)(e) | | 13,825 | 13,825 |

| Kentucky - 0.1% | | | |

| Jefferson County Poll. Cont. Rev. Bonds Series 2001 A, 0.93% tender 10/3/17, CP mode | | 2,100 | 2,100 |

| Massachusetts - 0.4% | | | |

| Massachusetts Indl. Fin. Agcy. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.): | | | |

| Series 1992, 1% tender 9/5/17, CP mode | | 2,100 | 2,100 |

| Series 1993 A, 1% tender 10/6/17, CP mode | | 5,900 | 5,900 |

| Series 93B, 0.98% tender 9/28/17, CP mode | | 2,400 | 2,400 |

| | | | 10,400 |

| New Hampshire - 0.7% | | | |

| New Hampshire Bus. Fin. Auth. Poll. Cont. Rev. Bonds: | | | |

| (New England Pwr. Co. Proj.) Series 1990 B, 0.95% tender 9/11/17, CP mode | | 4,100 | 4,100 |

| Series 1990 A: | | | |

| 1.05% tender 10/13/17, CP mode (b) | | 7,200 | 7,200 |

| 1.07% tender 9/5/17, CP mode (b) | | 2,490 | 2,490 |

| Series A1, 1.03% tender 9/7/17, CP mode (b) | | 6,200 | 6,200 |

| | | | 19,990 |

| Virginia - 0.1% | | | |

| Halifax County Indl. Dev. Auth. Poll. Cont. Rev. Bonds Series 1992, 1.03% tender 9/14/17, CP mode (b) | | 3,700 | 3,700 |

| West Virginia - 0.1% | | | |

| Grant County Cmnty. Solid Waste Disp. Rev. Bonds Series 96, 1.07% tender 9/5/17, CP mode (b) | | 3,000 | 3,000 |

| TOTAL OTHER MUNICIPAL SECURITY | | | |

| (Cost $740,536) | | | 740,536 |

| | | Shares (000s) | Value (000s) |

|

| Investment Company - 2.7% | | | |

| Fidelity Municipal Cash Central Fund, 0.88% (g)(h) | | | |

| (Cost $80,052) | | 80,052 | 80,052 |

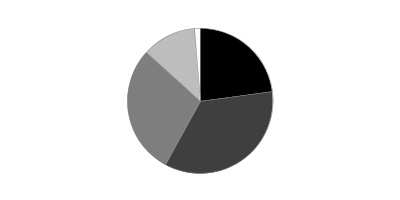

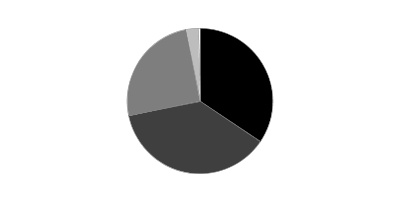

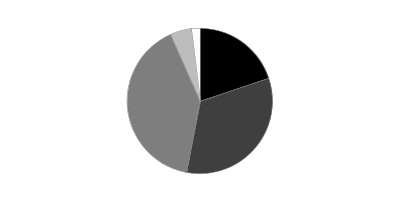

| TOTAL INVESTMENT IN SECURITIES - 99.6% | | | |

| (Cost $2,931,643) | | | 2,931,643 |

| NET OTHER ASSETS (LIABILITIES) - 0.4% | | | 13,125 |

| NET ASSETS - 100% | | | $2,944,768 |

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(c) Provides evidence of ownership in one or more underlying municipal bonds.

(d) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $24,500,000 or 0.8% of net assets.

(e) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(f) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $37,480,000 or 1.3% of net assets.

(g) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund.

(h) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

1. Organization.

Fidelity California Municipal Money Market Fund (the Fund) is a fund of Fidelity California Municipal Trust II (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust. Shares of the Fund are only available for purchase by retail shareholders. The Fund may be affected by economic and political developments in the state of California.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustees compensation.

The Fund purchases municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

As of period end, the cost and unrealized appreciation (depreciation) in securities for federal income tax purposes were as follows:

4. Fees and Other Transactions with Affiliates.

5. Expense Reductions.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $1.

In addition, during the period the investment adviser reimbursed and/or waived a portion of operating expenses in the amount of $11.

6. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2017 to August 31, 2017).

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

245 Summer St.