UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6398

Fidelity New York Municipal Trust II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | January 31 |

| |

Date of reporting period: | January 31, 2016 |

Item 1.

Reports to Stockholders

Fidelity® New York Municipal Money Market Fund

Annual Report January 31, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary/Performance (Unaudited)

Effective Maturity Diversification

| Days | % of fund's investments 1/31/16 | % of fund's investments 7/31/15 | % of fund's investments 1/31/15 |

| 1 - 7 | 74.2 | 71.0 | 69.4 |

| 8 - 30 | 5.4 | 3.2 | 3.6 |

| 31 - 60 | 2.3 | 7.9 | 5.5 |

| 61 - 90 | 1.7 | 5.0 | 2.6 |

| 91 - 180 | 11.8 | 2.1 | 14.5 |

| > 180 | 4.6 | 10.8 | 4.4 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940.

Weighted Average Maturity

| | 1/31/16 | 7/31/15 | 1/31/15 |

| Fidelity New York Municipal Money Market Fund | 36 Days | 42 Days | 41 Days |

| New York Tax-Free Money Market Funds Average(a) | 27 Days | 37 Days | 34 Days |

(a) Source: iMoneyNet, Inc.

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM.

Weighted Average Life

| | 1/31/16 | 7/31/15 | 1/31/15 |

| Fidelity New York Municipal Money Market Fund | 39 Days | 43 Days | 41 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security.

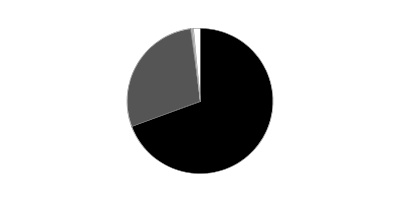

Asset Allocation (% of fund's net assets)

| As of January 31, 2016 |

| | Variable Rate Demand Notes (VRDNs) | 69.3% |

| | Other Municipal Debt | 28.7% |

| | Investment Companies | 0.5% |

| | Net Other Assets (Liabilities) | 1.5% |

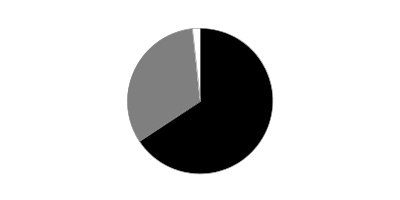

| As of July 31, 2015 |

| | Variable Rate Demand Notes (VRDNs) | 65.9% |

| | Other Municipal Debt | 32.8% |

| | Investment Companies | 1.7% |

| | Net Other Assets (Liabilities)* | (0.4)% |

* Net Other Assets (Liabilities) are not included in the pie chart

Current And Historical 7-Day Yields

| | 1/31/16 | 10/31/15 | 7/31/15 | 4/30/15 | 1/31/15 |

| Fidelity® New York Municipal Money Market Fund | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

Yield refers to the income paid by the Fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending January 31, 2016, the most recent period shown in the table, would have been -0.39%.

Investments January 31, 2016

Showing Percentage of Net Assets

| Variable Rate Demand Note - 69.3% | | | |

| | | Principal Amount | Value |

| Alabama - 0.2% | | | |

| Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 0.42% 2/5/16, VRDN (a)(b) | | $3,200,000 | $3,200,000 |

| Mobile Indl. Dev. Board Poll. Cont. Rev. (Alabama Pwr. Co. Barry Plant Proj.) Series 2007 C, 0.06% 2/5/16, VRDN (a) | | 5,750,000 | 5,750,000 |

| | | | 8,950,000 |

| Arizona - 0.0% | | | |

| Maricopa County Poll. Cont. Rev. (Arizona Pub. Svc. Co. Palo Verde Proj.) Series 2009 A, 0.2% 2/5/16, VRDN (a) | | 1,900,000 | 1,900,000 |

| Arkansas - 0.1% | | | |

| Blytheville Indl. Dev. Rev. (NUCOR Corp. Proj.) Series 1998, 0.42% 2/5/16, VRDN (a)(b) | | 1,600,000 | 1,600,000 |

| Osceola Solid Waste Disp. Rev. (Plum Point Energy Associates, LLC Proj.) Series 2006, 0.06% 2/5/16, LOC Royal Bank of Scotland PLC, VRDN (a)(b) | | 4,600,000 | 4,600,000 |

| | | | 6,200,000 |

| Delaware - 0.0% | | | |

| Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.): | | | |

| Series 1987, 0.1% 2/1/16, VRDN (a)(b) | | 300,000 | 300,000 |

| Series 1994, 0.1% 2/1/16, VRDN (a)(b) | | 1,100,000 | 1,100,000 |

| | | | 1,400,000 |

| Florida - 0.0% | | | |

| Tamarac Indl. Dev. Rev. (Fazio Hldgs. LP Proj.) Series 2000, 0.2% 2/5/16, LOC Wells Fargo Bank NA, VRDN (a)(b) | | 200,000 | 200,000 |

| Georgia - 0.6% | | | |

| Bartow County Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Bowen Proj.) First Series 2009, 0.17% 2/5/16, VRDN (a) | | 9,250,000 | 9,250,000 |

| Burke County Indl. Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Vogtle Proj.): | | | |

| Eighth Series 1994, 0.2% 2/1/16, VRDN (a) | | 3,800,000 | 3,800,000 |

| Second Series 1995, 0.18% 2/1/16, VRDN (a) | | 2,000,000 | 2,000,000 |

| Series 2012, 0.21% 2/1/16, VRDN (a)(b) | | 7,525,000 | 7,525,000 |

| Series 2013, 0.17% 2/5/16, VRDN (a) | | 1,900,000 | 1,900,000 |

| Coweta County Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Yates Proj.) Series 2006, 0.18% 2/1/16, VRDN (a) | | 1,000,000 | 1,000,000 |

| Kennesaw Dev. Auth. Multi-family Hsg. Rev. (Alta Ridenour Apts. Proj.) Series 2008, 0.03% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 6,930,000 | 6,930,000 |

| Monroe County Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Scherer Proj.) First Series 2009, 0.27% 2/5/16, VRDN (a) | | 700,000 | 700,000 |

| | | | 33,105,000 |

| Indiana - 0.0% | | | |

| Indiana Dev. Fin. Auth. Envir. Rev. (PSI Energy Proj.) Series 2003 B, 0.35% 2/5/16, VRDN (a)(b) | | 2,100,000 | 2,100,000 |

| Louisiana - 0.0% | | | |

| Saint James Parish Gen. Oblig. (Nucor Steel Louisiana LLC Proj.): | | | |

| Series 2010 A1, 0.4% 2/5/16, VRDN (a) | | 2,000,000 | 2,000,000 |

| Series 2010 B1, 0.35% 2/5/16, VRDN (a) | | 600,000 | 600,000 |

| | | | 2,600,000 |

| Montana - 0.1% | | | |

| Forsyth Poll. Cont. Rev. Series 2008 A, 0.19% 2/5/16, VRDN (a)(b) | | 2,650,000 | 2,650,000 |

| Nebraska - 0.1% | | | |

| Stanton County Indl. Dev. Rev. (Nucor Corp. Proj.) Series 1996, 0.42% 2/5/16, VRDN (a)(b) | | 3,200,000 | 3,200,000 |

| New Jersey - 0.1% | | | |

| Salem County Poll. Cont. Fin. Auth. Rev. (Pub. Svc. Elec. and Gas Co. Proj.) Series 2012 A, 0.2% 2/5/16, VRDN (a)(b) | | 3,100,000 | 3,100,000 |

| New York - 63.4% | | | |

| Albany Indl. Dev. Agcy. Ind. Dev. 0.45% 2/5/16, LOC HSBC Bank U.S.A., NA, VRDN (a)(b) | | 630,000 | 630,000 |

| Barclays Bank PLC Participating VRDN Series BC 11 11B, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 3,240,000 | 3,240,000 |

| New York City Gen. Oblig.: | | | |

| Participating VRDN: | | | |

| Series 15 XF0092, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 14,175,000 | 14,175,000 |

| Series 15 ZF0197, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,500,000 | 2,500,000 |

| Series 15 ZF0201, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,435,000 | 3,435,000 |

| Series 2015 ZF0206, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,700,000 | 2,700,000 |

| Series BC 13 19U, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 5,310,000 | 5,310,000 |

| Series MS 3324, 0.01% 2/5/16 (Liquidity Facility Cr. Suisse AG) (a)(c) | | 6,650,000 | 6,650,000 |

| Series Putters 14 0013, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,330,000 | 3,330,000 |

| Series Putters 3118, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,180,000 | 5,180,000 |

| Series Putters 3793, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,000,000 | 5,000,000 |

| Series Putters 4345, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,750,000 | 3,750,000 |

| Series ROC II R 14045, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 11,350,000 | 11,350,000 |

| Series 2004 H1, 0.01% 2/1/16, LOC Bank of New York, New York, VRDN (a) | | 7,155,000 | 7,155,000 |

| Series 2004 H4, 0.01% 2/1/16, LOC Bank of New York, New York, VRDN (a) | | 3,000,000 | 3,000,000 |

| Series 2006 E2, 0.01% 2/1/16, LOC Bank of America NA, VRDN (a) | | 21,015,000 | 21,015,000 |

| Series 2006 H1, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 1,000,000 | 1,000,000 |

| Series 2006 I4, 0.01% 2/1/16 (Liquidity Facility California Pub. Employees Retirement Sys.), VRDN (a) | | 29,100,000 | 29,100,000 |

| Series 2006 I6, 0.01% 2/1/16 (Liquidity Facility Bank of New York, New York), VRDN (a) | | 1,300,000 | 1,300,000 |

| Series 2008 J5, 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 3,000,000 | 3,000,000 |

| Series 2008 L4, 0.01% 2/1/16 (Liquidity Facility U.S. Bank NA, Cincinnati), VRDN (a) | | 1,400,000 | 1,400,000 |

| Series 2008 L5, 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 15,500,000 | 15,500,000 |

| Series 2010 G4, 0.01% 2/5/16 (Liquidity Facility Barclays Bank PLC), VRDN (a) | | 62,400,000 | 62,400,000 |

| Series 2012 D3A, 0.01% 2/1/16, LOC California Pub. Employees Retirement Sys., VRDN (a) | | 5,115,000 | 5,115,000 |

| Series 2013 A3, 0.01% 2/1/16 (Liquidity Facility Mizuho Corporate Bank Ltd.), VRDN (a) | | 10,100,000 | 10,100,000 |

| Series 2013 F3, 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 64,900,000 | 64,900,000 |

| Series 2014 D3, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 55,800,000 | 55,800,000 |

| Series 2014 D4, 0.01% 2/1/16, LOC TD Banknorth, NA, VRDN (a) | | 2,000,000 | 2,000,000 |

| Series 2015 F6, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 41,850,000 | 41,850,000 |

| Series 2104 1, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 11,250,000 | 11,250,000 |

| Series D5, 0.01% 2/1/16, LOC PNC Bank NA, VRDN (a) | | 7,500,000 | 7,500,000 |

| Series H2, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 21,100,000 | 21,100,000 |

| New York City Hsg. Dev. Corp. Multi-family Hsg. Mtg. Rev. (The Crest Proj.) Series 2005 A, 0.01% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 47,300,000 | 47,300,000 |

| New York City Hsg. Dev. Corp. Multi-family Mtg. Rev.: | | | |

| (15 East Clark Place Apts. Proj.) Series A, 0.01% 2/5/16, LOC JPMorgan Chase Bank, VRDN (a)(b) | | 5,430,000 | 5,430,000 |

| (Aldus Street Apts. Proj.) Series A, 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 8,100,000 | 8,100,000 |

| (Beacon Mews Dev. Proj.) Series 2006 A, 0.01% 2/5/16, LOC Citibank NA, VRDN (a)(b) | | 15,500,000 | 15,500,000 |

| (Grace Towers Dev. Proj.) Series 2005 A, 0.02% 2/5/16, LOC Citibank NA, VRDN (a)(b) | | 9,700,000 | 9,700,000 |

| (La Casa del Sol Proj.) Series 2005 A, 0.02% 2/5/16, LOC Citibank NA, VRDN (a)(b) | | 4,450,000 | 4,450,000 |

| (Manhattan Court Dev. Proj.) Series A, 0.03% 2/5/16, LOC Citibank NA, VRDN (a)(b) | | 1,000,000 | 1,000,000 |

| (Peter Cintron Apts. Proj.) Series C, 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 3,700,000 | 3,700,000 |

| (Related-Upper East Proj.) Series A, 0.02% 2/5/16, LOC Landesbank Baden-Wurttemberg, VRDN (a)(b) | | 47,000,000 | 47,000,000 |

| (Spring Creek Hsg. Proj.) Series 2006 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 21,000,000 | 21,000,000 |

| (State Renaissance Court Proj.) Series A, 0.02% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 6,500,000 | 6,500,000 |

| (Urban Horizons II Dev. Proj.) Series 2005 A, 0.02% 2/5/16, LOC Citibank NA, VRDN (a)(b) | | 5,365,000 | 5,365,000 |

| (West 48th Street Dev. Proj.) Series 2001 A, 0.01% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 6,000,000 | 6,000,000 |

| New York City Hsg. Dev. Corp. Multi-family Rental Hsg. Rev.: | | | |

| (Morris Avenue Apts. Proj.) Series A, 0.01% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 13,600,000 | 13,600,000 |

| (One Columbus Place Dev. Proj.) Series A, 0.01% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 49,200,000 | 49,200,000 |

| New York City Indl. Dev. Agcy. Civic Facility Rev. (American Civil Liberties Union Foundation, Inc. Proj.) Series 2005, 0.01% 2/1/16, LOC JPMorgan Chase Bank, VRDN (a) | | 1,700,000 | 1,700,000 |

| New York City Indl. Dev. Agcy. Indl. Dev. Rev. (Tiago Hldgs., LLC Proj.) Series 2007, 0.04% 2/5/16, LOC Lloyds Bank PLC, VRDN (a)(b) | | 40,000,000 | 40,000,000 |

| New York City Indl. Dev. Agcy. Solid Waste Facility Rev. (U.S.A. Waste Svcs. Proj.) 0.02% 2/5/16, LOC JPMorgan Chase Bank, VRDN (a)(b) | | 18,600,000 | 18,600,000 |

| New York City Muni. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev.: | | | |

| Participating VRDN: | | | |

| Series 15 XF0097, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,515,000 | 2,515,000 |

| Series 15 XF0128, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 8,940,000 | 8,940,000 |

| Series 15 XF0129, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 23,535,000 | 23,535,000 |

| Series 2015 ZF0207, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 4,000,000 | 4,000,000 |

| Series BA 08 1206, 0.09% 2/5/16 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(c) | | 9,000,000 | 9,000,000 |

| Series BC 13 16U, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 3,000,000 | 3,000,000 |

| Series BC 13 3WX, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 2,810,000 | 2,810,000 |

| Series EGL 06 74 Class A, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 13,000,000 | 13,000,000 |

| Series EGL 09 46A, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 9,900,000 | 9,900,000 |

| Series EGL 14 0043, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 5,000,000 | 5,000,000 |

| Series Floaters 3129, 0.01% 2/5/16 (Liquidity Facility Cr. Suisse AG) (a)(c) | | 24,860,000 | 24,860,000 |

| Series MS 3362, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 5,000,000 | 5,000,000 |

| Series MS 3373, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 5,980,000 | 5,980,000 |

| Series Putters 15 XM0002, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 18,030,000 | 18,030,000 |

| Series Putters 3223, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 1,670,000 | 1,670,000 |

| Series Putters 3384, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 1,875,000 | 1,875,000 |

| Series Putters 3496Z, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 7,050,000 | 7,050,000 |

| Series Putters 3497Z, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 13,025,000 | 13,025,000 |

| Series Putters 4378, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 4,715,000 | 4,715,000 |

| Series RBC O 23, 0.01% 2/5/16 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 8,265,000 | 8,265,000 |

| Series ROC II R 11916, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 5,005,000 | 5,005,000 |

| Series ROC II R 11931, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 6,815,000 | 6,815,000 |

| Series ROC II R 11966, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 10,000,000 | 10,000,000 |

| Series 2001 F1, 0.01% 2/1/16 (Liquidity Facility Mizuho Corporate Bank Ltd.), VRDN (a) | | 17,700,000 | 17,700,000 |

| Series 2006 AA-1B, 0.01% 2/1/16 (Liquidity Facility State Street Bank & Trust Co., Boston), VRDN (a) | | 25,000,000 | 25,000,000 |

| Series 2009 BB1, 0.01% 2/1/16 (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | | 5,000,000 | 5,000,000 |

| Series 2009 BB2, 0.01% 2/1/16 (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | | 5,000,000 | 5,000,000 |

| Series 2011 DD, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 4,500,000 | 4,500,000 |

| Series 2011 DD-3A, 0.01% 2/1/16 (Liquidity Facility U.S. Bank NA, Cincinnati), VRDN (a) | | 3,070,000 | 3,070,000 |

| Series 2011 DD-3B, 0.01% 2/1/16 (Liquidity Facility State Street Bank & Trust Co., Boston), VRDN (a) | | 9,100,000 | 9,100,000 |

| Series 2012 B2, 0.01% 2/1/16 (Liquidity Facility California Pub. Employees Retirement Sys.), VRDN (a) | | 2,000,000 | 2,000,000 |

| Series 2012 B3, 0.01% 2/1/16 (Liquidity Facility State Street Bank & Trust Co., Boston), VRDN (a) | | 9,500,000 | 9,500,000 |

| Series 2013 AA-1, 0.01% 2/1/16 (Liquidity Facility PNC Bank NA), VRDN (a) | | 8,400,000 | 8,400,000 |

| Series 2014 AA: | | | |

| 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 1,200,000 | 1,200,000 |

| 0.01% 2/1/16 (Liquidity Facility Mizuho Corporate Bank Ltd.), VRDN (a) | | 4,865,000 | 4,865,000 |

| 0.01% 2/1/16 (Liquidity Facility TD Banknorth, NA), VRDN (a) | | 5,000,000 | 5,000,000 |

| Series 2014 BB1, 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 34,965,000 | 34,965,000 |

| Series 2016 AA2: | | | |

| 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 20,500,000 | 20,500,000 |

| 0.01% 2/1/16 (Liquidity Facility Royal Bank of Canada), VRDN (a) | | 6,000,000 | 6,000,000 |

| Series FF, 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 9,000,000 | 9,000,000 |

| 0.01% 2/1/16 (Liquidity Facility PNC Bank NA), VRDN (a) | | 12,400,000 | 12,400,000 |

| New York City Transitional Fin. Auth. Rev.: | | | |

| Participating VRDN: | | | |

| Series 2014 XM0029, 0.01% 2/5/16 (Liquidity Facility Royal Bank of Canada New York Branch) (a)(c) | | 3,270,000 | 3,270,000 |

| Series 2015 ZF0185, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 6,250,000 | 6,250,000 |

| Series BC 11 8B, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 5,800,000 | 5,800,000 |

| Series MS 15 XM0104, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 3,500,000 | 3,500,000 |

| Series MS 3358, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 5,165,000 | 5,165,000 |

| Series MS 3399, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 2,115,000 | 2,115,000 |

| Series Putters 3544, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 10,655,000 | 10,655,000 |

| Series Putters 4043, 0.05% 2/1/16 (Liquidity Facility JPMorgan Chase & Co.) (a)(c) | | 14,940,000 | 14,940,000 |

| Series Putters 4084Z, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,850,000 | 3,850,000 |

| Series Putters 4331, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,240,000 | 3,240,000 |

| Series Putters 4399, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,000,000 | 5,000,000 |

| Series RBC O 65, 0.01% 2/5/16 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 4,500,000 | 4,500,000 |

| Series ROC II R 11994, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 8,880,000 | 8,880,000 |

| Series ROC II R 14082, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 6,380,000 | 6,380,000 |

| Series 2003 1A, 0.01% 2/5/16 (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | | 2,480,000 | 2,480,000 |

| Series 2003 1D, 0.01% 2/1/16 (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | | 2,410,000 | 2,410,000 |

| Series 2003 A2, 0.01% 2/1/16 (Liquidity Facility Bank of Tokyo-Mitsubishi UFJ Ltd.), VRDN (a) | | 64,000,000 | 64,000,000 |

| Series 2003 A4, 0.01% 2/1/16 (Liquidity Facility TD Banknorth, NA), VRDN (a) | | 3,000,000 | 3,000,000 |

| Series 2003 C1, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 11,050,000 | 11,050,000 |

| Series 2003 C2, 0.01% 2/1/16 (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | | 6,300,000 | 6,300,000 |

| Series 2013 A6, 0.01% 2/1/16 (Liquidity Facility State Street Bank & Trust Co., Boston), VRDN (a) | | 3,800,000 | 3,800,000 |

| Series 2013 C4, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 4,300,000 | 4,300,000 |

| Series 2014 A4, 0.01% 2/1/16 (Liquidity Facility Wells Fargo Bank NA), VRDN (a) | | 15,250,000 | 15,250,000 |

| Series 2014 B3, 0.01% 2/1/16 (Liquidity Facility Barclays Bank PLC), VRDN (a) | | 14,865,000 | 14,865,000 |

| Series 2015 E4, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | | 28,150,000 | 28,150,000 |

| Series 2016 A4, 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 19,350,000 | 19,350,000 |

| Series 2016 A5, 0.01% 2/1/16 (Liquidity Facility Royal Bank of Canada), VRDN (a) | | 7,000,000 | 7,000,000 |

| Series C, 0.01% 2/1/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah), VRDN (a) | | 15,000,000 | 15,000,000 |

| New York City Trust Cultural Resources Rev.: | | | |

| (Alvin Ailey Dance Foundation, Inc. Proj.) Series 2003, 0.01% 2/5/16, LOC Citibank NA, VRDN (a) | | 11,510,000 | 11,510,000 |

| Participating VRDN Series ROC II R 11927, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 6,000,000 | 6,000,000 |

| New York Dorm. Auth. Personal Income Tax Rev. Participating VRDN: | | | |

| Series 3792Z, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 6,365,000 | 6,365,000 |

| Series MS 3275, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 10,000,000 | 10,000,000 |

| Series Putters 14 0014, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 10,000,000 | 10,000,000 |

| Series Putters 3281Z, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 1,120,000 | 1,120,000 |

| Series Putters 3518, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 12,685,000 | 12,685,000 |

| Series ROC II R 11984, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 5,000,000 | 5,000,000 |

| New York Dorm. Auth. Revs.: | | | |

| (Catholic Heath Sys. Obligated Group Proj.) Series 2008, 0.01% 2/5/16, LOC HSBC Bank U.S.A., NA, VRDN (a) | | 2,935,000 | 2,935,000 |

| (City Univ. Proj.) Series 2008 D, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 30,530,000 | 30,530,000 |

| (College of New Rochelle Proj.) Series 2008, 0.05% 2/5/16, LOC RBS Citizens NA, VRDN (a) | | 12,760,000 | 12,760,000 |

| (Northern Westchester Hosp. Assoc. Proj.) Series 2009, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 2,000,000 | 2,000,000 |

| (The Culinary Institute of America Proj.): | | | |

| Series 2004 C, 0.02% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 9,825,000 | 9,825,000 |

| Series 2006, 0.02% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 6,075,000 | 6,075,000 |

| (Univ. of Rochester Proj.) Series 2003 A, 0.01% 2/1/16, LOC JPMorgan Chase Bank, VRDN (a) | | 7,600,000 | 7,600,000 |

| Participating VRDN: | | | |

| ROC II R 11944, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 11,400,000 | 11,400,000 |

| Series EGL 07 0002, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 5,160,000 | 5,160,000 |

| Series Putters 1955, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 6,440,000 | 6,440,000 |

| Series Putters 3382, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 4,995,000 | 4,995,000 |

| Series Putters 3383, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 14,995,000 | 14,995,000 |

| Series Putters 3803, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 6,000,000 | 6,000,000 |

| Series ROC II R 11722, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 9,870,000 | 9,870,000 |

| Series ROC II R 11955, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 9,000,000 | 9,000,000 |

| Series ROC II R 11975, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 5,290,000 | 5,290,000 |

| New York Envir. Facilities Corp. Clean Wtr. & Drinking Wtr. Participating VRDN: | | | |

| Series BC 12 9 W, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c) | | 4,100,000 | 4,099,988 |

| Series Putters 3376, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 4,450,000 | 4,450,000 |

| New York Envir. Facilities Corp. State Personal Income Tax Rev. Participating VRDN Series 15 XF0086, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,005,000 | 2,005,000 |

| New York Hsg. Fin. Agcy. Rev.: | | | |

| (125 West 31st Street Proj.) Series 2005 A, 0.01% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 49,200,000 | 49,200,000 |

| (150 East 44th Street Hsg. Proj.) Series 2000 A, 0.01% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 3,250,000 | 3,250,000 |

| (1500 Lexington Avenue Proj.) Series A, 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 30,000,000 | 30,000,000 |

| (250 West 50th Street Hsg. Proj.) Series 1997 A, 0.01% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 87,005,000 | 87,005,000 |

| (350 West 43rd Street Hsg. Proj.): | | | |

| Series 2001 A, 0.01% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a)(b) | | 26,000,000 | 26,000,000 |

| Series 2002 A, 0.01% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a)(b) | | 34,090,000 | 34,090,000 |

| (455 West 37th Street Hsg. Proj.) Series A, 0.01% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a)(b) | | 17,500,000 | 17,500,000 |

| (505 West 37th Street Proj.): | | | |

| Series 2008 A, 0.03% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a)(b) | | 46,000,000 | 46,000,000 |

| Series 2009 A, 0.02% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 27,700,000 | 27,700,000 |

| Series 2009 B, 0.02% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 27,700,000 | 27,700,000 |

| (600 West and 42nd St. Hsg. Proj.): | | | |

| Series 2007 A: | | | |

| 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 182,235,000 | 182,235,001 |

| 0.03% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 66,100,000 | 66,100,000 |

| Series 2008 A: | | | |

| 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 18,900,000 | 18,900,000 |

| 0.02% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a)(b) | | 5,090,000 | 5,090,000 |

| (80 DeKalb Ave. Hsg. Proj.): | | | |

| Series 2009 A, 0.01% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 31,700,000 | 31,700,000 |

| Series 2009 B, 0.01% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 17,760,000 | 17,760,000 |

| (Chelsea Apts. Proj.) Series 2003 A, 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 45,000,000 | 45,000,000 |

| (Clinton Green North Hsg. Proj.): | | | |

| Series 2005 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 40,000,000 | 40,000,000 |

| Series 2006 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 47,000,000 | 47,000,000 |

| (Clinton Green South Hsg. Proj.) Series 2006 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 46,500,000 | 46,500,000 |

| (Helena Hsg. Proj.) Series 2003 A, 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 33,000,000 | 33,000,000 |

| (Parkledge Apts. Hsg. Proj.) Series A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 9,940,000 | 9,940,000 |

| (Saville Hsg. Proj.) Series 2002 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 22,000,000 | 22,000,000 |

| (Sea Park East Hsg. Proj.) Series 2004 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 13,300,000 | 13,300,000 |

| (Sea Park West Hsg. Proj.) Series 2004 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 2,800,000 | 2,800,000 |

| (South Cove Plaza Proj.) Series A, 0.02% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 4,000,000 | 4,000,000 |

| (Talleyrand Crescent Hsg. Proj.) Series A, 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 28,320,000 | 28,320,000 |

| (Union Square South Proj.) Series 1996 A, 0.01% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 41,550,000 | 41,550,000 |

| Series 2001 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 44,000,000 | 44,000,000 |

| Series 2002 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 13,000,000 | 13,000,000 |

| Series 2004 A, 0.02% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 1,000,000 | 1,000,000 |

| Series 2008 A, 0.01% 2/5/16, LOC Freddie Mac, VRDN (a) | | 50,100,000 | 50,100,000 |

| Series 2010 A: | | | |

| 0.01% 2/5/16, LOC Freddie Mac, VRDN (a) | | 10,100,000 | 10,100,000 |

| 0.02% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 3,900,000 | 3,900,000 |

| 0.02% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 34,500,000 | 34,500,000 |

| Series 2013 A2, 0.04% 2/5/16, LOC Manufacturers & Traders Trust Co., VRDN (a) | | 5,700,000 | 5,700,000 |

| Series 2014 A: | | | |

| 0.01% 2/1/16, LOC PNC Bank NA, VRDN (a) | | 20,975,000 | 20,975,000 |

| 0.01% 2/5/16, LOC Bank of New York, New York, VRDN (a) | | 7,700,000 | 7,700,000 |

| Series 2014 A2: | | | |

| 0.04% 2/5/16, LOC Manufacturers & Traders Trust Co., VRDN (a) | | 11,200,000 | 11,200,000 |

| 0.07% 2/5/16, LOC Manufacturers & Traders Trust Co., VRDN (a) | | 15,300,000 | 15,300,000 |

| Series 2015 A, 0.01% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 21,500,000 | 21,500,000 |

| Series 2015 A1: | | | |

| 0.01% 2/5/16, LOC Bank of America NA, VRDN (a) | | 14,300,000 | 14,300,000 |

| 0.01% 2/5/16, LOC Bank of New York, New York, VRDN (a) | | 35,990,000 | 35,990,000 |

| New York Liberty Dev. Corp. Participating VRDN Series Putters 4011 Z, 0.03% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 30,000,000 | 30,000,000 |

| New York Metropolitan Trans. Auth. Dedicated Tax Fund Rev. Series 2008 A1, 0.01% 2/1/16, LOC Royal Bank of Canada, VRDN (a) | | 2,000,000 | 2,000,000 |

| New York Metropolitan Trans. Auth. Rev.: | | | |

| Series 2005 D1, 0.01% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 2,500,000 | 2,500,000 |

| Series 2005 D2, 0.01% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 8,600,000 | 8,600,000 |

| Series 2005 E1, 0.01% 2/1/16, LOC Bank of Montreal Chicago CD Prog., VRDN (a) | | 20,600,000 | 20,600,000 |

| Series 2012 G2, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 20,000,000 | 20,000,000 |

| Series 2015 E, 0.02% 2/5/16, LOC Bank of The West San Francisco, VRDN (a) | | 6,100,000 | 6,100,000 |

| Series 2015 E1, 0.01% 2/1/16, LOC U.S. Bank NA, Cincinnati, VRDN (a) | | 9,100,000 | 9,100,000 |

| New York Sales Tax Asset Receivables Corp. Participating VRDN Series 15 XF0133, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,145,000 | 3,145,000 |

| New York State Energy Research & Dev. Auth. Facilities Rev.: | | | |

| (Consolidated Edison Co. of New York, Inc. Proj.): | | | |

| Series 2004 C1, 0.01% 2/5/16, LOC Mizuho Bank Ltd., VRDN (a)(b) | | 15,200,000 | 15,200,000 |

| Series 2004 C3, 0.01% 2/5/16, LOC Mizuho Bank Ltd., VRDN (a)(b) | | 33,000,000 | 33,000,000 |

| Series 2010 A3, 0.02% 2/5/16, LOC Bank of Nova Scotia, VRDN (a)(b) | | 55,150,000 | 55,150,000 |

| Series 2010 A, 0.01% 2/5/16, LOC Bank of Nova Scotia, VRDN (a)(b) | | 48,700,000 | 48,700,000 |

| New York State Gen. Oblig. Participating VRDN Series ROC II R 11936, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 16,800,000 | 16,800,000 |

| New York State Hsg. Fin. Agcy. Rev. Series 2015 A, 0.01% 2/5/16, LOC Wells Fargo Bank NA, VRDN (a) | | 3,750,000 | 3,750,000 |

| New York Thruway Auth. Second Gen. Hwy. & Bridge Trust Fund Participating VRDN Series ROC II R 11997, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 8,080,000 | 8,080,000 |

| Riverhead Indl. Dev. Auth. Indl. Dev. Rev. (Adchem Corp. Facility Proj.) Series 1998, 0.25% 2/5/16, LOC Citibank NA, VRDN (a)(b) | | 440,000 | 440,000 |

| Triborough Bridge & Tunnel Auth. Revs.: | | | |

| Participating VRDN: | | | |

| Series BC 12 10W, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c)(d) | | 5,000,000 | 5,000,000 |

| Series Putters 3330, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 36,730,000 | 36,730,000 |

| Series Putters 3685, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 2,000,000 | 2,000,000 |

| Series Putters 4405, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,800,000 | 5,800,000 |

| Series Putters 4406, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 3,000,000 | 3,000,000 |

| Series ROC II R11934, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 9,450,000 | 9,450,000 |

| Series 2001 C, 0.01% 2/5/16, LOC Bank of Tokyo-Mitsubishi UFJ Ltd., VRDN (a) | | 7,860,000 | 7,860,000 |

| Series 2002 F, 0.02% 2/1/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 39,100,000 | 39,100,000 |

| Series 2003 B1, 0.01% 2/5/16, LOC PNC Bank NA, VRDN (a) | | 19,405,000 | 19,405,000 |

| Series 2003 B3, 0.01% 2/1/16, LOC Wells Fargo Bank NA, VRDN (a) | | 3,675,000 | 3,675,000 |

| Series 2005 A, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 13,390,000 | 13,390,000 |

| Series 2005 B2, 0.01% 2/1/16, LOC Wells Fargo Bank NA, VRDN (a) | | 19,605,000 | 19,605,000 |

| Util. Debt Securitization Auth. Participating VRDN: | | | |

| Series 2015 ZF0195, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 5,700,000 | 5,700,000 |

| Series RBC O 74, 0.01% 2/5/16 (Liquidity Facility Royal Bank of Canada) (a)(c) | | 5,550,000 | 5,550,000 |

| Westchester County Indl. Agcy. Rev. Series 2001, 0.22% 2/5/16, LOC RBS Citizens NA, VRDN (a) | | 4,765,000 | 4,765,000 |

| | | | 3,368,779,989 |

| New York And New Jersey - 3.6% | | | |

| Port Auth. of New York & New Jersey: | | | |

| Participating VRDN: | | | |

| Series BC 11 17B, 0.02% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(c)(d) | | 3,150,000 | 3,150,000 |

| Series EGL 06 107 Class A, 0.04% 2/5/16 (Liquidity Facility Citibank NA) (a)(b)(c) | | 87,600,000 | 87,600,000 |

| Series Floaters 14 0001, 0.04% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 1,710,000 | 1,710,000 |

| Series GS 08 31TP, 0.01% 2/5/16 (Liquidity Facility Wells Fargo & Co.) (a)(b)(c) | | 20,190,000 | 20,190,000 |

| Series MS 15 ZM0099, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c)(d) | | 1,100,000 | 1,100,000 |

| Series MS 3249, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(c) | | 3,500,000 | 3,500,000 |

| Series Putters 14 0002, 0.04% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 8,885,000 | 8,885,000 |

| Series Putters 14 0010, 0.04% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 6,665,000 | 6,665,000 |

| Series Putters 15 XM013, 0.04% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 6,500,000 | 6,500,000 |

| Series Putters 1546, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c) | | 8,385,000 | 8,385,000 |

| Series Putters 2945, 0.04% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 1,665,000 | 1,665,000 |

| Series Putters 3991 Z, 0.04% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 5,415,000 | 5,415,000 |

| Series Putters 4001 Z, 0.04% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b)(c) | | 985,000 | 985,000 |

| Series RBC O 19, 0.03% 2/5/16 (Liquidity Facility Royal Bank of Canada) (a)(b)(c) | | 7,700,000 | 7,700,000 |

| Series ROC II R 11715, 0.04% 2/5/16 (Liquidity Facility Citibank NA) (a)(b)(c) | | 11,250,000 | 11,250,000 |

| Series ROC II R 14077, 0.02% 2/5/16 (Liquidity Facility Citibank NA) (a)(c) | | 2,585,000 | 2,585,000 |

| Series TD 0013, 0.03% 2/5/16 (Liquidity Facility Toronto-Dominion Bank) (a)(b)(c) | | 5,120,000 | 5,120,000 |

| Series 1991 2, 0.09% 2/29/16, VRDN (a)(b)(e) | | 6,400,000 | 6,400,000 |

| Series 1992 2, 0.06% 2/29/16, VRDN (a)(e) | | 500,000 | 500,000 |

| Series 1997 1, 0.06% 2/29/16, VRDN (a)(e) | | 500,000 | 500,000 |

| Series 1997 2, 0.06% 2/29/16, VRDN (a)(e) | | 1,000,000 | 1,000,000 |

| | | | 190,805,000 |

| Texas - 0.9% | | | |

| Calhoun Port Auth. Envir. Facilities Rev.: | | | |

| (Formosa Plastics Corp. Proj.) Series 2012, 0.02% 2/5/16, LOC JPMorgan Chase Bank, VRDN (a)(b) | | 4,800,000 | 4,800,000 |

| (Formosa Plastics Corp. Texas Proj.) Series 2008, 0.04% 2/5/16, LOC Bank of America NA, VRDN (a)(b) | | 10,000,000 | 10,000,000 |

| Gulf Coast Waste Disp. Auth. Solid Waste Disp. Rev. (Waste Mgmt., Inc. Proj.) Series A, 0.02% 2/5/16, LOC JPMorgan Chase Bank, VRDN (a)(b) | | 2,500,000 | 2,500,000 |

| Houston Hsg. Fin. Corp. Multi-family Hsg. Rev. (Mayfair Park Apts. Proj.) Series 2004, 0.03% 2/5/16, LOC Fannie Mae, VRDN (a)(b) | | 3,400,000 | 3,400,000 |

| Port Arthur Navigation District Envir. Facilities Rev. (Motiva Enterprises LLC Proj.): | | | |

| Series 2001 A, 0.2% 2/1/16, VRDN (a) | | 3,675,000 | 3,675,000 |

| Series 2004, 0.23% 2/5/16, VRDN (a)(b) | | 2,200,000 | 2,200,000 |

| Series 2009 A, 0.2% 2/1/16, VRDN (a) | | 1,215,000 | 1,215,000 |

| Series 2009 C, 0.21% 2/1/16, VRDN (a) | | 1,800,000 | 1,800,000 |

| Series 2010 B, 0.2% 2/1/16, VRDN (a) | | 6,600,000 | 6,600,000 |

| Series 2010 D, 0.21% 2/1/16, VRDN (a) | | 11,000,000 | 11,000,000 |

| | | | 47,190,000 |

| Virginia - 0.1% | | | |

| Arlington County Indl. Dev. Auth. Multi-family Hsg. Rev. Series A, 0.04% 2/5/16, LOC Freddie Mac, VRDN (a)(b) | | 3,000,000 | 3,000,000 |

| West Virginia - 0.1% | | | |

| West Virginia Econ. Dev. Auth. Solid Waste Disp. Facilities Rev. (Appalachian Pwr. Co.- Mountaineer Proj.) Series 2008 A, 0.4% 2/5/16, VRDN (a)(b) | | 2,800,000 | 2,800,000 |

| Wyoming - 0.0% | | | |

| Converse County Envir. Impt. Rev. Series 1995, 0.22% 2/5/16, VRDN (a)(b) | | 800,000 | 800,000 |

| Converse County Poll. Cont. Rev. (PacifiCorp Proj.) Series 1994, 0.22% 2/5/16, VRDN (a) | | 1,800,000 | 1,800,000 |

| | | | 2,600,000 |

| TOTAL VARIABLE RATE DEMAND NOTE | | | |

| (Cost $3,680,579,989) | | | 3,680,579,989 |

|

| Other Municipal Debt - 28.7% | | | |

| Georgia - 0.4% | | | |

| Main Street Natural Gas, Inc. Georgia Gas Proj. Rev. Bonds: | | | |

| Series 2010 A1, 0.07%, tender 6/1/16 (Liquidity Facility Royal Bank of Canada) (a) | | 19,900,000 | 19,900,000 |

| Series 2010 A2, 0.07%, tender 4/1/16 (Liquidity Facility Royal Bank of Canada) (a) | | 700,000 | 700,000 |

| | | | 20,600,000 |

| Kentucky - 0.0% | | | |

| Jefferson County Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series 2001 A, 0.25% tender 2/16/16, CP mode | | 2,300,000 | 2,300,000 |

| Massachusetts - 0.2% | | | |

| Massachusetts Indl. Fin. Agcy. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1993 A: | | | |

| 0.4% tender 2/24/16, CP mode | | 6,200,000 | 6,200,000 |

| 0.4% tender 3/10/16, CP mode | | 2,200,000 | 2,200,000 |

| | | | 8,400,000 |

| New Hampshire - 0.3% | | | |

| New Hampshire Bus. Fin. Auth. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.): | | | |

| Series 1990 A: | | | |

| 0.45% tender 3/10/16, CP mode (b) | | 1,000,000 | 1,000,000 |

| 0.45% tender 3/11/16, CP mode (b) | | 8,500,000 | 8,500,000 |

| Series 1990 A1, 0.5% tender 2/8/16, CP mode (b) | | 4,200,000 | 4,200,000 |

| Series 1990 B: | | | |

| 0.48% tender 2/5/16, CP mode | | 1,200,000 | 1,200,000 |

| 0.48% tender 3/10/16, CP mode | | 3,100,000 | 3,100,000 |

| | | | 18,000,000 |

| New York - 27.0% | | | |

| Albany Gen. Oblig. BAN 2% 7/1/16 | | 37,200,000 | 37,447,556 |

| Amherst Central School District BAN Series 2015, 2% 6/23/16 | | 19,421,000 | 19,543,394 |

| Amherst Gen. Oblig. BAN Series 2015, 2% 11/10/16 | | 17,300,000 | 17,500,919 |

| Amityville Union Free School District TAN Series 2015, 1.5% 6/24/16 | | 8,700,000 | 8,738,908 |

| Baldwinsville Central School District BAN Series 2015, 2% 7/15/16 | | 10,300,000 | 10,370,209 |

| Bay Shore Union Free School District TAN 2% 6/24/16 | | 17,300,000 | 17,412,104 |

| Bellmore-Merrick Central School District BAN Series 2015, 2% 7/22/16 | | 15,400,000 | 15,497,752 |

| Bethlehem Central School District BAN Series 2015, 1.5% 6/16/16 | | 16,633,134 | 16,702,671 |

| Cheektowaga Gen. Oblig. Bonds Series 2015, 1.75% 7/15/16 | | 934,000 | 939,411 |

| Clarence Central School District BAN Series 2015, 2% 7/14/16 | | 6,200,000 | 6,241,733 |

| Commack Union Free School District TAN 1.5% 6/27/16 | | 13,000,000 | 13,064,639 |

| Connetquot Central School District TAN 2% 6/27/16 | | 14,600,000 | 14,701,818 |

| Deer Park Union Free School District TAN 2% 6/27/16 | | 16,400,000 | 16,510,331 |

| East Greenbush Central School District BAN: | | | |

| Series 2015, 1.2% 2/12/16 | | 10,800,000 | 10,803,226 |

| 1.25% 2/12/16 | | 9,040,000 | 9,042,910 |

| 2% 2/10/17 (f) | | 10,900,000 | 11,055,652 |

| East Hampton Union Free School District TAN 1.5% 6/28/16 | | 11,700,000 | 11,758,470 |

| East Islip Unified School District TAN 2% 6/30/16 | | 19,000,000 | 19,126,492 |

| Elwood Union Free School District TAN 2% 6/24/16 | | 10,400,000 | 10,468,649 |

| Erie County Gen. Oblig. RAN Series 2015, 1.5% 6/30/16 | | 52,900,000 | 53,129,278 |

| Erie County Indl. Dev. Agcy. School Facilities Rev. Bonds Series 2015 A, 4% 5/1/16 | | 9,200,000 | 9,285,212 |

| Grand Island Central School District BAN Series 2015, 2% 12/2/16 | | 37,135,000 | 37,568,129 |

| Hampton Bays Union Free School District TAN 2% 6/20/16 | | 9,100,000 | 9,155,756 |

| Hauppauge Union Free School District TAN 2% 6/24/16 | | 11,200,000 | 11,276,608 |

| Hilton Central School District BAN Series 2015, 1% 6/24/16 | | 15,000,000 | 15,000,000 |

| Huntington Union Free School District TAN 1.5% 6/24/16 | | 17,300,000 | 17,385,283 |

| Islip Gen. Oblig. BAN Series 2015, 1.5% 10/21/16 | | 6,900,000 | 6,945,840 |

| JPMorgan Chase Bonds Series Putters 4410, 0.08%, tender 4/21/16 (Liquidity Facility JPMorgan Chase Bank) (a)(c)(e) | | 67,205,000 | 67,205,000 |

| Kings Park Central School District TAN 2% 6/24/16 | | 13,800,000 | 13,893,163 |

| Liverpool Central School District Gen. Oblig. BAN 2% 9/30/16 | | 3,020,150 | 3,048,744 |

| Longwood Central School District TAN 1.5% 6/24/16 | | 17,300,000 | 17,383,661 |

| Middle Country Century School District TAN 2% 6/27/16 | | 20,600,000 | 20,741,130 |

| Mount Sinai Union Free School District TAN Series 2015, 2% 6/30/16 | | 7,300,000 | 7,344,926 |

| New York City Gen. Oblig. Bonds: | | | |

| Series 1994 A5, 5% 8/1/16 | | 2,115,000 | 2,164,560 |

| Series 2004 HA, 5% 3/1/16 | | 5,000,000 | 5,018,988 |

| Series 2011 I, 3% 8/1/16 | | 1,175,000 | 1,190,450 |

| Series 2012 G1, 5% 4/1/16 | | 1,985,000 | 2,000,726 |

| Series 2013 1, 4% 8/1/16 | | 1,500,000 | 1,527,571 |

| Series 2013 F1, 5% 3/1/16 | | 2,250,000 | 2,258,524 |

| Series 2014 D, 5% 8/1/16 | | 3,710,000 | 3,795,196 |

| Series 2014 J, 3% 8/1/16 | | 1,965,000 | 1,991,240 |

| Series 2015 C, 2% 8/1/16 | | 8,700,000 | 8,766,335 |

| New York City Transitional Fin. Auth. Rev. Bonds Series 2013 F1, 4% 2/1/16 | | 1,200,000 | 1,200,000 |

| New York City Trust For Cultural Bonds Series 2014 B2: | | | |

| 0.02%, tender 6/10/16 (a) | | 13,000,000 | 13,000,000 |

| 0.08%, tender 8/29/16 (a) | | 43,525,000 | 43,525,000 |

| New York Dorm. Auth. Personal Income Tax Rev. Bonds: | | | |

| Series 2006 D, 5% 9/15/16 (Pre-Refunded to 9/15/16 @ 100) | | 2,345,000 | 2,413,139 |

| Series 2011 C, 5% 3/15/16 | | 1,225,000 | 1,232,011 |

| Series 2014 C, 4% 3/15/16 | | 21,955,000 | 22,053,205 |

| Series 2014 E, 3% 2/15/16 | | 20,445,000 | 20,467,038 |

| Series A, 5% 2/15/16 | | 3,980,000 | 3,987,211 |

| 5% 2/15/16 | | 9,700,000 | 9,717,817 |

| 5% 9/15/16 (Pre-Refunded to 9/15/16 @ 100) | | 6,150,000 | 6,322,612 |

| New York Dorm. Auth. Revs.: | | | |

| Bonds: | | | |

| Series 2008 D, 5% 2/15/16 | | 8,815,000 | 8,831,388 |

| Series WF 113C, 0.14%, tender 3/3/16 (Liquidity Facility Wells Fargo Bank NA) (a)(c)(e) | | 11,000,000 | 11,000,000 |

| 0.06% 3/8/16, CP | | 17,500,000 | 17,500,000 |

| 0.08% 3/23/16, CP | | 5,000,000 | 5,000,000 |

| New York Dorm. Auth. Sales Tax Rev. Bonds Series 2015 A, 2% 3/15/16 | | 21,600,000 | 21,648,079 |

| New York Envir. Facilities Corp. Clean Wtr. & Drinking Wtr. Bonds (New York City Muni. Wtr. Fin. Auth. Projs.): | | | |

| Series 2011 B, 5% 6/15/16 | | 3,190,000 | 3,245,890 |

| Series 2012 D, 4% 6/15/16 | | 2,920,000 | 2,959,500 |

| New York Local Govt. Assistance Corp. Bonds: | | | |

| Series 2010 A, 5% 4/1/16 | | 2,330,000 | 2,348,166 |

| Series 2012 A, 5% 4/1/16 | | 3,735,000 | 3,764,666 |

| New York Pwr. Auth.: | | | |

| Series 1: | | | |

| 0.02% 2/1/16, CP | | 15,900,000 | 15,900,000 |

| 0.02% 2/2/16, CP | | 17,500,000 | 17,500,000 |

| 0.02% 2/23/16, CP | | 11,266,000 | 11,266,000 |

| 0.03% 2/11/16, CP | | 37,859,000 | 37,859,000 |

| 0.08% 8/1/16, CP | | 38,300,000 | 38,300,000 |

| 0.09% 2/4/16, CP | | 36,695,000 | 36,695,000 |

| Series 2: | | | |

| 0.02% 2/1/16, CP | | 21,800,000 | 21,800,000 |

| 0.02% 2/2/16, CP | | 6,500,000 | 6,500,000 |

| 0.02% 2/16/16, CP | | 9,935,000 | 9,935,000 |

| 0.02% 2/16/16, CP | | 4,656,000 | 4,656,000 |

| 0.02% 2/18/16, CP | | 8,700,000 | 8,700,000 |

| 0.03% 2/9/16, CP | | 25,100,000 | 25,100,000 |

| 0.03% 2/18/16, CP | | 23,580,000 | 23,580,000 |

| New York State Envir. Facilities Corp. Rev. Bonds (2010 Master Fin. Prog.) Series 2011, 5% 8/15/16 | | 1,595,000 | 1,635,156 |

| New York State Gen. Oblig. Bonds: | | | |

| Series 2008 A, 4% 3/1/16 | | 2,030,000 | 2,036,166 |

| Series 2011 A, 5% 2/15/16 | | 6,090,000 | 6,101,128 |

| Series 2013 C, 5% 4/15/16 | | 8,700,000 | 8,785,408 |

| Series 2015 A, 4% 3/15/16 | | 4,580,000 | 4,600,412 |

| New York Thruway Auth. Hwy. & Bridge Trust Fund Bonds Series 2007 B, 5% 4/1/16 | | 3,405,000 | 3,431,510 |

| New York Thruway Auth. Second Gen. Hwy. & Bridge Trust Fund Bonds Series 2010 A, 5% 4/1/16 | | 1,490,000 | 1,501,508 |

| New York Urban Dev. Corp. Rev. Bonds Series 2010 A, 5% 3/15/16 | | 10,075,000 | 10,132,221 |

| North Hempstead Gen. Oblig. BAN: | | | |

| Series 2015 C, 2% 9/30/16 | | 33,078,984 | 33,434,060 |

| Series 2015 D, 2% 9/30/16 | | 11,700,000 | 11,822,487 |

| Patchogue Medford Unified Free School District TAN 2% 6/24/16 | | 12,900,000 | 12,985,407 |

| Pittsford Central School District BAN: | | | |

| 1.25% 2/12/16 | | 17,400,000 | 17,405,600 |

| 2% 2/10/17 (f) | | 13,740,000 | 13,933,322 |

| Port Washington Union Free School District TAN 2% 6/21/16 | | 13,500,000 | 13,587,680 |

| Riverhead Central School District: | | | |

| BAN 2% 9/16/16 | | 2,280,000 | 2,302,916 |

| TAN 2% 6/27/16 | | 18,000,000 | 18,124,660 |

| Rochester Gen. Oblig. Bonds Series 2015 I, 4% 8/1/16 | | 5,870,000 | 5,974,141 |

| Rockville Ctr. Union Free School District TAN 2% 6/24/16 | | 6,900,000 | 6,945,739 |

| Sag Hbr. Union Free School District BAN 1.25% 2/26/16 | | 1,600,000 | 1,600,982 |

| Sayville Union Free School District TAN 1.5% 6/28/16 | | 9,100,000 | 9,142,709 |

| Schenectady County Gen. Oblig. BAN 0.3% 2/17/16 | | 35,600,000 | 35,600,000 |

| Smithtown Central School District TAN 1.5% 6/30/16 | | 17,300,000 | 17,387,432 |

| South Huntington Union Free School District TAN 1.5% 6/28/16 | | 13,000,000 | 13,064,897 |

| Syosset Central School District TAN 2% 6/28/16 | | 20,800,000 | 20,944,583 |

| Tobacco Settlement Fing. Corp. Bonds Series 2011: | | | |

| 5% 6/1/16 | | 7,250,000 | 7,363,325 |

| 5% 6/1/16 | | 26,120,000 | 26,531,770 |

| Tonawanda Town BAN 2% 9/1/16 | | 8,225,000 | 8,299,781 |

| Triborough Bridge & Tunnel Auth. Revs. Bonds Series 2012 B, 4% 11/15/16 | | 6,300,000 | 6,476,364 |

| Ulster County Gen. Oblig. BAN Series 2015 A, 2% 11/11/16 | | 1,145,000 | 1,157,000 |

| Victor Central School District BAN: | | | |

| Series 2015 A, 2% 7/7/16 | | 8,600,000 | 8,661,939 |

| Series 2015 B, 2% 9/23/16 | | 1,663,231 | 1,678,189 |

| Wappingers Central School District BAN Series 2015 B, 1.5% 6/15/16 | | 30,915,000 | 31,030,395 |

| West Babylon Union Free School District BAN 2% 8/5/16 | | 3,400,000 | 3,424,916 |

| West Seneca BAN 2% 7/28/16 | | 25,800,000 | 25,994,558 |

| | | | 1,436,108,247 |

| New York And New Jersey - 0.5% | | | |

| Port Auth. of New York & New Jersey: | | | |

| Bonds: | | | |

| Series 178, 5% 12/1/16 (b) | | 2,775,000 | 2,875,171 |

| Series 186, 4% 10/15/16 (b) | | 1,200,000 | 1,230,744 |

| 3% 5/1/16 (b) | | 6,570,000 | 6,613,857 |

| 4% 6/1/16 | | 1,155,000 | 1,168,972 |

| 5% 9/1/16 (b) | | 5,645,000 | 5,797,207 |

| Series A: | | | |

| 0.03% 3/9/16, CP (b) | | 6,000,000 | 6,000,000 |

| 0.03% 3/17/16, CP (b) | | 4,000,000 | 4,000,000 |

| | | | 27,685,951 |

| Virginia - 0.1% | | | |

| Halifax County Indl. Dev. Auth. Poll. Cont. Rev. Bonds (Virginia Elec. & Pwr. Co. Proj.) Series 1992, 0.5% tender 2/16/16, CP mode (b) | | 4,800,000 | 4,800,000 |

| Prince William County Indl. Dev. Auth. Poll. Cont. Rev. Bonds (Virginia Elec. & Pwr. Co. Proj.) Series 1986, 0.45% tender 2/16/16, CP mode | | 1,100,000 | 1,100,000 |

| | | | 5,900,000 |

| Washington - 0.1% | | | |

| Port of Seattle Rev. Series B1, 0.04% 2/2/16, LOC Bank of America NA, CP (b) | | 3,427,500 | 3,427,500 |

| West Virginia - 0.1% | | | |

| Grant County Cmnty. Solid Waste Disp. Rev. Bonds (Virginia Elec. & Pwr. Co. Proj.) Series 1996, 0.45% tender 3/10/16, CP mode (b) | | 2,800,000 | 2,800,000 |

| TOTAL OTHER MUNICIPAL DEBT | | | |

| (Cost $1,525,221,698) | | | 1,525,221,698 |

| | | Shares | Value |

|

| Investment Company - 0.5% | | | |

| Fidelity Municipal Cash Central Fund, 0.02% (g)(h) | | | |

| (Cost $26,159,000) | | 26,159,000 | 26,159,000 |

| TOTAL INVESTMENT PORTFOLIO - 98.5% | | | |

| (Cost $5,231,960,687) | | | 5,231,960,687 |

| NET OTHER ASSETS (LIABILITIES) - 1.5% | | | 79,230,170 |

| NET ASSETS - 100% | | | $5,311,190,857 |

Security Type Abbreviations

BAN – BOND ANTICIPATION NOTE

CP – COMMERCIAL PAPER

RAN – REVENUE ANTICIPATION NOTE

TAN – TAX ANTICIPATION NOTE

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

Legend

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(c) Provides evidence of ownership in one or more underlying municipal bonds.

(d) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $9,250,000 or 0.2% of net assets.

(e) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $86,605,000 or 1.6% of net assets.

(f) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(g) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund.

(h) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Cost |

| JPMorgan Chase Bonds Series Putters 4410, 0.08%, tender 4/21/16 (Liquidity Facility JPMorgan Chase Bank) | 10/31/13 - 3/12/15 | $67,205,000 |

| New York Dorm. Auth. Revs. Bonds Series WF 113C, 0.14%, tender 3/3/16 (Liquidity Facility Wells Fargo Bank NA) | 12/3/15 | $11,000,000 |

| Port Auth. of New York & New Jersey Series 1991 2, 0.09% 2/29/16, VRDN | 12/3/03 | $6,400,000 |

| Port Auth. of New York & New Jersey Series 1992 2, 0.06% 2/29/16, VRDN | 8/13/15 | $500,000 |

| Port Auth. of New York & New Jersey Series 1997 1, 0.06% 2/29/16, VRDN | 6/4/14 | $500,000 |

| Port Auth. of New York & New Jersey Series 1997 2, 0.06% 2/29/16, VRDN | 7/8/13 | $1,000,000 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Municipal Cash Central Fund | $32,254 |

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | January 31, 2016 |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $5,205,801,687) | $5,205,801,687 | |

| Fidelity Central Funds (cost $26,159,000) | 26,159,000 | |

| Total Investments (cost $5,231,960,687) | | $5,231,960,687 |

| Cash | | 87,284,351 |

| Receivable for investments sold | | 7,250,000 |

| Receivable for fund shares sold | | 42,206,835 |

| Interest receivable | | 8,868,016 |

| Distributions receivable from Fidelity Central Funds | | 455 |

| Prepaid expenses | | 9,306 |

| Other receivables | | 10,374 |

| Total assets | | 5,377,590,024 |

| Liabilities | | |

| Payable for investments purchased | | |

| Regular delivery | $3,600,810 | |

| Delayed delivery | 24,988,974 | |

| Payable for fund shares redeemed | 37,033,797 | |

| Distributions payable | 3,996 | |

| Accrued management fee | 221,592 | |

| Other affiliated payables | 42,848 | |

| Other payables and accrued expenses | 507,150 | |

| Total liabilities | | 66,399,167 |

| Net Assets | | $5,311,190,857 |

| Net Assets consist of: | | |

| Paid in capital | | $5,311,157,368 |

| Distributions in excess of net investment income | | (1,639) |

| Accumulated undistributed net realized gain (loss) on investments | | 35,128 |

| Net Assets, for 5,306,532,401 shares outstanding | | $5,311,190,857 |

| Net Asset Value, offering price and redemption price per share ($5,311,190,857 ÷ 5,306,532,401 shares) | | $1.00 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended January 31, 2016 |

| Investment Income | | |

| Interest | | $4,179,809 |

| Income from Fidelity Central Funds | | 32,254 |

| Total income | | 4,212,063 |

| Expenses | | |

| Management fee | $19,268,505 | |

| Transfer agent fees | 6,427,584 | |

| Accounting fees and expenses | 456,149 | |

| Custodian fees and expenses | 50,059 | |

| Independent trustees' compensation | 22,147 | |

| Registration fees | 46,976 | |

| Audit | 41,275 | |

| Legal | 22,632 | |

| Miscellaneous | 527,879 | |

| Total expenses before reductions | 26,863,206 | |

| Expense reductions | (23,183,789) | 3,679,417 |

| Net investment income (loss) | | 532,646 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 371,232 | |

| Total net realized gain (loss) | | 371,232 |

| Net increase in net assets resulting from operations | | $903,878 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended January 31, 2016 | Year ended January 31, 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $532,646 | $517,204 |

| Net realized gain (loss) | 371,232 | 231,630 |

| Net increase in net assets resulting from operations | 903,878 | 748,834 |

| Distributions to shareholders from net investment income | (533,892) | (552,756) |

| Distributions to shareholders from net realized gain | (159,501) | – |

| Total distributions | (693,393) | (552,756) |

| Share transactions at net asset value of $1.00 per share | | |

| Proceeds from sales of shares | 12,407,460,200 | 13,659,292,288 |

| Reinvestment of distributions | 653,269 | 527,270 |

| Cost of shares redeemed | (12,622,883,423) | (13,782,563,584) |

| Net increase (decrease) in net assets and shares resulting from share transactions | (214,769,954) | (122,744,026) |

| Total increase (decrease) in net assets | (214,559,469) | (122,547,948) |

| Net Assets | | |

| Beginning of period | 5,525,750,326 | 5,648,298,274 |

| End of period (including distributions in excess of net investment income of $1,639 and distributions in excess of net investment income of $393, respectively) | $5,311,190,857 | $5,525,750,326 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity New York Municipal Money Market Fund

| | | January 31, | | | |

| Years ended January 31, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | – | – | – | – | – |

| Net realized and unrealized gain (loss)A | – | – | – | – | – |

| Total from investment operationsA | – | – | – | – | – |

| Distributions from net investment incomeA | – | – | – | – | – |

| Distributions from net realized gain | –A | – | – | –A | – |

| Total distributionsA | – | – | – | – | – |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB | .01% | .01% | .01% | .01% | .01% |

| Ratios to Average Net AssetsC,D | | | | | |

| Expenses before reductions | .50% | .49% | .50% | .50% | .50% |

| Expenses net of fee waivers, if any | .07% | .08% | .12% | .20% | .21% |

| Expenses net of all reductions | .07% | .08% | .12% | .20% | .21% |

| Net investment income (loss) | .01% | .01% | .01% | .01% | .01% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $5,311,191 | $5,525,750 | $5,648,298 | $5,548,564 | $5,146,244 |

A Amount represents less than $.0005 per share.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended January 31, 2016

1. Organization.

Fidelity New York Municipal Money Market Fund (the Fund) is a fund of Fidelity New York Municipal Trust II (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust. Effective January 1, 2016 shares of the Fund are only available for purchase by retail shareholders. The Fund may be affected by economic and political developments in the state of New York.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Investment Transactions and Income. The net asset value per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Security transactions, including the Fund's investment activity in the Fidelity Central Funds, are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. During the period, the Fund incurred a corporate tax liability on undistributed long-term capital gain which is included in Miscellaneous expense on the Statement of Operations. As of January 31, 2016, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustees compensation.

The Fund purchases municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $– |

| Gross unrealized depreciation | – |

| Net unrealized appreciation (depreciation) on securities | $– |

| Tax Cost | $5,231,960,687 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed long-term capital gain | $35,128 |

The tax character of distributions paid was as follows:

| | January 31, 2016 | January 31, 2015 |

| Tax-exempt Income | $533,892 | $552,756 |

| Long-term Capital Gains | 159,501 | - |

| Total | $693,393 | $ 552,756 |

Delayed Delivery Transactions and When-Issued Securities. During the period, the Fund transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The securities purchased on a delayed delivery or when-issued basis are identified as such in the Fund's Schedule of Investments. The Fund may receive compensation for interest forgone in the purchase of a delayed delivery or when-issued security. With respect to purchase commitments, the Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Fees and Other Transactions with Affiliates.

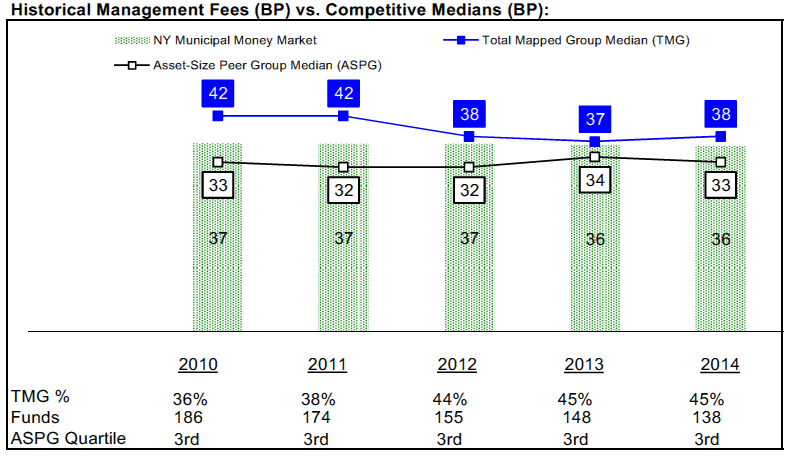

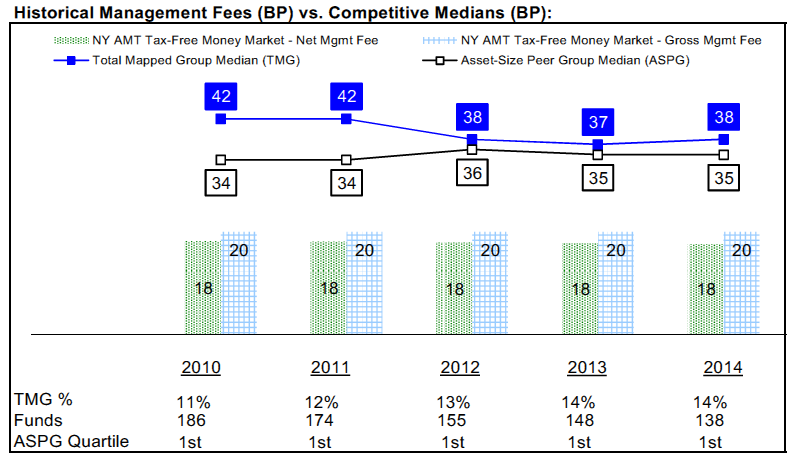

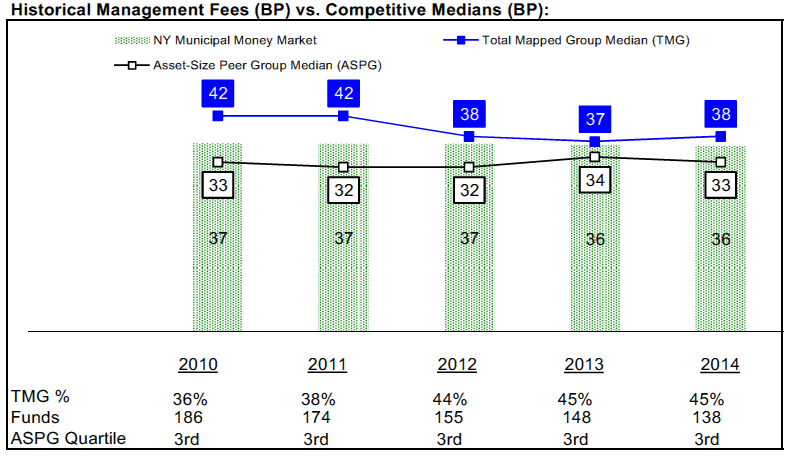

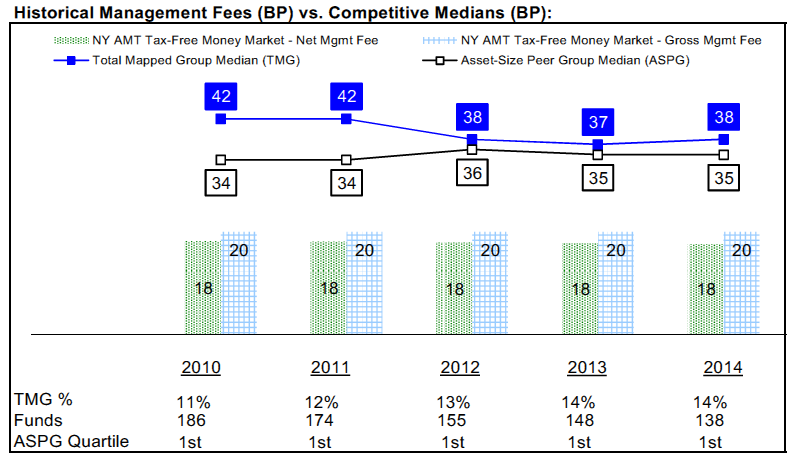

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .25% of the Fund's average net assets and an annualized group fee rate that averaged .11% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .36% of the Fund's average net assets.

Transfer Agent Fees. Pursuant to the transfer agent contract approved by the Board of Trustees effective May 1, 2015, Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for the Fund. FIIOC receives account fees and asset-based fees that vary according to account size and type of account. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, transfer agent fees were equivalent to an annual rate of .12% of average net assets.

Prior to May 1, 2015, Citibank, N.A. was the transfer, dividend disbursing and shareholder servicing agent for the Fund. Prior to May 8, 2015, Citibank, N.A. was the custodian for the Fund.

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The fee is based on the level of average net assets for each month.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act.

5. Expense Reductions.

The investment adviser or its affiliates voluntarily agreed to waive certain fees in order to maintain a minimum annualized yield of .01%. Such arrangements may be discontinued by the investment adviser at any time. For the period, the amount of the waiver was $23,133,365.

In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $27,819.

In addition, during the period the investment adviser reimbursed and/or waived a portion of operating expenses in the amount of $22,605.

6. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity New York Municipal Trust II and the Shareholders of Fidelity New York Municipal Money Market Fund:

We have audited the accompanying statement of assets and liabilities of Fidelity New York Municipal Money Market Fund (the Fund), a fund of Fidelity New York Municipal Trust II, including the schedule of investments, as of January 31, 2016, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.