AS FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION ON SEPTEMBER 8, 2022

1933 Act File No. 333-

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

| REGISTRATION STATEMENT UNDER THE | |

| SECURITIES ACT OF 1933 | /X/ |

Pre-Effective Amendment No.

Post-Effective Amendment No.

THE ADVISORS’ INNER CIRCLE FUND

(Exact Name of Registrant as Specified in Charter)

One Freedom Valley Drive

Oaks, Pennsylvania 19456

(Address of Principal Executive Offices, Zip Code)

1-800-932-7781

(Registrant’s Telephone Number)

Michael Beattie

c/o SEI Investments

One Freedom Valley Drive

Oaks, Pennsylvania 19456

(Name and Address of Agent for Service)

Copy to:

| Sean Graber, Esquire |

| Morgan, Lewis & Bockius LLP |

| 1701 Market Street |

| Philadelphia, Pennsylvania 19103 |

Title of Securities being Registered: Institutional Class Shares of the Cambiar Opportunity Fund and Cambiar Small Cap Fund and Investor Class Shares of the Cambiar Small Cap Fund.

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933, as amended.

No filing fee is required under the Securities Act of 1933, as amended, because an indefinite number of shares of beneficial interest have previously been registered pursuant to Section 24(f) under the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on October 8, 2022 pursuant to Rule 488 under the Securities Act of 1933, as amended.

GREAT LAKES DISCIPLINED EQUITY FUND

GREAT LAKES LARGE CAP VALUE FUND

GREAT LAKES SMALL CAP OPPORTUNITY FUND

Dear Shareholder:

Your vote is needed.

Enclosed you will find important information concerning your investment in the Great Lakes Disciplined Equity Fund, Great Lakes Large Cap Value Fund and Great Lakes Small Cap Opportunity Fund, as applicable (each, a “Target Fund,” and together, the “Target Funds”), each a series of Managed Portfolio Series (the “Target Trust”). The Board of Trustees of the Target Trust (the “Board”), after careful consideration, has approved the following reorganizations (each, a “Reorganization,” and together, the “Reorganizations”):

| · | The reorganization of the Great Lakes Disciplined Equity Fund into the Cambiar Opportunity Fund, a series of The Advisors’ Inner Circle Fund (the “Acquiring Trust”); |

| · | The reorganization of the Great Lakes Large Cap Value Fund into the Cambiar Opportunity Fund, a series of the Acquiring Trust; and |

| · | The reorganization of the Great Lakes Small Cap Opportunity Fund into the Cambiar Small Cap Fund, a series of the Acquiring Trust (together with the Cambiar Opportunity Fund, the “Acquiring Funds,” and each, an “Acquiring Fund” and together with the Target Funds, the “Funds” and each, a “Fund”). |

A joint special meeting of shareholders of the Target Funds has been scheduled for November 22, 2022 at 2:00 p.m. CT, to vote on the Reorganizations. Due to the public health impact of the coronavirus pandemic (COVID-19), the meeting will be held by webcast format only. If you plan to attend the Meeting virtually, please follow the registration instructions as outlined in the enclosed Proxy Statement/Prospectus. Target Fund shareholders of record as of the close of business on September 30, 2022, are entitled to vote at the meeting and at any adjournment or postponement of the meeting.

The attached combined Proxy Statement/Prospectus gives you information relating to the Reorganizations. The Board of Trustees of the Target Trust recommends that shareholders of the Target Funds approve the Reorganizations.

If shareholders of a Target Fund approve its Reorganization, and all other closing conditions are met, the Reorganization is expected to take effect on or about Monday, December 12, 2022. Upon the completion of a Reorganization, each shareholder of the applicable Target Fund will receive shares of the corresponding class of shares of the Acquiring Fund, as discussed in greater detail in the Proxy Statement/Prospectus. We encourage you to support the Trustees’ recommendation to approve the proposals. Before you vote, however, please read the full text of the combined Proxy Statement/Prospectus.

Please read the enclosed materials and cast your vote on the proxy card(s) or by telephone or via the Internet. Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be. Thank you for your participation in this important initiative.

| | /s/ Brian R. Wiedmeyer | |

| | Brian R. Wiedmeyer | |

| | President and Principal Executive Officer | |

Managed Portfolio Series

615 East Michigan Street

Milwaukee, Wisconsin 53202

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

GREAT LAKES DISCIPLINED EQUITY FUND

GREAT LAKES LARGE CAP VALUE FUND

GREAT LAKES SMALL CAP OPPORTUNITY FUND

To Be Held on November 22, 2022

A joint special meeting (the “Meeting”) of the shareholders of the Great Lakes Disciplined Equity Fund, Great Lakes Large Cap Value Fund and Great Lakes Small Cap Opportunity Fund (each, a “Target Fund,” and together, the “Target Funds”), each a series of the Managed Portfolio Series (the “Target Trust”) will be held on November 22, 2022 at 2:00 p.m. CT to vote on the following proposals (each, a “Proposal,” and together, the “Proposals”), and any other matters that may properly come before the Meeting or any adjournment or postponement thereof. Due to the public health impact of the coronavirus pandemic (COVID-19), the Meeting will be held in webcast format only.

Proposal 1: Great Lakes Disciplined Equity Fund – Cambiar Opportunity Fund Reorganization

To approve an Agreement and Plan of Reorganization pursuant to which the Cambiar Opportunity Fund would acquire all of the assets and assume the stated liabilities of the Great Lakes Disciplined Equity Fund in exchange for Institutional Class Shares of the Cambiar Opportunity Fund to be distributed pro rata by the Great Lakes Disciplined Equity Fund to its shareholders of Institutional Class Shares in a complete liquidation of the Great Lakes Disciplined Equity Fund.

Proposal 2: Great Lakes Large Cap Value Fund – Cambiar Opportunity Fund Reorganization

To approve an Agreement and Plan of Reorganization pursuant to which the Cambiar Opportunity Fund would acquire all of the assets and assume the stated liabilities of the Great Lakes Large Cap Value Fund in exchange for Institutional Class Shares of the Cambiar Opportunity Fund to be distributed pro rata by the Great Lakes Large Cap Value Fund to its shareholders of Institutional Class Shares in a complete liquidation of the Great Lakes Large Cap Value Fund.

Proposal 3: Great Lakes Small Cap Opportunity Fund – Cambiar Small Cap Fund Reorganization

To approve an Agreement and Plan of Reorganization pursuant to which the Cambiar Small Cap Fund would acquire all of the assets and assume the stated liabilities of the Great Lakes Small Cap Opportunity Fund in exchange for Institutional Class Shares and Investor Class Shares of the Cambiar Small Cap Fund to be distributed pro rata by the Great Lakes Small Cap Opportunity Fund to its shareholders of Institutional Class Shares and Investor Class Shares, respectively, in a complete liquidation of the Great Lakes Small Cap Opportunity Fund.

Shareholders of each Target Fund will vote separately on each Proposal. The approval of one Reorganization is not contingent upon the approval of any other Reorganization.

Target Fund shareholders of record as of the close of business on September 30, 2022 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting or any adjournment or postponement of the Meeting. If sufficient votes to approve a Proposal are not received by the date of the Meeting or any reconvened Meeting following an adjournment, the Meeting or reconvened Meeting may be adjourned or postponed to permit further solicitations of proxies.

Please vote your shares by completing the enclosed proxy card and returning it in the enclosed postage-paid return envelope or by voting by telephone or via the internet using the instructions on the proxy card. If you are voting by mail, please sign and promptly return the proxy card in the postage-paid return envelope regardless of the number of shares owned. Proxy card instructions may be revoked at any time before they are exercised by submitting a written notice of revocation or a subsequently executed proxy card or by participating in the virtual Meeting and recasting your vote.

The Board of Trustees of the Target Trust (the “Target Trust Board”) requests that you vote your shares by completing the enclosed proxy card and returning it in the enclosed postage-paid return envelope or by voting by telephone or via the internet using the instructions on the proxy card.

The Target Trust Board recommends that shareholders of the Target Funds vote “FOR” the Proposals as described in the accompanying Proxy Statement/Prospectus.

| | By order of the Board of Trustees, | |

| | | |

| | /s/ Brian R. Wiedmeyer | |

| | Brian R. Wiedmeyer | |

| | President and Principal Executive Officer | |

| | [____], 2022 | |

SUBJECT TO COMPLETION

THE INFORMATION IN THIS PROXY STATEMENT/PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROXY STATEMENT/PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Great Lakes Disciplined Equity Fund, Great Lakes Large Cap Value Fund and Great Lakes Small Cap Opportunity Fund, each a series of Managed Portfolio Series 615 East Michigan Street Milwaukee, Wisconsin 53202 414-765-6844 | Cambiar Opportunity Fund and Cambiar Small Cap Fund, each a series of The Advisors’ Inner Circle Fund One Freedom Valley Drive Oaks, Pennsylvania 19456 800-932-7781 |

PROXY STATEMENT/PROSPECTUS

[____], 2022

Introduction

This Proxy Statement/Prospectus contains information that shareholders of the Great Lakes Disciplined Equity Fund, Great Lakes Large Cap Value Fund and Great Lakes Small Cap Opportunity Fund (each, a “Target Fund” and together, the “Target Funds”), each a series of Managed Portfolio Series (the “Target Trust”), should know before voting on the proposed reorganizations that are described herein (each, a “Reorganization,” and together, the “Reorganizations”), and should be retained for future reference. This document is both the proxy statement of the Target Funds and also a prospectus for the Cambiar Opportunity Fund and the Cambiar Small Cap Fund (each, an “Acquiring Fund” and together, the “Acquiring Funds”), each a series of The Advisors’ Inner Circle Fund (the “Acquiring Trust”). The Target Funds and the Acquiring Funds (each a “Fund” and together, the “Funds”) are each series of registered open-end management investment companies.

The Reorganizations will be effected pursuant to an Agreement and Plan of Reorganization (the “Agreement”). Under the Agreement, each Target Fund will transfer all of its assets to its corresponding Acquiring Fund in exchange for (i) the assumption by the Acquiring Fund of the Target Fund’s stated liabilities and (ii) the classes of shares of the Acquiring Fund as set forth in the following chart:

| If you own shares of the Target Fund listed below | Share Class | You will receive shares of the Acquiring Fund listed below | Share Class |

| Great Lakes Disciplined Equity Fund | Institutional Class | Cambiar Opportunity Fund | Institutional Class |

| Great Lakes Large Cap Value Fund | Institutional Class | Cambiar Opportunity Fund | Institutional Class |

| Great Lakes Small Cap Opportunity Fund | Institutional Class | Cambiar Small Cap Fund | Institutional Class |

| | Investor Class | | Investor Class |

A joint special meeting of the shareholders of the Target Funds (the “Meeting”) will be held on November 22, 2022 at 2:00 p.m. CT. Due to the public health impact of the coronavirus pandemic (COVID-19), the Meeting will be held in webcast format only. At the Meeting, shareholders of the Target Funds will be asked to consider the following proposals relating to the Reorganizations (each, a “Proposal,” and together, the “Proposals”), and any other matters that may properly come before the Meeting or any adjournment or postponement thereof.

Proposal 1: Great Lakes Disciplined Equity Fund – Cambiar Opportunity Fund Reorganization

To approve an Agreement and Plan of Reorganization pursuant to which the Cambiar Opportunity Fund would acquire all of the assets and assume the stated liabilities of the Great Lakes Disciplined Equity Fund in exchange for Institutional Class Shares of the Cambiar Opportunity Fund to be distributed pro rata by the Great Lakes Disciplined Equity Fund to its shareholders of Institutional Class Shares in a complete liquidation of the Great Lakes Disciplined Equity Fund.

Proposal 2: Great Lakes Large Cap Value Fund – Cambiar Opportunity Fund Reorganization

To approve an Agreement and Plan of Reorganization pursuant to which the Cambiar Opportunity Fund would acquire all of the assets and assume the stated liabilities of the Great Lakes Large Cap Value Fund in exchange for Institutional Class Shares of the Cambiar Opportunity Fund to be distributed pro rata by the Great Lakes Large Cap Value Fund to its shareholders of Institutional Class Shares in a complete liquidation of the Great Lakes Large Cap Value Fund.

Proposal 3: Great Lakes Small Cap Opportunity Fund – Cambiar Small Cap Fund Reorganization

To approve an Agreement and Plan of Reorganization pursuant to which the Cambiar Small Cap Fund would acquire all of the assets and assume the stated liabilities of the Great Lakes Small Cap Opportunity Fund in exchange for Institutional Class Shares and Investor Class Shares of the Cambiar Small Cap Fund to be distributed pro rata by the Great Lakes Small Cap Opportunity Fund to its shareholders of Institutional Class Shares and Investor Class Shares, respectively, in a complete liquidation of the Great Lakes Small Cap Opportunity Fund.

Shareholders of each Target Fund will vote separately on each Proposal, as shown below:

| Target Fund | Acquiring Fund | Proposal # |

| Great Lakes Disciplined Equity Fund | Cambiar Opportunity Fund | 1 |

| Great Lakes Large Cap Value Fund | Cambiar Opportunity Fund | 2 |

| Great Lakes Small Cap Opportunity Fund | Cambiar Small Cap Fund | 3 |

The approval of one Reorganization is not contingent upon the approval of any other Reorganization.

Each Reorganization is anticipated to be a tax-free transaction for federal income tax purposes. For more detailed information about the federal income tax consequences of each Reorganization, please refer to the section titled “Federal Income Tax Considerations” below.

The Board of Trustees of the Target Trust (the “Target Trust Board”) has fixed the close of business on September 30, 2022 as the record date (“Record Date”) for the determination of Target Fund shareholders entitled to notice of and to vote at the Meeting and at any adjournment or postponement thereof. Shareholders of each Target Fund on the Record Date will be entitled to one vote for each share of the Target Fund held (and a proportionate fractional vote for each fractional share). This Proxy Statement/Prospectus, the enclosed Notice of Joint Special Meeting of Shareholders, and the enclosed proxy card will be mailed on or about October 24, 2022, to all shareholders eligible to vote on the Proposals.

The Target Trust Board has approved the Agreement and has determined that each Reorganization is in the best interests of the applicable Target Fund and its shareholders and will not dilute the interests of the existing shareholders of such Target Fund. Accordingly, the Target Trust Board recommends that shareholders vote “FOR” the Proposals. If shareholders of a Target Fund do not approve its Reorganization, the Target Trust Board will consider what further action is appropriate for such Target Fund, which could include the liquidation of the Target Fund, which would be a fully taxable redemption to shareholders.

ii

This Proxy Statement/Prospectus sets forth certain information about the Reorganization and the Acquiring Fund that you should consider before voting on the Proposals or investing in the Acquiring Funds. You should retain this information for future reference. The Target Trust and Acquiring Trust are separate registered open-end management investment companies. Additional information about the Target Funds is available in the following documents, as each may be amended or supplemented:

| 1. | Summary Prospectus dated July 29, 2022 for the Great Lakes Disciplined Equity Fund (the “Great Lakes Disciplined Equity Fund Summary Prospectus”); |

| 2. | Summary Prospectus dated July 29, 2022 for the Great Lakes Large Cap Value Fund (the “Great Lakes Large Cap Value Fund Summary Prospectus”); |

| 3. | Summary Prospectus dated July 29, 2022 for the Great Lakes Small Cap Opportunity Fund (the “Great Lakes Small Cap Opportunity Fund Summary Prospectus”, and together with the Great Lakes Disciplined Equity Fund Summary Prospectus and Great Lakes Large Cap Value Fund Summary Prospectus, the “Target Funds Summary Prospectuses”); |

| 4. | Prospectus dated July 29, 2022 for the Target Funds (the “Target Funds Prospectus”); |

| 5. | Statement of Additional Information dated July 29, 2022 for the Target Funds (the “Target Funds SAI”); and |

| 6. | Each Target Fund’s audited financial statements and the related report of the independent registered public accounting firm included in the Target Funds’ Annual Report to Shareholders for the fiscal year ended March 31, 2022 (the “Target Funds Annual Report”). |

The Target Funds Summary Prospectuses, Target Funds Prospectus, Target Funds SAI and Target Funds Annual Report are available on the Target Funds’ website at www.glafunds.com. Copies of these documents are also available at no cost by calling 855-278-2020 or writing to the Target Funds at Great Lakes Funds, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701. The Target Funds Summary Prospectuses and Target Funds Annual Report have previously been delivered to shareholders.

Additional information about the Acquiring Funds is available in the following, as each may be amended or supplemented:

| 1. | Summary Prospectus dated March 16, 2022 for the Cambiar Opportunity Fund (the “Cambiar Opportunity Fund Summary Prospectus”); |

| 2. | Summary Prospectus dated March 16, 2022 for the Cambiar Small Cap Fund (the “Cambiar Small Cap Fund Summary Prospectus,” and together with the Cambiar Opportunity Fund Summary Prospectus, the “Acquiring Funds Summary Prospectuses”); |

| 3. | Prospectus dated March 1, 2022 for the Acquiring Funds (the “Acquiring Funds Prospectus”); |

| 4. | Statement of Additional Information dated March 1, 2022 for the Acquiring Funds (the “Acquiring Funds SAI”); |

iii

| 5. | Each Acquiring Fund’s audited financial statements and the related report of the independent registered public accounting firm included in the Acquiring Funds’ Annual Report to Shareholders for the fiscal year ended October 31, 2021 (the “Acquiring Funds Annual Report”); and |

| 6. | Each Acquiring Fund’s unaudited financial statements included in the Acquiring Funds’ Semi-Annual Report to shareholders for the fiscal period ended April 30, 2022 (the “Acquiring Funds Semi-Annual Report”). |

The Acquiring Funds Summary Prospectuses, Acquiring Funds Prospectus, Acquiring Funds SAI, Acquiring Funds Annual Report and Acquiring Funds Semi-Annual Report are available at www.cambiar.com. Copies of these documents are also available at no charge by writing to the Cambiar Funds at P.O. Box 219009, Kansas City, MO 64121-9009 (Express Mail Address: The Cambiar Funds c/o DST Systems, Inc., 430 West 7th Street, Kansas City, MO 64105) or by calling 1-866-777-8227 (toll free). Copies of the SAI to this Proxy Statement/Prospectus (the “Merger SAI”) are available at no charge by writing to the Cambiar Funds at One Freedom Valley Drive, Oaks, Pennsylvania 19456, or by calling 1-866-777-8227.

The Target Trust and Acquiring Trust are subject to the information requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”) and, in accordance therewith, file reports and other information, including proxy materials and trust documents, with the U.S. Securities and Exchange Commission (the “SEC”). Reports, proxy statements, registration statements and other information may be inspected without charge and copied at the public reference facility maintained by the SEC at 100 F Street, N.E., Washington, DC 20549 at prescribed rates, as well as online at http://www.sec.gov, which contains reports, proxy and information statements and other information filed with the SEC. The file number for the Target Fund documents listed above is 333-172080. The file number for the Acquiring Fund documents listed above is 033-42484.

Each of the following documents is incorporated herein by reference and is legally deemed to be part of this Proxy Statement/Prospectus:

| 1. | The Target Funds Prospectus; |

| 2. | The Acquiring Funds Prospectus; |

| 4. | The Acquiring Funds SAI; |

| 5. | Each Target Fund’s audited financial statements and the related report of the independent registered public accounting firm included in the Target Funds Annual Report (no other parts of the Target Funds Annual Report are incorporated herein by reference); |

| 6. | Each Acquiring Fund’s audited financial statements and the related report of the independent registered public accounting firm included in the Acquiring Funds Annual Report (no other parts of the Acquiring Funds Annual Report are incorporated herein by reference); |

| 7. | Each Acquiring Fund’s unaudited financial statements included in the Acquiring Funds Semi-Annual Report (no other parts of the Acquiring Funds Semi-Annual Report are incorporated herein by reference); and |

iv

A copy of the Acquiring Funds Prospectus accompanies this Proxy Statement/Prospectus. The financial highlights for the Target Funds and Acquiring Funds contained in the Target Funds Annual Report and the Acquiring Funds Semi-Annual Report, respectively, are included in this Proxy Statement/Prospectus as Exhibit C. The file number for the Merger SAI is [XX].

These securities have not been approved or disapproved by the SEC nor has the SEC passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense. An investment in the Funds is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose money by investing in the Funds.

v

TABLE OF CONTENTS

| | Page |

| SUMMARY OF KEY INFORMATION | 7 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | 17 |

| THE PROPOSED REORGANIZATIONS | 63 |

| VOTING INFORMATION | 69 |

| OTHER MATTERS | 72 |

| Exhibits | |

| EXHIBIT A Ownership of the Funds | A-1 |

| EXHIBIT B Form of Agreement and Plan of Reorganization | B-1 |

| EXHIBIT C Financial Highlights | C-1 |

No dealer, salesperson or any other person has been authorized to give any information or to make any representations regarding the Reorganizations other than those contained in this Proxy Statement/Prospectus or related solicitation materials on file with the SEC, and you should not rely on such other information or representations.

vi

SUMMARY OF KEY INFORMATION

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus, in the Agreement, and/or in the Target Funds Prospectus, Target Funds SAI, Acquiring Funds Prospectus and Acquiring Funds SAI. Shareholders should read the entire Proxy Statement/Prospectus, the Agreement, the Target Funds Prospectus, the Target Funds SAI, the Acquiring Funds Prospectus and the Acquiring Funds SAI carefully for more complete information.

Why are you sending me the Proxy Statement/Prospectus?

You are receiving this Proxy Statement/Prospectus because you own shares of a Target Fund as of the Record Date and have the right to vote on the very important Proposal described herein concerning your Target Fund. This Proxy Statement/Prospectus contains information that shareholders of the Target Funds should know before voting on the Proposals.

On what am I being asked to vote?

You are being asked to approve reorganizing your Target Fund into its corresponding Acquiring Fund. Specifically, you are being asked to vote on the approval of the Agreement between your Target Fund and the corresponding Acquiring Fund providing for the Reorganization of your Target Fund into the corresponding Acquiring Fund as described in the applicable Proposal.

The principal differences between each Target Fund and its corresponding Acquiring Fund are described in this Proxy Statement/Prospectus. The Acquiring Funds Prospectus that accompanies this Proxy Statement/Prospectus contains additional information about the Acquiring Funds.

Approval of the shareholders of the Target Funds is needed to proceed with the Proposals with respect to each Target Fund. The Meeting will be held on November 22, 2022 to consider the Proposals. Shareholders of each Target Fund will vote separately on each Proposal. The approval of one Reorganization is not contingent upon the approval of any other Reorganization. If shareholders of the Target Funds do not approve the Reorganizations, the Target Fund Board will consider what further actions to take with respect to each Target Funds.

What are the reasons for the proposed Reorganizations?

Cambiar Investors, LLC (“Cambiar” or the “Acquiring Funds’ Adviser”) and Great Lakes Advisors, LLC (“GLA” or the “Target Funds’ Adviser”) believe that, from an asset class perspective, the synergies that exist between the two organizations make reorganizing each Target Fund into its respective Acquiring Fund a compelling proposition. The similar orientations and objectives of each organization’s respective Funds are complementary and led GLA to believe that transitioning Target Fund shareholders into the Acquiring Funds would benefit such shareholders. Cambiar further believes that the increased asset levels of the Acquiring Funds that would result from the Reorganizations have the opportunity to assist the Acquiring Funds in achieving improved economies of scale to the benefit of both the current investors in the Target Funds and the Acquiring Funds.

What is the expected timing of the Reorganizations?

If shareholders of each Target Fund approve its Reorganization at the Meeting, and all other closing conditions are met, each Reorganization is expected to take effect on or about December 12, 2022 (the “Closing Date”).

Has the Target Trust Board approved the Reorganizations?

Yes. The Target Trust Board has carefully reviewed the Proposals and unanimously approved the Agreement and the Reorganizations. The Target Trust Board recommends that shareholders of the Target Funds vote “FOR” the Proposals.

How will the number of Acquiring Fund shares that I will receive be determined?

Immediately after the Reorganization of your Target Fund, you will receive your pro rata share of the Acquiring Fund shares received by your Target Fund in the Reorganization. The number of Acquiring Fund shares that a Target Fund’s shareholders will receive will be based on the relative net asset value (“NAV”) of the Target Fund and its corresponding Acquiring Fund as of immediately after the close of regular trading on the New York Stock Exchange (“NYSE”) on the business day immediately preceding the Closing Date (the “Valuation Time”). Subject to the terms of the Agreement, each Target Fund’s assets will be valued pursuant to the Acquiring Trust’s valuation procedures, determined as of the Valuation Time.

How do the Funds’ investment objectives, principal investment strategies and principal risks compare?

Investment Objective

The investment objective of each of the Great Lakes Disciplined Equity Fund and Great Lakes Large Cap Value Fund is to seek to provide total return, while the investment objective of the Cambiar Opportunity Fund is to seek to provide total return and capital preservation.

The investment objective of the Great Lakes Small Cap Opportunity Fund is to seek to provide total return, while the investment objective of the Cambiar Small Cap Fund is to seek to provide long-term capital appreciation.

The section below entitled “ADDITIONAL INFORMATION ABOUT THE FUNDS — Comparison of Investment Objectives” compares the investment objective of each Target Fund and its corresponding Acquiring Fund in greater detail.

Principal Investment Strategies

The principal investment strategies of each Target Fund are similar to the principal investment strategies of its corresponding Acquiring Fund.

The Great Lakes Disciplined Equity Fund and Cambiar Opportunity Fund employ large-cap focused investment strategies, and thus the universes of securities in which the Funds may invest and which are considered by the respective portfolio managers are similar. These Funds also share relatively similar valuation principles. However, the Great Lakes Disciplined Equity Fund employs a more quantitative investment approach, may invest principally in equity securities of large-cap companies with smaller market capitalizations and holds a larger portfolio of securities than the Cambiar Opportunity Fund. The Great Lakes Disciplined Equity Fund also utilizes a “core” approach to investing that is intended not to exhibit a pronounced style bias towards either growth or value, whereas the Cambiar Opportunity Fund employs a value strategy.

The Great Lakes Large Cap Value Fund and Cambiar Opportunity Fund each employ a large-cap value investment strategy and employ a fundamental investment discipline that utilizes an active “bottom up” investment approach, seeking to build focused portfolios of well-managed businesses trading at discounts to intrinsic values and possessing superior quality characteristics. The Great Lakes Large Cap Value Fund generally holds a similar number of securities as the Cambiar Opportunity Fund, in that the Great Lakes Large Cap Fund generally holds approximately 35-55 securities, while the Cambiar Opportunity Fund generally holds approximately 35 securities. However, the Great Lakes Large Cap Value Fund may invest principally in equity securities of companies with smaller market capitalizations than the companies in which the Cambiar Opportunity Fund may invest principally. The Great Lakes Large Cap Value Fund also incorporates environmental, social and governance (“ESG”) factors into its principal investment strategies, while the Cambiar Opportunity Fund’s principal investment strategies do not contain a formal position on ESG factors.

The Great Lakes Small Cap Opportunity Fund and Cambiar Small Cap Fund each employ a small-cap value investment strategy and employ a fundamental investment discipline that utilizes an active “bottom up” investment approach, seeking to build focused portfolios of well-managed businesses trading at discounts to intrinsic values and possessing superior quality characteristics. The Great Lakes Small Cap Opportunity Fund generally hold a similar number of securities as the Cambiar Small Cap Fund.

In addition to the foregoing:

| · | Each Target Fund may invest in preferred stock, convertible securities, other investment companies, including exchange traded funds (“ETFs”), and real estate investment trusts (“REITs”) as a principal investment strategy. Each Acquiring Fund may invest in such instruments but does not do so as a principal investment strategy. |

| · | Each Target Fund may also invest up to 20% of its total assets in securities denominated in foreign currencies or in American Depositary Receipts (“ADRs”) that trade on a United States exchange. Each Acquiring Fund may invest in such instruments but does not do so as a principal investment strategy. |

The section below entitled “ADDITIONAL INFORMATION ABOUT THE FUNDS —Comparison of Principal Investment Strategies” compares the principal investment strategies of each Target Fund and its corresponding Acquiring Fund in greater detail.

Principal Risks

Each Target Fund and its corresponding Acquiring Fund share certain principal risks. In this regard:

| · | The Great Lakes Disciplined Equity Fund and Cambiar Opportunity Fund share the following principal risks: market risk, equity risk and pandemic risk. |

| · | The Great Lakes Large Cap Value Fund and Cambiar Opportunity Fund share the following principal risks: market risk, equity risk, value-style investing risk and pandemic risk. |

| · | The Great Lakes Small Cap Opportunities Fund and Cambiar Small Cap Fund share the following principal risks: market risk, equity risk, small capitalization company risk, value-style investing risk and pandemic risk. |

However, there are also differences in the principal risks of each Target Fund and its corresponding Acquiring Fund. In this regard, each Target Fund is subject to the following principal risks to which its corresponding Acquiring Fund is not subject because the Acquiring Fund does not utilize the principal investment strategies that give rise to such principal risks: preferred stock risk, convertible securities risk, investment company risk, ETF risk, sector emphasis risk, foreign securities risk, currency risk, ADR risk and portfolio turnover risk. In addition, the following Target Funds and Acquiring Fund include the following principal risk disclosures that the corresponding Acquiring Fund or Target Fund, as applicable, do not:

| · | The Great Lakes Disciplined Equity Fund discloses information technology sector risk, management risk, large companies risk and REIT risk. |

| · | The Great Lakes Large Cap Value Fund discloses limited holdings risk, large companies risk, ESG risk and financial sector risk. |

| · | The Great Lakes Small Cap Opportunities Fund discloses an industrial sector risk and financial sector risk. |

| · | The Cambiar Opportunity Fund discloses value style investing risk. |

Given the differences in investment objectives and principal investment strategies, Target Fund shareholders may experience different principal investment strategies and risk profiles as shareholders of the Acquiring Funds. The section below entitled “ADDITIONAL INFORMATION ABOUT THE FUNDS —Comparison of Principal Risks of Investing in the Funds” compares the principal risks of each Target Fund and its corresponding Acquiring Fund in greater detail.

How do the Funds’ fees and expenses compare?

The investment advisory fee rate payable by the Cambiar Opportunity Fund to Cambiar is the same as the investment advisory fee rate payable by each of the Great Lakes Disciplined Equity Fund and Great Lakes Large Cap Value Fund to the Target Funds’ Adviser. The current Total Annual Fund Operating Expenses of the Institutional Class of the Cambiar Opportunity Fund are lower than the current Total Annual Fund Operating Expenses of the Institutional Class of each of the Great Lakes Disciplined Equity Fund and Great Lakes Large Cap Value Fund, and the pro forma Total Annual Fund Operating Expenses of the Institutional Class of the Cambiar Opportunity Fund after giving effect to the Reorganization are expected to be lower than the current Total Annual Fund Operating Expenses of the Institutional Class of each of the Great Lakes Disciplined Equity Fund and Great Lakes Large Cap Value Fund. Further, the Cambiar Opportunity Fund has a lower contractual fee cap than each of the Great Lakes Disciplined Equity Fund and Great Lakes Large Cap Value Fund.

The investment advisory fee rate payable by the Cambiar Small Cap Fund to Cambiar is higher than the investment advisory fee rate payable by the Great Lakes Small Cap Opportunity Fund to the Target Funds’ Adviser. However, the current Total Annual Fund Operating Expenses of the Investor Class and Institutional Class of the Cambiar Small Cap Fund are lower than the current Total Annual Fund Operating Expenses of the Investor Class and Institutional Class of the Great Lakes Small Cap Opportunity Fund, respectively, and the pro forma Total Annual Fund Operating Expenses of the Investor Class and Institutional Class of the Cambiar Small Cap Fund after giving effect to the Reorganization are expected to be lower than the current Total Annual Fund Operating Expenses of the Investor Class and Institutional Class of the Great Lakes Small Cap Opportunity Fund. Further, the Cambiar Small Cap Fund has a lower contractual fee cap than the Great Lakes Small Cap Opportunity Fund.

The section below entitled “ADDITIONAL INFORMATION ABOUT THE FUNDS – Comparison of Fund Fees and Expenses” compares the fees and expenses of each Target Fund to its corresponding Acquiring Fund.

How do the Funds’ share classes compare?

Holders of Institutional Class Shares of each Target Fund will receive Institutional Class Shares of the corresponding Acquiring Fund in connection with the Target Fund’s Reorganization. Institutional Class Shares of each Target Fund and its corresponding Acquiring Fund do not impose any sales charges, fees pursuant to a plan adopted under Rule 12b-1 of the 1940 Act (“Rule 12b-1 Fees”) or shareholder servicing fees adopted pursuant to a shareholder servicing plan (a “Shareholder Servicing Plan Fee”).

Holders of Investor Class Shares of the Great Lakes Small Cap Opportunity Fund will receive Investor Class Shares of the Cambiar Small Cap Fund in connection with the Great Lakes Small Cap Opportunity Fund’s Reorganization. Investor Class Shares of the Great Lakes Small Cap Opportunity Fund impose a Rule 12b-1 Fee of 0.25% of the average daily net assets attributable to the Investor Class Shares but do not impose a sales charge or Shareholder Servicing Plan Fee, while Investor Class Shares of the Cambiar Small Cap Fund impose a Shareholder Servicing Plan Fee not to exceed 0.25% of the average daily net assets attributable to the Investor Class Shares annually for non-distribution-related services but do not impose a sales charge or Rule 12b-1 Fee.

Institutional Class Shares of each Target Fund have a significantly lower minimum investment amount than its corresponding Acquiring Fund. Institutional Class Shares of each Target Fund have a subsequent minimum investment amount, while Institutional Class Shares of each Acquiring Fund do not.

Investor Class Shares of the Cambiar Small Cap Fund offered through non-retirement accounts have a higher minimum investment amount than Investor Class Shares of the Great Lakes Small Cap Opportunity Fund offered through non-retirement accounts. Investor Class Shares of the Cambiar Small Cap Fund offered through retirement accounts have the same or lower minimum investment amounts than Investor Class Shares of the Great Lakes Small Cap Opportunity Fund offered through non-retirement accounts.

Target Fund shareholders will not be subject to the minimum initial investment amounts of the Acquiring Funds described above with respect to their receipt of Acquiring Fund Shares issued in connection with the Reorganizations.

The section below entitled “ADDITIONAL INFORMATION ABOUT THE FUNDS – Comparison of Share Class Features” provides additional details on the features of each share class of each Target Fund to those of its corresponding Acquiring Fund.

How do the Funds’ portfolio turnover rates compare?

Each Fund pays transaction costs, such as brokerage commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the Example, affect the Fund’s performance.

During the fiscal year ended March 31, 2022, the Great Lakes Disciplined Equity Fund’s portfolio turnover rate was 163% of the average value of its portfolio, the Great Lakes Large Cap Value Fund’s portfolio turnover rate was 56% of the average value of its portfolio and the Great Lakes Small Cap Opportunity Fund’s portfolio turnover rate was 46% of the average value of its portfolio. During the fiscal year ended October 31, 2021, the Cambiar Opportunity Fund’s portfolio turnover rate was 36% of the average value of its portfolio and the Cambiar Small Cap Fund’s portfolio turnover rate was 64% of the average value of its portfolio.

How do the investment advisers and portfolio managers of the Funds compare?

The Target Funds and Acquiring Funds have different investment advisers and portfolio managers. Below is a summary of the investment adviser and portfolio managers of each Fund. For more information, please see the section below entitled “ADDITIONAL INFORMATION ABOUT THE FUNDS – Comparison of Investment Advisers and Portfolio Managers.”

Investment Adviser

GLA serves as investment adviser of the Target Funds. GLA is located at 231 South LaSalle Street, 4th Floor, Chicago, Illinois 60604. As of December 30, 2021, GLA had approximately $12.6 billion in assets under management and advisement.

Cambiar serves as investment adviser of the Acquiring Funds. Cambiar is located at 200 Columbine Street, Suite 800, Denver, Colorado 80206. As of December 31, 2021, Cambiar had approximately $5.7 billion in assets under management.

Portfolio Managers

The Great Lakes Disciplined Equity Fund is managed by the Great Lakes Disciplined Equity Team. This team is comprised of Jon E. Quigley, CFA and John D. Bright, CFA. They are responsible for the day-to-day management of the Fund. Mr. Quigley has served the Fund since its inception in June 2009 through the Fund’s predecessor and Mr. Bright has served the Fund since June 2009.

The Great Lakes Large Cap Value Fund is managed by the Great Lakes Value Equity Team. The team is comprised of Edward Calkins, CFA; Wells L. Frice, CFA; Benjamin J. Kim, CFA, CPA, Portfolio Manager/Head of Research; and Ray Wicklander, III, CFA, CPA, Portfolio Manager/Analyst. They are responsible for the day-to-day management of the Fund. Messrs. Calkins and Frice have managed the Fund since its inception in September 2012. Messrs. Kim and Wicklander have managed the Fund since April, 2020.

The Great Lakes Small Cap Opportunity Fund is managed by the Great Lakes Small Cap Equity Team. Benjamin Kim, CFA, CPA is responsible for the day-to-day management of the Fund. Mr. Kim has served the Fund since June 2014.

The Cambiar Opportunity Fund is managed by the Cambiar domestic investment team. This team includes:

Brian M. Barish, CFA, President, Chief Investment Officer, joined Cambiar in 1997 and has served as Lead Manager of the portfolio team for the Fund since its inception in 1998.

Anna (Ania) A. Aldrich, CFA, Investment Principal, joined Cambiar in 1999 and has served on the portfolio team for the Fund since 1999.

Andrew P. Baumbusch, Investment Principal, joined Cambiar in 2004 and has served on the portfolio team for the Fund since 2004.

Colin M. Dunn, CFA, Investment Principal, joined Cambiar in 2011 and has served on the portfolio team for the Fund since 2011.

Joseph S. Chin, CFA, Investment Principal, joined Cambiar in 2019 and has served on the portfolio team for the Fund since 2019.

The Cambiar Small Cap Fund is managed by the Cambiar domestic investment team. This team includes:

Andrew P. Baumbusch, Investment Principal, joined the Adviser in 2004, is Co-Lead Manager of the Fund, and has served on the portfolio team for the Fund since its inception in 2004.

Colin M. Dunn, CFA, Investment Principal, joined the Adviser in 2011, is Co-Lead Manager of the Fund, and has served on the portfolio team for the Fund since 2011.

Brian M. Barish, CFA, President, Chief Investment Officer, joined the Adviser in 1997 and has served on the portfolio team for the Fund since its inception in 2004.

Anna (Ania) A. Aldrich, CFA, Investment Principal, joined the Adviser in 1999 and has served on the portfolio team for the Fund since its inception in 2004.

Joseph S. Chin, CFA, Investment Principal, joined the Adviser in 2019 and has served on the portfolio team for the Fund since 2019.

How do the Funds’ other principal service providers compare?

The following table identifies the other principal service providers of the Target Funds and the Acquiring Funds:

| | Target Funds’ Service Providers | Acquiring Funds’ Service Providers |

| Administrator | U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services | SEI Investments Global Funds Services |

| Distributor | Quasar Distributors, LLC | SEI Investments Distribution Co. |

| Transfer Agent: | U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services | DST Systems, Inc. |

| Custodian: | U.S. Bank N.A. | U.S. Bank N.A. |

| Auditor: | Cohen & Company, Ltd. | Ernst & Young, LLP |

How do the Funds’ purchase and redemption procedures and exchange policies compare?

The purchase and redemption procedures and exchange policies of the Target Funds and Acquiring Funds are substantively similar. For more information, please see the “How to Purchase Fund Shares,” “How to Redeem Fund Shares,” and “How to Exchange Fund Shares” sections of the Target Funds Prospectus previously sent to shareholders and the “Buying Fund Shares,” Redeeming Fund Shares,” and “Exchanging Fund Shares” sections of the Acquiring Funds Prospectus that accompanies this Proxy Statement/Prospectus.

How will my distributions be affected by the Reorganizations?

Each Acquiring Fund and its corresponding Target Fund distribute their net investment income, and make distributions of their net realized capital gains, if any, as follows:

| Fund | Distributions | Capital Gains |

| Great Lakes Disciplined Equity Fund | Quarterly | Annually |

| Cambiar Opportunity Fund | Annually | |

| Great Lakes Large Cap Value Fund | Quarterly | Annually |

| Cambiar Opportunity Fund | Annually | |

| Great Lakes Small Cap Opportunity Fund | Annually | Annually |

| Cambiar Small Cap Fund | | |

Who will pay the costs of the Reorganizations?

GLA and Cambiar have agreed to bear the costs of the Reorganizations.

However, each Target Fund will pay the brokerage or other transaction costs, including capital gains taxes and transfer taxes for foreign securities, incurred in connection with the alignment of the Target Fund’s portfolio holdings with the corresponding Acquiring Fund’s investment strategies and the transfer of the Target Fund’s portfolio holdings to the Acquiring Fund. Based on the information available as of the date of this Proxy Statement/Prospectus, including information regarding GLA’s proposed alignment of each Target Fund’s portfolio holdings with the corresponding Acquiring Fund’s investment strategies in anticipation of their respective Reorganizations: the Great Lakes Disciplined Equity Fund is expected to pay approximately $552 ($0.00 per share) in brokerage and other transaction costs; the Great Lakes Large Cap Value Fund is expected to pay approximately $1,406 ($0.00 per share) in brokerage and other transaction costs; and the Great Lakes Small Cap Opportunity Fund is expected to pay approximately $2,960 ($0.00 per share) in brokerage and other transaction costs.

It is also expected that each Acquiring Fund will experience higher portfolio turnover and increased trading costs following the Closing Date as Cambiar aligns each Target Fund’s securities received by its corresponding Acquiring Fund pursuant to the Reorganization to Cambiar’s investment strategy. Transaction costs relating to these anticipated sales and purchases are expected to have no material impact on either Acquiring Fund.

The actual brokerage and other transaction costs incurred by a Fund will vary depending upon market conditions, shareholder activity, the portfolio holdings of the Target Fund and its corresponding Acquiring Fund, the commission rates charged by brokers, and the specific securities sold and/or transferred to the Acquiring Fund.

Will there be any tax consequences resulting from the Reorganizations?

Each Reorganization is designed to qualify as a tax-free reorganization for federal income tax purposes and each Target Fund anticipates receiving a legal opinion to that effect, although there can be no assurance that the Internal Revenue Service (“IRS”) will adopt a similar position. This means that the shareholders of each Target Fund will recognize no gain or loss for federal income tax purposes upon the exchange of all of their shares in the Target Fund for shares in the corresponding Acquiring Fund. In addition, the tax basis and holding period of a shareholder’s Target Fund Shares are expected to carry over to the Acquiring Fund Shares the shareholder receives as a result of the applicable Reorganization. At any time prior to the consummation of the Reorganizations, Target Fund shareholders may redeem their Target Fund Shares, generally resulting in the recognition of gain or loss to such shareholders for U.S. federal income tax purposes.

However, the sale of certain of each Target Fund’s portfolio holdings in connection with the alignment of the Target Fund’s portfolio holdings with the corresponding Acquiring Fund’s investment strategies prior to the transfer of the Target Fund’s portfolio holdings to the Acquiring Fund may result in the realization of capital gains by the Target Fund that, to the extent not offset by capital losses, would be distributed to shareholders, and those distributions would be taxable to shareholders who hold shares in taxable accounts. Based on the information available as of the date of this Proxy Statement/Prospectus, including information regarding GLA’s proposed alignment of each Target Fund’s portfolio holdings with the corresponding Acquiring Fund’s investment strategies in anticipation of their respective Reorganizations, the Great Lakes Disciplined Equity Fund is expected to realize approximately $470,000 ($0.18 per share) in capital gains; the Great Lakes Large Cap Value Fund is expected to realize approximately $1.3 million ($0.48 per share) in capital gains; and the Great Lakes Small Cap Opportunity Fund is expected to realize approximately $0 ($0 per share) in capital gains.

Accordingly, any sale of portfolio holdings of a Target Fund prior to a Reorganization, whether in the ordinary course of business or in anticipation of the Reorganization, may increase the amount of the final distribution made by a Target Fund prior to its Reorganization. Immediately prior to a Reorganization, each Target Fund will declare and pay a distribution to shareholders of all of the Target Fund’s remaining undistributed investment company taxable income and net capital gain, if any, recognized in taxable years ending on or before the day of the Reorganization. Furthermore, any sales of portfolio securities after the closing of the Reorganizations could result in increased taxable distributions to shareholders of an Acquiring Fund.

The actual tax consequences of any sale of portfolio holdings will vary depending upon market conditions, shareholder activity, the portfolio holdings of a Target Fund and its corresponding Acquiring Fund, the specific securities sold, the Target Fund’s and Acquiring Fund’s other gains and losses, and the Target Fund’s and Acquiring Fund’s ability to use any available capital loss carryforwards. As of December 31, 2021, the Target Funds had no capital loss carryforwards.

Shareholders should consult their tax adviser about state and local tax consequences of the Reorganizations, if any, because the information about tax consequences in this Proxy Statement/Prospectus relates only to the federal income tax consequences of the Reorganizations.

For detailed information about the federal income tax consequences of the Reorganizations, please refer to the section titled “THE PROPOSED REORGANIZATIONS – Federal Income Tax Considerations” below.

How do I vote on the Reorganizations?

There are several ways you can vote your shares, including by participating in the Meeting virtually and casting your vote, by mail, by telephone, or via the Internet. The proxy card that accompanies this Proxy Statement/Prospectus provides detailed instructions on how you may vote your shares. If you properly fill in and sign your proxy card and send it to us in time to vote at the Meeting, your “proxy” (the individuals named on your proxy card) will vote your shares as you have directed. If you sign your proxy card but do not make specific choices, your proxy will vote your shares “FOR” the Proposal, as recommended by the Target Fund Board, and in their best judgment on other matters to the extent permitted by the proxy rules of the U.S. Securities and Exchange Commission.

What will happen if shareholders of a Target Fund do not approve its Reorganization?

The approval of one Reorganization is not contingent upon the approval of any other Reorganization. If the shareholders of a Target Fund do not approve its Reorganization, the Target Trust Board will consider other possible courses of action for the Target Fund, including liquidation of the Target Fund.

What if I do not wish to participate in the Reorganizations?

If you do not wish to have your Target Fund shares exchanged for shares of the corresponding Acquiring Fund, you may redeem your shares prior to the consummation of your Target Fund’s Reorganization. If you redeem your shares, and if you hold shares in a taxable account, you will recognize a taxable gain or loss based on the difference between your tax basis in the shares and the amount you receive for them.

ADDITIONAL INFORMATION ABOUT THE FUNDS

Comparison of Investment Objectives

The investment objective of each Target Fund and its corresponding Acquiring Fund are described below. Each Fund’s investment objective is classified as non-fundamental, which means that a Target Fund’s investment objective can be changed by the Target Trust Board without shareholder approval, and an Acquiring Fund’s investment objective can be changed by the Board of Trustees of the Acquiring Funds (the “Acquiring Trust Board”) without shareholder approval. Each Fund’s investment objective is set forth in the following table:

Investment Objectives

| Target Fund | Acquiring Fund |

| The Great Lakes Disciplined Equity Fund seeks to provide total return. | The Cambiar Opportunity Fund seeks total return and capital preservation. |

| The Great Lakes Large Cap Value Fund seeks to provide total return. | |

| The Great Lakes Small Cap Opportunity Fund seeks to provide total return. | The Cambiar Small Cap Fund seeks long-term capital appreciation. |

Comparison of Fund Fees and Expenses

Great Lakes Disciplined Equity Fund – Cambiar Opportunity Fund Reorganization

This table describes (1) the actual fees and expenses for the Institutional Class Shares of the Great Lakes Disciplined Equity Fund for the fiscal year ended March 31, 2022; (2) the actual fees and expenses for the Institutional Class Shares of the Cambiar Opportunity Fund for the fiscal period ended April 30, 2022; and (3) the pro forma fees and expenses of the Institutional Class Shares of the Cambiar Opportunity Fund on a combined basis after giving effect to the Reorganization.

| | Great Lakes Disciplined Equity Fund | Cambiar Opportunity Fund | Cambiar Opportunity Fund, Pro Forma Combined |

| | | |

| Shareholder Fees (fees paid directly from your account) | None | None | None |

| | | | |

| Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | |

| Management Fee | 0.60% | 0.60% | 0.60% |

| Other Expenses | 0.62% | 0.15% | 0.15% |

| Total Annual Fund Operating Expenses | 1.22% | 0.75% | 0.75% |

| Less Fee Reductions and/or Expense Reimbursements | (0.37)%1 | (0.10)%2 | (0.10)% |

| Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | 0.85% | 0.65% | 0.65% |

| 1 | GLA has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and other transactional expenses, and extraordinary expenses) do not exceed 0.85% of the average daily net assets of the Great Lakes Disciplined Equity Fund. Fees waived and expenses paid by GLA may be recouped by GLA for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least July 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Target Trust Board or GLA, with the consent of the Target Trust Board. |

| 2 | Cambiar has contractually agreed to reduce fees and reimburse expenses in order to keep net operating expenses (excluding any class-specific expenses, interest, taxes, brokerage commissions and other costs and expenses relating to the securities that are purchased and sold by the Cambiar Opportunity Fund, acquired fund fees and expenses, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other non-routine expenses (collectively, “excluded expenses”)) from exceeding 0.65% of the average daily net assets of the Fund’s Institutional Class Shares until March 1, 2023. In addition, Cambiar may receive from the Fund the difference between the Total Annual Fund Operating Expenses (not including excluded expenses) and the expense cap to recoup all or a portion of the fees waived or reduced or other payments remitted by Cambiar during the rolling three-year period preceding the date of the reimbursement if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the expense cap (i) at the time of the fee waiver or expense payment; and (ii) at the time of the reimbursement. This Agreement may be terminated: (i) by the Acquiring Trust Board, for any reason at any time; or (ii) by Cambiar, upon ninety (90) days’ prior written notice to the Acquiring Trust, effective as of the close of business on March 1, 2023. This Agreement automatically terminates upon the termination of the investment advisory agreement between Cambiar and the Acquiring Trust. |

Example

This Example is intended to help you compare the costs of investing in the Great Lakes Disciplined Equity Fund and the Cambiar Opportunity Fund with the cost of investing in other mutual funds. Pro forma costs of investing in the Cambiar Opportunity Fund after giving effect to the Reorganization are provided. All costs are based upon the information set forth in the fee table above.

The Example assumes that (i) you invest $10,000 for the time periods indicated and then sell or redeem all your shares at the end of those periods, (ii) your investment has a 5% return each year, and (iii) operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements for the contractual period above and the Total Annual Fund Operating Expenses thereafter. Only the first year of each period in the Example takes into account the fee reduction/expense reimbursement described in the footnotes above. Your actual costs may be higher or lower:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Great Lakes Disciplined Equity Fund | $87 | $351 | $635 | $1,445 |

| Cambiar Opportunity Fund | $66 | $230 | $407 | $921 |

| Cambiar Opportunity Fund, Pro Forma Combined | $66 | $230 | $407 | $921 |

Great Lakes Large Cap Value Fund – Cambiar Opportunity Fund Reorganization

This table describes (1) the actual fees and expenses for the Institutional Class Shares of the Great Lakes Large Cap Value Fund for the fiscal year ended March 31, 2022; (2) the actual fees and expenses for the Institutional Class Shares of the Cambiar Opportunity Fund for the fiscal period ended April 30, 2022; and (3) the pro forma fees and expenses of the Institutional Class Shares of the Cambiar Opportunity Fund on a combined basis after giving effect to the Reorganization.

| | Great Lakes Large Cap Value Fund | Cambiar Opportunity Fund | Cambiar Opportunity Fund, Pro Forma Combined |

| | | |

| Shareholder Fees (fees paid directly from your account) | None | None | None |

| | | | |

| Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | |

| Management Fee | 0.60% | 0.60% | 0.60% |

| Other Expenses | 0.42% | 0.15% | 0.15% |

| Total Annual Fund Operating Expenses | 1.02% | 0.75% | 0.75% |

| Less Fee Reductions and/or Expense Reimbursements | (0.17)%1 | (0.10)%2 | (0.10)% |

| Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | 0.85% | 0.65% | 0.65% |

| 1 | GLA has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and other transactional expenses, and extraordinary expenses) do not exceed 0.85% of the average daily net assets of the Great Lakes Large Cap Value Fund. Fees waived and expenses paid by GLA may be recouped by GLA for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least July 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Target Trust Board or GLA, with the consent of the Target Trust Board. |

| 2 | Cambiar has contractually agreed to reduce fees and reimburse expenses in order to keep net operating expenses (excluding any class-specific expenses, interest, taxes, brokerage commissions and other costs and expenses relating to the securities that are purchased and sold by the Cambiar Opportunity Fund, acquired fund fees and expenses, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other non-routine expenses (collectively, “excluded expenses”)) from exceeding 0.65% of the average daily net assets of the Fund’s Institutional Class Shares until March 1, 2023. In addition, Cambiar may receive from the Fund the difference between the Total Annual Fund Operating Expenses (not including excluded expenses) and the expense cap to recoup all or a portion of the fees waived or reduced or other payments remitted by Cambiar during the rolling three-year period preceding the date of the reimbursement if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the expense cap (i) at the time of the fee waiver or expense payment; and (ii) at the time of the reimbursement. This Agreement may be terminated: (i) by the Acquiring Trust Board, for any reason at any time; or (ii) by Cambiar, upon ninety (90) days’ prior written notice to the Acquiring Trust, effective as of the close of business on March 1, 2023. This Agreement automatically terminates upon the termination of the investment advisory agreement between Cambiar and the Acquiring Trust. |

Example

This Example is intended to help you compare the costs of investing in the Great Lakes Large Cap Value Fund and the Cambiar Opportunity Fund with the cost of investing in other mutual funds. Pro forma costs of investing in the Cambiar Opportunity Fund after giving effect to the Reorganization are provided. All costs are based upon the information set forth in the fee table above.

The Example assumes that (i) you invest $10,000 for the time periods indicated and then sell or redeem all your shares at the end of those periods, (ii) your investment has a 5% return each year, and (iii) operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements for the contractual period above and the Total Annual Fund Operating Expenses thereafter. Only the first year of each period in the Example takes into account the fee reduction/expense reimbursement described in the footnotes above. Your actual costs may be higher or lower:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Great Lakes Large Cap Value Fund | $87 | $308 | $547 | $1,232 |

| Cambiar Opportunity Fund | $66 | $230 | $407 | $921 |

| Cambiar Opportunity Fund, Pro Forma Combined | $66 | $230 | $407 | $921 |

Great Lakes Small Cap Opportunity Fund – Cambiar Small Cap Fund Reorganization

Institutional Class Shares

This table describes (1) the actual fees and expenses for the Institutional Class Shares of the Great Lakes Small Cap Opportunity Fund for the fiscal year ended March 31, 2022; (2) the actual fees and expenses for the Institutional Class Shares of the Cambiar Small Cap Fund for the fiscal period ended April 30, 2022; and (3) the pro forma fees and expenses of the Institutional Class Shares of the Cambiar Small Cap Fund on a combined basis after giving effect to the Reorganization.

| |

| Great Lakes Small Cap Opportunity Fund | Cambiar Small Cap Fund | Cambiar Small Cap Fund, Pro Forma Combined |

| Shareholder Fees (fees paid directly from your account) | | | |

| Redemption Fees (as a percentage of amount redeemed, if shares redeemed have been held for less than 90 days) | None | 2.00%2 | 2.00% |

| | | | |

| Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | |

| Management Fee | 0.60% | 0.85% | 0.85% |

| Other Expenses | 0.45% | 0.23% | 0.21% |

| Total Annual Fund Operating Expenses | 1.05% | 1.08% | 1.06% |

| Less Fee Reductions and/or Expense Reimbursements | (0.06)%1 | (0.18)%3 | (0.18)% |

| Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | 0.99% | 0.90% | 0.90% |

| 1 | GLA has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and other transactional expenses, and extraordinary expenses) do not exceed 0.99% of the average daily net assets of the Institutional Class. Fees waived and expenses paid by GLA may be recouped by GLA for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least July 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Target Trust Board or GLA, with the consent of the Target Trust Board. |

| 2 | The Cambiar Small Cap Fund charges a redemption fee on redemptions (including exchanges) of shares that have been held for less than 90 days. |

| 3 | Cambiar has contractually agreed to reduce fees and reimburse expenses in order to keep net operating expenses (excluding any class-specific expenses, interest, taxes, brokerage commissions and other costs and expenses relating to the securities that are purchased and sold by the Cambiar Small Cap Fund, acquired fund fees and expenses, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other non-routine expenses (collectively, “excluded expenses”)) from exceeding 0.90% of the average daily net assets of the Fund’s Institutional Class Shares until March 1, 2023. In addition, Cambiar may receive from the Fund the difference between the Total Annual Fund Operating Expenses (not including excluded expenses) and the expense cap to recoup all or a portion of the fees waived or reduced or other payments remitted by Cambiar during the rolling three-year period preceding the date of the reimbursement if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the expense cap (i) at the time of the fee waiver or expense payment; and (ii) at the time of the reimbursement. This Agreement may be terminated: (i) by the Acquiring Trust Board, for any reason at any time; or (ii) by Cambiar, upon ninety (90) days’ prior written notice to the Acquiring Trust, effective as of the close of business on March 1, 2023. This Agreement automatically terminates upon the termination of the investment advisory agreement between Cambiar and the Acquiring Trust. |

Example

This Example is intended to help you compare the costs of investing in the Great Lakes Small Cap Opportunity Fund and the Cambiar Small Cap Fund with the cost of investing in other mutual funds. Pro forma costs of investing in the Cambiar Small Cap Fund after giving effect to the Reorganization are provided. All costs are based upon the information set forth in the fee table above.

The Example assumes that (i) you invest $10,000 in the Funds’ Institutional Class Shares for the time periods indicated and then redeem all of your Institutional Class Shares at the end of those periods; (ii) your investment has a 5% return each year; and (iii) operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements for the contractual period above and the Total Annual Fund Operating Expenses thereafter. Only the first year of each period in the Example takes into account the fee reduction/expense reimbursement described in the footnotes above. Your actual costs may be higher or lower:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Great Lakes Small Cap Opportunity Fund | $101 | $328 | $574 | $1,277 |

| Cambiar Small Cap Fund | $92 | $326 | $578 | $1,301 |

| Cambiar Small Cap Fund, Pro Forma Combined | $92 | $321 | $569 | $1,280 |

Investor Class Shares

This table describes (1) the actual fees and expenses for the Investor Class Shares of the Great Lakes Small Cap Opportunity Fund for the fiscal year ended March 31, 2022; (2) the actual fees and expenses for the Investor Class Shares of the Cambiar Small Cap Fund for the fiscal period ended April 30, 2022; and (3) the pro forma fees and expenses of the Investor Class Shares of the Cambiar Small Cap Fund on a combined basis after giving effect to the Reorganization.

| | | | |

| Great Lakes Small Cap Opportunity Fund | Cambiar Small Cap Fund | Cambiar Small Cap Fund, Pro Forma Combined |

| Shareholder Fees (fees paid directly from your account) | | | |

| Redemption Fees (as a percentage of amount redeemed, if shares redeemed have been held for less than 90 days) | None | 2.00%2 | 2.00% |

| | | | |

| Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | |

| Management Fee | 0.60% | 0.85% | 0.85% |

| Distribution (Rule 12b-1) Fee | 0.25% | None | None |

| Shareholder Service Fee | None | 0.20%3 | 0.20% |

| Other Expenses | 0.46% | 0.23% | 0.21% |

| Total Annual Fund Operating Expenses | 1.31% | 1.28% | 1.26% |

| Less Fee Reductions and/or Expense Reimbursements | (0.07)%1 | (0.18)%4 | (0.16)% |

| Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements | 1.24% | 1.10% | 1.10% |

| 1 | GLA has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and other transactional expenses, and extraordinary expenses) do not exceed 0.99% of the average daily net assets of the Investor Class. Fees waived and expenses paid by GLA may be recouped by GLA for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least July 29, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Target Trust Board or GLA, with the consent of the Target Trust Board. |

| 2 | The Cambiar Small Cap Fund charges a redemption fee on redemptions (including exchanges) of shares that have been held for less than 90 days. |

| 3 | The Cambiar Small Cap Fund’s Investor Class Shares are subject to a maximum annual shareholder servicing fee of 0.25% of the average daily net assets of the Fund’s Investor Class Shares. |

| 4 | Cambiar has contractually agreed to reduce fees and reimburse expenses in order to keep net operating expenses (excluding any class-specific expenses (including shareholder servicing fees), interest, taxes, brokerage commissions and other costs and expenses relating to the securities that are purchased and sold by the Cambiar Small Cap Fund, acquired fund fees and expenses, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other non-routine expenses (collectively, “excluded expenses”)) from exceeding 0.90% of the average daily net assets of the Fund’s Investor Class Shares until March 1, 2023. In addition, Cambiar may receive from the Fund the difference between the Total Annual Fund Operating Expenses (not including excluded expenses) and the expense cap to recoup all or a portion of the fees waived or reduced or other payments remitted by Cambiar during the rolling three-year period preceding the date of the reimbursement if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the expense cap (i) at the time of the fee waiver or expense payment; and (ii) at the time of the reimbursement. This Agreement may be terminated: (i) by the Acquiring Trust Board, for any reason at any time; or (ii) by Cambiar, upon ninety (90) days’ prior written notice to the Acquiring Trust, effective as of the close of business on March 1, 2023. This Agreement automatically terminates upon the termination of the investment advisory agreement between Cambiar and the Acquiring Trust. |

Example

This Example is intended to help you compare the costs of investing in the Great Lakes Small Cap Opportunity Fund and the Cambiar Small Cap Fund with the cost of investing in other mutual funds. Pro forma costs of investing in the Cambiar Small Cap Fund after giving effect to the Reorganization are provided. All costs are based upon the information set forth in the fee table above.

The Example assumes that (i) you invest $10,000 in the Funds’ Investor Class Shares for the time periods indicated and then redeem all of your Investor Class Shares at the end of those periods; (ii) your investment has a 5% return each year; and (iii) operating expenses remain equal to the Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements for the contractual period above and the Total Annual Fund Operating Expenses thereafter. Only the first year of each period in the Example takes into account the fee reduction/expense reimbursement described in the footnotes above. Your actual costs may be higher or lower:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Great Lakes Small Cap Opportunity Fund | $126 | $408 | $711 | $1,573 |

| Cambiar Small Cap Fund | $112 | $388 | $685 | $1,529 |

| Cambiar Small Cap Fund, Pro Forma Combined | $112 | $384 | $676 | $1,509 |

Comparison of Share Class Features

The following summarizes the primary features of the Institutional Class Shares and, as applicable, Investor Class Shares of the Funds:

| Fund | Share Class | Investment Minimums | Fees |

Great Lakes Disciplined Equity Fund Great Lakes Large Cap Value Fund | Institutional | Initial: $1,000 Subsequent: $100 | No Rule 12b-1 Fees No Shareholder Servicing Plan Fees No redemption fee |

| Cambiar Opportunity Fund | Institutional | Initial: $500,000 Subsequent: None | No Rule 12b-1 Fees No Shareholder Servicing Plan Fees No redemption fee |

| Great Lakes Small Cap Opportunity Fund | Institutional | Initial: $100,000 Subsequent: $100 | No Rule 12b-1 Fees No Shareholder Servicing Plan Fees No redemption fee |

| Investor | Initial: $100 for regular accounts and $500 for retirement accounts Subsequent: $200 for regular accounts and $200 for retirement accounts | Maximum 0.25% Rule 12b-1 Fees No Shareholder Servicing Plan Fees No redemption fee |

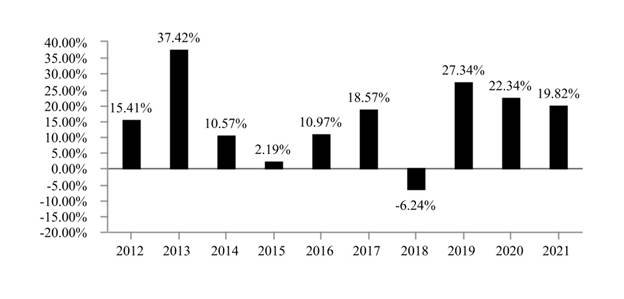

| Cambiar Small Cap Fund | Institutional | Initial: $500,000 Subsequent: None | No Rule 12b-1 Fees No Shareholder Servicing Plan Fees 2.00% redemption fee (as a percentage of amount redeemed, if shares redeemed have been held for less than 90 days) |