UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-06400

The Advisors' Inner Circle Fund

(Exact name of registrant as specified in charter)

________

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant's telephone number, including area code: (877) 446-3863

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

| Item 1. | Reports to Stockholders. |

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") (17 CFR § 270.30e-1), is attached hereto.

The Advisors' Inner Circle Fund

Loomis Sayles Full Discretion Institutional Securitized Fund

Institutional Class Shares

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Institutional Class Shares of the Loomis Sayles Full Discretion Institutional Securitized Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://info.loomissayles.com/full-discretion-funds. You can also request this information by contacting us at 1-800-343-2029.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Loomis Sayles Full Discretion Institutional Securitized Fund, Institutional Class Shares | $22 | 0.20% |

How did the Fund perform in the last year?

The ICE BofA US ABS & CMBS Index (TR) (USD) (the index), a broad measure of the securitized credit market, posted a total return of 9.41%. Over the same time period, the fund generated a return of 19.46%, significantly outperforming its benchmark by 1,005 basis points.

Spread and specific contribution were positive for the period given the funds deeper credit exposure relative to the benchmark. The fund’s effective duration as of October 31, 2024 was 2.44, approximately 0.07 years shorter than that of the index.

Commercial ABS, CLOs, RMBS, CMBS, and Consumer ABS led account outperformance. Commercial ABS was the largest contributor to outperformance for the period. An overweight of issues backed by aircraft leases in commercial ABS led outperformance within the subsectors, followed by an allocation to lower mezzanine CLOs, and an allocation to special situation CMBS conduit subs. On the negative side relative to the benchmark, an underweight position to agency CMBS had a slight negative impact.

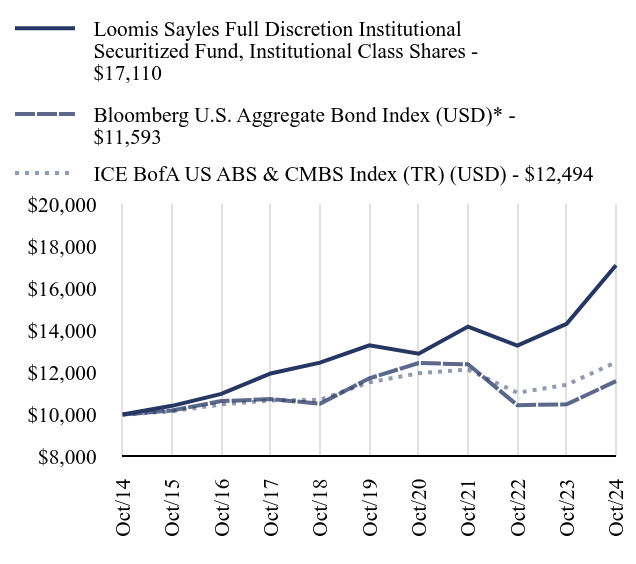

How did the Fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| Loomis Sayles Full Discretion Institutional Securitized Fund, Institutional Class Shares - $17110 | Bloomberg U.S. Aggregate Bond Index (USD)* - $11593 | ICE BofA US ABS & CMBS Index (TR) (USD) - $12494 |

|---|

| Oct/14 | $10000 | $10000 | $10000 |

| Oct/15 | $10417 | $10196 | $10154 |

| Oct/16 | $10983 | $10641 | $10483 |

| Oct/17 | $11959 | $10737 | $10674 |

| Oct/18 | $12471 | $10517 | $10704 |

| Oct/19 | $13296 | $11727 | $11535 |

| Oct/20 | $12897 | $12453 | $11965 |

| Oct/21 | $14188 | $12393 | $12140 |

| Oct/22 | $13286 | $10450 | $11039 |

| Oct/23 | $14323 | $10487 | $11419 |

| Oct/24 | $17110 | $11593 | $12494 |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-800-343-2029 or visit https://info.loomissayles.com/full-discretion-funds for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Loomis Sayles Full Discretion Institutional Securitized Fund, Institutional Class Shares | 19.46% | 5.17% | 5.52% |

| Bloomberg U.S. Aggregate Bond Index (USD)* | 10.55% | -0.23% | 1.49% |

| ICE BofA US ABS & CMBS Index (TR) (USD) | 9.41% | 1.61% | 2.25% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $376,266,155 | 249 | $- | 39% |

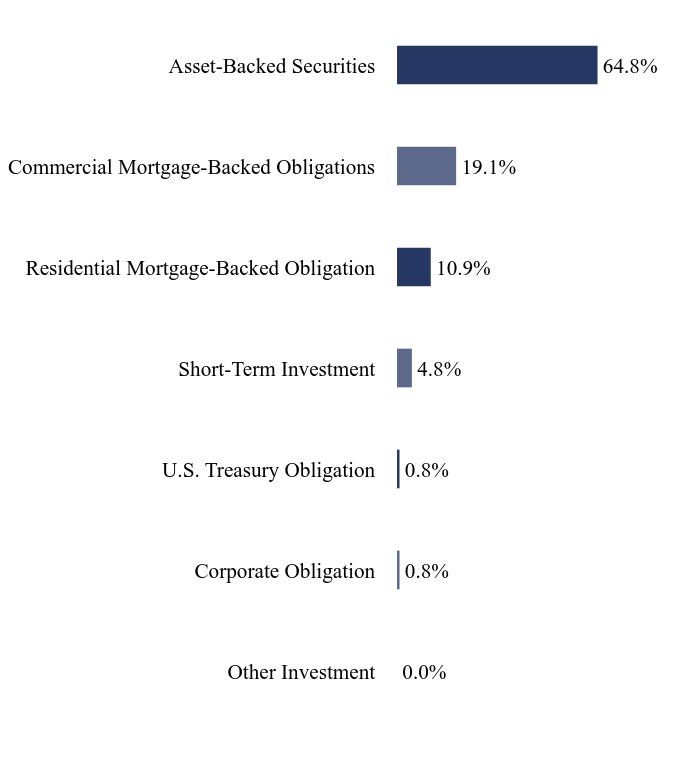

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Investment | 0.0% |

| Corporate Obligation | 0.8% |

| U.S. Treasury Obligation | 0.8% |

| Short-Term Investment | 4.8% |

| Residential Mortgage-Backed Obligation | 10.9% |

| Commercial Mortgage-Backed Obligations | 19.1% |

| Asset-Backed Securities | 64.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | Coupon Rate | Maturity Date | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| FHLMC POOL, Ser 2023-2326 | 4.450% | 12/01/32 | 1.8% |

| Harbour Aircraft Investments, Ser 2017-1, Cl C | 10.000% | 11/15/37 | 1.6% |

| Harbour Aircraft Investments, Ser 2017-1, Cl A | 6.000% | 11/15/37 | 1.5% |

| Fortiva Retail Credit Master Note Business Trust, Ser 2024-ONE, Cl C | 12.560% | 11/15/29 | 1.4% |

| AIM Aviation Finance, Ser 2015-1A, Cl B1 | 5.072% | 02/15/40 | 1.4% |

| Avis Budget Rental Car Funding AESOP, Ser 2021-1A, Cl D | 3.710% | 08/20/27 | 1.3% |

| AASET Trust, Ser 2020-1A, Cl B | 4.335% | 01/16/40 | 1.2% |

| Palmer Square CLO, Ser 2024-2A, Cl E, TSFR3M + 5.700% | 10.994% | 07/20/37 | 1.1% |

| Citigroup Commercial Mortgage Trust, Ser 2014-GC21, Cl D | 4.797% | 05/10/47 | 1.1% |

| Frontier Issuer, Ser 2024-1, Cl C | 11.160% | 06/20/54 | 1.0% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-800-343-2029 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund

Loomis Sayles Full Discretion Institutional Securitized Fund / Institutional Class Shares

Annual Shareholder Report: October 31, 2024

(b) Not applicable.

The Registrant (also referred to as the "Trust") has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, controller or principal accounting officer, and any person who performs a similar function. There have been no amendments to or waivers granted to this code of ethics during the period covered by this report.

| Item 3. | Audit Committee Financial Expert. |

(a)(1) The Registrant's board of trustees has determined that the Registrant has at least one audit committee financial expert serving on the audit committee.

(a)(2) The Registrant's audit committee financial expert is Robert Mulhall. Mr. Mulhall is considered to be "independent", as that term is defined in Form N-CSR Item 3(a)(2).

| Item 4. | Principal Accountant Fees and Services. |

Fees billed by PricewaterhouseCoopers LLP ("PwC") related to the Trust.

PwC billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $91,274 | None | None | $72,710 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | $115,395(2) |

| (d) | All Other Fees | None | None | None | None | None | $47,411(3) |

Fees billed by Ernst & Young LLP ("E&Y") related to the Trust.

E&Y billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $539,063 | None | None | $550,800 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | None | None | None | None |

Fees billed by Cohen & Co. ("Cohen") related to the Trust.

Cohen billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $43,700 | None | None | $61,000 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | None | None | None | None |

Notes:

| (1) | Audit fees include amounts related to the audit of the Trust's annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. |

| (2) | Tax compliance services provided to service affiliates of the funds. |

| (3) | Non-audit assurance engagements for service affiliates of the funds. |

(e)(1) The Trust's Audit Committee has adopted and the Board of Trustees has ratified an Audit and Non-Audit Services Pre-Approval Policy (the "Policy"), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent auditor of the Funds may be pre-approved.

The Policy provides that all requests or applications for proposed services to be provided by the independent auditor must be submitted to the Registrant's Chief Financial Officer ("CFO") and must include a detailed description of the services proposed to be rendered. The CFO will determine whether such services:

| (1) | require specific pre-approval; |

| (2) | are included within the list of services that have received the general pre-approval of the Audit Committee pursuant to the Policy; or |

| (3) | have been previously pre-approved in connection with the independent auditor's annual engagement letter for the applicable year or otherwise. In any instance where services require pre-approval, the Audit Committee will consider whether such services are consistent with SEC's rules and whether the provision of such services would impair the auditor's independence. |

Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by the CFO. The Audit Committee will be informed by the CFO on a quarterly basis of all services rendered by the independent auditor. The Audit Committee has delegated specific pre-approval authority to either the Audit Committee Chair or financial expert, provided that the estimated fee for any such proposed pre-approved service does not exceed $100,000 and any pre-approval decisions are reported to the Audit Committee at its next regularly-scheduled meeting.

Services that have received the general pre-approval of the Audit Committee are identified and described in the Policy. In addition, the Policy sets forth a maximum fee per engagement with respect to each identified service that has received general pre-approval.

All services to be provided by the independent auditor shall be provided pursuant to a signed written engagement letter with the Registrant, the investment adviser, or applicable control affiliate (except that matters as to which an engagement letter would be impractical because of timing issues or because the matter is small may not be the subject of an engagement letter) that sets forth both the services to be provided by the independent auditor and the total fees to be paid to the independent auditor for those services.

In addition, the Audit Committee has determined to take additional measures on an annual basis to meet the Audit Committee's responsibility to oversee the work of the independent auditor and to assure the auditor's independence from the Registrant, such as (a) reviewing a formal written statement from the independent auditor delineating all relationships between the independent auditor and the Registrant, and (b) discussing with the independent auditor the independent auditor's methods and procedures for ensuring independence.

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (PwC):

| | 2024 | 2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (E&Y):

| | 2024 | 2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (Cohen):

| | 2024 | 2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(f) Not applicable.

(g) The aggregate non-audit fees and services billed by PwC for services rendered to the Registrant, and rendered to the Registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $0 and $162,806 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by E&Y for services rendered to the Registrant, and rendered to the Registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $0 and $0 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by Cohen for services rendered to the Registrant, and rendered to the Registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $0 and $0 for 2024 and 2023, respectively.

(h) During the past fiscal year, all non-audit services provided by the Registrant's principal accountant to either the Registrant's investment adviser or to any entity controlling, controlled by, or under common control with the Registrant's investment adviser that provides ongoing services to the Registrant were pre-approved by the Audit Committee of Registrant's Board of Trustees. Included in the Audit Committee's pre-approval of these non-audit service were the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant's independence.

(i) Not Applicable. The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the "PCAOB") has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

(j) Not applicable. The Registrant is not a "foreign issuer," as defined in 17 CFR § 240.3b-4.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to open-end management investment companies.

| Item 6. | Schedule of Investments. |

(a) The Schedule of Investments is included as part of the Financial Statements and Other Information filed under Item 7 of this form.

(b) Not applicable.

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Financial statements and financial highlights are filed herein.

Table of Contents

Loomis Sayles Full Discretion Institutional Securitized Fund

| Financial Statements (Form N-CSR Item 7) | |

| Portfolio of Investments | 1 |

| Statement of Assets and Liabilities | 15 |

| Statement of Operations | 16 |

| Statements of Changes in Net Assets | 17 |

| Financial Highlights | 18 |

| Notes to Financial Statements | 20 |

| Report of Independent Registered Public Accounting Firm | 35 |

| Notice to Shareholders (Unaudited) | 37 |

| Approval of Investment Advisory Agreement (Form N-CSR Item 11) (Unaudited) | 38 |

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Asset-Backed Securities — 64.8% | | | | |

| | | | | 37 Capital CLO 1, Series 2021-1A, Class E | | | | |

| $ | 1,000,000 | | | 12.118%, TSFR3M + 7.462%, 10/15/34 (A)(B) | | $ | 1,003,047 | |

| | | | | 522 Funding CLO, Series 2021-6A, Class A1R | | | | |

| | 2,265,000 | | | 6.038%, TSFR3M + 1.412%, 10/23/34 (A)(B) | | | 2,265,913 | |

| | | | | 720 East CLO VI, Series 2024-3A, Class E | | | | |

| | 3,720,000 | | | 0.000%, 01/20/38 (A)(B)(C) | | | 3,720,000 | |

| | | | | AASET, Series 2018-2A, Class A | | | | |

| | 462,579 | | | 4.454%, 11/18/38 (B) | | | 451,761 | |

| | | | | AASET, Series 2018-2A, Class C | | | | |

| | 1,552,724 | | | 6.892%, 11/18/38 (B) | | | 605,791 | |

| | | | | AASET, Series 2024-1A, Class A2 | | | | |

| | 1,625,260 | | | 6.261%, 05/16/49 (B) | | | 1,643,852 | |

| | | | | AASET Trust, Series 2019-2C, Class C | | | | |

| | 2,442,344 | | | 6.413%, 10/16/39 (B) | | | 904,024 | |

| | | | | AASET Trust, Series 2020-1A | | | | |

| | 17,029,000 | | | 0.000%, 01/16/40 (C)(D) | | | 1,106,885 | |

| | | | | AASET Trust, Series 2020-1A, Class B | | | | |

| | 5,614,794 | | | 4.335%, 01/16/40 (B) | | | 4,646,713 | |

| | | | | AASET Trust, Series 2020-1A, Class C | | | | |

| | 7,673,171 | | | 6.413%, 01/16/40 (B) | | | 2,592,519 | |

| | | | | Accelerated Assets, Series 2018-1, Class B | | | | |

| | 208,830 | | | 4.510%, 12/02/33 (B) | | | 204,626 | |

| | | | | Affirm Asset Securitization Trust, Series 2023-A, Class D | | | | |

| | 1,570,000 | | | 9.090%, 01/18/28 (B) | | | 1,579,558 | |

| | | | | Affirm Asset Securitization Trust, Series 2023-X1, Class D | | | | |

| | 1,000,000 | | | 9.550%, 11/15/28 (B) | | | 1,023,276 | |

| | | | | AGL CLO, Series 2020-3A, Class D | | | | |

| | 2,100,000 | | | 8.218%, TSFR3M + 3.562%, 01/15/33 (A)(B) | | | 2,102,207 | |

| | | | | AGL CLO, Series 2021-7A, Class ER | | | | |

| | 2,345,000 | | | 11.268%, TSFR3M + 6.612%, 07/15/34 (A)(B) | | | 2,341,696 | |

| | | | | AIM Aviation Finance, Series 2015-1A, Class B1 | | | | |

| | 8,883,378 | | | 5.072%, 02/15/40 (B)(E) | | | 5,152,625 | |

| | | | | AIMCO CLO Series, Series 2021-AA, Class DR | | | | |

| | 665,000 | | | 8.029%, TSFR3M + 3.412%, 04/20/34 (A)(B) | | | 664,884 | |

| | | | | Allegro CLO VI, Series 2018-2A, Class D | | | | |

| | 250,000 | | | 7.659%, TSFR3M + 3.012%, 01/17/31 (A)(B) | | | 249,881 | |

| | | | | APL Finance DAC, Series 2023-1A, Class A | | | | |

| | 1,138,104 | | | 7.000%, 07/21/31 (B) | | | 1,143,735 | |

| | | | | Auxilior Term Funding, Series 2023-1A, Class E | | | | |

| | 2,750,000 | | | 10.970%, 12/15/32 (B) | | | 2,804,195 | |

| | | | | Aventura Mall Trust, Series 2018-AVM, Class A | | | | |

| | 3,760,000 | | | 4.112%, 07/05/40 (A)(B) | | | 3,606,922 | |

| | | | | Avis Budget Rental Car Funding AESOP, Series 2021-1A, Class D | | | | |

| | 5,000,000 | | | 3.710%, 08/20/27 (B) | | | 4,724,644 | |

The accompanying notes are an intergral part of the financial statements.

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Asset-Backed Securities — 64.8% (continued) | | | | |

| | | | | Avis Budget Rental Car Funding AESOP, Series 2024-1A, Class A | | | | |

| $ | 2,870,000 | | | 5.360%, 06/20/30 (B) | | $ | 2,901,788 | |

| | | | | BHG Securitization Trust, Series 2022-C, Class E | | | | |

| | 1,890,000 | | | 9.730%, 10/17/35 (B) | | | 1,906,227 | |

| | | | | BHG Securitization Trust, Series 2023-B, Class E | | | | |

| | 2,500,000 | | | 12.400%, 12/17/36 (B) | | | 2,631,916 | |

| | | | | BHG Securitization Trust, Series 2024-1CON, Class E | | | | |

| | 2,500,000 | | | 10.450%, 04/17/35 (B) | | | 2,514,858 | |

| | | | | Biz2Credit Asset Securitization, Series 2024-1A, Class B | | | | |

| | 1,520,000 | | | 9.437%, 05/15/31 (B) | | | 1,528,980 | |

| | | | | BMO Mortgage Trust, Series 2024-C9, Class A5 | | | | |

| | 3,560,000 | | | 5.759%, 07/15/57 | | | 3,720,885 | |

| | | | | BPR Trust, Series 2021-NRD, Class E | | | | |

| | 2,030,000 | | | 10.425%, TSFR1M + 5.621%, 12/15/38 (A)(B) | | | 1,938,650 | |

| | | | | Bridgecrest Lending Auto Securitization Trust, Series 2024-2, Class A3 | | | | |

| | 2,740,000 | | | 5.840%, 06/15/28 | | | 2,766,766 | |

| | | | | BX Commercial Mortgage Trust, Series 2024-VLT5, Class A | | | | |

| | 750,000 | | | 5.410%, 11/13/46 (A)(B) | | | 761,250 | |

| | | | | CAL Funding IV, Series 2020-1A, Class B | | | | |

| | 672,290 | | | 3.500%, 09/25/45 (B) | | | 622,608 | |

| | | | | CarVal CLO IV, Series 2021-1A, Class A1A | | | | |

| | 1,850,000 | | | 6.059%, TSFR3M + 1.442%, 07/20/34 (A)(B) | | | 1,850,033 | |

| | | | | Carvana Auto Receivables Trust, Series 2022-P1, Class A3 | | | | |

| | 1,432,255 | | | 3.350%, 02/10/27 | | | 1,422,465 | |

| | | | | Carvana Auto Receivables Trust, Series 2022-P2, Class B | | | | |

| | 2,382,000 | | | 5.080%, 04/10/28 | | | 2,375,834 | |

| | | | | Carvana Auto Receivables Trust, Series 2024-N3, Class D | | | | |

| | 785,000 | | | 5.380%, 12/10/30 (B) | | | 773,402 | |

| | | | | Carvana Auto Receivables Trust, Series 2024-N3, Class E | | | | |

| | 1,250,000 | | | 7.660%, 04/12/32 (B) | | | 1,225,941 | |

| | | | | Castlelake Aircraft Securitization Trust, Series 2018-1, Class B | | | | |

| | 592,540 | | | 5.300%, 06/15/43 (B) | | | 474,040 | |

| | | | | CIFC Funding, Series 2018-1A, Class D | | | | |

| | 365,000 | | | 7.544%, TSFR3M + 2.912%, 04/18/31 (A)(B) | | | 364,950 | |

| | | | | CIG Auto Receivables Trust, Series 2021-1A, Class D | | | | |

| | 2,673,630 | | | 2.110%, 04/12/27 (B) | | | 2,652,637 | |

| | | | | CIG Auto Receivables Trust, Series 2021-1A, Class E | | | | |

| | 2,550,000 | | | 4.450%, 05/12/28 (B) | | | 2,525,534 | |

| | | | | CLI Funding VI, Series 2020-3A, Class B | | | | |

| | 584,500 | | | 3.300%, 10/18/45 (B) | | | 541,023 | |

| | | | | Clover CLO, Series 2021-2A, Class E | | | | |

| | 2,500,000 | | | 11.379%, TSFR3M + 6.762%, 07/20/34 (A)(B) | | | 2,491,803 | |

| | | | | Clsec Holdings 22T, Series 2021-1, Class C | | | | |

| | 3,725,255 | | | 6.171%, 05/11/37 (B) | | | 3,188,582 | |

The accompanying notes are an intergral part of the financial statements.

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Asset-Backed Securities — 64.8% (continued) | | | |

| | | | | College Ave Student Loans, Series 2023-A, Class E | | | | |

| $ | 1,000,000 | | | 8.490%, 05/25/55 (B) | | $ | 996,246 | |

| | | | | Compass Datacenters Issuer II, Series 2024-2A, Class A1 | | | | |

| | 1,530,000 | | | 5.022%, 08/25/49 (B) | | | 1,507,427 | |

| | | | | CoreVest American Finance Trust, Series 2019-1, Class E | | | | |

| | 575,000 | | | 5.514%, 03/15/52 (A)(B) | | | 551,722 | |

| | | | | CoreVest American Finance Trust, Series 2020-2, Class D | | | | |

| | 1,211,000 | | | 4.604%, 05/15/52 (A)(B) | | | 1,109,791 | |

| | | | | Credit Acceptance Auto Loan Trust, Series 2023-1A, Class C | | | | |

| | 495,000 | | | 7.710%, 07/15/33 (B) | | | 513,930 | |

| | | | | Elmwood CLO XI, Series 2021-4A, Class E | | | | |

| | 1,250,000 | | | 10.879%, TSFR3M + 6.262%, 10/20/34 (A)(B) | | | 1,256,875 | |

| | | | | EverBright Solar Trust, Series 2024-A, Class A | | | | |

| | 1,027,731 | | | 6.430%, 06/22/54 (B) | | | 1,021,608 | |

| | | | | EWC Master Issuer, Series 2022-1A, Class A2 | | | | |

| | 1,564,000 | | | 5.500%, 03/15/52 (B) | | | 1,519,123 | |

| | | | | Falcon Aerospace, Series 2017-1, Class A | | | | |

| | 162,126 | | | 4.581%, 02/15/42 (B) | | | 158,885 | |

| | | | | Falcon Aerospace, Series 2019-1, Class C | | | | |

| | 1,959,135 | | | 6.656%, 09/15/39 (B) | | | 1,469,432 | |

| | | | | Falcon Aerospace, Series 2019-1, Class E | | | | |

| | 5,000,000 | | | 0.000%, 09/15/39 (B)(C)(D) | | | 1,000,000 | |

| | | | | First Investors Auto Owner Trust, Series 2021-1A, Class E | | | | |

| | 660,000 | | | 3.350%, 04/15/27 (B) | | | 653,774 | |

| | | | | First Investors Auto Owner Trust, Series 2022-2A, Class D | | | | |

| | 750,000 | | | 8.710%, 10/16/28 (B) | | | 787,971 | |

| | | | | FirstKey Homes Trust, Series 2020-SFR2, Class F1 | | | | |

| | 2,450,000 | | | 3.017%, 10/19/37 (B) | | | 2,383,762 | |

| | | | | FirstKey Homes Trust, Series 2020-SFR1, Class F1 | | | | |

| | 3,619,000 | | | 3.638%, 08/17/37 (B) | | | 3,550,159 | |

| | | | | FirstKey Homes Trust, Series 2020-SFR1, Class F2 | | | | |

| | 2,305,000 | | | 4.284%, 08/17/37 (B) | | | 2,271,296 | |

| | | | | Fora Financial Asset Securitization, Series 2024-1A, Class D | | | | |

| | 3,000,000 | | | 12.010%, 08/15/29 (B) | | | 2,991,104 | |

| | | | | Fortiva Retail Credit Master Note Business Trust, Series 2024-ONE, Class C | | | | |

| | 5,270,000 | | | 12.560%, 11/15/29 (B)(D) | | | 5,329,994 | |

| | | | | Foundation Finance Trust, Series 2024-2A, Class E | | | | |

| | 1,290,000 | | | 9.350%, 03/15/50 (B) | | | 1,292,677 | |

| | | | | Foursight Capital Automobile Receivables Trust, Series 2022-2, Class D | | | | |

| | 2,745,000 | | | 7.090%, 10/15/29 (B) | | | 2,787,913 | |

| | | | | Foursight Capital Automobile Receivables Trust, Series 2023-2, Class E | | | | |

| | 1,000,000 | | | 10.980%, 07/15/30 (B) | | | 1,063,294 | |

| | | | | Foursight Capital Automobile Receivables Trust, Series 2024-1, Class E | | | | |

| | 1,250,000 | | | 10.250%, 05/15/31 (B) | | | 1,315,617 | |

The accompanying notes are an intergral part of the financial statements.

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Asset-Backed Securities — 64.8% (continued) | | | |

| | | | | Frontier Issuer, Series 2023-1, Class C | | | | |

| $ | 3,000,000 | | | 11.500%, 08/20/53 (B) | | $ | 3,199,167 | |

| | | | | Frontier Issuer, Series 2024-1, Class C | | | | |

| | 3,500,000 | | | 11.160%, 06/20/54 (B) | | | 3,915,862 | |

| | | | | GS Mortgage Securities Trust, Series 2014-GC22, Class B | | | | |

| | 3,065,000 | | | 4.391%, 06/10/47 (A) | | | 2,487,036 | |

| | | | | Harbour Aircraft Investments, Series 2017-1, Class A | | | | |

| | 5,822,783 | | | 6.000%, 11/15/37 | | | 5,740,886 | |

| | | | | Harbour Aircraft Investments, Series 2017-1, Class C | | | | |

| | 8,121,188 | | | 10.000%, 11/15/37 | | | 6,139,033 | |

| | | | | Hardee's Funding, Series 2024-1A, Class A2 | | | | |

| | 616,900 | | | 7.253%, 03/20/54 (B) | | | 628,267 | |

| | | | | Hilton Grand Vacations Trust, Series 2018-AA, Class C | | | | |

| | 62,486 | | | 4.000%, 02/25/32 (B) | | | 61,807 | |

| | | | | Hilton Grand Vacations Trust, Series 2022-2A, Class C | | | | |

| | 365,890 | | | 5.570%, 01/25/37 (B) | | | 362,566 | |

| | | | | Hilton Grand Vacations Trust, Series 2024-1B, Class D | | | | |

| | 361,753 | | | 8.850%, 09/15/39 (B) | | | 365,603 | |

| | | | | Huntington Bank Auto Credit-Linked Notes Series, Series 2024-1, Class C | | | | |

| | 414,736 | | | 8.040%, SOFR30A + 3.150%, 05/20/32 (A)(B) | | | 416,672 | |

| | | | | JPMorgan Chase Bank, Series 2021-1, Class F | | | | |

| | 76,912 | | | 4.280%, 09/25/28 (B) | | | 76,858 | |

| | | | | JPMorgan Chase Bank, Series 2021-2, Class F | | | | |

| | 1,200,000 | | | 4.393%, 12/26/28 (B) | | | 1,197,686 | |

| | | | | Kapitus Asset Securitization IV, Series 2024-1A, Class D | | | | |

| | 600,000 | | | 9.900%, 09/10/31 (B) | | | 591,579 | |

| | | | | KDAC Aviation Finance, Series 2017-1A, Class C | | | | |

| | 14,052,247 | | | 7.385%, 12/15/42 (B) | | | 3,471,447 | |

| | | | | Kestrel Aircraft Funding, Series 2018-1A, Class A | | | | |

| | 1,215,174 | | | 4.250%, 12/15/38 (B) | | | 1,187,468 | |

| | | | | KKR CLO, Series 2018-23, Class F | | | | |

| | 840,000 | | | 12.729%, TSFR3M + 8.112%, 10/20/31 (A)(B) | | | 798,622 | |

| | | | | KKR CLO, Series 2019-24, Class E | | | | |

| | 860,000 | | | 11.259%, TSFR3M + 6.642%, 04/20/32 (A)(B) | | | 861,613 | |

| | | | | Labrador Aviation Finance, Series 2016-1A, Class A1 | | | | |

| | 2,800,702 | | | 4.300%, 01/15/42 (B) | | | 2,716,651 | |

| | | | | Labrador Aviation Finance, Series 2016-1A, Class B1 | | | | |

| | 2,504,442 | | | 5.682%, 01/15/42 (B) | | | 2,016,049 | |

| | | | | MAPS, Series 2018-1A, Class B | | | | |

| | 230,151 | | | 5.193%, 05/15/43 (B) | | | 222,705 | |

| | | | | Mariner Finance Issuance Trust, Series 2023-AA, Class E | | | | |

| | 1,940,000 | | | 11.120%, 10/22/35 (B) | | | 1,996,774 | |

| | | | | Mariner Finance Issuance Trust, Series 2024-AA, Class D | | | | |

| | 250,000 | | | 6.770%, 09/22/36 (B) | | | 252,887 | |

The accompanying notes are an intergral part of the financial statements.

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Asset-Backed Securities — 64.8% (continued) | | | |

| | | | | Mercury Financial Credit Card Master Trust, Series 2023-1A, Class B | | | | |

| $ | 1,160,000 | | | 9.590%, 09/20/27 (B) | | $ | 1,164,986 | |

| | | | | Mercury Financial Credit Card Master Trust, Series 2024-2A, Class A | | | | |

| | 1,430,000 | | | 6.560%, 07/20/29 (B) | | | 1,443,516 | |

| | | | | Mission Lane Credit Card Master Trust, Series 2023-A, Class A | | | | |

| | 590,000 | | | 7.230%, 07/17/28 (B) | | | 594,588 | |

| | | | | Mission Lane Credit Card Master Trust, Series 2023-B, Class A | | | | |

| | 1,155,000 | | | 7.690%, 11/15/28 (B) | | | 1,168,271 | |

| | | | | Mission Lane Credit Card Master Trust, Series 2024-B, Class A | | | | |

| | 1,620,000 | | | 5.880%, 01/15/30 (B) | | | 1,619,841 | |

| | | | | MVW, Series 2022-1A, Class A | | | | |

| | 1,213,707 | | | 4.150%, 11/21/39 (B) | | | 1,189,806 | |

| | | | | New Residential Mortgage Loan Trust, Series 2024-RPL1, Class B2 | | | | |

| | 1,195,000 | | | 3.877%, 01/25/64 (A)(B) | | | 921,660 | |

| | | | | NYMT Loan Trust Series, Series 2024-BPL3, Class M1 | | | | |

| | 1,000,000 | | | 6.903%, 09/25/39 (A)(B) | | | 988,241 | |

| | | | | OCP CLO, Series 2018-15A, Class D | | | | |

| | 645,000 | | | 10.729%, TSFR3M + 6.112%, 07/20/31 (A)(B) | | | 644,433 | |

| | | | | OCP CLO, Series 2024-17A, Class ER2 | | | | |

| | 3,500,000 | | | 10.867%, TSFR3M + 6.250%, 07/20/37 (A)(B) | | | 3,490,932 | |

| | | | | Octane Receivables Trust, Series 2024-1A, Class E | | | | |

| | 1,872,000 | | | 7.820%, 08/20/31 (B) | | | 1,861,620 | |

| | | | | Octane Receivables Trust, Series 2024-2A, Class E | | | | |

| | 1,250,000 | | | 9.040%, 07/20/32 (B) | | | 1,291,636 | |

| | | | | OHA Credit Funding, Series 2021-2A, Class AR | | | | |

| | 2,300,000 | | | 6.029%, TSFR3M + 1.412%, 04/21/34 (A)(B) | | | 2,302,489 | |

| | | | | OHA Credit Funding, Series 2021-8A, Class D | | | | |

| | 1,880,000 | | | 7.744%, TSFR3M + 3.112%, 01/18/34 (A)(B) | | | 1,876,761 | |

| | | | | OHA Credit Funding, Series 2021-2A, Class ER | | | | |

| | 445,000 | | | 11.239%, TSFR3M + 6.622%, 04/21/34 (A)(B) | | | 445,634 | |

| | | | | OHA Credit Funding, Series 2021-4A, Class ER | | | | |

| | 2,355,000 | | | 11.293%, TSFR3M + 6.662%, 10/22/36 (A)(B) | | | 2,351,698 | |

| | | | | OHA Credit Funding, Series 2021-3A, Class ER | | | | |

| | 2,415,000 | | | 11.129%, TSFR3M + 6.512%, 07/02/35 (A)(B) | | | 2,424,385 | |

| | | | | OnDeck Asset Securitization Trust IV, Series 2024-2A, Class C | | | | |

| | 420,000 | | | 7.030%, 10/17/31 (B) | | | 415,582 | |

| | | | | Palmer Square CLO, Series 2021-1A, Class CR | | | | |

| | 1,000,000 | | | 8.428%, TSFR3M + 3.312%, 11/14/34 (A)(B) | | | 999,318 | |

| | | | | Palmer Square CLO, Series 2021-4A, Class E | | | | |

| | 1,875,000 | | | 10.968%, TSFR3M + 6.312%, 10/15/34 (A)(B) | | | 1,884,549 | |

| | | | | Palmer Square CLO, Series 2024-2A, Class E | | | | |

| | 4,000,000 | | | 10.994%, TSFR3M + 5.700%, 07/20/37 (A)(B) | | | 3,972,644 | |

| | | | | Pikes Peak CLO, Series 2021-4A, Class ER | | | | |

| | 1,990,000 | | | 11.528%, TSFR3M + 6.872%, 07/15/34 (A)(B) | | | 1,971,101 | |

The accompanying notes are an intergral part of the financial statements.

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Asset-Backed Securities — 64.8% (continued) | | | |

| | | | | Planet Fitness Master Issuer, Series 2022-1A, Class A2I | | | | |

| $ | 2,613,000 | | | 3.251%, 12/05/51 (B) | | $ | 2,496,020 | |

| | | | | Prestige Auto Receivables Trust, Series 2020-1A, Class E | | | | |

| | 2,740,000 | | | 3.670%, 02/15/28 (B) | | | 2,727,944 | |

| | | | | Raptor Aircraft Finance I, Series 2019-1, Class A | | | | |

| | 2,146,573 | | | 4.213%, 08/23/44 (B) | | | 1,824,587 | |

| | | | | Redwood Funding Trust, Series 2023-1, Class A | | | | |

| | 794,111 | | | 7.500%, 07/25/59 (B)(E) | | | 782,747 | |

| | | | | Redwood Funding Trust, Series 2024-1, Class A | | | | |

| | 727,187 | | | 7.745%, 12/25/54 (B)(E) | | | 727,980 | |

| | | | | RFS Asset Securitization II, Series 2024-1, Class E | | | | |

| | 2,500,000 | | | 14.782%, 07/15/31 (B) | | | 2,504,728 | |

| | | | | Roc Mortgage Trust, Series 2024-RTL1, Class M1 | | | | |

| | 3,740,000 | | | 7.277%, 10/25/39 (A)(B) | | | 3,722,087 | |

| | | | | Rockford Tower CLO, Series 2017-3A, Class D | | | | |

| | 250,000 | | | 7.529%, TSFR3M + 2.912%, 10/20/30 (A)(B) | | | 250,123 | |

| | | | | Santander Bank, Series 2021-1A, Class E | | | | |

| | 700,000 | | | 6.171%, 12/15/31 (B) | | | 699,063 | |

| | | | | Santander Bank Auto Credit-Linked Notes, Series 2022-C, Class E | | | | |

| | 117,821 | | | 11.366%, 12/15/32 (B) | | | 120,373 | |

| | | | | Santander Drive Auto Receivables Trust, Series 2024-3, Class D | | | | |

| | 2,090,000 | | | 5.970%, 10/15/31 | | | 2,125,123 | |

| | | | | SCF Equipment Leasing, Series 2021-1A, Class E | | | | |

| | 755,000 | | | 3.560%, 08/20/32 (B) | | | 743,577 | |

| | | | | SCF Equipment Leasing, Series 2022-2A, Class E | | | | |

| | 3,750,000 | | | 6.500%, 06/20/35 (B) | | | 3,660,163 | |

| | | | | SCF Equipment Leasing, Series 2023-1A, Class E | | | | |

| | 1,500,000 | | | 7.000%, 07/21/36 (B) | | | 1,460,440 | |

| | | | | SEB Funding, Series 2024-1A, Class A2 | | | | |

| | 1,075,000 | | | 7.386%, 04/30/54 (B) | | | 1,095,530 | |

| | | | | Sierra Timeshare Receivables Funding, Series 2021-1A, Class D | | | | |

| | 237,928 | | | 3.170%, 11/20/37 (B) | | | 228,982 | |

| | | | | Sierra Timeshare Receivables Funding, Series 2023-1A, Class D | | | | |

| | 552,264 | | | 9.800%, 01/20/40 (B) | | | 570,976 | |

| | | | | Sierra Timeshare Receivables Funding, Series 2024-1A, Class D | | | | |

| | 736,072 | | | 8.020%, 01/20/43 (B) | | | 741,229 | |

| | | | | Stellar Jay Ireland DAC, Series 2021-1, Class A | | | | |

| | 229,538 | | | 3.967%, 10/15/41 (B) | | | 221,776 | |

| | | | | Stream Innovations Issuer Trust, Series 2024-2A, Class C | | | | |

| | 1,000,000 | | | 9.050%, 02/15/45 (B) | | | 991,368 | |

| | | | | Stream Innovations Issuer Trust, Series 2024-1A, Class C | | | | |

| | 2,000,000 | | | 11.400%, 07/15/44 (B) | | | 2,029,126 | |

| | | | | Sunnova Helios V Issuer, Series 2021-A, Class B | | | | |

| | 688,843 | | | 3.150%, 02/20/48 (B) | | | 398,844 | |

The accompanying notes are an intergral part of the financial statements.

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Asset-Backed Securities — 64.8% (continued) | | | |

| | | | | Sunnova Helios X Issuer, Series 2022-C, Class C | | | | |

| $ | 2,705,257 | | | 6.000%, 11/22/49 (B) | | $ | 2,170,701 | |

| | | | | Sunnova Helios XIII Issuer, Series 2024-A, Class A | | | | |

| | 2,706,502 | | | 5.300%, 02/20/51 (B) | | | 2,571,123 | |

| | | | | Textainer Marine Containers VII, Series 2021-1A, Class B | | | | |

| | 492,639 | | | 2.520%, 02/20/46 (B) | | | 444,721 | |

| | | | | Thunderbolt III Aircraft Lease, Series 2019-1, Class B | | | | |

| | 454,404 | | | 4.750%, 11/15/39 (B) | | | 327,171 | |

| | | | | TIC Home Improvement Trust, Series 2024-A, Class C | | | | |

| | 1,145,000 | | | 11.730%, 10/15/46 (B) | | | 1,174,936 | |

| | | | | Tricon American Homes Trust, Series 2020-SFR1, Class F | | | | |

| | 160,000 | | | 4.882%, 07/17/38 (B) | | | 157,429 | |

| | | | | TVC Mortgage Trust, Series 2024-RRTL1, Class M1 | | | | |

| | 3,610,000 | | | 7.415%, 07/25/39 (B)(E) | | | 3,581,948 | |

| | | | | VStrong Auto Receivables Trust, Series 2023-A, Class C | | | | |

| | 2,845,000 | | | 8.040%, 02/15/30 (B) | | | 3,038,888 | |

| | | | | WAVE, Series 2019-1, Class C | | | | |

| | 2,852,859 | | | 6.413%, 09/15/44 (B) | | | 1,055,301 | |

| | | | | WAVE Trust, Series 2017-1A, Class A | | | | |

| | 1,190,662 | | | 3.844%, 11/15/42 (B) | | | 1,095,647 | |

| | | | | Welk Resorts, Series 2019-AA, Class D | | | | |

| | 121,985 | | | 4.030%, 06/15/38 (B) | | | 117,700 | |

| | | | | Willis Engine Structured Trust V, Series 2020-A, Class A | | | | |

| | 942,313 | | | 3.228%, 03/15/45 (B) | | | 872,034 | |

| | | | | Willis Engine Structured Trust VI, Series 2021-A, Class A | | | | |

| | 1,288,439 | | | 3.104%, 05/15/46 (B) | | | 1,157,509 | |

| | | | | Ziply Fiber Issuer, Series 2024-1A, Class C | | | | |

| | 1,000,000 | | | 11.170%, 04/20/54 (B) | | | 1,061,014 | |

| | | | | Total Asset-Backed Securities | | | | |

| | | | | (Cost $232,076,606) | | | 243,931,363 | |

| | | | | | | | | |

| Commercial Mortgage-Backed Obligations — 19.1% | | | |

| | | | | BANK, Series 2021-BN34, Class A5 | | | | |

| | 1,000,000 | | | 2.438%, 06/15/63 | | | 825,792 | |

| | | | | BBCMS Mortgage Trust, Series 2020-BID, Class A | | | | |

| | 2,885,000 | | | 7.059%, TSFR1M + 2.254%, 10/15/37 (A)(B) | | | 2,881,394 | |

| | | | | BB-UBS Trust, Series 2012-TFT, Class C | | | | |

| | 2,000,000 | | | 3.559%, 06/05/30 (A)(B) | | | 1,002,582 | |

| | | | | Benchmark Mortgage Trust, Series 2021-B31, Class A5 | | | | |

| | 1,000,000 | | | 2.669%, 12/15/54 | | | 855,293 | |

| | | | | BPR Trust, Series 2021-NRD, Class F | | | | |

| | 2,545,000 | | | 11.674%, TSFR1M + 6.870%, 12/15/38 (A)(B) | | | 2,411,315 | |

| | | | | BPR Trust, Series 2022-STAR, Class A | | | | |

| | 1,530,000 | | | 8.036%, TSFR1M + 3.232%, 08/15/39 (A)(B) | | | 1,523,306 | |

The accompanying notes are an intergral part of the financial statements.

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Commercial Mortgage-Backed Obligations — 19.1% (continued) |

| | | | | BPR Trust, Series 2022-SSP, Class A | | | | |

| $ | 2,920,000 | | | 7.804%, TSFR1M + 3.000%, 05/15/39 (A)(B) | | $ | 2,927,300 | |

| | | | | BPR Trust, Series 2022-SSP, Class D | | | | |

| | 2,170,000 | | | 11.435%, TSFR1M + 6.631%, 05/15/39 (A)(B) | | | 2,172,712 | |

| | | | | CG-CCRE Commercial Mortgage Trust, Series 2014-FL2, Class COL1 | | | | |

| | 923,043 | | | 8.418%, TSFR1M + 3.614%, 11/15/31 (A)(B) | | | 434,065 | |

| | | | | CG-CCRE Commercial Mortgage Trust, Series 2014-FL2, Class COL2 | | | | |

| | 2,247,610 | | | 9.418%, TSFR1M + 4.614%, 11/15/31 (A)(B) | | | 896,343 | |

| | | | | Citigroup Commercial Mortgage Trust, Series 2014-GC21, Class D | | | | |

| | 4,790,000 | | | 4.797%, 05/10/47 (A)(B) | | | 3,951,750 | |

| | | | | COMM Mortgage Trust, Series 2012-LC4, Class C | | | | |

| | 17,000 | | | 5.304%, 12/10/44 (A) | | | 15,112 | |

| | | | | COMM Mortgage Trust, Series 2012-LC4, Class D | | | | |

| | 1,605,000 | | | 5.304%, 12/10/44 (A)(B) | | | 1,019,726 | |

| | | | | COMM Mortgage Trust, Series 2012-CCRE3, Class D | | | | |

| | 1,005,000 | | | 4.435%, 10/15/45 (A)(B) | | | 699,081 | |

| | | | | COMM Mortgage Trust, Series 2014-UBS4, Class AM | | | | |

| | 762,000 | | | 3.968%, 08/10/47 | | | 721,048 | |

| | | | | COMM Mortgage Trust, Series 2014-CR21, Class AM | | | | |

| | 315,931 | | | 3.987%, 12/10/47 | | | 314,910 | |

| | | | | CSMC OA, Series 2014-USA, Class C | | | | |

| | 985,000 | | | 4.336%, 09/15/37 (B) | | | 806,148 | |

| | | | | CSMC OA, Series 2014-USA, Class D | | | | |

| | 660,000 | | | 4.373%, 09/15/37 (B) | | | 487,360 | |

| | | | | CSMC OA, Series 2014-USA, Class E | | | | |

| | 5,475,000 | | | 4.373%, 09/15/37 (B) | | | 2,761,724 | |

| | | | | DC Commercial Mortgage Trust, Series 2023-DC, Class C | | | | |

| | 1,510,000 | | | 7.379%, 09/12/40 (A)(B) | | | 1,555,537 | |

| | | | | DC Commercial Mortgage Trust, Series 2023-DC, Class D | | | | |

| | 1,370,000 | | | 7.141%, 09/12/40 (A)(B) | | | 1,381,514 | |

| | | | | Extended Stay America Trust, Series 2021-ESH, Class F | | | | |

| | 2,639,905 | | | 8.619%, TSFR1M + 3.814%, 07/15/38 (A)(B) | | | 2,649,788 | |

| | | | | GS Mortgage Securities Trust, Series 2011-GC5, Class C | | | | |

| | 100,000 | | | 5.151%, 08/10/44 (A)(B) | | | 77,364 | |

| | | | | GS Mortgage Securities Trust, Series 2011-GC5, Class D | | | | |

| | 4,972,728 | | | 5.151%, 08/10/44 (A)(B) | | | 2,713,298 | |

| | | | | GS Mortgage Securities Trust, Series 2012-BWTR, Class A | | | | |

| | 3,880,441 | | | 2.954%, 11/05/34 (B) | | | 3,229,512 | |

| | | | | GS Mortgage Securities Trust, Series 2013-PEMB, Class A | | | | |

| | 1,005,000 | | | 3.550%, 03/05/33 (A)(B) | | | 845,389 | |

| | | | | GS Mortgage Securities Trust, Series 2013-GC13, Class C | | | | |

| | 610,000 | | | 3.870%, 07/10/46 (A)(B) | | | 509,350 | |

| | | | | GS Mortgage Securities Trust, Series 2014-GC22, Class D | | | | |

| | 3,000,000 | | | 4.573%, 06/10/47 (A)(B) | | | 967,293 | |

The accompanying notes are an intergral part of the financial statements.

8 |

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Commercial Mortgage-Backed Obligations — 19.1% (continued) | | | | |

| | | | | GS Mortgage Securities Trust, Series 2023-SHIP, Class B | | | | |

| $ | 3,440,000 | | | 4.936%, 09/10/38 (A)(B) | | $ | 3,401,193 | |

| | | | | Hudsons Bay Simon JV Trust, Series 2015-HB10, Class A10 | | | | |

| | 3,375,000 | | | 4.155%, 08/05/34 (B) | | | 3,252,990 | |

| | | | | JPMBB Commercial Mortgage Securities Trust, Series 2014-C24, Class AS | | | | |

| | 230,000 | | | 3.914%, 11/15/47 (A) | | | 218,389 | |

| | | | | JPMorgan Chase Commercial Mortgage Securities Trust, Series 2011-C3, Class C | | | | |

| | 2,490,000 | | | 5.360%, 02/15/46 (A)(B) | | | 2,255,044 | |

| | | | | JPMorgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class C | | | | |

| | 945,000 | | | 3.958%, 04/15/46 (A) | | | 624,647 | |

| | | | | Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C11, Class B | | | | |

| | 3,330,000 | | | 4.077%, 08/15/46 (A) | | | 2,033,040 | |

| | | | | Morgan Stanley Bank of America Merrill Lynch Trust, Series 2016-C31, Class A5 | | | | |

| | 305,000 | | | 3.102%, 11/15/49 | | | 290,193 | |

| | | | | Morgan Stanley Capital I Trust, Series 2011-C2, Class E | | | | |

| | 2,930,000 | | | 5.211%, 06/15/44 (A)(B) | | | 2,345,063 | |

| | | | | Morgan Stanley Capital I Trust, Series 2012-C4, Class D | | | | |

| | 453,729 | | | 5.164%, 03/15/45 (A)(B) | | | 421,719 | |

| | | | | Morgan Stanley Capital I Trust, Series 2013-ALTM, Class E | | | | |

| | 2,500,000 | | | 3.705%, 02/05/35 (A)(B) | | | 2,088,065 | |

| | | | | MSBAM Commercial Mortgage Securities Trust, Series 2012-CKSV, Class C | | | | |

| | 830,000 | | | 4.282%, 10/15/30 (A)(B) | | | 544,458 | |

| | | | | MSBAM Commercial Mortgage Securities Trust, Series 2012-CKSV, Class D | | | | |

| | 400,000 | | | 4.282%, 10/15/30 (A)(B) | | | 163,852 | |

| | | | | RBS Commercial Funding Trust, Series 2013-SMV, Class F | | | | |

| | 2,000,000 | | | 3.584%, 03/11/31 (A)(B) | | | 1,376,200 | |

| | | | | Starwood Retail Property Trust, Series 2014-STAR, Class A | | | | |

| | 342,670 | | | 8.000%, PRIME + 0.000%, 11/15/27 (A)(B) | | | 195,075 | |

| | | | | Starwood Retail Property Trust, Series 2014-STAR, Class E | | | | |

| | 3,185,000 | | | 8.000%, PRIME + 0.000%, 11/15/27 (A)(B)(D) | | | 127,400 | |

| | | | | Starwood Retail Property Trust, Series 2014-STAR, Class F | | | | |

| | 3,040,405 | | | 8.000%, PRIME + 0.000%, 11/15/27 (A)(B)(D) | | | 30,404 | |

| | | | | UBS Commercial Mortgage Trust, Series 2018-C14, Class C | | | | |

| | 1,885,000 | | | 5.209%, 12/15/51 (A) | | | 1,626,221 | |

| | | | | VOLT XCIV, Series 2021-NPL3, Class A2 | | | | |

| | 1,698,481 | | | 4.949%, 02/27/51 (B)(E) | | | 1,677,779 | |

| | | | | VOLT XCVI, Series 2021-NPL5, Class A2 | | | | |

| | 663,542 | | | 4.826%, 03/27/51 (B)(E) | | | 652,573 | |

| | | | | Wells Fargo Commercial Mortgage Trust, Series 2014-LC16, Class C | | | | |

| | 1,485,000 | | | 4.458%, 08/15/50 | | | 900,929 | |

The accompanying notes are an intergral part of the financial statements.

| 9

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Commercial Mortgage-Backed Obligations — 19.1% (continued) |

| | | | | Wells Fargo Commercial Mortgage Trust, Series 2016-C34, Class C | | | | |

| $ | 2,902,000 | | | 5.056%, 06/15/49 (A) | | $ | 2,703,535 | |

| | | | | Wells Fargo Commercial Mortgage Trust, Series 2016-C36, Class C | | | | |

| | 500,000 | | | 4.115%, 11/15/59 (A) | | | 397,668 | |

| | | | | WFRBS Commercial Mortgage Trust, Series 2011-C4, Class D | | | | |

| | 529,926 | | | 4.983%, 06/15/44 (A)(B) | | | 487,293 | |

| | | | | WFRBS Commercial Mortgage Trust, Series 2011-C3, Class D | | | | |

| | 853,099 | | | 5.855%, 03/15/44 (A)(B) | | | 291,668 | |

| | | | | WFRBS Commercial Mortgage Trust, Series 2011-C4, Class E | | | | |

| | 1,680,000 | | | 4.983%, 06/15/44 (A)(B) | | | 1,446,530 | |

| | | | | WFRBS Commercial Mortgage Trust, Series 2012-C10, Class C | | | | |

| | 2,130,000 | | | 4.311%, 12/15/45 (A) | | | 1,734,702 | |

| | | | | Total Commercial Mortgage-Backed Obligations | | | | |

| | | | | (Cost $86,765,842) | | | 71,922,636 | |

| |

| Residential Mortgage-Backed Obligations — 10.9% |

| | | | | Alternative Loan Trust, Series 2004-J3, Class 1A1 | | | | |

| | 169,927 | | | 5.500%, 04/25/34 | | | 166,287 | |

| | | | | Alternative Loan Trust, Series 2004-J10, Class 2CB1 | | | | |

| | 178,665 | | | 6.000%, 09/25/34 | | | 177,034 | |

| | | | | Alternative Loan Trust, Series 2004-28CB, Class 5A1 | | | | |

| | 99,785 | | | 5.750%, 01/25/35 | | | 96,501 | |

| | | | | Alternative Loan Trust, Series 2004-14T2, Class A11 | | | | |

| | 156,416 | | | 5.500%, 08/25/34 | | | 151,957 | |

| | | | | Banc of America Alternative Loan Trust, Series 2003-8, Class 1CB1 | | | | |

| | 254,723 | | | 5.500%, 10/25/33 | | | 249,950 | |

| | | | | Banc of America Funding Trust, Series 2005-7, Class 3A1 | | | | |

| | 241,417 | | | 5.750%, 11/25/35 | | | 238,385 | |

| | | | | Banc of America Funding Trust, Series 2007-4, Class 5A1 | | | | |

| | 55,982 | | | 5.500%, 11/25/34 | | | 47,766 | |

| | | | | CHL Mortgage Pass-Through Trust, Series 2004-12, Class 8A1 | | | | |

| | 188,922 | | | 6.864%, 08/25/34 (A) | | | 177,692 | |

| | | | | CIM TRUST, Series 2022-R2, Class A1 | | | | |

| | 808,443 | | | 3.750%, 12/25/61 (A)(B) | | | 749,588 | |

| | | | | Citigroup Mortgage Loan Trust, Series 2005-3, Class 2A3 | | | | |

| | 444,537 | | | 6.124%, 08/25/35 (A) | | | 363,424 | |

| | | | | Citigroup Mortgage Loan Trust, Series 2009-10, Class 6A2 | | | | |

| | 131,882 | | | 7.329%, 09/25/34 (A)(B) | | | 118,062 | |

| | | | | Citigroup Mortgage Loan Trust, Series 2010-9, Class 2A2 | | | | |

| | 231,062 | | | 6.310%, T1Y + 2.400%, 11/25/35 (A)(B) | | | 220,007 | |

| | | | | Citigroup Mortgage Loan Trust, Series 2019-RP1, Class M3 | | | | |

| | 1,005,000 | | | 4.000%, 01/25/66 (A)(B) | | | 864,026 | |

| | | | | Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B1 | | | | |

| | 730,000 | | | 7.957%, SOFR30A + 3.100%, 10/25/41 (A)(B) | | | 749,365 | |

The accompanying notes are an intergral part of the financial statements.

10 |

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Residential Mortgage-Backed Obligations — 10.9% (continued) |

| | | | | Deutsche Mortgage Securities Mortgage Loan Trust, Series 2004-1, Class 3A5 | | | | |

| $ | 707,781 | | | 6.160%, 12/25/33 (E) | | $ | 677,890 | |

| | | | | Deutsche Mortgage Securities Mortgage Loan Trust, Series 2004-4, Class 7AR1 | | | | |

| | 73,216 | | | 5.202%, TSFR1M + 0.464%, 06/25/34 (A) | | | 64,966 | |

| | | | | FHLMC POOL, Series 2023-2326 | | | | |

| | 6,920,000 | | | 4.450%, 12/01/32 | | | 6,718,037 | |

| | | | | FHLMC REMIC, Series 2023-5365, Class LY | | | | |

| | 3,110,000 | | | 6.500%, 12/25/53 | | | 3,238,345 | |

| | | | | FHLMC STACR REMIC Trust, Series 2020-DNA6, Class B1 | | | | |

| | 2,000,000 | | | 7.857%, SOFR30A + 3.000%, 12/25/50 (A)(B) | | | 2,162,175 | |

| | | | | FHLMC STACR REMIC Trust, Series 2021-DNA3, Class B1 | | | | |

| | 2,000,000 | | | 8.357%, SOFR30A + 3.500%, 10/25/33 (A)(B) | | | 2,240,000 | |

| | | | | FHLMC STACR REMIC Trust, Series 2022-DNA7, Class M1B | | | | |

| | 1,845,000 | | | 9.857%, SOFR30A + 5.000%, 03/25/52 (A)(B) | | | 2,022,609 | |

| | | | | IndyMac Index Mortgage Loan Trust, Series 2004-AR6, Class 4A | | | | |

| | 575,251 | | | 5.998%, 10/25/34 (A) | | | 546,034 | |

| | | | | IndyMac Index Mortgage Loan Trust, Series 2005-AR11, Class A3 | | | | |

| | 841,829 | | | 3.951%, 08/25/35 (A) | | | 607,415 | |

| | | | | JPMorgan Mortgage Trust, Series 2004-S1, Class 2A1 | | | | |

| | 791,789 | | | 6.000%, 09/25/34 | | | 801,203 | |

| | | | | Lehman Mortgage Trust, Series 2007-9, Class 1A1 | | | | |

| | 60,733 | | | 6.000%, 10/25/37 | | | 56,399 | |

| | | | | Lehman XS Trust, Series 2006-2N, Class 1A1 | | | | |

| | 424,481 | | | 5.372%, TSFR1M + 0.634%, 02/25/46 (A) | | | 371,557 | |

| | | | | MASTR Adjustable Rate Mortgages Trust, Series 2005-2, Class 3A1 | | | | |

| | 665,228 | | | 4.659%, 03/25/35 (A) | | | 606,838 | |

| | | | | MASTR Adjustable Rate Mortgages Trust, Series 2006-2, Class 1A1 | | | | |

| | 335,943 | | | 6.649%, 04/25/36 (A) | | | 321,696 | |

| | | | | MASTR Alternative Loan Trust, Series 2003-9, Class 4A1 | | | | |

| | 179,863 | | | 5.250%, 11/25/33 | | | 175,957 | |

| | | | | MASTR Alternative Loan Trust, Series 2004-2, Class 8A4 | | | | |

| | 1,692,673 | | | 5.500%, 03/25/34 | | | 1,516,201 | |

| | | | | MASTR Alternative Loan Trust, Series 2004-5, Class 1A1 | | | | |

| | 131,868 | | | 5.500%, 06/25/34 | | | 129,962 | |

| | | | | MASTR Alternative Loan Trust, Series 2004-5, Class 2A1 | | | | |

| | 214,243 | | | 6.000%, 06/25/34 | | | 214,483 | |

| | | | | MASTR Alternative Loan Trust, Series 2004-8, Class 2A1 | | | | |

| | 493,899 | | | 6.000%, 09/25/34 | | | 483,041 | |

| | | | | Mill City Mortgage Loan Trust, Series 2021-NMR1, Class M3 | | | | |

| | 730,000 | | | 2.500%, 11/25/60 (A)(B) | | | 593,839 | |

| | | | | Morgan Stanley Mortgage Loan Trust, Series 2005-7, Class 7A5 | | | | |

| | 104,445 | | | 5.500%, 11/25/35 | | | 95,359 | |

| | | | | PRPM, Series 2020-4, Class A2 | | | | |

| | 1,405,808 | | | 8.193%, 10/25/25 (B)(E) | | | 1,406,106 | |

The accompanying notes are an intergral part of the financial statements.

| 11

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Principal Amount | | | Description | | Value | |

| Residential Mortgage-Backed Obligations — 10.9% (continued) |

| | | | | PRPM, Series 2021-4, Class A2 | | | | |

| $ | 574,869 | | | 6.474%, 04/25/26 (B)(E) | | $ | 568,156 | |

| | | | | PRPM, Series 2024-2, Class A1 | | | | |

| | 1,133,871 | | | 7.026%, 03/25/29 (B)(E) | | | 1,134,864 | |

| | | | | PRPM, Series 2024-5, Class A2 | | | | |

| | 3,730,000 | | | 9.076%, 09/25/29 (B)(E) | | | 3,676,789 | |

| | | | | RFMSI Series Trust, Series 2005-SA1, Class 1A1 | | | | |

| | 1,513,225 | | | 5.105%, 03/25/35 (A) | | | 889,431 | |

| | | | | Structured Adjustable Rate Mortgage Loan Trust, Series 2005-14, Class A1 | | | | |

| | 2,667,118 | | | 5.162%, TSFR1M + 0.424%, 07/25/35 (A) | | | 1,584,572 | |

| | | | | Towd Point Mortgage Trust, Series 2018-4, Class A2 | | | | |

| | 1,100,000 | | | 3.000%, 06/25/58 (A)(B) | | | 917,854 | |

| | | | | Towd Point Mortgage Trust, Series 2018-5, Class M1 | | | | |

| | 505,000 | | | 3.250%, 07/25/58 (A)(B) | | | 417,642 | |

| | | | | Towd Point Mortgage Trust, Series 2019-2, Class M1 | | | | |

| | 890,000 | | | 3.749%, 12/25/58 (A)(B) | | | 762,220 | |

| | | | | Towd Point Mortgage Trust, Series 2020-4, Class M1 | | | | |

| | 2,300,000 | | | 2.875%, 10/25/60 (B) | | | 1,814,227 | |

| | | | | Total Residential Mortgage-Backed Obligations | | | | |

| | | | | (Cost $42,768,264) | | | 41,185,911 | |

| |

| U.S. Treasury Obligation — 0.8% |

| | | | | U.S. Treasury Bills | | | | |

| | 3,000,000 | | | 5.118%, 11/07/24 (F) | | | 2,997,671 | |

| | | | | Total U.S. Treasury Obligation | | | | |

| | | | | (Cost $2,997,474) | | | 2,997,671 | |

| |

| Corporate Obligation — 0.8% |

| | | | | PG&E Wildfire Recovery Funding | | | | |

| | 3,000,000 | | | 4.263%, 06/01/36 | | | 2,841,602 | |

| | | | | Total Corporate Obligation | | | | |

| | | | | (Cost $2,999,906) | | | 2,841,602 | |

| |

| Other Investment — 0.0% |

| | | | | ECAF I BLOCKER Ltd. | | | | |

| | 900 | | | 03/15/40 (C)(D) | | | — | |

| | | | | Total Other Investment | | | | |

| | | | | (Cost $9,000,000) | | | — | |

The accompanying notes are an intergral part of the financial statements.

12 |

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| Shares | | | Description | | Value | |

| Short-Term Investment — 4.8% |

| | | | | First American Treasury Obligations Fund, X Class | | | | |

| | 18,059,440 | | | 4.740%(G) | | $ | 18,059,440 | |

| | | | | | | | | |

| | | | | Total Short-Term Investment | | | | |

| | | | | (Cost $18,059,440) | | | 18,059,440 | |

| | | | | | | | | |

| | | | | Total Investments — 101.2% | | | | |

| | | | | (Cost $394,667,532) | | | 380,938,623 | |

| | | | | Other Assets and Liabilities, net — (1.2)% | | | (4,672,468 | ) |

| | | | | Net Assets — 100.0% | | $ | 376,266,155 | |

| (A) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

| (B) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other "accredited investors." The total value of these securities at October 31, 2024, was $295,125,136, representing 78.4% of Net Assets of the Portfolio. All securities are considered liquid unless otherwise noted. |

| (C) | No interest rate available. |

| (D) | Level 3 security in accordance with fair value hierarchy. |

| (E) | Step coupon security. Coupon rate will either increase (step-up bond) or decrease (step-down bond) at regular intervals until maturity. Interest rate shown reflects the rate currently in effect. |

| (F) | Interest rate represents the security's effective yield at the time of purchase. |

| (G) | The rate reported is the 7-day effective yield as of October 31, 2024. |

CLO — Collateralized Loan Obligation

DAC — Designated Activity Company

FHLMC — Federal Home Loan Mortgage Corporation

Ltd. — Limited

REMIC — Real Estate Mortgage Investment Conduit

SOFR30A — Secured Overnight Financing Rate 30-day Average

STACR — Structured Agency Credit Risk

T1Y — Secured Overnight Financing 12 Month

TSFR1M — Term Secured Overnight Financing Rate 1 Months

TSFR3M — Term Secured Overnight Financing Rate 3 Months

The accompanying notes are an intergral part of the financial statements.

| 13

Portfolio of Investments — as of October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

The following is a summary of the inputs used to value the Fund's investments as of October 31, 2024, at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Asset-Backed Securities | | $ | — | | | $ | 236,494,484 | | | $ | 7,436,879 | | | $ | 243,931,363 | |

| Commercial Mortgage-Backed Obligations | | | — | | | | 71,764,832 | | | | 157,804 | | | | 71,922,636 | |

| Residential Mortgage-Backed Obligations | | | — | | | | 41,185,911 | | | | — | | | | 41,185,911 | |

| U.S. Treasury Obligation | | | — | | | | 2,997,671 | | | | — | | | | 2,997,671 | |

| Corporate Obligation | | | — | | | | 2,841,602 | | | | — | | | | 2,841,602 | |

| Other Investment | | | — | | | | — | | | | — | ^ | | | — | ^ |

| Short-Term Investment | | | 18,059,440 | | | | — | | | | — | | | | 18,059,440 | |

| Total Investments in Securities | | $ | 18,059,440 | | | $ | 355,284,500 | | | $ | 7,594,683 | | | $ | 380,938,623 | |

The following is a reconciliation of the investments in which significant unobservable inputs (Level 3) were used in determining value:

| | | Investments In Asset-Backed Securities | | | Investments In Commercial Mortgage-Backed Obligations | | | Investments In Other Investment | | | Total | |

| Balance as of November 1, 2023 | | $ | — | | | $ | 189,654 | | | $ | — | | | $ | 189,654 | |

| Accrued discounts/premiums | | | — | | | | — | | | | — | | | | — | |

| Realized gain/(loss) | | | — | | | | — | | | | — | | | | — | |

| Change in unrealized appreciation/(depreciation) | | | — | | | | (31,850 | ) | | | — | | | | (31,850 | ) |

| Purchases | | | 7,436,879 | | | | — | | | | — | | | | 7,436,879 | |

| Sales | | | — | | | | — | | | | — | | | | — | |

| Net transfer into Level 3 | | | — | | | | — | | | | — | | | | — | |

| Net transfer out of Level 3 | | | — | | | | — | | | | — | | | | — | |

| Ending Balance as of October 31, 2024 | | | 7,436,879 | | | | 157,804 | | | | — | | | | 7,594,683 | |

| Changes in unrealized gains/(losses) included in earnings related to securities still held at reporting date | | $ | — | | | $ | (31,850 | ) | | $ | — | | | $ | (31,850 | ) |

| ^ | Includes security valued at zero. |

For the year ended October 31, 2024, there have been no significant changes to the Fund's fair value methodologies.

Amounts designated as "—" are $0 or have been rounded to $0.

The accompanying notes are an intergral part of the financial statements.

Statement of Assets and Liabilities October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

| ASSETS | | | |

| Investments at cost | | $ | 394,667,532 | |

| Investments at value | | $ | 380,938,623 | |

| Cash | | | 2,306 | |

| Interest receivable | | | 1,572,008 | |

| Receivable from Investment Adviser | | | 12,552 | |

| Prepaid expenses | | | 6,926 | |

| TOTAL ASSETS | | | 382,532,415 | |

| LIABILITIES | | | | |

| Payable for securities purchased | | | 6,103,398 | |

| Administration fees payable | | | 38,022 | |

| Trustees' fees payable | | | 5,985 | |

| Chief Compliance Officer fees payable | | | 5,476 | |

| Other accounts payable and accrued expenses | | | 113,379 | |

| TOTAL LIABILITIES | | | 6,266,260 | |

| NET ASSETS | | $ | 376,266,155 | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 383,499,732 | |

| Total accumulated losses | | | (7,233,577 | ) |

| NET ASSETS | | $ | 376,266,155 | |

| Institutional Class: | | | | |

| Net assets | | $ | 376,266,155 | |

| Outstanding shares of beneficial interest (unlimited authorization - no par value) | | | 36,301,132 | |

| Net asset value, offering and redemption price per share | | $ | 10.37 | |

The accompanying notes are an integral part of the financial statements.

Statement of Operations For the year ended October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

INVESTMENT INCOME

| Interest | | $ | 30,650,307 | |

| Total Income | | | 30,650,307 | |

| Expenses | | | | |

| Administration fees | | | 415,199 | |

| Trustees' fees | | | 23,860 | |

| Chief Compliance Officer fees | | | 10,903 | |

| Pricing fees | | | 99,321 | |

| Audit fees | | | 64,368 | |

| Transfer agent fees | | | 57,984 | |

| Registration fees | | | 41,208 | |

| Legal fees | | | 38,407 | |

| Custodian fees | | | 37,308 | |

| Shareholder reporting fees | | | 16,328 | |

| Other expenses | | | 25,967 | |

| Total expenses | | | 830,853 | |

| Less: | | | | |

| Reimbursement of expenses (Refer to Note 5) | | | (137,280 | ) |

| Net Expenses | | | 693,573 | |

| Net investment income | | | 29,956,734 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN/LOSS | | | | |

| Net realized gain on investments | | | 3,300,607 | |

| Net change in unrealized appreciation on investments | | | 27,801,096 | |

| Net realized and unrealized gain | | | 31,101,703 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 61,058,437 | |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

Loomis Sayles Full Discretion Institutional Securitized Fund

| | | Year Ended October 31, 2024 | | | Year Ended October 31, 2023 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 29,956,734 | | | $ | 20,241,515 | |

| Net realized gain/(loss) | | | 3,300,607 | | | | (3,167,929 | ) |

| Net change in unrealized appreciation | | | 27,801,096 | | | | 5,011,918 | |

| Net increase in net assets resulting from operations | | | 61,058,437 | | | | 22,085,504 | |

| | | | | | | | | |

| DISTRIBUTIONS: | | | (26,565,252 | ) | | | (20,648,582 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS:(1) | | | | | | | | |

| Issued | | | 6,750,000 | | | | 12,930,000 | |

| Reinvestment of distributions | | | 26,565,252 | | | | 20,648,582 | |

| Redeemed | | | (3,803,265 | ) | | | (584,883 | ) |

| Net increase in net assets from capital share transactions | | | 29,511,987 | | | | 32,993,699 | |

| Net increase in net assets | | | 64,005,172 | | | | 34,430,621 | |

| NET ASSETS: | | | | | | | | |

| Beginning of the year | | | 312,260,983 | | | | 277,830,362 | |

| End of the year | | $ | 376,266,155 | | | $ | 312,260,983 | |

| (1) | For share transactions, see Note 6 in the Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

Financial Highlights For a share outstanding throughout the years

Loomis Sayles Full Discretion Institutional Securitized Fund

| | | | Net asset value, beginning of the year | | | Net investment income (a) | | | Net realized and unrealized gain/(loss) | | | Total from investment operations | | | Dividends from net investment income | | | Distributions from net realized capital gains | | | Return of capital | |

| 10/31/24 | | | $ | 9.37 | | | $ | 0.86 | | | $ | 0.90 | | | $ | 1.76 | | | $ | (0.76 | ) | | $ | — | | | $ | – | |

| 10/31/23 | | | | 9.31 | | | | 0.64 | | | | 0.07 | | | | 0.71 | | | | (0.65 | ) | | | — | | | | – | |

| 10/31/22 | | | | 10.55 | | | | 0.46 | | | | (1.11 | ) | | | (0.65 | ) | | | (0.49 | ) | | | (0.10 | ) | | | – | |

| 10/31/21 | | | | 10.12 | | | | 0.55 | | | | 0.44 | | | | 0.99 | | | | (0.47 | ) | | | (0.09 | ) | | | – | |

| 10/31/20 | | | | 11.03 | | | | 0.54 | | | | (0.87 | ) | | | (0.33 | ) | | | (0.56 | ) | | | (0.02 | ) | | | – | |

| (a) | Per share data calculated using average shares method. |

| (b) | Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Had certain expenses not been waived/reimbursed during the year, if applicable, total returns would have been lower. |

Amounts designated as "-" are $0 or have been rounded to $0.

| Total distributions | | | Net asset value, end of the year | | | Total return (%) (b) | | | Net assets, end of the year (000's) | | | Ratio of expenses to average net assets (%) | | | Ratio of expenses to average net assets (excluding waivers, reimbursements and fees paid indirectly) (%) | | | Ratio of net investment income to average net assets (%) | | | Portfolio turnover rate (%) | |

| $ | (0.76 | ) | | $ | 10.37 | | | | 19.46 | | | $ | 376,266 | | | | 0.20 | | | | 0.24 | | | | 8.66 | | | | 39 | |

| | (0.65 | ) | | | 9.37 | | | | 7.81 | | | | 312,261 | | | | 0.20 | | | | 0.27 | | | | 6.76 | | | | 23 | |

| | (0.59 | ) | | | 9.31 | | | | (6.36 | ) | | | 277,830 | | | | 0.20 | | | | 0.27 | | | | 4.67 | | | | 19 | |

| | (0.56 | ) | | | 10.55 | | | | 10.01 | | | | 254,802 | | | | 0.20 | | | | 0.26 | | | | 5.28 | | | | 42 | |

| | (0.58 | ) | | | 10.12 | | | | (3.00 | ) | | | 235,775 | | | | 0.20 | | | | 0.26 | | | | 5.20 | | | | 32 | |

The accompanying notes are an integral part of the financial statements.

Notes to Financial Statements

October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

1. Organization. The Advisors' Inner Circle Fund (the "Trust") is organized as a Massachusetts business trust under an Amended and Restated Agreement and Declaration of Trust dated February 18, 1997. The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company with 26 funds. The financial statements herein are those of the Loomis Sayles Full Discretion Institutional Securitized Fund (the "Fund"). The Fund is diversified and its investment objective is to provide current income and the potential for total return. The Fund commenced operations on December 15, 2011. The financial statements of the remaining funds of the Trust are presented separately. The assets of each fund of the Trust are segregated, and a shareholder's interest is limited to the fund of the Trust in which shares are held.

2. Significant Accounting Policies. The accompanying financial statements have been prepared in conformity with U.S. generally accepted accounting principles ("U.S. GAAP") and are presented in U.S. dollars which is the functional currency of the Fund. The Fund is an investment company and therefore applies the accounting and reporting guidance issued by the U.S. Financial Accounting Standards Board ("FASB") in Accounting Standards Codification ("ASC") Topic 946, Financial Services — Investment Companies. The following are significant accounting policies which are consistently followed in the preparation of the financial statements.

a. Use of Estimates. The preparation of financial statements requires management to make estimates and assumptions that affect the fair value of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and such differences could be material.

b. Security Valuation. Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on an exchange or market (foreign or domestic) on which they are traded on valuation date (or at approximately 4:00 pm ET if a security's primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Such methodologies generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. On the first day a new debt security purchase is recorded, if a price is not available on the automated pricing feeds from our primary and secondary pricing vendors nor is it available from an independent broker, the security may be valued at its purchase price. Each day thereafter, the debt security will be valued according to the Trusts' Fair Value Procedures until an independent source can be secured. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value provided that it is determined the amortized cost continues to approximate fair value. Should existing credit, liquidity or interest rate conditions in the relevant markets and issuer specific circumstances suggest that amortized cost does not approximate fair value, then the amortized cost method may not be used.

20 |

Notes to Financial Statements

October 31, 2024

Loomis Sayles Full Discretion Institutional Securitized Fund

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end of day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Securities for which market prices are not "readily available" are valued in accordance with fair value procedures (the "Fair Value Procedures") established by the Loomis, Sayles & Company, L.P. (the "Adviser") and approved by the Trust's Board of Trustees (the "Board"). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the "valuation designee" to determine the fair value of securities and other instruments for which no readily available market quotations are available. The Fair Value Procedures are implemented through a Fair Value Committee (the "Committee") of the Adviser.

Some of the more common reasons that may necessitate that a security be valued using fair value procedures include: the security's trading has been halted or suspended; the security has been de-listed from a national exchange; the security's primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security's primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. When a security is valued in accordance with the fair value procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.