SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Embrex, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

EMBREX, INC.

1040 Swabia Court

Durham, North Carolina 27703

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 19, 2005

To Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Embrex, Inc. (the “Company”), which will be held on Thursday, May 19, 2005, at 9:00 a.m. local time, at the Company’s headquarters at 1040 Swabia Court, Durham, North Carolina 27703 for the following purposes:

(1) To elect a Board of Directors of the Company for the ensuing year.

(2) To transact such other business as may properly come before the Annual Meeting or any adjournments of the meeting.

Shareholders of record at the close of business on March 21, 2005, are entitled to notice of the Annual Meeting and to vote at such meeting and any adjournment of the meeting.

IT IS DESIRABLE THAT YOUR SHARES OF STOCK BE REPRESENTED AT THE MEETING REGARDLESS OF THE NUMBER OF SHARES YOU MAY HOLD. EVEN THOUGH YOU MAY PLAN TO ATTEND THE MEETING IN PERSON, PLEASE CAST YOUR VOTE ACCORDING TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. IF VOTING BY MAIL, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED PREPAID ENVELOPE, AND ALLOW SUFFICIENT TIME FOR THE POSTAL SERVICE TO DELIVER YOUR PROXY BEFORE THE MEETING. IF VOTING BY TELEPHONE OR ON THE INTERNET, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON.

|

By Order of the Board of Directors |

|

/s/ Don T. Seaquist |

Don T. Seaquist |

Secretary |

Durham, North Carolina

April 11, 2005

EMBREX, INC.

1040 Swabia Court

Durham, North Carolina 27703

PROXY STATEMENT

Annual Meeting of Shareholders to be held May 19, 2005

SOLICITATION AND VOTING RIGHTS

This Proxy Statement and the accompanying proxy card are being mailed to shareholders on or about April 11, 2005, in connection with the solicitation of proxies by the Board of Directors of Embrex, Inc. (the “Company”) for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held at the Company’s headquarters at 1040 Swabia Court, Durham, North Carolina on May 19, 2005, at 9:00 a.m., local time, and at any adjournment of the meeting. All expenses incurred in connection with this solicitation, including postage, printing, handling, and the actual expenses incurred by custodians, nominees, and fiduciaries in forwarding proxy material to beneficial owners, will be paid by the Company. In addition to solicitation by mail, certain officers, directors, and employees of the Company, who will receive no additional compensation for their services, may solicit proxies by telephone, personal communication or other means. Automatic Data Processing has been engaged by the Company to tabulate the proxy voting. The aggregate fees to be paid to Automatic Data Processing are not expected to exceed $20,000.

The purposes of the Annual Meeting are:

(1) to elect six nominees to the Board of Directors; and

(2) to act upon such other matters as may properly come before the Annual Meeting or any adjournments of the meeting.

The Board of Directors knows of no other matters other than those stated above to be brought before the Annual Meeting or any adjournment of the meeting.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted by: filing with the Secretary of the Company written notice of revocation, provided such notice is actually received prior to the vote of shareholders; duly executing and filing a subsequent proxy with the Secretary of the Company before the vote of shareholders; or attending the Annual Meeting and voting in person. If the accompanying proxy card is properly voted according to the instructions, the proxy and the shares of the Company represented by the proxy will be voted at the Annual Meeting or any adjournments of the meeting in the manner directed in the proxy card. If no direction is made, the proxy and such shares will be votedFOR the proposals set forth in the accompanying proxy card and described in this Proxy Statement. If any other matter properly comes before the Annual Meeting or any adjournments of the meeting, the proxy card will confer discretionary authority to vote and the proxyholders named in the proxy card will vote on any such matters in their discretion.

The Board of Directors has fixed the close of business on March 21, 2005 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting and all adjournments of the meeting. As of the close of business on March 21, 2005, there were 7,942,439 shares of Common Stock of the Company outstanding and entitled to vote. On all matters to come before the

1

Annual Meeting, each holder of Common Stock will be entitled to one vote for each share held. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares entitled to vote at the meeting will constitute a quorum.

SHARE OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

Share Ownership of Management

The following table sets forth certain information, as of March 21, 2005, regarding shares of Common Stock of the Company owned of record or known to the Company to be owned beneficially by each director and nominee for director, certain executive officers including all those named in the Summary Compensation Table in this Proxy Statement, and all such directors and executive officers as a group. Except as indicated in the footnotes to this table, each of the persons named in the table has sole voting and investment power with respect to the shares beneficially owned by such person. The percentages are based on 7,942,439 shares of Common Stock of the Company outstanding as of March 21, 2005 plus each individual director’s and executive officer’s exercisable stock options. The address of the directors, nominees and executive officers is the Company’s address.

| | | | | |

Name

| | Shares

Beneficially

Owned (1)

| | Percent of Class

| |

Randall L. Marcuson (2) | | 413,282 | | 5.04 | % |

C. Daniel Blackshear (3) | | 46,900 | | * | |

David L. Castaldi (4) | | 25,800 | | * | |

Peter J. Holzer (5) | | 100,350 | | 1.26 | % |

Ganesh M. Kishore, Ph.D. (6) | | 14,000 | | * | |

John E. Klein (7) | | 23,000 | | * | |

Don T. Seaquist (8) | | 121,033 | | 1.50 | % |

David M. Baines, Ph.D. (9) | | 130,098 | | 1.62 | % |

Catherine A. Ricks, Ph.D. (10) | | 141,713 | | 1.77 | % |

Brian C. Hrudka (11) | | 90,546 | | 1.13 | % |

Joseph P. O’Dowd (12) | | 67,953 | | * | |

All Directors and Executive Officers as a Group (11 Persons) (13) | | 1,174,675 | | 13.45 | % |

| (1) | The shares of Common Stock and voting rights owned by each person or by all directors and executive officers as a group, and the shares included in the total number of shares of Common Stock outstanding used to determine the percentage of shares of Common Stock owned by each person and such group, have been calculated in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to reflect the ownership of shares issuable upon exercise of outstanding options or other common stock equivalents which are exercisable within 60 days. As provided in such Rule, such shares issuable to any holder are deemed outstanding for the purpose of calculating such holder’s beneficial ownership but not any other holder’s beneficial ownership. |

| (2) | Includes 149,334 shares owned by Mr. Marcuson, which includes 19,500 and 18,200 shares issued to Mr. Marcuson pursuant to restricted stock awards granted under the Company’s Amended and Restated Incentive Stock Option and Nonstatutory Stock Option Plan (including any predecessor plans, the “Stock Plan”) in April 2003 and February 2004, respectively, which vest at a rate of 25% per year on each of the first four anniversaries of the date of issuance. Also |

2

| | includes 262,254 shares subject to exercisable options issued under the Stock Plan. Also includes 1,694 shares owned by Mr. Marcuson’s children. |

| (3) | Includes 15,400 shares owned by Mr. Blackshear. Also includes 31,500 shares subject to exercisable options issued under the Stock Plan. |

| (4) | Includes 9,800 shares owned by Mr. Castaldi. Also includes 10,000 shares subject to exercisable options issued under the Stock Plan. Also includes 2,500 shares owned by Mr. Castaldi’s spouse. Also includes 3,500 shares owned by Mr. Castaldi’s children. Mr. Castaldi disclaims beneficial ownership of the shares held by his spouse and his children. |

| (5) | Includes 39,000 shares owned by Mr. Holzer. Also includes 31,500 shares subject to exercisable options issued under the Stock Plan. Also includes 27,800 shares owned by Mr. Holzer’s spouse. Also includes 2,050 shares owned by Mr. Holzer’s children. With regard to the shares owned by Mr. Holzer’s children, the children have sole voting power and Mr. Holzer and the children share investment power. |

| (6) | Includes 14,000 shares subject to exercisable options issued under the Stock Plan. |

| (7) | Includes 5,000 shares held in trust for the benefit of Mr. Klein. Also includes 18,000 shares subject to exercisable options issued under the Stock Plan. |

| (8) | Includes 12,233 shares owned by Mr. Seaquist, which includes 5,600 and 5,800 shares issued to Mr. Seaquist pursuant to restricted stock awards granted under the Stock Plan in April 2003 and February 2004, respectively, which vest at a rate of 25% per year on each of the first four anniversaries of the date of issuance. Also includes 108,800 shares subject to exercisable options issued under the Stock Plan. |

| (9) | Includes 32,624 shares owned by Dr. Baines, which includes 4,900 and 4,100 shares issued to Dr. Baines pursuant to restricted stock awards granted under the Stock Plan in April 2003 and February 2004, respectively, which vest at a rate of 25% per year on each of the first four anniversaries of the date of issuance. Also includes 96,052 shares subject to exercisable options issued under the Stock Plan. Also includes 1,422 shares owned by Dr. Baines’ spouse. |

| (10) | Includes 61,630 shares owned by Dr. Ricks, which includes 4,900 and 4,800 shares issued to Dr. Ricks pursuant to restricted stock awards granted under the Stock Plan in April 2003 and February 2004, respectively, which vest at a rate of 25% per year on each of the first four anniversaries of the date of issuance. Also includes 79,983 shares subject to exercisable options issued under the Stock Plan. Also includes 100 shares owned by Dr. Ricks’ spouse. Dr. Ricks disclaims beneficial ownership of the shares held by her spouse. |

| (11) | Includes 10,645 shares owned by Mr. Hrudka, which includes 5,000 and 4,100 shares issued to Mr. Hrudka pursuant to restricted stock awards granted under the Stock Plan in April 2003 and February 2004, respectively, which vest at a rate of 25% per year on each of the first four anniversaries of the date of issuance. Also includes 79,901 shares subject to exercisable options issued under the Stock Plan. |

| (12) | Includes 9,894 shares owned by Mr. O’Dowd, which includes 4,500 and 4,200 shares issued to Mr. O’Dowd pursuant to restricted stock awards granted under the Stock Plan in April 2003 and February 2004, respectively, which vest at a rate of 25% per year on each of the first four anniversaries of the date of issuance. Also includes 58,028 shares subject to exercisable options issued under the Stock Plan. Also includes 31 shares owned by Mr. O’Dowd’s spouse. Mr. O’Dowd disclaims beneficial ownership of the shares held by his spouse. |

| (13) | Includes 790,018 shares subject to exercisable options issued under the Stock Plan. |

Share Ownership of Certain Beneficial Owners

In addition, the following table sets forth certain information as to each person known to the Company to be the beneficial owner of more than five percent of the Company’s Common Stock (other than directors and officers shown in the preceding table) as of March 21, 2005. The percentage is calculated based on 7,942,439 shares outstanding of the Company as of March 21, 2005.

3

| | | | | | |

Name and Address of Beneficial Owner

| | Shares Beneficially Owned

| | | Percent of Class

| |

Mohamed Abdulmohsin Al Kharafi & Sons W.L.L. P.O. Box 886 Safat 3009 Safat Kuwait | | 629,500 | (1) | | 7.9 | % |

| | |

Connors Investor Services, Inc. 1100 Berkshire Boulevard Suite 300 Wyomissing, PA 19610 | | 641,650 | (2) | | 8.1 | % |

| | |

FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson 82 Devonshire Street Boston, MA 02109 | | 631,500 | (3) | | 8.0 | % |

| (1) | Based on a Schedule 13D filed by Mohamed Abdulmohsin Al Kharafi & Sons W.L.L. (“Kharafi”) with the Securities and Exchange Commission dated May 15, 1996. Kharafi indicated in the Schedule 13D that it holds the Company’s Common Stock as an equity investment. |

| (2) | Based on a Schedule 13G filed by Connors Investor Services, Inc. (“Connors”) with the Securities and Exchange Commission on February 14, 2005. Connors is an investment advisor and the shares are held for the accounts of discretionary clients. |

| (3) | Based on a Schedule 13G/A filed by FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson with the Securities and Exchange Commission on February 14, 2005. Fidelity Management & Research Company (“Fidelity”) is a wholly-owned subsidiary of FMR Corp. and an investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940, including Fidelity Low Priced Stock Fund (the “Fund”), which beneficially owns 631,500 shares of the Company’s Common Stock. Mr. Johnson is Chairman of FMR Corp. and Ms. Johnson is a Director of FMR Corp. Mr. Johnson and Ms. Johnson each is a substantial shareholder of FMR Corp. and, together with other members of Mr. Johnson’s family, may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR Corp. FMR Corp. and Mr. Johnson each report sole dispositive power over the 631,500 shares beneficially owned by the Fund through control of Fidelity. |

4

MANAGEMENT

Under the Company’s Bylaws, each executive officer of the Company is appointed by the Board of Directors and serves until his or her successor is appointed and qualified. The executive officers of the Company are as follows:

| | | | |

Name

| | Age

| | Position with Company

|

Randall L. Marcuson | | 56 | | President, Chief Executive Officer and Director |

Don T. Seaquist | | 56 | | Vice President, Finance and Administration and Corporate Secretary |

David M. Baines, Ph.D. | | 57 | | Vice President, Global Sales |

Catherine A. Ricks, Ph.D. | | 58 | | Vice President, Research and Development |

Brian C. Hrudka | | 47 | | Vice President, Latin America and Vice President, Global Marketing |

Joseph P. O’Dowd | | 50 | | Vice President, Global Product Development and Supply |

Randall L. Marcuson joined the Company in 1990 as President and Chief Executive Officer and a director. Prior to coming to the Company, Mr. Marcuson was Vice President, Animal Health Products for the International Agricultural Division of American Cyanamid. Mr. Marcuson joined American Cyanamid in 1984 after 10 years of domestic and international marketing experience with Monsanto Agricultural Products Company. Mr. Marcuson holds a B.A. degree in international relations from the University of Kansas.

Don T. Seaquist joined the Company in 1996 as Vice President, Finance and Administration and Corporate Secretary. Prior to joining the Company, Mr. Seaquist was Vice President and Treasurer of Greyhound Lines, Inc. from February 1990 to January 1995. Previously, Mr. Seaquist was Managing Director of Trinity Litchfield Group, an investment firm, Vice President and Treasurer of Horsehead Industries, an international manufacturing company, and Manager of International Corporate Finance for United Technologies Corporation. Mr. Seaquist holds a B.S.B.A. in Management from Georgetown University and an MBA in Finance and Marketing from Columbia University.

David M. Baines, Ph.D. was appointed Vice President, Global Marketing and Sales in July 1999 (title subsequently changed to Vice President, Global Sales). Dr. Baines has been a Vice President of Embrex, Inc. since 1995 and joined the Company in 1993 as Managing Director of Embrex Europe Limited and served in that capacity until 1999. Prior to joining the Company, Dr. Baines served as a consultant to the Company. Before his affiliation with Embrex, Dr. Baines had a 23-year career with Rhone Merieux, a subsidiary of Rhone-Poulenc. Dr. Baines served as Chief Executive of Rhone Merieux’s United Kingdom animal health subsidiary, and before that as General Manager of its operations in New Zealand. Dr. Baines began his career as a development and senior research scientist for Rhone Merieux, and holds a B.Sc. degree in Zoology from Reading University and a Ph.D. degree in Entomology from London University.

Catherine A. Ricks, Ph.D. joined the Company in 1989 as Vice President, Research and Development. Prior to joining the Company, Dr. Ricks was Manager of Animal Industry Discovery and Biotechnology for American Cyanamid. During her 10 years with American Cyanamid she managed a variety of research programs directed at increasing livestock productivity. She holds a B.S. in botany and an M.S. in plant physiology from London University, London, England, and a Ph.D. in dairy science from Michigan State University, and serves on the Boards of Directors of the Poultry Science Association, Inc. and the Poultry Science Association Foundation, Inc.

5

Brian C. Hrudka was appointed Vice President, Latin America and Vice President, Global Marketing in April 2002. Mr. Hrudka joined the Company in 1999 as Vice President Global Commercial Development (title subsequently changed to Vice President, Global Product Development and Supply). Prior to joining the Company, Mr. Hrudka was with Novartis in the United States for approximately nine years, where he served in various capacities, including Vice President, Operations and Chief Financial Officer & Director of Business Development for the Animal Health Division, and as Brand Manager for the Plant Genetics Division for Ciba-Geigy, Inc., the predecessor company to Novartis prior to the merger of Ciba-Geigy and Sandoz. He also worked at Ciba-Geigy Global Headquarters in Basel, Switzerland for three years. He worked for King Agro Inc. in a variety of sales and managerial positions. Mr. Hrudka holds both a B.S. degree in Biochemistry and an MBA from the University of Western Ontario.

Joseph P. O’Dowdwas appointed Vice President, Global Product Development and Supply in April 2002. Mr. O’Dowd joined the Company in 1997 as Director of Embrex Latin America. Prior to joining the Company, Mr. O’Dowd spent approximately 16 years with Solvay Animal Health where he served in various capacities including Vice President Sales and Marketing-Latin America, International Marketing Director, and Regional Marketing Director Asia/Pacific. Mr. O’Dowd holds both a B.A. in Asian Studies from California State University, Northridge and a Master’s of International Management (or M.I.M.) from the American Graduate School of International Management.

6

PROPOSAL 1: ELECTION OF DIRECTORS

Pursuant to the authority granted by the Company’s Bylaws, the Board of Directors of the Company has established the number constituting the Board of Directors to be six. The proxies cannot be voted for a greater number of persons than the number of nominees named, and any seat not filled at the Annual Meeting may be filled as a vacancy by the Board of Directors as permitted by the Company’s Bylaws. Each of the nominees currently serves as a director of the Company. The six nominees for election as directors are named and certain other information is provided below:

| | | | | | |

Name

| | Position with Company

| | Age

| | First Year

Elected

Director

|

Randall L. Marcuson | | President, Chief Executive Officer and Director | | 56 | | 1990 |

C. Daniel Blackshear (1)(3) | | Director | | 61 | | 1998 |

David L. Castaldi (2)(3) | | Director | | 65 | | 2003 |

Peter J. Holzer (1)(3) | | Chairman of the Board of Directors | | 59 | | 1998 |

Ganesh M. Kishore, Ph.D. (2)(3) | | Director | | 51 | | 2002 |

John E. Klein (1)(2)(3) | | Director | | 59 | | 2001 |

| (1) | Member of the Audit Committee of the Board. |

| (2) | Member of the Compensation Committee of the Board. |

| (3) | Member of the Nominations Committee of the Board. |

Randall L. Marcuson’s biographical information is included under the heading “MANAGEMENT” in this Proxy Statement.

C. Daniel Blackshear has served as a director of the Company since 1998. Mr. Blackshear has been President and CEO of Carolina Turkeys since 1994. Carolina Turkeys is the fourth largest turkey producer in the U.S. From 1982 to 1994, Mr. Blackshear was Senior Vice President, Food Division, of Cuddy Farms, Inc., responsible for operation of this vertically integrated operation. From 1971 to 1982, he served in a number of managerial positions at Pillsbury Farms, Country Pride Foods and ConAgra Poultry. Early in his career, he worked as Quality Assurance Director and Food Scientists Section Manager at Gold Kist, Inc. Mr. Blackshear holds both a B.S. degree in Agriculture as a poultry major and a M.S. degree in Food Science and Management from the University of Georgia. He is a past President of both the North Carolina Turkey Federation and the North Carolina Poultry Federation. He is former Director of the American Meat Institute and currently is a director of the National Turkey Federation.

David L. Castaldi became a director of the Company in January 2003. Mr. Castaldi is currently an independent consultant to companies in the science and medical device fields and is the former Chairman and Chief Executive Officer of Cadent Medical Corporation, which was acquired by Cardiac Science, Inc. in July 2000. At Cadent, he led a team that developed a personal, wearable cardioverter defibrillator. Prior to joining Cadent in 1998, Mr. Castaldi was the Chairman and Chief Executive Officer of Biolink Corporation, where he led a team that developed an implantable vascular access device, and founder, President and Chief Executive Officer of BioSurface Technology, a biotechnology company. At BioSurface Technology, Mr. Castaldi oversaw $52 million in capital financing, the company’s initial public offering and the company’s sale to Genzyme Corporation, creating a new public entity, Genzyme Tissue Repair. Mr. Castaldi also has 16 years of experience with Baxter International, completing his

7

tenure there as President of Baxter’s biopharmaceutical division, Hyland Therapeutics. Mr. Castaldi served as Chancellor and Chief Financial Officer of the Roman Catholic Archdiocese of Boston during 2001. He holds a B.A. degree in business from the University of Notre Dame and a MBA from the Harvard Graduate School of Business Administration, where he was a Baker Scholar. Mr. Castaldi also serves on the boards of Nabi Biopharmaceuticals (Nasdaq: NABI), Biolex Inc., and Tissue Regeneration, Inc.

Peter J. Holzer, a private investor and management consultant, has served as a director of the Company since May 1998 and became Chairman of the Board in 2000. From 1996 to 2001, Mr. Holzer was an Advisory Director of AMT Capital Management, LLC, a New York-based strategic consulting and financial advisory firm focused on the financial services industry. From 1967 to 1996, he served in a number of managerial capacities at JP Morgan Chase, Inc., formerly The Chase Manhattan Corporation, most recently as Executive Vice President and Director, Strategic Planning and Development from 1990 to 1996. In this role, he was a member of the senior management team responsible for determining strategic direction as well as managing internal corporate development. From 1987 to 1990, he was Senior Vice President and Sector Executive, International Individual Banking, responsible for all of Chase’s international private banking and consumer banking businesses. Prior positions at Chase included Vice President and General Manager in Switzerland, Vice President and General Manager in Singapore, as well as responsibilities for credit training and management of the bank’s European petroleum division. Mr. Holzer also serves on the board of CAS Holdings, Inc., a privately owned firm that operates environmental testing laboratories and, in 2005, became a director of Easy Link Services Corp. (Nasdaq: EASY), an electronic information exchange service provider to businesses. Mr. Holzer also serves as a trustee of both Big Brothers/Big Sisters, New York, NY and The High Desert Museum in Bend, Oregon. He holds a B.A. degree in International Affairs from Princeton University and an MBA from Stanford University.

Ganesh M. Kishore, Ph.D., became a director of the Company in January 2002. Dr. Kishore also serves as Vice President, Science and Technology, and Chief Biotechnology Officer for Dupont Company, a Fortune 500 industrial/service corporation. Prior to joining Dupont in 2002, Dr. Kishore enjoyed a 20-year career with Monsanto Company, a leading provider of agricultural products and solutions, including service as President, Nutrition Sector, as well as Assistant Chief Scientist, Chief Biotechnologist, and was responsible for building a leading genomic research capability. At Monsanto he received the Queeny Award, the highest honor bestowed by Monsanto for outstanding applications of basic research to produce commercial products that create societal and investor value. Dr. Kishore was also a Distinguished Science Fellow at Monsanto. Dr. Kishore received his Ph.D. in biochemistry from the Indian Institute of Science, and his master’s and bachelor’s degrees in biochemistry, physics and chemistry from the University of Mysore, India.

John E. Klein became a director of the Company in March 2001. Since September 1, 2004, Mr. Klein has served as Executive Vice Chancellor for Administration of Washington University in St. Louis, a private research university. Mr. Klein also serves as a director of Energizer Holdings, Inc. (NYSE: ENR) and as chairman of the Advisory Board of Bunge North America, Inc., the North American operating arm of Bunge Limited (NYSE: BG), a major international agribusiness company primarily engaged in grain and oilseed processing and the manufacture and marketing of edible oil and bakery products. Mr. Klein previously served as President and Chief Executive Officer of Bunge North America, Inc., for nearly 19 years, retiring on December 31, 2003, and serving as non-executive Chairman of Bunge North America, Inc. until August 2004. After joining Bunge in 1976, Mr. Klein held various financial, trading and management positions in Europe, South America and New York before becoming CEO of Bunge North America, Inc. in 1985. Prior to joining Bunge, Mr. Klein taught at International College, Beirut, Lebanon and practiced law at the New York law firm of Sullivan & Cromwell. Mr. Klein holds an A.B. degree from Princeton University and a J.D. degree from the University of Michigan.

8

The Board of Directors has no reason to believe that the persons named above as nominees for directors will be unable or will decline to serve if elected. However, in the event of death or disqualification of any nominee or refusal or inability of any nominee to serve, it is the intention of the proxyholders named in the accompanying proxy card to vote for the election of such other person or persons as the proxyholders determine in their discretion. In no circumstance will the proxy be voted for more than six nominees. Properly signed and returned proxies or proxies voted via telephone or Internet, unless revoked, will be voted as directed by the shareholder or, in the absence of such direction, will be voted in favor of the election of the recommended nominees.

Under North Carolina law and the Company’s Bylaws, directors are elected by a plurality of the votes cast by the holders of the Common Stock of the Company at a meeting at which a quorum is present. Plurality means that the individuals who receive the largest number of votes cast, even if less than a majority, are elected as directors up to the maximum number of directors to be chosen at the meeting. Consequently, any shares not voted (whether by abstention, broker nonvote or otherwise) will not be included in determining which nominees receive the highest number of votes. All directors hold office until the next Annual Meeting of the Company’s shareholders and until the election and qualification of their successors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEES.

Director Independence

The Board of Directors has determined that all of the members of the Board other than Mr. Marcuson are “independent directors” within the meaning of Nasdaq Marketplace Rule 4200(a)(15). Mr. Marcuson is not considered independent because he is an executive officer of the Company.

Director Attendance

During the last fiscal year, the Board of Directors met five times. Each person who served as a director during the 2004 fiscal year attended 75% or more of the aggregate number of the meetings of the full Board of Directors and 75% or more of the aggregate number of meetings of all committees of the Board of which the director was a committee member, in each case as held during the period for which the director was in office. The Company encourages, but does not require, directors to attend the annual meeting of shareholders. Historically, nearly all of the directors have attended the annual meeting and last year all of the directors attended the 2004 annual meeting.

Board Committees and Director Nominations

The Board of Directors has three standing committees—an Audit Committee, a Compensation Committee and a Nominations Committee. Each of these committees is comprised solely of directors that the Board of Directors has determined are “independent directors” within the meaning of Nasdaq Marketplace Rule 4200(a)(15). The members of these committees are identified in the table above.

The Audit Committee oversees the accounting and financial reporting processes of the Company and acts on behalf of the Board of Directors in providing oversight with respect to (i) the quality and integrity of the Company’s financial statements, internal accounting and financial controls; (ii) all audit, review and attest services relating to the Company’s financial statements and internal controls, including the appointment, compensation, retention, termination and oversight of the work of the auditors engaged to provide audit services to the Company; and (iii) compliance with applicable laws, rules and regulations

9

relating to the financial affairs of the Company. The Audit Committee acts under an Audit Committee Charter, a copy of which was filed with the Securities and Exchange Commission (“SEC”) on April 12, 2004 as Appendix A to the Company’s Proxy Statement for the 2004 Annual Meeting of Shareholders. The Audit Committee and the Board of Directors have determined that each of the members of the Audit Committee meet all applicable requirements of the SEC and the National Association of Securities Dealers (“NASD”) regarding independence and financial literacy. In addition, the Audit Committee and the Board of Directors determined that Mr. Holzer possesses certain financial sophistication as required by Nasdaq Marketplace Rules and is an “audit committee financial expert” under SEC rules based upon his relevant experience. See “Report of the Audit Committee of the Board of Directors”, below. During 2004, the Audit Committee held nine meetings.

The Compensation Committee recommends to the Board of Directors compensation arrangements for officers and directors and is responsible for the administration of the Company’s compensation plans. Specifically, the Compensation Committee administers the Company’s incentive and nonstatutory stock option plans and employee stock purchase plans. During 2004, the Compensation Committee held two meetings.

The Nominations Committee identifies individuals qualified to serve as directors of the Company and recommends to the Board of Directors nominees for election as directors. The Nominations Committee acts under a Nominations Committee Charter, a copy of which was filed with SEC on April 12, 2004 as Appendix B to the Company’s Proxy Statement for the 2004 Annual Meeting of Shareholders. The Company may also in its discretion make its Nominations Committee Charter available on the Company’s Internet website, http://www.embrex.com. During 2004, the Nominations Committee met informally in conjunction with Board of Directors meetings but held no formal committee meetings.

The Company’s Bylaws contain procedures by which a shareholder may nominate a person for election to the Board of Directors. Under these procedures, nominations by shareholders must be made pursuant to timely notice and in proper written form to the Secretary of the Company, as described in the Bylaws (Article IV, Section 3). Any nominees nominated by shareholders pursuant to these procedures contained in the Bylaws also will be considered by the Nominations Committee for potential recommendation by the Nominations Committee to the Board of Directors as nominees of the Board for election as director. Director candidates nominated by shareholders in accordance with such procedures will be evaluated by the Nominations Committee in the same manner as candidates identified by the Nominations Committee.

The Nominations Committee uses a variety of methods for identifying and evaluating nominees for directors. The Board of Directors or the Nominations Committee periodically assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominations Committee considers various potential candidates for director. Candidates may come to the attention of the Nominations Committee through current board members, shareholders or other persons. The Nominations Committee has from time to time engaged director search firms to assist it in identifying and evaluating potential director candidates. Identified candidates are evaluated by the Nominations Committee and may be considered at any point during the year. In identifying and evaluating candidates for membership on the Board of Directors, the Nominations Committee takes into account all factors it considers appropriate, which may include:

| | • | | The knowledge, skills and experience of the person, including experience in business, finance, administration, and the Company’s industry, and the knowledge, skills and experience already possessed by existing members of the Board. |

| | • | | The present needs of the Company with respect to particular talents or expertise on the Board. |

10

| | • | | The person’s experience in accounting and auditing practices (including expertise that could qualify a person as an “audit committee financial expert” as defined under applicable SEC rules). |

| | • | | The character, integrity, judgment and independence of the person. |

| | • | | The person’s availability to devote sufficient time to the affairs of the Company in order to carry out the responsibilities of a director. |

Communications with Directors

The Board of Directors provides a process for shareholders to send communications to the Board or any individual director. Shareholders can send written communications to the Board or any director c/o Corporate Secretary, Embrex, Inc., Post Office Box 13989, Research Triangle Park, North Carolina 27709. Historically, the Company’s practice has been that all such communications are sent by the Corporate Secretary directly to the Board or the individual director, as applicable. The Company may periodically review and assess this practice and make changes as deemed appropriate.

Compensation of Directors

During 2004, non-officer directors received a $15,000 annual retainer, payable $3,750 each calendar quarter. The Chairman of the Board received an additional $8,000 fee and the Chairmen of the Audit Committee and Compensation Committee each received an additional $3,000 fee for service in such capacities. Directors also were paid meeting fees as follows: $1,500 per Board of Directors meeting attended in person, $1,000 per committee meeting attended in person, and $500 per Board of Directors meeting or committee meeting attended telephonically, in all cases plus expenses. During 2005, non-officer directors are being paid retainer and meeting fees at the same rates as were paid in 2004.

Non-officer directors also are eligible to receive equity compensation pursuant to the Company’s Amended and Restated Incentive Stock Option and Nonstatutory Stock Option Plan (the “Plan”). During 2004, each non-officer director of the Company received fully vested options to purchase 5,000 shares of Common Stock at an exercise price of $13.09 under the Plan. In March 2005, each non-officer director of the Company received a grant of 2,500 restricted stock units under the Plan, which restricted stock units will automatically be converted into shares of Common Stock of the Company when the restricted stock units vest in full on January 2, 2006, subject to an optional deferral election under the Plan.

11

EXECUTIVE COMPENSATION

The following tables set forth a summary of compensation earned by or paid to the Company’s Chief Executive Officer and the next four most highly compensated executive officers of the Company who served in such capacities on December 31, 2004, for services rendered during the fiscal years indicated.

Summary Compensation Table

| | | | | | | | | | | | |

| | | Year

| | Annual Compensation

(1)(2)

| | Long Term

Compensation(5)

|

Name and Principal Position

| | | Salary

| | Bonus (3)

| | Restricted

Stock Awards (4)

| | Securities

Underlying Options(#)

|

Randall L. Marcuson President and Chief

Executive Officer | | 2004

2003

2002 | | $

$

$ | 325,000

315,000

305,000 | | $

$

| 120,000

157,000

-0- | | 18,200

19,500

-0- | | 28,000

30,000

20,000 |

Don T. Seaquist Vice President, Finance and

Administration and Corporate

Secretary | | 2004

2003

2002 | | $

$

$ | 217,000

216,000

215,000 | | $

$

| 39,000

65,000

-0- | | 5,800

5,600

-0- | | 9,000

8,600

5,000 |

| | | | | |

David M. Baines, Ph.D. Vice President, Global Sales | | 2004

2003

2002 | | $

$

$ | 235,426

210,000

190,500 | | $

$

| 55,000

76,600

-0- | | 4,100

4,900

-0- | | 6,300

7,550

2,000 |

Catherine A. Ricks, Ph.D. Vice President, Research

and Development | | 2004

2003

2002 | | $

$

$ | 194,000

192,000

190,000 | | $

$

| 32,000

50,000

-0- | | 4,800

4,900

-0- | | 7,500

7,550

16,000 |

| | | | | |

Brian C. Hrudka Vice President, Latin America and Vice President, Global Marketing | | 2004

2003

2002 | | $

$

$ | 194,000

193,000

192,000 | | $

$

| 42,000

35,000

-0- | | 4,100

5,000

-0- | | 6,300

7,650

16,000 |

| (1) | No executive officer of the Company received any personal benefits other than those benefits available to all employees through participation in employee benefit plans. |

| (2) | Includes compensation that has been deferred under the Company’s 401(k) Retirement Savings Plan. |

| (3) | These are incentive compensation payments consisting of cash, which are reported by the Company for the fiscal year in which the incentive compensation payments are earned, even if not paid until the following fiscal year. |

| (4) | The named executive officers are eligible to receive restricted stock awards under the Company’s Amended and Restated Incentive Stock Option and Nonstatutory Stock Option Plan (the “Plan”). Restricted stock awards vest at a rate of 25% per year on each of the first four anniversaries of the date of grant. The aggregate number of shares of restricted stock awarded, but which remain restricted as of December 31, 2004, and the value thereof based on the closing market price of $13.26 per share on such date, were as follows: Mr. Marcuson, 32,825 shares valued at $435,260; Mr. Seaquist, 10,000 shares valued at $132,600; Dr. Baines, 7,775 shares valued at $103,097; Dr. Ricks, 8,475 shares valued at $112,379; and Mr. Hrudka, 7,850 shares valued at $104,091. The named executive officers are eligible to receive dividends with respect to restricted stock awards, although the Company has paid no dividends on any stock since inception and has no plans to pay dividends on its Common Stock in the foreseeable future. |

| (5) | The named executive officers also are eligible to receive restricted stock unit awards under the Plan. Restricted stock unit awards vest at a rate of 25% per year on each of the first four anniversaries of the vesting commencement date. Restricted stock unit awards were granted on March 18, 2005 (which are not included in the Summary Compensation Table above since they were not granted in fiscal year 2004), with a vesting commencement date of January 2, 2005, and the value thereof based on the closing price of $11.25 per share on such date, were as follows: Mr. Marcuson, 29,900 shares valued at $336,375; Mr. Seaquist, 8,700 shares valued at $97,875; Dr. Baines, 8,500 shares valued at $95,625; Dr. Ricks, 6,820 shares valued at $76,725; and Mr. Hrudka, 8,120 shares valued at $91,350. The named executive officers are not eligible to receive dividends with respect to restricted stock unit awards until the restricted stock units vest and are converted into shares of the Company’s Common Stock pursuant to the terms of the Plan. As noted above, the Company has paid no dividends on any |

12

| | stock since inception and has no plans to pay dividends on its Common Stock in the foreseeable future. |

Option Grants in Last Fiscal Year

The following table sets forth stock options granted by the Company to the named executive officers in the past fiscal year. The table also sets forth the hypothetical potential realizable values that would exist for the options at the end of their 10-year terms, at assumed rates of stock price appreciation of 5% and 10% per year throughout such 10-year term. The actual value of the options will depend on the market value of the Company’s Common Stock. No gain to the option holders is possible without an increase in the stock price, which will benefit all shareholders proportionately. These potential realizable values, based on the 5% and 10% annualized appreciation rates prescribed by the Securities and Exchange Commission, are not intended to forecast possible future appreciation, if any, of the Company’s stock price.

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | |

Name

| | Number of

Securities

Underlying

Options

Granted (1)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year

| | | Exercise Price Per

Share

| | Expiration

Date

| | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option Term

|

| | | | | | 5% ($)

| | 10% ($)

|

Randall L. Marcuson | | 28,000 | | 16.7 | % | | $ | 13.09 | | 2/13/2014 | | $ | 199,032 | | $ | 534,027 |

Don T. Seaquist | | 9,000 | | 5.4 | % | | $ | 13.09 | | 2/13/2014 | | $ | 63,975 | | $ | 171,652 |

David M. Baines, Ph.D. | | 6,300 | | 3.7 | % | | $ | 13.09 | | 2/13/2014 | | $ | 44,782 | | $ | 120,156 |

Catherine A. Ricks, Ph.D. | | 7,500 | | 4.5 | % | | $ | 13.09 | | 2/13/2014 | | $ | 53,312 | | $ | 143,043 |

Brian C. Hrudka | | 6,300 | | 3.7 | % | | $ | 13.09 | | 2/13/2014 | | $ | 44,782 | | $ | 120,156 |

Total potential stock price appreciation from February 13, 2004 to February 13, 2014 for all shareholders at assumed rates of stock price appreciation (2) | | | | $ | 62,566,566 | | $ | 158,555,961 |

| (1) | The options granted are incentive stock options and nonstatutory stock options and become exercisable 25% per year commencing one year from the date of grant and are fully exercisable four years from the date of grant. Payment of the exercise price must be in cash or in capital stock of the Company or, at the discretion of the Compensation Committee, by other lawful means. Generally, the options granted must be exercised within 10 years from the date of grant, but must be exercised within three months after termination of the option holder’s employment (for reasons other than disability or death) and within one year after the option holder’s disability or death. These stock options include a provision that would accelerate the vesting of the options upon a change in control of the Company. |

| (2) | Based on a price of $12.40 on February 13, 2004, and a total of 8,023,110 shares of Common Stock outstanding. |

13

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | | | | | | | | |

Name

| | Number

of Shares

Acquired

on Exercise

| | Value Realized

($)(1)

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End Exercisable/Unexercisable

| | Value of Unexercised “In-the-Money” Options

at Fiscal Year-End

Exercisable/

Unexercisable(2)

|

Randall L. Marcuson | | 1,000 | | $ | 6,840 | | 228,381 /78,619 | | $ | 1,070,683 /$105,992 |

Don T. Seaquist | | — | | | — | | 98,150 /22,950 | | $ | 484,400 /$24,750 |

David M. Baines, Ph.D. | | 11,299 | | $ | 78,285 | | 87,089 / 17,962 | | $ | 431,583 /$21,454 |

Catherine A. Ricks, Ph.D. | | 19,100 | | $ | 112,910 | | 68,385 / 25,165 | | $ | 297,549 /$22,569 |

Brian C. Hrudka | | — | | | — | | 68,038 / 24,412 | | $ | 300,776 /$21,724 |

| (1) | The value realized is calculated by subtracting the exercise price from the closing market price of the shares acquired on the date of exercise. |

| (2) | Options are “In-the-Money” if the fair market value of the underlying securities exceeds the exercise price of the options. The value of the options is calculated by subtracting the exercise price from $13.74, the closing market price of the underlying Common Stock as of December 31, 2004. |

Employment Agreements

All employees of the Company, including the executive officers named in the above tables, have entered into employment agreements with the Company. Each executive employment agreement provides for merit-based salary increases at the Board of Directors’ sole discretion and includes confidentiality and non-competition provisions, as well as an ownership provision in the Company’s favor for techniques, discoveries and inventions arising during the term of employment. Each executive employment agreement provides that the named executive officer serves at the pleasure of the Company and does not state a term of employment. Each executive employment agreement also provides that if the Company terminates the officer’s employment without cause, the officer will be entitled to receive an amount ranging from one to one and one-half times the officer’s annual compensation.

Each of the executive officers of the Company named in the above tables has entered into a Change in Control Severance Agreement with the Company. Each of these agreements provides that after a change in control of the Company, the officer will be entitled to receive certain payments and benefits, including a payment equal to 2.9 times the officer’s annual compensation, if within two years after such change in control the Company terminates the officer’s employment for reasons other than cause, disability or death, or if the employee terminates his employment for good reason, for example, a change in the employee’s position, responsibilities, or salary. Under these agreements, all stock options held by such officers immediately vest upon a change in control of the Company.

Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers, directors and certain beneficial owners of the Company’s equity securities (the “Section 16 Reporting Persons”) to file reports of ownership and changes in ownership with the SEC. The Company reviewed filings with the SEC from January 1, 2004 through March 21, 2005 with respect to the Section 16 Reporting Persons and written representations from certain Section 16 Reporting Persons. Based upon this review, to the Company’s knowledge, all transactions in the Company’s equity securities by the Company’s Section 16 Reporting Persons were reported on time, except for one transaction with respect

14

to 2004, which is described as follows: Mr. Baines filed one late report, which covered one late transaction. In this case, the failure to file on a timely basis was inadvertent.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

General

The primary responsibilities of the Compensation Committee (the “Committee”) are to: (a) assist the Board of Directors (the “Board”) in meeting its responsibilities relating to oversight and determination of executive compensation; (b) review and make recommendations to the Board regarding the compensation of the Chief Executive Officer and other officers of the Company; (c) administer the Company’s stock option and stock award plans; (d) review and make recommendations to the Board regarding the overall compensation structure and programs of the Company, including employee benefit plans, stock option and stock award plans, employee stock purchase plans, and other programs as deemed appropriate by the Committee; and (e) review and make recommendations to the Board regarding compensation arrangements relating to directors. The Committee is composed entirely of non-officer and non-employee directors, each of whom the Committee and the Board has determined is an “independent director” as that term is defined by Nasdaq Marketplace Rule 4200(a)(15).

Executive Compensation

The Company’s policy is to pay its executives and other employees at rates competitive with the national or local markets in which it must recruit to enable the Company to maintain a highly competent and productive staff. The Company competes for management personnel with many larger companies that have substantially greater resources than the Company.

Compensation of executives consists generally of: monthly salary, company paid benefits (consisting principally of group health and other insurance), bonus (including cash payments and stock based awards), and equity-based awards (consisting of stock options, restricted stock, restricted stock units or stock appreciation rights). Presently, bonus payments and equity-based awards are the principal means for rewarding executives for good performance.

Executives are paid salaries within a range established for their position. Salary ranges for executive positions are established by systematically evaluating the position and assigning a salary range based on comparisons with pay scales for similar positions in reasonably comparable companies using regional and national salary surveys. Companies included in these salary surveys will vary and are not necessarily the same as the companies used for purposes of the performance graph included in the Company’s Proxy Statement for the 2005 Annual Meeting of Shareholders. Adjustments to executive salaries are generally made annually. Adjustments to salaries of executives other than the Chief Executive Officer (“CEO”) are recommended to the Committee by the CEO based on an executive’s performance during the preceding year, the executive’s salary relative to the salary range for the position, and the competitive situation. That performance is measured based on the executive’s success in achieving goals established at the beginning of the year. The Committee will exercise its subjective judgment in determining the degree to which goals are achieved when making recommendations to the Board. Corporate performance also is considered by the Committee, although it is not solely determinative of adjustments to executive salary.

Bonus payments to executives are generally considered annually. Bonus payments for executives other than the CEO are recommended to the Committee by the CEO based on an executive’s performance during the preceding year. The performance is measured based on the executive’s success in achieving

15

goals established in the beginning of the year and on corporate performance and is subject to the discretion of the Committee and the Board.

Equity-based awards (stock options, restricted stock, restricted stock units or stock appreciation rights) are generally considered annually and are intended to reward executives for good performance and to encourage ownership of Company stock by executives. This ownership is intended to enhance the long-term proprietary interest in the Company on the part of those persons who can contribute to the Company’s overall success and to increase the value of the Company to its shareholders.

Guidelines are established for equity-based awards based on the salary ranges of various position levels within the Company. Guideline ranges for equity-based awards increase relative to cash compensation as position levels increase, since the Committee believes that employees at higher levels in the organization have a greater opportunity to influence and contribute to building long-term shareholder value. The Committee may decide to make equity-based awards greater than the guideline amounts or more frequently than annually, if it believes the recipient has made an exceptional contribution to the Company’s progress. Equity-based awards may be made upon hiring employees to fill certain senior positions in the Company. The size of those awards is determined based on the guidelines for annual awards for the position to be occupied by the new employee and the competitive situation.

Equity-based awards for executives other than the CEO are recommended to the Committee by the CEO. The process for determining amounts of equity-based awards is based on the same criteria as those used for determining bonus payments. Generally, equity-based awards vest in equal 25% increments over four years.

During 2002, the Committee conducted a senior executive compensation survey to evaluate and benchmark Embrex’s base salary, bonus and equity-based award components of its compensation structure. As a result, the Company in 2003 made certain changes to the timing and mix of the various elements of compensation for all officers of the Company, including the CEO. The principal effects occurred in two areas. First, bonus payments were modified to be entirely cash, based on the same criteria as before. Second, equity-based awards, formerly entirely stock options, were modified to be comprised of two elements: a stock option component and a restricted stock component to encourage executive ownership of the Company’s Common Stock.

During 2004 and early 2005, the Committee engaged in a review of the Company’s equity-based compensation and as part of this review considered whether any changes should be made to equity-based compensation. Based on this review, the Committee determined that it was in the best interests of the Company to make equity-based awards for 2004 entirely in restricted stock units rather than a combination of stock option and restricted stock awards, including for the CEO. A restricted stock unit entitles the grantee to receive shares of Common Stock of the Company at such times and on such terms as may be determined by the Committee or the Board, including vesting upon service or the attainment of performance goals. In the case of the awards for 2004, the restricted stock units vest over a period of four years so long as the grantee continues to provide services to the Company. The Committee made this change to restricted stock units principally because of recent changes in the rules relating to accounting for stock options and because restricted stock units generally involve the issuance of a fewer number of shares of stock than stock options. To facilitate this change, the Company has amended its stock option plan to permit the award of restricted stock units and also stock appreciation rights. Stock appreciation rights are settled in shares of common stock equal in value on the date of exercise to the increase in the value of the underlying stock from the date of grant until the date of exercise. Overall, the Company’s objective is to incentivize senior executives to focus on building long-term shareholder value.

16

Prior to 2004, all employees generally were eligible to receive annual stock option grants. As part of its review described above, the Committee determined that it was in the best interests of the Company to eliminate this broad-based grant of options. In connection with this change, the Committee determined that it was appropriate to make cash bonuses to certain employees on a one-time basis.

The Company has established stock ownership targets for officers and directors. The stock ownership target for the CEO is the lesser of 1.5% of the total outstanding shares of the Company or the number of shares having a market value of five times the CEO’s base salary, and the target for other executive officers is the lesser of 0.5% of total shares outstanding or two times base salary. The stock ownership target for the directors is that, within five years of becoming a director of the Company, a director should own the number of shares having a market value of five times the annual retainer fee of the director.

The Committee has concluded that it would be appropriate to study further the Company’s compensation package, including salary, bonus and equity-based awards, and plans to do so in the coming year. As part of this process, the Committee expects to engage a compensation consultant to update the compensation survey and advice from the 2002 study.

CEO Compensation

The CEO’s compensation is recommended by the Committee to the Board based on the Committee’s determination as to the level appropriate to enable the Company to remain competitive and retain top management. As with other executive compensation decisions, the Committee also considers corporate performance and the CEO compensation in reasonably comparable companies using regional and national salary surveys.

In addition, the compensation of Randall Marcuson, President and Chief Executive Officer, has been and is based on the Committee’s subjective assessment of his progress toward achieving Company objectives of profitability, further commercial placements of devices and other products, commercial introduction of those products to the global poultry industry, development and commercialization of new devices and products, establishing a commercial presence in international markets, continuing to strengthen, expand and defend Embrex’s intellectual property portfolio, overall organizational development, and other enhancements of long-term shareholder value.

Review of All Components of Executive Compensation

The Committee has reviewed all components of the compensation of the CEO and other executives, including salary, bonus and equity-based awards, accumulated realized and unrealized stock option and restricted stock gains, and the projected payout obligations under potential severance and change-of-control scenarios. Based on this review, the Committee found the CEO’s and other executives’ compensation (and, in the case of severance and change-of-control scenarios, the potential payouts) in the aggregate to be reasonable and not excessive.

Personal Benefits

The Company does not have arrangements for providing personal benefits or perquisites to officers such as lodging, transportation or defraying the cost of personal entertainment or travel. No executive receives any personal benefits other than those benefits available to all employees, consisting principally of group health and other insurance. Moreover, executives are not entitled to operate under different standards than other Embrex employees and executives are expected to set exemplary conduct standards under our Code of Business Conduct and Ethics.

17

Policy with Respect to $1.0 Million Deduction Limit

All compensation that the Company has paid to its executive officers has been deductible under Section 162(m) of the Internal Revenue Code of 1986, as amended. That section imposes a $1.0 million limit on the U.S. corporate income tax deduction a publicly-held company may claim for annual compensation paid to its Chief Executive Officer or any one of the four most highly compensated officers of the Company (other than the Chief Executive Officer) for the taxable year. An exception to this limitation is available for performance-based compensation. Compensation received as a result of the exercise of stock options may be considered performance-based compensation if certain requirements of Section 162(m) are satisfied. The Company’s Amended and Restated Incentive Stock Option and Nonstatutory Stock Option Plan contains appropriate provisions such that compensation attributable to incentive stock options may qualify as performance-based compensation, and the Committee intends for all compensation attributable to incentive stock options granted to its executive officers to be deductible as performance-based compensation. In the event that the Committee considers approving compensation in the future that would be subject to Section 162(m) and would exceed the $1.0 million threshold, the Committee will consider what actions, if any, should be taken to make such compensation deductible.

This report is submitted by the Compensation Committee of the Board of Directors, consisting of the following members:

David L. Castaldi

Ganesh M. Kishore

John E. Klein

18

COMPARISON OF CUMULATIVE TOTAL RETURN

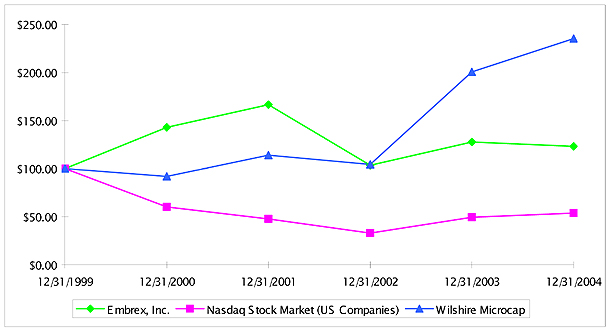

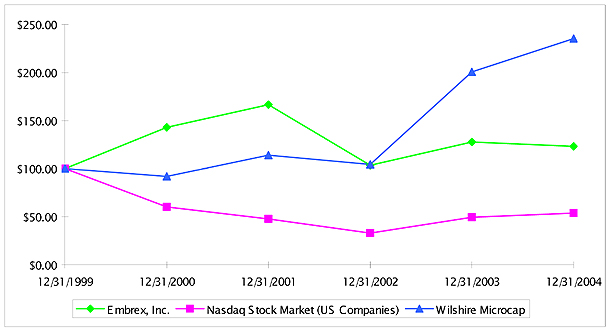

The following graph compares the cumulative total shareholder return on the Company’s Common Stock over the five-year period ended December 31, 2004, with the cumulative total return for the same period on the Nasdaq Composite (US) Index and the Wilshire MicroCap Index. In accordance with Regulation S-K under the Securities Act of 1933, Embrex has elected to use the Wilshire MicroCap Index in lieu of a published industry or line-of-business index or a peer group. Embrex does not believe it can reasonably identify a peer group. Also, Embrex believes that the Wilshire MicroCap Index, which is an index of issuers with similar market capitalizations to the Company, is a more appropriate index for comparison purposes. The graph assumes that at the beginning of the period indicated $100 was invested in the Company’s Common Stock and the stock of the companies comprising the Nasdaq Composite (US) Index and the Wilshire MicroCap Index, and that all dividends, if any, were reinvested.

COMPARISON OF CUMULATIVE TOTAL RETURN

| | | | | | | | | | | | | | | | | | |

| | | 12/31/1999

| | 12/31/2000

| | 12/31/2001

| | 12/31/2002

| | 12/31/2003

| | 12/31/2004

|

Embrex, Inc. | | $ | 100.00 | | $ | 143.02 | | $ | 166.51 | | $ | 103.52 | | $ | 127.81 | | $ | 123.35 |

Nasdaq Composite (US) Index | | $ | 100.00 | | $ | 60.31 | | $ | 47.84 | | $ | 33.07 | | $ | 49.45 | | $ | 53.81 |

Wilshire MicroCap Index | | $ | 100.00 | | $ | 91.95 | | $ | 114.08 | | $ | 104.40 | | $ | 200.72 | | $ | 235.27 |

19

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The role of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and to act on behalf of the Board of Directors in providing oversight with respect to (i) the quality and integrity of the Company’s financial statements, internal accounting and financial controls; (ii) all audit, review and attest services relating to the Company’s financial statements and internal controls, including the appointment, compensation, retention, termination and oversight of the work of the auditors engaged to provide audit services to the Company; and (iii) compliance with applicable laws, rules and regulations relating to the financial affairs of the Company. The Audit Committee acts under an Audit Committee Charter, which describes in greater detail the full responsibilities of the Audit Committee. A copy of the Audit Committee Charter was filed with the Securities and Exchange Commission (“SEC”) on April 12, 2004 as Appendix A to the Company’s Proxy Statement for the 2004 Annual Meeting of Shareholders. The Company also makes the Audit Committee Charter available on its Internet website, www.embrex.com.

The Audit Committee is comprised of three directors, Messrs. Blackshear, Holzer and Klein. The Audit Committee and the Board of Directors have determined that each of these directors: (i) meets the definition of “independent director” as that term is defined by the applicable Nasdaq Marketplace Rules; (ii) has not participated in the preparation of the Company’s financial statements at any time during the past 3 years; (iii) is “independent” within the meaning of SEC Rule 10A-3(b) issued under the Securities Exchange Act of 1934; and (iv) satisfies the applicable Nasdaq Marketplace Rules relating to financial literacy. In addition, the Audit Committee and the Board of Directors determined that Mr. Holzer (i) satisfies the Nasdaq Marketplace Rule requirement that at least one Audit Committee member possess certain financial sophistication requirements; and (ii) is an “audit committee financial expert” under SEC rules based upon his relevant experience. In particular, the Audit Committee and the Board of Directors considered Mr. Holzer’s MBA in finance, his nearly 30 years experience as a commercial banking executive with JP Morgan Chase, Inc., formerly The Chase Manhattan Corporation, his experience managing bank business units of Chase Manhattan Corporation, and his service with Chase Manhattan Bank (Switzerland) S.A. as its General Manager, which was the chief executive officer of the bank. In addition, the Audit Committee and the Board of Directors noted Mr. Holzer’s service since 1998 on the Company’s Audit Committee, and his service since 1999 as Chairman of the Audit Committee of CAS Holdings, Inc.

The Audit Committee has adopted a policy and related procedures requiring that the Audit Committee pre-approve all audit and non-audit services proposed to be provided by the Company’s independent auditors, which policy and procedures are described in the Company’s Proxy Statement for the 2005 Annual Meeting of Shareholders in which this report appears. The Audit Committee also has established procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters.

In the performance of its oversight function, the Audit Committee has reviewed and discussed the audited financial statements with management and the independent auditors. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees”, as currently in effect. In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” as currently in effect, has considered whether the provision of non-audit services by the independent auditors to the Company is compatible with maintaining the auditors’ independence, and has discussed with the auditors the auditors’ independence.

20

During the course of 2004, management completed the documentation, testing and assessment of the Company’s internal control over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. The Audit Committee was kept apprised of the progress of the assessment and provided oversight to management during the process. In connection with this oversight, the Committee received periodic updates provided by management, Grant Thornton LLP (whom the Company engaged to assist in the assessment of internal controls) and Ernst & Young LLP (the independent auditors) at each regularly scheduled Committee meeting. The Committee also held a number of special meetings to discuss issues as they arose. At the conclusion of the process, the Committee discussed management’s assessment of the effectiveness of the Company’s internal control over financial reporting. The Committee also reviewed Management’s Report on Internal Control over Financial Reporting contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 filed with the SEC, as well as Ernst & Young LLP’s Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K related to its audit of (i) the consolidated financial statements, (ii) management’s assessment of the effectiveness of internal control over financial reporting and (iii) the effectiveness of internal control over financial reporting. The Committee continues to oversee the Company’s efforts related to improving its internal control over financial reporting, including addressing certain deficiencies noted in such Management’s Report, and management’s preparations for the assessment in 2005.

Management of the Company is responsible for ensuring the Company’s financial statements are complete, accurate and in accordance with generally accepted accounting principles, for selection of appropriate financial reporting principles, and for establishing, maintaining and assessing internal control over financial reporting designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for auditing the Company’s financial statements and expressing an opinion as to their conformity with generally accepted accounting principles. It is not the duty of the Audit Committee to plan or conduct audits, to determine that the financial statements are complete and accurate and are in accordance with generally accepted accounting principles, or to assure compliance with laws and regulations or the Company’s internal policies, procedures and controls. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management or the independent auditors have fulfilled their respective responsibilities described above.

Based upon the review and discussions described in this report, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004, to be filed with the SEC.

This report is submitted by the Audit Committee of the Board of Directors, consisting of the following members:

C. Daniel Blackshear

Peter J. Holzer

John E. Klein

Independent Registered Public Accounting Firm

Ernst & Young LLP has served as the independent accounting firm of the Company and its subsidiaries since its inception. The Audit Committee has appointed Ernst & Young LLP as the independent registered public accounting firm of the Company and its subsidiaries for the fiscal year ending December 31, 2005. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and to be available to respond to appropriate questions, and will be afforded an opportunity to make a statement.

21

Independent Registered Public Accounting Firm Fees

During fiscal years 2004 and 2003, the Company engaged Ernst & Young LLP to provide services in the following categories and amounts:

Audit Fees

The Company was billed $714,000 and $171,000 in 2004 and 2003, respectively, for fees associated with the annual audit, the reviews of the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the SEC, statutory audits required internationally and various accounting and reporting consultations.

Audit-Related Fees

The Company was billed $55,000 and $21,000 in 2004 and 2003, respectively, for audit-related services, which are assurance and accounting advisory services related to the audit or review of the Company’s financial statements that are not included in the “Audit Fees” category above.

Tax Fees

The Company was billed $99,000 and $240,000 in 2004 and 2003, respectively, for tax services including services related to tax credits and carry forwards, tax compliance and tax planning.

All Other Fees

Other than the fees for services described above, the Company was not billed by Ernst & Young LLP for any other professional services rendered to the Company in 2004 or 2003.

Policy on Audit Committee Pre-Approval of Audit

and Non-Audit Services of Independent Auditor

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the Company’s independent auditors. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has delegated pre-approval authority to its Chairman for non-audit services with anticipated costs of less than $50,000. In addition, on an annual basis, the Audit Committee pre-approves the provision of certain specifically-described non-audit services, which need not be reviewed by the Audit Committee before commencement of the engagement so long as the amount of such non-audit services in a fiscal year do not exceed $25,000 in the aggregate. Management, the Audit Committee Chairman and the Company’s independent auditors are required to make reports on a quarterly basis to the Audit Committee regarding any such services during the prior calendar quarter. None of the fees paid to the independent auditors under the categories Audit-Related, Tax and All Other fees described above were approved by the Audit Committee after services were rendered pursuant to the de minimis exception under SEC rules.

22

ADDITIONAL INFORMATION

Upon written request made by any shareholder to Don T. Seaquist, Vice President Finance and Administration and Corporate Secretary, Embrex, Inc., Post Office Box 13989, Research Triangle Park, North Carolina 27709, a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2004, including the financial statements and financial statement schedule, will be provided without charge.

SUBMISSION OF SHAREHOLDER PROPOSALS

FOR 2006 ANNUAL MEETING

Any proposal which a shareholder intends to present for a vote of shareholders at the annual meeting of shareholders for the year 2006 and which such shareholder wishes to have included in the Company’s proxy statement and form of proxy relating to that meeting must be sent to the Company’s principal executive offices, marked to the attention of the Secretary of the Company, and received by the Company at such offices on or before December 12, 2005, which is 120 days prior to the anniversary of the date this Proxy Statement is being released to shareholders. Proposals received after December 12, 2005 will not be considered for inclusion in the Company’s proxy materials for its 2006 annual meeting.