December 9, 2011

Via e-mail:

Assistant Director

Division of Corporation Finance

Securities and Exchange Commission

Washington, D.C. 20549

Re: Quadrant 4 Systems Corporation

Form 10-K for Fiscal Year Ended

December 31, 2010

Filed May 19, 2011

Form 10-Q for Fiscal Quarter Ended June 30, 2011

Filed August 17, 2011

File No. 033-42498

Dear Mr. Spirgel:

The above-referenced registrant, Quadrant 4 Systems Corporation, is in receipt of your letter dated November 23, 2011, addressed to Mr. Dhru Desai, Chief Financial Officer of the registrant. Your letter sets forth a number of comments of the Securities and Exchange Commission with respect to the above-referenced filings. Set forth below are the registrant’s responses to such comments. To aid in your review, each of the registrant’s responses follows a copy of the subject comment.

Form 10-K for the Fiscal Year Ended December 31, 2010

General

| 1. | We note your responses to comments one and two from our letter dated October 13, 2011. Tell us whether and how you determined that you were a public shell company, as defined in Rule 12b-2 of the Exchange Act, prior to the May 20, 2010 acquisitions. If you were a public shell, it appears that you should have accounted for the transaction as a recapitalization of the private operating companies, rather than as a reverse merger. If it is determined that you were not a public shell, then you should have accounted for the transaction as a reverse merger. Please note that if the registrant acquires another entity in a transaction accounted for as either a reverse acquisition or reverse recapitalization, for accounting purposes, the legal acquiree is treated as the continuing reporting entity that acquired the registrant (the legal acquirer). Reports filed by the registrant after a reverse acquisition or reverse recapitalization should parallel the financial reporting required under GAAP, as if the accounting acquirer were the legal successor to the registrant’s reporting obligations as of the date of the acquisition. |

Response

We are not a public shell company as we had more than nominal revenues. For the year ended December 31, 2009, we had revenues of $168,863 and for the three months ended March 31, 2010, we had revenues of $11,725.

We do not believe that our purchases of assets should be accounted for as a reverse merger for the following reasons:

| a. | We purchased assets rather than a business. Our effective transaction was to purchase accounts receivable primarily from Bank of America who obtained such assets under a security agreement and did not engage in any business related to the business of the previous owners of the assets. Further, we do not believe we acquired an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members, or participants. After the acquisition of these accounts receivable (assets purchased), we then had to: (1) proceed with the selling of services to customers and (2) hire a work force, which included some previous employees to provide these services. We did not acquire any systems, standards, protocols, conventions, or rules in connection with the accounts receivable to enable us to provide services. More specifically, we did not acquire an organized workforce having the necessary skills and experience following rules and conventions to provide the necessary processes that are capable of being applied to inputs to create outputs. Instead we hired individual computer consultants, some of which did work for the original owner of the assets, as well as others. In our effective transaction, we issued shares to raise the necessary cash and then such cash, together with the liabilities assumed, were used to acquire the assets. If our acquisition was classified as a business combination, it would not be a reverse acquisition as we did not issue equity interest to any seller of the assets acquired (805-10-55-12) Therefore we are the accounting acquirer. Further, the stockholders of the legal acquirer prior to the acquisition of the assets maintained the largest portion of voting rights after the acquisition of assets. |

In addition, we have revised the wording in our notes to the financial statements to be included in our amended Form 10-K, for the year ended December 31, 2010, to more clearly discuss what the effective acquisitions of assets were and our accounting for these acquisitions of assets, as attached. We will file an amended Form 10-K.

| 2. | In your particular case, your December 31, 2010 Form 10-K as currently filed is deficient because it does not include audited financial statements of the private operating companies prior to the acquisition. We note that you (the legal acquirer) acquired 100 % of the outstanding shares of VSG, RMI and ISS from StoneGate Holdings, Inc. Therefore, the legal acquirees (VSG, RMI and ISS) are the legal successors to the registrant’s reporting obligations as of the date of the acquisition. We acknowledge that you are unable to provide audited financial statements of VSG, RMI and ISS and of the assets and operations acquired by VSG, RMI and ISS on May 20, 2010, April 10, 2010 and May 3, 2010, respectively. Please note that the financial statements of the accounting acquirer are deemed to be predecessor financial statements, which should be filed for the periods required by Regulation S-X Rules 3-01 through 3-04. Until you file these financial statements, we will not declare effective any registration statements or post-effective amendments, including the registration statement filed on September 27, 2011. Further, you should not make offerings under effective registration statements or under Rules 505 and 506 of Regulation D where any purchasers are not accredited investors under Rule 501(a) of that Regulation, until they file the required financial statements. This restriction does not apply to: |

| a) | offerings or sales of securities upon the conversion of outstanding convertible securities or upon the exercise of outstanding warrants or rights; |

| b) | dividend or interest reinvestment plans; |

| c) | employee benefit plans; |

| d) | transactions involving secondary offerings; or |

| e) | sales of securities under Rule 144. |

Response

As stated in our response to Comment 1, we do not believe we acquired a business and, therefore, are not required to include audited financial statements of the private operating companies (legal acquirees) prior to the acquisition. We (the legal acquirer) acquired the assets.

| 3. | We note on page F-5 that you assigned a value of $4,050,000 to the 32 million shares you issued to StoneGate Holdings, Inc. in exchange for 100% of the outstanding shares of VSG, RMI and ISS from StoneGate Holdings, Inc. Tell us the accounting journal entry you recorded to account for this transaction. Also, tell us whether VSG, RMI and ISS had any operations prior to the acquisitions described in Note 3 on page F-9. |

Response

First, in our amended Form 10-K, the value assigned is $3,800,000. Our journal entry was a debit to Investment in Subsidiaries and a credit to Equity. The investment in subsidiaries was eliminated in consolidation. This entry was to reflect legal transactions. To reflect the effective transactions, the journal entries would have been a debit to Cash and a credit to Equity and a debit to Investment in Subsidiaries and a credit to Cash.

Consolidated Financial Statements

Notes to Consolidated Financial Statements

4. Intangible Assets, page F-10

| 4. | We note your response to comment three from our letter dated October 13, 2011. Tell us in detail about the nature of the customer lists and how you determined its fair value. We also note in note 3 on page F-9 that the majority of the purchase price in the acquisitions made by VSG, RMI and ISS were allocated only to accounts receivable and customer lists. In this regard, tell us in detail of the nature of the operations of the assets acquired by VSG, RMI and ISS. |

Response

The customer lists represent the entrée to identifiable customers that the accounts receivable were due from. The fair values of the customer lists were based on the excess of the purchase prices over the assets acquired. There was no nature of the operations related to the assets acquired.

Form 10-Q for the Quarterly Period Ended June 30, 2011

Notes to Consolidated Financial Statements

Note 3 – Acquisitions

Quadrant 4 Solutions, Inc., page 9

| 5. | We note your response to comment nine from our letter dated October 13, 2011. Tell us the basis for your statement that the parties agreed to value the shares at $1 per share through arms-length negotiations. We cannot find any reference to this value in the Securities Purchase Agreement that you filed as Exhibit 10.3 to your Form S-1 filed on September 28, 2011. We also noted that the purchase price is not the same as that disclosed in your financial statement footnotes. The exhibit discloses a purchase price comprised of a note for $3 million, a note for $5 million, 4 million shares of common stock of the purchaser without any value given to those shares, a $5 million contingent earn-out payable over three years and a $2 million limit on certain accrued liabilities. Please reconcile the differences between the agreement and your financial statements. |

Response

The Securities Purchase Agreement included as Exhibit 10.3, was an early version, and the correct one will be filed with the amended Form 10-K. Please see page 3 of the agreement to describing the $1, per share, value. In addition, please see the revised note to the financial statements, as attached, which will more clearly discuss what the effective acquisition of assets were and the purchase price of the assets acquired. The effective purchase price is the combined/ effect of all the related agreements.

| 6. | It does not appear that $1 per share is the fair value of your shares at the acquisition date. Disclose the method you used to determine the fair value. Tell us why you believe $1 is more indicative of the market value of your shares at the acquisition date. |

Response

We valued the fair value of the shares based on the negotiated price between the buyer and the seller. See the response to comment 5.

| 7. | Please disclose in detail, the terms of the $10 million contingent earn-out in the acquisition of Quadrant 4 Solutions, Inc. Please note our earlier comment regarding the discrepancies between the Securities Purchase Agreement and your disclosure. |

Response

As per our Stock Purchase Agreement, the terms of the contingent earn-out are as follows:

The [seller] is eligible for earn-out or performance based payments capped at Five Million Dollars ($5,000,000) over a period of 36 months. The earn-outs are paid on a quarterly basis ($417,000), if the base performance of the transferred assets stays at or above the agreed 3.0M annual EDIT run rate.

Further, the contingent earn-out will be recognized if and when earned.

| 8. | Please show us and disclose how you determined the $9,100,000 purchase price. It appears that you have not considered the fair value of the contingent consideration. Please refer to ASC 805. Also please refer to Exhibit 10.3 in Form S-1 filed September 28, 2011 and reconcile the purchase price in Form 10-Q with the Securities Purchase Agreement. |

Response

Please see the revised note to the financial statements, as attached, which will more clearly disclose the accounting treatment for the contingent earn-out.

Note 4 – Intangible Assets, page 10

| 9. | We note your response to comment ten from our letter dated October 13, 2011. Tell us in detail about the nature of the customer lists and how you determined its fair value. |

Response

The customer list represents the entrée to identifiable customers related to accounts receivables acquired. The fair value of the customer list was determined based on the excess of purchase price over the fair values of the other assets acquired.

The registrant believes that the responses set forth above adequately address all of the comments set forth in your letter of November 23, 2011, as they relate to the Form 10-K and 10-Q. However, should you or the other members of the staff have questions regarding the registrant’s responses or other comments; you should contact the undersigned at the registrant’s principal executive offices at 2850 Golf Road, Suite 405, Rolling Meadows, Illinois 60008.

Sincerely,

/s/ Dhru Desai

Dhru Desai

Chief Financial Officer

Form 10-K for the Fiscal Year Ended December 31, 2010

3. ACQUISITIONS OF ASSETS

StoneGate Holdings

On May 20, 2010, the Company acquired 100% of the outstanding shares of VSG Acquisition, Inc. (VSG), RMI Acquisition, Inc. (RMI) and ISS Acquisition, Inc. (ISS) from StoneGate Holdings, Inc. (StoneGate Holdings), in exchange for a note payable of $3,800,000 and 32,000,000 shares of common stock of the Company. StoneGate Holdings, through VSG, RMI and ISS had either recently or was about to complete the following acquisitions. All of these purchases were to expand the Company’s customer base. The note payable is due May 31, 2012, plus interest at 5%, per annum.

At the time of the acquisitions of these assets, the Company was unable to complete the acquisition of assets of VSG, RMI and ISS and Stonegate Holdings acquired the assets on behalf of the Company. In addition, Stonegate obtained the necessary cash to complete the transaction by agreeing to distribute shares of common stock of the Company.

VSG

Effective April 1, 2010, VSG purchased certain assets owned by Bank of America, acquired under its security agreement with Cornerstone Information Systems, Inc. and Orionsoft, Inc., in exchange for $3,800,000 in cash, the assumption of certain liabilities of $6,957,641 and a commitment to issue 32,000,000 of the Company’s common stock to StoneGate Holdings for distribution to their investors. The purchase agreement provided for the Company to take control of the assets and operations on April 1, 2010.The asset acquisition agreements also provided for the Company to charge all uncollectable accounts receivable purchased against the note payable to Stonegate Holdings.

RMI

On May 3, 2010, RMI purchased certain assets owned by Resource Mine, Inc. in exchange for a note payable of $250,000 and the assumption of certain liabilities of $588,333. The purchase agreement provided for the Company to take control of the assets and operations on April 1, 2010.

ISS

Effective July 1, 2010 the ISS acquired certain assets of Software Solutions, Inc. in exchange for: (a) $850,000 in cash, which was paid $150,000 into escrow and $700,000 paid on October 15, 2010, plus interest at 10%, per annum, (b) $500,000 due on June 30, 2012, plus interest at 5%, per annum, and (c) 2,000,000 shares of the Company’s common stock. The shares were valued at $900,000, the share price on the date of the acquisition. The purchase agreement provided for the Company to take control of the assets and operations on July 1, 2010.

The Company has accounted for all of the above transactions as if the Company was the accounting acquirer of all the assets acquired on the acquisition method. The aggregate acquisition price of $15,765,974 ($12,677,641, 838,333 and $2,250,000 for VSG, RMI and ISS, respectively), consisted of cash, liabilities assumed and shares issued, was allocated over the fair values of the assets acquired, liabilities assumed and shares issued. The shares of common stock of the Company were valued at $1,920,000 for VSG and $2,000,000 for ISS, the stock price of the Company's common stock as of the effective dates of the acquisitions.

The Company included the operations of VSG as of the date of control. The aggregate acquisition price was allocated over the assets acquired, as follows:

| Accounts receivable - VSG | | $ | 4,957,138 | |

| Accounts receivable – RMI | | | 37,299 | |

| Accounts receivable - ISS | | | 2,243,175 | |

| Customer list - VSG | | | 7,720,503 | |

| Customer list - RMI | | | 801,034 | |

| Deposit - ISS | | | 6,825 | |

| | | | | |

| Purchase price | | $ | 15,765,974 | |

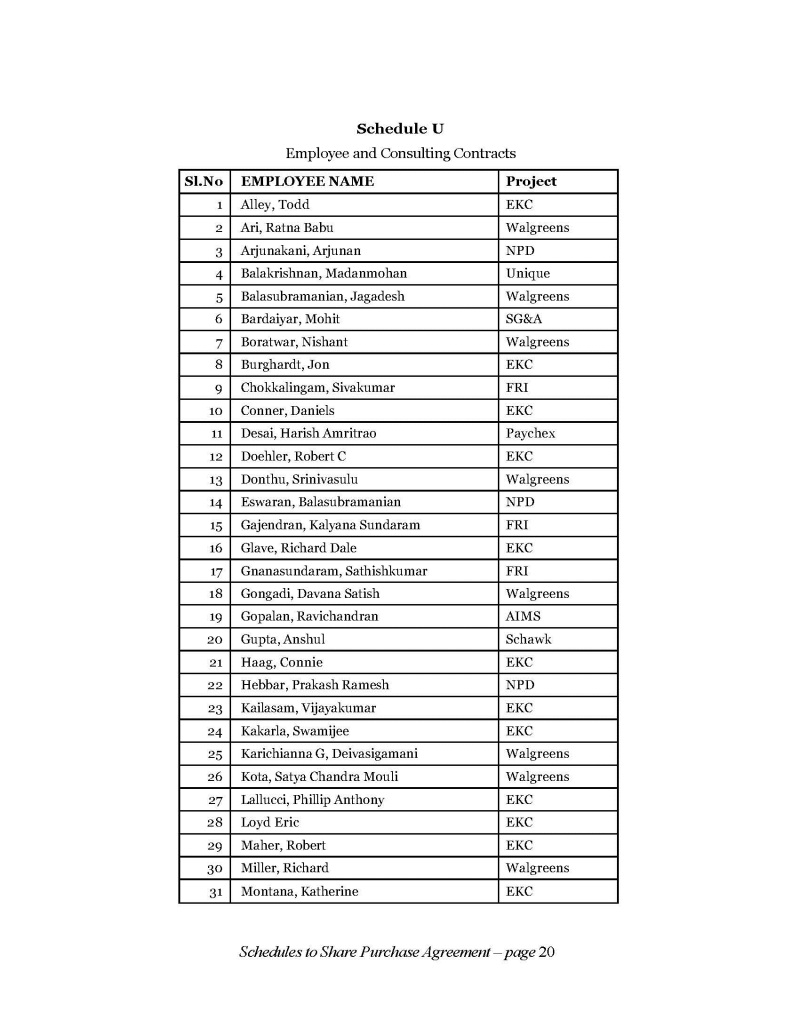

Form 10-Q for the Quarterly Period Ended June 30, 2011

Quadrant 4 Solutions, Inc.

Effective March 1, 2011, the Company acquired all of the outstanding shares of Quadrant 4 Solutions, Inc. (formerly MGL Solutions, Inc.) and also purchased certain software development resources and assets based in India and assume certain liabilities associated with those assets.

The aggregate purchase of $9, 100,000, was paid as follows:

- Note payable of $5,000,000 to the seller, payable June 30, 2014,

- Issuance of 4,000,000 shares of common stock of the Company, and

- Assumption of up to $100,000 of accounts payable.

In addition, the purchase agreement requires a contingent earn-out/performance based payments of up to $5,000,000 over a period of 36 months, if the base performance of the transferred assets is at least at a $3,000,000 EDIT run rate, per year. The contingent earn-out payments, if any, will be charged to operations.

The Company took control of the assets and operations on March 1, 2011.

The shares were valued at $4,000,000 ($1.00 per share), the purchase price as determined by the parties.

The Company included the operations of Quadrant 4 Solutions as of the date of control. The Company recorded the purchase of the Quadrant 4 Solutions on the purchase method of accounting and allocated the aggregate purchase price over the assets acquired, as follows:

| | | | |

| | | | |

Framework software technology | | | | |

| | | | |

Accounts payable and accrued expenses | | | | |

| | | | |

| | | | | |

| | | | |