- WTT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEFM14A Filing

Wireless Telecom (WTT) DEFM14AProxy related to merger

Filed: 9 May 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ![]()

Filed by a Party other than the Registrant ![]()

Check the appropriate box:![]() Preliminary Proxy Statement

Preliminary Proxy Statement![]() Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))![]() Definitive Proxy Statement

Definitive Proxy Statement![]() Definitive Additional Materials

Definitive Additional Materials![]() Soliciting Material Pursuant to § 240.14a-12

Soliciting Material Pursuant to § 240.14a-12

WIRELESS TELECOM GROUP, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: Common Stock, $0.01 par value, of Wireless Telecom Group, Inc. ("WTT Common Stock") |

| (2) | Aggregate number of securities to which transaction applies: 8,000,000 |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): Pursuant to Rules 14a-6(i)(1) and 0-11 under the Exchange Act, the per unit price of each share of WTT Common Stock is $2.87 (the average of the high and low prices per share of WTT Common Stock reported on the American Stock Exchange on January 7, 2005), and a fee of $5,992 has been paid herewith, which is equal to 1/50th of 1% of the sum of (i) the product of 8,000,000 (the number of shares of WTT Common Stock to be issued in the Acquisition to shareholders of Willtek Communications GmbH) and $2.87, and (ii) $7,000,000 (the amount of cash consideration originally payable in the Acquisition to shareholders of Willtek Communications GmbH). |

| (4) | Proposed maximum aggregate value of transaction: $29,960,000 |

| (5) | Total fee paid: $5,992 |

| Fee paid previously with preliminary materials. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

WIRELESS TELECOM GROUP, INC.

25 Eastmans Road

Parsippany, New Jersey 07054

(201) 261-8797

May 9, 2005

Dear Shareholders of Wireless Telecom Group, Inc.:

You are cordially invited to attend the 2005 annual meeting of shareholders of Wireless Telecom Group, Inc., to be held at The Parsippany Hilton, One Hilton Court, Parsippany, New Jersey 07054, on June 24, 2005, beginning at 10:00 a.m., local time.

As previously announced, on March 29, 2005, we entered into an amended and restated stock purchase agreement with Willtek Communications GmbH, a leading German supplier of testing solutions for emerging wireless services and cellular networks, and each of Willtek's two shareholders. Under the terms of the agreement, the Willtek shareholders agreed to sell to our company all of the outstanding share capital of Willtek, in exchange for 8,000,000 newly issued shares of our common stock. Following completion of the acquisition, Willtek will become a wholly owned subsidiary of our company and will serve as the base of our European operations. Based on the number of shares of our common stock outstanding on May 5, 2005, the record date for the annual meeting, immediately following completion of the acquisition, the Willtek shareholders will own in the aggregate approximately 31.4% of our outstanding common stock on a primary basis. In connection with the acquisition, we also have agreed to guaranty payment of certain outstanding indebtedness of Willtek to its principal shareholder equal to €3.5 million (approximately $4.6 million), plus accrued but unpaid interest at the rate of 8% per year through the closing date of the acquisition (as of April 30, 2005, approximately €561,000, or approximately $735,000).

Based on the $2.50 closing price of a share of our common stock on the American Stock Exchange on May 6, 2005, the last trading day prior to the date of this proxy statement, the dollar value of the acquisition consideration is approximately $20.0 million. This amount does not represent the value of the acquisition for financial accounting purposes. The agreement does not provide for an adjustment in the number of shares of our common stock to be issued to the Willtek shareholders in the acquisition in the event of a fluctuation in the market price of our common stock prior to completion of the acquisition. Therefore, depending on the market price of our common stock on the closing date of the acquisition, the actual dollar value of the acquisition consideration may be less or more than the $20.0 million amount referenced above. Our common stock is listed on the American Stock Exchange under the symbol "WTT".

In connection with the acquisition, substantial changes will be made to the composition of our board and to our senior management team, including the appointment of Cyrille Damany, Willtek's Chief Executive Officer, as the new Chief Executive Officer of our company, and the appointment of two designees of Investcorp Technology Ventures, L.P., the 80.9% shareholder of Willtek, to our seven-member board of directors at the closing of the acquisition, one of whom will be appointed Chairman of the Board. As a result of the foregoing chief executive succession, board composition changes and the Willtek shareholders' significant post-acquisition percentage ownership of our outstanding common stock, the Willtek shareholders will have substantial influence and control over the leadership, day-to-day management and strategic direction of our company, and will be able to significantly influence the outcome of all matters, transactions and corporate actions that require approval of our shareholders.

At the annual meeting, you will be asked to consider and vote on a proposal to approve the acquisition and the issuance of 8,000,000 shares of our common stock to the Willtek shareholders in the acquisition, and all of the other transactions contemplated by the amended stock purchase agreement and the related ancillary agreements. You will also be asked to elect six nominees to our board of directors and to consider the other matters described in the accompanying proxy statement. You are not entitled to dissenter's or appraisal rights in connection with the acquisition.

After careful consideration, our board of directors unanimously has determined that the acquisition and the issuance of our common stock in the acquisition are advisable and in the best interest of our company and its shareholders and has unanimously approved the acquisition and the issuance of our common stock in the acquisition. Accordingly, our board of directors unanimously recommends that you vote "FOR" approval of the acquisition, the issuance of our common stock in the acquisition and all of the other transactions contemplated by the amended stock purchase agreement and the related ancillary agreements, "FOR" the election of each of the nominees named in this proxy statement to our board of directors and "FOR" each of the other proposals to be voted on at the annual meeting.

Capitalink, L.C. delivered a written opinion to our board of directors to the effect that, based upon and subject to the assumptions made, matters considered, and limitations on its review as set forth in the opinion, as of March 29, 2005, the acquisition consideration is fair, from a financial point of view, to our shareholders.

We urge you to consider carefully all of the information provided in this proxy statement and its attachments. In particular, you should consider carefully the "Risk Factors" beginning on page 30 of this proxy statement.

Your vote is very important, regardless of the number of shares you own. If you are a shareholder of record, you may vote by mailing the enclosed proxy card in the envelope provided or by attending the annual meeting in person. To approve the proposals submitted to you, vote "FOR" the proposals by following the instructions in the proxy statement and on the enclosed proxy card. If your shares are held in "street name" (that is, held for your account by a broker or other nominee), you will receive instructions from your broker or nominee on how to vote your shares.

We greatly appreciate your continued support.

| Sincerely, |

| KARABET "GARY" SIMONYAN Chairman of the Board of Directors |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction or the securities to be issued pursuant to this transaction or passed upon the adequacy or accuracy of this proxy statement. Any representation to the contrary is a criminal offense.

This proxy statement is dated May 9, 2005 and is first being mailed to our shareholders on or about May 10, 2005.

WIRELESS TELECOM GROUP, INC.

25 Eastmans Road

Parsippany, New Jersey 07054

(201) 261-8797

Notice of Annual Meeting of Shareholders

to be held on June 24, 2005

To our Shareholders:

The 2005 annual meeting of shareholders of Wireless Telecom Group Inc. will be held at The Parsippany Hilton, One Hilton Court, Parsippany, New Jersey 07054, on June 24, 2005, beginning at 10:00 a.m., local time, for the following purposes:

1. To consider and vote upon a proposal to approve the acquisition of all of the outstanding share capital of Willtek Communications GmbH by our company, as contemplated by the amended and restated stock purchase agreement, dated as of March 29, 2005, by and among our company, Willtek and each of the shareholders of Willtek, resulting in Willtek becoming a wholly owned subsidiary of our company, and all of the other transactions contemplated by the amended stock purchase agreement and the related ancillary agreements, including the issuance of 8,000,000 shares of our common stock to the Willtek shareholders as consideration for all of the outstanding share capital of Willtek;

2. To elect each of Paul Genova, Karabet "Gary" Simonyan, Henry L. Bachman, John Wilchek, Michael Manza and Andrew Scelba as a member of our board of directors, each to serve until the next annual meeting of shareholders or until their respective successors are elected and qualified;

3. To consider and vote upon a proposal to adjourn the annual meeting, if necessary, to solicit additional proxies in favor of the acquisition and the issuance of our common stock in the acquisition; and

4. To transact such other business as may properly come before the annual meeting and any adjournment or postponement of the annual meeting.

The accompanying proxy statement describes in more detail the acquisition and the issuance of our common stock in the acquisition, as well as each of the other proposals to be presented at the annual meeting. A copy of the amended stock purchase agreement and each of the other material agreements relating to the acquisition are attached as annexes to the proxy statement. We encourage you to read the entire proxy statement and each of its attachments carefully.

Our board of directors has set the close of business (5:00 p.m., Eastern time) on May 5, 2005 as the record date for determining shareholders entitled to notice of, and to vote at, the annual meeting.

After careful consideration, our board of directors unanimously has determined that the acquisition and the issuance of our common stock in the acquisition are advisable and in the best interest of our company and its shareholders and has unanimously approved the acquisition and the issuance of our common stock in the acquisition. Accordingly, our board of directors unanimously recommends that you vote "FOR" approval of the acquisition, the issuance of our common stock in the acquisition and all of the other transactions contemplated by the amended stock purchase agreement and the related ancillary agreements, "FOR" the election of each of the nominees named in this proxy statement to our board of directors and "FOR" each of the other proposals to be voted on at the annual meeting.

You are cordially invited to attend the annual meeting in person. In order to ensure that a quorum is present at the annual meeting, please date, sign and promptly return the enclosed proxy card whether or not you plan to attend the annual meeting. A postage-prepaid envelope is included for your convenience. If you are a shareholder of record and plan to attend the annual meeting, upon your written request, your proxy will be returned to you and you may vote your shares in person.

| By Order of the Board of Directors, |

| REED E. DUBOW Secretary |

May 9, 2005

Parsippany, New Jersey

Whether or not you plan to attend the annual meeting, please complete, date and sign the enclosed proxy card and return it promptly in the enclosed return envelope, which requires no postage if mailed in the United States. You can revoke your proxy at any time before it is voted.

TABLE OF CONTENTS

| Page | ||||||||||

| SUMMARY TERM SHEET | 1 | |||||||||

| QUESTIONS AND ANSWERS ABOUT THE ACQUISITION AND THE OTHER MATTERS TO BE VOTED ON AT THE 2005 ANNUAL MEETING | 13 | |||||||||

| FORWARD LOOKING STATEMENTS | 17 | |||||||||

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA OF WIRELESS TELECOM GROUP, INC. | 18 | |||||||||

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA OF WILLTEK COMMUNICATIONS GmbH | 19 | |||||||||

| EXCHANGE RATE INFORMATION | 20 | |||||||||

| WIRELESS TELECOM GROUP, INC. UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | 21 | |||||||||

| COMPARATIVE HISTORICAL AND PRO FORMA PER SHARE DATA | 28 | |||||||||

| MARKET PRICE INFORMATION | 29 | |||||||||

| DIVIDEND POLICY | 29 | |||||||||

| RISK FACTORS | 30 | |||||||||

| Risks Related to the Acquisition | 30 | |||||||||

| Risks Related to the Business of the Combined Company | 34 | |||||||||

| THE 2005 ANNUAL MEETING OF WTT'S SHAREHOLDERS | 43 | |||||||||

| Time and Place of the Annual Meeting | 43 | |||||||||

| Purpose of the Annual Meeting | 43 | |||||||||

| Record Date; Voting Power; Quorum | 43 | |||||||||

| Share Ownership of Management and Certain Shareholders | 44 | |||||||||

| Vote Required | 44 | |||||||||

| Voting of Proxies | 45 | |||||||||

| Revocability of Proxies | 45 | |||||||||

| Adjournments | 45 | |||||||||

| Solicitation of Proxies and Expenses of Solicitation | 46 | |||||||||

| Voting Results of the Annual Meeting | 46 | |||||||||

| PROPOSAL 1: APPROVAL OF THE ACQUISITION OF ALL OF THE OUTSTANDING SHARE CAPITAL OF WILLTEK COMMUNICATIONS GmbH BY OUR COMPANY AND THE ISSUANCE OF 8,000,000 SHARES OF OUR COMMON STOCK IN CONNECTION WITH THE ACQUISITION | 47 | |||||||||

| THE ACQUISITION | 47 | |||||||||

| Background of the Acquisition | 47 | |||||||||

| Reasons for the Acquisition | 60 | |||||||||

| Vote Required and Recommendation of WTT's Board of Directors | 64 | |||||||||

| Opinion of Capitalink, L.C. | 64 | |||||||||

| Absence of Dissenter's or Appraisal Rights | 75 | |||||||||

| Directors and Executive Officers of WTT Following Completion of the Acquisition | 75 | |||||||||

i

| Page | ||||||

| Directors and Executive Officers of Willtek Following Completion of the Acquisition | 77 | |||||

| Interests of WTT's Executive Officers and Directors in the Acquisition | 77 | |||||

| Past Contacts, Transactions or Negotiations | 78 | |||||

| Acquisition Consideration to be Received By Executive Officers and Advisory Board Members of Willtek | 78 | |||||

| Retention Payment | 79 | |||||

| Accounting Treatment and U.S. Federal Income Tax Consequences | 79 | |||||

| Securities Act Exemptions; Resales of WTT's Common Stock by the Willtek Shareholders | 79 | |||||

| Regulatory Filings Required in Connection with the Acquisition | 80 | |||||

| THE AMENDED AND RESTATED STOCK PURCHASE AGREEMENT | 81 | |||||

| The Acquisition | 81 | |||||

| Timing of Completion of the Acquisition | 81 | |||||

| Acquisition Consideration | 81 | |||||

| Escrow | 81 | |||||

| Senior Management Succession, Board Composition Changes and Significant Shareholder Influence | 82 | |||||

| Representations and Warranties | 82 | |||||

| Conduct of Business Prior to the Completion of the Acquisition | 85 | |||||

| Additional Covenants | 86 | |||||

| Limitation on the Willtek Shareholders' and Willtek's Ability to Solicit Other Acquisition Proposals | 87 | |||||

| Non-Solicitation of Clients and Employees | 88 | |||||

| Conditions to the Completion of the Acquisition | 88 | |||||

| Termination of the Stock Purchase Agreement | 90 | |||||

| Indemnification Provisions | 91 | |||||

| Fees and Expenses | 93 | |||||

| Amendments and Waivers | 93 | |||||

| OTHER AGREEMENTS RELATED TO THE ACQUISITION | 93 | |||||

| Shareholders' Agreement | 94 | |||||

| Amended and Restated Loan Agreement | 96 | |||||

| Indemnification Escrow Agreement | 97 | |||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT OF WTT | 99 | |||||

| WTT FINANCIAL INFORMATION | 101 | |||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF WTT | 101 | |||||

| Introduction | 101 | |||||

| Critical Accounting Policies | 101 | |||||

| Results of Operations | 102 | |||||

| Liquidity and Capital Resources | 104 | |||||

| Inflation and Seasonality | 105 | |||||

| Impact of Recently Issued Accounting Standards | 105 | |||||

| Quantitative and Qualitative Disclosures about Market Risk | 105 | |||||

| BUSINESS OF WILLTEK | 105 | |||||

| General Overview and Background | 105 | |||||

ii

| Page | ||||||

| Industry | 106 | |||||

| Technology and Products | 106 | |||||

| Competition | 108 | |||||

| Manufacturing and Suppliers | 108 | |||||

| Distribution Channels and Customers | 108 | |||||

| Patents | 108 | |||||

| Employees | 109 | |||||

| Location and Facilities | 109 | |||||

| Legal Proceedings | 109 | |||||

| Management of Willtek | 109 | |||||

| WILLTEK FINANCIAL INFORMATION | 110 | |||||

| WILLTEK OPERATING AND FINANCIAL REVIEW | 110 | |||||

| Overview | 110 | |||||

| Critical Accounting Policies | 110 | |||||

| Trend Information | 112 | |||||

| Results of Operations | 112 | |||||

| Annual Loss | 114 | |||||

| Liquidity and Financial Resources | 114 | |||||

| Commitments and Contingencies | 114 | |||||

| Quantitive and Qualitative Disclosures about Market Risk | 115 | |||||

| Market Price | 115 | |||||

| PROPOSAL 2: ELECTION OF DIRECTORS | 116 | |||||

| General | 116 | |||||

| Director Nominees, Current Directors and Executive Officers of WTT | 116 | |||||

| Appointment of Investcorp Designated Director Nominees | 117 | |||||

| Independence of Directors | 118 | |||||

| Meetings of the Board of Directors | 118 | |||||

| Corporate Governance and Board Committees | 118 | |||||

| Director Nominations | 120 | |||||

| Communications by Shareholders with Directors | 120 | |||||

| Director Attendance at Annual Meetings | 120 | |||||

| Vote Required and Recommendation of WTT's Board of Directors | 121 | |||||

| EXECUTIVE COMPENSATION AND RELATED MATTERS | 121 | |||||

| Executive Compensation | 121 | |||||

| Employment Contracts, Termination of Employment and Change-in-Control Arrangements | 123 | |||||

| Compensation of Directors | 125 | |||||

| Director and Officer Liability | 125 | |||||

| Compensation Committee Interlocks and Insider Participation in Compensation Decisions | 125 | |||||

| Certain Relationships and Related Transactions | 125 | |||||

| Section 16(a) Beneficial Ownership Reporting Compliance | 126 | |||||

| EQUITY COMPENSATION PLAN INFORMATION | 126 | |||||

| REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION | 127 | |||||

| Compensation Philosophy | 127 | |||||

| Forms of Compensation | 127 | |||||

| 2004 Compensation | 128 | |||||

iii

| Page | ||||||

| REPORT OF THE AUDIT COMMITTEE | 129 | |||||

| Fees Paid to Principal Accountants | 130 | |||||

| RELATIONSHIP WITH INDEPENDENT PUBLIC ACCOUNTANTS | 131 | |||||

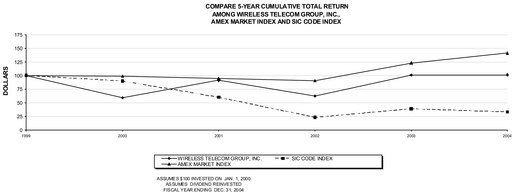

| COMPARISON OF SHAREHOLDER RETURN | 131 | |||||

| PROPOSAL 3: ADJOURNMENT OF THE ANNUAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IN FAVOR OF THE ACQUISITION AND THE ISSUANCE OF OUR COMMON STOCK IN THE ACQUISITION | 132 | |||||

| DEADLINE FOR SUBMISSION OF SHAREHOLDER PROPOSALS FOR THE 2005 ANNUAL MEETING OF SHAREHOLDERS OF WTT | 132 | |||||

| OTHER MATTERS | 132 | |||||

| INDEPENDENT ACCOUNTANTS | 132 | |||||

| WHERE YOU CAN FIND MORE INFORMATION | 132 | |||||

| INDEX TO FINANCIAL STATEMENTS | F-1 | |||||

| ANNEXES | ||||||

| Annex A—Amended and Restated Stock Purchase Agreement | ||||||

| Annex B—Opinion of Capitalink, L.C. | ||||||

| Annex C—Form of Shareholders' Agreement | ||||||

| Annex D—Amended and Restated Loan Agreement | ||||||

| Annex E—Form of Indemnification Escrow Agreement | ||||||

| Annex F—Audit Committee Charter | ||||||

iv

SUMMARY TERM SHEET

This summary term sheet highlights the material information contained in this proxy statement, but may not contain all of the information that is important to you. You should read carefully this entire document, including the attachments and the other documents to which we refer you for a more complete understanding of the proposed acquisition of Willtek Communications GmbH and related transactions and the other matters to be voted on at the annual meeting.

Throughout this proxy statement, "$" indicates amounts denominated in United States dollars and "€" indicates amounts denominated in euros. For your convenience, in certain places throughout this proxy statement we have converted amounts denominated in euros to amounts denominated in United States dollars using (unless otherwise stated or the context otherwise requires) the noon buying rate of euros for United States dollars of 1.2832 on May 6, 2005, the last trading day prior to the date of this proxy statement.

Proposal 1:

Approval of the Acquisition of all of the Outstanding Share Capital of

Willtek Communications GmbH by Our Company and the Issuance of 8,000,000 Shares

of Our Common Stock in Connection with the Acquisition

The Acquisition

(Page 81)

We entered into an amended and restated stock purchase agreement, dated as of March 29, 2005, with Willtek Communications GmbH, and each of its two shareholders, Investcorp Technology Ventures, L.P. and Damany Holding GmbH. Under the terms of the amended stock purchase agreement, the Willtek shareholders agreed to sell to our company all of the outstanding share capital of Willtek. As a result of the acquisition, Willtek will become a wholly owned subsidiary of our company and will serve as the base of our European operations.

The Companies

Wireless Telecom Group, Inc.

25 Eastmans Road

Parsippany, New Jersey 07054

(201) 261-8797

www.wtt.bz

Our company is a global provider of electronic noise generation equipment in the telecommunications field. It develops, manufactures and markets a wide variety of electronic noise sources, passive microwave components and electronic testing and measuring instruments including power motors, volt meters and modulation meters. Our products have historically been primarily used to test the performance and capability of cellular/PCS and satellite communications systems, and to measure the power of radio frequencies and microwave systems. Other applications include radio, radar, wireless local area network and digital television. Our current operations are conducted through our company and its wholly owned subsidiaries Boonton Electronics Corporation and Microlab/FXR. Boonton Electronics Corporation is a leader in the manufacture of test equipment dedicated to measuring the power of radio frequencies and microwave systems used in multiple telecommunications markets. Microlab/FXR is a global provider of passive microwave components including power splitters, directional couplers and filters. These products are employed as system components in commercial applications such as wireless base stations for cellular, paging and private communications, in-building wireless signal distribution, television transmitters and aircraft navigation counter measures and missile guidance. Our website address is www.wtt.bz. Information contained on our website does not constitute part of this proxy statement.

Willtek Communications GmbH

Gutenbergstrasse 2-4

85737 Ismaning

1

Germany

Telephone: 011-49-89-996-410

www.willtek.com

Willtek, headquartered in Ismaning, Germany, is a leading provider of solutions that enable manufacturers and operators of wireless communications devices to test mobile phones, air interface, and base stations of cellular networks. Willtek serves a base of more than 5,000 customers worldwide with state-of-the-art products including testing equipment for GSM, GPRS, CDMA and WCDMA phones and wireless devices, as well as handheld spectrum analyzers. With a team of 146 people, Willtek has extensive research and development, sales and marketing departments, as well as established distribution channels. Willtek's website address is www.willtek.com. Information contained on Willtek's website does not constitute part of this proxy statement.

Acquisition Consideration

(Page 81)

In exchange for all of the outstanding share capital of Willtek, the Willtek shareholders will receive an aggregate of 8,000,000 newly issued shares of our common stock. We have also agreed to guaranty payment of certain outstanding indebtedness of Willtek to Investcorp equal to €3.5 million (approximately $4.6 million), plus accrued but unpaid interest at the rate of 8% per year through the closing date of the acquisition (as of April 30, 2005, approximately €561,000, or approximately $735,000). Based on the number of shares of our common stock outstanding on May 5, 2005, the record date for the annual meeting, immediately following completion of the acquisition, the Willtek shareholders will own in the aggregate approximately 31.4% of our outstanding common stock on a primary basis, with Investcorp owning approximately 25.4% and Damany Holding owning approximately 6.0%.

Based on the $2.50 closing price of a share of our common stock on the American Stock Exchange on May 6, 2005, the last trading day prior to the date of this proxy statement, the dollar value of the acquisition consideration is approximately $20.0 million. The amended stock purchase agreement does not provide for an adjustment in the number of shares of our common stock to be issued to the Willtek shareholders in the acquisition in the event of a fluctuation in the market price of our common stock prior to completion of the acquisition. Therefore, depending on the market price of our common stock on the closing date of the acquisition, the actual dollar value of the acquisition consideration may be less or more than the $20.0 million amount referenced above.

Escrow

(Page 81)

1,000,000, or 12.5%, of the shares of common stock to be issued to the Willtek shareholders as acquisition consideration will be deposited into an escrow account at the closing of the acquisition for a one-year period following the closing date of the acquisition to secure the indemnification obligations of the Willtek shareholders under the amended stock purchase agreement.

Senior Management Succession, Board Composition Changes and Significant Shareholder Influence

(Page 82)

In connection with the acquisition, substantial changes will be made to the composition of our board and to our senior management team. At closing, Kabaret "Gary" Simonyan, our Chairman of the Board and interim Chief Executive Officer, will resign as interim Chief Executive Officer and Cyrille Damany, Willtek's current Chief Executive Officer, will succeed Mr. Simonyan as our new Chief Executive Officer. Accordingly, Mr. Damany will be the principal executive officer of our company and, as such, will have general and active managerial control of the day-to-day policies and affairs of our company and will be primarily responsible for ensuring the execution of management's business strategies for our company, subject to oversight by our board of directors. Paul Genova, our current President and Chief Financial Officer, will continue as such and report directly to Mr. Damany following completion of the acquisition.

2

Moreover, as described elsewhere in this proxy statement, two designees of Investcorp, the 80.9% shareholder of Willtek, will be appointed to our seven-member board of directors at the closing of the acquisition, one of whom will be appointed Chairman of the Board. At each annual meeting following the closing, Investcorp will have the right to designate to our company's nominating committee up to two candidates for nomination for election to our board of directors, for so long as Investcorp retains a requisite percentage beneficial ownership of our outstanding common stock.

Although the acquisition is structured for accounting and financial reporting purposes as a purchase of Willtek's outstanding share capital by our company, as a result of the foregoing chief executive succession, board composition changes, and the Willtek shareholders' significant post-acquisition percentage ownership of our outstanding common stock, the Willtek shareholders will have substantial influence and control over the leadership, day-to-day management and strategic direction of our company, and will be able to significantly influence the outcome of all matters, transactions and corporate actions that require approval of our shareholders.

Timing of Completion of the Acquisition

(Page 81)

We expect to complete the acquisition on or about July 1, 2005. However, because the acquisition is subject to certain approvals and other conditions, we cannot predict exactly when the acquisition will be completed.

Reasons for the Acquisition

(Page 60)

Our board of directors determined that the acquisition of Willtek and the combination of its operations with our company would strengthen our competitive position, based on anticipated potential benefits that include:

| • | the addition of substantial incremental revenue; |

| • | the complementary nature of the companies' markets, products, technologies and customers; |

| • | the more diversified product portfolio that will result from the combination of the companies' product lines; |

| • | the opportunity to accelerate revenue growth as a result of being able to offer a wider range of products to a larger customer base; |

| • | the potential ability of the combined entity to capitalize on complementary customer relationships and distribution channels, and to diversify the combined company's customers and end users of products; |

| • | the potential ability of the combined company to effectively develop new, state-of-the-art products and improve existing products by leveraging technologies and intellectual property; |

| • | the potential ability to realize global economies of scale and operating synergies; |

| • | the expansion of our presence in Europe and Asia; |

| • | the development of an international platform for future synergistic acquisitions as and when attractive opportunities arise (although we do not have any plans, proposals, commitments or agreements to make any acquisitions at this time); |

| • | the acquisition of important intellectual property; and |

| • | the strong management team in place at Willtek, with particular capabilities in the areas of marketing, engineering and operations. |

Our board also recognized a number of risks and uncertainties inherent in the acquisition, but concluded that, on balance, the potential benefits outweighed the risks associated with the transaction. To review the background and reasons for the acquisition in more detail, see pages 47 through 64.

3

Risks Related to the Acquisition and the Business of the Combined Company

(Page 30)

By voting to approve the acquisition and the issuance of our common stock in the acquisition, you will be voting to approve the combination of the businesses of our company and Willtek, which we refer to as the "combined company". In considering whether to vote your shares in favor of the acquisition and the issuance of our common stock in the acquisition, you should carefully consider various potential negative factors and risks, including the following:

| • | Willtek has an extended history of operating losses, and the combined company will incur significant integration costs and operating expenses in the months following completion of the acquisition; |

| • | the dollar value of the acquisition consideration we pay to acquire Willtek may increase, because the number of shares of our common stock to be issued in the acquisition will be fixed at 8,000,000 and will not be adjusted for any increases in the market value of our common stock prior to completion of the acquisition; |

| • | the issuance of 8,000,000 shares our common stock in the acquisition will result in immediate and substantial dilution to our current shareholders; |

| • | the Willtek shareholders will have substantial influence and control over the leadership, day-to-day management and strategic direction of the combined company and will be able to significantly influence the outcome of all matters, transactions and corporate actions that require approval of our shareholders; |

| • | the acquisition may not be consummated; |

| • | some or all of the potential benefits of the acquisition may not be realized for a prolonged period of time, if at all; |

| • | we may not be successful in integrating the products, technologies and operations of the two businesses; |

| • | the risks associated with diverting management resources from day-to-day operational matters, as well as other strategic opportunities; |

| • | the risk of management and employee disruption associated with the acquisition, including the risk that, despite the efforts of management, key personnel may elect not to remain employed with the combined company; |

| • | the risk that acquisition and related integration activities may require more capital and other resources than anticipated, resulting in a greater and more accelerated reduction of our cash reserves and other resources than originally anticipated; |

| • | the risk that we may incur significant restructuring charges upon completion of the acquisition or in subsequent quarters for severance or relocation costs relating to our employees; and |

| • | the risk that we could incur substantial liability and expenses, and our business, results of operations and financial condition could be materially adversely affected, if the Germany-based company that recently made certain written allegations that some of Willtek's products may be utilizing (without license) patented intellectual property owned by such company (the "IP Allegations") were to assert a claim of infringement against Willtek or the combined company after we have completed the acquisition. |

We urge you to read carefully the risks factors discussed in the section of this proxy statement entitled "Risk Factors" beginning on page 30.

Material Conditions to the Completion of the Acquisition

(Page 88)

The respective obligations of each party to complete the acquisition are subject to the satisfaction (or, where legally permissible, the waiver by the parties), at or prior to the closing of the acquisition, of the following conditions:

4

| • | the approval by our shareholders of the acquisition and the issuance of our common stock in the acquisition in accordance with New Jersey law and the rules of the American Stock Exchange, respectively; |

| • | receipt of all governmental and non-governmental third-party consents and approvals required to complete the acquisition; and |

| • | the absence of any legal prohibition on completion of the acquisition. |

Our obligation to complete the acquisition is subject to the satisfaction (or, where legally permissible, our waiver), at or prior to the closing of the acquisition, of a number of additional conditions, including the following:

| • | the accuracy of the Willtek shareholders' representations and warranties and the performance by Willtek and the Willtek shareholders of their respective obligations as required under the amended stock purchase agreement; |

| • | the Willtek shareholders' execution and delivery of a share transfer and assignment agreement in an agreed form effecting the transfer of all of the outstanding share capital of Willtek to our company; |

| • | our receipt of an opinion of counsel to the Willtek shareholders with respect to certain agreed upon matters; |

| • | since March 31, 2004, the absence of any change, event or development or series of changes, events or developments which, individually or in the aggregate, has had or would reasonably be expected to have a material adverse effect on Willtek; |

| • | the fairness opinion of Capitalink, L.C. received by our board of directors not having been withdrawn, revoked, modified or qualified in any respect; and |

| • | our receipt, not later than April 30, 2005, of a definitive operating cost reduction plan from Willtek detailing a comprehensive program to permanently reduce Willtek's annual operating expenses by approximately $3,000,000, which must be acceptable to us in our sole discretion. |

The Willtek shareholders' obligation to complete the acquisition is subject to the satisfaction (or, where legally permissible, the waiver by the Willtek shareholders), at or prior to the closing of the acquisition, of a number of additional conditions, including the following:

| • | the accuracy of our representations and warranties and the performance by our company of its obligations as required under the amended stock purchase agreement; |

| • | the receipt by the Willtek shareholders of the acquisition consideration (less the 1,000,000 shares of our common stock deposited into escrow for one year following the closing of the acquisition to secure the Willtek shareholders' indemnification obligations under the amended stock purchase agreement); |

| • | the receipt by Willtek's shareholders of an opinion of our counsel with respect to certain agreed upon matters; |

| • | since September 30, 2004, the absence of any change, event or development or series of changes, events or developments which, individually or in the aggregate, has had or would reasonably be expected to have a material adverse effect on our company; and |

| • | the receipt by the Willtek shareholders of (1) the resignation of Paul Genova, our President and Chief Financial Officer, as a director of our company (although Mr. Genova will continue to serve in his capacity as the President and Chief Financial Officer of our company at the pleasure of our board of directors following completion of the acquisition), and (2) resolutions of our company's board of directors appointing two Investcorp designees as directors of our company (one of which will be appointed Chairman of the Board) and appointing Cyrille Damany, the Chief Executive Officer of Willtek, as the new Chief Executive Officer of our company. |

5

We presently do not expect that any of the conditions listed above will be waived by any of the parties.

Termination of the Amended Stock Purchase Agreement

(Page 90)

The amended stock purchase agreement may be terminated at any time prior to the completion of the acquisition by:

| • | mutual written consent of our company and the Willtek shareholders; |

| • | by either our company or the Willtek shareholders, if: |

| — | the acquisition is not completed by August 15, 2005; |

| — | the acquisition and the issuance of our common stock in the acquisition are not approved by our shareholders within 60 days after the date this proxy statement is first mailed to our shareholders; or |

| — | there exists any final non-appealable legal prohibition on completion of the acquisition; |

| • | by our company, if any of the closing conditions to its obligations under the amended stock purchase agreement have become incapable of fulfillment and have not been waived by us (provided we are not then in material breach of any of our representations, warranties, covenants or agreements contained in the amended stock purchase agreement); |

| • | by our company if, notwithstanding any prior disclosure, any change, event or development or series of changes, events or developments arising from or relating to the IP Allegations, individually or in the aggregate, has had or would reasonably be expected to have a material adverse effect on Willtek; |

| • | by the Willtek shareholders, if any of the closing conditions to their obligations under the amended stock purchase agreement have become incapable of fulfillment and have not been waived by them (provided the Willtek shareholders are not then in material breach of any of their representations, warranties, covenants or agreements contained in the amended stock purchase agreement); or |

| • | by the Willtek shareholders, if they would be required under the amended stock purchase agreement to indemnify us in an amount in excess of $5,000,000 for certain liabilities arising from or relating to the IP Allegations. |

No termination fee would be payable by any party to the stock purchase agreement in the event of termination of the amended stock purchase agreement by any party under the circumstances set forth above.

Indemnification Provisions

(Page 91)

The amended stock purchase agreement contains detailed provisions regarding the indemnification obligations of the parties. Specifically, the amended stock purchase agreement provides that the Willtek shareholders must indemnify us for any losses arising from any breach of a representation or warranty made by them, or any breach or violation of, or failure to fully perform, any of the Willtek shareholders' or Willtek's covenants, agreements, undertakings or obligations contained in the amended stock purchase agreement. We must indemnify the Willtek shareholders for any losses arising from any breach of a representation or warranty made by us or any breach or violation of, or failure to fully perform, any of our covenants, agreements, undertakings or obligations contained in the amended stock purchase agreement. In addition, we and the Willtek shareholders will be required to indemnify each other for certain tax obligations. Subject to certain exceptions, the parties' general and tax indemnification obligations are subject to the following limitations and qualifications:

6

| • | claims for general and tax indemnification must be asserted by the first anniversary of the closing date of the acquisition, except that indemnification claims for breaches of representations and warranties relating to certain pension matters, tax matters and environmental matters, and any tax indemnification claims must be asserted by the third anniversary of the closing date of the acquisition; |

| • | claims for general and tax indemnification must exceed a deductible of €25,000 (approximately $32,000) per individual claim and €150,000 (approximately $192,500) in the aggregate for all claims (in which case the party seeking indemnification may recover all amounts above and below this threshold); and |

| • | the aggregate liability of the Willtek shareholders for general and tax indemnification to us, and our aggregate liability for general and tax indemnification to the Willtek shareholders, is each limited to an amount equal to $6.0 million. |

In addition to the general and tax indemnification obligations described above, the Willtek shareholders will be required to indemnify us for certain liabilities arising from or relating to the IP Allegations. The IP Allegations consist of written allegations received by Willtek in late September 2004 from a large, Germany-based company alleging that certain products of Willtek utilize (without license) intellectual property for mobile phone measuring instruments that are the subject of certain European patents owned by such company. These products represented approximately 8.9% of Willtek's revenues for its fiscal year ended March 31, 2004, and approximately 5.7% of Willtek's revenues for the nine months ended December 31, 2004. Subject to certain exceptions, these IP Allegations-related indemnification obligations of the Willtek shareholders are not subject to any limitations (including those applicable to the Willtek shareholders' general and tax indemnification obligations), and we may make claims for indemnification for certain liabilities arising from or related to the IP Allegations at any time following completion of the acquisition.

The general, tax and IP Allegations-related indemnification obligations of each of the Willtek shareholders described above are joint and several, which means that we may seek indemnification for all or any part of our losses from any one or both of the Willtek shareholders, subject to the limitations and qualifications contained in the amended stock purchase agreement. If we are entitled to indemnification from the Willtek shareholders, during the one-year period following the closing date of the acquisition, we must first proceed against the 1,000,000 shares of our common stock held in escrow before we can seek monetary damages directly from the Willtek shareholders. Based on the $2.50 closing price of a share of our common stock on the American Stock Exchange on May 6, 2005, the aggregate value of the shares of our common stock to be held in escrow would be approximately $2.5 million.

Limitation on Willtek's Shareholders' and Willtek's Ability to Solicit Other Acquisition Proposals

(Page 87)

The amended stock purchase agreement prohibits the Willtek shareholders and Willtek from directly or indirectly soliciting, initiating, encouraging or otherwise facilitating the receipt or submission of an alternative acquisition proposal or entering into any agreement, arrangement or understanding with respect to any alternative acquisition proposal. The Willtek shareholders and Willtek have also agreed to promptly notify us orally and within 24 hours in writing of the receipt of any alternative acquisition proposal.

Interests of Our Executive Officers and Directors in the Acquisition

(Page 77)

When considering the recommendation of our board of directors with respect to the acquisition, you should be aware that Mr. Simonyan, our Chairman of the Board and interim Chief Executive Officer, and Mr. Genova, our President and Chief Operating Officer, have pecuniary interests in the acquisition that are materially different from, or that are in addition to, the interests of our shareholders. Accordingly, Messrs, Simonyon and Genova may have potential conflicts of interest and may not be deemed to be disinterested with respect to their approval and recommendation of the acquisition in their capacity as directors of our company. These interests are as follows:

7

| • | Genova Severance Agreement. On March 29, 2005, we entered into an agreement with Mr. Genova which provides that if Mr. Genova's employment is terminated by our company without "cause," or if Mr. Genova terminates his employment for "good reason," either before or after the acquisition, then Mr. Genova would be entitled to receive, (1) at the sole discretion of our company, either a lump-sum cash payment equal to 75% of his annual base compensation then in effect (which, based on Mr. Genova's current annual base compensation, would be approximately $135,000), payable within 30 days after termination, or continuation of his base compensation then in effect for a period of nine months after termination, and (2) the continuation of all benefits to which he is currently entitled for a period of nine months following his termination. |

| • | Incentive Stock Options. On March 22, 2005, our board of directors granted Mr. Simonyan incentive stock options to purchase 100,000 shares of our common stock, at an exercise price of $2.57 per share, representing the closing price of our common stock as reported on the American Stock Exchange on the date of grant. The options will vest over a period of three years from the date of grant, with one third vesting on the first, second and third anniversaries of the date of grant. |

As a result of the substantial changes that will be made to the composition of our board of directors and to our senior management team upon completion of the acquisition, our compensation committee took the opportunity to evaluate senior executive employment, severance and compensation arrangements and determined that the above arrangements were appropriate in light of Messrs. Simonyan's and Genova's relative contributions to our company. All such arrangements presenting potential conflicts of interest for Messrs. Simonyan and Genova were thoroughly reviewed by our compensation committee, which approved such arrangements individually, and were thoroughly reviewed by each of our independent directors, who approved such arrangements as part of their overall approval of the acquisition.

Except as set forth above, none of our directors or executive officers or any of their respective associates has any direct or indirect interest in the acquisition.

No Dissenter's or Appraisal Rights

(Page 75)

Our shareholders are not entitled to dissenter's or appraisal rights under New Jersey law in connection with the acquisition because our common stock is listed on the American Stock Exchange, a national securities exchange.

Recommendation of Our Board of Directors

(Page 64)

After careful consideration, our board of directors unanimously has determined that the acquisition and the issuance of our common stock in the acquisition are advisable and in the best interest of our company and its shareholders and has unanimously approved the acquisition and the issuance of our common stock in the acquisition. Accordingly, our board of directors unanimously recommends that you vote "FOR" approval of the acquisition and the issuance of our common stock in the acquisition.

None of our directors is affiliated with or has any interest in Willtek or any of the Willtek shareholders.

Opinion of Capitalink, L.C.

(Page 64)

Capitalink, L.C. delivered a written opinion to our board of directors to the effect that, based upon and subject to the assumptions made, matters considered, and limitations on its review as set forth in the opinion, as of March 29, 2005, the acquisition consideration is fair, from a financial point of view, to our shareholders. The full text of Capitalink's opinion is attached to this proxy statement

8

as Annex B. We encourage you to read the text of the opinion in its entirety for a description of the procedures followed, assumptions made, matters considered and limitations on the review undertaken. Capitalink's opinion is addressed to our board of directors, and does not constitute a recommendation to any shareholder as to how such shareholder should vote or act on any matter relating to the acquisition and the issuance of our common stock in the acquisition.

Capitalink received a fee of $42,500 in cash in connection with the preparation and issuance of its opinion dated March 29, 2005, and previously received a fee of $85,000 in cash in connection with the preparation and issuance of an opinion dated September 27, 2004, which was delivered to our board of directors in connection with the execution of the original stock purchase agreement in October 2004. In addition, we have agreed to reimburse Capitalink for reasonable out-of-pocket expenses and to indemnify Capitalink against certain liabilities. Capitalink was not engaged by our company to provide any financial advisory or other services other than the preparation and issuance of the foregoing opinions, and Capitalink is not entitled to any fee dependent on the completion of the acquisition.

Effect of a Negative Vote on the Approval of the Acquisition and the Issuance of Our Common Stock in the Acquisition

If our shareholders do not approve the acquisition and the issuance of our common stock in the acquisition, we will abandon our efforts to acquire Willtek.

Amended and Restated Loan Agreement

(Page 96)

Investcorp presently owns 80.9% of Willtek's outstanding share capital, and representatives of Investcorp presently occupy three of five seats on Willtek's advisory board.

Under the terms of a loan agreement, dated March 12, 2003, Investcorp provided an unsecured loan to Willtek in the principal amount of €3.5 million. The loan bears interest at the rate of 8% per year and matures on March 1, 2008. The loan agreement permits Investcorp to terminate the agreement any time after March 1, 2008, or upon completion of a change-in-control transaction, such as the acquisition of Willtek by our company, upon which Willtek is required to pay all outstanding principal and accrued but unpaid interest under the agreement.

In connection with the amended stock purchase agreement, Willtek entered into an amended and restated loan agreement dated March 29, 2005 with Investcorp, pursuant to which Investcorp will waive its right to terminate the loan agreement upon completion of the acquisition and to immediately collect the €3.5 million outstanding principal amount (approximately $4.6 million), together with all interest accrued and then unpaid under the existing loan agreement at the rate of 8% per year through the closing date of the acquisition (as of April 30, 2005, approximately €561,000, or approximately $735,000). Willtek entered into the amended loan agreement primarily to allow the acquisition of Willtek by our company to be completed without triggering Investcorp's termination right under the original loan agreement, to reduce the rate at which interest will accrue on the loan after the acquisition, and to make other provisions relating to our company, as the parent company of Willtek following the acquisition. Our company signed the amended loan agreement to guaranty payment of any amounts payable by Willtek to Investcorp under the amended loan agreement.

The amended loan agreement will not become effective until the closing date of the acquisition, at which time the existing loan agreement dated March 12, 2003 will be terminated. Under the terms of the amended loan agreement, following the acquisition, the loan will bear interest at the rate of 4% per year accruing at the end of each calendar quarter and will be due and payable in one lump-sum on December 31, 2006. The amended loan agreement will not be secured by any assets of Willtek or our company. Investcorp may terminate the amended loan agreement under certain circumstances set forth in the new loan agreement.

Our company believes that the terms of the amended loan agreement with Investcorp are no less favorable than loan terms available from an independent third party.

9

A copy of the amended and restated loan agreement is attached to this proxy statement as Annex D.

Shareholders' Agreement

(Page 94)

As a condition to the completion of the acquisition, the Willtek shareholders and our company will enter into a shareholders' agreement, in the form attached to this proxy statement as Annex C, at the closing of the acquisition to provide for certain rights and obligations of the parties with respect to the shares of our common stock to be issued to the Willtek shareholders in the acquisition, and certain related corporate matters. The principal terms of the shareholders' agreement are summarized below.

| • | Board Representation. The shareholders' agreement will provide that effective at the closing of the acquisition, (1) our board of directors will consist of seven members, (2) Mr. Genova, our President and Chief Financial Officer, will resign as a director of our company (although Mr. Genova will continue to serve in his capacity as President and Chief Financial Officer of our company at the pleasure of our board of directors following completion of the acquisition), (3) the remaining five board members of our company will appoint two Investcorp designees to serve as directors of our company, (4) Savio W. Tung, one of Investcorp's director designees, will be appointed Chairman of the Board, and (5) Mr. Simonyan, our current Chairman of the Board and interim Chief Executive Officer, will be appointed non-executive Vice Chairman of the Board and will resign as interim Chief Executive Officer. |

| • | Chief Executive Officer Appointment. The shareholders' agreement will provide that effective at the closing of the acquisition, our board of directors will appoint Cyrille Damany, Willtek's Chief Executive Officer, to serve as our new Chief Executive Officer. |

| • | Rights to Designate Director Candidates for Nomination. The shareholders' agreement will provide that for so long as Investcorp's level of beneficial ownership of our common stock continuously equals or exceeds certain percentage thresholds, at each annual or special meeting of our shareholders at which directors are to be elected, Investcorp will be entitled to designate to our nominating committee up to two candidates for nomination for election to our board of directors. These rights will expire at such time as Investcorp owns less than 5% of the issued and outstanding shares of our common stock, subject to a 20-day grace period. |

| • | Voting Obligations of the Willtek Shareholders. The shareholders' agreement will provide that until the earlier of the second anniversary of the closing date of the acquisition or the date on which Investcorp no longer has the right to designate director candidates for nomination under the shareholders' agreement, in any meeting of our shareholders at which directors are to be elected, the Willtek shareholders will (1) cause their shares of our common stock to be present (in person or by proxy) for purposes of establishing a quorum and (2) affirmatively vote their shares for the election of Investcorp's director nominees and for the election of each of the other director candidates nominated by our board of directors, subject to certain exceptions. |

| • | Restrictions on Transfer. In addition to restrictions on transfer imposed under U.S. federal and state securities or "blue sky" laws, the shareholders' agreement will provide for the following restrictions on the transfer of the shares of our common stock to be received by the Willtek shareholders in the acquisition: (1) Investcorp may not transfer any shares of our common stock for a period of one year following the closing date of the acquisition and Damany Holding may not transfer any shares of our common stock for a period of six months following the closing date of the acquisition, in each case except for transfers to certain permitted transferees; and (2) without the prior written approval of a majority of the members of our board of directors (excluding any Investcorp director nominee), they may not transfer any shares of our common stock to certain specified direct competitors of our company without first offering us the opportunity to purchase such shares on the same terms and conditions. |

10

| • | Registration Rights. The shareholders' agreement will provide that after a period of one year following the closing date of the acquisition, the Willtek shareholders will have the right to demand that our company file up to two registration statements with the Securities and Exchange Commission covering their shares of our common stock acquired in the acquisition, and will also have incidental or "piggyback" registration rights covering such shares effective after such one-year period, subject, in the latter case, to certain limitations related to underwriter "cut-backs". |

Indemnification Escrow Agreement

(Page 97)

As a condition to completion of the acquisition, the Willtek shareholders, our company and American Stock Transfer & Trust Company, as escrow agent, will enter into an indemnification escrow agreement at the closing of the acquisition in the form attached to this proxy statement as Annex E. The principal terms of the indemnification escrow agreement are summarized below.

Deposit of Indemnification Shares. The indemnification escrow agreement will provide that at the closing of the acquisition, we will deposit 1,000,000, or 12.5%, of the shares of our common stock to be issued as acquisition consideration with the escrow agent to hold in escrow as collateral for the indemnification obligations of the Willtek shareholders under the stock purchase agreement. With respect to monetary remedies for valid claims, during the one-year period following the closing date of the acquisition, our company must first seek recourse against the shares held in escrow and will be entitled to pursue other monetary remedies only to the extent that the escrowed shares are not sufficient to compensate us for all of our losses. At the end of the one-year escrow period, any of the escrowed shares that have not been used to satisfy valid claims for indemnification by our company will be delivered to the Willtek shareholders.

Uncontested and Contested Claims. The indemnification escrow agreement will provide certain procedures for release of escrowed shares in the event of both contested and uncontested claims. The Willtek shareholders will be permitted to satisfy valid claims for indemnification by our company by making a cash payment to us in the amount of such claims. If the escrow agent does not receive written confirmation from us that the owed losses have been paid in full in cash before a certain time, then the escrow agent will immediately release from escrow and transfer to us for cancellation that number of escrowed shares having a value equal to the amount of our losses.

Value of Indemnification Shares. For purposes of calculating the number of escrowed shares deliverable to us with respect to a valid claim for indemnification, the value of each share will be equal to the numerical average of the closing price of our common stock on the American Stock Exchange for the ten trading days ending on the date immediately preceding the date that notification of a claim for indemnification is made under the amended stock purchase agreement.

Accounting and Tax Treatment of the Acquisition

(Page 79)

| • | We intend to account for the acquisition using the "purchase" method of accounting. |

| • | The acquisition is not a taxable event for our company or its shareholders. |

Regulatory Filings

(Page 80)

In connection with the acquisition:

| • | we have made the required filings with the German Federal Cartel Office under applicable German antitrust laws and received clearance from such office on March 16, 2005; |

| • | we have made and will continue to make the required filings under the Securities Exchange Act of 1934, as amended, relating to the acquisition and the issuance of our common stock in the acquisition, including the filing of this proxy statement with the SEC pursuant to Regulation 14A under the Exchange Act; and |

11

| • | we will file an additional listing application with the American Stock Exchange for the purpose of listing the shares of our common stock to be issued to the Willtek shareholders in the acquisition. |

Other Important Terms of Acquisition

To learn more about the other important terms of the acquisition, you should read carefully the sections of this proxy statement titled "The Acquisition" beginning on page 47, "The Amended and Restated Stock Purchase Agreement" beginning on page 81 and "Other Agreements Related to the Acquisition" beginning on page 93, and each of the annexes to this proxy statement.

Proposal 2:

Election of Directors

(Page 116)

At the annual meeting, Paul Genova, Karabet "Gary" Simonyan, Henry L. Bachman, John Wilchek, Michael Manza and Andrew Scelba will stand for reelection as members of our board of directors, each to serve until the next annual meeting of shareholders or until their respective successors are elected and qualified.

Although Mr. Genova has been nominated for election to our board of directors at the annual meeting, if the acquisition of Willtek is completed (which we presently anticipate will occur on or about July 1, 2005, assuming all of the other conditions to completion of the acquisition have been satisfied or waived), Mr. Genova (if reelected at the annual meeting) will resign from WTT's board of directors at the closing of the acquisition, and two designees of Investcorp will be appointed to the board at that time. Mr. Genova will, however, continue to serve in his capacity as the President and Chief Financial Officer of our company at the pleasure of our board of directors following completion of the acquisition.

Our board of directors unanimously recommends that you vote "FOR" the election of each of the nominees named above to our board of directors.

Proposal 3:

Adjournment of the Annual Meeting, If Necessary, to

Solicit Additional Proxies In Favor of the Acquisition and the

Issuance of Our Common Stock in the Acquisition

(Page 132)

Although it is not expected, the annual meeting may be adjourned in the absence of a quorum or for the purpose of soliciting additional proxies in favor of the acquisition and the issuance of our common stock in the acquisition.

Our board of directors unanimously recommends that you vote "FOR" adjournment of the annual meeting, if necessary, to solicit additional proxies in favor of the acquisition and the issuance of our common stock in the acquisition.

12

QUESTIONS AND ANSWERS ABOUT THE ACQUISITION AND

THE OTHER MATTERS TO BE VOTED ON AT THE 2005 ANNUAL MEETING

| Q: | When and where will the annual meeting be held? (See page 43) |

| A: | The annual meeting will be held at The Parsippany Hilton, One Hilton Court, Parsippany, New Jersey 07054, beginning at 10:00 a.m., local time, on June 24, 2005. |

| Q: | Who is making this proxy solicitation? (See page 43) |

| A: | We are furnishing this proxy statement to the holders of record of our common stock as of the close of business on May 5, 2005, the record date for the annual meeting, as part of the solicitation of proxies by our board of directors for use at the annual meeting and any adjournments or postponements of the annual meeting. |

| Q: | What am I being asked to vote on at the annual meeting? (See page 43) |

| A: | At the annual meeting, you will be asked to: |

| • | consider and vote upon a proposal to approve the acquisition of all of the outstanding share capital of Willtek by our company, and all of the other transactions contemplated by the amended and restated stock purchase agreement, dated as of March 29, 2005, and the related ancillary agreements, including the issuance of 8,000,000 shares of our common stock to the Willtek shareholders as consideration for all of the outstanding share capital of Willtek; |

| • | elect each of Paul Genova, Karabet "Gary" Simonyan, Henry L. Bachman, John Wilchek, Michael Manza and Andrew Scelba as a member of our board of directors, each to serve until the next annual meeting of shareholders or until their respective successors are elected and qualified; |

| • | consider and vote upon a proposal to adjourn the annual meeting, if necessary, to solicit additional proxies in favor of the acquisition and the issuance of our common stock in the acquisition; and |

| • | transact such other business as may properly come before the annual meeting and any adjournment or postponement of the annual meeting. |

| Q: | What shares can be voted at the annual meeting? (See page 43) |

| A: | At the annual meeting, you may vote all shares of our common stock that you own as of the close of business on May 5, 2005, the record date for the annual meeting. You may cast one vote per share of common stock that you owned as of the record date. These shares include shares that are: (1) held directly in your name as the holder of record and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee. |

| Q: | What is the difference between holding shares as a holder of record and as a beneficial owner? |

| A: | Most of our shareholders hold their shares through a stock brokerage account, bank or other nominee, rather than directly in their own name. As summarized below, there are some distinctions between shares held as a holder of record and those beneficially owned. |

Holders of Record

If your shares of our common stock are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the holder of record, and we have sent these proxy materials directly to you. As the holder of record, you have the right to grant your voting proxy directly to the persons named on the enclosed proxy card or to vote in person at the annual meeting. We have enclosed a proxy card with this proxy statement for you to use.

13

Beneficial Owners

If your shares of our common stock are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in "street name", and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the holder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the annual meeting. However, since you are not the holder of record, you may not vote these shares in person at the annual meeting. Your broker or nominee has enclosed a voting instruction card with this proxy statement for you to use in directing the broker or nominee how to vote your shares.

| Q: | How can I vote my shares in person at the annual meeting? |

| A: | Shares of our common stock held directly in your name as the holder of record as of the record date may be voted in person by you at the annual meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the annual meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the annual meeting. Shares of our common stock held in street name may be voted in person by you only if you obtain a signed proxy from the holder of record giving you the right to vote the shares. |

| Q: | How can I vote my shares without attending the annual meeting? |

| A: | Whether you hold shares directly as the holder of record or beneficially in street name, you may direct your vote without attending the annual meeting by completing and mailing your proxy card or voting instruction card in the enclosed postage-prepaid return envelope as soon as possible. |

| Q. | What is the quorum requirement with respect to the annual meeting? (See page 43) |

| A: | The presence, in person or by properly executed proxy, at the annual meeting of the holders of shares entitled to cast a majority of the votes at the annual meeting is necessary to constitute a quorum in order to transact business at the annual meeting. |

| Q: | Why is our board of directors soliciting shareholder approval of the acquisition and the issuance of our common stock in the acquisition? (See page 44) |

| A: | Our company is incorporated under New Jersey law. Under New Jersey law, approval of the acquisition by our shareholders is required before we can complete the acquisition, because the acquisition will result in an increase by more than 40% of the total number of shares of our common stock outstanding immediately prior to the acquisition. |

In addition to and aside from shareholder voting rights provided for under New Jersey law, under the listing rules of the American Stock Exchange, where our common stock is listed for trading, the approval by our shareholders of the issuance of 8,000,000 shares of our common stock to the Willtek shareholders in the acquisition is required, because the issuance will result in an increase by more than 20% of the total number of shares of our common stock outstanding immediately prior to the issuance.

Approval of the acquisition under New Jersey law and approval of the issuance of our common stock in the acquisition under the listing rules of the American Stock Exchange each requires the same threshold of affirmative shareholder votes — the affirmative vote of a majority of the votes cast at the annual meeting. Therefore, our board of directors is soliciting shareholder approval of the acquisition and the issuance of our common stock in the acquisition at the annual meeting to satisfy applicable shareholder voting requirements under New Jersey law and the rules of the American Stock Exchange, respectively.

14

| Q: | What is the voting requirement to elect directors at the annual meeting? |

| A: | The affirmative vote of a plurality of the votes cast at the annual meeting is required to elect each of the nominees named in this proxy statement as a director of our company. By "plurality" we mean that the nominees who receive the highest number of votes cast "FOR" will be elected as directors. |

| Q: | Under what circumstances will the annual meeting be adjourned? (See page 45) |

| A: | Although it is not expected, the annual meeting may be adjourned in the absence of a quorum or for the purpose of soliciting additional proxies in favor of the acquisition and the issuance of our common stock in the acquisition. Any adjournment of the annual meeting may be made without notice, other than by an announcement made at the annual meeting, by the affirmative vote of a majority of the votes cast at the annual meeting, whether or not a quorum exists. |

| Q: | How will votes be counted at the annual meeting? (See page 44) |

| A: | In the election of directors, you may vote "FOR" all of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees. You may vote "FOR," "AGAINST" or "ABSTAIN" for each of the other proposals. For purposes of determining the number of votes cast with respect to a matter, only those votes cast "FOR" or "AGAINST" a proposal are counted. "Broker non-votes," if any are submitted by brokers or nominees in connection with the annual meeting, will not be counted as votes "FOR" or "AGAINST" for purposes of determining the number of votes cast, but will be treated as present for quorum purposes. "Broker non-votes" are shares held by brokers or nominees as to which voting instructions have not been received from the beneficial owners or the persons entitled to vote those shares and the broker or nominee does not have discretionary voting power under the applicable securities exchange rules. Shares as to which a shareholder or broker withholds from voting or as to which a shareholder or broker abstains will be treated as shares that are present for purposes of determining the presence of a quorum. Abstentions, however, will not be counted "FOR" or "AGAINST" a proposal. Abstentions and broker non-votes will have no effect on the outcome of any proposal presented at the annual meeting. |

All shares of our common stock represented by properly executed proxies received before or at the annual meeting will, unless the proxies are revoked, be voted in accordance with the instructions on those proxies. If you sign and send in your proxy card and do not indicate how you want to vote, your proxy will be counted as a vote "FOR" the acquisition of Willtek and the issuance of our common stock to the Willtek shareholders in the acquisition, and "FOR" the election of each of the nominees named in this proxy statement as a director.

| Q: | If my shares of common stock are held in street name by a broker or other nominee, will the broker or other nominee vote my shares? (See page 45) |

| A: | Under American Stock Exchange rules, brokers and nominees are not permitted to exercise their voting discretion on the proposals to approve the acquisition and the issuance of our common stock in the acquisition and to adjourn the annual meeting, if necessary, to solicit additional proxies in favor of the acquisition and the issuance of our common stock in the acquisition. A broker or other nominee will vote your shares of our common stock at the annual meeting on those proposals only if you give the broker or other nominee instructions on how to vote your shares. Without instructions, your shares will not be voted on those proposals. Brokers and nominees may, however, exercise voting discretion in the election of directors. If your shares are held by a broker or other nominee, you should follow the directions your broker or other nominee provides to you to instruct your broker or other nominee how to vote your shares. |

15

| Q: | Can I change my vote after I have voted by proxy? (See page 45) |

| A: | Yes. You can change your vote at any time before your proxy is voted at the annual meeting. |

If you are a holder of record of our common stock, you can do this in three ways: