UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 0-19582

OLD DOMINION FREIGHT LINE, INC.

(Exact name of registrant as specified in its charter)

| | |

| VIRGINIA | | 56-0751714 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

500 Old Dominion Way

Thomasville, NC 27360

(Address of principal executive offices)

(Zip Code)

(336) 889-5000 (Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock ($0.10 par value) | | The NASDAQ Stock Market LLC

(NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

| | |

Large accelerated filer x | | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2008 was $662,707,351, based on the closing sales price as reported on the NASDAQ Global Select Market.

As of February 26, 2009, the registrant had 37,284,675 outstanding shares of Common Stock ($0.10 par value).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the 2009 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

INDEX

Forward-Looking Information

Forward-looking statements appear in this Annual Report, including but not limited to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in other written and oral statements made by or on behalf of us. These forward-looking statements include, but are not limited to, statements relating to our goals, strategies, expectations, competitive environment, regulation, availability of resources, future events and future financial performance. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements typically can be identified by such words as “anticipate,” “estimate,” “forecast,” “project,” “intend,” “expect,” “believe,” “should,” “could,” “may,” or other similar words or expressions. We caution readers that such forward-looking statements involve risks and uncertainties that could cause actual events or results to differ materially from those expressed or implied herein, including, but not limited to, the risk factors detailed in this Annual Report.

Our forward-looking statements are based on our beliefs and assumptions using information available at the time the statements are made. We caution the reader not to place undue reliance on our forward-looking statements (i) as these statements are neither a prediction nor a guarantee of future events or circumstances and (ii) the assumption, beliefs, expectations and projections about future events may differ materially from actual results. The Company undertakes no obligation to publicly update any forward-looking statement to reflect developments occurring after the statement is made.

PART I

ITEM 1. BUSINESS

Unless the context requires otherwise, references in this report to “Old Dominion”, the “Company”, “we”, “us” and “our” refer to Old Dominion Freight Line, Inc.

General

Old Dominion is a leading non-union less-than-truckload (“LTL”) motor carrier providing multi-regional service among six regions in the United States and next-day and second-day service within each of these regions. We operate as one business segment and offer an expanding array of innovative products and services through our four branded product groups, OD-Domestic, OD-Expedited, OD-Global and OD-Technology with direct service to 48 states within the Southeast, Gulf Coast, Northeast, Midwest, Central and West regions of the country. We plan to continue to expand our service center network, as opportunities arise, to complete our full-state coverage throughout the continental United States. We expect the additional service centers necessary to achieve this goal will provide a platform for future growth and help ensure that our service center network has sufficient capacity. In addition to our domestic LTL services, we offer container delivery services to and from all of North America, Central America, South America and the Far East. We also offer a broad range of expedited, logistical and warehousing services for both our domestic and global markets.

We have grown substantially through both strategic acquisitions and internal growth. Prior to 1995, we provided inter-regional service to major metropolitan areas from, and regional service within, the Southeast region of the United States. Since 1995, we have expanded our infrastructure to provide next-day and second-day service within five additional regions, as well as expanded inter-regional service among those regions. From 1995 through December 31, 2008, we increased our number of service centers from 53 to 206 and our states directly served from 21 to 48. We believe that our present infrastructure will enable us to increase freight density, which is the volume of freight moving through our network, and thereby improve our profitability.

We are committed to providing our customers with high quality and value-driven service. We provide consistent customer service from a single organization, offering our customers information and pricing from one

3

point of contact. Our multi-regional competitors that offer inter-regional service typically do so through independent companies or with separate points of contact within different operating segments, which can result in inconsistent service and pricing, as well as poor shipment visibility. Our integrated structure allows us to offer our customers consistent and continuous service across all areas of our operations and for each of our service products.

Old Dominion was founded in 1934 and incorporated in Virginia in 1950. Our principal executive offices are at 500 Old Dominion Way, Thomasville, North Carolina, 27360. Please refer to the Balance Sheets and Statements of Operations included in Item 8, “Financial Statements and Supplementary Data” of this report for information regarding our total assets, revenue from operations and net income.

Our Industry

Trucks provide transportation services to virtually every industry operating in the United States and generally offer higher levels of reliability and faster transit times than other surface transportation options. The trucking industry is comprised principally of two types of motor carriers: truckload and LTL. Truckload carriers generally provide an entire trailer to one customer from origin to destination. LTL carriers pick up multiple shipments from multiple customers on a single truck and then route those shipments through service centers, where freight may be transferred to other trucks with similar destinations for delivery.

In contrast to truckload carriers, LTL motor carriers require expansive networks of local pickup and delivery (“P&D”) service centers, as well as larger breakbulk, or hub, facilities. The significant capital that LTL motor carriers must commit to create and maintain a network of service centers and a fleet of tractors and trailers makes it difficult for start-up or small operations to effectively compete with established companies. In addition, successful LTL motor carriers generally employ, and continuously update, a high level of technology to provide information to customers and to reduce operating costs.

Service Center Operations

At December 31, 2008, we conducted operations through 206 service center locations, of which we own 108 and lease 98. We operate major breakbulk facilities in Atlanta, Georgia; Rialto, California; Indianapolis, Indiana; Greensboro, North Carolina; Harrisburg, Pennsylvania; Memphis and Morristown, Tennessee; and Dallas, Texas, while using some smaller service centers for limited breakbulk activity in order to serve our next-day markets. Our service centers are strategically located in six regions of the country to provide the highest quality service and minimize freight rehandling costs.

Each of our service centers is responsible for the pickup and delivery of freight within its service area. Each service center loads outbound freight by destination the day it is picked up. All inbound freight received by the service center in the evening or during the night is scheduled for local delivery the next business day, unless a customer requests a different delivery schedule. Our management reviews the productivity and service performance of each service center on a daily basis to ensure quality service and efficient operations.

While we have established primary responsibility for customer service at the local service center level, our customers may access information and initiate transactions through our centralized customer service department located at our corporate office or several other gateways, such as our web site, electronic data interchange (“EDI”), automated voice response systems and automated fax systems. Our systems offer direct access to information such as freight tracking, shipping documents, rate quotes, rate databases and account activity. These centralized systems and our customer service department provide our customers with a single point of contact to access information across all areas of our operations and for each of our service products.

Linehaul Transportation

Linehaul dispatchers are centralized at our corporate office and control the movement of freight among service centers through integrated freight movement systems. We also utilize load-planning software to optimize

4

efficiencies in our linehaul operations. Our senior management continuously monitors freight movements, transit times, load factors and other productivity measurements to ensure that we maintain our highest levels of service and efficiency.

We utilize scheduled routes, and additional linehaul dispatches as necessary, to meet our published service standards. In addition, we lower our cost structure by maintaining flexible workforce rules and by primarily using twin 28-foot trailers in our linehaul operations. The use of twin 28-foot trailers permits us to transport freight directly from its point of origin to destination with minimal unloading and reloading, which also reduces cargo loss and damage expenses. We also utilize long-combination vehicles, such as triple 28-foot trailers and combinations of 48-foot and 28-foot trailers, in states where permitted. Twin trailers and long-combination vehicles permit more freight to be hauled behind a tractor than could otherwise be hauled by one large trailer.

Tractors, Trailers and Maintenance

At December 31, 2008, we owned 5,058 tractors. We generally use new tractors in linehaul operations for approximately three to five years and then transfer those tractors to P&D operations for the remainder of their useful lives. In many of our service centers, tractors perform P&D functions during the day and linehaul functions at night to maximize tractor utilization.

At December 31, 2008, we operated a fleet of 20,067 trailers. We primarily purchase new trailers for our operations; however, we occasionally purchase pre-owned equipment meeting our specifications from other trucking companies.

At various times, we have also acquired tractors and trailers through our acquisition of business assets from other carriers. The purchase of pre-owned equipment can provide an excellent value, but can increase our fleet’s average age. The table below reflects, as of December 31, 2008, the average age of our tractors and trailers:

| | | | |

Type of equipment (categorized by primary use) | | Number

of units | | Average

age

(in years) |

Linehaul tractors | | 2,699 | | 2.6 |

P&D tractors | | 2,359 | | 7.1 |

P&D trucks | | 105 | | 3.8 |

Linehaul trailers | | 14,365 | | 7.7 |

P&D trailers | | 5,702 | | 11.6 |

We develop certain specifications for tractors and trailers and then negotiate the production and purchase of this equipment with several manufacturers. These purchases are planned well in advance of anticipated delivery dates in order to accommodate manufacturers’ production schedules. We believe that there is sufficient capacity among suppliers to ensure an uninterrupted supply of equipment to support our operations.

The table below sets forth our capital expenditures for tractors and trailers for the years ended December 31, 2008, 2007 and 2006. Our capital expenditures for tractors and trailers in 2008 were lower than 2007 and 2006, as we were able to effectively utilize our existing fleet in 2008 to meet our freight demands. As a result, our purchases were limited to replacing a portion of the equipment being retired through the normal replacement cycle, as compared to the capital expenditures in 2007 and 2006, when we both replaced equipment and increased capacity to support our growth and geographic expansion.

| | | | | | | | | |

| | | Year ended December 31, |

(In thousands) | | 2008 | | 2007 | | 2006 |

Tractors | | $ | 27,516 | | $ | 52,807 | | $ | 59,759 |

Trailers | | | 20,599 | | | 43,793 | | | 49,209 |

| | | | | | | | | |

Total | | $ | 48,115 | | $ | 96,600 | | $ | 108,968 |

| | | | | | | | | |

5

At December 31, 2008, we had major maintenance operations at our service centers in Rialto, California; Denver, Colorado; Atlanta, Georgia; Indianapolis, Indiana; Kansas City and Parsons, Kansas; Greensboro, North Carolina; Columbus, Ohio; Harrisburg, Pennsylvania; Morristown and Memphis, Tennessee; Dallas, Texas; and Salt Lake City, Utah. In addition, seventeen other service center locations are equipped to perform routine and preventive maintenance and repairs on our equipment.

We adhere to established maintenance policies and procedures to ensure our fleet is properly maintained. Linehaul tractors are routed to appropriate maintenance facilities at designated mileage or time intervals, depending upon how the equipment was utilized. P&D tractors and trailers are scheduled for maintenance every 90 days.

Marketing and Customers

At December 31, 2008, we had a sales staff of 461 employees. We compensate our sales force, in part, based upon on-time service performance, revenue generated and Company and service center profitability, which we believe helps motivate our employees to achieve our service, growth and profitability objectives.

We utilize a computerized freight-costing model to determine the price level at which a particular shipment of freight will be profitable. We can modify elements of this freight-costing model to simulate the actual conditions under which the freight will be moved. We also compete for business by participating in bid solicitations. Customers generally solicit bids for relatively large numbers of shipments for a period of one to two years, and typically choose to enter into contractual arrangements with a limited number of motor carriers based upon price and service.

Revenue is generated from many customers and locations primarily across the United States and North America. In 2008, our largest customer accounted for approximately 2.7% of our revenue and our largest 5, 10 and 20 customers accounted for approximately 5.4%, 10.4% and 16.5% of our revenue, respectively. For each of the previous three years, more than 90% of our revenue was derived from transporting LTL shipments for our customers and less than 5% of our revenue was generated from international services. We believe the diversity of our revenue base helps protect our business from adverse developments in a single geographic region and the reduction or loss of business from a single customer. For information concerning total revenue for each of the last three fiscal years, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Competition

The transportation industry is highly competitive on the basis of both price and service. At December 31, 2008, we were the sixth largest LTL carrier in the United States, as measured by revenue. We compete with regional, inter-regional and national LTL carriers and, to a lesser extent, with truckload carriers, small package carriers, airfreight carriers and railroads. Competition is based primarily on service, price and business relationships. We believe that we are able to compete effectively in our markets by providing high-quality and timely service at competitive prices.

We believe our transit times are generally faster than those of our principal national competitors. We believe this performance is due primarily to our more efficient service center network, use of team drivers and investment in technology. In addition, we provide greater geographic coverage than most of our regional competitors. Our diversified mix and scope of regional and inter-regional services enable us to provide our customers with a single source to meet their LTL shipping needs, and we believe this provides us with a distinct advantage over our regional, multi-regional and national competition.

We also believe we have a significant advantage over our unionized LTL competition. Advantages provided by our non-union operations include flexible work schedules and the ability of our employees to perform multiple tasks, which we believe result in greater productivity, customer service, efficiency and cost savings.

6

We compete with several larger transportation service providers, each of which may have more equipment, a broader coverage network and a wider range of services than we have. Our larger competitors may also have greater financial resources and, in general, the ability to reduce prices to gain business, especially during times of reduced growth rates in the economy. This could potentially limit our ability to maintain or increase prices, and could also limit our growth in shipments and tonnage.

Seasonality

Our tonnage levels and revenue mix are subject to seasonal trends common in the motor carrier industry. Operating margins in the first quarter are normally lower due to reduced shipments during the winter months. Harsh winter weather can also adversely impact our performance by reducing demand and increasing operating expenses. Freight volumes typically build to a peak in the third quarter and early fourth quarter, which generally results in improved operating margins for those periods. This typical build in freight volumes did not occur in 2008 due to the economic downturn, which increased the competitiveness of our industry.

Technology

We continually upgrade our technological capabilities, and we provide access to our systems through multiple gateways that offer our customers maximum flexibility and immediate access to information. We employ vehicle safety systems, freight handling systems and logistics technology to reduce costs and transit times. Our principal technologies include:

| | • | | www.odfl.com – We continuously update our web site with current information, including service products, coverage maps, financial data, news releases, corporate governance matters, employment opportunities and other information of importance to our customers, investors and employees. Customers may also use our web site to: receive rate estimates; schedule pickups; trace shipments; check transit times; and view or print shipping documents, among other things. |

| | • | | odfl4me.com – Customers may also manage their shipping needs by registering on the secure area of our web site, odfl4me.com, which provides access to: enhanced shipment tracing; customizable reports; document archives; on-line cargo claims processing; interactive bills of lading; and customized rate estimates for customer-specific pricing programs. |

| | • | | Electronic Data Interchange – For our customers who prefer to exchange information electronically, we provide a number of EDI options with flexible formats, File Transfer Protocol servers and a multitude of web-service alternatives. Our customers can transmit or receive invoices, remittance advices, shipping documents, bills of lading and shipment status information, as well as other customized information. |

| | • | | Radio Frequency Identification System – Our automated arrival/dispatch system monitors equipment location and freight movement throughout our network. Transponders are attached to the equipment in our fleet to enable readers to automatically record arrivals and departures, eliminating the need for manual entry and providing real-time freight tracing capabilities for our customers and employees. |

| | • | | Dock Yard Management (DYM) System – The DYM system records the status of shipments moving within our freight handling systems through a network of handheld and fixed mounted computers on our freight docks, switching tractors and forklifts. Each barcoded shipment is monitored by these devices, which provides for real-time tracing and freight management. |

| | • | | Handheld Computer System – Handheld computers provide direct communication to our freight handling systems and allow our drivers to capture information during pickups and deliveries, including individual pieces and weights as well as origin and destination shipping points. Timely pickup information allows for better direct loading and more efficient scheduling of linehaul operations and provides our customers real-time visibility of their supply chain. |

7

| | • | | P&D Optimization System – This mapping system is utilized by our service centers to improve the efficiency of P&D routes. The optimization of our P&D routes improves the efficiency of our operations, reduces costs and reduces transit times. In addition, this system enhances labor productivity by determining proper staffing and providing the most efficient freight loading patterns at our service centers. |

| | • | | Lane Departure Warning Systems – Lane departure warning systems consist of vehicle-mounted cameras, an onboard computer and sophisticated software that monitors the position of our vehicles in relation to highway lane markings. The system is designed to emit an audible warning signal, or “rumble strip” effect, from either side of the vehicle cabin, in the event the vehicle crosses a highway marking. We began to require these systems in our specifications for all new tractor purchases in 2008 and retrofitted a portion of our existing tractor fleet. As a result, the systems are utilized in approximately 55% of our fleet. |

| | • | | Onboard Computer System– We plan to install onboard computer systems on our new tractor purchases beginning in 2009, after the completion of a successful pilot program in 2008. These devices have global positioning system capabilities and should improve our service and reduce costs. We will be able to use these systems to monitor fuel efficiency, P&D efficiency metrics and improve driver safety. We will also integrate these computer systems with our lane departure warning systems, which can allow for real-time driver safety monitoring as well as the ability to electronically log driver hours. |

Insurance

We carry a significant amount of insurance with third-party insurance carriers and we self-insure a portion of this risk. We are currently self-insured for bodily injury and property damage claims up to $2,750,000 per occurrence. Cargo loss and damage claims are self-insured up to $100,000 per occurrence. We are responsible for workers’ compensation claims up to $1,000,000 per occurrence, through either self-insurance or insurance deductibles. Group health claims are self-insured up to $325,000 per occurrence and long-term disability claims are self-insured to a maximum per individual of $3,000 per month.

We believe that our policy of self-insuring a portion of our risk, together with our safety and loss prevention programs, is an effective means of managing insurance costs. We also believe that our current insurance coverage is adequate to cover our liability risks.

Diesel Fuel Availability and Cost

Our industry depends heavily upon the availability of diesel fuel. Although we maintain fuel storage and pumping facilities at 36 of our service center locations, we may experience shortages at certain locations and may be forced to incur additional expense to ensure adequate supply on a timely basis to prevent a disruption to our service schedules. As a result of higher diesel fuel costs, we implemented a fuel surcharge program in August 1999 that has remained in effect since that time and has become one of many components in the overall price for our transportation services. Our fuel surcharges are generally indexed to the U.S. Department of Energy’s (the “DOE”) published fuel prices that reset each week. Our management believes that our operations and financial condition are susceptible to the same diesel fuel price increases or shortages as those of our competitors. Diesel fuel costs, including fuel taxes, totaled 16.8% and 14.1% of revenue in 2008 and 2007, respectively.

Employees

As of December 31, 2008, we employed 10,864 individuals on a full-time basis in the following categories:

| | |

Category | | Number of

employees |

Drivers | | 5,610 |

Platform | | 1,797 |

Fleet technicians | | 367 |

Sales | | 461 |

Salaried, clerical and other | | 2,629 |

8

As of December 31, 2008, we employed 2,788 linehaul drivers and 2,822 P&D drivers on a full-time basis. All of our drivers are selected based upon safe driving records and experience. Each of our drivers is required to pass a drug test and have a current U.S. Department of Transportation (“DOT”) physical and a valid commercial driver’s license prior to employment. Once employed, drivers are required to obtain and maintain hazardous materials endorsements to their commercial driver’s licenses. Drivers are also required to take drug and alcohol tests, by random selection.

To help fulfill driver needs, we offer qualified employees the opportunity to become drivers through the “Old Dominion Driver Training Program”. Since its inception in 1988, 2,551 individuals have graduated from this program, from which we have experienced an annual turnover rate of approximately 10%. We believe our driver training and qualification programs have been important factors in improving our safety record. Drivers with safe driving records are rewarded with bonuses payable each year. Driver safety bonuses paid during 2008 and 2007 were $2,035,000 and $1,154,000, respectively. We increased this incentive for our drivers in 2008 by raising the maximum bonus amount from $1,000 to $3,000.

Our focus on communication and the continued education, development and motivation of our employees helps to ensure that we maintain an excellent relationship with our employees. There are no employees represented under a collective bargaining agreement, which we believe is an important factor in our continued success.

Governmental Regulation

We are subject to regulation by the Federal Motor Carrier Safety Administration, the Pipeline and Hazardous Materials Safety Agency and the Surface Transportation Board, which are agencies within the DOT, as well as the regulations of various state agencies. These regulatory authorities have broad powers, generally governing matters such as authority to engage in motor carrier operations, motor carrier registration, driver hours of service, safety and fitness of transportation equipment and drivers, certain mergers, consolidations and acquisitions, and periodic financial reporting. In addition, we are subject to compliance with cargo-security and transportation regulations issued by the Transportation Security Administration within the U.S. Department of Homeland Security.

The trucking industry is subject to regulatory and legislative changes from a variety of other governmental authorities, which address matters such as: (i) increasingly stringent environmental and occupational safety and health regulations; (ii) limits on vehicle weight and size; (iii) ergonomics; and (iv) hours of service. These changes may affect our business or the economics of our industry by requiring changes in operating practices, or by influencing the demand for and increasing the costs of providing our services.

The cost of compliance with applicable laws and regulations has not materially impacted our results of operations or financial condition, and we believe that this will continue to be the case.

Environmental Regulation

We are subject to various federal, state and local environmental laws and regulations that focus on, among other things: the emission and discharge of hazardous materials into the environment or their presence on or in our properties and vehicles; fuel storage tanks; transportation of certain materials; and the discharge or retention of storm water. Under specific environmental laws, we could also be held responsible for any costs relating to contamination at our past or present facilities and at third-party waste disposal sites. We do not believe that the cost of future compliance with environmental laws or regulations will have a material adverse effect on our operations, financial condition, competitive position or capital expenditures for the remainder of fiscal year 2009 or fiscal year 2010.

9

Available Information

Through our web site, http://www.odfl.com, we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Act of 1934, as soon as practicable after we electronically file the material with or furnish it to the U.S. Securities and Exchange Commission (“SEC”). The public may read or copy any document we file with the SEC at the SEC’s web site, http://www.sec.gov (File No. 0-19582), or at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The SEC can be reached at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. Information contained on our web site is neither part of nor incorporated by reference in this Form 10-K or any other report we file with or furnish to the SEC.

Various factors exist that could cause our actual results to differ materially from those projected in any forward-looking statement. In addition to the factors discussed elsewhere in this report, we believe the following are some of the important risk factors that could materially affect our business, financial condition or results of operations:

We operate in a highly competitive industry, and our business will suffer if we are unable to adequately address potential downward pricing pressures and other factors that may adversely affect our operations and profitability.

Numerous competitive factors could impair our ability to maintain our current profitability. These factors include, but are not limited to, the following:

| | • | | we compete with many other transportation service providers of varying sizes, some of which may have more equipment, a broader coverage network, a wider range of services, greater capital resources or have other competitive advantages; |

| | • | | some of our competitors periodically reduce their prices to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase prices or maintain revenue growth; |

| | • | | many customers reduce the number of carriers they use by selecting “core carriers,” as approved transportation service providers, and in some instances we may not be selected; |

| | • | | many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress prices or result in the loss of some business to competitors; |

| | • | | the trend towards consolidation in the ground transportation industry may create other large carriers with greater financial resources and other competitive advantages relating to their size; |

| | • | | advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher prices to cover the cost of these investments; and |

| | • | | competition from non-asset-based logistics and freight brokerage companies may adversely affect our customer relationships and pricing policies. |

If our employees were to unionize, our operating costs would increase and our ability to compete would be impaired.

None of our employees are currently represented by a collective bargaining agreement. However, from time to time there have been efforts to organize our employees at various service centers. We can offer no assurance that our employees will not unionize in the future, particularly if legislation is passed that facilitates unionization such as the Employee Free Choice Act (“EFCA”).

10

The unionization of our employees could have a material adverse effect on our business, financial condition and results of operations because:

| | • | | some shippers have indicated that they intend to limit their use of unionized trucking companies because of the threat of strikes and other work stoppages; |

| | • | | restrictive work rules could hamper our efforts to improve and sustain operating efficiency; |

| | • | | restrictive work rules could impair our service reputation and limit our ability to provide next-day services; |

| | • | | a strike or work stoppage would negatively impact our profitability and could damage customer and employee relationships; and |

| | • | | an election and bargaining process could divert management’s time and attention from our overall objectives and impose significant expenses. |

If we are unable to successfully execute our growth strategy, our business and future results of operations may suffer.

Our growth strategy includes increasing the volume of freight moving through our existing service center network, selectively expanding our geographic footprint and broadening the scope of our service offerings. In connection with our growth strategy, at various times, we have purchased additional equipment, expanded and upgraded service centers, hired additional personnel and increased our sales and marketing efforts, and we expect to continue to do so. Our growth strategy exposes us to a number of risks, including the following:

| | • | | geographic expansion and acquisitions require start-up costs that could expose us to temporary losses; |

| | • | | growth and geographic expansion is dependent on the availability of real estate. Shortages of suitable real estate may limit our geographic expansion and might cause congestion in our service center network, which could result in increased operating expenses; |

| | • | | growth may strain our management, capital resources, information systems and customer service; |

| | • | | hiring new employees may increase training costs and may result in temporary inefficiencies until those employees become proficient in their jobs; |

| | • | | expanding our service offerings may require us to enter into new markets and encounter new competitive challenges; and |

| | • | | growth through acquisition could require us to temporarily match existing freight rates of the acquiree’s markets, which may be lower than the rates that we would typically charge for our services. |

We cannot assure that we will overcome the risks associated with our growth. If we fail to overcome those risks, we may not realize additional revenue or profits from our efforts, we may incur additional expenses and therefore our financial position and results of operations could be materially and adversely affected.

Insurance and claims expenses could significantly reduce our profitability.

We are exposed to claims related to cargo loss and damage, property damage, personal injury, workers’ compensation, long-term disability and group health. We have insurance coverage with third-party insurance carriers, but self-insure a portion of the risk associated with these claims. If the number or severity of claims for which we are self-insured increases, or we are required to accrue or pay additional amounts because the claims prove to be more severe than our original assessment, our operating results would be adversely affected. In addition, insurance companies require us to obtain letters of credit to collateralize our self-insured retention. If these requirements increase, our borrowing capacity could be adversely affected.

11

Our customers and suppliers’ business may be impacted by the current downturn in the worldwide economy and disruption of financial markets.

Current economic conditions have adversely affected and may continue to adversely affect our customers’ business levels, the amount of transportation services they need and their ability to pay for our services. Customers encountering adverse economic conditions may be unable to obtain additional financing, or financing under acceptable terms, because of the disruptions to the capital and credit markets. These customers represent a greater potential for bad debt losses, which may require us to increase our reserve for bad debt. Economic conditions resulting in bankruptcies of one or more of our large customers could have a significant impact on our financial position, results of operations or liquidity in a particular year or quarter.

Our supplier’s business levels have also been and may continue to be adversely affected by current economic conditions or financial constraints, which could lead to disruptions in the supply and availability of equipment, parts and services critical to our operations. A significant interruption in our normal supply chain could disrupt our operations, increase our costs and negatively impact our ability to serve our customers.

We have significant ongoing cash requirements that could limit our growth and affect our profitability if we are unable to obtain sufficient financing.

Our business is highly capital intensive. Our purchases of property and equipment in 2008 and 2007 were $181,499,000 and $186,828,000, respectively. We expect our net capital expenditures for 2009 to be approximately $190,000,000. While we intend to finance expansion and renovation projects with existing cash, cash flow from operations and available borrowings under our existing senior unsecured credit agreement, we may require additional financing to support our continued growth. However, due to the existing uncertainty in the capital and credit markets, capital may not be available on terms acceptable to us. If we are unable in the future to generate sufficient cash flow from operations or borrow the necessary capital to fund our planned capital expenditures, we will be forced to limit our growth and operate our equipment for longer periods of time, which could have a material adverse effect on our operating results.

In addition, our business has significant operating cash requirements. If our cash requirements are high or our cash flow from operations is low during particular periods, we may need to seek additional financing, which may be costly or difficult to obtain. We have a $225,000,000 senior unsecured revolving credit facility that matures on August 10, 2011, which we believe provides us with a sufficient source for borrowing as needed. If any of the financial institutions that have extended credit commitments to us are or continue to be adversely affected by current economic conditions and disruption to the capital and credit markets, they may become unable to fund borrowings under their credit commitments or otherwise fulfill their obligations to us, which could have a material and adverse impact on our financial condition and our ability to borrow additional funds, if needed, for working capital, capital expenditures, acquisitions and other corporate purposes.

We may be adversely impacted by fluctuations in the price and availability of diesel fuel.

Diesel fuel is a significant operating expense. We do not hedge against the risk of diesel fuel price increases. An increase in diesel fuel prices or diesel fuel taxes, or any change in federal or state regulations that results in such an increase, could have a material adverse effect on our operating results, unless the increase is offset by increases in freight rates or fuel surcharges charged to our customers. Historically, we have been able to offset significant increases in diesel fuel prices through fuel surcharges to our customers, and we were able to minimize the negative impact on our profitability in 2008 that resulted from the rapid and significant increase to the cost of diesel fuel. Depending on the base rate and fuel surcharge levels agreed upon by individual shippers, a rapid and significant decline in the cost of diesel fuel could also have a material adverse effect on our operating results. We continuously monitor the components of our pricing, including base freight rates and fuel surcharges, and address individual account profitability issues with our customers when necessary. While we have historically been able to adjust our pricing to offset changes to the cost of diesel fuel, through changes to base rates and/or fuel surcharges, we cannot be certain that we will be able to do so in the future.

12

Although we maintain fuel storage and pumping facilities at 36 of our service center locations, we may experience shortages in the availability of diesel fuel at certain locations and may be forced to incur additional expense to ensure adequate supply on a timely basis to prevent a disruption to our service schedules. An interruption in the supply of diesel fuel could have a material adverse effect on our operating results.

Difficulty in attracting drivers could affect our profitability.

We periodically experience difficulties in attracting and retaining qualified drivers. Our operations may be affected by a shortage of qualified drivers in the future, which could cause us to temporarily under-utilize our fleet, face difficulty in meeting shipper demands and increase our compensation levels for drivers. If we encounter difficulty in attracting or retaining qualified drivers, our ability to service our customers and increase our revenue could be adversely affected.

Limited supply and increased prices for new equipment may adversely affect our earnings and cash flow.

Investment in new equipment is a significant part of our annual capital expenditures. We may face difficulty in purchasing new equipment due to decreased supply. The price of our equipment may also be adversely affected in the future by regulations on newly manufactured tractors and diesel engines. See the risk factor below entitled: “We are subject to various environmental laws and regulations, and costs of compliance with, liabilities under, or violations of, existing or future environmental laws or regulations could adversely affect our business.”

We are subject to various environmental laws and regulations, and costs of compliance with, liabilities under, or violations of, existing or future environmental laws or regulations could adversely affect our business.

We are subject to various federal, state and local environmental laws and regulations that govern, among other things, the emission and discharge of hazardous materials into the environment, the presence of hazardous materials at our properties or in our vehicles, fuel storage tanks, the transportation of certain materials and the discharge or retention of storm water. Under certain environmental laws, we could also be held responsible for any costs relating to contamination at our past or present facilities and at third-party waste disposal sites. Environmental laws have become and are expected to continue to be increasingly more stringent over time, and there can be no assurance that our costs of complying with current or future environmental laws or liabilities arising under such laws will not have a material adverse effect on our business, operations or financial condition.

The Environmental Protection Agency has issued regulations that require progressive reductions in exhaust emissions from diesel engines through 2010. Beginning in October 2002, new diesel engines were required to meet these new emission limits. Some of the regulations required reductions in the sulfur content of diesel fuel beginning in June 2006 and the introduction of emissions after-treatment devices on newly-manufactured engines and vehicles beginning with model year 2007. These regulations have resulted in higher prices for tractors and diesel engines and increased fuel and maintenance costs, and there can be no assurance that continued increases in pricing or costs will not have an adverse effect on our business and operations.

We operate in a highly regulated industry, and increased costs of compliance with, or liability for violation of, existing or future regulations could have a material adverse effect on our business.

We are regulated by the DOT and by various state agencies. These regulatory authorities have broad powers, generally governing matters such as authority to engage in motor carrier operations, as well as motor carrier registration, driver hours of service, safety and fitness of transportation equipment and drivers, transportation of hazardous materials, certain mergers and acquisitions and periodic financial reporting. In addition, the trucking industry is subject to regulatory and legislative changes from a variety of other governmental authorities, which address matters such as: (i) increasingly stringent environmental, occupational safety and health regulations; (ii) limits on vehicle weight and size; (iii) ergonomics; and (iv) hours of service. In

13

addition, we are subject to compliance with cargo-security and transportation regulations issued by the Transportation Security Administration within the U.S. Department of Homeland Security. Regulatory requirements, and changes in regulatory requirements, may affect our business or the economics of the industry by requiring changes in operating practices or by influencing the demand for and increasing the costs of providing transportation services.

Our financial results may be adversely impacted by potential future changes in accounting practices.

Future changes in accounting standards or practices, and related legal and regulatory interpretations of those changes, may adversely impact public companies in general, the transportation industry or our operations specifically. New accounting standards or requirements, such as a conversion from U.S. generally accepted accounting principles to International Financial Reporting Standards, could change the way we record revenues, expenses, assets and liabilities or could be costly to implement. These types of regulations could have a negative impact on our financial position, liquidity, results of operations or access to capital.

Our results of operations may be affected by seasonal factors and harsh weather conditions.

Our operations are subject to seasonal trends common in the trucking industry. Our operating margins in the first quarter are normally lower due to reduced demand during the winter months. Harsh weather can also adversely affect our performance by reducing demand and reducing our ability to transport freight, which could result in increased operating expenses.

Our information technology systems are subject to certain risks that we cannot control.

Our information systems, including our accounting systems, are dependent upon third-party software, global communications providers, telephone systems and other aspects of technology and Internet infrastructure that are susceptible to failure. Although we have implemented redundant systems and network security measures, our information technology remains susceptible to outages, computer viruses, break-ins and similar disruptions that may inhibit our ability to provide services to our customers and the ability of our customers to access our systems. This may result in the loss of customers or a reduction in demand for our services.

If we are unable to retain our key employees, our financial condition, results of operations and cash flows could be adversely affected.

Our success will continue to depend upon the experience and leadership of our key employees and executive officers. In that regard, the loss of the services of any of our key personnel could have a material adverse effect on our financial condition, results of operation and liquidity.

Our principal shareholders control a large portion of our outstanding common stock.

Earl E. Congdon, John R. Congdon and members of their respective families beneficially own approximately one-third of the outstanding shares of our common stock. As long as the Congdon family controls a large portion of our voting stock, they will be able to significantly influence the election of the entire Board of Directors and the outcome of all matters involving a shareholder vote. The Congdon family’s interests may differ from the interests of other shareholders.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

14

ITEM 2. PROPERTIES

We own our general office located in Thomasville, North Carolina, consisting of a two-story office building of approximately 160,000 square feet on 30.1 acres of land. At December 31, 2008, we operated 206 service centers, of which 108 were owned and 98 were leased. We own all of our major breakbulk facilities, which are listed below with the number of doors as of December 31, 2008.

| | |

Service Center | | Doors |

Harrisburg, Pennsylvania | | 305 |

Morristown, Tennessee | | 247 |

Dallas, Texas | | 234 |

Atlanta, Georgia | | 227 |

Indianapolis, Indiana | | 223 |

Greensboro, North Carolina | | 219 |

Memphis, Tennessee | | 169 |

Rialto, California | | 152 |

These facilities are strategically dispersed over the states in which we operate. At December 31, 2008, the terms of our leased properties ranged from month-to-month to a lease that expires in 2023. We believe that as current leases expire, we will be able to renew them or find comparable facilities without incurring any material negative impact on service to our customers or our operating results.

We also own thirteen non-operating properties, all of which are held for lease. Eight of these properties are leased with lease terms that range from month-to-month to a lease that expires in 2011.

We believe that all of our properties are in good repair and are capable of providing the level of service required by current business levels and customer demands.

ITEM 3. LEGAL PROCEEDINGS

We are involved in various legal proceedings and claims that have arisen in the ordinary course of our business that have not been fully adjudicated. Many of these are covered in whole or in part by insurance. Our management does not believe that these actions, when finally concluded and determined, will have a material adverse effect upon our financial position, liquidity or results of operations.

On July 30, 2007, the Company was named in a putative class action complaint against us and 10 other major LTL motor carriers and large transportation companies offering LTL services (together, “the Defendants”). This complaint alleges that the Defendants conspired to restrain trade in violation of Section 1 of the Sherman Act in connection with fuel surcharges to customers, and seeks injunctive relief, treble damages and attorneys’ fees. Subsequent to this original complaint, similar complaints have been filed against the Defendants and other LTL motor carriers, each with the same allegation of conspiracy to fix fuel surcharge rates. On December 20, 2007, these cases were consolidated in the U.S. District Court for the Northern District of Georgia, and all of the pending cases were transferred to that court. On May 23, 2008, plaintiffs filed a consolidated amended complaint naming the Company and eight other defendants. The defendants concluded briefing on a motion to dismiss the consolidated amended complaint, and on January 28, 2009, the motion to dismiss was granted without prejudice by the U.S. District Court. The plaintiffs are permitted to file a motion to amend the complaint on or before March 16, 2009. We believe that these allegations have no merit and intend to vigorously defend ourselves in the event that the plaintiffs amend their complaint prior to this date. Due to the nature and status of these claims, we cannot determine the likelihood of an adverse outcome nor an amount or reasonable range of potential loss, if any, in these matters.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

15

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Common Stock and Dividend Information

Our common stock is traded on the NASDAQ Global Select Market under the symbol ODFL. At February 24, 2009, there were approximately 8,781 holders of our common stock, including 152 shareholders of record. We did not pay any dividends on our common stock during fiscal year 2008 or 2007, and we have no current plans to declare or pay any dividends on our common stock during fiscal year 2009. For information concerning restrictions on our ability to make dividend payments, seeLiquidity and Capital Resourcesin Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 3 in Item 8, “Financial Statements and Supplementary Data” of this report.

The following table sets forth the high and low sales price of our common stock for the periods indicated, as reported by the NASDAQ Global Select Market:

| | | | | | | | | | | | |

| | | 2008 |

| | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter |

High | | $ | 33.62 | | $ | 33.58 | | $ | 40.09 | | $ | 30.60 |

Low | | $ | 20.31 | | $ | 27.00 | | $ | 26.74 | | $ | 18.47 |

| |

| | | 2007 |

| | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter |

High | | $ | 33.78 | | $ | 33.65 | | $ | 32.57 | | $ | 25.65 |

Low | | $ | 24.45 | | $ | 27.67 | | $ | 23.82 | | $ | 20.41 |

16

Performance Graph

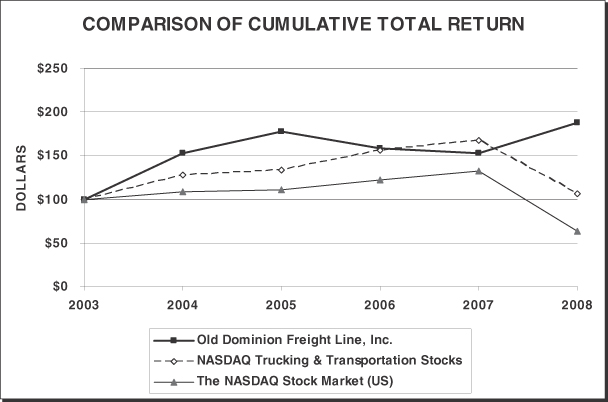

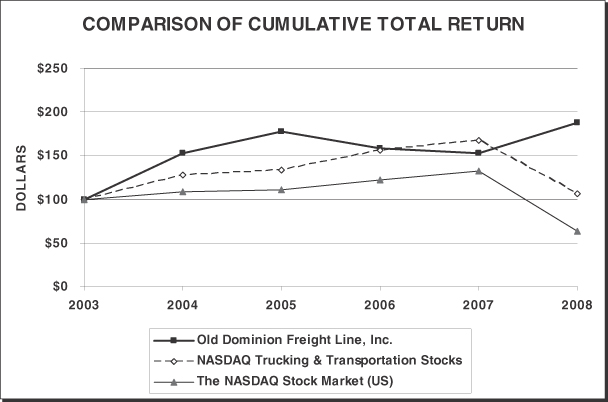

The following graph compares the total shareholder cumulative returns, assuming the reinvestment of all dividends, of $100 invested on December 31, 2003, in (i) our Common Stock, (ii) the NASDAQ Trucking & Transportation Stocks and (iii) the NASDAQ Stock Market (US) for the five-year period ended December 31, 2008:

Cumulative Total Return

| | | | | | | | | | | | | | | | | | |

| | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 | | 12/31/08 |

Old Dominion Freight Line, Inc | | $ | 100 | | $ | 153 | | $ | 178 | | $ | 159 | | $ | 153 | | $ | 188 |

NASDAQ Trucking and Transportation Stocks | | $ | 100 | | $ | 128 | | $ | 134 | | $ | 156 | | $ | 167 | | $ | 107 |

The NASDAQ Stock Market (US) | | $ | 100 | | $ | 109 | | $ | 111 | | $ | 122 | | $ | 132 | | $ | 64 |

17

ITEM 6. SELECTED FINANCIAL DATA

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

(In thousands, except per share amounts and operating statistics) | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Revenue from operations | | $ | 1,537,724 | | | $ | 1,401,542 | | | $ | 1,279,431 | | | $ | 1,061,403 | | | $ | 824,051 | |

Total operating expenses | | | 1,408,654 | | | | 1,271,605 | | | | 1,148,946 | | | | 963,818 | | | | 753,443 | |

Operating income | | | 129,070 | | | | 129,937 | | | | 130,485 | | | | 97,585 | | | | 70,608 | |

Income before cumulative effect of accounting change | | | 68,677 | | | | 71,832 | | | | 72,569 | | | | 53,883 | | | | 38,992 | |

Cumulative effect of accounting change, net | | | — | | | | — | | | | — | | | | 408 | | | | — | |

Net income | | | 68,677 | | | | 71,832 | | | | 72,569 | | | | 53,475 | | | | 38,992 | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Diluted earnings per share before cumulative effect of accounting change | | | 1.84 | | | | 1.93 | | | | 1.95 | | | | 1.45 | | | | 1.06 | |

Diluted earnings per share | | | 1.84 | | | | 1.93 | | | | 1.95 | | | | 1.43 | | | | 1.06 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Current assets | | | 209,230 | | | | 216,277 | | | | 256,367 | | | | 150,213 | | | | 122,537 | |

Current liabilities | | | 142,190 | | | | 127,723 | | | | 121,546 | | | | 111,028 | | | | 93,820 | |

Total assets | | | 1,074,905 | | | | 981,048 | | | | 892,193 | | | | 641,648 | | | | 504,733 | |

Long-term debt (including current maturities) | | | 251,989 | | | | 263,754 | | | | 274,582 | | | | 128,956 | | | | 79,454 | |

Shareholders’ equity | | | 558,129 | | | | 489,452 | | | | 417,620 | | | | 345,051 | | | | 291,528 | |

Operating Statistics: | | | | | | | | | | | | | | | | | | | | |

Operating ratio | | | 91.6 | % | | | 90.7 | % | | | 89.8 | % | | | 90.8 | % | | | 91.4 | % |

Revenue per hundredweight | | $ | 13.88 | | | $ | 13.30 | | | $ | 13.16 | | | $ | 12.63 | | | $ | 11.61 | |

Revenue per intercity mile | | $ | 4.60 | | | $ | 4.31 | | | $ | 4.32 | | | $ | 4.12 | | | $ | 3.76 | |

Intercity miles(in thousands) | | | 334,219 | | | | 325,268 | | | | 296,464 | | | | 257,900 | | | | 219,201 | |

Total tons(in thousands) | | | 5,545 | | | | 5,271 | | | | 4,859 | | | | 4,203 | | | | 3,550 | |

Total shipments(in thousands) | | | 6,691 | | | | 6,765 | | | | 6,428 | | | | 5,751 | | | | 4,918 | |

Average length of haul(1)(miles) | | | 901 | | | | 926 | | | | 922 | | | | 912 | | | | 937 | |

| (1) | We refined our average length of haul calculation in 2008 by excluding miles from the Company’s agent carriers, which had the effect of lowering this metric slightly. We restated this metric for each year presented in this report, except 2004 for which we were unable to recalculate. The average length of haul calculation in 2004 includes miles to the final destination, which could include miles from the Company’s agent carriers. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

We are a leading non-union less-than-truckload (“LTL”) multi-regional motor carrier providing one- to five-day service among six regions in the United States and next-day and second-day service within these regions. More than 90% of our revenue has historically been derived from transporting LTL shipments for our customers, whose demand for our services is generally tied to the overall health of the U.S. domestic economy.

In analyzing the components of our revenue, we monitor changes and trends in the following key metrics:

| | • | | Revenue Per Hundredweight – This measurement reflects our pricing policies, which are influenced by competitive market conditions and our growth objectives. Generally, freight is rated by a class system, |

18

| | which is established by the National Motor Freight Traffic Association, Inc. Light, bulky freight typically has a higher class and is priced at higher revenue per hundredweight than dense, heavy freight. Changes in the class, packaging of the freight and length of haul of the shipment can also affect this average. Fuel surcharges, accessorial charges and revenue adjustments, excluding adjustments for undelivered freight, are included in this measurement. Although we include revenue for undelivered freight in this measure, we defer such revenue for financial statement purposes in accordance with our revenue recognition policy. Including deferred revenue in our revenue per hundredweight measurements matches total billed revenue with the corresponding shipments, which we believe results in a better indicator of changes in our yields. |

| | • | | Weight Per Shipment – Fluctuations in weight per shipment can indicate changes in the class, or mix, of freight we receive from our customers as well as changes in the number of units included in a shipment. Generally, increases in weight per shipment indicate higher demand for our customers’ products and overall increased economic activity. However, many shippers have recently started to consolidate their shipments in an effort to reduce the impact of the high cost of fuel on their transportation costs. In doing so, these shippers have caused an increase in our weight per shipment by shipping the same volume of goods with fewer shipments. |

| | • | | Average Length of Haul – We consider lengths of haul less than 500 miles to be regional traffic, lengths of haul between 500 miles and 1,000 miles to be inter-regional traffic, and lengths of haul in excess of 1,000 miles to be national traffic. By monitoring this metric, we can determine our market share within these lanes of traffic and the growth potential of our service products in those markets. |

| | • | | Revenue Per Shipment – This measurement is primarily determined by the three metrics listed above and is used, in conjunction with the number of shipments we receive, to calculate total revenue, excluding adjustments for undelivered freight. |

Our primary revenue focus is to increase shipment and tonnage growth within our existing infrastructure, generally referred to as increasing density, thereby maximizing asset utilization and labor productivity. We measure density over many different functional areas of our operations including revenue per service center, linehaul load factor, P&D stops per hour, P&D shipments per hour and platform pounds handled per hour. We believe continued improvement in density and a focus on individual account profitability are key components in our ability to sustain profitable growth.

Our primary cost elements are direct wages and benefits associated with the movement of freight; operating supplies and expenses; and depreciation of our equipment fleet and service center facilities. We gauge our overall success in managing these costs by monitoring our operating ratio, a measure of profitability calculated by dividing total operating expenses by revenue, which also allows industry-wide comparisons with our competition.

We continually upgrade our technological capabilities to improve our customer service and lower our operating costs. Our technology provides our customers with visibility of their shipments throughout our network, increases the productivity of our workforce and provides key metrics from which we can monitor our processes.

19

Results of Operations

The following table sets forth, for the years indicated, expenses and other items as a percentage of revenue from operations:

| | | | | | | | | |

| | | 2008 | | | 2007 | | | 2006 | |

Revenue from operations | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

Operating expenses: | | | | | | | | | |

Salaries, wages and benefits | | 52.3 | | | 53.6 | | | 53.4 | |

Operating supplies and expenses | | 19.9 | | | 17.0 | | | 16.0 | |

General supplies and expenses | | 2.9 | | | 2.9 | | | 2.9 | |

Operating taxes and licenses | | 3.4 | | | 3.6 | | | 3.6 | |

Insurance and claims | | 2.3 | | | 2.4 | | | 2.6 | |

Communication and utilities | | 1.0 | | | 1.1 | | | 1.1 | |

Depreciation and amortization | | 5.7 | | | 5.7 | | | 5.3 | |

Purchased transportation | | 2.8 | | | 3.1 | | | 3.4 | |

Building and office equipment rents | | 0.9 | | | 0.8 | | | 0.9 | |

Miscellaneous expenses, net | | 0.4 | | | 0.5 | | | 0.6 | |

| | | | | | | | | |

Total operating expenses | | 91.6 | | | 90.7 | | | 89.8 | |

| | | | | | | | | |

Operating income | | 8.4 | | | 9.3 | | | 10.2 | |

Interest expense, net * | | 0.8 | | | 0.9 | | | 0.8 | |

Other expense, net | | 0.2 | | | 0.1 | | | 0.1 | |

| | | | | | | | | |

Income before income taxes | | 7.4 | | | 8.3 | | | 9.3 | |

Provision for income taxes | | 2.9 | | | 3.2 | | | 3.6 | |

| | | | | | | | | |

Net income | | 4.5 | % | | 5.1 | % | | 5.7 | % |

| | | | | | | | | |

| * | For the purpose of this table, interest expense is presented net of interest income. |

2008 Compared to 2007

Key financial and operating metrics for 2008 and 2007 are presented below:

| | | | | | | | | | | | | | | |

| | | 2008 | | | 2007 | | | Change | | | % Change | |

Work days | | | 254 | | | | 253 | | | | 1 | | | 0.4 | % |

Revenue(in thousands) | | $ | 1,537,724 | | | $ | 1,401,542 | | | $ | 136,182 | | | 9.7 | % |

Operating ratio | | | 91.6 | % | | | 90.7 | % | | | 0.9 | % | | 1.0 | % |

Net income(in thousands) | | $ | 68,677 | | | $ | 71,832 | | | $ | (3,155 | ) | | (4.4 | )% |

Basic and diluted earnings per share | | $ | 1.84 | | | $ | 1.93 | | | $ | (0.09 | ) | | (4.7 | )% |

Total tons(in thousands) | | | 5,545 | | | | 5,271 | | | | 274 | | | 5.2 | % |

Shipments(in thousands) | | | 6,691 | | | | 6,765 | | | | (74 | ) | | (1.1 | )% |

Revenue per hundredweight | | $ | 13.88 | | | $ | 13.30 | | | $ | 0.58 | | | 4.4 | % |

Weight per shipment(lbs.) | | | 1,657 | | | | 1,558 | | | | 99 | | | 6.4 | % |

Average length of haul(miles) | | | 901 | | | | 926 | | | | (25 | ) | | (2.7 | )% |

Revenue per shipment | | $ | 229.99 | | | $ | 207.24 | | | $ | 22.75 | | | 11.0 | % |

We remained true to our long-term strategy in 2008 by providing consistent on-time service, maintaining price discipline and driving additional operating efficiencies into our processes, despite one of the most challenging operating environments we have ever experienced. We were faced with record high fuel prices in the first half of 2008, which contributed to the overall increase in our operating expenses. As fuel prices began to decline, the domestic economy slipped into a recession causing significant and further declines in tonnage for the

20

industry. As a result, pricing emerged as a primary driver of competition. While we maintained a commitment to our pricing philosophy and achieved productivity improvements, these factors were not sufficient to overcome our increased operating expenses and the negative impact of the recessionary economy. As a result, our earnings per diluted share decreased 4.7% to $1.84 for 2008 and our operating ratio increased 90 basis points to 91.6%. We believe our strategy of providing high service levels, maintaining price discipline and aggressively managing costs proved to be the best course of action in the LTL marketplace in 2008 and minimized much of the negative impact on our financial performance caused by increased competition and the downward spiral of the economy.

Despite the challenges in 2008, our revenue increased 9.7% to $1,537,724,000, which was driven by a 5.2% increase in total tonnage shipped and a 4.4% increase in revenue per hundredweight. The 5.2% increase in tonnage shipped resulted from a 6.4% increase in weight per shipment that was partially offset by a 1.1% decrease in the number of shipments. While an increase in weight per shipment is generally an indication of an improving economy, we believe the increase in 2008 is more attributable to changes in customer shipping patterns as transportation costs increased. We believe shippers are increasingly consolidating their shipments into larger units to ship less frequently at lower costs per hundredweight. Our mix of freight in 2008 reflects growth in truckload shipments, spot quotes and container shipments, all of which have an average higher weight per shipment.

We attribute our growth in tonnage primarily to increases in market share in our existing areas of operations. While we increased the total number of service centers in our network to 206 at December 31, 2008 from 192 at December 31, 2007, over 95% of our revenue was produced from service centers open for more than one year. As we continue to expand our geographic reach, increase our full-state coverage and increase our service capabilities, we believe we will continue to gain additional market share from our existing customers and new customers who seek consistent, high-quality and value-driven service. While we experienced an overall increase in tonnage for 2008, freight demand weakened throughout the second half of the year and our tonnage declined 4.9% during the fourth quarter. We believe that freight demand in the LTL industry will not improve until there is a general recovery in the domestic economy or a significant decrease in industry capacity. As a result, we could experience additional declines in our shipments and tonnage in 2009.

Revenue per hundredweight increased 4.4% to $13.88 from $13.30 in 2007. Revenue per hundredweight for 2008 reflects the impact of the general rate increase on our base rates and minimum charges for certain tariffs implemented on February 11, 2008, as well as an increase in fuel surcharge revenue that resulted from the increase in the average price of diesel fuel during the year. Excluding fuel surcharges, revenue per hundredweight decreased 1.4% in 2008. Our revenue per hundredweight was also negatively impacted by the increase in weight per shipment as well as the 2.7% decline in the average length of haul.

The pricing environment in the LTL industry was extremely competitive throughout 2008. The competitiveness intensified in the second half of the year as the historical seasonal increase in freight volumes did not materialize. As a result, many carriers in our industry reduced their prices in an attempt to minimize declines in tonnage and shipment volumes. Although we increased the volume of freight moving through our service center network, we did so while maintaining our basic pricing philosophy of evaluating each individual account for profitability in an effort to maintain rational pricing for our services. We intend to maintain our disciplined approach to pricing by keeping our service at superior levels, thus creating additional value to our customers. We believe our rational and measured approach to the current pricing environment will be in our best long-term interest. However, a prolonged recession and competitive forces may result in some short-term erosion in our pricing and shipment volumes, which could have a material adverse impact on our revenue and net income.

Fuel surcharge revenue increased to 17.2% of revenue from 12.4% in 2007. Most of our tariffs and contracts provide for a fuel surcharge, which is recorded as additional revenue, as diesel fuel prices increase above stated levels. These levels are generally indexed to the DOE’s published fuel prices that reset each week. The fuel surcharge is one of many components included in the overall negotiated price for our transportation services with

21

our customers. We continuously monitor the components of our pricing, including base freight rates and fuel surcharges, and address individual account profitability issues with our customers when necessary as part of our effort to minimize the negative impact on our profitability that would likely result from a rapid and significant change in any of our operating expenses.

Salaries, wages and benefits decreased to 52.3% of revenue in 2008 from 53.6% in 2007. While we were able to improve the productivity of our linehaul, P&D and platform operations, the decrease, as a percent of revenue, primarily resulted from the overall increase in revenue. The productivity improvements, however, helped minimize the impact of the annual general wage increase provided to our workforce in September 2007 and 2008 and the deleveraging effect of the fourth quarter decline in tonnage.

Driver wages decreased to 21.0% of revenue in 2008 from 22.1% in 2007. We were able to effectively match our labor with the changes in shipment volume during the year while also improving our productivity. In our linehaul operations, we increased our laden load average 1.8%. P&D shipments per hour and P&D stops per hour increased 2.3% and 0.7%, respectively. Platform wages decreased to 6.7% of revenue from 7.3% in 2007. Platform pounds handled per hour increased 10.4%, primarily as a result of the increase in weight per shipment.

Employee benefit costs increased to 30.1% of salaries and wages in 2008 from 28.5% in 2007. The increase is attributable to rising group health and dental costs, which increased to 10.3% of total salary and wages in 2008 from 9.1%, and increased costs associated with our paid time off for employees. We experienced an increase in the severity of our health claims in 2008, which resulted in a 16.3% increase in claim payments as compared to 2007.

Operating supplies and expenses increased to 19.9% of revenue in 2008 from 17.0% in 2007. This increase is primarily due to the significant rise in diesel fuel costs, excluding fuel taxes, which is the largest component of operating supplies and expenses. These costs increased 37.2% during the year as a result of a significant increase in the price of diesel fuel and, to a lesser extent, a 0.2% increase in gallons consumed. We were able to minimize our consumption of fuel in 2008 by implementing several initiatives designed to improve our miles per gallon. We do not use diesel fuel hedging instruments and are therefore subject to market price fluctuations.

Depreciation and amortization remained consistent at 5.7% of revenue for both 2008 and 2007. We continued to make significant investments in our service center network and revenue equipment in 2008. We purchased eleven service centers and also completed several expansion projects to existing service centers to increase the overall capacity of our service center network. We reduced our capital expenditures for revenue equipment in 2008 as compared to our purchases in recent years to appropriately match our fleet size with freight demands. We also incurred an increase in building and office equipment rents to 0.9% of revenue from 0.8% for 2007, due to an increase in both the number and size of leased facilities.

Other expense, net increased to 0.2% of revenue from 0.1% of revenue in 2007. The increase reflects the decline in the cash value of our variable life insurance contracts related to the Company’s non-qualified deferred compensation plans. The cash value of these contracts was unfavorably impacted by the decline in equity markets during 2008.

Our effective tax rate for 2008 was 39.0% compared to 38.0% in 2007. Our effective tax rate was lower in 2007 as a result of the favorable impact of alternative fuel tax credits for the use of propane in our operations that we became eligible for in 2007 and, to a lesser extent, the resolution of various state tax matters in the first quarter of 2007 that decreased our liability for unrecognized tax benefits. We expect the alternative fuel tax credits will continue to favorably impact our effective tax rate until these credits are no longer available in 2010. Our effective tax rate exceeded the federal statutory rate of 35% primarily due to the impact of state taxes and certain non-deductible items.

22

2007 Compared to 2006

Key financial and operating metrics for 2007 and 2006 are presented below:

| | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | Change | | | % Change | |

Work days | | | 253 | | | | 253 | | | | — | | | — | |

Revenue(in thousands) | | $ | 1,401,542 | | | $ | 1,279,431 | | | $ | 122,111 | | | 9.5 | % |

Operating ratio | | | 90.7 | % | | | 89.8 | % | | | 0.9 | % | | 1.0 | % |

Net income(in thousands) | | $ | 71,832 | | | $ | 72,569 | | | $ | (737 | ) | | (1.0 | )% |

Diluted earnings per share | | $ | 1.93 | | | $ | 1.95 | | | $ | (0.02 | ) | | (1.0 | )% |

Total tons(in thousands) | | | 5,271 | | | | 4,859 | | | | 412 | | | 8.5 | % |

Shipments(in thousands) | | | 6,765 | | | | 6,428 | | | | 337 | | | 5.2 | % |

Revenue per hundredweight | | $ | 13.30 | | | $ | 13.16 | | | $ | 0.14 | | | 1.1 | % |

Weight per shipment(lbs.) | | | 1,558 | | | | 1,512 | | | | 46 | | | 3.0 | % |

Average length of haul(miles) | | | 926 | | | | 922 | | | | 4 | | | 0.4 | % |

Revenue per shipment | | $ | 207.24 | | | $ | 199.03 | | | $ | 8.21 | | | 4.1 | % |