Exhibit 99.1

Platts 20th Annual Global Power Markets Conference

CEO Roundtable: Operating in a New Era

Bruce A. Williamson Chairman, President & CEO

Forward-looking Statement

This presentation contains statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward-looking statements.” You can identify these statements by the fact that they do not relate strictly to historical or current facts. Management cautions that any or all of Dynegy’s forward-looking statements may turn out to be wrong. Please read Dynegy’s annual, quarterly and current reports under the Securities Exchange Act of 1934, as amended, including its 2004 Form 10-K, for additional information about the risks, uncertainties and other factors affecting these forward-looking statements and Dynegy generally. Dynegy’s actual future results may vary materially from those expressed or implied in any forward-looking statements. All of Dynegy’s forward-looking statements, whether written or oral, are expressly qualified by these cautionary statements and any other cautionary statements that may accompany such forward-looking statements. In addition, Dynegy disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

2

Company Overview

Headquartered in Houston, Texas

Power Generation and Natural Gas Liquids facilities/operations throughout the United States 2,300 employees “DYN” ticker symbol; traded on NYSE

Successful execution of self-restructuring plan

Focused on core unregulated energy businesses Solid liquidity and cash positions

Renewed commitments to ethics, compliance, accountability and transparency Leadership team with a proven track record of results

3

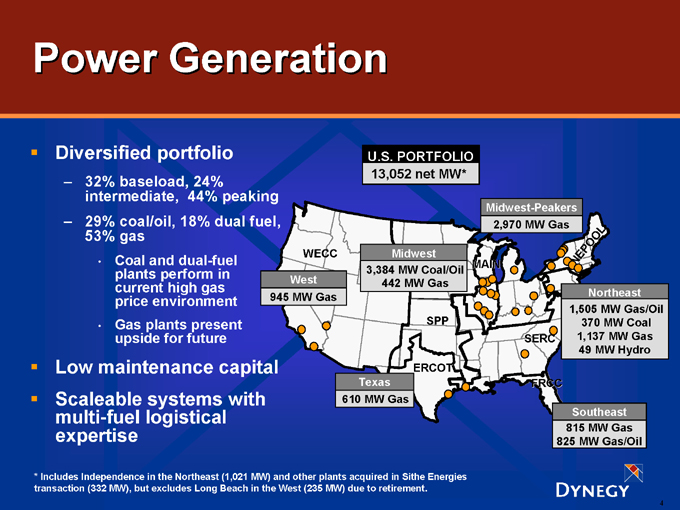

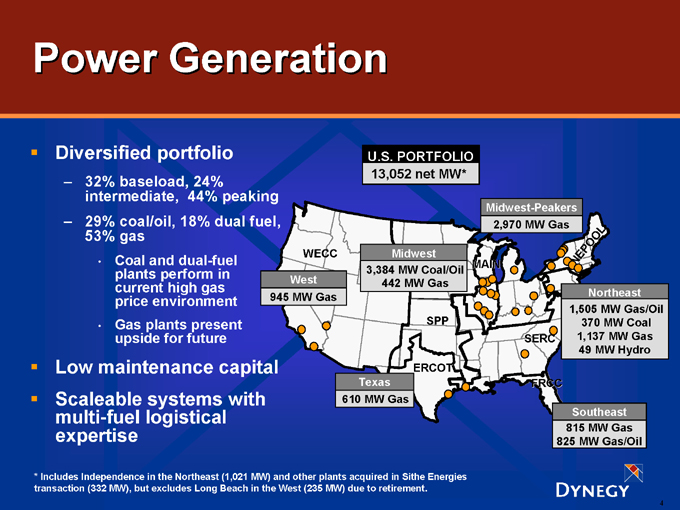

Power Generation

Diversified portfolio

32% baseload, 24% intermediate, 44% peaking 29% coal/oil, 18% dual fuel, 53% gas

Coal and dual-fuel plants perform in current high gas price environment Gas plants present upside for future

Low maintenance capital Scaleable systems with multi-fuel logistical expertise

U.S. PORTFOLIO 13,052 net MW*

West 945 MW Gas

Texas 610 MW Gas

Midwest 3,384 MW Coal/Oil 442 MW Gas

WECC

SPP

ERCOT

MAIN

Midwest-Peakers 2,970 MW Gas

SERC

NEPOOL

Northeast 1,505 MW Gas/Oil 370 MW Coal 1,137 MW Gas 49 MW Hydro

FRCC

Southeast 815 MW Gas 825 MW Gas/Oil

* Includes Independence in the Northeast (1,021 MW) and other plants acquired in Sithe Energies transaction (332 MW), but excludes Long Beach in the West (235 MW) due to retirement.

4

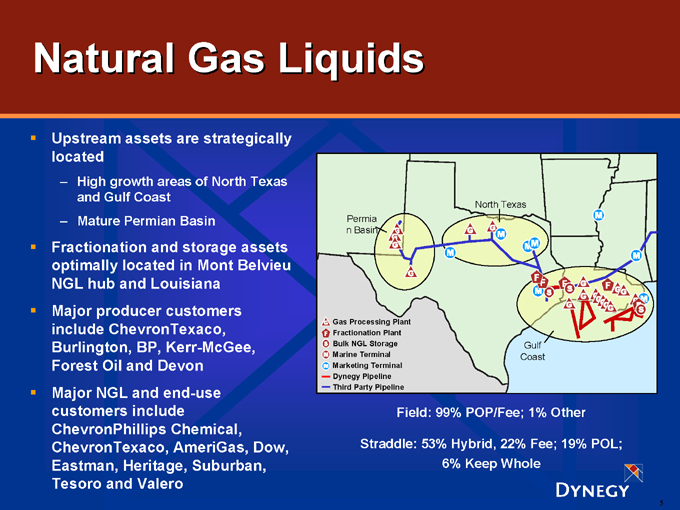

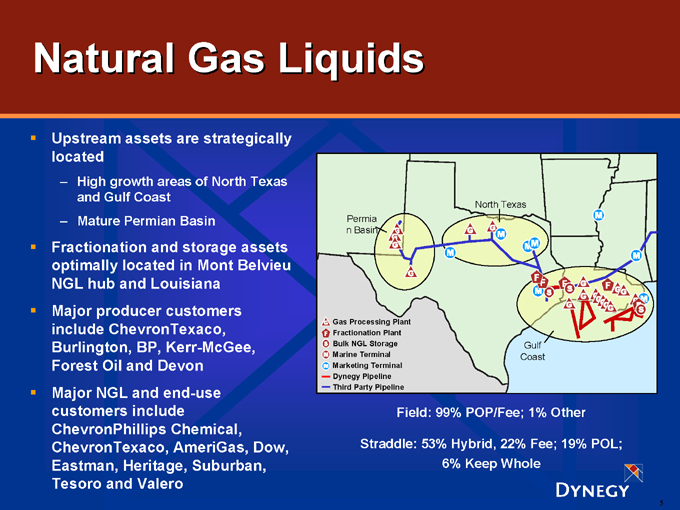

Natural Gas Liquids

Upstream assets are strategically located

High growth areas of North Texas and Gulf Coast Mature Permian Basin

Fractionation and storage assets optimally located in Mont Belvieu NGL hub and Louisiana Major producer customers include ChevronTexaco, Burlington, BP, Kerr-McGee, Forest Oil and Devon Major NGL and end-use customers include ChevronPhillips Chemical, ChevronTexaco, AmeriGas, Dow, Eastman, Heritage, Suburban, Tesoro and Valero

Permia n Basin

North Texas

Gulf Coast

Gas Processing Plant Fractionation Plant Bulk NGL Storage Marine Terminal Marketing Terminal Dynegy Pipeline Third Party Pipeline

Field: 99% POP/Fee; 1% Other

Straddle: 53% Hybrid, 22% Fee; 19% POL; 6% Keep Whole

5

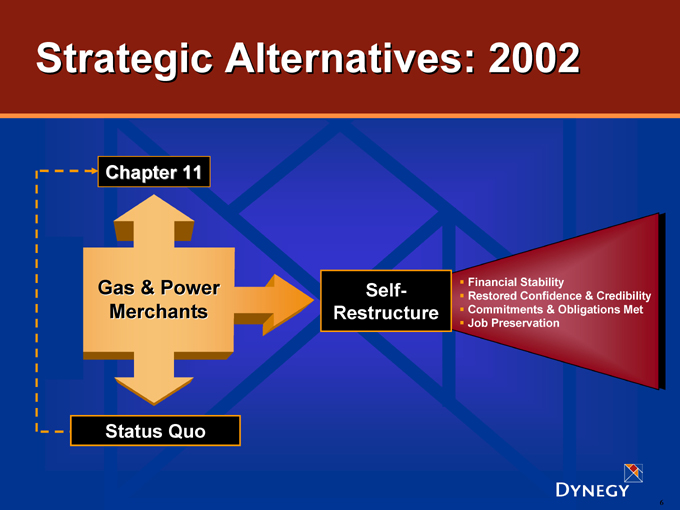

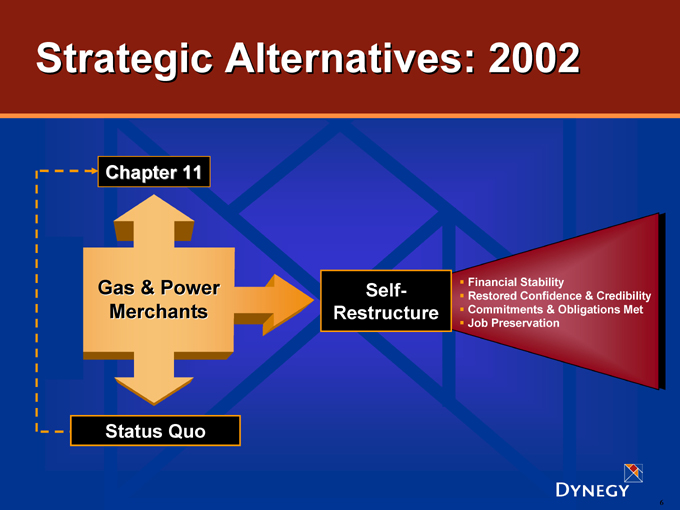

Strategic Alternatives: 2002

Chapter 11

Gas & Power Merchants

Status Quo

Self-Restructure

Financial Stability

Restored Confidence & Credibility Commitments & Obligations Met Job Preservation

6

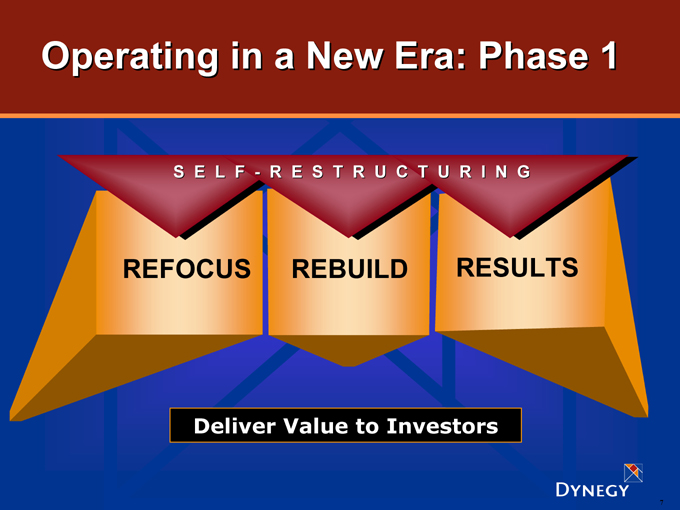

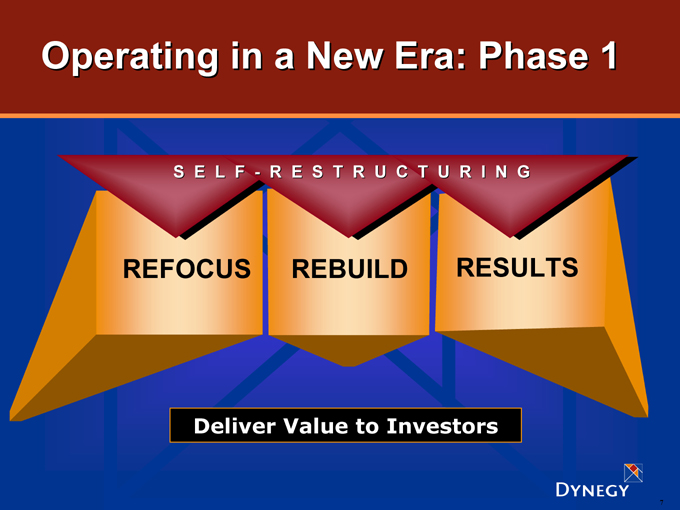

Operating in a New Era: Phase 1

SELF-RESTRUCTURING

REFOCUS

REBUILD

RESULTS

Deliver Value to Investors

7

Strategic

Protect value of the company Refocus employees through shared principles and goals Cooperate fully with investigations; address and resolve expeditiously Credibility & Trust: The right things to do

8

Financial

Respect the preference of ownership Work for all of the capital Get the senior claims (banks and bondholders) on your side Extend maturities Reduce cost structures Focus on new financial metrics

9

Operational

Rebuild company around Core Businesses with competitive advantages Shut down or sell non-core assets Capitalize on in-market asset availability to capture benefits from higher commodity prices and wider spreads Improvement projects to increase efficiency Safety and reliability are always top priorities

10

Governance

Renewed commitment to accountability and responsibility Commitment to ethical business practices Focus on stronger internal controls Established Ethics and Compliance and Internal Audit groups Support third-party governance rankings

11

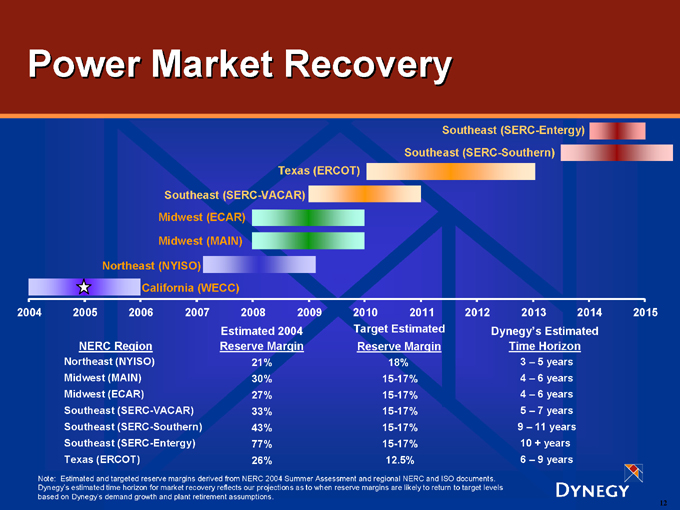

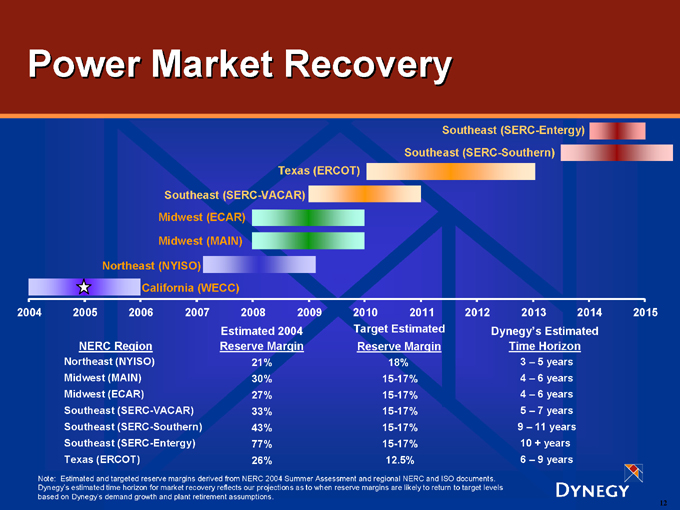

Power Market Recovery

Southeast (SERC-Entergy)

Southeast (SERC-Southern)

Texas (ERCOT)

Southeast (SERC-VACAR)

Midwest (ECAR)

Midwest (MAIN)

Northeast (NYISO)

California (WECC)

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Estimated 2004 Target Estimated Dynegy’s Estimated

NERC Region Reserve Margin Reserve Margin Time Horizon

Northeast (NYISO) 21% 18% 3 – 5 years

Midwest (MAIN) 30% 15-17% 4 – 6 years

Midwest (ECAR) 27% 15-17% 4 – 6 years

Southeast (SERC-VACAR) 33% 15-17% 5 – 7 years

Southeast (SERC-Southern) 43% 15-17% 9 – 11 years

Southeast (SERC-Entergy) 77% 15-17% 10 + years

Texas (ERCOT) 26% 12.5% 6 – 9 years

Note: Estimated and targeted reserve margins derived from NERC 2004 Summer Assessment and regional NERC and ISO documents. Dynegy’s estimated time horizon for market recovery reflects our projections as to when reserve margins are likely to return to target levels based on Dynegy’s demand growth and plant retirement assumptions.

12

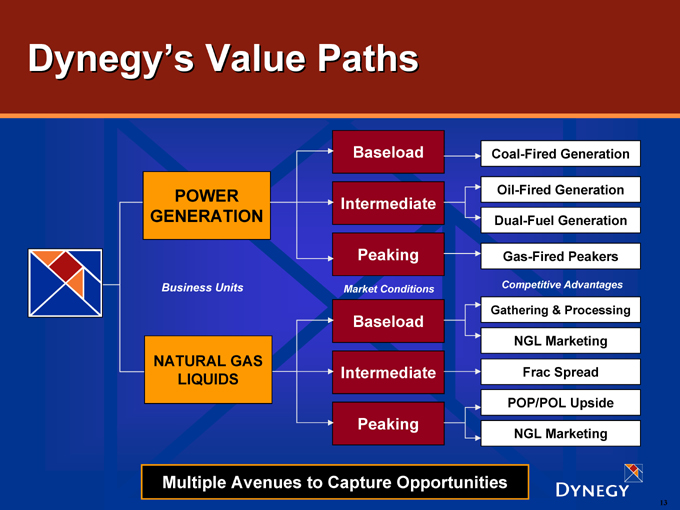

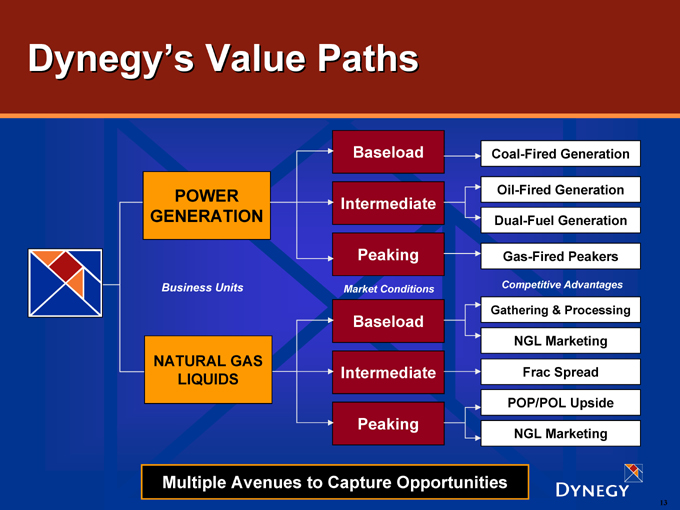

Dynegy’s Value Paths

POWER GENERATION

Business Units

NATURAL GAS LIQUIDS

Baseload

Intermediate

Peaking

Market Conditions

Baseload

Intermediate

Peaking

Coal-Fired Generation

Oil-Fired Generation

Dual-Fuel Generation

Gas-Fired Peakers

Competitive Advantages

Gathering & Processing

NGL Marketing

Frac Spread

POP/POL Upside

NGL Marketing

Multiple Avenues to Capture Opportunities

13

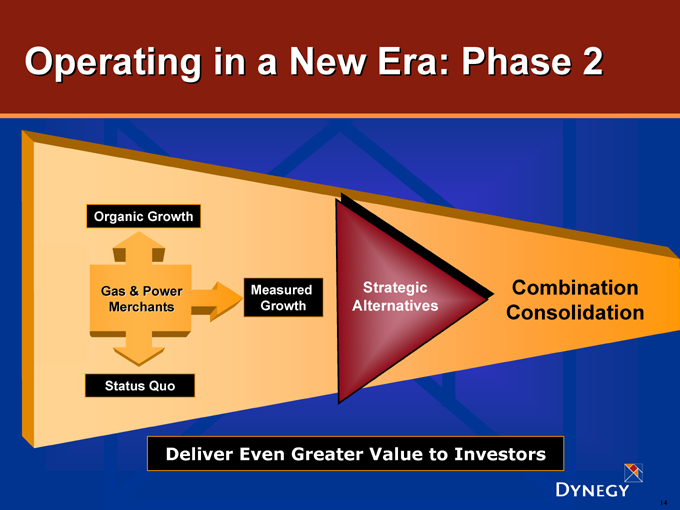

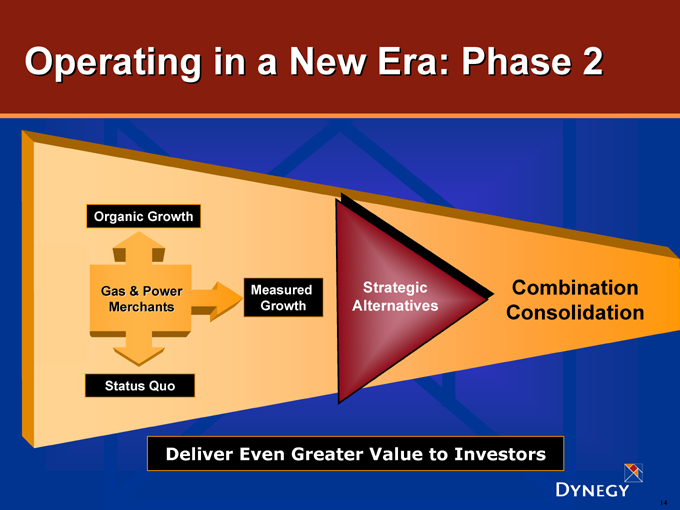

Operating in a New Era: Phase 2

Organic Growth

Gas & Power Merchants

Status Quo

Measured Growth

Strategic Alternatives

Combination Consolidation

Deliver Even Greater Value to Investors

14

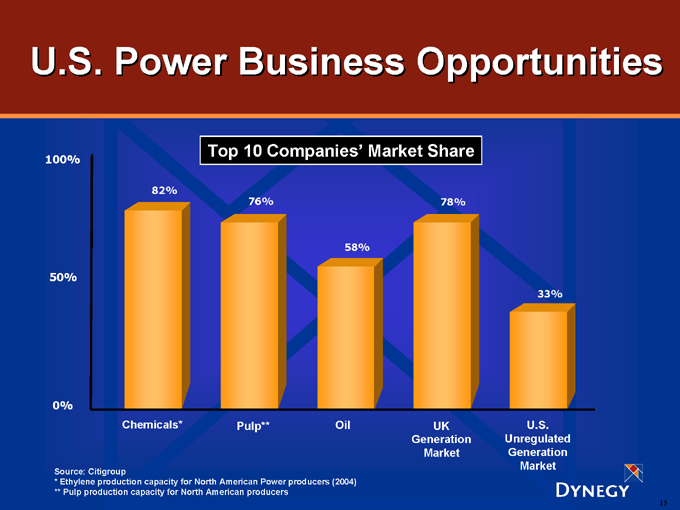

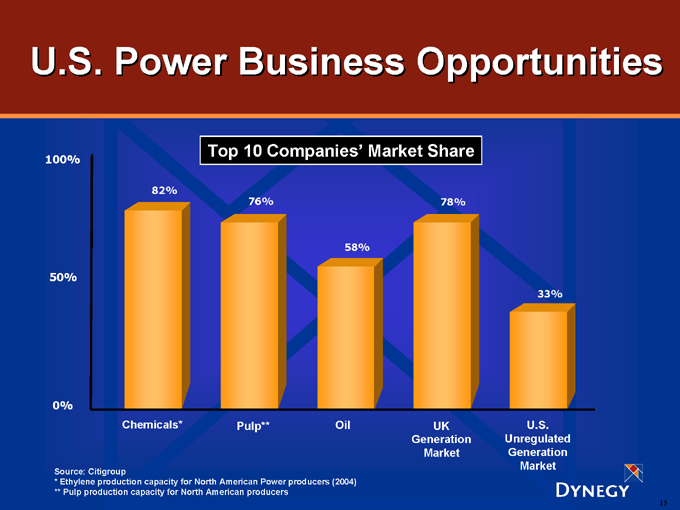

U.S. Power Business Opportunities

Top 10 Companies’ Market Share

100% 50% 0%

82%

76%

58%

78%

33%

Chemicals* Pulp** Oil UK Generation Market U.S. Unregulated Generation Market

Source: Citigroup

* Ethylene production capacity for North American Power producers (2004) ** Pulp production capacity for North American producers

15

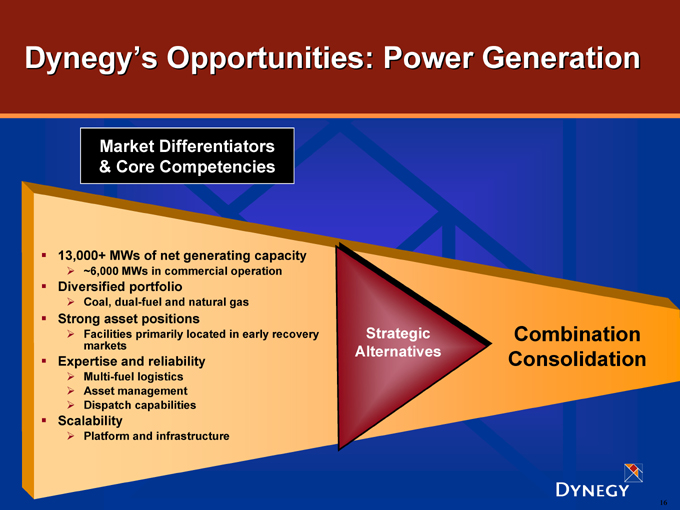

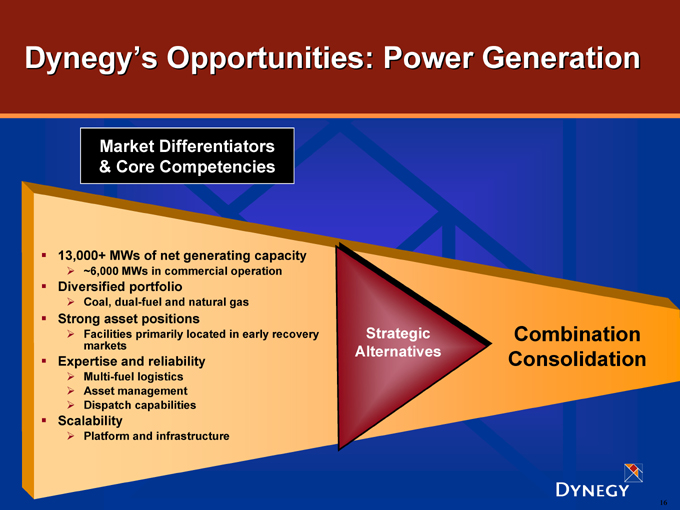

Dynegy’s Opportunities: Power Generation

Market Differentiators & Core Competencies

13,000+ MWs of net generating capacity

~6,000 MWs in commercial operation

Diversified portfolio

Coal, dual-fuel and natural gas

Strong asset positions

Facilities primarily located in early recovery markets

Expertise and reliability

Multi-fuel logistics Asset management Dispatch capabilities

Scalability

Platform and infrastructure

Strategic Alternatives

Combination Consolidation

16

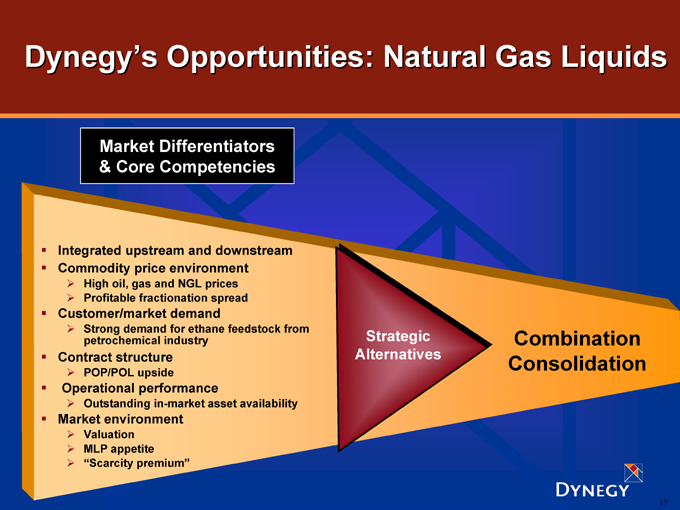

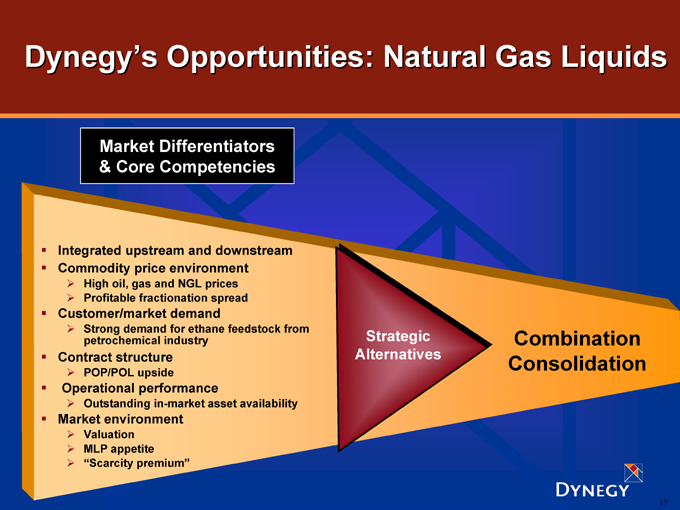

Dynegy’s Opportunities: Natural Gas Liquids

Market Differentiators & Core Competencies

Integrated upstream and downstream Commodity price environment

High oil, gas and NGL prices Profitable fractionation spread

Customer/market demand

Strong demand for ethane feedstock from petrochemical industry

Contract structure

POP/POL upside

Operational performance

Outstanding in-market asset availability

Market environment

Valuation MLP appetite “Scarcity premium”

Strategic Alternatives

Combination Consolidation

17

Benefits of Consolidation

Overhead cost savings Improved best practices

Ability to weather issues and fund capex Stronger credit ratings Precedents from other commodity industries

Higher Valuation

Shareholders Retain Opportunity to Participate in Power Market Recovery

18

Platts 20th Annual Global Power Markets Conference

CEO Roundtable: Operating in a New Era

Bruce A. Williamson Chairman, President & CEO