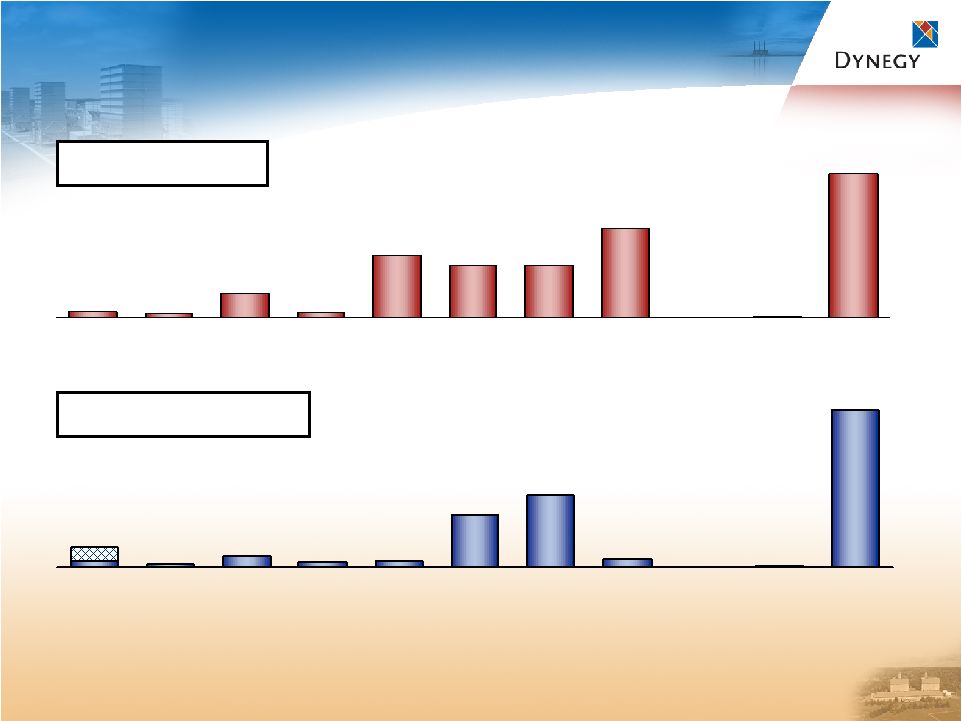

16 2006 EARNINGS ESTIMATES: GAAP BASIS 2006 EARNINGS ESTIMATES: GAAP BASIS Interest expense of $580 MM reflects savings from recent debt reduction, more than offset by $245 MM in premiums and costs related to liability management activities and $25 MM accelerated deferred financing costs Premiums/costs for liability management activities reflect $200 MM paid for redemption of SPNs and $45 MM for expected convertible security exchange Upon redemption of Series C, preferred dividend will reduce (zero beginning in 2007); the sale of Rockingham is expected to have minimal impact on 2006 EBITDA Note: 2006 estimates are presented on a GAAP basis and are based on quoted forward commodity price curves as of April 11, 2006. Actual results may vary materially from these estimates based on changes in commodity prices, among other things, including operational activities, legal settlements, financing or investing activities and other uncertain or unplanned items. Core business represents continuing operating results, excluding significant items. (1) Included in interest expense for income statement purposes. (2) Included in EBITDA calculation for income statement purposes. As Presented May 9, 2006; Based on Price Curves as of April 11, 2006 ($ in millions) Midwest Northeast South Total GEN CRM OTHER 2006 Total EBITDA Estimates $ 490-540 $ 80-115 $ (5)-5 $ 565-660 $ 5 $ (100-90) $ 470-575 Depreciation (175) (25) (25) (225) - (10) (235) Interest (580) Tax Benefit 127-87 Preferred Dividend (22) Net Loss Applicable to Common Shareholders - GAAP $ (240-175) Add Back: Premiums on Liability Management Activities, Pre-Tax (1) 245 245 Add Back: Accelerated Deferred Financing Costs, Pre-Tax (1) 25 25 Add Back: Legal and Settlement Charge, Pre-Tax (2) 15 15 Less: Tax Benefit from Items Above (5) (100) (105) Net Income (Loss) Applicable to Common Shareholders - Core Business $ (60)-5 |