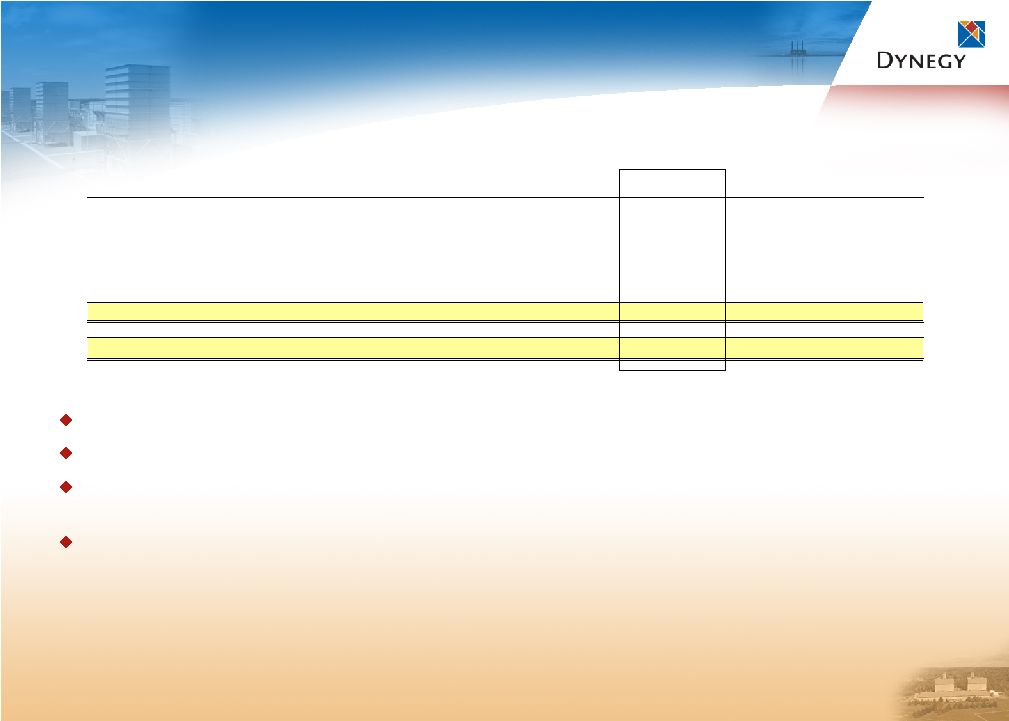

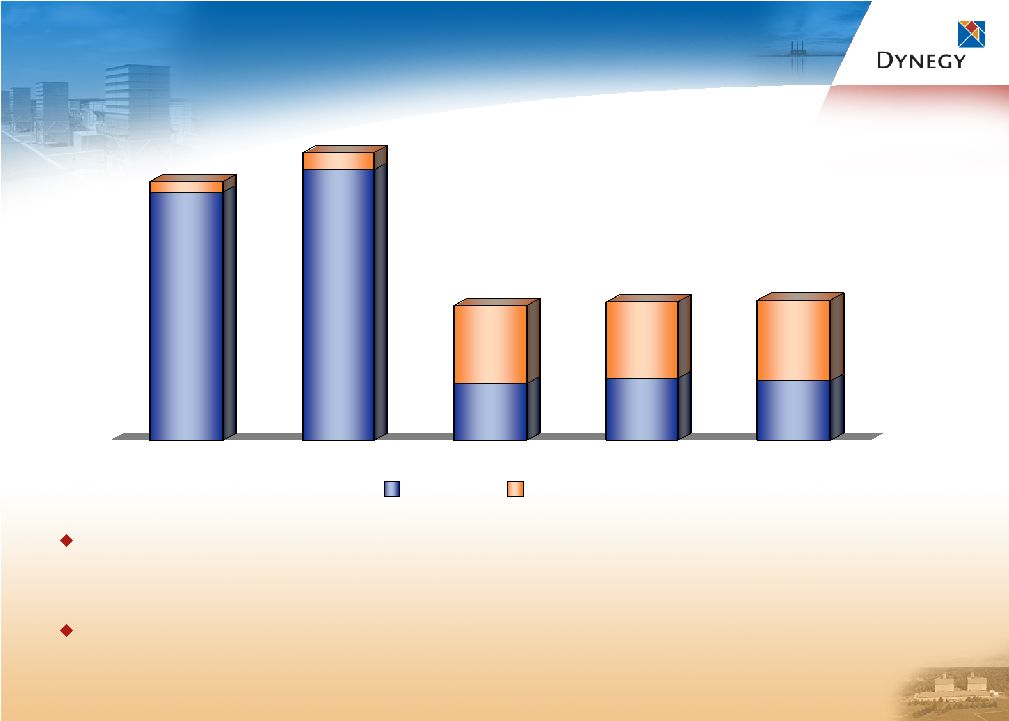

20 2007 CASH FLOW ESTIMATES: GAAP BASIS 2007 CASH FLOW ESTIMATES: GAAP BASIS Development capex related to Plum Point of $155 MM expected to be funded from Plum Point’s restricted cash Net proceeds from asset sales and acquisition includes $200 MM from potential generation asset sales, offset by $100 MM cash paid to LS Power and $45 MM expected transaction costs Other OCF includes all interest payments, including Sithe interest previously recorded in GEN, as well as Plum Point cash interest of $30 MM funded from Plum Point’s restricted cash Note: 2007 estimates are presented on a GAAP basis, are based on quoted forward commodity price curves as of 11/01/06 and assume closing of the LS Power transaction at end 1Q 2007. Actual results may vary materially from these estimates based on changes in commodity prices, among other things, including operational activities, legal settlements, financing or investing activities and other uncertain or unplanned items. Core business represents continuing operating results, excluding significant items. (1) Asset sale proceeds in the range of $200-500 MM are expected from potential divestitures of (a) non-core assets where the earnings potential is limited, or (b) assets where the value that can be captured through a divestiture is believed to outweigh the benefits of continuing to own or operate such assets. Divestitures could result in impairment charges and could reduce 2007 and forward EBITDA or free cash flow. As Presented December 13, 2006; Based on Price Curves as of November 1, 2006 ($ in millions) GEN OTHER 2007 Total GAAP OCF $ 1,170-1,260 $ (570-560) $ 600-700 GAAP ICF Capex - Maintenance (155) (15) (170) Capex - Consent Decree (90) - (90) Capex - Plum Point Development (155) - (155) Investment in Development Portfolio - (10) (10) Proceeds from Asset Sales and Acquisition Costs, Net (1) 200 (145) 55 Change in Restricted Cash 155 30 185 Free Cash Flow $ 415-515 Add Back: Acquisition Costs 145 Less: Proceeds from Asset Sales (1) (200) Free Cash Flow - Core Business $ 360-460 |