FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month ofMay 13, 2003

Commission File Number1-12838

Bema Gold Corporation

(Translation of registrant’s name into English)

Suite 3100, 595 Burrard Street

Vancouver, British Columbia, Canada, V7X 1J1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F:

Form 20-F_______ Form 40-F ___X___

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):_______

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No___X___

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X___

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_______

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf by the undersigned, thereunto duly authorized.

| | | Bema Gold Corporation |

| | | | |

| Dated: | May 13, 2003 | By | /s/ “Roger Richer” |

| | | |

|

| | | | |

| | | | Roger Richer |

| | | | Vice President, Administration, General |

| | | | Counsel, Secretary |

2

BEMA GOLD CORPORATION

Suite 3100, Three Bentall Centre

595 Burrard Street

Vancouver, British Columbia V7X 1J1

Tel: (604) 681-8371

Fax: (604) 681-6209

| | | | | |

| 2003 | | | | Notice of Annual and Special General Meeting of Shareholders |

| | | | | |

| ANNUAL | | | | Management Proxy Circular |

| | | | | |

| GENERAL | | | | Audited Financial Statements (included in the Annual Report being filed by paper with a Form 6K) |

| | | | | |

| MEETING | | | | Form of Proxy and Notes Thereto |

| | | | | |

| | | | | Return Card |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Place: | | | | Versailles “A” Room |

| | | | | Sutton Place Hotel |

| | | | | 845 Burrard Street |

| | | | | Vancouver, British Columbia |

| | | | | |

| Time: | | | | 2:00 p.m. |

| | | | | |

| Date: | | | | Wednesday, June 11, 2003 |

BEMA GOLD CORPORATION

NOTICE OF ANNUAL AND SPECIAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual and Special General Meeting of Shareholders ofBEMA GOLD CORPORATION (hereinafter called the "Corporation") will be held in the Versailles “A” Room at the Sutton Place Hotel, 845 Burrard Street, Vancouver, British Columbia, on Wednesday, the 11th day of June 2003 at 2:00 p.m. (local time), for the following purposes:

| 1. | To receive the report of the Directors; |

| | |

| 2. | To receive the audited consolidated financial statements of the Corporation for the fiscal year ended December 31, 2002 (with comparative statements relating to the preceding fiscal period) together with the report of the Auditors thereon; |

| | |

| 3. | To elect Directors; |

| | |

| 4. | To appoint Auditors and to authorize the Directors to fix their remuneration; |

| | |

| 5. | To consider, and if thought fit, approve an amendment to the Corporation's Incentive Stock Option Plan to increase the maximum number of shares reserved for stock options under the Plan from 19,800,000 to 31,000,000 shares, as more particularly set out in the Management Proxy Circular forming part hereof; |

| | |

| 6. | To consider, and if thought fit, to approve a special resolution to authorize the adoption of an amendment to the By-Laws of the Corporation; and |

| | |

| 7. | To transact such further or other business as may properly come before the meeting or any adjournment or adjournments thereof. |

Accompanying this Notice is the Corporation’s Annual Report containing the Directors' Report referred to in Item 1 above, as well as the Corporation's audited consolidated financial statements for the fiscal year ended December 31, 2002, a Management Proxy Circular, Amended By-Law No. 1, a form of Proxy and an Annual Return Card Form. The accompanying Management Proxy Circular provides information relating to the matters to be addressed at the meeting and is incorporated into this Notice.

Shareholders are entitled to vote at the meeting either in person or by proxy. Those who are unable to attend the meeting are requested to read, complete, sign and mail the enclosed form of proxy in accordance with the instructions set out in the proxy and in the Management Proxy Circular accompanying this Notice. Please advise the Corporation of any change in your mailing address.

DATED at Vancouver, British Columbia, this 13th day of May, 2003.

BY ORDER OF THE BOARD

BEMA GOLD CORPORATION

“Clive T. Johnson”

Clive T. Johnson

Chairman, President and Chief Executive Officer

BEMA GOLD CORPORATION

Suite 3100, Three Bentall Centre

595 Burrard Street

Vancouver, B.C. V7X 1J1

MANAGEMENT PROXY CIRCULAR

(Containing information as at May 6, 2003, unless indicated otherwise)

SOLICITATION OF PROXIES

This Management Proxy Circular is furnished in connection with the solicitation of proxies by the management ofBEMA GOLD CORPORATION (the "Corporation") for use at the Annual and Special General Meeting (the “Meeting”) of the Shareholders of the Corporation (and any adjournment thereof) to be held onWednesday, June 11, 2003, at the time and place and for the purposes set forth in the accompanying Notice of Meeting. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the regular employees of the Corporation at nominal cost. All costs of solicitation by management will be borne by the Corporation.

APPOINTMENT AND REVOCATION OF PROXIES

The individuals named in the accompanying form of proxy are Clive Johnson, the President, Chairman and Chief Executive Officer and a director of the Corporation and Roger Richer, the Secretary, General Counsel and Vice President of Administration of the Corporation.A Shareholder wishing to appoint some other person (who need not be a shareholder) to represent him at the Meeting has the right to do so, either by stroking out the names of those persons named in the accompanying form of proxy and inserting the desired person’s name in the blank space provided in the form of proxy or by completing another form of proxy. A proxy will not be valid unless the completed form of proxy is received by Computershare Trust Company of Canada, of 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof.

A proxy may be revoked by an instrument in writing executed by the shareholder or by his attorney authorized in writing or, where the Shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered to Computershare Trust Company of Canada, at the address above or to the head office of the Corporation, Suite 3100, Three Bentall Centre, 595 Burrard Street, Vancouver, British Columbia, V7X 1J1, no later than 2:00 p.m. Vancouver time on the day prior to the Meeting or to the Chairman or Scrutineer of the Meeting on the day of the Meeting or, if adjourned, any reconvening thereof or in any other manner provided by law. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

VOTING OF PROXIES

Shares represented by properly executed proxies in favour of persons designated in the enclosed form of proxy will be voted for the election of directors and the appointment of auditors as stated under those headings in this Management Proxy Circular or withheld from voting if so indicated on the form of proxy.

The shares represented by proxies will, on any poll where a choice with respect to any matter to be acted upon has been specified in the form of proxy, be voted in accordance with the specification made.

Such shares will, on a poll, be voted in favour of each matter for which no choice has been specified or where both choices have been specified by the Shareholder.

The enclosed form of proxy when properly completed and delivered and not revoked confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. In the event

- 2 -

that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the enclosed form of proxy to vote in accordance with their best judgment on such matters or business. At the time of the printing of this Management Proxy Circular, the management of the Corporation knows of no such amendment, variation or other matter which may be presented to the Meeting.

ADVICE TO BENEFICIAL SHAREHOLDERS

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Shareholders who do not hold their Shares in their own name (referred to herein as “Beneficial Shareholders”) are advised that only proxies from registered Shareholders can be recognized and voted at the Meeting.Beneficial Shareholders who complete and return an instrument of proxy must indicate thereon the person (usually a brokerage house) who holds their Shares as a registered Shareholder. Every intermediary (broker) has its own mailing procedure and provides its own return instructions which should be carefully followed. The instrument of proxy supplied to Beneficial Shareholders is identical to that provided to registered Shareholders. However, its purpose is limited to instructing the registered Shareholder how to vote on behalf of the Beneficial Shareholder.

If Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those Shares will not be registered in such Shareholder’s name on the records of the Corporation. Such Shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities, which company acts as nominee for many Canadian brokerage firms). Shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers/nominees are prohibited from voting shares for their clients. The directors and officers of the Corporation do not know for whose benefit the Shares registered in the name of CDS & Co. are held.

In accordance with National Instrument 54-101 of the Canadian Securities Administrators, the Corporation has distributed copies of the Notice of Meeting, this Management Proxy Circular, form of proxy and related documents together with the 2002 financial statements (the “Meeting Materials”) to the clearing agencies and intermediaries for onward distribution to non-registered members. Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of Shareholders’ meetings unless the Beneficial Shareholders have waived the right to receive meeting materials. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their Shares are voted at the Meeting. Often the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided by the Corporation to the Registered Shareholder. However, its purpose is limited to instructing the registered Shareholder how to vote on behalf of the Beneficial Shareholder. Should a non-registered Shareholder receiving such a form wish to vote at the Meeting, the non-registered Shareholder should strike out the names of the management proxyholders named in the form and insert the non-registered Shareholder’s name in the blank provided prior to returning the proxy. The majority of brokers now delegate responsibility for obtaining instructions from clients to ADP Investor Communications (“ADP”). ADP typically applies a special sticker to the proxy forms, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the proxy forms to ADP. ADP then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Shares to be represented at the Meeting.A Beneficial Shareholder receiving a proxy with an ADP sticker on it cannot use that proxy to vote Shares directly at the Meeting – the proxy must be returned to ADP well in advance of the Meeting in order to have the Shares voted. All references to Shareholders in this Circular and the accompanying form of proxy and Notice of Meeting are to registered Shareholders unless specifically stated otherwise.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation is authorized to issue an unlimited number of common shares without par value (“common shares”), of which 318,524,765 fully paid and non-assessable common shares were issued and outstanding as of May 6, 2003 (the “Record Date”).

- 3 -

Only registered Shareholders at the close of business on the Record Date who either personally attend the Meeting or who have completed and delivered a form of proxy in the manner and subject to the provisions described above shall be entitled to vote or to have their shares voted at the Meeting.

On a show of hands, every individual who is present as a Shareholder or as a representative of one or more corporate shareholders, or who is holding a proxy on behalf of a Shareholder who is not present at the Meeting, will have one vote, and on a poll every Shareholder present in person or represented by a proxy and every person who is a representative of one or more corporate shareholders, will have one vote for each common share registered in his name on the list of shareholders, which is available for inspection during normal business hours at Computershare Trust Company of Canada and will be available at the Meeting.

To the knowledge of the directors and senior officers of the Corporation, there are no persons or companies who beneficially own, directly or indirectly or exercise control or direction over shares carrying more than 10% of the voting rights attached to all outstanding shares of the Corporation.

ELECTION OF DIRECTORS

The Board of Directors presently consists of 11 directors and it is intended to elect 11 directors for the ensuing year.

On June 9, 1989 the By-Laws of the Corporation were amended by special resolution in order to provide for three year staggered terms for the election of directors of the Corporation. On April 16, 2003, as part of a corporate governance review by the Corporation, the By-Laws were amended by the Board of Directors to remove the staggered terms for the election of directors and to have the directors resign each year and stand for re-election at the Corporation’s Annual General Meeting. A retiring director is eligible for re-election and shall act as a director throughout the meeting at which he retires.

In accordance with theCanada Business Corporations Act, the amendment to the By-Laws took effect when adopted by the Board of Directors and will continue in force, subject to ratification by the Shareholders. See “Particulars of Other Matters to be Acted Upon” below for further details of the proposed resolution to ratify this amendment to the By-Laws.

The following table and notes thereto sets out the names of Management’s nominees for election as directors, the country in which each is ordinarily resident, all offices of the Corporation and Board committee positions now held by each, their principal occupation, the period of time for which each has been a director of the Corporation, and the number of common shares of the Corporation beneficially owned, directly or indirectly, or over which each exercises control or direction, as at the date hereof.

| Name, Position and | Principal Occupation and, if not an Elected | Director | Number |

| Country of Residence(1) | Director, Employment for Past Five Years(1) | Since(1) | of Shares(1) |

|

|

|

|

| ALLEN, Thomas I.A.(2)(3)(5) | Senior partner in the Toronto law firm of Ogilvy | November 24, 1998 | 10,000 |

| Director | Renault since October 1996. | | |

| Canada | | | |

| | | | |

| ANGUS, R. Stuart | Senior partner in the law firm of Fasken | June 18, 1992 | 43,879 |

| Director | Martineau DuMoulin LLP since March, 2001. | | |

| Canada | | | |

| | | | |

| CROSS, Robert M.D.(3)(5) | Director of various private and public companies | March 1, 2003 | 2,000,000 |

| Director | including serving as Chairman of Northern Orion | | |

| Canada | Explorations Ltd. Previously President of | | |

| | Yorkton Securities Inc. from November, 1998 to | | |

| | February, 2001. | | |

- 4 -

| Name, Position and | Principal Occupation and, if not an Elected | Director | Number |

| Country of Residence(1) | Director, Employment for Past Five Years(1) | Since(1) | of Shares(1) |

|

|

|

|

| GAYTON, Robert J. (2)(5) | Vice President of Finance with Western Silver | April 1, 2003 | 3,000 |

| Director | Corporation, a Toronto Stock Exchange listed | | |

| Canada | mining company, since 1995. | | |

| | | | |

| HAAS, Erwin J. | Principal and financial consultant with | December 5, 1988 | 0 |

| Director | E.H.& P. Investments AG, a private financial | | |

| Switzerland | investment corporation based in Zurich, | | |

| | Switzerland. | | |

| | | | |

| JOHNSON, Clive T.(4)(5) | Chairman, President and Chief Executive Officer | December 5, 1988 | 181,181(6) |

| Chairman, President, Chief | of the Corporation. | | |

| Executive Officer and Director | | | |

| Canada | | | |

| | | | |

| KORPAN, Jerry R. | Executive Director of Emergis Capital, a property | June 28, 2002 | 500,000 |

| Director | development company based in Antwerp, | | |

| England | Belgium, since April 2001. | | |

| | | | |

| MCFARLAND,Cole E.(2)(3) | Retired since 1995. Prior thereto President and | November 24, 1998 | 3,500 |

| Director | Chief Executive Officer, Placer Dome U.S. since | | |

| U.S.A. | 1987. | | |

| | | | |

| | | | |

| PÉREZ-COTAPOS, Eulogio | Senior partner in the law firm of Cariola, Diez, | June 20, 1997 | 0 |

| Director | Pérez-Cotapos & Cia. Ltda. in Santiago, Chile. | | |

| Chile | | | |

| | | | |

| RAYMENT, Barry D. | Principal of Mining Assets Corporation, a | December 5, 1988 | 31,162 |

| Director | technical consulting firm which provides | | |

| U.S.A. | services to the mining industry. | | |

| | | | |

| WOODYER, Neil(3)(4) | Managing Director of Endeavour Financial | February 9, 1990 | 515,000 |

| Director | Corporation, a private financial and corporate | | |

| Canada | advisory firm specializing in the mining | | |

| | industry. | | |

NOTES:

|

(1)

| The information as to country of residence, principal occupation and the number of shares beneficially owned or over which a Director exercises control or direction, not being within the knowledge of the Corporation, has been furnished by the respective Directors individually |

| (2) | Denotes member of the Audit Committee. |

| (3) | Denotes member of the Compensation Committee. |

| (4) | Denotes member of the Hedging Committee. |

| (5) | Denotes member of the Corporate Governance and Nominating Committee. |

| (6) | Of these shares, 9,233 are held by 392611 B.C. Ltd., a private corporation wholly owned by Mr. Johnson. |

The Corporation does not have an Executive Committee.

- 5 -

On March 1, 2003 pursuant to the completion of a business combination by way of Plan of Arrangement with EAGC Ventures Corp. (“EAGC”), Mr. Robert Cross, a former director of EAGC, was appointed to the Board of Directors of the Corporation. See “Interest of Insiders in Material Transactions” below for further details.

On March 25, 2003 Mr. Roger Richer stepped down as a Director of the Corporation. On April 1, 2003 Mr. Robert Gayton was appointed to the Board of Directors to fill the vacancy left by Mr. Richer.

STATEMENT OF EXECUTIVE COMPENSATION

1. Summary Compensation Table

The Corporation currently has five named executive officers as set out in the table below (the “Named Executive Officers”). The following table sets forth compensation information for services in all capacities to the Corporation and its subsidiaries for the three fiscal years ended December 31, 2002, 2001 and 2000 by the Chief Executive Officer and the other four most highly compensated executive officers of the Corporation:

Name and Position

Of Principal | Year | Annual Compensation | Long-Term Compensation | All Other

Compen-

sation

($)(4) |

| Awards | Payouts |

Salary

(Cdn$)(1) | Bonus

$ | Other

Annual

Compen-

sation $(2) | Securities

Under

Options/SARs

Granted(#)(3) | Restricted

Shares/Units

Awarded(#) | LTIP

Payouts

($) |

Clive Johnson

Chief Executive Officer,

Chairman, and President | 2002

2001

2000 | 398,830

333,478

403,107 | 74,051

Nil

Nil | 31,416

48,829

47,789 | 1,000,000

750,000

0 | N/A

N/A

N/A | N/A

N/A

N/A | 1,412

1,412

1,412 |

Roger Richer

Vice President

Administration, General

Counsel and Secretary | 2002

2001

2000 | 183,507

152,893

185,480 | 34,708

Nil

Nil | 16,452

16,842

16,791 | 200,000

150,000

0 |

N/A

N/A

N/A | N/A

N/A

N/A | Nil

Nil

Nil |

Tom Garagan

Vice President,

Exploration | 2002

2001

2000 | 183,507

152,893

185,480 | 34,708

Nil

Nil | 2,052

2,052

1,625 | 200,000

150,000

0 | N/A

N/A

N/A | N/A

N/A

N/A | Nil

Nil

Nil |

Mark Corra,

Vice President,

Finance | 2002

2001

2000 | 182,674

139,268

150,480 | 11,250

Nil

Nil | 16,977

16,952

16,799 | 200,000

150,000

0 | N/A

N/A

N/A | N/A

N/A

N/A | Nil

Nil

Nil |

George Johnson

Senior Vice President,

Operations | 2002

2001

2000 | 276,056

254,375

275,823 | 21,250

Nil

Nil | 16,452

16,452

17,033 | 200,000

150,000

0 | N/A

N/A

N/A | N/A

N/A

N/A | Nil

Nil

Nil |

| (1) | See “Termination of Employment, Change in Responsibilities and Employment Contracts” below for further details of salary reductions previously affecting these individuals. |

| (2) | Includes car allowance, housing allowance, parking, club membership and imputed interest on loans. |

| (3) | Figures represent only options granted during a particular year; see “Aggregated Option Exercises” table below for the aggregate number of options outstanding at year-end. |

| (4) | Includes Private Long Term Disability Insurance. |

2. Long-Term Incentive Plans – Awards in Most Recent Completed Financial Year

Long term incentive plan awards (“LTIP”) means “any plan providing compensation intended to serve as an incentive for performance to occur over a period longer than one financial year whether performance is measured by reference to financial performance of the Corporation or an affiliate, or the price of the Corporation’s shares but does not include option or stock appreciation right plans or plans for compensation through restricted shares or units”. The Corporation has not granted any LTIP’s during the past fiscal year.

- 6 -

3. Options and SARs

Stock appreciation rights (“SAR’s”) means a right, granted by an issuer or any of its subsidiaries as compensation for services rendered or in connection with office or employment, to receive a payment of cash or an issue or transfer of securities based wholly or in part on changes in the trading price of the Corporation’s common shares. There were no SAR's granted to or exercised by the Named Executive Officers during the fiscal year ended December 31, 2002.

Option/SAR Grants in Last Fiscal Year

The following table sets forth stock options granted under the Corporation's Stock Option Plan (the "Stock Option Plan") to each of the Named Executive Officers, during the fiscal year ended December 31, 2002.

| Name | Securities

Under

Options/SARs

Granted (#)(1) | % of Total

Options/SARs

Granted in

Fiscal year(2) | Exercise or

Base Price

($/Security)(3) | Market Value of

Securities

Underlying

Options/SARs on

Date of Grant

($/Security) | Expiration

Date |

| Clive Johnson | 1,000,000 | 27.0% | $1.04 | $1.04 | April 18/07 |

| Roger Richer | 200,000 | 5.4% | $1.04 | $1.04 | April 18/07 |

| Tom Garagan | 200,000 | 5.4% | $1.04 | $1.04 | April 18/07 |

| Mark Corra | 200,000 | 5.4% | $1.04 | $1.04 | April 18/07 |

| George Johnson | 200,000 | 5.4% | $1.04 | $1.04 | April 18/07 |

| (1) | Number of common shares of the Corporation acquired on the exercise of stock options. |

| (2) | Percentage of all options granted during the last fiscal year. |

| (3) | The exercise price of stock options is set at not less than 100% of the market value of the common shares of the Corporation on the date of grant. The exercise price of stock options may only be adjusted in the event that specified events cause dilution of the Corporation’s share capital. |

Aggregated Options Exercises in Last Fiscal Year and

Fiscal Year-End Option Values

The following table sets forth details of all exercises of stock options during the fiscal year ended December 31, 2002 by each of the Named Executive Officers and the fiscal year-end value of unexercised options on an aggregated basis:

| Name | Securities

Acquired on

Exercise

(#)(1) | Aggregate

Value

Realized

($)(2) | Unexercised

Options/SARs at

Fiscal Year-End (#)(3)

Exercisable/

Unexercisable | Value of Unexercised

In-the-Money Options/

SARs at Fiscal Year-End

($)(3)(4)

Exercisable/ Unexercisable |

| Clive Johnson | 750,000 | $1,002,000 | 2,500,000 / 0 | $2,160,000 / 0 |

| Roger Richer | 350,000 | $474,000 | 300,000 / 0 | $234,000 / 0 |

| Tom Garagan | 50,000 | $120,500 | 600,000 / 0 | $604,000 / 0 |

| Mark Corra | 100,000 | $103,000 | 500,000 / 0 | $479,000 / 0 |

| George Johnson | 100,000 | $179,000 | 500,000 / 0 | $479,000 / 0 |

| (1) | Number of shares of the Corporation acquired on the exercise of options. |

| (2) | Calculated using the difference between the exercise price and the closing price of common shares of the Corporation on the Toronto Stock Exchange on the date of exercise. |

| (3) | As freestanding SARs have not been granted, the number relates solely to options. |

| (4) | Value of unexercised in-the-money options calculated using the closing price of common shares of the Corporation on the Toronto Stock Exchange on December 31, 2002 of $2.03, less the exercise price of in-the-money options. |

- 7 -

4. Option Repricings

No options were repriced during the fiscal year ended December 31, 2002.

5. Defined Benefit or Actuarial Plan Disclosure

The Corporation does not provide retirement benefits for directors and executive officers.

6. Termination of Employment, Change in Responsibilities and Employment Contracts

As at December 31, 2002 the Corporation had five Named Executive Officers as set out in the Summary Compensation Table above. The Corporation has a formal employment agreement (the “Employment Agreement”) dated July 3, 1990, as amended August 29, 1991, with Clive Johnson, one of its Named Executive Officers. The Employment Agreement has an indefinite term and is subject to termination in certain events. In the event of termination of Mr. Johnson’s employment for other than just cause (as defined therein) the Employment Agreement provides for payment by the Corporation of a severance allowance payable as follows:

(1)

| an amount equal to his aggregate salary for the preceding 12 months, payable at the time of termination; |

(2)

| an amount equal to 100% of such aggregate salary, payable one year after termination; and |

(3)

| an amount equal to 100% of such aggregate salary, payable two years after termination. |

The Employment Agreement provides that if any such severance allowance is paid, Mr. Johnson is prohibited from engaging in any activity competitive with the Corporation’s business, which includes engaging in mining operations within an area of five miles from any mineral properties being explored or developed by the Corporation at termination, for a period of one year following termination, except with the written consent of the Corporation.

The Employment Agreement provides for annual review of the salary of Mr. Johnson and a minimum annual increase of 10%. The current salary is fixed at $402,627 per annum. Mr. Johnson’s 10% increase was deferred for the years 1999, 2000, 2001 and 2002. In addition, pursuant to the Employment Agreement, Mr. Johnson receives a car allowance of $14,400 per annum.

Each of Messrs. Richer, Garagan and Corra, all Named Executive Officers, has an employment agreement with the Corporation, dated for reference as of the 1stday of November, 1996. Mr. George Johnson has an employment agreement with the Corporation dated August 11, 1999. The terms of these employment agreements are similar to the Employment Agreement of Mr. Clive Johnson described above except that an amount of 50% of the annual salary will be paid two years following termination without cause and there is no prohibition to engaging in activity competitive with the Corporation’s business. Under the terms of these employment agreements the salaries are subject to review annually however there is no minimum increase. There have been no salary increases under the employment agreements for Messrs. Richer and Garagan for the past four years, whereas Mr. Corra received a salary increase to $185,000 in 2002 from $150,000 in the previous year. The respective current annual salaries under these employment agreements are as follows:

| | Roger Richer | $185,000 |

| | Tom Garagan | $185,000 |

| | Mark Corra | $185,000 |

| | George Johnson | $275,000 |

Mr. Richer, Mr. Corra and Mr. George Johnson are each paid a car allowance of $1,200 per month. Each of the employment agreements provide for basic medical and dental plans, an allowance for a sport or social club membership, reimbursement of all reasonable travel expenses incurred in connection with the business of the Corporation or any of its subsidiaries and the maintenance of life insurance or equivalent death benefits to a maximum of 200% of the employee’s annual salary.

On April 1, 2001, Messrs. Clive Johnson, Roger Richer, Tom Garagan and Mark Corra voluntarily agreed to a 15% reduction in their annual salaries. On February 13, 2002, salaries were reinstated effective February 1, 2002 to their previous levels.

- 8 -

7. Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors of the Corporation is comprised of Neil Woodyer, Thomas Allen, Cole McFarland and Robert Cross, all directors of the Corporation, none of whom is or was during the most recently completed year an officer or employee of the Corporation or any of its subsidiaries, or an executive officer of the Corporation.

8. Report on Executive Compensation

The Corporation’s executive compensation program is supervised by the Compensation Committee (the “Committee”) of the Board of Directors. The Committee has, as part of its mandate, responsibility for reviewing recommendations from management for subsequent approval by the Board of Directors with respect to the appointment and remuneration of executive officers of the Corporation. The Committee also monitors the performance of the Corporation’s senior executive officers and review the design and competitiveness of the Corporation’s compensation plans.

Executive Compensation Program

The Corporation’s executive compensation program is based on pay for performance philosophy. It is comprised of three elements:

| 1. | base salaries which are set at levels which are competitive with the base salaries paid by comparable corporations of a comparable size within the mining industry and with operations at approximately the same state, thereby enabling the Corporation to compete for and retain executives critical to the Corporation’s long term success; |

| 2. | annual bonuses which are considered from time to time, based on individual and corporate performance criteria; and |

| 3. | share ownership opportunities through a stock option plan which provides additional incentive and aligns the interests of executive officers with the longer term interests of shareholders. |

Compensation for the Named Executive Officers, as well as for executive officers as a whole, consists of a base salary, possible bonuses and a longer term incentive in the form of stock options. As an executive officer’s level of responsibility increases, a greater percentage of total compensation is based on performance (as opposed to base salary and standard employee benefits) and the mix of total compensation shifts towards bonus and stock options, thereby increasing the mutual interest between executive officers and shareholders. The level of base salary for each employee within a specified range is determined by past performance, as well as by the level of responsibility and the importance of the position to the Corporation.

The Committee’s recommendations for base salaries and bonuses, if any, for the senior executive officers, are submitted to the Board of Directors of the Corporation for approval.

The Compensation Committee is currently considering a recommendation to the Board that bonus payments or other forms of compensation be made to senior management in respect of fiscal 2002 in recognition of the accomplishments of the Corporation during that period. No decision has yet been made as to the quantum of such payments or other forms of compensation, if any are to be made.

Stock Options

The Corporation’s Stock Option Plan (“the Stock Option Plan”) is administered by the Board of Directors. The Compensation Committee makes recommendations to the Board on the Stock Option Plan.The Stock Option Plan is designed to give each option holder an interest in preserving and maximizing shareholder value in the longer term, to enable the Corporation to attract and retain individuals with experience and ability and to reward individuals for current performance and expected future performance.

- 9 -

The number of stock options which may be issued under the Stock Option Plan in aggregate and in respect of any fiscal year is limited under the terms of the Stock Option Plan and cannot be increased without shareholder approval. Stock options usually have a five year term, and are exercisable at the market price (as defined in the Stock Option Plan) of the Corporation’s common shares on the date of grant. A holder of stock options must be a director, officer or employee of or consultant to the Corporation or its associated, affiliated, controlled or subsidiary companies in order to exercise stock options. See “Particulars of Other Matters to be Acted Upon” below for details of the proposed resolution to amend the Stock Option Plan.

Other Compensation

The Corporation’s Chief Executive Officer has entered into an employment agreement with the Corporation which specifies the minimum increase in the level of annual base salary to be paid to such executive, as well as other terms of employment (see “Termination of Employment” above for detailed descriptions). The employment agreement was approved by the Board of Directors.

The foregoing report, dated May 13, 2002, was reviewed by Neil Woodyer, Thomas Allen, Cole McFarland and Robert Cross.

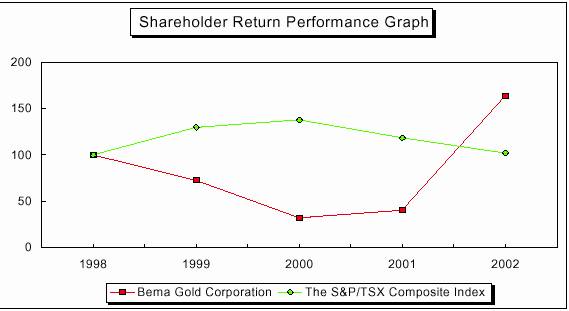

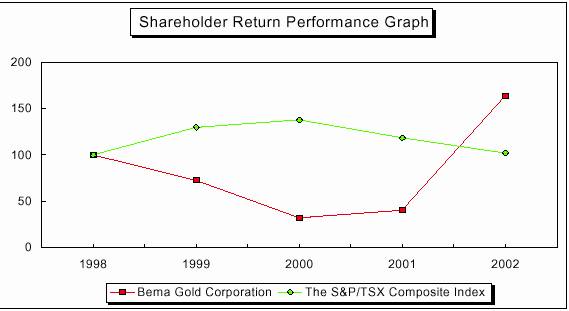

9. Performance Graph

The Chart below compares the yearly percentage change in the cumulative total shareholder return on the Corporation’s common shares against the cumulative total shareholder return of the TSX 300 Stock Index for the five fiscal year period commencing January 1, 1998 and ending December 31, 2002.

| Note: Assumes that the initial value of the investments on The Toronto Stock Exchange in the Corporation's common shares and in each of the indices was $100.00 on January 1, 1998 and that any dividends were reinvested. |

10. Compensation of Directors

Effective January 1, 2001, the directors voluntarily agreed to a reduction of 15% in their $10,000 annual retainers. In 2001, each director of the Corporation who is not an employee of the Corporation was paid an annual retainer of $8,500 and a fee of $1,000 per full board meeting. Directors entitled to receive such remuneration who are also members of board committees are paid a $1,000 fee per committee meeting. The Chairman of each of the Audit and

- 10 -

Compensation committees is paid an annual retainer of $2,500. The annual retainers were reinstated to the pre-2001 levels on March 1, 2002, effective January 2002.

In 2002 the following amounts were paid to directors with respect to the above services:

| | Thomas Allen | $ | 24,500 |

| | R. Stuart Angus | $ | 25,000 |

| | Erwin Haas | $ | 15,500 |

| | Eulogio Pérez-Cotapos | $ | 17,500 |

| | Cole McFarland | $ | 26,500 |

| | Barry Rayment | $ | 19,500 |

| | Neil Woodyer | $ | 23,375 |

| | Jerry Korpan | $ | 4,500 |

Fasken Martineau Dumoulin LLP, a law firm in which R. Stuart Angus, a director of the Corporation, was a senior partner during the year 2002, charged the corporation an aggregate of $167,576 for professional services rendered and out-of-pocket expenses during the 2002 financial year.

Mr. Neil Woodyer is a director of the Corporation and a Managing Director of Endeavour Financial Corporation (“Endeavour”). Endeavour, under certain financial consulting arrangements with the Corporation, charged the Corporation $372,179 as consulting fees for financial advisory services rendered and out-of-pocket expenses during the fiscal year ended December 31, 2002. See “Interest of Insiders in Material Transactions” below for further details regarding additional transactional fees paid to Endeavour during the year.

Cariola, Diez, Pérez-Cotapos & Cia. Ltd., a law firm in which Eulogio Pérez-Cotapos, a director of the Corporation, was a partner during 2002, charged the Corporation $70,578 for professional services rendered and out-of-pocket expenses during the 2002 financial year.

Mr. Jerry Korpan, a director of the Corporation, also provides consulting services to the Corporation. During the year 2002, Mr. Korpan was paid a total of $70,000 for corporate/investor relations consulting services rendered in the United Kingdom and Europe and out-of-pocket expenses, pursuant to the terms of a consulting agreement between the Corporation and Mr. Korpan.

The Corporation granted stock options to certain directors who are not Named Executive Officers. The following table sets forth stock options granted by the Corporation during the fiscal year ended December 31, 2002, to directors who are not named Named Executive Officers of the Corporation, as a group:

| Name | Securities

Under

Options/SARs

Granted (#)(1) | % of Total

Options/SARs

Granted in

Fiscal year(2) | Exercise or

Base Price

($/Security)(3) | Market Value of

Securities

Underlying

Options/SARs on

Date of Grant

($/Security) | Expiration

Date |

Directors who are not

named Executive

Officers (8 persons) | 1,250,000 | 33.8% | $1.04 | $1.04 | April 18, 2007 |

| (1) | Number of common shares of the Corporation acquired on the exercise of stock options. |

| (2) | Percentage of all options granted during the last fiscal year. |

| (3) | The exercise price of stock options is set at not less than 100% of the market value of the common shares of the Corporation on the date of grant. The exercise price of stock options may only be adjusted in the event that specified events cause dilution of the Corporation’s share capital. |

- 11 -

In addition, Mr. Robert Cross, who was appointed to the Board on March 1, 2003, was previously granted options to purchase 1,000,000 common shares of EAGC Ventures Corp. (“EAGC”) at an exercise price of $1.40, which expire on October 24, 2007. Pursuant to a business combination by way of Plan of Arrangement between the Corporation and EAGC, Mr. Cross was issued the same number of stock options of the Corporation to replace these EAGC options. These replacement options were issued outside of the Corporation’s Stock Option Plan in connection with the business combination with EAGC.

The following table sets forth details of all exercises of stock options during the fiscal year ended December 31, 2002 by directors who are not Named Executive Officers of the Corporation, as a group and the fiscal year-end value of unexercised options on an aggregated basis:

| Name | Securities

Acquired on

Exercise

(#)(1) | Aggregate

Value

Realized

($)(2) | Unexercised

Options at Fiscal

Year-End

Exercisable/

Unexercisable | Value of Unexercised

In-the-Money Options at

Fiscal Year-End

Exercisable/Unexercisable

($)(3) |

Directors who are not

Named Executive Officers

(8 persons) | 605,000 | $983,700 | 1,990,000 / 0 | $1,905,400 / 0 |

| (1) | Number of common shares of the Corporation acquired on the exercise of stock options. |

| (2) | Calculated using the difference between the exercise price and the closing price of common shares of the Corporation on the Toronto Stock Exchange on the date of exercise. |

| (3) | Value using the closing price of common shares of the Corporation on the Toronto Stock Exchange on December 31, 2002 of $2.03 per share, less the exercise price per share. |

STATEMENT OF CORPORATE GOVERNANCE REPORT PRACTICES

General

In July 2000, the Toronto Stock Exchange (the “TSX”), the TSX Venture Exchange and the Canadian Institute of Chartered Accountants mandated the Joint Committee on Corporate Governance to review and modify the TSX Corporate Governance Guidelines (the “Guidelines”) originally introduced in 1995. Particulars of the Corporation’s corporate governance practices and procedures are set forth below, together with the plans of the Board of Directors of the Corporation (the “Board”) to assure a greater degree of compliance with the Guidelines during the current and future fiscal years of the Corporation.

Mandate of the Board of Directors

The mandate of the Board is to supervise the management of the business and affairs of the Corporation. The Board’s principal responsibilities are to supervise and evaluate management, to oversee the conduct of the Corporation’s business, to set policies appropriate for the business of the Corporation and to approve corporate strategies and goals. The Board is to carry out its mandate in a manner consistent with the fundamental objective of enhancing shareholder value. Every director is required to act honestly and in good faith in the best interests of the Corporation and to exercise the care, diligence and skill of a reasonably prudent person. Responsibilities not delegated to senior management or to a committee of the Board remain those of the full Board.

Composition of the Board of Directors

It is the responsibility of each board to make a determination of the status of each of its board members as related, unrelated, outside or inside, as such terms are defined or understood in the Guidelines. The Board of the Corporation is currently composed of 11 directors, ten outside directors, being directors who are not officers or employees of the Corporation, and one inside director. The Board has further determined that of its ten outside directors, six are unrelated directors (i.e. a director who is independent of management and is free from any interest

- 12 -

or any business or other relationship which could, or could reasonably be perceived to materially interfere with the director’s ability to act in the best interest of the Corporation, other than interests arising from shareholdings). Four outside directors provide services to the Corporation on a consulting basis and are therefore related directors. The one inside director is, by definition, also a related director.

The Guidelines recommend that each board examine its size and, with a view to determining the impact of the number upon effectiveness, undertake, where appropriate, a program to reduce the number of directors to a number which facilitates more effective decision making. The Board considers this guideline on at least an annual basis and has determined 11 as the optimum number of members for the Board of the Corporation at this time. The members of the Board of Directors have been chosen on the basis of their skill, expertise and experience in the international gold mining industry and other businesses as well as their ability to actively contribute on the broad range of issues with which the Board must deal.

Significant Shareholder

The Corporation does not have a “significant shareholder”, which by the definition in the Guidelines is a “shareholder with the ability to exercise a majority of the votes for the election of the board of directors”.

Board Independence

The Board should have the responsibility to ensure that the Board functions independently of management. Mr. Clive Johnson is Chairman of the Board of Directors and Chief Executive Officer (“CEO”) of the Corporation. In the view of the Board, the fact that Mr. Johnson occupies both offices does not impair the ability of the Board to act independently of management. The Board has reached this conclusion for various reasons, including the number of unrelated, independent directors on the Board.

The Board is responsible for approving long-term strategic plans and annual operating budgets and plans recommended by management. Board consideration and approval is also required for all material contracts and business transactions and all debt and equity financing proposals. The Board is also responsible for senior executive recruitment and compensation.

The Board believes that adequate structures and processes are in place to facilitate the functioning of the Board independently of the Corporation’s management. The Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee consist of at least a majority of directors who are unrelated to the Corporation’s management.

Board Committees

The Board has established four committees: the Audit Committee, the Compensation Committee, the Hedging Committee and the Corporate Governance and Nominating Committee. Ad hoc committees of the Board may also be appointed from time to time. The Guidelines state that board committees should be comprised of outside directors but go on to state that a majority of their members should be unrelated directors.

Audit Committee

The Audit Committee is comprised of three directors, all of whom are unrelated directors. The Audit Committee is comprised of Thomas Allen, Cole McFarland and Robert Gayton. The Audit Committee reviews the annual and quarterly financial statements of the Corporation, oversees the annual audit process, the Corporation’s internal accounting controls and the resolution of issues identified by the Corporation’s auditors and recommends to the Board the firm of independent auditors to be nominated for appointment by the shareholders at the next Annual General Meeting.

The Audit Committee has prepared a Charter which is available for viewing on the Corporation’s website atwww.bemagold.com.

- 13 -

Compensation Committee

The Corporation’s Compensation Committee consists of Thomas Allen, Cole McFarland, Neil Woodyer and Robert Cross, of whom only Mr. Woodyer is a related director. The Compensation Committee determines the salary and benefits of the executive officers of the Corporation, determines the general compensation structure, policies and programs of the Corporation, makes recommendations to the Board on the Corporation’s stock option plan and delivers an annual report to shareholders on executive compensation.

Hedging Committee

The Hedging Committee consists of Clive Johnson and Neil Woodyer. The Committee was established to assist the Board in managing the risks involved in the Corporation’s commodity and currency hedging arrangements.

Corporate Governance and Nominating Committee

The Corporation’s Corporate Governance and Nominating Committeeconsists of Clive Johnson, Thomas Allen, Robert Cross and Robert Gayton, of whom only Mr. Johnson is a related director. The Corporate Governance and Nominating Committee assumes responsibility for the following:

| 1. | proposing new nominees to the Board and for assessing the performance of directors on an ongoing basis; |

| | |

| 2. | developing and implementing an orientation and educational program for new recruits to the Board in order to familiarize new directors with the business of the Corporation, its management and professional advisors and its facilities; |

| | |

| 3. | developing and implementing a process for assessing the effectiveness of the Board and its committees and for assessing the contribution of each of the Corporation’s directors; |

| | |

| 4. | continuing to develop the Corporation’s approach to corporate governance issues; and |

| | |

| 5. | reviewing and responding to requests by individual directors of the Corporation to engage outside advisors at the expense of the Corporation. |

Decisions Requiring Prior Approval by the Board

The Board has delegated the day-to-day management of the business and affairs of the Corporation to the senior management of the Corporation, subject to compliance with strategic and capital plans approved from time to time by the Board. Prior approval by the Board is also required in many specific instances under theCanada Business Corporations Act, securities legislation and the rules and policies of the TSX.

Board Performance

It is the responsibility of the Chairman of the Board to ensure the effective operation of the Board. The Chairman meets with directors to discuss the effectiveness of the processes the Board follows and the quality of information provided to the directors by management.

Shareholder Feedback and Concerns

The Corporation seeks to provide to its shareholders clear and accessible information on the Corporation’s operations.

The officers and senior management of the Corporation routinely make themselves available to shareholders to respond to questions and concerns. Shareholder concerns are dealt with on an individual basis, usually by providing requested information. Significant shareholder concerns are brought to the attention of the management of the Corporation or the Board.

- 14 -

Management Performance

The Board expects management of the Corporation to conduct the business of the Corporation in accordance with the Corporation’s ongoing strategic plan and to meet or surpass the annual and long-term goals of the Corporation set by the Board in consultation with management. As part of its annual strategic planning process, the Board specifies its expectation of management both over the next financial year and in the context of the Corporation’s long-term goals. The Board reviews management’s progress in meeting these expectations at Board meetings normally held every quarter.

Disclosure

The Board as a whole is responsible for ensuring disclosure is made pursuant to an appropriate communications policy governing the timeliness and content of the Corporation’s disclosure.

In keeping with the overall responsibility for the stewardship of the Corporation, the Board is responsible for the integrity of the Corporation’s internal control and management information systems. In this regard, the Corporate Governance Committee is establishing a Disclosure Controls and Procedure Policy and a Disclosure Committee which will be comprised of designated members of senior management who will report to the Corporate Governance Committee.

Conclusion

The Corporation has adopted substantially all of the recommendations for improved corporate governance contained in the Guidelines. In certain areas the Board has determined that the TSX guidelines are not appropriate for the conduct of the Corporation’s business at this stage of its development. However, the Board of Directors continuously reviews its corporate governance practices to determine if any changes are necessary.

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS

The following tables sets forth the indebtedness to, or guaranteed or supported by, the Corporation or any of its subsidiaries, of each director, executive officer, senior officer, proposed nominee for election as a director and each associate of any such director, officer or proposed nominee in respect of indebtedness to the Corporation since the beginning of the most recently completed financial year.

Name and

Principal

Position | Involvement

of the

Corporation | Largest

Amount

Outstanding

During Last

Completed

Financial Year | Amount

Outstanding as

At May 1,

2003 | Financially Assisted

Securities Purchases

During Last

Completed

Financial Year | Security for

Indebtedness |

Clive Johnson

Chief Executive

Officer, Chairman and

President | Lender | $55,130(1) $500,000(2) | $55,881(1) $500,000(2) | Nil | Nil |

| (1) | This amount represents the balance of loans originally advanced during 1986 and 1987. The loans were advanced as employee share purchase loans, repayable in annual installment over ten years and, if in default, bear interest at prime plus ¼%. |

| (2) | Interest free loan granted under employment agreement with the Corporation. |

- 15 -

INTEREST OF INSIDERS IN MATERIAL TRANSACTIONS

Other than as set forth below or elsewhere in this Management Proxy Circular and other than transactions carried out in the ordinary course of business of the Corporation or any of its subsidiaries, none of the directors or senior officers of the Corporation, a proposed management nominee for election as a director of the Corporation, any member beneficially owning shares carrying more than 10% of the voting rights attached to the shares of the Corporation nor an associate or affiliate of any of the foregoing persons had since January 1, 2002 being the commencement of the Corporation’s last completed financial year, any material interest, direct or indirect, in any transactions which materially affected or would materially affect the Corporation or any of its subsidiaries, except as disclosed elsewhere in this Management Proxy Circular and except for the fact that certain of the directors or officers of the Corporation are also directors and/or officers and/or securityholders of other publicly traded companies of which the Corporation is the largest shareholder. Particulars of those companies are as follows:

| 1. | Consolidated Westview Resource Corp. (“Westview”), a TSX Venture Exchange listed company of which the Corporation holds approximately 44% of its issued and outstanding shares. Messrs. Clive Johnson, Roger Richer, Tom Garagan and Mark Corra, directors and/or officers of the Corporation are also directors and/or officers and/or securityholders of Westview; |

| | |

| 2. | Consolidated Puma Minerals Corp. (“Puma”), a TSX Venture Exchange listed company of which the Corporation holds approximately 64% of its issued and outstanding shares. Messrs. Clive Johnson, Roger Richer, Jerry Korpan, Tom Garagan, Mark Corra and George Johnson, directors and/or officers of the Corporation are also directors and/or officers and/or securityholders of Puma; and |

| | |

| 3. | Victoria Resource Corporation (“Victoria”), a TSX Venture Exchange listed company of which the Corporation hold approximately 33% of its issued and outstanding shares. Messrs. Clive Johnson, Roger Richer, Tom Garagan and Mark Corra, directors and/or officers of the Corporation are also directors and/or officers and/or securityholders of Victoria. |

The Corporation has, since January 1, 2002, entered into transactions and arrangements with the above referenced companies, however, such transactions and arrangements are not considered material to the Corporation, with the exception of the following:

Effective August 22, 2002, pursuant to an assignment agreement dated May 17, 2002, the Corporation assigned all of its rights to earn up to a 90% interest in the East Pansky platinum-palladium property ("East Pansky"), located in the Kola peninsula of Western Russia, to Puma. In consideration, the Corporation received 4 million common shares of Puma as reimbursement for US$641,000 of the Corporation's expenditures related to the East Pansky property. In addition, the assignment agreement provided for the settlement by Puma of US$2,845,000 ($4,433,000) of accumulated debt owed to Bema by the issuance to Bema of 13 million common shares. The Corporation had previously set up bad debt provisions of US$2,815,000 against this debt in 1998 and 2000. Concurrent with the closing of the transaction, Puma completed an equity financing by issuing 6 million Puma shares for gross proceeds of US$1.5 million ($2.4 million). Upon the completion of this transaction, the Corporation's ownership interest in Puma increased from 33% to 64%.

In addition to the foregoing, the Corporation was involved in the following transactions with Endeavour Financial Corporation (“Endeavour”). Mr. Neil Woodyer, a director of the Corporation is a managing director of Endeavour and is a director of Endeavour Holdings Corporation, the parent company of Endeavour.

- 16 -

Endeavour acted as a financial advisor for each of the Corporation and EAGC on a business combination by way of Plan of Arrangement (the “Arrangement”) which completed on February 14, 2003. Pursuant to an advisory agreement between the Corporation and Endeavour, the Corporation was required to pay to Endeavour a Milestone Fee of US$100,000 upon the entering into of the Arrangement. The Milestone Fee was issued to Endeavour in the form of a promissory note issued on January 10, 2003 convertible into a maximum of 82,590 common shares of the Corporation. In addition, Success Fees of 1% from the Corporation and 2% by EAGC (collectively the “Success Fees”) were payable to Endeavour upon closing of the Arrangement, based on the value of the transaction. The Success Fees were issued to Endeavour, by the Corporation, in the form of convertible promissory notes in the amount of US$1,620,289 and US$760,145 on February 14, 2003, convertible into a maximum of 1,948,938 common shares of the Corporation in aggregate.In addition,prior to the close of the Plan of Arrangement,Endeavour Mining Capital Corporation, a listed company of which Mr. Woodyer is the Chief Financial Officer, held 500,000 EAGC Common Shares and 350,000 Special Warrants of EAGC. As a result of the completion of the business combination by way of Plan of Arrangement, these EAGC Common Shares and EAGC Special Warrants were converted into 850,000 common shares and 175,000 share purchase warrants of the Corporation.

Mr. Robert Cross, a former director of EAGC, held 1,000,000 stock options of EAGC and 2,000,000 common shares of EAGC. As a result of the completion of the business combination by way of Plan of Arrangement, Mr. Cross now holds 2,000,000 common shares of the Corporation. Mr. Cross, following his appointment as a director of the Corporation on March 1, 2003, was granted 1,000,000 Bema options as replacement options. See “Compensation of Directors” above for additional details.

See also “Compensation of Directors” above for details of other consulting arrangements and fees paid directly or indirectly to individuals who are directors of the Corporation.

APPOINTMENT OF AUDITORS

Unless such authority is withheld, the persons named in the accompanying proxy intend to vote for the reappointment of PricewaterhouseCoopers LLP as auditors of the Corporation and to authorize the directors to determine their remuneration. PricewaterhouseCoopers LLP were first appointed auditors of the Corporation on November 6, 1996.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Other than as set forth in this Management Proxy Circular, no person who has been a director or senior officer of the Corporation at any time since the beginning of the last financial year, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of any of the foregoing, has any material interest, directly or indirectly, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon other than the election of directors.

PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

Amendment to the Stock Option Plan

The Corporation has an incentive stock option plan (the "Plan") for the granting of incentive stock options from time to time to directors, employees, officers and consultants providing substantial services to the Corporation and its associated, affiliated, controlled and subsidiary companies (collectively the "Eligible Persons"), as the Board or the duly appointed Compensation Committee of the Board designates. The Corporation first implemented an incentive stock option plan in 1991. The current plan was adopted by shareholders on May 24, 1995 and amended on September 10, 1997, on June 9, 1999 and on June 28, 2002.

Under the Plan, options may be granted to Eligible Persons to purchase from the Corporation such number of its common shares as the Board or its Compensation Committee may designate. Pursuant to paragraph 1 of the current Plan, options may be granted on authorized but unissued common shares up to but not exceeding an aggregate of 19,800,000 common shares of the Corporation, provided that the total number of common shares to be optioned to any one optionee may not exceed 5% of the issued common shares of the Corporation at the time of grant.

- 17 -

There were 3,323,500options outstanding under the predecessor plan on May 24, 1995 when the current Plan was approved. Since that time, the Corporation has granted incentive stock options under the Plan to Eligible Persons for the purchase of an additional 17,348,459 shares. In addition to the grant of 17,348,459 options under the Plan, an additional 1,250,000 stock options were granted to former EAGC option holders as part of completing the business combination by way of Plan of Arrangement with EAGC. Approval was received from the Toronto Stock Exchange for these options to be granted outside of the Corporation’s Stock Option Plan. Of the 17,348,459 options granted under the Plan,7,925,250 representing approximately 2.5% of the current issued and outstanding share capital, remain in effect and unexercised to date.

Management and the Board considers it to be in the best interests of the Corporation for the shareholders to adopt an amendment to paragraph 1 of the Plan to increase the maximum number of common shares reserved for issue under the terms of the Plan by 11,200,000 to 31,000,000in aggregate, subject to regulatory approval. The reservation of the additional 11,200,000shares for options represents less than 4% of the Corporation's presently issued and outstanding share capital. The additional 11,200,000 shares, when added to the current number of options which remain reserved under the Plan of 13,971,750, totals 25,171,750, representing 7.9% of the Corporation’s presently issued and outstanding share capital. As a result, the total amount available for granting under the Amended Plan will be approximately 17,246,500 (representing 5.4% of the Corporation’s presently issued and outstanding share capital), being the total amount of options reserved minus the total amount of options currently outstanding.

Management considers the current proposed amendment to be in the Corporation's best interest because the Plan is designed to give each option holder a parallel interest with the shareholders in preserving and maximizing shareholder value. In addition, it enables the Corporation to attract and retain qualified directors, officers and employees with experience and ability, and to reward these individuals for current and expected future performance.

Under the existing terms of the Plan the purchase price per common share for any option granted under the Plan may not be less than the closing price of the Corporation's shares on The Toronto Stock Exchange on the last trading day immediately preceding the date of the grant. Pursuant to the Plan, options must be granted pursuant to an option agreement in a form that complies with the rules and policies of The Toronto Stock Exchange, which provide as follows:

| (a) | all options granted shall be non-assignable; |

| (b) | an option must be exercisable during a period not extending beyond 10 years from the time of grant. |

It is the Corporation’s current policy to grant maximum 5-year options. In addition, it is also the Corporation’s policy that a vesting provision will apply to all stock options granted such that the option only vests, and becomes exercisable over a defined time period following grant of the options.

In accordance with the rules and policies of The Toronto Stock Exchange, the proposed amendment to the Plan must be approved by a majority of the votes cast at the Meeting. Accordingly, the shareholders will be asked at the Annual and Special General Meeting to pass an ordinary resolution in the following terms:

| "RESOLVED that the amendment of the Corporation's Incentive Stock Option Plan as adopted by the shareholders on May 24, 1995 and amended on September 10, 1997, June 9, 1999 and on June 28, 2002, (the "Plan") to increase the maximum number of shares reserved for stock options under the Plan from 19,800,000 shares to 31,000,000 shares, as more particularly set out in the Management Proxy Circular dated May 13, 2003, is hereby approved." |

An ordinary resolution requires the favourable vote of the shareholders of the Corporation in general meetings by a simple majority of the votes cast in person or by proxy.

Ratification of Amendment to Bylaw No. 1

On July 19, 2002, following shareholder approval, the Corporation elected to continue under theCanada Business Corporations Act (“CBCA”) and ceased to be governed by theCompany Act (British Columbia). As a result of the

- 18 -

continuance, the Corporation adopted By-Laws governing the corporate affairs of the Corporation. The By-Laws of the Corporation, as had the Corporation’s previous Articles of Incorporation, provided for one-third of the directors to retire from office at each Annual General Meeting. The Directors to retire at each Annual General Meeting were those who had been longest in office since their last election or appointment.

On April 16, 2003, as part of a corporate governance review by the Corporation, the Directors approved an amendment to the existing Bylaws to eliminate the staggered terms for directors and to provide for a Director’s term of office to commence on the date on which he is elected or appointed and to expire at the next following Annual General Meeting.

The Directors also approved an amendment to the quorum requirements for general meetings from “a majority of the shares entitled to vote at the meeting” to “two persons present and being or represented by proxy, shareholders holding not less than one-twentieth of the issued shares entitled to vote at the meeting.”

The shareholders are being asked to consider and vote upon an ordinary resolution ratifying and approving the above-mentioned amendments to By-Law No. 1. A copy of the proposed By-Law No. 1 is attached to this Management Proxy Circular as Schedule “A”. Accordingly, the shareholders present at the Meeting will be asked to ratify the following resolution:

| “RESOLVED that the new By-Law No. 1 dated April 16, 2003, which was approved by the Board of Directors on such date and is attached to the Corporation’s Management Proxy Circular dated May 13, 2003, is hereby ratified and confirmed as By-Law No. 1 of the Corporation.” |

An ordinary resolution requires the favourable vote of the shareholders of the Corporation in a general meeting by a simple majority of the votes cast in person or by proxy.

ANY OTHER MATTERS

Pursuant to the CBCA, proposals intended to be presented by shareholders for action at the 2004 Annual General Meeting must comply with the provisions of the CBCA and be deposited at the Corporation’s head office not later than February 13, 2004 in order to be included in the Management Proxy Circular and form of proxy relating to such meeting.

Management of the Corporation knows of no matters to come before the Meeting other than those referred to in the Notice of Meeting accompanying this Management Proxy Circular. However, if any other matters properly come before the Meeting, it is the intention of the persons named in the form of proxy accompanying this Management Proxy Circular to vote the same in accordance with their best judgment of such matters.

A copy of the Corporation’s current Annual Information Form will be provided to any Shareholder by the head office of the Corporation upon request to the secretary or to a person, who is not a security holder of the Corporation, upon payment of a nominal fee.

The contents and the sending of this management proxy Management Proxy Circular have been approved by the Board of Directors of the Corporation.

DATED at Vancouver, British Columbia, this 13th day of May 2003.

- 19 -

CERTIFICATE

The foregoing contains no untrue statement of a material fact and does not omit to state a material fact that is required to be stated or that is necessary to make a statement misleading in light of the circumstances in which it was made.

Dated: May 13, 2003

| “Clive T. Johnson” | “Mark A. Corra” |

| | |

| Clive T. Johnson, Chairman, | Mark A. Corra, |

| Chief Executive Officer and President | Vice President of Finance |

- 1 -

Schedule “A”

BY-LAW NO. 1

| Made by the Directors: | April 16, 2003 |

| Confirmed by the Shareholders: | [June 11, 2003] [to be approved] |

A By-Law relating generally to the transaction of the business and affairs of

BEMA GOLD CORPORATION

(the “Corporation”)

CONTENTS

| ARTICLE 1 | INTERPRETATION | 1 | |

| ARTICLE 2 | BUSINESS OF THE CORPORATION | 3 | |

| ARTICLE 3 | DIRECTORS | 4 | |

| ARTICLE 4 | COMMITTEES | 6 | |

| ARTICLE 5 | OFFICERS | 6 | |

| ARTICLE 6 | PROTECTION OF DIRECTORS, OFFICERS AND OTHERS | 8 | |

| ARTICLE 7 | SHARES | 8 | |

| ARTICLE 8 | MEETINGS OF SHAREHOLDERS | 10 | |

| ARTICLE 9 | DIVIDENDS AND RIGHTS | 13 | |

| ARTICLE 10 | NOTICE | 13 | |

ARTICLE 1

INTERPRETATION

1.1 Definitions –

(a)

| In the By-Laws of the Corporation |

| | |

| (i) | “Act” means the Canada Business Corporations Act and regulations made pursuant thereto, and any statute that may be substituted therefor, as from time to time amended, and any reference to a particular provision of the Act shall be deemed also to be a reference to any similar provision resulting from the amendment or replacement thereof; |

| | | |

| | (ii) | “appoint” includes “elect” and vice-versa; |

| | | |

| | (iii) | “Articles” means the articles attached to the Certificate of Continuance of the Corporation dated July 19, 2002 as may from time to time be amended or restated; |

| | | |

| | (iv) | “Board” means the board of directors of the Corporation; |

- 2 -

| | (v) | “By-Laws” means this By-Law as amended or restated and all other By-Laws of the Corporation from time to time in force and effect; |

| | | |

| | (vi) | “Chair” means the Chairperson of the Board; |

| | | |

| | (vii) | “contracts, documents or instruments in writing” include, without limitation, deeds, mortgages, hypothecs, charges, conveyances, transfers and assignments of property, real or personal, movable or immovable, agreements, releases, receipts and discharges for the payment of money or other obligations, conveyances, transfers and assignments of securities and all paper writings;

|

| | | |

| | (viii) | “meeting of shareholders” includes an annual meeting of shareholders and a special meeting of shareholders; “special meeting of shareholders” means a meeting of any class or classes of shareholders and a special meeting of all shareholders entitled to vote at an annual meeting of shareholders; |

| | | |

| | (ix) | “non-business day” means Saturday, Sunday and any other day that is a holiday as defined in the Interpretation Act (British Columbia) and any statute that may be substituted therefor, as from time to time amended; |

| | | |

| | (x) | “recorded address” means, in the case of a shareholder, the shareholder’s address as recorded in the securities register of the Corporation; and in the case of joint shareholders, the address appearing in such securities register in respect of such joint holding or the first address so appearing if there is more than one; in the case of a director, the director’s latest address as shown in the records of the Corporation or in the last notice of directors or notice of change of directors as filed in accordance with the Act; in the case of an officer or auditor, such person’s address as recorded in the records of the Corporation; and in the case of the Corporation, its registered office; |

| | | |

| | (xi) | “Signing Officer” means, in relation to any contracts, documents or instruments in writing, any person authorized to sign the same on behalf of the Corporation by section 2.2 or by any resolution passed pursuant thereto and, with respect to certificates for shares of the Corporation, means any person authorized to sign the same on behalf of the Corporation by or pursuant to section 7.7; and |

| | | |

| | (xii) | “Unanimous Shareholders Agreement” means a written agreement among all the shareholders of the Corporation, or among all the shareholders and one or more persons who are not shareholders or a written declaration of a person who is the beneficial owner of all the issued shares of the Corporation, that restricts, in whole or in part, the powers of the directors to manage, or supervise the management of, the business and affairs of the Corporation, as from time to time amended. |

| | |

(b)

| Subject to sub-section 1.1(a), terms defined in the Act and used herein shall, unless the context otherwise requires, have the same meaning herein as in the Act.

|

1.2 Gender and Number – In this By-Law, words importing the singular number include the plural and vice versa and words importing the masculine gender include the feminine and neuter genders.

1.3 References – The terms “herein”, “hereof”, “hereby” and similar expressions refer to this By-Law and not to any particular section or other portion hereof. References to an article, section, subsection or paragraph shall be construed as references to an article, section, subsection or paragraph of this By-Law unless the context otherwise requires.

1.4 Headings – The division of this By-Law into articles and sections and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation hereof.

- 3 -

ARTICLE 2

BUSINESS OF THE CORPORATION