BEMA GOLD CORPORATION

Suite 3100, Three Bentall Centre

595 Burrard Street

Vancouver, British Columbia V7X 1J1

Tel: (604) 681-8371

Fax: (604) 681-6209

| | | |

| 2005 | | Notice of Annual and Special General Meeting of Shareholders |

| | | |

| ANNUAL AND | | Management Proxy Circular |

| | | |

| SPECIAL GENERAL | | Form of Proxy |

| | | |

| MEETING | | Return Card |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Place: | | Versailles "A" Room |

| | | Sutton Place Hotel |

| | | 845 Burrard Street |

| | | Vancouver, British Columbia |

| | | |

| Time: | | 2:00 p.m. |

| | | |

| Date: | | Thursday, June 23, 2005 |

BEMA GOLD CORPORATION

NOTICE OF ANNUAL AND SPECIAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual and Special General Meeting of Shareholders ofBEMA GOLD CORPORATION (hereinafter called the "Corporation") will be held in the Versailles "A" Room, Sutton Place Hotel, 845 Burrard Street, Vancouver, British Columbia, on Thursday, the23rd day of June, 2005 at 2:00 p.m. (local time), for the following purposes:

| 1. | To receive the report of the Directors; |

| |

| 2. | To receive the audited consolidated financial statements of the Corporation for the fiscal year ended December 31, 2004 (with comparative statements relating to the preceding fiscal period) together with the report of the Auditors thereon; |

| |

| 3. | To determine the number of Directors at nine (9); |

| |

| 4. | To elect Directors; |

| |

| 5. | To appoint Auditors and to authorize the Directors to fix their remuneration; |

| |

| 6. | To approve by ordinary resolution the adoption of a new stock option plan to replace the Corporation’s current incentive stock option plan, (as described in the Management Proxy Circular) reserving for the grant of options up to a maximum of 10% of the issued and outstanding shares of the Corporation at the time of any stock option grant; and |

| |

| 7. | To transact such further or other business as may properly come before the meeting or any adjournment or adjournments thereof. |

Accompanying this Notice is the Corporation’s Annual Report containing the Directors' Report referred to in Item 1 above, as well as the Corporation's audited consolidated financial statements for the fiscal year ended December 31, 2004, a Management Proxy Circular, a form of Proxy and a return card. The accompanying Management Proxy Circular provides information relating to the matters to be addressed at the meeting and is incorporated into this Notice.

Shareholders are entitled to vote at the meeting either in person or by proxy. Those who are unable to attend the meeting are requested to read, complete, sign and mail the enclosed form of proxy in accordance with the instructions set out in the proxy and in the Management Proxy Circular accompanying this Notice. Please advise the Corporation of any change in your mailing address.

DATED at Vancouver, British Columbia, this 13th day of May, 2005.

BY ORDER OF THE BOARD

BEMA GOLD CORPORATION

“Clive T. Johnson”

Clive T. Johnson

Chairman, President and Chief Executive Officer

- - 2 -

BEMA GOLD CORPORATION

Suite 3100, Three Bentall Centre

595 Burrard Street

Vancouver, B.C. V7X 1J1

MANAGEMENT PROXY CIRCULAR

(Containing information as at May 9, 2005, unless indicated otherwise)

SOLICITATION OF PROXIES

This Management Proxy Circular is furnished in connection with the solicitation of proxies by the management ofBEMA GOLD CORPORATION (the "Corporation") for use at the Annual and Special General Meeting (the “Meeting”) of the Shareholders of the Corporation (and any adjournment thereof) to be held onThursday, June 23, 2005, at the time and place and for the purposes set forth in the accompanying Notice of Meeting. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the regular employees of the Corporation at nominal cost. All costs of solicitation by management will be borne by the Corporation.

The contents and the sending of this Management Proxy Circular have been approved by the directors of the Corporation.

APPOINTMENT OF PROXIES

The individuals named in the accompanying form of proxy are Clive Johnson, the President, Chairman and Chief Executive Officer and a director of the Corporation and Roger Richer, the Secretary, General Counsel and Vice President, Administration of the Corporation.A SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON (WHO NEED NOT BE A SHAREHOLDER) TO REPRESENT HIM AT THE MEETING HAS THE RIGHT TO DO SO, EITHER BY STRIKING OUT THE NAMES OF THOSE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY AND INSERTING THE DESIRED PERSON’S NAME IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY OR BY COMPLETING ANOTHER FORM OF PROXY. A proxy will not be valid unless the completed form of proxy is received byCOMPUTERSHARE TRUST COMPANY OF CANADA, Proxy Dept. of 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof or may be accepted by the Chairman of the Meeting prior to the commencement of the Meeting.

REVOCATION OF PROXIES

A shareholder who has given a proxy may revoke it by an instrument in writing executed by the shareholder or by his attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered to the registered office of the Corporation, at Suite 3350, 1055 Dunsmuir Street, Vancouver, British Columbia, V7X 1J1 at any time up to and including the last business day preceding the day of the Meeting, or if adjourned, any reconvening thereof, or to the Chairman of the Meeting on the day of the meeting or, if adjourned, any reconvening thereofor in any other manner provided by law. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

INFORMATION FOR NON-REGISTERED SHAREHOLDERS

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of the Corporation are “non-registered” shareholders because the shares they own are not registered in their names but are instead registered in the names of a brokerage firm, bank or other intermediary or in the name of a clearing agency. Shareholders who do not hold their shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only registered shareholders may

- 3 -

vote at the Meeting.If common shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those common shares will not be registered in such shareholder’s name on the records of the Corporation. Such common shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities, which company acts as nominee for many Canadian brokerage firms). Common shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted (for or against resolutions) at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the brokers’ clients. Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

In accordance with National Instrument 54-101 of the Canadian Securities Administrators, the Corporation has distributed copies of the Notice of Meeting, this Management Proxy Circular and the Proxy to the clearing agencies and intermediaries for onward distribution to Beneficial Shareholders.

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting. Often the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided by the Corporation to the registered shareholders. However, its purpose is limited to instructing the registered shareholder (ie. the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to ADP Investor Communications Services (“ADP”). ADP typically prepares a machine-readable voting instruction form, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the forms to ADP, or otherwise communicate voting instructions to ADP (by way of the internet or telephone, for example). ADP then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting.A Beneficial Shareholder who receives an ADP voting instruction form cannot use that form to vote common shares directly at the Meeting. The voting instruction form must be returned to ADP (or instructions respecting the voting of common shares must be communicated to ADP) well in advance of the Meeting in order to have the common shares voted.

All references to shareholders in this Management Proxy Circular and the accompanying form of Proxy and Notice of Meeting are to shareholders of record unless specifically stated otherwise.

VOTING OF PROXIES

SHARES REPRESENTED BY PROPERLY EXECUTED PROXIES IN FAVOUR OF PERSONS DESIGNATED IN THE ENCLOSED FORM OF PROXY WILL BE VOTEDFOR ALL MATTERS TO BE VOTED ON AT THE MEETING AS SET OUT IN THIS MANAGEMENT PROXY CIRCULAR OR WITHHELD FROM VOTING IF SO INDICATED ON THE FORM OF PROXY.

The common shares represented by proxies will, on any poll where a choice with respect to any matter to be acted upon has been specified in the form of Proxy, be voted in accordance with the specification made.

SUCH COMMON SHARES WILL, ON A POLL, BE VOTEDIN FAVOUR OF EACH MATTER FOR WHICH NO CHOICE HAS BEEN SPECIFIED OR WHERE BOTH CHOICES HAVE BEEN SPECIFIED BY THE SHAREHOLDER.

The enclosed form of Proxy when properly completed and delivered and not revoked confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the enclosed form of Proxy to vote in accordance with their best judgment on such matters or

- 4 -

business. At the time of the printing of this Management Proxy Circular, the management of the Corporation knows of no such amendment, variation or other matter which may be presented to the Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation is authorized to issue an unlimited number of common shares without par value (“common shares”), of which 400,636,569 fully paid and non-assessable common shares were issued and outstanding as of May 6, 2005 (the “Record Date”).

Only registered Shareholders at the close of business on the Record Date, who either personally attend the Meeting or who have completed and delivered a form of proxy in the manner and subject to the provisions described above shall be entitled to vote or to have their shares voted at the Meeting.

On a show of hands, every individual who is present as a Shareholder or as a representative of one or more corporate Shareholders, or who is holding a proxy on behalf of a Shareholder who is not present at the Meeting, will have one vote, and on a poll every Shareholder present in person or represented by a proxy and every person who is a representative of one or more corporate Shareholders, will have one vote for each common share registered in his name on the list of shareholders, which is available for inspection during normal business hours at Computershare Trust Company of Canada and will be available at the Meeting.

To the knowledge of the directors and senior officers of the Corporation, there are no persons or companies who beneficially own, directly or indirectly or exercise control or direction over shares carrying more than 10% of the voting rights attached to all outstanding shares of the Corporation.

ELECTION OF DIRECTORS

The Board of Directors presently consists of nine directors and it is intended to elect nine directors for the ensuing year.

On June 9, 1989 the By-Laws of the Corporation were amended by special resolution in order to provide for three year staggered terms for the election of directors of the Corporation. On April 16, 2003, as part of a corporate governance review by the Corporation, the By-Laws were amended by the Board of Directors to remove the staggered terms for the election of directors and to have the directors retire each year and stand for re-election at the Corporation’s Annual General Meeting. A retiring director is eligible for re-election and shall act as a director throughout the meeting at which he retires.

In accordance with theCanada Business Corporations Act, the amendment to the By-Laws took effect when adopted by the Board of Directors, although the amendment was also ratified by the Shareholders of the Corporation at the Annual General Meeting held on June 11, 2003.

The following table and notes thereto set out the names of Management’s nominees for election as directors, the province/state and country in which each is ordinarily resident, all offices of the Corporation and Board committee positions now held by each, their principal occupation, the period of time for which each has been a director of the Corporation, and the number of common shares of the Corporation beneficially owned, directly or indirectly, or over which each exercises control or direction, as at the date hereof.

- - 5 -

| | | | Number of Shares |

| | Principal Occupation and, if not | | Beneficially Owned |

| | at present an Elected Director, | | or Directly / |

| Name, Position, Province/State | Occupation During the Past | Previous Service | Indirectly |

| and Country of Residence(1) | Five Years(1) | as a Director(1) | Controlled(1) |

| | | | |

| | | | |

| ALLEN, Thomas I.A.(2)(4)(7) | Senior partner in the Toronto law firm | November 24, 1998 | 10,000 |

| Director | of Ogilvy Renault since October | | |

| Ontario, Canada | 1996. | | |

| | | | |

| ANGUS, R. Stuart(3) | Managing Director, Mergers and | June 18, 1992 | 126,879 |

| Director | Acquisitions, of Endeavour Financial | | |

| British Columbia, Canada | Corporation, a private financial and | | |

| | corporate advisory firm specializing | | |

| | in the mining industry, since | | |

| | November 1, 2003. Prior to that | | |

| | senior partner in the law firm of | | |

| | Fasken Martineau DuMoulin LLP. | | |

| | | | |

| CROSS, Robert M.D.(2)(3) | Executive Chairman of Northern | March 1, 2003 | 100,000 |

| Director | Orion Resources Inc. and Non- | | |

| British Columbia, Canada | Executive Chairman of Bankers | | |

| | Petroleum Ltd. Served as Chairman | | |

| | and Chief Executive Officer of | | |

| | Yorkton Securities from 1996 to | | |

| | 1998. | | |

| | | | |

| GAYTON, Robert J.(2)(4)(5)(8) | Chartered Accountant. Director of | April 1, 2003 | 27,500 |

| Director | various public companies including | | |

| British Columbia, Canada | Intrynsic Software, Nevsun Resources | | |

| | Ltd., Northern Orion Resources Inc. | | |

| | and Amerigo Resources Ltd. | | |

| | | | |

| | | | |

| JOHNSON, Clive T.(2)(5) | Chairman, President and Chief | December 5, 1988 | 454,392(6) |

| Chairman, President, Chief | Executive Officer of the Corporation. | | |

| Executive Officer and Director | | | |

| British Columbia, Canada | | | |

| | | | |

| KORPAN, Jerry R. | Executive Director of Emergis | June 28, 2002 | 500,000 |

| Director | Capital, a property development | | |

| London, England | company based in Antwerp, Belgium, | | |

| | since April 2001. | | |

| | | | |

| MCFARLAND, Cole E.(3)(4) | Retired since 1995. Prior thereto | November 24, 1998 | 8,100 |

| Director | President and Chief Executive | | |

| California, U.S.A. | Officer, Placer Dome U.S. since | | |

| | 1987. | | |

| | | | |

| PÉREZ-COTAPOS, Eulogio | Senior partner in the law firm of | June 20, 1997 | 0 |

| Director | Cariola, Diez, Pérez-Cotapos & Cia. | | |

| Santiago, Chile | Ltda. in Santiago, Chile. | | |

| | | | |

| RAYMENT, Barry D. | Principal of Mining Assets | December 5, 1988 | 31,162 |

| Director | Corporation, a technical consulting | | |

| California, U.S.A. | firm which provides services to the | | |

| | mining industry. | | |

- 6 -

NOTES:

| (1) | The information as to province/state and country of residence, principal occupation and the number of shares beneficially owned or over which a Director exercises control or direction, not being within the knowledge of the Corporation, has been furnished by the respective Directors individually. |

| (2) | Denotes member of the Corporate Governance and Nominating Committee. |

| (3) | Denotes member of the Compensation Committee. |

| (4) | Denotes member of the Audit Committee. |

| (5) | Denotes member of the Hedging Committee. |

| (6) | Of these shares, 9,233 are held by 392611 B.C. Ltd., a private corporation wholly owned by Mr. Johnson. |

| (7) | Mr. Allen was a former director of Unisphere Waste Conversion Ltd. ("Unisphere") until February 9, 2005, when he resigned from that position. On February 25, 2005, within one year of Mr. Allen's resignation, Unisphere filed a Notice of Intention to make a proposal to its creditors under theBankruptcy and Insolvency Act(Canada). |

| (8) | Mr. Gayton was a director/officer of New Coast Silver Mines at the date of a cease trade order issued by the B.C. Securities Commission on September 30, 2003 and by the Alberta Securities Commission on October 31, 2003 for failure to file financial statements. The orders were revoked on October 23, 2003 and March 25, 2004 respectively. |

The Corporation does not have an Executive Committee.

EXECUTIVE COMPENSATION

1. Summary Compensation Table

The Corporation currently has five "named executive officers" as set out in the table below. Named Executive Officers means the Chief Executive Officer ("CEO") and the Chief Financial Officer ("CFO") of the Corporation, or if the Corporation does not have a CFO, an individual which acted in a similar capacity, regardless of the amount of compensation of that individual, each of the Corporation's three most highly compensated executive officers other than the CEO and CFO, who were serving as executive officers at the end of the most recent financial year and whose total salary and bonus amounted to $150,000 or more.

The following table sets forth compensation information for services in all capacities to the Corporation and its subsidiaries for the three fiscal years ended December 31, 2004, 2003 and 2002 by the CEO, the CFO and the other three most highly compensated executive officers of the Corporation: All figures are in Canadian dollars unless otherwise indicated.

- 7 -

Name and Position

Of Principal

| Year

| Annual Compensation | Long-Term Compensation | All

Other

Compen-

sation

(Cdn$)(4)

|

| Awards | Payouts |

Salary

(Cdn $)

| Bonus

(Cdn$)

| Other

Annual

Compen-

sation

(Cdn$)(1)

| Securities

Under

Options/SARs

Granted(#)(2)

| Restricted

Shares/Units

Awarded(#)

| LTIP

Payouts

($)

|

Clive Johnson

Chief Executive Officer,

Chairman, and President

| 2004

2003

2002

| 600,900

551,311

398,830

| 600,000

500,000

74,051

| 39,804

37,148

31,416

| 1,000,000(3)

2,500,000

1,000,000

| N/A

N/A

N/A

| N/A

N/A

N/A

| 1,412

1,412

1,412 |

Roger Richer

Vice President

Administration, General

Counsel and Secretary

| 2004

2003

2002

| 275,900

253,155

183,507

| 165,000

225,000

34,708

| 17,080

17,880

16,452

| 250,000(3)

600,000

200,000

| N/A

N/A

N/A

| N/A

N/A

N/A

| Nil

Nil

Nil |

Tom Garagan

Vice President,

Exploration

| 2004

2003

2002

| 260,900

241,905

183,507

| 156,000

175,000

34,708

| 17,880

14,280

2,052

| 250,000(3)

600,000

200,000

| N/A

N/A

N/A

| N/A

N/A

N/A

| Nil

Nil

Nil |

George Johnson

Senior Vice President,

Operations

| 2004

2003

2002

| 329,808

313,397

276,056

| 195,000

225,000

21,250

| 18,082

17,880

16,452

| 250,000(3)

600,000

200,000

| N/A

N/A

N/A

| N/A

N/A

N/A

| Nil

Nil

Nil |

Mark Corra

Vice President,

Finance | 2004

2003

2002

| 250,900

234,405

182,674

| 150,000

175,000

11,250

| 18,405

18,405

16,977

| 250,000(3)

500,000

200,000

| N/A

N/A

N/A

| N/A

N/A

N/A

| Nil

Nil

Nil |

| | (1) | Includes car allowance, parking, club membership and imputed interest on loans. |

| | (2) | Figures represent only options granted during a particular year; see “Aggregated Option Exercises” table below for the aggregate number of options outstanding at year-end; |

| | (3) | 50% of these options were vested as at December 31, 2004 and the remaining 50% vested on April 13, 2005; and |

| | (4) | Includes Private Long Term Disability Insurance. |

2. Long-Term Incentive Plans – Awards in Most Recent Completed Financial Year

Long term incentive plan awards (“LTIP”) means “any plan providing compensation intended to serve as an incentive for performance to occur over a period longer than one financial year whether performance is measured by reference to financial performance of the Corporation or an affiliate, or the price of the Corporation’s shares but does not include option or stock appreciation right plans or plans for compensation through restricted shares or units”. The Corporation has not granted any LTIP’s during the past fiscal year.

3. Options and SARs

Stock appreciation rights (“SAR’s”) means a right, granted by an issuer or any of its subsidiaries as compensation for services rendered or in connection with office or employment, to receive a payment of cash or an issue or transfer of securities based wholly or in part on changes in the trading price of the Corporation’s common shares. There were no SAR's granted to or exercised by the Named Executive Officers during the fiscal year ended December 31, 2004.

- 8 -

4. Option/SAR Grants in Last Fiscal Year

The following table sets forth stock options granted under the Corporation's Stock Option Plan (the "Stock Option Plan") to each of the Named Executive Officers, during the fiscal year ended December 31, 2004.

| Name | Securities

Under

Options/SARs

Granted (#)(1)(4) | % of Total

Options/SARs

Granted in

Fiscal year(2)(4) | Exercise or

Base Price

($/Security)(3) | Market Value of

Securities Underlying

Options/SARs on

Date of Grant

($/Security)(4) | Expiration

Date |

| Clive Johnson | 1,000,000 | 21.9 | 4.07 | 4.07 | April 12, 2014 |

| Roger Richer | 250,000 | 5.5 | 4.07 | 4.07 | April 12, 2014 |

| Tom Garagan | 250,000 | 5.5 | 4.07 | 4.07 | April 12, 2014 |

| George Johnson | 250,000 | 5.5 | 4.07 | 4.07 | April 12, 2014 |

| Mark Corra | 250,000 | 5.5 | 4.07 | 4.07 | April 12, 2014 |

| | (1) | Number of common shares of the Corporation to be acquired on the exercise of stock options. |

| | (2) | Percentage of all options granted during the last fiscal year (a total of 4,570,000 options were granted in 2004, representing 1.1% of the current issued and outstanding shares of the Corporation). |

| | (3) | The exercise price of stock options is set at not less than 100% of the market value of the common shares of the Corporation on the date of grant. The exercise price of stock options may be adjusted in the event that specified events cause dilution of the Corporation’s share capital. |

| | (4) | No SARS were granted during the fiscal year ended December 31, 2004. |

5. Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth details of all exercises of stock options during the fiscal year ended December 31, 2004 by each of the Named Executive Officers and the fiscal year-end value of unexercised options on an aggregated basis:

| Name | Securities

Acquired on

Exercise

(#) (1) | Aggregate

Value

Realized

($)(2) | Unexercised

Options/SARs at

Fiscal Year-End (#)(3)

Exercisable/

Unexercisable | Value of Unexercised

In-the-Money Options/

SARs at Fiscal

Year-End ($)(3)(4)

Exercisable/Unexercisable |

| Clive Johnson | 500,000

750,000 | $1,560,000

$1,312,500 | 2,400,000 / 1,350,000 | $4,254,500/$1,853,000 |

Roger Richer

| 200,000 | $480,000 | 125,000 / 325,000 | 0/ $436,000 |

| Tom Garagan | 200,000

100,000 | $538,000

$224,000 | 425,000 / 325,000 | $654,000/ $436,000 |

| George Johnson | 50,000

200,000 | $179,000

$570,000 | 525,000 / 325,000 | $872,000/ $436,000 |

| Mark Corra | 50,000

200,000 | $177,500

$480,000 | 355,000 / 295,000 | $546,400/ $370,600 |

| | (1) | Number of shares of the Corporation acquired on the exercise of options. |

| | (2) | Calculated using the difference between the exercise price and the closing price of common shares of the Corporation on the Toronto Stock Exchange on the date of exercise. |

| | (3) | As freestanding SARs have not been granted, the number relates solely to options. |

| | (4) | Value of unexercised in-the-money options calculated using the closing price of common shares of the Corporation on the Toronto Stock Exchange on December 31, 2004 of $3.67, less the exercise price of in-the-money options. |

- 9 -

6. Option Repricings

No options were repriced during the fiscal year ended December 31, 2004.

7. Defined Benefit or Actuarial Plan Disclosure

The Corporation does not provide retirement benefits for directors and executive officers.

8. Termination of Employment, Change in Responsibilities and Employment Contracts

As at December 31, 2004 the Corporation has five Named Executive Officers as set out in the Summary Compensation Table above. The Corporation has a formal employment agreement (the “Employment Agreement”) dated and approved by the Board on July 3, 1990, as amended August 29, 1991, with Clive Johnson, one of its Named Executive Officers. The Employment Agreement has an indefinite term and is subject to termination in certain events. In the event of termination of Mr. Johnson’s employment for other than just cause (as defined therein) the Employment Agreement provides for payment by the Corporation of a severance allowance payable as follows:

(1) an amount equal to his aggregate salary for the preceding 12 months, payable at the time of termination;

(2) an amount equal to 100% of such aggregate salary, payable one year after termination; and

(3) an amount equal to 100% of such aggregate salary, payable two years after termination.

The Employment Agreement provides that if any such severance allowance is paid, Mr. Johnson is prohibited from engaging in any activity competitive with the Corporation’s business, which includes engaging in mining operations within an area of five miles from any mineral properties being explored or developed by the Corporation at termination, for a period of one year following termination, except with the written consent of the Corporation.

The Employment Agreement provides for an annual review of the salary of Mr. Johnson and a minimum annual increase of 10%. The current salary is fixed at $660,000 per annum. Mr. Johnson’s 10% increase was deferred for the years 2001 and 2002. In addition, pursuant to the Employment Agreement, Mr. Johnson receives a car allowance of $14,400 per annum.

Each of Messrs. Richer, Garagan, Corra and George Johnson, all Named Executive Officers, has an employment agreement with the Corporation that contain provisions for payment of severance payments on termination that are identical to the Employment Agreement of Mr. Clive Johnson as described above. Under the terms of these employment agreements the salaries are subject to review annually however there is no minimum increase. There were no salary increases under the employment agreements for Messrs. Richer, Garagan and Johnson for the years 2001 and 2002. In 2003, 2004 and 2005, the salaries were increased and the current annual salaries under these employment agreements are as follows:

| | Roger Richer | $302,500 | |

| | Tom Garagan | $286,000 | |

| | George Johnson | $357,500 | |

| | Mark Corra | $275,000 | |

- 10 -

9. Composition of the Compensation Committee

The Compensation Committee of the Board of Directors of the Corporation is comprised of R. Stuart Angus, Robert Cross and Cole McFarland, all directors of the Corporation none of whom is or was during the most recently completed year an officer or employee of the Corporation or any of its subsidiaries. Mr. Angus is Managing Director of Merger and Acquisitions for Endeavour Financial Ltd. ("Endeavour"). See "Compensation of Directors" and "Interest of Informed Persons in Material Transactions" below for fees paid to Endeavour during the financial year ended December 31, 2004.

10. Report on Executive Compensation

The Corporation’s executive compensation program is supervised by the Compensation Committee (the “Committee”) of the Board of Directors. The Committee has, as part of its mandate, responsibility for reviewing recommendations from management for subsequent approval by the Board of Directors with respect to the appointment and remuneration of executive officers of the Corporation. The Committee also monitors the performance of the Corporation’s executive officers and reviews the design and competitiveness of the Corporation’s executive compensation plans.

Executive Compensation Program

The Corporation’s executive compensation program is based on a pay for performance philosophy. It is comprised of three elements:

| 1. | base salaries which are set at levels which are competitive with the base salaries paid by corporations of a comparable size within the mining industry and with operations at approximately the same state, thereby enabling the Corporation to compete for and retain executives critical to the Corporation’s long term success; |

| 2. | annual bonuses which are considered from time to time, based on individual and corporate performance criteria; and |

| 3. | share ownership opportunities through a stock option plan which provides additional incentive and aligns the interests of executive officers with the longer term interests of shareholders. |

As an executive officer’s level of responsibility increases, a greater percentage of total compensation is based on performance (as opposed to base salary and standard employee benefits) as the mix of total compensation shifts towards a greater emphasis on bonus and stock options, thereby increasing the mutual interest between executive officers and shareholders. The level of base salary for each employee within a specified range is determined by past performance, as well as by the level of responsibility and the importance of the position to the Corporation.

The Committee’s recommendations for base salaries and bonuses, if any, for the executive officers, are submitted to the Board of Directors of the Corporation for approval.

Stock Options

The Corporation’s Stock Option Plan (“the Stock Option Plan”) is administered by the Board of Directors. The Compensation Committee makes recommendations to the Board for grants of stock options under the Stock Option Plan.The Stock Option Plan is designed to give each option holder an interest in preserving and maximizing shareholder value in the longer term, to enable the Corporation to attract and retain individuals with experience and ability and to reward individuals for current performance and expected future performance.

The number of stock options which may be issued under the current Stock Option Plan in aggregate and in respect of any fiscal year is limited under the terms of the current Stock Option Plan and cannot be increased without shareholder approval. Stock options usually have a ten year term, and are exercisable at the market price (as defined in the Stock Option Plan) of the Corporation’s common shares on the date of grant. A holder of stock options must be a director, officer or employee of or consultant to the Corporation or its associated, affiliated, controlled or subsidiary companies in order to exercise stock options. See “Particulars of Other Matters to be Acted Upon” below for details of the proposed resolution to amend the Stock Option Plan.

- 11 -

Other Compensation

The Corporation’s Chief Executive Officer has entered into an employment agreement with the Corporation which specifies the minimum increase in the level of annual base salary to be paid to such executive, as well as other terms of employment (see “Termination of Employment, Change in Responsibilities and Employment Contracts” above for a more detailed description).

The foregoing report, dated May 9, 2005, was reviewed by R. Stuart Angus, Robert Cross and Cole McFarland.

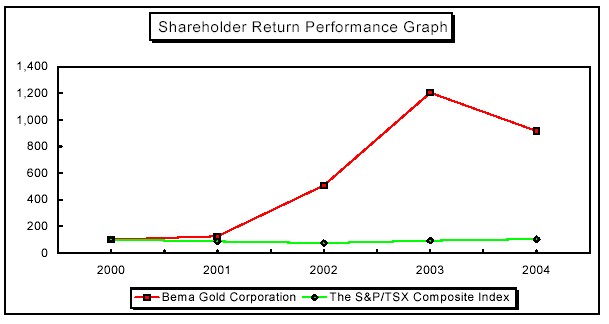

11. Performance Graph

The chart below compares the yearly percentage change in the cumulative total shareholder return on the Corporation’s common shares against the cumulative total shareholder return of the TSX 300 Stock Index for the five fiscal year period commencing January 1, 2000 and ending December 31, 2004.

Note: Assumes that the initial value of the investments on the Toronto Stock Exchange in the Corporation's common shares and in each of the indices was $100.00 on January 1, 2001 and that any dividends were reinvested.

12. Compensation of Directors

Currently each of the non-executive directors is paid an annual retainer of $20,000, and a meeting fee of $1,500 per board meeting attended. The annual retainer payable to the Chairman of the Audit Committee is $7,500 and the annual retainer for the Chairmen of the other committees is $5,000. In addition, directors who are also members of board committees, receive a fee of $1,500 per committee meeting attended.

- 12 -

In 2004, the following amounts were paid to directors with respect to the above services:

| | Board

Meetings

Attended | Audit

Committee

Meetings | Corporate

Governance and

Nominating

Committee Meetings | Compensation

Committee

Meetings | Total

Compensation

Paid |

| Thomas Allen | 7 | 5 | 2 | N/A | $46,000 |

| R. Stuart Angus | 6 | N/A | N/A | 4 | $35,000 |

| Eulogio Pérez-Cotapos | 6 | N/A | N/A | N/A | $29,000 |

| Cole McFarland | 6 | 5 | N/A | 4 | $42,500 |

| Barry Rayment | 7 | N/A | N/A | N/A | $30,500 |

| Jerry Korpan | 5 | N/A | N/A | N/A | $27,500 |

| Robert Cross | 6 | N/A | 2 | 4 | $43,000 |

| Robert Gayton | 7 | 5 | 2 | N/A | $48,500 |

Mr. R. Stuart Angus is a director of the Corporation and is Managing Director, Mergers and Acquisitions of Endeavour Financial Ltd. (“Endeavour”). Endeavour, under certain financial consulting arrangements with the Corporation, charged the Corporation $145,247 as consulting fees for financial advisory services rendered and out-of-pocket expenses during the fiscal year ended December 31, 2004. See “Interest of Insiders in Material Transactions” below for further details regarding additional transactional fees paid to Endeavour during the year.

Mr. Eulogio Pérez-Cotapos, senior partner in the law firm of Cariola, Diez, Pérez-Cotapos & Cia. Ltd., in Santiago, Chile and a director of the Corporation, charged the Corporation $54,331 for professional services rendered and out-of-pocket expenses during the 2004 financial year.

Mr. Jerry Korpan, a director of the Corporation, also provides consulting services to the Corporation. During the 2004 financial year, Mr. Korpan was paid a total of $84,000 for corporate/investor relations consulting services rendered in the United Kingdom and Europe and out-of-pocket expenses, pursuant to the terms of a consulting agreement between the Corporation and Mr. Korpan.

The Corporation granted stock options to certain directors who are not Named Executive Officers. The following table sets forth stock options granted by the Corporation during the fiscal year ended December 31, 2004, to directors who are not named Named Executive Officers of the Corporation, as a group:

Name

| Securities

Under

Options/SARs

Granted (#)(1)

| % of Total

Options/SARs

Granted in

Fiscal year(2)

| Exercise or

Base Price

($/Security)(3)

| Market Value of

Securities Underlying

Options/SARs on

Date of Grant

($/Security)

| Expiration

Date |

Directors who are

notnamed Executive

Officers (8 persons) | 800,000 | 18% | $4.07 | $4.07 | June 9, 2014 |

| (1) | Number of common shares of the Corporation which may be acquired on the exercise of stock options. |

| (2) | Percentage of all options granted during the last fiscal year. |

| (3) | The exercise price of stock options is set at not less than 100% of the market value of the common shares of the Corporation on the date of grant. The exercise price of stock options may be adjusted in the event that specified events cause dilution of the Corporation’s share capital. |

- 13 -

The following table sets forth details of all exercises of stock options during the fiscal year ended December 31, 2004 by directors who are not Named Executive Officers of the Corporation, as a group, and the fiscal year-end value of unexercised options on an aggregated basis:

Name

| Securities

Acquired on

Exercise

(#)(1)

| Aggregate

Value

Realized

($)(2)

| Unexercised

Options at Fiscal

Year-End

Exercisable/

Unexercisable

| Value of Unexercised

In-the-Money Options

at Fiscal Year-End

Exercisable/

Unexercisable ($)(3) |

Directors who are not

Named Executive Officers

(8 persons) | 765,000 | 1,801,800 | 3,152,000 / 1,233,000 | $5,560,560/ $1,815,940 |

| | (1) | Number of common shares of the Corporation acquired on the exercise of stock options. |

| | (2) | Calculated using the difference between the exercise price and the closing price of common shares of the Corporation on the Toronto Stock Exchange on the date of exercise. |

| | (3) | Value using the closing price of common shares of the Corporation on the Toronto Stock Exchange on December 31, 2004 of $3.67 per share, less the exercise price per share. |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information regarding compensation plans under which securities of the Corporation are authorized for issuance in effect as of the end of the Corporation’s most recently completed financial year ended December 31, 2004:

Plan Category

| Number of Securities to

be Issued Upon Exercise

of Outstanding Options,

Warrants and Rights

(a) | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

(b) (Cdn$) | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding

Securities Reflected in

Column (a))

(c) |

Equity Compensation Plans

Approved By Shareholders

| 15,091,041 | 2.31 | 10,101,967 |

Equity Compensation Plans Not

Approved By Shareholders(1)

(stock options)

| 1,000,000 | 1.40 | N/A |

Equity Compensation Plans Not

Approved By Shareholders

(warrants) | 25,286,650 | 1.87 | N/A |

| (1) | These options (the “EAGC Options”), were granted to a former option holder of EAGC Ventures Corp. (“EAGC”) as part of a business combination between the Corporation and EAGC in 2003. |

See "Replacement of Stock Option Plan" below for a description of the current Stock Option Plan and the description for the proposed new stock option plan.

- 14 -

STATEMENT OF CORPORATE GOVERNANCE REPORT PRACTICES

General

In July 2000, the Toronto Stock Exchange (the “TSX”), the TSX Venture Exchange and the Canadian Institute of Chartered Accountants mandated the Joint Committee on Corporate Governance to review and modify the TSX Corporate Governance Guidelines (the “Guidelines”) originally introduced in 1995. Particulars of the Corporation’s corporate governance practices and procedures are set forth below, together with the plans of the Board of Directors of the Corporation (the “Board”) to assure a greater degree of compliance with the Guidelines during the current and future fiscal years of the Corporation.

| | | |

| TSX Corporate | | |

| Governance Guidelines | | Bema's Approach |

| | | | | |

| 1. | The board should explicitly assume responsibility for stewardship of the Company and, as part of the overall stewardship, assume responsibility for: | | The mandate of the Board is to supervise the management of the business and affairs of the Corporation. The Board’s principal responsibilities are to supervise and evaluate management, to oversee the conduct of the Corporation’s business, to set policies appropriate for the business of the Corporation and to approve corporate strategies and goals. The Board is to carry out its mandate in a manner consistent with the fundamental objective of enhancing shareholder value. Every director is required to act honestly and in good faith in the best interests of the Corporation and to exercise the care, diligence and skill of a reasonably prudent person. Responsibilities not delegated to senior management or to a committee of the Board remain those of the full Board. Prior approval by the Board is required in many specific instances under theCanada Business Corporations Act, securities legislation and the rules and policies of the Toronto Stock Exchange, the American Stock Exchange and the Alternative Investment Market of the London Stock Exchange. |

| | | | | |

| (a) | adoption of a strategic planning process | | The Board has delegated the day-to-day management of the business and affairs of the Corporation to the senior management of the Corporation, subject to compliance with strategic and capital plans approved from time to time by the Board. |

| | | | | |

| (b) | identification of principal risks and implementation of appropriate systems to manage those risks | | The Board, through the Audit Committee and the Hedging Committee, takes responsibility for identifying the principal risks of the Corporation's business and for ensuring these risks are effectively monitored and mitigated to the extent practicable. The Audit Committee meets regularly to review reports and discuss significant risk areas with the auditors. The Hedging Committee assists the Board in managing the risks involved in the Corporation’s commodity and currency hedging arrangements. |

| | | | | |

| (c) | succession planning, including appointing, training and monitoring management | | The Board does not have a formal succession planning model, however discussions have begun to formulate and implement one. |

- 15 -

| (d) | a communications policy | | The Board, as a whole, is responsible for ensuring disclosure is made pursuant to an appropriate communications policy governing the timeliness and content of the Corporation’s disclosure (see Item 1(e) below). |

| | | | | |

| (e) | the integrity of internal control and management information systems | | In keeping with the overall responsibility for the stewardship of the Corporation, the Board,through its Audit Committee, examines the Corporation’s internal control and management information systems. As well, the Corporate Governance Committee has established a Disclosure Controls and Procedure Policy and a Disclosure Committee which is comprised of designated members of senior management who report to the Corporate Governance Committee. |

| | | | | |

| 2. | The board should be constituted with a majority of individuals who qualify as unrelated directors. An unrelated director is a director who is independent of management and is free from any interest and any business or other relationship which could, or could reasonably be perceived to; materially interfere with the director’s ability to act with a view to the best interests of the Company. | | The Board of the corporation is currently composed of nine directors, six of whom are unrelated. The six unrelated directors are Barry Rayment, Thomas Allen, Cole McFarland, Eulogio Pérez- Cotapos, Robert Cross and Robert Gayton. |

| | | | | |

| 3. | The board is required to disclose on an annual basis whether the board has a majority of unrelated directors and the analysis of the application of the principles of supporting this conclusion. | | The Board of the Corporation is currently composed of nine directors, eight outside directors, being directors who are not officers or employees of the Corporation, and one inside director, the Corporation's CEO. The Board has further determined that of its eight outside directors, six are unrelated directors (i.e. a director who is independent of management and is free from any interest or any business or other relationship which could, or could reasonably be perceived to materially interfere with the director’s ability to act in the best interest of the Corporation, other than interests arising from shareholdings). Three outside directors, R. Stuart Angus, Jerry Korpan and Eulogio Pérez-Cotapos, provide services to the Corporation on a consulting basis, however, Mr. Perez-Cotapos billed the Corporation less than $75,000 for the 2004 year, therefore only Messrs. Angus and Korpan are considered related directors (see "Compensation of Directors" for further details). The one inside director is, by definition, also a related director. |

| | | | | |

| 4. | The board should appoint a committee, the majority of whom are unrelated directors, with responsibility for proposing new nominees to the board and assessing directors. | | The Corporation's Corporate Governance and Nominating Committee, the majority of whom are unrelated directors, assumes responsibility for the following:

- proposing new nominees to the Board;

|

- 16 -

| | | - developing and implementing an orientation and educational program for new recruits to the Board in order to familiarize new directors with the business of the Corporation, its management and professional advisors and its facilities;

- developing and implementing a process for assessing the effectiveness of the Board and its committees and for assessing the contribution of each of the Corporation’s directors;

- continuing to develop the Corporation’s approach to corporate governance issues; and

- reviewing and responding to requests by individual directors of the Corporation to engage outside advisors at the expense of the Corporation.

|

| | | | |

| 5. | Every board should implement a process for assessing the effectiveness of the board as a whole, the board’s committees and individual directors. | | The Corporation currently has informal evaluations in place. The Corporate Governance and Nominating Committee has under consideration the development of an effective program for the evaluation of the effectiveness of the Board, its committees and individual directors. |

| | | | |

| 6. | Every Company should provide an orientation and education program for new recruits to the board. | | Responsibility of Corporate Governance and Nominating Committee - see #4 above. |

| | | | |

| 7. | Every board should examine its size and, where appropriate, undertake a program to reduce the number of directors. | | The Board considers this guideline from time to time and has determined nine as the optimum number of members for the Board of the Corporation for the ensuing year. The members of the Board of Directors have been chosen on the basis of their skill, expertise and experience in the international gold mining industry and other businesses as well as their ability to actively contribute on the broad range of issues with which the Board or the Corporation must deal. |

| | | | |

| 8. | The board should review the compensation of directors to ensure it adequately reflects the responsibilities and risks involved in being an effective director. | | The Corporation's Compensation Committee, the majority of whom are unrelated directors, determines the salary and benefits of the executive officers of the Corporations, determines the general compensation structure, policies and programs of the Corporation, makes recommendations to the Board on the Corporation’s stock option plan and delivers an annual report to shareholders on executive compensation. |

| | | | |

| 9. | Committees of the board should generally be composed of outside directors, a majority of whom are unrelated directors. | | The Board has established four committees: the Audit Committee, the Compensation Committee, the Hedging Committee and the Corporate Governance and Nominating Committee. |

- 17 -

| | | The Audit Committee is comprised of Thomas Allen, Cole McFarland and Robert Gayton, all of whom are unrelated directors. The Audit Committee has prepared a Charter which is available for viewing on the Corporation’s website atwww.bemagold.com. The Compensation Committee consists of R. Stuart Angus, Robert Cross and Cole McFarland of whom only Mr. Angus is a related director. The Compensation Committee determines the salary and benefits of the executive officers of the Corporation, determines the general compensation structure, policies and programs of the Corporation, makes recommendations to the Board on the Corporation’s stock option plan and delivers an annual report to shareholders on executive compensation. The Hedging Committee currently consists of Clive Johnson and Robert Gayton. Although Mr. Johnson is a related director, it is the view of the Board that the skills and expertise of this individual is such that it outweighs the fact that he is related and that therefore he is the appropriate person to serve on this committee at the present time. The Committee was established to assist the Board in managing the risks involved in the Corporation’s commodity and currency hedging arrangements. The Corporation’s Corporate Governance and Nominating Committee consists of Clive Johnson, Thomas Allen, Robert Cross and Robert Gayton, of whom only Mr. Johnson is a related director. |

| | | | |

| 10. | Every board should expressly assume responsibility for, or assign to a committee, the general responsibility for, developing the Company’s approach to governance issues. | | The Corporation's Corporate Governance and Nominating Committee is responsible for developing, making recommendations to the Board with regard to, and monitoring the implementation of the Corporation’s approach to governance issues. This committee considers best practices among major Canadian companies to ensure the Corporation continues to attain high standards of corporate governance. |

| | | | |

| 11. | The board, together with the CEO, should develop position descriptions for the board and for the CEO, involving the definition of the limits to management’s responsibilities. In addition, the board should approve or develop the corporate objective which the CEO is responsible for meeting. | | The mandate of the Board is to supervise the management of the business and affairs of the Corporation. The Board’s principal responsibilities are to supervise and evaluate management, to oversee the conduct of the Corporation’s business, to set policies appropriate for the business of the Corporation and to approve corporate strategies and goals. The Board expects management of the Corporation to conduct the business of the Corporation in accordance with the Corporation’s ongoing strategic plan. The Board reviews management’s progress in meeting these expectations at Board meetings normally held every quarter. The Corporate Governance and Nominating Committee has under consideration a position description for the CEO. |

- 18 -

| 12. | Every board should have in place appropriate structures and procedures to ensure that the board can function independently of management. | | The Board has the responsibility to ensure that the Board functions independently of management. Mr. Clive Johnson is Chairman of the Board of Directors and Chief Executive Officer (“CEO”) of the Corporation. In the view of the Board, the fact that Mr. Johnson occupies both offices does not impair the ability of the Board to act independently of management.The Board has reached this conclusion for various reasons, including the number of unrelated, independent directors on the Board. The Board is responsible for approving long-term strategic plans and annual operating budgets and plans recommended by management. Board consideration and approval is also required for all material contracts and business transactions and all debt and equity financing proposals. The Board is also responsible for the review of senior executive recruitment and compensation. The Board believes that adequate structures and processes are in place to facilitate the functioning of the Board independently of the Corporation’s management. The Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee consist of at least a majority of directors who are unrelated to the Corporation’s management. |

| | | | |

| 13. | The audit committee of every board of directors should be composed of only unrelated directors. The roles and responsibilities of the audit committee should be specifically defined. | | The Audit Committee is comprised of three directors, Dr. Robert Gayton, Mr. Thomas Allen and Mr. Cole McFarland, all of whom are unrelated directors. The Audit Committee reviews the annual and quarterly financial statements of the Corporation, oversees the annual audit process, the Corporation’s internal accounting controls and the resolution of issues identified by the Corporation’s auditors and recommends to the Board the firm of independent auditors to be nominated for appointment by the shareholders at the next Annual General Meeting. All members of the Audit Committee are financially literate (are able to read and understand a set of financial statements that present a breadth and complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company's financial statements). The Chairman of the Audit Committee, Dr. Gayton, is a chartered accountant and has a Ph.D in Finance and Accounting. The Audit Committee's responsibilities are set out in its charter, which is available for viewing on the Corporation's website atwww.bemagold.com. The Corporation's external auditors have a direct line of communication with the committee at all times and meet with the Audit Committee without management present at least quarterly. The Committee approves all non-audit work performed by the external auditors. See below for the Corporation's Audit Committee Charter. |

- 19 -

| 14. | The board of directors should implement a system which enables an individual director to engage an outside advisor at the expense of the Company. | | The Corporate Governance and Nominating Committee is responsible for reviewing and responding to requests by individual directors of the Corporation to engage outside advisors at the expense of the Corporation. |

Conclusion

The Corporation has adopted substantially all of the recommendations for improved corporate governance contained in the Guidelines. In certain areas the Board has determined that the TSX guidelines are not appropriate for the conduct of the Corporation’s business at this stage of its development. However, the Board of Directors continuously reviews its corporate governance practices to determine if any changes are necessary.

THE AUDIT COMMITTEE CHARTER

Under Multilateral Instrument 52-110 - Audit Committees ("MI 52-110"), companies are required to provide disclosure with respect to their audit committee including the text of the audit committee's charter, composition of the audit committee and the fees paid to the external auditor. Accordingly, the Corporation provides the following disclosure with respect to it is audit committee.

Following is a copy of the Corporation's Audit Committee Charter, in full:

1 Overall Purpose / Objectives

The audit committee will assist the Board in fulfilling its responsibilities. The audit committee will review the financial reporting process, the system of internal control and management of financial risks, the audit process, and the Corporation's process for monitoring compliance with laws and regulations and its own code of business conduct. In performing its duties, the committee will maintain effective working relationships with the Board of directors, management, and the external auditors and monitor the independence of those auditors. To perform his or her role effectively, each committee member will obtain an understanding of the responsibilities of committee membership as well as the Corporation’s business, operations and risks.

2 Authority

2.1 The Board authorizes the audit committee, within the scope of its responsibilities, to seek any information it requires from any employee and from external parties, to obtain outside legal or professional advice and to ensure the attendance of company officers at meetings as appropriate.

3 Organization

Membership

3.1 The audit committee will be comprised of at least three members, each of which should be an unrelated director.

3.2 The chairman of the audit committee will be nominated by the committee from time to time.

3.3 A quorum for any meeting will be two members.

3.4 The secretary of the audit committee will be the company secretary, or such person as nominated by the Chairman.

- 20 -

Attendance at Meetings

3.5 The audit committee may invite such other persons (e.g. the CEO) to its meetings, as it deems appropriate.

3.6 The external auditors should be present at each quarterly audit committee meeting and be expected to comment on the financial statements in accordance with best practices.

3.7 Meetings shall be held not less than four times a year. Special meetings shall be convened as required. External auditors may convene a meeting if they consider that it is necessary.

3.8 The proceedings of all meetings will be minuted.

4 Roles and Responsibilities

The audit committee will:

4.1 Gain an understanding of whether internal control recommendations made by external auditors have been implemented by management.

4.2 Gain an understanding of the current areas of greatest financial risk and whether management is managing these effectively.

4.3 Review significant accounting and reporting issues, including recent professional and regulatory pronouncements, and understand their impact on the financial statements.

4.4 Review any legal matters which could significantly impact the financial statements as reported on by the general counsel and meet with outside counsel whenever deemed appropriate.

4.5 Review the annual and quarterly financial statements including Management's Discussion and Analysis and annual and interim earnings press releases prior to public dissemination and determine whether they are complete and consistent with the information known to committee members; determine that the auditors are satisfied that the financial statements have been prepared in accordance with generally accepted accounting principles.

4.6 Pay particular attention to complex and/or unusual transactions such as those involving derivative instruments and consider the adequacy of disclosure thereof.

4.7 Focus on judgmental areas, for example those involving valuation of assets and liabilities and other commitments and contingencies.

4.8 Review audit issues related to the company's material associated and affiliated companies that may have a significant impact on the company's equity investment.

4.9 Meet with management and the external auditors to review the annual financial statements and the results of the audit.

4.10 Assess the fairness of the interim financial statements and disclosures, and obtain explanations from management on whether:

| | (a) | actual financial results for the interim period varied significantly from budgeted or projected results; |

| | (b) | generally accepted accounting principles have been consistently applied; |

| | (c) | there are any actual or proposed changes in accounting or financial reporting practices; |

| | (d) | there are any significant or unusual events or transactions which require disclosure and, if so, consider the adequacy of that disclosure. |

- 21 -

4.11 Review the external auditors' proposed audit scope and approach and ensure no unjustifiable restriction or limitations have been placed on the scope.

4.12 Review the performance of the external auditors and approve in advance provision of services other than auditing. Consider the independence of the external auditors, including reviewing the range of services provided in the context of all consulting services bought by the company. The Board authorizes the Chairman of the Audit Committee to approve any non-audit or additional audit work which the Chairman deems as necessary and to notify the other members of the Audit Committee of such non-audit or additional work.

4.13 Make recommendations to the Board regarding the reappointment of the external auditors and the compensation to be paid to the external auditors.

4.14 Review any significant disagreement among management and the external auditors in connection with the preparation of the financial statements.

4.15 Review and approve the Corporation's hiring policies regarding partners, employees and former partners and employees of the present and former external auditors of the Corporation.

4.16 Establish a procedure for the: (i) confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters, (ii) receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal accounting controls, or auditing matters.(1)

4.17 Meet separately with the external auditors to discuss any matters that the committee or auditors believe should be discussed privately.

4.18 Endeavour to cause the receipt and discussion on a timely basis of any significant findings and recommendations made by the external auditors.

4.19 Obtain regular updates from management and the company's legal counsel regarding compliance matters, as well as certificates from the Chief Financial Officer as to required statutory payments and bank covenant compliance and from senior operating personnel as to permit compliance.

4.20 Ensure that the Board is aware of matters which may significantly impact the financial condition or affairs of the business.

4.21 Perform other functions as requested by the full Board.

4.22 If necessary, institute special investigations and, if appropriate, hire special counsel or experts to assist, and set the compensation to be paid to such special counsel or other experts.

4.23 Review and update the charter; receive approval of changes from the Board.

| (1) | A whistleblower service, which will be provided by a third party, will be in effect by the date of the Corporation's annual general meeting to be held on June 23, 2005; |

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS UNDER SECURITIES PURCHASE AND OTHER PROGRAMS

At no time during the Corporation’s last completed financial year, was any director, executive officer, employee, proposed management nominee for election as a director of the Corporation nor any associate of any such director, executive officer, or proposed management nominee of the Corporation or any former director, executive officer or employee of the Corporation or any of its subsidiaries indebted to the Corporation or any of its subsidiaries indebted to another entity where such indebtedness was the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation or any of its subsidiaries, other than routine indebtedness.

- 22 -

The following tables sets forth the indebtedness to, or guaranteed or supported by, the Corporation or any of its subsidiaries, of each director, executive officer, senior officer, proposed nominee for election as a director and each associate of any such director, officer or proposed nominee in respect of indebtedness to the Corporation existing since the beginning of the most recently completed financial year.

Name and

Principal

Position | Involvement

of the

Corporation | Largest

Amount

Outstanding

During Last

Completed

Financial Year | Amount

Outstanding as

at

May 9, 2005 | Financially

Assisted

Securities

Purchases

During Last

Completed

Financial Year | Security for

Indebtedness | Amount

Forgiven

During Last

Completed

Financial Year

($) |

Clive Johnson

Chief Executive

Officer, Chairman

and President | Lender | $500,000(1) | $500,000(1) | Nil | Nil | |

(1) Interest free loan granted under employment agreement with the Corporation.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other than as set forth below or elsewhere in this Management Proxy Circular and other than transactions carried out in the ordinary course of business of the Corporation or any of its subsidiaries, none of the directors or senior officers of the Corporation, a proposed management nominee for election as a director of the Corporation, any member beneficially owning shares carrying more than 10% of the voting rights attached to the shares of the Corporation nor an associate or affiliate of any of the foregoing persons had since January 1, 2004 being the commencement of the Corporation’s last completed financial year, any material interest, direct or indirect, in any transactions which materially affected or would materially affect the Corporation or any of its subsidiaries.

The Corporation was involved in the following transactions with Endeavour. Mr. R. Stuart Angus, a director of the Corporation, is Managing Director, Mergers and Acquisitions of Endeavour.

| | • | On February 25, 2004 the Corporation completed an offering of $70 million senior unsecured convertible notes maturing February 25, 2011 (the "Convertible Notes"). The Corporation paid to Endeavour a financing fee of $525,000 or 0.75% of the face value of the Convertible Notes upon closing in payment for financial advisory services rendered; |

| | | |

| | • | On July 21, 2004, a subsidiary of the Corporation signed an agreement with Bayerische Hypo-und Vereinsbank AG ("HVB") whereby HVB is providing a $60 million bridge loan facility for the continued development of the Corporation's Kupol project. In connection with this facility and financial advisory services provided by Endeavour, the Corporation paid to Endeavour a success fee of $225,000; and |

| | | |

| | • | On April 13, 2005, the above referenced $60 million bridge loan facility was increased to US$100 million. An additional fee is payable to Endeavour on this increased amount. The amount of the fee is still being negotiated. |

See also “Compensation of Directors” above for details of other consulting arrangements and fees paid directly or indirectly to individuals who are directors of the Corporation.

- 23 -

APPOINTMENT OF AUDITORS

Unless such authority is withheld, the persons named in the accompanying proxy intend to vote for the reappointment of PricewaterhouseCoopers LLP as auditors of the Corporation and to authorize the directors to determine their remuneration. PricewaterhouseCoopers LLP were first appointed auditors of the Corporation on November 6, 1996.

The following table sets forth the aggregate fees billed to the Corporation for the years ended December 31, 2004 and 2003 by its independent accountants, PricewaterhouseCoopers LLP. All figures in the following table are in U.S. dollars.

| | Year ended | Year ended |

| | December 31, 2004 | December 31, 2003 |

| | (US$) | (US$) |

| Audit Fees | $686,839 | $563,195 |

| Audit-Related Fees | $62,699 | $26,838 |

| Tax Fees | $321,799 | $224,613 |

| All Other Fees | - | - |

| Total | $1,071,337 | $814,646 |

“Audit Fees” are the aggregate fees billed by PricewaterhouseCoopers LLP for the audit of the Corporation’s consolidated annual financial statements, reviews of interim financial statements and attestation services that are provided in connection with statutory and regulatory filings or engagements.

“Audit-Related Fees” are fees charged by PricewaterhouseCoopers LLP for assurance and related services that are reasonably related to the performance of the audit or review of the Corporation’s financial statements and are not reported under "Audit Fees." This category includes advisory services associated with the Corporation’s financial reporting.

“Tax Fees” are fees for professional services rendered by PricewaterhouseCoopers LLP for tax compliance and tax advice on actual or contemplated transactions.

No fees were paid under the category “All Other Fees.”

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Other than as set forth in this Management Proxy Circular, no person who has been a director or senior officer of the Corporation at any time since the beginning of the last financial year, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of any of the foregoing, has any material interest, directly or indirectly, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon other than the election of directors.

PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

Replacement of Stock Option Plan

Under the previous policies of the Toronto Stock Exchange (“TSX”), all TSX listed companies were required to adopt a stock option plan which set a maximum number of common shares that could be issued pursuant to the exercise of stock options. Effective January 1, 2005, the TSX amended its policies with respect to security based compensation arrangements to allow for “evergreen/rolling maximum” stock option plans, being stock option plans that base the maximum number of common shares that may be issued pursuant to stock option exercises on an established percentage of the corporation’s issued and outstanding share capital as at the date of grant of such stock option.

- 24 -

The Corporation currently has an incentive stock option plan in place (the “Current Plan”), based on the previous policies of the TSX, which provides for the granting of options to purchase common shares based on a maximum fixed number, currently an aggregate of 40,000,000 common shares of the Corporation (representing 9.98% of the Corporation’s issued and outstanding share capital as at the date of this Management Proxy Circular). The Current Plan was adopted by the Shareholders on May 24, 1995, and amended on September 10, 1997, June 9, 1999, June 28, 2002, June 11, 2003 and June 23, 2004.

Under the Current Plan, as at the date of this Management Proxy Circular, an aggregate of 19,386,708 common shares of the Corporation remain outstanding and unexercised (the “Existing Options”). Since the implementation of the Current Plan, the Corporation has granted options under such plan for the purchase of 41,973,959 common shares, of which 15,503,659 options have been exercised and 7,000,592 options have been cancelled resulting in an aggregate of 25,083,341 common shares currently being reserved for issuance under the Current Plan. In addition, 1,250,000 stock options were granted to former option holders of EAGC Ventures Corp. (“EAGC”) as part of a business combination between the Corporation and EAGC outside of the Current Plan. Of these, 1,000,000 options (the "EAGC Options") remain outstanding and unexercised. The Existing Options and the EAGC Options represent 5.09% of the Corporation’s issued and outstanding share capital as at the date of this Management Proxy Circular.

Management of the Corporation and the Board has determined that it is in the best interests of the Corporation to replace its Current Plan with a rolling maximum stock option plan providing for the number of shares reserved for issuance under such plan to be equal to 10% of the Corporation’s issued and outstanding share capital at the time of any stock option grant (the “New Plan”). The Existing Options and EAGC Options which are outstanding under the Current Plan will be incorporated into the New Plan and will be governed by the New Plan except to the extent they are inconsistent with the New Plan in which case they will be governed by the stock option agreement evidencing their issuance.

The effect of the New Plan is that at any point in time the Corporation may have stock options outstanding for the purchase of up to 10% of the issued and outstanding share capital of the Corporation. As at the date of this Management Proxy Circular, 10% of the Corporation’s issued and outstanding share capital is equal to 40,063,657 common shares. Based on the issued share capital of the Corporation as at the date of this Management Proxy Circular, and provided Shareholders approve the New Plan, as there are currently 19,386,708 Existing Options and 1,000,000 EAGC Options issued and outstanding which will be incorporated under the New Plan, the Corporation’s additional shares reserved for stock options under the New Plan will be 19,676,949 common shares as compared to 5,801,633 common shares under the Current Plan. Additional stock options under the New Plan may be granted as additional common shares of the Corporation are issued.

Management of the Corporation and the Board considers the adoption of the New Plan to be in the Corporation’s best interest as the New Plan is designed to give each option holder a parallel interest with the Shareholders in preserving and maximizing shareholder value. In addition, it enables the Corporation to attract and retain qualified directors, officers, employees and consultants with experience and ability, and to reward these individuals for current and expected future performance.

The New Plan will incorporate many of the terms and conditions of the Current Plan, previously approved by the Shareholders, including the following:

| 1. | only eligible persons, being directors, officers or employees of, and consultants to, the Corporation or any of the Corporation’s associated, affiliated, controlled and subsidiary companies, will be entitled to receive options under the New Plan; |

| |

| 2. | the number of common shares subject to each option will be determined by the Board (or its duly appointed Compensation Committee) provided that the New Plan, together with all of the Corporation’s other previously established share compensation arrangements, may not result in the maximum number of common shares: |

| |

| | (a) | issuable to insiders, at any time, and their associates and affiliates, exceeding 10% of the common shares of the Corporation issued and outstanding on the date of grant; |

- 25 -

| | (b) | issued to insiders, and their associates and affiliates, within any one year period exceeding 10% of the common shares of the Corporation issued and outstanding on the date of grant; and |

| |

| | (c) | the issuance to any one individual insider within a one year period exceeding 5% of the common shares of the Corporation issued and outstanding on the date of grant; |

| |