Bema Gold Corporation

Technical Report

Summarizing the Kupol Project Feasibility Study,

Chukhotka Okrug, Russia

Prepared for and in co-operation with:

Bema Gold Corporation

Suite 3100- Three Bentall Centre

595 Burrard Street

PO Box 49143

Vancouver, BC

V7X 1J1

Tel (604) 681-8371

Prepared by:

| . | Thomas Garagan, P.Geo. |

| | |

| William J Crowl, P.G | Fred Stahlbush |

| | |

| Gustavson Associates, LLC | Bema Gold Corporation |

| | |

| 5757 Central Ave, Suite D | Suite 3100- Three Bentall Centre |

| Boulder, Colorado USA 80301 | 595 Burrard Street |

| Tel (303) 443-.2209 | PO Box 49143 |

| | Vancouver, BC V7X 1J1 |

| | Tel (604) 681-8371 |

| | |

| GA Project No. BEM003 | |

| | |

| July 4, 2005 | |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page i |

| Kupol Project | Summary of Feasibility Study |

SUMMARY (Item 3)

On December 18, 2002, Bema Gold announced that it had completed the terms of a definitive agreement with the Government of Chukotka, an autonomous Okrug (region) in northeast Russia, to acquire up to a 75% interest in the Kupol gold and silver project.

The Kupol deposit is located approximately 430 km northwest of Anadyr, 200 km southeast of Bilibino / Keperveyem, 320 km south of Pevek and 1250 km northeast of Magadan. Kupol can be accessed by winter road and by helicopter; an airstrip is under construction for fixed wing aircraft.

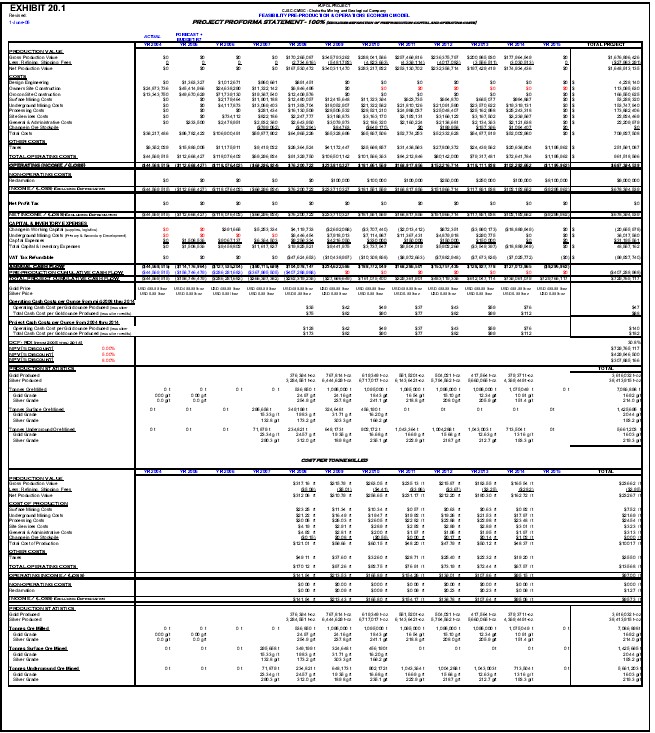

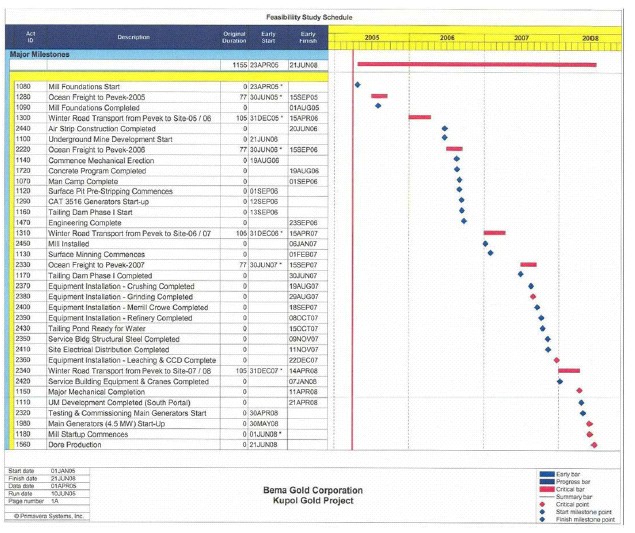

Preliminary Economic Assessment (PEA) to Feasibility

Bema Gold completed a Preliminary Assessment of the property in 2004. The results of this assessment indicated that the project should advance to the feasibility level. This document is a full feasibility study of the Kupol Project. The results of the feasibility study summarized herein indicate that the development and production of precious metal ores from the Kupol Deposit is feasible. Total Cash Cost per Ounce of gold is below $100/ounce net of by-product silver credits and the project pays back the initial capital cost of $407,000,000 in less than 2 years based on a $400/ounce gold price and $6.00 silver price. The initial production life of the deposit is approximately 7 years based on Probable Mineral Reserves, with mill production beginning in June 2008. The exploitation of the inferred mineral resources may extend the life of the project.

Feasibility Management

Bema Gold managed the feasibility study efforts leading to this document. Several independent firms were commissioned to provide specific work packages. Bema’s Russian entities, the Julietta Mine and the Magadan office in the Magadan Oblast contributed their Russian mining and administrative expertise to major portions of the study. Bema staff, exploration, operations and engineering played a key role in providing input. The majority of the contributors to the Kupol Feasibility have been to the Kupol site.

In addition to the development of the feasibility study, Bema Gold will develop and in some cases has developed several documents required under Russian guidelines.

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page ii |

| Kupol Project | Summary of Feasibility Study |

Feasibility Results (All USD unless otherwise stated)

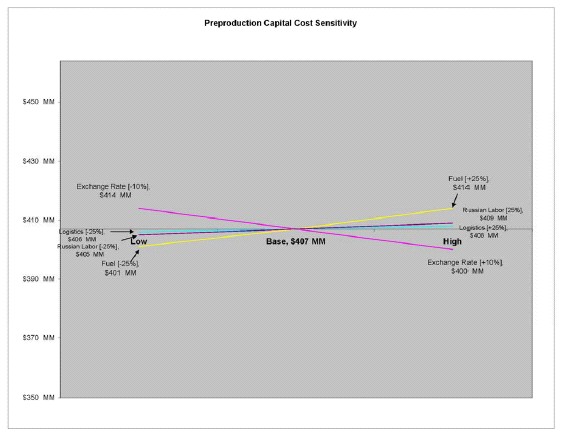

Preproduction Capital Costs

| Preproduction Costs | USD (Millions) |

| Design Engineering | $4 |

| Owners Site Construction (includes certain inventory items) | $113 |

| Orocon Site Construction | $167 |

| Surface Mining Costs | $19 |

| Underground Mining Costs | $22 |

| Processing Costs | $3 |

| Site Services Costs | $2 |

| General and Administrative | $7 |

| Sub-Total Preproduction Costs | $337 |

| | |

| Other Costs | |

| VAT Tax (Supplies and Fuel) | $42 |

| Customs Duties & Clearance | $4 |

| Property Tax & Other | $1 |

| Sub-Total Other Costs | $46 |

| | |

| Total Preproduction and Other Costs | $383 |

| | |

| Capital and Inventory (inventory change not actual inventory value) Expenses | $24 |

| | |

| Total Preproduction Capital Costs | $407 |

Items of Note

| • | Total Preproduction Capital Payback ($407 Million) less than 2 years |

| • | Revenue and Cost Parameters |

| | o | Gold @ $400/oz |

| | o | Silver @ $6.00/oz |

| | o | Fuel @ $40/Barrel |

| | o | Exchange Rates |

| | | • | Ruble:USD of 30:1 |

| | | • | CDN:USD of 1.2 to 1.0 |

| | | • | Euro:USD of .75 to 1.0 |

| | o | Logistics – known costs and benefit of learning curve |

| | o | Labor – Russian Labor February 2005 increased by 8% |

| • | Project Statistics for Probable Reserves – 7.1 Million Tonnes (7 years) |

| | o | $$47/oz of gold Cash Operating Cost* |

| | o | $88/oz of gold Total Cash Costs* |

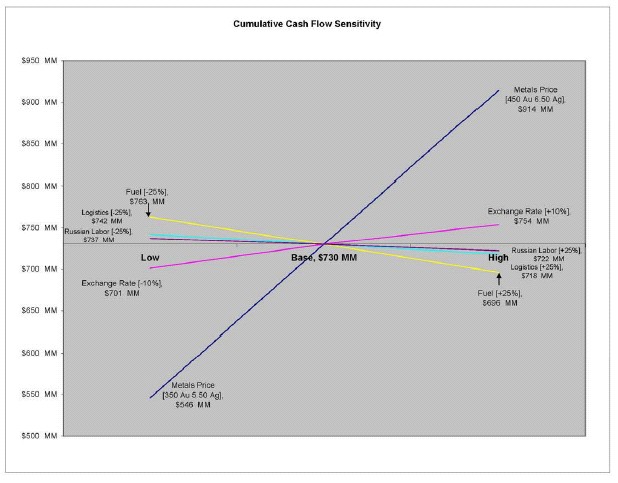

| | o | $$730 Million Cumulative Cash Flow |

| | o | $430 Million NPV @ 5% |

| | o | 552,000 Ounces Gold Average Annual Production |

| | | * Net of Silver Credits |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page iii |

| Kupol Project | Summary of Feasibility Study |

The Kupol exploration effort continues. Gustavson considers it likely a substantial portion of the present 4 million tonnes of inferred resources may be converted to probable reserves from further exploration activity and during the exploitation of the existing probable reserves. No major capital, with the exception of continued underground development, will be required to mine beyond the present probable reserves.

Geology, Resources & Reserves

Quartz veins at the Kupol site were discovered in 1966 by a Soviet Government Exploration Expedition and the main vein was discovered in 1995 by the Bilibino based, State funded Anyusk Geological Expedition. Gold and silver mineralization at Kupol is hosted by poly-phase brecciated quartz-adularia veins. The extent of brecciation is variable but generally higher-grade zones are more strongly brecciated. The Kupol deposit can be classified as a low sulphidation epithermal fissure vein type deposit. The silver to gold ratio is on average 12 to 1. Between 1996 and 2002 a limited amount of exploration work was conducted, in 2003, Bema commenced extensive drilling and sampling programs. The following table summarizes the number and meterage for diamond drilling, trenching and channel sampling completed by Bema during 2003 and 2004.

| Year | No. of Diamond

Drill Holes | Drill Hole

Meterage (m) | No. of

trenches | Trench

Meterage (m) | No. of Channel

Samples | Channel Sample

Meterage |

| 2003 | 166 | 22,200 | 15 | 2500 | -- | -- |

| 2004 | 309 | 53,800 | 2 | 226 | 87 | 700 |

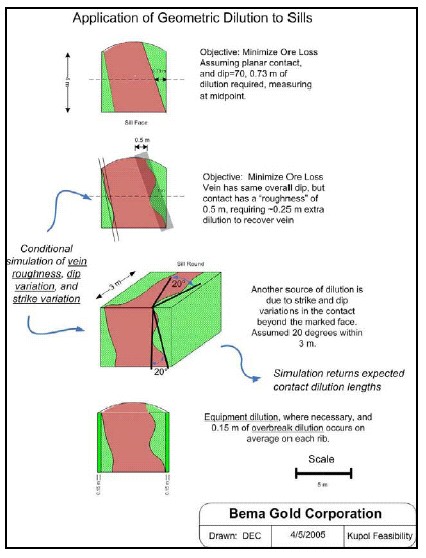

The 2004 exploration activities included diamond drilling, trenching and channel sampling. The diamond drill program was focused on results for exploration, infill (including detailed vein configuration), geotechnical and condemnation work over the entire 3.6 km strike length of the deposit. Overburden removal, mapping and channel sampling was completed in three separate areas. The channel samples and a set (63 drill holes) of closely spaced drill holes provided detailed information on vein continuity and was used for assessing dilution and ore loss factors. Additional testing included 3200 wax-coated density measurements in vein and waste lithologies and an extensive program to define metallurgical domains and confirm recoveries and consumption of reagents.

Mineral Resources are categorized using the classification of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM 2000). In situ Indicated and Inferred Resources for Vein, above a 6g/t cutoff, as published by Bema are as follows:

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page iv |

| Kupol Project | Summary of Feasibility Study |

Resource

Class | Tonnes

(1000) | Au(g/t) | Contained Au

(Ounces X 1000) | Ag(g/t) | Contained Ag

(Ounces X 1000) |

| Indicated | 6,403 | 20.33 | 4,184 | 257 | 52,911 |

| Inferred | 4,090 | 12.45 | 1,637 | 171 | 22,539 |

The resources reported above do not include dilution or ore-loss.

The total Probable Mineral Reserve outlined by the open pit and underground plans is 7.1 million tonnes at a grade of 16.9 grams / tonne gold and 214 grams / tonne silver. The distribution of the Probable Mineral Reserve is shown below:.

| Production (includes dilution and ore loss) |

| Open Pit | Tonnages (millions) | 1.42 |

| Au (g/t) | 20.4 |

| Ag (g/t) | 193 |

| Underground | Tonnages (millions) | 5.66 |

| Au (g/t) | 16.0 |

| Ag (g/t) | 219 |

| Total | Tonnages (millions) | 7.09 |

| Au (g/t) | 16.9 |

| Ag (g/t) | 214 |

Open Pit Mining

Open Pit mining methods during the first 4 years of the project will be used to mine the ore on a two shift per day, 340 days per year schedule (25 days per year are not scheduled to allow for weather delays), at a rate of approximately 1,000 tonnes per day of ore and 11,500 tonnes per day of waste. Low Grade ore will be stockpiled and delivered to the mill in the later years of the project’s life. The waste to ore strip ratio is 12 to 1. The average dilution in the final pit model is 22%. The production schedule for the Open Pit is:

| OPEN PIT PRODUCTION | 2007 | 2008 | 2009 | 2010 |

| High Grade Ore Pit Production | 178,628 t | 229,895 t | 268,454 t | 273,222 t |

| Au Grade | 21.2 g /t | 26.8 g /t | 36.9 g /t | 22.7 g /t |

| Ag Grade | 182 g /t | 230 g /t | 352 g /t | 229 g /t |

| Low Grade Ore Pit Production | 117,030 t | 119,304 g /t | 56,194 g /t | 182,968 t |

| Au Grade | 6.3 g /t | 6.3 g /t | 6.8 g /t | 6.5 g /t |

| Ag Grade | 57 g /t | 64 g /t | 69 g /t | 79 g /t |

| Total Ore Pit Production | 295,658 t | 349,199 t | 324,648 t | 456,190 t |

| Au Grade | 15.3 g /t | 19.8 g /t | 31.7 g /t | 16.2 g /t |

| Ag Grade | 133 g /t | 173 g /t | 303 g /t | 169 g /t |

| Waste Pit Production (2006 waste included with 2007) |

| Total Waste | 6,490,000 t | 4,140,000 t | 3,532,000 t | 2,749,000 t |

| High Grade Ore per Day ~ | 525 t /d | 675 t /d | 790 t /d | 800 t /d |

| Low Grade Ore (Stockpiled) per | | | | |

| Day ~ | 350 t /d | 350 t /d | 160 t /d | 540 t /d |

| Waste Tonnes per Day ~ | 12,000 t /d | 12,000 t /d | 10,400 t /d | 8,000 t /d |

| Total Rock Tonnes per Day ~ | 12,875 t /d | 13,025 t /d | 11,350 t /d | 9,340 t /d |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page v |

| Kupol Project | Summary of Feasibility Study |

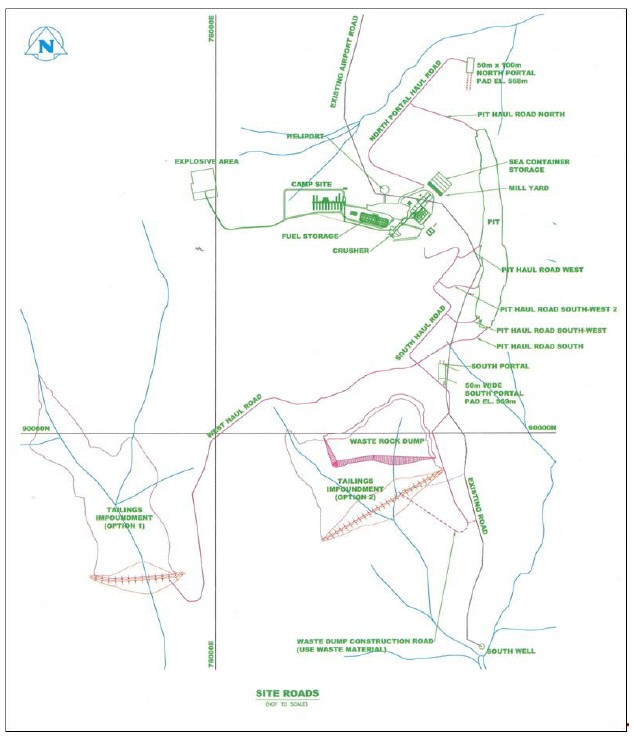

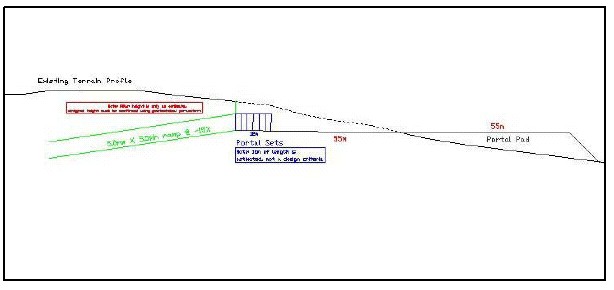

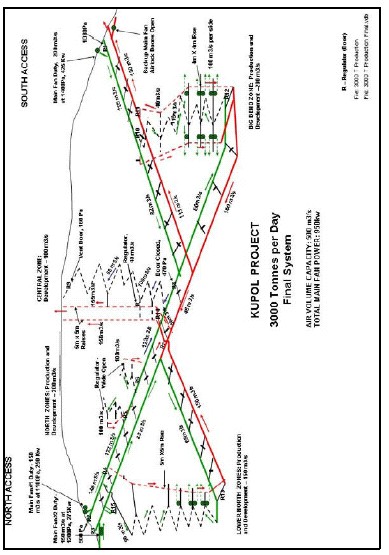

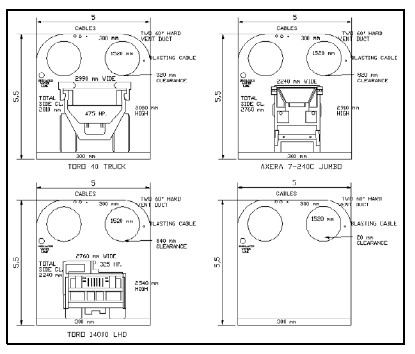

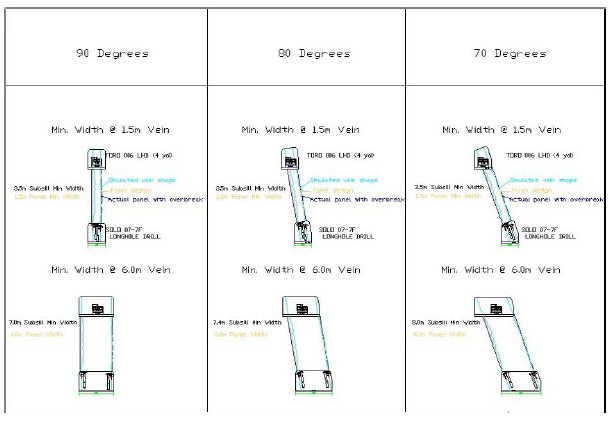

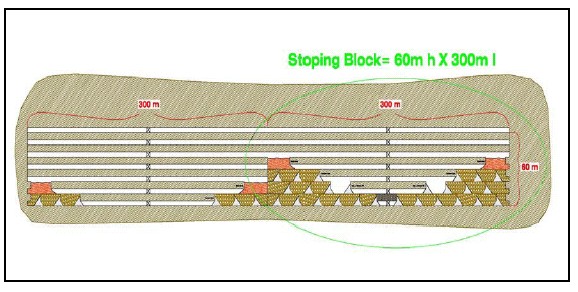

Underground Mining

Underground mechanized sublevel mining methods will be used to mine the ore on a two shift per day, 365 days per year schedule from two portal locations, the South Underground Mine and the North Underground Mine. The South Mine underground development will begin in 2006 and the North Underground Mine in 2008. Each of the mines will reach a production rate of approximately 1,750 tonnes per day of ore during its life. The average dilution in the final underground model is 24%. The production schedule for the Underground Production is:

Underground

Production | Tonnes | Gold

Grade | Silver

Grade | Tonnes per

Day |

| | | | | |

| 2006 | | | | |

| 2007 | 71,879 t | 23.3 g /t | 290 g /t | 296 t /d |

| 2008 | 234,821 t | 24.6 g /t | 312 g /t | 643 t /d |

| 2009 | 648,173 t | 19.3 g /t | 190 g /t | 1,775 t /d |

| 2010 | 902,172 t | 16.7 g /t | 235 g /t | 2,470 t /d |

| 2011 | 1,043,364 t | 16.7 g /t | 223 g /t | 2,850 t /d |

| 2012 | 1,004,288 t | 15.7 g /t | 219 g /t | 2,750 t /d |

| 2013 | 1,043,003 t | 12.6 g /t | 213 g /t | 2,850 t /d |

| 2014 | 713,504 t | 13.2 g /t | 193 g /t | 1,950 t /d |

| 2015 | | | | |

| TOTAL | 5,661,203 t | 16.0 g /t | 219 g /t | |

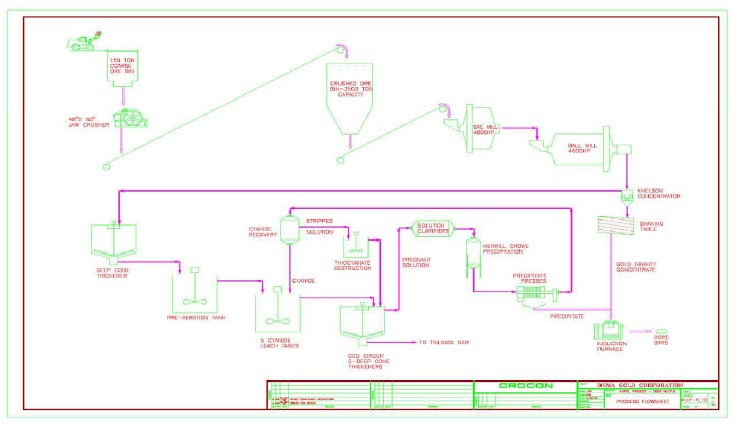

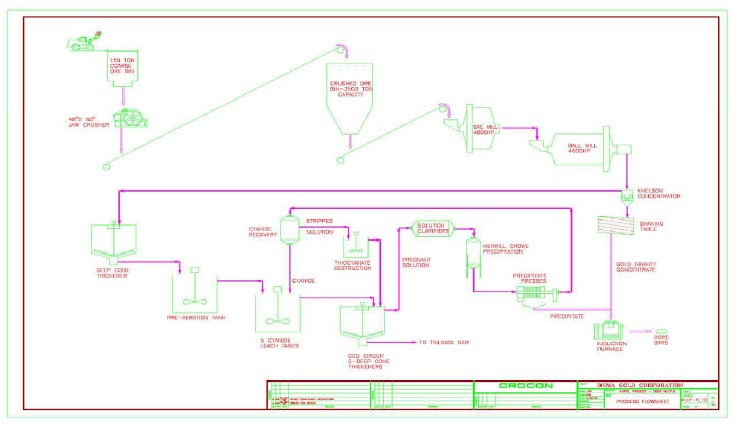

Ore Processing

The Mill will process the ore on a two shift per day, 365 days per year schedule at a rate of approximately 3,000 tonnes per day of ore during the operation of the open pit, South Underground Mine and then the North Underground Mine.. Low grade ore from the pit is stockpiled through 2010 then milled in 2011 and beyond to keep the mill at its design capacity as long as possible. The milling rate is 1,095,000 tonnes per year. The gold recovery will average 93.8% and the silver recovery will average 78.8% . The mill availability will be 94%. The milling process will consist of a primary crushing and grinding circuit and will include conventional gravity technology followed by whole ore leaching. Merrill Crowe precipitation will be used to produce doré bars. Doré will be sent to a refinery located near Magadan or shipped by air to a refinery in central Russia. The production schedule for the mill follows:

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page vi |

| Kupol Project | Summary of Feasibility Study |

Mill

Production | Tonnes per

Day | Tonnes per

Year | Gold

Grade | Silver

Grade | Gold Produced

[troy ounces] | Silver Produced

[troy ounces] | Gold

Recovery | Silver

Recovery |

| | | | | | | | | |

| 2008 | To 3,000t/d | 536,850 t | 25.0 g/t | 255 g/t | 376,394 t-oz | 3,284,551 t-oz | 92.7% | 79.2% |

| 2009 | 3,000t/d | 1,095,000 t | 24.2 g/t | 238 g/t | 767,814 t-oz | 6,444,629 t-oz | 92.9% | 79.1% |

| 2010 | 3,000t/d | 1,095,000 t | 18.4 g/t | 241 g/t | 619,349 t-oz | 6,717,017 t-oz | 93.9% | 79.2% |

| 2011 | 3,000t/d | 1,095,000 t | 16.5 g/t | 219 g/t | 551,520 t-oz | 6,143,642 t-oz | 94.1% | 79.3% |

| 2012 | 3,000t/d | 1,095,000 t | 15.1 g/t | 208 g/t | 504,021 t-oz | 5,794,562 t-oz | 94.3% | 78.9% |

| 2013 | 3,000t/d | 1,095,000 t | 12.3 g/t | 206 g/t | 417,564 t-oz | 5,660,065 t-oz | 95.0% | 78.0% |

| 2014 | 2,943 t/d | 1,095,000 t | 10.9 g/t | 151 g/t | 379,371 t-oz | 4,369,449 t-oz | 94.4% | 77.3% |

| 2015 | | | | | | | | |

| TOTAL | | 7,086,898 t | 16.9 g/t | 214 g/t | 3,616,033 t-oz | 38,413,915 t-oz | 93.8% | 78.8% |

A cyanide recovery system followed by cyanide destruction system will be used to reduce cyanide concentrations to an acceptable level for disposal. These tails will be pumped to a conventional tailings impoundment.

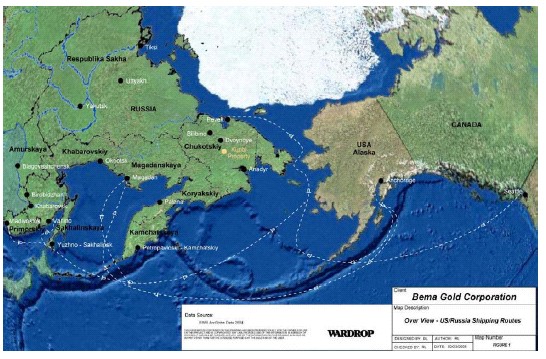

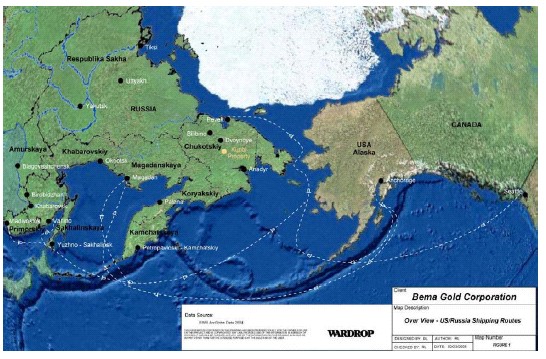

Logistics

The primary access road to the Kupol site is the proven winter road from Pevek to Kupol. A summer road system may be used to transport freight to a staging area 125 km north of Kupol. Airport facilities presently under construction are located approximately 10 km north of the Kupol site will be used for personnel transport, light freight movement, dore´ shipments and fresh food shipments.

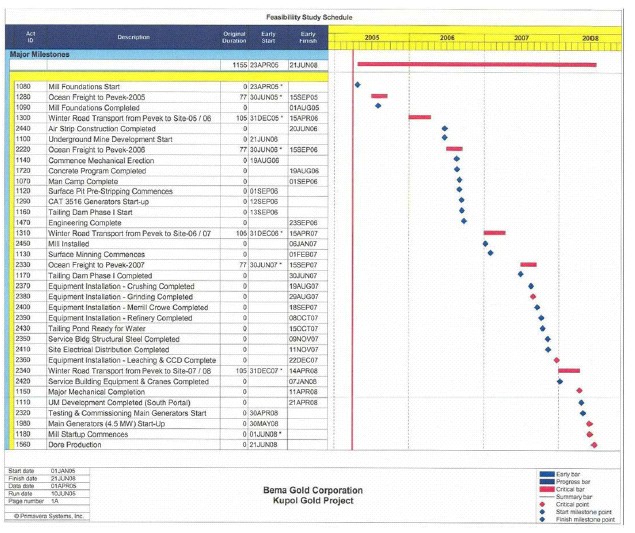

Execution Plan

The Kupol Project execution plan encompasses project management by Bema Gold Corporation and utilizes a delivery method comprised of a combination of Engineering, Procurement, and Construction (EPC) combined with multiple prime engineering contracts and some self performed owner construction.

Engineering and Procurement will be managed from the Bema corporate offices in Vancouver, British Columbia, Canada with construction management occurring from the Kupol Site. The majority of equipment and supplies are sourced from North American or European suppliers and is ocean shipped to the North Siberian Seaport of Pevek with subsequent overland delivery utilizing dedicated winter roads constructed and maintained by the project.

The site development will take place year round, utilizing a work force of experienced Russian nationals, trained and supervised by Russian and expatriate supervision, many of whom have worked on Bema’s previous Russian projects. Personnel will be “fly in-fly out” on a standard rotational basis.

Logistics will be supported from the large existing Bema support structure in place and operating in Russia and North America.

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page vii |

| Kupol Project | Summary of Feasibility Study |

Contents

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page viii |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page ix |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page x |

| Kupol Project | Summary of Feasibility Study |

Tables

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page xi |

| Kupol Project | Summary of Feasibility Study |

Figures

Appendices

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 1 |

| Kupol Project | Summary of Feasibility Study |

| 1.0 | INTRODUCTION AND TERMS OF REFERENCE(Item 4) Gustavson Associates, LLC (“Gustavson”) was commissioned by Bema Gold Corporation ("Bema") in April, 2005 to assist Bema with the preparation of a Canadian National Instrument 43-101 compliant summary of the Kupol Project Feasibility Study, Chukotka A.O., Russian Federation. The purpose of this Technical Report is to provide a concise summary of the Kupol Project Feasibility Study. |

| | |

| 1.1 | Terms of Reference A significant information base is in the public domain concerning the Kupol Project. In November, 2003 a Technical Report was authored by Tom Garagan, P. Geo.(Bema’s Vice President, Exploration) and Hugh MacKinnon, P. Geo. (Kupol Project Geologist), titled “Kupol Project, Chukotka A.O., Russian Federation”. A second Technical Report, titled “Kupol Project Preliminary Assessment Summary, Chukotka A.O., Russian Federation” was authored by Tom Garagan, P. Geo. in June, 2004. Most recently, another Technical Report was written by Tom Garagan, P. Geo. titled “Technical Report on the Kupol Project, Chukotka A.O., Russian Federation, Report for NI 43-101” on 31 March, 2005. The most recent report comprises a complete NI 43-101 compliant report on the geology, exploration and mineral resource estimates of the Kupol Project. Each of the above reports is filed on SEDAR. With respect to Items 6 through 11 of Form 43-101F1, the Garagan report of 31 March 2005 presented the current knowledge of each Item. These Items will be cited herein with a note as to the location in Garagan’s report, with any additional, material information added. If warranted, summary tables are presented. Bema is a “producing issuer” with respect to mineral resource and mineral reserve reporting to Canadian securities authorities. There is no requirement for the independence of the Qualified Person in reporting. This technical report has been prepared in accordance with the guidelines provided in National Instrument 43-101 ("NI43-101"), Standards of Disclosure for Mineral Projects and Form 43-101F1. Where possible, the applicable 43-101F1 paragraph number in this report’s section headings, i.e.(Item 29).

|

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 2 |

| Kupol Project | Summary of Feasibility Study |

William Crowl, Gustavson’s Vice President, Mining Sector and Mr. Fred Stahlbush, Bema’s Kupol Feasibility Study Manager are ultimately responsible for the preparation of this report. They are Qualified Persons as defined in NI43-101. Certificates by Messrs. Crowl and Stahlbush are included in Appendix A. Mr. Crowl visited the Kupol Project site and critical project infrastructure sites from May 15 through May 18, 2005. Fred Stahlbush visited the site twice in 2004.

The Kupol Preliminary Economic Assessment and the Feasibility Study involved a multitude of professionals in the Bema organization and several individual and consulting firms performing engineering and providing third party reviews. All of the firms and individuals have the requisite expertise and experience to provide Bema with engineering products meeting or exceeding industry standards. Table 1.1 lists the major contributors to the Kupol Project.

Table 1.1: Kupol Feasibility Study Responsible Parties, Contractors and Consultants

Major Feasibility

Area | Sub Area | In-House Expertise | Consultants/

Third Party

Reviewers | Comments |

| Business Issues/Systems | Country Taxation | Jim Sullivan and Magadan

Staff

Mark Corra and Staff

| | Bema Russian

Experience |

| Local Taxation | Jim Sullivan and Magadan

Staff

Mark Corra and Staff

| | “ |

| Dore Marketing | Jim Sullivan and Magadan

Staff

Mark Corra and Staff

| | “ |

| Legal Considerations | Roger Richer

Bill Lytle

Jim Sullivan

| | “ |

| Organization | HR | Jim Sullivan and Russia Staff

| | Bema Russian

Experience |

| Territorial/Region Laws | Jim Sullivan and Staff

Bill Lytle | | Bema Russian

Experience |

| Government relations | Magadan Staff

Bill Lytle

Bema Executives

Jim Sullivan

| | |

| Safety and Health Issues | Julietta Operations personnel

Jim Sullivan and Staff

Bill Lytle

| | Operations Experience |

| Surface Mine | Material Handling

Characteristics | John Rajala

George Johnson

Doug Wollant

Julietta Operators

| Diamondback

Consulting | Diamondback formerly Jeneke and Johanson |

Waste/Ore

Characteristics | Tom Garagan/Large

Experienced Geologic Staff

John Rajala | | Bema has strong exploration track record |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 3 |

| Kupol Project | Summary of Feasibility Study |

Major Feasibility

Area | Sub Area | In-House Expertise | Consultants/

Third Party

Reviewers | Comments |

| | Waste Rock Issues

(ARD, acid rock

drainage etc.) and

Geochemical

Characterization

| Bill Lytle

Fred Stahlbush

| Geochemica - Mark

Logsdon

Steve Atkins

AMEC – Peter

Lighthall

| |

Geotechnical – Slope

Analysis and Stability

| Fred Stahlbush

Hugh McKinnon

Vernon Shein

Travis Naugle

| Wardrop Mining and

Minerals – Dave

West

SRK Consulting

| SRK consultant during

the PEA |

Surface Mine

Production Engineering

| Doug Wollant

Fred Stahlbush

George Johnson

| Wardrop – Andy

Nichols, Ian

Pritchard, and

Gordon Zurowski

SRK Jim Robertson

| |

Equipment,

Maintenance Facilities

| Julietta Personnel

Richard Matson and Kupol

Site personnel

Doug Wollant

Fred Stahlbush

Rick Thomas

George Johnson

Julietta Personnel

Orocon Personnel

| Wardrop – Andy

Nichols and Gordon

Zurowski

Mike Ross - Orocon

| Mike Ross and Richard

Matson (with staffs) and

Julietta Personnel bring

years of experience to

this area |

| Underground Mine | Mine Openings/Mine

Preproduction

development

| Fred Stahlbush

Doug Wollant

Travis Naugle

Don Cameron

Julietta Staff – Randy

Reichert and Pat Dougherty

| Wardrop – Jim

Campbell, Dave West

and Andy Nichols

| Bema has considerable

underground excavation

expertise |

Underground Mining

methods/Stoping Cycles

and Backfill Knowledge | Same as above

| SRK

Wardrop – same as

above

| Bema has considerable

underground excavation

expertise |

Geotechnical

| George Johnson

Jim Sullivan

Fred Stahlbush

Travis Naugle

Hugh McKinnon

Vernon Shein

| Wardrop Mining and

Minerals – Dave

West

SRK Consulting

| SRK consultant during

the PEA |

Underground

Equipment

Capital Cost

Experience

Operating cost

estimation

Review of Proposals

| Fred Stahlbush

Travis Naugle

Doug Wollant

| Wardrop – Ian

Pritchard and Andy

Nichols

Thyssen

| Underground

development and

mining straightforward

– Conventional Rubber-

tired development and

short level spacing

Longhole stoping |

Underground

Infrastructure

| Fred Stahlbush

Travis Naugle

George Johnson

Doug Wollant

| Wardrop - Andy

Nichols, Jim

Campbell, Martin

Drennen

Thyssen

| |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 4 |

| Kupol Project | Summary of Feasibility Study |

Major Feasibility

Area | Sub Area | In-House Expertise | Consultants/

Third Party

Reviewers | Comments |

| Metallurgy/Mill | Metallurgical

Characterization | John Rajala

Geology Staff at Kupol and

Vancouver – Tom Garagan,

Hugh Mackinnon, Vern Shein

Art Winckers

Mike Ross | Orocon

Tony Brown &

Doug Halbe –

reviews

Fred Pena of Metso -

Grinding

Multiple labs used:

Lakefield Research

McClelland labs

McPherson Limited

Dorr-Oliver Eimco

Canmet (leach

optimization)

Inco (CN destruction) | Au and Ag recoveries

CN use Optimization

CN recoveries testwork

Thickening testwork

Flow Sheet – Whole

Ore Leach |

Flow Sheet

Development | See Above | See Above

Chris Fleming

Unifield Engineering

- AVR | See Above |

| Equipment Selection | John Rajala

Mike Ross

Art Winckers

Julietta Personnel | Orocon – Mike Ross,

Art Winkers and

several staff

| John Rajala and Orocon

personnel have

construction multiple

successful metallurgical

installations |

| Operations | Mike Ross

Art Winckers

John Rajala

| Orocon

Tony Brown

Doug Halbe

| |

| Tailing Disposal | John Rajala

Mike Ross

Fred Stahlbush

Bill Lytle | AMEC – Peter

Lighthall

| Mike Ross – Looked at

conventional tailing

impoundment and dry-

stacked tailings –

conventional chosen |

| Water Supply | Bill Lytle | Russian Hydrologists

familiar with Arctic

Environment

AMEC

| |

| Geology | Very Experienced Staff | Tom Garagan

Brian Scott

Hugh MacKinnon

Vern Shein

Multiple site geologists

Susan Meister

Don Cameron | Harry Parker

David Rhys

Greg Warren

Ken Brisebois

Bill Crowl

| Proven Track record |

Structural Geology

| Above | David Rhys

| |

Resource Interpretation

and Reserve Calculation

| Above | AMEC - Harry

Parker and team

| |

Services/Infrastructure

/Movement of

Personnel and

materials | Logistics | Doug Wollant

Magadan Staff of Buyers and

expediters

Steve Olsen | Multiple contracting

companies

| 5 years of Julietta

successful construction

and operations

Kupol – two successful

winters getting supplies

to the property |

| Maintenance facilities | Doug Wollant

Richard Matson | Orocon

Wardrop

| Experience in services

available |

Material transportation

Costs and Material

Supply Costs | Jim Sullivan Magadan

Staff\Doug Wollant | | Constant ongoing

supply stream to

Exploration effort and

Julietta

Major materials to

Kupol winters of 2003-

04 and 2004-05 |

| Power Generation | Richard Matson

Doug Wollant

Julietta | Orocon and

consultants | |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 5 |

| Kupol Project | Summary of Feasibility Study |

Major Feasibility

Area | Sub Area | In-House Expertise | Consultants/

Third Party

Reviewers | Comments |

| | Water Supply | Bill Lytle | AMEC – Andzej

Slawinski | Process water source

established

Permanent Potable

water Source

exploration underway |

| Site - Geotechnical | Hugh Mackinnon

Vernon Shein

Doug Wollant

| AMEC – Rodney

Kostaschuk

Peter Lighthall | Considerable Russian

Expertise used

Also performed

aggregate testing |

| Environmental | Socio-Economic Issues | Bill Lytle

Jim Sullivan and Magadan

Staff

| | “Daily” experience |

| Flora and Fauna Issues | Bill Lytle

| Various Russian Consultants | Operating Experience |

Permitting Regulations

and timelines | Jim Sullivan and Magadan

Staff

Bill Lytle

| | Multiple project permits

in place |

| | | | | |

| General | Construction

Experience

Equipment Procurement

Expediting | Randy Reichert – Polaris

Doug Wollant – Julietta

George Johnson – Multiple

mines

John Rajala-Kubaka

Fred Stahlbush – Multiple

mines with major

construction

projects

| Orocon – Multiple

Mill facilities

construction

Richard Matson –

Multiple Road and

Civil Construction

projects (mining and

Petrochemical)

George Stone –

Catering and

Infrastructure support | The exploration man

camp at Kupol housed

150+ people for the

entire summer during

the drilling and

construction effort.

Roadway, aggregate

crushing and mill site

excavation currently

underway at Kupol

Summer 2005 camp of

400+personnel |

| Transportation | Doug Wollant

Jim Sullivan and Magadan

Staff

| Orocon

Equipment suppliers

Komatsu (on site at

Kupol now)

Tamrock

General – Investment

activity in Russia has

increase in the last 10

years. Infrastructure

and logistics are

known by the mining

industry and the

petrochemical

industry

| Bema Presently:

Ships by sea to Pevek

and Magadan

Ships by rail across

Russia

Ships by fixed wing

propeller aircraft to

Keperveem

Ships by Chopper

wherever required

Supplies by full season

road to Julietta

Supplies by Winter road

to Kupol from Pevek

and Magadan

Charter flights from

Nome to Keperveyem |

| Cost Estimating | Data from Julietta

Kupol Experience

Fred Stahlbush

Rick Thomas

Tony Ketley

Doug Wollant

George Johnson

In general – very experienced

staff

| Orocon – Experience

Independents:

James Rawley

Anthony Brown

Wardrop – Andy

Nichols

Thyssen Mining

Tony Ketley

| 2004 actual costs

2005 – Experience from

actual site activities

(civil work)

Logistics – Actual cost

and recognition of

improvements

Final contracts signed

and fabrication

underway (mill services

building and permanent

camp for example |

| Scheduling | Doug Wollant

John Rajala

Rick Thomas | Wardrop – Andy

Nichols

Orocon

| Significant Site and

Logistics events have

already taken place |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 6 |

| Kupol Project | Summary of Feasibility Study |

Major Feasibility

Area | Sub Area | In-House Expertise | Consultants/

Third Party

Reviewers | Comments |

| | | Goran Serdarevic | AMEC (tailing

impoundment) | |

| | | | | |

| 1.2 | Effective Date(Item 24) The effective date of the mineral resource statements in this report is March 31, 2005, as reported in Tom Garagan’s “Technical Report on the Kupol Project, Chukotka A.O., Russian Federation, Report for NI 43-101”, dated March 31, 2005. The effective date of this Technical Report is July 4, 2005. |

| | |

| 1.3 | Metal Prices and Exchange Rates The currency exchange rates used in the Kupol Feasibility Study are 30 Russian Rubles per US$ and $1.20 Canadian dollars per US$. The gold and silver prices used are US$400 and US$6.00 per troy ounce of gold and silver, respectively. |

| | |

| 1.4 | Units of Measure Unless stated otherwise, all quantities are in metric units. |

| | |

| 1.5 | Qualifications of Consultant Portions of this report have been prepared based on technical reviews and first-hand examinations/investigations by William Crowl, P.G. from Gustavson Associates, LLC’s Boulder, Colorado, USA office. Neither Gustavson nor any of its employees and associates employed in the preparation of this report has any beneficial interest in Bema Gold Corporation. Gustavson will be paid a fee for this work in accordance with normal professional consulting practice. William Crowl, P.G. has extensive experience in the mining industry and is a member in good standing of appropriate professional organizations and is a Qualified Person as defined by NI43-101. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 7 |

| Kupol Project | Summary of Feasibility Study |

| 2.0 | DISCLAIMER(Item 5) |

| | |

| 2.1 | Limitations & Reliance on Information Data presented in this report reflect various technical and economic conditions at the time of writing. Given the nature of the mining business, these conditions can change significantly over relatively short periods of time. This report summarizes the results of the Kupol Project Feasibility Study, which is the result of the compilation of the work of a number of individuals and companies by Bema Gold Corporation. The achievability of LoM plans, budgets and forecasts are inherently uncertain. Consequently, actual results may be significantly more or less favorable. This report includes technical information, which requires subsequent calculations to derive sub-totals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, Gustavson does not consider them to be material. Gustavson is not an insider, associate or an affiliate of Bema. The results of the study by Gustavson are not dependent on any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings. Gustavson reviewed a limited amount of correspondence, pertinent maps and agreements to assess the validity and ownership of the mining concessions. Bema assumes full responsibility for statements on mineral title and ownership. No information came to Gustavson’s attention during their review of the data and information provided by Bema that would cause Gustavson to doubt the integrity of such data and information. This report was prepared in cooperation with senior Bema personnel, who are persons well experienced in their respective fields. Gustavson and William Crowl, P.G. take responsibility specifically for the reporting of the Mineral Reserves as converted from the Mineral Resources estimated under the supervision of Qualified Persons employed by Bema, namely Tom Garagan, P. Geo. Fred Stahlbush, as Bema’s Kupol Project

|

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 8 |

| Kupol Project | Summary of Feasibility Study |

| | Feasibility Study Manager, is the Qualified Person responsible for the remaining sections of this report. |

| | |

| 2.2 | Disclaimers & Cautionary Statements for US Investors In considering the following statements Gustavson notes that the term “ore reserve” for all practical purposes is synonymous with the term “Mineral Reserve”. The United States Securities and Exchange Commission (the “SEC”) permits mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce from. Certain items are used in this report, such as “resources,” that the SEC guidelines strictly prohibit companies from including in filings with the SEC. Ore reserve estimates are based on many factors, including, in this case, data with respect to drilling and sampling. Ore reserves are determined from estimates of future production costs, future capital expenditures, and future product prices. The reserve estimates contained in this report should not be interpreted as assurances of the economic life of the Mining Assets or the future profitability of operations. Because ore reserves are only estimates based on the factors described herein, in the future these ore reserve estimates may need to be revised. For example, if production costs decrease or product prices increase, a portion of the resources may become economical to recover, and would result in higher estimated reserves. The converse is also true. The LoM Plans and the technical economic projections include forward-looking statements that are not historical facts. These forward-looking statements are estimates and involve a number of risks and uncertainties that could cause actual results to differ materially. Gustavson has been informed by Bema that to the best of its knowledge, there is no current litigation that may be material to the Kupol Project Assets. |

| | |

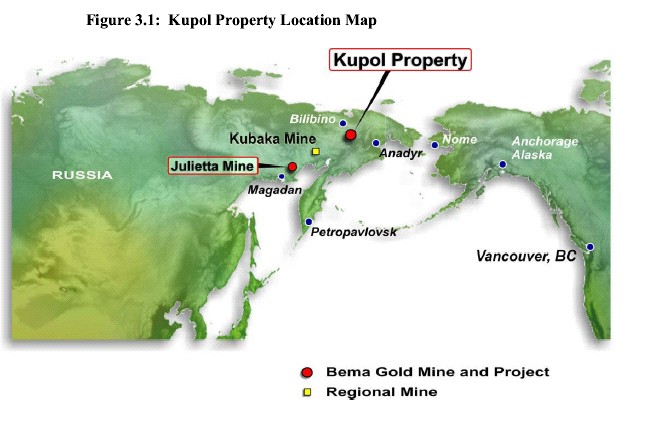

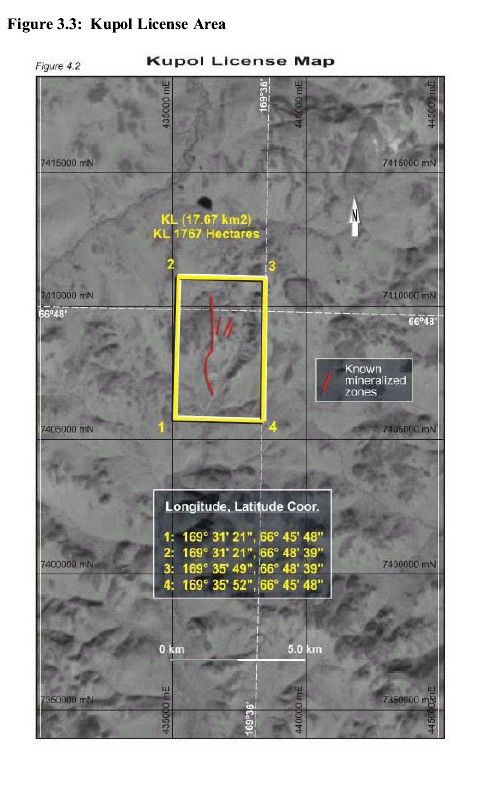

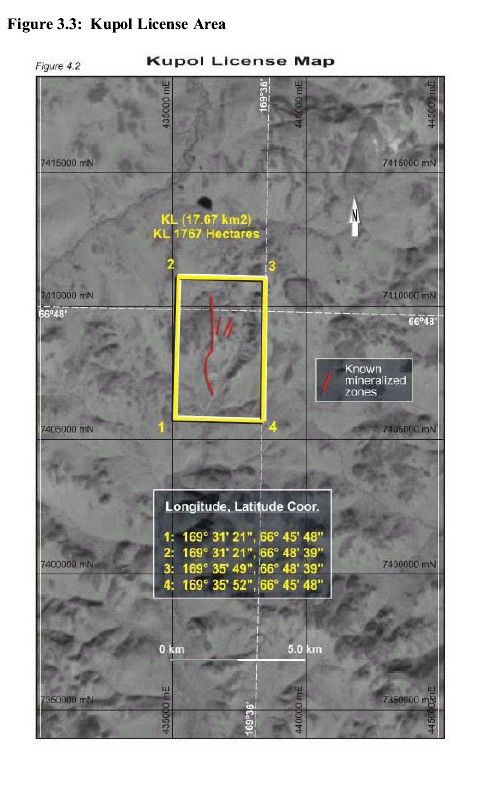

| 3.0 | PROPERTY DESCRIPTION AND LOCATION(Item 6) Refer to Section 4 of Garagan, T., 2005, Technical Report on the Kupol Project, Chukotka A.O., Russian Federation – Report for NI 43-101, dated 31 March 2005 filed on SEDAR as per provisions of 43-101F1 for details of the Property Description and Location. Figure 3.1 is a general location map for the Kupol Project and Figure |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 9 |

| Kupol Project | Summary of Feasibility Study |

| | 3.2 is a map of the local area with roads, ports, etc. Figure 3.3 is included to show the property boundaries and the coordinates of the property corners. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 10 |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 11 |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 12 |

| Kupol Project | Summary of Feasibility Study |

| 4.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY(Item 7) Refer to Section 5 of Garagan, T., 2005, Technical Report on the Kupol Project, Chukotka A.O., Russian Federation – Report for NI 43-101, dated 31 March 2005 filed on SEDAR as per provisions of 43-101F1 for details of the Property Description and Location. Clarifying additional information on Accessibility and Infrastructure, not provided in the above referenced report, is included below. |

| | |

| 4.1 | Accessibility & Infrastructure Refer to Section 20.8 of this Report for information on access and infrastructure. |

| | |

| 5.0 | HISTORY(Item 8) Refer to Section 6 of Garagan, T., 2005, Technical Report on the Kupol Project, Chukotka A.O., Russian Federation – Report for NI 43-101, dated 31 March 2005 filed on SEDAR as per provisions of 43-101F1 for details of the Kupol Project history. |

| | |

| 6.0 | GEOLOGICAL SETTING(Item 9) Refer to Section 7 of Garagan, T., 2005, Technical Report on the Kupol Project, Chukotka A.O., Russian Federation – Report for NI 43-101, dated 31 March 2005 filed on SEDAR as per provisions of 43-101F1 for details of the Kupol Deposit geology and geological setting. |

| | |

| 7.0 | DEPOSIT TYPES(Item 10) Refer to Section 8 of Garagan, T., 2005, Technical Report on the Kupol Project, Chukotka A.O., Russian Federation – Report for NI 43-101, dated 31 March 2005 filed on SEDAR as per provisions of 43-101F1 for details of the Kupol gold deposit types.

|

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 13 |

| Kupol Project | Summary of Feasibility Study |

| 8.0 | MINERALIZATION(Item 11) Refer to Section 9 of Garagan, T., 2005, Technical Report on the Kupol Project, Chukotka A.O., Russian Federation – Report for NI 43-101, dated 31 March 2005 filed on SEDAR as per provisions of 43-101F1 for details of the Kupol deposit mineralization. |

| | |

| 9.0 | EXPLORATION(Item 12) |

| | |

| 9.1 | Exploration History In summary, the vein system was defined by thirty-five trenches over a strike length of three kilometers and by geophysics, geochemistry, and mapping over a strike length of four kilometers. Trench spacing ranged from 200 meters along strike to the south to fifty meters in the Big Bend. The central portion of the vein system was stripped, mapped and channel sampled in detail. A soil geochemical survey that covered 7.8 square kilometers defined the deposit as a gold, silver, arsenic anomaly with localized areas of anomalous mercury, lead, zinc, and antimony. Magnetic and resistivity surveys were completed over a similar area with initial 100 by 20-metre grids followed by detailed 25-metre by 5-metre and 20-metre by 5-metre grids, respectively. This work defined the deposit as an area of magnetic low response and higher apparent resistivity. Twenty-six drillholes totaling 3,004 meters were drilled over a strike length of 450 meters to a maximum depth of 140 meters. In 2003, six more trenches were excavated, and 166 drillholes, for 22,257.69 meters were drilled over a strike length of 3.1 kilometers to a maximum depth of 250 meters. Table 9.1 summarizes the drilling, trenching and channel sampling. Garagan and MacKinnon (2003) documents the 2003 exploration program. Table 9.1: Summary of Work Prior to 2004 |

| 1998 |

| Type of Work | Count | Meterage |

| Drilling | 2 | 160.00 |

| | | |

| Trenching | 4 | 700.00 |

| | | |

| 1999 |

| Type of Work | Count | Meterage |

| Stripping and Channel Sampling | 12 | 416.50 |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 14 |

| Kupol Project | Summary of Feasibility Study |

| Drilling | 7 | 741.40 |

| Trenching | 1 | 120.00 |

| | | |

| 2000 |

| Type of Work | Count | Meterage |

| Stripping and Channel Sampling | 80 | 2099.30 |

| Drilling | 12 | 1509.30 |

| Trenching | 13 | 2618.60 |

| | | |

| 2001 |

| Type of Work | Count | Meterage |

| Stripping and Channel Sampling | 17 | 595.00 |

| Drilling | 5 | 593.30 |

| Trenching | 16 | 1595.50 |

| | | |

| 2003 |

| Type of Work | Count | Meterage |

| Drilling | 166 | 22257.69 |

| Trenching | 6 | 805.22 |

| 9.1.1 | 2004 Exploration In 2004, the field season spanned from May through November. The work consisted of drilling, trenching, and the stripping and channel sampling of the Kupol vein. Table 9.2 summarizes the work completed in 2004. Table 9.2: Summary of Work in 2004 |

| Type of Work | Number | Meterage |

| Stripping and Channel Sampling | 87 | 698.89 |

| Drilling | 309 | 52,828.50 |

| Trenching | 2 | 225.53 |

| | Additional sampling for metallurgical testing was completed. |

| | |

| 9.1.1.1 | Trenching Two trenches, for 225.53 meters were excavated in the South Extension zone. These trenches were cleaned and mapped; seventy-one samples were collected. Coarse-grained stibnite, the first occurrence of larger crystals documented in the deposit area, was observed in trench K-53. The results of significance are presented in Table 93. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 15 |

| Kupol Project | Summary of Feasibility Study |

| | Table 9.3: Trench Results |

| Trench ID | From | To | Width | Au gpt | Ag gpt | Ag:Au |

| K-53 | 26.10 | 28.60 | 2.50 | 2.53 | 59.53 | 235:1 |

| | 35.40 | 39.00 | 3.60 | 1.03 | 40.12 | 39.0:1 |

| K-54 | 58.30 | 59.00 | 0.70 | 2.80 | 18.00 | 6.4:1 |

| 9.1.1.2 | Stripping and Channel Sampling In 2004, approximately 4,680 square meters of the Kupol vein mineralization was exposed, mapped, and sampled in sections of the North, Big Bend, and Central zones. Prior to 2003, large areas of the Big Bend and Central zones were stripped, mapped, and sampled in the same manner. The purpose of this work was to aid in calculating dilution and assessing grade continuity in conjunction with the very close-spaced drilling in the Big Bend and South zones. The areas were mechanically cleared of surface debris and were pressure washed using a Wajax pump. A five meter by five meter control grid was established by Russian surveyors over each area. The areas were mapped by Russian geologists at a scale of 1:50. The exposures were channel sampled along east-west lines at five to ten meters spacing. The start and end of each sample was surveyed. A summary of the extents of this work is presented in Table 9.4. Table 9.4: Summary of Stripping, Mapping and Channel Sampling |

| Zone | Area (m2) | Spacing (m) | Strike

Length (m) | No of

Lines | No. of

Channels | No. of

Samples |

| North | 1415 | 10 | 60 | 7 | 8 | 195 |

| Big Bend | 2080 | 5 and 10 | 270 | 38 | 49 | 448 |

| South | 1185 | 5 and 10 | 100 | 19 | 30 | 328 |

| Total | 4680 | | 430 | 64 | 87 | 971 |

| | In the North zone, due to freezing temperatures only the southern most twenty percent of the area was washed and sampled. This extended up to fifteen meters east of the main vein system across a zone of sheeted and stockwork quartz veining. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 16 |

| Kupol Project | Summary of Feasibility Study |

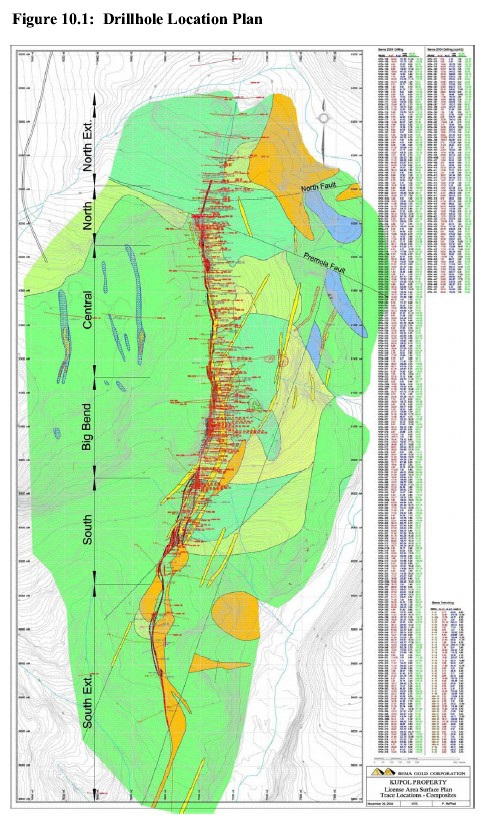

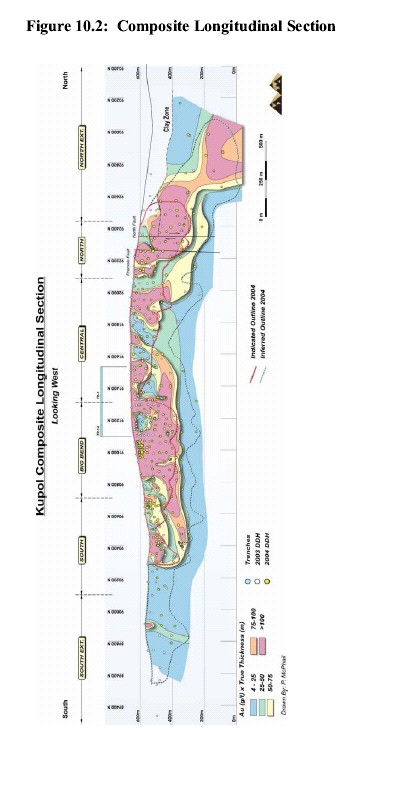

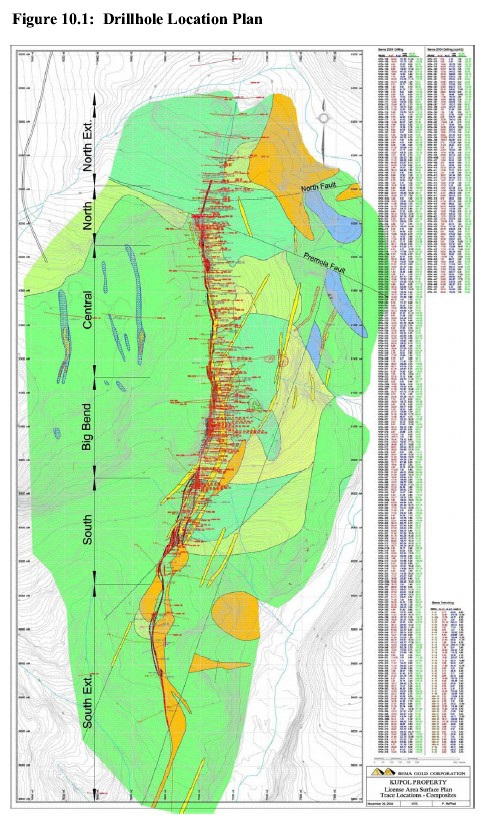

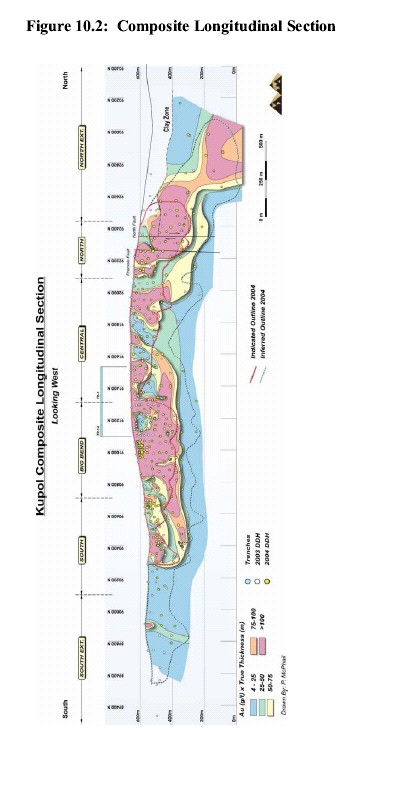

| 10.0 | DRILLING(Item 13) The primary emphasis of the 2004 drilling program was to upgrade the inferred resource to indicated. The drilling program was successful in confirming and improving upon known mineralization. In the North Zone multiple veins were confirmed, new veins were identified and the deeper mineralization at the north end was extended 350 meters to the north. In the Big Bend Zone, drilling continued to prove the continuity of high-grade mineralization. Mineralization remains open to the south and at depth and along strike in the north. Several parallel structures are untested. In 2004, 309 drillholes were drilled for a total of 52,828.5 meters. The drillhole locations are shown on Figure 10.1. Figure 10.2 is a composite longitudinal section of the Kupol drilling and mineralization. The diamond drilling was conducted using two Longyear 38 drill rigs, three Longyear 44 drill rigs and two Russian CKB-4 drill rigs. The Longyear rigs drilled PQ, HQ and NQ diameter core; the Russian rigs drilled NQ diameter core. Core recovery varies by location. Recoveries in the mineralized zones range from 3% to 100%; the average is 96.3% . Drilling muds and polymers were used extensively to enhance recoveries. The property grid is a Russian local grid system; it replaces the Gauss Kruger (Pulkovo 42) datum used in 2003. Grid lines are oriented east-west, perpendicular to the average strike of the deposit. The Kupol deposit is divided into six zones: |

| | 1. | South Extension Zone: | 89525N to 90075N |

| | 2. | South Zone: | 90075N to 90700N |

| | 3. | Big Bend Zone: | 90700N to 91275N |

| | 4. | Central Zone: | 91275N to 92100N |

| | 5. | North Zone: | 92100N to 92425N |

| | 6. | North Extension Zone: | 92425N to 93150N |

| | |

| | The zones are contiguous and mineralization has been defined within the zones over 3.6 kilometers of strike. The geology and the results are summarized by zone in the following sections. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 17 |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 18 |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 19 |

| Kupol Project | Summary of Feasibility Study |

| 10.1 | South Extension Zone: 89525N to 90075N The South Extension zone extends from the Kaiemraveem River at section 89525N to 90075N. In 2004, six drillholes for 1,038.3 meters were drilled. The drill spacing ranged from 75 meters to greater than 200 meters along strike. The zone has been drilled to a maximum vertical depth of 200 meters. The drilling focused on testing down-dip and strike extensions to several higher-grade zones that were intersected in 2003. Drilling, trenching, and mapping has defined three main veins with variable widths and grades that are spaced over a fifteen to thirty meter wide north trending corridor that is bounded to the east and in part to the west by several rhyolite dykes and flow dome complexes up to 150 meters wide. Significant grades have been intersected in all three veins; however, the ore shoots are not yet well defined. The vein is disrupted by the rhyolite units. The South Extension zone is characterized by quartz vein material with distinct olive-green quartz and a hematite overprint. Veins are commonly brecciated, not as well banded and the quartz tends to be more sucrosic and/or massive than to the north. The sulphosalts are a bit finer-grained than in the Big Bend zone and, in general, there is more gypsum than in the vein systems observed to the north. There is no obvious zonation or strong base metal signature to suggest that the South Extension zone is distal to the main mineralization pathways. Silver to gold ratios vary from 7:1 to 30:1 with an average of approximately 12:1, similar to the rest of the Kupol deposit. A moderate to strong acid sulphate alteration zone is defined over the zone from the Kaiemraveem River, in the south, to the South zone. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 20 |

| Kupol Project | Summary of Feasibility Study |

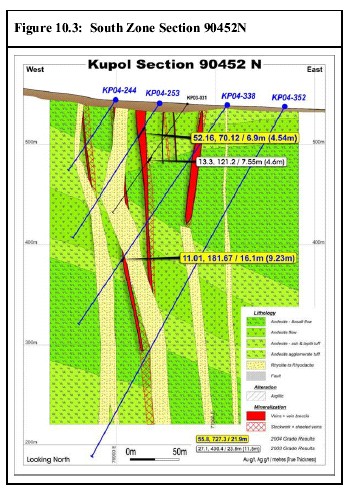

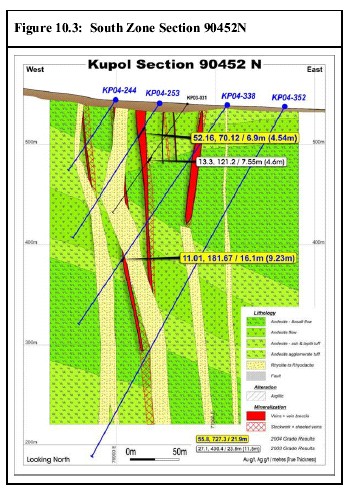

| 10.2 | South Zone: 90075N to 90700N Fifty-six holes, totaling 7,197.8 meters were drilled in the South zone in 2004. The drill spacing ranged from 50 meters to greater than 100 meters along strike for most of the zone. Sixteen holes were drilled on four sections between 90640 and 90670N, spaced ten meters apart and to a vertical depth of 30 meters vertical depth. This work, in conjunction with the detailed channel sampling of the exposed vein, helped to assess grade continuity, vein contact geometry, and dilution. The South zone contains up to five significant veins that occur in a forty to seventy meter wide north-northeast trending corridor. The veins are locally disrupted by a series of two to four rhyolite dykes up to 100 meters wide at surface with a similar north-northeast trend. A large rhyolite dyke/flow dome complex cuts off the veins at 90100 N; this marks the southern termination of the South zone. The north end of the zone is defined by a northwest trending fault and the start of the southward bifurcation of the main vein system. Significant intersections from these veins include: |

| | • | KP04-224 - average 35.33 g/t Au and 831.17 g/t Ag over 7.0 meters (4.09m true width) |

| | • | KP04-253 - average 52.16 g/t Au with 70.12 g/t Ag over 6.9 meters (3.78m true width) |

| | | |

| | A well-mineralized vein that occurs sixty meters east of the main vein system is inferred to be the faulted southern extension of the Big Bend vein, and has been referred to as the “Offset Vein.” This vein was intersected in only two holes; its extent is unknown. Significant intersections from this vein include: |

| | |

| | • | KP04-338 – average 11.01 g/t Au and 181.67 g/t Ag over 16.1 meters (9.23 m true width) |

| | • | KP04-451 - average 29.54 g/t Au with 156.56 g/t Ag over 7.0 meters (3.86 m true width) |

| | | |

| | As with the South Extension zone, the South zone is characterized by an abundance of olive green quartz and two phases of hematite. The Offset Vein lacks the hematite rich phases, is less brecciated, and has better developed crustiform banding than the rest of the South Extension zone veins. This supports the inference that the vein is the strike continuation of the main (eastern) South - Big Bend vein. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 21 |

| Kupol Project | Summary of Feasibility Study |

Preliminary petrographic and infrared spectroscopy (PIMA) studies indicate a mixed alteration assemblage similar to other areas of the deposit. The presence of kaolinite and boiling textures in the vein and at depth in holes KP03-46 and 42 suggest a relatively high stratigraphic position in the epithermal system and good potential for mineralization at depth. Petrographic work to date indicates that acanthite is the dominant silver sulphide mineral.

A northwest trending sinistral fault cuts through the north end of the zone and offsets the main vein. Dyke and vein discontinuities that became evident during the modeling process indicate that additional faults likely disrupt the zone. Due to drilling density and orientation, the fault geometry is uncertain. Additional drilling, including oblique drillholes, is required to better define the vein and fault geometry. Vein fragments in the rhyolitic polymitic breccia, coupled with discontinuities in veins across the dykes suggest that some assimilation of the vein by the dyke has occurred.

South Zone cross section 90452N is presented as Figure 10.3.

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 22 |

| Kupol Project | Summary of Feasibility Study |

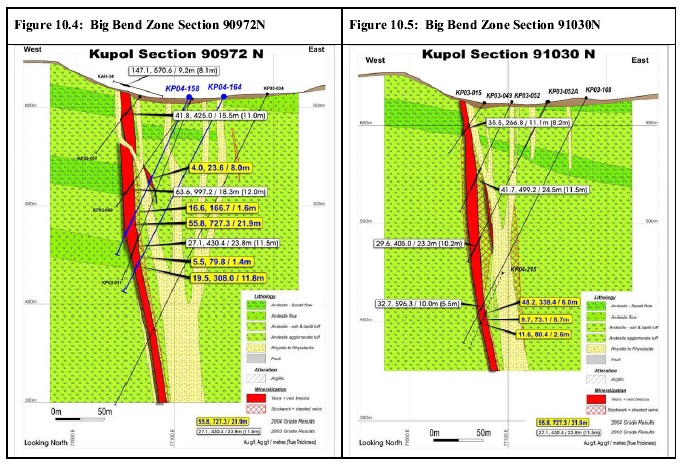

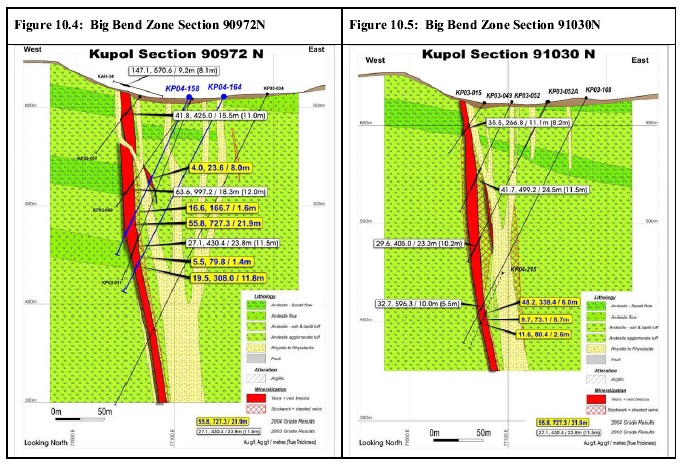

| 10.3 | Big Bend Zone: 90700N to 91275N The Big Bend zone has a strike length of 575 meters. The north end of the Big Bend zone is defined by the location of a large rhyolite dyke that bisects the zone at Section 91275 N. Southwest trending splays off the main vein structure at a sinistral fault at Section 90700 N defines the south end of the zone. The Big Bend zone has been tested by 120 drill holes totaling 16,071.9 meters, on sections spaced 25 to 50 meters apart to a depth of 250 meters below surface (400m elev.) and on sections spaced 50 to greater than 100 meter apart to a vertical depth of 400 meters. In the interval between 90930 N and 91050 N, fifty holes were drilled on sections ten meters apart to up to thirty meters below surface. The close-spaced |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 23 |

| Kupol Project | Summary of Feasibility Study |

drilling, in conjunction with the detailed channel sampling of the exposed vein, was to assess grade continuity and the nature of the contacts for dilution studies.

The zone is localized along a change in strike of the Kupol structure from 000 to 020 that was previously interpreted as a right-lateral dilatant flexure in the vein system. Various field relationships now suggest low magnitude (tens of meters) sinistral displacement along a pre-existing bend in the Kupol structure during formation of the vein system.

The Big Bend zone is comprised of a single, large banded fissure vein with associated sheeted veining. This vein is divided into footwall and hanging wall segments by a twenty to forty meter wide rhyolite dyke that bisects the zone between 400 to 550 meters elevation. This dyke branches upwards into two to four smaller dykes that are mostly situated in the hanging wall of the vein system. There is no apparent difference in the grade of intersections on either side of the dykes. The width of the Big Bend vein varies from one to twenty-two meters and is associated with a lower-grade stockwork/sheeted vein that is up to 30 meters wide. Clay gouge, sheeted and stockwork veins, and small islands of wall rock occur locally within the main vein envelope.

Gold and silver mineralization exhibits remarkable continuity within individual vein intercepts and between sections. The surface exposure of the vein indicates very strong development of continuous sulphosalt rich banding that helps explain the grade continuity. The new surface exposure of the vein indicates less brecciation of the colloform-crustiform banding than previously thought. Either the polyphase brecciation is a feature of deeper levels of the system or the brecciation seen in core is partially a cockade texture or other irregular banding features of the veins.

Gold and silver grades decrease significantly at 250 to 300 meters below surface over the length of the zone. This reduction in grade at 300 to 350 meters elevation is inferred to represent a precious metal deposition horizon. The controls on the horizon are not yet understood. Textures such as cyclic banding, open space filling, hydrothermal brecciation, cryptocrystalline quartz and partially replaced (by chlorite and pyrite) sulphosalt banding are present below this level, and to the level of the deepest drilling, which indicates that this area is still within the boiling level of the hydrothermal system. It is uncertain if there are stacked precious metal horizons in this area; this will be tested by drilling in 2005.

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 24 |

| Kupol Project | Summary of Feasibility Study |

| | Overall, the styles of mineralization are similar throughout the Big Bend zone, but within each vein intersection there are varieties of textural and mineralogical types that reflect local variability in hydrothermal brecciation/boiling events. The following five phases have been documented in surface exposures (Rhys, 2004): |

| | | |

| | • | Stage 1: early colloform-crustiform quartz-adularia phase containing sulphosalt bands |

| | • | Stage 2: quartz-sulphosalt healed breccia containing quartz fragments in a dark, sulphosalt rich matrix |

| | • | Stage 3: quartz-jarosite breccia comprised of cream to yellowy massive quartz +/- jarosite with variable fragments of banded quartz |

| | • | Stage 4: massive white quartz that occurs in bands up to four meters wide that anastomose through the core of the vein |

| | • | Stage 5: cockscomb textured amethyst as a late open space filling |

| | | |

| | In general, the highest grades are associated with stages 1 and 2 Gold and silver mineralization occurs as native gold, electrum, acanthite, freibergite/tetrahedrite, stephanite and to a lesser extent pyrargyrite and other sulphosalt minerals. Electrum and native gold is free and occurs adjacent to or within the silver sulphosalts and sulphides. Kaolinite, illite, smectite, and montmorillonite are the dominant clay species with jarosite and minor gypsum present in the upper parts of the zone associated with the clays. Scorodite, after arsenopyrite, is associated with the jarositic fracture filling. A minor amount of chlorargyrite was noted in a single trench sample; it is associated with late jarositic fracture infilling. Adularia, sericite/illite, and clay (smectite + kaolinite) are the dominant alteration minerals associated with the multiple phases of quartz within the veins. Quartz ranges in character from chalcedonic to finely crystalline; coarser comb-textured amethyst is locally present. Banded opaline quartz is virtually absent. Two Big Bend cross sections, 90972 N and 91030N, are presented as Figure 10.4 and Figure 10.5. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 25 |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 26 |

| Kupol Project | Summary of Feasibility Study |

| 10.4 | Central Zone: 91275N to 92100N The Central zone covers an 825 meter strike length of the Kupol vein structure. The zone was tested by fifty-nine drillholes totaling 9746.5 meters in 2004. Drill spacing on the upper levels of the zone ranges from 25 meters to 50 meters, but drillhole spacing in the deeper levels (>75 meters depth) varies from 50 to greater than 100 meters. The zone was drilled to a maximum depth of 430 meters below surface on a single section (91960N). The bulk of the 2004 drilling was biased toward definition of near surface mineralization. Mineralization in the Central zone is hosted within one to two veins, as opposed to the single vein in the Big Bend zone. These veins occur within a wider, lower grade, sheeted and stockwork zone. Shoot development in this zone appears to be related to dilatant jogs in the vein structure and is possibly related to junctions with northeast and/or northwest trending structures. Individual veins range in width up to fifteen meters but are commonly less than five meters wide. The dip of the veins is shallower at 72 to 78 degrees in the central and southern portions of the zone but steepens to the north. The main rhyolite dyke bisects the zone,into hanging wall and footwall vein segments; this is similar to the Big Bend zone. The dyke diverges to the northwest, away from the zone at approximately 91925N. The shallower portion of the zone, between 500 to 600 meters elevation, is bisected by a fault zone. Results from holes KP04- 363 (24.90 g/t gold and 493.21 g/t silver over 15.0 meters[10.12 m true width]) and KP04-232 (20.0 g/t gold and 244.29 g/t silver over 9.70 meters[6.96 m true width]) coupled with the results from KP04-403 (23.53 g/t gold and 753.55 g/t silver over 1.80 meters[1.2 m true width]) show that mineralization exists at depth below this barren fault and dyke zone. This indicates that the high-grade mineralization continues north at depth from the Big Bend zone. The zone is comprised of three high-grade shoots separated by lower grade zones, dykes, and faults. The high grade shoots range in length from 75 to 175 meters. They are defined to the 400 meter elevation level and are open at depth. Significant results from the northern ore shoot include: |

| | | |

| | • | KP04-298 - average 17.16 g/t Au and 143.14 g/t Ag over 16.8 meters (9.38 meters true width) |

| | • | KP04-299 - average 71.6 g/t Au and 2674.49 g/t Ag over 8.5 meters (4.23 meters true width) |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 27 |

| Kupol Project | Summary of Feasibility Study |

| | Significant results from the southern ore shoot include: |

| | | |

| | • | KP04-363 - average 24.90 g/t Au and 493.21 g/t Ag over 15.0 meters (7.49 meters true width) |

| | • | KP04-399 - average 223.90 g/t gold and 819.31 g/t silver over 4.90 meters (3.65 meters true width) and average 159.91 g/t gold and 553.87 g/t silver 6.10 meters (4.58 meters true width) |

| | |

| | The Central zone, between 91300N and 91520N had been exposed and channel-sampled at four-meter centers prior to 2004. The vein system ranges in width from five to thirty meters and is limited to the east by a four to seven meter wide rhyolite dyke. There is good continuity of grades within and along strike in this exposed vein area, with the highest grades encountered at the south end of the vein and in the western, hanging wall vein. Sparse drilling deeper in the main vein system encountered sub-economic but anomalous gold values in cyclic banded and chalcedonic quartz, suggesting the occurrence of boiling to at least 430 meters below surface (240m elevation). Sulphosalt concentrations are generally lower in this zone and there is a higher percentage of pyrite, especially north of 91770 N. The precious metal-rich fluid pathways in the central and northern portion of the Central zone are more constrained. Lower-grade crustiform and chalcedonic veining occurs adjacent to higher-grade sulphidic colloform-banded brecciated vein material. Banded, crustiform, opaline and chalcedonic quartz is more common in this zone than in the other zones and occurs to depths of up to 350 meters below surface. The zone has a chlorite-pyrite metasomatic overprint at depth, which is similar to the deeper part of the Big Bend zone. This overprint starts at an elevation of approximately 560 m in the southern part of the zone and continues to below the 400m elevation over the remainder of the zone. Petrography of samples from near surface in the Central zone indicates similar mineralogy to the Big Bend zone. One sample from 225 meters deep (KP03-99) indicates a complex paragenesis as follows: |

| | |

| | • | quartz-adularia vein |

| | • | breccia infill by a sulphidic (pyritic) iron-carbonate phase |

| | • | base metal (chalcopyrite, sphalerite), arsenic (arsenopyrite) and gold-silver (electrum, acanthite, freibergite) bearing phase; |

| | • | at least one other phase of quartz + adularia |

| | • | partial recrystallization by the thermal aureole |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 28 |

| Kupol Project | Summary of Feasibility Study |

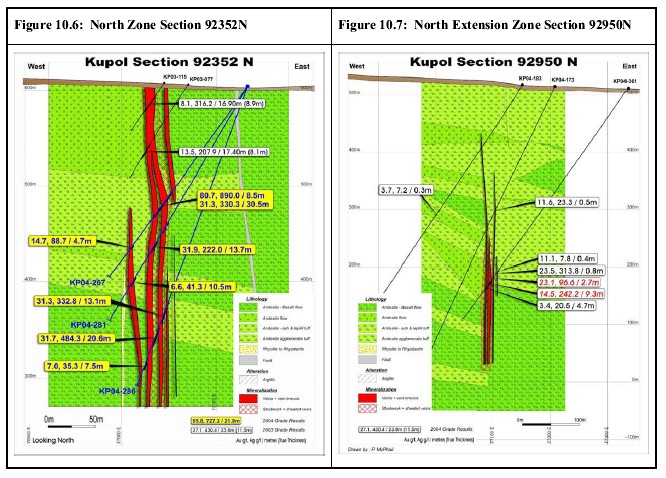

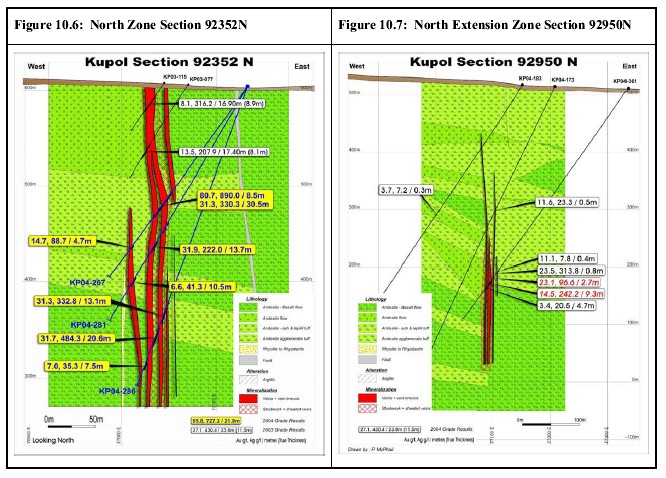

| 10.5 | North Zone: 92100N to 92425N Forty-four holes totaling 9,995.8 meters were drilled in 2004. Drill spacing was 25 to 50 meters near surface and 50 to 100 meters at depth. The zone has been drilled to a vertical depth of 425 meters (210 m elevation). In addition, the zone was stripped over 300 meters of strike length to 92400N. The southernmost sixty meters was mapped and channel sampled along lines spaced at ten meters apart. The northern end of the North zone is defined by a point where the top of the vein system starts to gradually plunge northward under a cover of strongly clay altered volcanics. It is uncertain if the plunge is a function of a change in hydrothermal gradient (possibly due to paleo-topography) or fault controls. The southern limit is defined by the start of the North zone high grade ore shoot. The vein system is laterally offset forty meters by the Premola Fault (92250N), a west-northwest trending dextral-normal fault. Farther north, a second fault is inferred at about 92340N. Here, the Main Marker unit is down-dropped to the north by fifty meters and the vein is displaced dextrally by up to twenty meters. A third shallow dipping fault truncates the vein and a parallel rhyolite dyke at about the 100 m elevation on section 92400N. Although up to five to six veins are locally present, the North zone is primarily made up of two main veins separated by up to twenty meters of stockwork, with the east, hanging wall vein commonly wider than the west, footwall vein. These two veins coalesce near surface above 550 m elevation. A third vein, locally well mineralized, occurs up to twenty meters west of the two veins between 92350N and 92470N. Narrower (<2m), occasionally gold bearing veins occur up to fifty meters east of the main vein system. Exposure, through stripping, of the southern portion of the vein indicates a complex anastamosing vein zone up to 30 meters wide with individual veins to five meters wide. Silver to gold ratios range from 5:1 to 15:1 in the east and 6:1 to 35:1 in the west. Grades are generally higher and more continuous in the east vein than in the west vein. Significant results from 2004 drilling include: |

| | | |

| | • | KP04-267 – average 31.31 g/t Au and 330.33 g/t Ag over 30.5 meters (17.96m true width) (HW + FW veins) |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 29 |

| Kupol Project | Summary of Feasibility Study |

| | • | KP04-280 - average 30.27 g/t Au with 281.46 g/t Ag over 15.2 meters (7.2m true width) (HW vein) |

| | • | KP04-286 - average 31.66 g/t Au with 484.31 g/t Ag over 20.6 meters (7.24m true width) (FW vein) |

| | | |

| | The textures and the character of the quartz and clay mineralogy, even at depth, suggest the intersection of the upper levels of a bonanza epithermal system. Lattice, frothy, vuggy and drusy textures at surface between the Premola and North faults suggest a vigorous boiling environment potentially close to the paleosurface or vadose zone. No consistent changes in silver-gold ratios are present to suggest a progressive change toward the roots of the boiling zone. Examples of high-level style boiling textures present at depth and at surface include quartz pseudomorphing of bladed calcite, opaline quartz infilling of voids, crustiform chalcedony and multiple re-healed breccia phases. In general, there are less sulphosalts within this area than in the Big Bend zone. There is a drop in grade in drillhole KP04-159 (8.87 g/t gold and 128.97 g/t silver over 10.0 meters) suggesting that the lower limit of the precious zone may be 400 to 450 meters below surface. A undercut of this drillhole with KP04-202A failed to intersect any vein; this suggests that a fault that offsets the zone is present at depth or that the vein rapidly pinches to depth. A representative North Zone cross section, 92352N, is presented as Figure 10.6. |

| | |

| 10.6 | North Extension Zone: 92425N to 93150N Twenty-four holes totaling 8,778.2 meters tested the North Extension zone in 2004. Drilling density is low with drilled sections spaced 50 meters between 92450N and 92600N to 100 meters or more north of 92600N. The two veins comprising the North zone continue northward, locally as one vein, under a cover of clay altered volcanics, to about 92750N where they pinch out. A second set of veins, seventy to 100 meters east of the main vein system, continues northward from 92590N for about 360 meters to 92950N. The eastern vein system comprises up to four veins up to five meters wide within a ten to twenty meter wide, north-northwest trending zone that remains open to the north and at depth. Significant results from both vein systems include: |

| | |

| | • | KP04-240 - average 37.03 g/t Au and 293.62 g/t Ag over 4.85 meters (2.15m true width) (main vein system) |

| | • | KP04-251 - 51.78 g/t Au and 229.67 g/t Ag over 6.7 meters (2.52m true width) (main vein system) |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 30 |

| Kupol Project | Summary of Feasibility Study |

| | • | KP04-204 - 41.78 g/t Au and 374.05 g/t Ag over 2.7 meters (1.47m true width) (eastern vein system) |

| | • | KP04-361 – 14.53 g/t Au and 242.21 g/t Ag over 9.3 meters (5.4m true width) (eastern vein system, northern most intersection) |

| | | |

| | The two vein systems are covered by a 100 to 150 meter thick cap of intense kaolinite + montmorillonite altered andesite pyroclastics and flows. This alteration zone manifests itself as a broad north trending magnetic low that extends to the limit of the survey. No soil or rock geochemical anomaly is present over the zone. Minor stringer veins, with low gold and silver values occur in vuggy siliceous pyrite-rich veins within the lower levels of the alteration blanket and demarcate the start of the transition into the precious metal zone. Local areas of vuggy silica alteration are present within the clay alteration zone; this is further evidence of an acid leach environment. The clay blanket, together with the presence of amorphous silica colloform banding, kaolinite and open space filling suggests that the veins occur in the higher levels of an epithermal system. The alteration above the veins is inferred to be the steam heated alteration zone at the top of the epithermal system (Hedenquist and White, 2005). An inferred fault down-drops the two vein systems by 100 to 150 meters between sections 92600N and 92725N. This is based on the rapid northward thickening of the overlying clay altered cap and the steep northward plunge of the top of the main vein system here. The most northerly hole, KP04-195, intersected 8.64 g/t Au and 33.98 g/t Ag over 1.0 meter suggesting that the zone has potential for an on-strike extension of at least 200. Based on the intersection in KP04-361, this hole is inferred to be above the main zone. Well developed colloform ginguro banding is present at depth in KP04-204 but is less well developed in KP04-361. Both vein systems are weakly chloritic and pyritic at depth (mostly below 250m elevation). This may be due to thermal, and hence mineralogical, zonation within the deposit or a late overprint, similar to that in Central and Big Bend. A representative North Extension cross section, 92950, is presented as Figure 10.7. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 31 |

| Kupol Project | Summary of Feasibility Study |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 32 |

| Kupol Project | Summary of Feasibility Study |

| 10.7 | Replacement Drilling The Russian holes drilled prior to 2003 were excluded from the resource and geological interpretation for the following reasons: |

| | | |

| | • | Questions about accuracy of collar and downhole surveys; down-hole surveying was not performed on all holes due to difficult ground conditions. |

| | • | There was no geological QA/QC program to confirm or check the results. |

| | • | There was an internal laboratory control program but the control results could not be verified. |

| | • | The whole core was sampled, so representative core does not remain to verify results. |

| | • | The drill program was not supervised by a qualified person. |

| | • | Whenever the drillholes were utilized for geological interpretation there was a resultant complication that was more likely a function of inaccurate surveys rather than incorrect geology. |

| | | |

| | All pre-2003 Russian drillholes, except those noted below, were ‘replaced’ with new ones drilled in 2004. The geology of the holes CKB-4, 10 and 19 were included in the resource model for the following reasons: |

| | | |

| | • | There was not enough time to drill new holes to replace these ones. |

| | • | The geology of the holes is such that the exclusion of these drillholes would have a material effect on the interpretation of the vein. |

| | | |

| | Due to poor core recoveries in the drillhole KP03-144 it was re-drilled as hole KP03-240; KP03-144 was excluded from use in the resource estimations. |

| | |

| 10.8 | Logging Protocols This section includes detailed information on the logging protocols used at the Kupol project in 2004, including: |

| | | |

| | • | geological logging |

| | • | geotechnical logging |

| 10.8.1 | Geological Logging A quick log for each hole was completed by the drill rig geologist responsible for that hole. Detailed logging was conducted by university trained, professional Russian geologists. Logging is onto paper forms. |

| Kupol Feas Study TR.doc | July 4, 2005 |

| Gustavson Associates, LLC | Project No. BEM003 |

| Bema Gold Corporation | Page 33 |

| Kupol Project | Summary of Feasibility Study |

| | In addition to the lithology, the colour, grain size, structures, core axes angles and the intensity of occurrence or non-occurrence of the following geological characteristics were noted on the detailed logs: |

| | | | |

| | • | Oxidation type, mineralogy, and intensity |

| | • | Mineralization |

| | | | Pyrite |

| | | | Chalcopyrite |

| | | | Sulphosalts |

| | | | Acanthite |

| | | | Arsenopyrite |

| | | | Visible gold |

| | • | Alteration |

| | | | Silicification |

| | | | Carbonate |

| | | | Propylitic |

| | | | Argillic |

| | | | Sericite-adularia |

| | • | Vein texture and intensity |

| | • | Magnetism |

| | • | Structure and bedding |

| | | |

| | Most of the parameters were logged categorically, using integers of 0 (absent) to 3 (strong). Additionally, all the information that was codified or categorically logged was fully described in text. The original logs also contain a graphical log. Vein intervals for the first forty drillholes of 2003 were re-logged to ensure conformity of early logging with later logging. |

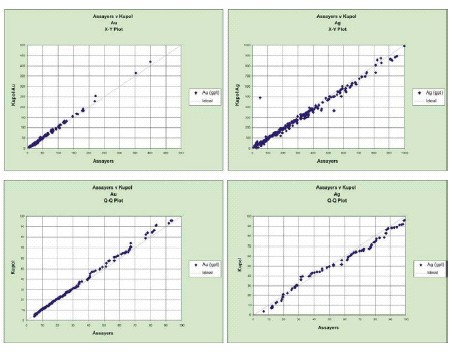

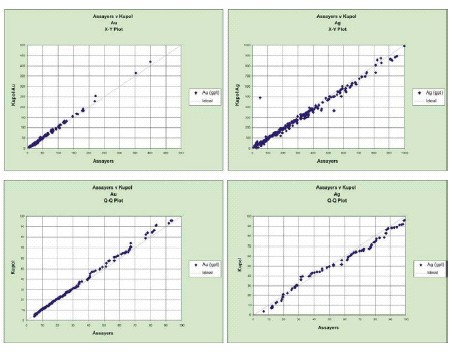

| | |