Wabash 2019 Investor Day Wabash 2019 Investor Day February 28 | NYC 1

Wabash 2019 Investor Day Safe Harbor Statement This presentation contains certain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements convey the Company’s current expectations or forecasts of future events. All statements contained in this presentation other than statements of historical fact are forward-looking statements. These forward-looking statements include, among other things, all statements regarding the Company’s outlook for trailer and truck body shipments, backlog, expectations regarding demand levels for trailers, truck bodies, non-trailer equipment and our other diversified product offerings, pricing, profitability and earnings, cash flow and liquidity, opportunity to capture higher margin sales, new product innovations, our growth and diversification strategies, our expectations for improved financial performance during the course of the year and our expectations with regards to capital allocation. These and the Company’s other forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward-looking statements. Without limitation, these risks and uncertainties include the continued integration of Supreme into the Company’s business, adverse reactions to the transaction by customers, suppliers or strategic partners, uncertain economic conditions including the possibility that customer demand may not meet our expectations, increased competition, reliance on certain customers and corporate partnerships, risks of customer pick-up delays, shortages and costs of raw materials including the impact of tariffs or other international trade developments, risks in implementing and sustaining improvements in the Company’s manufacturing operations and cost containment, dependence on industry trends and timing, supplier constraints, labor costs and availability, customer acceptance of and reactions to pricing changes and costs of indebtedness. Readers should review and consider the various disclosures made by the Company in this presentation and in the Company’s reports to its stockholders and periodic reports on Forms 10-K and 10-Q. We cannot give assurance that the expectations reflected in our forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in these forward-looking statements. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by the factors we disclose that could cause our actual results to differ materially from our expectations. Non-GAAP Financial Measures In addition to disclosing financial results calculated in accordance with United States generally accepted accounting principles (GAAP), the financial information included in this presentation contains non-GAAP financial measures, including free cash flow, operating EBITDA, operating EBITDA margin, adjusted operating income, adjusted net income and adjusted earnings per diluted share. These non-GAAP measures should not be considered a substitute for, or superior to, financial measures and results calculated in accordance with GAAP, including net income, and reconciliations to GAAP financial statements should be carefully evaluated. Operating EBITDA is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation, acquisition expenses, impairments, and other non-operating income and expense. Management believes providing operating EBITDA is useful for investors to understand the Company’s performance and results of operations period to period with the exclusion of the items identified above. Management believes the presentation of operating EBITDA, when combined with the GAAP presentations of operating income and net income, is beneficial to an investor’s understanding of the Company’s operating performance. A reconciliation of operating EBITDA to net income is included in the appendix to this presentation. Free cash flow is defined as net cash provided by operating activities minus capital expenditures. Management believes providing free cash flow is useful for investors to understand the Company’s performance and results of cash generation period to period with the exclusion of the items identified above. Management believes the presentation of free cash flow, when combined with the GAAP presentations of cash provided by operating activities, is beneficial to an investor’s understanding of the Company’s operating performance. A reconciliation of free cash flow and net income conversion to free cash is included in the appendix to this presentation. Adjusted operating income, a non-GAAP financial measure, excludes certain costs, expenses, other charges, gains or income that are included in the determination of operating income under U.S. GAAP, but that management would not consider important in evaluating the quality of the Company’s operating results as they are not indicative of the Company’s core operating results or may obscure trends useful in evaluating the Company’s continuing activities. Accordingly, the Company presents adjusted operating income excluding these special items to help investors evaluate our operating performance and trends in our business consistent with how management evaluates such performance and trends. Further, the Company presents adjusted operating income to provide investors with a better understanding of the Company’s view of our results as compared to prior periods. A reconciliation of adjusted operating income to operating income, the most comparable GAAP financial measure, is included in the tables following this presentation. Adjusted net income and adjusted earnings per diluted share, each reflect adjustments for acquisition expenses, the losses attributable to the Company’s extinguishment of debt, impairment charges, executive severance costs, income or losses recognized on the sale and/or closure of former Company locations, adjustments related to the Company’s deferred tax assets as a result of IRS guidance on application of the Tax Cuts and Jobs Act of 2017, and reversal of reserves for uncertain tax positions. Management believes providing adjusted measures and excluding certain items facilitates comparisons to the Company’s prior year periods and, when combined with the GAAP presentation of net income and diluted net income per share, is beneficial to an investor’s understanding of the Company’s performance. A reconciliation of each of adjusted net income and adjusted earnings per diluted share to net income and net income per diluted share is included in the tables following this presentation. 2

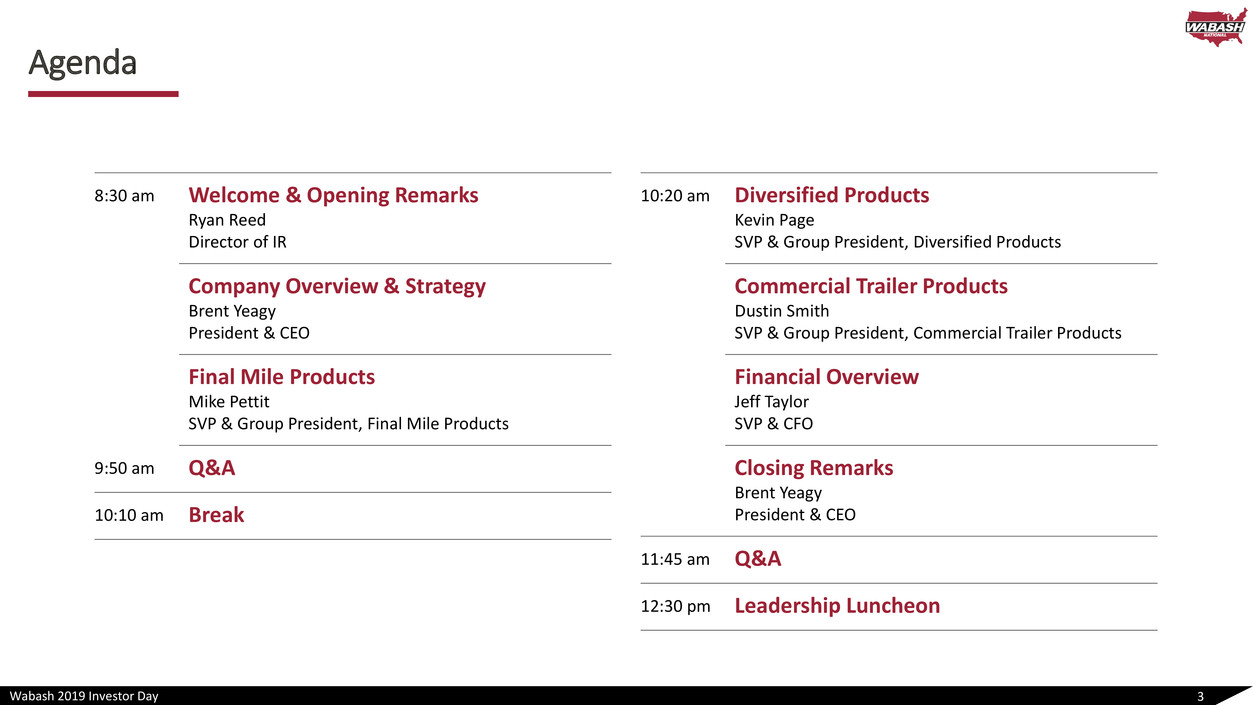

Wabash 2019 Investor Day Agenda 3 8:30 am Welcome & Opening Remarks Ryan Reed Director of IR Company Overview & Strategy Brent Yeagy President & CEO Final Mile Products Mike Pettit SVP & Group President, Final Mile Products 9:50 am Q&A 10:10 am Break 10:20 am Diversified Products Kevin Page SVP & Group President, Diversified Products Commercial Trailer Products Dustin Smith SVP & Group President, Commercial Trailer Products Financial Overview Jeff Taylor SVP & CFO Closing Remarks Brent Yeagy President & CEO 11:45 am Q&A 12:30 pm Leadership Luncheon

Wabash 2019 Investor Day Company Overview & Strategy Brent Yeagy | President & CEO 4

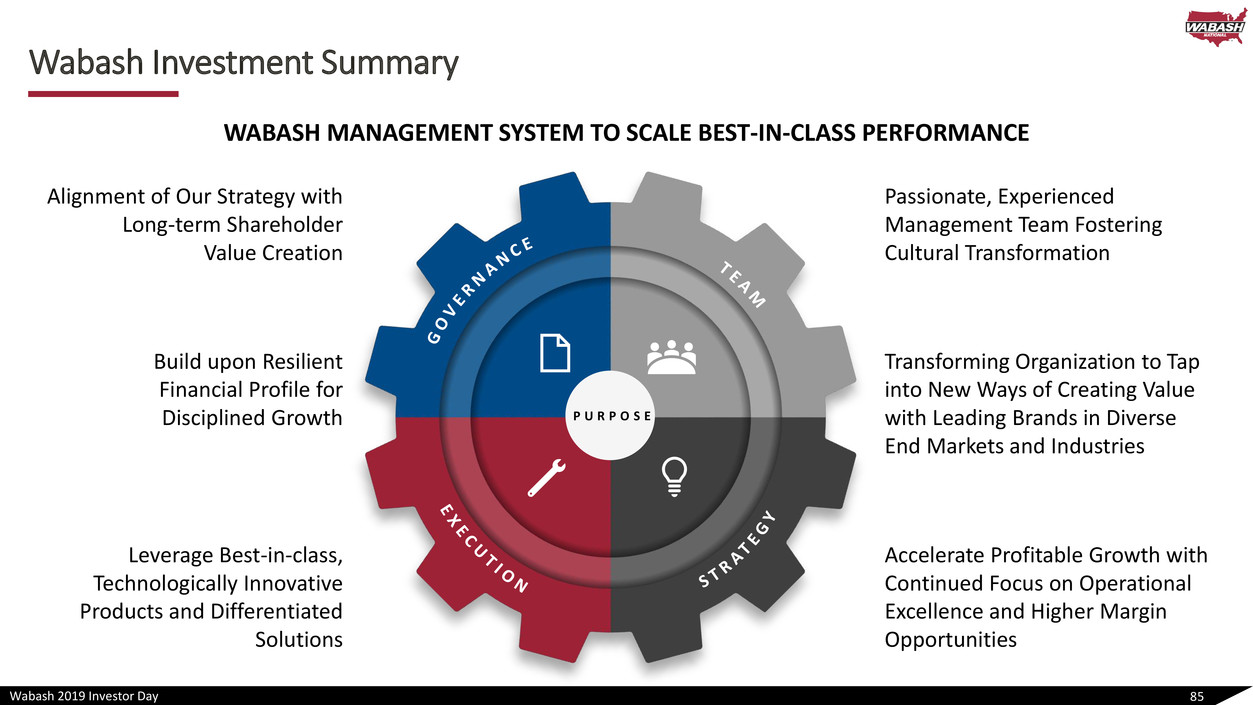

Wabash 2019 Investor Day Key Messages 5 Passionate, Experienced Management Team Fostering Cultural Transformation Transforming Organization to Tap into New Ways of Creating Value with Leading Brands in Diverse End Markets and Industries Best-in-class, Technologically Innovative Products and Differentiated Solutions Accelerate Profitable Growth with Continued Focus on Operational Excellence and Higher Margin Opportunities Leverage Financial Strength for Disciplined Growth to Build upon Resilient Financial Profile 1. 2. 3. 4. 5.

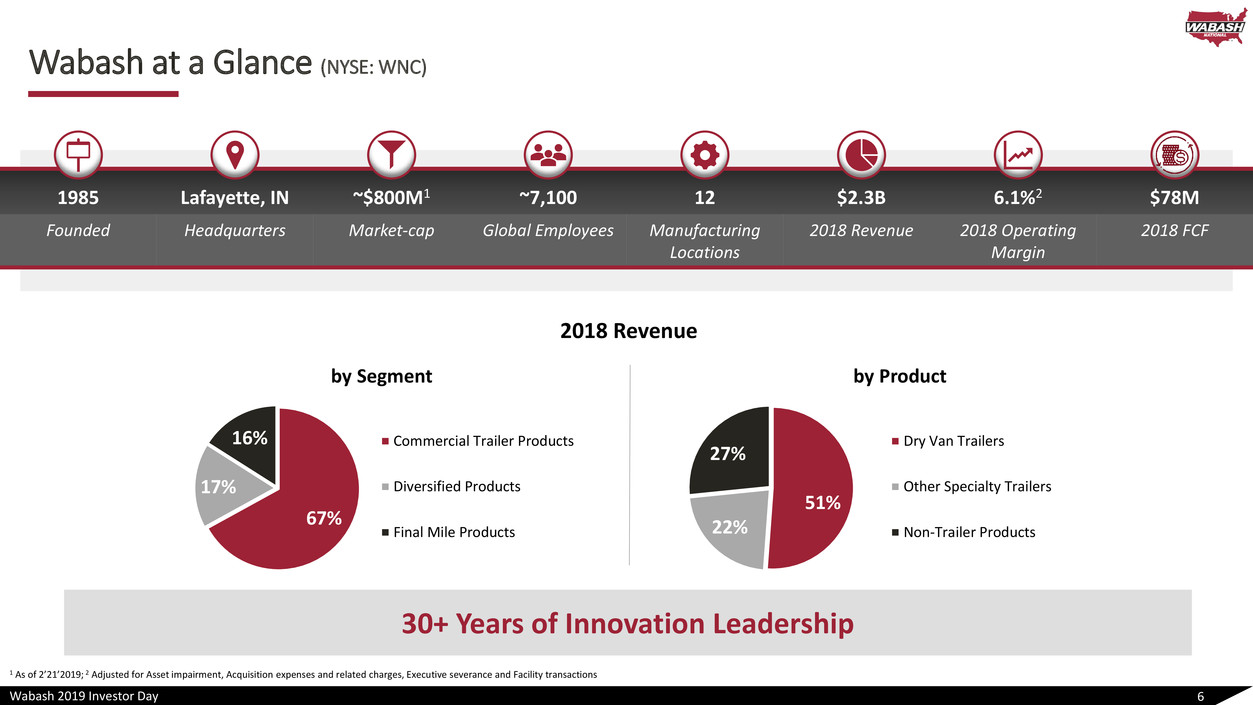

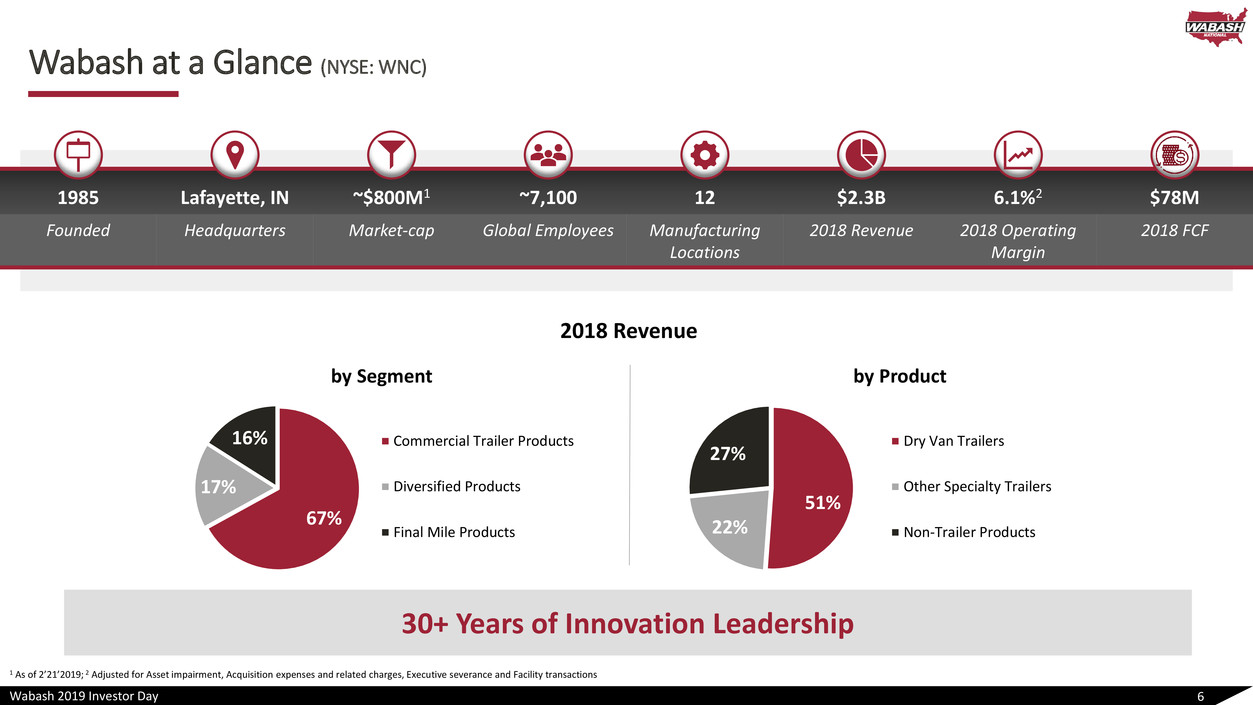

Wabash 2019 Investor Day 67% 17% 16% Commercial Trailer Products Diversified Products Final Mile Products 51% 22% 27% Dry Van Trailers Other Specialty Trailers Non-Trailer Products 2018 Revenue by Segment Wabash at a Glance (NYSE: WNC) 6 30+ Years of Innovation Leadership 1985 Lafayette, IN ~$800M1 ~7,100 12 $2.3B 6.1%2 $78M Founded Headquarters Market-cap Global Employees Manufacturing Locations 2018 Revenue 2018 Operating Margin 2018 FCF by Product 1 As of 2’21’2019; 2 Adjusted for Asset impairment, Acquisition expenses and related charges, Executive severance and Facility transactions

Wabash 2019 Investor Day Portfolio of Diversified Industrial Solutions Leading Brands in Diverse End Markets and Industries 7 $1.5B1 COMMERCIAL TRAILER PRODUCTS (CTP) $394M1 DIVERSIFIED PRODUCTS GROUP (DPG) $358M1 FINAL MILE PRODUCTS (FMP) ▪ Dry and Refrigerated Van Trailers ▪ Platform Trailers ▪ Fleet Used Trailers ▪ Aftermarket Parts and Service ▪ Tank Trailers and Truck-Mounted Tanks ▪ Composite Panels and Products ▪ Food, Dairy and Beverage Equipment ▪ Containment and Aseptic Systems ▪ Aftermarket Parts and Service ▪ Truck-Mounted Dry Bodies ▪ Truck-Mounted Refrigerated Bodies ▪ Service and Stake Bodies ▪ FRP Panel Sales ▪ Upfitting Parts and Services 1 2018 Revenue

Wabash 2019 Investor Day We Are Wabash 8 A Values-Driven Organization CORE VALUES of Integrity, Trust and Mutual Respect Voice of Customer Best-in-class Products and Services Stakeholder Value Continuous Improvement Culture Best-value Producer Breakthrough Innovation

Wabash 2019 Investor Day Corporate Social Responsibility | Taking Action for the Greater Good 9 SAFETY SUSTAINABILITY COMMUNITY #1 Value and Priority ▪ Apply innovation to engineer safer products and design better operating environments that put people first ▪ Highway and manufacturing safety ▪ ISO certifications and national distinctions ▪ Sharing best practices and ideas for implementing higher standards ▪ Design innovations that improve fleet fuel economy ▪ Standards for waste reduction exceed industry standards ▪ 50,000+ cubic yards of landfill space ▪ 56M kilowatt-hours of electricity ▪ 32,625 mature trees ▪ ~20,000 metric tons of greenhouse gas emissions ▪ Conserving energy in our manufacturing operations ▪ Our EPA SmartWay Elite verified solutions now improve fleet fuel economy by up to 11% ▪ Donate time, needed materials and financial resources to support the communities where we live and work ▪ Significant community program partnerships ▪ Partner with local and national programs that support our active duty troops and veterans and their families

Wabash 2019 Investor Day Our Vision is Engrained in Our Culture 10 Build Upon Culture of Innovation to Strategically Grow and Diversify the Company PEOPLE ▪ Safety is our #1 value and priority ▪ Cultural transformation built on honesty, collaboration and compassion ▪ Continually invest in the places we work and the communities we serve ▪ Act with a unified focus and increased velocity ▪ Do everything with a clear purpose, including production process changes and improvements ▪ Understand customer challenges to develop new designs, technologies and materials to ensure their success ▪ Deliver highest quality products available on time and to customer specifications to maintain our market leadership ▪ Perform as one team to leverage new technology and leading manufacturing processes ▪ Seek breakthroughs in products and our ways of thinking and doing ▪ Utilize the Wabash Management System to organize our business and improve the speed at which we act PURPOSE PERFORMANCE

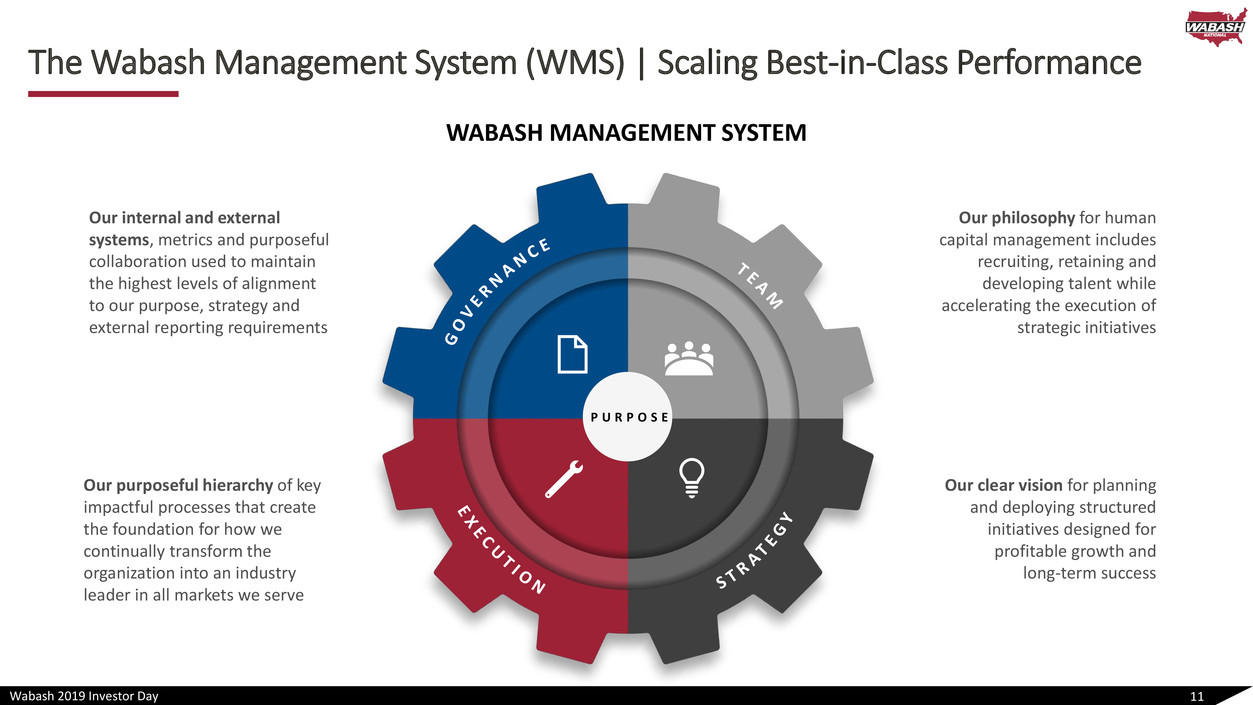

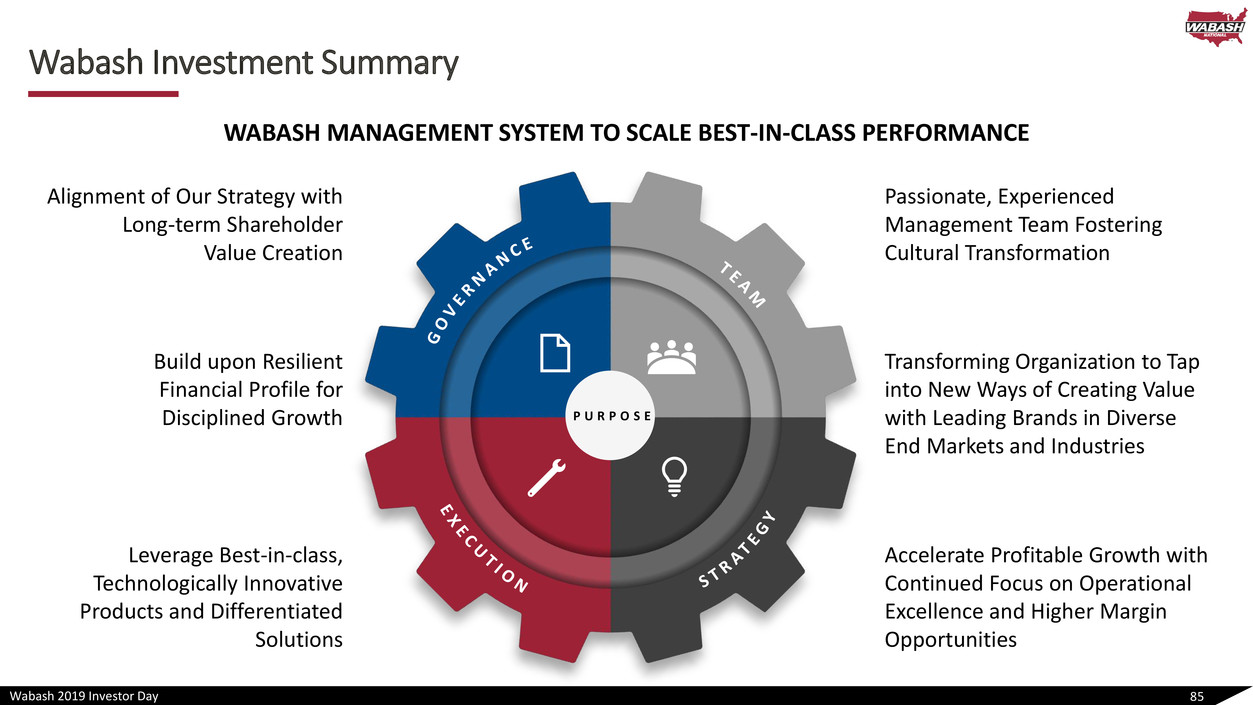

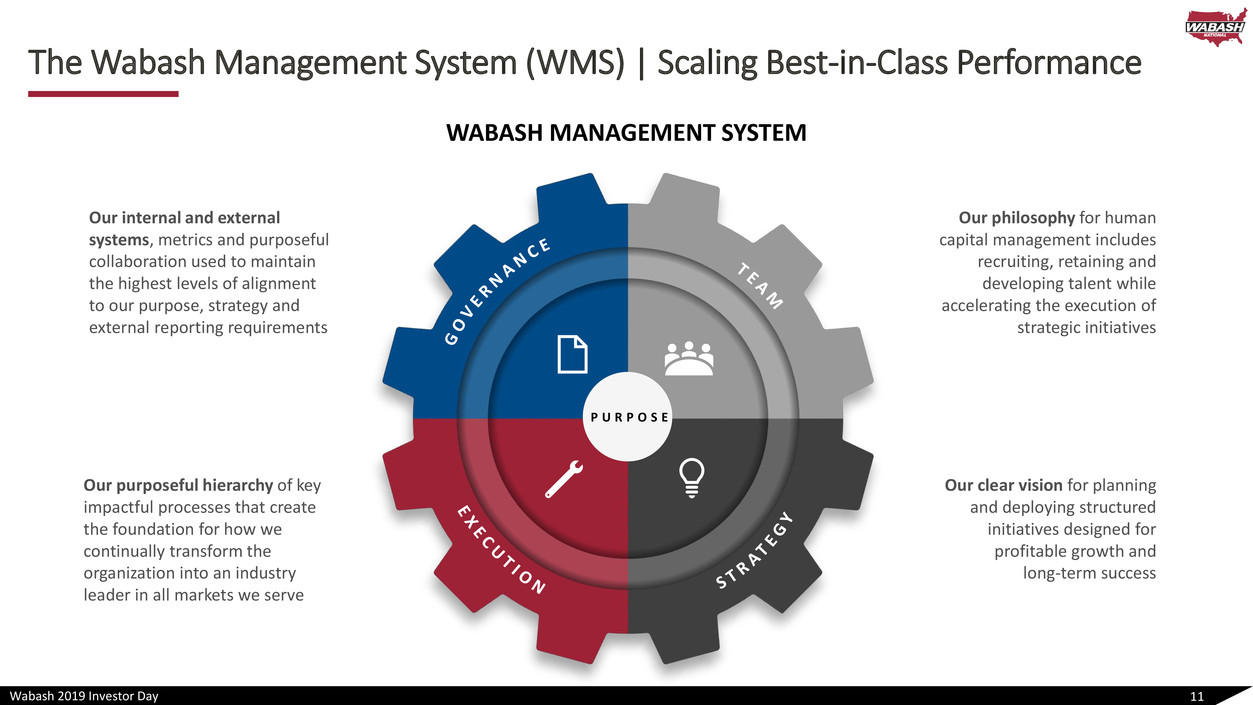

Wabash 2019 Investor Day The Wabash Management System (WMS) | Scaling Best-in-Class Performance 11 Our philosophy for human capital management includes recruiting, retaining and developing talent while accelerating the execution of strategic initiatives Our purposeful hierarchy of key impactful processes that create the foundation for how we continually transform the organization into an industry leader in all markets we serve Our internal and external systems, metrics and purposeful collaboration used to maintain the highest levels of alignment to our purpose, strategy and external reporting requirements Our clear vision for planning and deploying structured initiatives designed for profitable growth and long-term success P U R P O S E WABASH MANAGEMENT SYSTEM

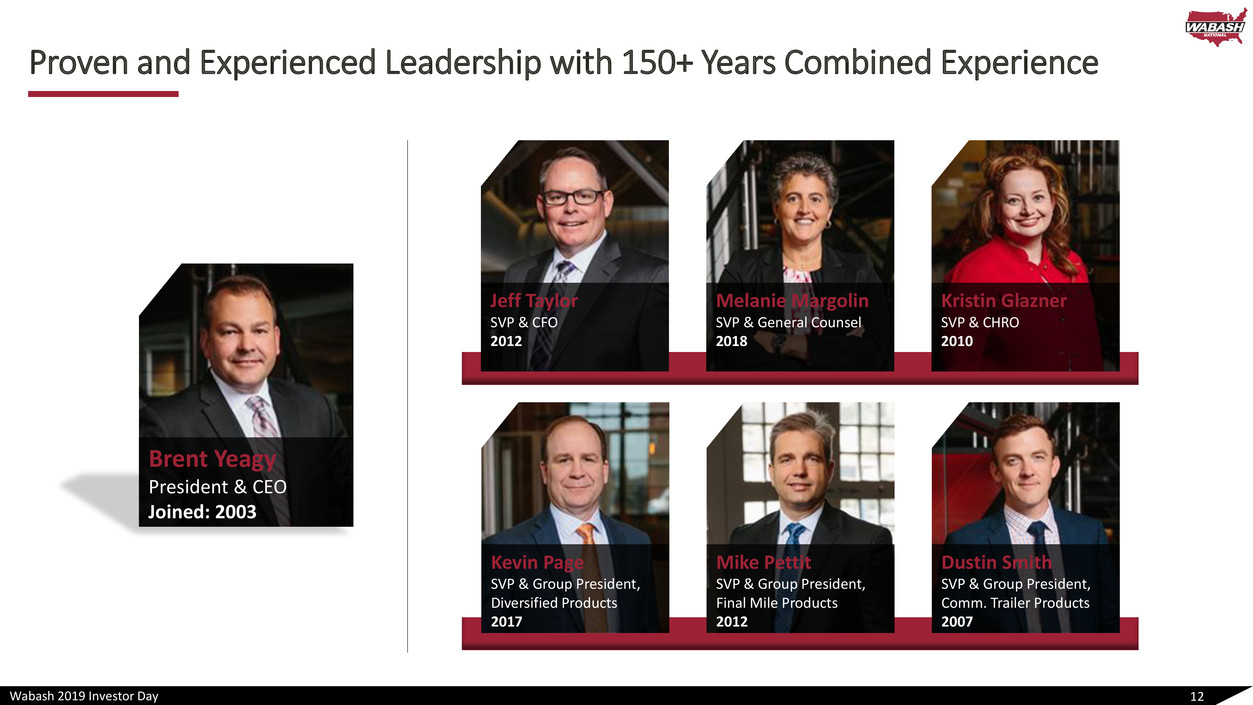

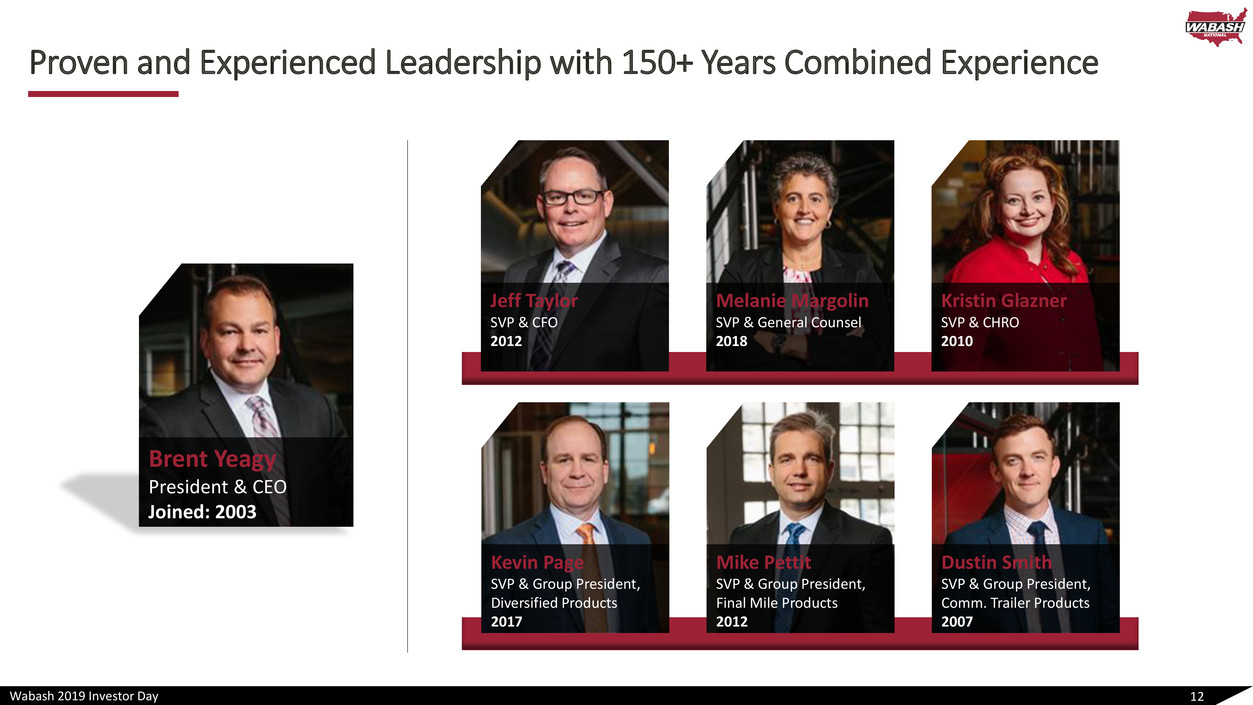

Wabash 2019 Investor Day Proven and Experienced Leadership with 150+ Years Combined Experience 12 Brent Yeagy President & CEO Joined: 2003 Kevin Page SVP & Group President, Diversified Products 2017 Mike Pettit SVP & Group President, Final Mile Products 2012 Dustin Smith SVP & Group President, Comm. Trailer Products 2007 Jeff Taylor SVP & CFO 2012 Melanie Margolin SVP & General Counsel 2018 Kristin Glazner SVP & CHRO 2010

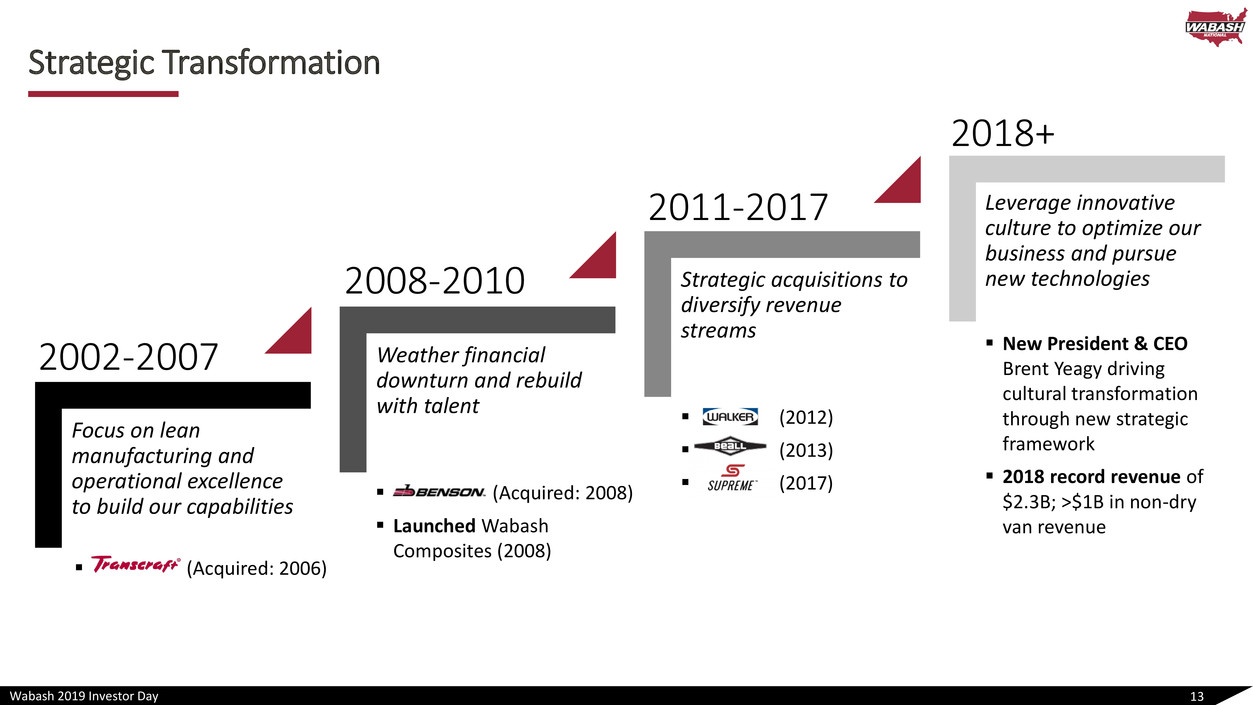

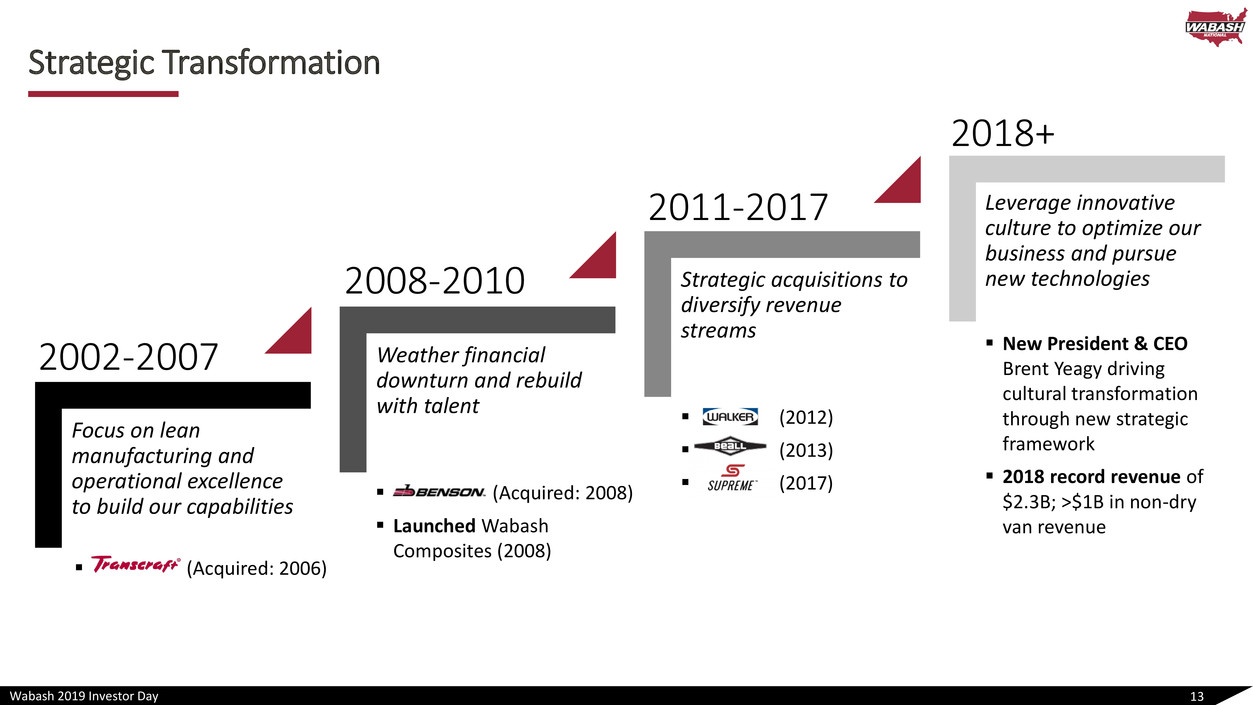

Wabash 2019 Investor Day Strategic Transformation 13 Focus on lean manufacturing and operational excellence to build our capabilities Weather financial downturn and rebuild with talent Strategic acquisitions to diversify revenue streams Leverage innovative culture to optimize our business and pursue new technologies 2002-2007 2008-2010 2018+ 2011-2017 ▪ (Acquired: 2006) ▪ (2012) ▪ (2013) ▪ (2017)▪ (Acquired: 2008) ▪ Launched Wabash Composites (2008) ▪ New President & CEO Brent Yeagy driving cultural transformation through new strategic framework ▪ 2018 record revenue of $2.3B; >$1B in non-dry van revenue

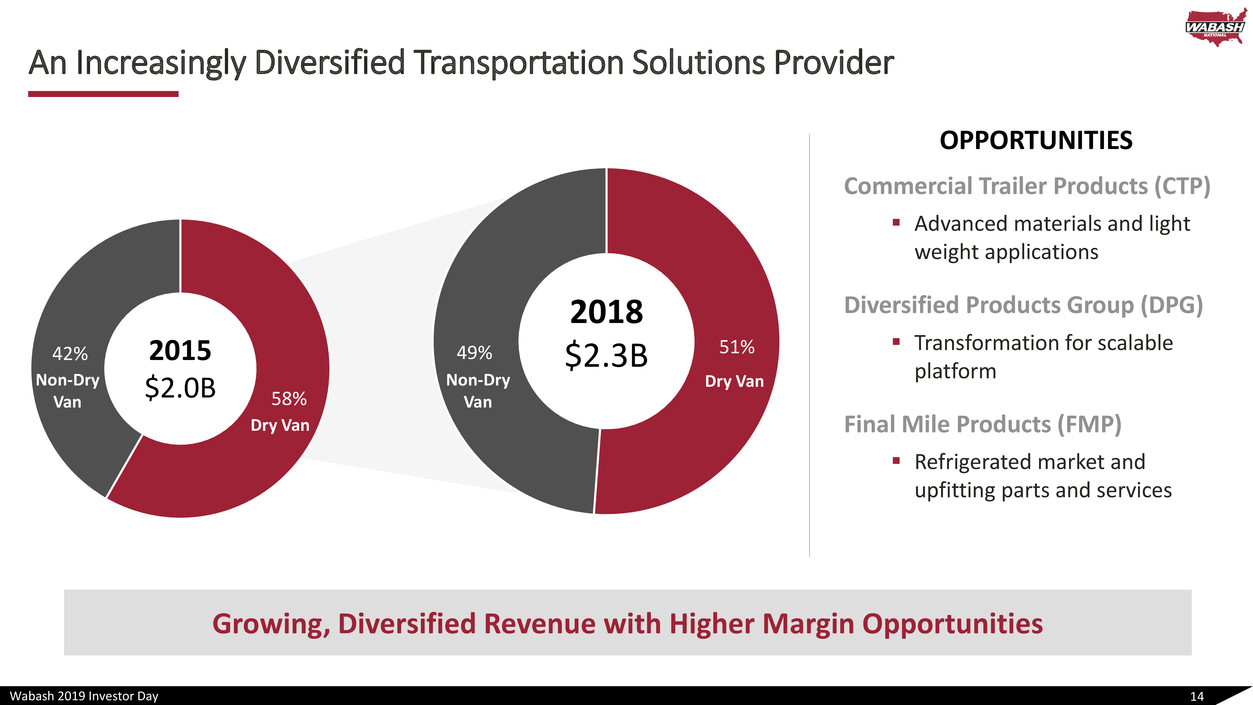

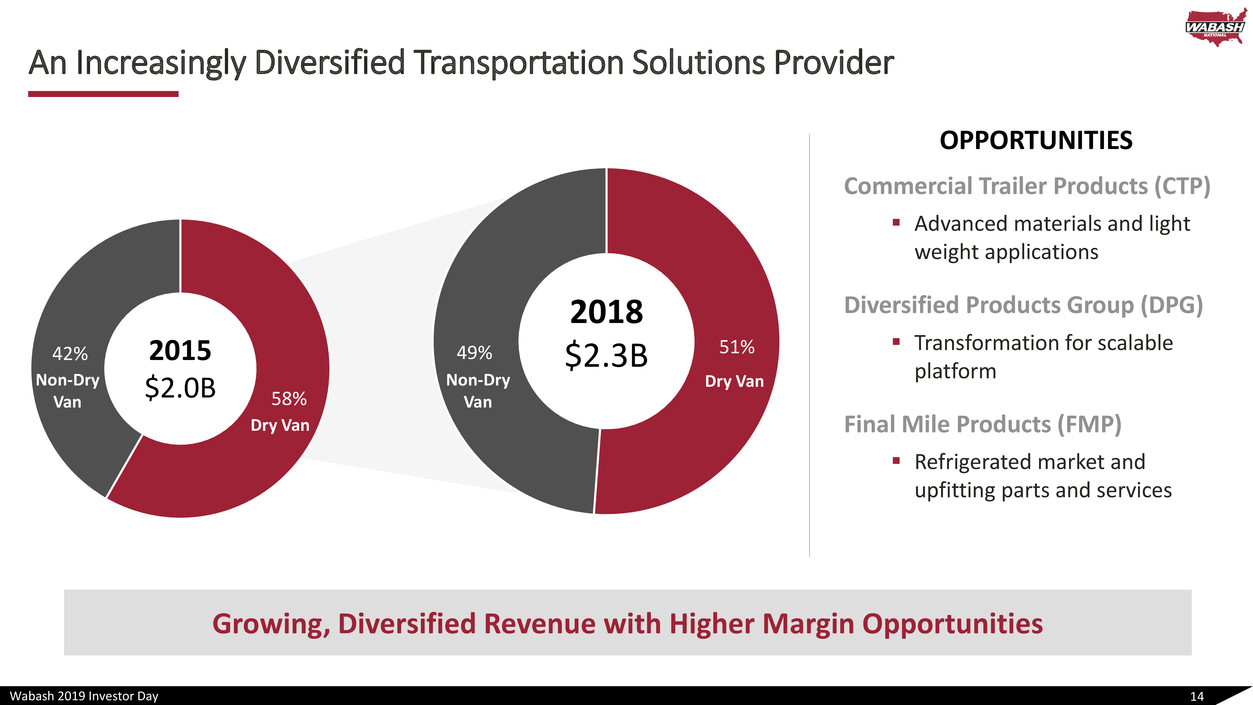

Wabash 2019 Investor Day An Increasingly Diversified Transportation Solutions Provider OPPORTUNITIES Commercial Trailer Products (CTP) ▪ Advanced materials and light weight applications Diversified Products Group (DPG) ▪ Transformation for scalable platform Final Mile Products (FMP) ▪ Refrigerated market and upfitting parts and services 14 Growing, Diversified Revenue with Higher Margin Opportunities 58% 42% 2015 $2.0B 51%49% Dry VanNon-Dry Van 2018 $2.3B Dry Van Non-Dry Van

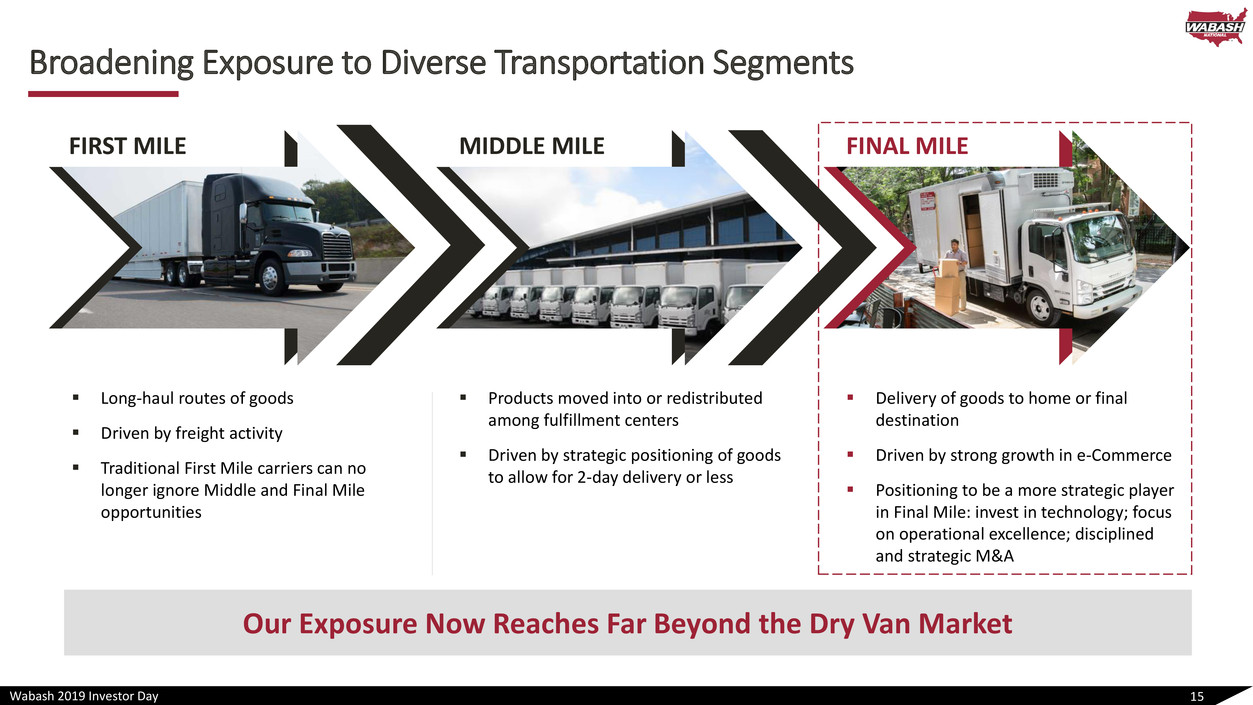

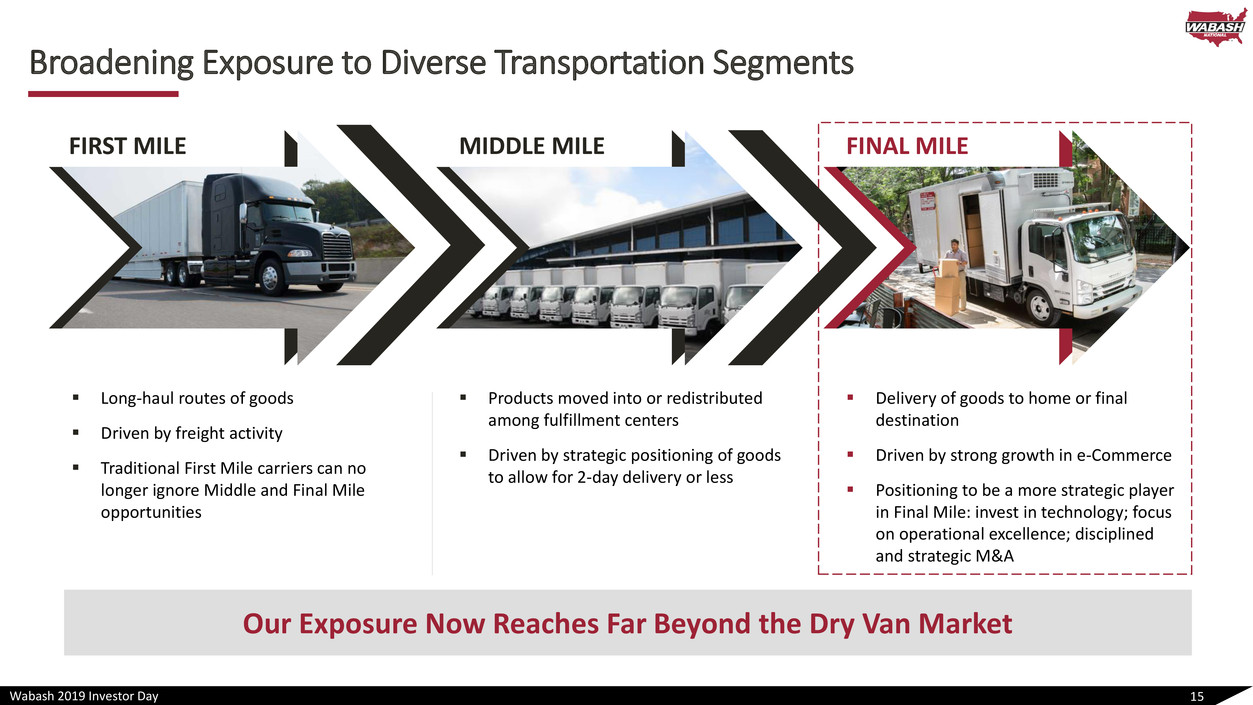

Wabash 2019 Investor Day Broadening Exposure to Diverse Transportation Segments 15 Our Exposure Now Reaches Far Beyond the Dry Van Market FIRST MILE MIDDLE MILE FINAL MILE ▪ Long-haul routes of goods ▪ Driven by freight activity ▪ Traditional First Mile carriers can no longer ignore Middle and Final Mile opportunities ▪ Products moved into or redistributed among fulfillment centers ▪ Driven by strategic positioning of goods to allow for 2-day delivery or less ▪ Delivery of goods to home or final destination ▪ Driven by strong growth in e-Commerce ▪ Positioning to be a more strategic player in Final Mile: invest in technology; focus on operational excellence; disciplined and strategic M&A

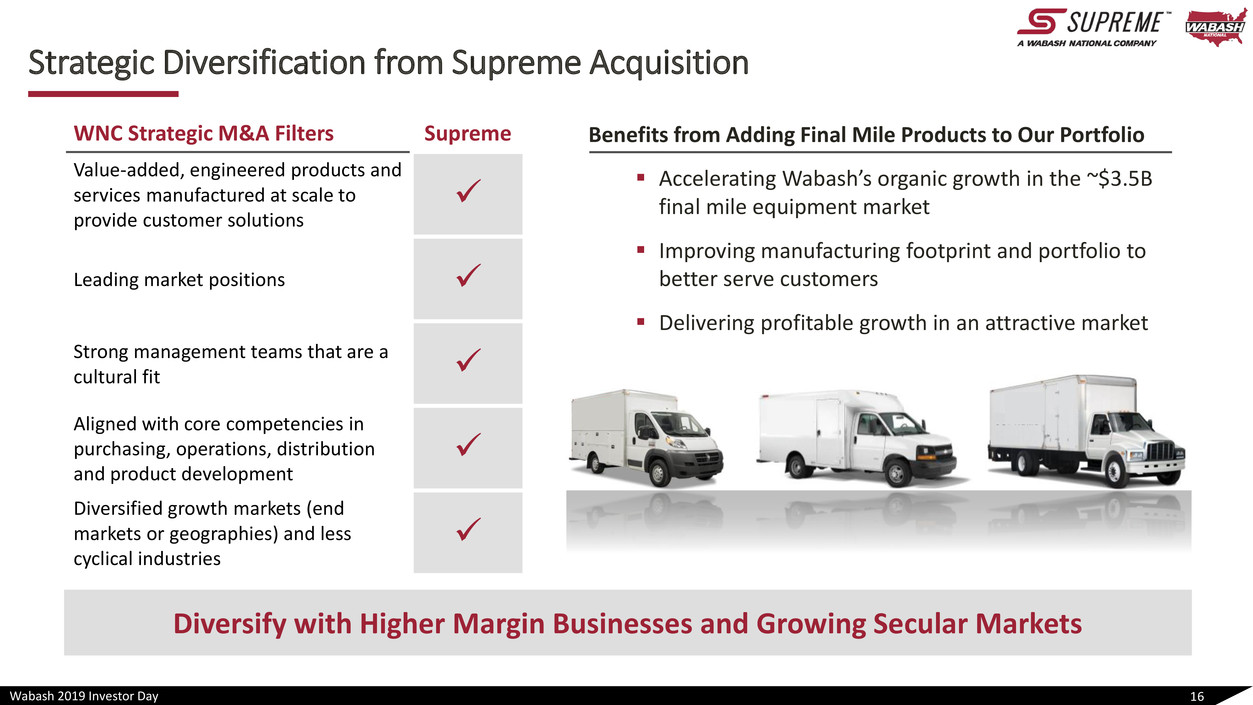

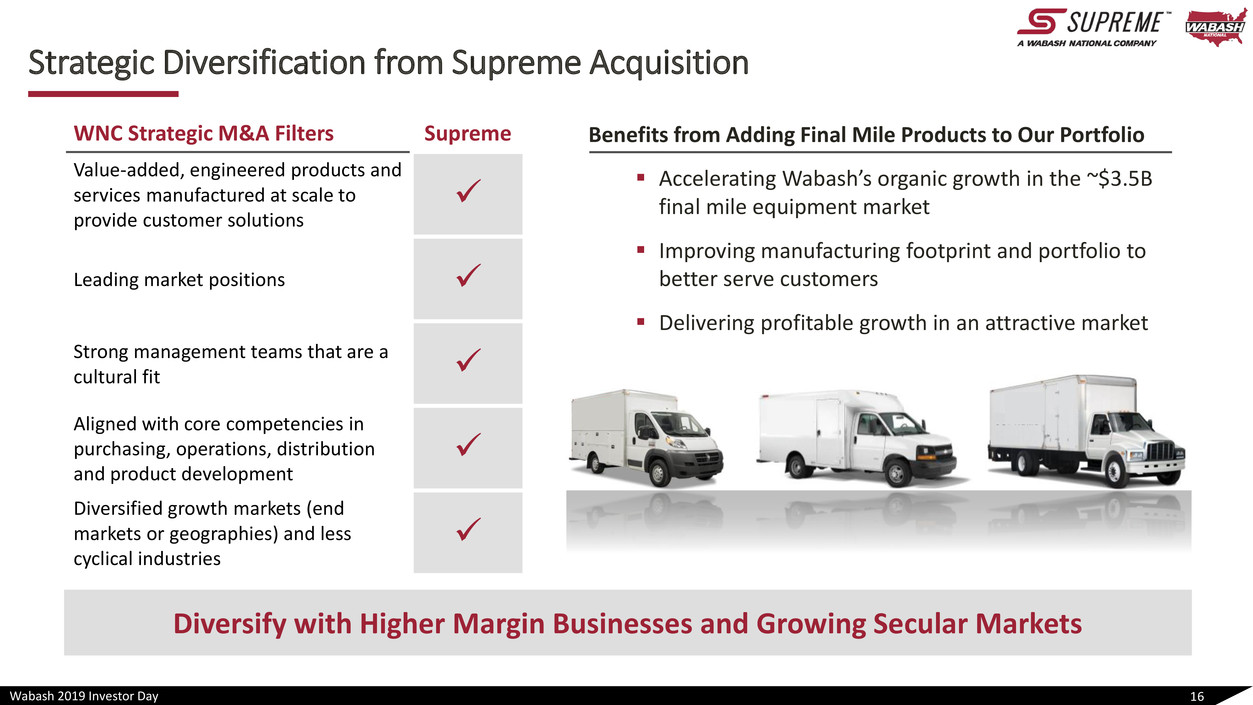

Wabash 2019 Investor Day Strategic Diversification from Supreme Acquisition Benefits from Adding Final Mile Products to Our Portfolio ▪ Accelerating Wabash’s organic growth in the ~$3.5B final mile equipment market ▪ Improving manufacturing footprint and portfolio to better serve customers ▪ Delivering profitable growth in an attractive market 16 Diversify with Higher Margin Businesses and Growing Secular Markets WNC Strategic M&A Filters Supreme Value-added, engineered products and services manufactured at scale to provide customer solutions ✓ Leading market positions ✓ Strong management teams that are a cultural fit ✓ Aligned with core competencies in purchasing, operations, distribution and product development ✓ Diversified growth markets (end markets or geographies) and less cyclical industries ✓

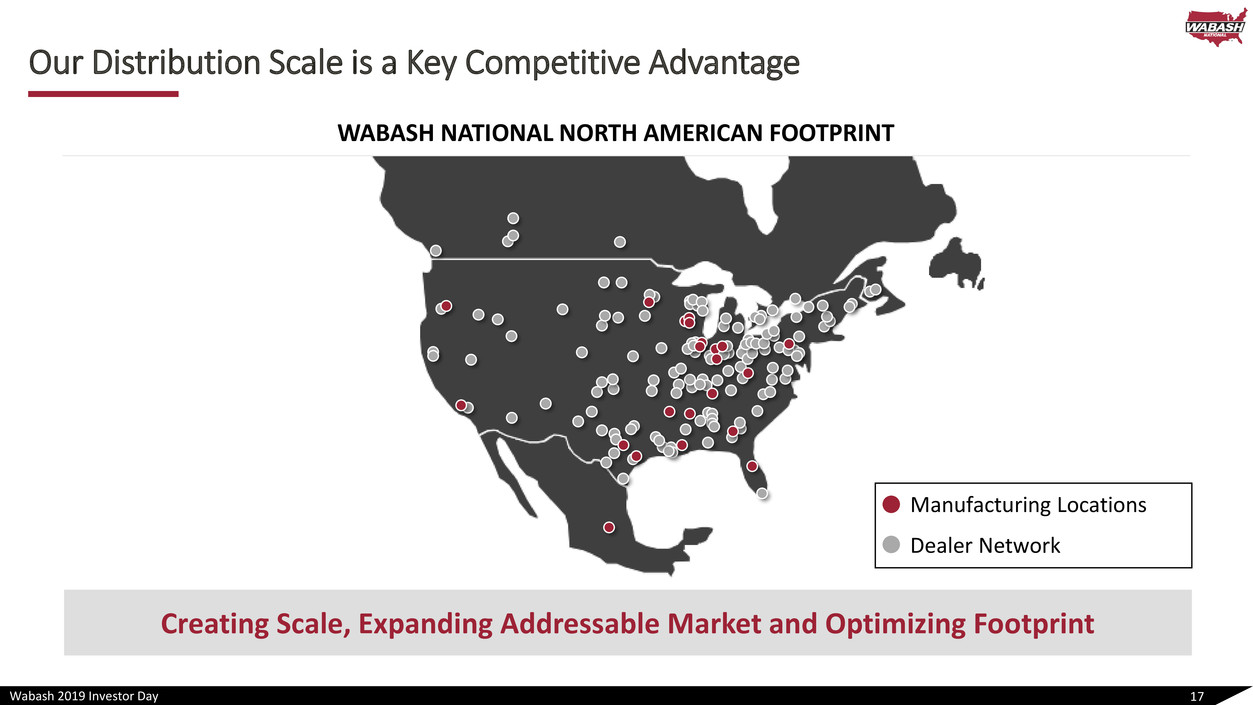

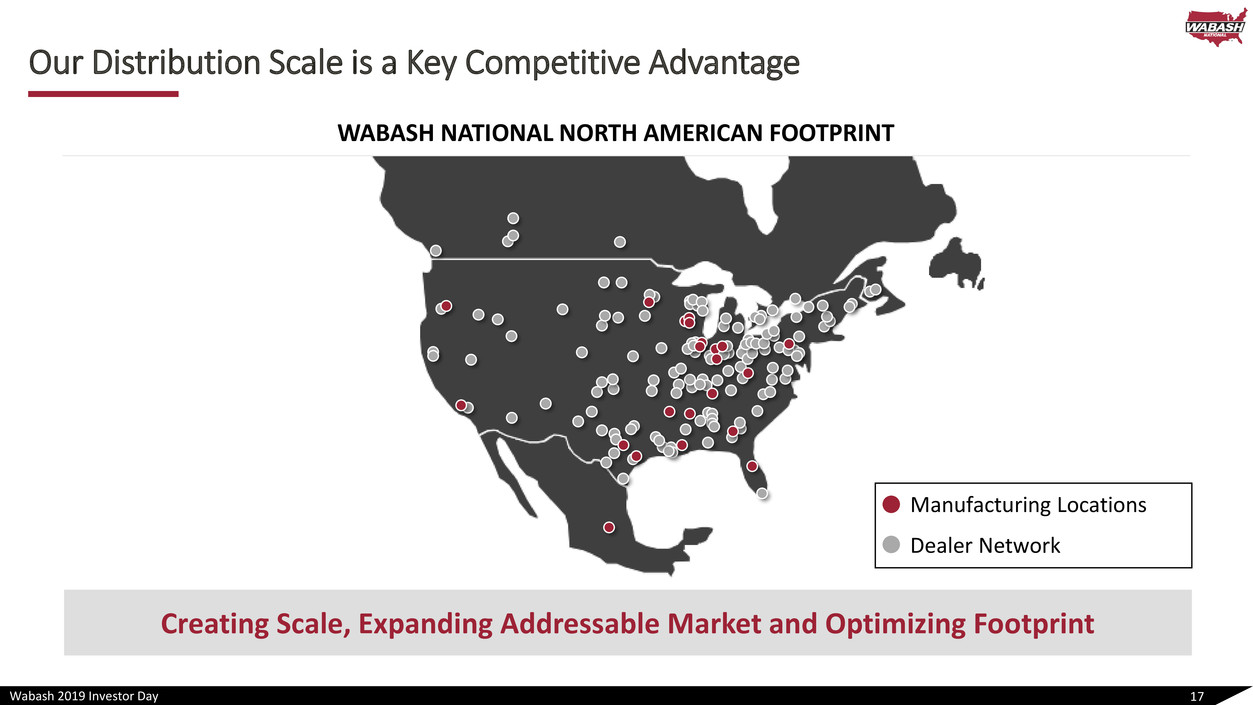

Wabash 2019 Investor Day Our Distribution Scale is a Key Competitive Advantage 17 Creating Scale, Expanding Addressable Market and Optimizing Footprint WABASH NATIONAL NORTH AMERICAN FOOTPRINT Manufacturing Locations Dealer Network

Wabash 2019 Investor Day Our Sustainable Competitive Advantages 18 Wabash is a Leader in Technology and Innovation Industry-leading Product Portfolio Innovative Technology Operational Excellence Strong Customer Relationships ▪ Leverage our 30+ years of engineering and mfg. experience to offer a wide selection of transportation and industrial products ▪ Provide customers with innovative products lowering their total cost of ownership ▪ Customer-focused engineered solutions in all our industries and markets ▪ 200+ patents and patent applications in the U.S. and abroad ▪ Emphasizing manufacturing velocity and business process optimization ▪ Breakthrough thought process ▪ Lean Six Sigma manufacturing approach for 13+ years ▪ Built on industry-leading, innovative products that provide superior long-term value ▪ Diverse customer base and end markets ▪ Established relationships with many of the largest carrier and industry leaders

Wabash 2019 Investor Day Mega Trends Driving Growth WNC is Poised to Capitalize on Industry Mega Trends 19 ▪ New and existing designs ▪ Growing customer base, including traditional freight fleets ▪ New patent-pending technology ▪ International expansion ▪ Low cost energy supports chemical production ▪ $200B+ of chemical capital investment³ ▪ Market share growth in aluminum products ▪ Advanced lightweight materials ▪ Full suite of aero products ▪ Aftermarket parts growth ▪ Mobile and on-site customer service Urbanization, Final Mile & Home Delivery Expansion of Cold Chain & Food Equipment Energy & Chemical Production, Storage & Transportation Increased Regulation (GHG1, ELDs2, Food Safety) 1 Greenhouse gasses (GHG); 2 Electronic logging devices (ELD); 3 Source: American Chemistry Council

Wabash 2019 Investor Day Expanding Our Total Addressable Market 20 Evolving to Serve More Diverse Markets $14B Total Addressable Market Market Size 3-year Industry CAGR1 Commercial Trailer Products ~$7.0B -6% to -8% Diversified Products Group ~$3.2B 2% to 3% Final Mile Products ~$3.5B 4% to 6% 1 Source: Industry reports and Company estimates

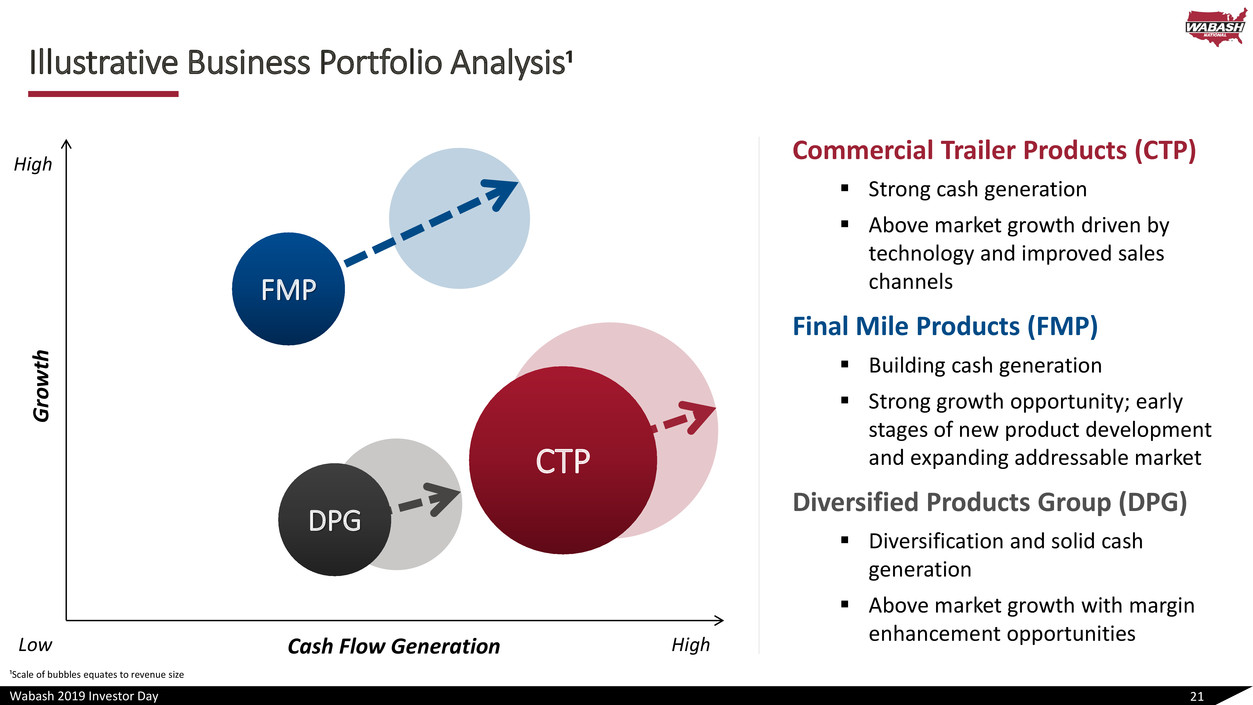

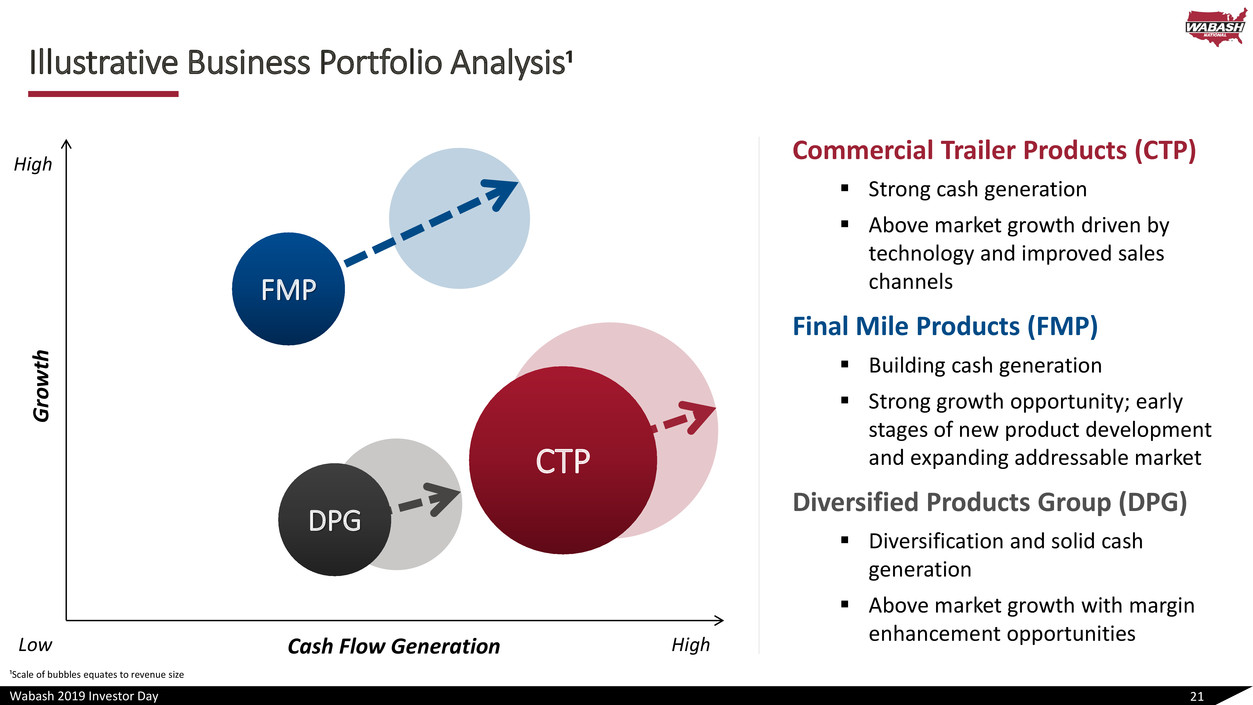

Wabash 2019 Investor Day Illustrative Business Portfolio Analysis¹ 21 Commercial Trailer Products (CTP) ▪ Strong cash generation ▪ Above market growth driven by technology and improved sales channels Final Mile Products (FMP) ▪ Building cash generation ▪ Strong growth opportunity; early stages of new product development and expanding addressable market Diversified Products Group (DPG) ▪ Diversification and solid cash generation ▪ Above market growth with margin enhancement opportunities G ro wt h High Low HighCash Flow Generation FMP CTP DPG ¹Scale of bubbles equates to revenue size

Wabash 2019 Investor Day Strategic Path Forward both in the Near- and Long-term Focused, Simplified Strategy 22 INNOVATE OPTIMIZE GROW ▪ Continue innovation leadership ▪ Develop new capabilities and capacity to enable growth ▪ Improve durability and reduce weight with material technologies ▪ Margin enhancement through integration, alignment and shared services activities ▪ Utilize WMS and lean manufacturing to drive margin enhancement through continuous focus on efficiency ▪ Expand Final Mile platform ▪ Commercialize MSC1 refrigerated van ▪ Increase corporate business development capability 1 Molded Structural Composites technology

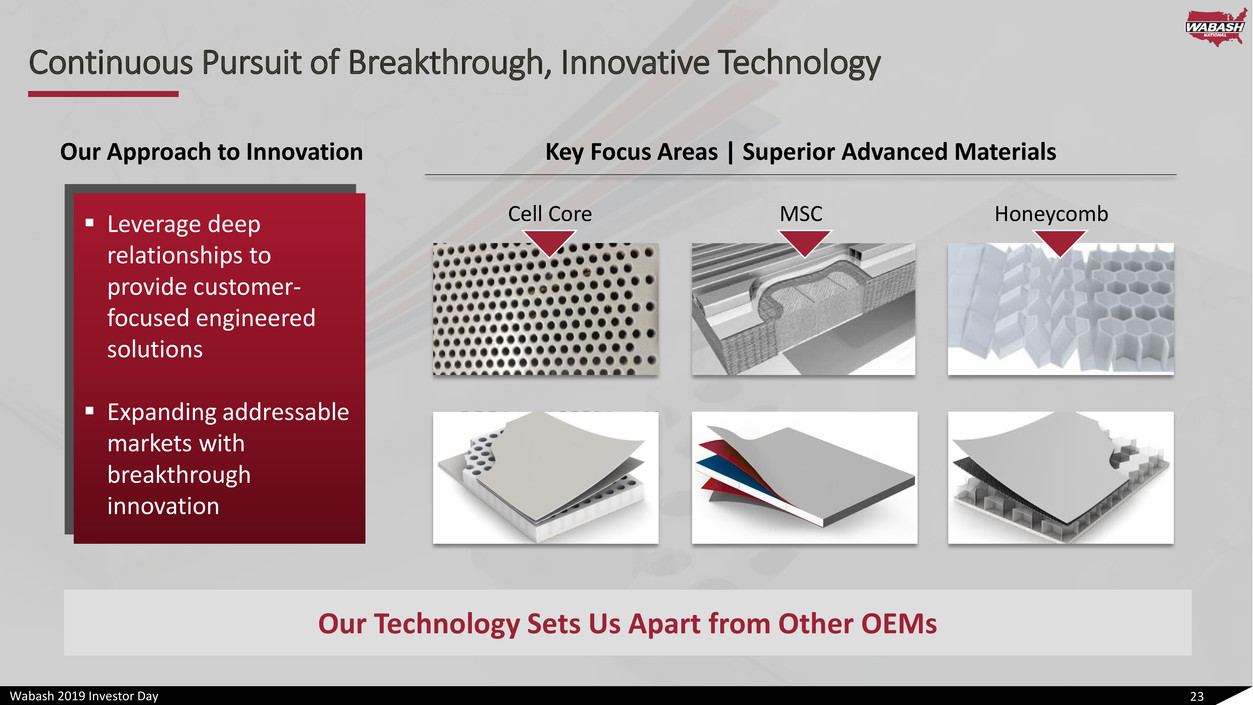

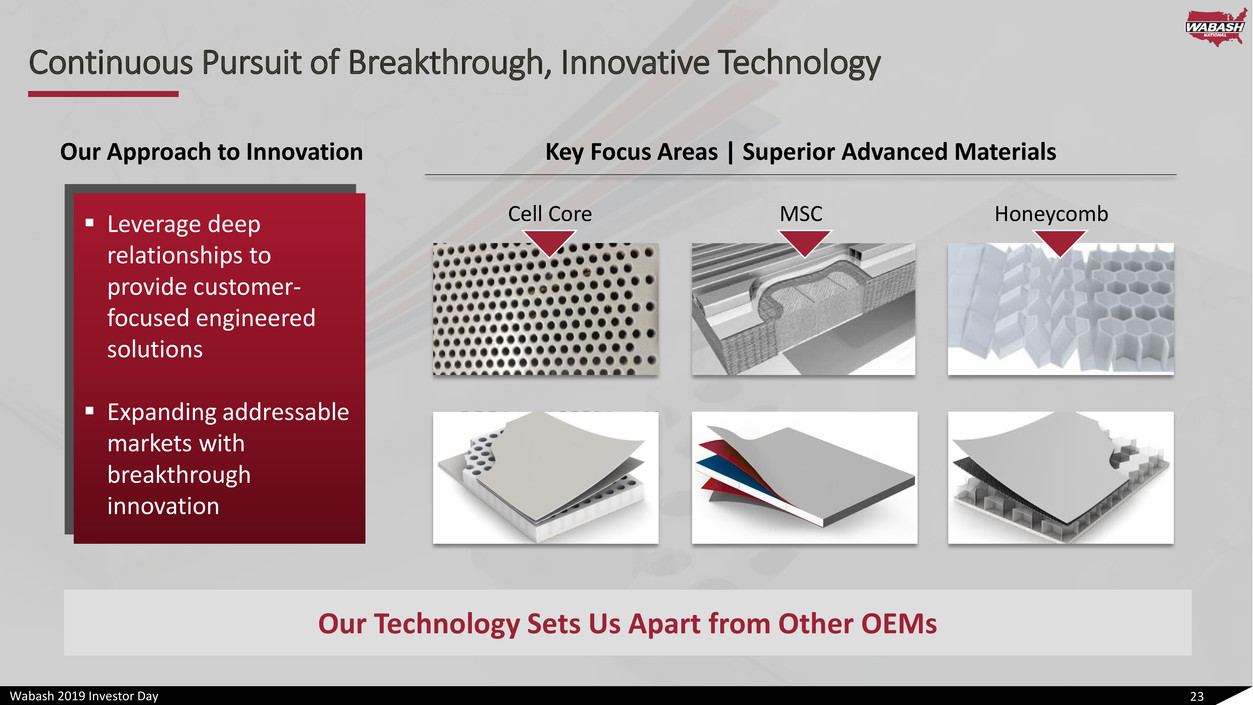

Wabash 2019 Investor Day Continuous Pursuit of Breakthrough, Innovative Technology ▪ Leverage deep relationships to provide customer- focused engineered solutions ▪ Expanding addressable markets with breakthrough innovation 23 Our Technology Sets Us Apart from Other OEMs Our Approach to Innovation Key Focus Areas | Superior Advanced Materials Cell Core MSC Honeycomb

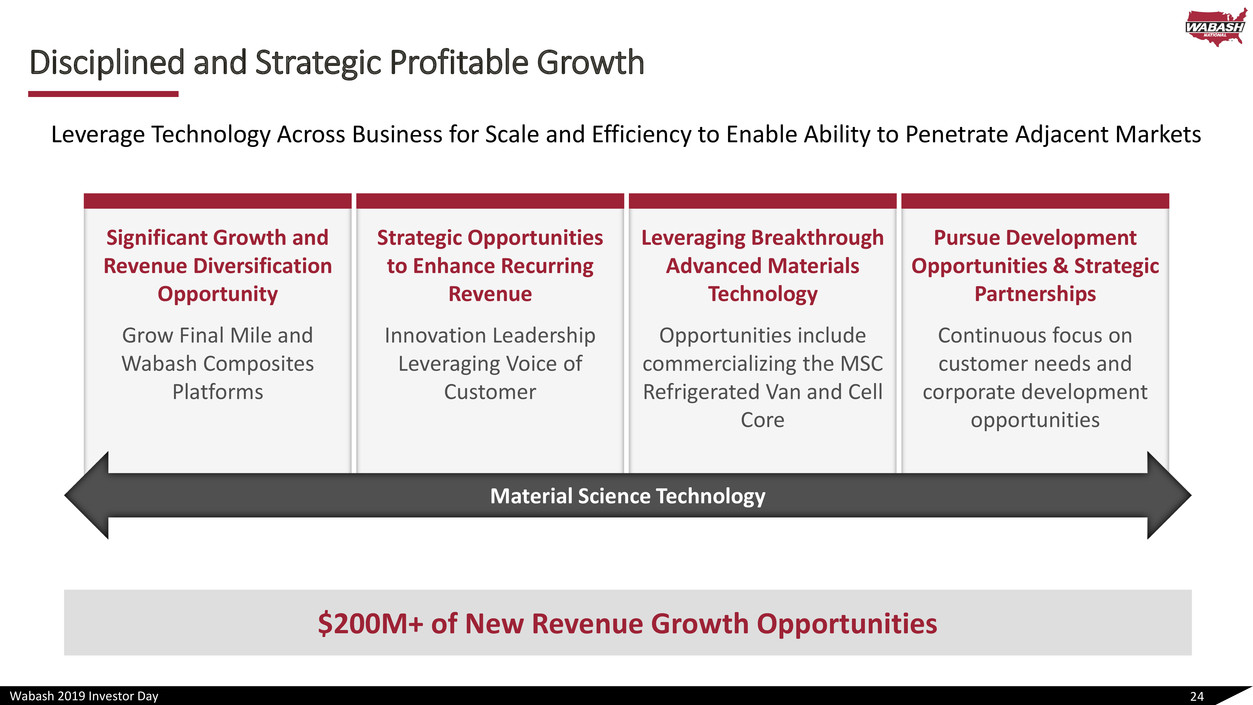

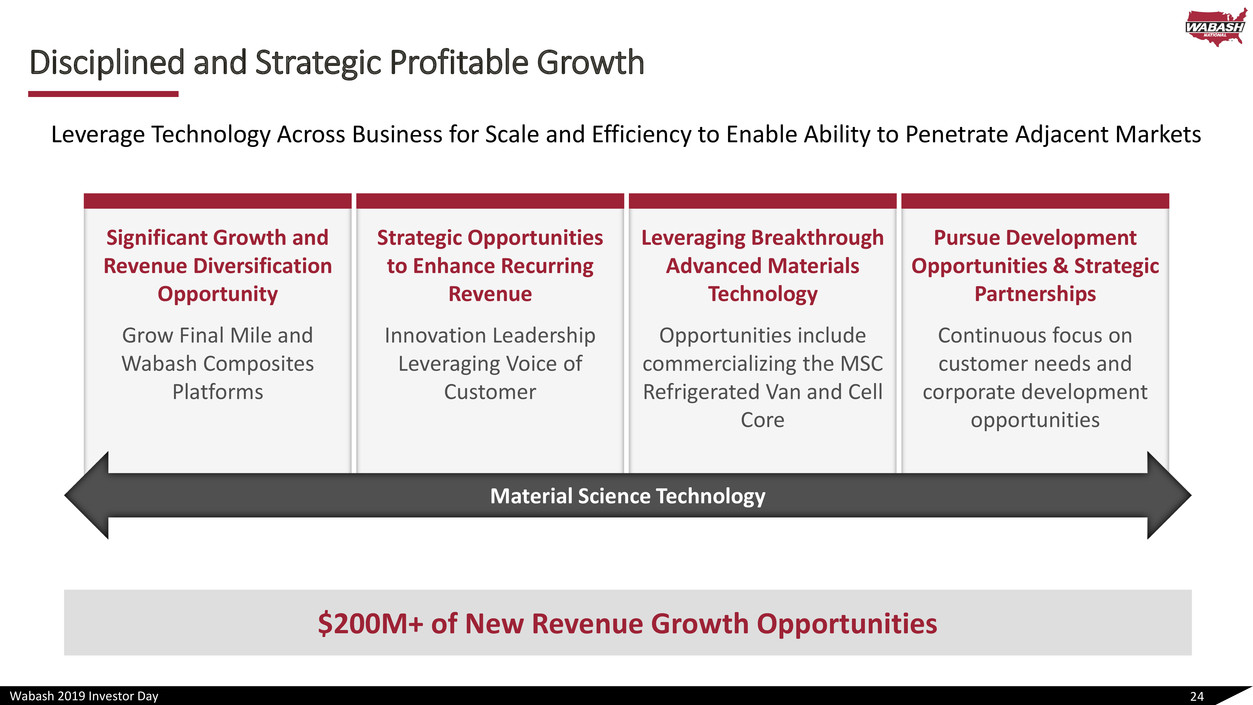

Wabash 2019 Investor Day Significant Growth and Revenue Diversification Opportunity Grow Final Mile and Wabash Composites Platforms Pursue Development Opportunities & Strategic Partnerships Continuous focus on customer needs and corporate development opportunities Leveraging Breakthrough Advanced Materials Technology Opportunities include commercializing the MSC Refrigerated Van and Cell Core Strategic Opportunities to Enhance Recurring Revenue Innovation Leadership Leveraging Voice of Customer Disciplined and Strategic Profitable Growth $200M+ of New Revenue Growth Opportunities 24 Leverage Technology Across Business for Scale and Efficiency to Enable Ability to Penetrate Adjacent Markets Material Science Technology

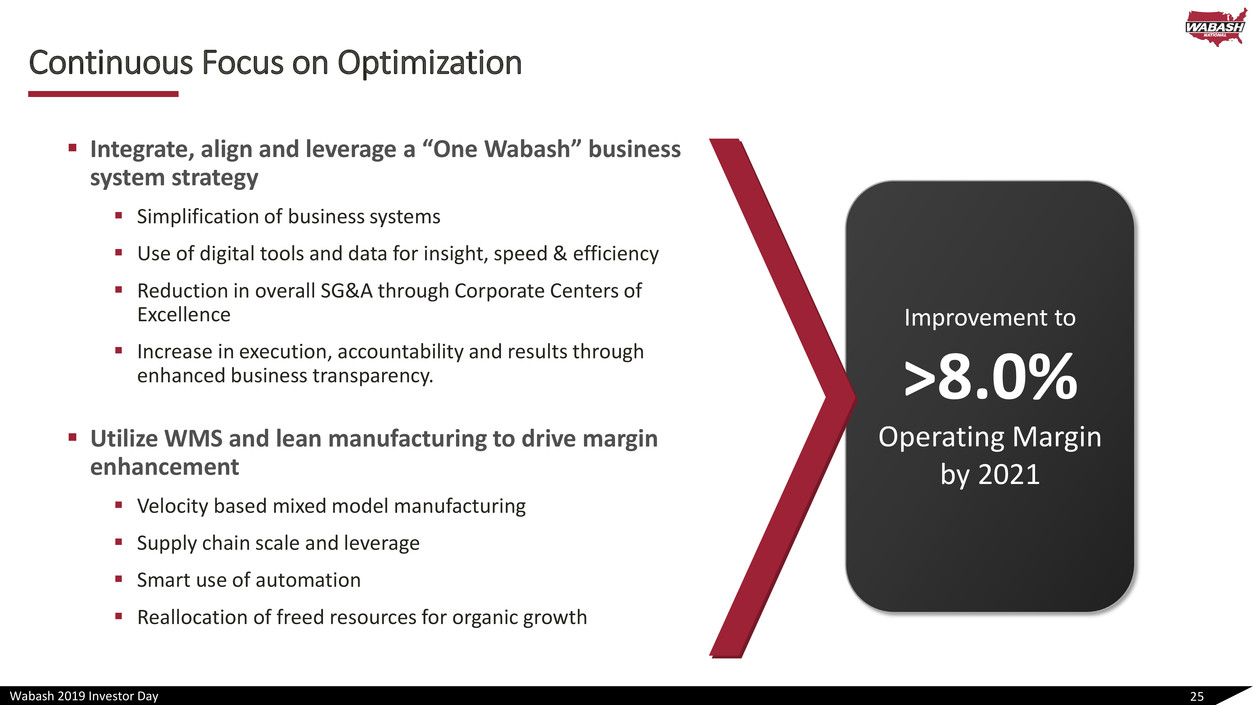

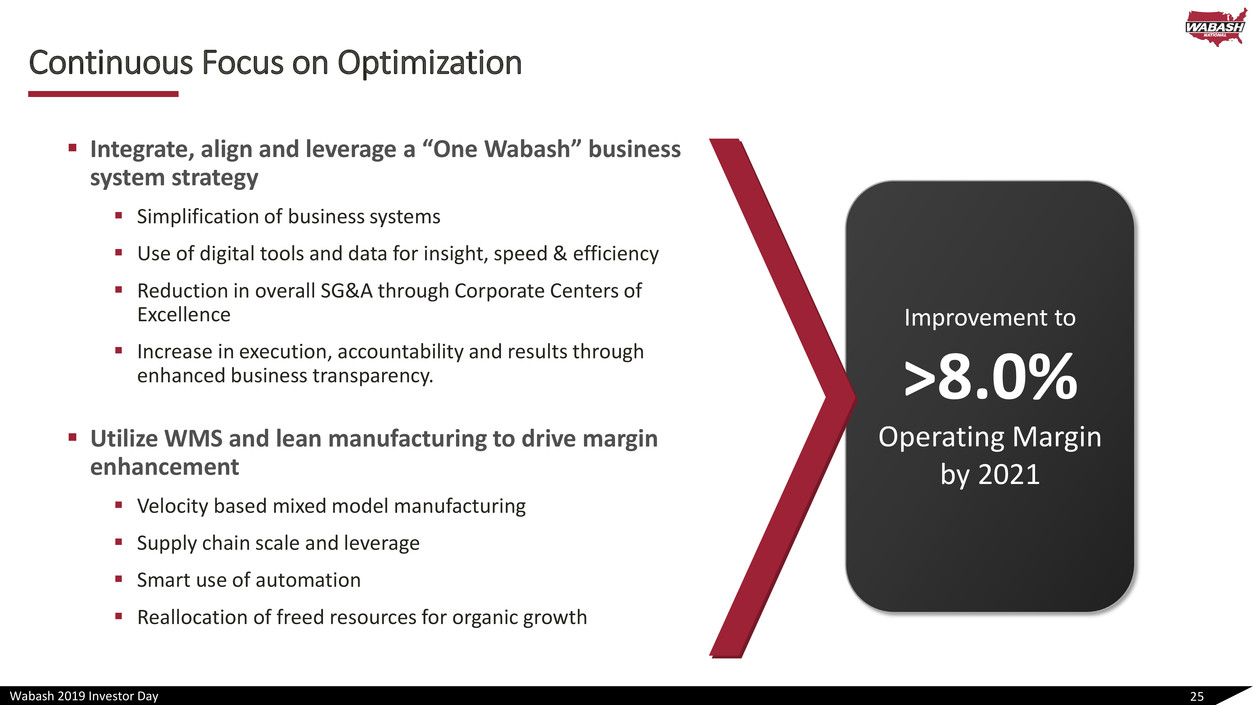

Wabash 2019 Investor Day Improvement to >8.0% Operating Margin by 2021 Continuous Focus on Optimization ▪ Integrate, align and leverage a “One Wabash” business system strategy ▪ Simplification of business systems ▪ Use of digital tools and data for insight, speed & efficiency ▪ Reduction in overall SG&A through Corporate Centers of Excellence ▪ Increase in execution, accountability and results through enhanced business transparency. ▪ Utilize WMS and lean manufacturing to drive margin enhancement ▪ Velocity based mixed model manufacturing ▪ Supply chain scale and leverage ▪ Smart use of automation ▪ Reallocation of freed resources for organic growth 25

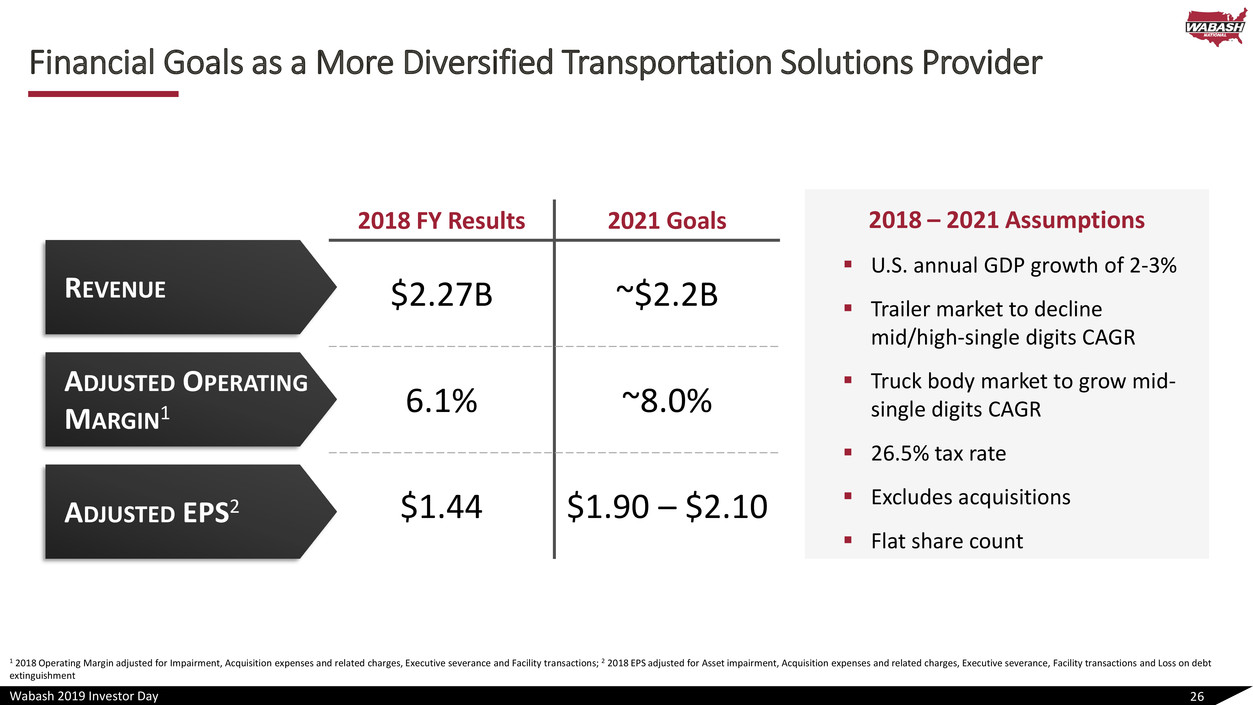

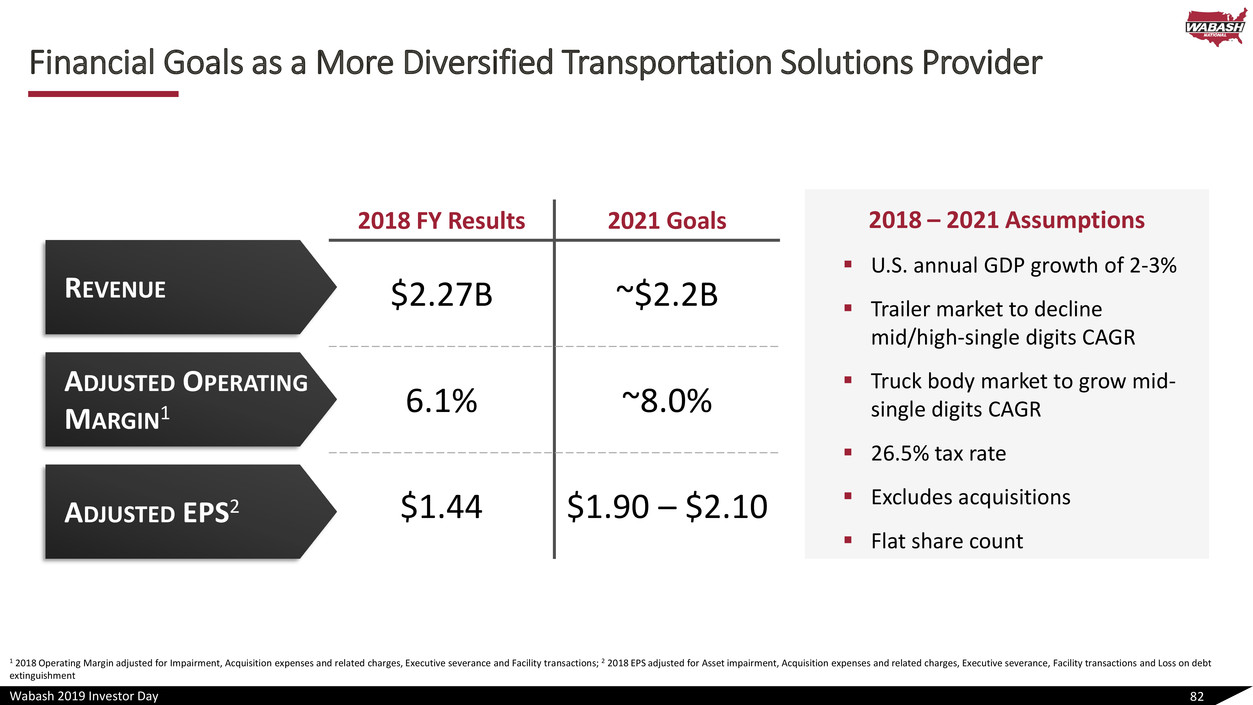

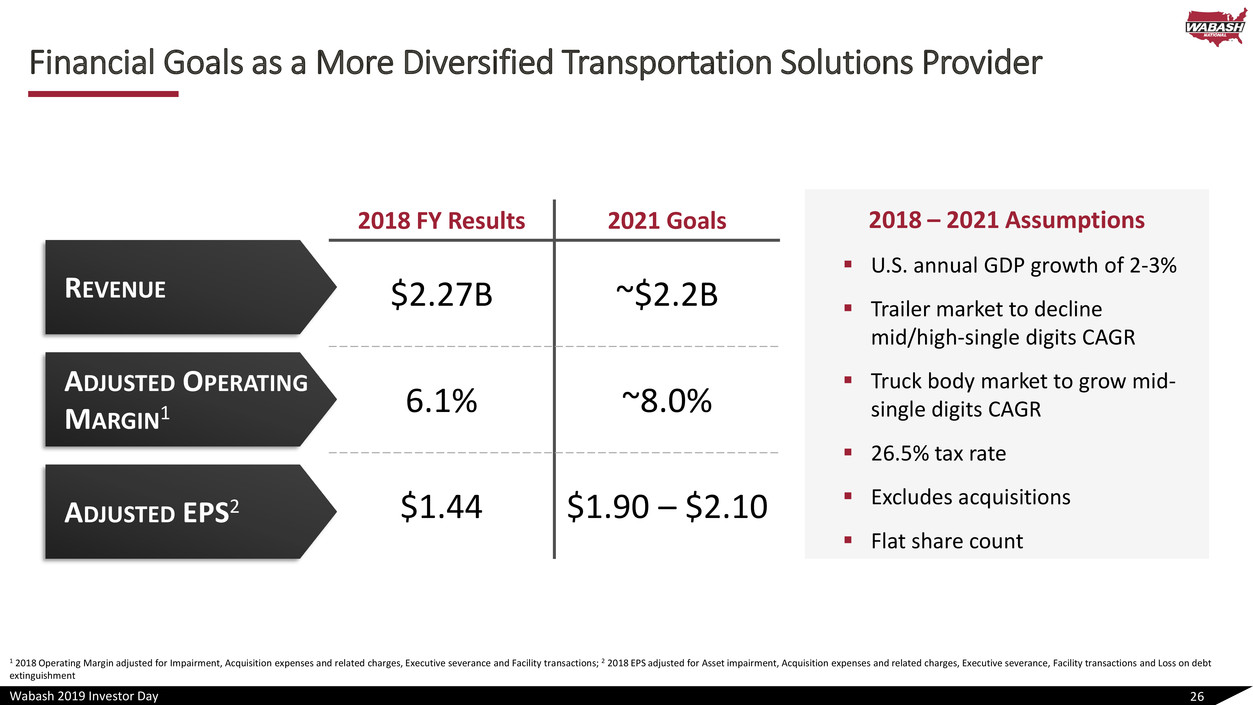

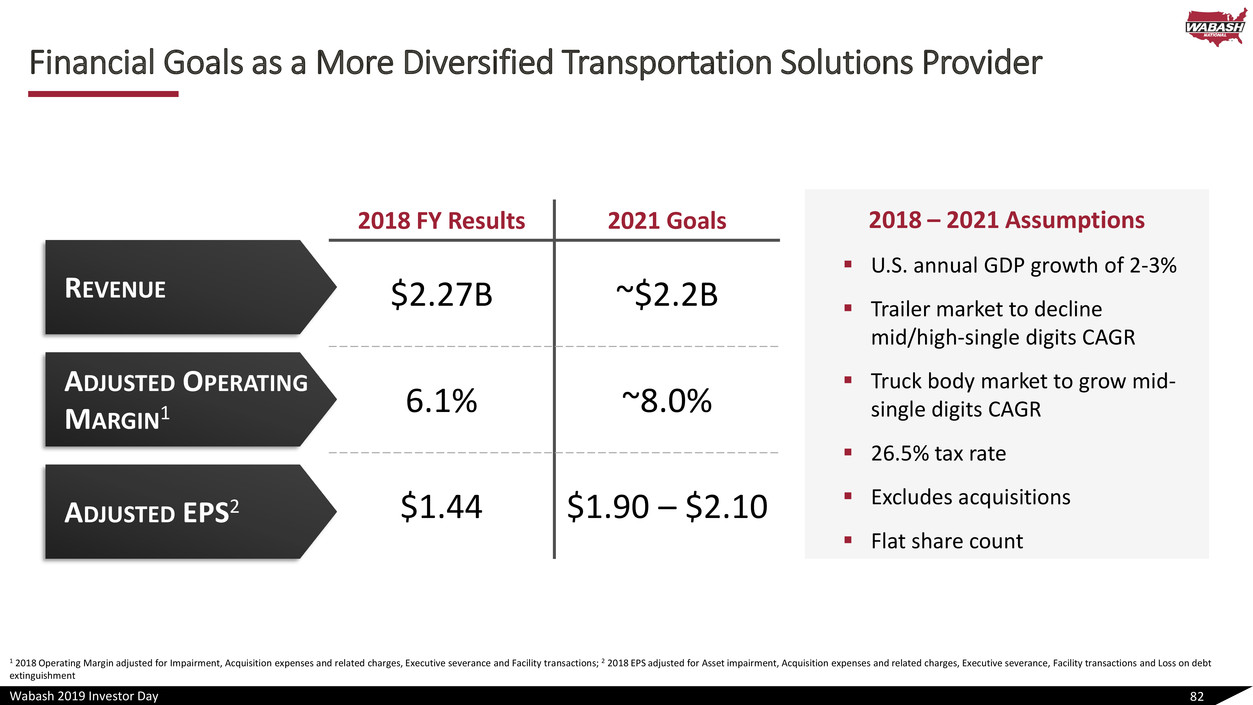

Wabash 2019 Investor Day Financial Goals as a More Diversified Transportation Solutions Provider 26 1 2018 Operating Margin adjusted for Impairment, Acquisition expenses and related charges, Executive severance and Facility transactions; 2 2018 EPS adjusted for Asset impairment, Acquisition expenses and related charges, Executive severance, Facility transactions and Loss on debt extinguishment 2018 – 2021 Assumptions ▪ U.S. annual GDP growth of 2-3% ▪ Trailer market to decline mid/high-single digits CAGR ▪ Truck body market to grow mid- single digits CAGR ▪ 26.5% tax rate ▪ Excludes acquisitions ▪ Flat share count REVENUE ADJUSTED OPERATING MARGIN1 ADJUSTED EPS2 2018 FY Results 2021 Goals $2.27B ~$2.2B 6.1% ~8.0% $1.44 $1.90 – $2.10

Wabash 2019 Investor Day Key Takeaways 27 1. Passionate, Experienced Management Team Fostering Cultural Transformation 2. Transforming Organization to Tap into New Ways of Creating Value with Leading Brands in Diverse End Markets and Industries 3. Best-in-class, Technologically Innovative Products and Differentiated Solutions 4. Accelerate Profitable Growth with Continued Focus on Operational Excellence and Higher Margin Opportunities 5. Leverage Financial Strength for Disciplined Growth to Build upon Resilient Financial Profile

Wabash 2019 Investor Day Final Mile Video 28

Wabash 2019 Investor Day Final Mile Products Mike Pettit – SVP & Group President 29

Wabash 2019 Investor Day FMP Key Messages 30 A Leader in Rapidly-evolving Final Mile Space with Technologies, Processes and Equipment to Solve Delivery and Logistic Challenges Integrating Best Practices and Leveraging Proven Business and Sales Processes that Value Velocity, Consistency and Flexibility Favorable Industry Trends Including Significant e- commerce Growth Fuels Increased Demand and Diversifies Overall Company Revenue Profile In Early Stages of Optimization and New Product Development to Expand Our Addressable Market Continuous Improvement Mindset as we Leverage the Wabash Management System for Profitable Growth and Stronger Cash Flow Generation 1. 2. 3. 4. 5.

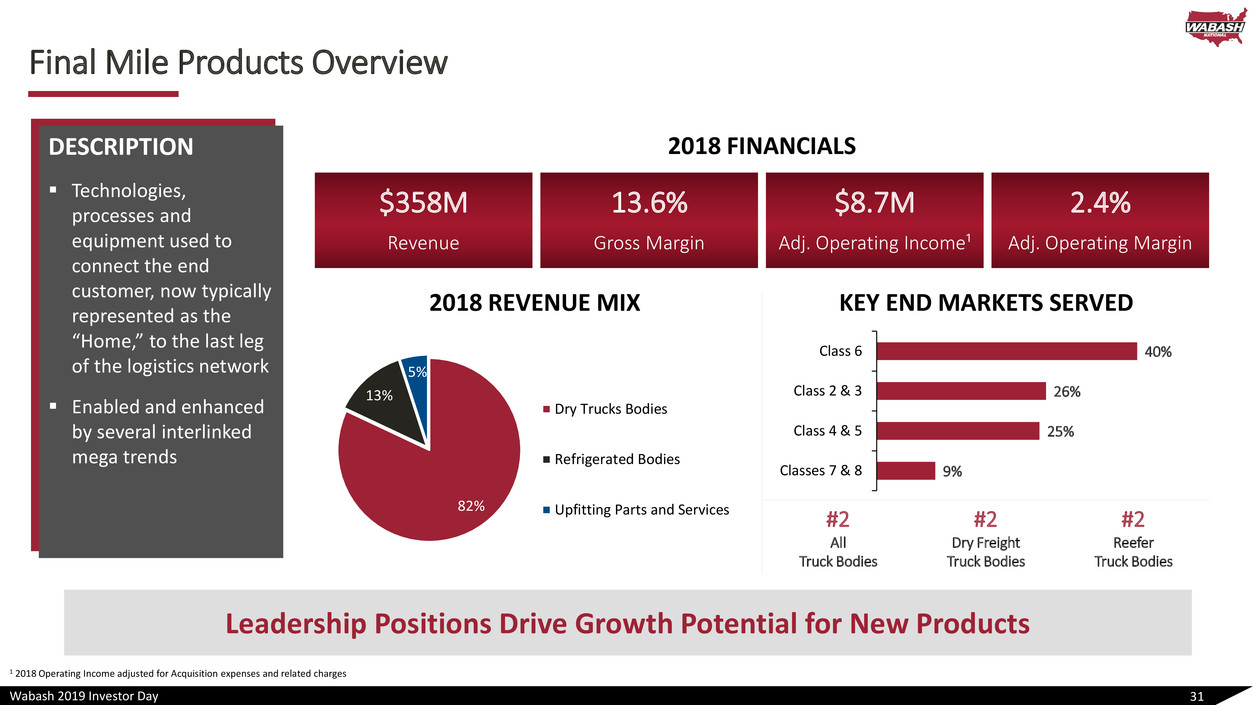

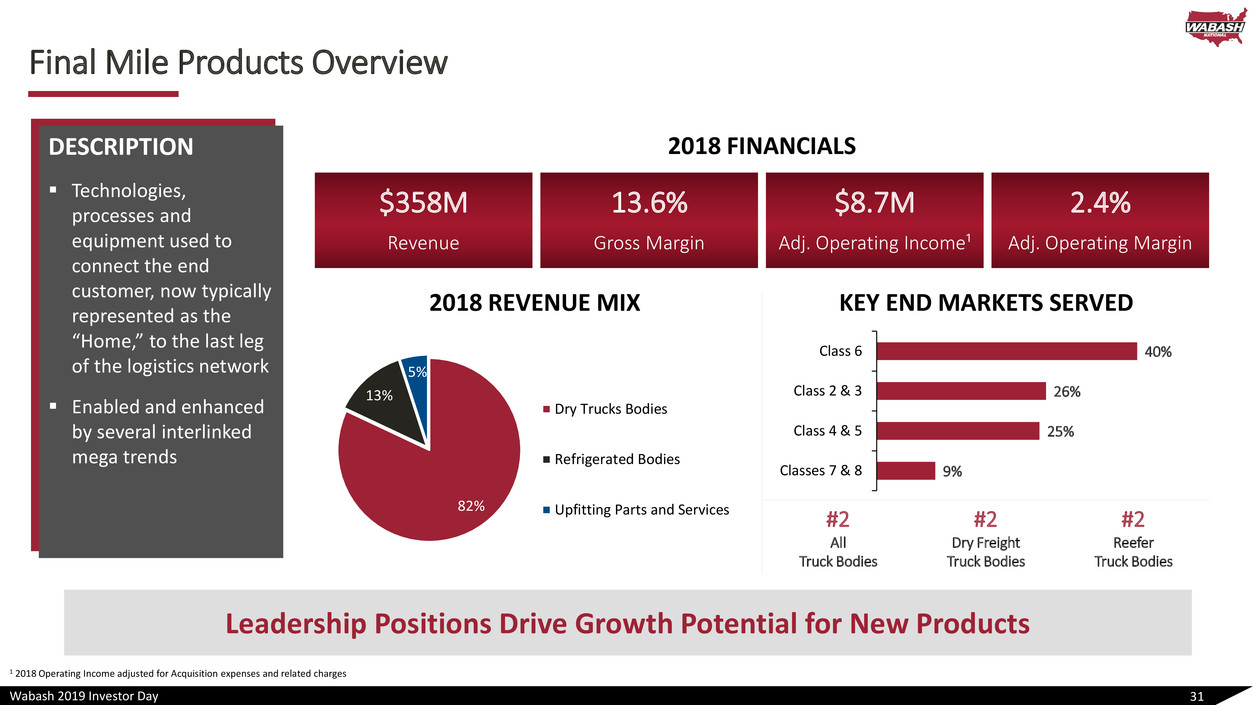

Wabash 2019 Investor Day Final Mile Products Overview 31 Leadership Positions Drive Growth Potential for New Products DESCRIPTION ▪ Technologies, processes and equipment used to connect the end customer, now typically represented as the “Home,” to the last leg of the logistics network ▪ Enabled and enhanced by several interlinked mega trends 2018 FINANCIALS $358M 13.6% $8.7M 2.4% Revenue Gross Margin Adj. Operating Income¹ Adj. Operating Margin 2018 REVENUE MIX KEY END MARKETS SERVED #2 All Truck Bodies #2 Dry Freight Truck Bodies #2 Reefer Truck Bodies 9% 25% 26% 40% Classes 7 & 8 Class 4 & 5 Class 2 & 3 Class 6 82% 13% 5% Dry Trucks Bodies Refrigerated Bodies Upfitting Parts and Services 1 2018 Operating Income adjusted for Acquisition expenses and related charges

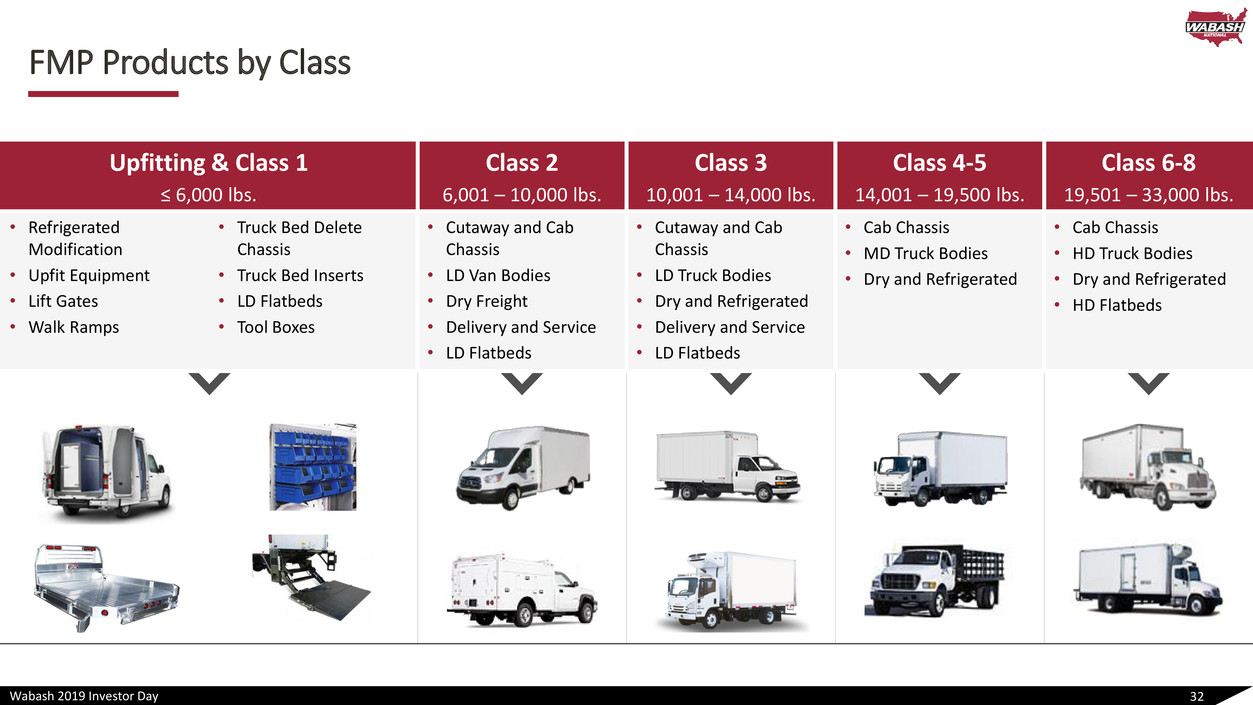

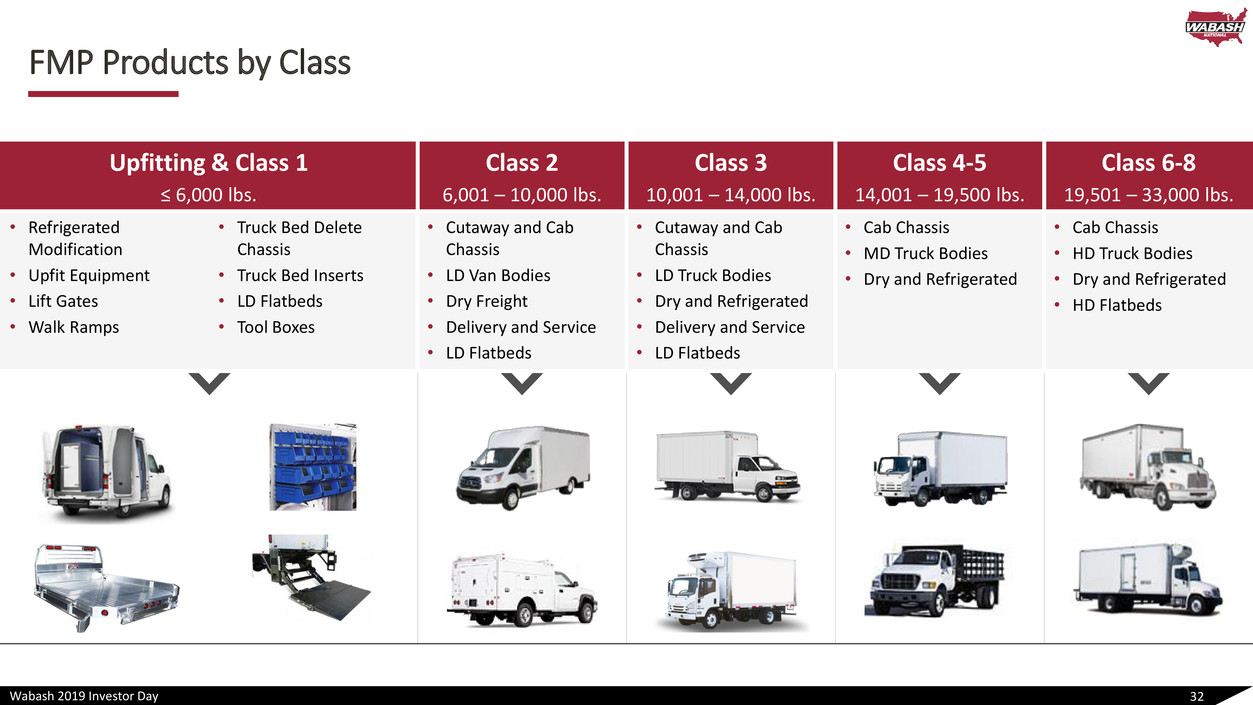

Wabash 2019 Investor Day FMP Products by Class 32 Upfitting & Class 1 ≤ 6,000 lbs. Class 2 6,001 – 10,000 lbs. Class 3 10,001 – 14,000 lbs. Class 4-5 14,001 – 19,500 lbs. Class 6-8 19,501 – 33,000 lbs. • Refrigerated Modification • Upfit Equipment • Lift Gates • Walk Ramps • Truck Bed Delete Chassis • Truck Bed Inserts • LD Flatbeds • Tool Boxes • Cutaway and Cab �� Chassis • LD Van Bodies • Dry Freight • Delivery and Service • LD Flatbeds • Cutaway and Cab Chassis • LD Truck Bodies • Dry and Refrigerated • Delivery and Service • LD Flatbeds • Cab Chassis • MD Truck Bodies • Dry and Refrigerated • Cab Chassis • HD Truck Bodies • Dry and Refrigerated • HD Flatbeds

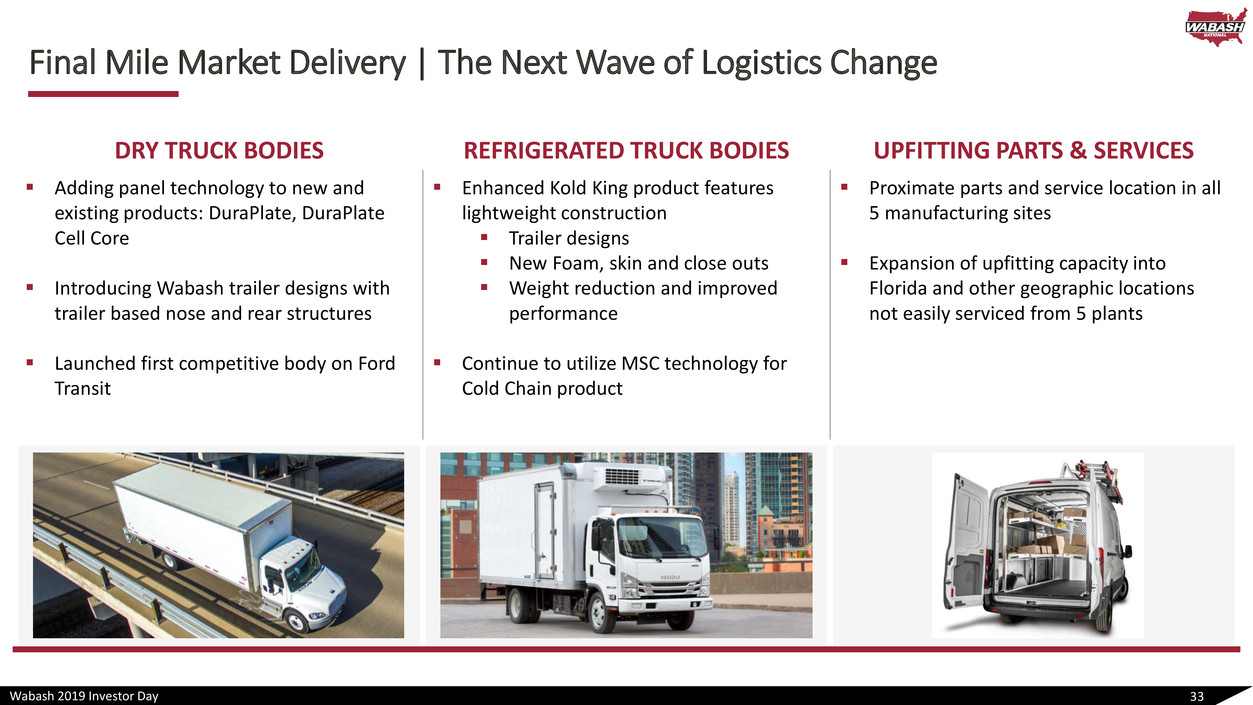

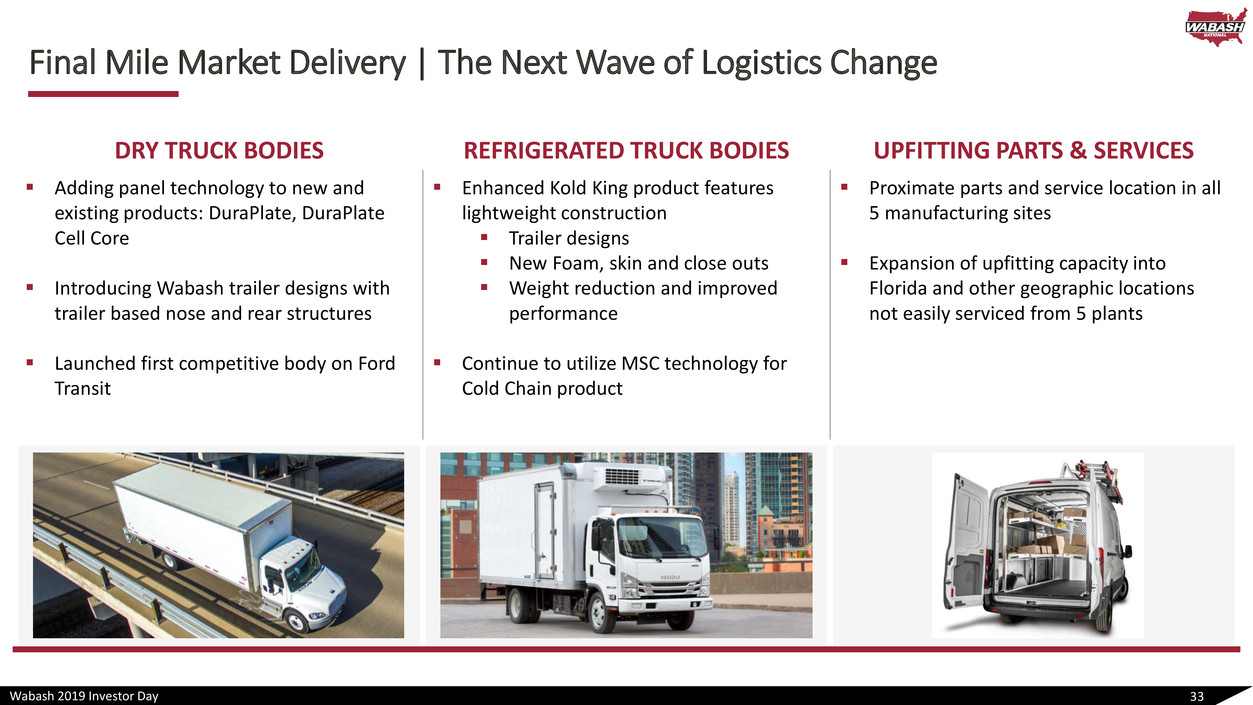

Wabash 2019 Investor Day Final Mile Market Delivery | The Next Wave of Logistics Change 33 DRY TRUCK BODIES REFRIGERATED TRUCK BODIES UPFITTING PARTS & SERVICES ▪ Adding panel technology to new and existing products: DuraPlate, DuraPlate Cell Core ▪ Introducing Wabash trailer designs with trailer based nose and rear structures ▪ Launched first competitive body on Ford Transit ▪ Enhanced Kold King product features lightweight construction ▪ Trailer designs ▪ New Foam, skin and close outs ▪ Weight reduction and improved performance ▪ Continue to utilize MSC technology for Cold Chain product ▪ Proximate parts and service location in all 5 manufacturing sites ▪ Expansion of upfitting capacity into Florida and other geographic locations not easily serviced from 5 plants

Wabash 2019 Investor Day 34 Why Final Mile Will Continue to Succeed | Sustainable Competitive Advantages… …Driven by Continuous Improvement Mindset Innovative Design for Manufacturability Mixed Model and High Velocity Manufacturing Breakthrough Panel Technology

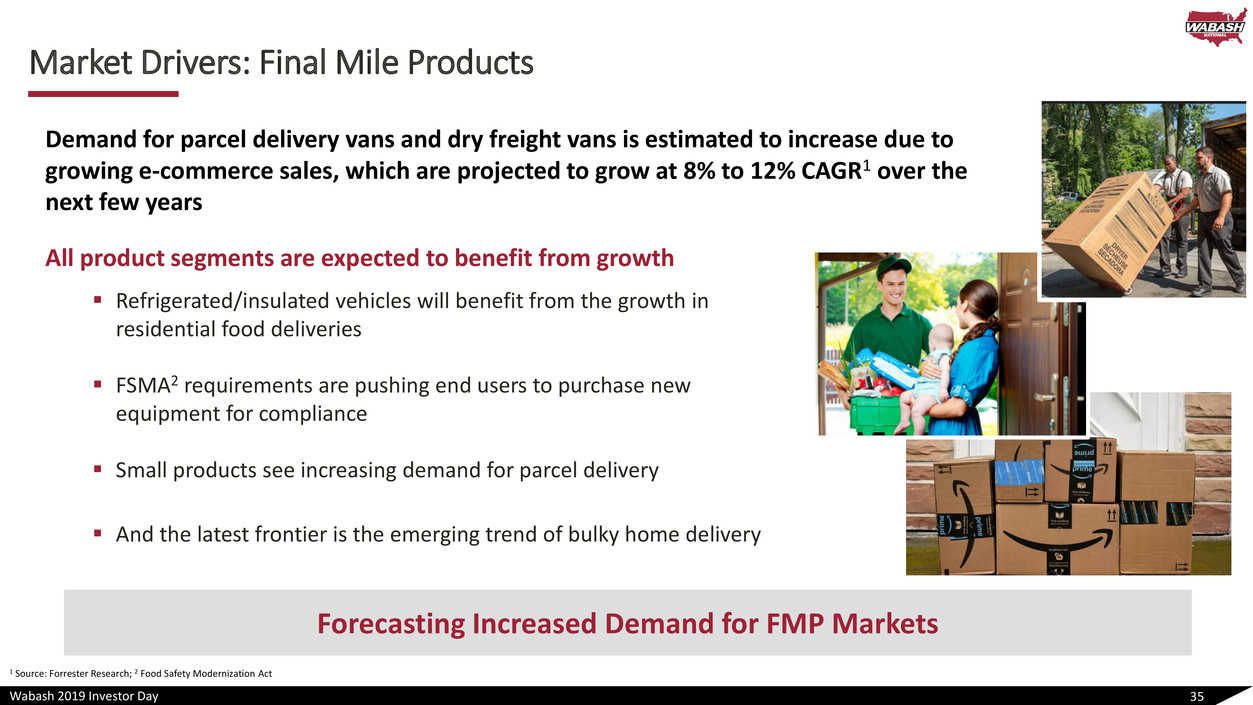

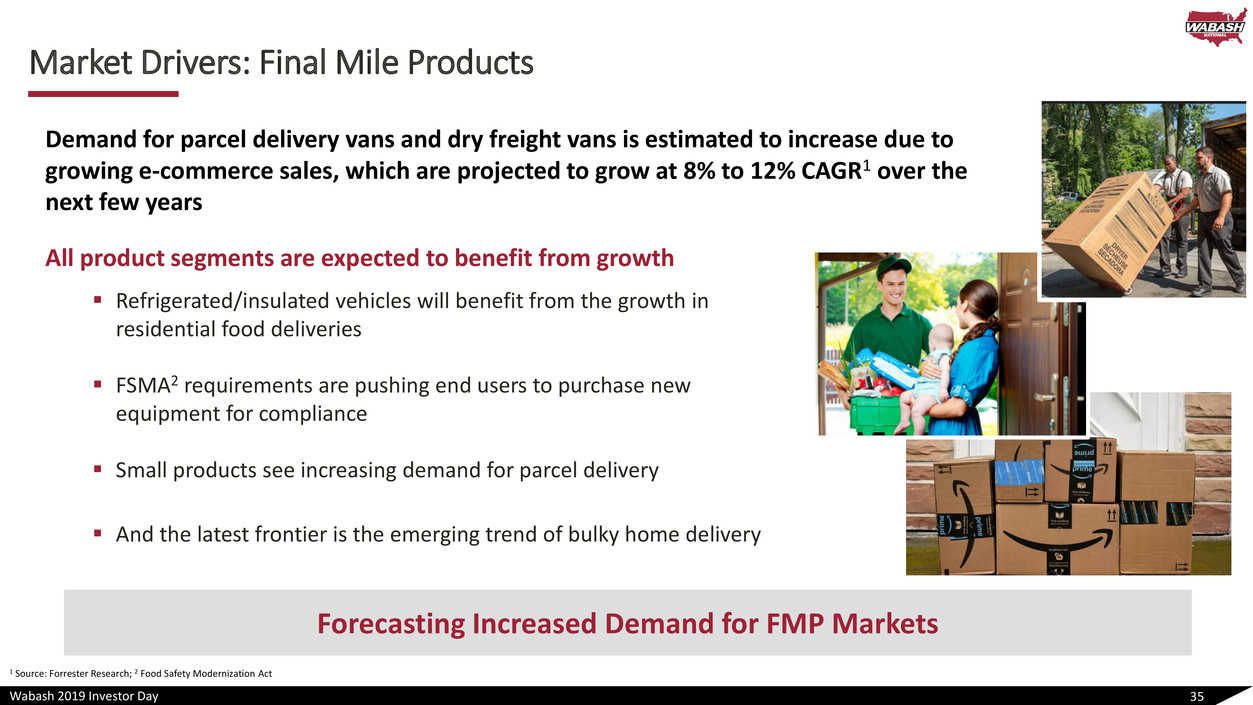

Wabash 2019 Investor Day Market Drivers: Final Mile Products All product segments are expected to benefit from growth ▪ Refrigerated/insulated vehicles will benefit from the growth in residential food deliveries ▪ FSMA2 requirements are pushing end users to purchase new equipment for compliance ▪ Small products see increasing demand for parcel delivery ▪ And the latest frontier is the emerging trend of bulky home delivery 35 Forecasting Increased Demand for FMP Markets Demand for parcel delivery vans and dry freight vans is estimated to increase due to growing e-commerce sales, which are projected to grow at 8% to 12% CAGR1 over the next few years 1 Source: Forrester Research; 2 Food Safety Modernization Act

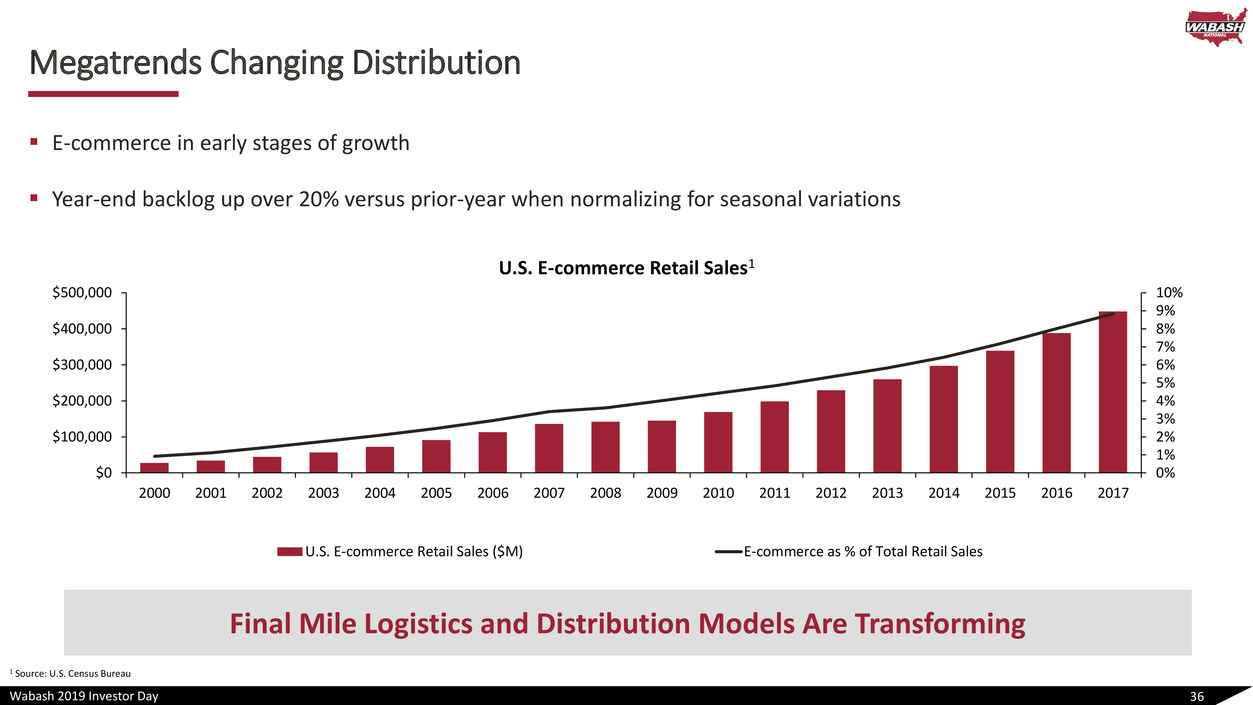

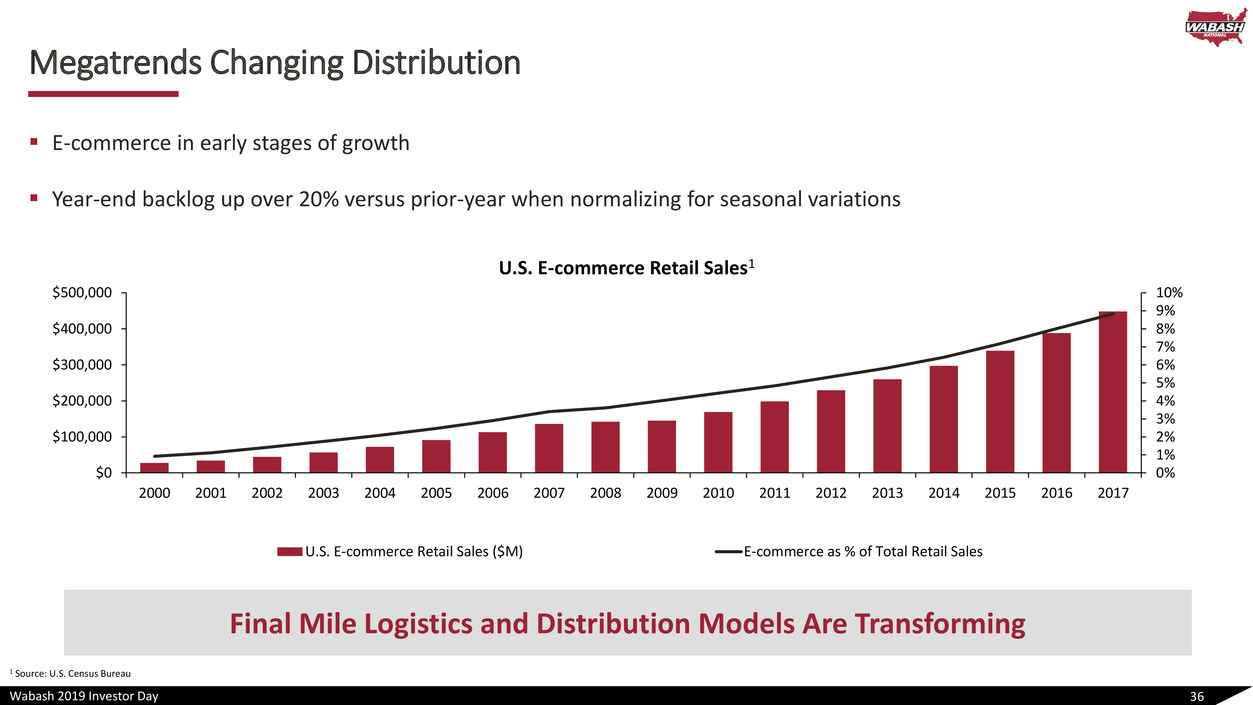

Wabash 2019 Investor Day ▪ E-commerce in early stages of growth ▪ Year-end backlog up over 20% versus prior-year when normalizing for seasonal variations Megatrends Changing Distribution 36 Final Mile Logistics and Distribution Models Are Transforming 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% $0 $100,000 $200,000 $300,000 $400,000 $500,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 U.S. E-commerce Retail Sales1 U.S. E-commerce Retail Sales ($M) E-commerce as % of Total Retail Sales 1 Source: U.S. Census Bureau

Wabash 2019 Investor Day Record Backlog with Secular and Cyclical Growth 37 Well Positioned for Growth with Record Backlog of $190M “E-commerce Set for Global Domination – But at Different Speeds” “E-commerce Logistics Market to Rise at 20.6% CAGR Due to Increasing Border E-commerce Activities” “Record 2.5B E-commerce Deliveries Were Made this Holiday” “Amazon Says it Delivered 1 Billion Holiday ‘Items’ for Free Under Prime Service” “Warehouse Space Growing Tighter on Rising E-commerce Demand” “E-commerce is on the Rise in Emerging Markets” “Amazon Announces a Record-Breaking Holiday, ‘Tens of Millions’ of New Prime Subscribers” August 2018 November 2018 December 2018 December 2018 October 2018 December 2018 December 2018

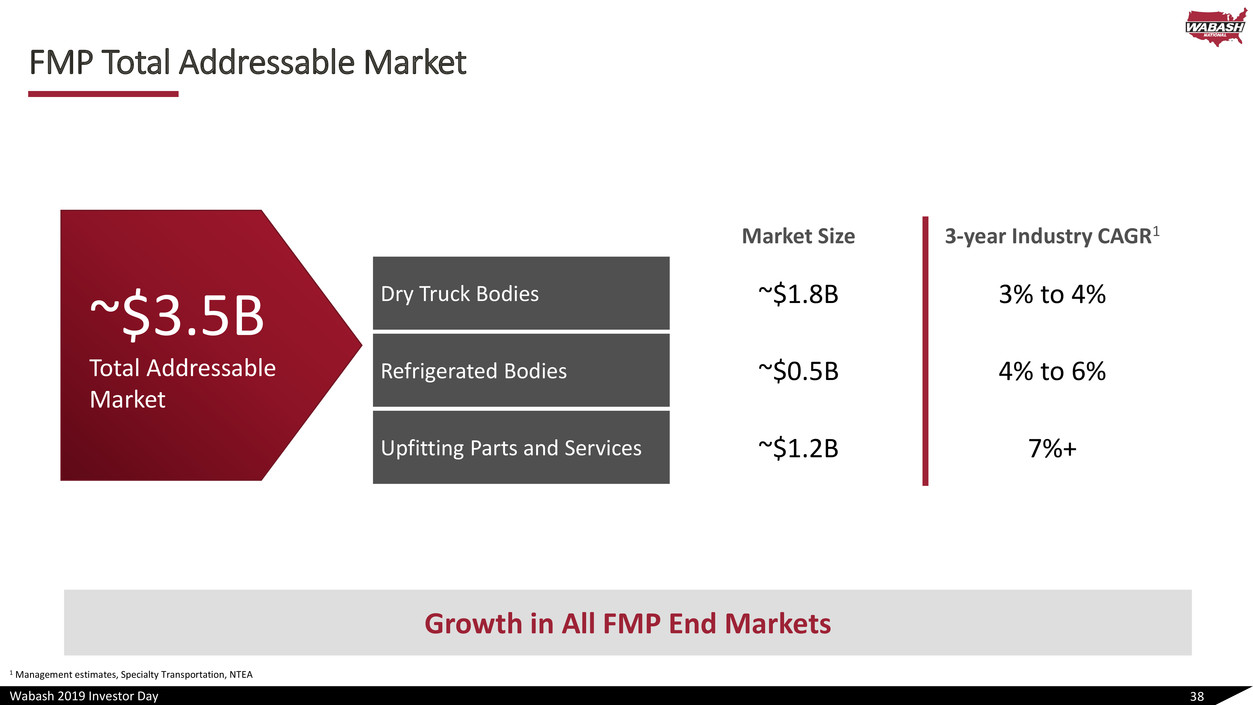

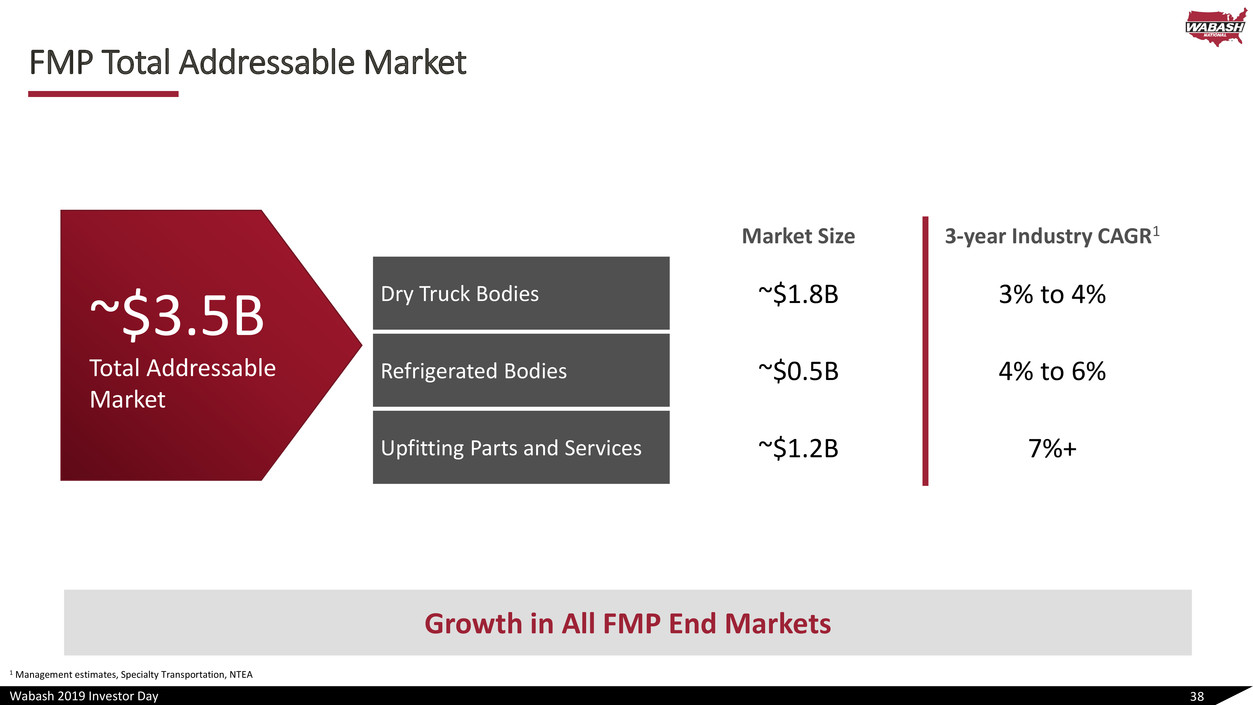

Wabash 2019 Investor Day FMP Total Addressable Market 38 Growth in All FMP End Markets ~$3.5B Total Addressable Market Market Size 3-year Industry CAGR1 Dry Truck Bodies ~$1.8B 3% to 4% Refrigerated Bodies ~$0.5B 4% to 6% Upfitting Parts and Services ~$1.2B 7%+ 1 Management estimates, Specialty Transportation, NTEA

Wabash 2019 Investor Day Strategic Path Forward 39 Leveraging the Best of Wabash and Legacy Supreme ▪ Incorporate proven Wabash technologies (Panel Tech and Trailer Designs) ▪ Develop lighter weight delivery vehicles ▪ Utilize WMS for profitable and consistent growth ▪ Solving delivery challenges by utilizing proven business and sales processes ▪ Expand presence in light-duty upfit market ▪ Expand presence in refrigerated market ▪ Revitalize legacy Kold King offering ▪ Introduce best-in-class Cold Chain with MSC INNOVATE OPTIMIZE GROW

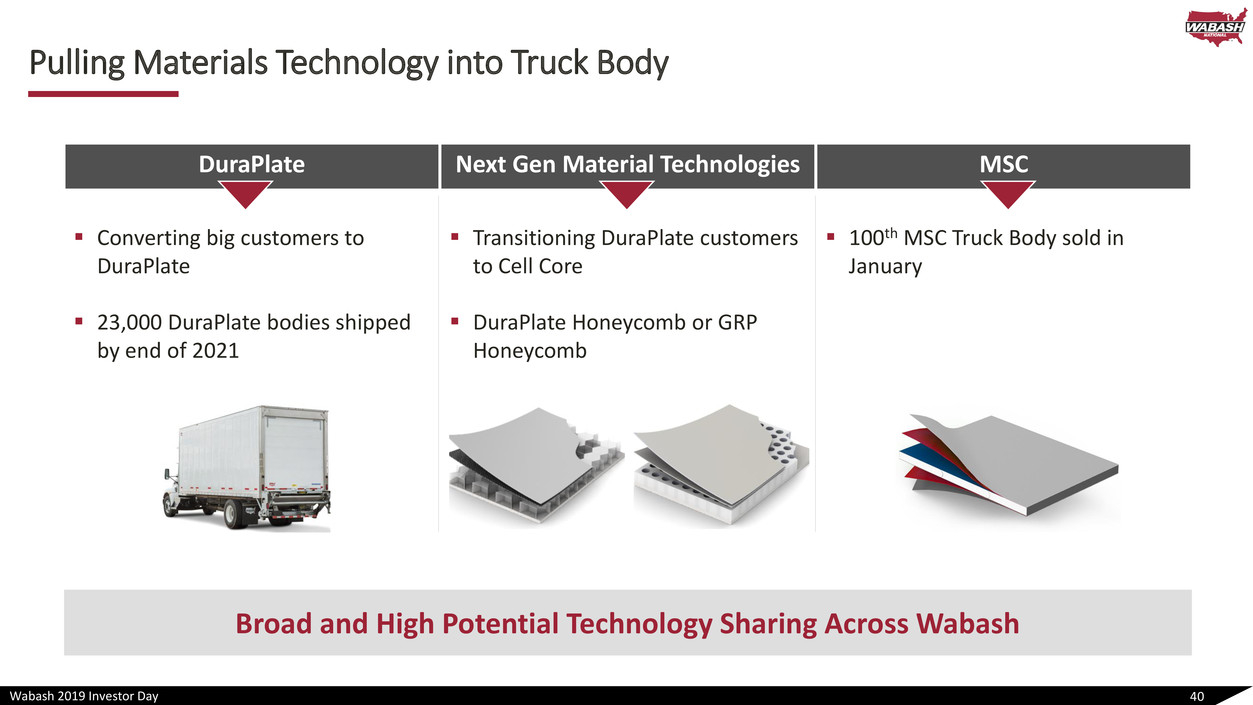

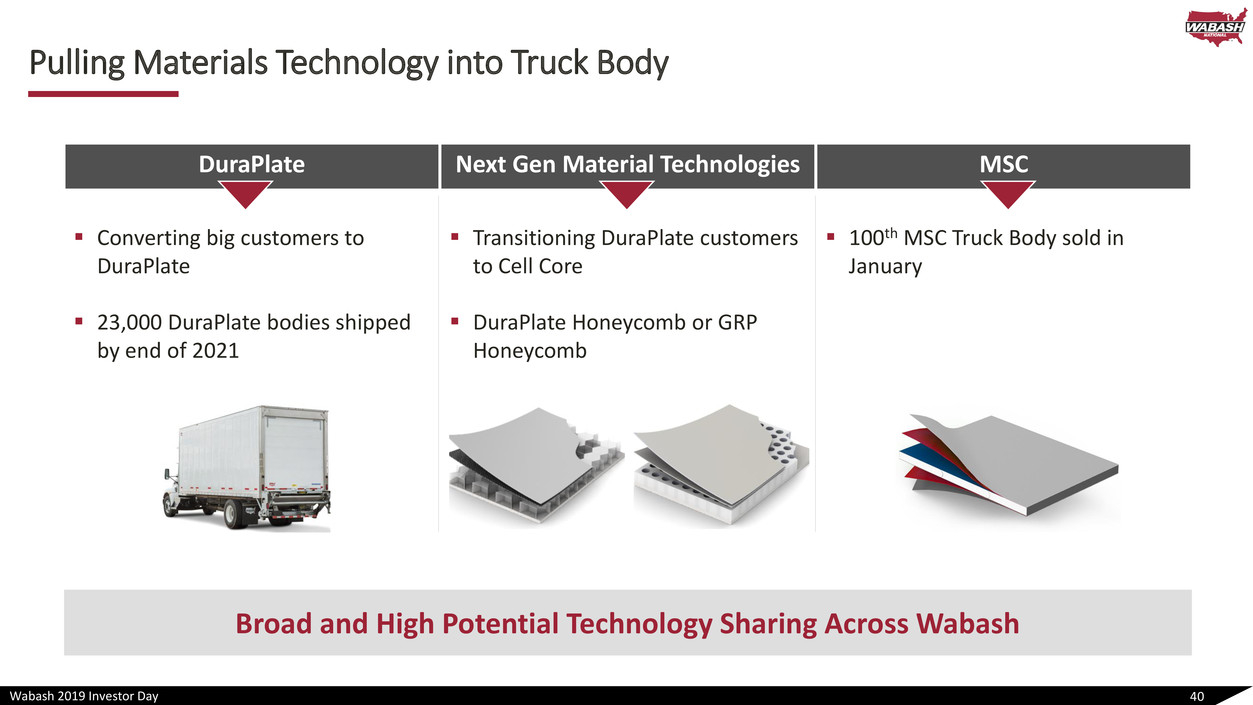

Wabash 2019 Investor Day Pulling Materials Technology into Truck Body 40 Broad and High Potential Technology Sharing Across Wabash DuraPlate Next Gen Material Technologies MSC ▪ Converting big customers to DuraPlate ▪ 23,000 DuraPlate bodies shipped by end of 2021 ▪ Transitioning DuraPlate customers to Cell Core ▪ DuraPlate Honeycomb or GRP Honeycomb ▪ 100th MSC Truck Body sold in January

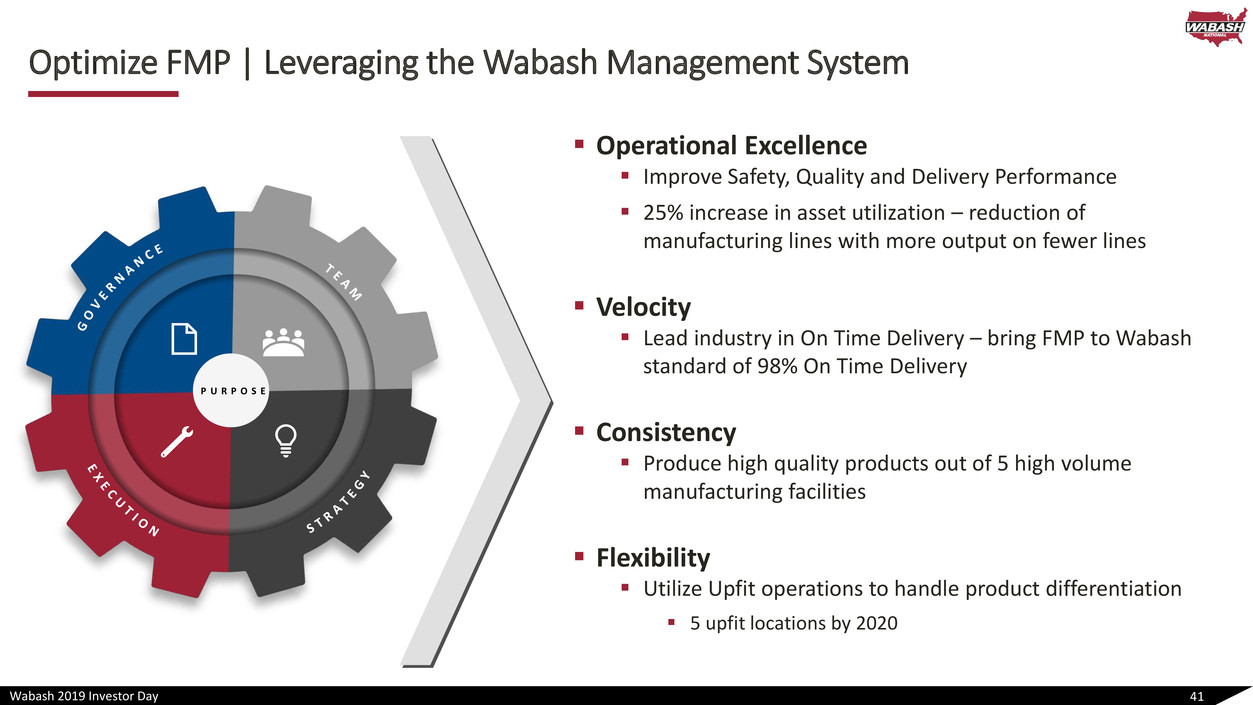

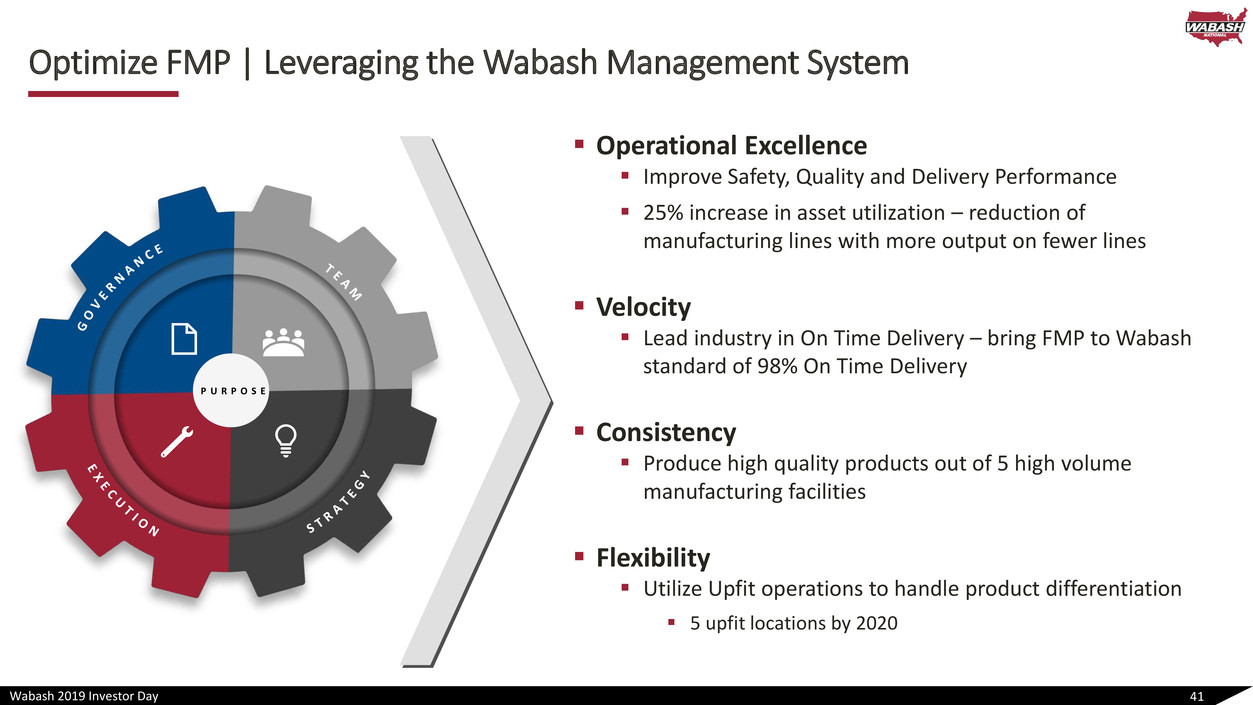

Wabash 2019 Investor Day Optimize FMP | Leveraging the Wabash Management System ▪ Operational Excellence ▪ Improve Safety, Quality and Delivery Performance ▪ 25% increase in asset utilization – reduction of manufacturing lines with more output on fewer lines ▪ Velocity ▪ Lead industry in On Time Delivery – bring FMP to Wabash standard of 98% On Time Delivery ▪ Consistency ▪ Produce high quality products out of 5 high volume manufacturing facilities ▪ Flexibility ▪ Utilize Upfit operations to handle product differentiation ▪ 5 upfit locations by 2020 41 P U R P O S E

Wabash 2019 Investor Day Upfit, Parts & Service 42 Establishing a Platform to Deliver Enhanced Brand Value Upfitting, Parts & Service Middle Mile Final Mile Work Truck Class 1 Upfits Delivering customized solutions and post-sale support to key Final Mile Product market segments Customers: Food, freight, leasing companies Customers: Package Delivery, furniture delivery, direct e- commerce Customers: Plumbers, electricians, contractors, service technicians Customers: Small business, Delivery Companies Market Growth Potential Dry Truck Bodies ~$1.8B Refrigerated Bodies ~$0.5B Upfitting, Parts & Service ~$1.2B ▪ $1.2B market that is presently very fragmented ▪ 7%+ annual growth rate ▪ Aligned with mega trends of urbanization and home delivery Existing Upfit Business ▪ 1,200 Cargo vans ▪ ~35-40% of FMP production gets some level of upfit at our factories today ▪ ~20% of FMP production gets sent to a 3rd party for additional upfit

Wabash 2019 Investor Day Refrigerated Product Update 43 Insulated/Refrigerated Market Offers Significant Potential 0 500 1000 1500 2000 2500 3000 2017 2018 2019E FMP Refrigerated Units By Year Market Potential ▪ FSMA requirements are pushing end users to purchase new equipment for compliance ▪ Grocery/home delivery will ensure growth continues, both for truck bodies and upfit/insert ▪ Product development and upgrades will continue to open market share potential Wabash Technologies ✓ Refreshed Kold King (Trailer Design) 20% annualized growth ✓ MSC Cold Chain

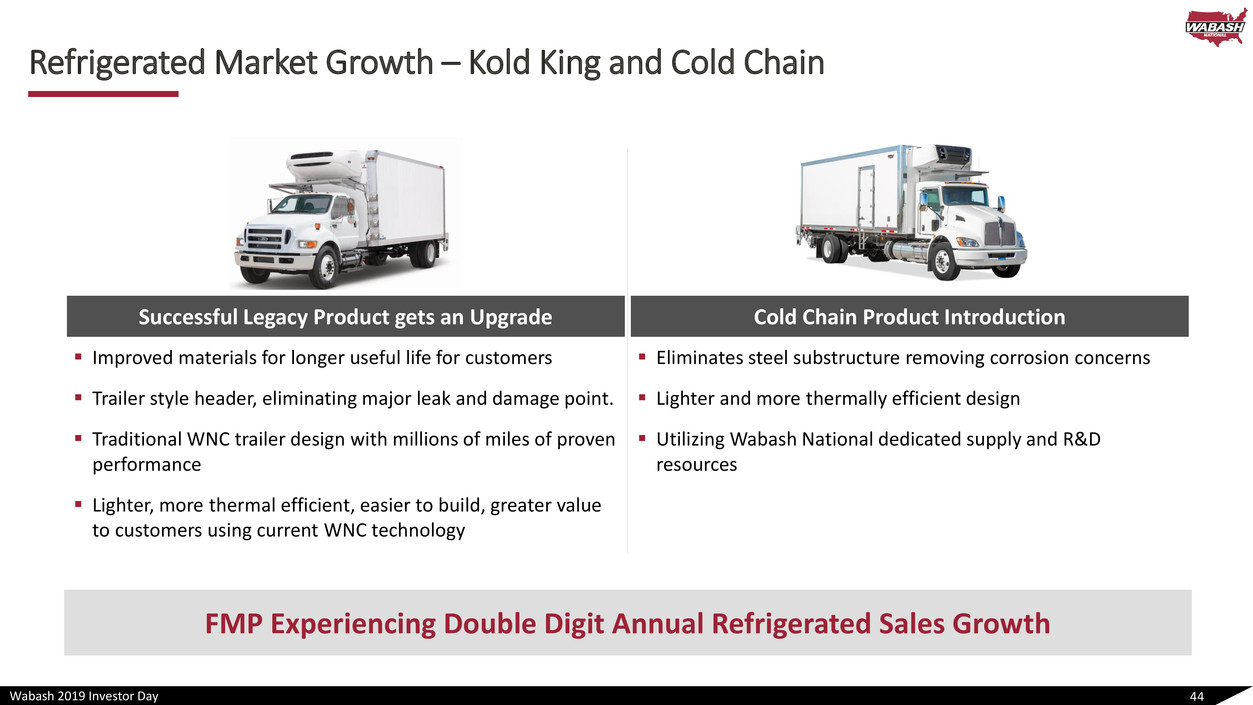

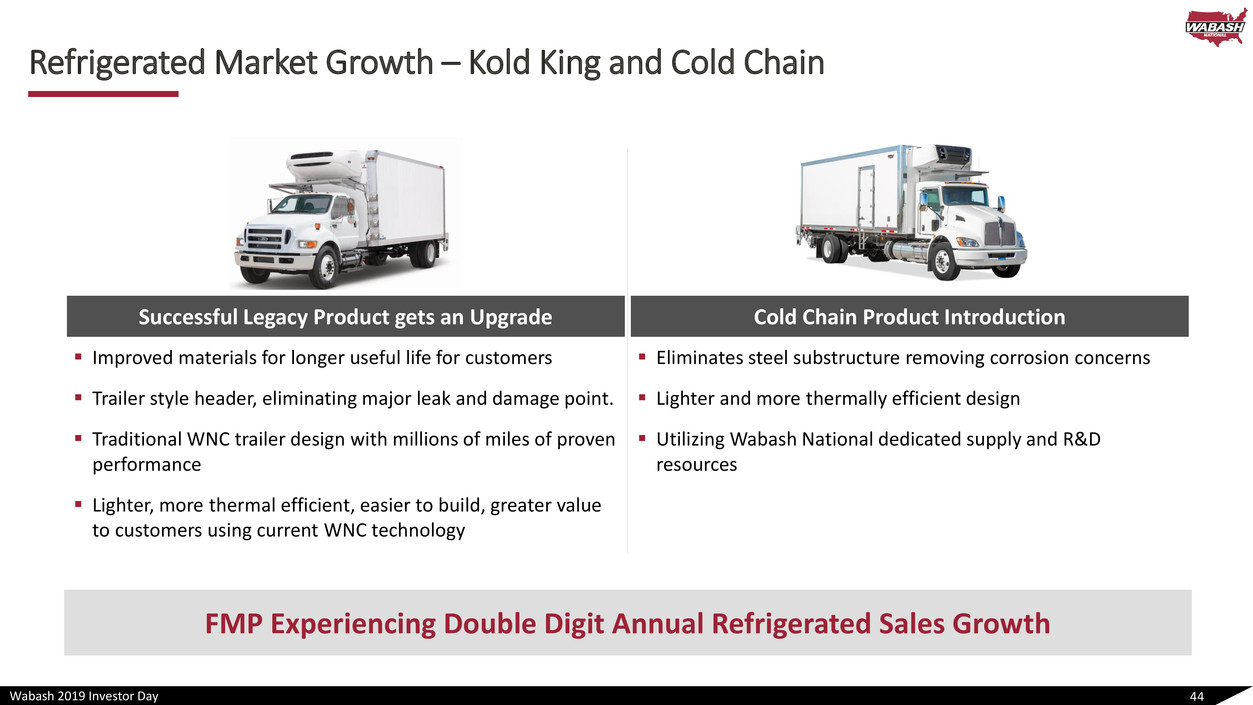

Wabash 2019 Investor Day Refrigerated Market Growth – Kold King and Cold Chain 44 FMP Experiencing Double Digit Annual Refrigerated Sales Growth Successful Legacy Product gets an Upgrade Cold Chain Product Introduction ▪ Improved materials for longer useful life for customers ▪ Trailer style header, eliminating major leak and damage point. ▪ Traditional WNC trailer design with millions of miles of proven performance ▪ Lighter, more thermal efficient, easier to build, greater value to customers using current WNC technology ▪ Eliminates steel substructure removing corrosion concerns ▪ Lighter and more thermally efficient design ▪ Utilizing Wabash National dedicated supply and R&D resources

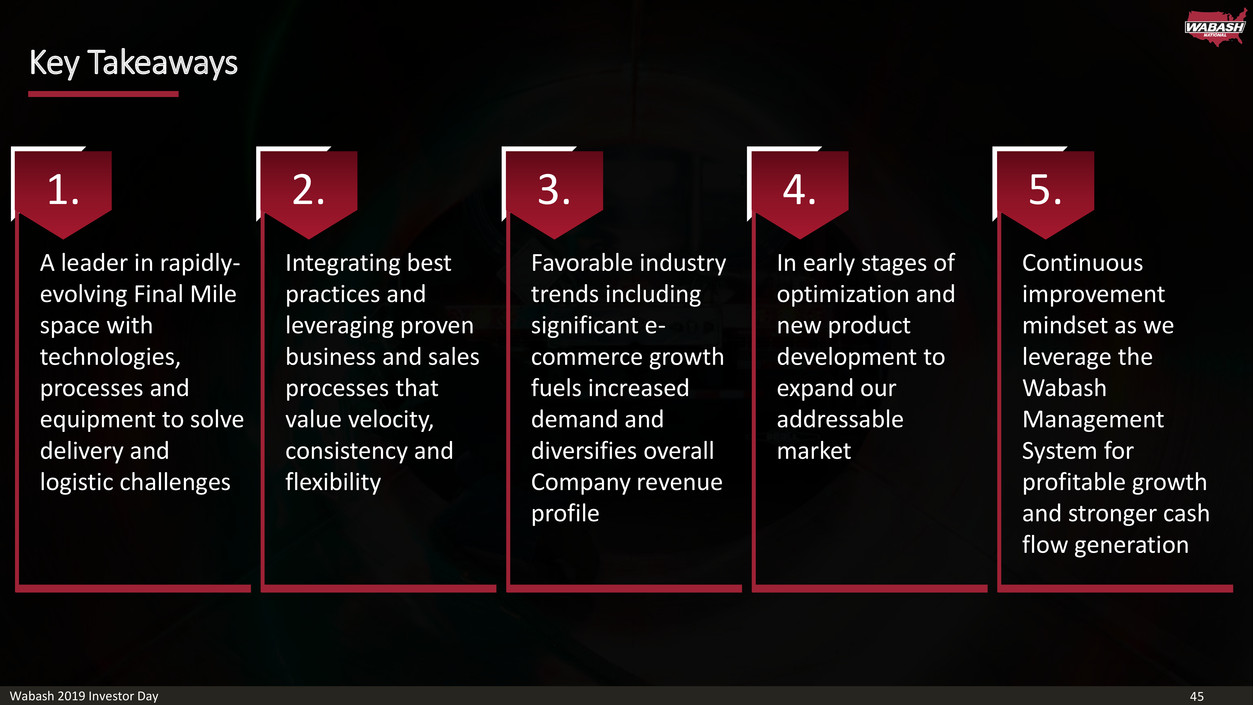

Wabash 2019 Investor Day Key Takeaways 45 1. A leader in rapidly- evolving Final Mile space with technologies, processes and equipment to solve delivery and logistic challenges 2. Integrating best practices and leveraging proven business and sales processes that value velocity, consistency and flexibility 3. Favorable industry trends including significant e- commerce growth fuels increased demand and diversifies overall Company revenue profile 4. In early stages of optimization and new product development to expand our addressable market 5. Continuous improvement mindset as we leverage the Wabash Management System for profitable growth and stronger cash flow generation

Wabash 2019 Investor Day Q&A Session Brent Yeagy – President & CEO Mike Pettit – SVP & Group President 46

Wabash 2019 Investor Day Break 10 minutes 47

Wabash 2019 Investor Day Diversified Products Kevin Page – SVP & Group President 48

Wabash 2019 Investor Day DPG Key Messages 49 Driving Accelerated Operational Execution for Margin Expansion Stable and Growing Markets Contributing to Revenue Gains; Growth Greater than Market Building on a Long History of Trusted Brands with Strong Market Positions Leveraging New ERP System and Corporate Centers of Excellence to Drive Business Process Optimization 1. 2. 3. 4. 5. Leading Further Product Diversification and Differentiation in the Transportation Segment through Innovation Leadership

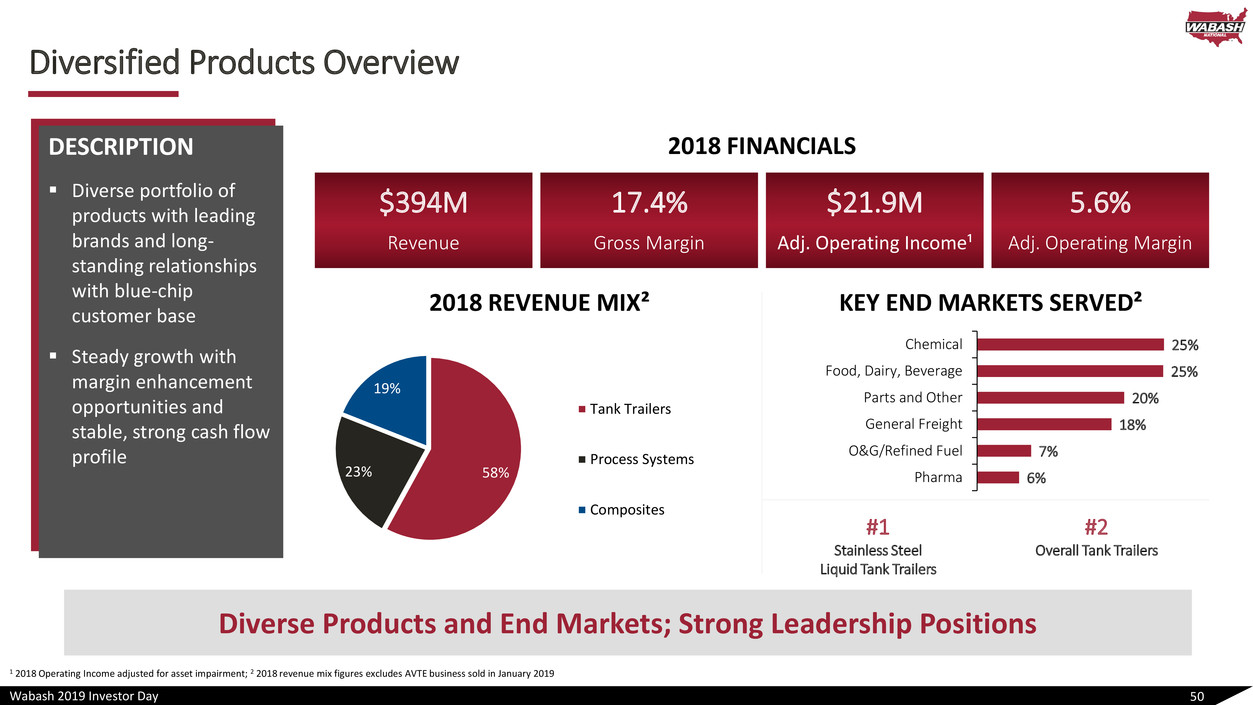

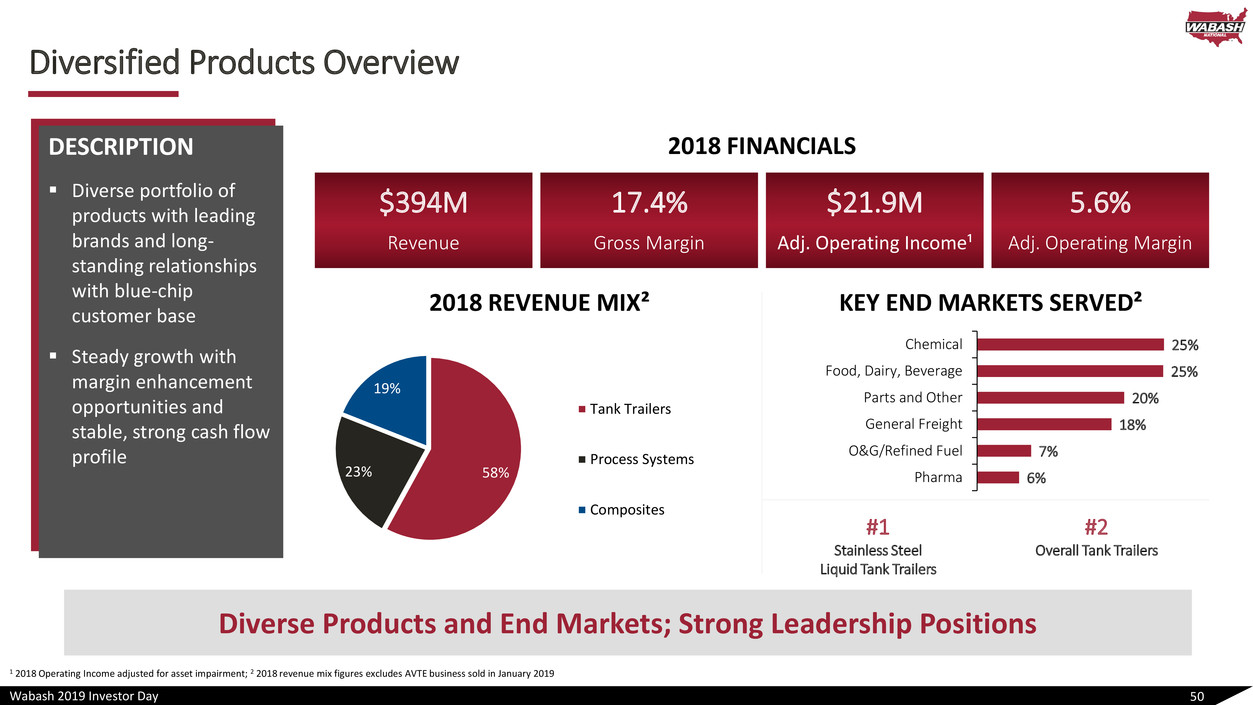

Wabash 2019 Investor Day Diversified Products Overview 50 Diverse Products and End Markets; Strong Leadership Positions DESCRIPTION ▪ Diverse portfolio of products with leading brands and long- standing relationships with blue-chip customer base ▪ Steady growth with margin enhancement opportunities and stable, strong cash flow profile 2018 FINANCIALS $394M 17.4% $21.9M 5.6% Revenue Gross Margin Adj. Operating Income¹ Adj. Operating Margin 58%23% 19% Tank Trailers Process Systems Composites 2018 REVENUE MIX² KEY END MARKETS SERVED² #1 Stainless Steel Liquid Tank Trailers #2 Overall Tank Trailers 6% 7% 18% 20% 25% 25% Pharma O&G/Refined Fuel General Freight Parts and Other Food, Dairy, Beverage Chemical 1 2018 Operating Income adjusted for asset impairment; 2 2018 revenue mix figures excludes AVTE business sold in January 2019

Wabash 2019 Investor Day Innovative and Wide Array of Product Offerings 51 TANK TRAILERS PROCESS SYSTEMS COMPOSITES ▪ Primarily comprised of chemical and food/dairy/beverage trailers ▪ Consistent order trends in food/dairy/beverage industry ▪ Market share leader with strong brands and customer loyalty ▪ Primarily comprised of sanitary equipment serving the food, dairy and pharmaceutical industries ▪ Consistent order trends in food, dairy, and pharmaceutical industry ▪ Designing solutions for customer unique applications ▪ Primarily comprised of composite panel technology for transportation solutions ▪ 20+ years of experience in materials science and composites technology ▪ Strong blue-chip customer base and robust product pipeline

Wabash 2019 Investor Day Why DPG Will Continue to Succeed | Sustainable Competitive Advantages… …Driven by Continuous Improvement Mindset 52 Strong brands, deep customer relationships and leading market positions in a wide variety of attractive industries Significant opportunity to optimize cost structure and achieve improved financial performance Technology and innovation that delivers unique solutions to create meaningful customer loyalty and value

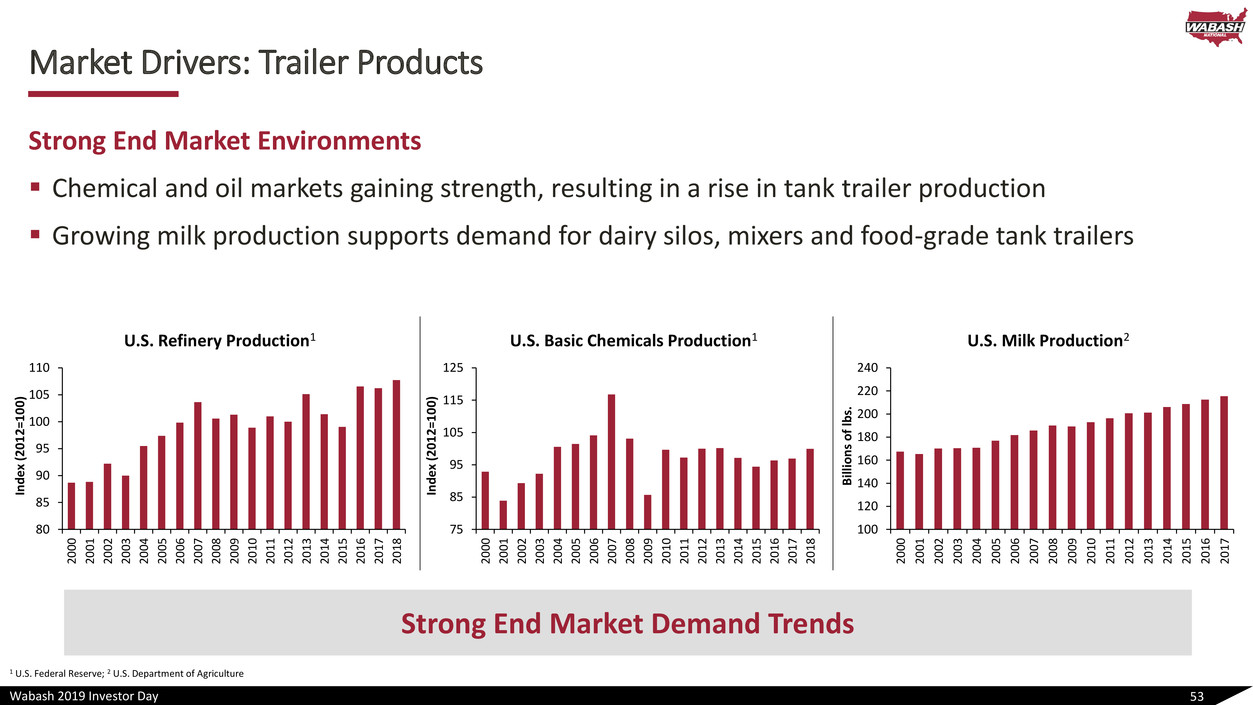

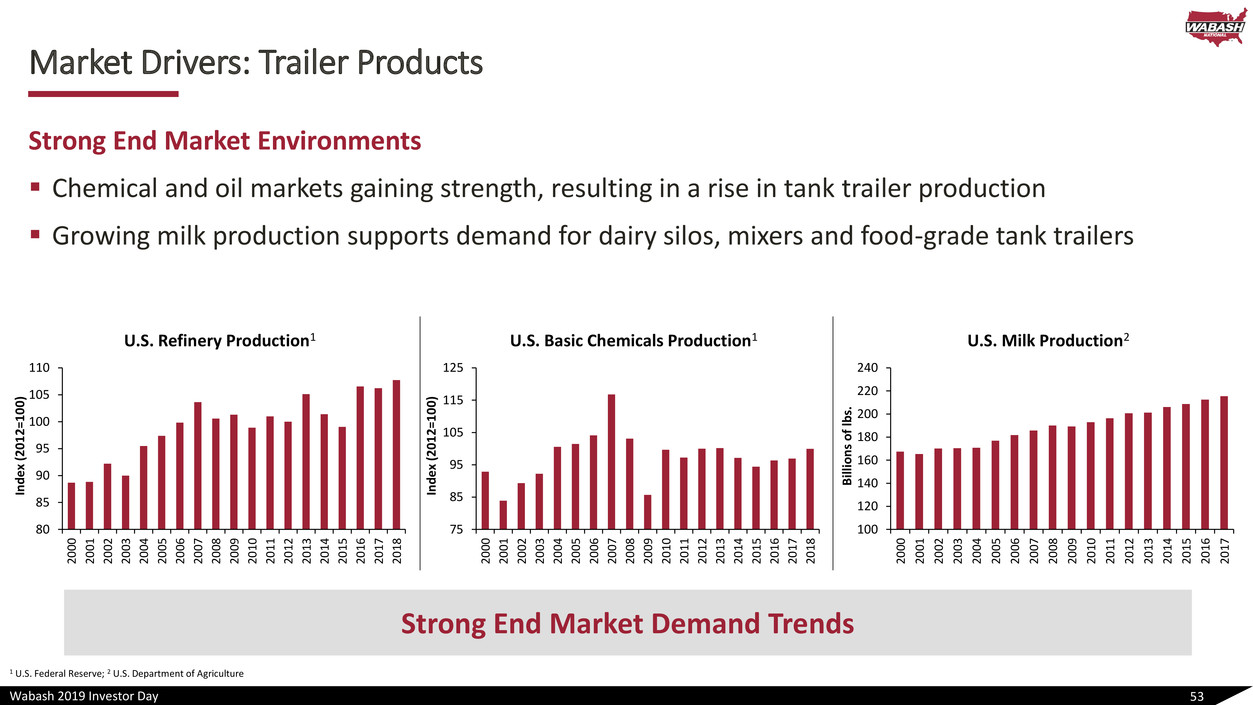

Wabash 2019 Investor Day Market Drivers: Trailer Products Strong End Market Environments ▪ Chemical and oil markets gaining strength, resulting in a rise in tank trailer production ▪ Growing milk production supports demand for dairy silos, mixers and food-grade tank trailers 53 Strong End Market Demand Trends 80 85 90 95 100 105 110 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 U.S. Refinery Production1 75 85 95 105 115 125 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 U.S. Basic Chemicals Production1 100 120 140 160 180 200 220 240 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 U.S. Milk Production2 In d ex ( 2 0 1 2 =1 0 0 ) In d ex ( 2 0 1 2 =1 0 0 ) B ill io n s o f lb s. 1 U.S. Federal Reserve; 2 U.S. Department of Agriculture

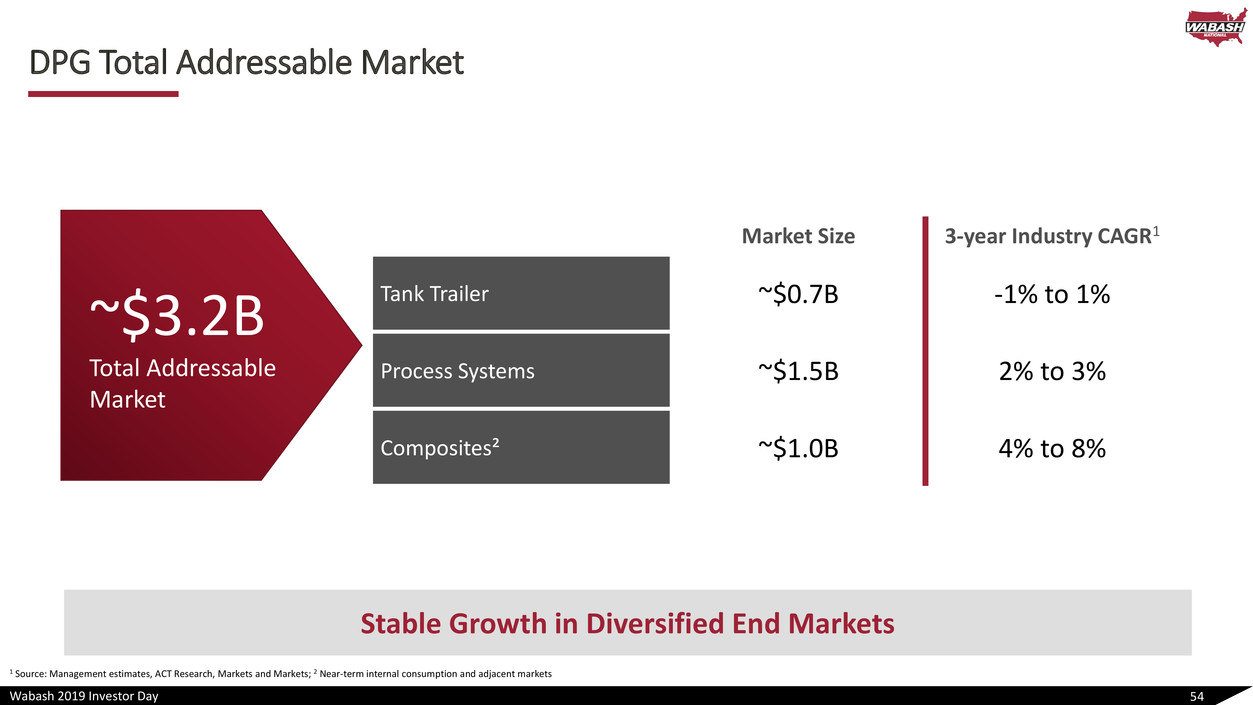

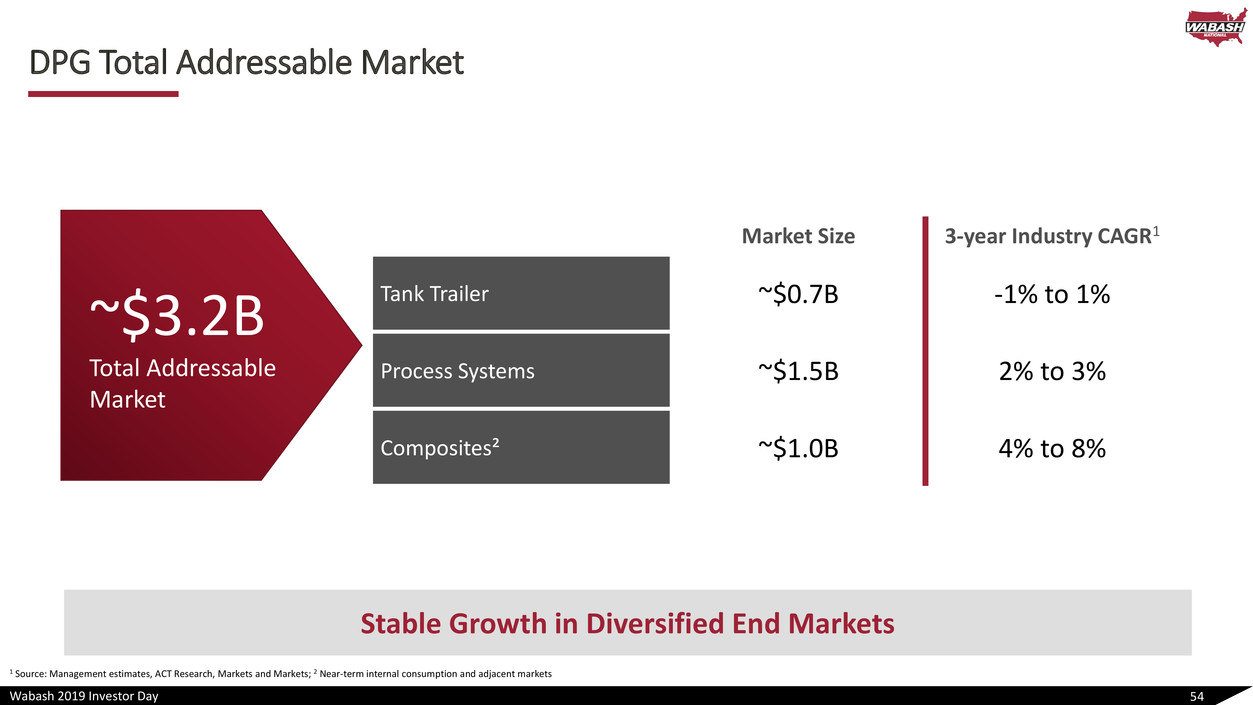

Wabash 2019 Investor Day DPG Total Addressable Market 54 Stable Growth in Diversified End Markets ~$3.2B Total Addressable Market Market Size 3-year Industry CAGR1 Tank Trailer ~$0.7B -1% to 1% Process Systems ~$1.5B 2% to 3% Composites² ~$1.0B 4% to 8% 1 Source: Management estimates, ACT Research, Markets and Markets; 2 Near-term internal consumption and adjacent markets

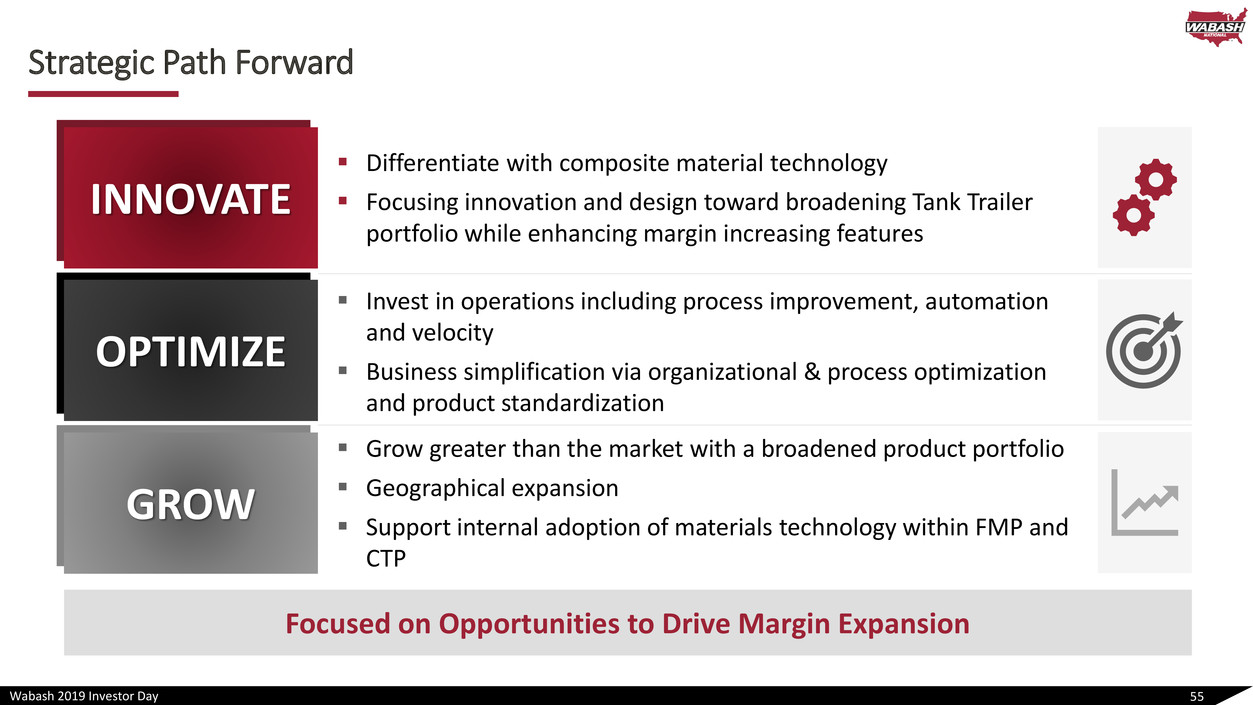

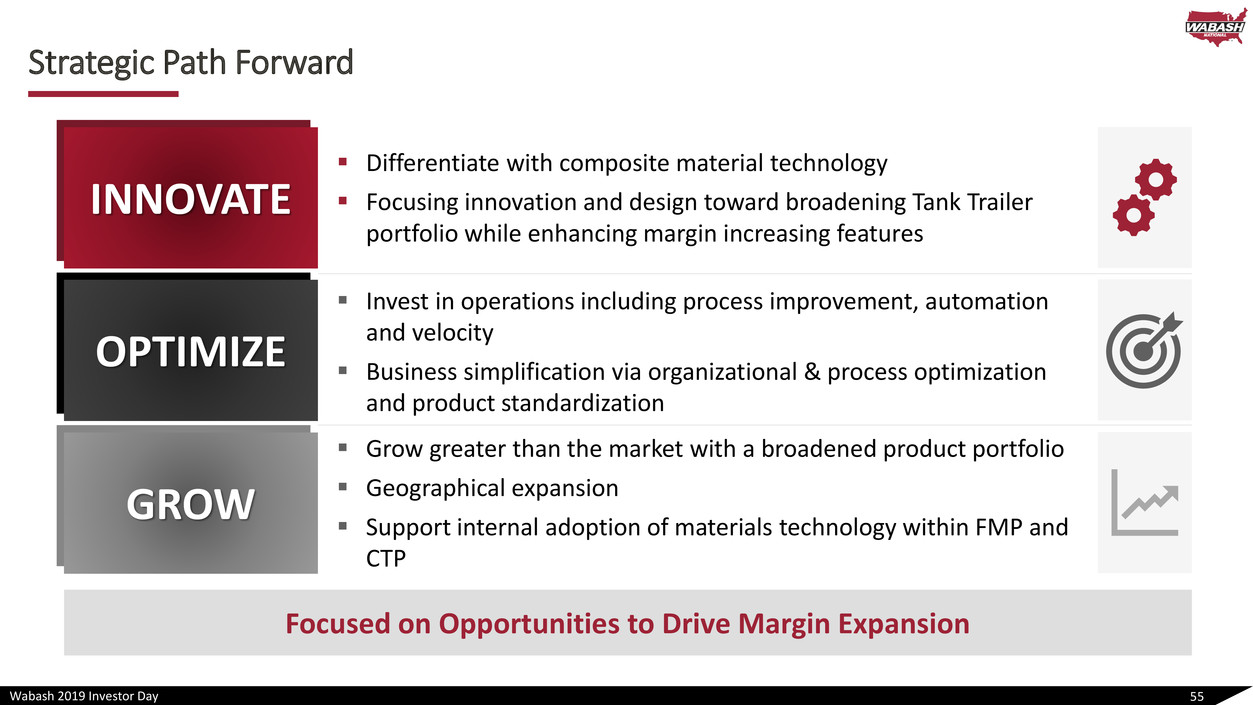

Wabash 2019 Investor Day Strategic Path Forward Focused on Opportunities to Drive Margin Expansion 55 ▪ Differentiate with composite material technology ▪ Focusing innovation and design toward broadening Tank Trailer portfolio while enhancing margin increasing features ▪ Invest in operations including process improvement, automation and velocity ▪ Business simplification via organizational & process optimization and product standardization ▪ Grow greater than the market with a broadened product portfolio ▪ Geographical expansion ▪ Support internal adoption of materials technology within FMP and CTP INNOVATE OPTIMIZE GROW

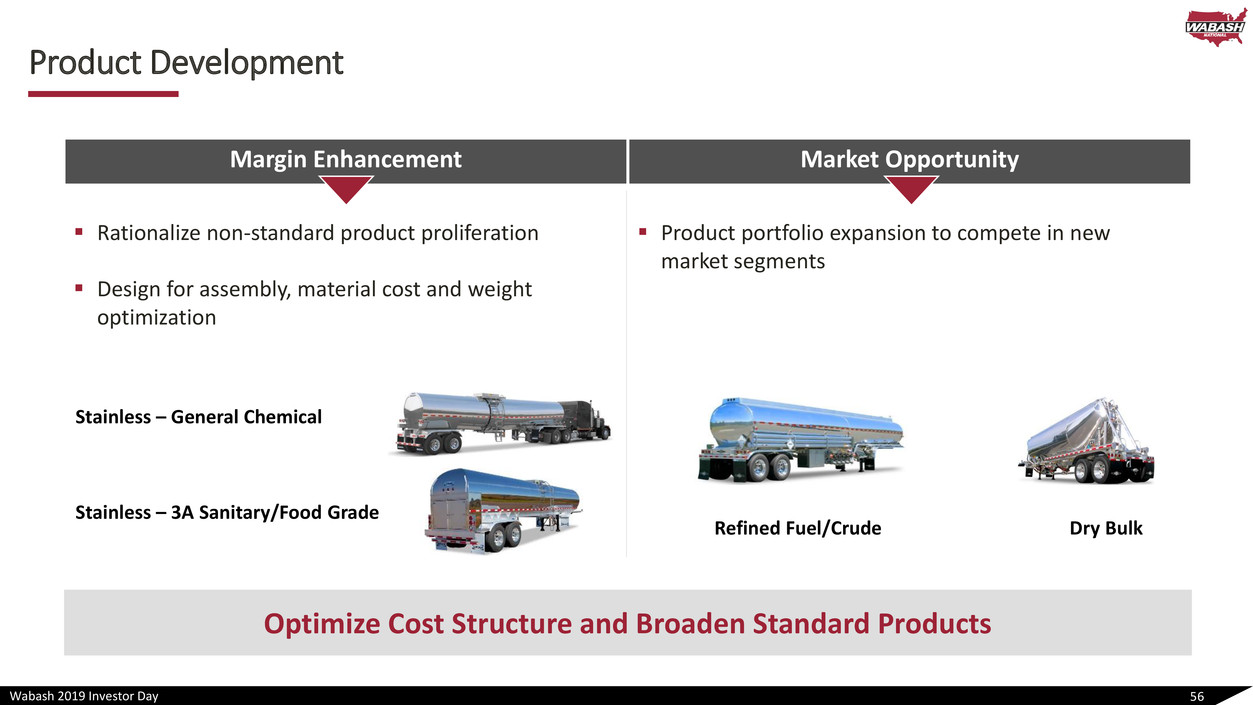

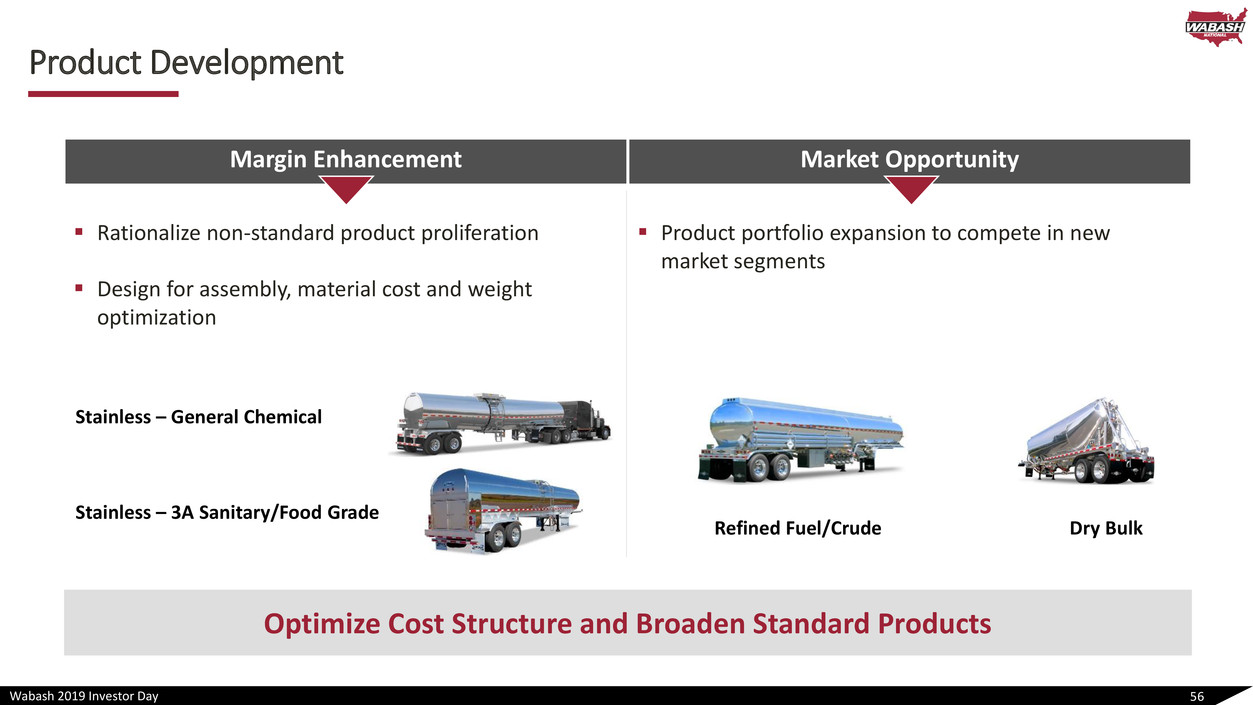

Wabash 2019 Investor Day Product Development 56 Optimize Cost Structure and Broaden Standard Products Margin Enhancement Market Opportunity ▪ Rationalize non-standard product proliferation ▪ Design for assembly, material cost and weight optimization ▪ Product portfolio expansion to compete in new market segments Stainless – General Chemical Stainless – 3A Sanitary/Food Grade Refined Fuel/Crude Dry Bulk

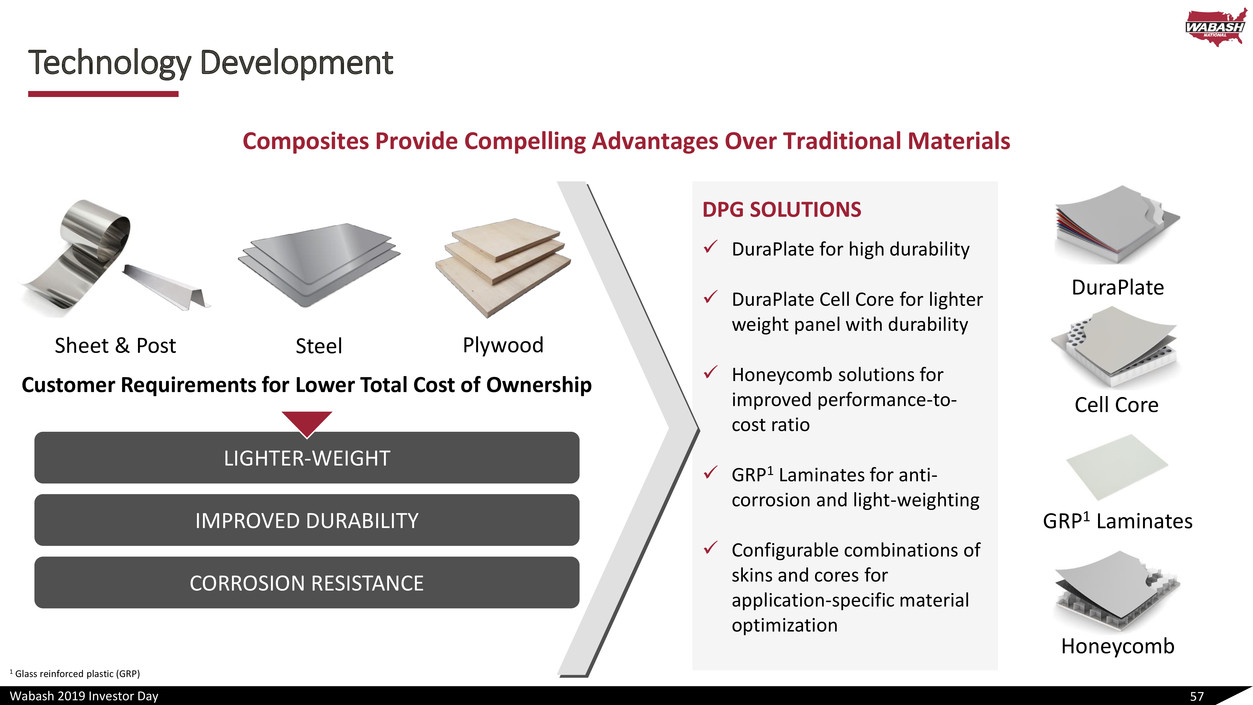

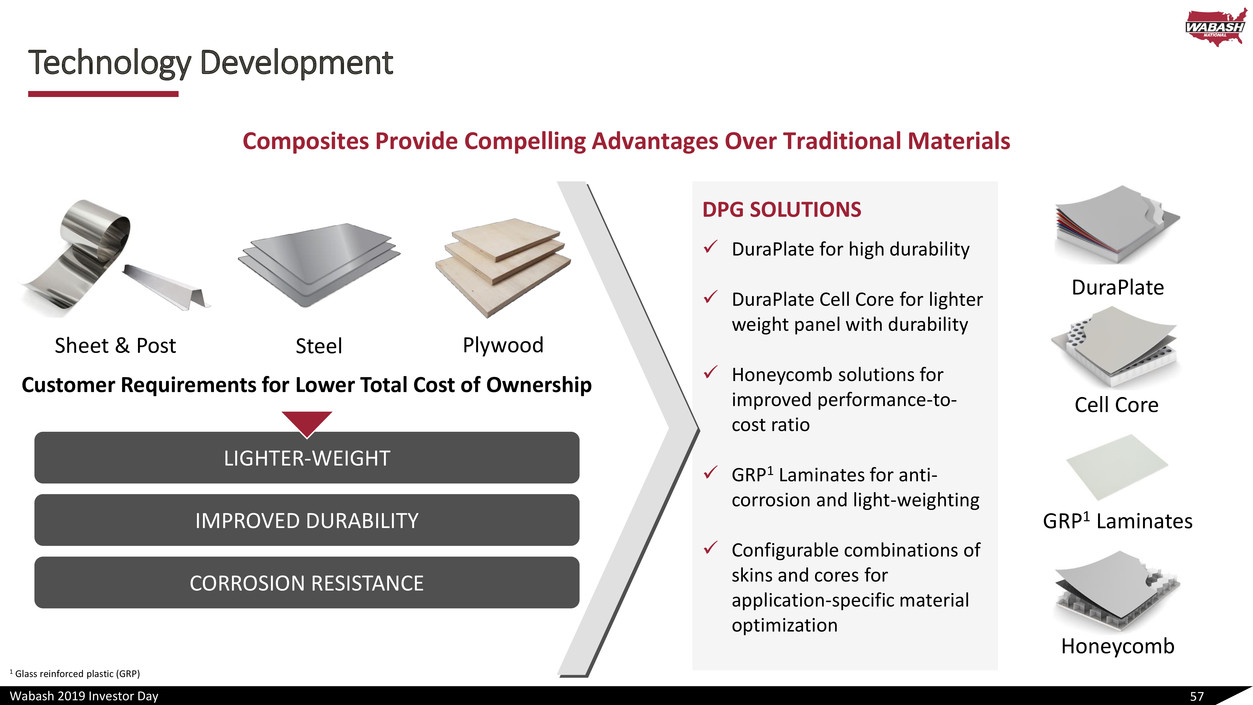

Wabash 2019 Investor Day Technology Development 57 Composites Provide Compelling Advantages Over Traditional Materials Sheet & Post Steel Plywood Customer Requirements for Lower Total Cost of Ownership LIGHTER-WEIGHT IMPROVED DURABILITY CORROSION RESISTANCE DPG SOLUTIONS ✓ DuraPlate for high durability ✓ DuraPlate Cell Core for lighter weight panel with durability ✓ Honeycomb solutions for improved performance-to- cost ratio ✓ GRP1 Laminates for anti- corrosion and light-weighting ✓ Configurable combinations of skins and cores for application-specific material optimization DuraPlate GRP1 Laminates Honeycomb Cell Core 1 Glass reinforced plastic (GRP)

Wabash 2019 Investor Day Optimize DPG | Leveraging the Wabash Management System ▪ Operational Excellence ▪ Increased product standardization resulting in a decrease in product variation and an increase in manufacturing velocity ▪ Driving Overall Equipment Effectiveness for all business units focused on scrap reduction, changeover improvement and equipment uptime ▪ Increased Automation ▪ Leveraging opportunities to increase automation to allow flexible labor deployment, increasing manufacturing velocity and productivity ▪ Optimize Cost Structure ▪ Leveraging world-class ERP system and common business processes ▪ Opportunity for improved labor availability and cost ▪ Corporate centers of excellence 58 P U R P O S E

Wabash 2019 Investor Day Key Takeaways 59 1. Driving accelerated operational execution for margin expansion 2. Stable and growing markets contributing to revenue gains; growth greater than market 3. Building on a long history of trusted brands with strong market positions 4. Leading further product diversification and differentiation in the transportation segment through innovation leadership 5. Leveraging new ERP system and corporate centers of excellence to drive business process optimization

Wabash 2019 Investor Day Commercial Trailer Products Dustin Smith – SVP & Group President 60

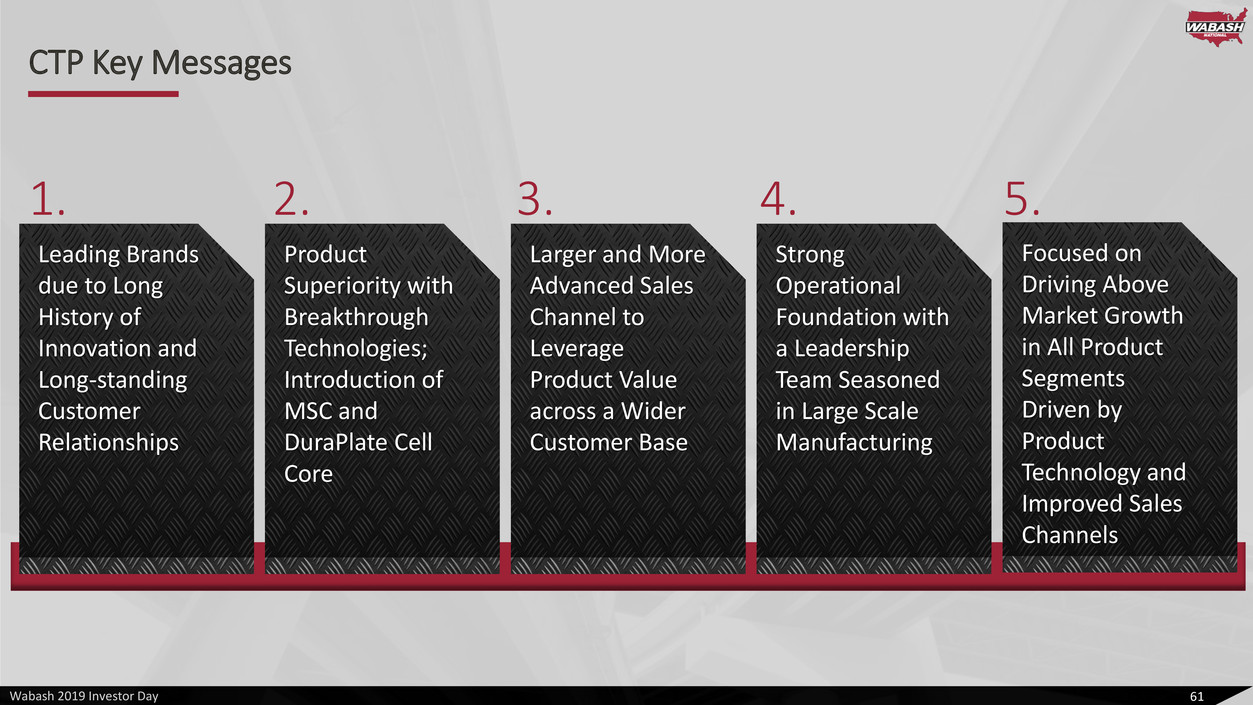

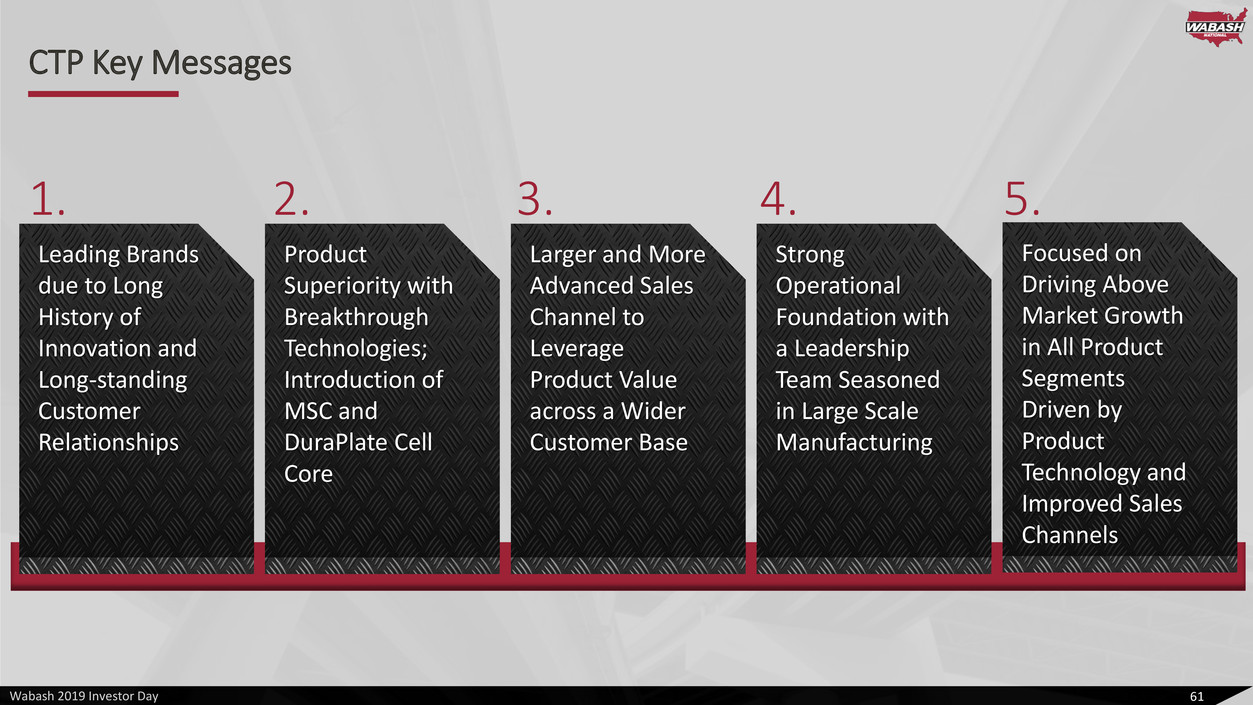

Wabash 2019 Investor Day CTP Key Messages 61 Leading Brands due to Long History of Innovation and Long-standing Customer Relationships Product Superiority with Breakthrough Technologies; Introduction of MSC and DuraPlate Cell Core Larger and More Advanced Sales Channel to Leverage Product Value across a Wider Customer Base Strong Operational Foundation with a Leadership Team Seasoned in Large Scale Manufacturing Focused on Driving Above Market Growth in All Product Segments Driven by Product Technology and Improved Sales Channels 1. 2. 3. 4. 5.

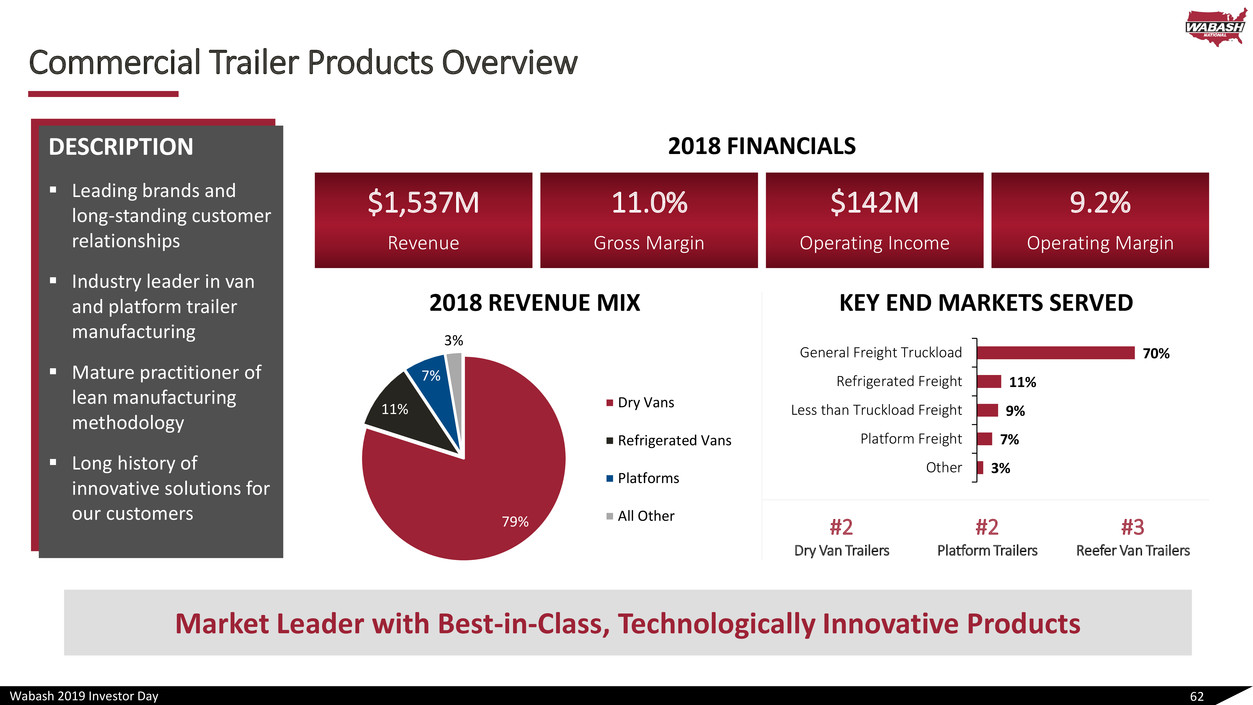

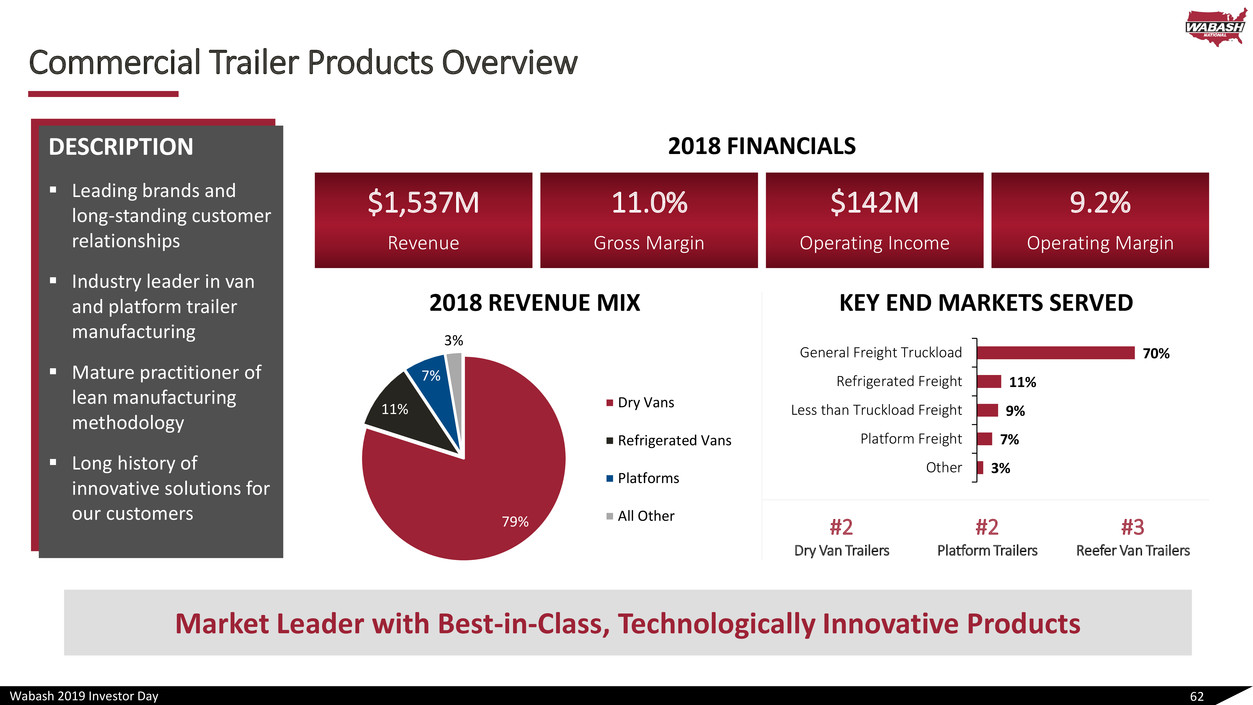

Wabash 2019 Investor Day Commercial Trailer Products Overview 62 Market Leader with Best-in-Class, Technologically Innovative Products DESCRIPTION ▪ Leading brands and long-standing customer relationships ▪ Industry leader in van and platform trailer manufacturing ▪ Mature practitioner of lean manufacturing methodology ▪ Long history of innovative solutions for our customers 2018 FINANCIALS $1,537M 11.0% $142M 9.2% Revenue Gross Margin Operating Income Operating Margin 79% 11% 7% 3% Dry Vans Refrigerated Vans Platforms All Other 2018 REVENUE MIX KEY END MARKETS SERVED 3% 7% 9% 11% 70% Other Platform Freight Less than Truckload Freight Refrigerated Freight General Freight Truckload #2 Dry Van Trailers #2 Platform Trailers #3 Reefer Van Trailers

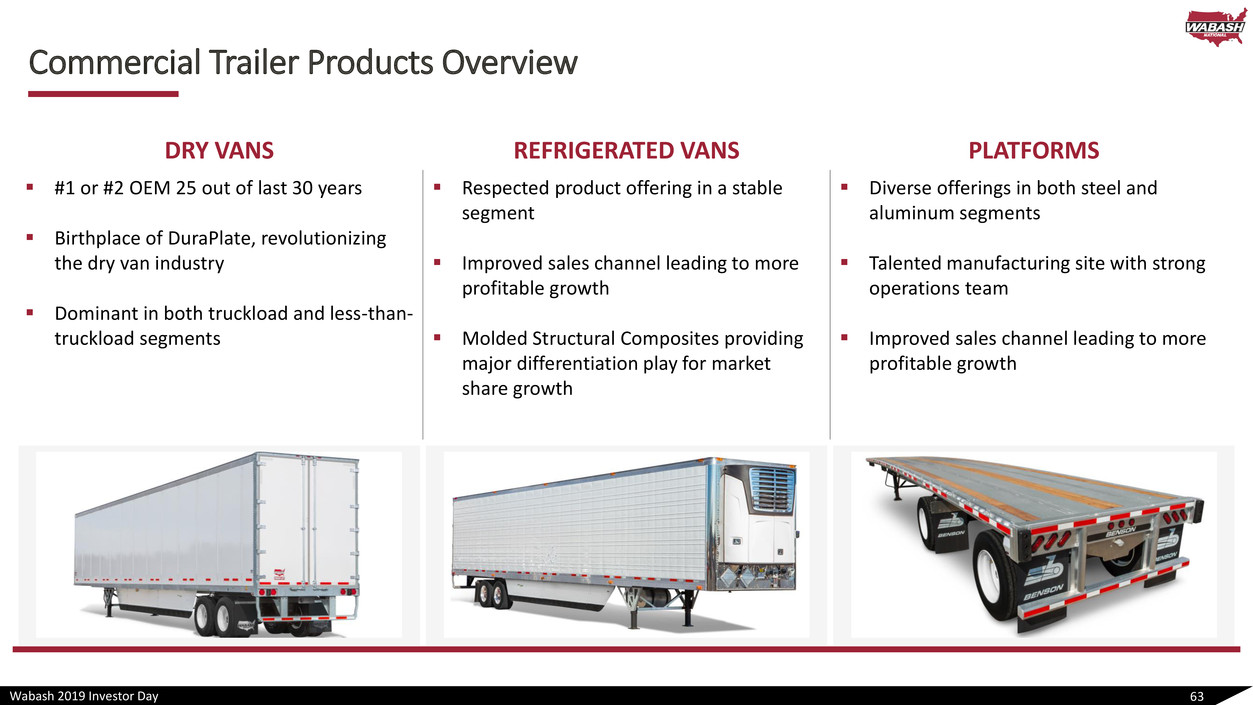

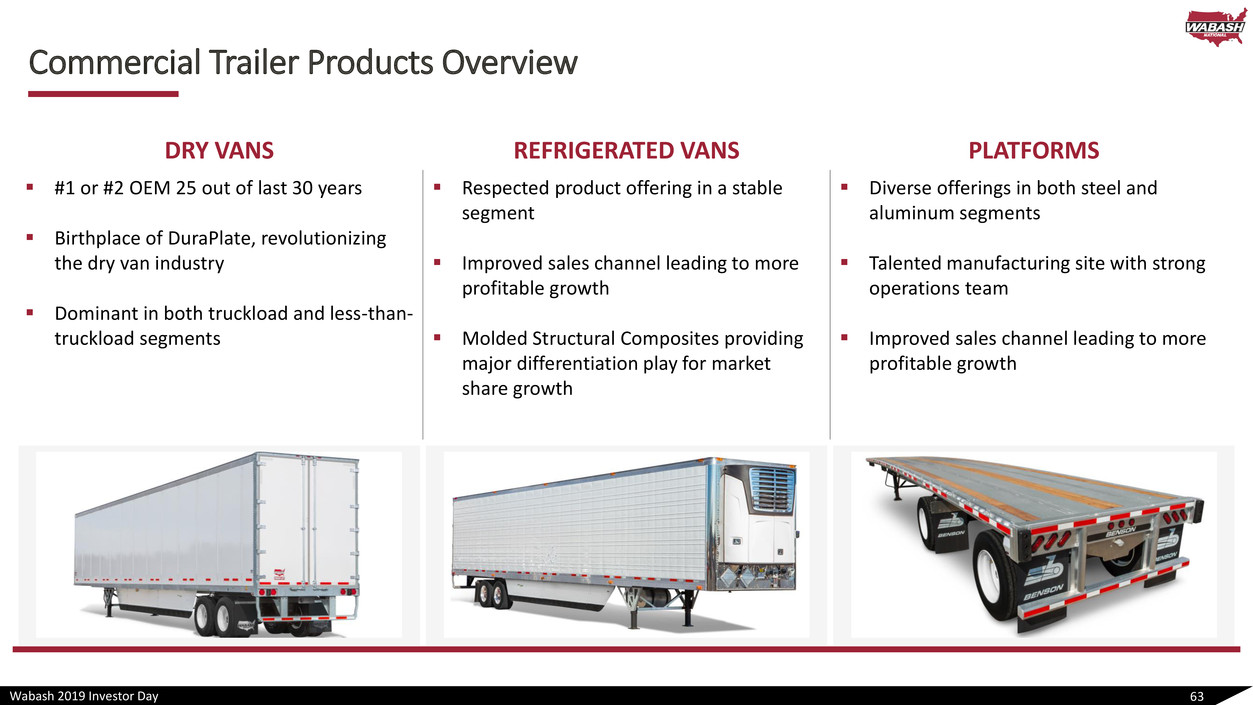

Wabash 2019 Investor Day Commercial Trailer Products Overview 63 DRY VANS REFRIGERATED VANS PLATFORMS ▪ #1 or #2 OEM 25 out of last 30 years ▪ Birthplace of DuraPlate, revolutionizing the dry van industry ▪ Dominant in both truckload and less-than- truckload segments ▪ Respected product offering in a stable segment ▪ Improved sales channel leading to more profitable growth ▪ Molded Structural Composites providing major differentiation play for market share growth ▪ Diverse offerings in both steel and aluminum segments ▪ Talented manufacturing site with strong operations team ▪ Improved sales channel leading to more profitable growth

Wabash 2019 Investor Day Why CTP Will Continue to Succeed | Sustainable Competitive Advantages… …Driven by Continuous Improvement Mindset 64 Continued strengthening of dealer channel that increases our reach and diversifies our customer base Breakthrough technologies; introduction of Molded Structural Composites and DuraPlate Cell Core Strong leadership team with talent in all levels of management drives customer confidence

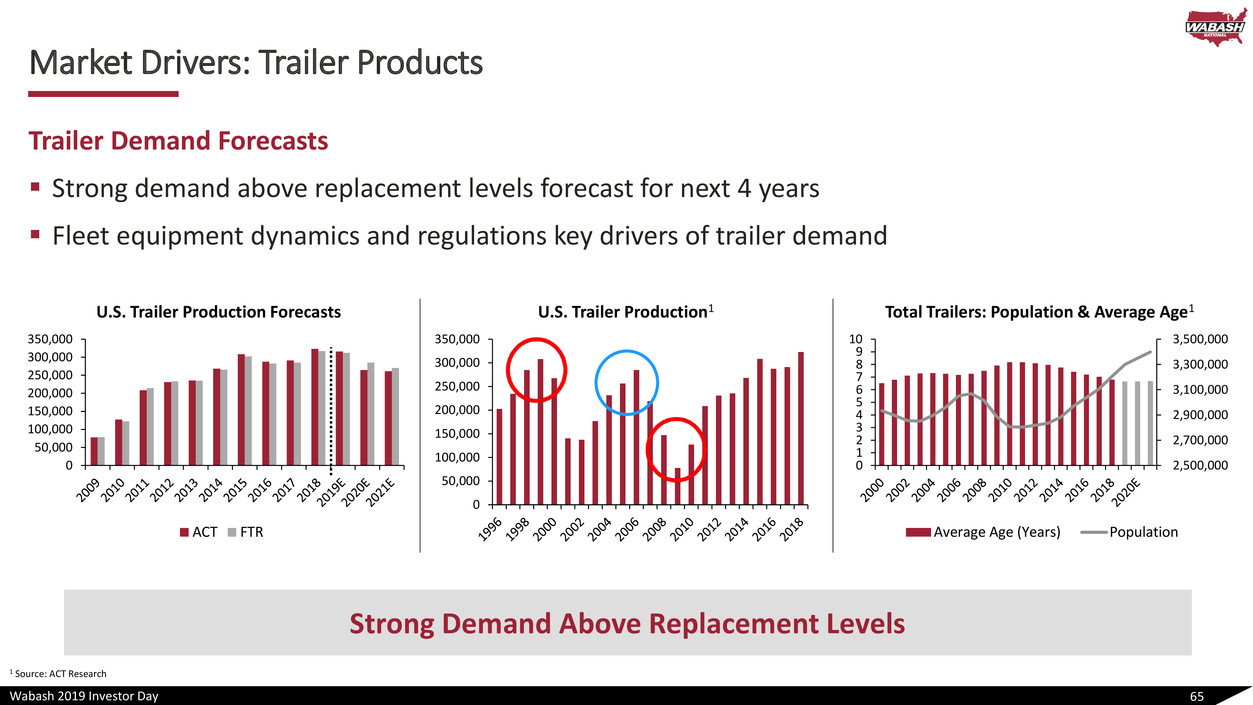

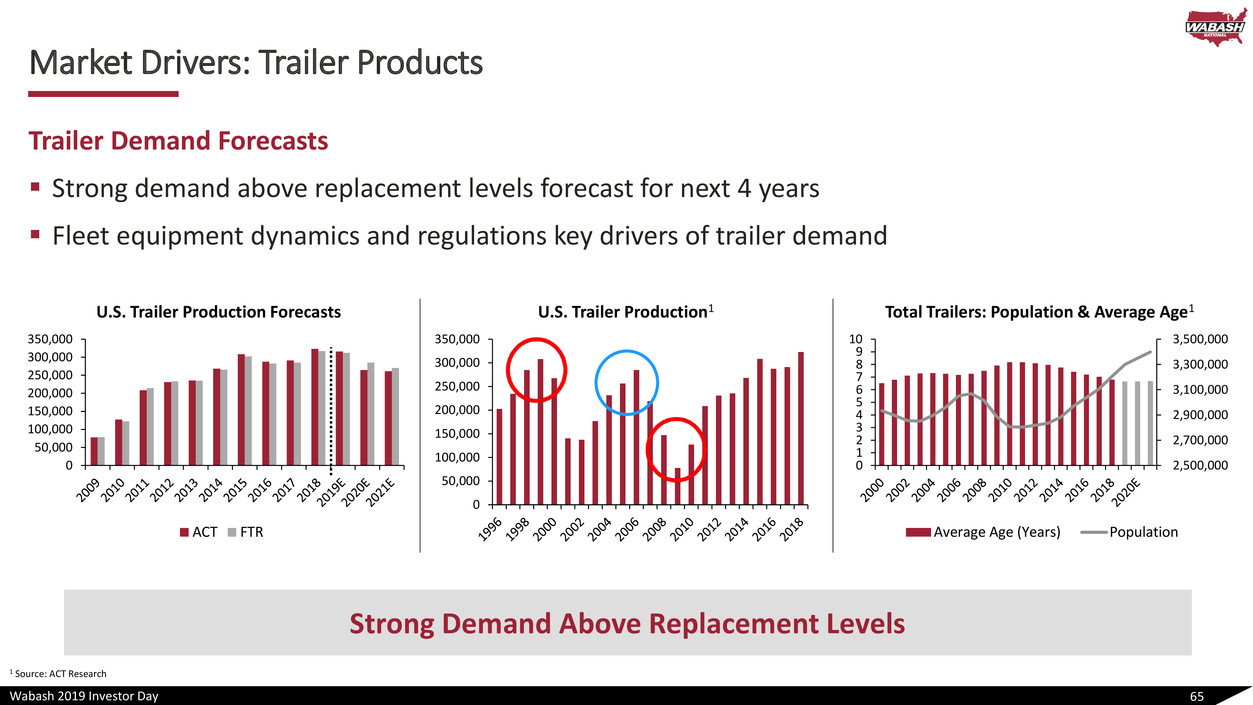

Wabash 2019 Investor Day 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 U.S. Trailer Production1 Market Drivers: Trailer Products Trailer Demand Forecasts ▪ Strong demand above replacement levels forecast for next 4 years ▪ Fleet equipment dynamics and regulations key drivers of trailer demand 65 Strong Demand Above Replacement Levels 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 U.S. Trailer Production Forecasts ACT FTR 1 Source: ACT Research 2,500,000 2,700,000 2,900,000 3,100,000 3,300,000 3,500,000 0 1 2 3 4 5 6 7 8 9 10 Total Trailers: Population & Average Age1 Average Age (Years) Population

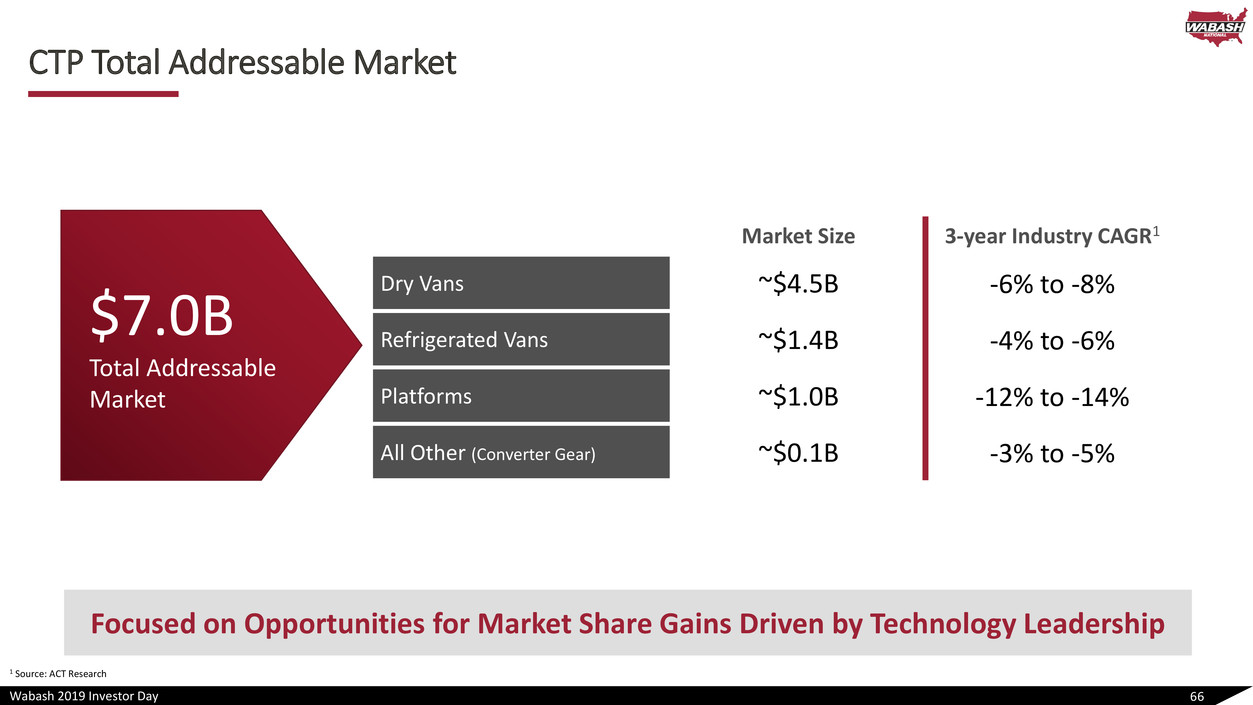

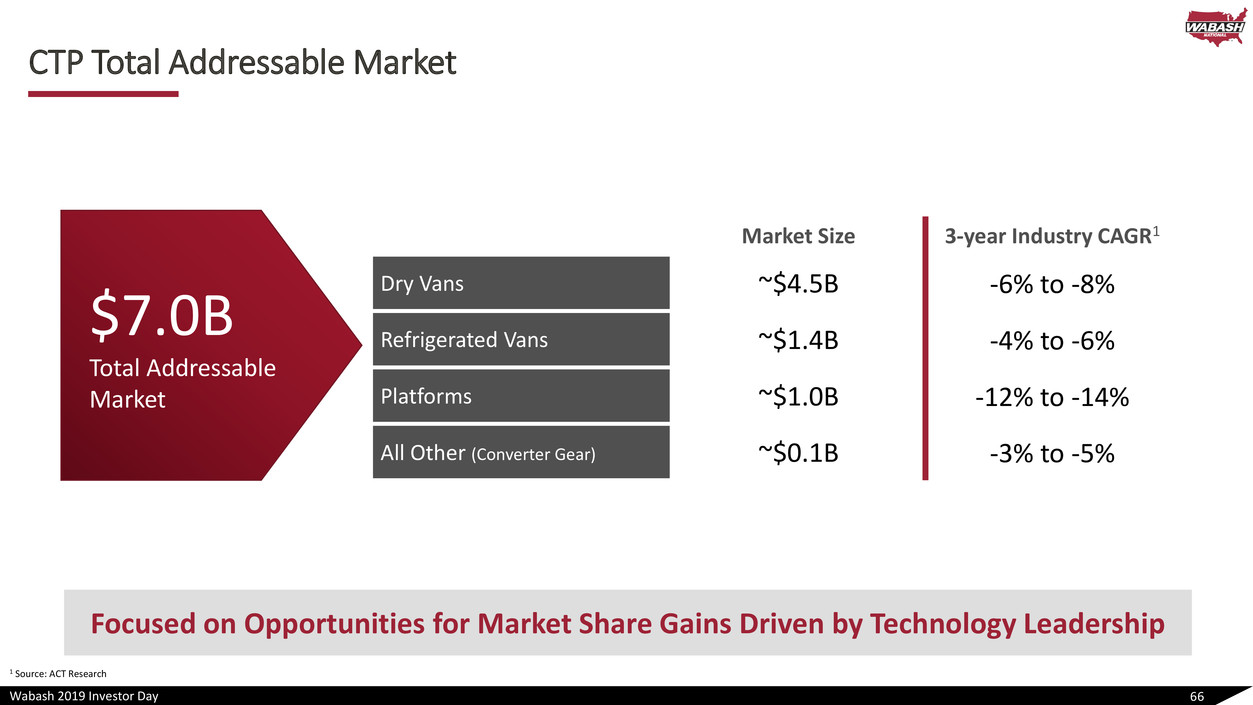

Wabash 2019 Investor Day CTP Total Addressable Market 66 Focused on Opportunities for Market Share Gains Driven by Technology Leadership $7.0B Total Addressable Market Market Size 3-year Industry CAGR1 Dry Vans ~$4.5B -6% to -8% Refrigerated Vans ~$1.4B -4% to -6% Platforms ~$1.0B -12% to -14% All Other (Converter Gear) ~$0.1B -3% to -5% 1 Source: ACT Research

Wabash 2019 Investor Day Strategic Path Forward 67 Core Focus on Product, Process and People ▪ Commercialization of advanced materials and lightweight applications drive breakthrough customer value ▪ Optimization of sales channel enhances customer mix and improves geographical coverage ▪ High quality management team drives customer experience ▪ Optimization focus areas drive market share gains in specific areas, with purposeful outcomes INNOVATE OPTIMIZE GROW

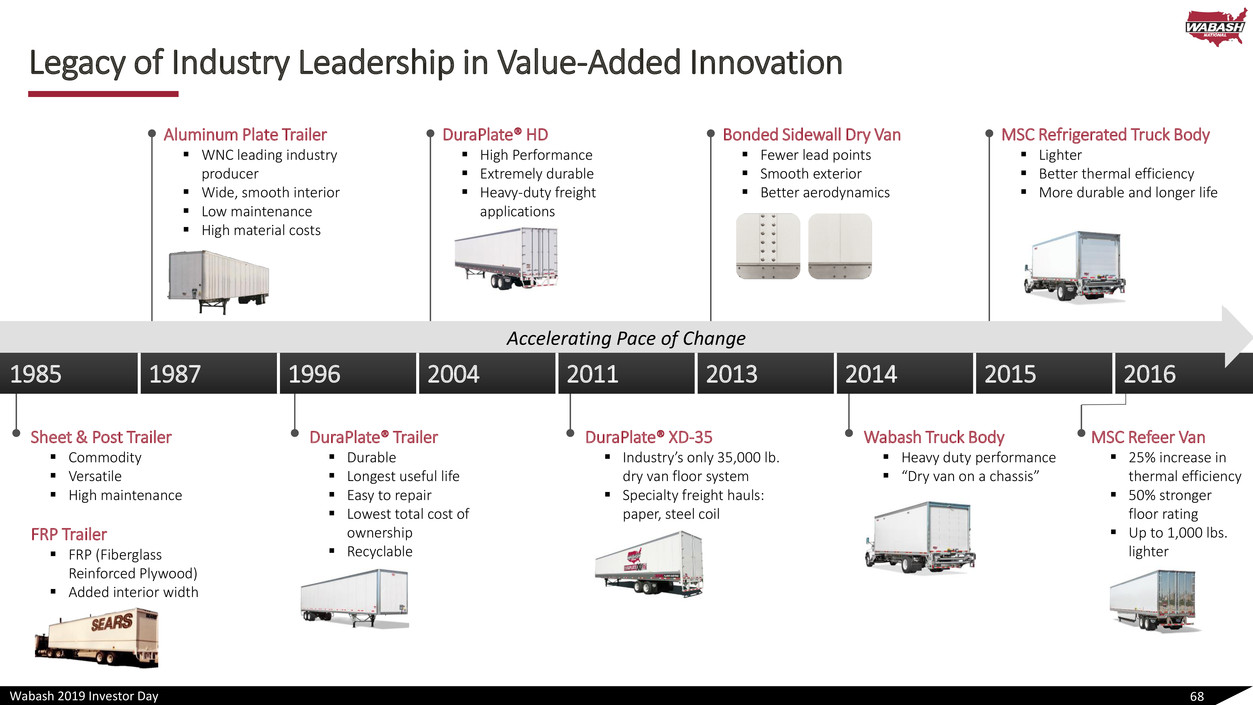

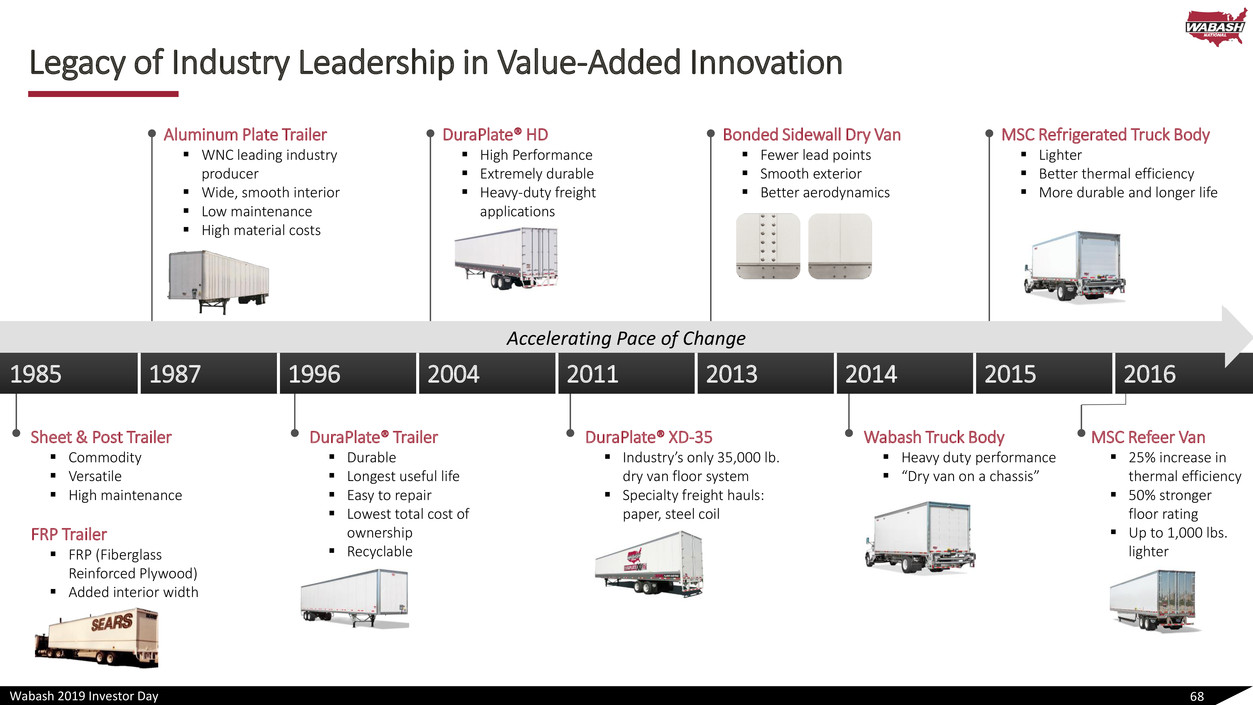

Wabash 2019 Investor Day Sheet & Post Trailer ▪ Commodity ▪ Versatile ▪ High maintenance FRP Trailer ▪ FRP (Fiberglass Reinforced Plywood) ▪ Added interior width Legacy of Industry Leadership in Value-Added Innovation 68 1985 1987 1996 2004 2011 2013 2014 2015 2016 Aluminum Plate Trailer ▪ WNC leading industry producer ▪ Wide, smooth interior ▪ Low maintenance ▪ High material costs DuraPlate® Trailer ▪ Durable ▪ Longest useful life ▪ Easy to repair ▪ Lowest total cost of ownership ▪ Recyclable DuraPlate® XD-35 ▪ Industry’s only 35,000 lb. dry van floor system ▪ Specialty freight hauls: paper, steel coil Wabash Truck Body ▪ Heavy duty performance ▪ “Dry van on a chassis” MSC Refeer Van ▪ 25% increase in thermal efficiency ▪ 50% stronger floor rating ▪ Up to 1,000 lbs. lighter DuraPlate® HD ▪ High Performance ▪ Extremely durable ▪ Heavy-duty freight applications Bonded Sidewall Dry Van ▪ Fewer lead points ▪ Smooth exterior ▪ Better aerodynamics MSC Refrigerated Truck Body ▪ Lighter ▪ Better thermal efficiency ▪ More durable and longer life Accelerating Pace of Change

Wabash 2019 Investor Day In Early Stages of MSC Opportunity 69 Opportunity to Leverage Across All Business Units Proprietary Technology → Protected Designs → Patented Processes → Realized Product Prisma Beams MSC Panels MSC Assemblies MSC Refrigerated Van 2016 20171 20181 CapEx $500k $10M $12M Manufacturing (sq. ft.) 5,000 100,000 225,000 Associates 5 80 100 R&D $2.8M $3.9M $5.6M Substantial Ramp in < 30 months… Significant Barriers to Entry Are Being Established 4+ Suppliers 10+ Trade Secrets 5+ Patent Issued 10+ Patent Applications 1 Cumulative

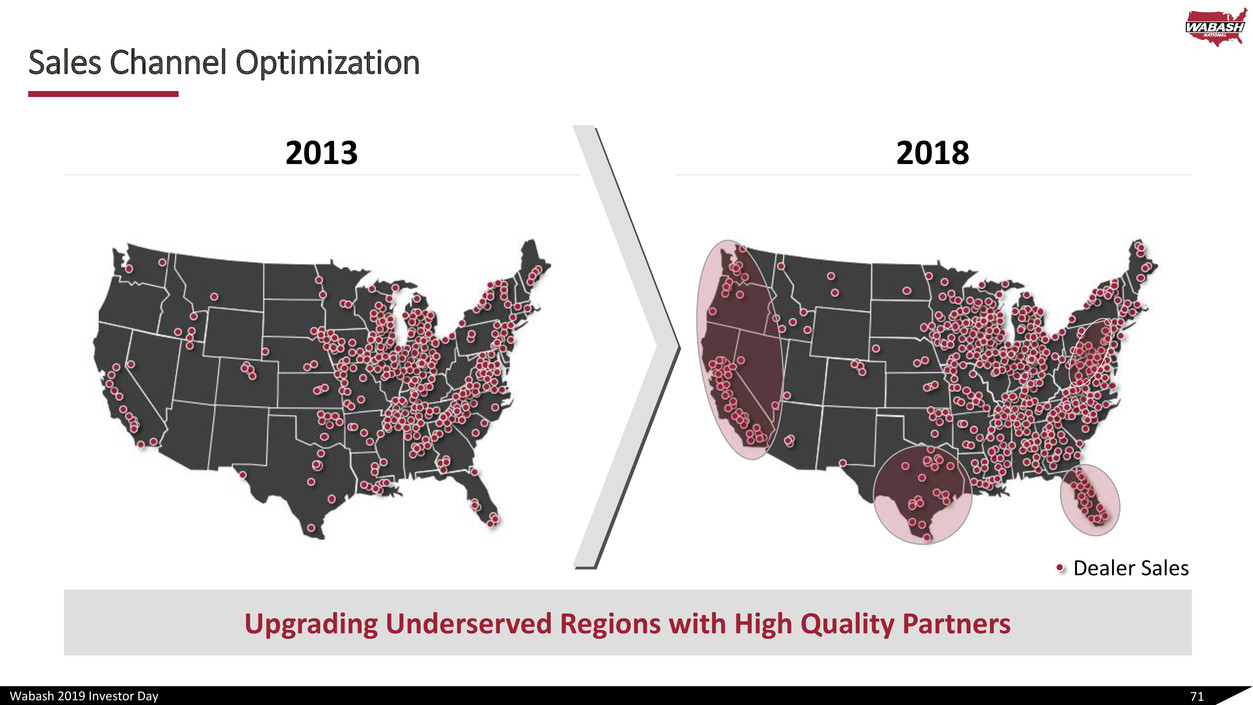

Wabash 2019 Investor Day Optimize CTP | Leveraging the Wabash Management System ▪ People/Management ▪ Strong leadership team with diversity of experience and high quality reputations in the industry ▪ In an mature industry, we have a strong pipeline of diverse talent for future leadership positions ▪ The management team strengthens our brand, and is noted as a differentiator with our customers ▪ Sales Channel Optimization ▪ Multi-year strategy of upgrades in key geographical regions have led to deeper penetration and higher margins ▪ Generating a more diverse customer base, leading to more optionality in non-peak demand environments ▪ Partnering with large power/tractor dealers has improved channel quality 70 P U R P O S E

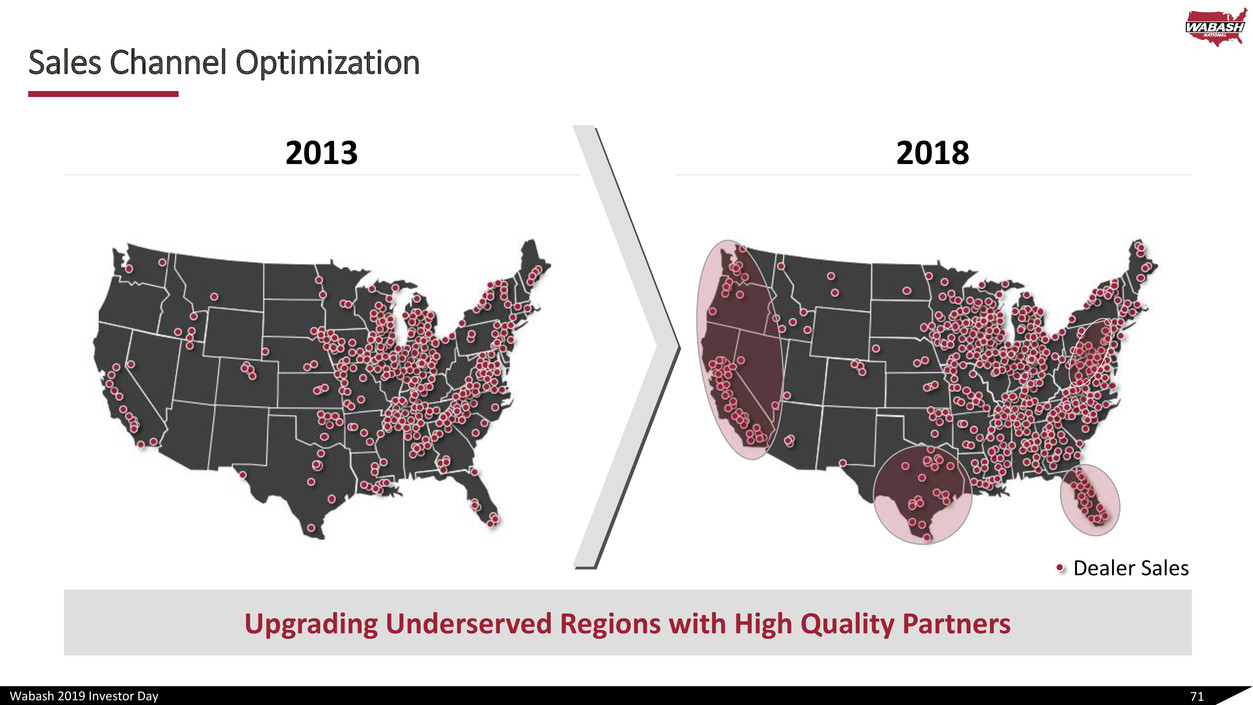

Wabash 2019 Investor Day Sales Channel Optimization 71 Upgrading Underserved Regions with High Quality Partners 20182013 Dealer Sales

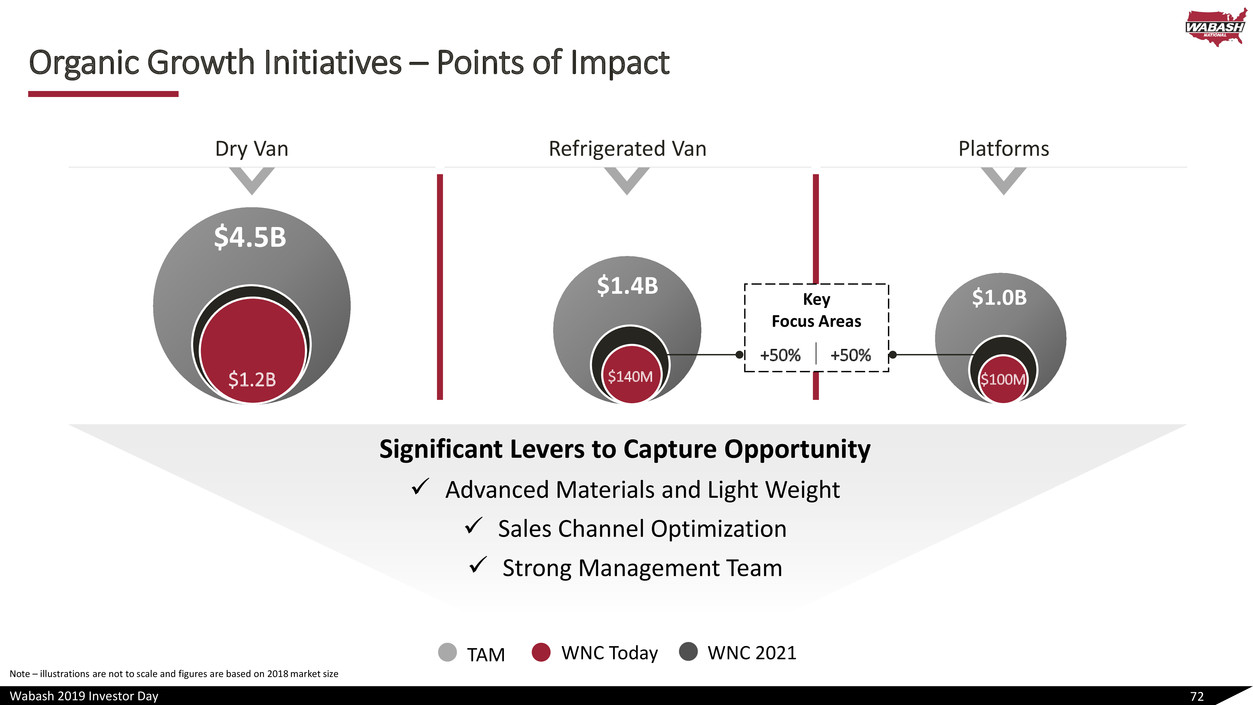

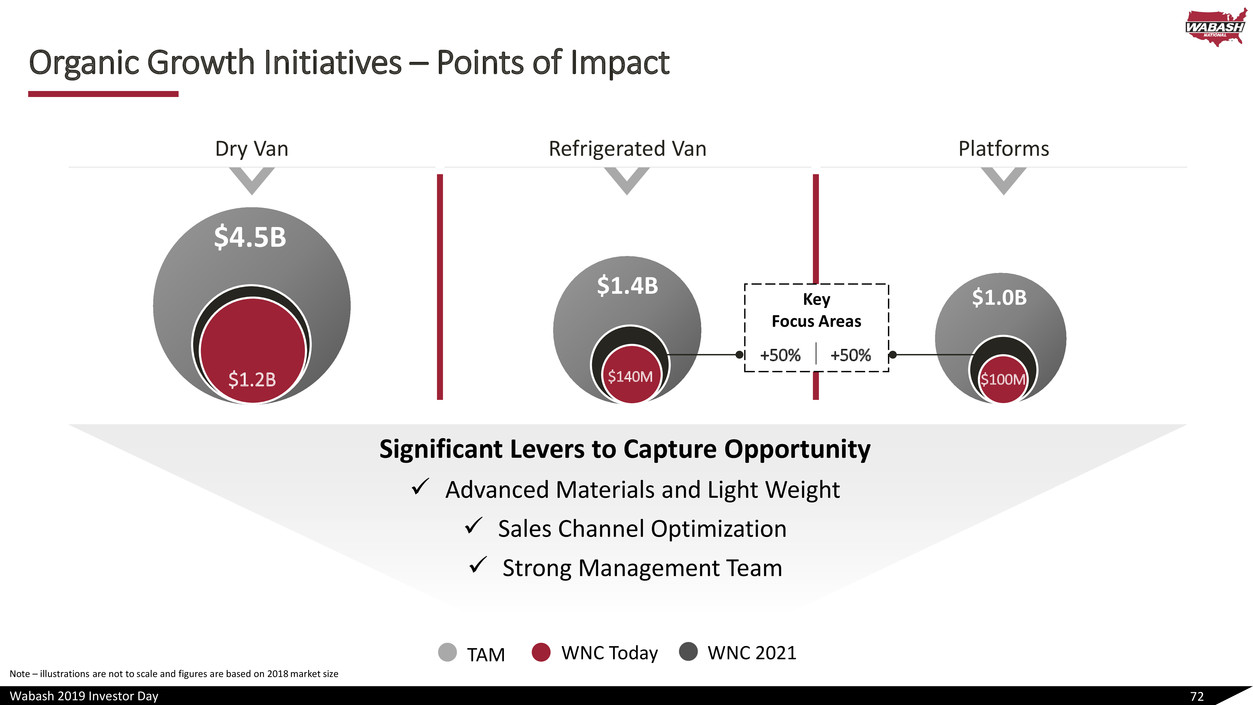

Wabash 2019 Investor Day Organic Growth Initiatives – Points of Impact 72 Dry Van Refrigerated Van Platforms $4.5B TAM WNC 2021WNC Today $1.2B $1.4B $140M $1.0B $100M Significant Levers to Capture Opportunity ✓ Advanced Materials and Light Weight ✓ Sales Channel Optimization ✓ Strong Management Team Key Focus Areas +50% +50% Note – illustrations are not to scale and figures are based on 2018 market size

Wabash 2019 Investor Day Key Takeaways 73 1. Leading brands due to long history of innovation and long-standing customer relationships 2. Product superiority with breakthrough technologies; introduction of MSC and DuraPlate Cell Core 3. Larger and more advanced sales channel to leverage product value across a wider customer base 4. Strong operational foundation with a leadership team seasoned in large scale manufacturing 5. Focused on driving above market growth in all product segments driven by product technology and improved sales channels

Wabash 2019 Investor Day Financial Overview Jeff Taylor – SVP & CFO 74

Wabash 2019 Investor Day Finance Key Messages 75 Strong Earnings and Cash Generation Profile Driving Margin Expansion and Operating Leverage Disciplined Balance Sheet Management and Balanced Capital Allocation Focused on Profitable Growth with Recurring and Diversified Revenue Streams Well Positioned with Financial Strength to be Actionable Across All Stages of the Business Cycle 1. 2. 3. 4. 5.

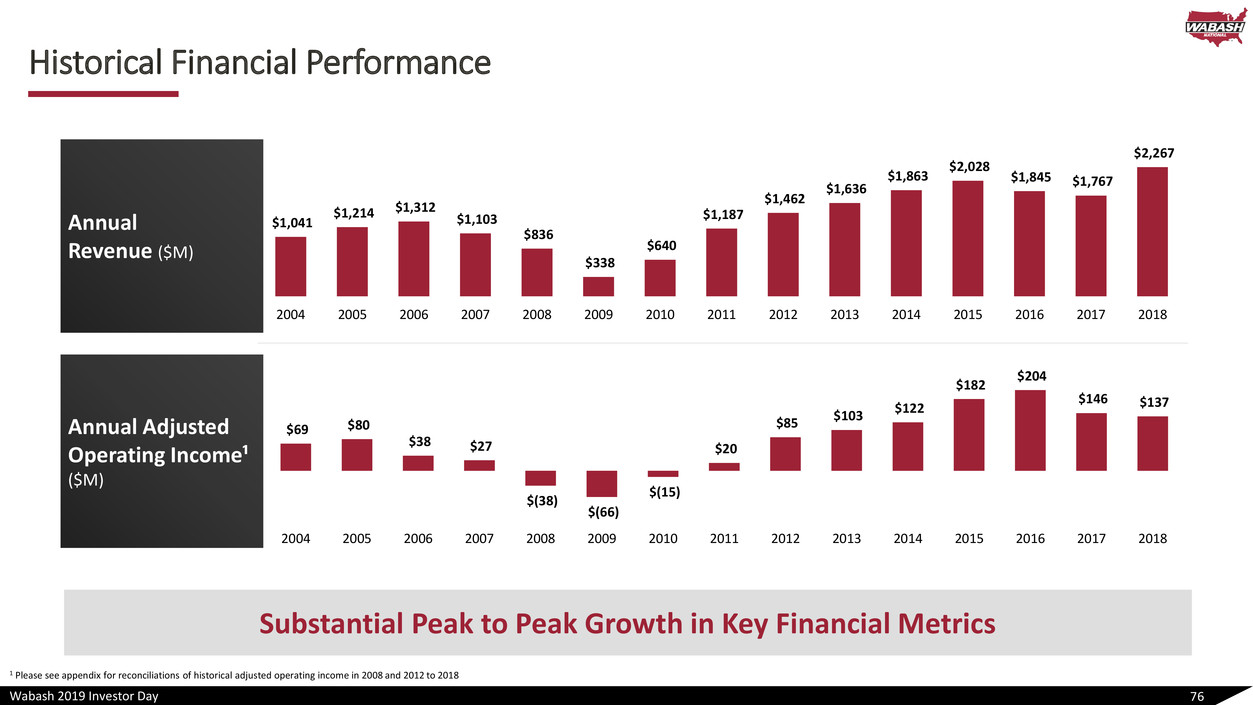

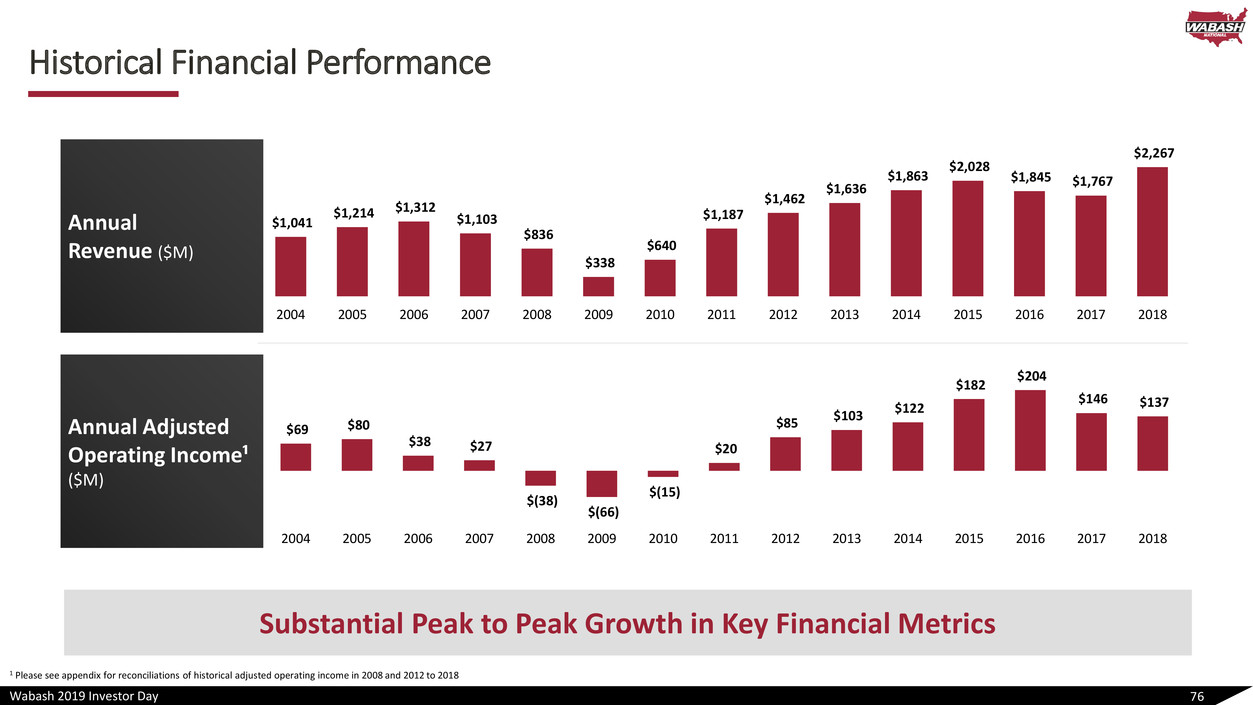

Wabash 2019 Investor Day Historical Financial Performance 76 Substantial Peak to Peak Growth in Key Financial Metrics $1,041 $1,214 $1,312 $1,103 $836 $338 $640 $1,187 $1,462 $1,636 $1,863 $2,028 $1,845 $1,767 $2,267 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Annual Revenue ($M) $69 $80 $38 $27 $(38) $(66) $(15) $20 $85 $103 $122 $182 $204 $146 $137 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Annual Adjusted Operating Income¹ ($M) 1 Please see appendix for reconciliations of historical adjusted operating income in 2008 and 2012 to 2018

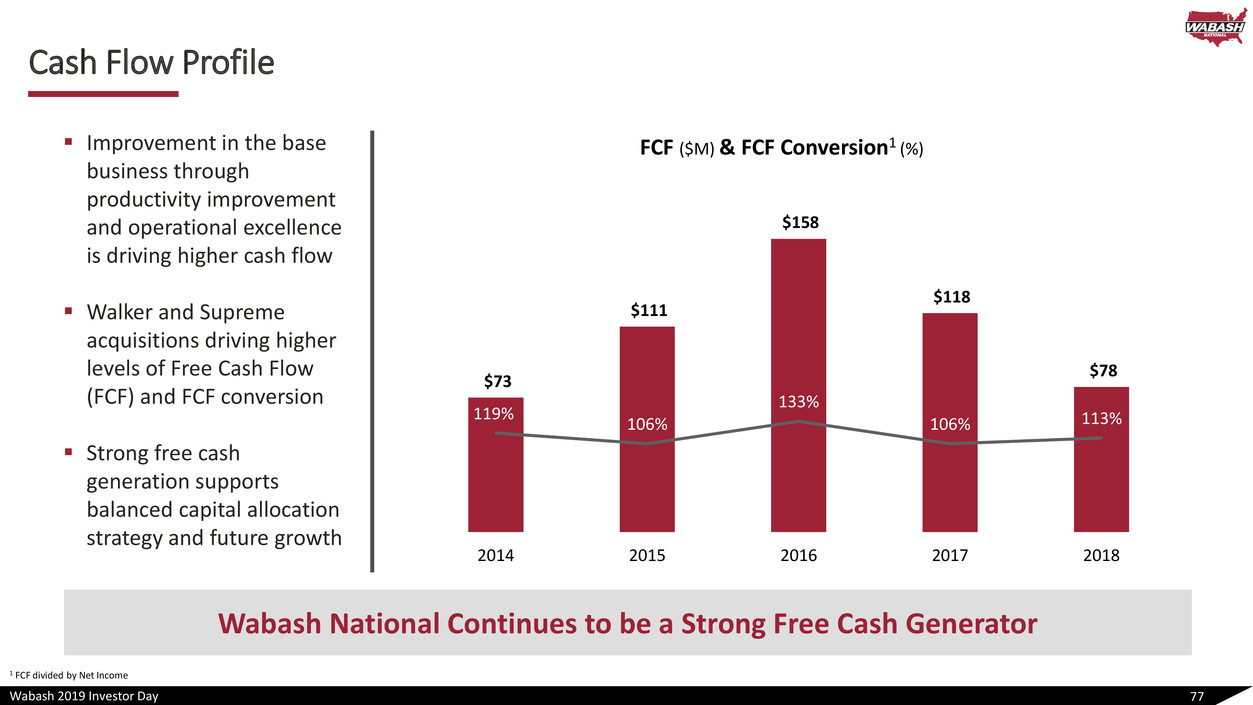

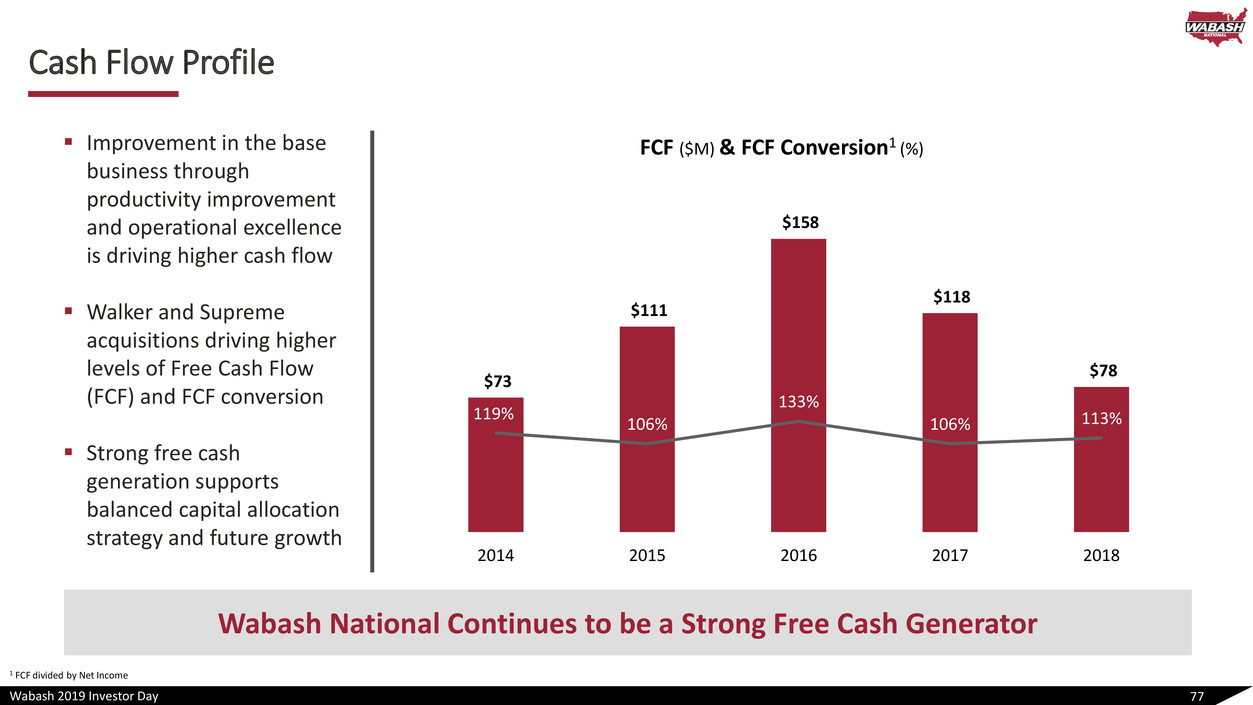

Wabash 2019 Investor Day Cash Flow Profile ▪ Improvement in the base business through productivity improvement and operational excellence is driving higher cash flow ▪ Walker and Supreme acquisitions driving higher levels of Free Cash Flow (FCF) and FCF conversion ▪ Strong free cash generation supports balanced capital allocation strategy and future growth 77 Wabash National Continues to be a Strong Free Cash Generator $73 $111 $158 $118 $78 119% 106% 133% 106% 113% 0% 50% 100 % 150 % 200 % 250 % 300 % 350 % 400 % $- $20 $40 $60 $80 $10 0 $12 0 $14 0 $16 0 $18 0 2014 2015 2016 2017 2018 FCF ($M) & FCF Conversion1 (%) 1 FCF divided by Net Income

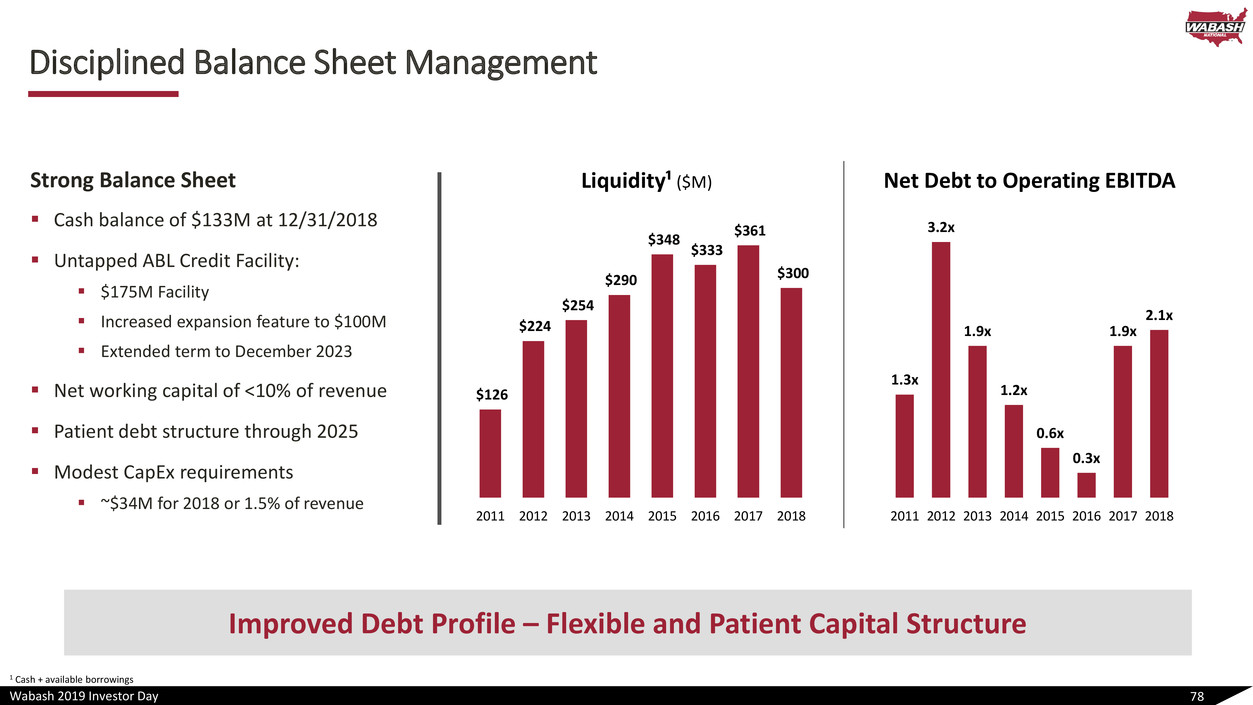

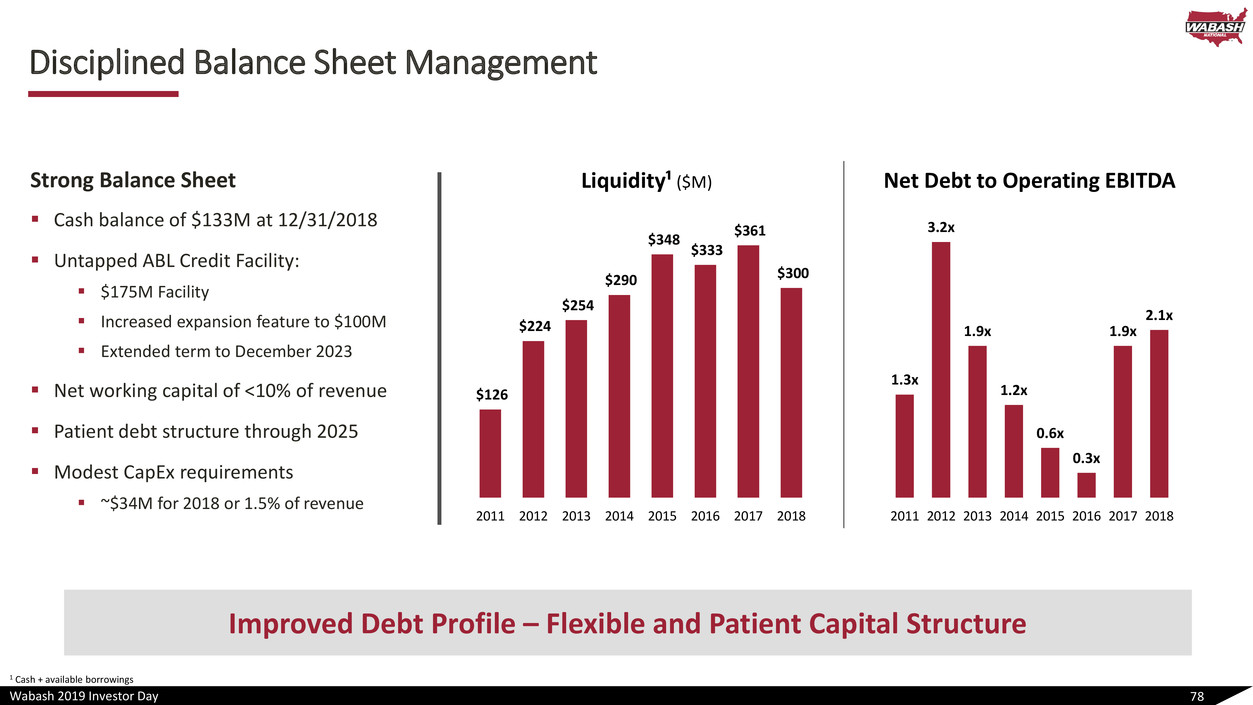

Wabash 2019 Investor Day Liquidity¹ ($M) Net Debt to Operating EBITDA 1.3x 3.2x 1.9x 1.2x 0.6x 0.3x 1.9x 2.1x 2011 2012 2013 2014 2015 2016 2017 2018 Disciplined Balance Sheet Management 78 Improved Debt Profile – Flexible and Patient Capital Structure $126 $224 $254 $290 $348 $333 $361 $300 2011 2012 2013 2014 2015 2016 2017 2018 1 Cash + available borrowings Strong Balance Sheet ▪ Cash balance of $133M at 12/31/2018 ▪ Untapped ABL Credit Facility: ▪ $175M Facility ▪ Increased expansion feature to $100M ▪ Extended term to December 2023 ▪ Net working capital of <10% of revenue ▪ Patient debt structure through 2025 ▪ Modest CapEx requirements ▪ ~$34M for 2018 or 1.5% of revenue

Wabash 2019 Investor Day Capital Allocation – 4 Year History 79 Building a Strong Capital Allocation Track Record $101M Capital Expenditures $232M Debt Repayments $323M M&A $260M Share Repurchases $33M Dividends $567M Cash Flow from Operations

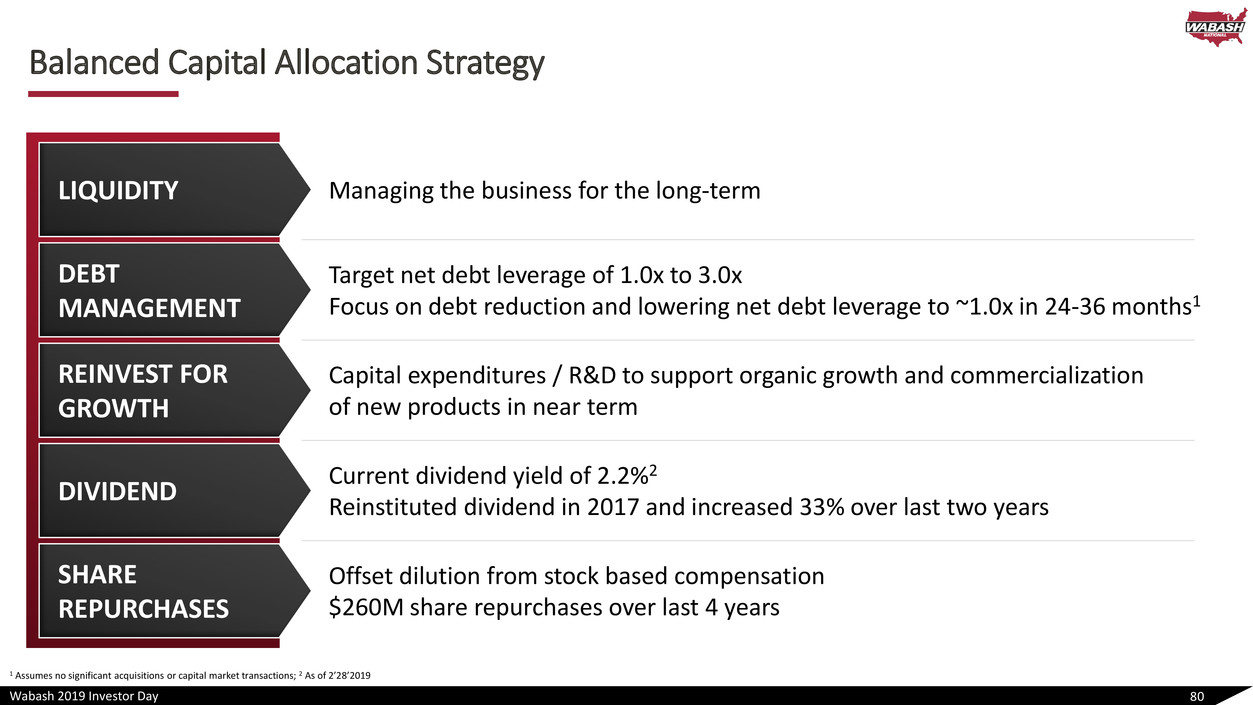

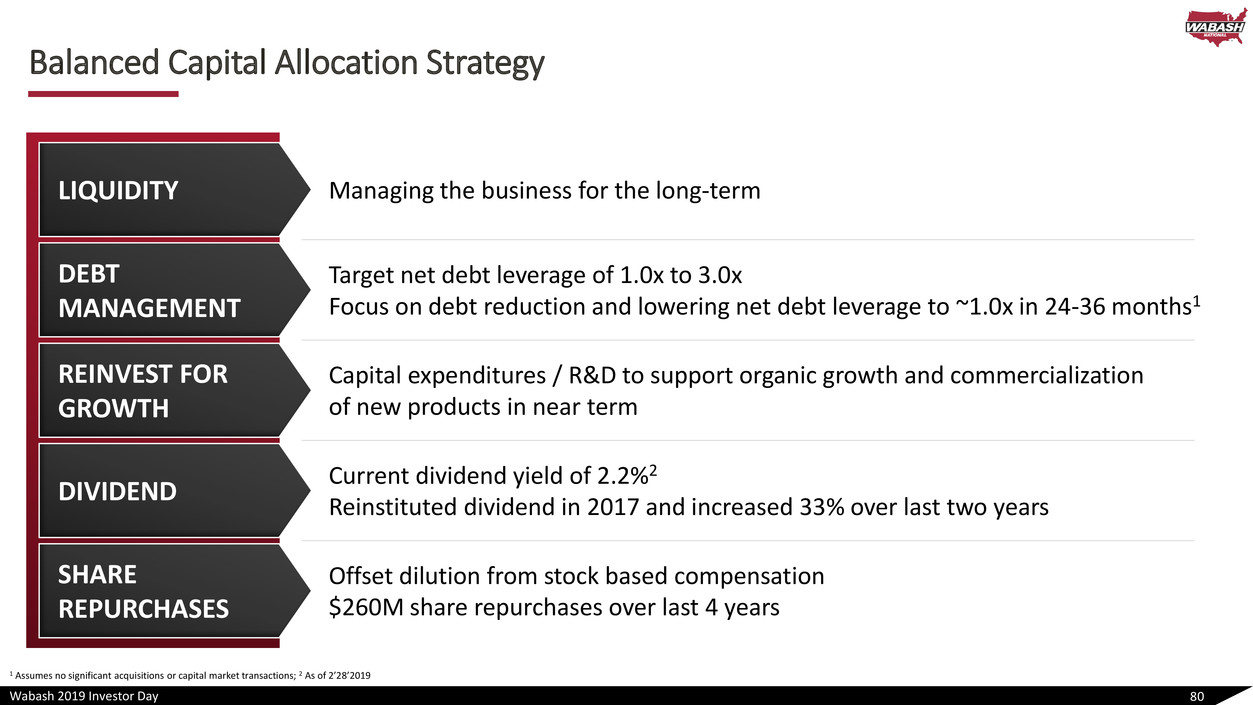

Wabash 2019 Investor Day Balanced Capital Allocation Strategy 80 Managing the business for the long-termLIQUIDITY Target net debt leverage of 1.0x to 3.0x Focus on debt reduction and lowering net debt leverage to ~1.0x in 24-36 months1 DEBT MANAGEMENT Capital expenditures / R&D to support organic growth and commercialization of new products in near term REINVEST FOR GROWTH Current dividend yield of 2.2%2 Reinstituted dividend in 2017 and increased 33% over last two years DIVIDEND Offset dilution from stock based compensation $260M share repurchases over last 4 years SHARE REPURCHASES 1 Assumes no significant acquisitions or capital market transactions; 2 As of 2’28’2019

Wabash 2019 Investor Day 2021 Revenue Growth Scenarios 81 2021 Sensitivity Analysis 2018 Results 10% Revenue Decline Flat Revenue 10% Revenue Growth Revenue $2.3B $2.1B $2.3B $2.5B Operating Margin 6.1% ~6-7% >8% ~9-10% Net Debt Leverage1 2.1x ~1.4x ~1.0x ~0.8x 1 Assumes ~$30-$50M of annual voluntary debt payment

Wabash 2019 Investor Day Financial Goals as a More Diversified Transportation Solutions Provider 82 1 2018 Operating Margin adjusted for Impairment, Acquisition expenses and related charges, Executive severance and Facility transactions; 2 2018 EPS adjusted for Asset impairment, Acquisition expenses and related charges, Executive severance, Facility transactions and Loss on debt extinguishment 2018 – 2021 Assumptions ▪ U.S. annual GDP growth of 2-3% ▪ Trailer market to decline mid/high-single digits CAGR ▪ Truck body market to grow mid- single digits CAGR ▪ 26.5% tax rate ▪ Excludes acquisitions ▪ Flat share count REVENUE ADJUSTED OPERATING MARGIN1 ADJUSTED EPS2 2018 FY Results 2021 Goals $2.27B ~$2.2B 6.1% ~8.0% $1.44 $1.90 – $2.10

Wabash 2019 Investor Day Key Takeaways 83 1. Strong Earnings and Cash Generation Profile 2. Driving Margin Expansion and Operating Leverage 3. Disciplined Balance Sheet Management and Balanced Capital Allocation 4. Focused on Profitable Growth with Recurring and Diversified Revenue Streams 5. Well Positioned with Financial Strength to be Actionable Across All Stages of the Business Cycle

Wabash 2019 Investor Day Closing Remarks Brent Yeagy | Chief Executive Officer 84

Wabash 2019 Investor Day Wabash Investment Summary 85 P U R P O S E WABASH MANAGEMENT SYSTEM TO SCALE BEST-IN-CLASS PERFORMANCE Passionate, Experienced Management Team Fostering Cultural Transformation Transforming Organization to Tap into New Ways of Creating Value with Leading Brands in Diverse End Markets and Industries Accelerate Profitable Growth with Continued Focus on Operational Excellence and Higher Margin Opportunities Leverage Best-in-class, Technologically Innovative Products and Differentiated Solutions Alignment of Our Strategy with Long-term Shareholder Value Creation Build upon Resilient Financial Profile for Disciplined Growth

Wabash 2019 Investor Day Q&A Session All Presenters 86

Wabash 2019 Investor Day Appendix 87

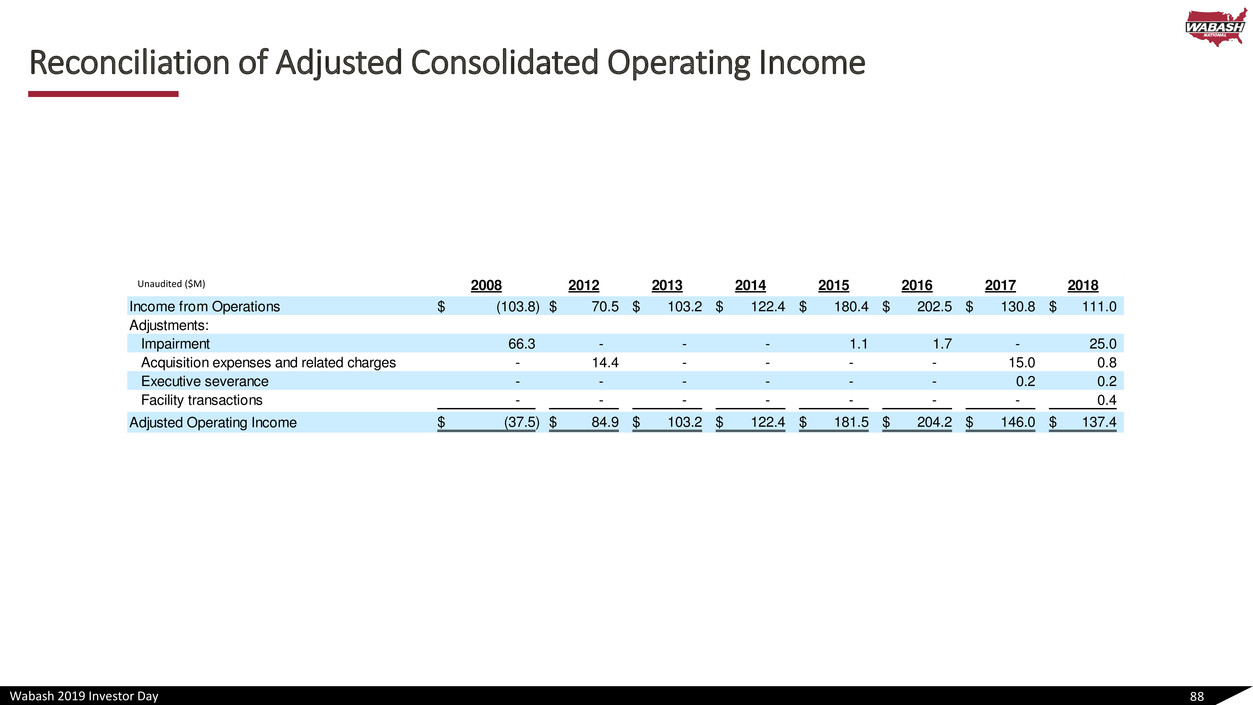

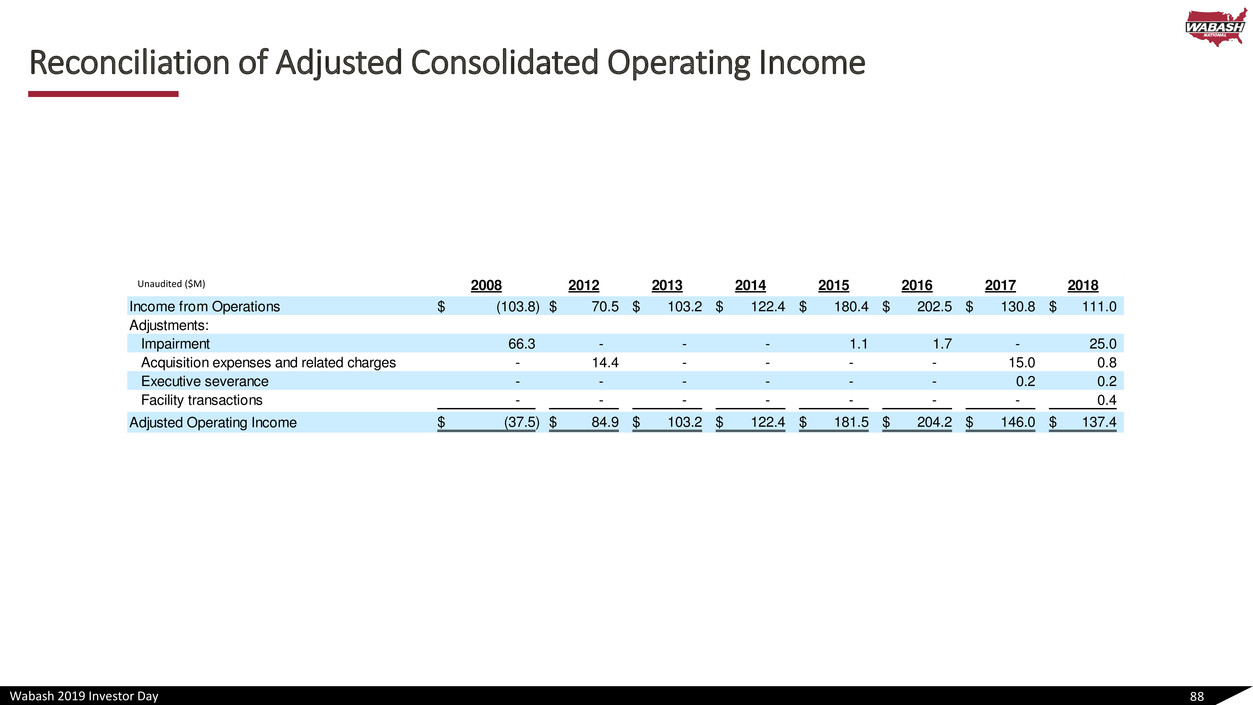

Wabash 2019 Investor Day 2008 2012 2013 2014 2015 2016 2017 2018 Income from Operations (103.8)$ 70.5$ 103.2$ 122.4$ 180.4$ 202.5$ 130.8$ 111.0$ Adjustments: Impairment 66.3 - - - 1.1 1.7 - 25.0 Acquisition expenses and related charges - 14.4 - - - - 15.0 0.8 Executive severance - - - - - - 0.2 0.2 Facility transactions - - - - - - - 0.4 Adjusted Operating Income (37.5)$ 84.9$ 103.2$ 122.4$ 181.5$ 204.2$ 146.0$ 137.4$ Reconciliation of Adjusted Consolidated Operating Income 88 Unaudited ($M)

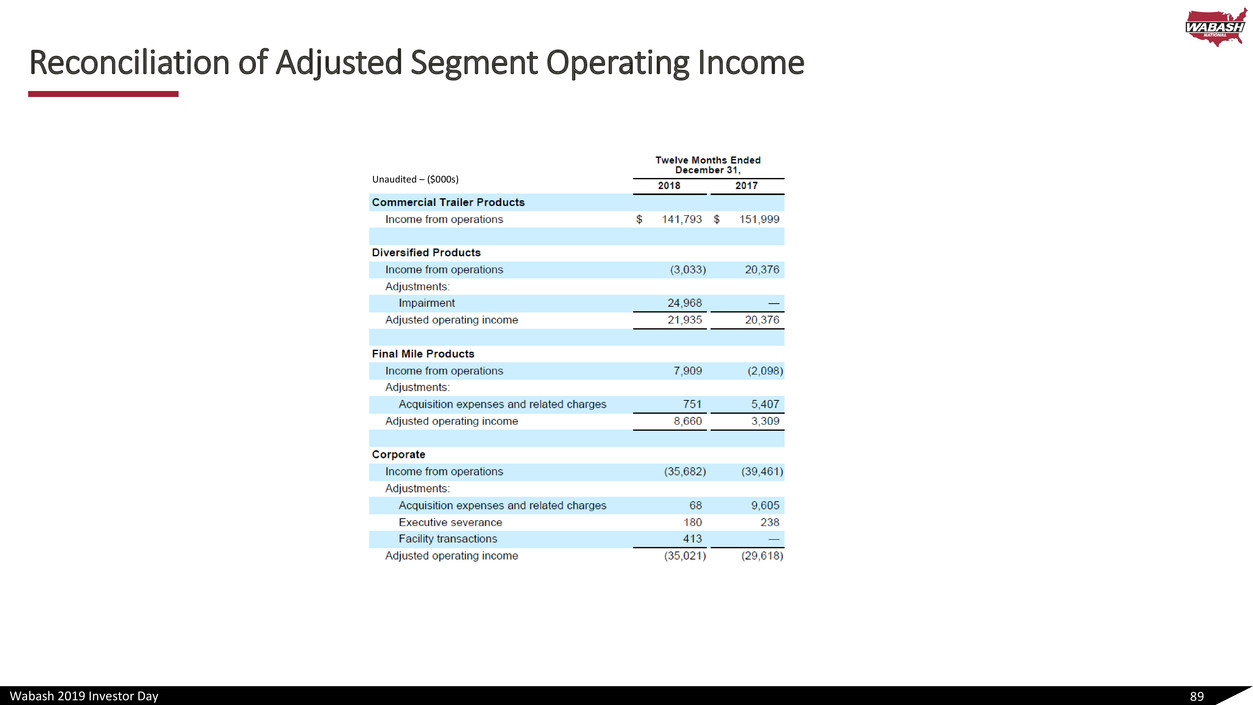

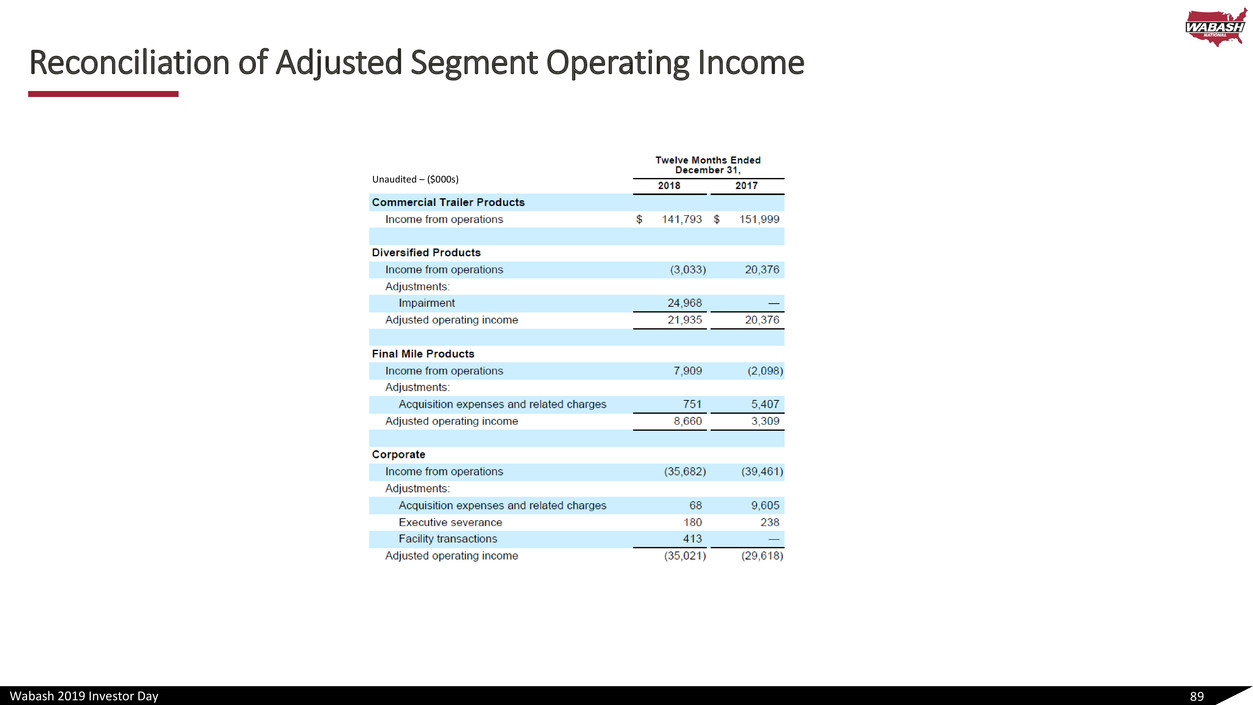

Wabash 2019 Investor Day Reconciliation of Adjusted Segment Operating Income 89 Unaudited – ($000s)

Wabash 2019 Investor Day Reconciliation of Adjusted Diluted Earnings Per Share 90 Unaudited – dollars per share

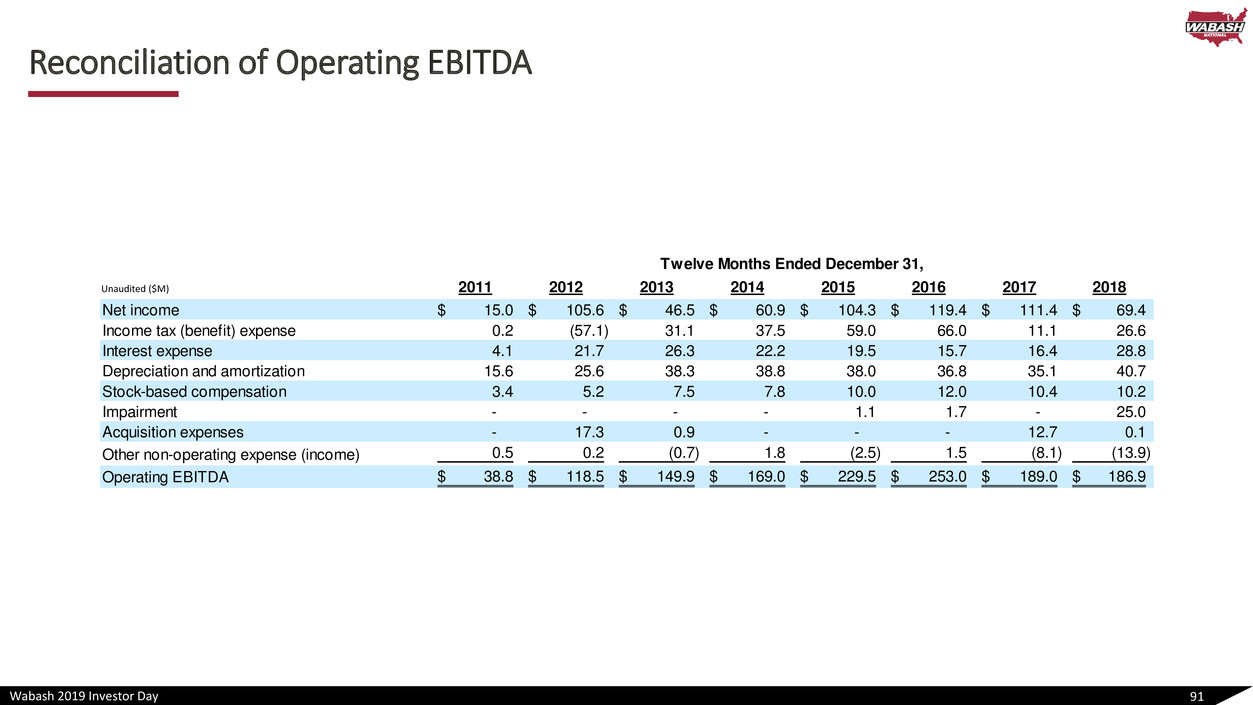

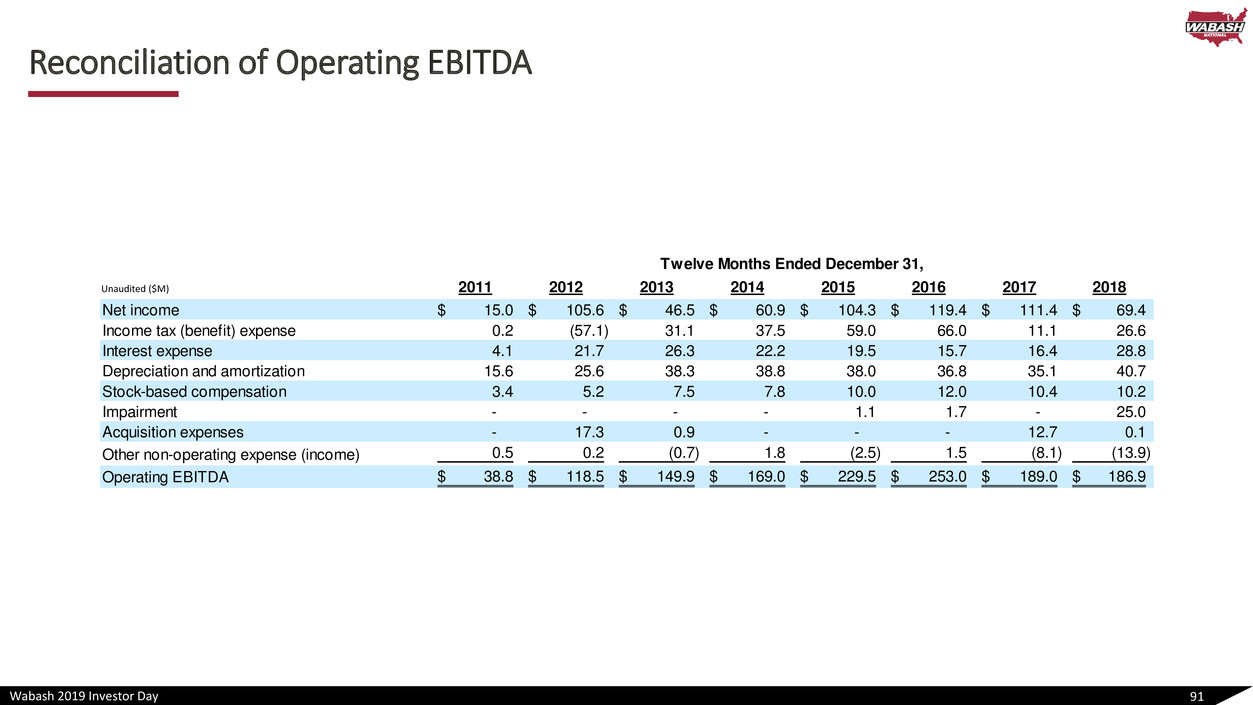

Wabash 2019 Investor Day Reconciliation of Operating EBITDA 91 2011 2012 2013 2014 2015 2016 2017 2018 Net income 15.0$ 105.6$ 46.5$ 60.9$ 104.3$ 119.4$ 111.4$ 69.4$ Income tax (benefit) expense 0.2 (57.1) 31.1 37.5 59.0 66.0 11.1 26.6 Interest expense 4.1 21.7 26.3 22.2 19.5 15.7 16.4 28.8 Depreciation and amortization 15.6 25.6 38.3 38.8 38.0 36.8 35.1 40.7 Stock-based compensation 3.4 5.2 7.5 7.8 10.0 12.0 10.4 10.2 Impairment - - - - 1.1 1.7 - 25.0 Acquisition expenses - 17.3 0.9 - - - 12.7 0.1 Other non-operating expense (income) 0.5 0.2 (0.7) 1.8 (2.5) 1.5 (8.1) (13.9) Operating EBITDA 38.8$ 118.5$ 149.9$ 169.0$ 229.5$ 253.0$ 189.0$ 186.9$ Twelve Months Ended December 31, Unaudited ($M)

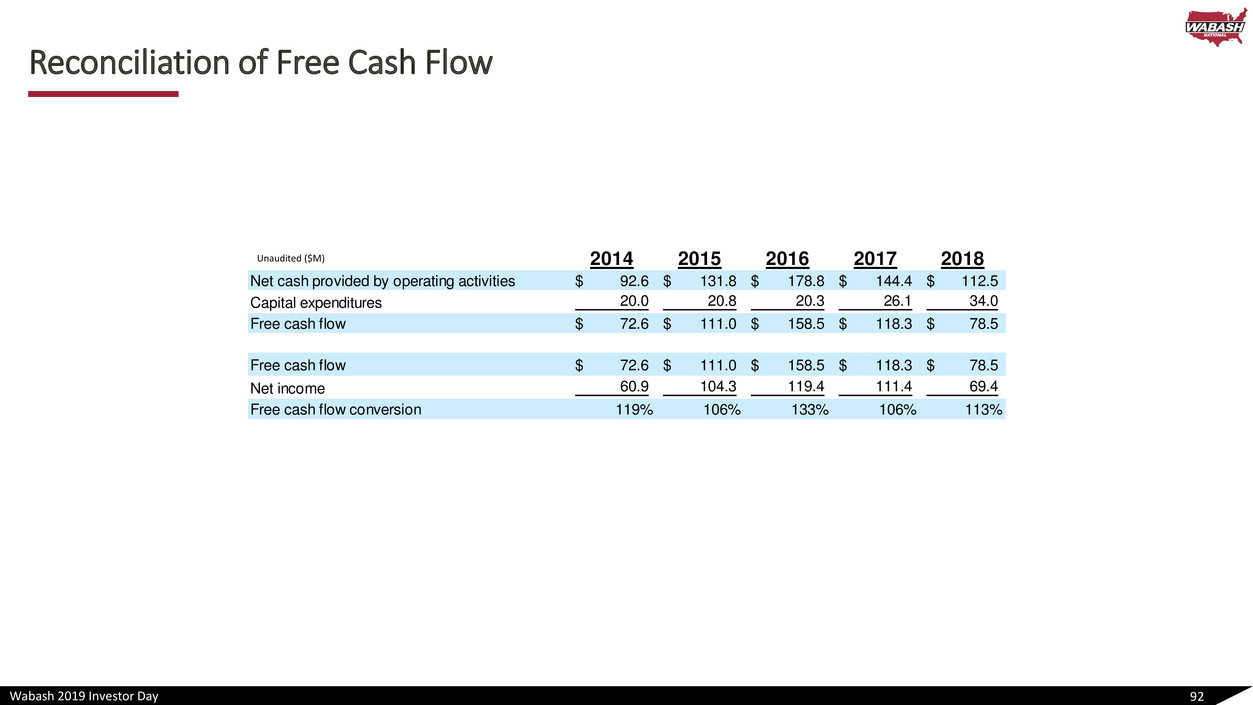

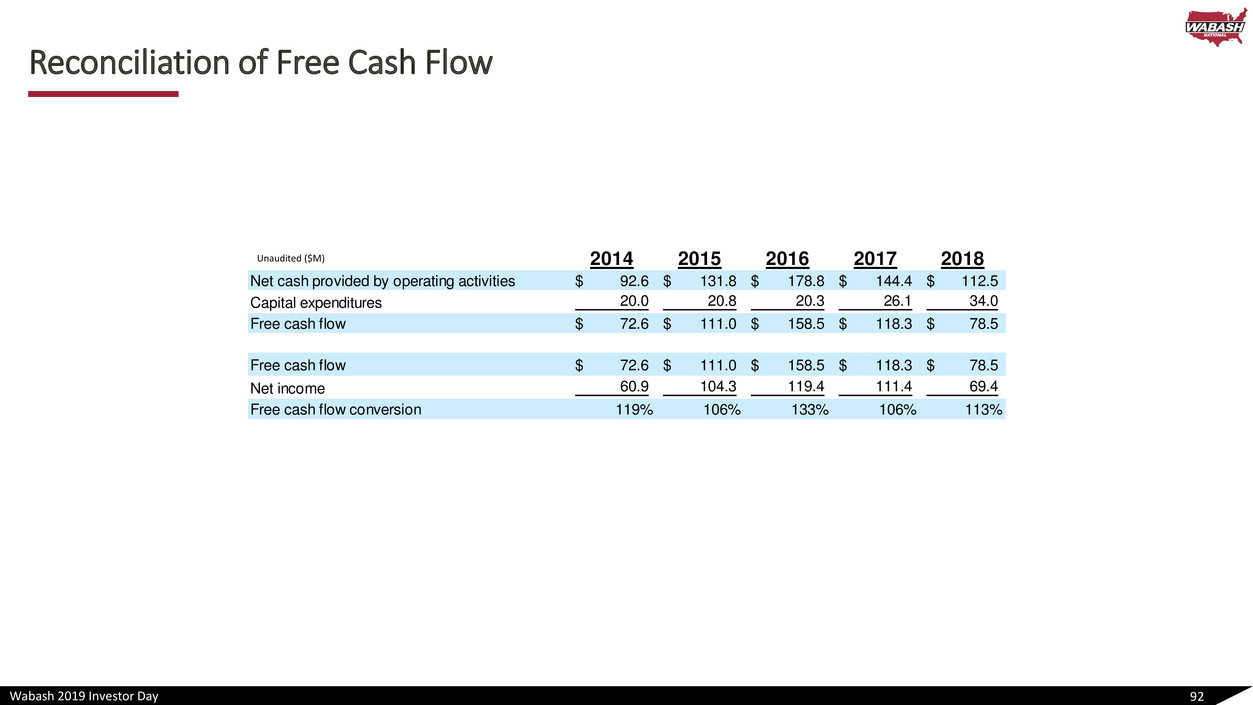

Wabash 2019 Investor Day Reconciliation of Free Cash Flow 92 2014 2015 2016 2017 2018 Net cash provided by operating activities 92.6$ 131.8$ 178.8$ 144.4$ 112.5$ Capital expenditures 20.0 20.8 20.3 26.1 34.0 Free cash flow 72.6$ 111.0$ 158.5$ 118.3$ 78.5$ Free cash flow 72.6$ 111.0$ 158.5$ 118.3$ 78.5$ Net income 60.9 104.3 119.4 111.4 69.4 Free cash flow conversion 119% 106% 133% 106% 113% Unaudited ($M)

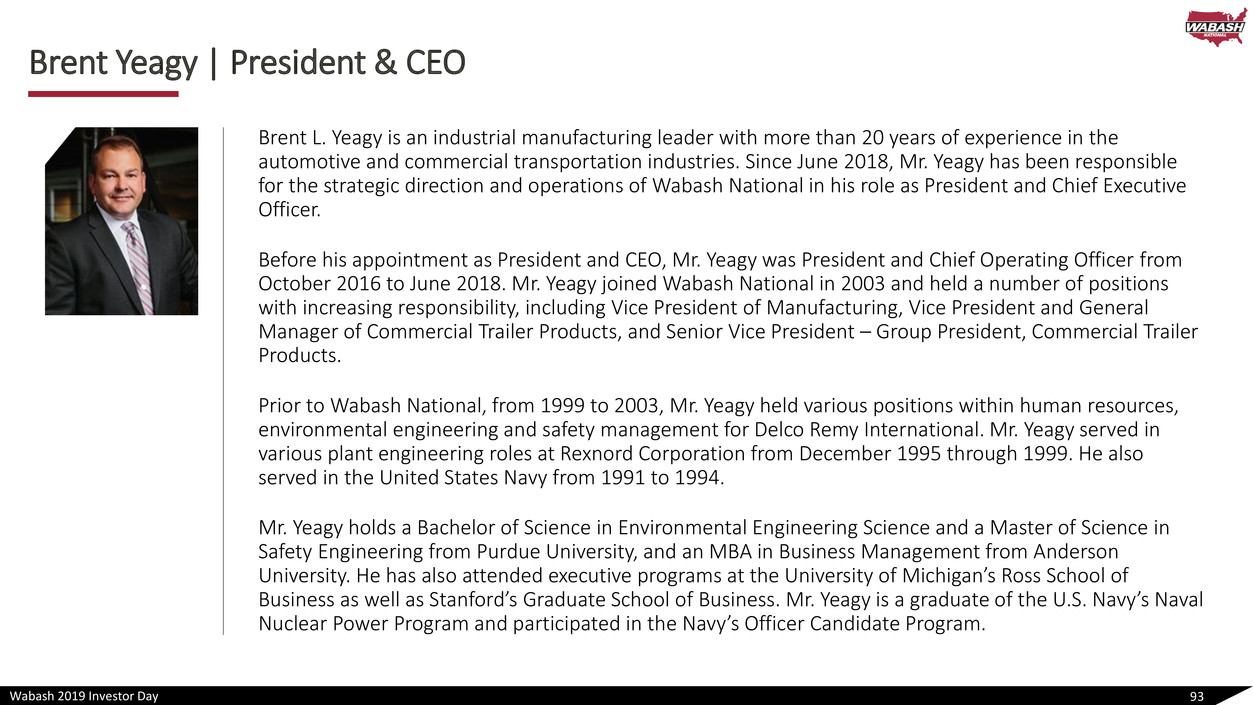

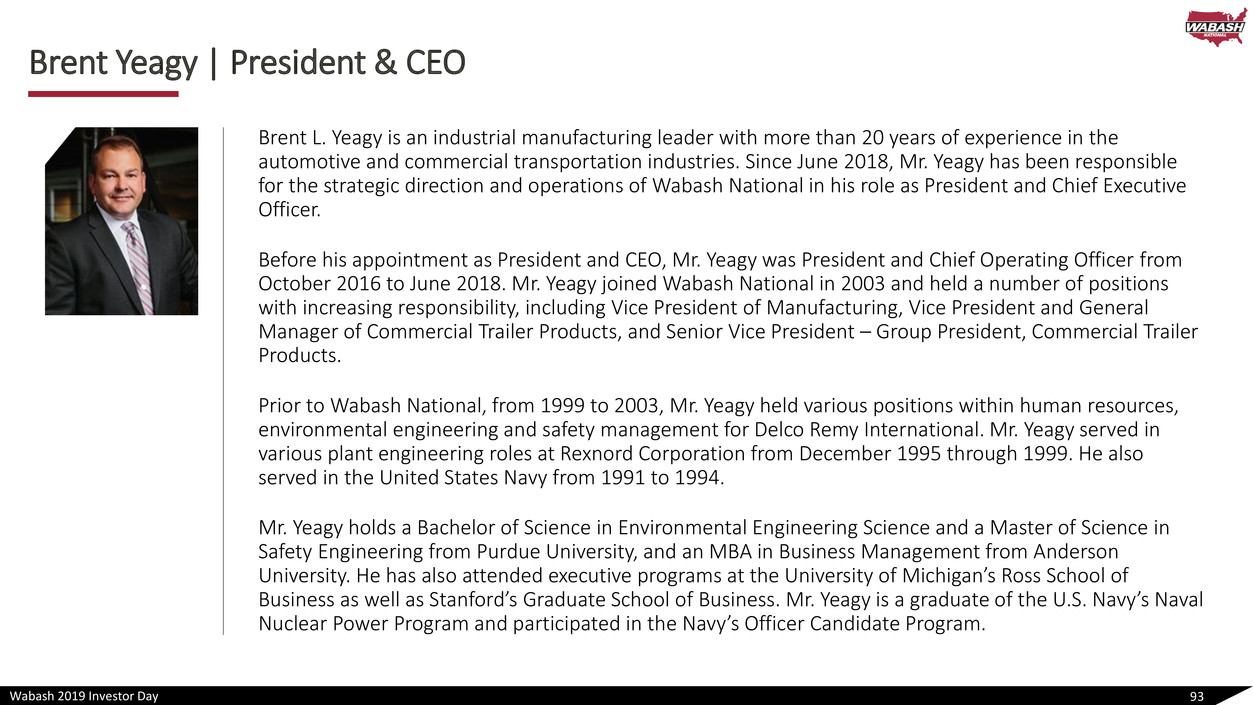

Wabash 2019 Investor Day Brent Yeagy | President & CEO 93 Brent L. Yeagy is an industrial manufacturing leader with more than 20 years of experience in the automotive and commercial transportation industries. Since June 2018, Mr. Yeagy has been responsible for the strategic direction and operations of Wabash National in his role as President and Chief Executive Officer. Before his appointment as President and CEO, Mr. Yeagy was President and Chief Operating Officer from October 2016 to June 2018. Mr. Yeagy joined Wabash National in 2003 and held a number of positions with increasing responsibility, including Vice President of Manufacturing, Vice President and General Manager of Commercial Trailer Products, and Senior Vice President – Group President, Commercial Trailer Products. Prior to Wabash National, from 1999 to 2003, Mr. Yeagy held various positions within human resources, environmental engineering and safety management for Delco Remy International. Mr. Yeagy served in various plant engineering roles at Rexnord Corporation from December 1995 through 1999. He also served in the United States Navy from 1991 to 1994. Mr. Yeagy holds a Bachelor of Science in Environmental Engineering Science and a Master of Science in Safety Engineering from Purdue University, and an MBA in Business Management from Anderson University. He has also attended executive programs at the University of Michigan’s Ross School of Business as well as Stanford’s Graduate School of Business. Mr. Yeagy is a graduate of the U.S. Navy’s Naval Nuclear Power Program and participated in the Navy’s Officer Candidate Program.

Wabash 2019 Investor Day Jeff Taylor | CFO & Senior Vice President 94 Jeff Taylor was appointed to Senior Vice President and Chief Financial Officer on January 1, 2014. He joined Wabash National in July 2012 as Vice President of Finance and Investor Relations. Prior to Wabash National, Mr. Taylor served as Vice President, Finance – Technical Operations for King Pharmaceuticals, Inc. and worked for Eastman Chemical Company in several positions of increasing responsibility within finance and accounting, investor relations, and business management, including its Global Business Controller – Coatings, Adhesives, Specialty Polymers and Inks. Mr. Taylor earned his Bachelor of Science in Chemical Engineering from Arizona State University and his Masters of Business Administration from the University of Texas at Austin.

Wabash 2019 Investor Day Dustin Smith | SVP & Group President, Commercial Trailer Products 95 Dustin Smith was appointed to Senior Vice President and Group President, Commercial Trailer Products on October 1, 2017. Most recently he served as Senior Vice President and General Manager, Commercial Trailer Products. Mr. Smith joined Wabash National in 2007 and has held a number of positions with increasing responsibility, including Director of Finance, Director of Manufacturing, and Vice President of Manufacturing for Wabash National. Prior to Wabash National, from 2000 to 2007, Mr. Smith held various positions at Ford Motor Company in Dearborn Michigan, across both product development and manufacturing divisions, including Plant Controller. His 17+ years of experience in finance and operations gives Mr. Smith a unique understanding of how manufacturing systems directly affect financial results. Mr. Smith holds a Bachelor of Science in Accounting and an MBA in Corporate Finance from Purdue University. He has also attended several executive programs at the Booth School of Management from University of Chicago, as well as Northwestern’s Kellogg School of Management. Mr. Smith resides on the board of directors for the West Lafayette Parks Foundation (West Lafayette, Indiana) and the Composites Company (Melbourne, Florida).

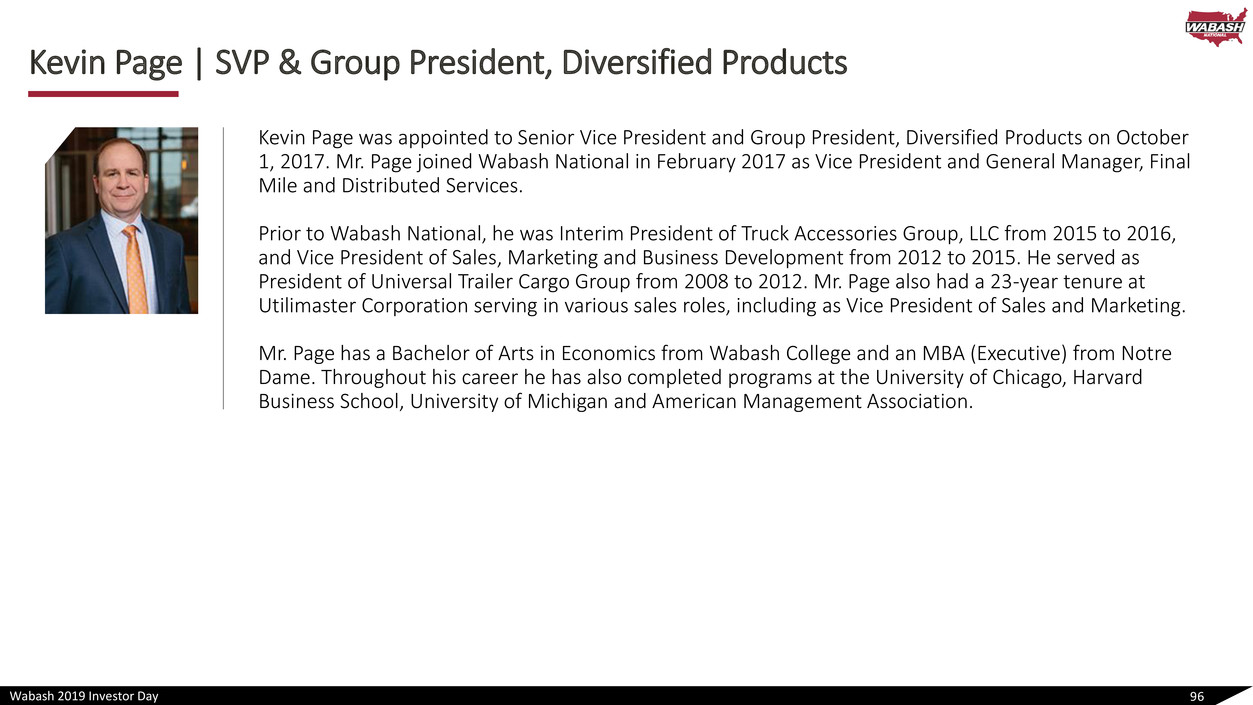

Wabash 2019 Investor Day Kevin Page | SVP & Group President, Diversified Products 96 Kevin Page was appointed to Senior Vice President and Group President, Diversified Products on October 1, 2017. Mr. Page joined Wabash National in February 2017 as Vice President and General Manager, Final Mile and Distributed Services. Prior to Wabash National, he was Interim President of Truck Accessories Group, LLC from 2015 to 2016, and Vice President of Sales, Marketing and Business Development from 2012 to 2015. He served as President of Universal Trailer Cargo Group from 2008 to 2012. Mr. Page also had a 23-year tenure at Utilimaster Corporation serving in various sales roles, including as Vice President of Sales and Marketing. Mr. Page has a Bachelor of Arts in Economics from Wabash College and an MBA (Executive) from Notre Dame. Throughout his career he has also completed programs at the University of Chicago, Harvard Business School, University of Michigan and American Management Association.

Wabash 2019 Investor Day Mike Pettit | SVP & Group President, Final Mile Products 97 Mike Pettit was appointed to Senior Vice President and Group President, Final Mile Products on January 1, 2018. He previously served as Vice President of Finance and Investor Relations since 2014. He joined Wabash National in 2012 as Director of Finance for Commercial Trailer Products. Prior to Wabash National, from 1998 to 2012, Mr. Pettit held various finance positions with increasing responsibility at Ford Motor Company. With nearly 20 years of experience in the transportation industry, he has a broad understanding of strategic planning, mergers and acquisitions, pricing strategy, production planning, and lean manufacturing processes and principles. Mr. Pettit has a Bachelor of Science in Industrial Management from Purdue University and an MBA from Indiana University.