SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO

SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005 |

or |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 0-191551

Atlantic Tele-Network, Inc.

(Exact name of Registrant as specified in its charter)

Delaware | | 47-0728886 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | identification No.) |

10 Derby Square | | |

Salem, Massachusetts | | 01970 |

(Address of principal executive offices) | | (Zip Code) |

(978) 745-8106

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | | | Name of each exchange on which registered | |

Common Stock, par value $.01 per share | | American Stock Exchange |

None

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of each class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Exchange Act Rule 12b-2). Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes o No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant as of June 30, 2005, was approximately $65,893,200, based on the closing price of the registrant’s Common Stock as reported on the American Stock Exchange.

As of March 31, 2006, the Registrant had 12,949,768 outstanding shares of Common Stock, $.01 par value, as adjusted for a 5-for-2 stock split effected as a 250% stock dividend on March 31, 2006.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement for the Annual Meeting of Stockholders to be held on May 17, 2006 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains statements about future events and expectations, or forward-looking statements, all of which are inherently uncertain. We have based those forward-looking statements on our current expectations and projections about future results. When we use words such as “anticipates,” “intends,” “plans,” “believes,” “estimates,” “expects,” or similar expressions, we do so to identify forward-looking statements. Examples of forward-looking statements include statements we make regarding future economic and political conditions in Guyana and Bermuda, the competitive environment in the markets in which we operate, legal and regulatory actions and technological changes, our future prospects for growth, our ability to maintain or increase our market share, our future operating results and our future capital expenditure levels. These statements are based on our management’s beliefs and assumptions, which in turn are based on currently available information. These assumptions could prove inaccurate. These forward-looking statements may be found under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this Report generally.

You should keep in mind that any forward-looking statement made by us in this Report or elsewhere speaks only as of the date on which we make it. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. In any event, these and other important factors may cause actual results to differ materially from those indicated by our forward-looking statements, including those set forth in Item 1A of this Report under the caption “Risk Factors.” We have no duty to, and do not intend to, update or revise the forward-looking statements made by us in this Report after the date of this Report, except as may be required by law. In light of these risks and uncertainties, you should keep in mind that the future events or circumstances described in any forward-looking statement made by us in this Report or elsewhere might not occur.

In this Report on Form 10-K, the words “we,” “our,” “ours” and “us” refer to Atlantic Tele-Network, Inc. and its subsidiaries. Also ClearChoice™ is a service mark of one of our subsidiaries. This Report also contains other trademarks, service marks and trade names that are the property of others.

Reference to dollars ($) refer to U.S. dollars unless otherwise specifically indicated.

Information regarding shares of our Common Stock set forth in this Report has been retroactively adjusted to reflect our 5-for-2 stock split on March 31, 2006.

i

PART I

ITEM 1. BUSINESS

Overview

We provide wireless and wireline telecommunications services in the Caribbean and North America. Through our operating subsidiaries and affiliates, we offer the following principal services:

· Wireless. We offer wireless voice and data services to retail customers in Guyana and Bermuda. In the United States, we offer wholesale wireless voice and data roaming services to national, regional and local wireless carriers in rural markets located principally in Arizona, Colorado, Illinois, Missouri and New Mexico.

· Local Telephone and Data. Our local telephone and data services include our operations in Guyana, the U.S. Virgin Islands and the mainland United States. We are the exclusive provider of domestic wireline local and long distance telephone services in Guyana. We are a leading Internet access service provider in the U.S. Virgin Islands. In the mainland United States, we offer facilities-based integrated voice and data communications services to residential and business customers in New England, primarily in Vermont.

· International Long Distance Voice and Data Services. We are the exclusive provider of international long distance voice and data communications into and out of Guyana. As part of our infrastructure, we own interests in major international fiber optic cables linking Guyana to, among other places, Suriname, French Guiana, Trinidad, the U.S. Virgin Islands and the mainland United States.

Strategy

The key elements of our strategy consist of the following:

· Focus on Providing Wireless and Wireline Telecommunications Services. We are focused on providing wireless and wireline voice and data services to residential and business customers across a variety of geographic and demographic markets. We have provided these services to our customers for over ten years and have demonstrated our ability to grow both customers and revenues by improving service and increasing the number of wireline and wireless products offered to these customers. We believe these sectors provide significant opportunities for organic and acquisitive growth.

· Target Underserved Markets Where We Can Compete Successfully. We operate in smaller, underserved markets where we believe we are or will be one of the leading providers of telecommunications services. Our businesses typically have strong local brand identities and leading market positions. By leveraging these attributes, along with our lower cost of capital and our senior management expertise at the holding company level, we seek to improve and expand available products and services in our targeted markets to better meet the needs of our customers and expand our customer base.

· Partner with Successful Local Owner/Operators. We partner with local management teams who have a demonstrated a successful track record. We believe that strong local management enhances our close relationship with customers and reduces risk. Our geographically diverse businesses are all operated and often partially owned by local managers, employees and investors. We seek to enhance our strong market position by maintaining these partnerships and by leveraging our extensive management experience to assist them in further improving operations.

· Maintain a Disciplined Earnings-Oriented Approach. We carefully assess the potential for earnings stability and growth when we evaluate the performance of our subsidiaries, new investment opportunities and prospective acquisitions. In managing our more mature businesses, we seek to

1

solidify our brands, improve customer satisfaction, add new services, control costs and preserve cash flow. In managing our newer, faster growing businesses, we seek to invest capital to improve our competitive position, increase market share and generate strong revenue and cash flow. We consider new investments and acquisitions on a disciplined return-on-investment basis and generally avoid transactions that we do not expect to have a near-term positive impact on our earnings.

As a result of these strategies, over the past four years we have increased our consolidated operating income and earnings per share by approximately 10% and 14%, respectively, on an annually compounded basis. We have also been able to pay cash dividends to our shareholders for 29 consecutive quarters and have increased our quarterly dividend per share by approximately 33% since the beginning of 2002.

Our Company

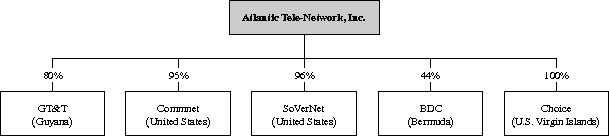

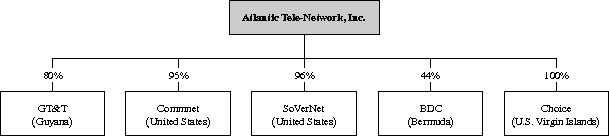

We conduct our operations in the mainland United States, Guyana, Bermuda, and U.S. Virgin Islands through the following principal operating subsidiaries and affiliate:

· Guyana Telephone & Telegraph (or GT&T). In 1991, we acquired an 80% equity interest in GT&T, which is the exclusive provider of domestic wireline local and long distance telecommunications services in Guyana and the largest service provider in Guyana’s competitive wireless tele-communications market. GT&T is the successor to the Guyana Telecommunications Corporation, a corporation wholly owned by the Government of Guyana. The remaining 20% equity interest in GT&T is held by the Government of Guyana.

· Commnet Wireless, LLC. In September 2005, we acquired a 95% equity interest in Commnet, which provides wireless voice and data communications roaming services in the United States. The remaining 5% equity interest in Commnet is held by Commnet management.

· SoVerNet, Inc. In February 2006, we acquired a 96% equity interest in SoVerNet, which provides facilities-based integrated voice and broadband data communications services in New England, primarily in Vermont. The remaining 4% equity interest in SoVerNet is held by SoVerNet management.

· Bermuda Digital Communications, Ltd (or BDC). In 1998, we acquired a 44% equity interest in BDC, which is the largest wireless voice and data communications service provider in Bermuda, operating under the Cellular One brand. The remaining equity holders include BDC’s Bermudian management team.

· Choice Communications, LLC. In October 1999, we acquired Choice, which provides fixed wireless broadband data services and dial-up Internet services to retail and business customers in the U.S. Virgin Islands. Through our Choice subsidiary, we also offer fixed wireless digital television services in the U.S. Virgin Islands.

In addition to our equity interests, we also receive management fees from our principal operating subsidiaries and affiliate.

2

Atlantic Tele-Network, Inc. was incorporated in the State of Delaware in 1987. Our principal corporate offices are located at 10 Derby Square, Salem, Massachusetts 01970. The telephone number at our principal corporate offices is (978) 745-8106. We also maintain corporate offices in St. Thomas, U.S. Virgin Islands.

Our Services

Through our operating subsidiaries and affiliates, we provide wireless, local telephone and data, and international long distance services in Guyana, the mainland United States, U.S. Virgin Islands and Bermuda. For fiscal years 2003, 2004 and 2005, our Guyana operations generated 95%, 94% and 85%, respectively, of our consolidated revenue. For information about our financial segments and geographical information about our operating revenues and long-lived assets, see Note 13 to the Consolidated Financial Statements included in this Report.

Wireless Services

We provide wireless voice and data communications services in the United States, Guyana and Bermuda.

U.S. Operations

Through our Commnet subsidiary, we provide wholesale wireless voice and data roaming services in rural markets to national, regional and local wireless carriers. We offer these services through our own networks in markets located principally in Arizona, Colorado, Illinois, Missouri and New Mexico. Roaming is a service offered by most wireless service providers that enables their subscribers to utilize their mobile phone service while traveling outside of their service provider’s network coverage area. Roaming enables wireless service providers to offer their customers extended coverage without the need to own a network or spectrum. We design, install and operate our wireless networks in areas where our wholesale customers need extended coverage.

Network. We currently operate networks with GSM, TDMA, CDMA and analog technologies in both the 850 MHz and 1900 MHz bands. This mix of technologies and spectrum varies by market. However, we typically have at least two technologies deployed at each cell site in order to maximize revenue opportunities. Our networks are comprised of telecommunications switches, base stations, consisting of radio transceivers located on towers and buildings typically owned by others, and leased transport facilities. As of March 2006, we own and operate 273 base stations consisting of 129 GSM, 25 CDMA and 119 TDMA/analog stations.

Sales and Marketing. Traditionally, roaming agreements have been cancelable at-will. Recently however, major carriers have been experiencing technological malfunctions and incompatibility with other wholesalers’ networks, which has increased carriers’ willingness to make longer term commitments in exchange for supporting technologies and features. We have taken advantage of this environment by entering into long-term, preferred roaming agreements with several major wireless carriers, including Cingular, Verizon and T-Mobile. Under these preferred roaming agreements, we agree to build a new mobile network at a specified location and offer the preferred carrier long-term pricing certainty in exchange for priority designation with respect to their customers’ wireless traffic. We believe we have established a track record of building highly-reliable, feature-rich network coverage in a variety of technical environments for major wireless carriers on time and at attractive rates. We believe carriers are drawn to our ability to timely meet buildout requirements, the reliability of our networks and our status as a trusted partner that does not compete for retail subscribers. Once we complete building a rural network, we then benefit from existing roaming agreements with other national, regional, and local carriers to supplement our initial revenues. These nonpreferred roaming agreements are usually terminable within 30

3

days. Because we have no retail subscribers, we do not incur retail distribution or retail marketing costs and our customer service costs are largely limited to technical and engineering support.

Customers. We currently have roaming agreements with 77 United States-based wireless service providers, including preferred agreements with Cingular, Verizon and T-Mobile. As of December 31, 2005, we were the preferred roaming carrier for Cingular (under an agreement that terminates in mid-2008) and Verizon (under an agreement that terminates in mid-2007) in selected markets. From September 15, 2005, the date we acquired Commnet, through December 31, 2005, Cingular and Verizon accounted for 81% of our U.S. wireless revenues.

Competition. Our wireless roaming services enable our carrier customers to provide their subscribers with additional network coverage and service without having to build and operate their own extended wireless networks. We compete with wireless service providers that operate networks in our markets and offer wholesale roaming services. In addition, our carrier customers may also elect to build or acquire their own infrastructure in a market in which we operate, reducing or eliminating their need for our services in that market. We believe the bases on which we compete for wholesale roaming customers are price, network coverage and quality of service. We expect competition in the rural wireless sector to be dynamic, as competitors expand their networks and as new products and services that require supporting connectivity are developed.

Guyana Operations

Through our GT&T subsidiary, we offer wireless telephone service in the vast majority of populated areas in Guyana, including the Georgetown area (Guyana’s capital and largest city) and substantially all of Guyana’s coastal plain where 70% of Guyana’s population is concentrated.

Guyana is an English speaking nation and part of the British Commonwealth. Located along the Caribbean Rim on the north coast of South America, it is approximately 83,000 square miles in size. Guyana has a population of approximately 765,000 people and a per capita GDP of approximately $3,900. As of the end of 2005, we estimate that Guyana’s teledensity was approximately 15 access lines per 100 inhabitants. Approximately 32% of the population are wireless subscribers. Economic activity in Guyana is mainly centered on the export of sugar, gold, bauxite/alumina, rice, shrimp, molasses, rum, and timber.

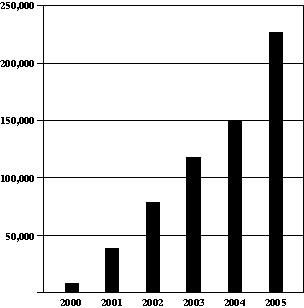

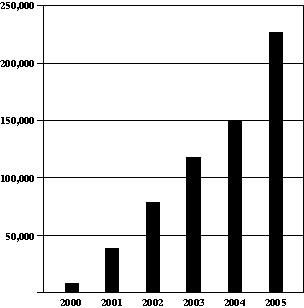

We estimate that approximately 87% of the country’s population resides in areas covered by our wireless network. We first introduced wireless service in 1992. As of December 31, 2005, we had approximately 228,000 wireless subscribers, up 51% from the approximately 151,000 subscribers we had at December 31, 2004. In the fourth quarter of 2004, we launched services on a GSM overlay across most of our existing TDMA wireless network. As of December 31, 2005, over 100,000 of our wireless subscribers were GSM subscribers.

4

The following table shows the increase in our wireless subscribers:

Our Guyana Wireless Subscribers

Network. We initially constructed a TDMA wireless network in Guyana. In the fourth quarter of 2004, we launched services on our new GSM/GPRS mobile wireless network, alongside our existing TDMA network. GSM/GPRS is a more advanced wireless digital service than TDMA, allowing us to offer richer handset features and certain wireless data services, while increasing our network capacity. The launch of GSM services has also helped us enter into roaming agreements with wireless carriers in a number of other countries, including some of the largest carriers in the U.S. and Caribbean, enabling our subscribers to use their handsets in other countries and allowing some visitors to use their wireless phones while in Guyana. At December 31, 2005, we had roaming agreements with 53 wireless carriers.

We are currently operating both the TDMA and GSM networks. At December 31, 2005, approximately 55% of our subscribers were on the TDMA network and 45% were on the GSM network. We anticipate substantially all of the TDMA subscribers will migrate to the GSM network over the next 18 months or will otherwise cease to be TDMA subscribers because they already have a GSM handset and account.

Our TDMA network operates on approximately 30 MHz of spectrum in the 800 MHz band. Prior to March 2006, our GSM network operated on approximately 16 MHz of spectrum in the 900 MHz band. In March 2006, the National Frequency Management Unit (or NFMU) in Guyana reallocated the GSM 900 MHz spectrum, which was previously divided into two bands of 24 MHz each, into four bands of 12 MHz each, with the expectation of licensing two additional wireless providers. See “—Regulation of Our GT&T Subsidiary—Other Regulatory Developments.”

Sales and Marketing. We actively market our wireless services through widespread signage, sponsored events, and merchandise giveaways as well as through our close, promotional relationships with leading disc jockeys and radio personalities and other popular figures. We do not maintain any traditional retail stores, although all post-paid wireless customers set up accounts at one of our six business centers and pre-paid customers may do so as well. Our handsets, prepaid cards and pre-paid accounts are sold primarily through independent dealers who we pay competitive commissions for sales. Wireless subscribers

5

are offered various calling plans and are charged a monthly fee plus airtime based on the selected plan. These fees are payable on either a pre-paid basis, which means a customer purchases a calling card with a prescribed number of minutes in advance of any usage, or a post-paid basis, which means the subscriber is billed for his or her minutes of use after usage. Pre-payments can be made by the purchase of disposable prepaid calling card, which come in fixed Guyanese dollar amounts, or by recharging an account via electronic terminals from any authorized vendor.

Customers. As of December 31, 2005 we had approximately 228,000 wireless subscribers, of whom we estimate over 96% were on prepaid plans.

Competition. We provide wireless services in Guyana pursuant to a non-exclusive license. We currently face competition from a nationwide wireless service provider and may face additional competition in the future. Guyana Government officials, including the President, have stated that it is their intention to provide a wireless license to Digicel, a large mobile telecommunications company operating in many Caribbean countries, and that licensing discussions with Digicel are in process. In addition, our existing competitor is attempting to obtain a second wireless license through an affiliated entity, although we believe that a second license is not permitted under the spectrum allocation proposal.

See “—Regulation of Our GT&T Subsidiary.” We believe the bases on which we compete for customers are price, coverage and quality of service.

Bermuda Operations

Through our BDC affiliate, we provide wireless voice and data service to retail and business customers under the name “Cellular One” throughout the island of Bermuda. BDC commenced operations in July 1999 and became the largest wireless operator in Bermuda by 2002. Bermuda has a total population of approximately 65,000 and a per capita GDP of approximately $36,000, one of the highest in the world. The customer base in Bermuda, with its high disposable income and business economy built on sophisticated financial services, has consistently shown demand for newer wireless services and capabilities.

Network. Following rapid upgrades in earlier years from analog to TDMA to CDMA, in early 2005, BDC enhanced the data speeds and capabilities of its CDMA 1XRTT network by deploying Evolution Data Optimized (or EV-DO) services. Together with the improved handset functionality and data services already enabled by CDMA 1XRTT technology, EV-DO enables BDC to offer significantly higher speed data services. BDC launched these services in the first quarter of 2005 and they proved to be popular with existing and new customers. In late 2005, however, BDC was ordered by Bermuda’s Minister of Telecommunications and Technology to cease providing certain of its new data services. BDC has appealed the order. See “—Regulation of Our BDC Affiliate.”

BDC’s advanced network, operating in the 850 MHz frequency band, covers virtually the entire population of Bermuda. BDC also has extensive backbone facilities on the island linking its sites, switching facilities and the international interconnection points.

Sales and Marketing. BDC maintains four retail stores and a service center in Bermuda that are a core part of its brand identity and sales efforts. BDC also advertises frequently in the newspapers and other media and sponsor various events and initiatives. BDC sells services in a number of post-paid subscription plans that are distinguished largely by the number of minutes and the enhanced features, such as text messaging, included in the plan. A substantial majority of BDC’s customers subscribe to one of its post-paid plans. BDC also has a small number of pre-paid subscribers and has established “point of sale” payment terminals to enable those customers to increase their account balance at any one of a number of stores, such as a local grocer, maintaining the terminals.

Customers. At December 31, 2005, BDC had approximately 22,600 subscribers, which it estimates to be just less than half of the wireless market in Bermuda. As the only CDMA operator on Bermuda, BDC is

6

the roaming partner for two of the largest U.S. wireless providers. Since entering into roaming agreements with these and other carriers in 2003 and 2004, BDC’s roaming traffic has grown and it has been able to offer improved roaming services and rates in North America and elsewhere. This has led to increased roaming revenue in 2005 from visitors to Bermuda and from BDC subscribers traveling abroad. To take advantage of its enhanced data capabilities, BDC plans to launch data roaming with these and other providers in 2006.

Competition. Until the fourth quarter of 2001, BDC competed only with the wireless division of the incumbent telephone company in Bermuda, which operates a GSM network. In 2001 another operator launched services on its newly built GSM network. This operator was acquired by Cingular (then AT&T Wireless) and was subsequently sold in 2005 to Digicel. Although we believe that BDC has the most advanced network in terms of data speeds and reliability, BDC’s competitors currently have an advantage in their ability to offer roaming in European countries, where all the major carriers operate GSM networks. As discussed above, however, as the only CDMA operator in Bermuda BDC has strong relationships with the North American CDMA carriers. We believe the bases on which we compete for wireless retail customers are features, price, technology deployed, network coverage (including through roaming arrangements), quality of service and customer care.

Local Telephone and Data Services

Our local telephone and data services include our operations in Guyana, the U.S. Virgin Islands and the mainland United States.

Guyana Operations

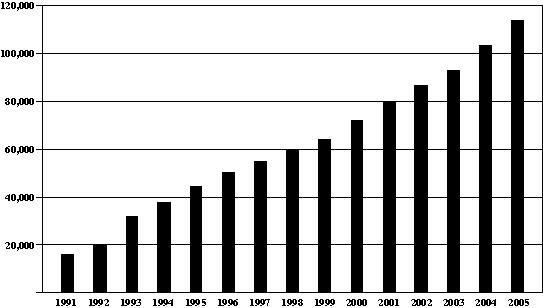

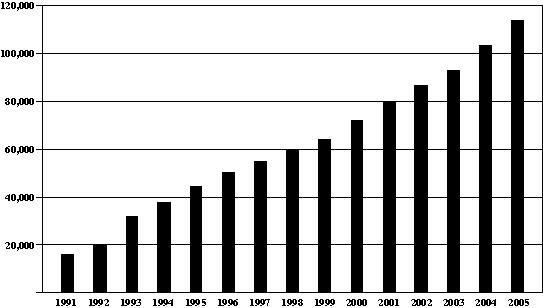

Through our GT&T subsidiary, we are the exclusive provider of domestic wireline local and long distance telephone services in Guyana. As of December 31, 2005, we had approximately 113,500 access lines in service. This represents approximately 15 lines per 100 inhabitants (based on an estimated population of approximately 765,000), an increase of approximately 10%, or over 10,200 net new lines, compared to lines in service at December 31, 2004. Of all fixed lines in service, the majority are in the largest urban areas, including Georgetown, Linden, New Amsterdam, Diamond and Beterverwagting. During 2005, we continued to extend our network to cover additional rural towns and communities. However, despite our substantial and continuing investment in extending our fixed line network, some rural areas still do not have telephone service.

7

Network. We have significantly rebuilt and expanded our telecommunications network. Through December 31, 2005, we have invested approximately US$228 million in Guyanese telecommunications infrastructure. The number of fixed access lines has increased from approximately 13,000 working lines in January 1991 to over 113,500 lines as of December 31, 2005, all of which are now digitally switched lines. The following table shows the increase in our fixed access lines over time:

Our Guyana Fixed Access Lines

In addition, we have installed over 700 public telephones in locations across the country providing telecommunications for both local and international calls in areas that previously did not have service. We also maintain three public telephone centers at which the public can pay to use an ordinary residential-type telephone to make international and domestic calls.

Sales and Marketing. Our revenues for fixed access domestic service are derived from installation charges for new lines, monthly line rental charges, monthly measured service charges based on the number and duration of calls and other charges for maintenance and other customer services. For each category of revenues, rates differ for residential and commercial customers. Customers desiring to obtain an access line submit written applications to one of our customer service offices. Service representatives process the applications and service is installed within about two weeks (or, if service is not yet available, the applicant is placed on a waiting list). We employ a minimal sales force, as wireline sales are primarily driven by network expansion and availability of service. Our wireline subscribers pay for telephone service (including international long distance) after being billed for it. Customers can pay their bills at any one of our six business centers, any Western Union branch, commercial banks and post offices.

Customers. We provide our wireline telephone services to residential and commercial customers. As a result of our continued network expansion into smaller communities, residential customers account for a growing portion of local telephone service revenues and the vast majority of new lines in service. In 2005, residential customers contributed approximately two thirds of the wireline local telephone service revenue and commercial customers provided one third.

Competition. Pursuant to our license from the Government of Guyana, we have the exclusive right to provide domestic wireline local and long distance telephone service in Guyana. The exclusivity provisions

8

of our license have been the subject of negotiations with the Government of Guyana. See “—Regulation of Our GT&T Subsidiary—Other Regulatory Developments” and “Risk Factors—Our exclusive license to provide local exchange and long distance telephone services in Guyana is subject to significant political and regulatory risk.”

U.S. Virgin Islands Operations

Through our Choice subsidiary, we are a leading provider of Internet access services in the U.S. Virgin Islands. We provide Internet access services throughout the U.S. Virgin Islands, primarily under the domain names viaccess.net and islands.vi. Internet service is provided by dial-up and a variety of wireless broadband technologies. The broadband services include WiFi hotspots, fixed wireless, and near-line-of-sight (or NLOS) portable wireless capabilities sold under the ClearChoice™ service name. We also provide fixed wireless digital television services to residential subscribers and hotel rooms. In July of 2005, we launched our new ClearChoice™ service, a NLOS broadband wireless service that allows customers to easily self-install the broadband Internet service and provides the customer the ability to move service from one location to another. We completed infrastructure build-outs in 2004 that significantly expanded the service areas covered by our wireless network. In 2005, aside from the launch of ClearChoice™ on the islands of St. Thomas and St. John, we expanded our television coverage with the addition of a new tower on the southeast side of St. Thomas. We also began the rollout of broadband WiFi hotspots to serve the extensive tourist market.

With respect to our Internet access services, we continue to experience an increase in customer demand for broadband access services and a decrease in customer demand for dial-up services. As of the end of 2005, the number of our broadband data customers increased by 220% compared to 2004, as we supplemented our existing broadband offering with ClearChoice™. During the same period the number of our dial-up subscribers decreased by 18%.

Network. We have expanded our digital television and data networks over the last two years to support new service capabilities and provide more capacity for new broadband Internet customers. In 2004, we decided to build our core and primary customer access data networks using licensed spectrum to avoid the radio interference that often occurs in the U.S. Virgin Islands. All our services (other than WiFi hotspots) are provided over this licensed spectrum. Currently, we are the only carrier in the U.S. Virgin Islands using licensed spectrum to provide these services. Our network consists of fixed wireless radio transceivers, WiFi modems and leased circuits connected to collocation equipment we maintain at the incumbent provider’s facilities.

Sales and Marketing. We have expanded our presence in the marketplace by continued leverage of the Choice name. New services, such as ClearChoice™, incorporate the marketplace recognition of the Choice name. Hotels continue to be an area of focus for our digital television services sales efforts. We have three retail locations in the U.S. Virgin Islands that account for the majority of customer interaction.

Customers. Our services are offered to local residential customers, the hotels catering to the tourism industry and other local businesses.

Competition. Our Internet access services compete mostly with the local telephone company, as well as some smaller Internet providers. Our digital television services compete mostly with the local cable television provider and, to a much lesser extent, satellite television service providers. We believe the bases on which we compete for wireless broadband customers are price, ease of installation and network quality. We believe the bases on which we compete for wireless digital television customers are price, programming and customer service.

9

U.S. Operations

As a result of acquiring SoVerNet in February 2006, we are the largest competitive integrated voice and broadband data communications services provider in Vermont. We also provide dial-up Internet access in parts of New Hampshire.

Network. We provide voice and data services using a network comprised of telecommunications switching and related equipment that we own and telecommunications lines that we typically lease from Verizon. We operate a high capacity fiber-optic ring network in Vermont that we use to connect 10 of our largest markets in the state. As of December 31, 2005, we had approximately 9,700 voice lines and 3,000 broadband data lines.

Sales and Marketing. We sell our services primarily through a direct sales force that assists customers in choosing tailored solutions for their unique communication needs. The direct sales staff focuses on selling integrated voice and data to small and medium-sized businesses and other organizations. In Vermont, the sales force is geographically dispersed to maximize customer acquisition. Residential services are largely sold through advertising and word of mouth. We advertise on television and radio through cooperative arrangements and engage in other promotional activities from time to time.

Customers. We focus on two subsets of customers in this market: small to medium sized businesses (or SMBs) and residential customers. Our SMB customers require up to 12 telephone lines for voice communications and digital subscriber line (or DSL), broadband data communications capability. Our residential customers require voice and data communications (using either DSL or lower-speed, dial-up modems for data communications). As of December 31, 2005, we had approximately 5,800 SMB and residential voice and broadband data customers and approximately 13,500 dial-up customers.

Competition. We compete for customers by offering them a set of voice and data services designed to meet the specific needs of our two targeted subsets of customers, coupled with superior customer service and competitive pricing. Our primary competitor is Verizon, the incumbent telecommunications provider. We also compete occasionally with other competitive service providers who target small and medium sized businesses, cable companies and other Internet service providers seeking to provide voice and/or data services primarily to residential customers.

International Long Distance Services

Through our GT&T subsidiary, we are the exclusive provider of international long distance voice and data communications into and out of Guyana. We collect a payment from foreign carriers for handling international long distance calls originating from the foreign carriers’ country and terminating in Guyana. We make a payment to foreign carriers for international calls from Guyana terminating in the foreign carrier’s country and are entitled to collect from our subscribers a rate that is regulated by the Public Utilities Commission of Guyana.

For fiscal years 2003, 2004 and 2005, our revenues from international long distance services were 50%, 53% and 44%, respectively, of our consolidated revenues. Most of these revenues were from collecting settlement rate payments, which are paid in U.S. dollars, for international long distance calls into Guyana from other countries.

10

For fiscal years 2003, 2004 and 2005, inbound international long distance traffic (together with outbound collect which also entitles us to receive a settlement rate payment), was approximately 85% of our total minutes of international long distance traffic as shown in the table below:

| | International Traffic | |

| | 2003 | | 2004 | | 2005 | |

| | (minutes in thousands) | |

Inbound paid and outbound collect | | 124,341 | | | 83 | % | | 150,111 | | | 85 | % | | 156,857 | | | 85 | % | |

Outbound paid | | 25,644 | | | 17 | % | | 27,083 | | | 15 | % | | 27,386 | | | 15 | % | |

Total | | 149,985 | | | 100 | % | | 177,194 | | | 100 | % | | 184,243 | | | 100 | % | |

We estimate that over one million Guyanese live in the United States, the United Kingdom, and Canada and drive this profitable traffic to Guyana. With respect to outgoing international traffic, during the past three years, amounts collected by us for outbound international traffic have in the aggregate exceeded the payments due to foreign carriers for such traffic, and the average rate we pay for outgoing international traffic has declined significantly as well.

The rates at which we collect fees from foreign carriers for handling incoming international long distance calls, and the rates at which we pay foreign carriers for handling outgoing international calls, are established by agreement between us and the foreign carriers, and can be affected by maximum limits set by foreign telecommunications regulators, such as the Federal Communications Commission (or the FCC), as to how much carriers under their jurisdiction may pay for the termination of an international traffic in another country.

Network. Our international long distance network is linked with the rest of the world principally through our ownership of a portion of the Americas II undersea fiber optic cable, which was commissioned in October 2000. We own capacity in four international fiber optic cables—the Americas I cable, which runs from Brazil to Trinidad, the U.S. Virgin Islands and the mainland United States, the Columbus II cable, which runs from the Caribbean region to the Azores, the Eastern Caribbean Fiber System (or ECFS) cable from Trinidad to Tortola and the Americas II cable which runs from Brazil through the Caribbean to the United States with a branch through French Guiana, Suriname and Guyana. We also lease capacity on an Intelsat satellite. We have two Intelsat B earth stations, which provide both international and local services, and provide a partial back-up to our fiber optic cable capacity.

Sales and Marketing. Our international long distance business is driven by the population of Guyanese living abroad and the number of people in Guyana capable of initiating and receiving international long distance calls, which consists of wireline telephone customers and all of the wireless subscribers in Guyana (including subscribers of other wireless service providers). We do not market long distance service independent of domestic wireline and wireless services.

Customers. With respect to outgoing international long distance calls, our customers consist of our local wireline customers and wireless subscribers. With respect to incoming international long distance calls, we receive payments from foreign carriers, especially MCI (now owned by Verizon) and IDT Corporation. For 2003, 2004 and 2005, MCI accounted for approximately 20%, 16% and 8%, respectively, and IDT Corporation accounted for approximately 4%, 12% and 14%, respectively, of our consolidated revenue. See Note 2 to the Consolidated Financial Statements included in this Report.

Competition. Pursuant to our license from the Government of Guyana, we have the exclusive right to provide international long distance voice and data service into and out of Guyana. The exclusivity provisions of our license have been the subject of negotiations with the Government of Guyana. See

“—Regulation of Our GT&T Subsidiary—Other Regulatory Developments.” and “Risk Factors—Our exclusive license to provide local exchange and long distances telephone services in Guyana is subject to significant political and regulatory risk.” We have become aware of efforts to bypass our international

11

exchange and avoid paying us termination fees. We have taken action against local companies and individuals who are engaging in these efforts. In addition, we have sent letters to various foreign carriers seeking cessation of their involvement with these services, and in one case have filed an informal complaint with the FCC in the United States, and against foreign carriers, in an effort to protect our network and our rights under our license. We will continue to monitor these activities and move vigorously to defend our interests. See “Risk Factors—Any significant decline in the price or volume of international long distance calls to Guyana could adversely affect our financial condition and results.”

Employees

As of December 31, 2005, we had 853 employees (803 full-time and 50 part-time), approximately 700 were employed by our GT&T subsidiary. At the holding company level, we employ the executive management team and minimal staff. The substantial majority of the GT&T full-time work force is represented by the Guyana Postal and Telecommunications Workers Union. GT&T completed negotiations with the union in the fourth quarter of 2004 on the salaries and wages section of a new contract and signed an agreement (which applies to non-unionized personnel as well) awarding workers a 7% increase for the period from October 2004 to September 2005 and a 6% increase for the period from October 2005 to September 2006. In November 2005, GT&T successfully concluded the negotiation of the allowances which are provided to all staff in the areas of meal allowances, cashier allowances and cycle allowances. All other allowances remained the same. GT&T’s contract with the union expires in September 2006. As a result of acquiring our SoVerNet subsidiary, we added approximately 67 employees in February 2006.

We consider our employee relations to be satisfactory.

Regulation

Our telecommunications operations are subject to extensive governmental regulation. The following summary of regulatory developments and legislation does not purport to describe all present and proposed federal, state, local, and foreign regulation and legislation that may affect our businesses. Please refer to Note 11 of the financial statements included in this Report for a more detailed discussion of regulatory and litigation matters that concern our business.

Legislative or regulatory requirements currently applicable to our businesses may change in the future and legislative or regulatory requirements may be adopted by those jurisdictions that currently have none. Any such changes could impose new obligations on us that would adversely affect our operating results.

Regulation of Our GT&T Subsidiary

We are subject to regulation in Guyana under the provisions of our licenses from the Government of Guyana, the Guyana Public Utilities Commission Act of 1999 (or PUC law) and the Guyana Telecommunications Act 1990 (or Telecommunications Law). The Public Utilities Commission of Guyana (or PUC) is an independent statutory body with the principal responsibility for regulating telecommunications services in Guyana. We also have certain significant rights and obligations under the agreement pursuant to which we acquired our interests in GT&T in 1991, which we refer to as the Guyana Agreement.

Licenses. We provide domestic wireline local and long distance telephone services in Guyana pursuant to a license from the Government of Guyana granting us the exclusive right to provide public telephone, radio telephone (except private radio telephone systems which do not interconnect with our network) and pay station telephone services and national and international voice and data communications, sale of advertising in any directories of telephone subscribers and switched or non-switched private line service. Under this license, our rates for most of our services must be approved by the PUC. The license, which was issued in December 1990, has a 20 year term and is renewable for an

12

additional 20 year term at our option. We provide wireless telephone service in Guyana pursuant to a non-exclusive license from the Government of Guyana to provide wireless radio telephone service. Similarly, our wireless license was granted in December 1990 and has a 20 year term, which is renewable for an additional 20 year term at our option.

Guyana Agreement. In 1991, we entered into the Guyana Agreement, pursuant to which we agreed to provide telecommunications services for public use, including completing by February 1995 a significant expansion of those services, in Guyana in exchange for a minimum return of 15% per annum on GT&T’s capital dedicated to public use (or rate base). We believe the rate base includes GT&T’s entire property, plant and equipment pursuant to a rate of return methodology consistent with the practices and procedures of the FCC. The PUC, however, has disallowed or challenged several million dollars of franchise rights and working capital that we believe should be included in the rate base. The Guyana Agreement also provides that, upon non-renewal of our exclusive wireline license, the Government of Guyana will be entitled to purchase our interest in GT&T or the assets of GT&T upon mutually agreed upon terms or, absent such agreement, as may be determined by arbitration before the International Center for the Settlement of Investment Disputes.

PUC Law and Telecommunications Law. The PUC Law and the Telecommunications Law provide the general framework for the regulation of telecommunications services in Guyana. The PUC has authority to set rates and has certain powers to monitor our compliance with our exclusive wireline license and to require us to supply it with such technical, administrative and financial information as it may request. While we have challenged its position, the PUC claims broad authority to review and amend any of our programs for development and expansion of facilities or services.

We believe that the PUC has failed to adhere to the provisions of the Guyana Agreement guaranteeing us a minimum 15% per annum return on GT&T’s rate base as required under the current PUC Law and predecessor statutes in effect since 1990. For a description of recent actions of the PUC, see Note 11 to the Consolidated Financial Statements included in this Report.

Other Regulatory Developments. In 2001, the Government of Guyana announced its intention to introduce additional competition into Guyana’s telecommunications sector and reports and comments since that date indicate that this remains the Government’s intention. We believe that the introduction of wireline based competition would require the termination of the exclusivity provisions of our wireline license, and thus would require our consent, presumably for compensation and/or regulatory considerations such as a rebalancing of rates so that the rates for each service represent the real economic cost of providing such services. We also believe that the government is considering shifting from rate of return regulation to incentive rate-cap regulation. In February 2002, we began negotiations with the Government on these issues and all other outstanding issues between us and the Government; however, negotiations have not progressed since the second quarter of 2002. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview” and Note 11 to the Consolidated Financial Statements included in this Report.

In March 2006, the NFMU reallocated the GSM 900 MHz spectrum, which was previously divided into two 24 MHz bands (awarded to us and CelStar Guyana, Inc.), into four 12 MHz bands, with the expectation of licensing two additional wireless providers. We are in the process of analyzing the effect of this reallocation on our network. We believe the most likely impact will be a further sectorizing of our network requiring us to add cell sites or equipment to existing sites in order to maintain and increase capacity. In connection with the subdivision of the GSM 900 MHz spectrum, we have reached a preliminary agreement with the Government pursuant to which we would be granted additional GSM 1800 MHz spectrum. In January 2006, we asked the Prime Minister, who is responsible for telecommunications, to increase the frequency allocation in the Georgetown boundary area as it is becoming clear that the limited spectrum allocation is creating significant problems for operators and their customers because of

13

the constraints it imposes on network capacity. This area has a very dense population and constitutes over 40% of total wireless use in Guyana.

During 2005, GT&T became aware that GT&T’s existing wireless competition, CelStar Guyana, Inc. (or CSG), intended to apply for a second license in the GSM 900 MHz band under the name and in the corporate entity of U-Mobile. After confirming such an application, GT&T asserted that this was an improper attempt by one company to use and benefit from 50% of the GSM 900 MHz band rather than the 25% per-company allocation under the NFMU’s regime. The Prime Minister informed GT&T that the required process of public notice and comment would be adhered to and that GT&T would be given an opportunity to voice its concerns and objections before any such application was acted upon. In the interim, GT&T filed an application to the High Court asking, among other things, that the Court order the publication of U-Mobile’s application so that the lawfulness of granting such an application could be publicly considered. GT&T is not in a position at this time to predict whether U-Mobile will receive and be able to implement a license utilizing only 25% of the GSM 900 MHz spectrum or the impact of any such action on GT&T’s operations.

Another wireless service provider, Digicel, who operates a cellular 900 MHz service in other Caribbean countries, has requested or applied for a mobile license in Guyana. GT&T has strongly opposed this position and it is unclear at this time whether the Government will act on the Digicel application and, if so, when such action will occur.

FCC Rule-Making and International Long Distance Rates. The actions of telecommunications regulators, especially the FCC, affect the settlement rate payable by foreign carriers to us for handling incoming international long distance calls. In 1997, the FCC adopted mandatory international accounting and settlement rate benchmarks for many countries. In January 2002, the FCC reduced the settlement rate benchmark for low-income countries, including Guyana from $0.85 to $0.23 per minute. The reduction in the settlement rate resulted in a substantial reduction in inbound international telecommunication revenue. See “Management Discussion and Analysis of Financial Condition and Results of Operations—Overview.” In 2002, and again in 2003, AT&T proposed further reductions in the settlement rate benchmarks for many countries, including Guyana, and requested that the FCC initiate a rule-making to consider the issue. While the FCC rejected AT&T’s request in early 2004, it indicated that it will continue to monitor and evaluate settlement rate benchmarks.

U.S. Federal Regulation of Our Commnet, SoVerNet, and Choice Subsidiaries

Our operations in the United States and the U.S. Virgin Islands are governed by the Communications Act of 1934, as amended (or Communications Act), among other regulatory regimes. The Communications Act contains provisions specifically applicable to our wireless services, as well as provisions applicable to both our wireless and landline services.

Wireless Services

The FCC regulates the licensing, construction, operation, acquisition and sale of wireless systems in the United States.

Licenses. We provide our wireless services under various commercial mobile radio services (or CMRS) licenses granted by the FCC. Some of these licenses are site-based while others cover specified geographic market areas, typically Metropolitan Statistical Areas (or MSAs) or Rural Service Areas (or RSAs), as defined by the FCC. The FCC generally grants all CMRS licenses through an auction process, after determining how many licenses to make available in particular frequency ranges and the terms on which the license auction will be conducted.

14

License Renewals. These licenses generally have a 10-year term and are renewable upon application to the FCC. Licenses may be revoked for cause, and license renewal applications may be denied if the FCC determines that renewal would not serve the public interest, convenience, or necessity. At the time of renewal, if we can demonstrate that we have complied with applicable FCC rules and policies and the Communications Act, then the FCC will award a renewal expectancy to us and will generally renew our existing licenses without further considering any competing applications. If we do not receive a renewal expectancy, then the FCC will accept competing applications for the license, subject to a comparative hearing. In that situation, the FCC may award the license to another applicant. While our licenses have been renewed regularly by the FCC in the past, there can be no assurance that all of our licenses will be renewed in the future.

The FCC may deny applications and, in extreme cases, revoke licenses, if it finds that an entity lacks the requisite “character” qualifications to be a licensee. In making that determination, the FCC considers whether an applicant or licensee has been the subject of adverse findings in a judicial or administrative proceeding involving felonies, the possession or sale of unlawful drugs, fraud, antitrust violations, or unfair competition, employment discrimination, misrepresentations to the FCC or other government agencies, or serious violations of the Communications Act or FCC regulations. To our knowledge, there are no activities and no judicial or administrative proceedings involving either the licensees in which we hold a controlling interest or us that would warrant such a finding by the FCC.

With respect to some of our licenses, if we were to discontinue operation of a wireless system for a period of at least 90 continuous days, our license for that area would be automatically forfeited.

License Acquisitions. The FCC’s prior approval is required for the assignment or transfer of control of a license for a wireless system. Before we can complete a purchase or sale, we must file appropriate applications with the FCC, which the FCC then puts on public notice, typically providing the public with 30 days to oppose or comment on the proposed transaction. In addition, the FCC has implemented disclosure obligations that require licensees that assign or transfer control of a license acquired in an auction within the first three years of the license term to file associated sale contracts, option agreements, management agreements, or other documents disclosing the total consideration that the licensee would receive in return for the transfer or assignment of its license. Non-controlling minority interests in an entity that holds a FCC license generally may be bought or sold without FCC approval, subject to any applicable FCC notification requirements.

The FCC now engages in a case-by-case review of proposed transactions in which an entity would be attributed ownership of both wireless frequency blocks in an MSA market or certain amounts of CMRS spectrum. We believe the FCC’s recent changes could further increase the ability of wireless operators to attract capital or to make investments in other wireless operators. Further, the FCC now permits licensees to lease spectrum under certain conditions. Spectrum leasing provides additional flexibility for wireless providers to structure transactions and creates additional business and investment opportunities. We are leasing spectrum in certain areas.

Other Requirements. Wireless providers must satisfy a variety of FCC requirements relating to technical and reporting matters. One requirement of wireless providers is the coordination of proposed frequency usage with adjacent wireless users, permittees, and licensees in order to avoid interference between adjacent systems. In addition, the height and power of wireless base station transmitting facilities and the type of signals they emit must fall within specified parameters. Also, CMRS operators must be able to transmit 911 calls from any qualified handset without credit check or validation and are required to provide the location of the 911 caller within an increasingly narrow geographic range. CMRS operators are also required to provide 911 service for individuals with speech and hearing disabilities.

The radio systems towers that we own and lease are subject to Federal Aviation Administration and FCC regulations that govern the location, marking, lighting, and construction of towers and are subject to

15

the requirements of the National Environmental Policy Act, National Historic Preservation Act, and other environmental statutes enforced by the FCC. The FCC has also adopted guidelines and methods for evaluating human exposure to radio frequency emissions from radio equipment. We believe that all of our radio systems on towers that we own or lease comply in all material respects with these requirements, guidelines, and methods.

In August 2005, the FCC initiated a proceeding to review the rules governing roaming services, or arrangements between CMRS operators when one operator’s subscribers make or receive calls over a second operator’s network. We cannot predict the net impact of any changes in the roaming rules on us.

Wireless and Wireline Services

In general, all telecommunications providers are obligated to contribute to the federal Universal Service Fund (or USF), which provides wireline and wireless telephone service to individuals and families qualifying for federal assistance or households located in remote areas. Contributions to the federal USF are based on end user interstate telecommunications revenue. Some states have similar programs which require contribution based on end user intrastate telecommunications revenue.

Amendments to the Communications Act encourage competition in local telecommunications markets by removing barriers to market entry and imposing on non-rural incumbent local exchange carriers (or ILECs), among other things, duties to:

· negotiate interconnection agreements at any technically feasible point on just, reasonable, and non-discriminatory rates, terms, and conditions;

· provide access to certain unbundled network elements (or UNEs), such as local loops and interoffice transport, or combinations of UNEs at nondiscriminatory, cost-based rates;

· provide physical collocation, which allows competitive local exchange carriers (or CLECs), such as SoVerNet, to install and maintain its network termination equipment in an ILEC’s central office or to obtain functionally equivalent forms of interconnection under certain circumstances;

· provide access to poles, ducts, conduits, and rights-of-way on a reasonable, non-discriminatory basis;

· offer retail local telephone services to resellers at discounted wholesale rates;

· when a call originates on its network, compensate other telephone companies for terminating or transporting the call;

· provide dialing parity, which ensures that customers are able to route their calls to telecommunications service providers without having to dial additional digits;

· provide notice of changes in information needed for another carrier to transmit and route services using its facilities; and

· provide telephone number portability, so customers may keep the same telephone number if they switch service providers.

In addition, under section 271 of the Communications Act, the Bell Operating Companies (or BOCs) have an obligation to provide certain network elements, including certain network elements (for example, local switching) that have been removed from the mandatory list of network elements that must be unbundled under section 251 of the Communications Act. The BOCs are required to provide network elements made available under section 271 of the Communications Act under a “just and reasonable” pricing standard.

16

SoVerNet operates in a region where the ILEC is required to comply with the above-mentioned statutory provisions, and, accordingly, has benefited from the reduced costs in acquiring required communication services, such as ILEC interconnection, and has benefited from the right to receive compensation for the termination of traffic. Provisions relating to interconnection, telephone number portability, equal access, and resale could, however, subject us to increased competition and additional economic and regulatory burdens.

Choice has not similarly benefited from these provisions, because, in contrast to SoVerNet, Choice operates in a region where the ILEC is classified as a rural ILEC, such that under section 251(f) of the Communications Act, the rural ILEC is exempt from certain unbundling and other obligations that are set forth in section 251(c) of the Communications Act.

Internet Services

We provide Internet access services as an Internet service provider (or ISP). The FCC has classified such services as information services, so they are not subject to various regulatory obligations that are imposed on common carriers, such as paying access charges or contributing to the Universal Service Fund. On September 23, 2005, the FCC announced a policy of ensuring neutral access to and operation of the Internet. SBC and Verizon, the two largest ILECs, agreed to conduct their businesses in compliance with the FCC policy as a condition of the FCC’s approval of their acquisitions of AT&T and MCI (now owned by Verizon), respectively. We, however, do not know to what extent or in what context the FCC will enforce these policies, and whether the FCC will constrain any ILEC actions taken in contravention of these policies. There may be new legislation or further FCC action to address access to the Internet, and we cannot predict the impact of any such actions on our results or operations. Also, the FCC generally preempts state and local regulation of information services.

State Regulation of Our Commnet and SoVerNet Subsidiaries

Federal law preempts state and local regulation of the entry of, or the rates charged by, any CMRS provider. As a practical matter, we are free to establish rates and offer new products and service with a minimum of regulatory requirements. The states in which we operate maintain nominal oversight jurisdiction. For example, although states do not have the authority to regulate the entry or the rates charged by CMRS providers, states may regulate the “other terms and conditions” of a CMRS provider’s service. Most states still maintain some form of jurisdiction over complaints as to the nature or quality of services and as to billing issues. Since states may continue to regulate “other terms and conditions” of wireless service, and a number of state authorities have initiated actions or investigations of various wireless carrier practices, the outcome of these proceedings is uncertain and could require us to change certain of our practices and ultimately increase state regulatory authority over the wireless industry. States and localities assess on wireless carriers such as us, taxes and fees that may equal or even exceed federal obligations.

The location and construction of our wireless transmitter towers and antennas are subject to state and local environmental regulation, as well as state or local zoning, land use and other regulation. Before we can put a system into commercial operation, we must obtain all necessary zoning and building permit approvals for the cell site and tower locations. The time needed to obtain zoning approvals and requisite state permits varies from market to market and state to state. Likewise, variations exist in local zoning processes. If zoning approval or requisite state permits cannot be obtained, or if environmental rules make construction impossible or infeasible on a particular site, our network design might be adversely affected, network design costs could increase and the service provided to our customers might be reduced.

17

Regulation of Our Choice Subsidiary

Our operations in the U.S. Virgin Islands are regulated by the FCC and governed by the Communications Act. Like other states, the U.S. Virgin Islands has a Public Services Commission (or PSC) that oversees public utilities including the local telephone company. We are not regulated by the PSC, however, we often appear before the PSC in our efforts to provide competitive telecommunications services in the U.S. Virgin Islands.

In 2002, we petitioned the PSC for classification as an “Eligible Telecommunications Carrier” (or ETC), which would permit us to apply for federal funds to deploy telecommunications services in rural and high-cost areas. In 2004, the PSC concluded that it lacked jurisdiction to decide this issue and directed the petition to the FCC. In January 2005, we filed a petition for ETC status with the FCC, which is pending. If we are designated an ETC, a significant capital investment may be necessary to build out the capabilities to sustain the ETC designation and meet the requirements for federal support.

In July 2004, the FCC released an Order revising the rules and spectrum band plan applicable to the Broadband Radio Service and Educational Broadband Service. These are the spectrum bands through which we operates our video and broadband data services. The new rules restructure these bands and could impact our operations and customers. We have objected to the new rules and requested an opportunity to opt-out of the new band plan. We are working to minimize the potential negative impact on us and, in 2005, obtained from the FCC additional spectrum in which to operate.

Regulation of Our BDC Affiliate

In Bermuda, our BDC affiliate is subject to Bermuda’s Telecommunications Act 1986, as amended. In November 2005, the Minister of Telecommunications and Technology directed BDC to cease offering certain data services through its “Bull” branded wireless modem. While BDC has appealed the directive in Bermuda court claiming that the directive contravenes BDC’s license to provide data services and BDC’s long history of providing data services, we cannot guarantee that BDC’s claim will prevail in court. This directive has no impact on BDC’s wireless voice services.

Taxation—Guyana

GT&T’s worldwide income is subject to Guyanese tax at a rate of 45% of taxable income. The Guyana Agreement provides that the repatriation of dividends to Atlantic Tele-Network and any payment of interest on GT&T debt denominated in foreign currency are not subject to withholding taxes. It also provides that fees payable by GT&T to Atlantic Tele-Network or any of its subsidiaries for management services shall be payable in foreign currency and shall not be subject to currency restrictions or withholding or other Guyana taxes. GT&T has a number of tax issues pending before the Guyana revenue authorities or the Guyana courts. See “Risk Factors—Risk Relating to Our Wireless and Wireline Services in Guyana—GT&T is engaged in significant tax disputes with the Guyanese tax authorities which could adversely affect our financial condition and results of operations.” Note 11 to the Consolidated Financial Statements included in this Report.

Taxation—United States

As a U.S. corporation, Atlantic Tele-Network is subject to U.S. federal income taxation on its worldwide net income, currently at rates up to 35% of taxable income. Due to the 2005 acquisition of Commnet Wireless, LLC and its classification as a domestic partnership for U.S. tax purposes, Atlantic Tele-Network has included its pro rata share of Commnet’s taxable income in its U.S. taxable income. In February 2006, Atlantic Tele-Network acquired SoVerNet, Inc., also a domestic based company.

18

In general, a U.S. corporation is only subject to U.S. taxation on the earnings and profits (or E&P) of a foreign corporation when they are actually distributed. However, there are exceptions for certain types of income of a controlled foreign corporation ("CFC") that may require E&P to be included in the United States parent's taxable income before it is actually distributed.

GT&T is a CFC for purposes of the Subpart F provisions of the Internal Revenue Code of 1986, as amended or the Code. Under those provisions, Atlantic Tele-Network may be required to include in income certain E&P at the time such E&P are earned by GT&T, or at certain other times prior to being distributed to Atlantic Tele-Network. These earnings are referred to as “Subpart F” income. In general, to the extent E&P are distributed in a later year, the previously taxed amounts are not subject to U.S. taxation upon the distribution. For the current year, Atlantic Tele-Network has included into U.S. income a portion of the unremitted E&P of GT&T. Pursuant to the foreign tax credit provisions of the Code, and subject to complex limitations contained under those provisions, Atlantic Tele-Network is entitled to credit foreign withholding taxes on dividends or interest received, and foreign corporate income taxes of its subsidiaries paid with respect to income distributed as dividends or income inclusions under Subpart F from such subsidiaries, against Atlantic Tele-Network’s U.S. federal income tax.

On October 22, 2004, the American Jobs Creation Act, which addressed multiple areas of U.S. taxation, was signed into law. For Atlantic Tele-Network, the most relevant sections included an increased carryforward period of certain foreign tax credits from 5 years to 10 years and increased ability to offset Alternative Minimum Tax (or AMT) with foreign tax credits. As of the end of 2005, Atlantic Tele-Network has a foreign tax credit carryforward of approximately $11 million. These credits begin expiring in 2011. Based upon current projections and planning, Atlantic Tele-Network currently estimates that it is more likely than not that $5.8 million of these credits will expire unutilized. The Company has therefore placed a valuation allowance of $5.8 million against the foreign tax credit carryforward. As of the end of 2005, Atlantic Tele-Network has Alternative Minimum Tax Credits of approximately $600,000. The AMT credits have no expiration date.

Historically, Atlantic Tele-Network’s overall effective tax rate exceeds the effective tax rates for Guyana and the U.S. The higher effective tax rate is attributable to reserves provided for uncertain tax positions in Guyana, the operating losses with respect to Choice Communications that Atlantic Tele-Network has not been able to derive any tax benefits from and state taxes that have resulted from the acquisition of Commnet.

A U.S. corporation is classified as a Personal Holding Company (or PHC) if (a) more than 50% of its capital stock is owned directly or indirectly by or for five or fewer individuals (or pension plans); and (b) at least 60% of its adjusted ordinary gross income consists of certain types of income (principally passive income, including interest and dividends) included in the Code definition of “PHC Income.” For any taxable year that a corporation is a PHC, the “undistributed personal holding company income” of such corporation for that year (i.e., the net income of the corporation as reflected on its U.S. corporate income tax return, with certain adjustments, minus, in general, federal income tax and dividends distributed or deemed distributed for this purpose) would be subject to an additional PHC tax of 15%. Atlantic Tele-Network currently satisfies the above ownership criterion but we believe Atlantic Tele-Network does not satisfy the income criterion for classification as a PHC for 2004 and 2005.

19

Available Information

Our website address is www.atni.com. The information on our website is not incorporated by reference in this Report and you should not consider information provided on our website to be part of this Report. You may access, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, plus amendments to such reports as filed or furnished pursuant to Section 13(a)or 15(d) of the Securities Exchange Act of 1934, as amended, through the “Financial Statements and Federal Filings” portion of our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. In addition, paper copies of these documents may be obtained free of charge by writing to us at 10 Derby Square, Salem, Massachusetts 01970, Attention: Investor Relations; or by calling us at (978) 745-8106.

We have adopted a written Code of Business Conduct and Ethics that applies to all of our employees and directors, including, but not limited to, our principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. Our code of conduct is incorporated by reference as an exhibit to this Report.

ITEM 1A. RISK FACTORS

Risks Relating to Our Wireless and Wireline Services in Guyana

Our exclusive license to provide local exchange and long distance telephone services in Guyana is subject to significant political and regulatory risk.

Since 1991, our subsidiary Guyana Telephone and Telegraph Company, Limited (or GT&T) has operated in Guyana pursuant to a license from the Government of Guyana to be the exclusive provider of local exchange and long distance services. From time to time, Guyana Government officials have publicly stated their intention to revoke or terminate the license and have made efforts to enact legislation that would allow for competition in areas that are precluded by the exclusivity terms. President Bharrat Jagdeo has publicly stated that it is a priority of his administration to enable other telecommunications companies to provide wireline services covered by our exclusive license, as well as to increase the number of wireless service providers. While we would seek to enforce our rights under the exclusive wireline license and believe that we would be entitled to damages for any termination of that license, we cannot guarantee that we would prevail in any court or arbitration proceedings.

We are highly dependent on GT&T for a substantial majority of our revenues and profits. Approximately 85% of our consolidated revenue for the year ended December 31, 2005 were generated by GT&T. As of December 31, 2005, we have invested approximately $228 million in Guyanese telecommunications infrastructure. Any modification, early termination or other revocation of the exclusive wireline license could adversely affect a substantial majority of our revenues and profits and diminish the value of our investment in Guyana.

Any significant decline in the price or volume of international long distance calls to Guyana could adversely affect our financial condition and results.

We collect payments from foreign carriers for handling international long distance calls originating from the foreign carriers’ countries and ending in Guyana. The payments, which are based on volume and payment rates, are pursuant to arrangements we have with the foreign carriers and are subject to the actions of telecommunications regulators, such as the U.S. Federal Communications Commission (or FCC). For the year ended December 31, 2005, our revenues from GT&T’s international long distance services were $45.4 million (or 44% of our consolidated revenue for 2005) and constituted a significant portion of our profits. Most of these revenues and profits were from collecting payments for international long distance calls into Guyana from other countries.

20