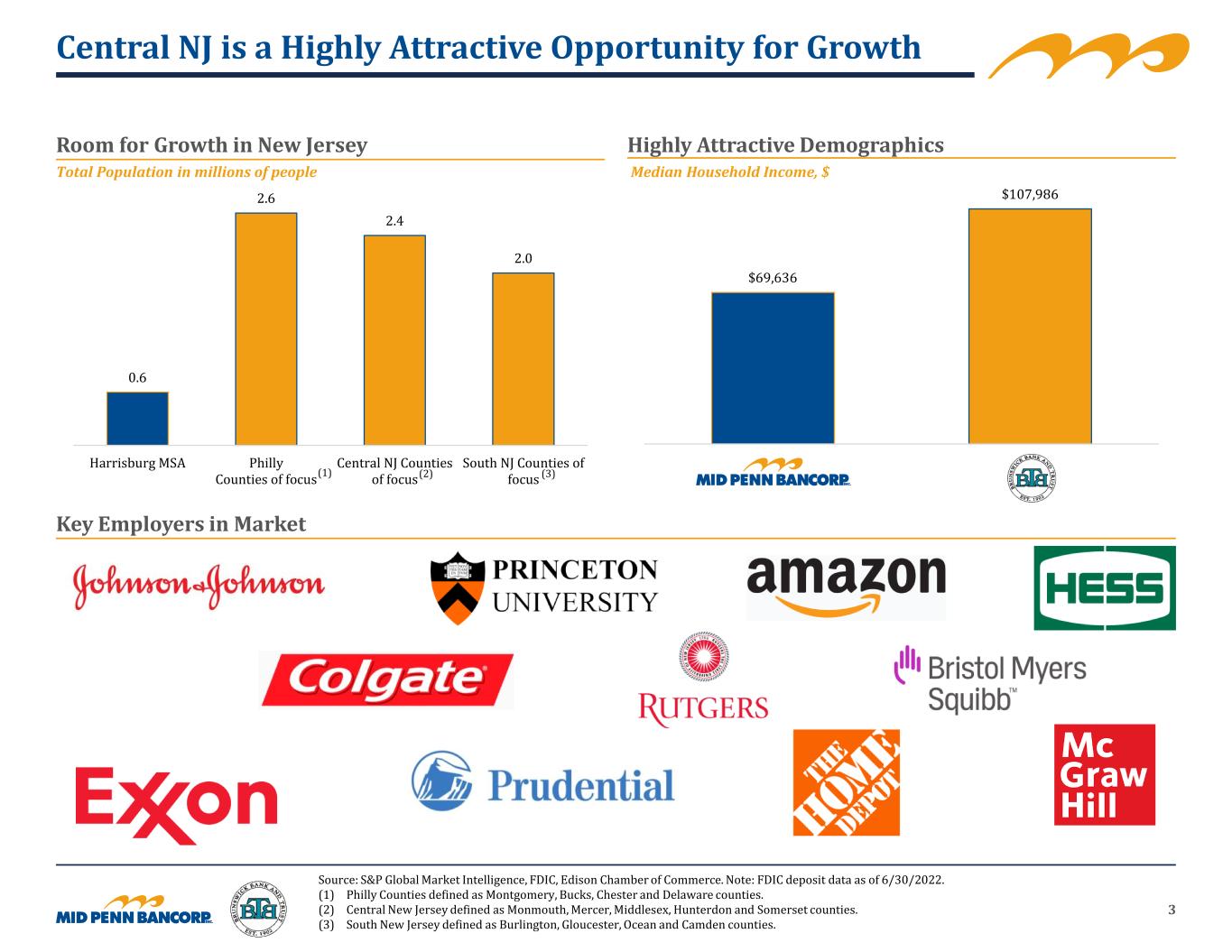

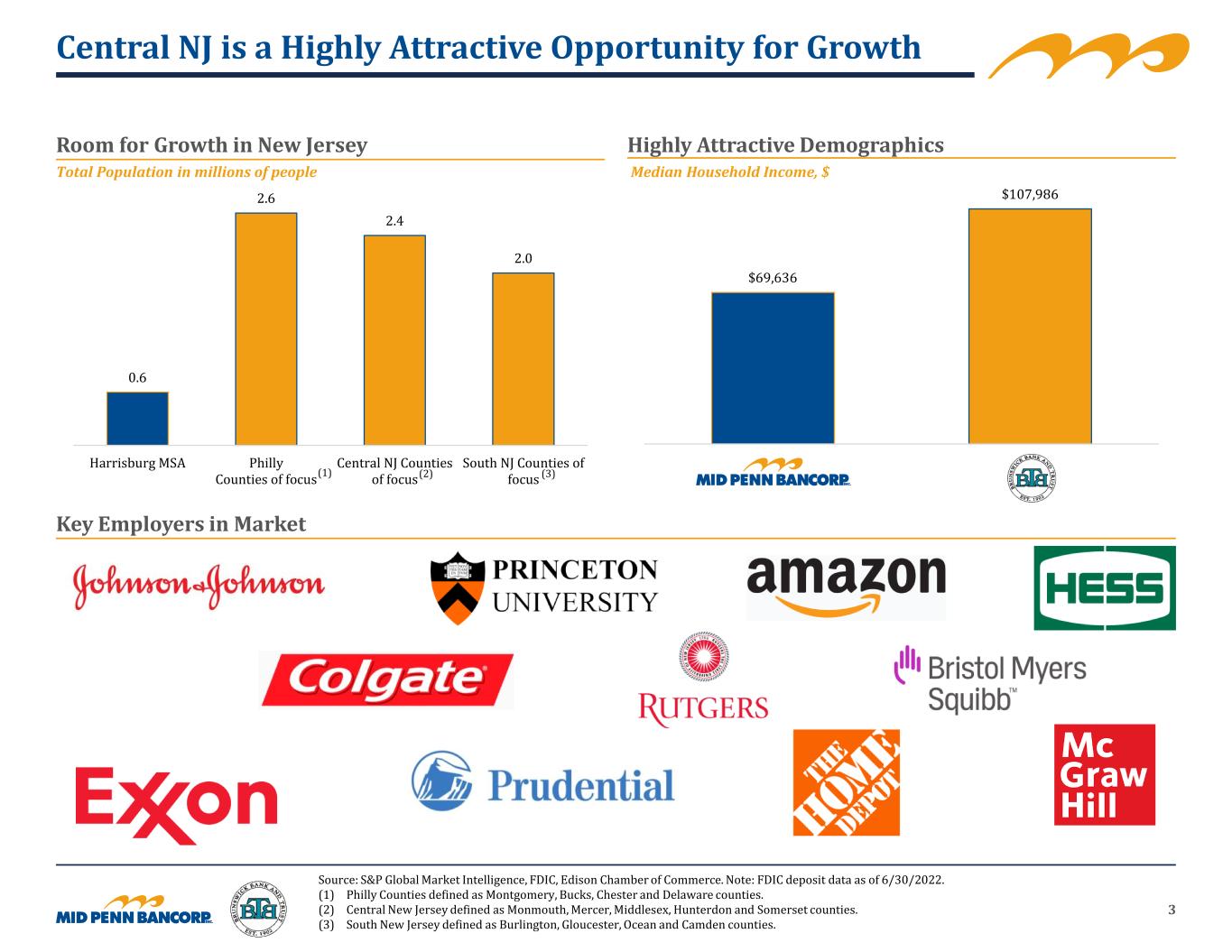

3 $69,636 $107,986 MPB BRBW Overall Central NJ is a Highly Attractive Opportunity for Growth Key Employers in Market Highly Attractive Demographics Median Household Income, $ Source: S&P Global Market Intelligence, FDIC, Edison Chamber of Commerce. Note: FDIC deposit data as of 6/30/2022. (1) Philly Counties defined as Montgomery, Bucks, Chester and Delaware counties. (2) Central New Jersey defined as Monmouth, Mercer, Middlesex, Hunterdon and Somerset counties. (3) South New Jersey defined as Burlington, Gloucester, Ocean and Camden counties. Room for Growth in New Jersey Total Population in millions of people 0.6 2.6 2.4 2.0 Harrisburg MSA Philly Counties of focus Central NJ Counties of focus South NJ Counties of focus (1) (2) (3)

4 $101,900 $109,236 $90,407 $70,856 Philly Counties of focus Central NJ Counties of focus South NJ Counties of focus State of PA 6.1% 5.4% 7.1% 2.2% Philly Counties of focus Central NJ Counties of focus South NJ Counties of focus State of PA Capitalizing on Market Disruption Sizeable Markets Above Average Growth and Wealth $737 Billion in Total Market Deposits Source: S&P Global Market Intelligence, FDIC. Note: FDIC deposit data as of 6/30/2022. (1) Central New Jersey defined as Monmouth, Mercer, Middlesex, Hunterdon and Somerset counties. (2) South New Jersey defined as Burlington, Gloucester, Ocean and Camden counties. (3) Philly Counties defined as Montgomery, Bucks, Chester and Delaware counties. Philadelphia MSA $535 Bn Total Deposits in the Market Top 3: Capital One, TD Bank, Wells 2023 Median Household IncomePopulation Change 2010 - 2023 (3) ✓ Lakeland Bancorp / 1st Constitution Bancorp ✓ OceanFirst Financial Corp. / Two River Bancorp ✓ OceanFirst Financial Corp. / Capital Bank of New Jersey ✓ OceanFirst Financial Corp. / Sun Bancorp ✓ Northfield Bancorp / Hopewell Valley ✓ Citizens Financial Services / HV Bancorp ✓ WSFS Financial Corp / Bryn Mawr Bank Corporation ✓ Citizens & Northern Corporation / Covenant Financial ✓ S&T Bancorp DNB Financial Corporation ✓ WSFS Financial Corp / Beneficial Bancorp The market area has undergone significant consolidation since 2016 (3) Philadelphia MSA Central/South Jersey Central NJ(1) $137 Bn Total Deposits in the Market Top 3: PNC, BofA, Wells South NJ(2) $65 Bn Total Deposits in the Market Top 3: TD Bank, Wells, PNC Focused on Growing the Broader Philadelphia + Central/Southern NJ Markets MPB Harrisburg MSA $19 Bn Total Deposits in the Market Top 3: PNC, M&T, F.N.B.

5 Important Additional Information This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of a vote or approval with respect to the proposed acquisition by Mid Penn Bancorp, Inc. (“Mid Penn”) of Brunswick Bancorp (“Brunswick”). No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed transaction, Mid Penn has filed with the U.S. Securities and Exchange Commission (the “SEC) a Registration Statement on Form S-4 that includes a joint proxy statement of Mid Penn and Brunswick and a prospectus of Mid Penn (the “Joint Proxy/Prospectus”), and Mid Penn may file with the SEC other relevant documents concerning the proposed transaction. The definitive Joint Proxy/Prospectus has been mailed to shareholders of Mid Penn and Brunswick. SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY/PROSPECTUS REGARDING THE PROPOSED TRANSACTION CAREFULLY AND IN THEIR ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY MID PENN, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MID PENN, BRUNSWICK AND THE PROPOSED TRANSACTION. Investors may obtain a free copy of the Joint Proxy/Prospectus, as well as other filings containing information about Mid Penn and Brunswick, at the SEC’s website (www.sec.gov). Copies of these documents can also be obtained, free of charge, by contacting Mid Penn Bancorp, Inc., 2407 Park Drive, Harrisburg, Pennsylvania 17110, attention: Investor Relations (telephone 717-692-7105); or Brunswick Bancorp 439 Livingston Avenue, New Brunswick, New Jersey 08901, attention: David Gazerwitz, Chief Financial Officer or Nicholas Frungillo, Jr., President and CEO (telephone 732-247-5800). Participants in the Solicitation Mid Penn, Brunswick and their respective directors, executive officers, and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from Mid Penn and/or Brunswick shareholders in connection with the proposed transaction under the rules of the SEC. Information regarding Mid Penn’s directors and executive officers is available in its definitive proxy statement relating to its 2023 Annual Meeting of Shareholders, which was filed with the SEC on March 24, 2023, and its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 16, 2023, and other documents filed by Mid Penn with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the Joint Proxy/Prospectus and other relevant materials filed with the SEC, which may be obtained free of charge as described in the preceding paragraph. Safe Harbor for Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, expectations or predictions of future financial or business performance, conditions relating to Mid Penn and Brunswick, or other effects of the proposed merger on Mid Penn and Brunswick. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may,” or by variations of such words or by similar expressions. These forward- looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements are made only as of the date of this filing, and neither Mid Penn nor Brunswick undertakes any obligation to update any forward-looking statements contained in this presentation to reflect events or conditions after the date hereof. Actual results may differ materially from those described in any such forward-looking statements. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward-looking statements: the failure to obtain shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all or other delays in completing the transaction; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement; the outcome of any legal proceedings that may be instituted against Mid Penn or Brunswick; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; the dilution caused by Mid Penn’s issuance of additional shares of its capital stock in connection with the transaction; the timing of closing the transaction; difficulties and delays in integrating the business or fully realizing cost savings and other benefits of the transaction; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of products and services; increased competition in the markets of Mid Penn and Brunswick; success, impact, and timing of business strategies of Mid Penn and Brunswick; economic conditions, including downturns in the local, regional or national economies; the impact, extent and timing of technological changes; changes in accounting policies or practices; changes in laws and regulations; actions of the Federal Reserve Board and other legislative and regulatory actions and reforms; and other factors that may affect the future results of Mid Penn and Brunswick. Additional factors that could cause results to differ materially from those described above can be found in the Joint Proxy/Prospectus, Mid Penn’s Annual Report on Form 10-K for the year ended December 31, 2022, and in Mid Penn’s subsequent Quarterly Reports on Form 10-Q, including in the respective Risk Factors sections of such documents, as well as in subsequent SEC filings, each of which is on file with the SEC and available in the “Investors” section of Mid Penn’s website, www.midpennbank.com, under the heading “SEC Filings”, and in other documents Mid Penn files with the SEC. Disclosures