1 DRAFT 04.07.2021 MID PENN BANCORP, INC. Investor Presentation February 2025

2 Important Additional Information and Where to Find It This presentation is solely for informational purposes and has been prepared to assist interested parties in making their own evaluation of Mid Penn Bancorp, Inc. (the Company or “Mid Penn”) and does not purport to contain all of the information that may be relevant. This communication does not constitute an offer to sell, or a solicitation of an offer to buy, any securities or the solicitation of a vote or approval with respect to the proposed acquisition by Mid Penn of William Penn Bancorporation (“William Penn”), in any jurisdiction in which or from any person to whom it is not lawful to make any such offer or solicitation in such jurisdiction. Neither the U.S. Securities and Exchange Commission (“SEC”) nor any other regulatory body has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. The Merger The proposed Merger will be submitted to the shareholders of William Penn and Mid Penn for their consideration and approval. In connection with the proposed Merger, Mid Penn has filed with the SEC a registration statement on Form S-4, which includes a joint proxy statement of Mid Penn and William Penn and a prospectus of Mid Penn and other relevant documents concerning the proposed transaction. INVESTORS AND SHAREHOLDERS OF MID PENN AND WILLIAM PENN ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors can obtain a free copy of the joint proxy statement/prospectus, as well as other filings containing information about Mid Penn and William Penn, free of charge from the SEC’s website (www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, free of charge, or by contacting Mid Penn Bancorp, Inc., 2407 Park Drive, Harrisburg, Pennsylvania, 17110, attention: Investor Relations (telephone (717) 692-7105); or William Penn Bancorporation, 10 Canal Street, Suite 104, Bristol, Pennsylvania 19007, attention: Kenneth J. Stephon, President and CEO (telephone (267) 540-8500). Participants in the Solicitation Mid Penn, William Penn and their respective directors, executive officers, and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from Mid Penn and/or William Penn shareholders in connection with the proposed Merger transaction under the rules of the SEC. Information regarding the directors and executive officers of Mid Penn and William Penn is available in each company’s respective most recent definitive proxy statement filed with the SEC and other documents filed by Mid Penn and William Penn with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC, which may be obtained free of charge as described in the preceding paragraph. Cautionary Note Regarding Forward-Looking Statements Statements included in this presentation which are not historical in nature or do not relate to current facts are intended to be, and are hereby identified as, forward-looking statements for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are based on, among other things, Mid Penn Bancorp, Inc. (the “Company” or “MPB”) management’s and William Penn Bancorporation (“William Penn” or “WMPN”) management’s beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the economy and the Company and William Penn. Words and phrases such as “may,” “approximately,” “continue,” “should,” “expects,” “projects,” “anticipates,” “is likely,” “look ahead,” “look forward,” “believes,” “will,” “intends,” “estimates,” “strategy,” “plan,” “could,” “potential,” “possible” and variations of such words and similar expressions are intended to identify such forward-looking statements. These forward-looking statements may include expectations relating to the anticipated opportunities and financial and other benefits of the business combination transaction between the Company and William Penn, and the projections of, or guidance on, the Company’s or the combined company’s future financial performance, asset quality, liquidity, capital levels, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Company’s business or financial results. The Company and William Penn caution readers that forward-looking statements are subject to certain risks and uncertainties that are difficult to predict with regard to, among other things, timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks and uncertainties include, among others, the following possibilities: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement entered into between the Company and William Penn; the outcome of any legal proceedings that may be instituted against the Company or William Penn; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the business combination transaction) and shareholder approvals or to satisfy any of the other conditions to the business combination transaction on a timely basis or at all; the possibility that the anticipated benefits of the business combination transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where the Company and William Penn do business; the possibility that the business combination transaction may be more expensive to complete than anticipated; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the business combination transaction; changes in the Company’s share price before the closing of the business combination transaction; risks relating to the potential dilutive effect of shares of the Company common stock to be issued in the business combination transaction; and other factors that may affect future results of the Company, William Penn and the combined company. Additional factors that could cause results to differ materially from those described in this presentation can be found in the “Risk Factors” section of the Registration Statement and Joint Proxy Statement/Prospectus, as well as in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, William Penn’s Annual Report for the year ended June 30, 2024, and in other documents that the Company and William Penn file with the SEC, which are available at the SEC’s website at www.sec.gov. All forward-looking statements, expressed or implied, included in this presentation are expressly qualified in their entirety by the cautionary statements contained or referred to herein. If one or more events related to these or other risks or uncertainties materialize, or if the Company’s or William Penn’s underlying assumptions prove to be incorrect, actual results may differ materially from what the Company and William Penn anticipate. The Company and William Penn caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and are based on information available at that time. Neither the Company nor William Penn assumes any obligation to update or otherwise revise any forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. Disclaimer

3 Market and Industry Data Unless otherwise indicated, market data and certain industry forecast data used in this presentation were obtained from third party sources and other publicly available information. While the Company believes these sources to be reliable as of the date of this presentation, the Company has not independently verified such information, and makes no representation as to its accuracy, adequacy, fairness or completeness. Data regarding the industries in which the Company and William Penn compete and their respective market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond the Company’s control. In addition, assumptions and estimates about the Company and its industries’ future performance industries are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause future performance to differ materially from assumptions and estimates. Company and William Penn Data Data about the Company provided in this presentation, including financial information, has been prepared by Company management. Data about William Penn provided in this presentation, including financial information, has been obtained from William Penn management and its public filings with the SEC. Combined Franchise Forward-Looking Data Neither the Company’s nor William Penn’s independent registered public accounting firms have studied, reviewed or performed any procedures with respect to the combined franchise forward-looking financial data for the purpose of inclusion in this presentation, and, accordingly, neither have expressed an opinion or provided any form of assurance with respect thereto for the purpose of this presentation. These combined franchise forward- looking financial data are for illustrative purposes only and should not be relied on as necessarily being indicative of future results. The assumptions and estimates underlying the combined franchise forward-looking financial data are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information, including those in the “Forward-Looking Statements” disclaimer above. Combined franchise forward-looking financial data is inherently uncertain due to a number of factors outside of the Company’s or William Penn’s control. Accordingly, there can be no assurance that the prospective results are indicative of future performance of the combined company after the proposed acquisition or that actual results will not differ materially from those presented in the combined franchise forward-looking financial data. Inclusion of combined franchise forward-looking financial data in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Non-GAAP Financial Measures This presentation includes certain financial measures derived from consolidated financial data but not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company believes that these non-GAAP measures, when taken together with its financial results presented in accordance with GAAP, provide meaningful supplemental information regarding its operating performance and facilitate internal comparisons of its historical operating performance on a more consistent basis These non-GAAP financial measures however are subject to inherent limitations, may not be comparable to similarly titled measures used by other companies and should not be considered in isolation or as an alternative to GAAP measures. Please refer to the Appendix for reconciliations of the non-GAAP financial measures to their most directly comparable GAAP financial measures. Disclaimer

4 Experienced Management Team Source: Company Documents. Years in Industry Years at MPB PositionExecutive 3816Chair, President & Chief Executive OfficerRory G. Ritrievi 1815 Sr. EVP / President of Commercial and Consumer Banking & Chief Revenue Officer Scott W. Micklewright 1812Sr. EVP / Chief Financial Officer Justin T. Webb 3811Sr. EVP / Chief Retail OfficerJoan E. Dickinson 257Sr. EVP / Market President & Chief Lending OfficerHeather R. Hall 172Sr. EVP / President of the Private Bank & Chief Operating OfficerJordan D. Space 388First EVP / Director of Trust & Wealth ManagementJoseph L. Paese, CFP 5315EVP / President of Commercial Real EstateRay M. Mincarelli, Jr. 2114EVP / Chief Technology & Chief Information OfficerJohn Paul Livingston 158EVP / Chief Risk OfficerZachary C. Miller 303EVP / Chief Credit OfficerPaul W. Spotts 2519First Sr. VP / Chief Data OfficerMatthew L. Miller 3813First Sr. VP / Senior Operations ManagerPaul F. Spiegel 1912First Sr. VP / Chief Administrative OfficerMargaret E. Steinour 27.411.1Average:

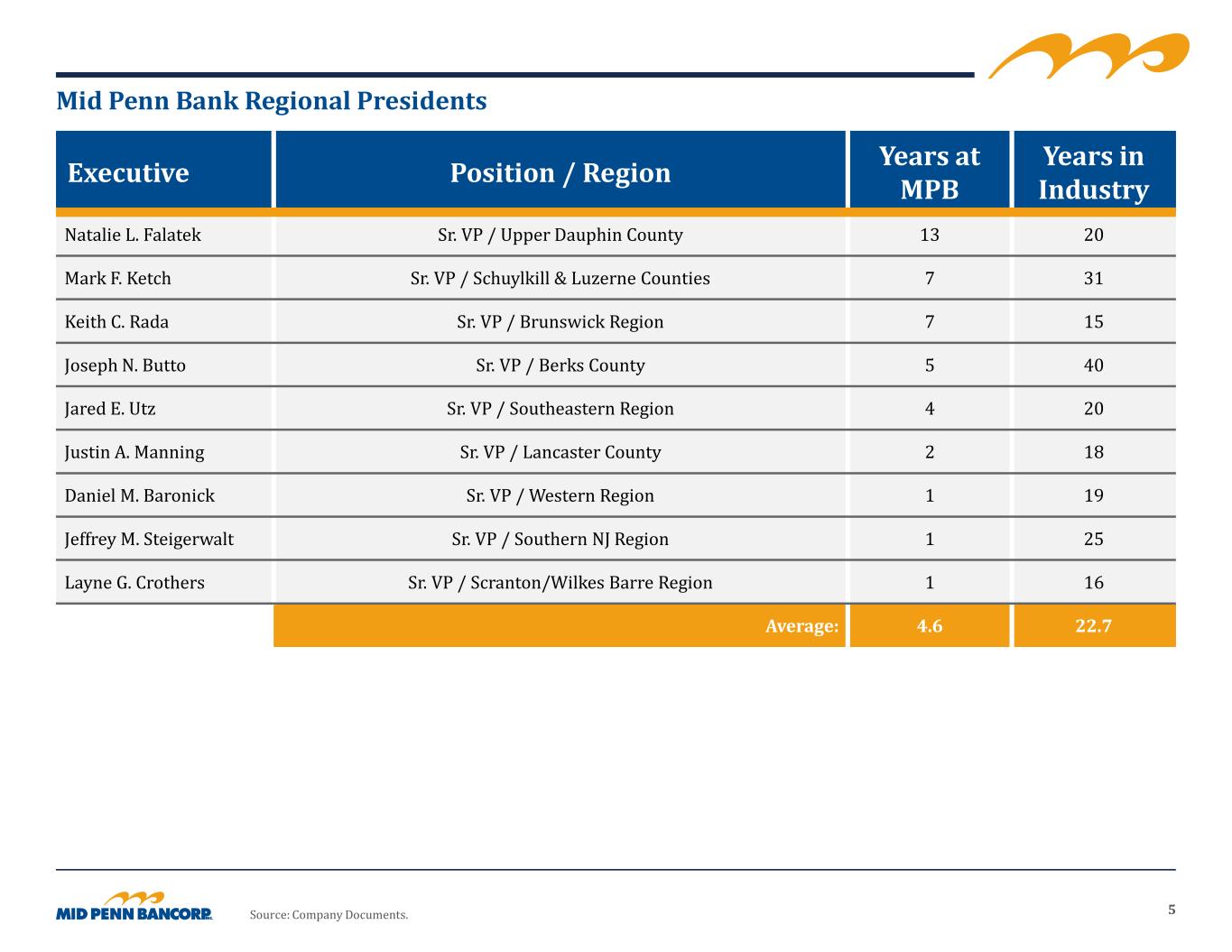

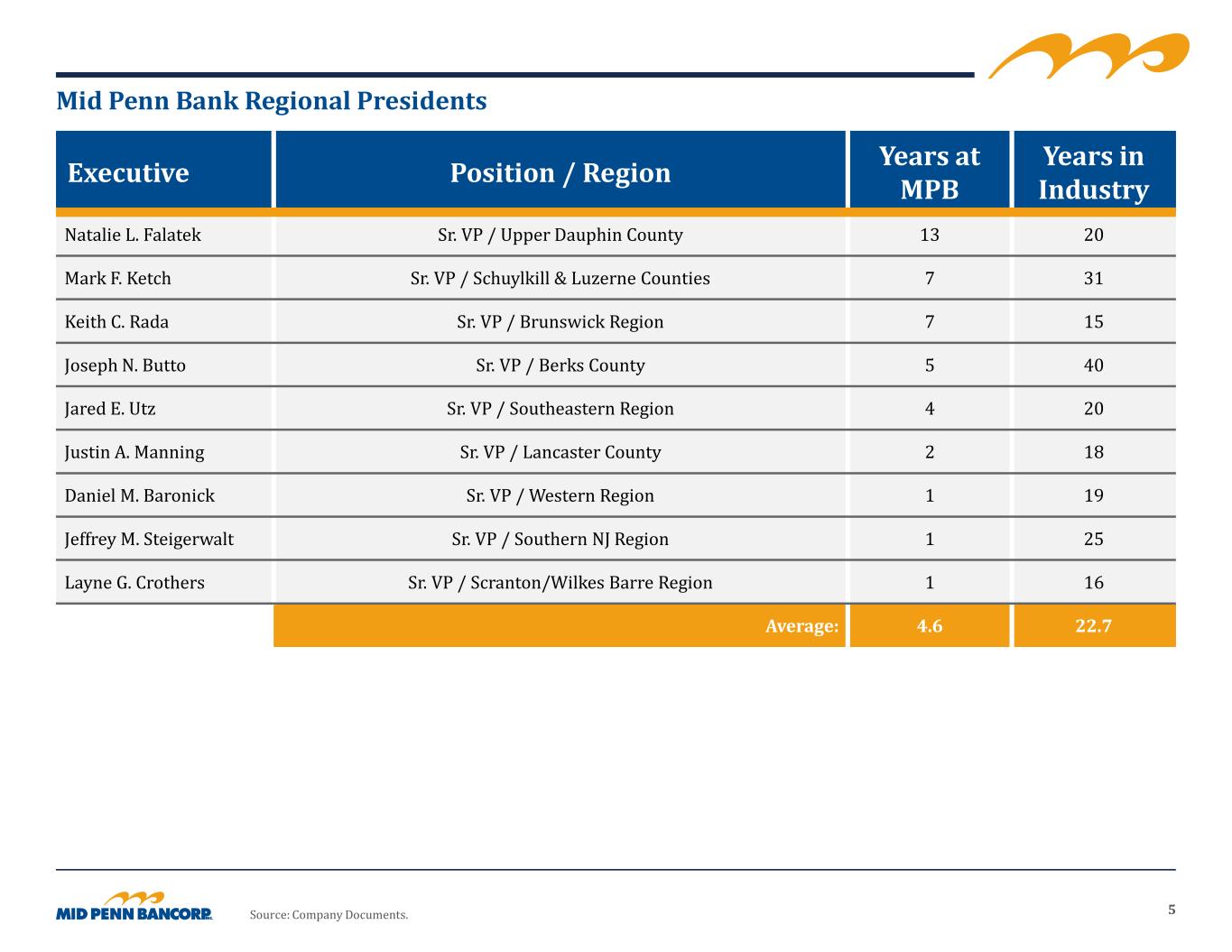

5 Mid Penn Bank Regional Presidents Source: Company Documents. Years in Industry Years at MPB Position / RegionExecutive 2013Sr. VP / Upper Dauphin CountyNatalie L. Falatek 317Sr. VP / Schuylkill & Luzerne CountiesMark F. Ketch 157Sr. VP / Brunswick RegionKeith C. Rada 405Sr. VP / Berks CountyJoseph N. Butto 204Sr. VP / Southeastern RegionJared E. Utz 182Sr. VP / Lancaster CountyJustin A. Manning 191Sr. VP / Western RegionDaniel M. Baronick 251Sr. VP / Southern NJ RegionJeffrey M. Steigerwalt 161Sr. VP / Scranton/Wilkes Barre RegionLayne G. Crothers 22.74.6Average:

6 I. Company Overview & 2024 Q4 Update

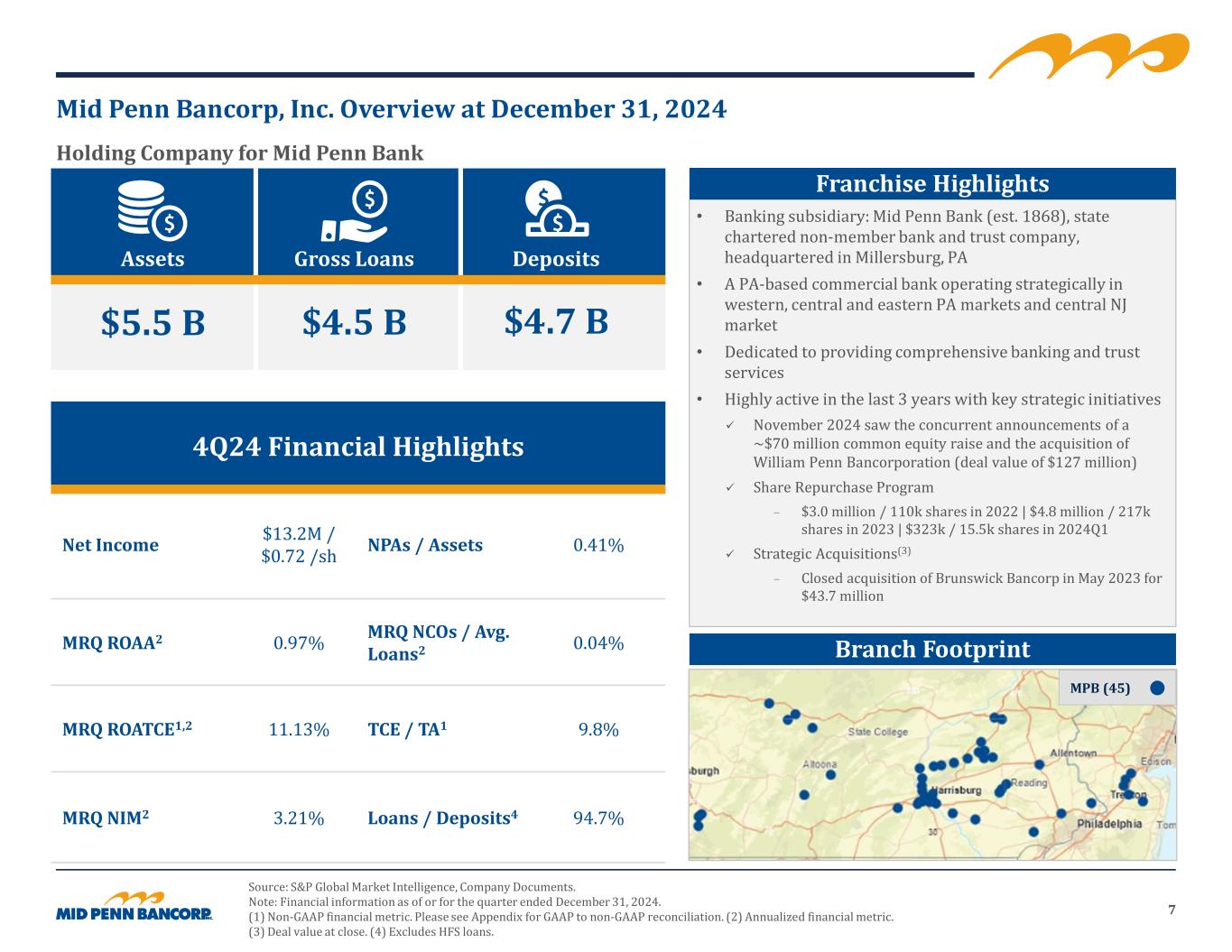

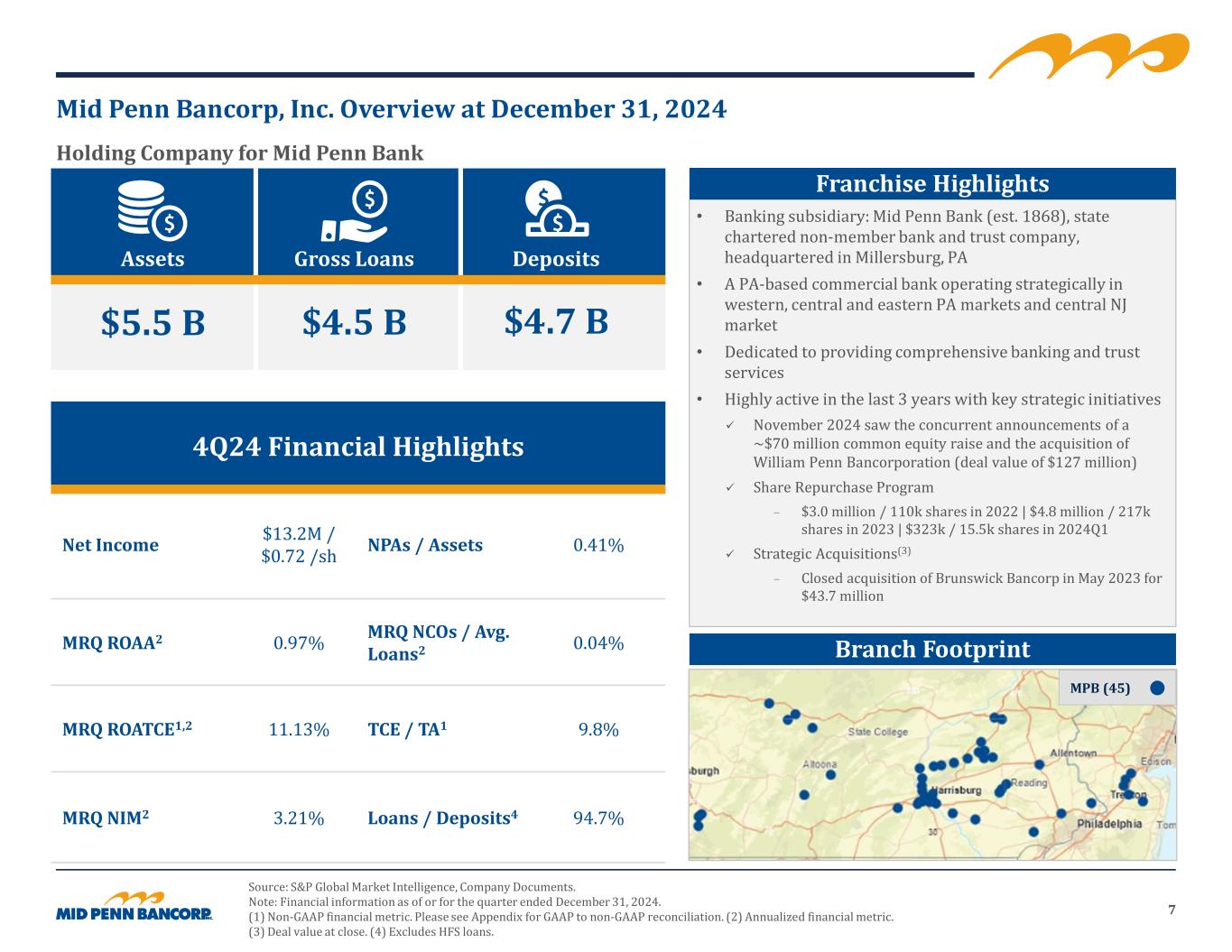

7 Mid Penn Bancorp, Inc. Overview at December 31, 2024 Source: S&P Global Market Intelligence, Company Documents. Note: Financial information as of or for the quarter ended December 31, 2024. (1) Non-GAAP financial metric. Please see Appendix for GAAP to non-GAAP reconciliation. (2) Annualized financial metric. (3) Deal value at close. (4) Excludes HFS loans. • Banking subsidiary: Mid Penn Bank (est. 1868), state chartered non-member bank and trust company, headquartered in Millersburg, PA • A PA-based commercial bank operating strategically in western, central and eastern PA markets and central NJ market • Dedicated to providing comprehensive banking and trust services • Highly active in the last 3 years with key strategic initiatives November 2024 saw the concurrent announcements of a ~$70 million common equity raise and the acquisition of William Penn Bancorporation (deal value of $127 million) Share Repurchase Program – $3.0 million / 110k shares in 2022 | $4.8 million / 217k shares in 2023 | $323k / 15.5k shares in 2024Q1 Strategic Acquisitions(3) – Closed acquisition of Brunswick Bancorp in May 2023 for $43.7 million Assets Gross Loans Deposits $5.5 B $4.5 B $4.7 B Holding Company for Mid Penn Bank Franchise Highlights 4Q24 Financial Highlights 0.41%NPAs / Assets $13.2M / $0.72 /sh Net Income 0.04% MRQ NCOs / Avg. Loans20.97%MRQ ROAA2 9.8%TCE / TA111.13%MRQ ROATCE1,2 94.7%Loans / Deposits43.21%MRQ NIM2 MPB (45) Branch Footprint

8 0.77% 0.91% 2023Y 2024Y $4.3 $4.7 2023Q4 2024Q4 $4.3 $4.4 2023Q4 2024Q4 Source: S&P Global Market Intelligence, Company Documents. Note: Financial information as of or for the quarter ended December 31, 2024. Momentum & Growth Across the Board Total Gross Loans ($B) Total Deposits ($B) 3.05% 3.23% 2023Q4 2024Q4 Net Interest Margin $24.67 $26.90 2023Q4 2024Q4 Tangible Book Value per Share 98% 95% 2023Y 2024Y Return on Average Assets Loans / Deposits Ratio

9 Compelling Investment Thesis Demonstrated track record of outsized shareholder value creation Successful whole-bank acquiror Exceptional asset quality and nicely diversified & granular commercial loan portfolio Strong profitability ratios, in-line or better than national peers Well-balanced deposit franchise with best-in-class growth rates in NIB accounts Significant opportunity to grow in the highly desirable greater Philadelphia metropolitan area

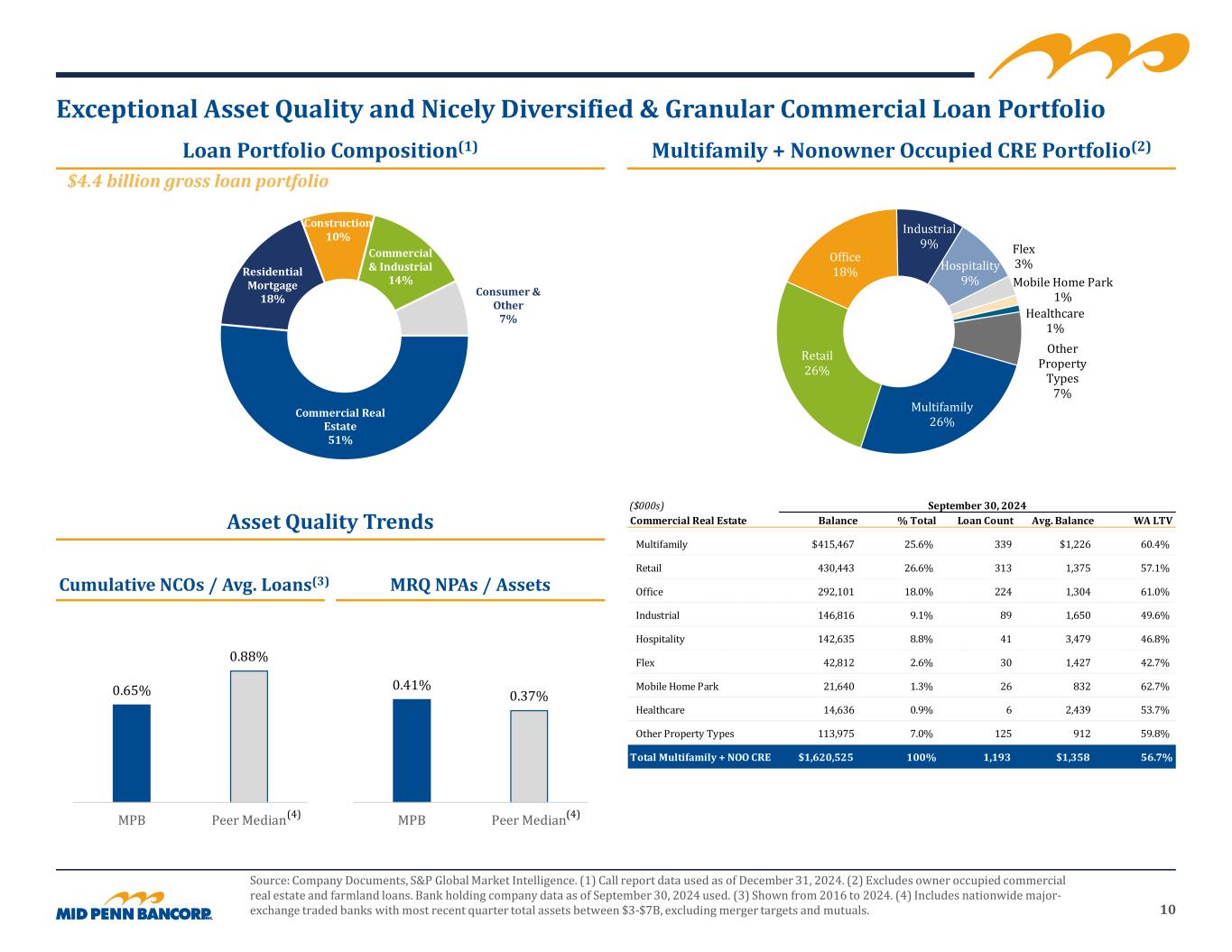

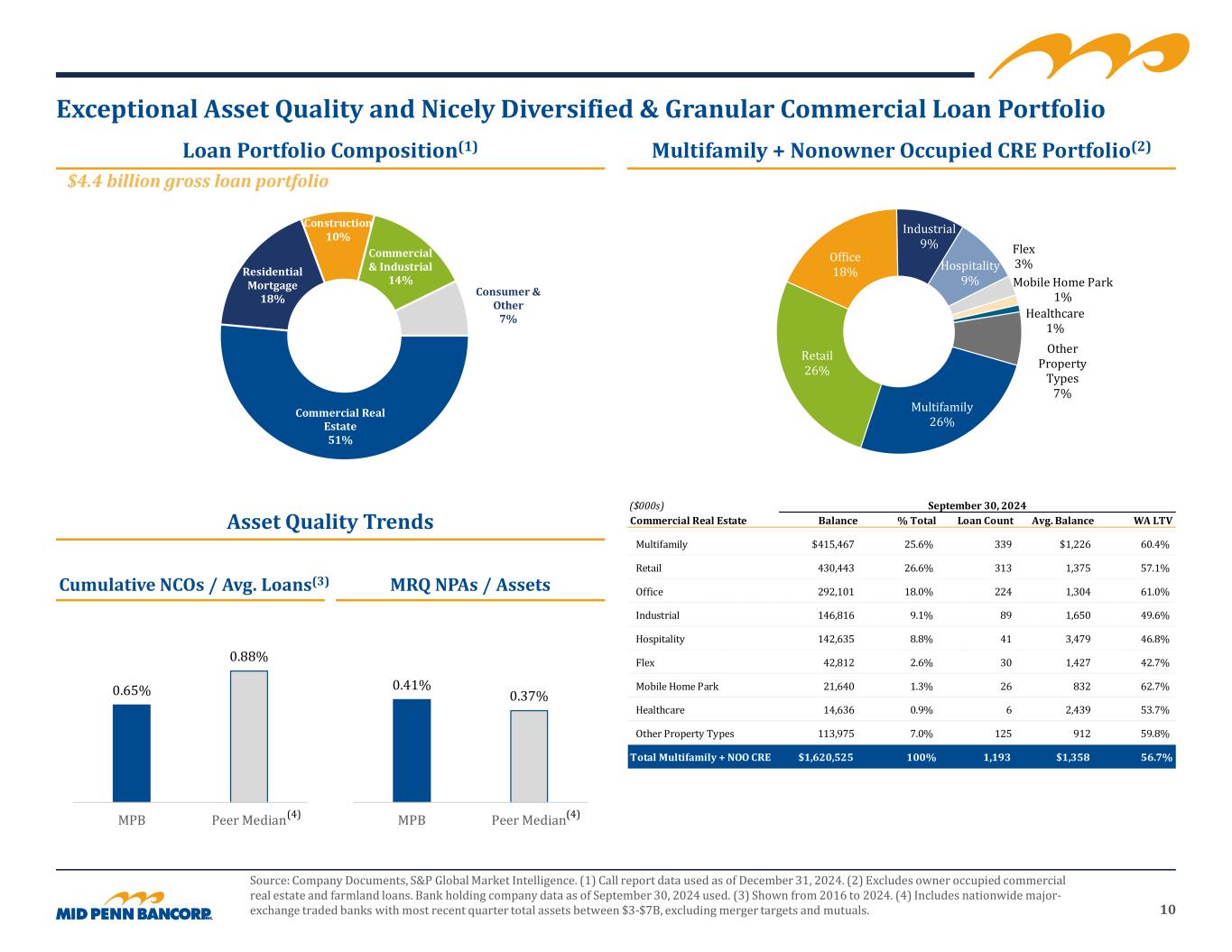

10 Multifamily 26% Retail 26% Office 18% Industrial 9% Hospitality 9% Flex 3% Mobile Home Park 1% Healthcare 1% Other Property Types 7% Cumulative NCOs / Avg. Loans(3) $4.4 billion gross loan portfolio Commercial Real Estate 51% Residential Mortgage 18% Construction 10% Commercial & Industrial 14% Consumer & Other 7% 0.41% 0.37% MPB Peer Median 0.65% 0.88% MPB Peer Median Exceptional Asset Quality and Nicely Diversified & Granular Commercial Loan Portfolio Source: Company Documents, S&P Global Market Intelligence. (1) Call report data used as of December 31, 2024. (2) Excludes owner occupied commercial real estate and farmland loans. Bank holding company data as of September 30, 2024 used. (3) Shown from 2016 to 2024. (4) Includes nationwide major- exchange traded banks with most recent quarter total assets between $3-$7B, excluding merger targets and mutuals. (4)(4) Loan Portfolio Composition(1) Multifamily + Nonowner Occupied CRE Portfolio(2) Asset Quality Trends MRQ NPAs / Assets ($000s) September 30, 2024 Commercial Real Estate Balance % Total Loan Count Avg. Balance WA LTV Multifamily $415,467 25.6% 339 $1,226 60.4% Retail 430,443 26.6% 313 1,375 57.1% Office 292,101 18.0% 224 1,304 61.0% Industrial 146,816 9.1% 89 1,650 49.6% Hospitality 142,635 8.8% 41 3,479 46.8% Flex 42,812 2.6% 30 1,427 42.7% Mobile Home Park 21,640 1.3% 26 832 62.7% Healthcare 14,636 0.9% 6 2,439 53.7% Other Property Types 113,975 7.0% 125 912 59.8% Total Multifamily + NOO CRE $1,620,525 100% 1,193 $1,358 56.7%

11 II. William Penn Transaction Overview

12 Noninterest- bearing Deposits 9% IB Checking 21% Money Market 27% Savings 13% Time Deposits 30% Overview of the Transactions Source: Company Documents. Note: Standalone data as of December 31, 2024. (1) Based on MPB’s closing stock price of $31.88 as of 10/30/2024, WMPN common shares outstanding of 9,208,217 and economic value of in-the-money options. (2) Bank level regulatory data used. (3) 12/31/2024 GAAP data used. Strategic Acquisition of William Penn • All-stock combination • Aggregate deal value of $127 million(1) ($119 million post-ESOP loan pay-down) • Combined assets of $6.3 billion ‒ MPB: $5.5 billion assets at 12/31/2024 ‒ WMPN: $796 million assets at 12/31/2024 • Materially expands presence in the broader Philadelphia region including Bucks County, and southern and central NJ • Financially compelling ‒ Lowers combined loan/deposit ratio and CRE concentration ratio ‒ Double digit accretive to EPS and 20-50bps accretive to capital ratios ‒ Short TBV earn back (2.4 years inclusive of purchase accounting) Key Highlights as of 12/31/2024 $796M Total Assets $627M Total Deposits $470M Total Gross Loans $119M Tangible Common Equity 75% Loan / Deposit 116% CRE / TRBC(2) 15.0% TCE / TA • Founded in 1870 • Headquartered in Bristol, Pennsylvania (Bucks County) • Since 2018, WMPN has completed three acquisitions and in 2021 completed a 2nd-step mutual-to-stock conversion raising $126 million in proceeds • Low risk, high quality franchise with excess capital and a granular, low-cost deposit base Loans / Deposits WMPN Total Deposits(3) 2.46% Cost of Total IB Deposits 94.7% 74.9% MPB WMPN 2024Q4

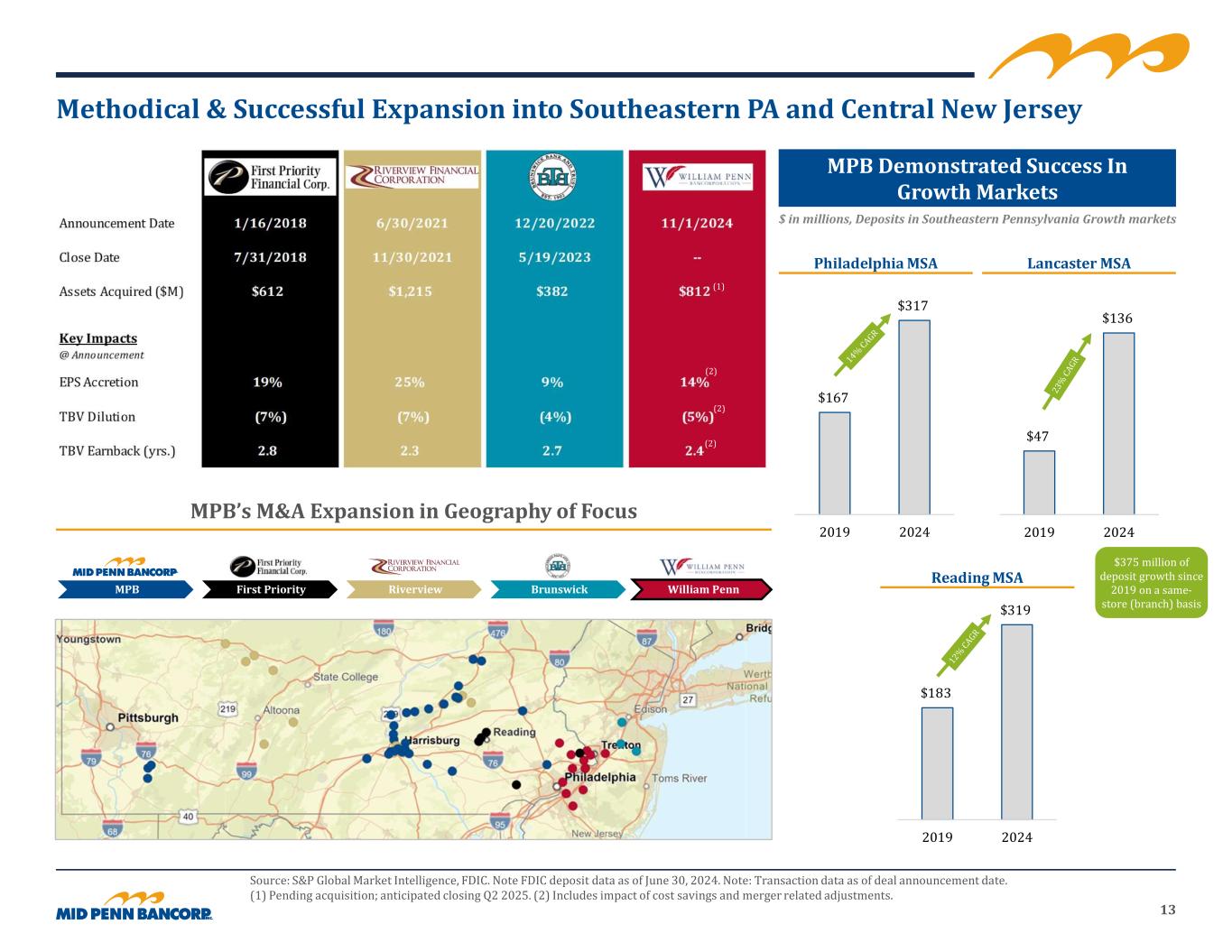

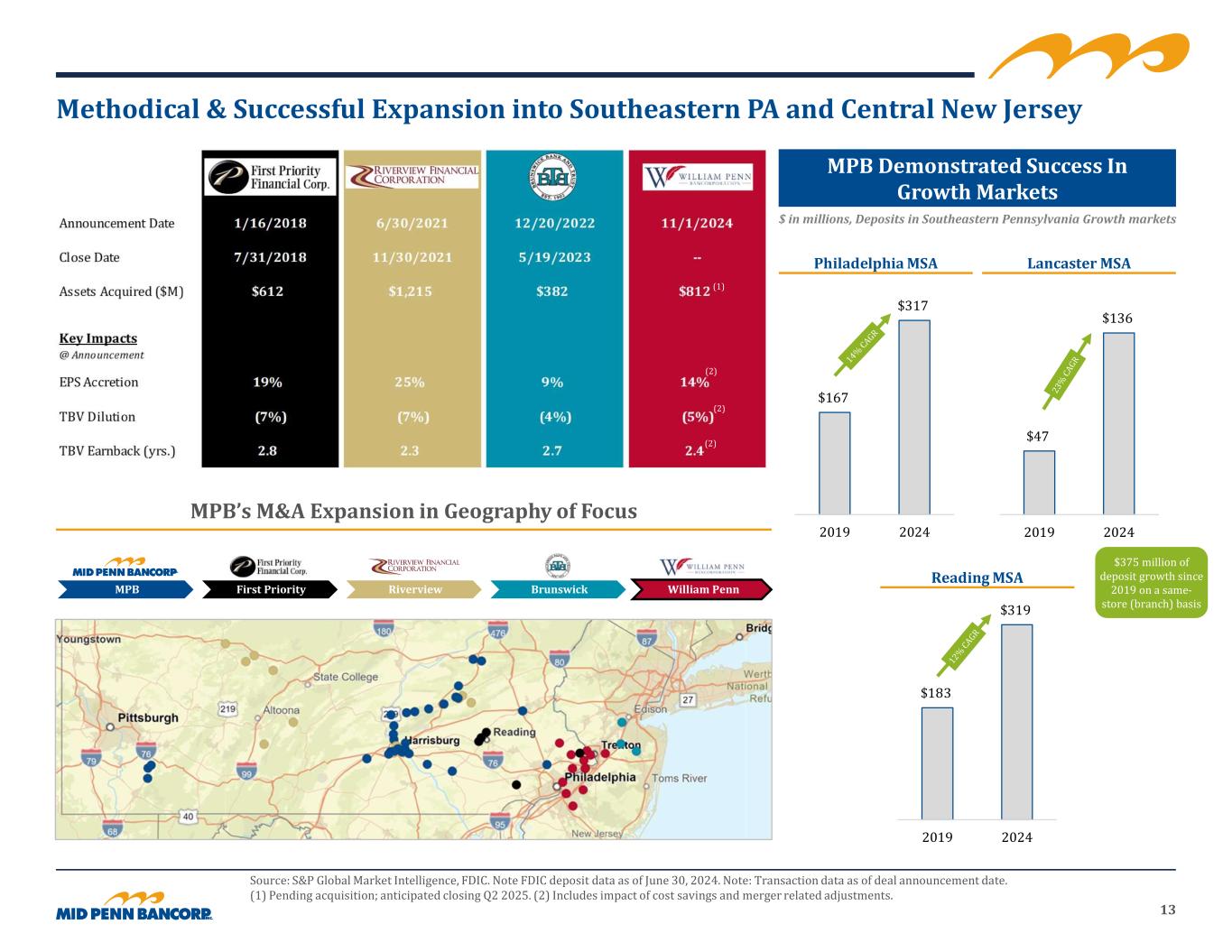

13 $47 $136 2019 2024 Methodical & Successful Expansion into Southeastern PA and Central New Jersey Source: S&P Global Market Intelligence, FDIC. Note FDIC deposit data as of June 30, 2024. Note: Transaction data as of deal announcement date. (1) Pending acquisition; anticipated closing Q2 2025. (2) Includes impact of cost savings and merger related adjustments. MPB First Priority $167 $317 2019 2024 Riverview Brunswick William Penn (1) (2) MPB Demonstrated Success In Growth Markets $ in millions, Deposits in Southeastern Pennsylvania Growth markets Philadelphia MSA Lancaster MSA $183 $319 2019 2024 Reading MSA $375 million of deposit growth since 2019 on a same- store (branch) basis MPB’s M&A Expansion in Geography of Focus (2) (2)

14 Significant Opportunity to Grow in Highly Desirable Greater Philadelphia Metro Area Source: S&P Global Market Intelligence, FDIC. Note: FDIC deposit data as of June 30, 2024. (1) Last reported assets between $1-$20 billion and with deposits in the Philadelphia MSA since 2014; list is ranked by last available deposits per FDIC in the MSA and excludes mutuals and specialty single branch entities. (2) Defined as the Philadelphia MSA excluding Gloucester, Camden, and Burlington counties. (3) Central New Jersey defined as Monmouth, Mercer, Middlesex, Hunterdon and Somerset counties. (4) Southern New Jersey defined as Burlington, Gloucester, Ocean and Camden counties. (5) Pro forma for acquisition of WMPN, excludes purchase accounting and merger related adjustments. The market is in need of a mid-size, $5-$10 billion community-focused bank following the material amount of consolidation over the last 10 years (5) Sizeable Markets: Broader Philadelphia(2) $517B Deposits 71% Top 3 Deposit Market Share Top 3: Capital One TD Bank Wells Fargo Central NJ(3) $125B Deposits 46% Top 3 Deposit Market Share Top 3: PNC Bank of America Wells Fargo Southern NJ (4) $60B Deposits 58% Top 3 Deposit Market Share Top 3: TD Bank Wells Fargo PNC 6M+ Population (8th largest MSA) 550K+ Businesses (9th largest MSA) $700B+ in Total Market Deposits 10 Year Lookback: Top Community Banks in the Philadelphia MSA(1) (5)

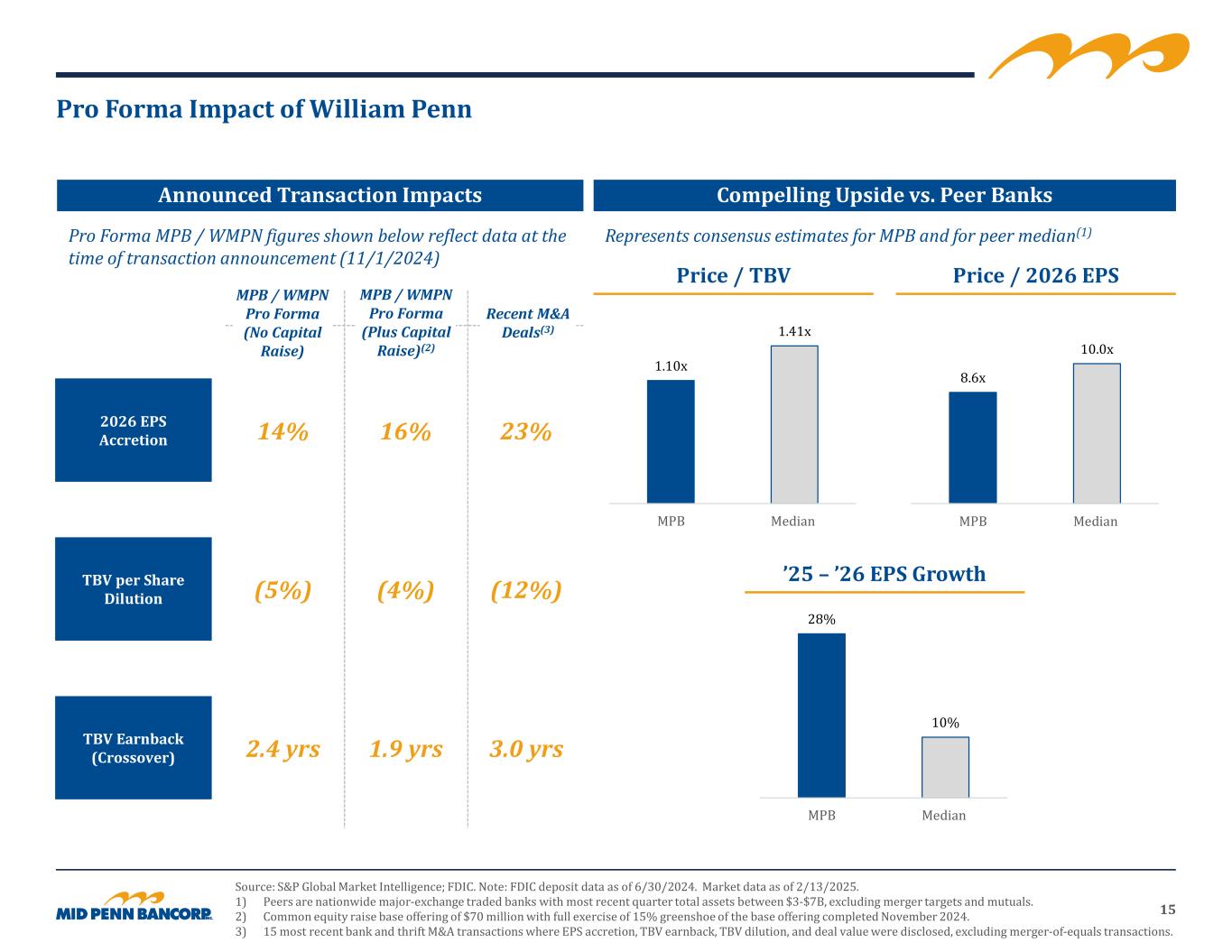

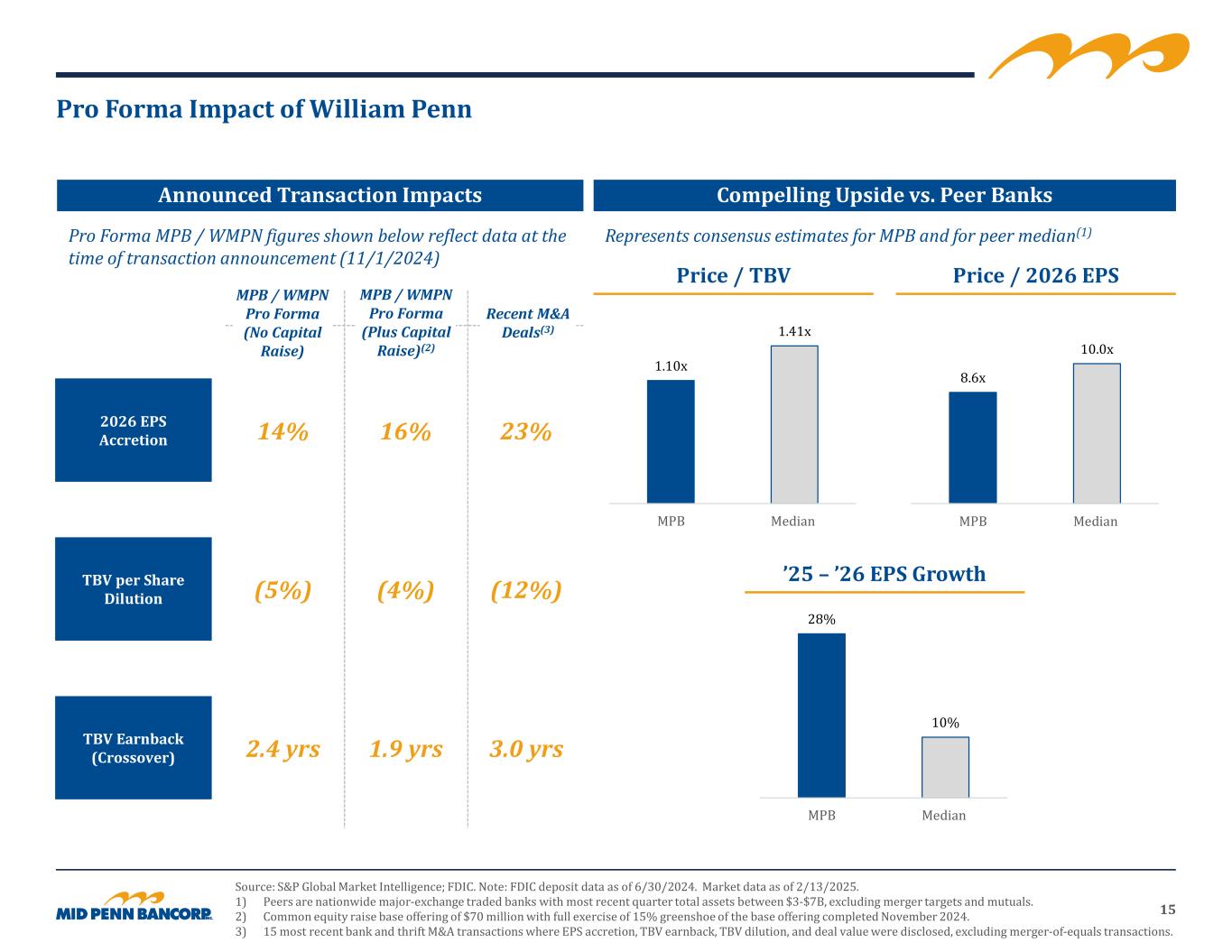

15 Pro Forma Impact of William Penn Source: S&P Global Market Intelligence; FDIC. Note: FDIC deposit data as of 6/30/2024. Market data as of 2/13/2025. 1) Peers are nationwide major-exchange traded banks with most recent quarter total assets between $3-$7B, excluding merger targets and mutuals. 2) Common equity raise base offering of $70 million with full exercise of 15% greenshoe of the base offering completed November 2024. 3) 15 most recent bank and thrift M&A transactions where EPS accretion, TBV earnback, TBV dilution, and deal value were disclosed, excluding merger-of-equals transactions. Pro Forma MPB / WMPN figures shown below reflect data at the time of transaction announcement (11/1/2024) Announced Transaction Impacts Price / TBV Price / 2026 EPS Compelling Upside vs. Peer Banks Represents consensus estimates for MPB and for peer median(1) ’25 – ’26 EPS Growth 28% 10% MPB Median 1.10x 1.41x MPB Median 8.6x 10.0x MPB Median 2026 EPS Accretion TBV per Share Dilution TBV Earnback (Crossover) MPB / WMPN Pro Forma (No Capital Raise) MPB / WMPN Pro Forma (Plus Capital Raise)(2) Recent M&A Deals(3) 14% 16% 23% (5%) (4%) (12%) 2.4 yrs 1.9 yrs 3.0 yrs

16 III. Long-Term Value Creation

17 33% 39% 6% 13% MPB Core MPB GAAP Peer Median KRX Median 157% 126% 122% MPB Peer Median KRX Median Conclusion & Demonstrated Track Record of Outsized Shareholder Value Creation Source: S&P Global Market Intelligence. Note: Market data as of February 13, 2025. (1) Shown from February 13, 2015 to February 13, 2025. (2) Includes nationwide major-exchange traded banks with most recent quarter total assets between $3- $7B, excluding merger targets and mutuals. (3) Absolute percent change shown. (4) Core per S&P Global Market Intelligence used for Peers. See appendix for MPB Core EPS reconciliations. (2) 2019-2024 EPS Growth(3)(4) (2) 10-Year Total Shareholder Return (TSR)(1) The proposed acquisition of William Penn materially increases our presence in one of the best markets in the United States Triple accretive acquisition: Increases EPS, increases capital ratios, and lowers CRE concentration & loan/deposit levels The completed capital raise in late 2024 will provide the dry powder to fully unlock the organic growth potential in the greater Philadelphia market 2024Q4 showcased momentum across the board: organic growth, profitability margins and capital generation

18 Appendix

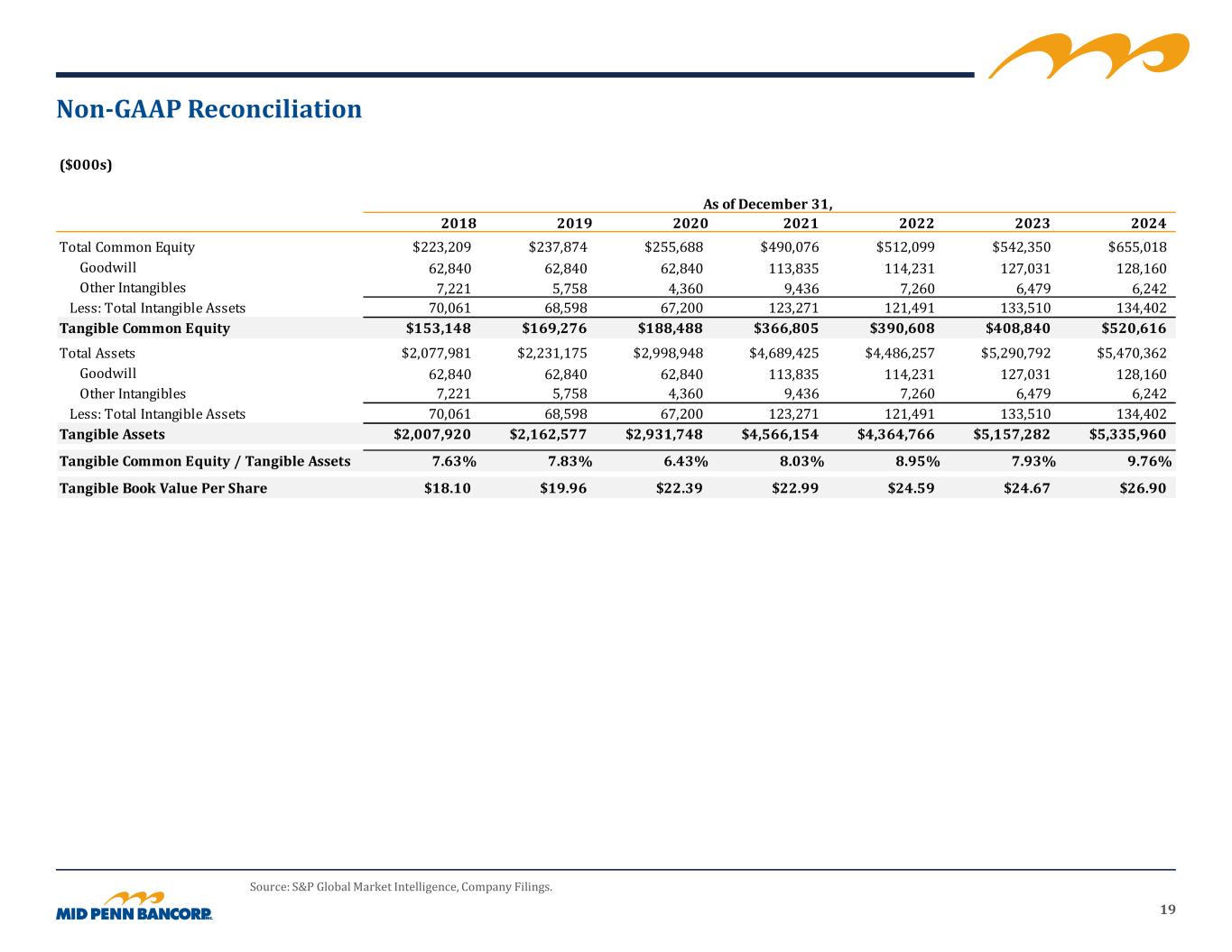

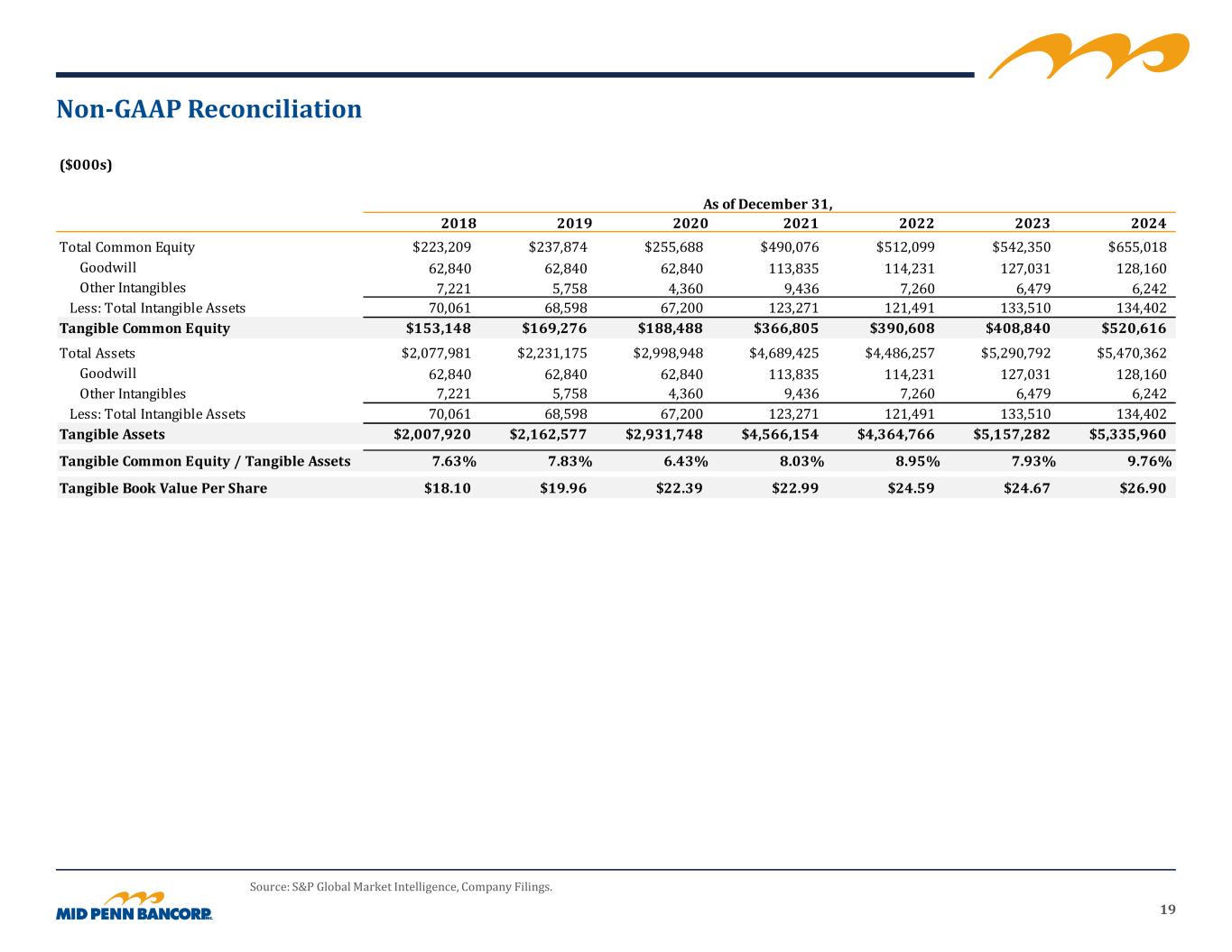

19 Non-GAAP Reconciliation Source: S&P Global Market Intelligence, Company Filings. ($000s) As of December 31, 2018 2019 2020 2021 2022 2023 2024 Total Common Equity $223,209 $237,874 $255,688 $490,076 $512,099 $542,350 $655,018 Goodwill 62,840 62,840 62,840 113,835 114,231 127,031 128,160 Other Intangibles 7,221 5,758 4,360 9,436 7,260 6,479 6,242 Less: Total Intangible Assets 70,061 68,598 67,200 123,271 121,491 133,510 134,402 Tangible Common Equity $153,148 $169,276 $188,488 $366,805 $390,608 $408,840 $520,616 Total Assets $2,077,981 $2,231,175 $2,998,948 $4,689,425 $4,486,257 $5,290,792 $5,470,362 Goodwill 62,840 62,840 62,840 113,835 114,231 127,031 128,160 Other Intangibles 7,221 5,758 4,360 9,436 7,260 6,479 6,242 Less: Total Intangible Assets 70,061 68,598 67,200 123,271 121,491 133,510 134,402 Tangible Assets $2,007,920 $2,162,577 $2,931,748 $4,566,154 $4,364,766 $5,157,282 $5,335,960 Tangible Common Equity / Tangible Assets 7.63% 7.83% 6.43% 8.03% 8.95% 7.93% 9.76% Tangible Book Value Per Share $18.10 $19.96 $22.39 $22.99 $24.59 $24.67 $26.90

20 Non-GAAP Reconciliation ($000s) 2024Q1 2024Q2 2024Q3 2024Q4 Net Income Available to Common Shareholders $12,133 $11,771 $12,301 $13,232 Less: BOLI Death Benefit Income 1,460 487 4 615 Plus: Merger and Acquisition Expenses 0 0 109 436 Less: Tax Effect of Merger and Acquisition Expenses 0 0 23 92 Net Income Excluding Non-Recurring Expenses $10,673 $11,284 $12,383 $12,961 Weighted Average Shares Outstanding 16,567,902 16,576,283 16,612,657 18,338,224 Core Earnings Per Common Share Excluding Non-Recurring Expenses $0.64 $0.68 $0.75 $0.71 Source: S&P Global Market Intelligence, Company Filings. ($000s) For the Years Ended December 31, As of Dec 31, 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2024Q4 Net Income Available to Common Shareholders $5,701 $6,528 $7,804 $7,089 $10,596 $17,701 $26,209 $29,319 $54,806 $37,397 49,437 $13,232 Less: BOLI Death Benefit Income 0 0 0 0 0 0 0 0 0 0 2,566 615 Plus: Merger and Acquisition Expenes 573 762 0 619 4,790 0 0 12,947 623 8,520 545 436 Less: Tax Affect of Merger and Acquisition Expenses 120 160 0 130 1,006 0 0 2,719 131 1,789 115 92 Net Income Excluding Non-Recurring Expenses $6,154 $7,130 $7,804 $7,578 $14,380 $17,701 $26,209 $39,547 $55,298 $44,128 $47,301 $12,961 Weighted Average Shares Outstanding 3,495,705 4,112,159 4,239,630 4,252,561 7,091,797 8,492,073 8,443,092 10,819,579 15,934,635 16,350,963 17,087,932 18,338,224 Core Earnings Per Common Share Ex. Non-Recurring Expenses $1.76 $1.73 $1.84 $1.78 $2.03 $2.08 $3.10 $3.66 $3.47 $2.70 $2.77 $0.71 Average Assets $734,236 $883,928 $1,001,452 $1,103,439 $1,665,721 $2,166,964 $2,758,429 $3,520,504 $4,476,174 $4,883,087 $5,412,673 $5,481,473 Core Return on Average Assets Ex. Non-Recurring Expenses 0.84% 0.81% 0.78% 0.69% 0.86% 0.82% 0.95% 1.12% 1.24% 0.90% 0.87% 0.95%

21 Non-GAAP Reconciliation ($000s) 2024Q1 2024Q2 2024Q3 2024Q4 Net Income Available to Common Shareholders $12,133 $11,771 $12,301 $13,232 Plus: Intangible Amortizations, Net of Tax 338 336 363 372 $12,471 $12,107 $12,664 $13,604 Average Shareholder's Equity $546,001 $553,675 $565,300 $623,670 Less: Average Goodwill 127,031 127,031 127,773 128,160 Less: Average Core Deposit and Other Intangibles 6,259 5,833 6,424 6,468 Average Tangible Shareholder's Equity $412,711 $420,811 $431,103 $489,042 Return on Average Tangible Common Equity 12.15% 11.57% 11.69% 11.07% Source: S&P Global Market Intelligence, Company Filings.