EXHIBIT 13

EXCERPTS FROM REGISTRANT’S

2005 ANNUAL REPORT TO SHAREHOLDERS

ANNUAL REPORT 2005

financial highlights

| | |

table of contents: | | page |

financial highlights | | 2 |

| |

unaudited graphs of financial data | | 3 |

| |

report of independent registered public accounting firm | | 4 |

| |

consolidated balance sheet | | 5 |

| |

consolidated statement of income | | 6 |

| |

consolidated statement of stockholders’ equity | | 7 |

| |

consolidated statement of cash flows | | 8 |

| |

notes to consolidated financial statements | | 9-25 |

| |

management’s discussion and analysis | | 26-40 |

| |

directors, officers and advisory board members | | 41 |

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

| | |

| Mid Penn Bancorp, Inc. | | FINANCIAL HIGHLIGHTS |

AS OF AND FOR YEARS ENDED DECEMBER 31, 2005 AND 2004

| | | | | | | | | | |

(Dollars in thousands, except per share data.) | | 2005 | | | 2004 | | | Percent

Change | |

Total Assets | | $ | 438,110 | | | 403,256 | | | +8.64 | % |

Total Deposits | | | 325,274 | | | 301,144 | | | +8.01 | % |

Net Loans | | | 308,133 | | | 275,904 | | | +11.68 | % |

Total Investments and Interest Bearing Balances | | | 105,427 | | | 105,020 | | | +0.39 | % |

Stockholders’ Equity | | | 36,861 | | | 35,272 | | | +4.50 | % |

Net Income | | | 4,603 | | | 4,369 | | | +5.36 | % |

Earnings Per Share | | | 1.37 | | | 1.30 | | | +5.38 | % |

Cash Dividend Per Share, historical | | | .80 | | | 1.80 | | | -55.56 | % |

Book Value Per Share | | | 11.01 | | | 10.53 | | | +4.56 | % |

| | | |

Return on Average Stockholders’ Equity | | | 12.87 | % | | 12.73 | % | | +1.10 | % |

Return on Average Assets | | | 1.10 | % | | 1.12 | % | | -1.79 | % |

Net Interest Margin | | | 3.67 | % | | 3.48 | % | | +5.46 | % |

Nonperforming Loans to Total Loans | | | 0.76 | % | | 0.63 | % | | +20.63 | % |

Per share information has been restated to reflect the retroactive effect of a five percent stock dividend paid in the first quarter of 2006.

Mid Penn Bancorp, Inc.

Stockholders’ Information

| | | | | | | | | | | |

| | | 2005 | | 2004 | | Quarter |

| | | High | | Low | | High | | Low | |

Market Value Per Share | | $ | 27.70 | | 25.10 | | 31.95 | | 23.75 | | 1st |

| | | 25.40 | | 24.60 | | 28.78 | | 27.25 | | 2nd |

| | | 27.00 | | 25.35 | | 31.25 | | 27.20 | | 3rd |

| | | 25.85 | | 24.20 | | 28.20 | | 25.10 | | 4th |

Market Value Information: The market share information was provided by the American Stock Exchange, New York, NY Mid Penn Bancorp, Inc. common stock trades on the American Stock Exchange under the symbol: MBP.

Transfer Agent: Registrar and Transfer Company, 10 Commerce Drive, Cranford, NJ 07016-3572. Phone: 1-800-368-5948.

Number of Stockholders: At December 31, 2005, there were 1,049 registered stockholders.

Dividends: A dividend of $.20 per share was paid during each quarter of 2005 and 2004. A special dividend of $1.00 per share was also paid in the first quarter of 2004. Mid Penn Bancorp, Inc. plans to continue a quarterly dividend payable in February, May, August and November.

Dividend Reinvestment and Stock Purchases: Stockholders of Mid Penn Bancorp, Inc. may acquire additional shares of common stock by reinvesting their cash dividends under the Dividend Reinvestment Plan without paying a brokerage fee. Voluntary cash contributions may also be made under the Plan. For additional information about the Plan, contact the Transfer Agent.

Form 10-K: A Copy of Mid Penn Bancorp, Inc.’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, will be provided to stockholders without charge upon written request to: Secretary, Mid Penn Bancorp, Inc., 349 Union Street, Millersburg, PA 17061.

Annual Meeting: The Annual Meeting of the Stockholders of Mid Penn Bancorp, Inc. will be held at 10:00 a.m. on Tuesday, April 25, 2006, at 349 Union Street, Millersburg, Pennsylvania.

Accounting, Auditing and Internal Control Complaints: Information on how to report a complaint regarding accounting, internal accounting controls or auditing matters is available at Mid Penn Bank’s website: www.midpennbank.com

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

2

| | |

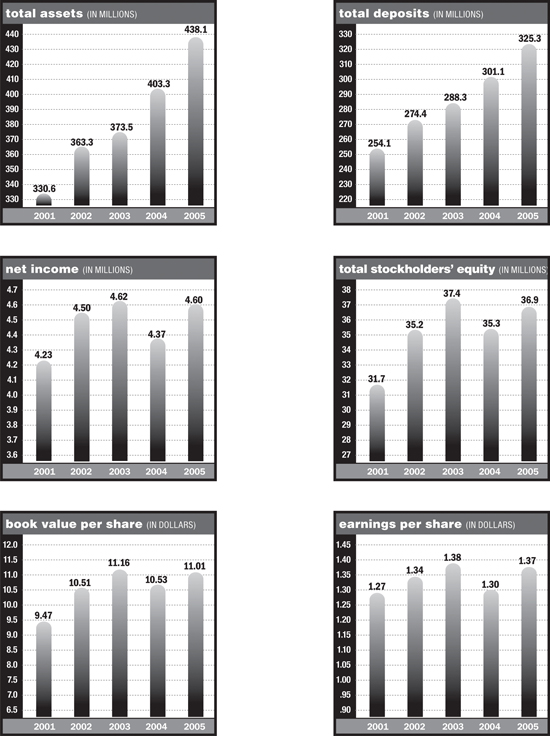

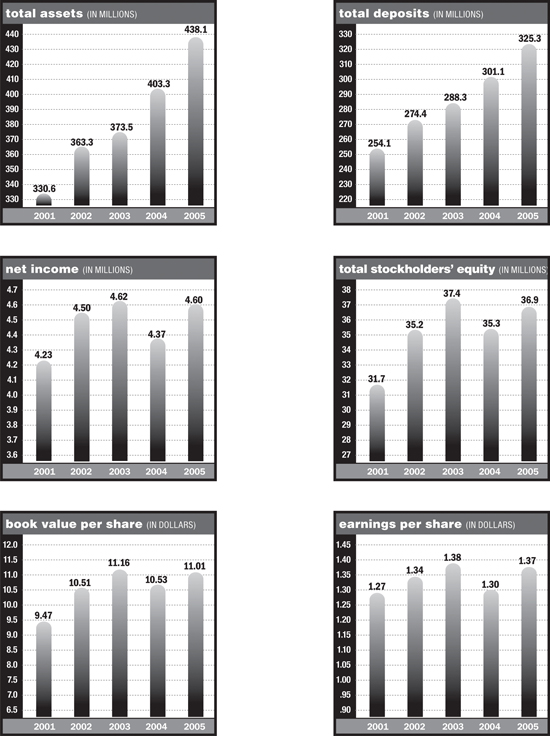

| Mid Penn Bancorp, Inc. | | UNAUDITED GRAPHS OF FINANCIAL DATA |

Per share information has been restated to reflect the retroactive effect of a five percent stock dividend paid in the first quarter of 2006.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

3

| | |

| Mid Penn Bancorp, Inc. | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Board of Directors and Stockholders

Mid Penn Bancorp, Inc.:

We have audited the accompanying consolidated balance sheet of Mid Penn Bancorp, Inc. and subsidiaries (collectively, the “Corporation”) as of December 31, 2005 and 2004, and the related consolidated statements of income, stockholders’ equity, and cash flows for each of the three years in the period ended December 31, 2005. These financial statements are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Mid Penn Bancorp, Inc. and subsidiaries as of December 31, 2005 and 2004, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2005 in conformity with accounting principles generally accepted in the United States of America.

We have also audited, in accordance with the Standards of the Public Company Accounting Oversight Board (United States), the effectiveness of the Corporation’s internal control over financial reporting as of December 31, 2005, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated February 1, 2006 expressed an unqualified opinion on management’s assessment of internal control over financial reporting and an unqualified opinion on the effectiveness of internal control over financial reporting.

PARENTE RANDOLPH, LLC

Williamsport, Pennsylvania

February 1, 2006

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

4

| | |

| Mid Penn Bancorp, Inc. | | CONSOLIDATED BALANCE SHEET |

DECEMBER 31, 2005 AND 2004

| | | | | | | |

(Dollars in thousands, except share data) | | 2005 | | | 2004 | |

ASSETS | | | | | | | |

Cash and due from banks | | $ | 6,350 | | | 6,679 | |

Interest-bearing balances with other financial institutions | | | 54,549 | | | 60,407 | |

Available-for-sale investment securities | | | 50,878 | | | 44,613 | |

Loans and leases | | | 313,423 | | | 281,083 | |

Less: | | | | | | | |

Unearned income | | | (1,586 | ) | | (1,536 | ) |

Allowance for loan and lease losses | | | (3,704 | ) | | (3,643 | ) |

| | | | | | | |

Net loans | | | 308,133 | | | 275,904 | |

| | | | | | | |

Bank premises and equipment, net | | | 6,334 | | | 4,874 | |

Foreclosed assets held for sale | | | 458 | | | 505 | |

Accrued interest receivable | | | 2,269 | | | 1,875 | |

Deferred income taxes | | | 1,392 | | | 982 | |

Goodwill | | | 259 | | | 259 | |

Core deposit intangible, net | | | 235 | | | 271 | |

Cash surrender value of life insurance | | | 6,402 | | | 6,180 | |

Other assets | | | 851 | | | 707 | |

| | | | | | | |

Total Assets | | $ | 438,110 | | | 403,256 | |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

Deposits: | | | | | | | |

Noninterest-bearing demand | | $ | 41,719 | | | 37,586 | |

Interest-bearing demand | | | 31,686 | | | 35,562 | |

Money market | | | 61,421 | | | 43,116 | |

Savings | | | 26,825 | | | 28,414 | |

Time | | | 163,623 | | | 156,466 | |

| | | | | | | |

Total Deposits | | | 325,274 | | | 301,144 | |

| | |

Short-term borrowings | | | 12,342 | | | 13,801 | |

Accrued interest payable | | | 1,535 | | | 1,192 | |

Other liabilities | | | 2,260 | | | 1,890 | |

Long-term debt | | | 59,838 | | | 49,957 | |

| | | | | | | |

Total Liabilities | | | 401,249 | | | 367,984 | |

| | | | | | | |

Stockholders’ Equity: | | | | | | | |

Common stock, par value $1 per share; authorized 10,000,000 shares; 3,207,912 shares issued in 2005 and 2004 | | | 3,208 | | | 3,208 | |

Additional paid-in capital | | | 23,472 | | | 23,472 | |

Retained earnings | | | 10,486 | | | 8,435 | |

Accumulated other comprehensive income | | | 231 | | | 693 | |

Treasury stock, at cost (19,056 and 19,086 shares at December 31, 2005 and 2004, respectively) | | | (536 | ) | | (536 | ) |

| | | | | | | |

Stockholders’ Equity, Net | | | 36,861 | | | 35,272 | |

| | | | | | | |

Total Liabilities and Stockholders’ Equity | | $ | 438,110 | | | 403,256 | |

| | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

5

| | |

| Mid Penn Bancorp, Inc. | | CONSOLIDATED STATEMENT OF INCOME |

FOR YEARS ENDED DECEMBER 31, 2005, 2004 AND 2003

| | | | | | | |

(Dollars in thousands, except share data) | | 2005 | | 2004 | | 2003 |

INTEREST INCOME | | | | | | | |

Interest and fees on loans | | $ | 19,251 | | 16,327 | | 15,470 |

Interest on interest-bearing balances | | | 2,067 | | 1,809 | | 2,099 |

Interest and dividends on investment securities: | | | | | | | |

U.S. Treasury and government agencies | | | 801 | | 599 | | 559 |

State and political subdivision obligations, tax-exempt | | | 1,030 | | 1,286 | | 1,783 |

Other securities | | | 92 | | 49 | | 64 |

Interest on federal funds sold and securities purchased under agreement to resell | | | 53 | | 7 | | 9 |

| | | | | | | |

Total Interest Income | | | 23,294 | | 20,077 | | 19,984 |

| | | | | | | |

INTEREST EXPENSE | | | | | | | |

Interest on deposits | | | 6,521 | | 5,624 | | 6,117 |

Interest on short-term borrowings | | | 203 | | 137 | | 128 |

Interest on long-term debt | | | 2,833 | | 2,244 | | 2,189 |

| | | | | | | |

Total Interest Expense | | | 9,557 | | 8,005 | | 8,434 |

| | | | | | | |

Net Interest Income | | | 13,737 | | 12,072 | | 11,550 |

PROVISION FOR LOAN AND LEASE LOSSES | | | 225 | | 725 | | 290 |

| | | | | | | |

Net Interest Income After Provision for Loan and Lease Losses | | | 13,512 | | 11,347 | | 11,260 |

| | | | | | | |

NONINTEREST INCOME | | | | | | | |

Trust department income | | | 312 | | 248 | | 202 |

Service charges on deposits | | | 1,348 | | 1,467 | | 1,227 |

Investment securities gains, net | | | 1 | | 475 | | 261 |

Gain on sale of loans | | | 19 | | 0 | | 45 |

Income on cash surrender value of life insurance | | | 222 | | 211 | | 210 |

Fee income from investment services | | | 70 | | 162 | | 21 |

Fee income from debit card transactions | | | 223 | | 169 | | 149 |

Other income | | | 758 | | 725 | | 592 |

| | | | | | | |

Total Noninterest Income | | | 2,953 | | 3,457 | | 2,707 |

| | | | | | | |

NONINTEREST EXPENSE | | | | | | | |

Salaries and employee benefits | | | 5,662 | | 4,918 | | 4,496 |

Occupancy expense, net | | | 594 | | 456 | | 423 |

Equipment expense | | | 734 | | 631 | | 602 |

Pennsylvania bank shares tax expense | | | 259 | | 265 | | 266 |

Legal and professional expense | | | 408 | | 385 | | 284 |

Marketing and advertising | | | 298 | | 185 | | 100 |

Debit card processing expense | | | 154 | | 214 | | 167 |

Director fees and benefits expense | | | 221 | | 196 | | 201 |

External audit/tax preparation expense | | | 132 | | 72 | | 64 |

Other expenses | | | 1,800 | | 1,708 | | 1,496 |

| | | | | | | |

Total Noninterest Expense | | | 10,262 | | 9,030 | | 8,099 |

| | | | | | | |

INCOME BEFORE PROVISION FOR INCOME TAXES | | | 6,203 | | 5,774 | | 5,868 |

Provision for income taxes | | | 1,600 | | 1,405 | | 1,253 |

| | | | | | | |

NET INCOME | | $ | 4,603 | | 4,369 | | 4,615 |

| | | | | | | |

EARNINGS PER SHARE | | $ | 1.37 | | 1.30 | | 1.38 |

| | | | | | | |

Weighted Average Number of Shares Outstanding | | | 3,348,299 | | 3,348,310 | | 3,347,929 |

| | | | | | | |

Earnings per share information has been restated to reflect the retroactive effect of a five percent stock dividend paid in the first quarter of 2006.

The accompanying notes are an integral part of these consolidated financial statements.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

6

| | |

| Mid Penn Bancorp, Inc. | | CONSOLIDATED STATEMENT OF STOCKHOLDER’S EQUITY |

FOR YEARS ENDED DECEMBER 31, 2005, 2004 AND 2003

| | | | | | | | | | | | | | | | | |

(Dollars in thousands, except share data) | | Common

Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | | Accumulated

Other

Comprehensive

Income (Loss) | | | Treasury

Stock | | | Total | |

Balance, December 31, 2002 | | $ | 3,057 | | 20,368 | | 10,944 | | | 1,357 | | | (522 | ) | | 35,204 | |

| | | | | | | | | | | | | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | |

Net income | | | 0 | | 0 | | 4,615 | | | 0 | | | 0 | | | 4,615 | |

Change in net unrealized gain (loss) on securities available for sale, net of reclassification adjustment and tax effects | | | 0 | | 0 | | 0 | | | 58 | | | 0 | | | 58 | |

Total comprehensive income | | | | | | | | | | | | | | | | 4,673 | |

| | | | | | | | | | | | | | | | | |

Cash dividends ($ .80 per share, historical) | | | 0 | | 0 | | (2,499 | ) | | 0 | | | 0 | | | (2,499 | ) |

| | | | | | | | | | | | | | | | | |

5% stock dividend (additional 151,411 shares) | | | 151 | | 3,104 | | (3,255 | ) | | 0 | | | 0 | | | 0 | |

Purchase of treasury stock (786 shares) | | | 0 | | 0 | | 0 | | | 0 | | | (17 | ) | | (17 | ) |

| | | | | | | | | | | | | | | | | |

Balance, December 31, 2003 | | | 3,208 | | 23,472 | | 9,805 | | | 1,415 | | | (539 | ) | | 37,361 | |

| | | | | | | | | | | | | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | |

Net income | | | 0 | | 0 | | 4,369 | | | 0 | | | 0 | | | 4,369 | |

Change in net unrealized gain (loss) on securities available for sale, net of reclassification adjustment and tax effects | | | 0 | | 0 | | 0 | | | (722 | ) | | 0 | | | (722 | ) |

Total comprehensive income | | | | | | | | | | | | | | | | 3,647 | |

| | | | | | | | | | | | | | | | | |

Cash dividends ($1.80 per share, historical) | | | 0 | | 0 | | (5,739 | ) | | 0 | | | 0 | | | (5,739 | ) |

| | | | | | | | | | | | | | | | | |

Sale of treasury stock (322 shares) | | | 0 | | 0 | | 0 | | | 0 | | | 3 | | | 3 | |

| | | | | | | | | | | | | | | | | |

Balance, December 31, 2004 | | | 3,208 | | 23,472 | | 8,435 | | | 693 | | | (536 | ) | | 35,272 | |

| | | | | | | | | | | | | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | |

Net income | | | 0 | | 0 | | 4,603 | | | 0 | | | 0 | | | 4,603 | |

Change in net unrealized gain (loss) on securities available for sale, net of reclassification adjustment and tax effects | | | 0 | | 0 | | 0 | | | (462 | ) | | 0 | | | (462 | ) |

| | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | 4,141 | |

| | | | | | | | | | | | | | | | | |

Cash dividends ($ .80 per share, historical) | | | 0 | | 0 | | (2,552 | ) | | 0 | | | 0 | | | (2,552 | ) |

| | | | | | | | | | | | | | | | | |

Balance, December 31, 2005 | | $ | 3,208 | | 23,472 | | 10,486 | | | 231 | | | (536 | ) | | 36,861 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

7

| | |

| Mid Penn Bancorp, Inc. | | CONSOLIDATED STATEMENT OF CASH FLOWS |

FOR YEARS ENDED DECEMBER 31, 2005, 2004 AND 2003

| | | | | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | | | 2003 | |

Operating Activities: | | | | | | | | | | |

Net income | | $ | 4,603 | | | 4,369 | | | 4,615 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | |

Provision for loan and lease losses | | | 225 | | | 725 | | | 290 | |

Depreciation | | | 579 | | | 475 | | | 426 | |

Amortization of core deposit intangible | | | 36 | | | 20 | | | 0 | |

Increase in cash surrender value of life insurance | | | (222 | ) | | (211 | ) | | (210 | ) |

Investment securities gains, net | | | (1 | ) | | (475 | ) | | (261 | ) |

(Gain) loss on sale of foreclosed assets | | | (66 | ) | | 4 | | | (20 | ) |

Gain on sale of loans | | | (19 | ) | | 0 | | | (45 | ) |

Loss on disposal of bank premises and equipment | | | 2 | | | 0 | | | 0 | |

Deferred income taxes | | | (173 | ) | | (307 | ) | | 123 | |

Change in accrued interest receivable | | | (394 | ) | | (112 | ) | | 244 | |

Change in other assets | | | (143 | ) | | 142 | | | 380 | |

Change in accrued interest payable | | | 343 | | | 147 | | | (142 | ) |

Change in other liabilities | | | 370 | | | 540 | | | (301 | ) |

| | | | | | | | | | |

Net Cash Provided By Operating Activities | | | 5,140 | | | 5,317 | | | 5,099 | |

| | | | | | | | | | |

Investing Activities: | | | | | | | | | | |

Net decrease (increase) in interest-bearing balances | | | 5,858 | | | 9,511 | | | (4,431 | ) |

Proceeds from the maturity of investment securities | | | 4,798 | | | 7,979 | | | 15,635 | |

Proceeds from the sale of investment securities | | | 535 | | | 17,195 | | | 5,793 | |

Purchases of investment securities | | | (12,297 | ) | | (16,305 | ) | | (16,313 | ) |

Purchase of life insurance | | | 0 | | | (1,016 | ) | | 0 | |

Cash received from business combination | | | 0 | | | 4,139 | | | 0 | |

Proceeds from sale of loans | | | 348 | | | 0 | | | 1,710 | |

Net increase in loans | | | (33,241 | ) | | (45,163 | ) | | (13,530 | ) |

Proceeds from sale of bank premises and equipment | | | 40 | | | 0 | | | 0 | |

Purchases of bank premises and equipment | | | (2,081 | ) | | (1,429 | ) | | (1,029 | ) |

Proceeds from the sale of foreclosed assets | | | 571 | | | 879 | | | 475 | |

Capitalized additions - foreclosed assets | | | 0 | | | (147 | ) | | 0 | |

| | | | | | | | | | |

Net Cash Used In Investing Activities | | | (35,469 | ) | | (24,357 | ) | | (11,690 | ) |

| | | | | | | | | | |

Financing Activities: | | | | | | | | | | |

Net increase in deposits | | | 24,130 | | | 5,613 | | | 13,635 | |

Net (decrease) increase in short-term borrowings | | | (1,459 | ) | | 4,113 | | | (8,468 | ) |

Cash dividends paid | | | (2,552 | ) | | (5,739 | ) | | (2,499 | ) |

Long-term debt repayment | | | (119 | ) | | (5,127 | ) | | (5,199 | ) |

Sale (purchase) of treasury stock | | | 0 | | | 3 | | | (17 | ) |

Long-term borrowings | | | 10,000 | | | 19,400 | | | 8,500 | |

| | | | | | | | | | |

Net Cash Provided By Financing Activities | | | 30,000 | | | 18,263 | | | 5,952 | |

| | | | | | | | | | |

Net decrease in cash and due from banks | | | (329 | ) | | (777 | ) | | (639 | ) |

Cash and due from banks at beginning of year | | | 6,679 | | | 7,456 | | | 8,095 | |

| | | | | | | | | | |

Cash and due from banks at end of year | | $ | 6,350 | | | 6,679 | | | 7,456 | |

| | | | | | | | | | |

Supplemental Disclosures of Cash Flow Information: | | | | | | | | | | |

Interest paid | | $ | 9,214 | | | 7,858 | | | 8,576 | |

Income taxes paid | | $ | 1,876 | | | 1,385 | | | 1,410 | |

Supplemental Noncash Disclosures: | | | | | | | | | | |

Loan charge-offs | | $ | 199 | | | 74 | | | 349 | |

Transfers to foreclosed assets held for sale | | $ | 458 | | | 124 | | | 791 | |

Business Combination: | | | | | | | | | | |

Fair value of assets acquired | | $ | 0 | | | 3,054 | | | 0 | |

Fair value of liabilities assumed | | $ | 0 | | | 7,193 | | | 0 | |

The accompanying notes are an integral part of these consolidated financial statements.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

8

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

The accompanying consolidated financial statements include the accounts of Mid Penn Bancorp, Inc. and its wholly-owned subsidiaries Mid Penn Bank (“Bank”), Mid Penn Investment Corporation and Mid Penn Insurance Services, LLC, (collectively, “MPB”). All significant intercompany balances and transactions have been eliminated in consolidation.

The Bank engages in a full-service commercial banking and trust business, making available to the community a wide range of financial services, including, but not limited to, installment loans, mortgage and home equity loans, secured and unsecured commercial and consumer loans, lines of credit, construction financing, farm loans, community development loans, loans to non-profit entities and local government loans and various types of time and demand deposits, including but not limited to, checking accounts, savings accounts, clubs, money market deposit accounts, certificates of deposit and IRAs. In addition, the Bank provides a full range of trust services through its Trust Department. Deposits are insured by the Federal Deposit Insurance Corporation (FDIC) to the extent provided by law.

The financial services are provided to individuals, partnerships, non-profit organizations and corporations through its eleven offices located in the northern portion of Dauphin County, Swatara Township in the lower portion of Dauphin County, the southern portion of Northumberland County, the western portion of Schuylkill County and Hampden Township in Cumberland County.

Mid Penn Investment Corporation is engaged in investing activities.

Mid Penn Insurance Services, LLC provides a range of personal and investment insurance products.

| (3) | Summary of Significant Accounting Policies |

The accounting and reporting policies of MPB conform with accounting principles generally accepted in the United States of America and to general practice within the financial industry. The following is a description of the more significant accounting policies.

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

A material estimate that is particularly susceptible to significant change relates to the determination of the allowance for loan and lease losses.

While management uses available information to recognize losses on loans and leases, future additions to the allowance may be necessary based on changes in local economic conditions. In addition, regulatory agencies, as an integral part of their examination process, periodically review the Bank’s allowance for loan and lease losses. Such agencies may require the Bank to recognize changes to the allowance based on their judgments about information available to them at the time of their examination. Because of these factors, it is reasonably possible that the allowance for loan and lease losses may change materially in the near term.

Available-for-Sale Securities include debt and restricted equity securities. Debt securities are reported at fair value, with unrealized holding gains and losses excluded from earnings and reported, net of deferred income taxes, as a component of accumulated other comprehensive income (loss) within stockholders’ equity. Realized gains and losses on sales of investment securities are computed on the basis of specific identification of the cost of each security. Restricted equity securities are generally carried at cost and evaluated for impairment due to the lack of available market data. Restricted equity securities for which market data is available are reported at fair value. MPB had no trading securities or held-to-maturity securities in 2005, 2004 or 2003.

Declines in the fair value of individual available-for-sale securities below their cost that are other than temporary result in write-downs of the individual securities to their fair value. The related write-downs are included in earnings as realized losses. In estimating other-than-temporary impairment losses, management considers (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Bank to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

Interest on loans is recognized on a method which approximates a level yield basis over the life of the loans. The accrual of interest on loans, including impaired loans, is generally discontinued when principal or interest has consistently been in default for a period of 90 days or more, or because of a deterioration in the financial condition of the borrower, payment in full of principal or interest is not expected. Interest income is subsequently recognized only to the extent cash payments are received. The placement of a loan on the nonaccrual basis for revenue recognition does not necessarily imply a potential charge-off of loan principal. Loan origination fees and certain direct origination costs are capitalized and recognized as an adjustment of the yield on the related loan.

| | (d) | Allowance for Loan and Lease Losses |

The Bank’s methodology for determining the allowance for loan and lease losses establishes both a specific and a general component. The specific portion of the allowance represents the results of analysis of leases and individual “watch list” loans (commercial, residential and consumer loans). The individual commercial loans are risk rated with specific attention to estimated loss exposure. Historical loan loss rates are applied to “problem” consumer credits, adjusted to reflect current conditions.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

9

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Specific regular reviews of credits exceeding $500,000 are performed to monitor the major portfolio risk. The Bank analyzes all commercial loans in excess of $10,000 that are rated as watch list credits. Potential credit problems are monitored to determine whether specific loans are impaired, with impairment normally measured by reference to borrowers’ collateral values and estimated cash flows.

The general portion of the allowance for loan and lease losses represents the results of measuring potential losses inherent in the portfolio that are not identified in the specific allowance analysis. This general portion is determined using historical loan and lease loss experience adjusted by assessing changes in the Bank’s underwriting criteria, growth and/or changes in the mix of loans originated, industry concentrations and evaluations, lending management changes, comparisons of certain factors to peer group banks and changes in economic conditions.

Management believes the allowance for loan and lease losses is adequate. Identification of specific losses is an ongoing process using available information. Specifically, quarterly management meetings to review “problem” loans and leases are utilized to determine a plan for collection and, if necessary, a recommendation to the Board for charge off. Future additions to the allowance for loan and lease losses through a provision for loan and lease losses will be made based on identified changes in the above factors coupled with loss experience.

Various regulatory agencies, as an integral part of their examination process, periodically review the Bank’s allowance for loan and lease losses. These agencies may require the Bank to recognize changes to the allowance based on their judgment about information available to them at the time of their examinations.

| | (e) | Bank Premises and Equipment |

Bank premises and equipment are stated at cost less accumulated depreciation. Depreciation is provided on the straight-line basis. Maintenance and repairs are charged to expense when incurred. Gains and losses on dispositions are reflected in current operations.

| | (f) | Foreclosed Assets Held for Sale |

Foreclosed assets held for sale consist of real estate acquired through, or in lieu of, foreclosure in settlement of debt and are recorded at fair value at the date of transfer. Any valuation adjustments required at the date of transfer are charged to the allowance for loan losses. Subsequent to acquisition, foreclosed assets are carried at the lower of cost or fair value less costs of disposal, based upon periodic evaluations that consider changes in market conditions and development and disposition costs. Operating results from assets acquired in satisfaction of debt, including rental income less operating costs and gains or losses on the sale of, or the periodic evaluation of foreclosed assets, are recorded in noninterest expense.

Certain items of income and expense are recognized in different accounting periods for financial reporting purposes than for income tax purposes. Deferred income tax assets and liabilities are provided in recognition of these temporary differences at currently enacted income tax rates. As changes in tax laws or rates are enacted, deferred income tax assets and liabilities are adjusted through the provision for income taxes.

| | (h) | Core Deposit Intangible |

Core deposit intangible is a measure of the value of consumer demand and savings deposits acquired in business combinations accounted for as purchases. The core deposit intangible is being amortized over an 8 year life on a straight-line basis.

Goodwill is the excess of the purchase price over the fair value of assets acquired in connection with a 2004 business acquisition accounted for as a purchase. The potential impairment of goodwill is tested on an annual basis. No impairment of goodwill was recognized in 2005 or 2004.

| | (j) | Marketing and Advertising Costs |

Marketing and advertising costs are expensed as incurred and were $298,000 in 2005, $185,000 in 2004 and $100,000 in 2003.

| | (k) | Pensions and Other Postretirement Benefit Plans |

Effective December 31, 2003, MPB adopted Statement of Financial Accounting Standards No. 132R (revised 2003), “Employers’ Disclosures about Pensions and Other Postretirement Benefits” (“SFAS No. 132R”). SFAS No. 132R requires additional disclosures about defined benefit pension plans and other postretirement defined benefit plans. It does not change the measurement or recognition of those plans.

A funded contributory profit-sharing plan is maintained for substantially all employees. The cost of the MPB profit-sharing plan is charged to current operating expenses and is funded annually.

| | (m) | Trust Assets and Income |

Assets held by the Bank in a fiduciary or agency capacity for customers of the Trust Department are not included in the consolidated financial statements since such items are not assets of the Bank. Trust income is recognized on the cash basis which is not materially different than if it were reported on the accrual basis.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

10

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Earnings per share is computed by dividing net income by the weighted average number of common shares outstanding during each of the years presented giving retroactive effect to stock dividends and stock splits. MPB’s basic and diluted earnings per share are the same since there are no potentially dilutive securities outstanding.

| | (o) | Statement of Cash Flows |

For purposes of cash flows, MPB considers cash and due from banks to be cash equivalents.

Certain prior year amounts have been reclassified to conform to the current year’s classifications.

The components of other comprehensive income (loss) and related tax effects are as follows:

| | | | | | | | | | |

(Dollars in thousands) | | Years Ended December 31, | |

| | 2005 | | | 2004 | | | 2003 | |

Unrealized holding (losses) gains on available-for-sale securities | | $ | (699 | ) | | (619 | ) | | 349 | |

Less reclassification adjustment for gains realized in income | | | (1 | ) | | (475 | ) | | (261 | ) |

| | | | | | | | | | |

Net unrealized (losses) gains | | | (700 | ) | | (1,094 | ) | | 88 | |

Income tax benefit (expense) | | | 238 | | | 372 | | | (30 | ) |

| | | | | | | | | | |

Net | | $ | (462 | ) | | (722 | ) | | 58 | |

| | | | | | | | | | |

| (5) | Restrictions on Cash and Due from Bank Accounts |

The Bank is required to maintain reserve balances with the Federal Reserve Bank of Philadelphia. The amounts of those required reserve balances were $480,000 at December 31, 2005 and $575,000 at December 31, 2004.

Deposits with one financial institution are insured up to $100,000.

At December 31, 2005 and 2004, amortized cost, fair value, and unrealized gains and losses on investment securities are as follows:

| | | | | | | | | |

(Dollars in Thousands) December 31, 2005 | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value |

Available-for-sale securities: | | | | | | | | | |

U.S. Treasury and U.S. government agencies | | $ | 14,999 | | 0 | | 305 | | 14,694 |

Mortgage-backed U.S. government agencies | | | 8,114 | | 6 | | 150 | | 7,970 |

State and political subdivision obligations | | | 24,160 | | 847 | | 35 | | 24,972 |

Restricted equity securities | | | 3,253 | | 0 | | 11 | | 3,242 |

| | | | | | | | | |

| | $ | 50,526 | | 853 | | 501 | | 50,878 |

| | | | | | | | | |

| | | | |

(Dollars in Thousands) December 31, 2004 | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value |

Available-for-sale securities: | | | | | | | | | |

U.S. Treasury and U.S. government agencies | | $ | 11,998 | | 12 | | 91 | | 11,919 |

Mortgage-backed U.S. government agencies | | | 5,508 | | 21 | | 87 | | 5,442 |

State and political subdivision obligations | | | 22,621 | | 1,213 | | 13 | | 23,821 |

Restricted equity securities | | | 3,435 | | 0 | | 4 | | 3,431 |

| | | | | | | | | |

| | $ | 43,561 | | 1,246 | | 195 | | 44,613 |

| | | | | | | | | |

Estimated fair values of debt securities are based on quoted market prices, where applicable. If quoted market prices are not available, fair values are based on quoted market prices of comparable instruments, adjusted for differences between the quoted instruments and the instruments being valued.

Restricted equity securities consist of stock in the Federal Home Loan Bank of Pittsburgh and Atlantic Central Bankers Bank which do not have a readily determinable fair value because their ownership is restricted and they lack a market. Also included in restricted equity securities is an investment in Access Capital Strategies, an equity fund that invests in low to moderate income financing projects. This investment was purchased in 2004 to help fulfill the Bank’s regulatory requirement of the Community Reinvestment Act Investment and at December 31, 2005, is reported at fair value.

Investment securities having a fair value of $36,385,000 at December 31, 2005 and $29,128,000 at December 31, 2004, were pledged to secure public deposits and other borrowings.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

11

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Gains from sales of investment securities amounted to $1,000 in 2005, $475,000 in 2004 and $261,000 in 2003. The proceeds from sales of investment securities were $535,000 in 2005, $17,195,000 in 2004 and $5,793,000 in 2003.

The following table presents gross unrealized losses and fair value of investments aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position at December 31, 2005 and 2004.

| | | | | | | | | | | | | |

| | | Less Than 12 Months | | 12 Months or More | | Total |

(Dollars in thousands) December 31, 2005 | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses |

Available-for-sale securities: | | | | | | | | | | | | | |

U.S. Treasury and U.S. government agencies | | $ | 6,935 | | 64 | | 7,759 | | 241 | | 14,694 | | 305 |

Mortgage-backed U.S. government agencies | | | 4,082 | | 66 | | 3,637 | | 84 | | 7,719 | | 150 |

State and political subdivision obligations | | | 2,684 | | 32 | | 268 | | 3 | | 2,952 | | 35 |

Restricted equity securities | | | 0 | | 0 | | 238 | | 11 | | 238 | | 11 |

| | | | | | | | | | | | | |

Total temporarily impaired available-for-sale securities | | $ | 13,701 | | 162 | | 11,902 | | 339 | | 25,603 | | 501 |

| | | | | | | | | | | | | |

| | | |

| | | Less Than 12 Months | | 12 Months or More | | Total |

(Dollars in thousands) December 31, 2004 | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses |

Available-for-sale securities: | | | | | | | | | | | | | |

U.S. Treasury and U.S. government agencies | | $ | 0 | | 0 | | 7,906 | | 91 | | 7,906 | | 91 |

Mortgage-backed U.S. government agencies | | | 0 | | 0 | | 4,071 | | 87 | | 4,071 | | 87 |

State and political subdivision obligations | | | 0 | | 0 | | 716 | | 13 | | 716 | | 13 |

Restricted equity securities | | | 0 | | 0 | | 246 | | 4 | | 246 | | 4 |

| | | | | | | | | | | | | |

Total temporarily impaired available-for-sale securities | | $ | 0 | | 0 | | 12,939 | | 195 | | 12,939 | | 195 |

| | | | | | | | | | | | | |

Management evaluates securities for other-than-temporary impairment at least on a quarterly basis; and more frequently when economic or market concerns warrant such evaluation. Consideration is given to (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near term prospects of the issuer, and (3) the intent and ability of MPB to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

At December 31, 2005 the thirty-two debt securities with unrealized losses have depreciated 2% from their amortized cost basis. These securities are issued by either the U.S. Government or municipalities. These unrealized losses relate principally to current interest rates for similar types of securities. In analyzing an issuer’s financial condition, management considers whether the securities are issued by the federal government or its agencies, whether downgrades by bond rating agencies have occurred, and the results of reviews of the issuer’s prior financial condition. As management has the ability to hold debt securities until maturity, or for the foreseeable future if classified as available-for-sale, no declines are deemed to be other-than-temporary.

The following is a schedule of the maturity distribution of investment securities at amortized cost and fair value at December 31, 2005:

| | | | | | | | | |

| | | December 31, 2005 | | December 31, 2004 |

(Dollars in thousands) | | Amortized

Cost | | Fair

Value | | Amortized

Cost | | Fair

Value |

Due in 1 year or less | | $ | 220 | | 222 | | 1,240 | | 1,252 |

Due after 1 year but within 5 years | | | 11,917 | | 11,861 | | 6,832 | | 6,857 |

Due after 5 years but within 10 years | | | 15,022 | | 15,375 | | 13,240 | | 13,709 |

Due after 10 years | | | 12,002 | | 12,208 | | 13,306 | | 13,922 |

| | | | | | | | | |

| | | 39,161 | | 39,666 | | 34,618 | | 35,740 |

| | | | |

Mortgage-backed securities (avg. life 1.96 years for 2005) | | | 8,112 | | 7,970 | | 5,508 | | 5,442 |

Restricted equity securities | | | 3,253 | | 3,242 | | 3,435 | | 3,431 |

| | | | | | | | | |

| | $ | 50,526 | | 50,878 | | 43,561 | | 44,613 |

| | | | | | | | | |

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

12

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

A summary of loans at December 31, 2005 and 2004 is as follows:

| | | | | |

(Dollars in thousands) | | 2005 | | 2004 |

Commercial real estate, construction and land development | | $ | 219,385 | | 195,549 |

Commercial, industrial and agricultural | | | 31,368 | | 30,940 |

Real estate - residential | | | 44,688 | | 43,914 |

Consumer | | | 17,982 | | 10,680 |

| | | | | |

| | $ | 313,423 | | 281,083 |

| | | | | |

Net unamortized loan fees and costs of $350,000 in 2005 and $344,000 in 2004 were deducted from loans.

Loans and available credit to Bank executive officers, directors, and corporations in which such executive officers and directors have beneficial interests as stockholders, executive officers, or directors aggregated approximately $2,722,000 at December 31, 2005 and $2,983,000 at December 31, 2004. New loans extended were $814,000 in 2005 and $867,000 in 2004. Net payments on these loans equalled $1,075,000 during 2005 and $1,159,000 during 2004. These loans were made on substantially the same basis, including interest rates and collateral as those prevailing for comparable transactions with other borrowers at the same time.

| (8) | Allowance for Loan and Lease Losses |

Changes in the allowance for loan and lease losses for the years 2005, 2004, and 2003 are summarized as follows:

| | | | | | | | | | |

| | | (Dollars in thousands) | |

| | | 2005 | | | 2004 | | | 2003 | |

Balance, January 1 | | $ | 3,643 | | | 2,992 | | | 3,051 | |

Provision for loan losses | | | 225 | | | 725 | | | 290 | |

Loans charged off | | | (199 | ) | | (121 | ) | | (409 | ) |

Recoveries on loans charged off | | | 35 | | | 47 | | | 60 | |

| | | | | | | | | | |

Balance, December 31 | | $ | 3,704 | | | 3,643 | | | 2,992 | |

| | | | | | | | | | |

The recorded investment in loans that are considered impaired amounted to $1,126,000, $1,013,000 and $439,000 on December 31, 2005, December 31, 2004 and December 31, 2003, respectively. By definition, impairment of a loan is considered when, based on current information and events, it is probable that all amounts due will not be collected according to the contractual terms of the loan agreement. The allowance for loan and lease losses related to loans classified as impaired amounted to approximately $150,000 at December 31, 2005 and $126,000 at December 31, 2004. All impaired loans at the end of 2005 and 2004 had related allowances. The average balances of these loans amounted to approximately $1,404,000, $945,000 and $983,000 for the years 2005, 2004 and 2003, respectively. The Bank recognizes interest income on impaired loans on a cash basis. The following is a summary of cash receipts on these loans and how they were applied in 2005, 2004 and 2003.

| | | | | | | |

(Dollars in thousands) | | 2005 | | 2004 | | 2003 |

Cash receipts applied to reduce principal balance | | $ | 23 | | 36 | | 4 |

Cash receipts recognized as interest income | | | 15 | | 3 | | 0 |

| | | | | | | |

Total cash receipts | | $ | 38 | | 39 | | 4 |

| | | | | | | |

Loans which were past due 90 days or more for which interest continued to be accrued amounted to approximately $1,002,000 at December 31, 2005 and $394,000 at December 31, 2004. Total nonaccrual loans amounted to $1,773,000 at December 31, 2005 and $873,000 at December 31, 2004. The Bank has no commitments to loan additional funds to borrowers with impaired or nonaccrual loans.

| (9) | Bank Premises and Equipment |

At December 31, 2005 and 2004, bank premises and equipment are as follows:

| | | | | |

(Dollars in thousands) | | 2005 | | 2004 |

Land | | $ | 1,823 | | 1,288 |

Buildings | | | 5,172 | | 4,732 |

Furniture and fixtures | | | 5,881 | | 4,966 |

Leasehold improvements | | | 133 | | 0 |

| | | | | |

| | | 13,009 | | 10,986 |

| | |

Less accumulated depreciation | | | 6,675 | | 6,112 |

| | | | | |

| | $ | 6,334 | | 4,874 |

| | | | | |

Depreciation expense was $579,000 in 2005, $475,000 in 2004 and $426,000 in 2003.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

13

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

At December 31, 2005 and 2004, time deposits in denominations of $100,000 or more amounted to $34,219,000 and $27,883,000, respectively. Interest expense on such certificates of deposit amounted to approximately $1,036,000, $830,000, and $873,000 for the years ended December 31, 2005, 2004 and 2003, respectively. Time deposits at December 31, 2005, mature as follows: (in thousands) 2006, $21,351; 2007, $6,297; 2008, $2,658; 2009, $962; 2010, $2,345 thereafter, $606.

Deposits and other funds from related parties held by MPB at December 31, 2005 and 2004 amounted to approximately $5,430,000 and $6,133,000, respectively.

| (11) | Short-term Borrowings |

Short-term borrowings as of December 31, 2005 and 2004 consisted of:

| | | | | |

(Dollars in thousands) | | 2005 | | 2004 |

Federal funds purchased | | $ | 5,000 | | 10,400 |

Repurchase agreements | | | 6,899 | | 2,928 |

Treasury, tax and loan notes | | | 443 | | 473 |

| | | | | |

| | $ | 12,342 | | 13,801 |

| | | | | |

The weighted average interest rate on total short-term borrowings outstanding was 4.22% at December 31, 2005 and 2.25% at December 31, 2004.

Federal funds purchased represent overnight funds. Securities sold under repurchase agreements generally mature between one day and one year. Treasury, tax and loan notes are open-ended interest bearing notes payable to the U.S. Treasury upon call. All tax deposits accepted by the Bank are placed in the Treasury note option account. The due to broker balance represents previous day balances transferred from deposit accounts under a sweep account agreement. The Bank also has unused lines of credit with several banks amounting to $21,748,000 dollars at December 31, 2005.

The Bank is a member of the Federal Home Loan Bank of Pittsburgh (FHLB) and through its membership, the Bank can access a number of credit products which are utilized to provide various forms of liquidity. As of December 31, 2005 and 2004, the Bank had long-term debt in the amount of $59,838,000 and $49,957,000, respectively, consisting of:

| | | | | |

| | | At December 31, |

(Dollars in thousands) | | 2005 | | 2004 |

Loans maturing in 2006 with rates ranging from 2.17% to 6.21% | | $ | 10,000 | | 10,000 |

Loans maturing in 2007 at a rate of 3.71% | | | 5,000 | | 5,000 |

Loans maturing in 2008 with rates ranging from 3.08% to 3.80% | | | 15,000 | | 5,000 |

Loans maturing in 2009 with rates ranging from 4.22% to 7.24% | | | 12,000 | | 12,000 |

Loans maturing in 2010 with rates ranging from 6.28% to 6.71% | | | 10,000 | | 10,000 |

Loans maturing in 2013 with rates ranging from 4.08% to 4.75% | | | 3,500 | | 3,500 |

Loans maturing in 2026 at a rate of 4.80% | | | 4,245 | | 4,362 |

Loans maturing in 2027 at a rate of 6.71% | | | 93 | | 95 |

| | | | | |

Total Long-term Debt | | $ | 59,838 | | 49,957 |

| | | | | |

The aggregate amounts of maturities of long-term debt subsequent to December 31, 2005 are $10,125,000 (2006), $5,131,000 (2007), $15,138,000 (2008), $12,145,000 (2009), $10,152,000 (2010),$7,147,000 thereafter. $4,700,000 of the Bank’s investments as well as the Bank’s mortgage loan portfolio are pledged to secure FHLB borrowings.

| (13) | Pension and Other Postretirement Benefit Plans |

MPB has an unfunded noncontributory defined benefit pension plan for directors. The plan provides defined benefits based on years of service.

MPB also has other postretirement benefit plans covering full-time employees. These health care and life insurance plans are noncontributory.

The significant aspects of each plan are as follows:

For full-time employees who retire after at least 20 years of service, MPB will pay premiums for major medical insurance (as provided to active employees) for a period ending on the earlier of the date the participant obtains other employment where major medical coverage is available or the date of the participant’s death; however, in all cases payment of medical premiums by MPB will not exceed five years. If the retiree becomes eligible for Medicare within the five year period beginning on his/her retirement date, the Bank may pay, at its discretion, premiums for 65 Special coverage or a similar supplemental coverage. After the five year period has expired, all MPB paid benefits cease; however, the retiree may continue coverage through the Bank at his/her own expense.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

14

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

For full-time employees who retire after at least 20 years of service, MPB will provide term life insurance. The amount of coverage prior to age 65 will be three times the participant’s annual salary at retirement or $50,000, whichever is less. After age 65, the life insurance coverage amount will decrease by 10% per year, subject to a minimum amount of $2,000.

MPB has an unfunded defined benefit retirement plan for directors with benefits based on years of service. The adoption of this plan generated unrecognized prior service cost of $274,000, which is being amortized based on the expected future years of service of active directors.

The following tables provide a reconciliation of the changes in the plan’s health and life insurance benefit obligations and fair value of plan assets for the years ended December 31, 2005 and 2004 and a statement of the funded status at December 31, 2005 and 2004:

| | | | | | | |

| | | December 31, | |

(Dollars in thousands) | | 2005 | | | 2004 | |

Change in benefit obligations: | | | | | | | |

Benefit obligations, January 1 | | $ | 646 | | | 501 | |

Service cost | | | 43 | | | 38 | |

Interest cost | | | 36 | | | 31 | |

Actuarial loss | | | 16 | | | 92 | |

Benefit payments | | | (21 | ) | | (16 | ) |

| | | | | | | |

Benefit obligations, December 31 | | $ | 720 | | | 646 | |

| | | | | | | |

Change in fair value of plan assets: | | | | | | | |

Fair value of plan assets, January 1 | | $ | 0 | | | 0 | |

Employer contributions | | | 21 | | | 16 | |

Benefit payments | | | (21 | ) | | (16 | ) |

| | | | | | | |

Fair value of plan assets, December 31 | | $ | 0 | | | 0 | |

| | | | | | | |

| |

| | | December 31, | |

(Dollars in thousands) | | 2005 | | | 2004 | |

Funded status: | | | | | | | |

Excess of the benefit obligation over the value of plan assets | | $ | (720 | ) | | (646 | ) |

Unrecognized transition obligation | | | 103 | | | 117 | |

Unrecognized loss (gain) | | | 20 | | | 4 | |

| | | | | | | |

Net amount recognized | | $ | (597 | ) | | (525 | ) |

| | | | | | | |

| | |

Amount recognized in the consolidated balance sheet at December 31, 2005 and 2004 is as follows: | | | | | | | |

| | |

(Dollars in thousands) | | 2005 | | | 2004 | |

Accrued benefit liability | | $ | (597 | ) | | (525 | ) |

| | | | | | | |

The accumulated benefit obligation for health and life insurance plans was $720,000 and $646,000 at December 31, 2005 and 2004, respectively.

The components of net periodic postretirement benefit cost for 2005, 2004 and 2003 are as follows:

| | | | | | | | |

(Dollars in thousands) | | 2005 | | 2004 | | 2003 | |

Service cost | | $ | 43 | | 38 | | 30 | |

Interest cost | | | 36 | | 31 | | 30 | |

Amortization of transition obligation | | | 15 | | 15 | | 15 | |

Amortization of net gain | | | 0 | | 0 | | (3 | ) |

| | | | | | | | |

Net periodic postretirement benefit cost | | $ | 94 | | 84 | | 72 | |

| | | | | | | | |

Assumptions used in the measurement of MPB’s benefit obligations at December 31, 2005 and 2004 are as follows:

| | | | | | |

| | | 2005 | | | 2004 | |

Weighted-average assumptions: | | | | | | |

Discount rate | | 5.50 | % | | 5.75 | % |

Rate of compensation increase | | 5.00 | % | | 5.00 | % |

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

15

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Assumptions used in the measurement of MPB’s net periodic benefit cost for the years ended December 31, 2005, 2004 and 2003 are as follows:

| | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Weighted-average assumptions: | | | | | | | | | |

Discount rate | | 5.75 | % | | 6.00 | % | | 6.75 | % |

Rate of compensation increase | | 5.00 | % | | 5.00 | % | | 5.00 | % |

Assumed health care cost trend rates at at December 31, 2005, 2004 and 2003 are as follows:

| | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Health care cost trend rate assumed for next year | | 9.00 | % | | 10.00 | % | | 5.50 | % |

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) | | 5.00 | % | | 5.00 | % | | 5.50 | % |

Year that the rate reaches the ultimate trend rate | | 2009 | | | 2009 | | | 2004 | |

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. A one-percentage-point change in assumed health care cost trend rates would have the following effects:

| | | | | |

| | | One-Percentage Point |

(Dollars in thousands) | | Increase | | Decrease |

Effect on total of service and interest cost | | $ | 13 | | 11 |

Effect on postretirement benefit obligation | | | 92 | | 78 |

MPB expects to contribute $20,526 to its postretirement benefit plans in 2006.

| | | |

Estimated Future Benefit Payments | | | |

1/1/2006 to 12/31/2006 | | $ | 20,526 |

1/1/2007 to 12/31/2007 | | | 21,769 |

1/1/2008 to 12/31/2008 | | | 21,188 |

1/1/2009 to 12/31/2009 | | | 29,043 |

1/1/2010 to 12/31/2010 | | | 33,120 |

1/1/2011 to 12/31/2015 | | | 223,626 |

The following tables provide a reconciliation of the changes in the directors’ defined benefit plan’s benefit obligations and fair value of plan assets for the years ended December 31, 2005 and 2004 and a statement of the funded status at December 31, 2005 and 2004:

| | | | | | | |

(Dollars in thousands) | | December 31, | |

| | 2005 | | | 2004 | |

Change in benefit obligations: | | | | | | | |

Benefit obligations, January 1 | | $ | 712 | | | 647 | |

Service cost | | | 26 | | | 22 | |

Interest cost | | | 41 | | | 39 | |

Actuarial (gain) loss | | | 17 | | | 5 | |

Change in assumptions | | | (57 | ) | | 17 | |

Benefit payments | | | (23 | ) | | (18 | ) |

| | | | | | | |

Benefit obligations, December 31 | | $ | 716 | | | 712 | |

| | | | | | | |

| | |

(Dollars in thousands) | | 2005 | | | 2004 | |

Change in fair value of plan assets: | | | | | | | |

Fair value of plan assets, January 1 | | $ | 0 | | | 0 | |

Employer contributions | | | 23 | | | 18 | |

Benefit payments | | | (23 | ) | | (18 | ) |

| | | | | | | |

Fair value of plan assets, December 31 | | $ | 0 | | | 0 | |

| | | | | | | |

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

16

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | | | | | | |

(Dollars in thousands) | | December 31, | |

Funded status: | | | | |

Excess of the benefit obligation over the value of plan assets | | $ | (716 | ) | | (712 | ) |

Unrecognized prior-service cost | | | 0 | | | 26 | |

Unrecognized loss | | | 17 | | | 57 | |

| | | | | | | |

Net amount recognized | | $ | (699 | ) | | (629 | ) |

| | | | | | | |

Amounts recognized in the consolidated balance sheet at December 31, 2005 and 2004 are as follows:

| | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | |

Accrued benefit liability | | $ | (716 | ) | | (645 | ) |

Intangible asset | | | 17 | | | 16 | |

| | | | | | | |

Net amount recognized | | $ | (699 | ) | | (629 | ) |

| | | | | | | |

The accumulated benefit obligation for the retirement plan was $716,000 and $645,000 at December 31, 2005 and 2004, respectively.

Other plan information at December 31, 2005 and 2004 is as follows:

| | | | | |

(Dollars in thousands) | | 2005 | | 2004 |

Projected benefit obligation | | $ | 716 | | 712 |

Accumulated benefit obligation | | | 716 | | 645 |

Fair value of plan assets | | | 0 | | 0 |

The components of net periodic pension cost for 2005, 2004 and 2003 are as follows:

| | | | | | | |

(Dollars in thousands) | | 2005 | | 2004 | | 2003 |

Service cost | | $ | 26 | | 22 | | 20 |

Interest cost | | | 41 | | 39 | | 37 |

Amortization of prior-service cost | | | 26 | | 26 | | 26 |

| | | | | | | |

Net periodic pension cost | | $ | 93 | | 87 | | 83 |

| | | | | | | |

Assumptions used in the measurement of MPB’s benefit obligations at December 31, 2005 and 2004 are as follows:

| | | | | | |

| | | 2005 | | | 2004 | |

Weighted-average assumptions: | | | | | | |

Discount rate | | 5.50 | % | | 5.75 | % |

Change in consumer price index | | 3.00 | % | | 4.00 | % |

Assumptions used in the measurement of MPB’s net periodic benefit cost for the years ended December 31, 2005, 2004 and 2003 are as follows:

| | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Weighted-average assumptions: | | | | | | | | | |

Discount rate | | 5.75 | % | | 6.00 | % | | 6.75 | % |

Rate of compensation increase | | 3.00 | % | | 4.00 | % | | 4.00 | % |

MPB expects to contribute $50,153 to its pension plan in 2006.

The Bank is the owner and beneficiary of insurance policies on the lives of certain officers and directors which informally fund the retirement plan obligation. The aggregate cash surrender value of these policies was $2,326,000 and $2,244,000 at December 31, 2005 and 2004, respectively.

| | | |

Estimated Future Benefit Payments | | | |

1/1/2006 to 12/31/2006 | | $ | 50,153 |

1/1/2007 to 12/31/2007 | | | 55,350 |

1/1/2008 to 12/31/2008 | | | 61,455 |

1/1/2009 to 12/31/2009 | | | 60,758 |

1/1/2010 to 12/31/2010 | | | 59,835 |

1/1/2011 to 12/31/2015 | | | 323,063 |

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

17

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

The Bank has a funded contributory profit-sharing plan covering substantially all employees. The Bank’s contribution to the plan was $277,000 for 2005, $307,000 for 2004 and $267,000 for 2003.

| | (b) | Deferred Compensation Plans |

The Bank has an executive deferred compensation plan which allows an executive officer to defer bonus compensation for a specified period in order to provide future retirement income. At December 31, 2005 and 2004, the Bank has accrued a liability of approximately $140,000 and $106,000, respectively, for this plan.

The Bank also has a directors’ deferred compensation plan which allows directors to defer receipt of monthly fees for a specified period in order to provide future retirement income. At December 31, 2005 and 2004, the Bank has accrued a liability of approximately $237,000 and $179,000, respectively, for this plan.

The Bank is the owner and beneficiary of insurance policies on the lives of the participating executive officer and directors which informally fund the benefit obligations. The aggregate cash surrender value of these policies was approximately $1,683,000 and $1,626,000 at December 31, 2005 and 2004, respectively.

| | (c) | Salary Continuation Agreement |

The Bank maintains a Salary Continuation Agreement (Agreement) for an executive officer. The Agreement provides the executive officer with a fixed annual benefit. The benefit is payable beginning at age 65 for a period of 15 years. If the executive officer terminates employment before the normal retirement date for reasons other than death, the annual benefit payable will be based on the vesting schedule as defined in the Agreement. Upon death or a change in control of the Bank, the executive officer or his beneficiary is entitled to the full fixed annual benefits. At December 31, 2005 and 2004, the Bank has accrued a liability of approximately $195,000 and $161,000, respectively, for the Agreement. The expense related to the Agreement was $34,000 for 2005, $32,000 for 2004 and $30,000 for 2003.

The Bank is the owner and beneficiary of an insurance policy on the life of the participating executive officer which informally funds the benefit obligation. The aggregate cash surrender value of this policy was approximately $897,000 and $866,000 at December 31, 2005 and 2004, respectively.

| | (d) | Employee Stock Ownership Plan |

MPB has an Employee Stock Ownership Plan (ESOP) covering substantially all employees. Contributions to the ESOP are made at the discretion of the Board of Directors. Total expense related to MPB’s contribution to the ESOP for 2005, 2004 and 2003 was $139,000, $155,000 and $134,000, respectively. The ESOP held 36,160 and 32,836 shares of MPB stock as of December 31, 2005 and December 31, 2004, respectively, all of which were allocated to plan participants. Shares held by the ESOP are considered outstanding for purposes of calculating earnings per share. Dividends paid on shares held by the ESOP are charged to retained earnings.

At December 31, 2005 and 2004, the Bank had Split Dollar Life Insurance arrangements with two executives for which the aggregate collateral assignment and cash surrender values are approximately $1,496,000 and $1,444,000, respectively.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

18

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

The following temporary differences gave rise to the net deferred tax asset at December 31, 2005 and 2004:

| | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | |

Deferred tax assets: | | | | | | | |

Allowance for loan losses | | $ | 1,106 | | | 1,085 | |

Benefit plans | | | 669 | | | 555 | |

Nonaccrual interest | | | 78 | | | 54 | |

Core deposit intangible | | | 8 | | | 3 | |

| | | | | | | |

Total | | | 1,861 | | | 1,697 | |

| | | | | | | |

Deferred tax liabilities: | | | | | | | |

Depreciation | | | (162 | ) | | (198 | ) |

Loan fees | | | (138 | ) | | (129 | ) |

Bond accretion | | | (27 | ) | | (20 | ) |

Other items | | | (22 | ) | | (11 | ) |

Unrealized gain on securities | | | (120 | ) | | (357 | ) |

| | | | | | | |

Total | | | (469 | ) | | (715 | ) |

| | | | | | | |

Deferred tax asset, net | | $ | 1,392 | | | 982 | |

| | | | | | | |

The provision for income taxes consists of the following:

| | | | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | | | 2003 |

Currently payable | | $ | 1,773 | | | 1,712 | | | 1,130 |

Deferred | | | (173 | ) | | (307 | ) | | 123 |

| | | | | | | | | |

Total provision for income taxes | | $ | 1,600 | | | 1,405 | | | 1,253 |

| | | | | | | | | |

A reconciliation of income tax at the statutory rate to MPB’s effective rate is as follows:

| | | | | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | | | 2003 | |

Provision at the expected statutory rate | | $ | 2,109 | | | 1,963 | | | 1,995 | |

Effect of tax-exempt income | | | (533 | ) | | (583 | ) | | (752 | ) |

Nondeductible interest | | | 39 | | | 34 | | | 53 | |

Other items | | | (15 | ) | | (9 | ) | | (43 | ) |

| | | | | | | | | | |

Provision for income taxes | | $ | 1,600 | | | 1,405 | | | 1,253 | |

| | | | | | | | | | |

On June 14, 2004, MPB consummated the purchase of assets and assumption of liabilities of the Dauphin office of Vartan National Bank (“Vartan”). MPB approved this deal in order to increase market share in the Central Pennsylvania Area. The net receipt of cash from Vartan was $4,139,000. The results of operations of Vartan from the date of acquisition have been included in the accompanying consolidated financial statements.

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition.

| | | |

(Dollars in thousands) | | 2004 |

Cash | | $ | 21 |

Loans | | | 2,483 |

Goodwill | | | 259 |

Core deposit intangible | | | 291 |

| | | |

Total Assets Acquired | | $ | 3,054 |

| | | |

Deposits: | | | |

Demand and savings deposits | | $ | 4,297 |

Time | | | 2,896 |

| | | |

Total Liabilities Assumed | | | 7,193 |

| | | |

Net Liabilities Assumed | | $ | 4,139 |

| | | |

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

19

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Presented herein is certain unaudited pro forma information for 2004 as if Vartan had been acquired on January 1, 2004 and for 2003 as if Vartan had been acquired on January 1, 2003. These results combine historical results of Vartan into MPB’s consolidated statement of income and, while certain adjustments were made for the estimated impact of purchase accounting adjustments and other acquisition-related activity, they are not necessarily indicative of what would have occurred had the acquisition taken place on the indicated dates.

| | | | | |

(Dollars in thousands, except per share data) | | Unaudited Pro Forma

for Year Ended December 31, |

| | 2004 | | 2003 |

Interest income | | $ | 20,178 | | 20,186 |

Noninterest income | | | 3,482 | | 2,757 |

Net income | | | 4,428 | | 4,733 |

Earnings per share | | | 1.39 | | 1.48 |

| (17) | Core Deposit Intangible |

A summary of core deposit intangible is as follows at December 31, 2005.

| | | |

(Dollars in thousands) | | |

Gross carrying amount | | $ | 291 |

Less accumulated amortization | | | 56 |

| | | |

Net carrying amount | | $ | 235 |

| | | |

Amortization expense amounted to $36,000 in 2005 and $20,000 in 2004.

The estimated amortization expense of intangible assets for each of the five succeeding fiscal years is $36,000 per year.

The Bank is subject to various regulatory capital requirements administered by the federal and state banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a direct material effect on the Bank’s financial statements. The regulations require the Bank to meet specific capital adequacy guidelines that involve quantitative measures of the Bank’s assets, liabilities, and certain off-balance sheet items as calculated under regulatory accounting practices. The Bank’s capital classification is also subject to qualitative judgments by the regulators about components, risk weightings and other factors.

Quantitative measures established by regulation to ensure capital adequacy require the Bank to maintain minimum amounts and ratios (set forth in the table below) of Tier I capital (as defined in the regulations) to total average assets (as defined), and minimum ratios of Tier I and total capital (as defined) to risk-weighted assets (as defined). To be considered adequately capitalized (as defined) under the regulatory framework for prompt corrective action, the Bank must maintain minimum Tier I leverage, Tier I risk-based and total risk-based ratios as set forth in the table. The Bank’s actual capital amounts and ratios are also presented in the table.

| | | | | | | | | | | | | | | | |

| | | | | | | | Capital Adequacy | | | To Be Well Capitalized

Under Prompt

Corrective Action Provisions: | |

| | | Actual: | | | Minimum Capital

Required: | | |

(Dollars in thousands) | | Amount | | Ratio | | | Amount | | Ratio | | | Amount | | Ratio | |

As of December 31, 2005: | | | | | | | | | | | | | | | | |

Tier I Capital (to Average Assets) | | $ | 31,404 | | 7.3 | % | | 17,172 | | 4.0 | % | | 21,465 | | 5.0 | % |

Tier I Capital (to Risk Weighted Assets) | | | 31,404 | | 9.3 | | | 13,487 | | 4.0 | | | 20,231 | | 6.0 | |

Total Capital (to Risk Weighted Assets) | | | 35,108 | | 10.4 | | | 26,974 | | 8.0 | | | 33,718 | | 10.0 | |

| | | | | | |

As of December 31, 2004: | | | | | | | | | | | | | | | | |

Tier I Capital (to Average Assets) | | $ | 27,346 | | 7.0 | % | | 15,604 | | 4.0 | % | | 19,505 | | 5.0 | % |

Tier I Capital (to Risk Weighted Assets) | | | 27,346 | | 9.0 | | | 12,147 | | 4.0 | | | 18,221 | | 6.0 | |

Total Capital (to Risk Weighted Assets) | | | 30,989 | | 10.2 | | | 24,294 | | 8.0 | | | 30,368 | | 10.0 | |

As of December 31, 2005 and 2004, the Bank’s capital ratios are in excess of the minimum and well-capitalized guidelines and MPB’s capital ratios are in excess of the Bank’s capital ratios.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

20

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| (19) | Concentration of Risk and Off-Balance Sheet Risk |

The Bank is a party to financial instruments with off-balance sheet risk in the normal course of business to meet the financing needs of its customers. These financial instruments include commitments to extend credit and financial standby letters of credit. Those instruments involve, to varying degrees, elements of credit and interest rate risk in excess of the amount recognized in the consolidated balance sheets.

The Bank evaluates each customer’s creditworthiness on a case-by-case basis. The amount of collateral obtained, if deemed necessary by the Bank upon extension of credit, is based on management’s credit evaluation of the borrower. Collateral held varies but may include accounts receivable, inventory, property, plant, and equipment, and income-producing commercial properties. The Bank’s exposure to credit loss in the event of nonperformance by the other party to the financial instrument for commitments to extend credit and financial standby letters of credit written is represented by the contractual amount of those instruments. The Bank uses the same credit policies in making commitments and conditional obligations as it does for direct, funded loans.

Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. Since many of the commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements.

Financial standby letters of credit are conditional commitments issued by the Bank to guarantee the performance of a customer to a third party. The credit risk involved in issuing letters of credit is essentially the same as that involved in extending loan facilities to customers. The term of these financial standby letters of credit is generally one year or less.

As of December 31, 2005, commitments to extend credit amounted to $64,795,000 and financial standby letters of credit amounted to $10,102,000.

Significant concentration of credit risk may occur when obligations of the same parties engaged in similar activities occur and accumulate in significant amounts.

In analyzing the Bank’s exposure to significant concentration of credit risk, management set a parameter of 10% or more of the Bank’s total net loans outstanding as the threshold in determining whether the obligations of the same or affiliated parties would be classified as significant concentration of credit risk. Concentrations by industry, product line, type of collateral, etc., are also considered. U.S. Treasury securities, obligations of U.S. government agencies and corporations, and any assets collateralized by the same were excluded.

As of December 31, 2005, commercial real estate financing was the only similar activity that met the requirements to be classified as a significant concentration of credit risk. However, there is a geographical concentration in that most of the Bank’s business activity is with customers located in Central Pennsylvania, specifically within the Bank’s trading area made up of Dauphin County, lower Northumberland County, western Schuylkill County and Hampden Township in Cumberland County.

The Bank’s highest concentrations of credit are in the areas of hotel/motel lodging financings and apartment building financing. Outstanding credit to these sectors amounted to $27,483,000 or 8.9% and $25,416,000 or 8.2%, respectively, of net loans outstanding as of December 31, 2005.

| (20) | Commitments and Contingencies |

Operating Lease

In April 2005, MPB entered into a non-cancelable operating lease agreement to lease approximately 2,500 square feet of office space in the downtown Harrisburg area, with the initial term extending through March 2010. MPB has the option to renew this lease for two additional five-year periods.

Minimum future rental payments under this operating lease as of December 31, 2005 for each of the next 5 years and in the aggregate are:

| | | |

2006 | | $ | 67,608 |

2007 | | | 69,636 |

2008 | | | 71,725 |

2009 | | | 73,877 |

2010 | | | 18,605 |

| | | |

| | $ | 301,451 |

| | | |

Litigation

MPB is subject to lawsuits and claims arising out of its business. In the opinion of management, after consultation with legal counsel, the ultimate disposition of these matters is not expected to have a material adverse effect on the consolidated financial condition of MPB.

A PROGRESSIVE, INDEPENDENT COMMUNITY BANK

21

| | |

| Mid Penn Bancorp, Inc. | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| (21) | Parent Company Statements |

The condensed balance sheet, statement of income and statement of cash flows for Mid Penn Bancorp, Inc., parent only, are presented below:

CONDENSED BALANCE SHEET

December 31, 2005 and 2004

| | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | |

ASSETS | | | | | | | |

Cash | | $ | 273 | | | 273 | |

Investment in Subsidiaries | | | 36,588 | | | 34,999 | |

| | | | | | | |

Total Assets | | $ | 36,861 | | | 35,272 | |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

Stockholders’ Equity | | $ | 37,397 | | | 35,808 | |

Less Treasury Stock | | | (536 | ) | | (536 | ) |

| | | | | | | |

Total Liabilities and Equity | | $ | 36,861 | | | 35,272 | |

| | | | | | | |

CONDENSED STATEMENT OF INCOME

For Years Ended December 31, 2005, 2004 and 2003

| | | | | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | | | 2003 | |

Dividends from Subsidiaries | | $ | 2,643 | | | 5,774 | | | 2,566 | |

Other Income from Subsidiaries | | | 47 | | | 23 | | | 24 | |

Undistributed Earnings of Subsidiaries | | | 2,051 | | | (1,361 | ) | | 2,097 | |

Other Expenses | | | (138 | ) | | (67 | ) | | (72 | ) |

| | | | | | | | | | |

Net Income | | $ | 4,603 | | | 4,369 | | | 4,615 | |

| | | | | | | | | | |

CONDENSED STATEMENT OF CASH FLOWS

For Years Ended December 31, 2005, 2004 and 2003

| | | | | | | | | | |

(Dollars in thousands) | | 2005 | | | 2004 | | | 2003 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | | |

Net Income | | $ | 4,603 | | | 4,369 | | | 4,615 | |

Undistributed Earnings of Subsidiaries | | | (2,051 | ) | | 1,361 | | | (2,097 | ) |

| | | | | | | | | | |

Net Cash Provided By Operating Activities | | | 2,552 | | | 5,730 | | | 2,518 | |

| | | | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | |

Dividends Paid | | | (2,552 | ) | | (5,739 | ) | | (2,499 | ) |