- TTE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

TotalEnergies SE (TTE) 6-KCurrent report (foreign)

Filed: 27 Oct 17, 12:00am

Exhibit 99.2

RECENT DEVELOPMENTS

TOTAL announces its 2017 third interim dividend

The Board of Directors of TOTAL S.A. met on October 26, 2017, and approved a 2017 third interim dividend of €0.62 per share. This interim dividend, unchanged compared to the proposed 2017 first and second interim dividends, is payable in euro according to the following timetable:

| • | ex-dividend date: March 19, 2018; | |

| • | record date: March 16, 2018; and | |

| • | payment date in cash or shares issued in lieu of cash: April 9, 2018. |

The Board of Directors will meet on March 14, 2018, to:

| • | declare the 2017 third interim dividend; | |

| • | offer, under the conditions set by the fourth resolution of the Combined Shareholders’ Meeting of May 26, 2017, the option for shareholders to receive the 2017 third interim dividend in cash or in new shares of the Company; | |

| • | set the issuance price of the new shares with a discount between 0% and 10% based on the average opening price on the Euronext Paris for the 20 trading days preceding the Board of Directors’ meeting, and reduced by the amount of the 2017 third interim dividend; | |

| • | set the period for shareholders to elect to receive the payment in new shares from March 19, 2018 to March 28, 2018, both dates inclusive; and | |

| • | authorize the payment of the dividend in cash or the delivery of shares issued in lieu of the dividend in cash on April 9, 2018. |

Holders of TOTAL’s American Depositary Receipts (“ADRs”) will receive the 2017 third interim dividend in dollars based on the then-prevailing exchange rate according to the following timetable:

| • | ADR ex-dividend date: March 15, 2018; | |

| • | ADR record date: March 16, 2018; and | |

| • | ADR payment date in cash or shares issued in lieu of cash: April 16, 2018. |

Registered ADR holders may also contact JP Morgan Chase Bank for additional information. Non-registered ADR holders should contact their broker, financial intermediary, bank or financial institution for additional information.

TOTAL enters the petroleum product retail sector in Mexico

On October 12, 2017, TOTAL S.A. (together with its subsidiaries and affiliates, “TOTAL” or the “Group”) announced that it had entered into an agreement with GASORED, a group of service station owners, to rebrand a network of around 250 service stations in and around Mexico City under the TOTAL brand.

Present in Mexico since 1982, TOTAL is aiming to capitalize on the deregulation of the country’s fuel sales and supply market to significantly expand its activities there.

The first TOTAL-branded stations will open by the end of the year, with deployment continuing in 2018 and 2019. The TOTAL-branded outlets will offer consumers and business customers the company’s full lineup of fuels and lubricants, as well as a broad range of products and services.

France: Total Solar and SunPower successful in solar rounds

On October 12, 2017, TOTAL announced that it continues to actively help drive the growth of solar power in France through a strong industrial commitment via its affiliates Total Solar, which develops projects, and SunPower, which supplies solar panels.

On the occasion of the second call for tenders for buildings and small carports, Total Solar, in partnership with the Groupe Carré, was awarded 70 projects totaling the capacity of more than 32 megawatts, or 22% of the allocated capacity.

SunPower will provide more than 500 megawatts of its SunPower® E-Series and X-Series solar panels for the 2017 winning various calls for tenders.

| 1 |

Results of the option to receive the 2017 first interim dividend in shares

The Board of Directors of TOTAL met on September 20, 2017, and declared a 2017 first interim dividend of €0.62 per share and offered, under the conditions set by the fourth resolution at the Combined Shareholders’ Meeting of May 26, 2017, the option for shareholders to receive the 2017 first interim dividend in cash or in new shares of the Company.

The period for exercising the option ran from September 25, 2017 to October 4, 2017. At the end of the option period, 68.5% of rights were exercised in favor of receiving the payment for the 2017 first interim dividend in shares.

25,633,559 new shares were issued, representing 1.0% of the Company’s share capital on the basis of the share capital of September 30, 2017. The share price for the new shares issued as payment of the 2017 first interim dividend was set at €41.12 on September 20, 2017. The price was equal to the average opening price on Euronext Paris for the twenty trading days preceding the meeting of the Board of Directors on September 20, 2017, reduced by the amount of the 2017 first interim dividend, with a 5% discount.

The settlement and delivery of the new shares as well as their admission to trading on Euronext Paris occurred on October 12, 2017. The shares carried dividend rights immediately and were fully assimilated with existing shares already listed.

The remaining cash dividend paid to shareholders who did not elect to receive the 2017 first interim dividend in shares amounted to €487 million and was paid on October 12, 2017.

Guinea: TOTAL reinforces its exploration in West Africa

On October 9, 2017, TOTAL and the National Office of Petroleum of Guinea (ONAP) announced the signature of a Technical Evaluation Agreement to study deep and ultra-deep offshore areas located off the coast of Guinea Conakry, covering approximately 55,000 square kilometers.

According to the terms of this agreement, TOTAL will have a year to assess the potential of the basin on the basis of existing data. At the end of this period, the Group will select three licenses to start an exploration program. As part of the agreement, TOTAL will also train ONAP staff to develop their technical skills in exploration and production.

TOTAL targets French residential market with natural gas and green power 10% cheaper than regulated tariffs

On October 5, 2017, TOTAL announced that it is expanding in the residential gas and power distribution market in France with the introduction of Total Spring, a natural gas and green power offering that is 10% cheaper than regulated tariffs.

Total Spring answers the needs of French consumers who want to reduce their energy bills and to access premium customer service. Total Spring leverages the TOTAL brand’s reputation for quality service, its reliability and the Group’s ambition to grow its power production from natural gas and renewable energies (solar, wind).

Statoil, Shell and TOTAL enter CO2 storage partnership

On October 2, 2017, the partners announced the signing of a partnership agreement to mature the development of carbon storage on the Norwegian continental shelf (NCS). The project is part of the Norwegian authorities’ efforts to develop full-scale carbon capture and storage in Norway.

In June, Gassnova awarded Statoil the contract for the first phase of the project. Norske Shell and Total E&P Norge are now entering as equal partners while Statoil will lead the project. All the partners will contribute people, experience and financial support.

| 2 |

The first phase of this CO2 project could reach a capacity of approximately 1.5 million tons per year. The project will be designed to accommodate additional CO2 volumes aiming to stimulate new commercial carbon capture projects in Norway, Europe and more globally across the world. In this way, the project has the potential to be the first storage project site in the world receiving CO2 from industrial sources in several countries.

The storage project will store CO2 captured from onshore industrial facilities in Eastern Norway. This CO2 will be transported by ship from the capture facilities to a receiving terminal located onshore on the west coast of Norway. At the receiving terminal, CO2 will be transferred from the ship to intermediate storage tanks, prior to being sent through a pipeline on the seabed to injection wells east of the Troll field on the NCS. There are three possible locations for the receiving terminal; a final selection will be made later this year.

The objective for the project, which is supported by Gassnova and other relevant governmental stakeholders, is to stimulate necessary development of CCS so the long-term climate targets in Norway and the EU can be reached. The collaboration will form the basis for establishing a further partnership for the construction and operational phases.

TOTAL signs agreement with Chevron on exploration in deepwater Gulf of Mexico

On September 22, 2017, TOTAL announced that its subsidiary, TOTAL E&P USA, INC. (“Total E&P USA”), has entered into an agreement to capture 7 prospects operated by CHEVRON U.S.A. INC. (“Chevron”) in the deepwater Gulf of Mexico (“GoM”). The agreement covers 16 blocks.

The associated prospects are located in two promising plays and areas of the GoM: Wilcox in Central GoM next to the Anchor discovery, and Norphlet in Eastern GoM nearby to the Appomattox discovery. Total E&P USA’s participation in these wells will be between 25% and 40%.The first of these wells was spudded late July 2017 on the Ballymore prospect in Mississippi Canyon.

TOTAL expands its energy efficiency business with the acquisition of GreenFlex

On September 19, 2017, TOTAL announced that it is to acquire GreenFlex, a French company specialized in energy efficiency.

Founded in 2009, GreenFlex is one of the European leaders in its sector, with more than 600 clients. The company is forecasting revenues of more than €350 million in 2017 and employs 230 people. GreenFlex combines data intelligence and equipment management and financing to help clients manage their energy consumption efficiently.

The acquisition will accelerate the expansion of TOTAL’s energy efficiency offering, over and above the growth of its affiliates BHC Energy in France and Tenag in Germany. TOTAL intends to offer its customers integrated solutions, from optimization of energy needs and sources and finding financing solutions to energy management and emissions measurement and reduction.

The transaction is expected to close in the fourth quarter of 2017, once it has been approved by the relevant regulatory authorities.

TOTAL partners with EREN Renewable Energy to expand its renewable business

On September 19, 2017, TOTAL announced the signature of an agreement with EREN Renewable Energy (“EREN RE”) to accelerate its growth in the production of power from renewable sources. TOTAL will acquire an indirect interest of 23% in EREN RE by subscribing to a capital increase for an amount of €237.5 million. The agreement also gives TOTAL the possibility to take over control of EREN RE after a period of 5 years.

Founded in 2012, EREN RE has developed a diversified asset base (notably wind, solar and hydro) representing a global installed gross capacity of 650 MW in operation or under construction. Its ambition is to achieve a global installed capacity of more than 3 GW within 5 years. The capital increase

| 3 |

subscribed by TOTAL will enable EREN RE to cover its financing needs to accelerate its development in the coming years.

The completion of this transaction remains subject to the approval of the relevant competition authorities.

TOTAL's stake in EREN RE complements the Group’s portfolio of renewable energy businesses. In particular, EREN RE, which will be renamed Total Eren upon completion of the transaction, will allow TOTAL to enter the wind power generation segment. Development of EREN RE's solar farm business will be mainly focused on emerging countries where the demand for electricity is growing.

TOTAL has been active in solar energy since 2011 as the majority shareholder in SunPower. In 2017, the Group also set up its own affiliate, Total Solar, in order to develop solar power plants in developed countries and distributed solar systems for industrial and commercial customers (B2B). SunPower, which manufactures and markets the world’s most efficient photovoltaic solar panels, worldwide, will focus its development activities on distributed generation in the B2C and B2B markets in the United States.

TOTAL divests its remaining 15% interest in Gina Krog field in Norway to KUFPEC

On September 4, 2017, TOTAL announced that it had signed an agreement to divest its remaining 15% interest in the Gina Krog field in Norway to Kuwait Foreign Petroleum Exploration Company (KUFPEC). This agreement builds on the 2016 transaction between TOTAL and KUFPEC concerning Norwegian North Sea assets, which included a 15% interest in Gina Krog. The overall consideration for both deals will total $617 million.

Upon completion of the sale, TOTAL will no longer have an interest in the Gina Krog field, while KUFPEC will have a 30% stake alongside Statoil (58.7%, operator), PGNiG Upstream International (8%) and Aker BP (3.3%). The Gina Krog oil and gas field started production in June 2017.

UK: TOTAL starts-up production of the Edradour & Glenlivet fields in the West of Shetland

On August 30, 2017, TOTAL announced the start-up of production from the Edradour & Glenlivet gas and condensate fields, located in about 300 to 435 meters of water in the West of Shetland area, close to the Laggan-Tormore fields that came on stream in February 2016. The Edradour and Glenlivet development will bring additional production capacity of up to 56,000 barrels of oil equivalent a day (boe/d).

The Edradour and Glenlivet development consists of a 35 kilometer tie-back of three subsea wells to the existing Laggan-Tormore production system, which include the 143 kilometer pipeline and the onshore Shetland Gas Plant. Following treatment at the gas plant, the gas is exported to the UK mainland via the Shetland Island Regional Gas Export System (SIRGE) and FUKA pipeline, and will serve the UK domestic market. The condensates are exported via the Sullom Voe Terminal.

Total E&P UK operates Edradour & Glenlivet with a 60% interest alongside partners DONG E&P (UK) Limited (20%) and SSE E&P UK Limited (20%).

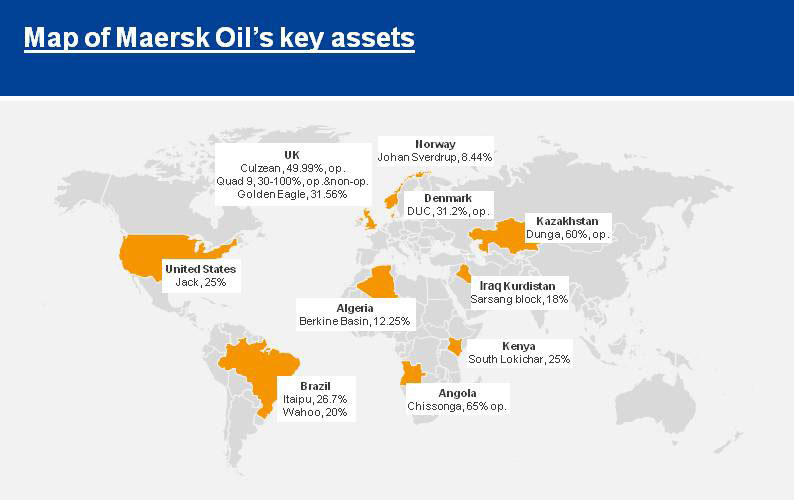

TOTAL acquires Maersk Oil for $7.45 billion in a share and debt transaction

On August 21, 2017, TOTAL announced that the Boards of TOTAL and A.P. Møller – Mærsk have both approved the acquisition of 100% of the equity of the E&P company Maersk Oil & Gas A/S (Maersk Oil), a wholly-owned subsidiary of A.P. Møller – Mærsk A/S, by TOTAL in a share and debt transaction.

Under the agreed terms, A.P. Møller – Maersk will receive consideration of $4.95 billion in TOTAL shares and TOTAL will assume $2.5 billion of Maersk Oil’s debt. TOTAL will issue to A.P. Møller – Maersk A/S, 97.5 million shares, based on the average TOTAL share price on the 20 business days prior to August 21 (signing date), which will represent 3.75% of the enlarged share capital of TOTAL. Underpinning this share-based partnership, subject to TOTAL shareholders’ approval, TOTAL has also offered the possibility of a seat on its Board of Directors to A.P. Møller Holding A/S, main shareholder of A.P. Møller – Mærsk.

| 4 |

The proposed transaction is subject to the applicable legally required consultation and notification processes for employee representatives and to approvals by the relevant regulatory authorities. The transaction is expected to close in the first quarter of 2018 and has an effective date of July 1, 2017.

The combination with Maersk Oil offers TOTAL an exceptional overlap of upstream businesses globally which will enhance TOTAL’s competitiveness and value in many core areas, in particular through some high quality growing assets and through the delivery of synergies. Specifically the transaction will bring the following benefits to TOTAL:

| • | significant OECD reserves, contributing to TOTAL’s continuous balancing of country risks of its portfolio to enhance shareholder value; | |

| • | the addition of 160 kboe/d of mainly liquids production in 2018, acquired at an average price of $46 k/boepd, offering high margins with an estimated free cash flow break-even of less than $30/b and growing to more than 200 kboe/d by the early 2020’s further strengthening TOTAL’s leading production growth outlook; | |

| • | TOTAL expects to generate operational, commercial and financial synergies of more than $400 million per year, in particular by the combination of assets of TOTAL and Maersk Oil in North Sea, an area of excellence for both companies; and | |

| • | the transaction is immediately accretive to both earnings and cash flow per share underpinning TOTAL’s dividend profile. |

At the closing of the transaction, in order that TOTAL’s shareholders benefit from the accretive impact of the acquisition of Maersk Oil on earnings and cash flow, the Board of Directors of TOTAL will consider removing the discount offered on the scrip dividend.

Key Themes of Transaction

Acquisition transforms TOTAL’s North West Europe outlook.

| • | This transaction will make TOTAL the second largest operator in the NW Europe offshore region, which is the 7th largest oil and gas producing region globally. Post completion, TOTAL will operate over 500 kboe/d (gross) production in this region. | |

| • | The transaction strengthens TOTAL’s existing North Sea offshore producing business in the UK and Norway. The addition of Maersk Oil’s world class assets, including the operated UK gas field Culzean (49.99% Working Interest), close to the Elgin-Franklin hub operated by TOTAL, and its stake in the giant Johan Sverdrup oil development (8.44% Working Interest) in Norway, will bolster TOTAL’s production profile in these countries. | |

| • | The transaction adds a new production hub with Maersk Oil’s operatorship and 31.2% ownership of the DUC producing assets in Denmark with net production in 2018 estimated at around 60 kboe/d. Maersk Oil has been the leading operator in Denmark for almost 50 years. The pooling of TOTAL’s and Maersk Oil’s technology and operating expertise will optimize the long-term value potential of the DUC assets to the benefit of Denmark and TOTAL shareholders. |

The transaction also will strengthen other core TOTAL regional businesses due to clear complementary positions between TOTAL and Maersk Oil, including:

| • | consolidating TOTAL’s US Gulf of Mexico presence with the Maersk Oil interest in the Jack development in the Wilcox formation; | |

| • | becoming the second largest IOC in Algeria by production; | |

| • | complementing TOTAL’s leading East Africa position via Maersk Oil’s Kenya assets; | |

| • | strengthening of TOTAL’s Kazakh business via addition of operated production; | |

| • | benefiting of potential upsides in Angola and Brazil; and | |

| • | pooling of TOTAL and Maersk Oil’s geological and operational expertise in the Middle East - North Africa Region. |

| 5 |

| 6 |