Exhibit 99.2

RECENT DEVELOPMENTS

Total announces the first 2019 interim dividend of €0.66/share, an increase of 3.1% compared to 2018

The Board of Directors on April 25, 2019 declared the distribution of the first 2019 interim dividend at an amount of €0.66/share, an increase of 3.1% from the 2018 interim dividends paid and the proposed final dividend, in accordance with the shareholder return policy from 2018 to 2020. This interim dividend will be detached and paid according to the following timetable:

| Shareholders | ADS holders |

Ex-dividend date | September 27, 2019 | September 25, 2019 |

Payment date | October 1, 2019 | October 18, 2019 |

As a reminder, the Board of Directors has decided not to propose to the Shareholders’ Meeting of May 29, 2019 the renewal of the scrip dividend option with effect from the payment of the final 2018 dividend.

TOTAL strengthens its presence in natural gas in Oman

On April 8, 2019, TOTAL S.A. (together with its direct and indirect consolidated companies located in or outside of France, "TOTAL" or the "Group") announced the signing of a Heads of Agreement (HoA) with the Ministry of Oil and Gas of the Sultanate of Oman (MOG) for the award to TOTAL of an exploration license on Block 12, located in Central Oman.

Under the terms of this HoA, both parties have agreed to finalize in the coming months, on an exclusive basis, a definitive agreement that will grant to TOTAL 100% working interest and operatorship of the exploration Block 12.

This new agreement was signed after TOTAL, the MOG and Oman Oil Company (OOC) reached a new milestone to implement their integrated gas project, which entails developing the gas resources of the Greater Barik area (Blocks 10 and 11), as well as building and operating a liquefaction plant to offer a bunkering service and supply liquefied natural gas as fuel to marine vessels.

Spread over 10,000 km2, Block 12 is located onshore in the northern part of Block 6 and to the south of the Greater Barik area (including Mabrouk North East and Mabrouk West fields).

TOTAL’s exploration program on the block will comprise seismic acquisition and drilling commitments, with drilling of the first well expected in 2020.

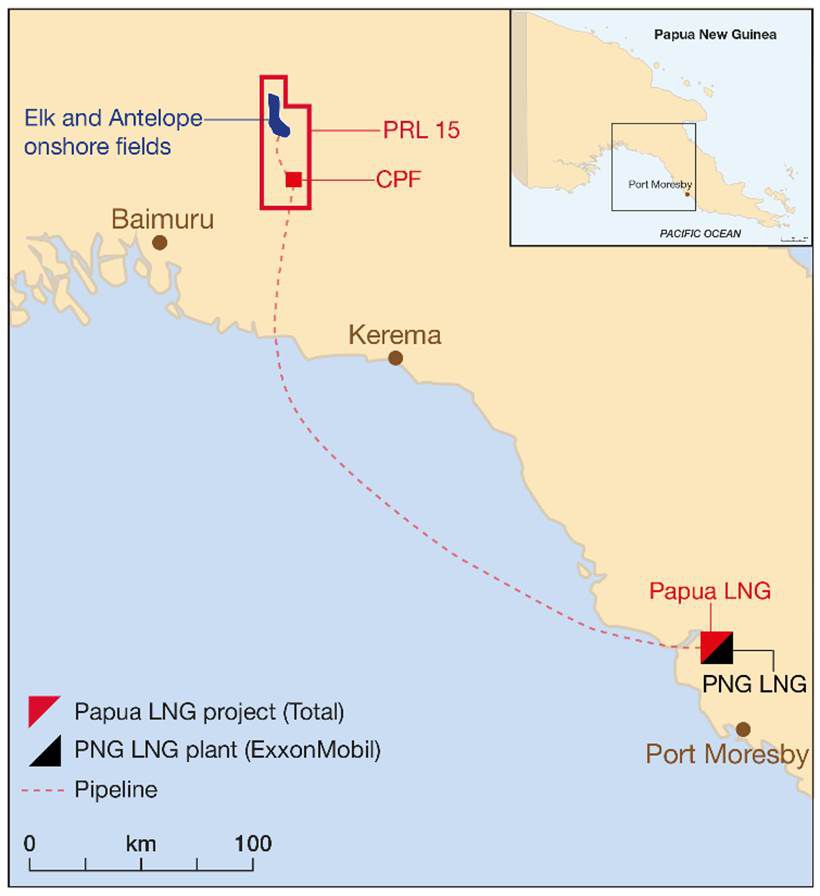

TOTAL and the State of Papua New Guinea sign gas agreement for Papua LNG project

On April 9, 2019, TOTAL announced the signing of a gas agreement among TOTAL and its partners ExxonMobil and Oil Search and the Independent State of Papua New Guinea defining the fiscal framework for the Papua LNG Project (the "Gas Agreement"). The Gas Agreement allows the partners to enter the Front-End Engineering Design (FEED) phase of study that will lead to a final investment decision in 2020.

The Papua LNG project of 5.4 million tons per annum (Mtpa) capacity will consist of two LNG trains of 2.7 Mtpa capacity each. The gas production will be operated by TOTAL and the LNG plant will be developed in synergy with the ExxonMobil-operated PNG LNG project through an expansion of the existing plant in Caution Bay.

Since the signing of a memorandum of understanding in November 2018,the pre-FEED engineering studies and the environmental baseline survey have been completed.

TOTAL operates the Elk and Antelope onshore fields and is the largest shareholder of the PRL-15 permit with a 31.1% interest, alongside partners ExxonMobil (28.3%) and Oil Search (17.7%), after accounting for the State of Papua New Guinea’s back-in right of a 22.5% interest.

Creation of the Integrated Gas, Renewables & Power business segment

Restatement of key figures of the business segments for 2017 and 2018

The profitable growth in the gas and low carbon electricity integrated value chains is one of the key axes of TOTAL’s strategy. In order to give more visibility to these businesses, a new reporting structure for the business segments’ financial information has been put in place, effective January 1, 2019, that is organized around four business segments: Exploration & Production ("EP"), Integrated Gas, Renewables & Power ("iGRP"), Refining & Chemicals ("RC") and Marketing & Services ("MS").

The iGRP segment spearheads TOTAL’s ambitions in integrated gas (including liquefied natural gas ("LNG")) and low carbon electricity businesses. It consists of the upstream and midstream LNG activity that was previously reported in the EP segment (refer to the indicative list of assets in the Annex) and the activity previously reported in the Gas Renewables & Power segment. The new EP segment has been adjusted accordingly.

The RC and MS segments are not affected.

The tables below show the key figures for 2017 and 2018 restated in order to reflect these changes.

Group hydrocarbon production

| 2017 | 2018 | 1Q18 | 2Q18 | 3Q18 | 4Q18 |

Group production (kboe/d) | 2,566 | 2,775 | 2,703 | 2,717 | 2,804 | 2,876 |

EP (kboe/d) | 2,165 | 2,394 | 2,359 | 2,375 | 2,433 | 2,408 |

iGRP (kboe/d) | 401 | 381 | 344 | 342 | 371 | 468 |

Group production (kboe/d) | 2,566 | 2,775 | 2,703 | 2,717 | 2,804 | 2,876 |

Oil (including bitumen) (kb/d) | 1,167 | 1,378 | 1,297 | 1,400 | 1,431 | 1,382 |

Gas (including Condensates and associated NGL) (kboe/d) | 1,398 | 1,397 | 1,406 | 1,317 | 1,373 | 1,493 |

Group production (kboe/d) | 2,566 | 2,775 | 2,703 | 2,717 | 2,804 | 2,876 |

Liquids (kb/d) | 1,346 | 1,566 | 1,481 | 1,582 | 1,611 | 1,589 |

Gas (Mcf/d) | 6,662 | 6,599 | 6,664 | 6,176 | 6,557 | 6,994 |

EP - Exploration-Production (redefined scope)

> Production

Hydrocarbon production | 2017 | 2018 | 1Q18 | 2Q18 | 3Q18 | 4Q18 |

EP (kboe/d) | 2,165 | 2,394 | 2,359 | 2,375 | 2,433 | 2,408 |

Liquids (kb/d) | 1,298 | 1,527 | 1,445 | 1,544 | 1,575 | 1,541 |

Gas (Mcf/d) | 4,728 | 4,724 | 4,976 | 4,536 | 4,678 | 4,710 |

> Key financial metrics

In millions of dollars | 2017 | 2018 | 1Q18 | 2Q18 | 3Q18 | 4Q18 |

Effective tax rate* | 40.5% | 46.2% | 48.7% | 46.6% | 47.5% | 41.2% |

Adjusted net operating income | 4,541 | 8,547 | 1,817 | 2,315 | 2,439 | 1,976 |

including income from equity affiliates | 827 | 1140 | 228 | 327 | 316 | 269 |

Investments** | 10,005 | 13,789 | 5,545 | 2,612 | 2 $,472 | 3,160 |

Divestments*** | 1,793 | 3,674 | 2,176 | 466 | 494 | 538 |

Organic investments**** | 9,110 | 7,953 | 1,798 | 1,785 | 1,605 | 2,765 |

* "Effective tax rate" = tax on adjusted net operating income / (adjusted net operating income - income from equity affiliates - dividends received from investments - impairment of goodwill + tax on adjusted net operating income).

** Including acquisitions and increases in non-current loans.

*** Including divestments and reimbursements of non-current loans.

**** "Organic investments" = net investments excluding acquisitions, divestments and other operations with non-controlling interests.

For the full-year 2018, EP’s cash flow from operating activities before changes in working capital at replacement cost and excluding financial charges was $17,832 million, compared to $12,758 million for the full-year 2017, $3,921 million in the first quarter of 2018, $4,800 million in the second quarter of 2018, $5,200 million in the third quarter of 2018 and $3,911 million in the fourth quarter of 2018.

For the full-year 2018, EP’s cash flow from operating activities excluding financial charges was $18,537 million, compared to $10,719 million for the full-year 2017, $3,322 million in the first quarter of 2018, $4,474 million in the second quarter of 2018, $4,431 million in the third quarter of 2018 and $6,310 million in the fourth quarter of 2018.

iGRP - Integrated Gas, Renewables & Power

> Production and LNG sales

Hydrocarbon production | 2017 | 2018 | 1Q18 | 2Q18 | 3Q18 | 4Q18 |

iGRP (kboe/d) | 401 | 381 | 344 | 342 | 371 | 468 |

Liquids (kb/d) | 48 | 40 | 36 | 38 | 36 | 48 |

Gas (Mcf/d) | 1,935 | 1,875 | 1,688 | 1,640 | 1,879 | 2,284 |

Liquefied natural gas (Mt) | 2017 | 2018 | 1Q18 | 2Q18 | 3Q18 | 4Q18 |

Overall LNG sales | 15.6 | 21.8 | 3.8 | 3.9 | 6.2 | 7.9 |

incl. sales from equity production* | 11.2 | 11.1 | 2.5 | 2.5 | 2.8 | 3.3 |

incl. sales by Total from equity production and | 7.6 | 17.1 | 2.6 | 2.7 | 5.1 | 6.7 |

* Equity production can be sold either by TOTAL or by a joint venture

> Key financial metrics

In millions of dollars | 2017 | 2018 | 1Q18 | 2Q18 | 3Q18 | 4Q18 |

Adjusted net operating income | 1,929 | 2,419 | 481 | 565 | 697 | 676 |

including income from equity affiliates | 804 | 1,249 | 228 | 250 | 324 | 447 |

Investments | 3,594 | 5,032 | 575 | 447 | 3,325 | 685 |

Divestments | 198 | 2,209 | 153 | 439 | 198 | 1,419 |

Organic investments | 2,553 | 1,745 | 336 | 388 | 407 | 614 |

For the full-year 2018, iGRP’s cash flow from operating activities before changes in working capital at replacement cost and excluding financial charges was $2,055 million, compared to $2,289 million for the full-year 2017, $393 million in the first quarter of 2018, $492 million in the second quarter of 2018, $553 million in the third quarter of 2018 and $617 million in the fourth quarter of 2018.

For the full-year 2018, iGRP’s cash flow from operating activities excluding financial charges was $596 million, compared to $3,157 million for the full-year 2017, $68 million in the first quarter of 2018, $258 million in the second quarter of 2018, $(164) million in the third quarter of 2018 and $434 million in the fourth quarter of 2018.

ANNEX

Indicative list of assets reported in EP segment through December 31, 2018

and in iGRP segment from January 1, 2019 onwards

Country | Asset | % equity |

Angola | Angola LNG | 13.60% |

Australia | Gladstone LNG | 27.50% |

Australia | Ichthys | 26.00% |

Indonesia | Mahakam | Until end 2017 (Mahakam license expired) |

Nigeria | Nigeria LNG | 15.00% |

Nigeria | OML 58 | 40.00% |

Norway | Snohvit | 18.40% |

Oman | Oman LNG | 5.54% |

Oman | Qalhat LNG | 2.04%. indirect participation through Oman LNG |

Papua New Guinea | Papua LNG | 40.10% |

Qatar | Qatargas 1 Upstream | 20.00% |

Qatar | Qatargas 1 Downstream | 10.00% |

Qatar | Qatargas 2 Train 5 | 16.70% |

Russia | Arctic LNG 2* | 10.00% direct working interest (21.64 % including indirect interest** and considering a 60% participation of Novatek in the project) |

Russia | Yamal LNG | 20.02% direct working interest (29.72% including indirect interest**) |

United Arab Emirates | ADNOC LNG | 5.00% |

USA | Barnett Shale *** | 90.92% in average |

Yemen | Yemen LNG | 39.62% |

* Total signed definitive agreements for entry into Arctic LNG 2 on March 5, 2019

** The iGRP segment includes the interests that Total holds in Arctic LNG 2 and Yamal LNG projects through its 19.4% ownership in Novatek. The other Novatek assets remain included in the EP figures.

*** Barnett shale consolidated in iGRP reporting along with the other Group’s LNG assets, such as the Group’s equity in Cameron LNG or Tellurian Inc., which were already reported in GRP December 31, 2018 figures.

Disclaimer: The restated data presented herein have been derived from TOTAL’s internal reporting system and have not been audited by TOTAL’s statutory auditors. Such related financial data are presented solely for information purposes. To the extent permitted by law, TOTAL S.A. disclaims all liability from the use of the restated financial data.

The list of assets in the Annex is presented for indicative purposes, and mentions the assets previously reported in the EP reporting segment, which are, as from January 1, 2019, reported in the iGRP reporting segment. This list refers to assets or contractual rights which may group the contributions of multiple subsidiaries and/or consolidated entities.

Financial information by business segment is reported in accordance with the internal reporting system and shows internal segment information that is used to manage and measure the performance of TOTAL. In addition to IFRS measures, adjusted net operating income, a performance indicator excluding the adjustment items described below is presented. This indicator is meant to facilitate the analysis of the financial performance of TOTAL and the comparison of income between periods. It allows investors to track the measures used internally to manage and measure the performance of the Group. These adjustment items include:

(i) Special items

Due to their unusual nature or particular significance, certain transactions qualified as "special items" are excluded from the business segment figures. In general, special items relate to transactions that are significant, infrequent or unusual. However, in certain instances, transactions such as restructuring costs or asset disposals, which are not considered to be representative of the normal course of business, may be qualified as special items although they may have occurred within prior years or are likely to occur again within the coming years.

(ii) Effect of changes in fair value

The effect of changes in fair value presented as an adjustment item reflects, for some transactions, differences between internal measures of performance used by TOTAL’s management and the accounting for these transactions under IFRS.

IFRS requires that trading inventories be recorded at their fair value using period-end spot prices. In order to best reflect the management of economic exposure through derivative transactions, internal indicators used to measure performance include valuations of trading inventories based on forward prices.

Furthermore, TOTAL, in its trading activities, enters into storage contracts, whose future effects are recorded at fair value in the Group’s internal economic performance. IFRS precludes recognition of this fair value effect.

Adjusted results including adjusted net operating income are defined as replacement cost results, adjusted for special items, excluding the effect of changes in fair value.

Additional information concerning the risk factors and uncertainties that may have an impact on the Group's financial results or activities is available in the most recent versions of the Registration Document (Document de référence) filed with the French Autorité des marchés financiers (AMF) and the Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (SEC).

Saft join forces with the Chinese group Tianneng to grow in China and scale up its e-mobility and energy storage businesses

On April 9, 2019, TOTAL announced that Saft, a subsidiary of TOTAL, signed an agreement with Tianneng Energy Technology ("TET"), a subsidiary of the Chinese privately-owned Tianneng Group, to create a joint venture ("JV") to expand their lithium-ion activity. Manufacturing will be based at the Changxing Gigafactory, with a potential capacity of 5.5 gigawatt hours ("GWh"), among which several GWh are already in operation. Saft will have a 40% shareholding in the new JV, while the Tianneng Group will hold the remaining shares.

The JV will primarily focus on the development, manufacturing and sales of advanced Li-ion cells, modules and packs for China and worldwide markets. E-bikes and Electric Vehicles as well as Energy Storage Solutions will be the target markets.

The partners also plan to expand the Changxing facility to ramp up its production capacity to meet future growing demand, mainly driven by e-mobility sales and the development of renewables.

Results of the option to receive the third 2018 interim dividend in shares

The Board of Directors of TOTAL S.A. met on March 13, 2019, and declared a third 2018 interim dividend of €0.64 per share and offered, under the conditions set by the fourth resolution at the Combined Shareholders’ Meeting on June 1, 2018, the option for shareholders to receive the third 2018 interim dividend in cash or in new shares of TOTAL S.A.

The period for exercising the option ran from March 21, 2019 to March 28, 2019. At the end of the option period, 44% of rights were exercised in favor of receiving the payment for the third 2018 interim dividend in shares.

14,864,169 new shares have been issued, representing 0.6% of the Company’s share capital on the basis of the share capital as of March 31, 2019. The share price for the new shares issued as payment of the third 2018 interim dividend was set at €49.30 on

April 5, 2019. The price is equal to the average opening price on Euronext Paris for the twenty trading days preceding the Board of Directors meeting on March 13, 2019, reduced by the amount of the third 2018 interim dividend, without any discount.

The settlement and delivery of the new shares as well as their admission to trading on Euronext Paris occurred on April 5, 2019. The shares carried immediate dividend rights and are fully assimilated with existing shares already listed.

In line with the shareholder return policy announced on February 8, 2018, in order to avoid any dilution linked to the issuance of new shares, the Group plans to buy back these newly issued shares with the intention to cancel them.

As a reminder, the Board of Directors has decided not to propose at the Shareholders’ Meeting on May 29, 2019 the renewal of the scrip dividend option beginning with the payment of the final 2018 dividend.

The cash dividend paid to the shareholders who did not elect to receive the third 2018 interim dividend in shares amounted to 928 million euros and the date for the cash payment was April 5, 2019.

Indicative ex-dividend dates for 2020 dividend

Subject to decisions by the Board of Directors and shareholders at the 2021 Shareholders’ Meeting to approve the 2020 financial statements, the allocation of earnings and the final dividend, the ex-dividend dates of the interim and the final dividends for 2020 will be as follows:

Type of coupon | Ex-dividend dates |

First interim | September 25, 2020 |

Second interim | January 4, 2021 |

Third interim | March 25, 2021 |

Final | June 24, 2021 |

The above ex-dividend dates relate to the TOTAL S.A. shares listed on the Euronext Paris.

TOTAL further commits to Tellurian-led Driftwood LNG project through 2.5 Mtpa of LNG offtake and equity investments

On April 3, 2019, TOTAL announced the signing of a series of agreements with Tellurian strengthening the partnership between the two companies to develop the Driftwood LNG project located in Louisiana, USA. The agreements include:

• A Heads of Agreement pursuant to which TOTAL will invest in Driftwood Holdings and plans to offtake 2.5 million tons per annum (Mtpa) of LNG. More precisely:

a. TOTAL is expected to make a $500 million equity investment in the Driftwood LNG and purchase 1 Mtpa of LNG from the proposed project;

b. Tellurian and TOTAL are also expected to enter into a sales and purchase agreement for a further 1.5 Mtpa of LNG from Tellurian Marketing’s LNG offtake volumes from the Driftwood LNG. The SPA will be for the purchase of LNG free on board for a minimum term of 15 years, at a price based on the Platts Japan Korea Marker.

• An agreement whereby TOTAL is expected to purchase around 20 million shares of Tellurian common stock for an amount of $200 million.

The agreements are subject to the relevant regulatory approvals and to the final investment decision of the Driftwood LNG project.

Driftwood LNG is an integrated LNG project that includes building gas pipelines from gas producing areas in Texas and a low cost modular concept liquefaction plant with a capacity of 16.6 Mtpa (Phase 1).

TOTAL has been a shareholder of Tellurian since 2017, when the Group acquired approximately 46 million shares of Tellurian for $207 million.

TOTAL and Guanghui sign a long-term LNG sale and purchase agreement

On April 3, 2019, TOTAL announced the signing of a long-term sale and purchase agreement with Guanghui1 for the supply of 0.7 million tons per year of liquefied natural gas (LNG) for a period of 10 years. The gas will be delivered to Guanghui’s regasification terminal in Qidong, Jiangsu Province, from TOTALs global LNG portfolio.

Angola: TOTAL launches full-field production on Kaombo with the start-up of the second FPSO

On April 2, 2019, TOTAL announced the start-up of production on Kaombo Sul, the second Floating Production Storage and Offloading ("FPSO") unit of the Kaombo project, located on Block 32, 260 kilometers off the coast of Luanda, in water depths ranging from 1,400 to 2,000 meters.

Eight months after its sister ship, Kaombo Norte, came on stream, Kaombo Sul is expected to add 115,000 barrels of oil per day (bopd) and bring the overall production capacity to 230,000 bopd, equivalent to 15% of the country’s production. The associated gas from Kaombo Sul will be exported to the Angola LNG plant, as part of the Group’s commitment to stop routine flaring.

The full Kaombo development consists of six fields spread over an area of 800 km2. Gengibre, Gindungo and Caril were connected to the Kaombo Norte FPSO which started up last year, while the three fields, Mostarda, Canela and Louro, have now been connected to Kaombo Sul. (see map)

The project comprises a large subsea system including 59 wells (with over 60% of them already drilled), and two FPSO units which were converted from Very Large Crude Carriers.

TOTAL operates Block 32 with a 30% participating interest, along with Sonangol P&P (30%), Sonangol Sinopec International 32 Limited (20%), Esso Exploration & Production Angola (Overseas) Limited (15%) and Galp Energia Overseas Block 32 B.V. (5%).

__________________________

[1] Guanghui International Natural Gas Trading Co., Ltd, a subsidiary of Guanghui Energy Co., Ltd, an integrated energy company based in Xinjiang, China.

Russia: TOTAL signs definitive agreements for entry into Arctic LNG 2

On March 5, 2019, TOTAL announced that it signed definitive agreements with Novatek for the acquisition of a direct 10% interest in Arctic LNG 2, a major liquefied natural gas development led by Novatek on the Gydan Peninsula, Russia.

Taking into account TOTAL’s 19.4% stake in Novatek and Novatek’s intention to retain 60% of the project, the Group's overall economic interest in this new LNG project will be approximately 21.6%. Should Novatek decide to reduce its participation below 60%, TOTAL will have the opportunity to increase its direct share up to 15%.

Novatek and TOTAL also agreed that TOTAL will have the opportunity to acquire a 10% to 15% direct interest in all Novatek's future LNG projects located on the Yamal and Gydan peninsulas.

With production capacity of 19.8 million tons per year (Mt/y), or 535,000 barrels of oil equivalent per day (boe/d), Arctic LNG 2 intends to develop the Utrenneye onshore gas and condensate field. The project will involve installation of three gravity-based structures in the Gulf of Ob on which three liquefaction trains of 6.6 Mt/y each will be installed.

Arctic LNG 2 production will be delivered to international markets by a fleet of ice-class LNG carriers that will be able to use the Northern Sea Route and a transshipment terminal in Kamchatka for cargoes destined for Asia and one close to Murmansk for those cargoes destined for Europe.

The project’s final investment decision is expected to be made in the second half of 2019, with plans to start the first liquefaction train in 2023.

Plastic Recycling: TOTAL acquires France’s Synova

On February 18, 2019, TOTAL announced that it acquired Synova, a French leader in manufacturing high-performance recycled polypropylene for the automotive sector.

Synova produces 20,000 tons per year of polypropylene that aims to meet the highest quality standards of original equipment manufacturers and automakers from recycled plastics.

France: TOTAL, Ørsted and Elicio join forces to bid for a wind farm offshore Dunkirk

On February 18, 2019, TOTAL, Ørsted, a renewable major, and Elicio, a renewable energy producer preselected by the French Energy Regulatory Commission, announced the creation of an industrial consortium to submit a joint bid for the Dunkirk offshore wind farm project for a projected power capacity of up to 600 MW.

Saudi Aramco and TOTAL invest in high-quality fuels and retail network in Saudi Arabia

On February 14, 2019, Saudi Aramco and TOTAL signed a Joint Venture ("JV") Agreement to develop a network of fuel and retail services in Saudi Arabia. The 50:50 JV plans to invest around $1 billion over the next 6 years in the Saudi fuel retail market and start providing motorists with premium fuels and retail services in Saudi Arabia.

The two companies also signed an agreement with the owners of Tas’helat Marketing Company (TMC) and Sahel Transport Company (STC) to acquire TMC and STC, including their existing network of 270 service stations and their fuel tanker fleet. Saudi Aramco and TOTAL plan to modernize this network and build high-quality service stations at selected locations.

This operation is subject to prior approval of the competent administrative authorities.