CONFIDENTIAL TREATMENT REQUESTED BY EDUCATION MANAGEMENT CORPORATION. PORTIONS OF THIS DOCUMENT HAVE BEEN OMITTED PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT. OMISSIONS ARE IDENTIFIED SEPARATELY BY “[*CONFIDENTIAL TREATMENT*]” THE CONFIDENTIAL MATERIAL HAS BEEN SUBMITTED SEPARATELY TO THE U.S. SECURITIES AND EXCHANGE COMMISSION’S DIVISION OF CORPORATION FINANCE.

September 4, 2014

Larry Spirgel

Division of Corporation Finance

Securities and Exchange Commission

Mail Stop 3720

100 F Street, NE

Washington, DC 20549

Re: Form 10-K for the Fiscal Year Ended June 30, 2013

Filed September 3, 2013

Form 10-Q for the Quarterly Period Ended March 31, 2014

Filed May 8, 2014

Response dated July 17, 2014

Response dated August 7, 2014

File No. 1-34466

Dear Mr. Spirgel:

This letter responds to the Staff’s request for information during an August 21, 2014 phone conversation with Carlos Pacho - Senior Assistant Chief Accountant, Ivette Leon - Assistant Chief Accountant, Jill Davis - Associate Chief Accountant, and Christy Adams - Senior Staff Accountant, related to the above referenced response letters submitted by Education Management Corporation (together with its subsidiaries, the “Company”) with respect to the Staff’s comments on the above referenced filings. Attached as Exhibit A is our SAB 99 materiality assessment relating to the recording of revenue upon the withdrawal of a student without a reduction for collectability risk. The following summarizes the nature of our policies around allowances for doubtful accounts as well as our assessment of the accuracy of our recognition of bad debt expense.

We estimate that we receive over 80% of our consolidated net revenues from sources from which we have historically had de minimis collections risk, such as Title IV programs, state grants, and private loans. We also receive funds from military aid sources that historically have accounted for approximately 5% of our net revenues, net of stipends. As a result, less than 15% of our revenues remain to be collected from students through cash payments. Given the low level of receivables that we must collect from students relative to the revenues that we record, our historical collections experience, our bad debt expense as a percentage of net revenues over the past couple of years of 7-8% and our write-off experience discussed below, we believe that our bad debt estimate has proven to be reasonable.

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 1 of 8

We determine our allowance for doubtful accounts in accordance with ASC 310-10-35 and ASC 450-20 by preparing a loss migration analysis for pools of similar receivables, which we believe is the most accurate way to evaluate how a large, generally homogeneous population of receivables will eventually pay. Accordingly, our process begins by first categorizing gross receivables (“A/R”) into three student statuses at each of our physical school locations (of which there were 110 as of June 30, 2013) as well as for fully online students at The Art Institute of Pittsburgh, Argosy University, and South University. The student statuses are as follows:

| |

| • | In-School, who we also refer to as active students; |

| |

| • | Out-of-School, which are for former students who have not made a payment for up to 120 days; and |

| |

| • | Collections, which are for former students who have not made a payment for between 121 and 365 days. |

This level of disaggregation of our student receivables results in 339 pools of receivables (113 pools * 3 statuses) which we believe appropriately differentiates credit risk in our portfolio and provides a reasonable basis for us to compute our estimate of loss. We calculate the rate for each physical location and for fully online students equal to the net amount of the original balance remaining after 18 months, regardless of a student’s status at the end of the 18-month period, which becomes the basis for the amount of reserve that is necessary for each student status at each location, which we refer to as the “validation rate.” To clarify:

| |

| • | The In-School validation rate is the result of the payment history and amounts that ultimately were written off for the population of students who were classified as In-School 18 months ago, even though a portion of those students are no longer in school and are currently in an Out-of-School or Collections status. |

| |

| • | Similarly, the Out-of-School validation rate is the result of the payment history and amounts that were ultimately written off for the population of students who were classified as Out-of-School 18 months ago, even though a portion of those students re-entered school and are now In-School students, and a portion of those students are either currently in the Collections category or have been written off entirely. |

We perform the above analysis on a monthly basis and aggregate the results into the seven subcomponents listed below to develop a weighted average validation rate for each 18-month period for In-School, Out-of-School and Collections:

| |

| • | Art Institute Ground campuses |

| |

| • | Art Institute Fully online programs |

| |

| • | Argosy University Ground campuses |

| |

| • | Argosy University Fully online programs |

| |

| • | South University Ground campuses |

| |

| • | South University Fully online programs |

Because we perform the above calculations on a monthly basis, we have historical payment data for every 18-month period, including mid-quarter beginning and ending dates. We utilize the most recent 18 data sets of validation rates for each of the seven subcomponents as of each balance sheet date to develop a

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 2 of 8

statistical trend line so we can determine our future reserve needs for each subcomponent and student status. For example, the reserve that was necessary for In-School students at The Art Institutes ground campuses at June 30, 2013 was based on the validation rates determined for the following 18-month periods: June 2010 through December 2011, July 2010 through January 2012, August 2010 through February 2011, and so on, culminating with the validation rate calculated for the period from December 2011 through June 2013.

We believe that basing our reserves on a trend line, rather than simply recording the reserve based on the most recent 18-month payment period, enables us to more adequately assess the collection risk on current receivables than the historical analysis alone would. For example, assume that one of our subcomponents’ In-School validation rates has steadily risen from 20% to 25% over the last 18 calculation periods. Without a trend analysis, the rate at which we would record the reserve would be 25%, the evidence of the last payment period. However, based on an analysis of a recent upward trend in rates, we may believe that, in order to properly account for current receivables, we should have a higher rate than 25%. Using statistical logic, the baseline rate upon which to base our allowance for doubtful accounts for this subcomponent would be a number higher than 25%. Assuming that rate is 27%, that will become the midpoint of a range that we develop, which is bound by one standard deviation above and below this midpoint, for each of our 21 validation rates (or 7 subcomponents times 3 student statuses). We develop a range because of the uncertainties inherent in forecasting future results, and where we ultimately record our allowance for doubtful accounts within that range is based on professional judgment in evaluating the impact of other factors, such as macroeconomic factors, on future expected repayments. Historically, our reserve has fallen between the midpoint and the highpoint of that range on a consolidated basis, and the difference between the midpoint and highpoint of the range has typically been within 2% of the total receivables at any balance sheet date.

We believe an effective way to evaluate historical accuracy of our allowance for doubtful accounts estimate is to compare the total reserve as of June 30 of the preceding year to the amounts written off in the next fiscal year because we write-off accounts receivable which are 365 days past due. Below is a chart depicting the total of such amounts, as derived from Schedule II - Valuation and Qualifying Accounts from our Form 10-K (in thousands):

| |

| • | June 30, 2012 reserve - $245,189 |

| |

| • | Fiscal 2013 write offs - $213,884 |

| |

| • | June 30, 2013 reserve - $202,611 |

| |

| • | Fiscal 2014 write offs - $156,205 (not yet filed) |

We note that our allowance for doubtful accounts balance at the end of a fiscal year has historically been higher than what we have written off in the following fiscal year, which we believe is appropriate because our reserve considers currently paying receivables that may be written off beyond one year in the future, based on our historical loss experience. Accordingly, we believe that our actual collections experience has been materially consistent with our estimates at prior balance sheet dates.

As requested by the Staff, Education Management Corporation (“EDMC”) acknowledges the following with regard to the filings:

| |

| • | The Company is responsible for the adequacy and accuracy of the disclosure in the filings |

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 3 of 8

| |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| |

| • | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Thank you for your consideration. If you have any further questions or comments, please address them to me at (412) 562-0900.

Sincerely,

EDUCATION MANAGEMENT CORPORATION

By: /s/ Mick J. Beekhuizen

Mick J. Beekhuizen

Executive Vice President and Chief Financial Officer

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 4 of 8

Exhibit A

To: Accounting Files

From: [*CONFIDENTIAL TREATMENT*]

CC: Ernst & Young

Date: August 20, 2014

Re: Materiality Analysis on Revenue Recognized at the Time of Student Withdrawals

We record the risk of not collecting revenue recognized when a student withdraws from school in bad debt expense as part of our evaluation of the allowance for doubtful accounts. This evaluation considers a student’s change in status (withdrawal from school), as historical collection rates for students who have withdrawn from school are worse than those for students who are still in school. We update the allowance for doubtful accounts at each reporting period end for changes in student statuses to ensure that our results of operations properly reflect only those amounts which we expect to collect.

We recognize that GAAP requires a reassessment of the collectability of revenue recognized at the time of a student’s withdrawal or loss of financial aid. Because the difference in presentation would only reduce the amount of revenue we record after applying the applicable refund policy with a corresponding reduction to the amount of bad debt expense we record when a student withdraws from school in the same reporting period (or an estimated 1.2% of net revenues for fiscal 2013), we believe that recording the collectability risk related to withdrawn students as a component of bad debt expense does not materially affect our financial statements taken as a whole.

Based on our quantitative and qualitative analysis of the recognition of a net amount of revenue and a lower bad debt expense for each of the last three fiscal years on our financial statements, we have concluded that any adjustment to our historical financial statements would not be material. We will continue to record revenue and bad debt expense associated with incremental revenue recorded at the time of student withdrawals under the current “gross” presentation. We will monitor the materiality of not using the “net” presentation on an ongoing basis in future periods to determine whether we should change our accounting policy.

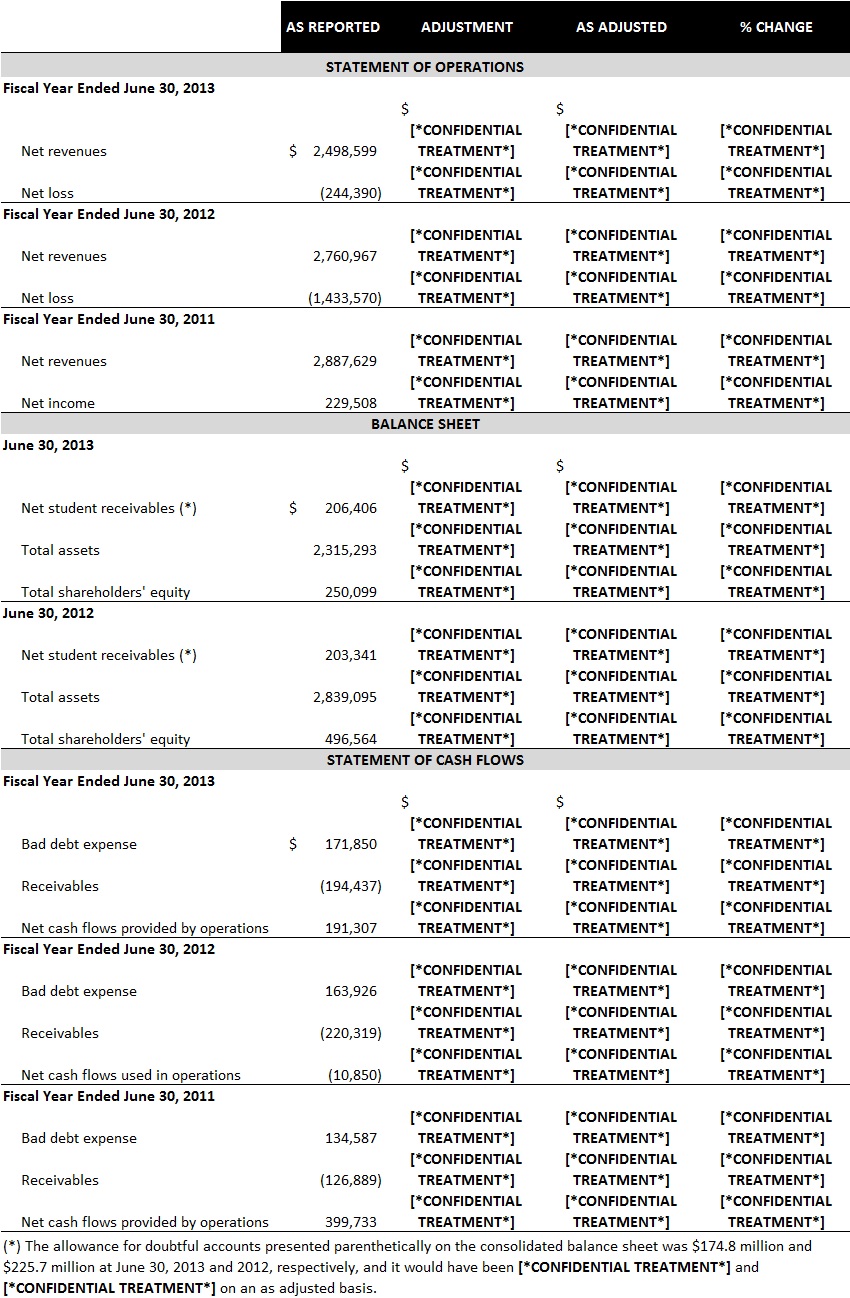

We estimated the impact on the applicable balance sheet, income statement and cash flow balances of recognizing a contra account to the revenue recorded at the time of student withdrawals to reduce the revenue by the amount which we did not expect to collect as follows (in thousands):

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 5 of 8

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 6 of 8

We conclude that the adjustments above are not quantitatively material to the fiscal 2013, 2012 and 2011 financial statements based on the following:

| |

| • | The adjustments are only 1.2% of total net revenues in each of the fiscal years ended June 30, 2013 and 2012 and 1.1% of total net revenues in the fiscal year ended June 30, 2011. |

| |

| • | These adjustments do not impact EBITDA excluding certain expenses, which is the primary income statement metric disclosed for segment reporting purposes under ASC 280 (Segment Reporting), and Adjusted EBITDA used for debt compliance purposes in any prior period. |

| |

| • | These adjustments do not impact net student receivables, total assets, total shareholders’ equity and cash flows from operations. |

In addition, there is no flow through impact of prior periods into subsequent periods, as the adjustments do not affect net income

Section M to Topic 1 of the Staff Accounting Bulletin Series, entitled "Materiality," provides guidance in applying materiality thresholds to the preparation of financial statements filed with the Securities and Exchange Commission and the performance of audits of those financial statements. Although Section M is to be used by auditors to assess whether adjustments identified as part of a review or audit should be recorded by a Company, it should also be used to help a Company determine whether prior period adjustments are material to previously filed financial statements. In addition to establishing “rules of thumb” to be used when determining quantitative materiality thresholds, it also prescribes a list of qualitative factors that should be assessed in determining materiality, as depicted below. The qualitative factors below have helped us conclude that the adjustments under a “net” presentation are not material when considered with our quantitative analysis above.

| |

| a) | whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate and, if so, the degree of imprecision inherent in the estimate |

Company Response: A change to the “net” presentation would require an estimate utilizing historical withdrawal data that incorporates the timing in the academic term of when these withdrawals occur. We believe that this estimate is materially accurate; therefore, the degree of imprecision is low.

| |

| b) | whether the misstatement masks a change in earnings or other trends |

Company Response: The adjustment did not mask a negative trend in earnings because it is a reclassification between income statement lines that has no impact on net income, EPS, and EBITDA excluding certain expenses. Further, it does not alter year-over-year trends in revenue. For example, net revenues decreased by approximately 9.5% and 4.4% in fiscal 2013 and 2012, respectively, as compared to the prior year period under both the reported “gross” presentation as well as on an as adjusted “net” presentation.

| |

| c) | whether the misstatement hides a failure to meet analysts' consensus expectations for the enterprise |

Company Response: This adjustment has no impact to EBITDA, net income or EPS excluding certain expenses which are the key measures that management has historically provided an outlook for in its quarterly earnings releases. We believe our presentation of collectability risk within bad debt expense is a common approach within the proprietary education sector and allows the users of our financial statements to understand bad debt expense trends related to our receivables and compare us to our peers. Although analysts estimate revenue, the adjustments noted are only approximately 1.2% of total net revenues, which is not material. Further, the overall financial

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 7 of 8

analysis of the business performed by analysts includes student enrollment, revenue and expenses which are ultimately used to estimate EBITDA excluding certain expenses in assessing profitability of the company. The adjustments do not impact the expectations of analysts when taken in the context of their overall analysis and outlook on the business taken as a whole.

| |

| d) | whether the misstatement changes a loss into income or vice versa |

Company Response: There is no impact to net income or any net earnings metric as noted above.

| |

| e) | whether the misstatement concerns a segment or other portion of the registrant's business that has been identified as playing a significant role in the registrant's operations or profitability |

Company Response: The adjustments impact all segments; they do not have a significantly more pronounced effect for any reportable segment relative to the total Company. Further, there is no impact to any net profitability metric for any reportable segment or the total Company.

| |

| f) | whether the misstatement affects the registrant's compliance with regulatory requirements |

Company Response: The adjustment does not affect the registrant from a regulatory standpoint. Two key metrics reviewed by regulatory bodies are the current ratio and the composite score. The current ratio is not impacted as current assets and current liabilities are not affected by the adjustment. The composite score is a computation utilizing three ratios, each of which has a strength factor and weighting applied to it in deriving a final result between (1.0) and 3.0 used to assess the financial health of an institution as set forth by the U.S. Department of Education (a score greater than 1.5 is necessary to be deemed “healthy”). We have failed the composite score on a consolidated basis since June 2006 as a result of the going-private transaction. The adjustments to revenue and bad debt expense would have had no impact on the composite score in any of the past periods. For example, the composite score in fiscal 2013 was (1.0) based upon both the reported numbers as well as the numbers adjusted to provide the net revenue and lower bad debt expense. While the underlying ratios used in the calculation can change slightly, the final result is not impacted after applying the strength factors and weighting.

| |

| g) | whether the misstatement affects the registrant's compliance with loan covenants or other contractual requirements |

Company Response: The adjustment does not impact our compliance with financial debt covenants as Adjusted EBITDA, as defined in our quarterly SEC filings, for debt compliance purposes is not affected.

| |

| h) | whether the misstatement has the effect of increasing management's compensation - for example, by satisfying requirements for the award of bonuses or other forms of incentive compensation |

Company Response: No impact as incentive compensation is based on EBITDA excluding certain expenses, and this financial measure is not impacted by the adjustment.

| |

| i) | whether the misstatement involves concealment of an unlawful transaction. |

Company Response: The adjustment does not conceal an unlawful transaction.

FOIA Request for Confidential Treatment Made by Education Management Corporation Pursuant to 17 C.F.R. §200.83 - p. 8 of 8