SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2006

Education Management Corporation

(Exact name of Registrant as Specified in its Charter)

| | | | |

| Pennsylvania | | 000-21363 | | 25-1119571 |

(State or other jurisdiction of Incorporation or Organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

210 Sixth Avenue, Pittsburgh, PA 15222

Registrant’s telephone number, including area code: (412)562-0900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

TABLE OF CONTENTS

| Item 7.01 | Regulation FD Disclosure. |

On March 3, 2006, EM Acquisition Corporation, a Pennsylvania corporation (“EM Acquisition”) formed by investment funds associated with Providence Equity Partners and Goldman Sachs Capital Partners (the “Sponsors”), entered into an agreement and plan of merger (the “Merger Agreement”) with Education Management Corporation pursuant to which EM Acquisition will merge with and into Education Management Corporation (the “Merger”). As a result of the Merger, investment funds associated with or designated by the Sponsors will own Education Management Corporation. This Form 8-K is being furnished to make available the following information that is being provided on a non-confidential basis to potential debt financing sources of EM Acquisition in connection with the Transactions, which information is required to be provided to potential debt financing sources pursuant to the terms of the Merger Agreement. Education Management LLC, a Delaware limited liability company, and Education Management Finance Corp., a Delaware corporation, were formed in connection with the Transactions. There can be no assurances that the Merger, which is subject to approval by the stockholders of EDMC and certain customary closing conditions, will occur. The information furnished in this Form 8-K, including but not limited to business strategies, investment considerations and pro-forma financial information, assumes consummation of the Transactions.

Unless the context otherwise requires, references in this Form 8-K to “we,” “our,” “us” and “the Company” refer to Education Management LLC and the entities that will be its consolidated subsidiaries (including Education Management Finance Corp., co-issuer of the notes), which consist of all of EDMC’s existing operations. References to “EDMC” refer to Education Management Corporation, which will be the indirect parent company of Education Management LLC. References to our fiscal year refer to the twelve month period ended June 30 of the year referenced. Financial information identified in this Form 8-K as “pro forma” gives effect to the closing of the Transactions. The initial borrowings under our new senior secured credit facilities, the equity investment and participation by the Investors (as defined below) in EDMC, the Merger, the related debt financing transactions and other related transactions are collectively referred to in this Form 8-K as the “Transactions.”

“Safe Harbor” Statement under Private Securities Litigation Reform Act of 1995

This current report on Form 8-K contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates” or similar expressions that concern our strategy, plans or intentions. All statements we make relating to the closing of the merger and related transactions described in this current report or to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Important factors that could cause actual results to differ materially from our expectations (“cautionary statements”) are more fully disclosed below under the section headed “Risk Factors.” All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. We assume no obligation to update any written or oral forward-looking statement made by us or on our behalf as a result of new information, future events or other factors.

As provided in General Instruction B.2 of Form 8-K, the information contained in this Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. Furnishing this information, we make no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

The Company is hereby furnishing the following information regarding its business:

OVERVIEW

Our Company

We are among the largest providers of post-secondary education in North America, with more than 72,000 active students as of the fall of 2005. Our educational institutions offer students the opportunity to earn undergraduate and graduate degrees in a broad range of disciplines, including media arts, design, psychology and behavioral sciences, education, information technology, legal studies, business, health sciences and culinary arts. Since 1996, we have generated a compounded annual enrollment growth rate of 18.7% and a compounded annual revenue growth rate of 23.9%.

Over our 35-year operating history, we have expanded the reach of our educational systems and currently operate 72 campuses across 24 states in the United States and two Canadian provinces. Additionally, we offer an online education platform, enabling our students to pursue degrees online or through a flexible combination of both online and local campuses. Our programs enable students to earn various degrees, including Doctorate, Master’s, Bachelor’s and Associate’s, as well as certain specialized non-degree diplomas. These academic programs are designed with a distinct emphasis on applied, career-oriented content and are primarily taught by faculty members that possess practical and relevant professional experience in their respective fields.

-3-

Our student population includes both traditional students, typically recent high school graduates pursuing their first higher education degree, and working adults, who are pursuing additional education in their current field or preparing for a new profession. Based on information collected by us from graduating students and employers, we believe that of the approximately 12,000 undergraduate students who graduated from our institutions during the calendar year ended December 31, 2004, approximately 85% of those available for employment obtained employment in their fields of study or a related field within six months of graduation. Similar to traditional public and private colleges and universities, each of our schools located in the United States is recognized by accreditation agencies and by the U.S. Department of Education, enabling students to access federal student loans, grants and other forms of public and private financial aid.

Our schools are organized and managed through four educational systems, each focused on specific programmatic and degree areas:

| | • | | The Art Institutes.The Art Institutes offer Master’s, Bachelor’s and Associate’s degree programs, as well as certain non-degree diploma programs, in graphic design, media arts and animation, multimedia and web design, game art and design, video and digital media production, interior and industrial design, culinary arts, photography and fashion. Students can pursue their degree at one of our 32 Art Institute campuses in 18 states and two Canadian provinces, including The Art Institute Online, a division of The Art Institute of Pittsburgh. |

| | • | | Argosy University.Argosy University is primarily focused on Doctorate and Master’s degree programs in clinical psychology, counseling, education and business administration. It also offers Bachelor’s and Associate’s degrees in similar fields. There are 14 Argosy University campus locations in eleven states. |

| | • | | Brown Mackie Colleges.The Brown Mackie Colleges offer Associate’s degree programs, as well as certain non-degree diploma programs, in health sciences, business, information technology, legal studies and design technologies. There are 21 Brown Mackie College campuses in ten states, primarily in the Midwestern United States. |

| | • | | South University. South University offers undergraduate and graduate degree programs in business, legal studies, information technology and health sciences fields through four campuses in the Southeastern United States and online programs. |

In addition to the educational systems listed above, we also operate Western State University College of Law in California, which offers Juris Doctor degrees. We have recently opened additional degree sites of Argosy University to assume the Associate’s degree programs of three Brown Mackie College locations that are scheduled to close once their remaining students complete their programs.

We have provided educational services for more than 35 years since the acquisition of our first Art Institute in Pittsburgh in 1970. Throughout our history, we have selectively pursued acquisitions to augment our network, program and degree offerings with established franchises such as Argosy University in 2001 and South University and American Education Centers (renamed the Brown Mackie Colleges) in 2003. Of the 26 acquisitions we have completed, the majority have been select acquisitions of single campuses where the economics of acquiring an existing school were more favorable than opening a new school.

Industry Overview

We believe the post-secondary education market in the U.S. is a $320 billion annual market, which includes public and private two-year and four-year degree granting institutions, graduate and professional schools, and non-degree vocational schools offering specialized diplomas. In the U.S., there are over 17 million students enrolled in over 6,000 institutions that offer Doctorate, Master’s, Bachelor’s and Associate’s degrees and diploma programs. According to the National Center of Education Statistics, traditional students, typically recent high school graduates under 25 years of age who are pursuing their first higher education degree, represent approximately 61% of the national student population, with the remaining 39% comprising non-traditional students, who are largely working adults pursuing additional education in their current field or preparing for a new profession.

We believe there are a number of factors contributing to the long-term growth of the post-secondary industry. First, the shift toward a services-based economy increases the demand for higher levels of education. According to the Bureau of Labor Statistics, over the next decade 61% of projected growth in employment is expected to come from jobs that require at least some college experience. Second, according to the U.S. Census Bureau, the median annual income in 2004 for a person with a Bachelor’s degree was 62% higher than that of a high school graduate. This income benefit of education has helped increase the percentage of adults over 25 years of age

-4-

with Bachelor’s degrees from 11% in 1970 to 28% in 2004. Third, government and private financial aid in various forms, including loan guarantees, grants and tax benefits for post-secondary students, has consistently increased from $4.4 billion to $142.7 billion between 1971 and 2005, representing a compounded annual growth rate of 10.7%. We believe this support will continue as the government emphasizes the development of a highly-skilled, educated workforce to maintain global competitiveness. Finally, the strong demand for post-secondary education has enabled educational institutions to consistently increase tuition and fees, with public four-year colleges increasing tuition and fees by 6.9% annually on average over the last ten years, according to the College Board.

We believe that for-profit providers will capture an increasing share of the growing demand for post-secondary education, as this demand has been largely unaddressed by traditional public and private universities. Non-profit public and private institutions may face limited financial capability to expand their offerings in response to the growing demand for education, due to a mix of state funding challenges, declining contributions and significant expenditures on research and the professor tenure system. Certain private institutions may also control enrollments to preserve the perceived prestige and exclusivity of their degree offerings. Additionally, we believe traditional non-profit institutions generally have not emphasized flexible course schedules and online offerings that appeal to working adults, nor have they aggressively pursued fully online course offerings.

As a result, for-profit post-secondary education providers continue to have significant opportunities for growth. The National Center of Education Statistics has reported that, over the last 7 years, enrollments at for-profit post-secondary education institutions have experienced a compounded annual growth rate of approximately 11%, compared to compounded annual growth rate of approximately 2% for traditional non-profit colleges and universities over the same time period. For-profit providers have continued their strong growth, principally due to the higher flexibility of their programmatic offerings and learning structure, their emphasis on applied, career-oriented content and their ability to consistently roll out new campuses and programs. Despite rapid growth, the market share of post-secondary education captured by for-profit providers remains relatively modest with ample room for continued growth. In 2003, according to the National Center for Education Statistics, for-profit institutions accounted for approximately 6% of all post-secondary enrollments, up from 4% in 1997. In addition, for-profit post-secondary providers continue to enlarge the size of the education market through targeting underserved students who might otherwise forgo post-secondary education, increasing marketing budgets and investment in online education, which is the fastest growing segment of the post-secondary market.

The post-secondary education industry is highly fragmented, with no one provider controlling significant market share. Students choose among providers based on programs and degrees offered, program flexibility and convenience, quality of instruction, placement rates, reputation and recruiting effectiveness. Such multi-faceted market fragmentation results in significant differentiation among various education providers, limited direct competition and minimal overlap between for-profit providers. The main competitors of for-profit post-secondary education providers are local public and private two-year junior and community colleges, traditional public and private undergraduate and graduate colleges and, to a lesser degree, other for-profit, career-oriented schools.

Our Strengths

We believe that the combination of the following strengths differentiates our business:

| | • | | Flexible, diverse program offerings and broad degree capabilities. Our operational infrastructure and management approach are highly flexible and enable us to adapt quickly to changing market trends. We continuously monitor and adjust our programs based on changes in demand for new programs, degrees, schedules and delivery methods. We provide education to our students through traditional classroom settings as well as through online instruction. Our educational institutions offer a diverse range of academic programs in the following areas: |

| | |

| — Business | | — Health sciences |

| — Information technology | | — Media arts |

| — Education | | — Design |

| — Law and legal studies | | — Fashion |

| — Psychology and behavioral science | | — Culinary arts |

| | | | Our breadth of programmatic and degree offerings enables us to appeal to a diverse range of potential students. This helps to reduce our exposure to a decline in popularity in any one area of study. Our online education platform enables us to leverage our unique educational systems to expand our total addressable market, reaching new students who would otherwise not have the opportunity to attend classes at one of our local campuses. |

| | • | | National campus presence.We have 72 primary campus locations in 24 states and two Canadian provinces. Our campuses are located primarily in major metropolitan areas and we focus our marketing efforts on generating demand within a 100-mile radius of the campus. Throughout our history, we have invested in our campuses in order to develop what we believe is an exceptional portfolio of schools, offering state-of-the-art facilities and learning infrastructure. Our campuses provide attractive and efficient learning environments including many elements found in traditional colleges, such as |

-5-

| | libraries, bookstores and laboratories, as well as the modern equipment necessary for the various programs we offer. This aids us in recruiting and retaining students and faculty. For the fiscal year ended June 30, 2005, no single campus accounted for more than 5.5% of our total revenues. |

| | • | | Strong reputation for positive student outcomes.We believe that the success of our business is based upon our ability to generate positive outcomes for our students in terms of education, graduate employment and starting salary. We use these performance metrics to determine a part of our management compensation both at the corporate and campus level. This focus on student achievement has resulted in a consistent record of high student retention and graduate employment rates, which have been critically important in maintaining a strong reputation among students, faculty and employers. Based on information collected by us from graduating students and employers, we believe that, of the approximately 12,000 undergraduate students who graduated from our institutions during the calendar year ended December 31, 2004, approximately 85% of those available for employment obtained employment in their fields of study or a related field within six months of graduation. Employers of our graduates include companies such as Nordstrom, Electronic Arts, Expo Design Center, Ethan Allen and Nike. |

| | • | | Strong regulatory reputation and recognition. Each of our schools located in the United States is authorized to offer educational programs and grant degrees or diplomas by the state in which the school is located and is accredited by a national or regional accreditation agency recognized by the U.S. Department of Education. Authorization by the state and accreditation by a recognized accrediting agency enables our students to access federal student loans, grants and other forms of public and private financial aid. In the regulated post-secondary education market, maintaining accreditation and state authorization at various levels is critical for operating existing schools, opening new schools and introducing new programs. We have established a culture of compliance and devote substantial resources to ensure that we meet applicable rules, standards and laws. Our success in this regard is evidenced by the success we have had maintaining the licensing and accreditation of our schools. |

| | • | | Highly attractive business model.We have predictable and consistent revenue growth, a scalable operating cost structure and significant operating cash flow generation. |

| | | | Predictable and consistent revenue growth.We believe that our revenue model is highly predictable given the extended period of student enrollment, historically stable retention rates and annual tuition increases. Since 1996, we have demonstrated a compounded annual enrollment growth rate of 18.7% while increasing our tuition on average by 5.7% annually. This combination of enrollment growth and tuition increases has resulted in a compounded annual revenue growth rate of 23.9% since 1996. |

| | | | Margin expansion from scalable cost structure. Management’s focus on increasing the efficiency of our existing physical infrastructure and leveraging the costs of operating these facilities over a broader student population is a key component of our operating margin improvement. The scalable nature of our cost structure at the campus level has enabled us to consistently expand our EBITDA margins in each of the last 10 years, improving from 15.4% in fiscal 1996 to 24.8% in fiscal 2005, an average of more than 90 basis points of annual improvement. With an aim towards maximizing utilization, we monitor and make adjustments to our facilities’ operation plan based on changes in demand for new programs, class schedules and other elements of our operations. In addition, we expect our shared location strategy to allow us to continue to leverage our historical investment in school facilities and to control our ongoing operational and maintenance costs. |

| | | | Significant operating cash flow generation. The combination of moderate maintenance capital requirements and a positive benefit from working capital enables us to convert a significant portion of our revenue to cash available for investment in existing campuses, organic growth initiatives and debt service. Additionally, given the advanced payment of tuition and fees which is customary for the post-secondary education industry, our working capital is on average a source of cash, although subject to significant seasonal fluctuations. |

Our Business Strategy

We intend to pursue the following key elements of our current business strategy:

| | • | | Augment and improve our academic curricula and programs |

| | | | Create new and revise existing academic programs.We continually strive to identify emerging industry trends in order to understand the evolving educational needs of our students and the employment market. We rapidly develop and introduce new programs in response to these needs with the assistance of our curriculum advisory teams, which consist of over 1,200 industry experts and employers. For example, during fiscal 2005, we introduced 11 new academic programs, including surgical technician, hospitality management, sales and marketing and healthcare management. We also regularly evaluate our existing program offerings and revise existing courses to meet changing market needs. |

| | | | Rollout existing programs to additional schools.Our broad base of 72 schools enables us to drive growth through introducing |

-6-

| | programs that have been successful at one school to other schools within our systems. During fiscal 2005, we successfully rolled out 119 existing educational programs to additional schools. The rollout of existing programs at additional campuses allows us to drive enrollment growth at existing locations with minimal incremental costs, leverage existing curriculum development and quickly capitalize on identified market needs. |

| | • | | Continue to improve our marketing and student services |

| | | | Increase and optimize the use of marketing resources. We continuously evaluate the efficiency of various marketing media channels by student, program, campus and school systems, which enables us to rapidly optimize the allocation of our marketing budget. We also put significant emphasis on recruiting qualified admission officers. To date in fiscal year 2006, we have increased the number of admissions officers at our schools by approximately 20%. |

| | | | Continue to emphasize student services. In student services, we focus on student retention and assisting our students in obtaining full-time employment. We maintain dedicated career services personnel at our schools, who provide assistance by establishing relationships with potential employers and preparing students for interviews and post-graduate employment. We also evaluate the placement of our students from each of our programs to assist us in determining how to allocate our resources in the future. Our focus on student outcomes also helps us to maintain a strong student retention rate and manage our cohort loan default rates, enhancing profitability and regulatory compliance. It also helps us to attract new students, because approximately 30% of the new students at our Art Institutes come to us through referrals, generally from satisfied existing students and alumnus. |

| | • | | Expand the number of online students. We believe that a significant growth opportunity exists in offering fully-online programs to students who may not otherwise have attended our schools. As the quality and acceptance of online education continues to increase, we continue to invest in both expanding our online course offerings and enhancing our online marketing presence. Online programs primarily target students who are not able to pursue campus-based post-secondary education, due to schedule and location constraints, and thus address an additional market beyond our campus-based target demographics. Online courses provide these students flexible schedules which can be tailored around a student’s working hours and can be combined with traditional on-campus classes. Online offerings represent an attractive avenue for growth that utilizes many of our existing education curricula while requiring less capital expenditures relative to campus-based expansion. Our online efforts continue to experience significant success, with 4,076 students taking all of their courses online and 9,077 students taking at least one of their courses online during the fall term of 2005, compared to 2,508 and 6,381 students, respectively, during the same term in 2004. |

| | • | | Grow our portfolio of schools in a capital-efficient manner |

| | | | Develop new school locations.We believe that there are many attractive opportunities available to us to develop new school locations in the United States. Prior to opening a new campus, we perform a detailed analysis of the geographic area, including ranking the statistical attractiveness of a metropolitan area based on population size and growth, the percentage of the population likely to pursue education in a particular program area and the level of unmet demand represented by a student population not served by existing local post-secondary educational institutions. In opening new campuses, we utilize our centralized infrastructure and existing curricula to cost-effectively expedite the opening and ramp-up of a location. Since the beginning of fiscal year 2005, we have opened eight new school locations. |

| | | | Utilize shared services locations.Since fiscal 2004, we have combined the facilities and administrative functions of some of our schools that are located in the same geographic regions. The administrative services which are combined for two or more schools located within a single facility may include career services, finance, human resources and information technology, among other functions. Currently, 24 of our schools are in shared services locations, and we plan to continue to utilize this model for new campuses in order to minimize capital expenditures and operating expenses, and increase facility utilization. |

-7-

INDUSTRY AND MARKET DATA

Some of the industry and market data contained in this Form 8-K are based on independent industry publications or other publicly available information, while other information is based on internal company sources. Although we believe that these independent sources and our internal data are reliable as of their respective dates, the information contained in them has not been independently verified, and we cannot assure you as to the accuracy or completeness of this information. As a result, you should be aware that the market industry data contained in this Form 8-K, and beliefs and estimates based on such data, may not be reliable. We obtained information relating to the U.S. post-secondary education market from the National Center for Education Statistics, which is the primary federal entity for collecting and analyzing data related to education, the College Board, the U.S. Census Bureau and the U.S. Department of Labor—Bureau of Labor Statistics.

THE TRANSACTIONS

On March 3, 2006, EM Acquisition, formed by investment funds associated with the Sponsors, entered into the Merger Agreement with EDMC pursuant to which EM Acquisition will merge with and into EDMC. As a result of the Merger, investment funds associated with or designated by the Sponsors will own EDMC.

At the effective time of the Merger, each share of EDMC’s common stock outstanding immediately prior to the Merger (other than shares held in treasury or shares held by any of our respective subsidiaries) will be cancelled and converted into the right to receive $43.00 in cash. Certain of our executive officers and members of senior management are expected to enter into agreements with the Sponsors, pursuant to which they will agree, among other things, to participate in the equity of EDMC in connection with the Transactions. These executive officers and members of senior management are referred to in this Form 8-K as the “senior management participants.” In connection with the Transactions, we also expect other of our managers to participate in the equity of EDMC through continued option ownership or other means. Together, these managers and the senior management participants are referred to in this Form 8-K as the “management participants.” We expect that the aggregate value of the equity participation by the senior management participants will be approximately $8.0 million. Investment funds associated with or designated by Providence Equity and Goldman Sachs Capital Partners will each invest $470.0 million in equity securities of EDMC for a total equity investment by the Sponsors of $940.0 million as part of the Transactions. Certain other investors, who have agreed to co-invest with the investment funds associated with or designated by the Sponsors (the “Co-Investors,” and together with investment funds associated with or designated by the Sponsors and the management participants, the “Investors”), have also committed to invest an aggregate of approximately $352.0 million of equity in EDMC as part of the Transactions. At or following the closing of the Transactions, the Sponsors expect to sell $100.0 million of their EDMC securities to the Co-Investors, reducing the Sponsors’ total investment to $840.0 million and increasing the Co-Investors’ investment to $452.0 million. The Merger is subject to approval by EDMC’s stockholders at a special meeting to be held on May 25, 2006 and other customary closing conditions. Approval of the Merger requires the affirmative vote of a majority of the votes cast by holders of shares of EDMC’s common stock entitled to vote thereon at the special meeting, assuming a quorum is present.

The purchase of EDMC by the Investors will be financed by borrowings under our new senior secured credit facilities, the issuance of new notes (the “notes”), the equity investment and participation described above and cash on hand.

-8-

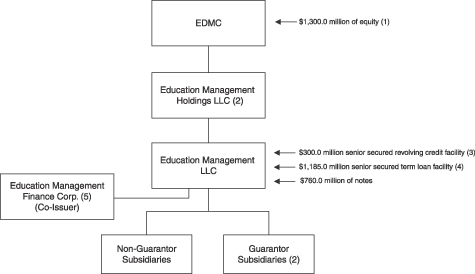

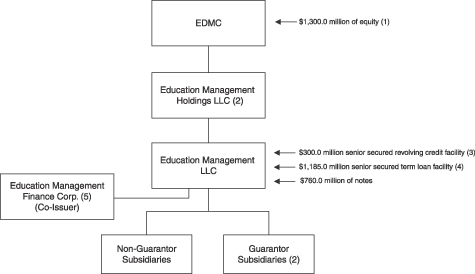

Ownership and Corporate Structure

The following diagram below sets forth our corporate structure following consummation of the Transactions. Subsidiaries of Education Management LLC will own all of the operating assets of EDMC after the Transactions. This structure will be achieved through a series of equity contributions expected to occur in connection with the Merger.

| (1) | | Includes approximately $940.0 million of cash equity contributed by investment funds associated with or designated by the Sponsors, approximately $352.0 million of cash equity contributed by the Co-Investors and approximately $8.0 million of equity of the senior management participants in the form of a cash investment. At or following the closing of the Transactions, the Sponsors expect to sell $100.0 million of their EDMC securities to the Co-Investors, reducing the Sponsors’ total investment to $840.0 million. |

| (2) | | The obligations under our new senior credit facilities will be guaranteed by Education Management Holdings LLC and all of Education Management LLC’s existing direct and indirect domestic subsidiaries, other than any subsidiary that directly owns or operates a school. The notes will be fully and unconditionally guaranteed by all of our existing direct and indirect domestic restricted subsidiaries, other than any subsidiary that directly owns or operates a school. |

| (3) | | Upon the closing of the Transactions, we will enter into a $300.0 million revolving credit facility with a six-year maturity, none of which will be drawn on the closing date of the Transactions, except as described below. To satisfy certain regulatory requirements, EDMC and its subsidiaries are likely to be required to maintain a letter of credit in favor of the U.S. Department of Education, which will be provided under and will reduce availability under our revolving credit facility. We estimate that the amount of the letter of credit to be posted after closing will be approximately $75.0 million during the first year after the Transactions. Additionally, to satisfy certain regulatory requirements, EDMC and its subsidiaries may draw on our revolving credit facility to fund cash to the accounts of our school subsidiaries at the time of closing or as otherwise consistent with regulatory requirements. We expect to use such funds to repay these borrowings under our revolving credit facility within a few days of funding. |

| (4) | | Upon the closing of the Transactions, we will enter into a $1,185.0 million term loan facility with a seven-year maturity. |

| (5) | | Education Management Finance Corp. has only nominal assets, does not currently conduct any operations and was formed solely to act as co-issuer of the notes. |

The expected estimated sources and uses of the funds for the Transactions, assuming they occurred as of March 31, 2006, are shown in the table below. Actual amounts will vary from estimated amounts depending on several factors, including differences from our estimate of fees and expenses, differences between the cash balance at March 31, 2006 and at the closing of the Transactions, any increase in the number of outstanding shares and any changes made to the sources of the contemplated debt financing.

| | | | | | | | |

Sources of funds: | | Uses of funds: |

| (in millions) |

Revolving credit facility(1) | | $ | — | | Equity purchase price(5) | | $ | 3,371.2 |

Cash and cash equivalents from balance sheet(2)(6) | | | 394.0 | | Cash and cash equivalents to balance sheet(6) | | | 117.8 |

Term loan facility(3) | | | 1,185.0 | | Transaction expenses(7) | | | 150.0 |

Notes | | | 760.0 | | | | | |

Equity(4) | | | 1,300.0 | | | | | |

| | | | | | | | |

Total sources of funds | | $ | 3,639.0 | | Total uses of funds | | $ | 3,639.0 |

| | | | | | | | |

| (1) | | Upon the closing of the Transactions, we will enter into a $300.0 million revolving credit facility with a six-year maturity, none of which will be drawn on the closing date of the Transactions, except as described below. To satisfy certain regulatory requirements, EDMC and its subsidiaries are likely to be required to maintain a letter of credit in favor of the U.S. Department of Education, which will be provided under and will reduce availability under our revolving credit facility. We estimate that the amount of the letter of credit to be posted after closing will be approximately $75 million during the first year after the Transactions. Additionally, to satisfy certain regulatory requirements, EDMC and its subsidiaries may draw on our revolving credit facility to fund cash to the accounts of our school subsidiaries at the time of closing or as otherwise consistent with regulatory requirements. We expect to use funds to repay these borrowings under our revolving credit facility within a few days of funding and therefore have excluded such amounts from the table above. |

| (2) | | We expect cash on hand to decrease from March 31, 2006 to the closing of the Transactions as a result of normal working capital movements, as cash on hand will be used to fund operations. |

| (3) | | Upon the closing of the Transactions, we will enter into a $1,185.0 million term loan facility with a seven-year maturity. |

| (4) | | Represents approximately $940.0 million to be invested in equity securities of EDMC by investment funds associated with or designated by the Sponsors, approximately $352.0 million to be invested in equity securities of EDMC by the Co-Investors and approximately $8.0 million of equity to be invested by the senior management participants. The amounts of equity participation by the senior management participants is subject to change prior to the closing of the Transactions. At or following the closing of the Transactions, the Sponsors expect to sell $100.0 million of their EDMC securities to the Co-Investors, reducing the Sponsors’ total investment to $840.0 million. |

| (5) | | The holders of outstanding shares of common stock will receive $43.00 in cash per share in connection with the Transactions. Assumes approximately 75.8 million shares outstanding and 0.5 million of restricted shares as of March 31, 2006 plus intrinsic value of options outstanding of approximately $90.2 million which is calculated based on approximately 4.5 million options outstanding with an average exercise price of $22.90 per share. |

| (6) | | Excludes restricted cash. |

| (7) | | Reflects our estimate of fees and expenses associated with the Transactions, including placement and other financing fees, advisory fees, transaction fees paid to affiliates of the Sponsors, and other transaction costs and professional fees. See “Certain Relationships and Related Party Transactions.” The estimated fees and expenses amount includes an estimated $7.7 million of severance costs that will be paid to Robert B. Knutson, Robert T. McDowell and J. William Brooks after the consummation of the Merger. |

9

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL DATA AND OTHER DATA

Set forth below is summary historical consolidated financial data and summary unaudited pro forma consolidated financial data of our business, at the dates and for the periods indicated. The historical data for the fiscal years ended June 30, 2003, 2004 and 2005 have been derived from EDMC’s historical consolidated financial statements included in our Form 10-K which was filed with the Securities and Exchange Commission (the “SEC”) on September 13, 2005, which have been audited by Ernst & Young LLP. The summary historical financial data as of March 31, 2006 and for the nine-month periods ended March 31, 2005 and 2006 have been derived from EDMC’s unaudited consolidated financial statements included in our Form 10-Q which was filed with the SEC on May 4, 2006, which have been prepared on a basis consistent with the annual audited consolidated financial statements. In the opinion of management, such unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The summary unaudited pro forma consolidated financial data for the twelve months ended March 31, 2006 have been prepared to give effect to the Transactions as if they had occurred on July 1, 2004, in the case of the summary unaudited pro forma consolidated statement of income data and other financial data, and on March 31, 2006, in the case of the summary unaudited pro forma consolidated balance sheet data. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable. The summary unaudited pro forma consolidated financial data are for informational purposes only and do not purport to represent what our results of operations or financial position actually would have been if the Transactions had occurred at any date, and such data do not purport to project the results of operations for any future period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended June 30, | | | Nine Months

Ended March 31, | | | Pro Forma Twelve Months Ended March 31, 2006 | |

| | | 2003(1) | | | 2004(2) | | | 2005(3) | | | 2005 | | | 2006 | | |

| | | (Dollars in millions) | |

Statement of Income Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net revenues | | $ | 640.0 | | | $ | 853.0 | | | $ | 1,019.3 | | | $ | 764.0 | | | $ | 878.1 | | | $ | 1,133.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Educational services | | | 417.5 | | | | 546.1 | | | | 640.4 | | | | 474.8 | | | | 520.9 | | | | 676.7 | |

General and administrative | | | 125.3 | | | | 167.0 | | | | 203.8 | | | | 149.0 | | | | 190.7 | | | | 245.4 | |

Amortization of intangible assets | | | 4.4 | | | | 6.9 | | | | 6.5 | | | | 5.1 | | | | 3.4 | | | | 39.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total costs and expenses | | | 547.2 | | | | 720.0 | | | | 850.7 | | | | 628.9 | | | | 715.0 | | | | 962.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income before interest and income taxes | | | 92.8 | | | | 133.0 | | | | 168.6 | | | | 135.1 | | | | 163.1 | | | | 171.5 | |

Interest (income) expense, net | | | 1.3 | | | | 2.5 | | | | (0.2 | ) | | | 0.7 | | | | (4.3 | ) | | | 174.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 91.5 | | | | 130.5 | | | | 168.8 | | | | 134.4 | | | | 167.4 | | | | (3.3 | ) |

Provision (benefit) for income taxes | | | 35.2 | | | | 53.5 | | | | 67.2 | | | | 52.4 | | | | 65.5 | | | | (1.1 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 56.3 | | | $ | 77.0 | | | $ | 101.6 | | | $ | 82.0 | | | $ | 101.9 | | | $ | (2.2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash flows provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 79.4 | | | $ | 163.3 | | | $ | 193.2 | | | $ | 256.6 | | | $ | 321.7 | | | | | |

Investing activities | | | (108.4 | ) | | | (236.9 | ) | | | (98.8 | ) | | | (83.5 | ) | | | (52.3 | ) | | | | |

Financing activities | | | 24.3 | | | | 102.0 | | | | (39.0 | ) | | | (112.7 | ) | | | (45.8 | ) | | | | |

Effect of foreign exchange on cash | | | 1.6 | | | | (0.6 | ) | | | (0.2 | ) | | | — | | | | (1.5 | ) | | | | |

-10-

| | | | | | | | | | | | | | | | | | |

| | | Year Ended June 30, | | Nine Months Ended March 31, | | Pro Forma Twelve Months Ended March 31, 2006 |

| | | 2003(1) | | 2004(2) | | 2005(3) | | 2005 | | 2006 | |

| | | (Dollars in millions) |

Other Data: | | | | | | | | | | | | | | | | | | |

EBITDA(4) | | $ | 137.7 | | $ | 188.3 | | $ | 252.7 | | $ | 201.3 | | $ | 213.6 | | $ | 266.5 |

Capital expenditures(5) | | | 80.8 | | | 80.7 | | | 71.2 | | | 53.5 | | | 48.9 | | | |

Enrollment at beginning of fall quarter(6) | | | 43,784 | | | 58,828 | | | 66,179 | | | 66,179 | | | 72,471 | | | |

Campus locations (at period end)(7) | | | 43 | | | 67 | | | 71 | | | 70 | | | 72 | | | 72 |

| | | | | | |

Pro Forma Balance Sheet Data: | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents, excluding restricted cash | | $ | 117.8 |

Total assets | | | 3,818.3 |

Total debt(8) | | | 1,950.1 |

Total shareholders’ equity | | | 1,300.0 |

| |

Pro Forma Data: | | | |

Adjusted EBITDA(4) | | $ | 287.6 |

Net debt(9) | | | 1,832.3 |

Ratio of net debt to Adjusted EBITDA(9) | | | 6.4x |

Cash interest expense(10) | | | 165.1 |

Ratio of Adjusted EBITDA to cash interest expense | | | 1.7x |

| (1) | Fiscal 2003 results reflect a change in accounting estimate due to our evaluation and adjustment of the useful lives for our property and equipment to more closely reflect actual usage. The useful life adjustment decreased income before interest and income taxes by $3.2 million. |

| (2) | South University and the Brown Mackie Colleges are included as of their respective acquisition dates during fiscal 2004. Note 1 to the consolidated financial statements for the fiscal year ended 2004 provides pro forma results as if the acquisitions had been acquired and consolidated as of July 1, 2002. A charge of $2.2 million was recognized in fiscal 2004 to increase the valuation allowance related to our Canadian net deferred tax assets. |

| (3) | Fiscal 2005 results include non-cash, pretax charges of approximately $4.2 million related to fixed asset impairments and write-offs. Also, cumulative adjustments for lease accounting recorded in fiscal 2005 increased educational services expense by approximately $3.8 million. These adjustments are comprised of $19.5 million of amortization expense and $15.7 million of reductions to rent expense. |

| (4) | EBITDA, a measure expected to be used by management to measure operating performance, is defined as net income plus interest expense (income), net, taxes, depreciation and amortization. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Management believes EBITDA is helpful in highlighting trends because EBITDA excludes the results of decisions that are outside the control of operating management and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate and capital investments. In addition, EBITDA provides more comparability between the historical results of EDMC and future results that will reflect purchase accounting and the new capital structure. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, these presentations of EBITDA may not be comparable to other similarly titled measures of other companies. |

-11-

Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain non-cash or unusual items permitted in calculating covenant compliance under the indentures governing the notes and/ or the new senior secured credit facilities. We believe that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA are appropriate to provide additional information to investors about certain material non-cash items and about unusual items that we do not expect to continue at the same level in the future. Such supplementary adjustments to EBITDA may not be in accordance with current SEC practice or with regulations adopted by the SEC that apply to registration statements filed under the Securities Act and periodic reports presented under the Securities Exchange Act of 1934, as amended. Accordingly, the SEC may require that Adjusted EBITDA be presented differently in filings made with the SEC than as presented in this Form 8-K, or not be presented at all.

Historical and pro forma EBITDA and pro forma Adjusted EBITDA are calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Historical | | | | | | Pro Forma Twelve Months Ended March 31, 2006 | |

| | | Year Ended June 30, | | | Nine Months

Ended March 31, | | | Cumulative

Twelve

Months Ended March 31, 2006 | | |

| | | 2003 | | 2004 | | 2005 | | | 2005 | | 2006 | | | |

| | | (Dollars in millions) | |

Net income (loss) | | $ | 56.3 | | $ | 77.0 | | $ | 101.6 | | | $ | 82.0 | | $ | 101.9 | | | $ | 121.6 | | | $ | (2.2 | ) |

Interest (income) expense, net | | | 1.3 | | | 2.5 | | | (0.2 | ) | | | 0.7 | | | (4.3 | ) | | | (5.3 | ) | | | 174.8 | |

Provision (benefit) for income taxes | | | 35.2 | | | 53.5 | | | 67.2 | | | | 52.4 | | | 65.5 | | | | 80.4 | | | | (1.1 | ) |

Depreciation and amortization, including amortization of intangible assets(a) | | | 44.9 | | | 55.3 | | | 84.1 | | | | 66.2 | | | 50.5 | | | | 68.4 | | | | 95.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 137.7 | | $ | 188.3 | | $ | 252.7 | | | $ | 201.3 | | $ | 213.6 | | | $ | 265.1 | | | $ | 266.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

Non-cash equity compensation(b) | | | $ | 17.6 | | | $ | 17.6 | |

| | |

Transaction-related expenses(c) | | | | 4.9 | | | | 4.9 | |

| | |

Reversal of impact of unfavorable lease liabilities(d) | | | | — | | | | (1.4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | | $ | 287.6 | | | $ | 287.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | | Depreciation and amortization includes non-cash charges related to property and equipment impairments and write-offs. The year ended June 30, 2005 and nine months ended March 31, 2005 also include $19.5 million related to cumulative adjustments for changes in lease accounting. |

| | (b) | | Represents non-cash equity compensation recognized in accordance with Statement of Financial Accounting Standards No. 123(R), “Share-Based Payment.” |

| | (c) | | Represents costs incurred by EDMC directly related to the Transactions that are required to be expensed. |

| | (d) | | Represents non-cash income due to the amortization of $6.7 million of unfavorable lease liabilities resulting from fair value adjustments required under purchase accounting as part of the Merger. |

| (5) | Capital expenditures represent net cash paid for property and equipment as well as software and other assets. |

| (6) | Represents the number of students enrolled in our schools as of the first week in October of the preceding calendar year. Excludes students enrolled at The National Center for Paralegal Training (“NCPT”), which has taught out all programs. NCPT had 45 students enrolled at the beginning of the fall quarter of fiscal 2003 and no students at the beginning of the fall quarters of 2004 and 2005. |

| (7) | Brown Mackie College-Dallas and Brown Mackie College-Fort Worth discontinued accepting new enrollments effective August 4, 2005 and the complete teach-out of all students at each school is expected to be completed in July 2006. Upon completion of the teach-out, each school will close. Brown Mackie |

12

| | College-Los Angeles, Brown Mackie College-Orange County, Brown Mackie College-San Diego and Brown Mackie College-Denver have discontinued new enrollments. We established a degree site of Argosy University at each location which assumed the non-diploma Brown Mackie College class offerings. The Brown Mackie College location will close once current students complete their classes. Except for Argosy University-Denver, the Argosy University degree sites that assumed or will assume the students of the closed Brown Mackie College locations do not constitute campus locations of Argosy University. |

| (8) | Pro forma total debt at March 31, 2006 includes the current portion of long term debt, existing long-term debt, the term loan facility, and the notes. |

| (9) | Net debt is not a defined term under GAAP. Net debt is calculated as total pro forma debt less pro forma cash and cash equivalents at March 31, 2006. |

| (10) | Cash interest expense is not a defined term under GAAP. Cash interest expense does not include any amortization of capitalized debt issuance cost. |

-13-

RISK FACTORS

Risks Related to Our Indebtedness

Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations under the notes.

After completing the Transactions, we will be highly leveraged. On a pro forma basis as of March 31, 2006, our total indebtedness would have been $1,950.1 million. We also would have had an additional $300.0 million available for borrowing under our revolving credit facility at that date. The following chart shows our level of indebtedness on a pro forma basis as of March 31, 2006 after giving effect to the Transactions.

| | | |

| | | Pro Forma as of

March 31, 2006 |

| | | (in millions) |

Existing long-term debt, including current portion | | $ | 5.1 |

Revolving credit facility(1) | | | — |

Term loan facility | | | 1,185.0 |

Notes | | | 760.0 |

| | | |

Total | | $ | 1,950.1 |

| | | |

| (1) | Upon the closing of the Transactions, we will enter into a $300.0 million revolving credit facility with a six-year maturity, none of which will be drawn on the closing date of the Transactions, except as described below. To satisfy certain regulatory requirements, EDMC and its subsidiaries are likely to be required to maintain a letter of credit in favor of the U.S. Department of Education, which, as described in the following paragraph, will be provided under and will reduce availability under our revolving credit facility. We estimate that the amount of the letter of credit to be posted after closing will be approximately $75.0 million during the first year after the Transactions, which amount is equal to 10% of the Title IV program funds utilized by the Company in its most recently completed fiscal year. |

| | All institutions participating in Title IV programs must satisfy certain standards of financial responsibility. For the year ended June 30, 2005, we believe that, on an individual institution basis, each of our schools then participating in Title IV programs satisfied the financial responsibility standards. Following the Transactions, the U.S. Department of Education may separately consider the compliance of the Company and our schools with the financial responsibility requirements. The U.S. Department of Education has informed the Company that if it does not meet the financial responsibility standards following the closing of the Transactions, it will be required to post the letter of credit referenced in the preceding paragraph in an amount not to exceed 10% of the Title IV program funds utilized by the Company in its most recently completed fiscal year, plus submit to additional monitoring. However, if other circumstances exist in conjunction with a failure to meet financial responsibility standards, the U.S. Department of Education could require the Company to post a significantly larger letter of credit. Such letter of credit would remain outstanding until the required financial responsibility standards are met. Such letter of credit would be subject to annual adjustment based on the amount of Title IV program funds utilized by the Company in its most recently completed fiscal year. |

-14-

| | Additionally, to satisfy certain regulatory requirements, EDMC and its subsidiaries may draw on our revolving credit facility to fund cash to the accounts of our school subsidiaries at the time of closing or as otherwise consistent with regulatory requirements. The amount of such funds could be material. We expect to use such funds to repay these borrowings under our revolving credit facility within a few days of funding. |

Our high degree of leverage could have important consequences for you, including:

| | • | | making it more difficult for us to make payments on the notes; |

| | • | | increasing our vulnerability to general economic and industry conditions; |

| | • | | requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities; |

| | • | | exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our senior secured credit facilities, will bear interest at variable rates; |

| | • | | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; |

| | • | | limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and |

| | • | | limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged. |

We and our subsidiaries may be able to incur substantial additional indebtedness in the future, subject to the restrictions contained in our senior secured credit facilities and the indentures governing the notes. If new indebtedness is added to our current debt levels, the related risks that we now face could intensify.

Our debt agreements contain restrictions that limit our flexibility in operating our business.

Our senior secured credit agreement and the indentures governing the notes contain various covenants that limit our ability to engage in specified types of transactions. These covenants limit our and our restricted subsidiaries’ ability to, among other things:

| | • | | incur additional indebtedness or issue certain preferred shares; |

| | • | | pay dividends on, repurchase or make distributions in respect of our capital stock or make other restricted payments; |

| | • | | make certain investments; |

| | • | | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; and |

| | • | | enter into certain transactions with our affiliates. |

In addition, under the senior secured credit agreement, we will be required to satisfy and maintain specified financial ratios and other financial condition tests. Our ability to meet those financial ratios and tests can be affected by events beyond our control, and we cannot assure you that we will meet those ratios and tests. A breach of any of these covenants could result in a default under the senior secured credit agreement. Upon the

-15-

occurrence of an event of default under the senior secured credit agreement, the lenders could elect to declare all amounts outstanding under the senior secured credit agreement to be immediately due and payable and terminate all commitments to extend further credit. If we were unable to repay those amounts, the lenders under the senior secured credit agreement could proceed against the collateral granted to them to secure that indebtedness. We have pledged a significant portion of our assets as collateral under the senior secured credit agreement. If the lenders under the senior secured credit agreement accelerate the repayment of borrowings, we cannot assure you that we will have sufficient assets to repay our indebtedness under the senior secured credit agreement, as well as our unsecured indebtedness, including the notes.

Risks Related to Our Business

Opening additional new schools and growing our online student programs could be difficult for us.

We anticipate continuing to open new schools in the future. Establishing new schools poses unique challenges and requires us to make investments in management, capital expenditures, marketing expenses and other resources. When opening a new school, we are required to obtain appropriate state or provincial and accrediting agency approvals. In addition, to be eligible for federal student financial aid programs, a school has to be certified by the U.S. Department of Education. Our failure to effectively manage the operations of newly established schools or service areas, or any diversion of management’s attention from our core school operating activities, could harm our business.

We anticipate significant future growth from online courses we offer to students. As of March 31, 2006, The Art Institute Online offers a broad suite of programs in the creative fields and South University offers online bachelor’s degree programs in business administration, information technology and health sciences. During fiscal 2006 and in future years we plan to continue to roll out new online programs at The Art Institutes and South University along with online classes at Argosy University. Further, the success of any new online programs and classes depends in part on our ability to expand the content of our programs, develop new programs in a cost-effective manner, and meet the needs of our students in a timely manner. The expansion of our existing online programs, the creation of new online classes and the development of new online programs may not be accepted by students or the online education market.

The development of new programs and classes, both conventional and online, is subject to requirements and limitations imposed by the U.S. Department of Education, the state licensing agencies and the accrediting bodies. Such requirements and limitations may or may not be related to the Transactions. The imposition of restrictions on the initiation of new educational programs by any of our regulatory agencies as a result of the Transactions may delay such expansion plans.

Our success depends, in part, on the effectiveness of our marketing and advertising programs in recruiting new students.

In order to maintain and increase our revenues and margins, we must continue to attract new students in a cost-effective manner. Over the last twelve months, we have increased the amounts spent on marketing and advertising, and we anticipate this trend to continue. If we are unable to successfully advertise and market our schools and programs, our ability to attract and enroll new students could be adversely impacted and, consequently, our financial performance could suffer. We use marketing tools such as the Internet, radio, television and print media advertising to promote our schools and programs. Our representatives also make presentations at high schools to promote The Art Institutes. Additionally, we rely on the general reputation of our schools and referrals from current students, alumni and employers as a source of new students. Among the factors that could prevent us from successfully marketing and advertising our schools and programs are the failure of our marketing tools and strategy to appeal to prospective students, current student and/or employer dissatisfaction with our program offerings and diminished access to high school campuses.

-16-

Failure to keep pace with changing market needs and technology could harm our student population.

The success of our schools depends to a large extent on the willingness of prospective employers to employ our students upon graduation. Our schools must keep current with changing technological needs and skills demanded by prospective employers. If we fail to respond to changes in industry requirements by offering new programs to our students or investing in new technology, it could have a material adverse effect on our ability to attract students.

Our success depends upon our ability to recruit and retain key personnel.

Our success also depends, in large part, upon our ability to attract and retain highly qualified faculty, school presidents and administrators and corporate management. We may have difficulty locating and hiring qualified personnel, and retaining such personnel once hired. The loss of the services of any of our key personnel, or our failure to attract and retain other qualified and experienced personnel on acceptable terms, could cause our business to suffer.

In June 2006, we will experience certain changes in our executive management. Robert T. McDowell will retire from his position as the Company’s Executive Vice President and Chief Financial Officer on June 29, 2006. J. William Brooks, the Company’s President and Chief Operating Officer, has announced his resignation from the Company, to be effective June 30, 2006. The Company has commenced a search for Mr. Brooks’ successor and has retained an executive search firm to assist in the search. If we are unable to retain a new Chief Financial Officer or Chief Operating Officer in a timely manner, there may be an adverse effect on our financial reporting processes. In order to mitigate any potential adverse effect, Mr. McDowell will continue to be employed by the Company on a part-time basis for a period of time following his retirement in order to provide transition assistance and other services to the Company.

Failure to obtain additional capital in the future could reduce our ability to grow.

We believe that funds from operations, cash, investments and borrowings under our revolving credit facility will be adequate to fund our current operating plans for the foreseeable future. However, we may need additional debt or equity financing in order to finance our continued growth. The amount and timing of such additional financing will vary principally depending on the timing and size of acquisitions and new school openings, the sellers’ willingness to provide financing for acquisitions, and the amount of cash flow from our operations. To the extent that we require additional financing in the future and are unable to obtain such additional financing, we may not be able to fully implement our growth strategy.

Competitors with greater resources could harm our business.

The post-secondary education market is highly fragmented and competitive. Our schools compete for students with traditional public and private two-year and four-year colleges and universities and other proprietary schools, including those that offer online learning programs. Many public and private colleges and universities, as well as other private career-oriented schools, offer programs similar to those we offer. Public institutions receive substantial government subsidies, and public and private institutions have access to government and foundation grants, tax-deductible contributions and other financial resources generally not available to proprietary schools. Accordingly, public and private institutions may have instructional and support resources superior to those in the proprietary sector, and public institutions can offer substantially lower tuition prices. Some of our competitors in both the public and private sectors also have substantially greater financial and other resources than we do.

Failure to effectively manage our growth could harm our business.

Our business has grown rapidly. Our continued rapid growth may place a strain on our management, operations, employees, or resources. We may not be able to maintain or accelerate our current growth rate,

-17-

effectively manage our expanding operations, or achieve planned growth on a timely or profitable basis. If we are unable to manage our growth effectively, we may experience operating inefficiencies, and our net income may be materially adversely affected.

Failure to integrate acquired schools could harm our business.

From time to time, we engage in evaluations of, and discussions with, possible acquisition candidates. We may not continue to be able to identify suitable acquisition opportunities or to acquire any such schools on favorable terms. Additionally, we may not be able to successfully integrate any acquired schools into our operations profitably. Continued growth through acquisition may also subject us to unanticipated business or regulatory uncertainties, barriers or liabilities. Acquired schools may not enhance our business and, if we do not successfully address associated risks and uncertainties, may ultimately have a material adverse effect on our growth and ability to compete.

In the event we decide to acquire an institution, the U.S. Department of Education and most applicable state authorizing and accrediting agencies would consider that a change of ownership or control of the institution has occurred. A change of ownership or control of an institution under the standards of the U.S. Department of Education may result in the imposition of requirements for the posting of a letter of credit in favor of the U.S. Department of Education. It may also result in the imposition of limitations on the growth of the institution and could result in the temporary suspension of the institution’s participation in the federal student financial aid programs until the U.S. Department of Education issues a temporary certification document. State authorizing agencies and accrediting agencies may likewise impose restrictions or deny or delay approval of an acquisition. If we were unable to promptly reestablish the state authorization, accreditation or U.S. Department of Education certification of an institution we acquired, depending on the size of the acquisition, that failure could have a material adverse effect on our business.

We may be unable to operate one or more of our schools due to a natural disaster.

A number of our schools are located in Florida and elsewhere in the Southeastern United States. We also have a number of schools located in southern California. One or more of these schools may be unable to operate for an extended period of time in the event of a hurricane, earthquake or other natural disaster which does substantial damage to the area in which a school is located. The failure of one or more of our schools to operate for a substantial period of time could have a material adverse effect on our results of operations.

After the Transactions, the Sponsors will, acting collectively, have the right to control us and may have conflicts of interest with us or you in the future.

Investment funds associated with or designated by the Sponsors will collectively own approximately 64% of our capital stock, on a fully-diluted basis, after consummation of the Transactions and the expected sale of additional equity to the Co-Investors. While the Sponsors are not under common control, either directly or indirectly, were the Sponsors to act collectively they would have control over our decisions to enter into any corporate transaction and have the ability to prevent any transaction that requires the approval of stockholders regardless of whether noteholders believe that any such transactions are in their own best interests. For example, the Sponsors could collectively cause us to make acquisitions that increase the amount of indebtedness that is secured or to sell assets.

Additionally, the Sponsors are in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. One or more of the Sponsors may also pursue acquisition opportunities that may be complementary to our business and, as a result, those acquisition opportunities may not be available to us. So long as investment funds associated with or designated by the Sponsors collectively continue to indirectly own a significant amount of the outstanding shares of our common stock, the Sponsors will collectively continue to be able to strongly influence or effectively control our decisions.

-18-

Risks Related to Our Industry

Failure of our schools to comply with extensive regulations could result in financial penalties, restrictions on our operations, or loss of external financial aid funding for our students.

Approximately 70% of our revenues in fiscal 2003, 2004 and 2005 were derived from federal student financial aid programs pursuant to Title IV of the Higher Education Act of 1965, as amended (“Title IV programs”). Our participation in the Title IV programs is subject to oversight by the U.S. Department of Education and is conditioned by approvals granted by other agencies as well as subject to independent certification by the U.S. Department of Education. Each of our schools must also obtain and maintain approval to enroll students, offer instruction and grant credentials from the state oversight agency in the state in which the school is located. Such approval is also a precondition to the ability of our students to participate in the Title IV programs. Participation in the Title IV programs also requires each school to be accredited by an accrediting agency recognized by the U.S. Department of Education as a reliable authority on institutional quality and integrity. Accreditation is, in turn, conditioned on each school maintaining applicable state authorization. Our schools must also comply with the requirements of any loan guarantee agencies which guarantee certain federal student loans made to our schools’ students, the requirements of such state grant programs as may be available to our students, and the requirements of specialized accrediting agencies which oversee institutional quality in particular program areas. As a result, our schools are subject to extensive regulation and review by these agencies which cover virtually all phases of our operations. These regulations also affect our ability to acquire or open additional schools, add new educational programs or substantially change existing programs, or change our corporate or ownership structure. The agencies that regulate our operations periodically revise their requirements and modify their interpretations of existing requirements.

If one of our schools were to violate or fail to meet any of these regulatory requirements, we could suffer financial penalty, limitations on our operating activities or termination of the school’s ability to grant degrees and certificates or the school’s eligibility to receive federal student financial aid funds on behalf of its students. A significant portion of our students rely on federal student financial aid funds to finance their education. We cannot predict with certainty how all of these requirements will be applied or interpreted by the regulatory body, or whether each of our schools will be able to comply with all of the requirements in the future.

Congress may change the law or reduce funding for federal student financial aid programs, which could harm our student population and revenue.

Political and budgetary concerns can significantly affect the Title IV programs and other laws governing the federal student financial aid programs. The Title IV programs are made available pursuant to the provisions of the Higher Education Act of 1965, as amended (“HEA”), and the HEA must be reauthorized by the Congress approximately every six years. Independent of reauthorization, Congress must annually appropriate funds to fund the Title IV programs. The HEA is currently in the process of reauthorization, which is expected to take place during 2006. Reauthorization may result in numerous legislative changes, including funding reductions. Congress may also impose certain requirements upon the state or accrediting agencies respecting their approval of our schools. Any action by Congress that significantly reduces funding for the federal student financial aid programs or the ability of our schools or students to participate in these programs would have a material adverse effect on our student population and revenue. Legislative action may also increase our administrative costs and require us to modify our practices in order for our schools to comply fully with applicable requirements.

If we do not meet specific financial responsibility ratios and other compliance tests established by the U.S. Department of Education our schools may lose eligibility to participate in federal student financial aid programs.

To participate in the federal student financial aid programs, an institution must either satisfy certain quantitative standards of financial responsibility on an annual basis, or post a letter of credit in favor of the U.S. Department of Education and possibly accept other conditions and/or limitations on its participation in the federal student financial aid programs. Currently, none of our schools are required to post a letter of credit in favor of the U.S. Department of Education or accept other conditions and/or limitations on its participation in the

-19-