UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

Clayton Williams Energy, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

CLAYTON WILLIAMS ENERGY, INC.

Six Desta Drive, Suite 6500

Midland, Texas 79705

NOTICE OF 2005 ANNUAL MEETING OF SHAREHOLDERS

To Be Held Tuesday, May 11, 2005

To Our Shareholders:

You are cordially invited to attend the 2005 Annual Meeting of Shareholders of Clayton Williams Energy, Inc. (the “Company”), to be held at the ClayDesta Conference Center, Six Desta Drive, Suite 6550, Midland, Texas, at 10:00 a.m. local time on Tuesday, May 11, 2005, for the following purposes:

1. To elect three directors for a term of three years, such term to continue until the annual meeting of shareholders in 2008 and until each director’s successor is duly elected and qualified;

2. To advise on the selection of KPMG LLP as our independent auditors for 2005; and

3. To transact such other business as may properly come before the meeting and any adjournments or postponements thereof.

Shareholders of record of our common stock at the close of business on March 22, 2005 will receive notice of and be entitled to vote at the meeting in person or by proxy. A list of shareholders entitled to vote at the meeting will be available at our corporate offices for ten days prior to the meeting, and may be inspected during normal business hours by shareholders for purposes relevant to the meeting. The list will also be available for inspection by shareholders during the annual meeting.

Midland, Texas | | By Order of the Board of Directors |

April 12, 2005 | | Mel G. Riggs |

| | Secretary |

YOUR VOTE IS IMPORTANT. Please vote promptly whether or not you plan to attend the meeting. If you hold your shares in your own name, please vote by signing, dating and returning your proxy card in the prepaid envelope, as explained on your proxy card. If your shares are held by a bank, broker, or other nominee on your behalf, please follow the voting instructions provided to you by that holder.

CLAYTON WILLIAMS ENERGY, INC.

Six Desta Drive, Suite 6500

Midland, Texas 79705

Proxy Statement

Annual Meeting of Shareholders

Your vote is very important. For this reason, the Board of Directors is requesting that you allow your common stock to be represented at the 2005 Annual Meeting of Shareholders by the proxies named on the enclosed proxy card. We are first mailing this proxy statement and the form of proxy in connection with this request on or about April 13, 2005.

Information About the Annual Meeting and Voting

Time and Place

The 2005 Annual Meeting of Shareholders will be held at the ClayDesta Conference Center, Six Desta Drive, Suite 6550, Midland, Texas at 10:00 a.m. local time on Tuesday, May 11, 2005.

Items to be Voted Upon

You will be voting on the following matters:

• The election of three directors for a term of three years, such term to continue until the annual meeting of shareholders in 2008 and until each director’s successor is duly elected and qualified;

• Advising the Audit Committee on the selection of KPMG LLP as our independent auditors for 2005; and

• Such other business as may properly come before the meeting and any adjournments or postponements thereof.

Who May Vote

You are entitled to vote your common stock if our records show that you held your shares as of the close of business on March 22, 2005, the record date selected by the Board of Directors. Each shareholder is entitled to one vote for each share of common stock held on that date, at which time we had 10,794,195 shares of common stock outstanding and entitled to vote. The Company’s common stock is its only issued and outstanding class of stock.

How to Vote

You may vote in person at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always revoke your proxy at or prior to the meeting. If your shares are held by a bank, broker, or other nominee on your behalf, that holder will ask you for instructions on how to vote your shares. If you are a registered shareholder, meaning you hold your shares in your own name, you should vote by proxy card. If you sign, date and return your proxy card before the annual meeting, we will vote your shares as you direct. For the election of

1

directors, you may vote for (i) all of the nominees, (ii) none of the nominees, or (iii) all of the nominees except those you designate.

If you return your signed proxy card but do not specify how you want to vote your shares, we will vote your shares:

• “FOR” the election of the three nominees for director identified on page 6;

• “FOR” the selection of KPMG LLP as the Company’s independent auditors for 2005 (advisory vote), as explained on page 7; and

• In our discretion as to other business that is properly brought before the meeting or any adjournment or postponement of the meeting.

Changing Your Vote

You can revoke your proxy at any time before it is voted at the annual meeting by:

• Signing and returning a new proxy card with a later date;

• Attending the annual meeting and voting in person (except for shares held through a bank, broker or other nominee of record); or

• Sending written notice of revocation to our Secretary, Mel G. Riggs.

Quorum

A quorum of shareholders is necessary to hold a valid meeting. The presence in person or by proxy of at least a majority of the shares of our common stock entitled to vote at the meeting is a quorum. Abstentions and broker “non-votes” will be counted as present for establishing a quorum.

A broker “non-vote” occurs on an item when shares held by a bank, broker or other nominee are present or represented at the meeting but such nominee is not permitted to vote on that item without instruction from the beneficial owner of the shares and no instruction is given. If you have returned valid proxy instructions or vote in person, your shares will be counted for the purpose of determining whether there is a quorum, even if you abstain from any matter introduced at the meeting.

Votes Required

The nominees for election as directors at the annual meeting will be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote. The Company’s Certificate of Incorporation and Bylaws prohibit cumulative voting in the election of directors. Neither abstentions nor broker non-votes will have an effect on the votes for or against the election of a director.

Advice on the selection of KPMG LLP as our independent auditors for 2005, and any other matters submitted to a vote of the shareholders at the annual meeting, will be determined by the affirmative vote of a majority of the shares present or represented by proxy at the meeting and entitled to vote on such matters. Abstentions will count toward the number of shares present but will not count as an affirmative vote and, therefore, an abstention will have the effect of a vote against the selection of KPMG LLP as our independent auditors for 2005, and against any other matter submitted to a vote of the shareholders at the annual meeting. Broker non-votes will not be considered present at the meeting with respect to this proposal, or any other matter submitted to a vote of the shareholders at the annual meeting, and so will have no effect on the approval of these proposals.

2

Proxy Solicitation

This proxy is being solicited by the Board of Directors of the Company. In addition to this mailing, our employees and agents may solicit proxies personally, electronically, telephonically or otherwise, and they will receive no extra compensation for making solicitations. The extent to which these proxy soliciting efforts will be necessary depends upon how promptly proxies are submitted. We encourage you to submit your proxy without delay. We will pay our costs of soliciting proxies and will also reimburse brokers and other nominees for their expenses in sending these materials to you and getting your voting instructions.

Corporate Governance

Role of the Board

The business and affairs of the Company are managed under the direction of the Board of Directors (the “Board”). The Board has responsibility for establishing broad corporate policies and for overall performance and direction of the Company. Members of the Board stay informed of the Company’s business by participating in Board and committee meetings, by reviewing analyses and reports sent to them regularly, and through discussions with the Chief Executive Officer and other officers.

Board Structure

The Board of Directors is comprised of three classes of members. One class of directors is elected each year to hold office for a three-year term and until successors of such class are duly elected and qualified. The Board currently consists of seven directors.

Director Independence

The Audit Committee of the Board has affirmatively determined that a majority of the directors qualify as independent directors under Securities and Exchange Commission (“SEC”) regulations and Nasdaq Stock Market (“Nasdaq”) corporate governance listing standards. The independent directors are Stanley S. Beard, Davis L. Ford, Robert L. Parker and Jordan R. Smith.

Codes of Conduct and Ethics

The Company has adopted a Code of Conduct and Ethics (“Code”) that applies to all directors, executive officers and employees of the Company, including its subsidiaries. This Code assists employees in complying with the law, in resolving ethical issues that may arise, and in complying with the Company’s policies. This Code is also designed to promote, among other things, ethical handling of actual or apparent conflicts of interest; full, fair, accurate and timely disclosure in filings with the SEC and in other public disclosures; compliance with law; and prompt internal reporting of violations of the Code.

The code is available on our website at www.claytonwilliams.com under “Investor Relations/Governance.” We will provide the Code in print, free of charge, to shareholders who request it. Any waiver of the Code with respect to executive officers or directors may be made only by the Board or a Board committee and will be promptly disclosed to shareholders on the Company’s website, as will any amendments to the Code.

3

Communications with the Board

Communications by shareholders or by other parties may be sent to the Board by U.S. mail or overnight delivery and should be addressed to the Board c/o Secretary, Clayton Williams Energy, Inc., Six Desta Drive, Suite 6500, Midland, Texas 79705. Communications directed to the Board, or one or more Board members, will be forwarded directly to the designated member or members and may be made anonymously.

Identification of Director Candidates

The Company’s Nominating and Governance Committee is responsible for identifying and reviewing director candidates to determine whether they qualify for and should be considered for membership on the Board. If any vacancies on the Board arise, the Nominating and Governance Committee considers potential candidates that come to the attention of the Committee through current members of the Board, management of the Company, shareholders, or other persons. Candidates for nomination to the Board, whether recommended to the Committee by other members of the Board, management, shareholders or otherwise, are evaluated with the intention of achieving a balance of knowledge, experience and capability on the Board and in light of the membership criteria established by the Nominating and Governance Committee which is as follows:

• High professional and personal ethics and values;

• Broad experience in management, policy-making and/or finance;

• Commitment to enhancing shareholder value and to representing the interests of shareholders;

• Sufficient time to carry out their duties; and

• Experience adequate to provide insight and practical wisdom.

2004 Board Meetings and Annual Meeting

The Board met eight times in 2004 and took action by unanimous consent five times. Each member of the Board attended 100% of the total number of meetings of the Board and 100% of the total number of meetings held by each committee of the Board on which he served. All directors attended the 2004 Annual Meeting of Shareholders. The Company encourages all Board members to attend its annual meetings.

Board Committees

The Board has three standing committees: Audit, Compensation and Nominating and Governance. The Audit Committee of the Board has determined that each member of these committees is independent consistent with SEC regulations and Nasdaq listing standards.

Compensation Committee. This Committee held seven meetings during 2004 and took action by unanimous consent four times. Directors Beard (Chairman), Ford, Parker and Smith currently serve on this Committee. The purposes of the Committee are:

• To review, evaluate, and approve the agreements, plans, policies and programs of the Company to compensate its officers;

• To produce a report on executive compensation each year and to publish the report in the Company’s proxy statement for its annual meeting of shareholders;

• To provide assistance to the Board in discharging its responsibilities relating to the compensation of the Chief Executive Officer and other executive officers of the Company; and

• To perform such other functions as the Board may assign to the Committee from time to time.

The specific responsibilities of the Compensation Committee are identified in the Committee’s charter, which is available on our website at www.claytonwilliams.com under “Investor Relations/Governance.”

4

Nominating and Governance Committee. This Committee was formed in February 2004 and met one time in March 2004. Directors Smith (Chairman), Beard, Ford and Parker currently serve on this Committee. The purposes of the Committee are:

• To identify individuals qualified to become Board members, and to select the director nominees for election at the annual meetings of shareholders or for appointment to fill vacancies;

• To recommend to the Board director nominees for each committee of the Board;

• To advise the Board about appropriate composition of the Board and its committees;

• To advise the Board about and recommend to the Board appropriate corporate governance practices and to assist the Board in implementing those practices;

• To lead the Board in its annual review of the performance of the Board and its committees; and

• To perform such other functions as the Board may assign to the Committee from time to time.

The specific responsibilities of the Nominating and Governance Committee are identified in the Committee’s charter, which is available on our website at www.claytonwilliams.com under “Investor Relations/Governance.”

Audit Committee. This Committee held eight meetings during 2004 and took action by unanimous consent one time. Directors Parker (Chairman), Beard, Ford, and Smith currently serve on this Committee. The Board has determined that no member of the Committee meets all of the criteria needed to qualify as an “audit committee financial expert” as defined by SEC regulations. The Board believes that each of the current members of the Committee has sufficient knowledge and experience in financial matters to perform his duties on the Committee. In addition, the Committee has engaged, at the Company’s expense, Davis Kinard & Co., certified public accountants, as a financial accounting consultant to independently advise the Committee in the area of technical accounting issues and to assist the Committee in fully understanding any matters that may come before the Committee, including matters related to:

• Generally accepted accounting principles and the application of such principles in connection with accounting for estimates, accruals and reserves;

• Internal controls and procedures for financial reporting; and

• Other audit committee functions.

The specific responsibilities of the Audit Committee are identified in the Committee’s charter, which is available on our website at www.claytonwilliams.com under “Investor Relations/Governance” The Committee serves as an independent and objective party to oversee the accounting and financial reporting practices of the Company, and the audits of the financial statements of the Company. The Committee has the sole authority and responsibility with respect to the selection, engagement, compensation, oversight, evaluation and, where appropriate, dismissal of the independent auditors and any other public accounting firm engaged by the Company. The independent auditors, and any other public accounting firm engaged by the Company, report directly to the Audit Committee.

Directors’ Compensation

During 2004, compensation for non-employee directors consisted of an annual retainer fee of $10,000 plus a $7,500 fee for each Board meeting attended and a $1,000 fee for attending a committee meeting held on a day other than the same day of a Board meeting. As compensation for service on the Board during 2004, employee directors received an annual fee of $5,000 plus a $2,500 fee for each Board meeting attended.

5

Directors’ Stock Plan

The Company has an Outside Directors Stock Option Plan in which only those directors who are not employed by the Company or any of its affiliates (collectively the “Outside Directors”) are eligible to participate. A total of 86,300 shares of Common Stock has been authorized and reserved for issuance under the plan, subject to adjustments to reflect changes in capitalization resulting from stock splits, stock dividends and similar events. The plan provides that an option for 1,000 shares of Common Stock will be granted on January 1 of each calendar year to each Outside Director in office on that date. Messers. Beard, Parker and Smith each received options under the plan covering 1,000 shares at an option price of $28.93 per share on January 1, 2004, and Messers Beard, Ford, Parker and Smith each received options under the plan covering 1,000 shares at an option price of $22.90 per share on January 1, 2005. Options granted in 2004 are currently exercisable, and those granted in 2005 become exercisable on July 1, 2005. These options expire in January 2014 and January 2015, respectively.

Election of Three Directors

The Board of Directors is composed of three classes of members. One class of directors is elected each year to hold office for a three-year term and until successors of such class are duly elected and qualified. Except where the authority to do so has been withheld, it is the intention of the persons named in the proxy to vote to elect Davis L. Ford, Robert L. Parker and Jordan R. Smith as directors for three-year terms. Each of the nominees has consented to being named in the Proxy Statement and to serve, if elected, but if any of them should decline or be unable to serve for any reason, the proxies will be voted to fill any vacancy so arising in accordance with the discretionary authority of the persons named in the proxy.

With respect to the nominees for election, and directors continuing in office, information regarding age, positions with the Company or other principal occupations for the past five years, other directorships and the year each was initially elected a director of the Company is as follows. For information concerning the security ownership of each director, see “Security Ownership of Certain Beneficial Owners and Management.” There are no family relationships among the named persons.

Nominees for Election to the Board of Directors

For Three-Year Term Expiring in 2008

DAVIS L. FORD, age 67, is a director of the Company and a member of the Audit, Compensation and Nominating and Corporate Governance Committees of the Board of Directors. Dr. Ford has served as a director of the Company since his appointment in February 2004. Dr. Ford has been president of Davis L. Ford & Associates, an environmental engineering and consulting firm, for more than the past five years and is also an adjunct Professor at the University of Texas at Austin.

ROBERT L. PARKER, age 81, is a director of the Company and a member of the Audit, Compensation and Nominating and Corporate Governance Committees of the Board of Directors. Mr. Parker has served as a director of the Company since May 1993. Mr. Parker is Chairman of the Board of Parker Drilling Company, a publicly owned corporation providing contract drilling services, having served in such capacity for more than the past five years. He also serves as a director of Bank of Oklahoma Financial Corp.

JORDAN R. SMITH, age 70, is a director of the Company and a member of the Audit, Compensation and Nominating and Corporate Governance Committees of the Board of Directors. Mr. Smith has served as a director of the Company since July 2000. Mr. Smith is President of Ramshorn Investments, Inc., a wholly owned subsidiary of Nabors Industries, having served in such capacity for more than the past five years. Mr. Smith serves as a director of Delta Petroleum Corporation and has served on the Board of the University of Wyoming Foundation and the Board of the Domestic Petroleum Council. Mr. Smith is also Founder and Chairman of the American Junior Golf Association.

The Board of Directors unanimously recommends a vote FOR the election of Messrs. Ford, Parker and Smith to the Board of Directors.

6

Members of the Board of Directors Continuing in Office

Term Expiring in 2006

STANLEY S. BEARD, age 64, is a director of the Company and a member of the Audit, Compensation and Nominating and Corporate Governance Committees. Mr. Beard has served as a director of the Company since September 1991. Mr. Beard has been engaged in private business related to the oil and gas industry for more than 20 years and has been involved in real estate development for more than 10 years.

MEL G. RIGGS, age 50, is Senior Vice President and Chief Financial Officer of the Company, having served in such capacities since September 1991. Mr. Riggs has served as a director of the Company since May 1994.

Members of the Board of Directors Continuing in Office

Term Expiring in 2007

CLAYTON W. WILLIAMS, age 73, is Chairman of the Board, President, Chief Executive Officer and a director of the Company, having served in such capacities since September 1991. For more than the past five years, Mr. Williams has also been the chief executive officer and director of certain entities which are controlled directly or indirectly by Mr. Williams (the “Williams Entities”). See “Certain Transactions and Relationships.”

L. PAUL LATHAM, age 53, is Executive Vice President, Chief Operating Officer and a director of the Company, having served in such capacities since September 1991. Mr. Latham also serves as an officer and director of certain Williams Entities.

Advisory Vote on Selection of Independent Auditors

KPMG LLP served as the independent auditors for the Company and its wholly owned subsidiaries for 2004. Representatives of KPMG LLP will be present at the annual meeting with the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The independent auditors for 2005 will be selected by the Audit Committee of the Board of Directors at an Audit Committee meeting following the 2005 annual meeting of shareholders. KPMG LLP has begun certain work related to the 2005 audit as approved by the Audit Committee. Information on independent auditor fees for the last two fiscal years can be found under “Fees to KPMG LLP” in this proxy statement.

Although SEC regulations and Nasdaq listing standards require that the Audit Committee be directly responsible for selecting and retaining the independent auditors, the Board of Directors is providing shareholders with the means to express their views on this important issue. Although this vote is not binding, the Audit Committee will consider the results of the shareholder vote in deciding whether to renew the engagement of KPMG LLP for 2005.

The Audit Committee of the Board of Directors unanimously recommends a vote FOR the selection of KPMG LLP as the Company’s independent auditors for 2005.

7

Executive Compensation

The following table sets forth information with respect to the compensation of the Company’s chief executive officer and each of the other six most highly compensated executive officers who received salary and bonus in excess of $100,000 during 2004 (the “named executive officers”).

Summary Compensation Table

| | | | | | | | | | Long-Term Compensation | | | |

| | | | | | | | | | Awards | | Payouts | | | |

| | | | | | | | | | Securities | | | | | |

| | | | | | | | | | Underlying | | | | | |

| | | | | | | | | | Options | | Long-Term | | All Other | |

Name and Principal | | | | Annual Compensation | | Granted | | Incentive | | Compensation | |

Position | | Year | | Salary($)(1) | | Bonus($)(2) | | Other(3) | | (#)(4) | | Plans(5) | | ($)(6)(7)(8) | |

| | | | | | | | | | | | | | | |

Clayton W. Williams, | | 2004 | | $ | 495,000 | | $ | 64,830 | | — | | 300,000 | | $ | — | | $ | 14,368 | |

Chairman of the Board, | | 2003 | | $ | 495,000 | | $ | 35,000 | | — | | 200,000 | | $ | — | | $ | 13,296 | |

President and Chief | | 2002 | | $ | 495,000 | | $ | 436,250 | | — | | — | | $ | — | | $ | 12,205 | |

Executive Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

L. Paul Latham, Executive | | 2004 | | $ | 247,646 | | $ | 304,177 | | — | | — | | $ | 151,007 | | $ | 37,201 | |

Vice President and Chief | | 2003 | | $ | 235,950 | | $ | 34,611 | | — | | — | | $ | 105,275 | | $ | 34,278 | |

Operating Officer | | 2002 | | $ | 235,950 | | $ | 121,119 | | — | | — | | $ | — | | $ | 30,948 | |

| | | | | | | | | | | | | | | | | | | |

Mel G. Riggs, Senior Vice | | 2004 | | $ | 198,521 | | $ | 292,545 | | — | | — | | $ | 157,002 | | $ | 12,945 | |

President and Chief | | 2003 | | $ | 175,450 | | $ | 37,595 | | — | | — | | $ | 110,251 | | $ | 10,401 | |

Financial Officer | | 2002 | | $ | 175,450 | | $ | 76,317 | | — | | — | | $ | — | | $ | 9,699 | |

| | | | | | | | | | | | | | | | | | | |

Jerry F. Groner, Vice | | 2004 | | $ | 143,295 | | $ | 44,158 | | — | | — | | $ | 252,042 | | $ | 8,542 | |

President – Land and | | 2003 | | $ | 131,107 | | $ | 24,892 | | — | | — | | $ | 162,473 | | $ | 7,798 | |

Lease Administration(9) | | 2002 | | $ | 131,107 | | $ | 26,142 | | — | | — | | $ | — | | $ | 7,849 | |

| | | | | | | | | | | | | | | | | | | |

Patrick C. Reesby, Vice | | 2004 | | $ | 162,500 | | $ | 48,750 | | — | | — | | $ | — | | $ | 8,861 | |

President – New | | 2003 | | $ | 160,000 | | $ | 4,444 | | — | | — | | $ | — | | $ | 7,548 | |

Ventures | | 2002 | | $ | 160,000 | | $ | 4,444 | | — | | — | | $ | — | | $ | 7,234 | |

| | | | | | | | | | | | | | | | | | | |

T. Mark Tisdale, Vice | | 2004 | | $ | 114,848 | | $ | 136,884 | | — | | — | | $ | 95,331 | | $ | 7,486 | |

President and General | | 2003 | | $ | 113,398 | | $ | 3,150 | | $ | 11,727 | | — | | $ | 72,510 | | $ | 6,789 | |

Counsel | | 2002 | | $ | 113,398 | | $ | 3,150 | | $ | 12,358 | | — | | $ | — | | $ | 6,681 | |

| | | | | | | | | | | | | | | | | | | | |

Michael L. Pollard, Vice | | 2004 | | $ | 137,000 | | $ | 116,355 | | — | | — | | $ | 50,344 | | $ | 8,811 | |

President - Accounting(10) | | 2003 | | $ | 130,000 | | $ | 3,610 | | — | | — | | $ | — | | $ | 8,501 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(1) | | All of Mr. Williams’ net salary for 2002, 2003 and 2004 was paid in the form of common stock in lieu of cash pursuant to the Company’s Executive Incentive Stock Compensation Plan. |

| | |

(2) | | Amounts shown in this column include director’s fees for Messrs. Williams, Latham, Riggs and Groner of $22,500 each for 2002 and $21,250 each for 2003. In 2004, Messrs. Williams, Latham and Riggs each received director’s fees of $25,000, and Mr. Groner received director’s fees of $7,500 prior to his resignation as a director in January 2004. In 2002, the Company paid Mr. Williams a bonus of $400,000, payable in 31,923 shares of common stock at a price of $12.53 per share, the market price of the common stock at the close of business on the date of grant. |

| | |

(3) | | Amounts shown in this column represent the cost of perquisites and other personal benefits provided by the Company to a named executive officer in any year in which such amounts exceed the lesser of $50,000 or 10% of the named executive officer’s salary and bonus for such year. For Mr. Tisdale, the personal use of a Company-owned vehicle accounted for $9,600 of the reported amounts in 2003 and 2002. |

| | |

(4) | | All amounts shown represent the number of shares covered by options granted under the Company’s 1993 Stock Compensation Plan. |

| | |

(5) | | Amounts shown in this column represent payments attributable to after payout working interests distributed to plan participants (see “Long-Term Incentive Plans”). |

| | |

(6) | | The amount shown in this column with respect to Mr. Latham for 2004 includes $21,826 of distributions made pursuant to assignments of overriding royalty interests and selected working interests from companies previously controlled by Mr. Williams which were consolidated into the Company in May 1993 in connection with the Company’s initial public offering (the “Williams Companies”). |

| | |

(7) | | Amounts shown in this column for 2004 include premiums paid by the Company, pursuant to a term life insurance plan available to all full-time employees, on behalf of the following officers: Mr. Williams - $1,287; Mr. Latham - $1,980; Mr. Riggs - $1,980; Mr. Groner - $1,702; Mr. Reesby - $1,914; Mr. Tisdale - $1,370; and Mr. Pollard - $1,544. |

| | |

(8) | | Amounts shown in this column for 2004 include contributions made by the Company pursuant to its 401(k) Plan & Trust on behalf of the following officers: Mr. Williams - $13,081; Mr. Latham - $13,395; Mr. Riggs - $10,965; Mr. Groner - $6,840; Mr. Reesby - $6,947; Mr. Tisdale - $6,116; and Mr. Pollard - $7,267. |

| | |

(9) | | Mr. Groner is the son-in-law of Mr. Williams. |

| | |

(10) | | Mr. Pollard did not serve as an executive officer at any time during 2002. |

8

The Company has no employment agreements with any of its executive officers. Although Messrs. Williams, Latham and Pollard devote a majority of their time to the Company, each is engaged in other business activities. Mr. Williams devotes a portion of his time to certain Williams Entities. Mr. Latham and Mr. Pollard are also employed by and devote a portion of their time to the business of certain Williams Entities (see “Certain Transactions and Relationships”). Messrs. Williams, Latham and Pollard receive compensation from the Williams Entities which compensation is not borne, directly or indirectly, by the Company and does not relate to any services provided to the Company.

All options in the “Summary Compensation Table” have been granted pursuant to the Company’s 1993 Stock Compensation Plan which provides for the grant of non-qualified options to officers, directors (other than Outside Directors), employees and advisors of the Company or a subsidiary of the Company. A total of 1,798,200 shares of Common Stock are authorized and reserved for issuance under the plan subject to adjustments to reflect changes in the Company’s capitalization resulting from stock splits, stock dividends and similar events. The Compensation Committee has the sole authority to interpret the plan, to determine the persons to whom options will be granted, to determine the basis upon which the options will be granted, and to determine the exercise price, duration and other terms of options to be granted under the plan; provided that (i) the exercise price of each option granted under the plan may not be less than the fair market value of the Common Stock at the date of grant of such option, (ii) the exercise price must be paid in cash upon exercise of such option, (iii) no option may be exercisable more than ten years after the date of grant, and (iv) no option is transferable other than by will or the laws of descent and distribution. No option is exercisable after an optionee terminates his relationship with the Company or a subsidiary of the Company, subject to the right of the Compensation Committee to extend the exercise period for not more than 90 days following the date of termination of an optionee’s employment. If an optionee’s employment is terminated by reason of disability, the Compensation Committee has the authority to extend the exercise period for not more than one year following the date of termination of the optionee’s employment. If an optionee dies and has not fully exercised options granted under the plan, such options may be exercised in whole or in part within 90 days of the optionee’s death by the executors or administrators of the optionee’s estate or by the optionee’s heirs. The vesting period, if any, specified for each option will be accelerated upon the occurrence of a change of control or a threatened change of control of the Company.

No stock options have been granted to executive officers in the past three years, other than to Mr. Williams. Certain executive officers, other than Mr. Williams, are participants in various other long-term incentive plans (see “Long-Term Incentive Plans”).

Table of Option Grants in 2004

| | Individual Grants | | | | | |

| | Number of | | % of Total | | | | | | Potential Realized Value at | |

| | Securities | | Options | | | | | | Assumed Annual Rates of | |

| | Underlying | | Granted to | | Exercise | | | | Stock Price Appreciation | |

| | Options | | Employees in | | Price | | Expiration | | For Option Term | |

Name | | Granted (#) (1) | | Fiscal Year | | ($/Share) | | Date | | 5% ($) | | 10% ($) | |

| | | | | | | | | | | | | |

Clayton W. Williams | | 300,000 | | 100 | % | $ | 26.06 | | 7/13/2014 | | $ | 4,917,000 | | $ | 12,459,000 | |

| | | | | | | | | | | | | | | | |

(1) The values shown for 5% and 10% appreciation equates to a stock price of $42.45 and $67.59, respectively, at the expiration date of the option.

9

Table of Aggregated Option Exercises in 2004 and Option Values as of December 31, 2004

| | | | | | Number of Securities | | Value of | |

| | Shares | | | | Underlying Unexercised | | Unexercised In-the-Money | |

| | Acquired on | | Value | | Options at December 31, 2004 (#) | | Options at December 31, 2004 ($ ) | |

Name | | Exercise (#) | | Realized ($) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| | | | | | | | | | | | | |

Clayton W. Williams | | — | | $ | — | | 1,050,500 | | — | | $ | 5,551,325 | | $ | — | |

| | | | | | | | | | | | | |

L. Paul Latham | | — | | $ | — | | 6,750 | | — | | $ | 117,450 | | $ | — | |

| | | | | | | | | | | | | | | | |

Mel G. Riggs | | — | | $ | — | | 7,888 | | — | | $ | 137,251 | | $ | — | |

| | | | | | | | | | | | | |

Jerry F. Groner | | — | | $ | — | | 8,207 | | — | | $ | 142,802 | | $ | — | |

| | | | | | | | | | | | | |

Patrick C. Reesby | | — | | $ | — | | 8,094 | | — | | $ | 140,836 | | $ | — | |

| | | | | | | | | | | | | |

T. Mark Tisdale | | — | | $ | — | | 3,100 | | — | | $ | 53,940 | | $ | — | |

| | | | | | | | | | | | | |

Michael L. Pollard | | — | | $ | — | | 2,690 | | — | | $ | 46,806 | | $ | — | |

(1) The value of In-the-Money options was computed at $22.90 per share, which was the market price for the Common Stock on December 31, 2004.

Long-Term Incentive Plans

After Payout Working Interest Trusts. During 2001, the Compensation Committee of the Board of Directors approved the creation of six trusts through which executive officers and key employees of the Company, excluding Mr. Williams, received after-payout working interests in wells or groups of wells drilled by the Company subsequent to the formation of the trusts. The aggregate working interests assignable to the trusts ranged from 4% to 5% of the Company’s working interest in the properties. Five of the six trusts are not expected to achieve payout and will be dissolved.

Effective May 1, 2003, the working interest trust covering certain wells in the Cotton Valley Reef Complex and the Austin Chalk (Trend) paid out. Upon payout, the related working interests were distributed to the participants. All net revenues, consisting of oil and gas sales, net of production taxes and other expenses, attributable to the distributed interests are paid to the participants in proportion to each participant’s ownership interest.

The following table sets forth certain information regarding the interests distributed from this trust for each executive officer and all other participants as a group.

Participant | | Ownership

Interest(1) | | 2004

Payouts | | Estimated

Future

Payouts(2) | |

| | | | | | | |

L. Paul Latham | | 5.16 | % | $ | 51,966 | | $ | 121,011 | |

| | | | | | | |

Mel G. Riggs | | 5.75 | % | 57,961 | | 134,847 | |

| | | | | | | |

Jerry Groner | | 19.43 | % | 195,768 | | 455,666 | |

| | | | | | | |

T. Mark Tisdale | | 1.24 | % | 12,488 | | 29,080 | |

| | | | | | | |

Michael L. Pollard | | 2.29 | % | 23,069 | | 53,704 | |

| | | | | | | |

All other participants as a group (5 persons) | | 66.13 | % | 666,407 | | 1,550,859 | |

| | | | | | | |

| | 100.00 | % | $ | 1,007,659 | | $ | 2,345,167 | |

(1) Represents each participants’ ownership interest in the various after-payout working interests distributed by the trust. The ownership interest of each participant was determined by Mr. Williams and approved by the Compensation Committee.

(2) Estimated future payouts have been computed based on the future net revenues from proved oil and gas reserves attributable to the distributed interests at December 31, 2004. These reserve estimates were made using guidelines established by the SEC, except that the future net revenues are undiscounted. Because of the uncertainties inherent in estimating quantities of proved reserves and future product prices and costs, it is not possible to predict estimated future payouts with any degree of certainty.

10

After Payout Working Interest Incentive Plan. In lieu of the working interest trusts discussed above, in September 2002 the Compensation Committee of the Board of Directors adopted an incentive plan for key employees and consultants, excluding Mr. Williams, who promote the Company’s drilling and acquisition programs. This plan is designed to further align the interests of the participants with those of the Company by granting the participants after-payout working interests in the production developed, directly or indirectly, by the participants. The plan provides for the creation of a series of limited partnerships to which the Company, as general partner, contributes a portion of its working interest in wells drilled within certain areas, and the key employees and consultants, as limited partners, initially contribute cash equal to $10 per unit. The Company pays all costs and receives all revenues attributable to the working interests held by the partnerships until the Company receives revenues equal to all of its costs, plus an interest factor (“Payout”). At Payout, the limited partners receive at least 99% of all subsequent revenues and pay at least 99% of all subsequent expenses attributable to the partnerships’ working interests.

The following table sets forth certain information regarding all partnerships formed in 2004 or prior years.

Name | | Year

Formed | | No. of

Participants | | No. of

LP Units | | Area of Interest | | WI%

Assigned | |

| | | | | | | | | | | |

CWEI Cotton Valley I, L.P. | | 2002 | | 23 | | 100.00 | | East Central Texas | | 5.00 | % |

| | | | | | | | | | | |

CWEI South Louisiana I, L.P. | | 2002 | | 24 | | 100.00 | | South Louisiana | | 5.00 | % |

| | | | | | | | | | | |

CWEI Romere Pass, L.P. | | 2002 | | 26 | | 104.78 | | Romere Pass Unit | | 5.00 | % |

| | | | | | | | | | | |

CWEI Longfellow Ranch I, L.P. | | 2003 | | 18 | | 100.00 | | Pecos Co., Texas | | 5.00 | % |

| | | | | | | | | | | |

CWEI South Louisiana II, L.P. | | 2004 | | 27 | | 100.00 | | South Louisiana | | 5.00 | % |

| | | | | | | | | | | |

CWEI Mississippi I, L.P. | | 2004 | | 24 | | 100.00 | | Mississippi | | 3.00 | % |

The Compensation Committee has approved the formation of seven additional partnerships with similar structures since December 31, 2004.

The following table sets forth the number of units granted to each named executive officer and all other participants as a group in each of the partnerships formed in 2004.

| | CWEI South | | CWEI | |

Participant | | Louisiana II, L.P. | | Mississippi I, L.P. | |

| | | | | |

L. Paul Latham | | 4.94 | | 5.07 | |

| | | | | |

Mel G. Riggs | | 4.94 | | 5.07 | |

| | | | | |

Jerry F. Groner | | 3.59 | | 18.98 | |

| | | | | |

Patrick C. Reesby | | 26.62 | | 3.82 | |

| | | | | |

T. Mark Tisdale | | 1.79 | | 9.49 | |

| | | | | |

Michael L. Pollard | | 2.69 | | 2.77 | |

| | | | | |

All other participants as a group (21 and 18, respectively) | | 55.43 | | 54.80 | |

| | | | | |

| | 100.00 | | 100.00 | |

11

CWEI Cotton Valley I, L.P. achieved Payout in April 2004, and the Company’s Partnership interest was reduced to 1%. The following table sets forth certain information regarding the interest owned in this partnership by each named executive officer who is a participant and all other participants as a group.

| | | | | | Estimated | |

| | Units | | 2004 | | Future | |

Participant | | Owned(1) | | Payouts | | Payouts(2) | |

| | | | | | | |

L. Paul Latham | | 6.67 | | $ | 22,276 | | $ | 34,841 | |

| | | | | | | |

Mel G. Riggs | | 6.67 | | 22,276 | | 34,841 | |

| | | | | | | |

Jerry F. Groner | | 16.85 | | 56,274 | | 88,017 | |

| | | | | | | |

T. Mark Tisdale | | 1.82 | | 6,078 | | 9,507 | |

| | | | | | | |

Michael L. Pollard | | 2.42 | | 8,082 | | 12,641 | |

| | | | | | | |

All other participants as a group (18 persons) | | 65.57 | | 218,983 | | 342,509 | |

| | | | | | | |

| | 100.00 | | $ | 333,969 | | $ | 522,356 | |

(1) Represents the number of limited partnership units owned by each participant in the partnership. The number of units assigned to each participant was determined by Mr. Williams and approval by the Compensation Committee.

(2) Estimated future payouts have been computed based on the future net revenues from proved oil and gas reserves attributable to the limited partnership units at December 31, 2004. These reserve estimates were made using guidelines established by the SEC, except that the future net revenues are undiscounted. Because of the uncertainties inherent in estimating quantities of proved reserves and future product prices and costs, it is not possible to predict estimated future payouts with any degree of certainty.

After Payout Working Interest Grant. In May 2003, the Compensation Committee of the Board of Directors approved the grant of 5% of the Company’s after-payout working interests in certain acreage in New Mexico to key employees, other than Mr. Williams, who contributed to the success of that project. In connection with the grant, the participants received a cash payment equal to the net revenues attributable to the distributed interests from payout (May 2002) through June 2003, and received an assignment of their proportionate share of the working interests in the acreage effective July 1, 2003. All net revenues, consisting of oil and gas sales, net of production taxes and other expenses, attributable to the distributed interests are paid to the participants in proportion to each participant’s ownership interest in the grant.

The following table sets forth certain information regarding this after-payout grant for each named executive officer who is a participant and all other participants as a group.

Participant | | Ownership

Interest(1) | | 2004

Payouts | | Estimated

Future

Payouts(2) | |

| | | | | | | |

L. Paul Latham | | 20 | % | $ | 76,765 | | $ | 613,536 | |

| | | | | | | |

Mel G. Riggs | | 20 | % | 76,765 | | 613,536 | |

| | | | | | | |

T. Mark Tisdale | | 20 | % | 76,765 | | 613,536 | |

| | | | | | | |

Michael L. Pollard | | 5 | % | 19,193 | | 153,384 | |

| | | | | | | |

All other participants as a group (5 persons) | | 35 | % | 134,346 | | 1,073,686 | |

| | | | | | | |

| | 100 | % | $ | 383,834 | | $ | 3,067,678 | |

(1) Represents each participants’ ownership interest in the various after-payout working interests assigned.

(2) Estimated future payouts have been computed based on the future net revenues from proved oil and gas reserves attributable to the distributed interests at December 31, 2004. These reserve estimates were made using guidelines established by the SEC, except that the future net revenues are undiscounted. Because of the uncertainties inherent in estimating quantities of proved reserves and future product prices and costs, it is not possible to predict estimated future payouts with any degree of certainty.

12

Report of the Compensation Committee

General

In 2004 the Compensation Committee consisted of Messrs. Beard, Ford, Parker and Smith, all of whom are independent directors under current SEC regulations and Nasdaq listing standards. The Committee establishes the salaries of all corporate officers, and administers the Company’s incentive compensation plans other than the Outside Directors Stock Option Plan. The Committee also reviews with the Board of Directors its recommendations relating to the future direction of corporate compensation practices and benefit programs.

The Compensation Committee has adopted a compensation policy which it believes to be a balance between fair and reasonable cash compensation and incentives linked to the Company’s overall performance, taking into consideration compensation of individuals with similar duties who are employed by the Company’s industry peers. The policy takes into account the cyclical nature of the oil and gas business, which may result in traditional performance standards being skewed due to erratic product prices. An analysis of the goals for the Company has resulted in a policy which places emphasis on increasing the Company’s proved oil and gas reserves and production, coupled with maintaining an acceptable balance between the Company’s overhead and profit margin. The Compensation Committee may award stock options, bonuses and units in incentive partnerships based upon the performance of the Company and efforts of individual officers.

Executive Officer Annual Compensation

The Compensation Committee has reviewed all components of the compensation of the Chief Executive Officer and the named executive officers, including salary, bonus, equity and long-term compensation, accumulated realized and unrealized stock option gains, the dollar value to the executive and the cost to the Company of all perquisites and other personal benefits, and the projected future payouts under the working interest partnerships. In addition, the Compensation Committee has reviewed components of compensation of executive officers of the other peer companies in the industry with such components including salary, bonus, stock options, restricted stock awards, life insurance, vehicle allowances and other compensation. The Compensation Committee has reviewed the compensation policies of the Company and discussed the increased competition encountered by the Company in attracting and retaining qualified employees.

Long-Term Compensation

In addition to the shares of Common Stock issued to Mr. Williams in lieu of cash salary and bonus under the Company’s Executive Incentive Stock Compensation Plan, the Compensation Committee awarded a fully vested stock option of 300,000 shares of Common Stock as an additional bonus in recognition of Mr. Williams’ current and potential contribution to the Company. See “Compensation of the Chief Executive Officer.” The Compensation Committee did not award any stock options or other stock based incentives to other officers of the Company during 2004.

The Company has continued an incentive plan for key employees and consultants, excluding Mr. Williams, who promote the Company’s drilling and acquisition programs, which was adopted in 2002. All officers, other than Mr. Williams, are eligible to participate in this plan at the discretion of the Compensation Committee. The plan provides for the creation of a series of limited partnerships to which the Company, as general partner, contributes a portion of its working interest in wells drilled within certain geographical areas. The Company pays all costs and receives all revenues until payout of its costs, plus interest. At payout, the participants, as limited partners, receive 99% of all subsequent revenues and pay 99% of all subsequent expenses attributable to the partnerships’ interests. Two limited partnerships were formed pursuant to this plan in March 2004, to which the Company committed to contribute 5% of its working interests in certain wells drilled in south Louisiana and 3% of its working interests in certain wells drilled in Mississippi. The Compensation Committee believes that aligning a portion of the officers’ long-term compensation to the performance of the Company’s oil and gas properties is both a reward for the acquisition and development of such properties and incentive to manage the properties in a manner that will maximize the long-term success of the properties for both the company and themselves.

13

Short-Term Compensation.

In March 2004, the Compensation Committee awarded cash bonuses to Messrs. Latham, Riggs and Pollard in recognition of their performance in the acquisition of properties in New Mexico. In June 2004, the Compensation Committee awarded cash bonuses to Messrs. Latham, Riggs, Groner and Pollard in recognition of their performance in the acquisition of Southwest Royalties, Inc. and their efforts to insure that the Company was in compliance with the requirements of the Sarbanes-Oxley Act of 2002.

The Committee believes that such bonuses serve both as a reward for performance and an incentive for future extraordinary performance in anticipation of such recognition. All officers also received Christmas bonuses relative to their annual salaries.

Compensation of the Chief Executive Officer

The Compensation Committee did not change Mr. Williams’ salary in 2004. Consistent with the compensation strategy and policies of recent years, Mr. Williams’ salary continues to be paid in shares of Common Stock under the Company’s Executive Incentive Stock Compensation Plan. The Committee continues to believe that payment of Mr. Williams’ salary in shares of Common Stock assists in aligning Mr. Williams’ interest with those of the other stockholders. In July 2004, the Committee granted Mr. Williams a fully vested option to purchase 300,000 shares of Common Stock based on the Company’s performance and the time, effort and leadership that Mr. Williams provides to the Company as its Chief Executive Officer. The Committee believes that the granting of this stock option provides an incentive for Mr. Williams’ continued effort and performance and further aligns Mr. Williams’ interests with those of other shareholders. Mr. Williams also received a Christmas bonus of $20,625 in 2004 relative to his annual salary.

The Compensation Committee believes it has developed an appropriate structure within which to reward and motivate its officers as they build value for the Company’s stockholders and considers the Company’s Chief Executive Officer and the named executive officers’ compensation in the aggregate to be reasonable and not excessive.

| COMPENSATION COMMITTEE |

| Stanley S. Beard, Chairman |

| Davis L. Ford |

| Robert L. Parker |

| Jordan R. Smith |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of Directors Beard, Ford, Parker and Smith. None of these committee members has or had a relationship with the Company that is or was required to be disclosed under the rules of the SEC.

Report of the Audit Committee

The following is the report of the Audit Committee with respect to the Company’s audited financial statements for the year ended December 31, 2004.

During 2004, the Audit Committee consisted of Messrs. Parker, Beard, Ford and Smith. The Audit Committee acts pursuant to the Audit Committee Charter, as amended and restated in March 2004. Each member of the Audit Committee qualifies as an “independent” director under current SEC regulations and Nasdaq listing standards.

14

In March 2005, the Audit Committee reviewed and discussed the Company’s audited financial statements with management and representatives of KPMG LLP, the Company’s independent auditors. Particular attention was paid to the selection, application and disclosure of the Company’s critical accounting policies. The Audit Committee also discussed with KPMG LLP the matters required to be discussed by Statements of Auditing Standards No. 61, Communication with Audit Committees. The Audit Committee received written disclosures and the letter from KPMG LLP required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and discussed with KPMG LLP their independence from the Company and management. The Audit Committee considered whether the non-audit services provided by KPMG LLP are compatible with their independence.

Based on the review and discussions referred to above, the Audit Committee took the following actions:

• Ratified management’s selection, application and disclosure of critical accounting policies as set forth in the Company’s audited financial statements for the year ended December 31, 2004;

• Recommended to the Board of Directors that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2004; and

• Reviewed the Audit Committee Charter, assessed the Charter for adequacy, and determined that the Charter, as stated, was adequate.

| AUDIT COMMITTEE |

| Robert L. Parker, Chairman |

| Stanley S. Beard |

| Davis L. Ford |

| Jordan R. Smith |

Fees to KPMG LLP

Audit Fees

KPMG LLP audited the consolidated financial statements of the Company for the years ended December 31, 2004 and 2003 and reviewed the consolidated financial statements for the interim quarters during 2004 and 2003. For these services, the Company paid KPMG LLP $235,000 for 2004 and $195,000 for 2003.

KPMG LLP audited the effectiveness of the Company’s internal control over financial reporting as of December 31, 2004. For these services, the Company paid KPMG LLP $260,000.

In 2004, KPMG LLP also issued a comfort letter in connection with a registration statement on Form S-3. For these services, the Company paid KPMG LLP $147,000.

Southwest Royalties, Inc., a wholly owned subsidiary of the Company, serves as Managing General Partner of 13 public and 10 private partnerships. KPMG LLP audited the financial statements of the 13 public partnerships for the year ended December 31, 2004 and reviewed the related quarterly interim financial statements. For these services, the partnerships, in the aggregate, paid KPMG LLP $123,000. KPMG LLP also audited the financial statements of the 10 private partnerships for the year ended December 31, 2004. For these services, the partnerships, in the aggregate, paid KPMG LLP $50,000.

15

Audit-Related Fees

KPMG LLP audited the financial statements of the Clayton Williams Energy, Inc. 401(k) Plan & Trust (the “Plan”) for the years ended December 31, 2003 and 2002 for inclusion in the Company’s Form 11-K for such periods. For these services, the Company paid KPMG LLP $25,000 in 2004 and $21,500 in 2003.

In 2004, KPMG LLP provided consultation services related to the requirements of Sarbanes-Oxley Section 404. For these services, the Company paid KPMG LLP $20,000.

Tax Fees

During 2004 and 2003, the Company incurred fees for professional services rendered by KPMG LLP totaling $63,070 and $21,500, respectively, for tax consulting services.

All Other Fees

KPMG LLP did not provide any other services to the Company in 2004 or 2003.

16

Security Ownership of Certain Beneficial Owners and Management

Under regulations of the Securities and Exchange Commission, persons who have power to vote or dispose of shares of common stock, either alone or jointly with others, are deemed to be beneficial owners. The following table sets forth certain information regarding the beneficial ownership of our common stock based upon 10,794,195 shares outstanding as of March 22, 2005, by (i) each person who is the beneficial owner of 5 percent or more of the outstanding common stock (based upon copies of all Schedule 13Gs and 13Ds provided to the Company), (ii) each director of the Company and each nominee for director, (iii) the normal executive officers and (iv) all officers and directors of the Company as a group. Because the voting or dispositive power of certain shares listed in the following table is shared, the same securities in such cases are listed opposite more than one name in the table and the sharing of voting or dispositive power is described in the referenced footnote. The total number of shares of common stock of the Company listed below for directors and executive officers as a group eliminates such duplication. Unless otherwise noted, the persons and entities named below have sole voting and investment power with respect to the shares listed opposite each of their names.

Name | | Amount and Nature of

Beneficial Ownership | | Percent

of Class | |

| | | | | |

Clayton Williams Partnership, Ltd. (1) | | 3,881,109 | | 36.0 | % |

| | | | | |

CWPLCO, Inc. (1) | | 3,881,109 | | 36.0 | % |

| | | | | |

Clayton W. Williams (1) | | 5,522,590 | (2) | 46.6 | % |

| | | | | |

State Street Research & Management Co. | | 1,250,996 | (3) | 11.6 | % |

One Financial Center, 30th Floor | | | | | |

Boston, MA 02111-2690 | | | | | |

| | | | | |

Wellington Management Company, LLP | | 995,300 | (4) | 9.2 | % |

75 State Street | | | | | |

Boston, MA 02109 | | | | | |

| | | | | |

Heartland Advisors, Inc. | | 684,741 | (5) | 6.3 | % |

789 North Water Street | | | | | |

Milwaukee, WI 53202 | | | | | |

| | | | | |

William J. Nasgovitz | | 684,741 | (5) | 6.3 | % |

789 North Water Street | | | | | |

Milwaukee, WI 53202 | | | | | |

| | | | | |

L. Paul Latham | | 7,506 | (6) | | * |

| | | | | |

Mel G. Riggs | | 9,897 | (7) | | * |

| | | | | |

Jerry F. Groner | | 40,547 | (8) | | * |

| | | | | |

Patrick C. Reesby | | 15,883 | (9) | | * |

| | | | | |

T. Mark Tisdale | | 10,195 | (10) | | * |

| | | | | |

Michael L. Pollard | | 3,122 | (11) | | * |

| | | | | |

Stanley S. Beard | | 18,401 | (12) | | * |

| | | | | |

Robert L. Parker | | 27,217 | (12) | | * |

| | | | | |

Jordan R. Smith | | 4,400 | (12) | | * |

| | | | | |

Davis L. Ford | | 15,740 | (12) | | * |

| | | | | |

All officers and directors as a group (12 persons) | | 5,703,519 | (13) | 47.9 | % |

* Less than 1 percent of the shares outstanding.

(1) The mailing address of Clayton Williams Partnership, Ltd., CWPLCO, Inc. and Mr. Williams is Six Desta Drive, Suite 3000, Midland, Texas 79705. Clayton Williams Partnership, Ltd. and CWPLCO, Inc. are referred to collectively

17

herein as the “Affiliated Holders”. CWPLCO, Inc. is the sole general partner of Clayton Williams Partnership, Ltd. and holds, in its own capacity and on behalf of Clayton Williams Partnership, Ltd., voting and investment power over the shares shown for the Affiliated Holders. Mr. Williams shares voting and investment power with respect to the shares owned by the Affiliated Holders.

(2) Consists of (a) an aggregate of 3,881,109 shares owned by the Affiliated Holders beneficially owned by Mr. Williams due to Mr. Williams’ control of the Affiliated Holders, (b) 11,044 shares owned by Mr. Williams’ wife, (c) 588 shares owned by a trust of which Mrs. Williams is the trustee, (d) 483,822 shares owned directly by Mr. Williams (including approximately 17,314 shares held in the Company’s 401(k) Plan & Trust over which Mr. Williams exercises investment control), (e) 34,611 shares owned by three of Mr. Williams’ children, (f) 49,179 shares in trusts of which Mr. Williams is the Trustee, (g) 5,749 shares in a trust for the benefit of Mr. Williams of which Mrs. Williams is the Trustee, (h) 5,988 shares owned by Mr. Williams’ grandchildren for which Mrs. Williams is custodian, and (i) the right to acquire beneficial ownership through presently exercisable options to purchase 1,050,500 shares of common stock granted under the 1993 Stock Compensation Plan.

(3) Represents shares owned by clients of State Street Research & Management Co. State Street Research & Management Co. disclaims beneficial ownership of all such shares.

(4) Represents shares owned by clients of Wellington Management Company, LLP.

(5) Represents shares owned by clients of Heartland Advisors, Inc. William J. Nasgovitz may be deemed to beneficially own the shares represented as a result of his ownership interest in Heartland Advisors, Inc. Heartland Advisors, Inc. and Mr. Nasgovitz disclaim beneficial ownership of all such shares.

(6) Includes (a) 756 shares held in the Company’s 401(k) Plan & Trust over which Mr. Latham exercises investment control and (b) the right to acquire beneficial ownership through presently exercisable options to purchase 6,750 shares of common stock granted under the 1993 Stock Compensation Plan.

(7) Includes (a) 627 shares held in the Company’s 401(k) Plan & Trust over which Mr. Riggs exercises investment control, (b) 1,382 shares over which Mr. Riggs exercises control under a Power of Attorney and (c) the right to acquire beneficial ownership through presently exercisable options to purchase 7,888 shares of common stock granted under the 1993 Stock Compensation Plan.

(8) Includes (a) 4,204 shares held in the Company’s 401(k) Plan & Trust over which Mr. Groner exercises investment control, (b) 20,870 shares owned by Mr. Groner’s wife as her separate property, (c) 4,506 shares owned by Mr. Groner’s children residing with him, and (d) the right to acquire beneficial ownership through presently exercisable options to purchase 8,207 shares of common stock granted under the 1993 Stock Compensation Plan.

(9) Includes (a) 2,789 shares held in the Company’s 401(k) Plan & Trust over which Mr. Reesby exercises investment control and (b) the right to acquire beneficial ownership through presently exercisable options to purchase 8,094 shares of common stock granted under the 1993 Stock Compensation Plan.

(10) Includes (a) 3,023 shares held in the Company’s 401(k) Plan & Trust over which Mr. Tisdale exercises investment control and (b) the right to acquire beneficial ownership through presently exercisable options to purchase 3,100 shares of common stock granted under the 1993 Stock Compensation Plan.

(11) Includes (a) 432 shares held in the Company’s 401(k) Plan & Trust over which Mr. Pollard exercises investment control and (b) the right to acquire beneficial ownership through presently exercisable options to purchase 2,690 shares of common stock granted under the 1993 Stock Compensation Plan.

(12) Includes the right to acquire beneficial ownership through presently exercisable options to purchase shares of common stock granted under the Outside Directors Stock Option Plan, as follows: Mr. Beard – 9,000 shares; Mr. Parker – 9,000 shares; and Mr. Smith – 4,000 shares.

(13) Includes all rights of directors and executive officers to acquire beneficial ownership through presently exercisable options to purchase shares of common stock granted under the Outside Directors Stock Option Plan and the 1993 Stock Compensation Plan.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3, 4 and 5 and amendments thereto furnished to the Company pursuant to the rules and regulations promulgated under Section 16(a) of the Securities Exchange Act of 1934 during and with respect to the Company’s last fiscal year and upon certain written representations received by the Company, the Company is not aware of any failure by a reporting person of the Company to timely file reports required under Section 16(a).

18

Certain Transactions and Relationships

The Company and the Williams Entities are parties to an agreement (the “Service Agreement”) pursuant to which the Company furnishes services to, and receives services from, such entities. Under the Service Agreement, the Company provides legal, computer, payroll and benefits administration, insurance administration and general accounting services to the Williams Entities, as well as technical services with respect to the operation of certain oil and gas properties owned by the Williams Entities. The Williams Entities provide tax preparation services, tax planning services, and business entertainment to or for the benefit of the Company. The following table summarizes the charges to and from the Williams Entities for the year ended December 31, 2004.

| | 2004 | |

| | (In thousands) | |

Amounts received from the Williams Entities: | | | |

Service Agreement: | | | |

Services | | $ | 314 | |

Insurance premiums and benefits | | 691 | |

Reimbursed expenses | | 388 | |

| | $ | 1,393 | |

Amounts paid to the Williams Entities: | | | |

Rent(1) | | $ | 493 | |

Service Agreement: | | | |

Business entertainment(2) | | 113 | |

Other services | | 85 | |

Reimbursed expenses | | 105 | |

| | $ | 796 | |

(1) Rent amounts were paid to CDBLP (see below). The Company owns 31.9% of the partnership, and affiliates of the Company own 23.3%.

(2) Consists of hunting and fishing rights pertaining to land owned by affiliates of Mr. Williams.

In March 2005, the Company and Mr. Williams amended the Service Agreement (i) to remove a $40,000 annual limit on the amount that the Williams Entities would be entitled to receive for providing tax return preparation and tax planning services to the Company, and a $50,000 annual limit on the amount that the Company would be entitled to receive for providing general accounting services to the Williams Entities; (ii) to provide for the Williams Entities to furnish hunting and fishing rights to the Company on lands owned by the Williams Entities pursuant to the terms of separate annual hunting leases, which services were previously provided to the Company by the Williams Entities on a daily usage basis; (iii) to include provisions defining the standard of care of the Company and the Williams Entities in providing services under the Service Agreement; and (iv) to limit the liability of the parties providing services under the Service Agreement to the amounts they received as payment for these services. This amendment to the Service Agreement was approved by the Audit Committee and by the Board of Directors.

In May 2001, the Company invested approximately $1.6 million as a limited partner in ClayDesta Buildings, L.P. (“CDBLP”). The general partner of CDBLP is owned and controlled by Mr. Williams. CDBLP purchased and presently operates two commercial office buildings in Midland, Texas, one of which is the location of the Company’s corporate headquarters. The Company’s ownership interest in CDBLP is 31.9% before payout (as defined in the partnership agreement) and 33.4% after payout. The Company is not liable for any indebtedness of CDBLP. Since the Company does not control CDBLP or manage the operations of these buildings, the Company utilizes the equity method of accounting for its investment in CDBLP.

A Williams Entity provides property management services to the buildings owned and operated by CDBLP. In 2004, CDBLP paid the Williams Entity $313,000 in fees for these services, including $133,000 in leasing commissions. The Williams Entity remitted a portion of the commissions received from CDBLP to Messrs. Williams and Latham for their leasing services, as follows: Mr. Williams - $8,183; and Mr. Latham - - $8,183. These payments are not subject to the Services Agreement and are not included in the above table or in the “Summary Compensation Table”.

19

Prior to April 1, 2004, Robert C. Lyon, Vice President Gas Gathering and Marketing, had a 5% net profits interest with respect to gas gathering systems of the Company (including its subsidiaries). Generally, the Company’s net profits from its gas gathering systems are computed in accordance with generally accepted accounting principles, except that the Company may charge against such profits an amount equal to its cost of funds on its net fixed assets after depreciation. Effective April 1, 2004, Mr. Lyon’s net profits interest was terminated (except for a 5% net profits interest in one system in Mississippi) and his annual salary was increased by $40,000. During 2004, payments to Mr. Lyon in accordance with the net profits interest totaled $46,941.

Shareholder Proposals

All shareholder proposals submitted for inclusion in the Company’s proxy statement and form of proxy for the annual meeting of shareholders of the Company to be held in 2006 must be received at the Company’s corporate offices, Six Desta Drive, Suite 6500, Midland, Texas 79705, Attention: Mel G. Riggs, by December 13, 2005. Such proposals must comply with the applicable regulations of the SEC. Notice to the Company of all other shareholder proposals for consideration at the annual meeting of shareholders of the Company to be held in 2006 that are not submitted for inclusion in the Company’s proxy statement and form of proxy will not be considered unless received at the Company’s principal corporate offices on or before March 20, 2006.

20

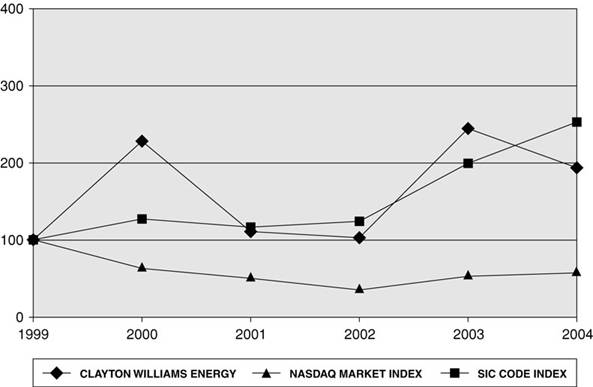

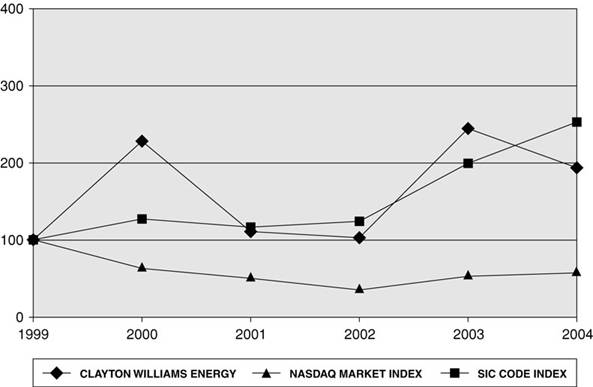

Comparison of Cumulative Total Shareholder Return

Set forth below is a chart comparing the percentage change in the cumulative total shareholder return on the Company’s Common Stock against the total return of the Nasdaq Stock Market’s Market Index and a peer group for the period from December 31, 1999 to December 31, 2004. The peer group is composed of all the crude petroleum and natural gas companies with stock trading on the Nasdaq Stock Market’s National Market System within SIC Code 1311, consisting of approximately 200 companies. The chart indicates the value, at the conclusion of each fiscal year from December 31, 1999 to December 31, 2004, of $100 invested at December 31, 1999 and assumes reinvestment of all dividends. The Company paid no dividends during this five-year period.

Date | | Company | | Nasdaq

Market

Index | | SIC

Code

Index | |

| | | | | | | |

12/99 | | 100.00 | | 100.00 | | 100.00 | |

12/00 | | 228.57 | | 62.85 | | 127.04 | |

12/01 | | 110.90 | | 50.10 | | 116.56 | |

12/02 | | 102.77 | | 34.95 | | 124.27 | |

12/03 | | 244.91 | | 52.55 | | 199.58 | |

12/04 | | 193.86 | | 56.97 | | 253.54 | |

21

Other Business

The Company knows of no other business to come before the meeting. If, however, other matters properly come before the meeting, it is the intention of the persons named in the enclosed proxy to vote the shares represented thereby in accordance with their best judgment.

| By order of the Board of Directors, |

| Mel G. Riggs |

| Secretary |

|

|

Dated: April 12, 2005 |

22

CLAYTON WILLIAMS ENERGY, INC.

ANNUAL MEETING OF SHAREHOLDERS

Wednesday, May 11, 2005

10:00 A.M.

CLAYDESTA CONFERENCE CENTER

Six Desta Drive, Suite 6550

Midland, Texas

Clayton Williams Energy, Inc.

Six Desta Drive, Suite 6500

Midland, Texas 79705-5519

proxy

This proxy is solicited by the Board of Directors for use at the Annual Meeting on May 11, 2005.

The undersigned appoints L. Paul Latham and Mel G. Riggs, or either of them, with full power to act without the other, as proxies with full power of substitution, to represent and to vote on behalf of the undersigned all the shares of common stock of Clayton Williams Energy, Inc. which the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held at the ClayDesta Conference Center, Six Desta Drive, Suite 6550, Midland, Texas on May 11, 2005 at 10:00 a.m., local time.

Should the undersigned be present and choose to vote at the Annual Meeting, and once the Company’s Corporate Secretary is notified of the decision to terminate this proxy, then the power of the proxies will be terminated.

The undersigned acknowledges receipt from the Company, prior to the execution of this Proxy, of a Notice of the Annual Meeting and a Proxy Statement, both dated April 12, 2005, and a copy of the Company’s 2004 Annual Report.

PLEASE ACT PROMPTLY

SIGN, DATE & MAIL YOUR PROXY CARD TODAY

See reverse for voting instructions.

The Board of Directors Recommends a Vote FOR Items 1 and 2.

1. Election of directors: | | 01 Robert L. Parker | | o Vote FOR | | o Vote WITHHELD |

| | 02 Jordan R. Smith | | all nominees | | from all nominees |

| | 03 Davis L. Ford | | (except as marked) | | |

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) | | |

2. | | Advisory vote on the selection of KPMG LLP as independent auditors for 2005: | | o | | For | | o | | Against | | o | | Abstain |

WHEN PROPERLY EXECUTED, THIS PROXY WILL BE VOTED AS DIRECTED. IF NO INSTRUCTION IS INDICATED, IT WILL BE VOTED “FOR” ALL NOMINEES IN ITEM 1, “FOR” ITEM 2, AND WITH AND IN ACCORDANCE WITH THEIR DISCRETION ON ANY OTHER BUSINESS THAT MAY PROPERLY COME BEFORE THE MEETING.

Address Change? Mark Box o

Indicate changes below:

| Date |

| |

| |

|

|

| |

| Signature(s) in Box |

| |

| Please sign exactly as your name appears on this proxy card. When signing as attorney, administrator, trustee or guardian, please give your full title. If shares are held jointly, each holder should sign. |