| | |

OMB APPROVAL |

|

| OMB Number: | | 3235-0059 |

|

| Expires: | | August 31, 2004 |

|

Estimated average burden

|

| hours per response . . . | | 14.73 |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

GEORGIA BANK FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

GEORGIA BANK FINANCIAL CORPORATION

3530 Wheeler Road

Augusta, Georgia 30909

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on April 14, 2004

TO THE SHAREHOLDERS OF GEORGIA BANK FINANCIAL CORPORATION:

You are hereby notified that the 2004 Annual Meeting of Shareholders (the “Annual Meeting”) of Georgia Bank Financial Corporation, a Georgia corporation (the “Company”), will be held at the offices of the Company located at 3530 Wheeler Road, Augusta, Georgia on April 14, 2004, at 4:00 p.m., Eastern time for the following purposes:

| | 1. | To elect eight (8) directors to serve for a term ending on the date of the 2005 Annual Meeting of Shareholders or until their respective successors shall have been elected and qualified; |

| | 2. | To transact such other business as may properly come before the Annual Meeting or an adjournment thereof. |

Information relating to the Annual Meeting and the proposals described above is set forth in the attached Proxy Statement. Shareholders of record at the close of business on March 17, 2004 are the only shareholders entitled to notice of and to vote at the Annual Meeting.

|

By Order of the Board of Directors |

|

Ronald L. Thigpen |

| Assistant Corporate Secretary |

Augusta, Georgia

March 17, 2004

EACH SHAREHOLDER IS URGED TO EXECUTE AND RETURN THE ENCLOSED PROXY PROMPTLY IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. IN THE EVENT A SHAREHOLDER DECIDES TO ATTEND THE MEETING, HE OR SHE MAY, IF SO DESIRED, REVOKE THE PROXY AND VOTE THE SHARES IN PERSON. YOUR BOARD RECOMMENDS THAT YOU VOTE IN FAVOR OF THE NOMINEES FOR DIRECTORS.

GEORGIA BANK FINANCIAL CORPORATION

3530 Wheeler Road

Augusta, Georgia 30909

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To be Held on April 14, 2004

This Proxy Statement is furnished in connection with the solicitation of proxies for use at the Annual Meeting of Shareholders (the “Meeting”) of Georgia Bank Financial Corporation (the “Company”) to be held on April 14, 2004, at 4:00 p.m., Eastern Time and at any adjournment thereof, for the purposes set forth in this Proxy Statement.The accompanying proxy is solicited by the Board of Directors of the Company.The Meeting will be held at the principal executive offices of the Company located at 3530 Wheeler Road, Augusta, Georgia, 30909. This Proxy Statement and the accompanying Form of Proxy were first mailed to shareholders on or about March 26, 2004. The Company’s 2003 Summary Annual Report to Shareholders and Annual Report on Form 10-K for the fiscal year ended December 31, 2003 accompany this Proxy Statement.

VOTING AND REVOCABILITY OF PROXY APPOINTMENTS

The Company has fixed March 17, 2004, as the record date (the “Record Date”) for determining the shareholders entitled to notice of and to vote at the Meeting. The Company’s only class of stock is its Common Stock. At the close of business on the Record Date, there were outstanding and entitled to vote 5,247,204 shares of the Common Stock held by approximately 826 shareholders of record, with each share being entitled to one vote. There are no cumulative voting rights. The approval of each proposal set forth in this Proxy Statement requires that a quorum be present at the Annual Meeting. Shares representing a majority of the votes entitled to be cast at the meeting will constitute a quorum. In determining whether a quorum exists at the Meeting for purposes of all matters to be voted on, all votes “for” or “against,” as well as all abstentions (including votes to withhold in certain cases), will be counted.

Directors are elected by a plurality of the votes cast by the holders of the Common Stock at a meeting at which a quorum is present. A “plurality” means that the individuals who receive the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. Consequently, any shares not voted (whether by abstention or otherwise) have no impact on the election of directors except to the extent that the failure to vote for an individual results in another individual receiving a larger number of votes for the same seat on the Board.

Any other proposal that is properly brought before the Annual Meeting generally requires approval by the holders of a majority of the shares of Common Stock entitled to vote at the Annual Meeting. With respect to such proposals, abstentions will be counted but broker non-votes will not be counted for purposes of determining the presence of a quorum. Both abstentions and broker non-votes will be counted as votesagainst such proposals for purposes of determining whether such proposal has received sufficient votes for approval.

All proxies will be voted in accordance with the instructions contained in the proxies. If no choice is specified, proxies will be voted “FOR” the election to the Board of Directors of all nominees listed below under “ELECTION OF DIRECTORS” and at the proxy holder’s discretion any other matter that may properly come before the Meeting. Any shareholder may revoke a proxy given pursuant to this solicitation prior to the Meeting by delivering an instrument revoking it, by delivering a duly executed proxy bearing a later date to the Company, or by attending the Meeting and voting in person. All written notices of revocation or other communications with

2

respect to revocation of proxies should be addressed as follows: Georgia Bank Financial Corporation, 3530 Wheeler Road, Augusta, Georgia, 30909, Attention: Ronald L. Thigpen, Executive Vice President.

The costs of preparing, assembling and mailing the proxy materials and of reimbursing brokers, nominees, and fiduciaries for the out-of-pocket and clerical expenses of transmitting copies of the proxy materials to the beneficial owners of shares held of record will be borne by the Company. Certain officers and employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies in addition to this solicitation by mail. The Company expects to reimburse brokers, banks, custodians, and other nominees for their reasonable out-of-pocket expenses in handling proxy materials for beneficial owners of the Common Stock held in their names.

PROPOSAL I

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board of Directors shall consist of not less than five nor more than twenty-five directors, with the exact number to be determined by the Board of Directors, each having a term of office of one year and continuing thereafter until his or her successor has been elected and has qualified. The Board has established eight as the number of persons to constitute the Board of Directors for the coming year, and has nominated the following persons to serve for one year and until their successors are elected and qualified:

| | | | | | |

Name

| | Age

| | Position with the Company

| | Position with the Bank (1)

|

| | | |

William J. Badger | | 53 | | Director | | Director |

| | | |

R. Daniel Blanton | | 53 | | President, Chief Executive Officer and Director | | President, Chief Executive Officer and Director |

| | | |

Warren A. Daniel | | 56 | | Director | | Director |

| | | |

Edward G. Meybohm | | 60 | | Vice Chairman and Director | | Chairman of the Board and Director |

| | | |

Robert W. Pollard, Jr. | | 53 | | Chairman of the Board, and Director | | Vice Chairman and Director |

| | | |

Randolph R. Smith, M.D. | | 60 | | Secretary and Director | | Secretary and Director |

| | | |

Ronald L. Thigpen | | 52 | | Executive Vice President, Chief Operating Officer and Director | | Executive Vice President, Chief Operating Officer and Director |

| | | |

John W. Trulock, Jr. | | 58 | | Director | | Director |

| (1) | Georgia Bank & Trust Company of Augusta, the Company’s commercial banking subsidiary (the “Bank”). |

Each of the nominees is currently a director of the Company, and has been nominated by the Board to serve for an additional term. When properly executed and returned, the enclosed Form of Proxy will be voted as specified thereon. If any nominee is unable or fails to accept nomination or election (which is not anticipated), the persons named in the proxy as proxies, unless specifically instructed otherwise in the proxy, will vote for the election in his or her stead of such other person as the Company’s existing Board of Directors may recommend.

3

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE EIGHT NOMINEES PREVIOUSLY NAMED.

DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY AND THE BANK

No director or executive officer of the Bank or Company is related to any other director or executive officer, except that Robert W. Pollard, Jr., Chairman of the Board is the brother-in-law of R. Daniel Blanton, President and Chief Executive Officer. No director or executive officer currently serves as an officer or director of any other financial institution or other public company.

All directors of the Company will serve until the next annual meeting of the shareholders of the Company or until their successors are elected and have qualified. Officers of the Company and the Bank serve at the pleasure of their respective Board of Directors.

The following additional information has been supplied by the directors and executive officers listed below.

William J. Badger, (53) has been a Director of the Bank and the Company since the organization of each (November 1988 and February 1992, respectively) and serves as Chairman of the Bank’s Loan Committee. He has been the President of Howard Lumber Company, a dealer in building materials and supplies, since 1978. He is also President of Augusta Sash and Door Sales of Georgia, Inc., a manufacturer of windows, doors, and millwork, since 2000. Mr. Badger received his Bachelor of Business Administration degree from the University of Georgia in 1972. He serves as a Trustee for the Augusta Museum of History. He also serves on the Executive Board of the Georgia Carolina Council of The Boy Scouts of America. He is active in the Construction Suppliers Association of Georgia and the Kiwanis Club of Augusta.

R. Daniel Blanton (53) has been President and Chief Executive Officer of the Company and the Bank since October, 1997. He has been a Director of the Company since it was formed and has been a Director of the Bank since June, 1990. Prior to his current position, he held the title of Executive Vice President and Senior Lending Officer of the Bank and was named Chief Operating Officer of the Company and the Bank in November, 1995. Mr. Blanton was Vice President of The Bank of Columbia County in Martinez, Georgia from 1987 to 1988. From 1986 to 1987, he was self-employed as a real estate developer. From 1976 to 1986, Mr. Blanton served as Senior Vice President and Senior Lending Officer of Georgia State Bank in Martinez, Georgia. A graduate of Georgia Military College, Mr. Blanton received his Bachelor of Science Degree from Clemson University in 1973 and received further training at the Georgia Banking School in 1982. He graduated from the Graduate School of Banking of the South at Louisiana State University in 1985. Mr. Blanton serves on the Board of Directors of University Health Care Foundation, Sacred Heart Cultural Center, United Way, Augusta Tomorrow Inc., and the CSRA Regional Development Companies. He is a member of the Advisory Board at Augusta State University-College of Business. Mr. Blanton is a member of the Board of Directors and serves as Chair-Elect of Georgia Bankers Association. He also serves on the Community Bankers Council of the American Bankers Association. He is a member of the Exchange Club of Augusta.

Warren A. Daniel, (56) became a Director of the Company with its formation in 1991 and has been a Director of the Bank since July, 1990. He serves as Chairman of the Bank’s Business Development Committee. Mr. Daniel has been a Financial Representative for Northwestern Mutual Financial Network since 1978. He is also President of Group & Benefits Consultants, Inc. Prior to 1978, Mr. Daniel was a Loan Officer with SunTrust Bank in Augusta. He is a graduate of Richmond Academy in Augusta and received his Bachelor of Business Administration degree from the University of Georgia in 1970. Mr. Daniel’s professional designations include Chartered Life Underwriter and Chartered Financial Consultant. He currently serves as a Director of Howard Lumber and is past Chairman of the Augusta Metro Chamber of Commerce and is active in other civic and business organizations.

4

Edward G. Meybohm (60) has served as Vice Chairman of the Company’s Board of Directors since its formation and is the current Chairman of the Bank’s Board of Directors and the Asset/Liability and Investment Committee of the Bank’s Board. He has been the President of Meybohm Realty, Inc., a real estate brokerage firm, since 1977. Prior to 1977, Mr. Meybohm worked at Southern Finance Corporation, where he was employed since 1970. Mr. Meybohm, a native of Harlem, Georgia, received his Bachelor of Science degree in Education from Georgia Southern University in 1964. He served as a member of the Board of Directors of Georgia State Bank, Martinez, Georgia, from November 1983 through December 1985, when Georgia State Bank was acquired by Georgia Railroad Bank. Thereafter, Mr. Meybohm continued to serve on the Columbia County Advisory Board of Georgia Railroad Bank and its successor, First Union National Bank of Georgia, until his resignation in June, 1988. Mr. Meybohm is past President of the Georgia Association of Realtors, a past Chairman of the Augusta Metro Chamber of Commerce, a past member of the Georgia State Board of Education, and active in other civic and business organizations.

Robert W. Pollard, Jr. (53) has been a Director of the Company and the Bank since August, 1994. In April, 1995, he was elected Chairman of the Board of the Company and Vice Chairman of the Bank. He also serves as Chairman of the Executive Committee and Compensation Committee of the Company’s Board. He is President of Pollard Lumber Company, Inc., a lumber manufacturer located in Appling, Georgia. He is a native of Appling, Georgia, and attended Harlem High School. He also attended the University of Georgia and received his Bachelor of Science degree in Forest Resources. Mr. Pollard has served on the Board of Directors of the Southeastern Lumber Manufacturers Association, the Georgia Forestry Association and as Chairman of the Southern Timber Council. He currently serves on the Board of Trustees of Westminster Schools and is a member and Deacon of Kiokee Baptist Church in Appling.

Randolph R. Smith, M.D. (60) has been a Director of the Bank and Company since each was organized and serves as Chairman of the Audit Committee of the Company’s Board. Dr. Smith is a specialist in plastic and reconstructive surgery and a member of the medical staff of University Hospital in Augusta, where he has served as Chief of Staff and is Chairman of University Health, Inc. He has practiced medicine in the Augusta area since 1978. Prior to that time, Dr. Smith served his residency at the Medical College of Georgia in Augusta and Duke University. He graduated from Richmond Academy in Augusta, received his Bachelor of Science Degree from Clemson University in 1966 and his M.D. degree from the Medical College of Georgia in 1970. Dr. Smith was awarded an honorary doctorate from Clemson in 1997 for his volunteer services in developing countries. Dr. Smith is an Augusta, Georgia native and is active in civic and professional associations and has received The Book of Golden Deeds Award from The Exchange Club of Augusta, The Paul Harris Fellowship award by the Rotary Club of Augusta, the Civic Endeavor Award by the Richmond County Medical Society and the Jack A. Raines Humanitarian Award presented by the Medical Association of Georgia for 1999. In 2001, Dr. Smith received the Pride in the Profession Award by the American Medical Association. Additionally, he was recognized by the city council of Nowy Sacz, Poland for years of service to Polish patients and education of Polish surgeons. He is past President of the Exchange Club of Augusta and previously served as Senior Warden at St. Paul’s Episcopal Church.

Ronald L. Thigpen (52) has served as Executive Vice President and Chief Operating Officer of the Company and the Bank since October, 1997, having joined the Company and the Bank as Chief Financial Officer upon the acquisition of FCS Financial Corporation in December, 1992. He was elected to the Board of Directors of both the Company and the Bank in April, 1995. He was previously employed as the President and Chief Executive Officer of FCS Financial Corporation and First Columbia Bank from January, 1991 to December, 1992. From 1971 through 1990, Mr. Thigpen served First Union National Bank, and its predecessors Georgia Railroad Bank and Central Bank of Georgia, in a variety of positions in Augusta, Macon, and Columbus, Georgia. He received his Bachelor of Business Administration degree from Augusta State University in 1973 and is a 1980 graduate of the Graduate School of Retail Bank Management at the University of Virginia. He also graduated from the Graduate School of Banking of the South at Louisiana State University in 1985. He is Chairman of the Board of Directors of the Financial Managers Society, headquartered in Chicago, Illinois. Mr. Thigpen is Immediate Past Chairman of the Augusta Metro Chamber of Commerce Board of Directors. He also serves on the Columbia County Planning Commission and is a member of the Development Authority of Columbia County. He is a member of the Board of Directors of the Golden Harvest Food Bank and the CSRA Alliance for Fort Gordon. He

5

is a member of the Georgia Bankers Association – Asset Liability Committee, the Rotary Club of Augusta and the Hephzibah Agricultural Club. He is a member of Wesley United Methodist Church.

John W. Trulock, Jr.,(58) a Director of the Company and the Bank since April, 1995. He was born in Thomasville, Georgia but raised in Augusta. He attended Augusta State University and is a graduate of the University of Georgia, Athens, Georgia. Mr. Trulock has served as an agent for Mass Mutual Financial Group and is President of ECP Benefits, LLC. Mr. Trulock is a past President of the Exchange Club of Augusta, the Augusta State University Alumni Association, Garden City Lions Club, and Boys Club of Augusta as well as past Chairman of the Augusta State University Foundation. He is a member of Covenant Presbyterian Church where he has served as Deacon, Elder, and Trustee.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Company’s Board of Directors has an Executive Committee, Audit Committee, and Compensation Committee. The full Board of Directors of the Company held three meetings, and the Board of Directors of the Bank held twelve meetings, during the year ended December 31, 2003. All of the Directors of the Company attended at least 75% of such meetings and the meetings of each committee on which they served. The Company does not have a policy regarding director attendance at shareholders’ meetings. All eight of the Company’s directors attended the 2003 Annual Meeting of Shareholders.

Executive Committee.The Executive Committee is responsible for making recommendations to the Board on a variety of matters. The Executive Committee’s members include: Robert W. Pollard, Jr., Chairman, R. Daniel Blanton, Edward G. Meybohm, Dr. Randolph R. Smith and Ronald L. Thigpen. The Executive Committee held nine meetings during 2003.

Audit Committee.The Audit Committee meets, at a minimum, quarterly prior to the regular Bank Board meeting and functions as a joint committee of the Company and the Bank. The Audit Committee has the responsibility of reviewing the Company’s consolidated financial statements, evaluating accounting functions and internal controls, assuring compliance with and reviewing reports of regulatory authorities, and determining that all audits and examinations required by law are properly performed. The Committee selects and oversees the Company’s independent auditors for the next fiscal year, pre-approves all audit and allowable non-audit fees, reviews and approves the internal auditors’ audit and internal controls program, and reviews with the independent auditors the results of the annual audit and management’s response thereto. Please see “Audit Committee Report” for additional information. Each member of the Audit Committee is independent pursuant to Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 4200(a)(15) promulgated by the Nasdaq Stock Market. The Committee does not include an “audit committee financial expert,” as that term is defined in the Exchange Act regulations. The Board has considered the qualifications of the members and has determined that they possess the skills necessary to review and analyze the Company’s financial statements and processes and to fulfill their other duties in accordance with the terms of the Audit Committee Charter, a copy of which is attached as Appendix A. As a result, the Board has determined that the absence of an audit committee financial expert will not adversely affect the Committee’s performance of its duties and responsibilities. Audit Committee members are Dr. Randolph R. Smith, Chairman, William J. Badger, James G. Blanchard, Jr., W. Marshall Brown and Edward J. Tarver. The Audit Committee met nine times during 2003.

Compensation Committee.The Compensation Committee is responsible for making recommendations to the Board to assure that competitive and fair compensation is provided to the officers and employees in order to recruit and retain quality personnel. This Committee also functions as a joint committee of both the Company and Bank Boards of Directors. This Committee periodically reviews and revises salary ranges and total compensation programs for officers and employees using an outside consultant to recommend salary ranges based upon current surveys of peer group market salaries for specific jobs. The Compensation Committee is comprised of the following members: Robert W. Pollard, Jr., Chairman, W. Marshall Brown, Warren A. Daniel,

6

Edward G. Meybohm and Dr. Randolph R. Smith. The Compensation Committee held three meetings during 2003. See “Compensation Committee Report” for additional information.

COMPENSATION OF EXECUTIVE OFFICERS

Under rules established by the Securities and Exchange Commission, the Company is required to provide certain data and information regarding the compensation and benefits provided to its chief executive officer and the four other most highly compensated executive officers who received more than $100,000 in combined salary and bonus for the past year. Only R. Daniel Blanton, the Company’s Chief Executive Officer, and Ronald L. Thigpen, the Company’s Chief Operating Officer, are compensated at this level. The disclosure requirements include the use of tables and a report explaining the rationale and considerations that led to executive compensation decisions. The Compensation Committee has prepared the following report for inclusion in this Proxy Statement in response to those requirements.

The Compensation Committee recommends to the Company’s Board of Directors payment amounts and bonus award levels for executive officers of the Company and the Bank. The report that appears later in this proxy statement reflects the compensation philosophy of the Company and the Bank as endorsed by the Company’s Board of Directors and the Compensation Committee and resulting actions taken by the Company for the reporting periods shown in the compensation table.

Summary Compensation Table

| | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation

| | Long Term Compensation

| | All Other Compensation (3)

|

| | | Salary

| | Bonus (1)

| | Awards

| | Payouts

| |

| | | | | Securities Underlying Options/ SARs (#)

| | LTIP Payouts (2)

| |

R. Daniel Blanton | | 2003 | | $ | 185,000 | | $ | 92,500 | | 14,600 | | $ | 13,279 | | $ | 10,000 |

President & | | 2002 | | | 167,000 | | | 75,150 | | 17,600 | | | 66,395 | | | 10,000 |

Chief Executive Officer | | 2001 | | | 147,000 | | | 49,688 | | -0- | | | -0- | | | 10,000 |

| | | | | | |

Ronald L. Thigpen | | 2003 | | $ | 165,000 | | $ | 82,500 | | 14,600 | | $ | 13,279 | | $ | 10,000 |

Executive Vice President & | | 2002 | | | 147,000 | | | 66,150 | | 17,600 | | | 66,395 | | | 10,000 |

Chief Operating Officer | | 2001 | | | 127,000 | | | 42,928 | | 6,325 | | | -0- | | | 10,000 |

| (1) | Indicates amounts paid under the annual cash incentive plan in the succeeding year based on performance objectives for the indicated year. |

| (2) | Represents a payment for vested Stock Appreciation Rights. See “Compensation Committee Report – Long- Term Incentive Plans.” |

| (3) | Reflects the annual 401(k) contribution of the Company. |

7

Options/SAR Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | Number of Securities Underlying Options/SARs Granted (#)

| | | Percent of total Options/SARs granted to employees in fiscal year

| | | | | | Potential realizable value at assumed annual

rates of stock price

appreciation for option term

|

Name

| | | | Exercise or base price ($/SH)

| | Expiration date

| | 5% ($) (2)

| | 10% ($) (2)

|

R. Daniel Blanton | | 14,600 | (1) | | 22.7 | | $ | 23.14 | | 10/16/2013 | | $ | 212,463 | | $ | 538,448 |

Ronald L. Thigpen | | 14,600 | (1) | | 22.7 | | $ | 23.14 | | 10/16/2013 | | $ | 212,463 | | $ | 538,448 |

| | |

|

| |

| |

|

| |

| |

|

| |

|

|

| (1) | Options vest over five years. Vesting will accelerate upon a change in control as defined in the 2000 Long-Term Incentive Plan. |

| (2) | In accordance with the rules of the SEC, the table sets forth the hypothetical gains that would exist for the options at the end of their ten year terms, based on assumed annual rates of compounded stock price appreciation of 5% and 10%. Actual gains, if any, on option exercises, are dependent upon the future performance of our common stock. |

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal

Year-End Option/SAR Values

| | | | | |

Name

| | Number of

Options/SARs at FY-End (#) Exercisable/

Unexercisable

| | Value of Options/

SARs at FY-End ($) Exercisable/

Unexercisable

|

R. Daniel Blanton President & Chief Executive Officer | | 3,520/28,680 | | $ | 49,122/$281,904 |

Ronald L. Thigpen Executive Vice President & Chief Operating Officer | | 17,435/40,065 | | $ | 304,313/$488,466 |

Neither Mr. Blanton nor Mr. Thigpen exercised options during 2003. The value of the options reflected above is based on a market value of $29.00 for the common stock as of December 31, 2003.

DIRECTOR COMPENSATION

Directors of the Company and the Bank who are not employees of the Company or the Bank receive a fee for their service on the Boards of the Company and the Bank equal to $200 for each such Board meeting attended. In addition non-employee Directors are paid a $200 fee for each Company or Bank Board committee meeting attended. The Chairman who presides over each respective meeting is paid a $300 fee for each meeting. Directors who are Company or Bank employees receive no compensation for their service on the Company and Bank Boards or their committees.

Employment Contracts and Termination of Employment and Change in Control Arrangements

Employment Agreement with Mr. Blanton. During 2003,the Company renewed the Employment Agreement of Mr. Blanton, President and Chief Executive Officer of the Company, which was originally entered into on January 1, 2000. The Employment Agreement is for a term of three years and is renewable annually for

8

additional terms of three years each year upon approval of the Compensation Committee. The base salary is set by the Compensation Committee annually. During 2003, the Company paid Mr. Blanton a base salary of $185,000 under this agreement and will pay him a base salary of $215,000 for 2004.

Pursuant to the Employment Agreement, Mr. Blanton will also be entitled to an annual incentive award in an amount to be determined by the Compensation Committee and will be eligible to participate in the Company’s Long-Term Incentive Plan. In the event of a change in control (as defined in the Employment Agreement), Mr. Blanton will be entitled to a cash payment equal to two times his average base salary plus cash bonuses paid during the last three years. All or a portion of such payment may not be deductible to the Company as a result of Section 280G of the Internal Revenue Code. Mr. Blanton will also be entitled to deferred compensation of at least $180,000 annually, commencing upon retirement at age 65.

In the event that Mr. Blanton’s employment is terminated as a result of his death or permanent disability, the Company will pay his estate, or him, as the case may be, an amount equal to six months of his then current base salary. If Mr. Blanton’s employment is terminated by the Company without “cause” (as defined in the Employment Agreement) he will be entitled to continue to receive his base salary for the longer of two years, or the remaining term of the Agreement. He will also be entitled to continuing medical coverage during such period, at the Company’s expense. If, following a change in control, Mr. Blanton is (i) required to relocate a distance greater than 50 miles, (ii) required to accept a reduction in his “total annual compensation” (as defined in the Employment Agreement), or (iii) is required to perform duties or occupy a position other than that described in the Employment Agreement, he will be entitled to resign and to receive continuation payments of his total annual compensation and medical insurance benefits for a period equal to the greater of two years or the remaining term of the Employment Agreement. The Employment Agreement contains covenants that restrict competitive, solicitation and confidentiality activities upon termination.

Employment Agreement with Mr. Thigpen. The Company also renewed the Employment Agreement with Mr. Thigpen, Executive Vice President and Chief Operating Officer during 2003. The Employment Agreement is for a term of three years and is renewable annually for additional terms of three years each upon approval of the Compensation Committee. The base salary is set by the Compensation Committee annually. During 2003, the Company paid Mr. Thigpen a base salary of $165,000 under this agreement and will pay him a base salary of $195,000 for 2004.

Pursuant to the Employment Agreement, Mr. Thigpen will also be entitled to an annual incentive award in an amount to be determined by the Compensation Committee and will be eligible to participate in the Company’s Long-Term Incentive Plan. In the event of a change in control (as defined in the Employment Agreement), Mr. Thigpen will be entitled to a cash payment equal to two times his average base salary plus cash bonuses paid during the last three years. All or a portion of such payment may not be deductible to the Company as a result of Section 280G of the Internal Revenue Code. Mr. Thigpen will also be entitled to deferred compensation of at least $180,000 annually, commencing upon retirement at age 65.

In the event that Mr. Thigpen’s employment is terminated as a result of his death or permanent disability, the Company will pay his estate, or him, as the case may be, an amount equal to six months of his then current base salary. If Mr. Thigpen’s employment is terminated by the Company without “cause” (as defined in the Employment Agreement) he will be entitled to continue to receive his base salary for the longer of two years, or the remaining term of the Agreement. He will also be entitled to continuing medical coverage during such period, at the Company’s expense. If, following a change in control, Mr. Thigpen is (i) required to relocate a distance greater than 50 miles, (ii) required to accept a reduction in his “total annual compensation” (as defined in the Employment Agreement), or (iii) is required to perform duties or occupy a position other than that described in the Employment Agreement, he will be entitled to resign and to receive continuation payments of his total annual compensation and medical insurance benefits for a period equal to the greater of two years or the remaining term of the Employment Agreement. The Employment Agreement contains covenants that restrict competitive, solicitation and confidentiality activities upon termination.

9

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee in 2003 were Robert W. Pollard, Jr., W. Marshall Brown, Warren A. Daniel, Edward G. Meybohm and Dr. Randolph R. Smith. There were no interlocks with respect to the Compensation Committee in 2003. Mr. Pollard is the brother-in-law of R. Daniel Blanton, President and Chief Executive Officer of the Company.

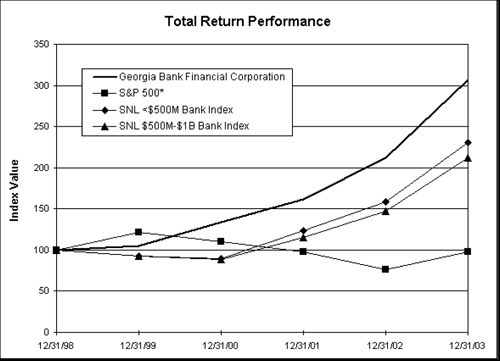

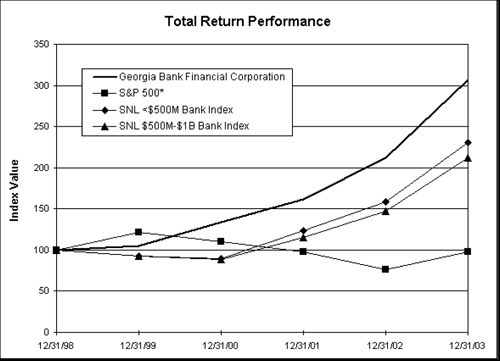

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

The following graph compares the yearly percentage change in cumulative shareholder return on Georgia Bank Financial Corporation Stock with the cumulative total return of the Standard & Poor’s 500 Index and SNL Less than $500 Million Southeast Index for the last five years (assuming a $100 investment on December 31, 1998).

Georgia Bank Financial Corporation

| | | | | | | | | | | | |

| | | Period Ending

|

Index

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

Georgia Bank Financial Corporation | | 100.00 | | 104.55 | | 133.82 | | 161.10 | | 211.60 | | 306.82 |

S&P 500* | | 100.00 | | 121.11 | | 110.34 | | 97.32 | | 75.75 | | 97.40 |

SNL <$500M Bank Index | | 100.00 | | 92.57 | | 89.30 | | 123.53 | | 158.20 | | 230.92 |

SNL $500M-$1B Bank Index | | 100.00 | | 92.57 | | 88.60 | | 114.95 | | 146.76 | | 211.62 |

10

COMPENSATION COMMITTEE REPORT

Overview

The Compensation Committee functions as a joint committee of the Company and Bank Board of Directors. The Compensation Committee fully supports the Company’s philosophy that the relationship between pay and individual performance is fundamental to a compensation program. Pay for performance relating to executive officer compensation is composed of base salary, annual cash incentives, stock options and long-term stock appreciation rights. The administration of executive officer compensation is based not only on individual performance and contributions, but also total Company performance relative to profitability measures and shareholder interests. The Compensation Committee makes recommendations to the Board to assure that competitive and fair compensation is provided to the officers and employees in order to recruit and retain quality personnel. The Compensation Committee periodically reviews and revises salary ranges and total compensation programs for officers and employees and uses an outside consultant to recommend salary ranges based upon current surveys of peer group market salaries for specific jobs. The peer group that the Company analyzes in determining officer and employee compensation is similarly situated banking organizations in the Southeast ranging in asset size of $500 million to $1 billion and other banks that are direct competitors with the Company in its markets.

Base Salary and Increases

In establishing executive officer salaries and increases, the Compensation Committee considers individual performance and responsibility, the relationship of base pay to the existing salary market, and increases in functional responsibility related to the growth of the Bank. The decision to increase base pay is recommended by the Chief Executive Officer and evaluated and approved by the Compensation Committee. It is further ratified by the full Board of Directors. Information regarding salaries paid by other financial institutions is obtained through formal salary surveys, information from benefits consultants and other means and is used in the decision process to ensure competitiveness with the Company’s peers and competitors.

The Company’s general philosophy is to provide a comprehensive total benefits package that is competitive with other banks and bank holding companies of similar size in the Southeast.

The Compensation Committee formally reviews the compensation paid to executive officers in January of each year. Changes in base salary and the awarding of cash incentives are based on overall financial performance and profitability of the Company as compared to the Company’s financial performance against budgeted objectives and the performance of the individual.

Annual Cash Incentives

In 1997, the Company implemented an annual cash incentive program for officers and key managers. The Company utilizes cash incentives to better align pay with individual and Company performance. Funding for the cash incentives is dependent on the Company attaining performance thresholds for net income. The performance objectives promote a group effort by all officers and key managers. Once these thresholds are attained, the Compensation Committee, based in part upon recommendations of the Chief Executive Officer, may consider and approve awards to those officers and key managers who have made superior contributions to Company profitability as measured and reported against the individual performance goals established at the beginning of the year. The full Board of Directors ratifies the awards approved by the Compensation Committee. This philosophy assists in overall better control of expenses associated with salary increases by reducing the need for significant annual base salary increases as a reward for past performance, and places more emphasis on annual profitability and the potential rewards associated with future performance. Over time, it is anticipated that an

11

increasing amount of the total earnings of all officers and key managers will be based on incentive compensation as opposed to automatic increases in base salaries. Market information regarding salaries is used to establish competitive rewards that are adequate to motivate strong individual performance during the year.

Long-Term Incentive Plans

The Company established in 1997 a Long-Term Incentive Plan designed to motivate sustained high levels of individual performance and align the interests of key officers with those of the Company’s shareholders by rewarding capital appreciation and earnings growth. Upon recommendation by the Chief Executive Officer, and subject to approval by the Compensation Committee, stock appreciation rights may be awarded annually to those key officers whose performance during the year has made a significant contribution to the Company’s long-term growth. Generally, stock appreciation rights are not grants or issuance of Company stock, but rather constitute a right to receive an amount of money in the future that is based upon the appreciation in the market value of the Company’s common stock. The value of the stock appreciation rights are established at the end of a five-year period and the grantee vests in such rights over a ten year period. At the end of the five-year period described above, participants are paid 50% of the market appreciation to date, with 10% of the remaining appreciation being paid during each of the five years thereafter. This ten year vesting period is intended to promote long-term employment and continued contribution by those key officers. Since the inception of this program, the Company has awarded 64,530 stock appreciation rights. All base prices per share and rights amounts have been adjusted to reflect the 10% stock dividend paid by the Company in August of 2003 and the two for one stock split in November of 2003. Only the remaining awards from 1999 and 2001 were subject to the dividend and stock split as the appreciation from the 1997 awards was previously frozen at end of five years. During 2003, the Company paid out $71,702 as the vested portion of stock appreciation rights awarded in 1997. This program was discontinued at the end of 2001 and has been replaced with the 2000 Long-Term Incentive Plan.

The Company established in 2000 and the shareholders approved in 2001 the 2000 Long-Term Incentive Plan. The purpose of the 2000 Long-Term Incentive Plan is to promote the success of and enhance the value of the Company by linking the personal interests of our employees and officers to those of our shareholders, and by providing participants with an incentive for outstanding performance. The Plan authorizes the granting of awards in the form of options to purchase shares of common stock. As of the end of 2003, as adjusted to reflect the 10% stock dividend and two for one stock split, 189,040 incentive stock options have been awarded under the Plan.

Section 401(k) Plan

The Bank has an employee savings plan that qualifies as a deferred salary arrangement under Section 401(k) of the Internal Revenue Code of 1986, as amended. Under this Plan, participating employees may defer a portion of their pre-tax earnings, up to the Internal Revenue Service annual contribution limit. The Bank has the obligation under the Plan to make an annual contribution of 3% of annual compensation of all eligible employees. The Bank has the option to make additional annual discretionary contributions to the Plan. For the year ended December 31, 2003, the Bank contributed $524,632 to the Plan, which represented 5.00% of the annual compensation of all eligible employees.

2003 Performance; Chief Executive Officer Compensation

The Company’s performance for the most recent five-year period has improved each year, and the Company exceeded its asset growth goal and achieved extraordinary profitability in 2003. In addition, the Company also continued to excel in non-financial performance areas, as the Company successfully addressed its policy objectives relating to customers, employees and communities. Shareholder value also continued to improve during 2003, as is evidenced by the performance graph included under “Comparison of Five-Year Cumulative Total Return” above.

Mr. Blanton’s compensation awards in 2003 were based upon the Compensation Committee’s assessment of the Company’s financial and non-financial performance and Mr. Blanton’s individual performance. Mr. Blanton was named President and Chief Executive Officer of the Company and Bank in October 1997. Prior to

12

being named Chief Executive Officer, Mr. Blanton served as Executive Vice President and Chief Operating Officer of the Company and Bank. Based on Mr. Blanton’s responsibilities, achievement and individual performance, the Company’s performance and the compensation paid to chief executive officers of peer banks and bank holding companies, Mr. Blanton received a salary of $185,000 in 2003. In addition, based on the factors discussed herein, Mr. Blanton earned a cash incentive payment of $92,500 for 2003.

$1 Million Deduction Limit

At this time, the Company does not appear to be at risk of losing deductions under the $1 million deduction limit on executive pay established under Section 162(m) of the Internal Revenue Code of 1986. As a result, the Compensation Committee has not established a policy regarding this limit. Nevertheless, in designing the 2000 Long-Term Incentive Plan, the Compensation Committee has taken steps ensuring that awards under that plan will be fully deductible.

Summary

In summary, the Compensation Committee believes that the overall compensation program of the Company is reasonable and competitive with compensation paid by other financial institutions of similar size. The program is designed to reward managers for superior individual, Company and share value performance. The compensation program incorporates a shareholder point of view in several different ways. The Compensation Committee monitors the various guidelines that make up the program and may adjust them annually, as it deems appropriate to continue to meet Company and shareholder objectives.

Submitted by the members of the Compensation Committee who are currently directors of the Company or the Bank:

| | |

Robert W. Pollard, Jr., Chairman | | Edward G. Meybohm |

W. Marshall Brown | | Warren A. Daniel |

Dr. Randolph R. Smith | | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of March 1, 2004, with respect to the Company’s directors, the executive officers named in the Summary Compensation Table, shareholders known to the Company to own 5% or more of the Company’s common stock, and all current directors and executive officers of the Company as a group. Percentage calculations are based on 5,247,204 shares issued and outstanding. An asterisk (*) indicates ownership of less than one percent of the outstanding common stock.

Information relating to beneficial ownership of Common Stock by directors is based upon information furnished by each person using “beneficial ownership” concepts set forth in the rules of the Securities and Exchange Commission (“SEC”) under the Securities and Exchange Act of 1934, as amended. Under such rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. The person is also deemed to be a beneficial owner of any security of which that person has right to acquire beneficial ownership within 60 days. Under such rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may disclaim any beneficial ownership. Accordingly, nominees are named as beneficial owners of shares as to which they may disclaim any beneficial interest. Except as indicated in other notes to this table describing special relationships with other persons and specifying shared voting or investment power, directors possess sole voting and investment power with respect to all shares of

13

common stock set forth opposite their names. Where noted, exercisable options for Executives are included in the number of shares beneficially owned.

| | | | | | | | |

Name and Address

| | Position(s) with the Company and the Bank (1)

| | Number of Shares

Beneficially Owned

| | | Percentage of

Ownership

| |

William J. Badger | | Director | | 69,006 | (2) | | 1.32 | % |

| | | |

R. Daniel Blanton 3530 Wheeler Road Augusta, Georgia 30909 | | Director, President and Chief Executive Officer | | 414,356 | (3) | | 7.88 | % |

| | | |

Warren A. Daniel | | Director | | 25,918 | (4) | | * | |

| | | |

Edward G. Meybohm | | Vice Chairman of the Board of the Company and Chairman of the Board of the Bank | | 258,060 | (5) | | 4.92 | % |

| | | |

Robert W. Pollard, Jr. 5863 Washington Road Appling, Georgia 30802 | | Chairman of the Board of the Company, Vice Chairman of the Board of the Bank | | 448,384 | (6) | | 8.55 | % |

| | | |

Randolph R. Smith, MD 1348 Walton Way Suite 6300 Augusta, Georgia 30901 | | Director | | 275,378 | (7) | | 5.25 | % |

| | | |

Ronald L. Thigpen | | Director, Executive Vice President and Chief Operating Officer | | 38,613 | (8) | | * | |

| | | |

John W. Trulock, Jr. | | Director | | 1,138 | | | * | |

| | | |

All current executive officers and directors As a group (8 persons) | | | | 1,530,853 | (9) | | 29.01 | % |

| | |

Other Beneficial Owners of Greater than 5% of the Company’s Common Stock | | | | | | |

| | | |

Jennie F. Pollard 5795 Washington Road Appling, GA 30802 | | | | 928,800 | | | 17.70 | % |

| | | |

Levi A. Pollard 3310 Scotts Ferry Road Appling, Georgia 30802 | | | | 369,388 | (10) | | 7.04 | % |

| * | Represents less than one percent of the outstanding shares. |

| 1. | Each person holds the offices and directorships listed with both the Company and the Bank unless otherwise noted. |

| 2. | Includes 7,462 shares held in Mr. Badger’s IRA and 2,124 shares held by Mrs. Badger. |

| 3. | Includes 880 shares held in Mr. Blanton’s IRA, 185,864 shares held by Mr. Blanton’s wife, 6,852 shares held jointly with Mr. Blanton’s wife, 94,544 shares held in trust by Mr. Blanton’s wife as trustee for their minor children, 9,494 shares held in Mr. Blanton’s children’s name and 8,360 shares in exercisable options |

| 4. | Includes 3,041 shares held in Mr. Daniel’s IRA. |

14

| 5. | Includes 3,052 shares held in an IRA and 63,902 shares owned by a pension and profit sharing plan as to which Mr. Meybohm is a beneficiary. |

| 6. | Includes 3,560 shares held by Mr. Pollard’s wife, 134,432 shares held in trust for their minor children, 6,012 shares held by Mr. Pollard’s child, and 8,134 shares held in Mr. Pollard’s IRA. |

| 7. | Includes 72,240 shares held in a pension and profit sharing plan as to which Dr. Smith is a beneficiary |

| 8. | Includes 11,778 shares held in Mr. Thigpen’s IRA, exercisable options for 22,275 shares and 460 shares held jointly with Mr. Thigpen’s wife. |

| 9. | Includes 30,635 shares subject to exercisable options |

| 10. | Includes 45,094 shares held in trust for Mr. Pollard’s children. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company and the Bank have had, and expect to have in the future, banking and other business transactions in the ordinary course of business with directors and officers of the Company and Bank and their related interests, including corporations, partnerships or other organizations in which such officers or directors have a controlling interest, on substantially the same terms (including price, or interest rates and collateral) as those prevailing at the time for comparable transactions with unrelated parties. Such transactions have not and will not involve more than the normal risk of collectability nor present other unfavorable features to the Company or the Bank.

Loans outstanding to officers, directors and affiliates totaled $13,503,399 and aggregated 25.1% of the Company’s shareholders’ equity at December 31, 2003. Deposit accounts with officers, directors and affiliates of the Company and the Bank totaled $9,972,897 at December 31, 2003.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board is responsible for providing independent, objective oversight of the Company’s accounting functions and internal controls. The Audit Committee is composed of five directors, each of whom is independent as such term is defined by Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards. The Audit Committee operates under a written charter approved by the Board of Directors. A copy of the charter is attached as Appendix A.

Management is responsible for establishing and maintaining effective internal controls over financial reporting in conformity with accounting principles generally accepted in the United States of America as well as certifying that the consolidated financial statements present fairly in all material respects, the financial condition results of operations and cash flows of the Company. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

In connection with these responsibilities, the Audit Committee met with management and the independent accountants to review and discuss the Company’s consolidated financial statements as of and for the year ended December 31, 2003. The Audit Committee also discussed with the independent accountants the matters required by Statement on Auditing Standards No. 61 (Communications with Audit Committees). The Audit Committee also received written disclosures from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants that firm’s independence.

Based upon the Audit Committee’s discussions with management and the independent accountants, and the Audit Committee’s review of the representations of management and the independent accountants, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the

15

Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2003 to be filed with the Securities and Exchange Commission.

| | | | |

Randolph R. Smith, M.D., Chairman | | William J. Badger | | James G. Blanchard, Jr. |

W. Marshall Brown | | Edward J. Tarver | | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, and regulations of the Securities and Exchange Commission thereunder require the Company’s executive officers and directors and persons who own more than ten percent of the Company’s Common Stock, as well as certain affiliates of such persons, to file reports of initial ownership of the Company’s Common Stock and changes in such ownership with the Securities and Exchange Commission. Executive officers, directors and persons owning more than ten percent of the Company’s Common Stock are required by Securities and Exchange Commission regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it and written representations that no other reports were required for those persons, the Company believes that, during the fiscal year ended December 31, 2003, all filing requirements applicable to its executive officers, directors, and owners of more than ten percent of the Company’s Common Stock were complied with in a timely manner.

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

KPMG LLP, Atlanta, Georgia, acted as the Company’s principal independent certified public accountants for the fiscal year ended December 31, 2003. On March 3, 2004, KPMG LLP was appointed by the Board of Directors to act as the Company’s independent certified public accountants for the current fiscal year ending December 31, 2004. The Board of Directors knows of no direct or material indirect financial interest by KPMG LLP in the Company or of any connection between KPMG LLP and the Company, in any capacity as promoter, underwriter, voting trustee, director, officer, shareholder or employee. Representatives of KPMG LLP will be present at the 2004 Annual Meeting and will have the opportunity to make a statement if they desire to do so and to respond to appropriate questions.

The following table sets forth the fees billed to the Bank for the fiscal years ended December 31, 2002 and 2003 by KPMG LLP:

| | | | | | |

| | | 2003

| | 2002

|

Audit Fees | | $ | 93,400 | | $ | 86,500 |

Audit-Related Fees | | $ | 17,000 | | $ | 16,000 |

Tax Fees | | $ | 13,940 | | $ | 9,200 |

All Other Fees | | $ | 122,500 | | $ | 16,200 |

Total Fees | | $ | 246,840 | | $ | 127,900 |

In 2003 and 2002, the audit-related fees were for the annual audit of the Bank’s 401(k) plan and for Federal Home Loan Bank collateral verification procedures. Tax fees for 2003 and 2002 were for services related to preparation of federal and state corporate tax returns and supporting schedules in addition to determination of the Company’s quarterly estimated tax payments. In 2003, all other fees included engagements to provide assistance with the preparation for and implementation of FDICIA internal controls compliance, the improvement of loan processing processes and assistance with short and long-term incentive compensation. In 2002, all other fees related to an engagement to provide assistance with short and long term incentive compensation.

16

Audit Committee Review

The Company’s Audit Committee has reviewed the services rendered and the fees billed by KPMG LLP for the fiscal year ending December 31, 2003. The Audit Committee has determined that the services rendered and the fees billed for the year ended December 31, 2003 that were not related to the audit of the Company’s consolidated financial statements are compatible with the independence of KPMG LLP as the Company’s independent accountants.

DIRECTOR NOMINATIONS AND SHAREHOLDER COMMUNICATIONS

Director Nominations

The full Board of Directors evaluates and nominates the members of the Board of Directors. The Board has not adopted a formal policy or process for identifying or evaluating nominees, but informally solicits and considers recommendations from a variety of sources, including other directors, members of the community, customers, and shareholders of the Company, and professionals in the financial services and other industries. Similarly, the Board does not prescribe any qualifications or skills that a nominee must possess, although it considers the potential nominee’s current and past employment and business experience; (ii) his or her experience and position with the Company and in the banking industry generally; (iii) if applicable, his or her record of service on the Company’s Board of Directors; (iv) his or her wisdom, integrity and ability to make analytical inquiries; (v) his or her profile in the communities served by the Company; and (vi) his or her commitment to, and availability for, service as a director of the Company. Current directors independent of management are: William J. Badger, Warren A. Daniel, Edward G. Meybohm, Dr. Randolph R. Smith and John W. Trulock, Jr.

The Board will consider shareholder nominations for directors that are made in writing and delivered in accordance with Section 3.8 of the Company’s Bylaws. Under our Bylaws, such nominations must state: (1) the proposed nominee’s name, age and business and residence addresses; (2) the proposed nominee’s principal business or occupation during the past five years; (3) the proposed nominee’s affiliation with or material interest in any person or entity having an interest materially adverse to the Company, and (4) a sworn or certified statement of the shareholder that the proposed nominee has consented to being nominated and that the shareholder believes that the proposed nominee would stand for election and would serve if elected. Section 3.8 of our Bylaws also requires that the notice of the nomination be submitted in writing to the Secretary of the Company at its principal office (currently located at 3530 Wheeler Road, Augusta, Georgia 30909) no later than 14 days before the annual meeting of shareholders or five days after notice of the meeting has been mailed, whichever is later. For the 2004 Meeting, nominations will be due on or before March 31, 2004. Nominations not made in accordance with this procedure may be discarded by the chair of the meeting at which the election is to be held, although the chair may also waive all or any part of these requirements for good cause shown.

Shareholder Proposals

To be included in the Company’s annual proxy statement, shareholder proposals not relating to the election of directors must be received by the Company at least 120 days before the one-year anniversary of the mailing date for the prior year’s proxy statement, which in our case would require that proposals be submitted prior to November, 17, 2004 for the next year’s annual meeting. The persons named as proxies in the Company’s proxy statement for the meeting will, however, have discretionary authority to vote the proxies they have received as they see fit with respect to any proposals received less than 60 days prior to the meeting date. SEC Rule 14a-8 provides additional information regarding the content and procedure applicable to the submission of shareholder proposals.

17

Shareholder Communications

Shareholders wishing to communicate with the Board of Directors or with a particular director may do so in writing addressed to the Board, or to the particular director, and sending it to the Secretary of the Company at the Company’s principal office at 3530 Wheeler Road, Augusta, Georgia 30909. The Secretary will promptly forward such communications to the applicable director of to the Chairman of the Board for consideration at the next scheduled meeting.

OTHER MATTERS

Management of the Company is not aware of any other matter to be presented for action at the Meeting other than those mentioned in the Notice of Annual Meeting of Shareholders and referred to in this Proxy Statement. If any other matters come before the Meeting, it is the intention of the persons named in the enclosed Proxy to vote on such matters in accordance with their judgment.

A copy of the Company’s 2003 Annual Report on Form 10-K is included herewith and is also available without charge (except for exhibits) upon written request to Georgia Bank Financial Corporation, 3530 Wheeler Road, Augusta, Georgia, 30909, Attention: Ronald L. Thigpen, Executive Vice President.

| | | | |

| | | | | By Order of the Board of Directors |

| | |

| | | | |

Ronald L. Thigpen |

Augusta, Georgia March 25, 2004 | | | | Assistant Corporate Secretary |

18

APPENDIX A

CHARTER OF THE AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

| I. | Audit Committee Purpose |

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee’s primary duties and responsibilities are to:

| | • | Appoint and discharge the Company’s independent auditors. |

| | • | Pre-approve all audit and allowable non-audit fees. |

| | • | Monitor the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance. |

| | • | Ensure the independence and oversee the performance of the Company’s independent auditors and internal auditing department. |

| | • | Provide an avenue of communication among the independent auditors, management, the internal auditing department, and the Board of Directors. |

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as anyone in the organization. The Audit Committee has the ability to retain, at the company’s expense, special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties.

| II. | Audit Committee Composition and Meetings |

Audit Committee members shall meet the requirements of Rule 4200 of the National Association of Securities Dealers listing standards. The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent non-executive directors, free from any relationship that would interfere with the exercise of his or her independent judgment. All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements, and at least one member of the Committee shall have accounting or related financial management expertise.

Audit Committee members shall be appointed by the Board on recommendation of the Nominating Committee if such a committee has been constituted. If an Audit Committee Chair is not designated or present, the members of the Committee may designate a Chair by majority vote of the Committee membership.

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Audit Committee Chair shall prepare and/or approve an agenda in advance of each meeting. The Committee should meet privately in executive session at least annually with management, the director of the internal auditing department, the independent auditors, and as a committee to discuss any matters that the Committee or each of these groups believe should be

19

discussed. In addition, the Committee, or at least its Chair, should communicate with management and the independent auditors quarterly to review the Company’s financial statements and significant findings based upon the auditors limited review procedures.

| III. | Audit Committee Responsibilities and Duties |

Review Procedures

| | 1. | Review and reassess the adequacy of this Charter at least annually. Submit the charter to the Board of Directors for approval and have the document published at least every three years in accordance with SEC regulations. |

| | 2. | Review the Company’s annual audited consolidated financial statements prior to filing or distribution. Review should include discussion of significant accounting principles, practices and judgments with management and independent auditors. |

| | 3. | In consultation with the management, the independent auditors, and the internal auditors, consider the integrity of the Company’s financial reporting process and controls. Discuss significant financial risk exposures and the steps management has taken to monitor, control, and report such exposures. Review significant findings prepared by the independent auditors and the internal auditing department together with management’s responses. |

| | 4. | Review with financial management and the independent auditors the Company’s quarterly financial results prior to the release of earnings and/or the Company’s quarterly consolidated financial statements prior to filing or distribution. Discuss any significant changes to the Company’s accounting principles and any items required to be communicated by the independent auditors in accordance with SAS 61 (see item 9). The Chair of the committee may represent the entire Audit Committee for purposes of this review. |

Independent Auditors

| | 5. | The independent auditors are ultimately accountable to the Audit Committee. The Audit Committee shall review the independence and performance of the auditors and appoint the independent auditors or discharge the auditors when circumstances warrant. |

| | 6. | The Committee shall pre-approve the audit and permissible non-audit fees to be paid to the independent auditors. The following activities may not be performed by the independent auditors contemporaneously with the audit: (1) bookkeeping or other services related to the accounting records or financial statements of the Company; (2) financial information systems design and implementation; (3) appraisal or valuation services, fairness opinions, or contribution-in-kind reports; (4) actuarial services; (5) internal audit outsourcing services; (6) management functions or human resources; (7) broker or dealer, investment adviser, or investment banking services; (8) legal services and expert services unrelated to the audit; and (9) any other services that the Public Company Accounting Oversight Board determines, by regulation, is impermissible. |

20

| | 7. | On an annual basis, the Committee should review and discuss with the independent auditors all significant relationships they have with the Company that could impair the auditors’ independence. |

| | 8. | The Committee shall ensure that the independent auditors provide the Committee with timely reports for their review regarding critical accounting policies and practices; all alternative treatments of financial information within GAAP that have been discussed with management, the effects of using such alternatives and the treatment preferred by the independent auditors; and other material written communications between the independent auditors and management. |

| | 9. | Determine the audit scope, staffing, locations, reliance upon management and internal audit, and general audit approach. |

| | 10. | Prior to releasing the year-end earnings, discuss the results of the audit with the independent auditors. Discuss certain matters required to be communicated to audit committees in accordance with AICPA SAS 61. |

| | 11. | Consider the independent auditors’ judgments about the quality and appropriateness of the Company’s accounting principles as applied in its financial reporting and other matters required under Independence Standards Board Standard No. 1. |

Internal Audit Department and Legal Compliance

| | 12. | Review the audit plan, changes in plan, activities, organizational structure, and qualifications of the internal audit department, as needed. |

| | 13. | Review the appointment, performance, and replacement of the senior internal audit executive. |

| | 14. | Review significant reports prepared by the internal audit department together with management’s response and follow-up to these reports. |

| | 15. | On at least an annual basis, review with the Company’s counsel, any legal matters that could have a significant impact on the organization’s financial statements, the Company’s compliance with applicable laws and regulations, and inquiries received from regulators or governmental agencies. |

Other Audit Committee Responsibilities

| | 16. | Establish, review, and update periodically a Code of Ethical Conduct and ensure that management has established a system to enforce this Code. |

| | 17. | Review financial and accounting personnel succession planning within the Company. |

| | 18. | Annually prepare a report to shareholders as required by the Securities and Exchange Commission. The report should be included in the Company’s annual proxy statement. |

| | 19. | Establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal controls or auditing matters, and for the |

21

| | confidential and anonymous submission by employees of concerns regarding questionable accounting or audit matters. |

| | 20. | Perform any other activities consistent with this Charter, the Company’s by-laws, and governing laws, as the Committee or the Board deems necessary or appropriate. |

| | 21. | Maintain minutes of meetings and periodically report to the Board of Directors on significant results of the foregoing activities. |

22

GEORGIA BANK FINANCIAL CORPORATION

3530 Wheeler Road

Augusta, Georgia 30909

PROXY SOLICITED BY

THE BOARD OF DIRECTORS OF GEORGIA BANK FINANCIAL CORPORATION

FOR THE 2004 ANNUAL MEETING OF SHAREHOLDERS

APRIL 14, 2004

The undersigned hereby appoints J. Pierce Blanchard, Jr. and Tom C. McLaughlin, and each of them, with full power of substitution, proxies to vote the shares of stock which the undersigned could vote if personally present at the 2004 Annual Meeting of Shareholders of Georgia Bank Financial Corporation to be held at 4:00 p.m., on April 14, 2004 at the principal offices of the Company, 3530 Wheeler Road, Augusta, Georgia, or at any adjournment thereof.

(1) Election of Directors:

| | |

¨ FOR all nominees listed below

(except as marked to the contrary) | | ¨ WITHHOLD AUTHORITY TO VOTE

for all nominees listed below: |

| | | | |

| William J. Badger | | Robert W. Pollard, Jr. | | Randolph R. Smith, M.D. |

| R. Daniel Blanton | | Edward G. Meybohm | | Ronald L. Thigpen |

| Warren A. Daniel | | | | John W. Trulock, Jr. |

(Instruction: To withhold authority to vote for any individual nominee, strike a line through that nominee’s name)

CONTINUED ON REVERSE

(2) In their discretion, upon such other matters as may properly come before the meeting.

This proxy will be voted in accordance with the direction of the undersigned as marked. If no direction is given, this proxy will be voted “FOR” the nominees listed above.

| | |

| | | Dated:_________________________________, 2004 |

| | | |

| | | ___________________________________ |

| | | |

| | | ___________________________________ Signature(s) of Shareholder |

| | | |

| | | Please sign exactly as name appears hereon. If shares are held jointly each shareholder should sign. Agents, executors, administrators, guardians, trustees, etc. should use full title. If the shareholder is a corporation, please sign full corporate name by an authorized officer. |

| | | |

Please fill in, date and sign the proxy and return in the enclosed postpaid envelope.