Exhibit 99.1

Annual Stockholder Meeting-FY’12 Review

October 30, 2012

Forward-Looking Statements

Some of the statements in this presentation constitute “forward-looking statements” about John B. Sanfilippo & Son, Inc. Such statements include, in particular, statements about our plans, strategies, business prospects, changes and trends in our business and the markets in which we operate. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,” “potential” or “continue” or the negative of those terms or other comparable terminology. These statements represent our present expectations or beliefs concerning future events and are not guarantees. Such statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement.

We caution that forward-looking statements are qualified by important factors, risks and uncertainties that could cause actual results to differ materially from those in the forward looking statements. Our periodic reports filed with the Securities and Exchange Commission, including our Forms 10-K and 10-Q and any amendments thereto, describe some of these factors, risks and uncertainties.

Agenda

JBSS Overview and Jeffrey Sanfilippo Chairman & CEO

Strategic Vision

Financial Review Mike Valentine CFO & Group President

Brand Marketing Howard Brandeisky VP Global Marketing &

Customer Solutions

Brand Sales Chris Gardier Sr. VP Consumer Sales

Closing Remarks Jeffrey Sanfilippo Chairman & CEO

90th Anniversary

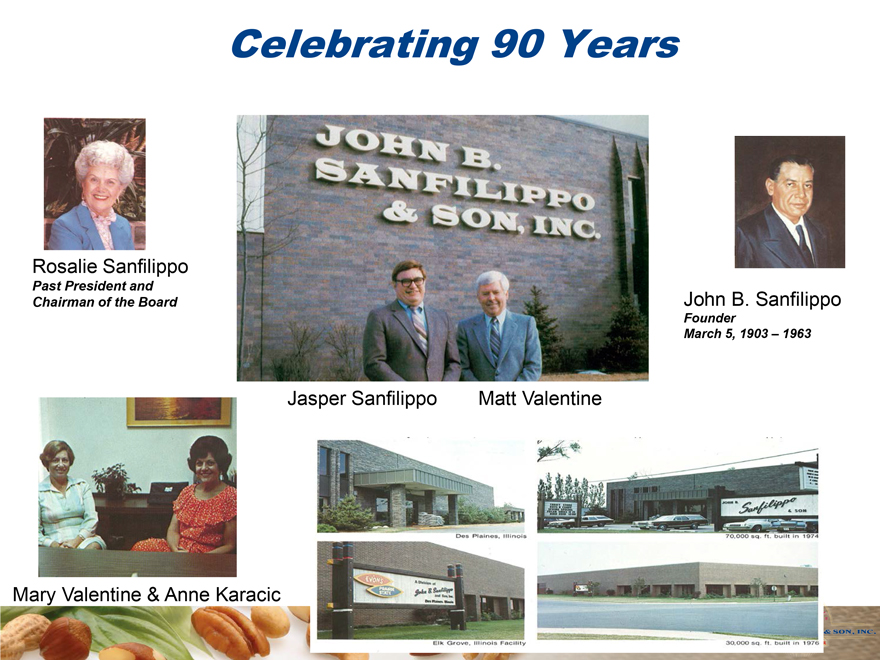

Celebrating 90 Years

Rosalie Sanfilippo

Past President and Chairman of the Board

Jasper Sanfilippo Matt Valentine

John B. Sanfilippo

Founder

March 5, 1903 – 1963

Mary Valentine & Anne Karacic

Celebrating 90 Years

Elgin

Garysburg

Gustine

Selma

Vision

To be the global source for nuts, committed to quality, expertise and innovation that delivers an unmatched experience to our customer and consumer.

Mission

To be the global leader of quality driven, innovative nut solutions that enhance the customer and consumer experience and achieve consistent, profitable growth for our shareholders. We will accomplish this through our commitment to a dynamic infrastructure that maximizes the potential of our brands, people and processes.

Core Values

Integrity People Investment Customer Driven Quality Innovation Execution Continuous Improvement Safety Resource Conservation

7

Community Relations

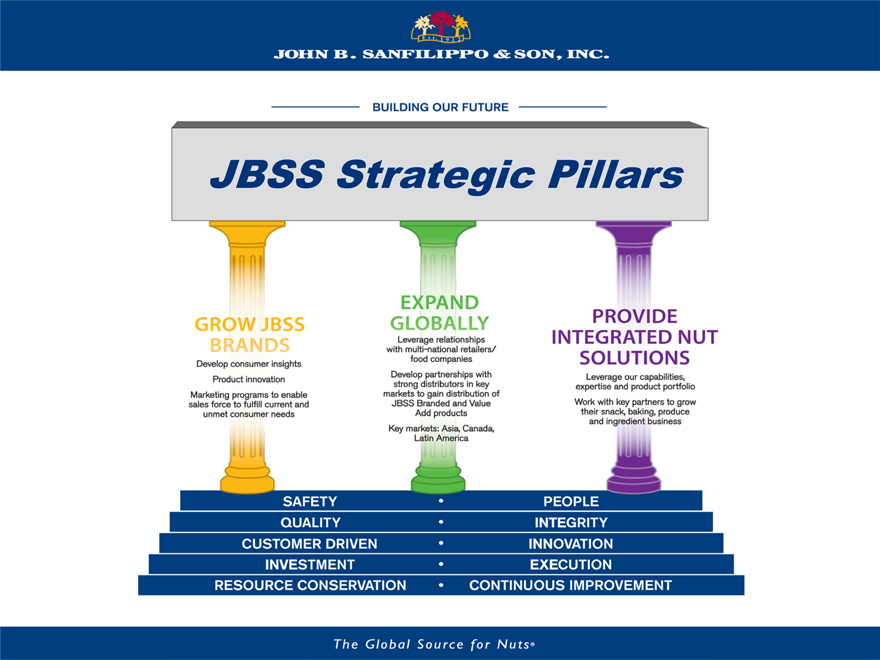

JBSS Strategic Pillars

Talent and knowledge will continue to facilitate the execution of our Strategic Plan

• Experienced management team

• Expanding global knowledge

• Investments in consumer insights & brand development

• Procurement expertise

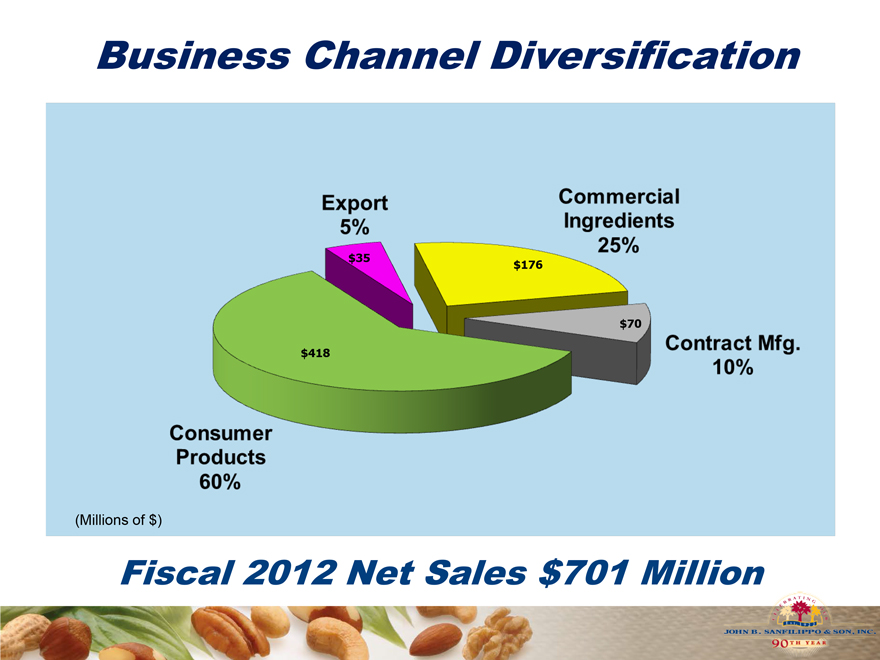

Business Channel Diversification

Fiscal 2012 Net Sales $701 Million

(Millions of $)

Export 5%

Commericial Ingredients 25%

Consumer Products 60%

Contract Mfg. 10%

FY 2012 Accomplishments

Transformed our Customer Relationships

Expanded our Innovation and Consumer Insights Focus

Continued to Optimize Operational Efficiencies

Innovation

152 new items launched during FY ‘12

Commercial Ingredients on a Roll!

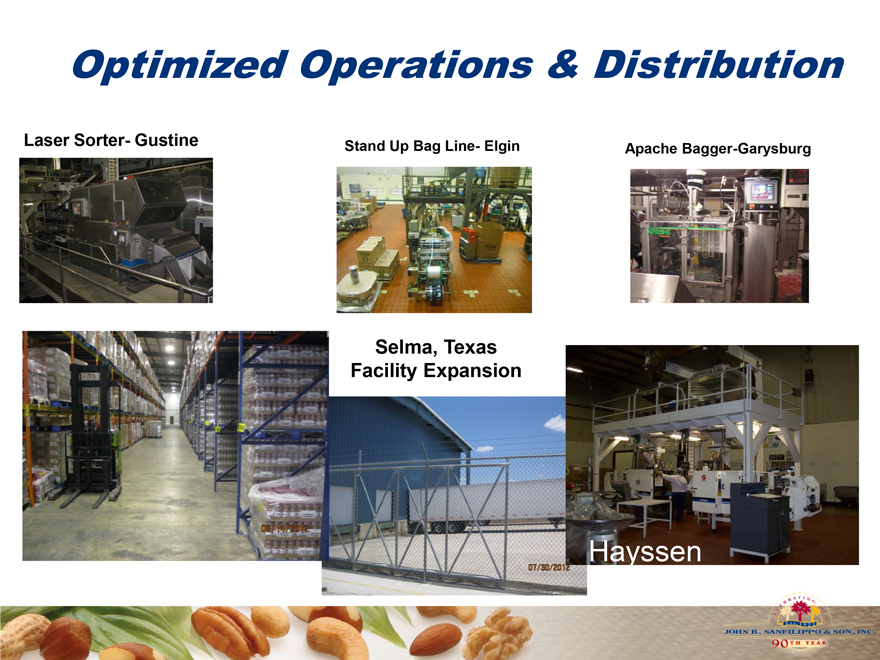

Optimized Operations & Distribution

Laser Sorter- Gustine

Stand Up Bag Line- Elgin

Apache Bagger-Garysburg

Selma, Texas Facility Expansion

Hayssen

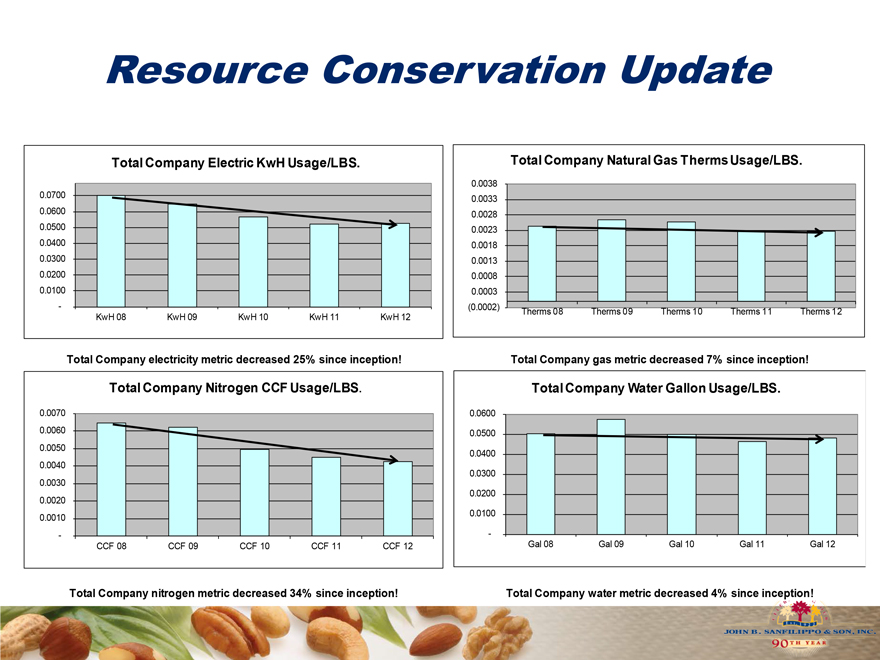

Resource Conservation Update

Total Company Electric KwH Usage/LBS. Total Company Natural Gas Therms Usage/LBS.

0.0038

0.0700 0.0033

0.0600 0.0028

0.0500 0.0023

0.0400 0.0018

0.0300 0.0013

0.0200 0.0008

0.0100 0.0003

- (0.0002) Therms 08 Therms 09 Therms 10 Therms 11 Therms 12

KwH 08 KwH 09 KwH 10 KwH 11 KwH 12

Total Company electricity metric decreased 25% since inception! Total Company gas metric decreased 7% since inception!

Total Company Nitrogen CCF Usage/LBS. Total Company Water Gallon Usage/LBS.

0.0070 0.0600

0.0060 0.0500

0.0050 0.0400

0.0040

0.0300

0.0030

0.0020 0.0200

0.0010 0.0100

- —

CCF 08 CCF 09 CCF 10 CCF 11 CCF 12 Gal 08 Gal 09 Gal 10 Gal 11 Gal 12

Total Company nitrogen metric decreased 34% since inception! Total Company water metric decreased 4% since inception!

FY 2012 Accomplishments

Fisher Baking—created a best in class integrated marketing program and gained tantial new distribution and market e

fisher Snack – stabilized distribution and improved unit volume sales per store per

Orchard Valley Harvest – refreshed brand age, product portfolio and positioning

Our Brands Over The Years

Our Branded Customers Today

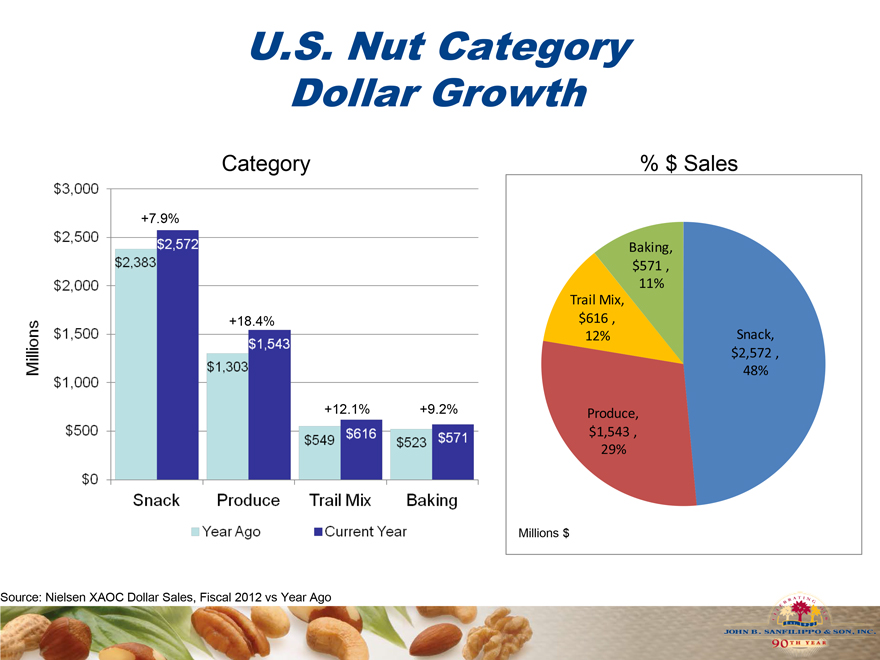

U.S. Nut Category Dollar Growth

Category

% $ Sales

Category

+7.9%

+18.4%

+12.1% +9.2%

Baking, $571 , 11% Trail Mix, $616 ,

12% Snack, $2,572 , 48%

Produce, $1,543 , 29%

Millions $

Source: Nielsen XAOC Dollar Sales, Fiscal 2012 vs Year Ago

Times Square November 17, 2011

FY 2012 Accomplishments

Achieved 30% increase in Global Fisher Snack sales

Developed New Private Brand Snack platform for global retailer

Completed China Market Entry study with International Consulting Firm

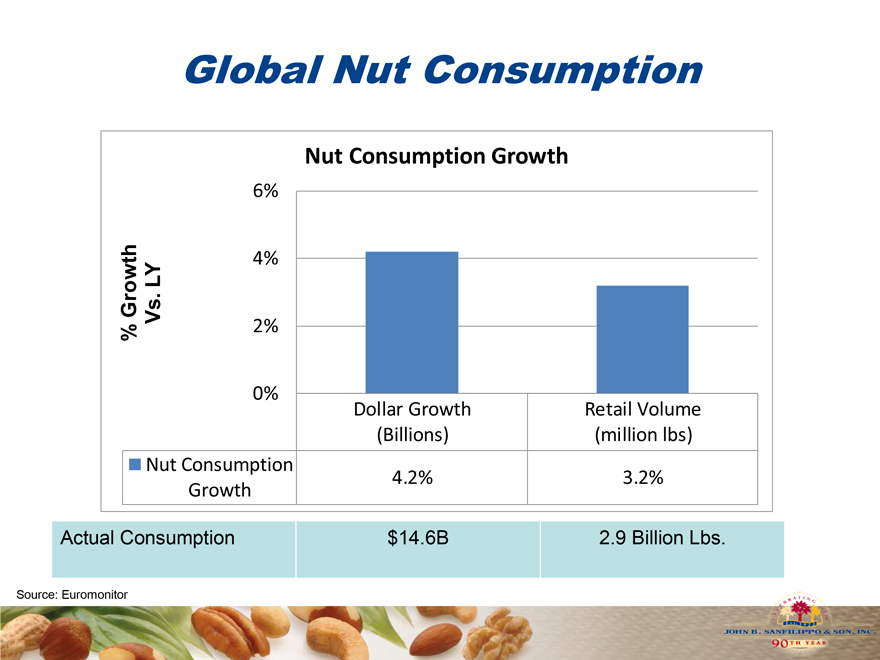

Global Nut Consumption

Nut Consumption Growth

% Growth Vs. LY

6% 4% 2% 0%

Nut Consumption Growth

4.2% 3.2%

$14.6B 2.9 Billion Lbs.

Actual Consumption

Source: Euromonitor

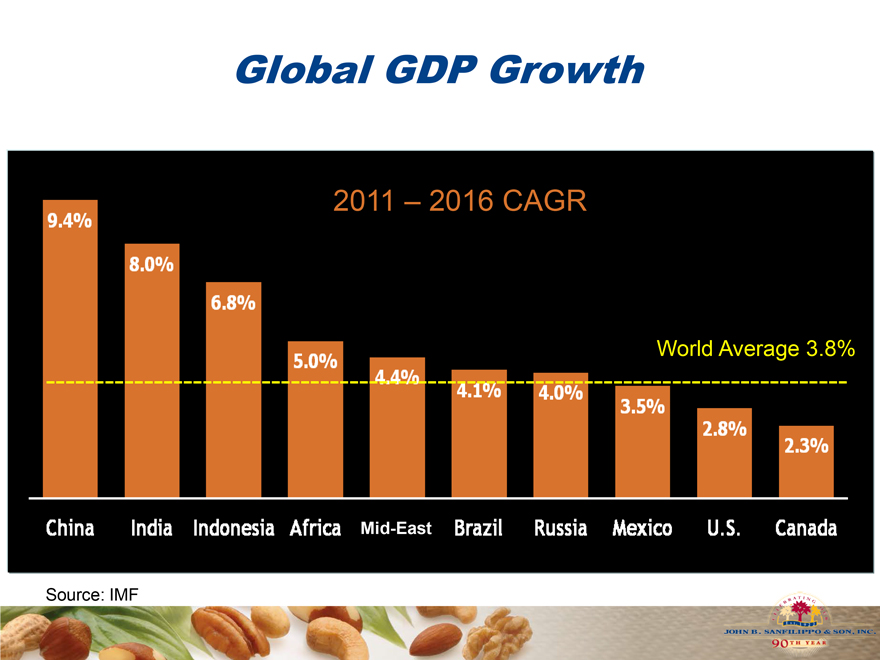

Global GDP Growth

2011 – 2016 CAGR

2011 – 2016 CAGR

2011 – 2016 CAGR

World Average 3.8%

Mid-East

World Average 3.8%

Source: IMF

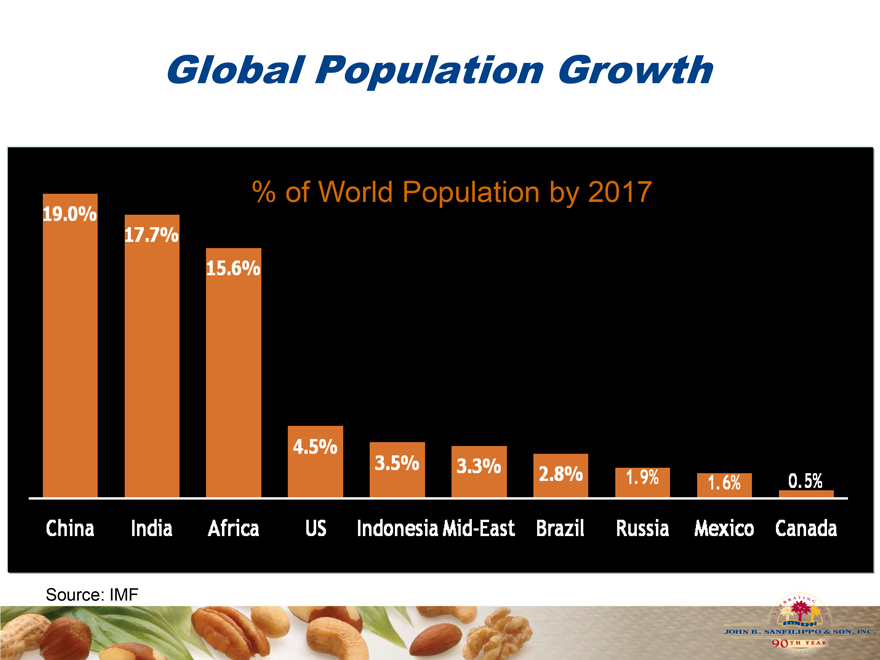

Global Population Growth

% of World Population by 2017

19.0%

17.7%

15.6%

4.5%

3.5%

3.3%

2.8%

1.9%

1.6%

0.5%

Source: IMF

International Sales on a Roll!

Super 99 Panama

Carrefour Dominican Republic

E-Mart Korea

Sweet Space Korea

Carrefour French Polynesia

Fisher in China 2012

FY 2012

Financial Milestones

28

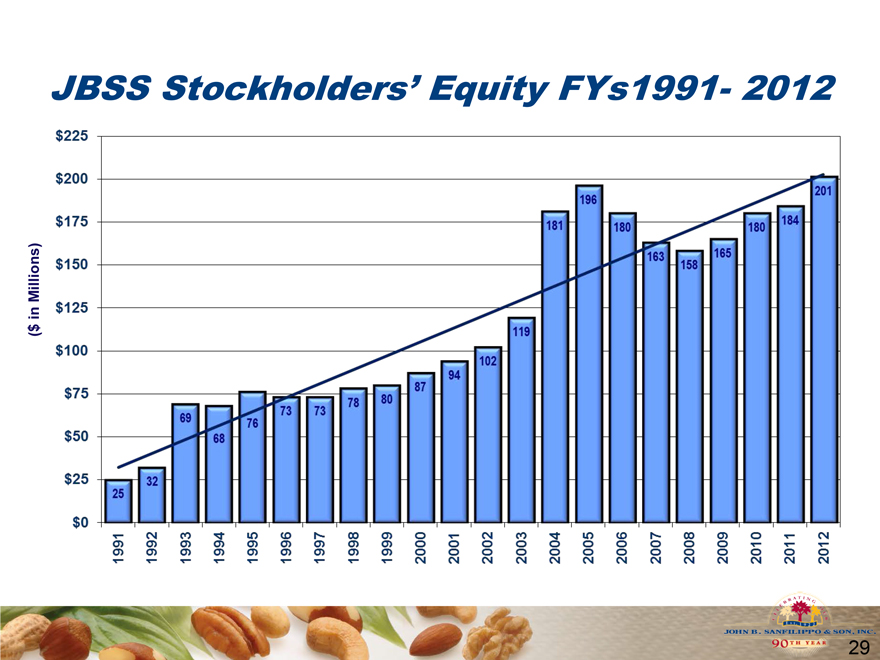

JBSS Stockholders’ Equity FYs1991- 2012

($ in Millions)

25 32 69 68 76 73 73 78 80 87 84 102 119 181 196 180 163 158 165 180 184 201

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

$225

$200

$175

$150

$125

$100

$75

$50

$25

$0

29

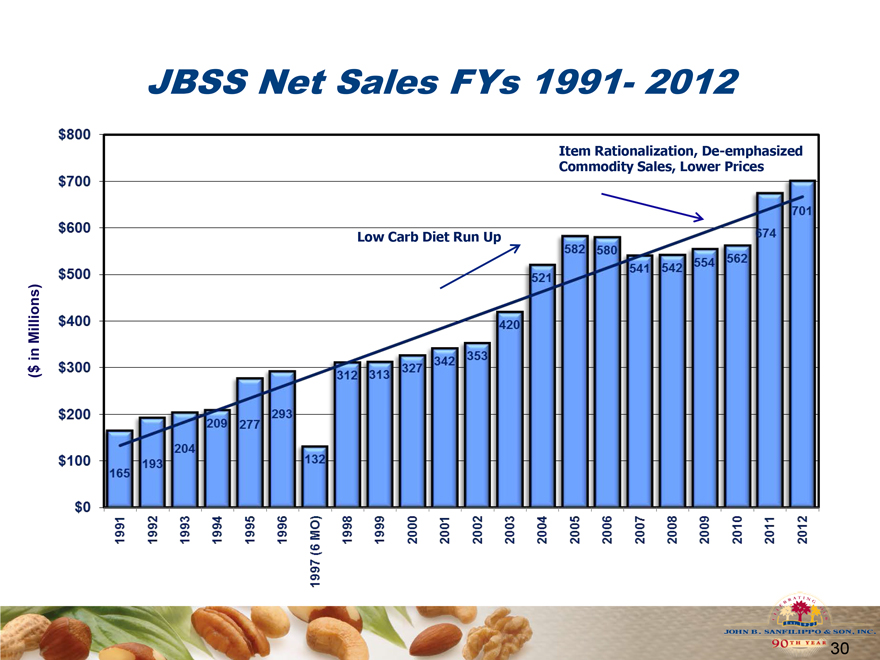

JBSS Net Sales FYs 1991- 2012

Low Carb Diet Run Up

Item Rationalization, De-emphasized Commodity Sales, Lower Prices

($ in Millions)

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

$800

$700

$600

$500

$400

$300

$200

$100

$0

165 193 204 209 277 293 132 312 313 327 342

353 420

521

582

580

541

542

554

562

674

701

6MO

30

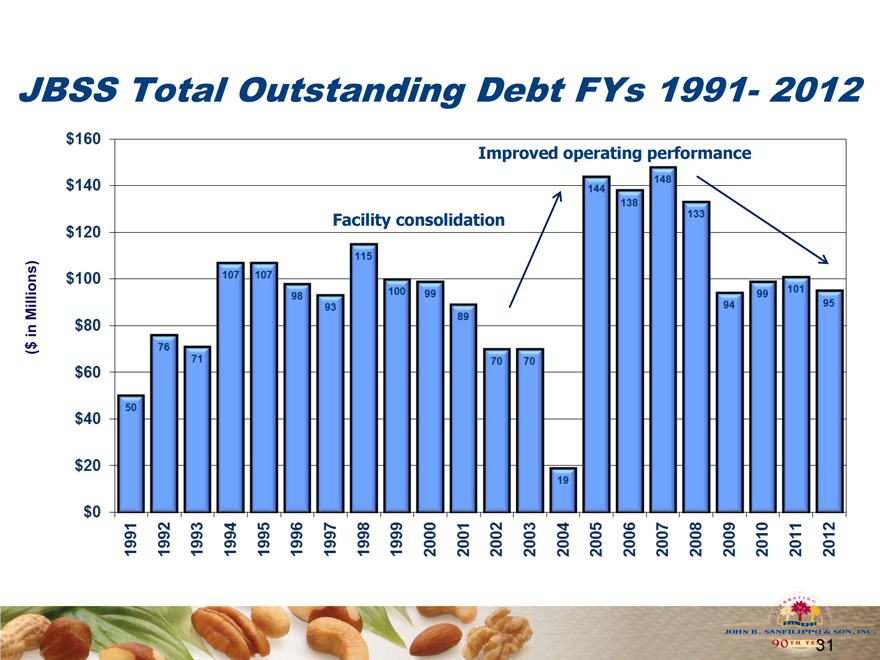

JBSS Total Outstanding Debt FYs 1991- 2012

Facility consolidation

Improved operating performance

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

$160

$140

$120

$100

$80

$60

$40

$20

$0

50

76

71

107

98

93

115

100

99

89

70

19

144

138

148

133

94

99

101

95

31

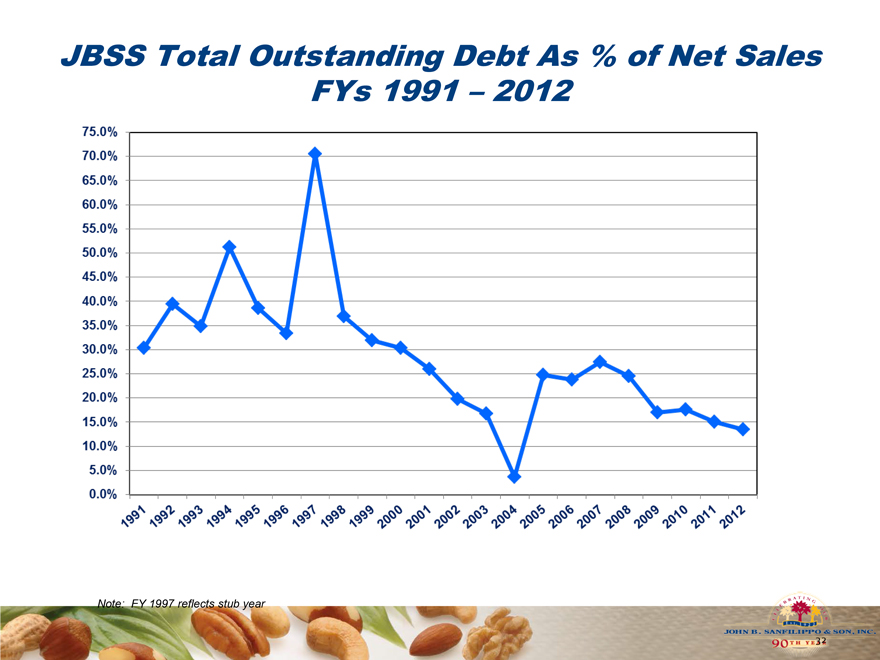

JBSS Total Outstanding Debt As % of Net Sales FYs 1991 – 2012

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

75.0%

70.0%

65.0%

60.0%

55.0%

50.0%

45.0%

40.0%

35.0%

30.0%

25.0%

20.0%

15.0%

5.0%

0%

32

EBITDA

EBITDA consists of earnings before interest, taxes, depreciation,

amortization and noncontrolling interest. EBITDA is not a measurement

of financial performance under accounting principles generally accepted

in the United States of America (“GAAP”), and does not represent cash

flow from operations. EBITDA is presented solely as a supplemental

disclosure because management believes that it is important in

evaluating JBSS’s financial performance and market

valuation. In conformity with Regulation G, a reconciliation of EBITDA to

the most directly comparable financial measures calculated and

presented in accordance with GAAP is presented in the following slide.

33

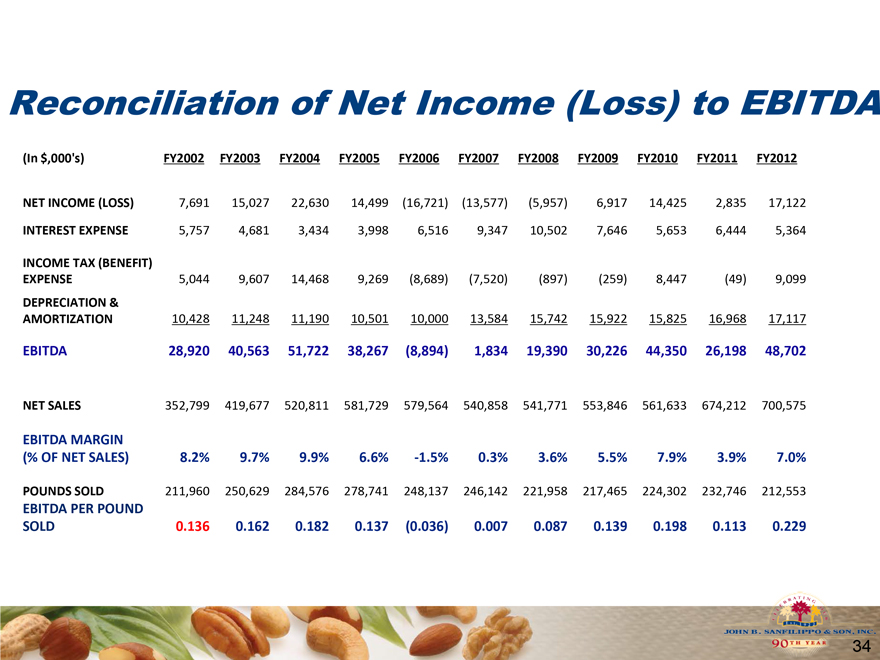

Reconciliation of Net Income (Loss) to EBITDA

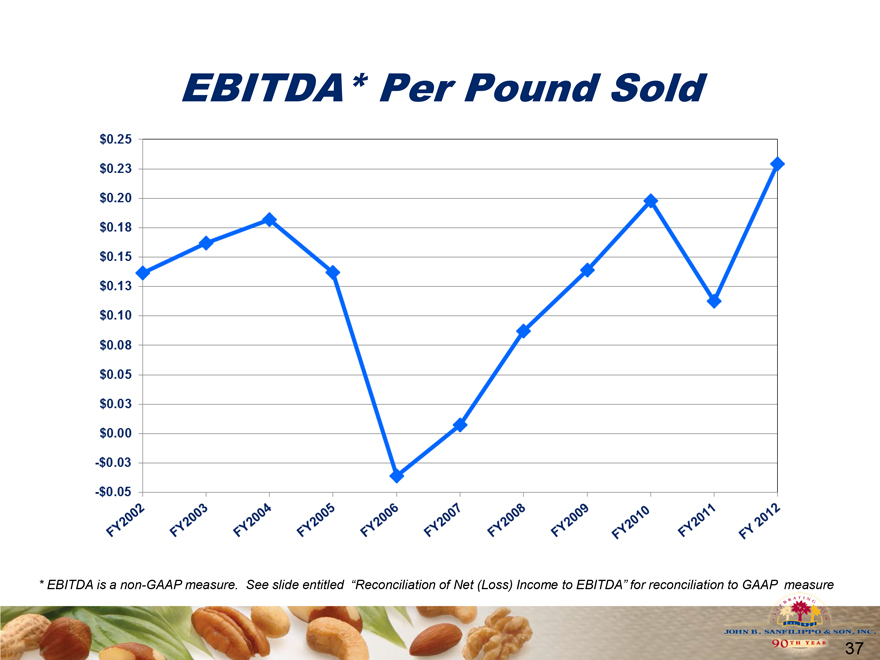

(In $,000’s) FY2002 FY2003 FY2004 FY2005 FY2006 FY2007 FY2008 FY2009 FY2010 FY2011 FY2012

NET INCOME (LOSS) 7,691 15,027 22,630 14,499 (16,721) (13,577) (5,957) 6,917 14,425 2,835 17,122

INTEREST EXPENSE 5,757 4,681 3,434 3,998 6,516 9,347 10,502 7,646 5,653 6,444 5,364

INCOME TAX (BENEFIT)

EXPENSE 5,044 9,607 14,468 9,269 (8,689) (7,520) (897) (259) 8,447 (49) 9,099

DEPRECIATION &

AMORTIZATION 10,428 11,248 11,190 10,501 10,000 13,584 15,742 15,922 15,825 16,968 17,117

EBITDA 28,920 40,563 51,722 38,267 (8,894) 1,834 19,390 30,226 44,350 26,198 48,702

NET SALES 352,799 419,677 520,811 581,729 579,564 540,858 541,771 553,846 561,633 674,212 700,575

EBITDA MARGIN

(% OF NET SALES) 8.2% 9.7% 9.9% 6.6% -1.5% 0.3% 3.6% 5.5% 7.9% 3.9% 7.0%

POUNDS SOLD 211,960 250,629 284,576 278,741 248,137 246,142 221,958 217,465 224,302 232,746 212,553

EBITDA PER POUND

SOLD 0.136 0.162 0.182 0.137 (0.036) 0.007 0.087 0.139 0.198 0.113 0.229

34

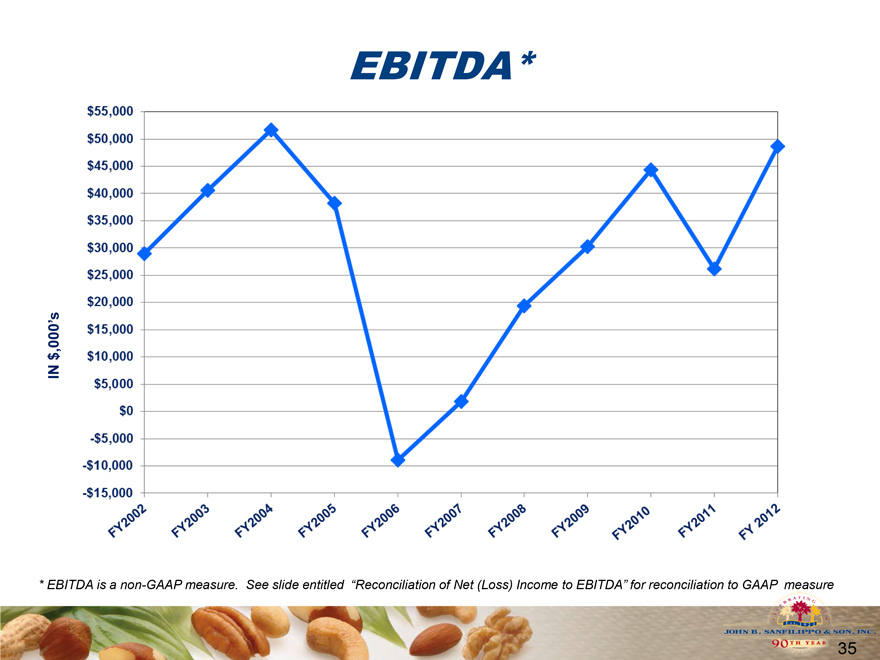

EBITDA*

IN $,000’s

* EBITDA is a non-GAAP measure. See slide entitled “Reconciliation of Net (Loss) Income to EBITDA” for reconciliation to GAAP measure

FY2002

FY2003

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

FY2012

35

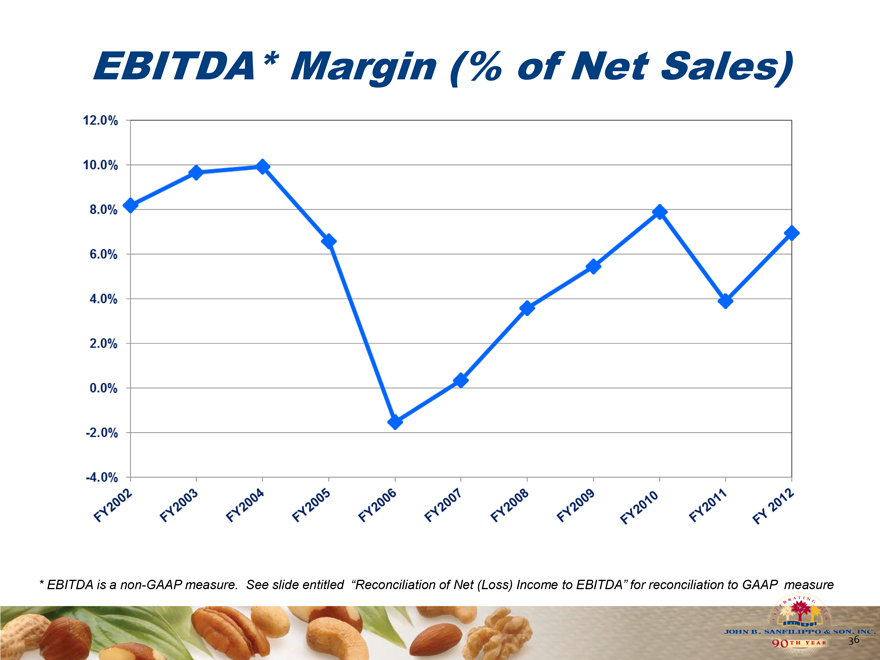

EBITDA* Margin (% of Net Sales)

* EBITDA is a non-GAAP measure. See slide entitled “Reconciliation of Net (Loss) Income to EBITDA” for reconciliation to GAAP measure

FY2002

FY2003

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

FY2012

12.0%

10.0%

8.0%

4.0%

2.0%

0%

-2.0%

-4.0%

36

EBITDA* Per Pound Sold

FY2002

FY2003

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

FY2012

* EBITDA is a non-GAAP measure. See slide entitled “Reconciliation of Net (Loss) Income to EBITDA” for reconciliation to GAAP measure

37

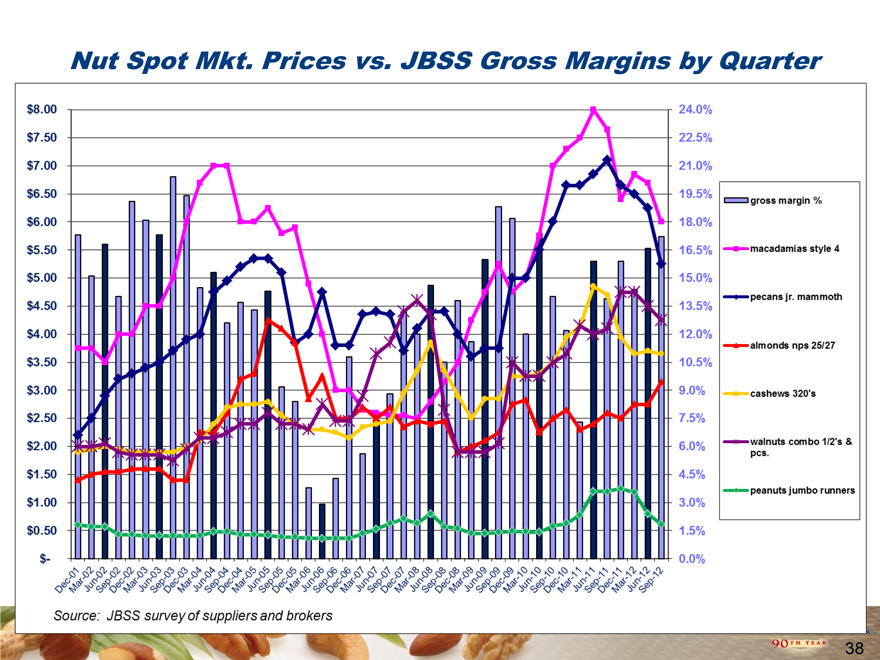

Nut Spot Mkt. Prices vs. JBSS Gross Margins by Quarter

$8.00%

$7.50%

$7.00%

$6.50%

$6.00%

$5.50%

$5.00%

$4.50%

$4.00%

$3.50%

$3.00%

$2.50%

$2.00%

$1.50%

$1.00%

$0.50%

24.0%

22.5%

21.0%

19.5%

18.0%

16.5%

15.0%

13.5%

12.0%

10.5%

9.0%

7.5%

6.0%

4.5%

3.0%

1.5%

1.5%

0.0%

38

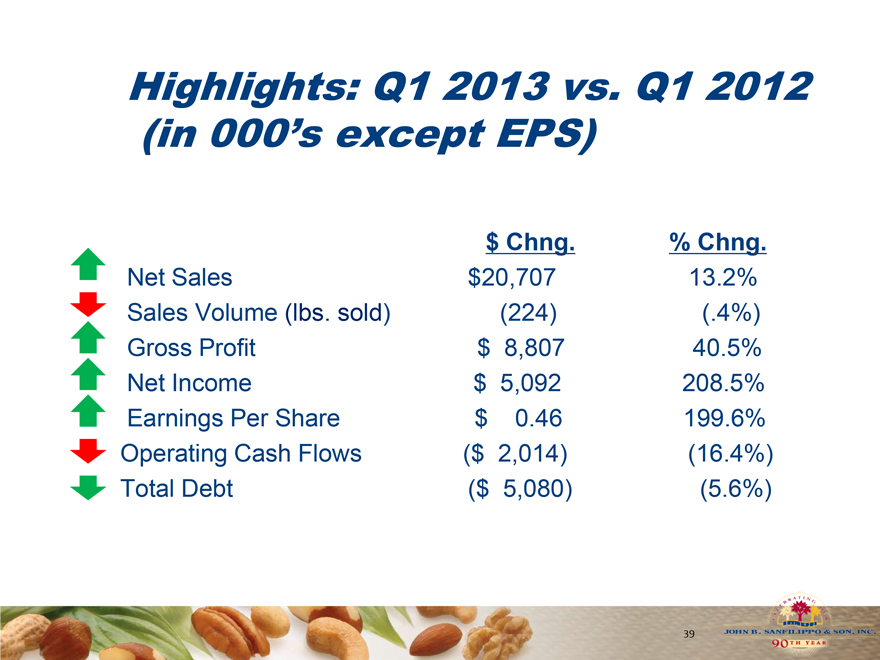

Highlights: Q1 2013 vs. Q1 2012

(in 000’s except EPS)

$ Chng. % Chng.

Net Sales $20,707 13.2%

Sales Volume (lbs. sold) (224) (.4%)

Gross Profit $ 8,807 40.5%

Net Income $ 5,092 208.5%

Earnings Per Share $ 0.46 199.6%

Operating Cash Flows ($ 2,014) (16.4%)

Total Debt ($ 5,080) (5.6%)

39

Sales & Marketing Update

40

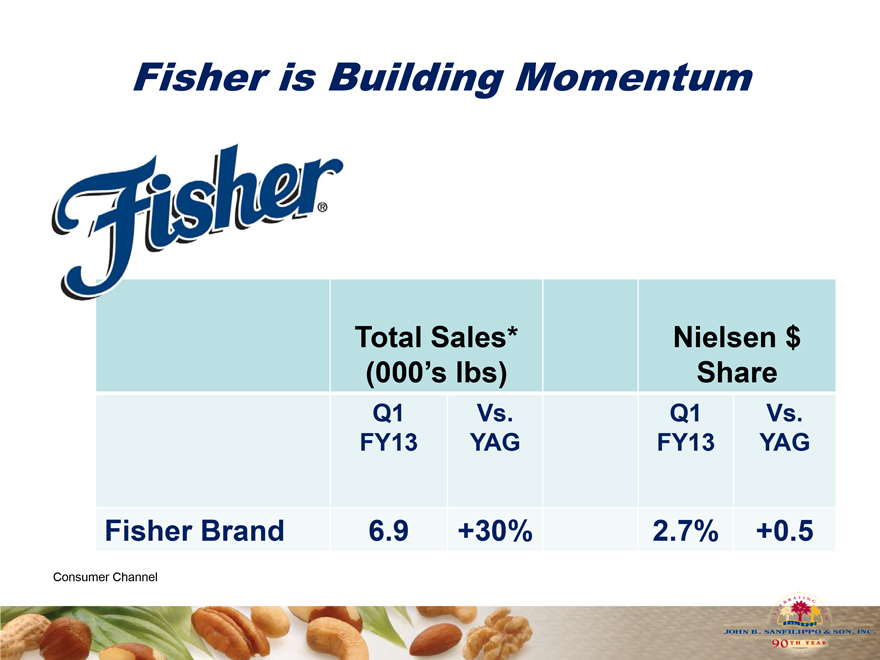

Fisher is Building Momentum

Total Sales* Nielsen $

(000’s lbs) Share

Q1 Vs. Q1 Vs.

FY13 YAG FY13 YAG

Fisher Brand 6.9 +30% 2.7% +0.5

Consumer Channel

Reinventing the Recipe Nut Aisle

YESTERDAY TODAY

Same package as everyone else

No Point of Difference

First to convert to “Freshness Seal” Stand Up Bag

Preferred 2:1 over competition*

* | | Quantitative paired comparison test – online study conducted by Blue Chip Marketing March 2011 |

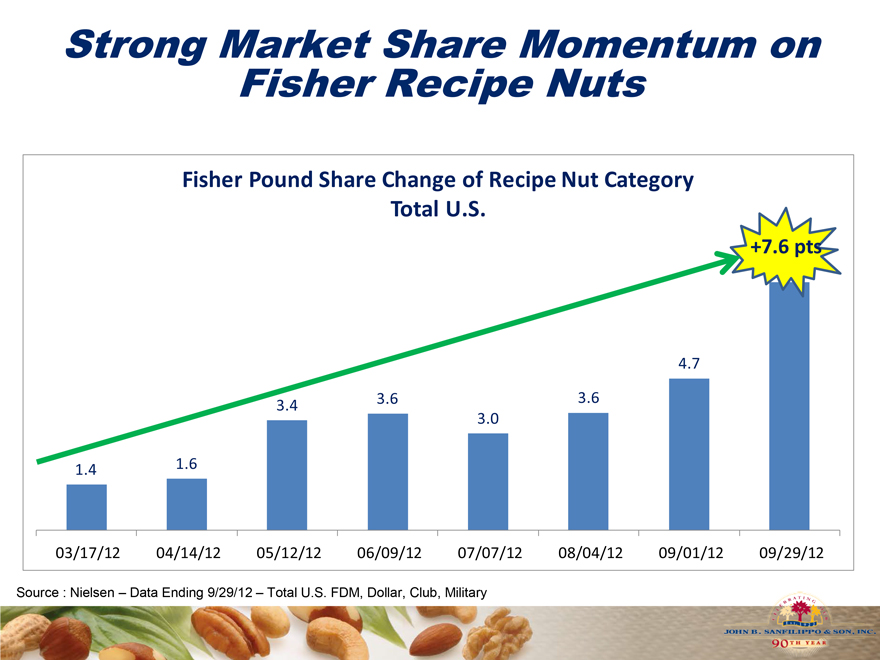

Strong Market Share Momentum on Fisher Recipe Nuts

Fisher Pound Share Change of Recipe Nut Category Total U.S.

4.7

3.4 3.6 3.6

3.0

1.4 1.6

03/17/12 04/14/12 05/12/12 06/09/12 07/07/12 08/04/12 09/01/12 09/29/12

Source : Nielsen – Data Ending 9/29/12 – Total U.S. FDM, Dollar, Club, Military

Supporting Fisher with Strong Branding Campaign

Custom TV vignettes Alex Guarnaschelli

Food Network Magazine

FoodNetwork.com

Vignettes will be featured on Food Network TV and Cooking Channel TV

Holiday Vignettes

Strong In-Store Support

Partnerships

Shippers

1/4 Pallet Displays

46

Translating into New Distribution!

We’ve Freshened Up Our Brand in Core Snacks…

YESTERDAY TODAY

Good awareness and nostalgic brand image

No consumer point of difference, no customer story

• Consumers prefer “Freshness You Can See” bundle over competition

48

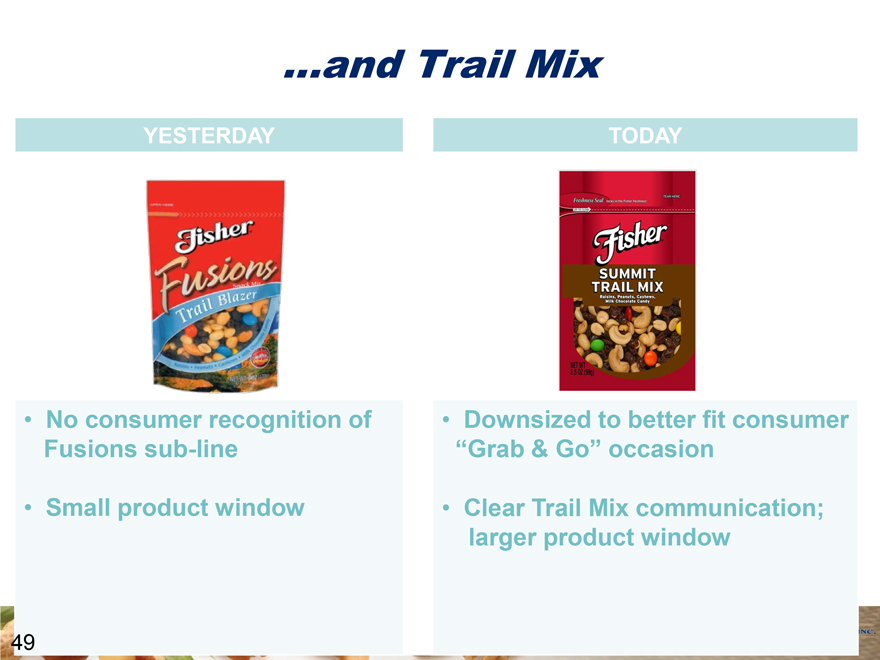

…and Trail Mix

YESTERDAY TODAY

No consumer recognition of Fusions sub-line

Small product window

Downsized to better fit consumer “Grab & Go” occasion

Clear Trail Mix communication; larger product window

49

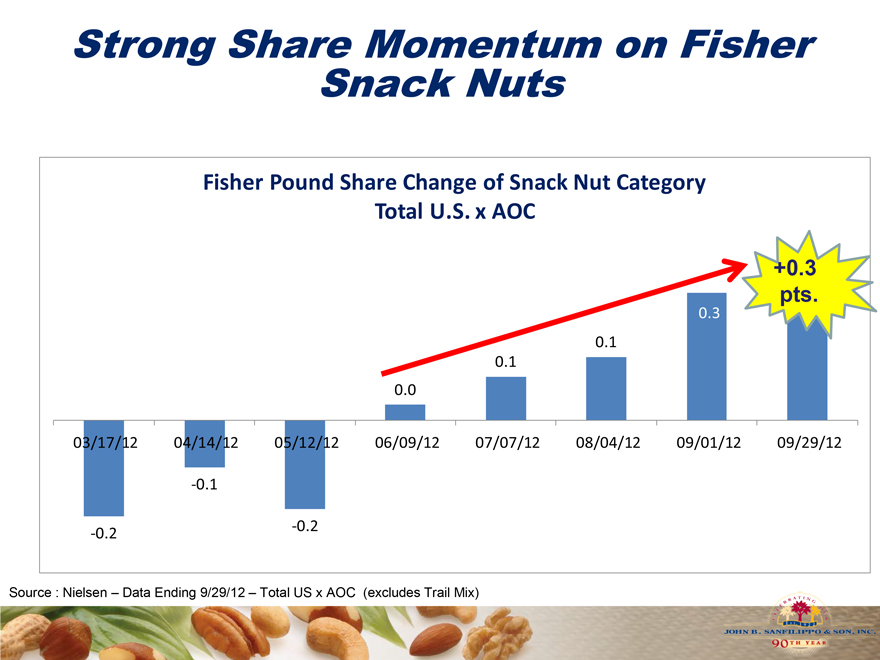

Strong Share Momentum on Fisher Snack Nuts

Fisher Pound Share Change of Snack Nut Category Total U.S. x AOC

+0.3 pts.

0.3 pts.

0.1

0.1

0.0

03/17/12 04/14/12 05/12/12 06/09/12 07/07/12 08/04/12 09/01/12 09/29/12

-0.1

-0.2 -0.2

Source : Nielsen – Data Ending 9/29/12 – Total US x AOC (excludes Trail Mix)

New Products to Build the Brand

FY 2012 FY 2013

Cocoa Mocha & Vanilla Bean Almonds

Specialty Snack Items

Smoked Bacon & Cheddar Crunch Almonds

Expanded Honey Roast Line

Omega 3 and Oatmeal Trail Mix

Mammoth Pecans

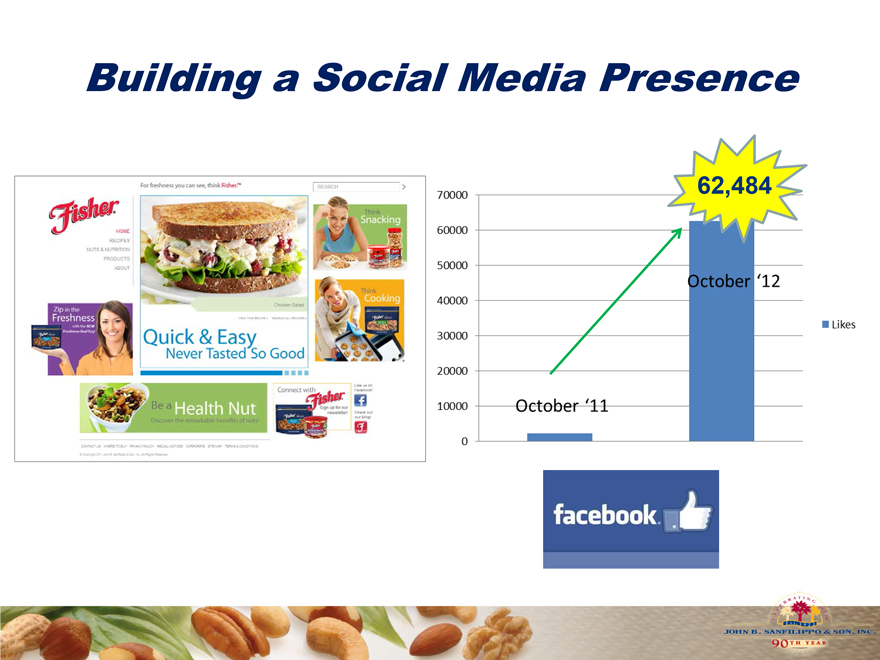

Building a Social Media Presence

62,484

October ‘11 October ‘12

70000

60000

50000

40000

30000

20000

10000

0

Likes

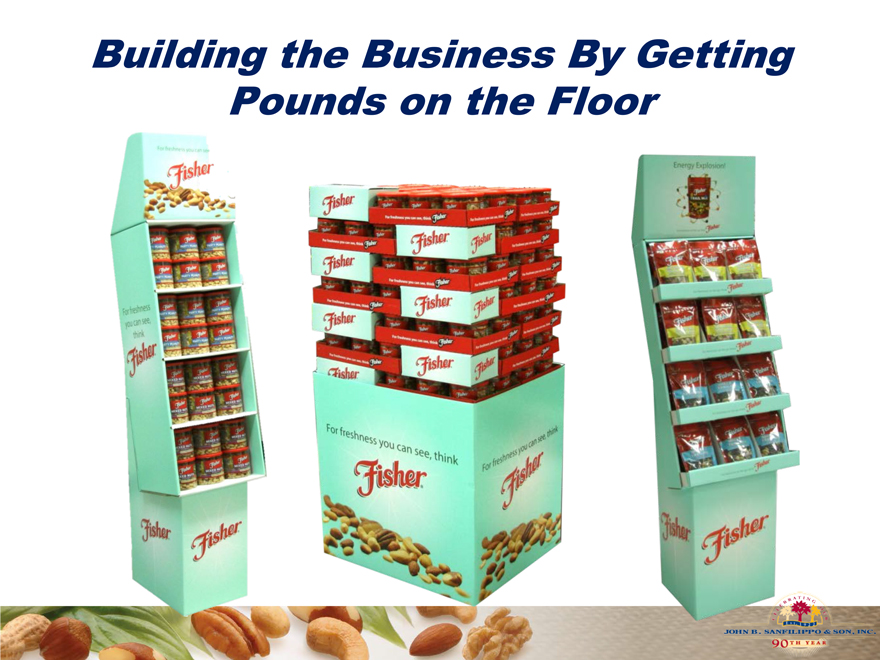

Building the Business By Getting Pounds on the Floor

Re-launching Orchard Valley Harvest

YESTERDAY TODAY

Poor Brand Registration

No clear brand meaning

Strong Brand Registration

Clean packaging graphics reinforce “from the earth” credentials

Clean ingredient line reinforces credentials

54

Produce shoppers expect more

• Fresh

• Natural

• Pure & Simple

• Authenticity

And Orchard Valley Harvest Delivers!

Fresh

Pure & Simple

From the Earth

Natural

Authentic

Integrated Program to Build the Brand

Right Brand Win In-Store Products Building

Closing Comments

58

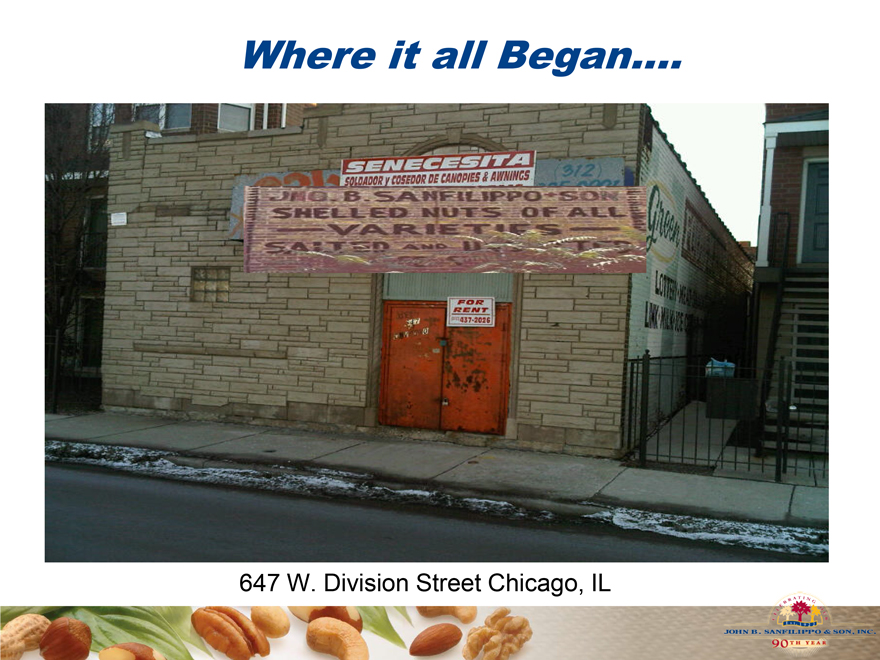

Where it all Began….

647 W. Division Street Chicago, IL

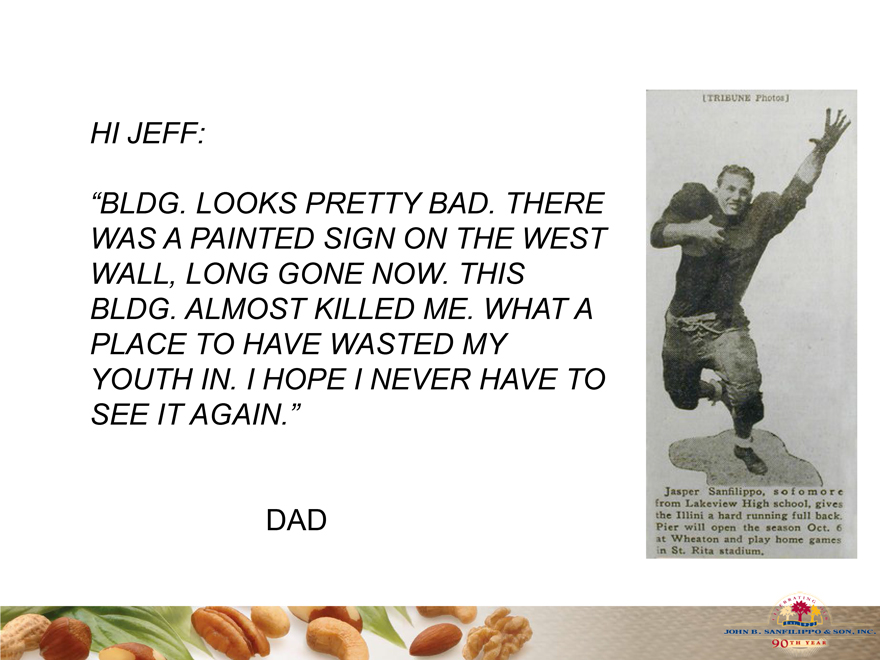

HI JEFF:

“BLDG. LOOKS PRETTY BAD. THERE WAS A PAINTED SIGN ON THE WEST WALL, LONG GONE NOW. THIS BLDG. ALMOST KILLED ME. WHAT A PLACE TO HAVE WASTED MY YOUTH IN. I HOPE I NEVER HAVE TO SEE IT AGAIN.”

DAD

A Foundation for the Future

Elgin, IL

Houston

GARYSBURG, NC

BAINBRIDGE, GA

PECANS PEANUTS

SELMA, TX

GUSTINE, CA

ALMOMONDS

Wallnut

Pecans

U.S Nut Growing Areas

JBSS Facilities

THANK YOU