Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

JBSS similar filings

- 20 Aug 15 Fourth Quarter EPS Increased by 27.1% to a Fourth Quarter Record $0.75 per Share Diluted

- 27 Apr 15 EPS Increased by 76% to a Third Quarter Record $0.58 per Share Diluted

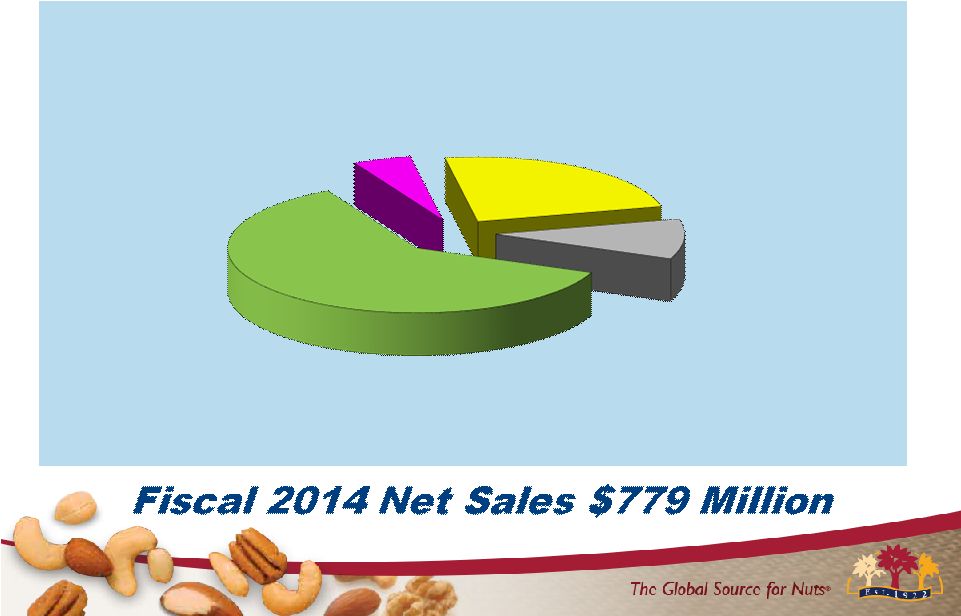

- 28 Jan 15 5.1% sales volume increase helped drive quarterly sales to a record $251.4 million

- 9 Jan 15 Regulation FD Disclosure

- 19 Nov 14 Regulation FD Disclosure

- 3 Nov 14 Submission of Matters to a Vote of Security Holders

- 31 Oct 14 Departure of Directors or Certain Officers

Filing view

External links