Sidoti & Company 2017 fall Conference September 2017 NASDAQ: JBSS Exhibit 99.1

Some of the statements in this presentation and any statements by management constitute “forward-looking statements” about John B. Sanfilippo & Son, Inc. Such statements include, in particular, statements about our plans, strategies, business prospects, changes and trends in our business and the markets in which we operate. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,” “potential” or “continue” or the negative of those terms or other comparable terminology. These statements represent our present expectations or beliefs concerning future events and are not guarantees. Such statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement. We caution that forward-looking statements are qualified by important factors, risks and uncertainties that could cause actual results to differ materially from those in the forward- looking statements. Our periodic reports filed with the Securities and Exchange Commission, including our Forms 10-K and 10-Q and any amendments thereto, describe some of these factors, risks and uncertainties. Forward-Looking Statements

One of the largest nut processors in the world with fiscal year 2017 net sales of approximately $847 million State-of-the-art nut processing capabilities, including what we believe is the single largest nut processing facility in the world A North American market leader in every major selling channel – from consumer and commercial ingredient customers to contract manufacturing customers Dual consumer strategy of offering branded nut and dried fruit programs (Fisher, Orchard Valley Harvest) and private brands Commodity procurement expertise with buyers averaging over 20+ years experience A category leader in packaging and product innovation Vertically integrated nut processing operation for pecans, peanuts and walnuts Who is JBSS?

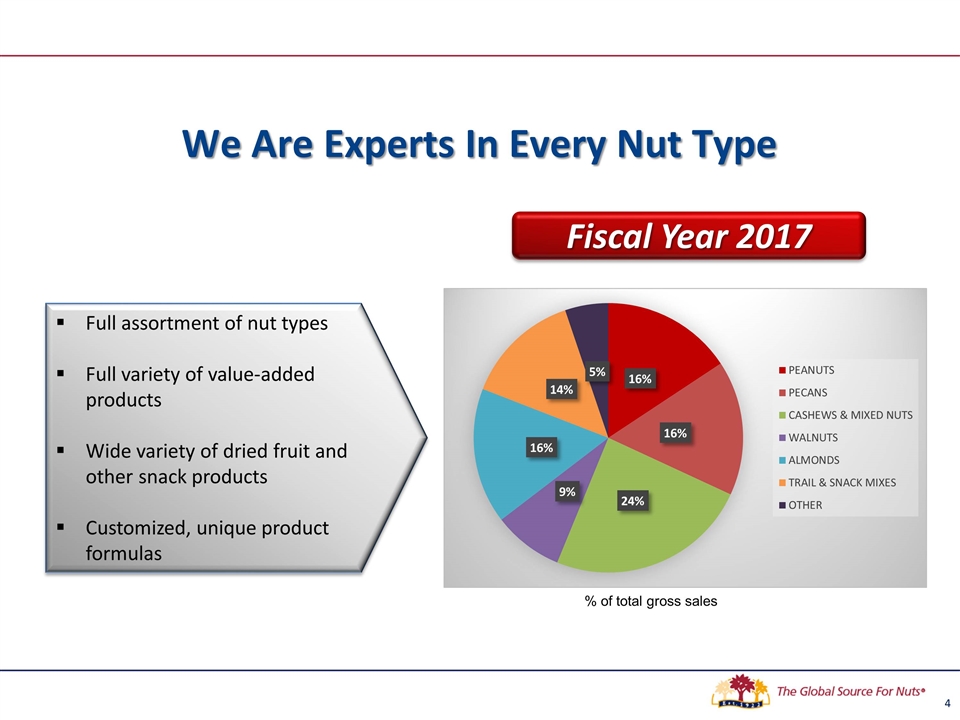

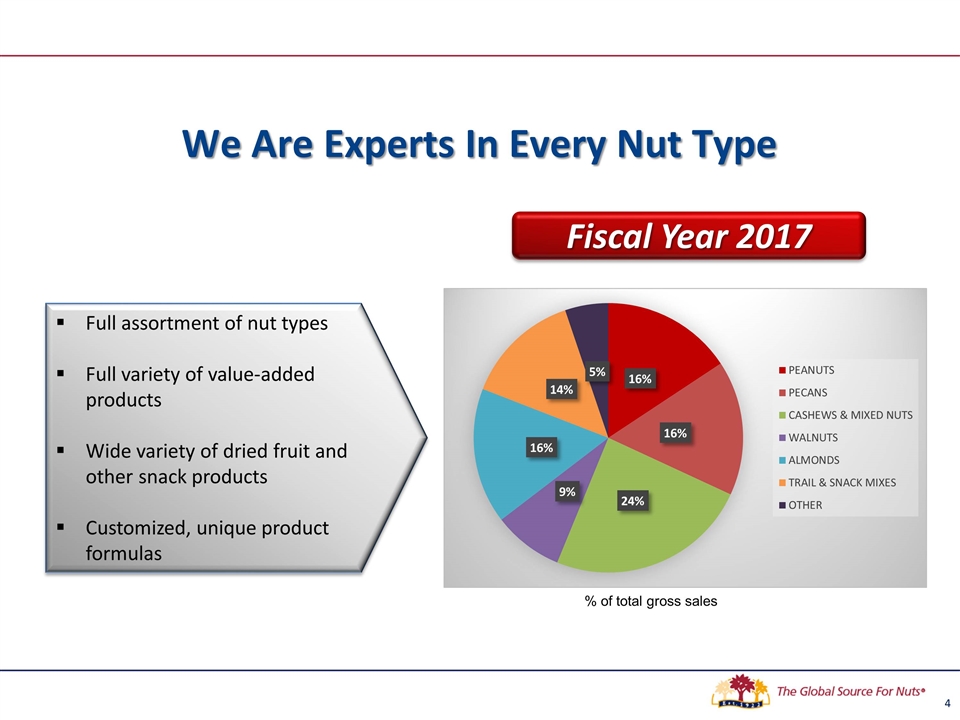

We Are Experts In Every Nut Type % of total gross sales Full assortment of nut types Full variety of value-added products Wide variety of dried fruit and other snack products Customized, unique product formulas Fiscal Year 2017

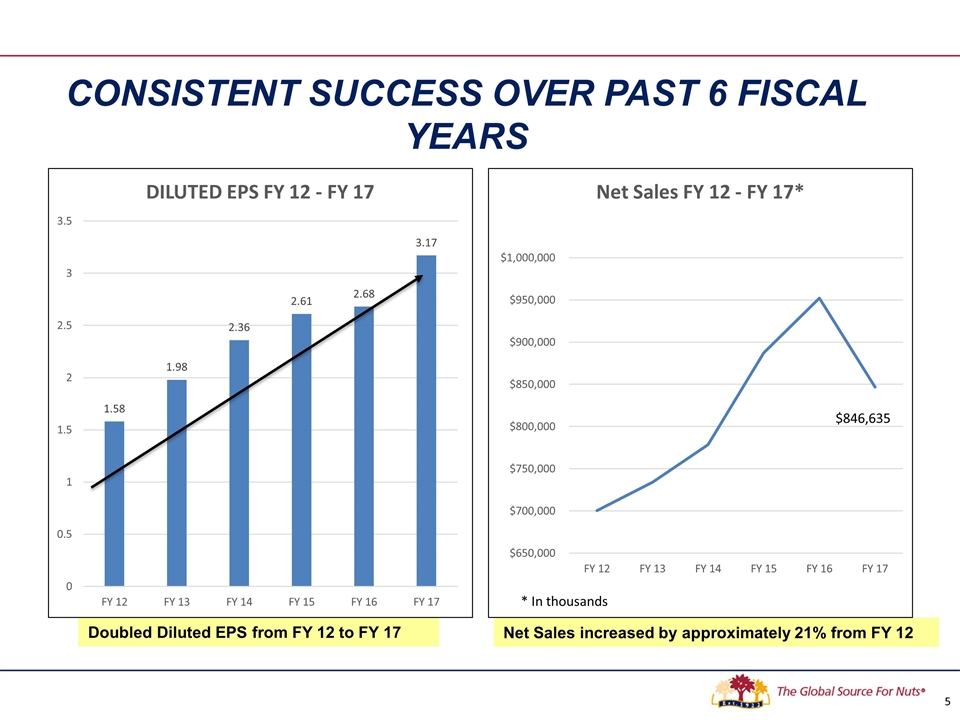

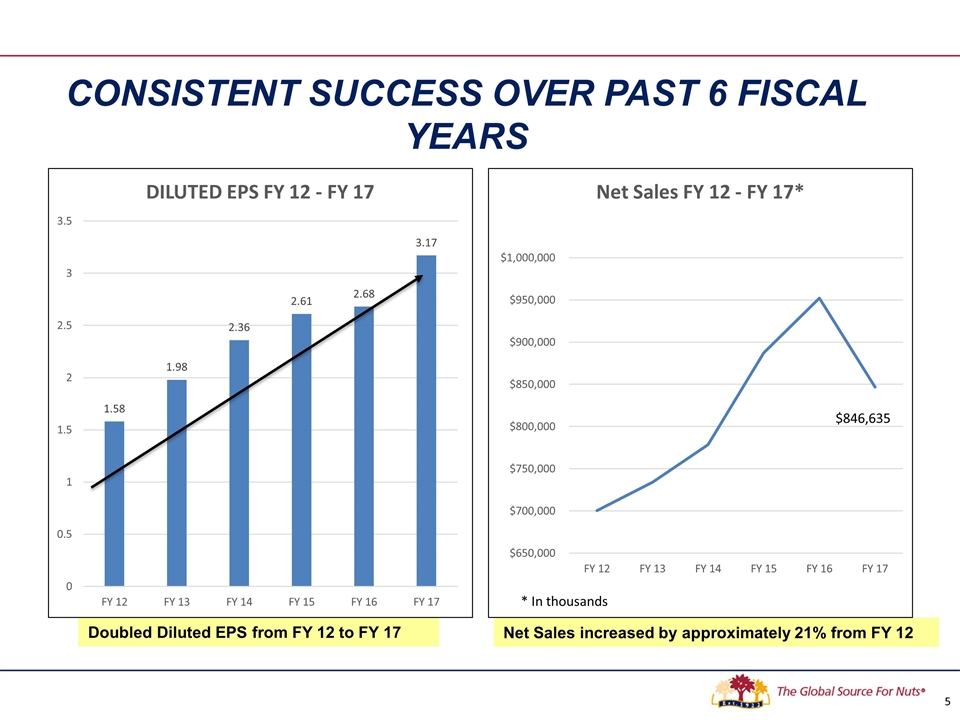

Consistent success over past 6 fiscal years Doubled Diluted EPS from FY 12 to FY 17 Net Sales increased by approximately 21% from FY 12

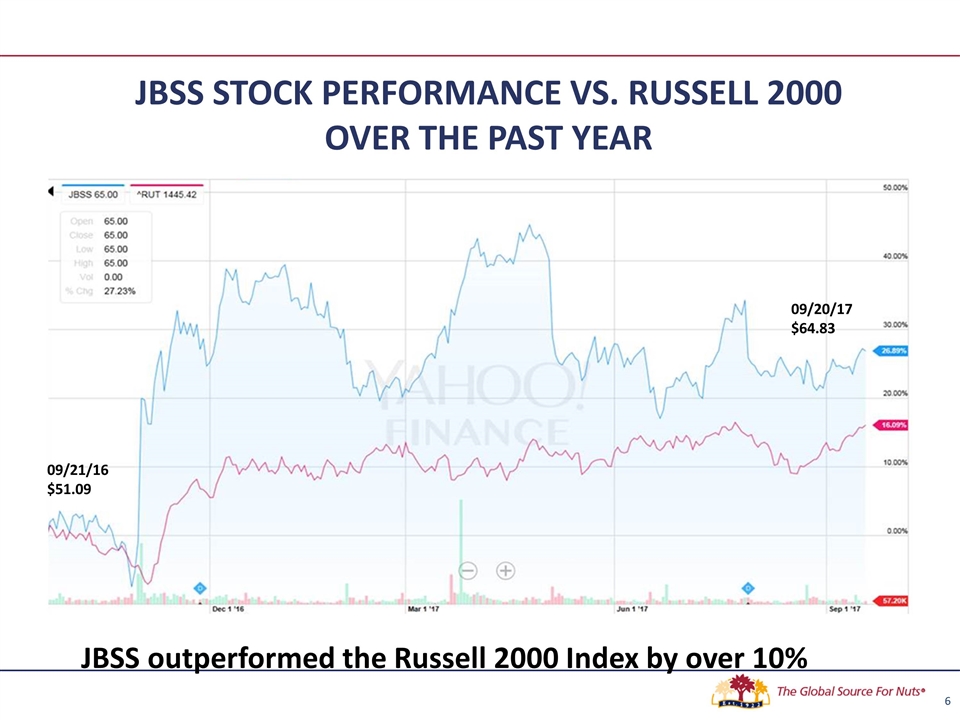

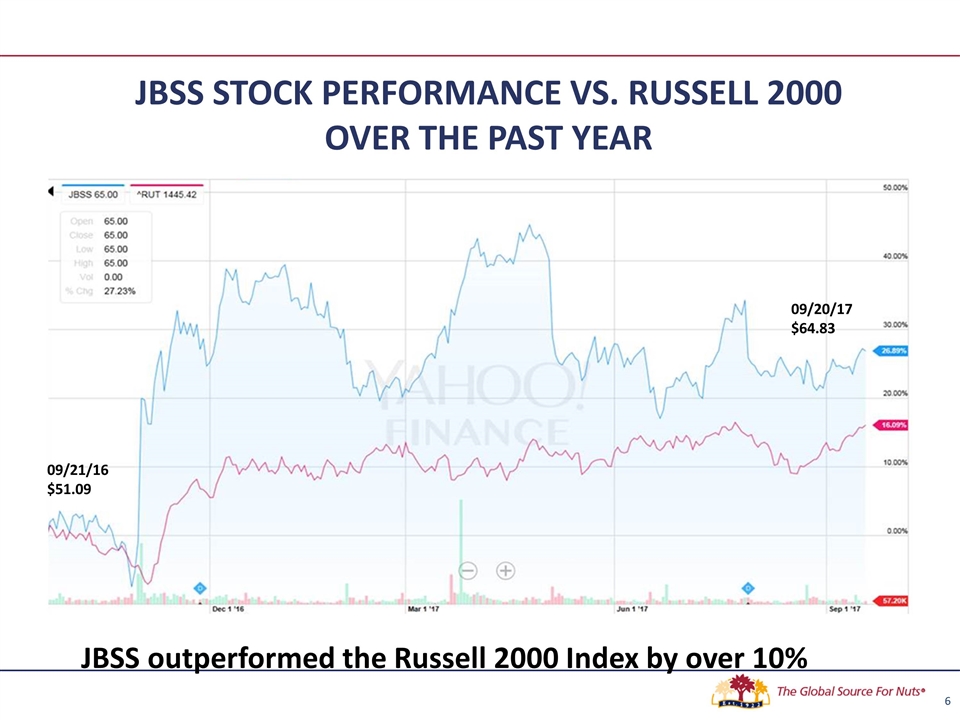

JBSS STOCK PERFORMANCE vs. RUSSELL 2000 OVER THE PAST YEAR 6 JBSS outperformed the Russell 2000 Index by over 10% 09/21/16 $51.09 09/20/17$64.83

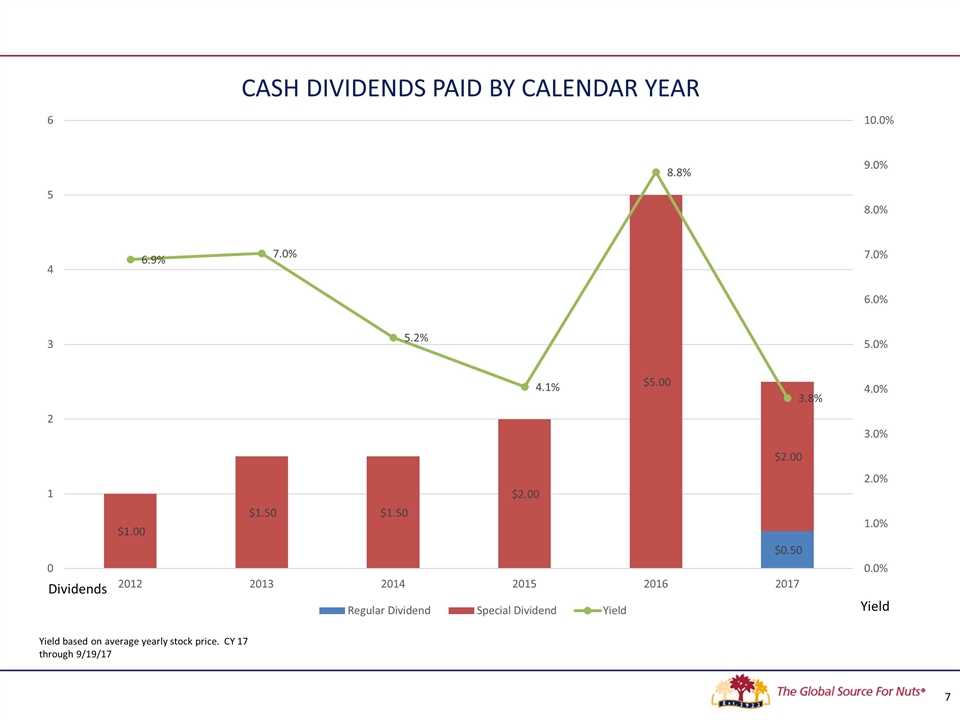

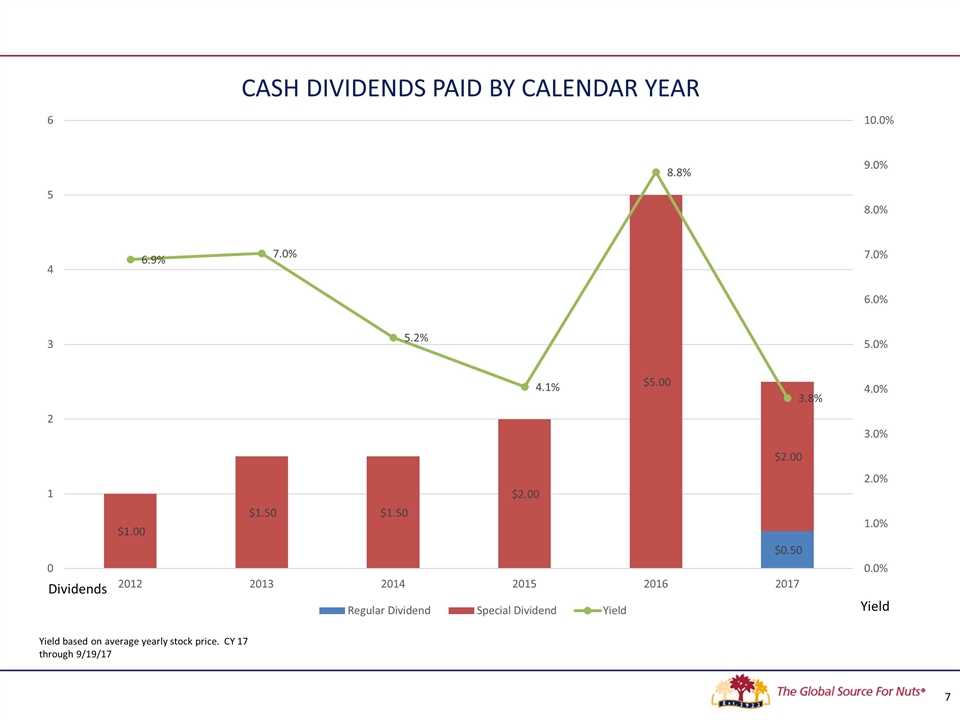

Yield based on average yearly stock price. CY 17 through 9/19/17

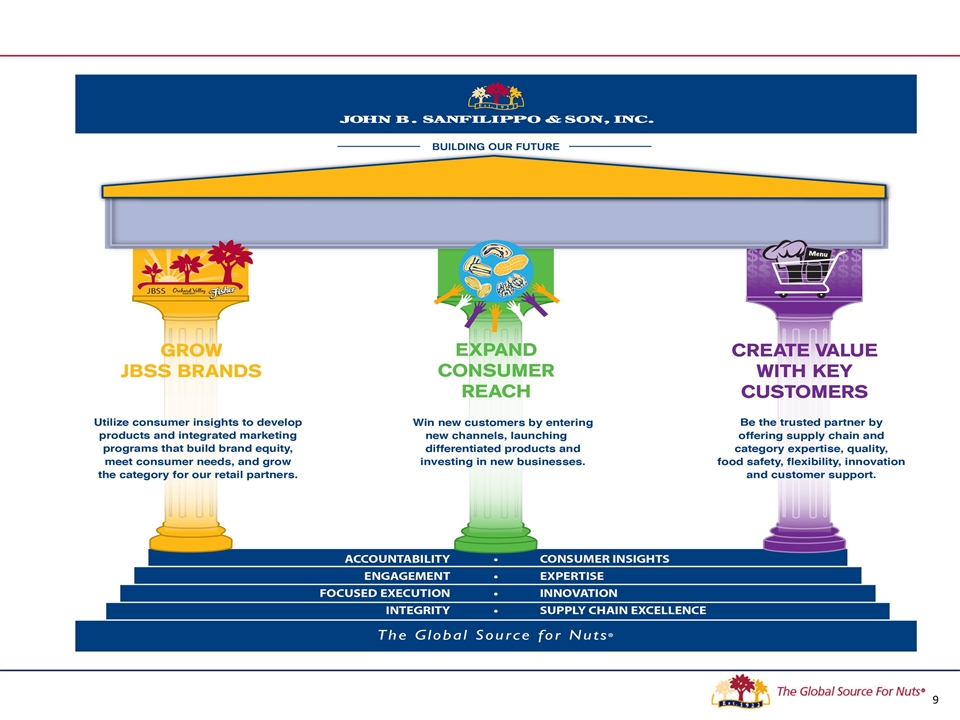

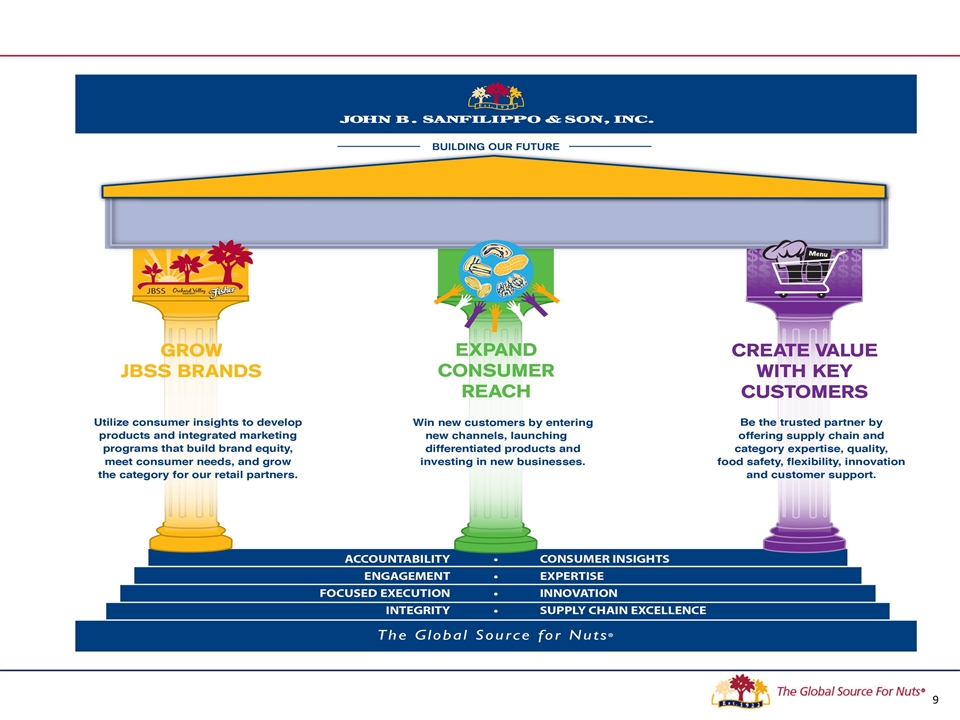

Strategy update

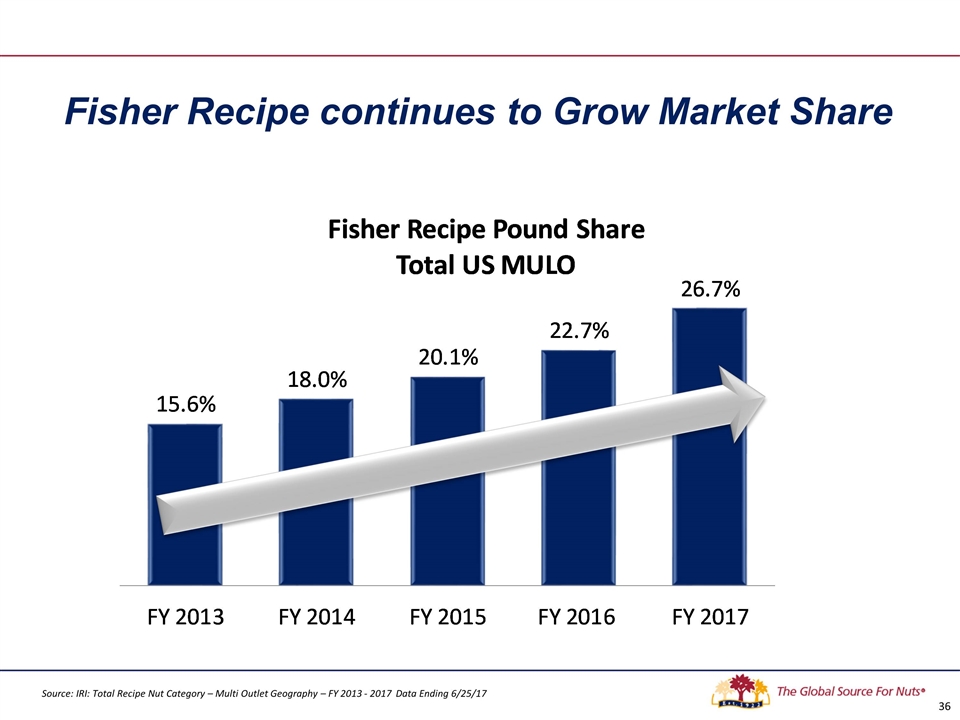

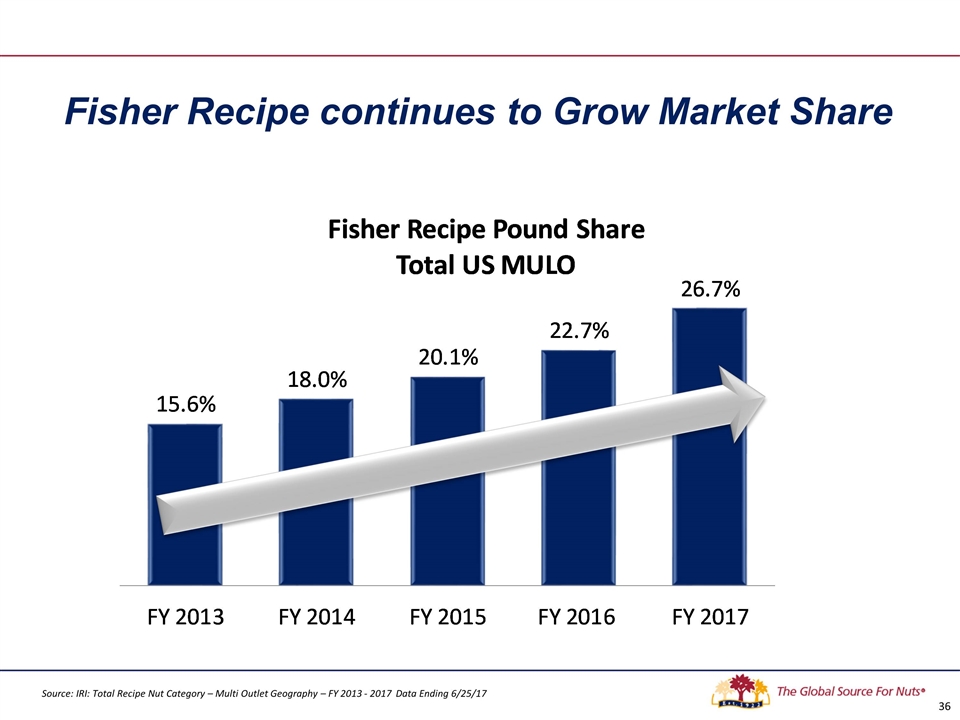

Fisher recipe nuts continued its share leadership of the recipe nut category by increasing pound market share by +4.0 points Increased market share and distribution in the produce nut category with OVH products FY 2017 Accomplishments Source : IRI FY Ending 6/25/17 Total US MULO for Recipe Nuts ; Fisher Core (Milwaukee, Minneapolis, Chicago, and St Louis) MULO for Fisher Snack

Launched 60+ new items with our private brand partners Expanded Fisher brand awareness and distribution in the Commercial Ingredients channel Obtained new snack bite business with our contract packing customers to fully utilize our cluster line in FY 2018 FY 2017 Accomplishments

Launched 100+ Fisher and Orchard Valley Harvest products on eCommerce sites Expanded Fisher and Orchard Valley Harvest in vending Started testing in dollar store channel FY 2017 Accomplishments

Nut category review 13

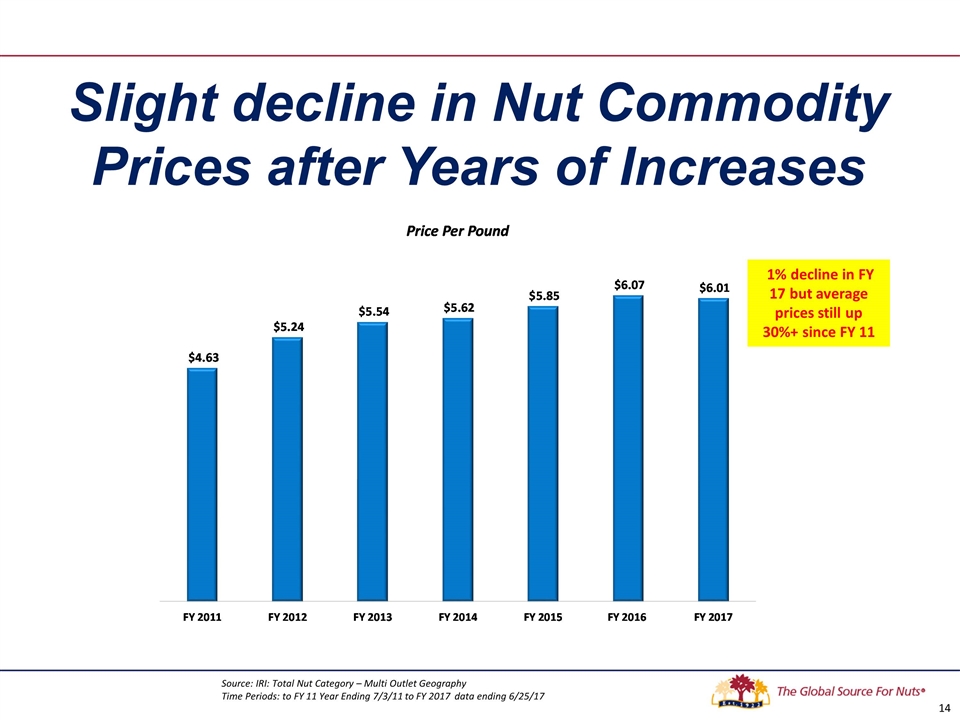

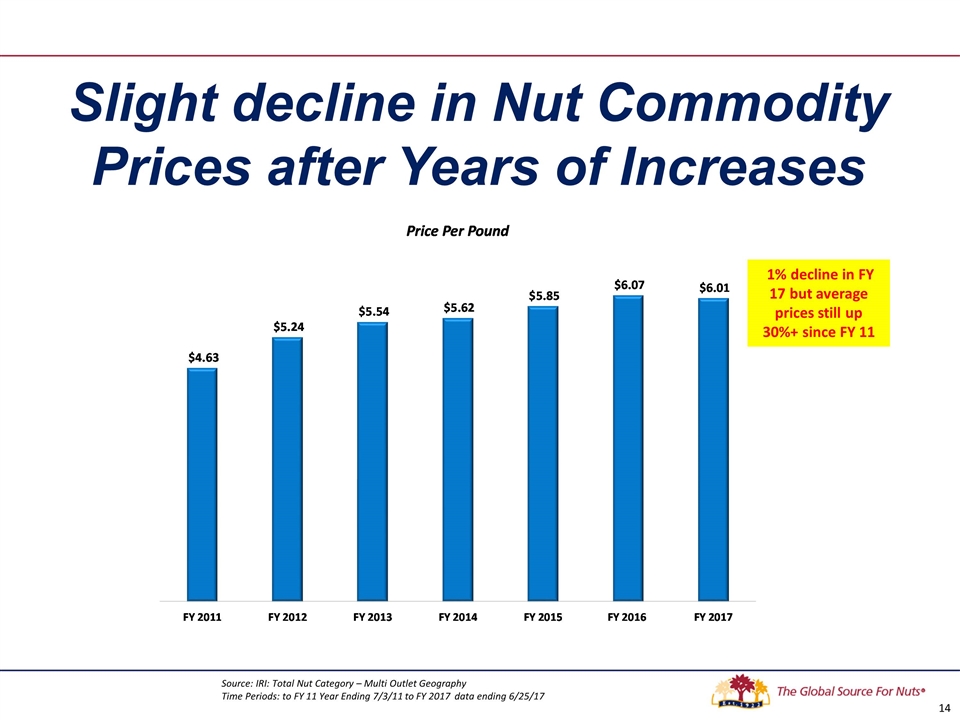

Slight decline in Nut Commodity Prices after Years of Increases Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: to FY 11 Year Ending 7/3/11 to FY 2017 data ending 6/25/17 1% decline in FY 17 but average prices still up 30%+ since FY 11

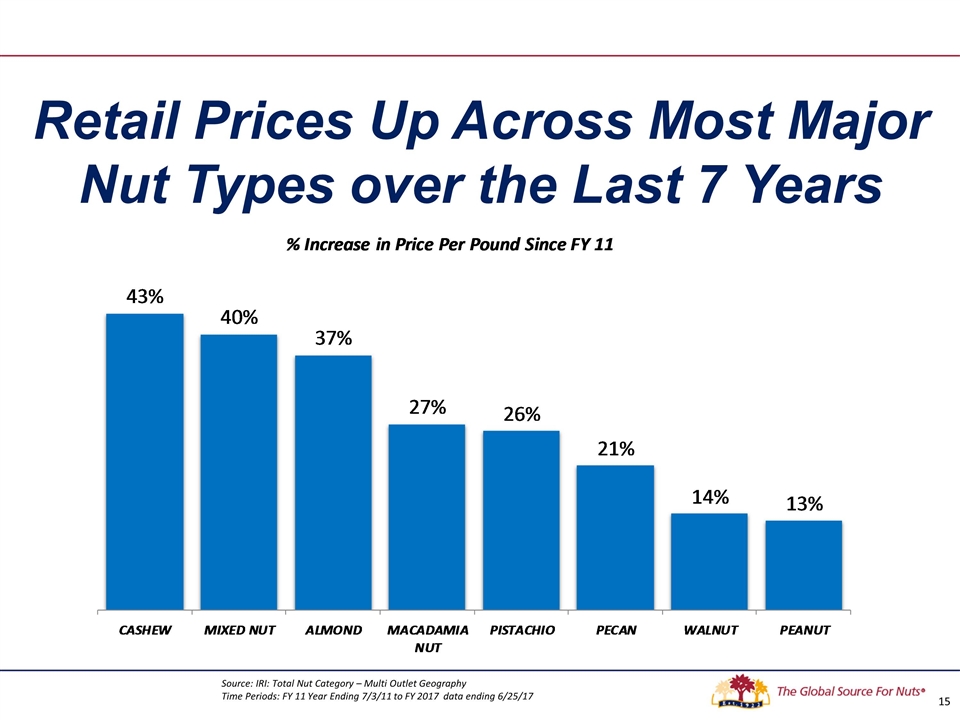

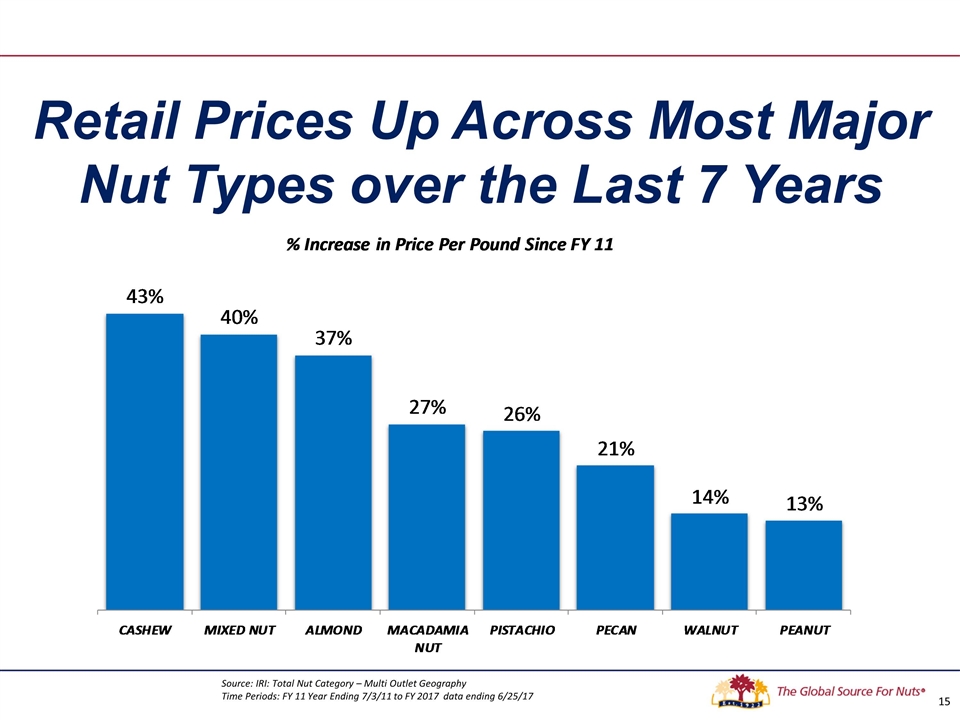

Retail Prices Up Across Most Major Nut Types over the Last 7 Years Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: FY 11 Year Ending 7/3/11 to FY 2017 data ending 6/25/17

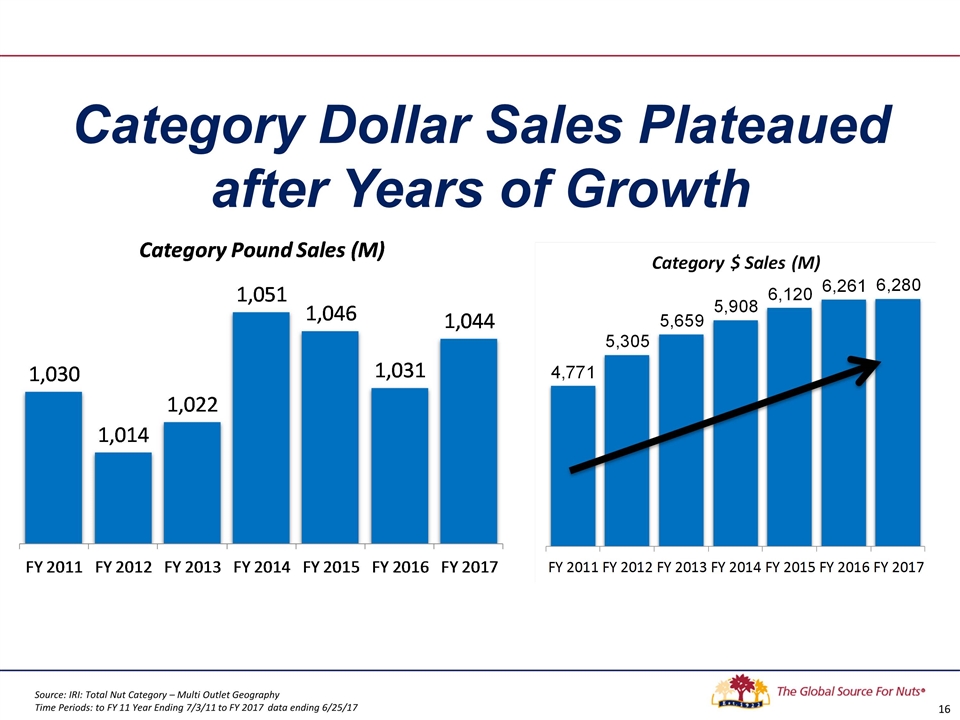

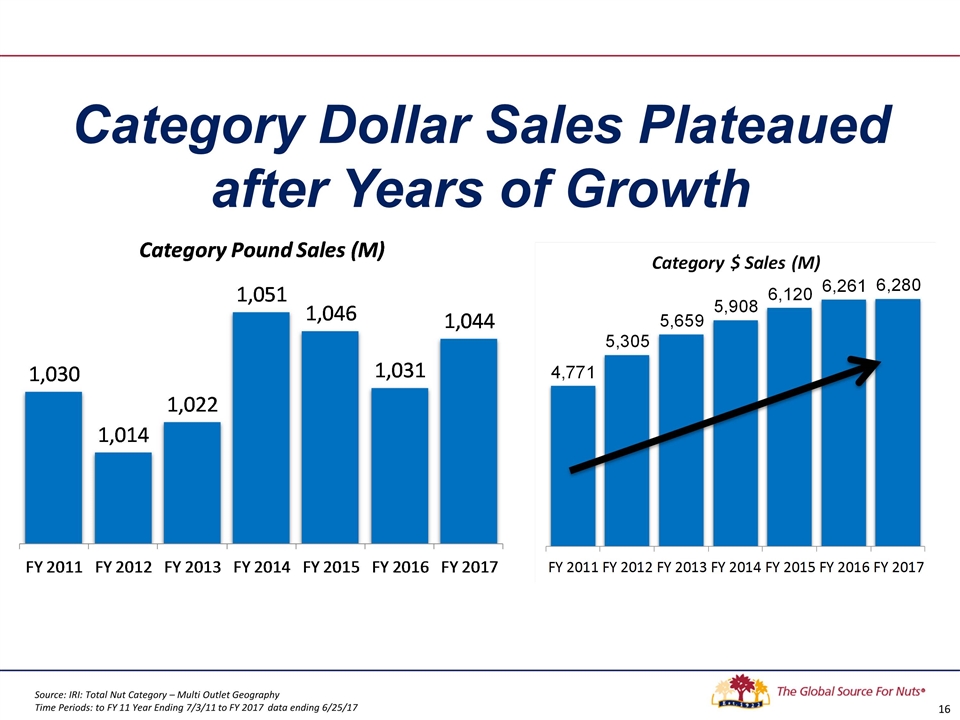

Category Dollar Sales Plateaued after Years of Growth Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: to FY 11 Year Ending 7/3/11 to FY 2017 data ending 6/25/17

SALES CHANNEL UPDATES 17

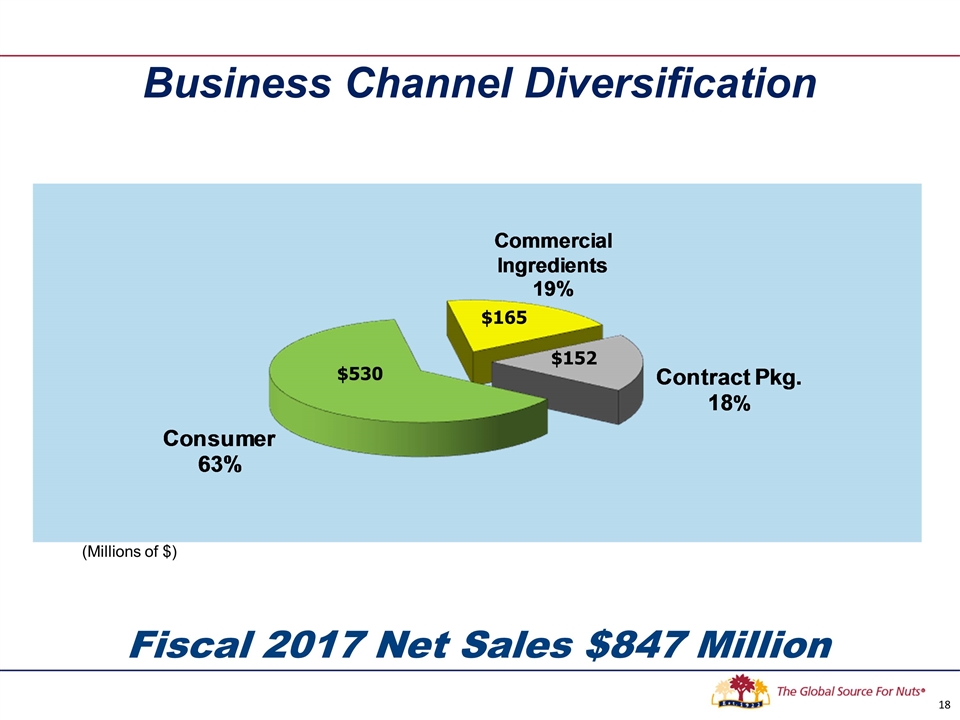

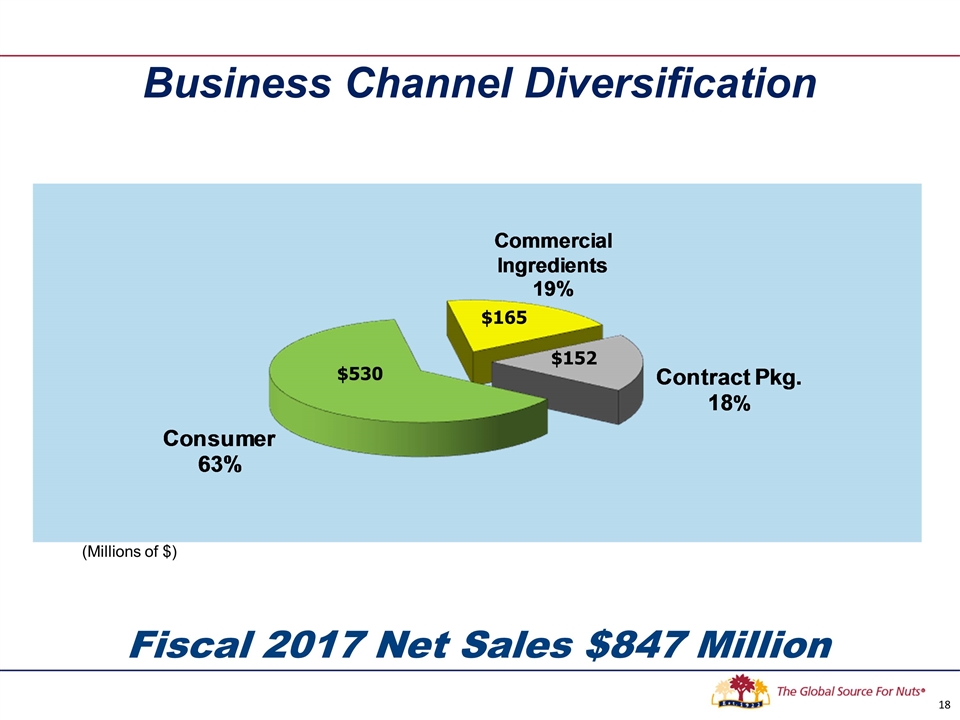

$530 Fiscal 2017 Net Sales $847 Million Business Channel Diversification (Millions of $) $165 $152

Fiscal 2017 Net Sales $530 Million FY 2017 Consumer Channel vs. FY 16 -6.4%

Fiscal 2017 Net Sales $165 Million FY 2017 Commercial Ingredients Channel vs. FY 16 -32.6%

FY 2017 Contract Packaging Channel Fiscal 2017 Net Sales $152 Million

FY 2017 financial milestones

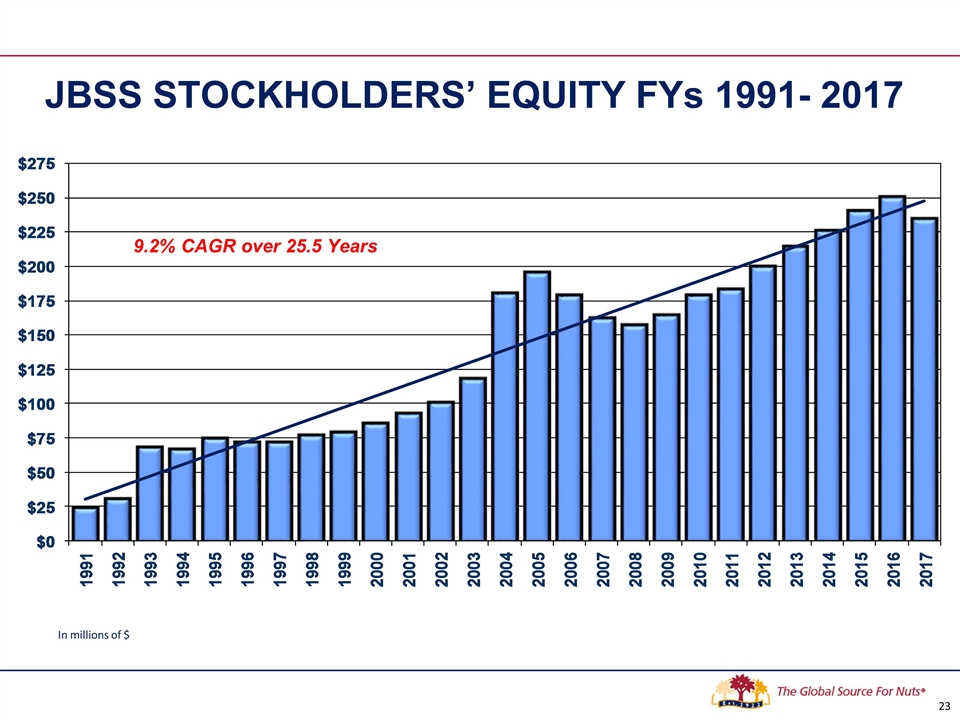

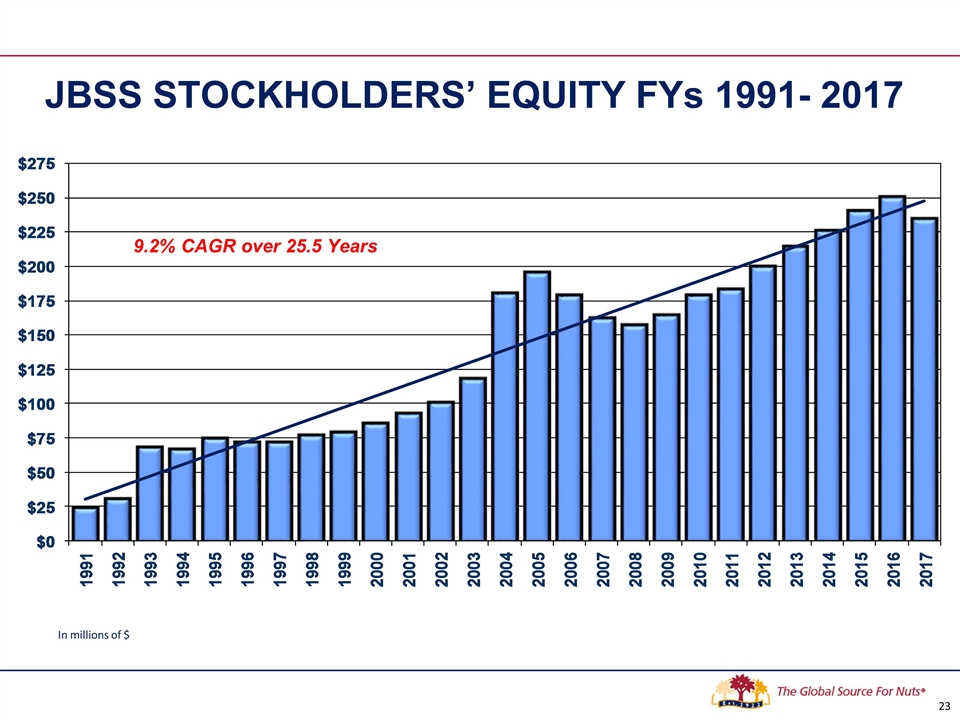

JBSS STOCKHOLDERS’ EQUITY FYs 1991- 2017 In millions of $ 9.2% CAGR over 25.5 Years

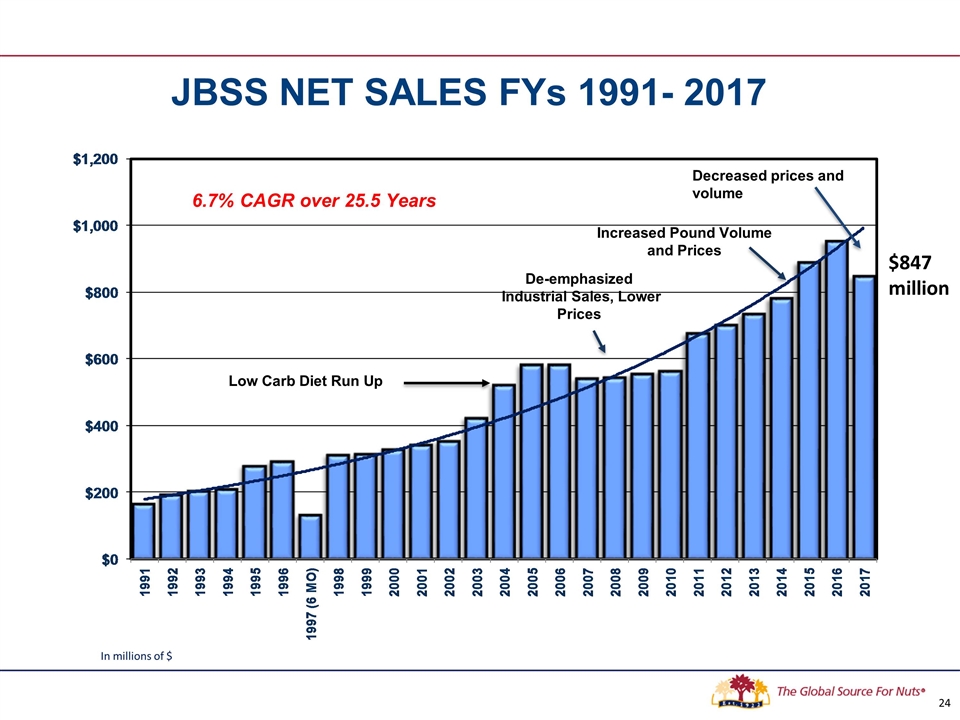

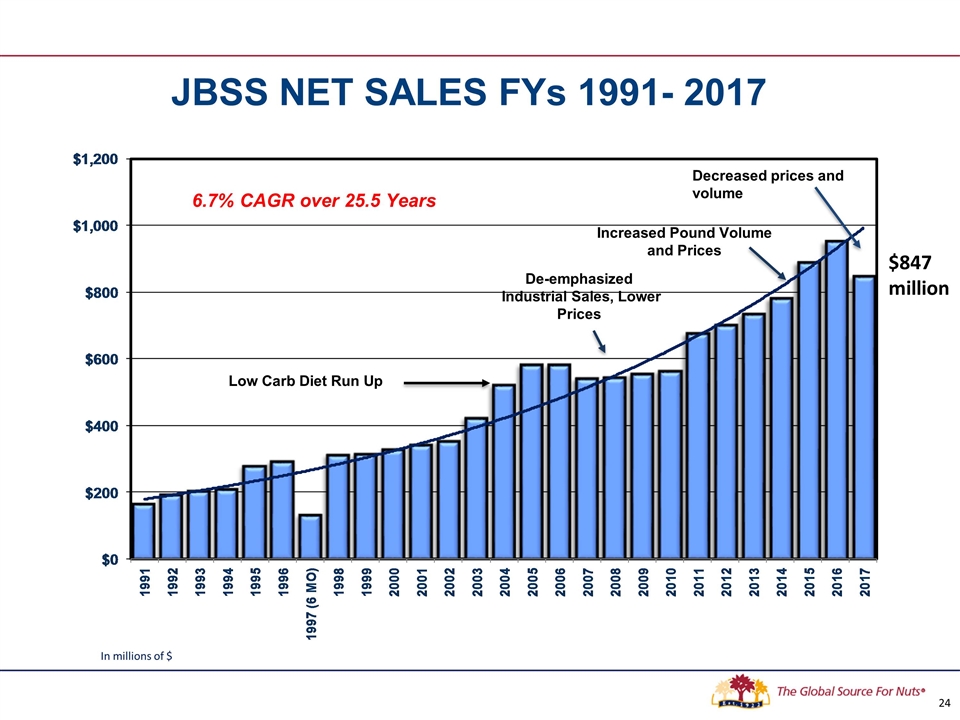

JBSS Net Sales FYs 1991- 2017 Increased Pound Volume and Prices De-emphasized Industrial Sales, Lower Prices Low Carb Diet Run Up $847 million In millions of $ Decreased prices and volume 6.7% CAGR over 25.5 Years

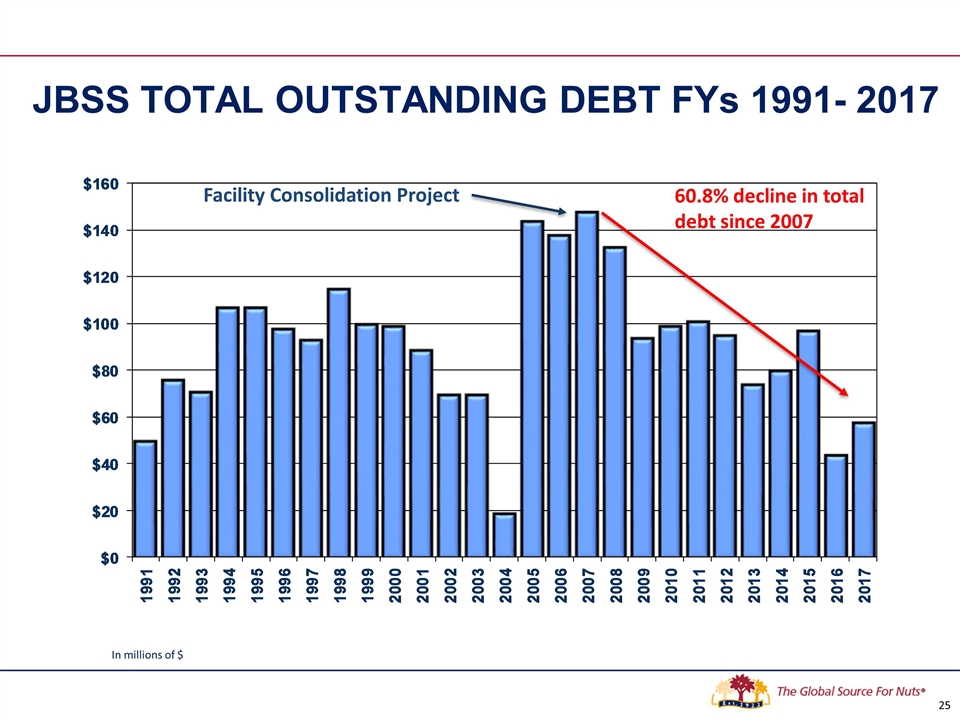

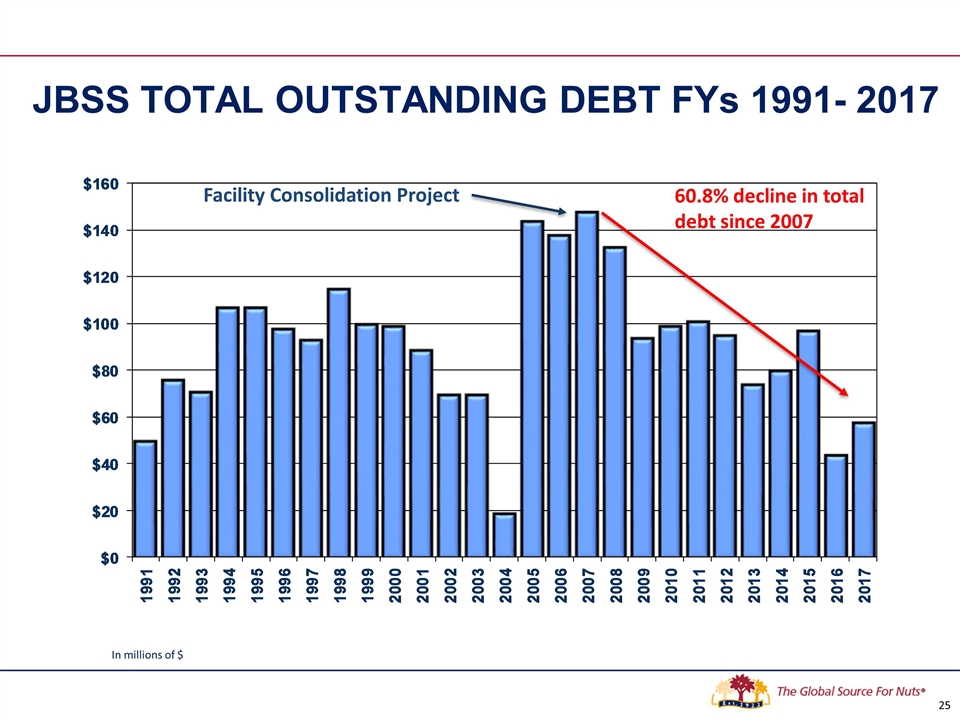

JBSS Total Outstanding Debt FYs 1991- 2017 In millions of $ Facility Consolidation Project 60.8% decline in total debt since 2007

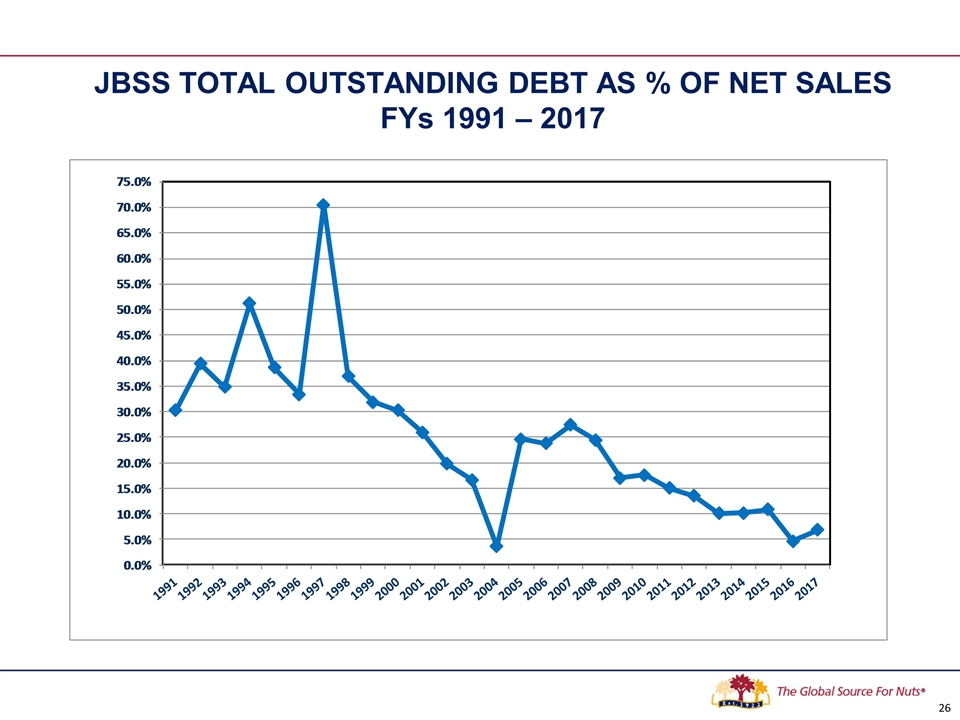

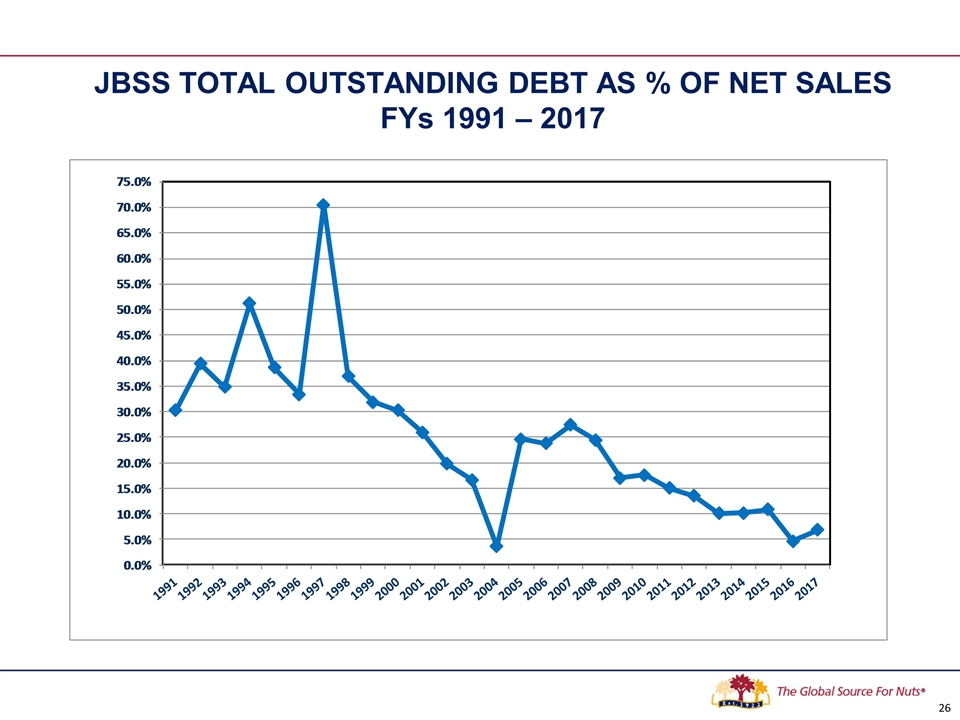

JBSS Total Outstanding Debt As % of Net Sales FYs 1991 – 2017

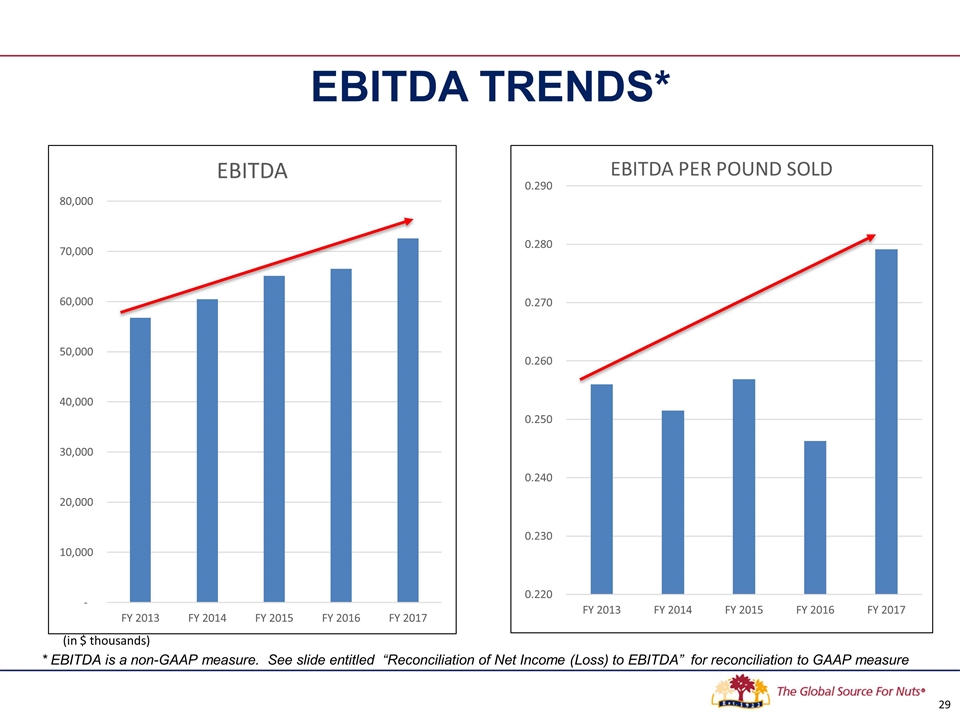

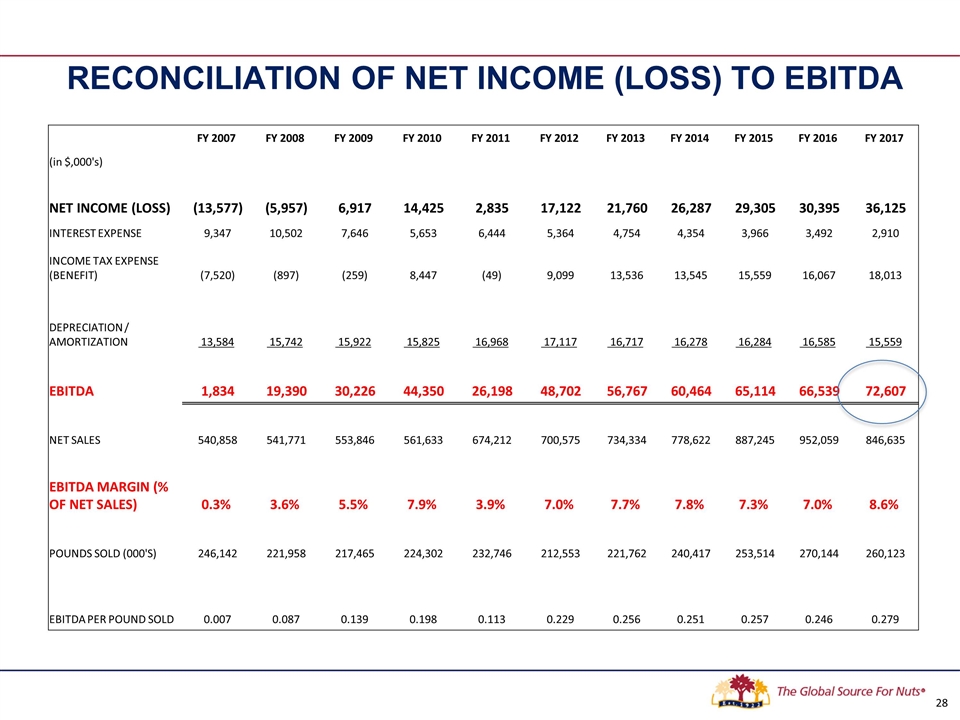

EBITDA EBITDA consists of earnings before interest, taxes, depreciation, amortization and noncontrolling interest. EBITDA is not a measurement of financial performance under accounting principles generally accepted in the United States of America ("GAAP"), and does not represent cash flow from operations. EBITDA is presented solely as a supplemental disclosure because management believes that it is important in evaluating JBSS's financial performance and market valuation. In conformity with Regulation G, a reconciliation of EBITDA to the most directly comparable financial measures calculated and presented in accordance with GAAP is presented in the following slide.

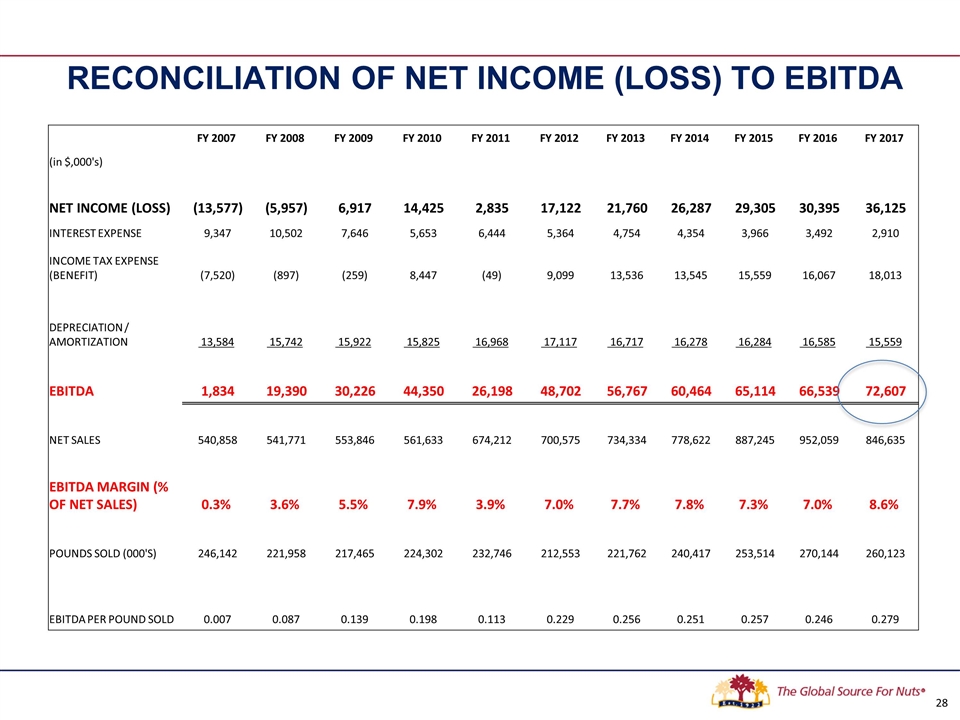

RECONCILIATION OF NET INCOME (LOSS) TO EBITDA FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 (in $,000's) NET INCOME (LOSS) (13,577) (5,957) 6,917 14,425 2,835 17,122 21,760 26,287 29,305 30,395 36,125 INTEREST EXPENSE 9,347 10,502 7,646 5,653 6,444 5,364 4,754 4,354 3,966 3,492 2,910 INCOME TAX EXPENSE (BENEFIT) (7,520) (897) (259) 8,447 (49) 9,099 13,536 13,545 15,559 16,067 18,013 DEPRECIATION / AMORTIZATION 13,584 15,742 15,922 15,825 16,968 17,117 16,717 16,278 16,284 16,585 15,559 EBITDA 1,834 19,390 30,226 44,350 26,198 48,702 56,767 60,464 65,114 66,539 72,607 NET SALES 540,858 541,771 553,846 561,633 674,212 700,575 734,334 778,622 887,245 952,059 846,635 EBITDA MARGIN (% OF NET SALES) 0.3% 3.6% 5.5% 7.9% 3.9% 7.0% 7.7% 7.8% 7.3% 7.0% 8.6% POUNDS SOLD (000'S) 246,142 221,958 217,465 224,302 232,746 212,553 221,762 240,417 253,514 270,144 260,123 EBITDA PER POUND SOLD 0.007 0.087 0.139 0.198 0.113 0.229 0.256 0.251 0.257 0.246 0.279

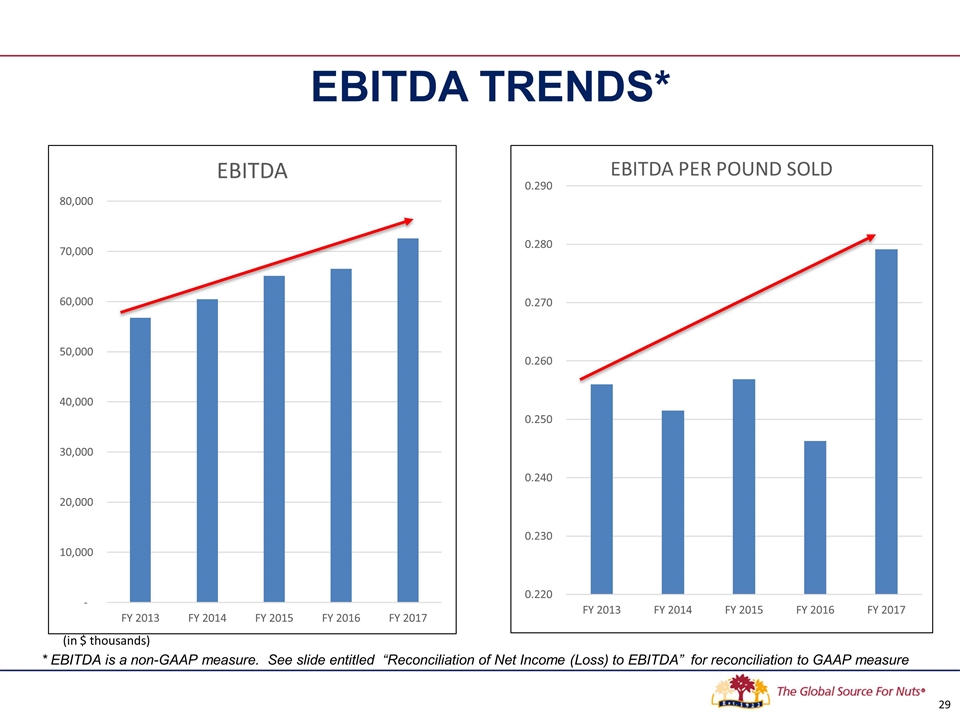

EBITDA Trends* * EBITDA is a non-GAAP measure. See slide entitled “Reconciliation of Net Income (Loss) to EBITDA” for reconciliation to GAAP measure (in $ thousands)

PEANUT AND TREE NUT SPOT MARKET PRICES VS. JBSS ROLLING 4 QTR. GROSS MARGIN %

FY 2017 Brand Marketing Overview

Snack Nuts Grow Brands Recipe Nuts

Recipe Nuts

National Distribution Hawaii Recipe Distribution As of 7/19/17

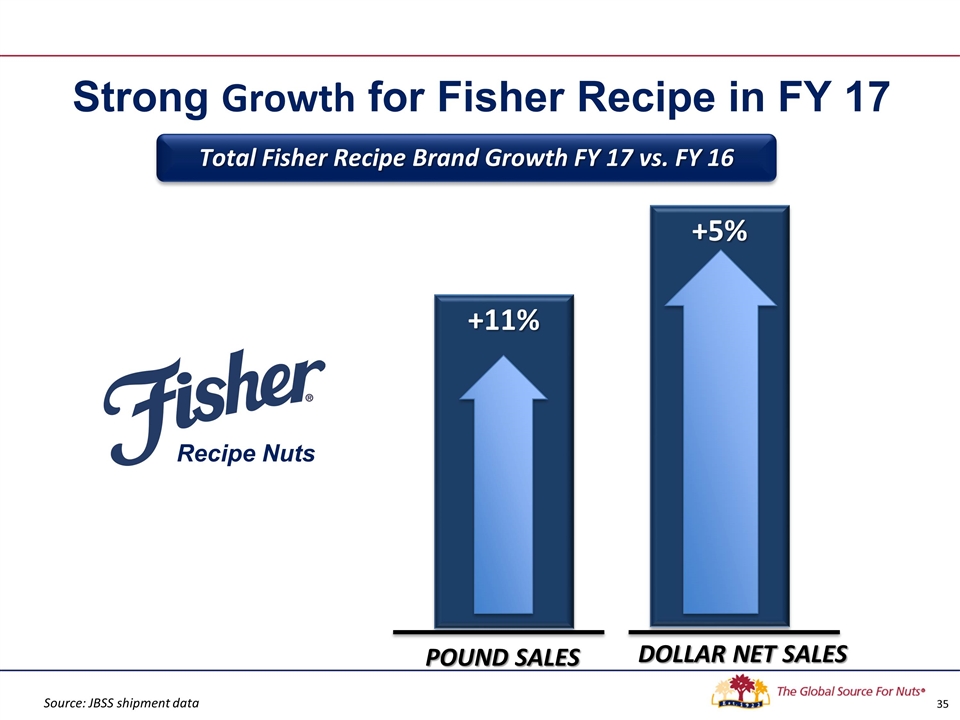

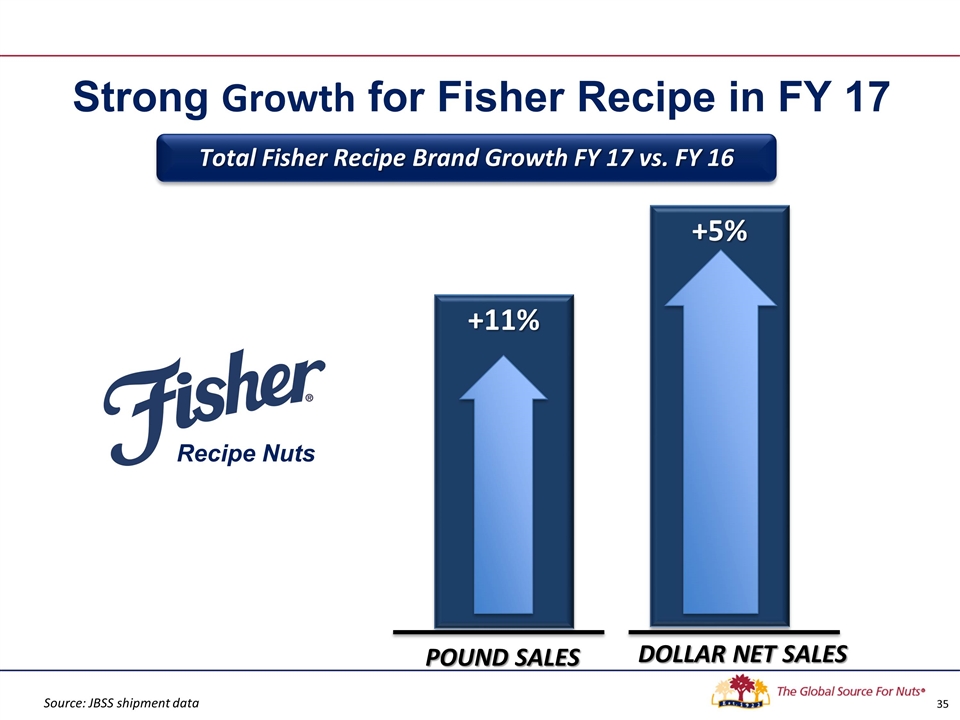

Strong Growth for Fisher Recipe in FY 17 Total Fisher Recipe Brand Growth FY 17 vs. FY 16 +11% +5% POUND SALES DOLLAR NET SALES Source: JBSS shipment data Recipe Nuts

Fisher Recipe continues to Grow Market Share Source: IRI: Total Recipe Nut Category – Multi Outlet Geography – FY 2013 - 2017 Data Ending 6/25/17

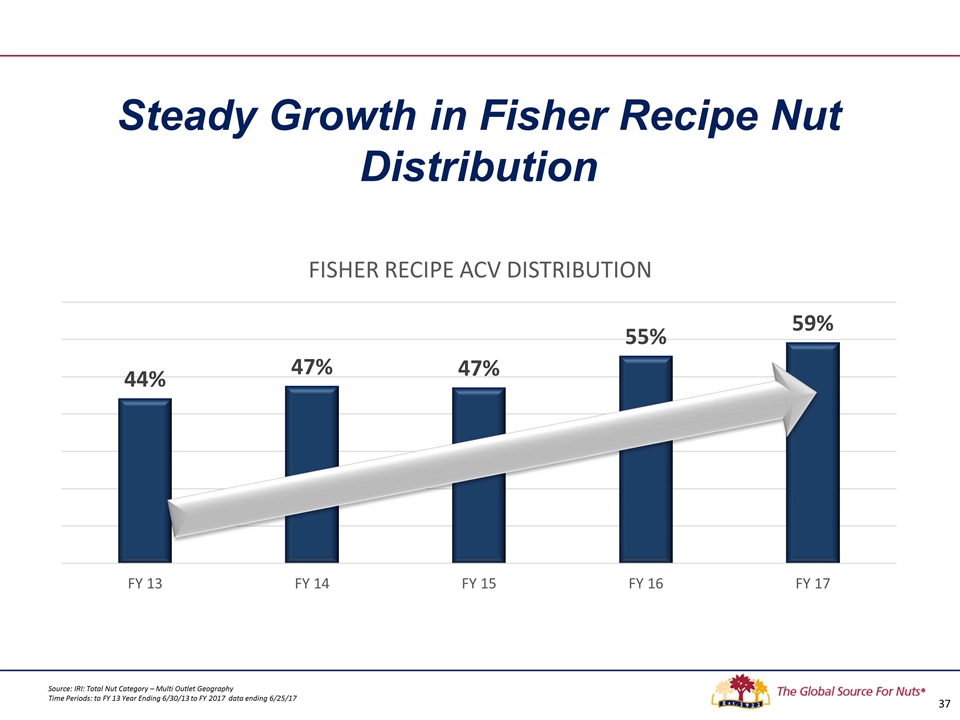

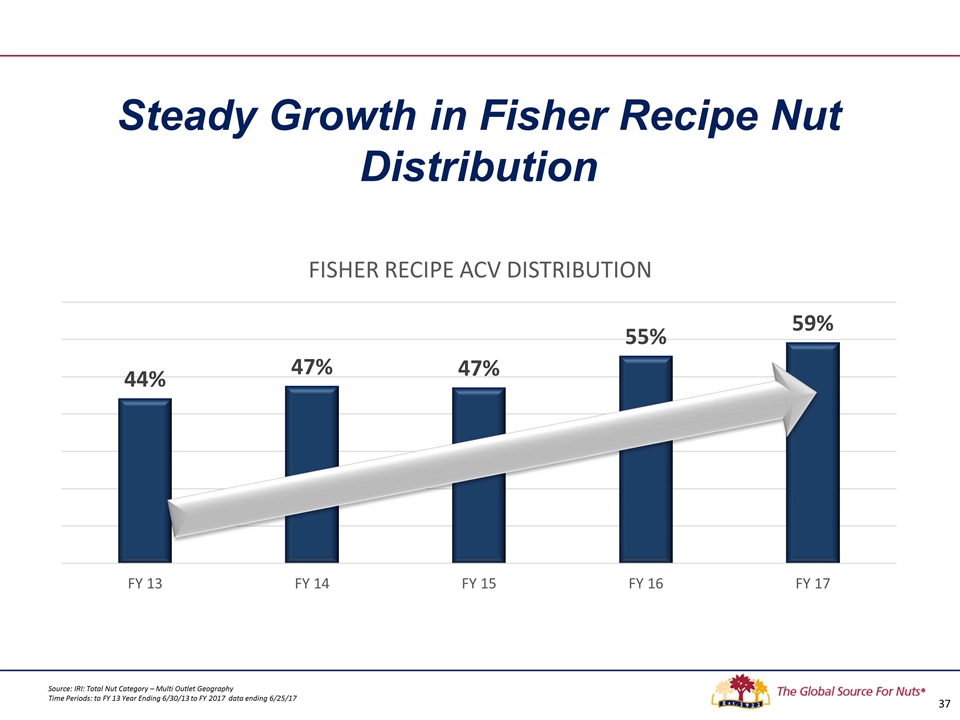

Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: to FY 13 Year Ending 6/30/13 to FY 2017 data ending 6/25/17 Steady Growth in Fisher Recipe Nut Distribution

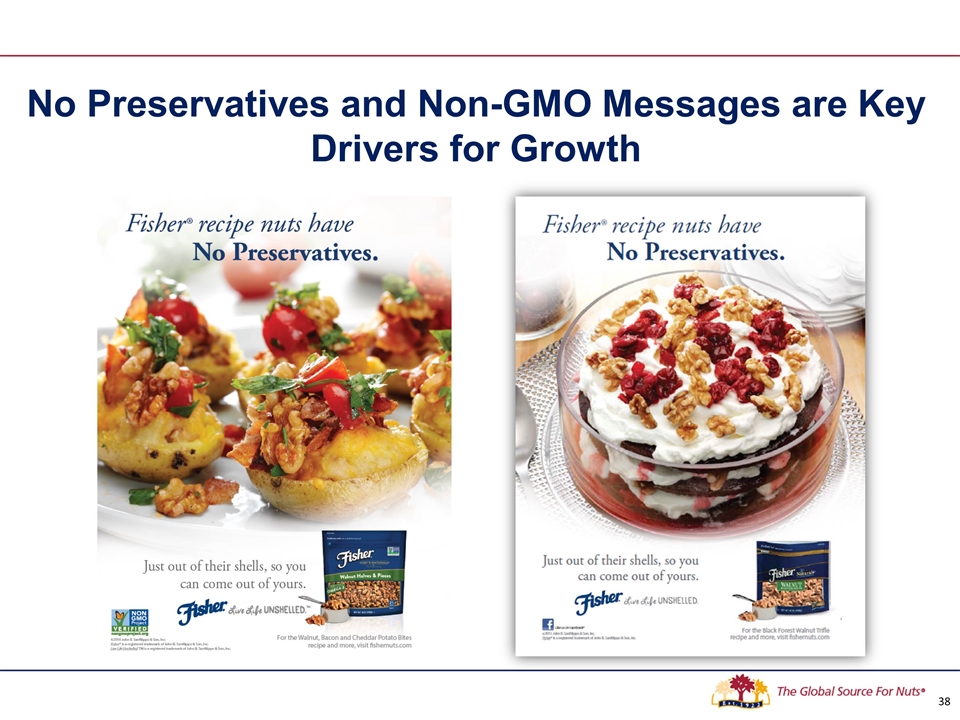

No Preservatives and Non-GMO Messages are Key Drivers for Growth

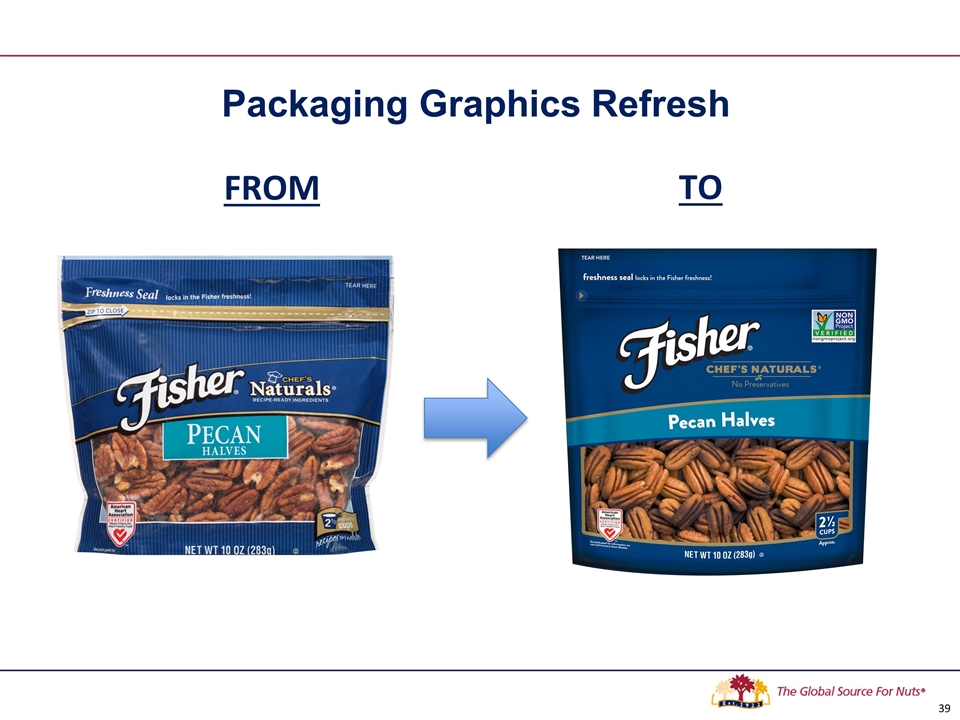

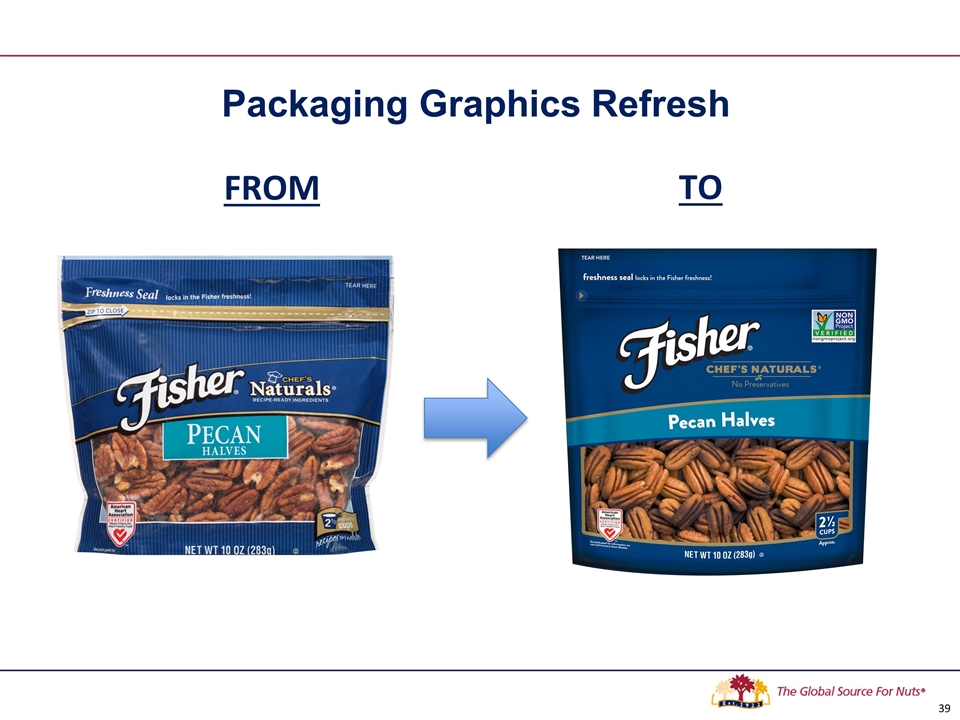

FROM TO Packaging Graphics Refresh 39

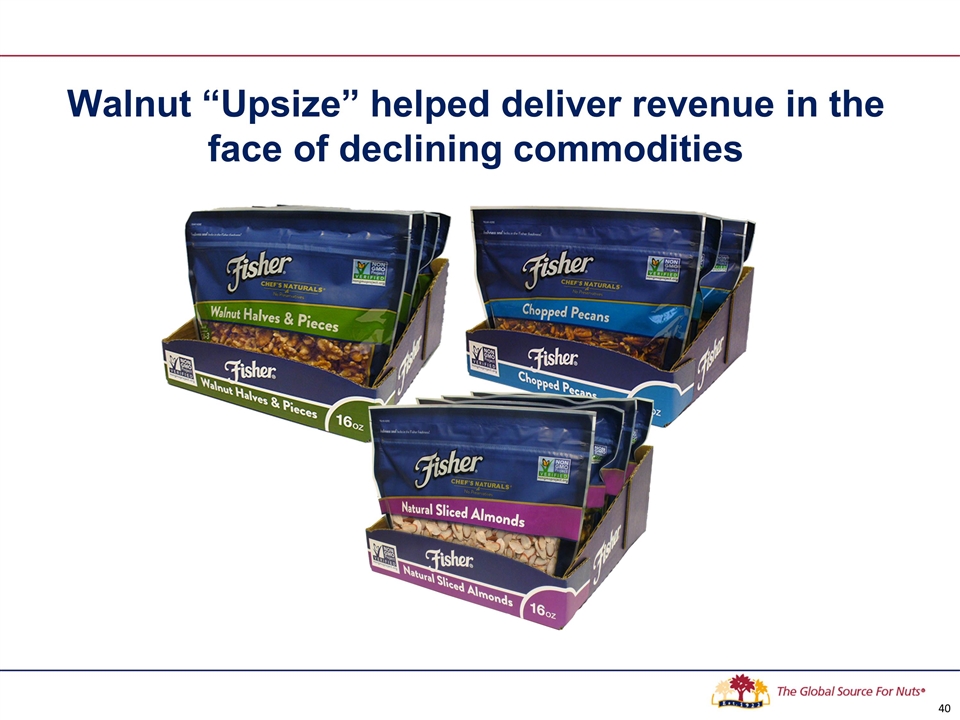

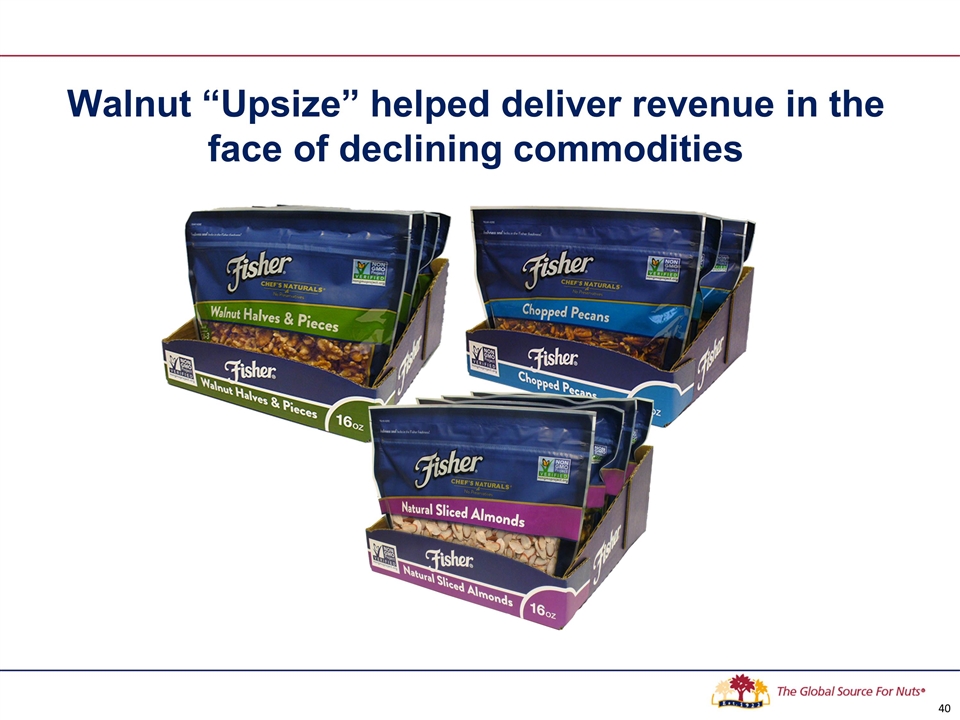

Walnut “Upsize” helped deliver revenue in the face of declining commodities 40

Continue to Build Fisher Brand Equity with Food Network Sponsorship

Integrated Marketing Key to Building Brand Equity Food Network Public Relations National Print In-Store Programs Social Media Original PR photo content created and photographed by the Fisher Fresh Thinkers Influencer Network 42

Snack Nuts

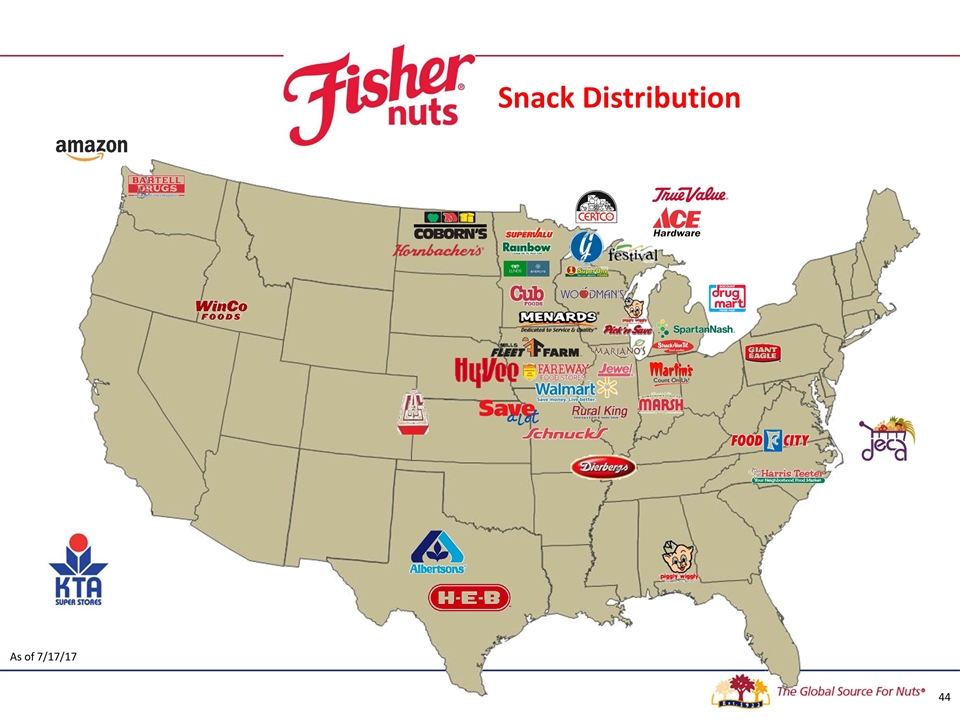

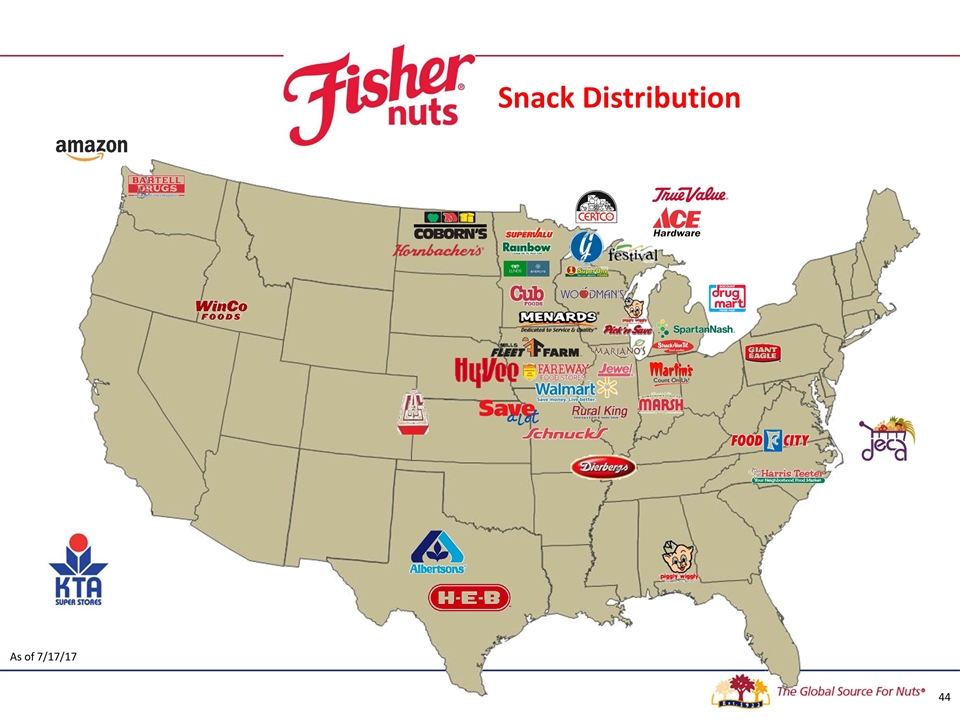

Snack Distribution As of 7/17/17

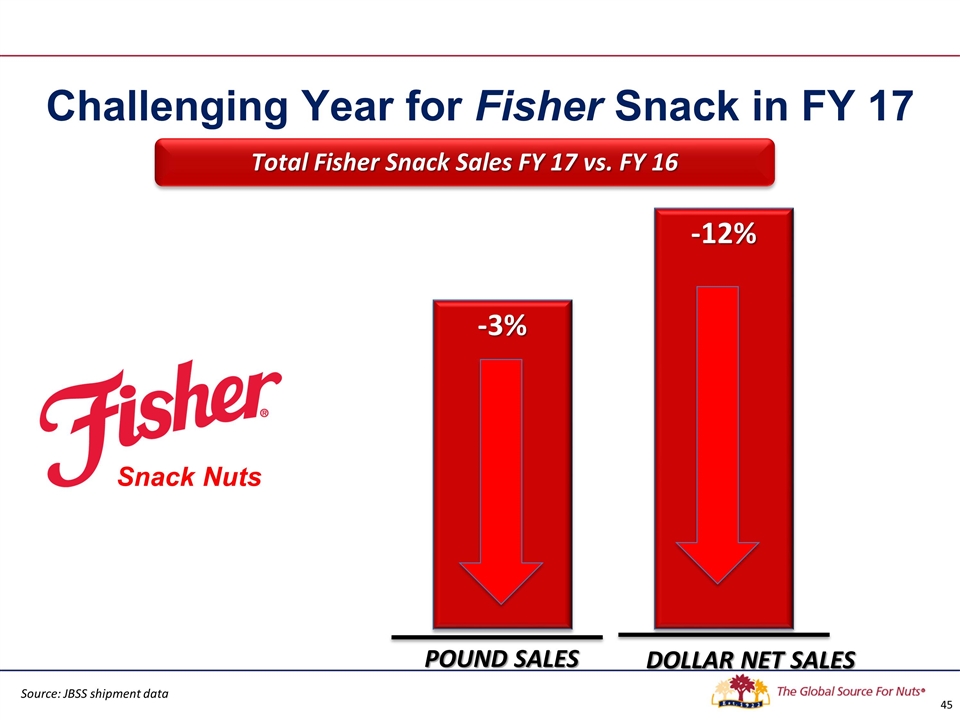

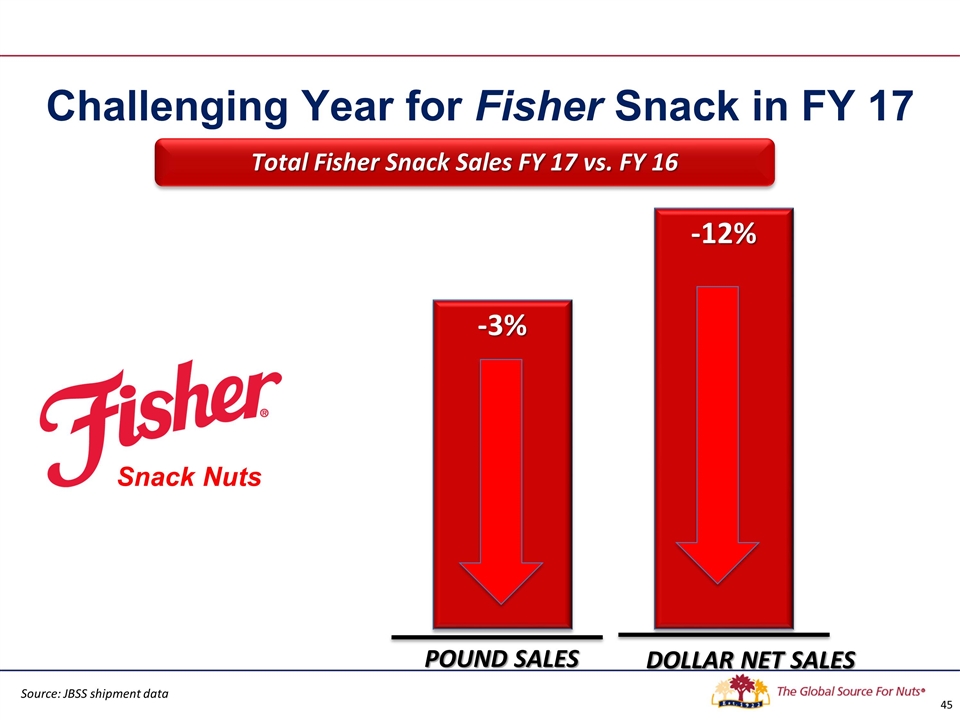

Challenging Year for Fisher Snack in FY 17 Total Fisher Snack Sales FY 17 vs. FY 16 -3% -12% POUND SALES DOLLAR NET SALES Source: JBSS shipment data Snack Nuts

Fisher Snack Nut Strategy Focuses on Midwest High Franchise Markets Snack Nuts

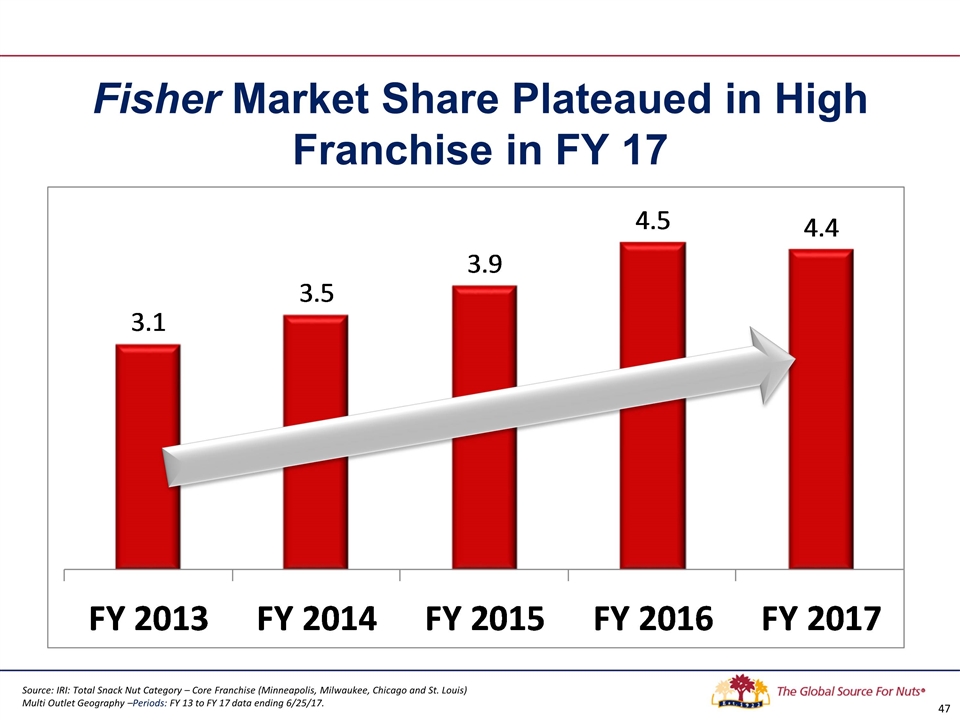

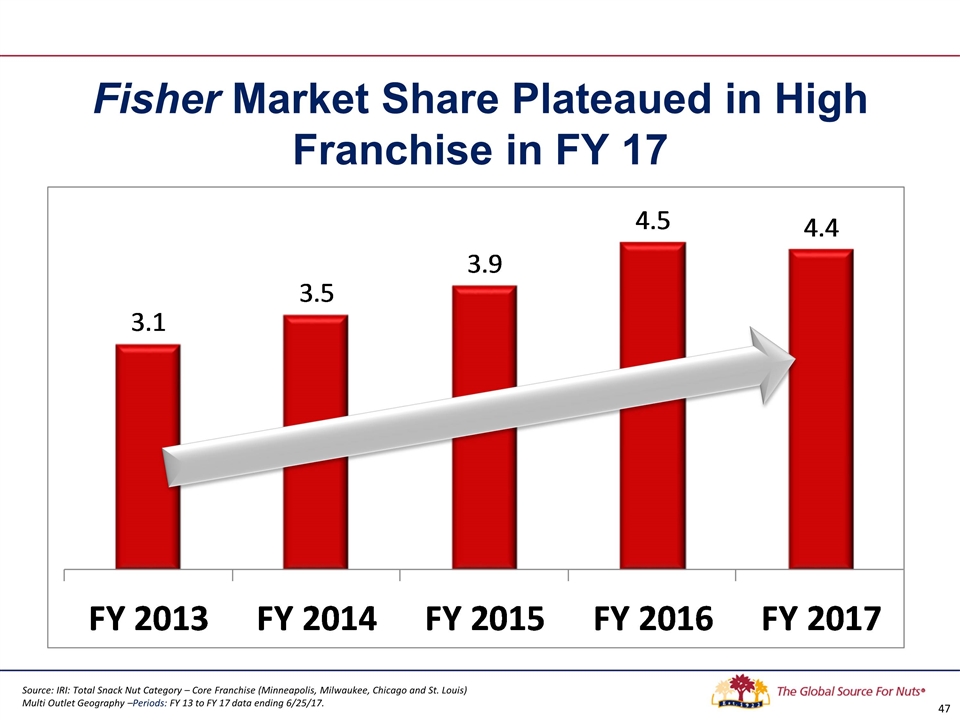

Fisher Market Share Plateaued in High Franchise in FY 17 Source: IRI: Total Snack Nut Category – Core Franchise (Minneapolis, Milwaukee, Chicago and St. Louis) Multi Outlet Geography –Periods: FY 13 to FY 17 data ending 6/25/17.

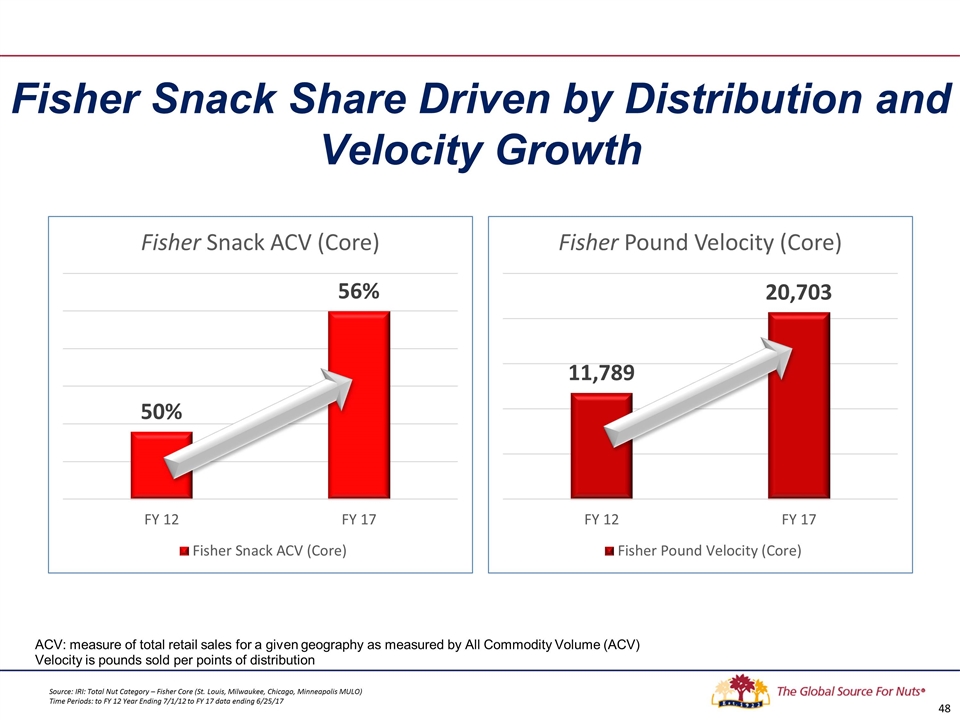

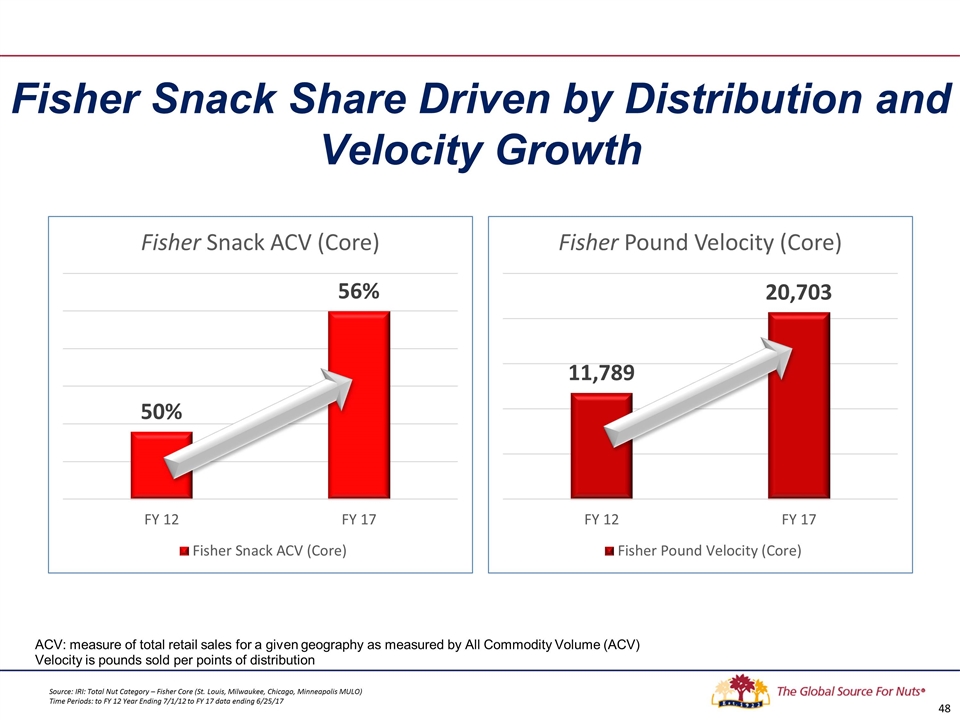

Source: IRI: Total Nut Category – Fisher Core (St. Louis, Milwaukee, Chicago, Minneapolis MULO) Time Periods: to FY 12 Year Ending 7/1/12 to FY 17 data ending 6/25/17 Fisher Snack Share Driven by Distribution and Velocity Growth ACV: measure of total retail sales for a given geography as measured by All Commodity Volume (ACV) Velocity is pounds sold per points of distribution

Driving Results on our Core Dry Roast Peanut Business

New Look for Fisher Snack Nuts

Pure and Simple Goodness

Ingredients: GLAZED PECANS (PECANS, SUGAR, SEA SALT), DRIED SWEETENED CRANBERRIES (CRANBERRIES, SUGAR, EXPELLER PRESSED SUNFLOWER OIL) ROASTED PEPITAS (PEPITAS, EXPELLER PRESSED SUNFLOWER OIL, SEA SALT). Orchard Valley Harvest is the Pure and Simple Alternative for Consumers

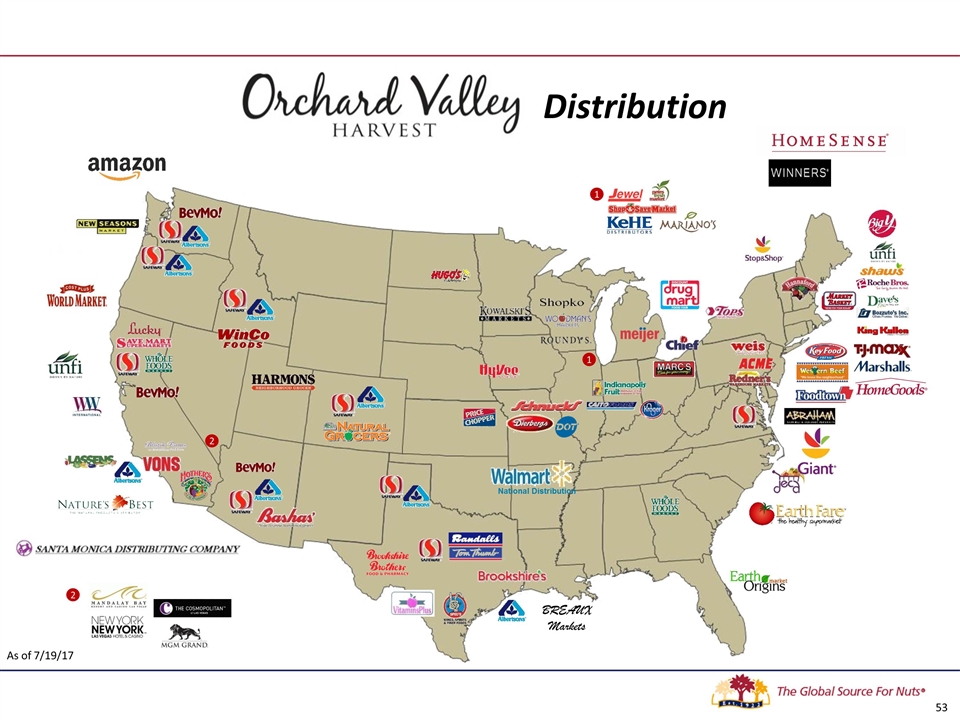

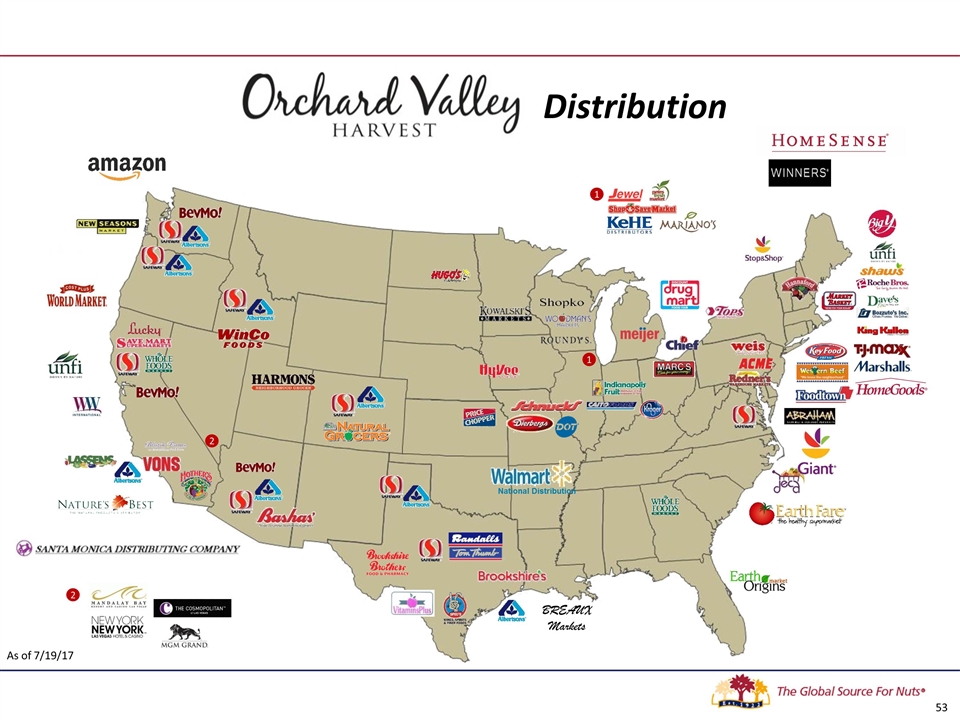

BREAUX Markets 1 1 Distribution 2 2 National Distribution Updated 7.19.17 As of 7/19/17

Strong Growth of Our Produce Brands Produce Brand Growth FY 17 vs. FY 16* +24% +29% POUND SALES DOLLAR NET SALES Source: JBSS shipment data * Includes Orchard Valley Harvest and Sunshine Country

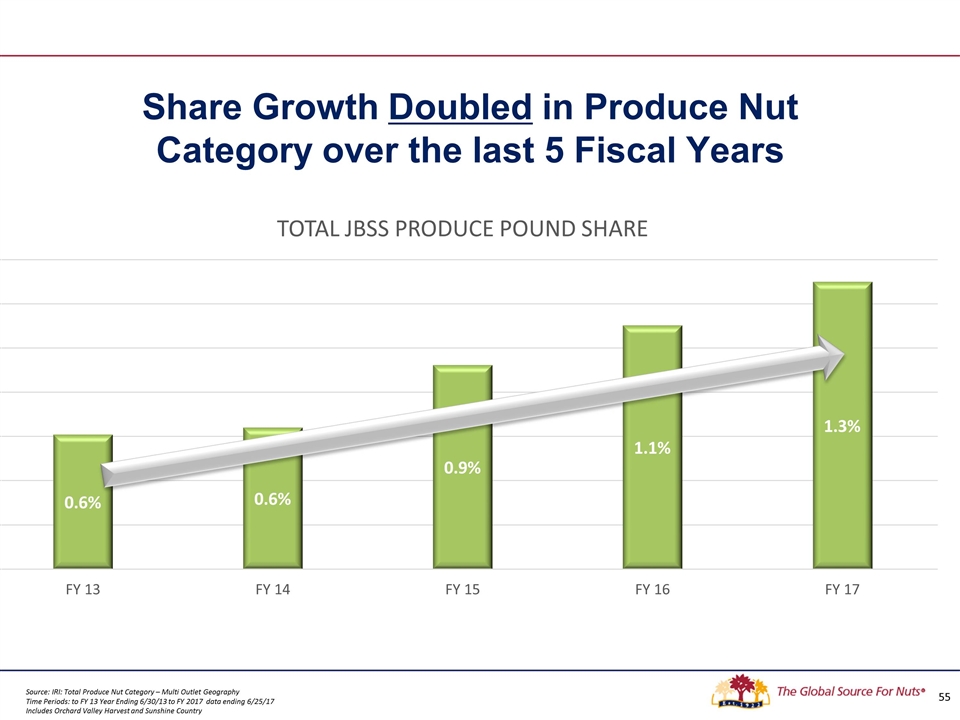

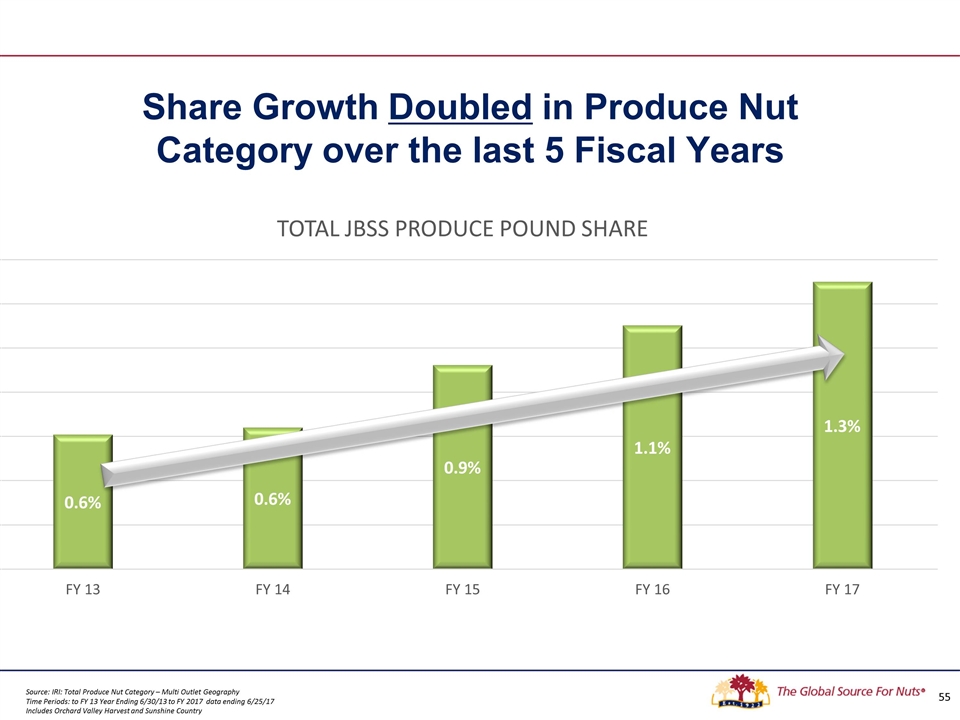

Share Growth Doubled in Produce Nut Category over the last 5 Fiscal Years Source: IRI: Total Produce Nut Category – Multi Outlet Geography Time Periods: to FY 13 Year Ending 6/30/13 to FY 2017 data ending 6/25/17 Includes Orchard Valley Harvest and Sunshine Country

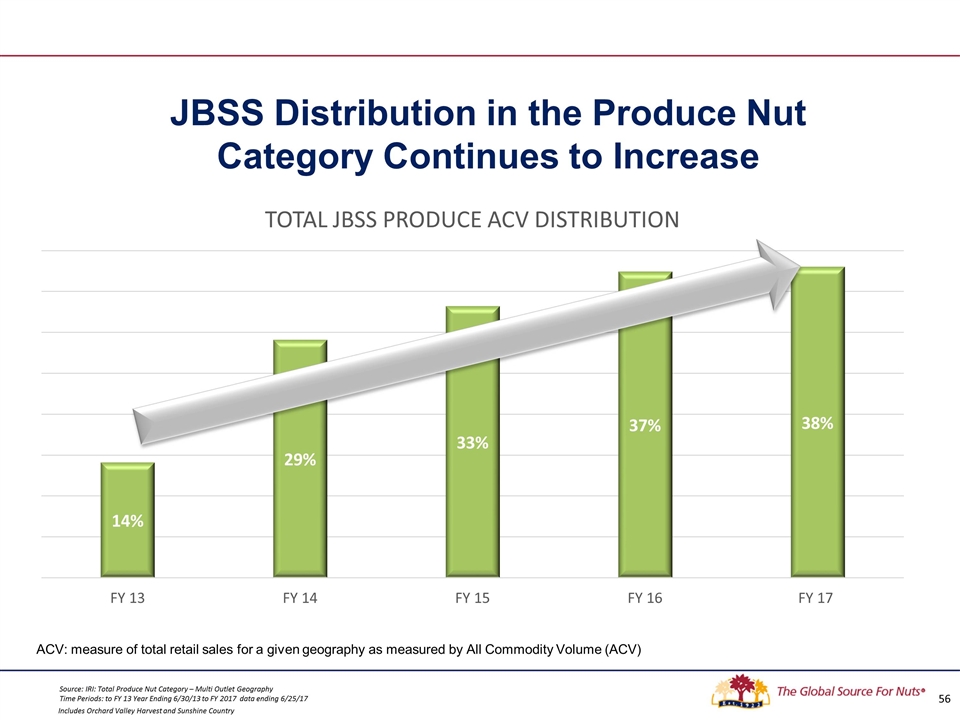

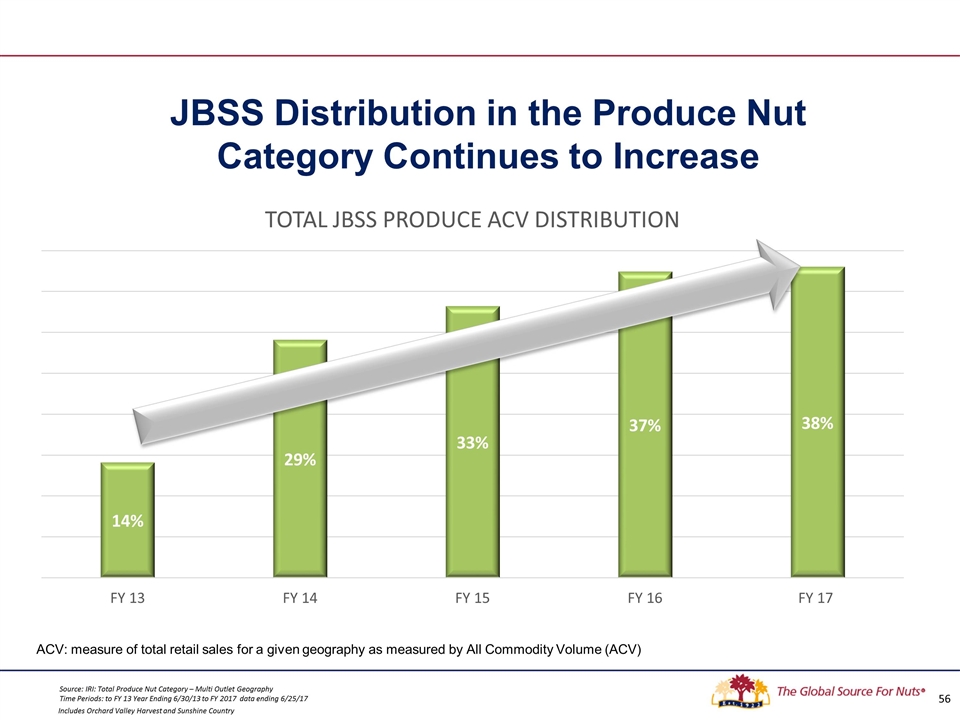

Source: IRI: Total Produce Nut Category – Multi Outlet Geography Time Periods: to FY 13 Year Ending 6/30/13 to FY 2017 data ending 6/25/17 JBSS Distribution in the Produce Nut Category Continues to Increase ACV: measure of total retail sales for a given geography as measured by All Commodity Volume (ACV) Includes Orchard Valley Harvest and Sunshine Country

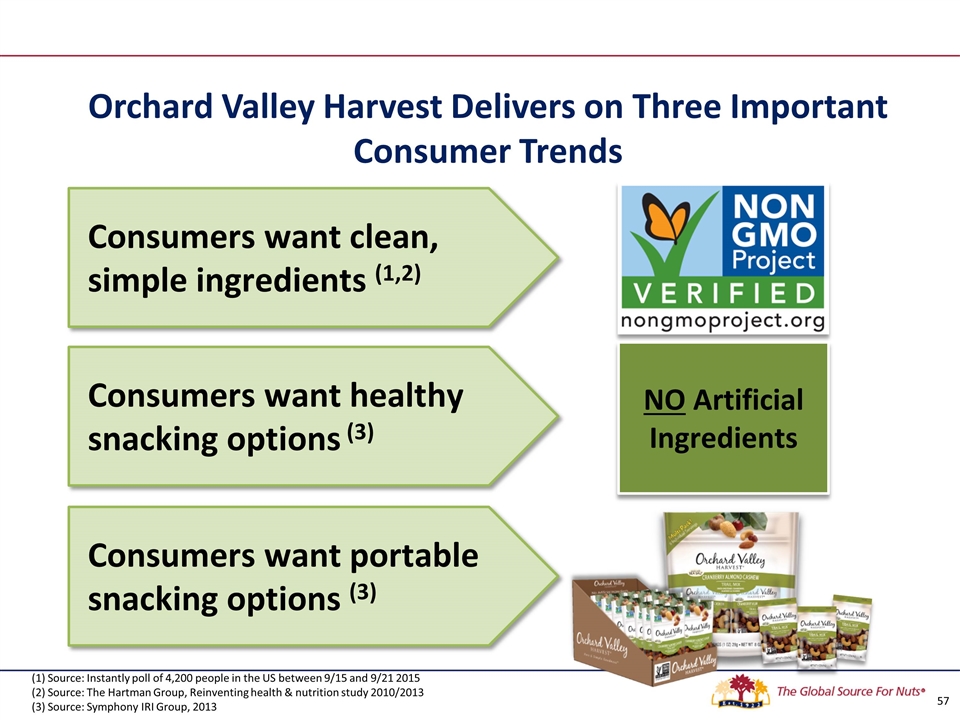

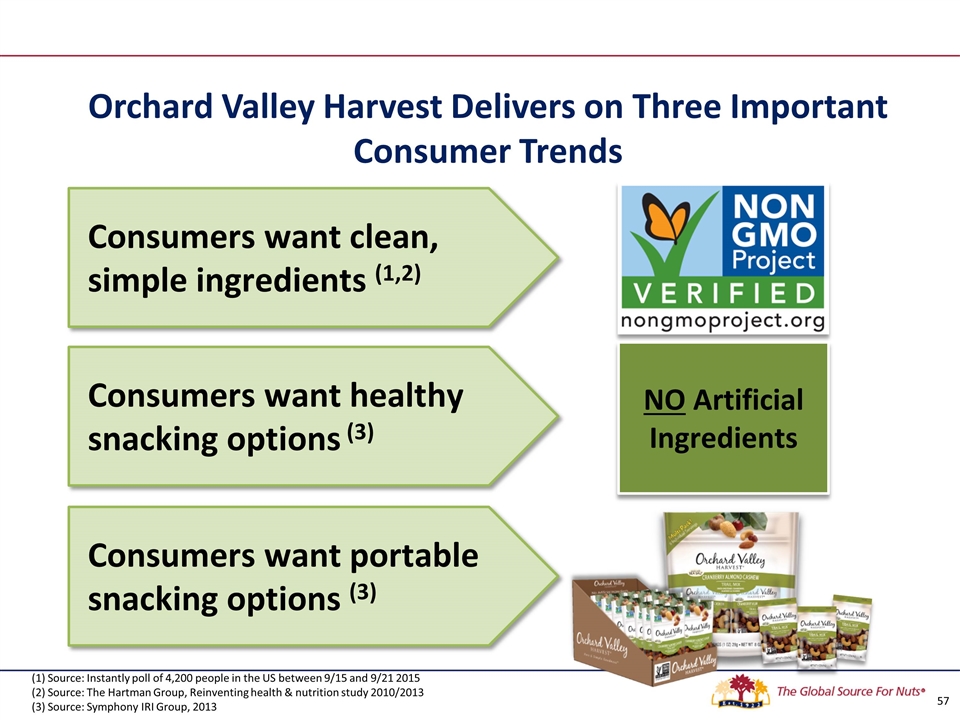

Consumers want healthy snacking options (3) (1) Source: Instantly poll of 4,200 people in the US between 9/15 and 9/21 2015 (2) Source: The Hartman Group, Reinventing health & nutrition study 2010/2013 (3) Source: Symphony IRI Group, 2013 Consumers want clean, simple ingredients (1,2) Consumers want portable snacking options (3) NO Artificial Ingredients Orchard Valley Harvest Delivers on Three Important Consumer Trends

Source: The Hartman Group : Eating Occasions, Compass 2012 The Hartman Group: Reimagining Health and Wellness, 2013 Snacking accounts for over 53% of all eating occasions in the U.S. 38% of consumers snack several times per day Multi-Packs and Grab ‘n Go Mini’s We Continue to Expand our Portfolio to Address Consumer Demand for On-The-Go Goodness

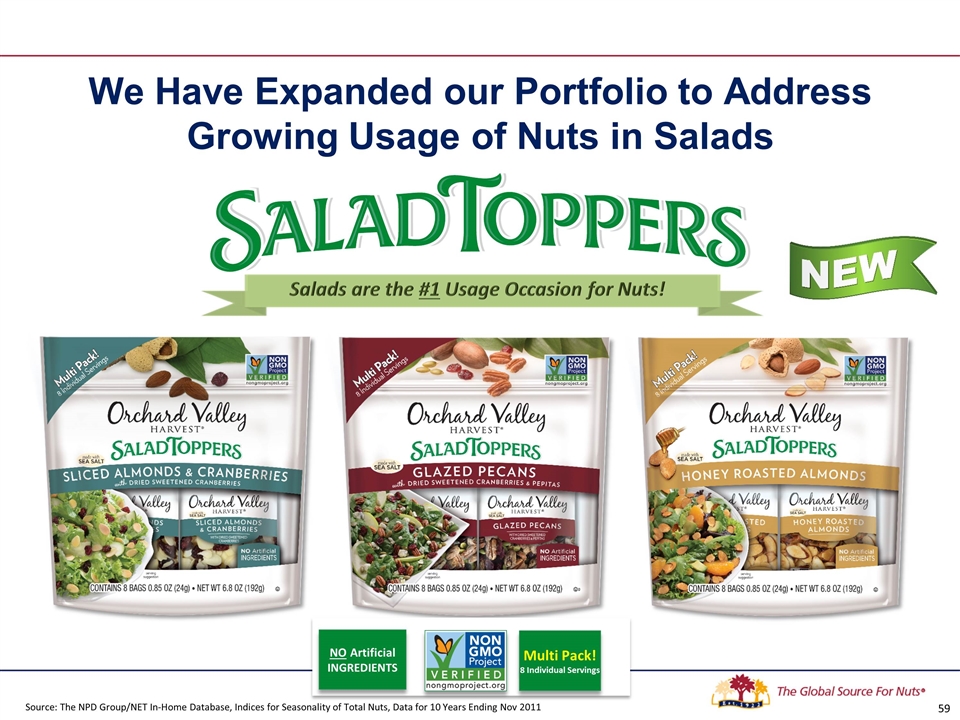

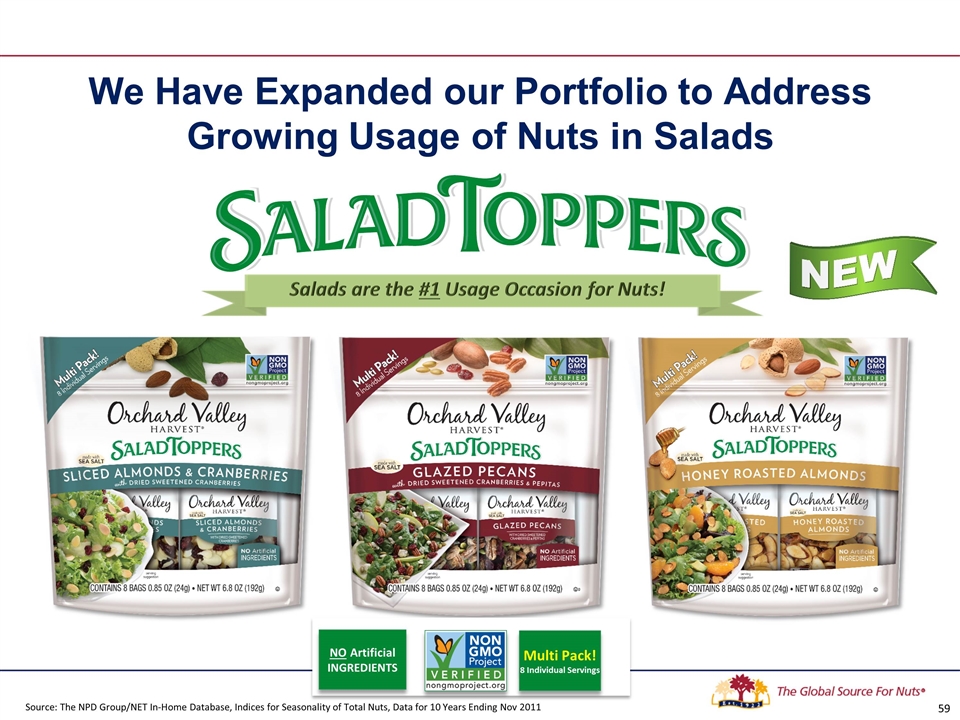

Salads are the #1 Usage Occasion for Nuts! Source: The NPD Group/NET In-Home Database, Indices for Seasonality of Total Nuts, Data for 10 Years Ending Nov 2011 We Have Expanded our Portfolio to Address Growing Usage of Nuts in Salads NO Artificial INGREDIENTS Multi Pack! 8 Individual Servings

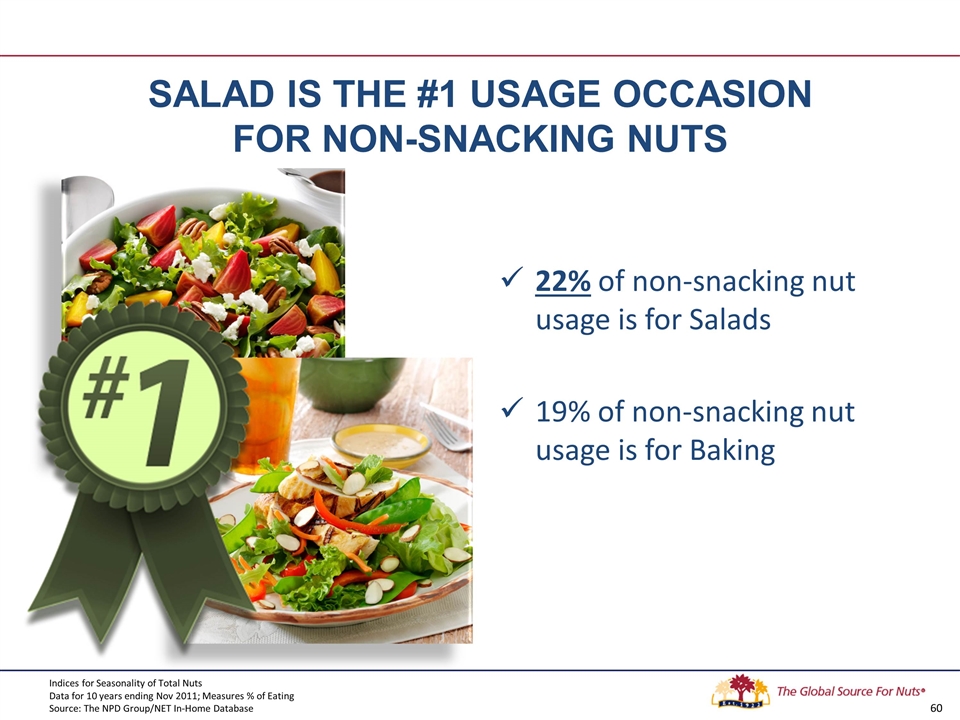

Salad is the #1 Usage Occasion for Non-Snacking Nuts 22% of non-snacking nut usage is for Salads 19% of non-snacking nut usage is for Baking Indices for Seasonality of Total Nuts Data for 10 years ending Nov 2011; Measures % of Eating Source: The NPD Group/NET In-Home Database 60

P | 14 High Impact Displays Drive Growth at Retail 61

NO ARTIFICIAL INGREDIENTS Public Relations Print Integrated Marketing Support 62

Expanding to Front of House Foodservice Locations

64 Thank You!