Annual stockholder meeting November 2nd, 2017 NASDAQ: JBSS Exhibit 99.1

JBSS Overview and Results - Jeffrey Sanfilippo Chairman & CEO FY 2017 Financial Milestones - Mike Valentine CFO & Group President Brand Marketing Overview - Howard Brandeisky Sr. VP Global Marketing & Customer Solutions JBSS FY 2018 Strategic Plan - Jeffrey Sanfilippo Chairman & CEO Closing Remarks - Jeffrey Sanfilippo Chairman & CEO Agenda

Some of the statements in this presentation and any statements by management constitute “forward-looking statements” about John B. Sanfilippo & Son, Inc. Such statements include, in particular, statements about our plans, strategies, business prospects, changes and trends in our business and the markets in which we operate. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,” “potential” or “continue” or the negative of those terms or other comparable terminology. These statements represent our present expectations or beliefs concerning future events and are not guarantees. Such statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement. We caution that forward-looking statements are qualified by important factors, risks and uncertainties that could cause actual results to differ materially from those in the forward- looking statements. Our periodic reports filed with the Securities and Exchange Commission, including our Forms 10-K and 10-Q and any amendments thereto, describe some of these factors, risks and uncertainties. Forward-Looking Statements

One of the largest nut processors in the world with fiscal year 2017 net sales of approximately $847 million State-of-the-art nut processing capabilities, including what we believe is the single largest nut processing facility in the world A North American market leader in every major selling channel – from consumer and commercial ingredient customers to contract manufacturing customers Dual consumer strategy of offering branded nut and dried fruit programs (Fisher and Orchard Valley Harvest) and private brands Commodity procurement expertise with buyers averaging over 20+ years experience A category leader in packaging and product innovation Vertically integrated nut processing operation for pecans, peanuts and walnuts JBSS Corporate Overview

We Are Experts In Every Nut Type % of total gross sales Full assortment of nut types Full variety of value-added products Wide variety of dried fruit and other snack products Customized, unique product formulas Fiscal Year 2017

Consistent Success Over Past 6 Fiscal Years Doubled Diluted EPS from FY 12 to FY 17 Net Sales increased by approximately 21% from FY 12

Yield based on average yearly stock price. CY 17 through 9/19/17

Vision To be the global source for nuts, committed to quality, expertise and innovation that delivers an unmatched experience to our customer and consumer Core Values People Integrity Investment Customer Driven Quality Innovation Execution Continuous Improvement Safety Resource Conservation

Fy 2017 results

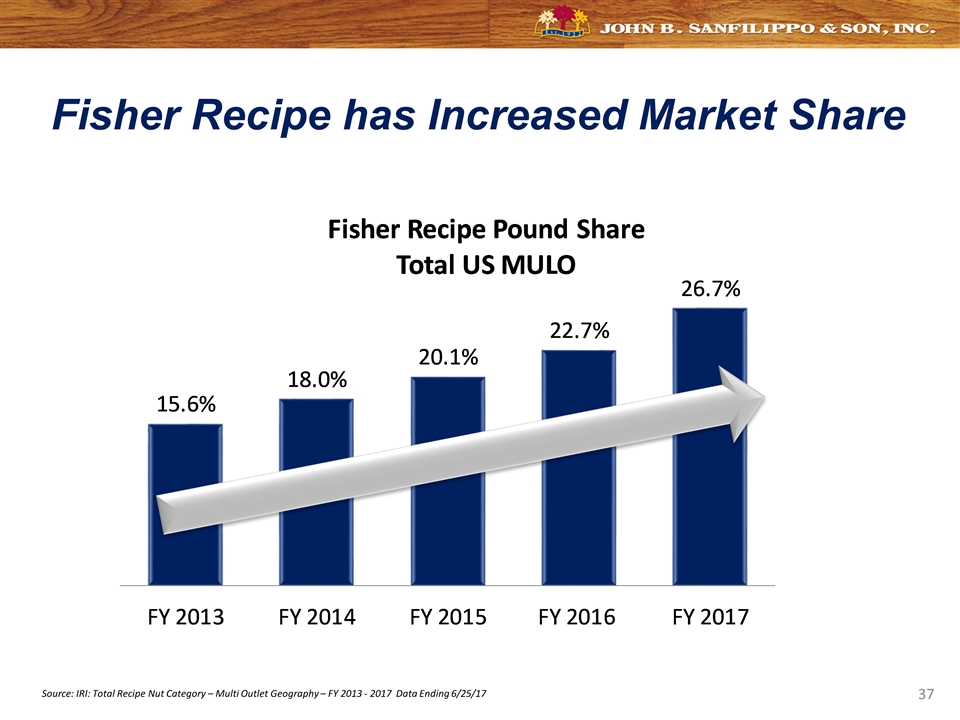

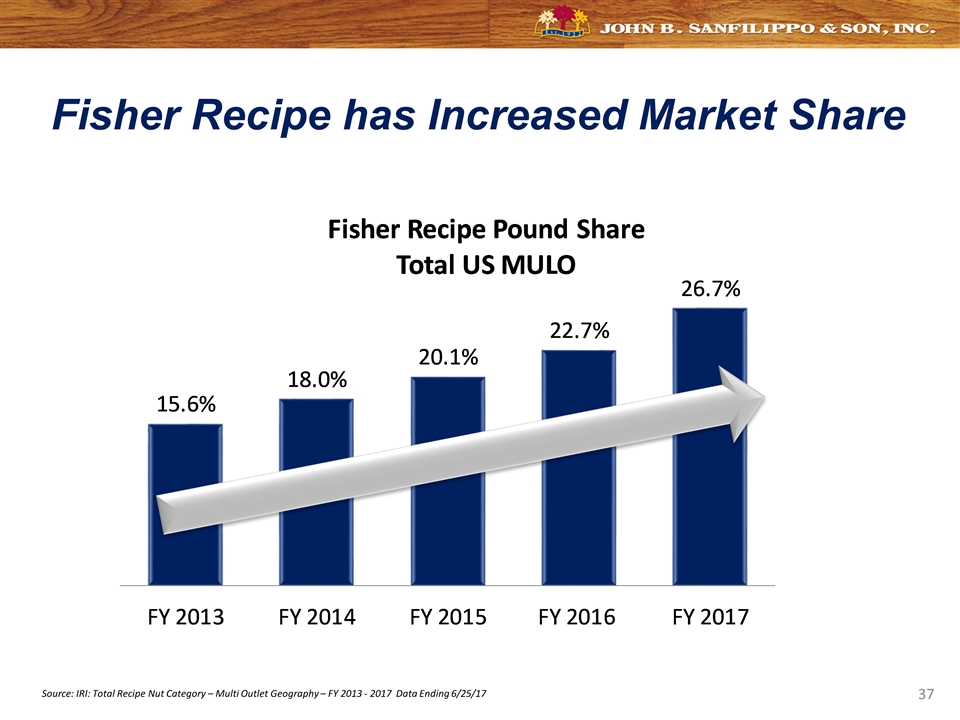

Fisher recipe nuts continued its share leadership of the recipe nut category by increasing pound market share by +4.0 points Increased market share and distribution in the produce nut category with Orchard Valley Harvest products FY 2017 Accomplishments Source : IRI FY Ending 6/25/17 Total US MULO for Recipe Nuts ; Fisher Core (Milwaukee, Minneapolis, Chicago, and St Louis) MULO for Fisher Snack

Launched over 60 new items with our private brand partners Expanded Fisher brand awareness and distribution in the Commercial Ingredients channel Obtained new snack bite business with our contract packing customers to fully utilize our cluster line in FY 2018 FY 2017 Accomplishments

Launched 100+ Fisher and Orchard Valley Harvest products on eCommerce sites Expanded Fisher and Orchard Valley Harvest in vending Started testing in Dollar Store channel FY 2017 Accomplishments

Sales channel updates

$530 Fiscal 2017 Net Sales $847 Million Business Channel Diversification (Millions of $) $165 $152

Fiscal 2017 Net Sales $530 Million FY 2017 Consumer Channel vs. FY 16 -6.4%

Fiscal 2017 Net Sales $165 Million FY 2017 Commercial Ingredients Channel vs. FY 16 -32.6%

FY 2017 Contract Packaging Channel Fiscal 2017 Net Sales $152 Million

Nut category review

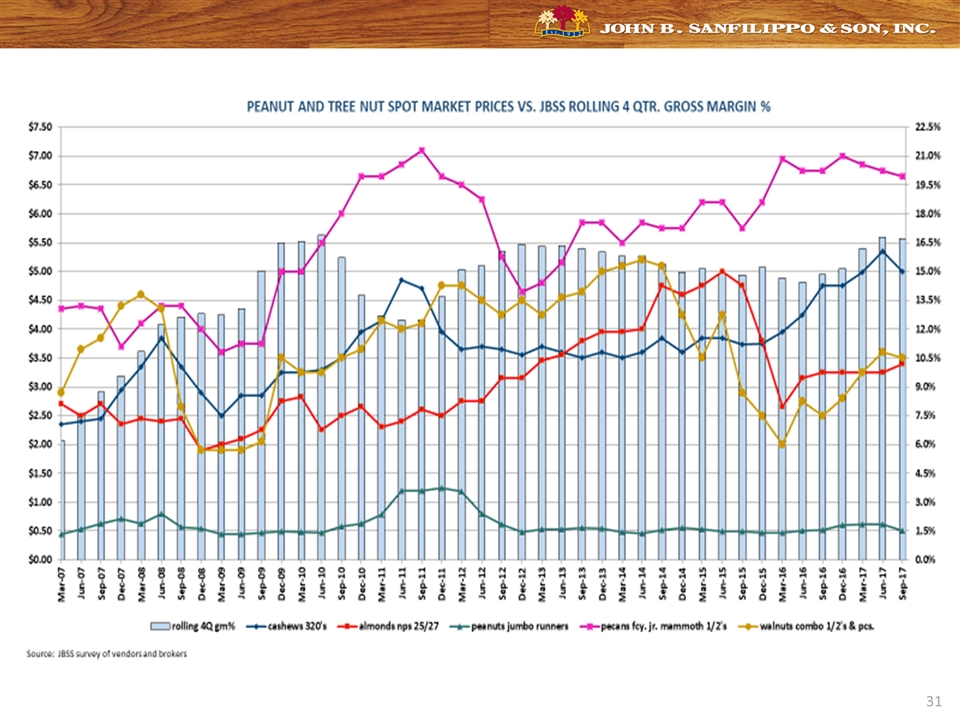

Slight decline in Nut Commodity Prices after Years of Increases Source: IRI: Nut Category – Multi Outlet Geography Time Periods: Total FY 11 Year Ending 7/3/11 to FY 2017 data ending 6/25/17 1% decline in FY 17 but average prices still up 30%+ since FY 11

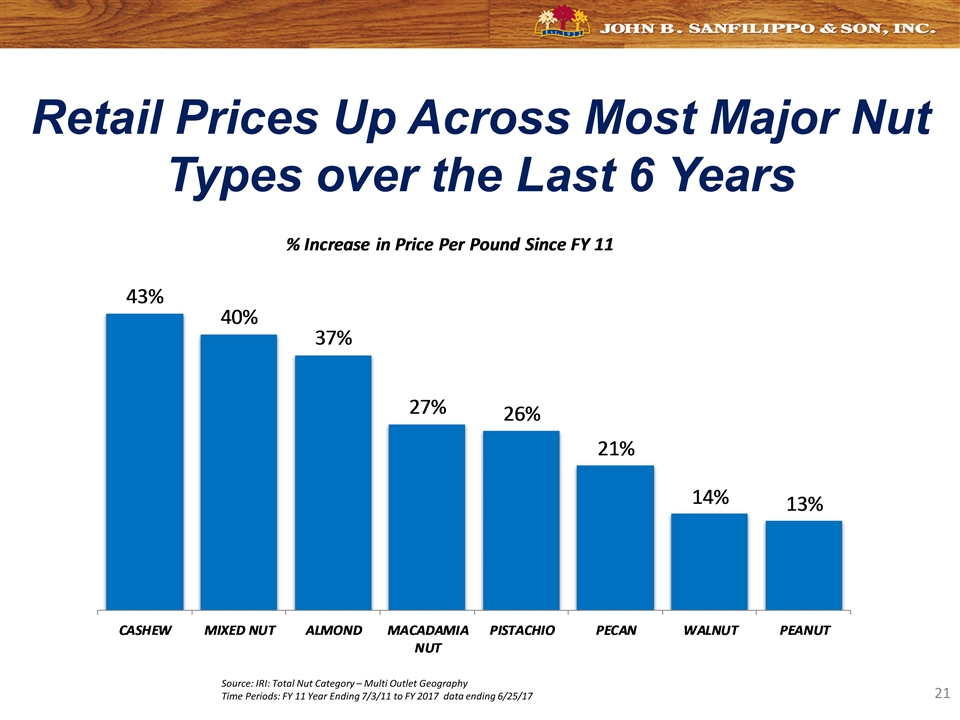

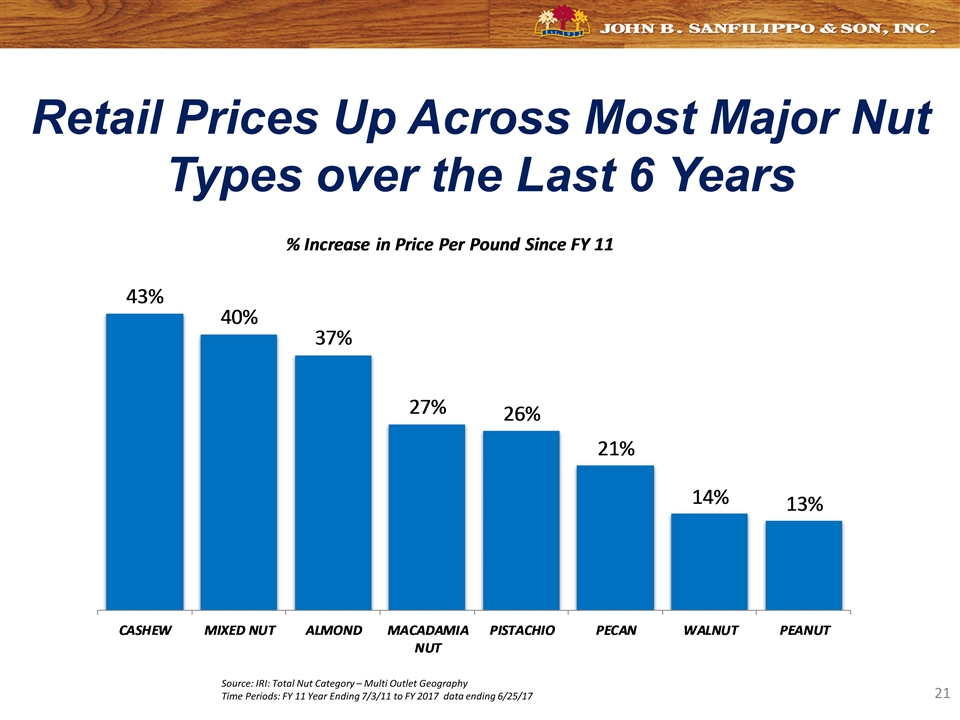

Retail Prices Up Across Most Major Nut Types over the Last 6 Years Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: FY 11 Year Ending 7/3/11 to FY 2017 data ending 6/25/17

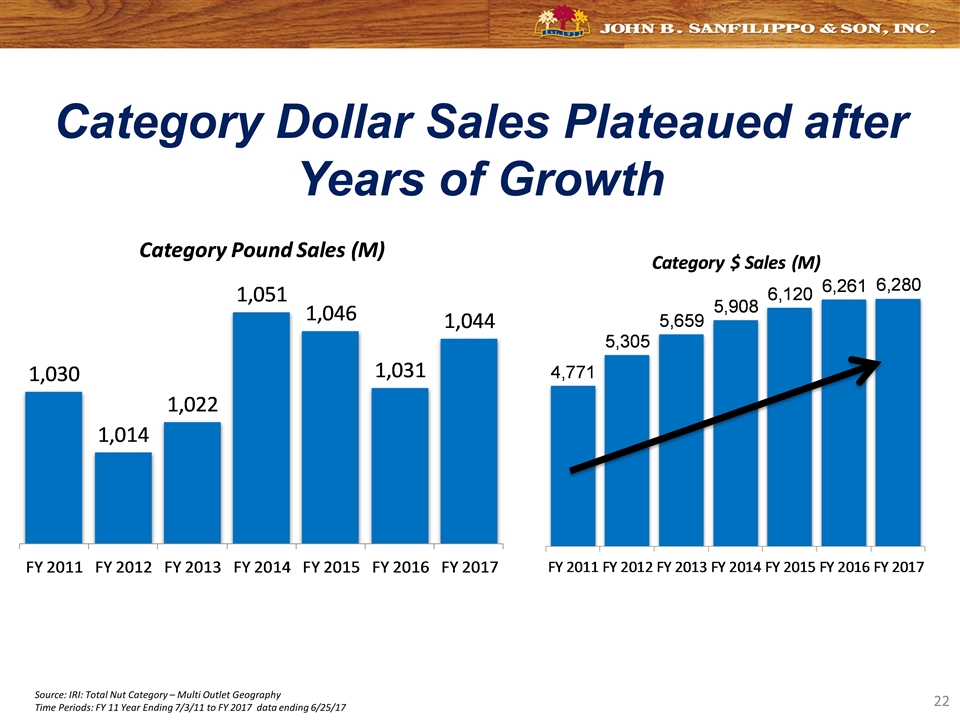

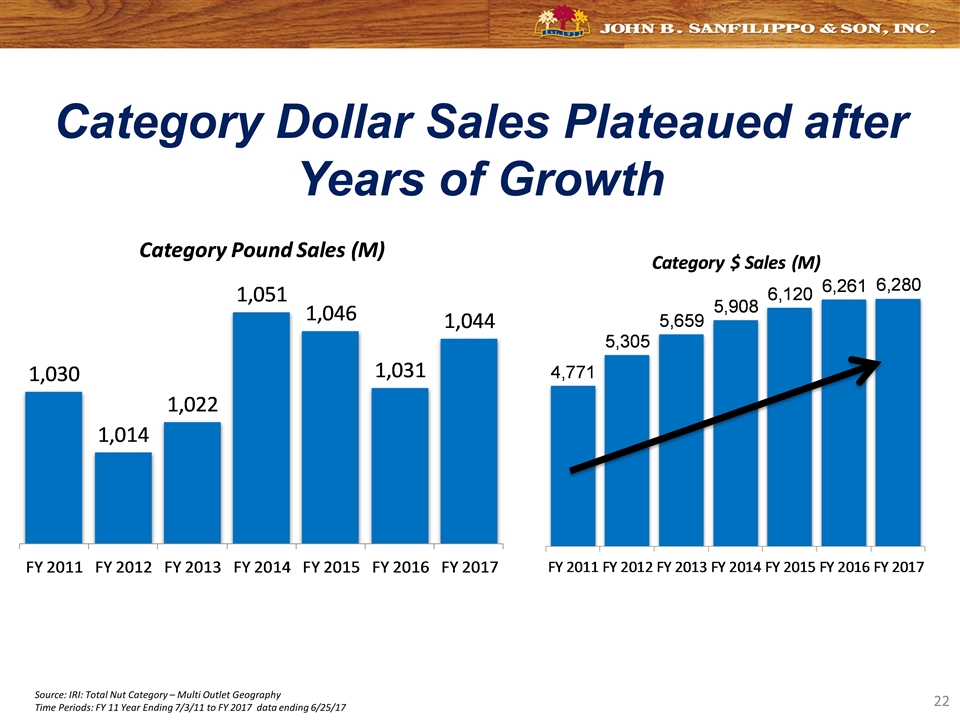

Category Dollar Sales Plateaued after Years of Growth Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: FY 11 Year Ending 7/3/11 to FY 2017 data ending 6/25/17

Fy 2017 financial milestones

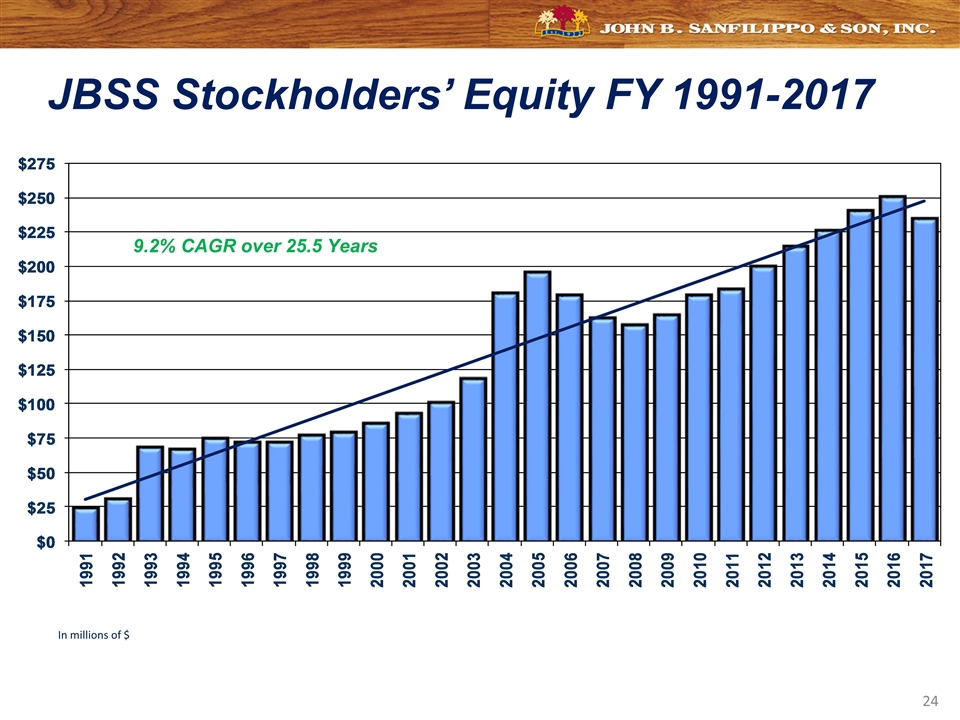

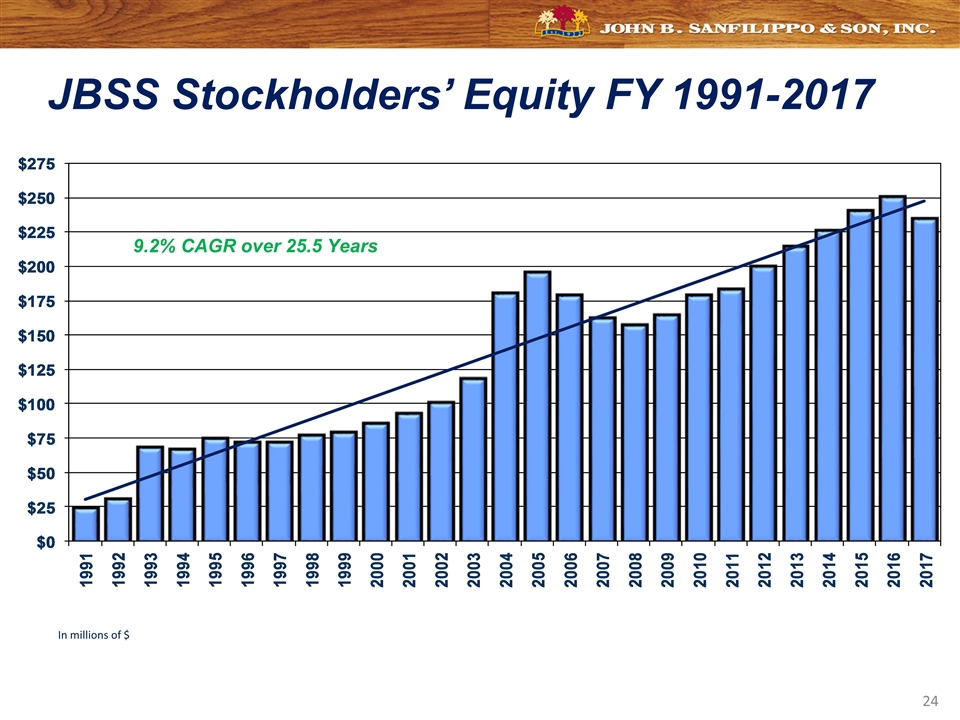

In millions of $ 9.2% CAGR over 25.5 Years JBSS Stockholders’ Equity FY 1991-2017

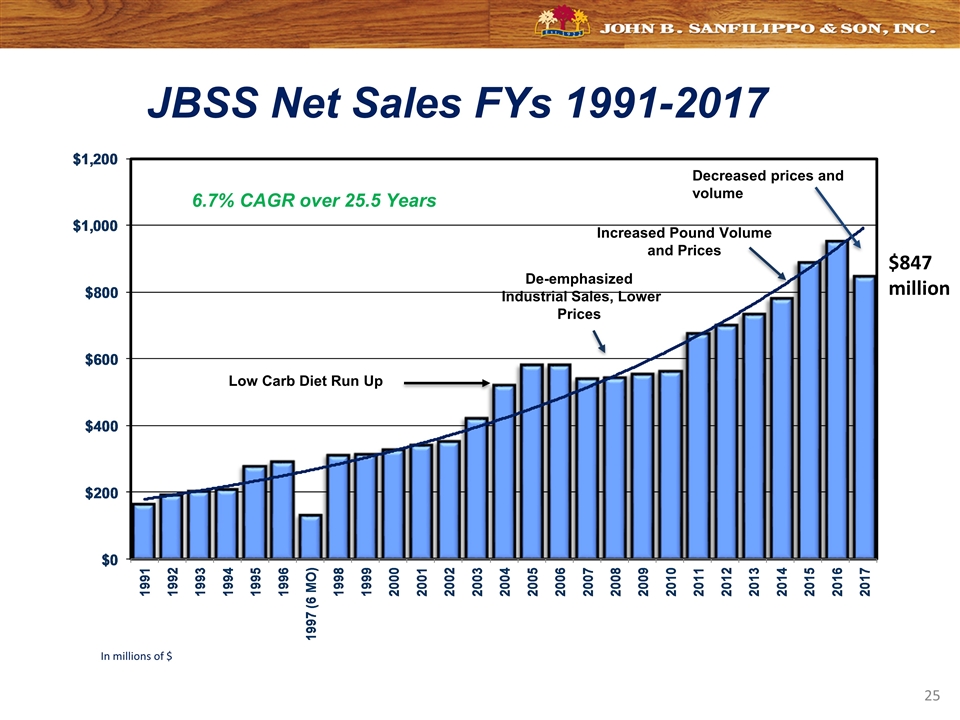

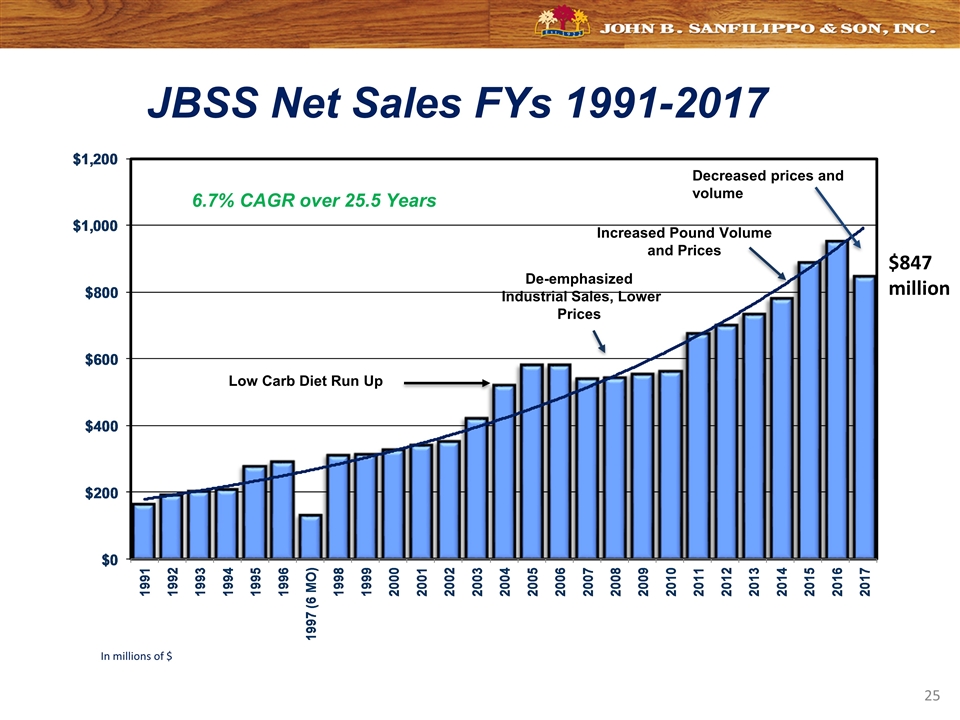

Increased Pound Volume and Prices De-emphasized Industrial Sales, Lower Prices Low Carb Diet Run Up $847 million In millions of $ Decreased prices and volume 6.7% CAGR over 25.5 Years JBSS Net Sales FYs 1991-2017

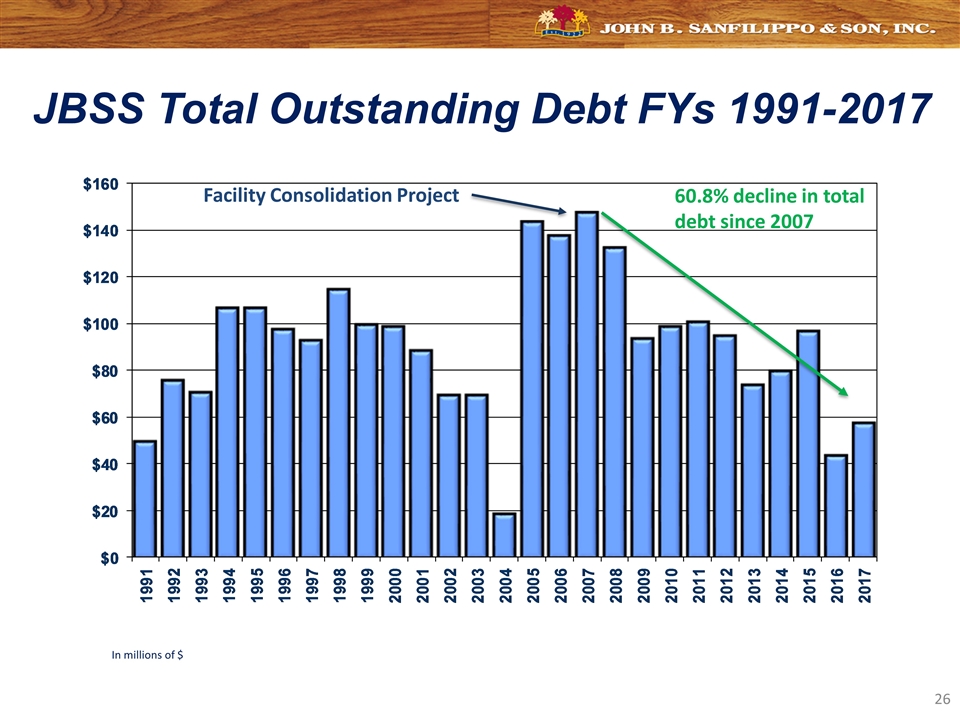

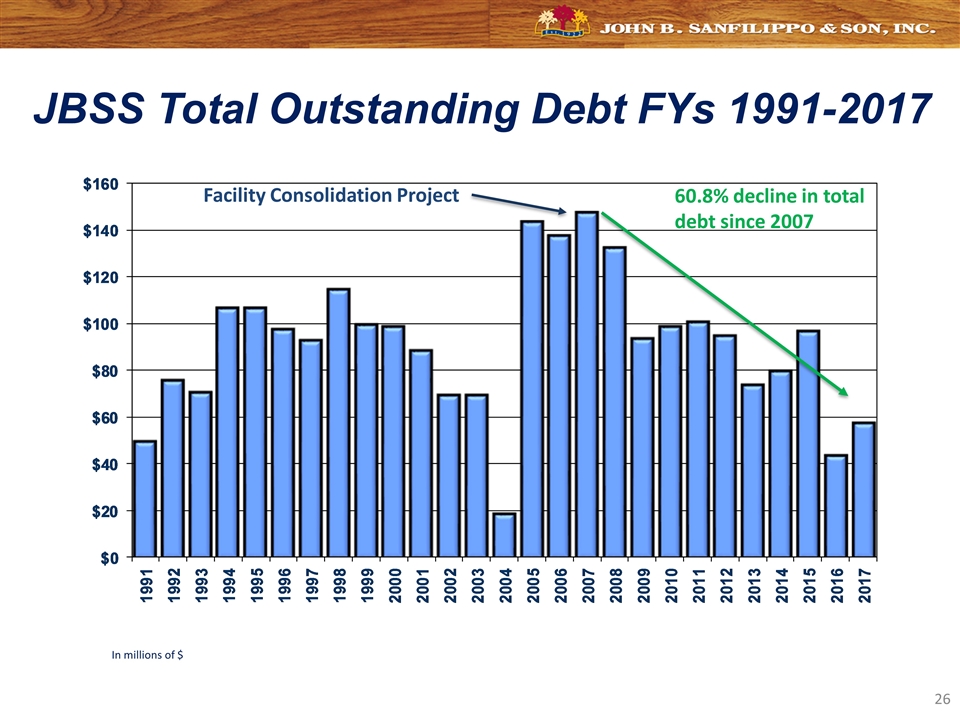

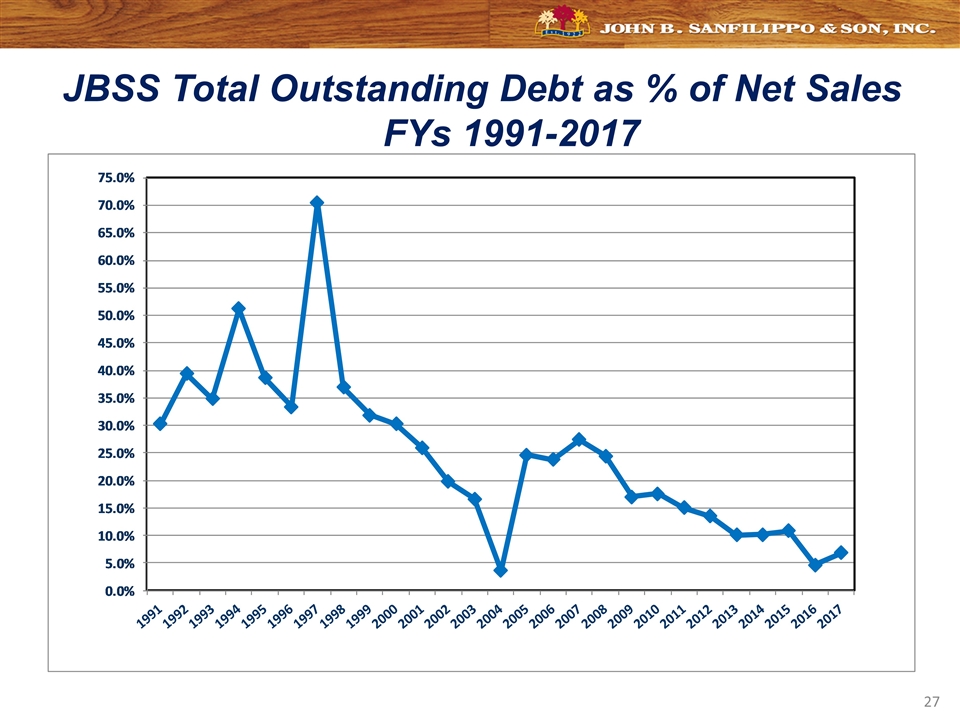

In millions of $ Facility Consolidation Project 60.8% decline in total debt since 2007 JBSS Total Outstanding Debt FYs 1991-2017

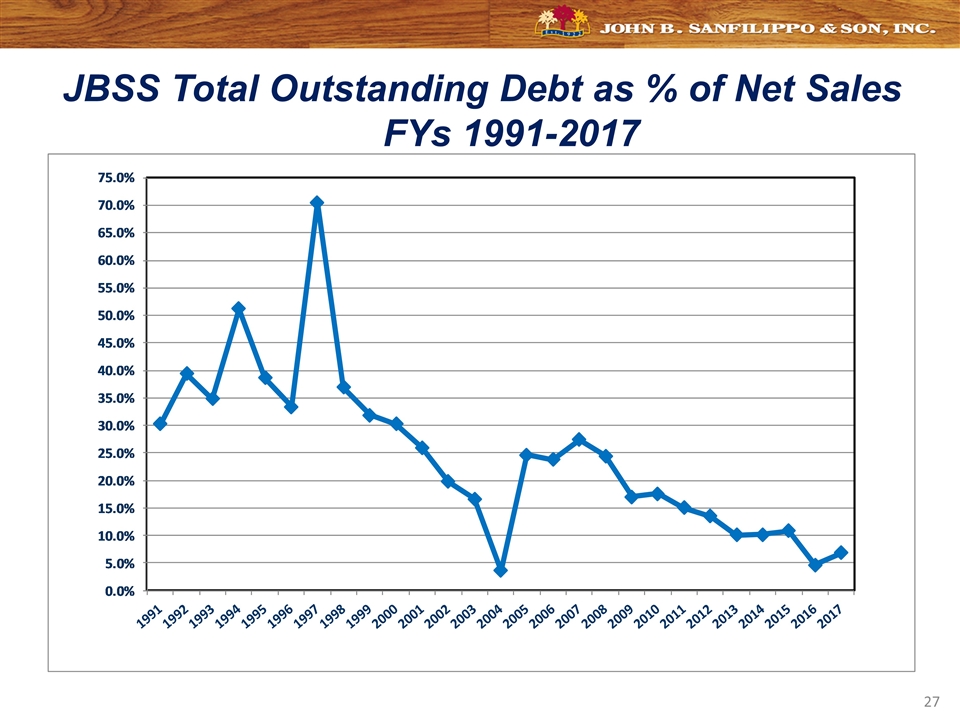

JBSS Total Outstanding Debt as % of Net Sales FYs 1991-2017

EBITDA EBITDA consists of earnings before interest, taxes, depreciation, amortization and noncontrolling interest. EBITDA is not a measurement of financial performance under accounting principles generally accepted in the United States of America ("GAAP"), and does not represent cash flow from operations. EBITDA is presented solely as a supplemental disclosure because management believes that it is important in evaluating JBSS's financial performance and market valuation. In conformity with Regulation G, a reconciliation of EBITDA to the most directly comparable financial measures calculated and presented in accordance with GAAP is presented in the following slide.

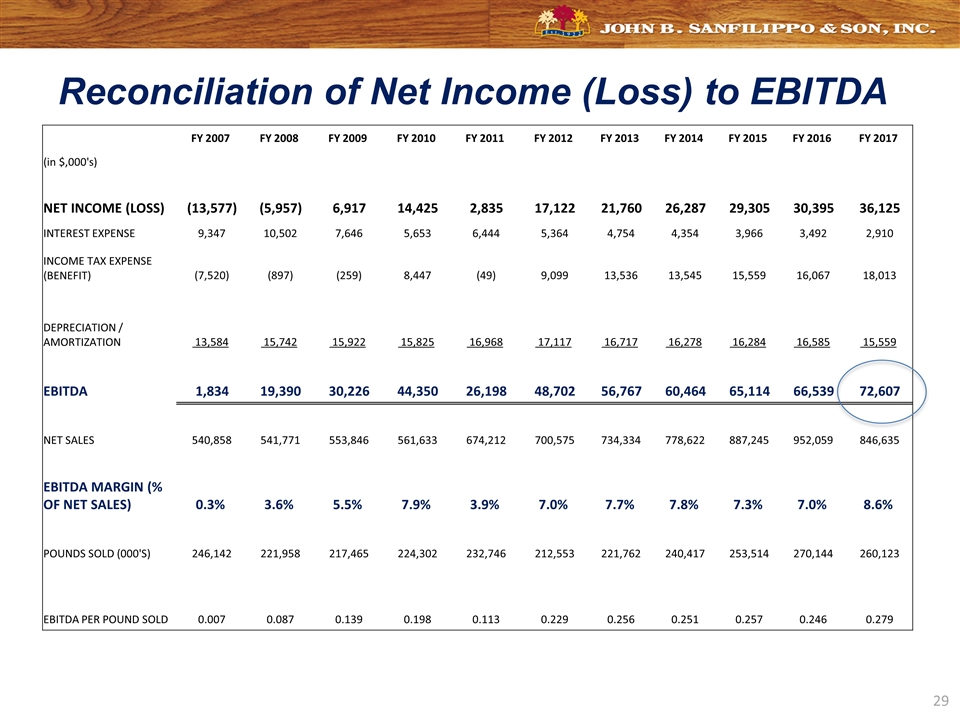

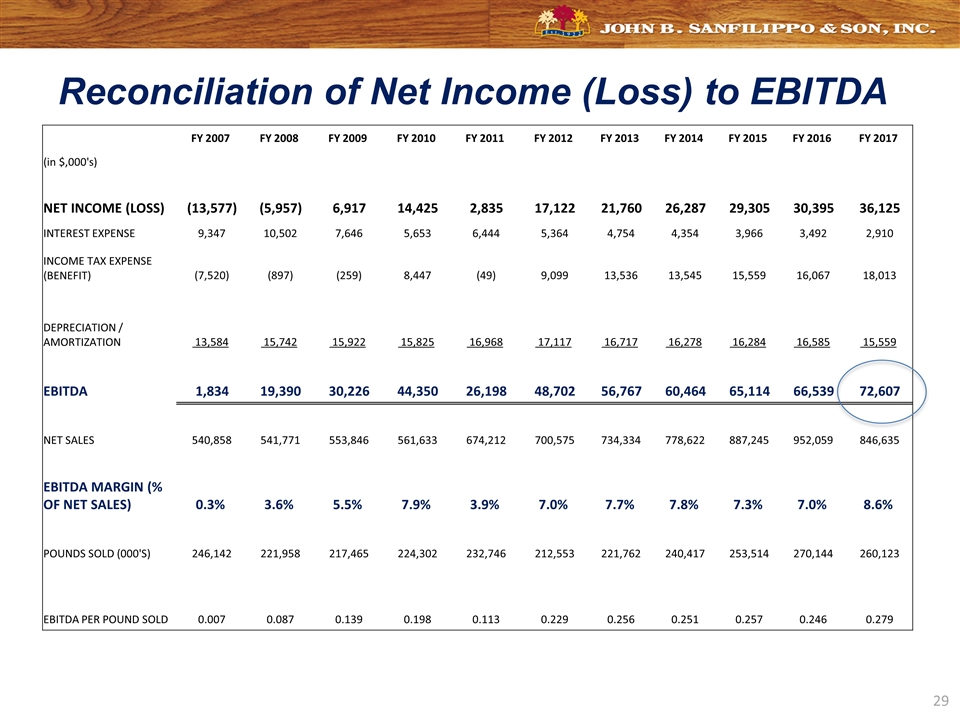

FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 (in $,000's) NET INCOME (LOSS) (13,577) (5,957) 6,917 14,425 2,835 17,122 21,760 26,287 29,305 30,395 36,125 INTEREST EXPENSE 9,347 10,502 7,646 5,653 6,444 5,364 4,754 4,354 3,966 3,492 2,910 INCOME TAX EXPENSE (BENEFIT) (7,520) (897) (259) 8,447 (49) 9,099 13,536 13,545 15,559 16,067 18,013 DEPRECIATION / AMORTIZATION 13,584 15,742 15,922 15,825 16,968 17,117 16,717 16,278 16,284 16,585 15,559 EBITDA 1,834 19,390 30,226 44,350 26,198 48,702 56,767 60,464 65,114 66,539 72,607 NET SALES 540,858 541,771 553,846 561,633 674,212 700,575 734,334 778,622 887,245 952,059 846,635 EBITDA MARGIN (% OF NET SALES) 0.3% 3.6% 5.5% 7.9% 3.9% 7.0% 7.7% 7.8% 7.3% 7.0% 8.6% POUNDS SOLD (000'S) 246,142 221,958 217,465 224,302 232,746 212,553 221,762 240,417 253,514 270,144 260,123 EBITDA PER POUND SOLD 0.007 0.087 0.139 0.198 0.113 0.229 0.256 0.251 0.257 0.246 0.279 Reconciliation of Net Income (Loss) to EBITDA

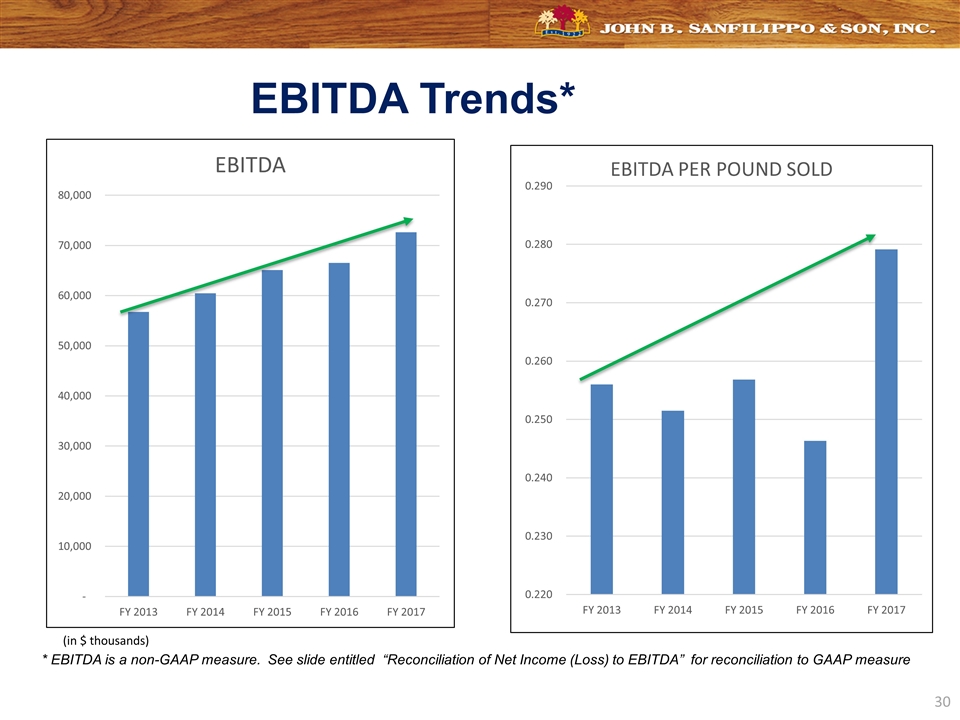

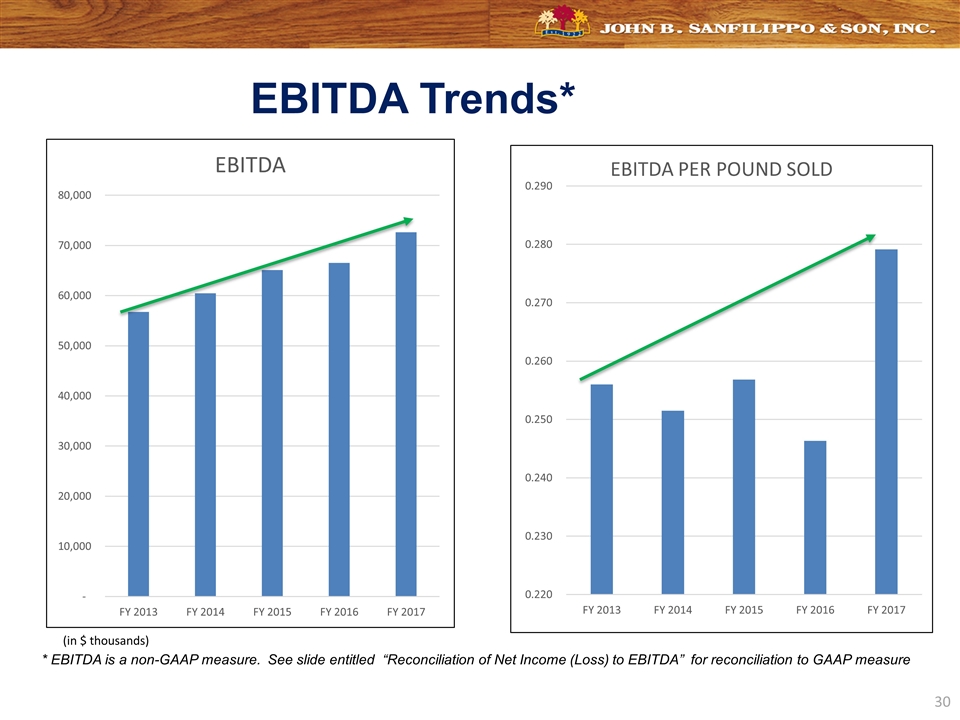

* EBITDA is a non-GAAP measure. See slide entitled “Reconciliation of Net Income (Loss) to EBITDA” for reconciliation to GAAP measure (in $ thousands) EBITDA Trends*

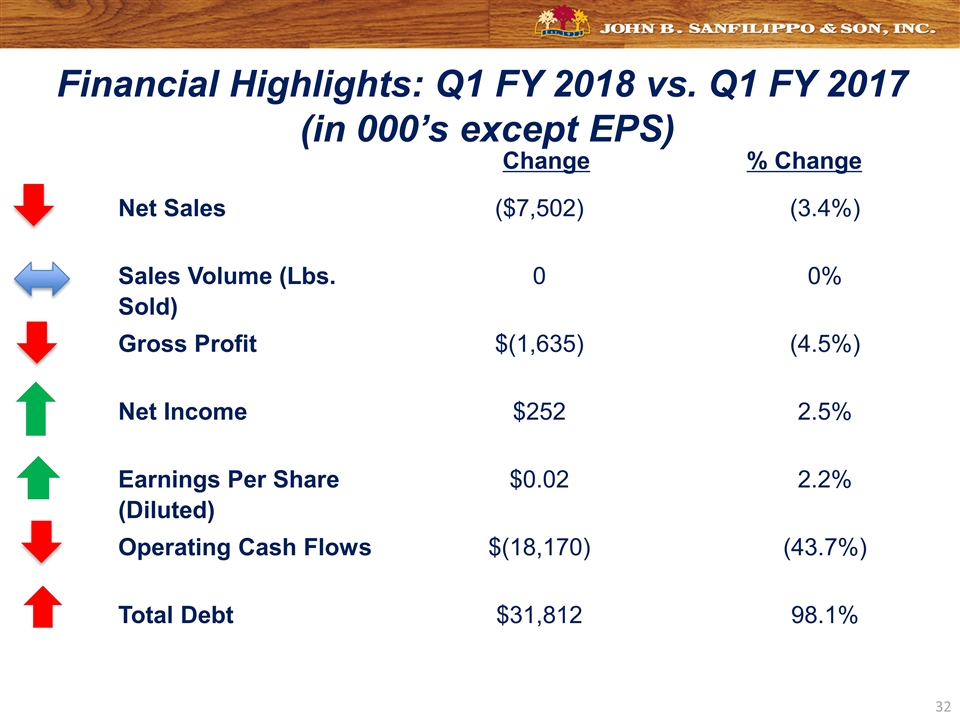

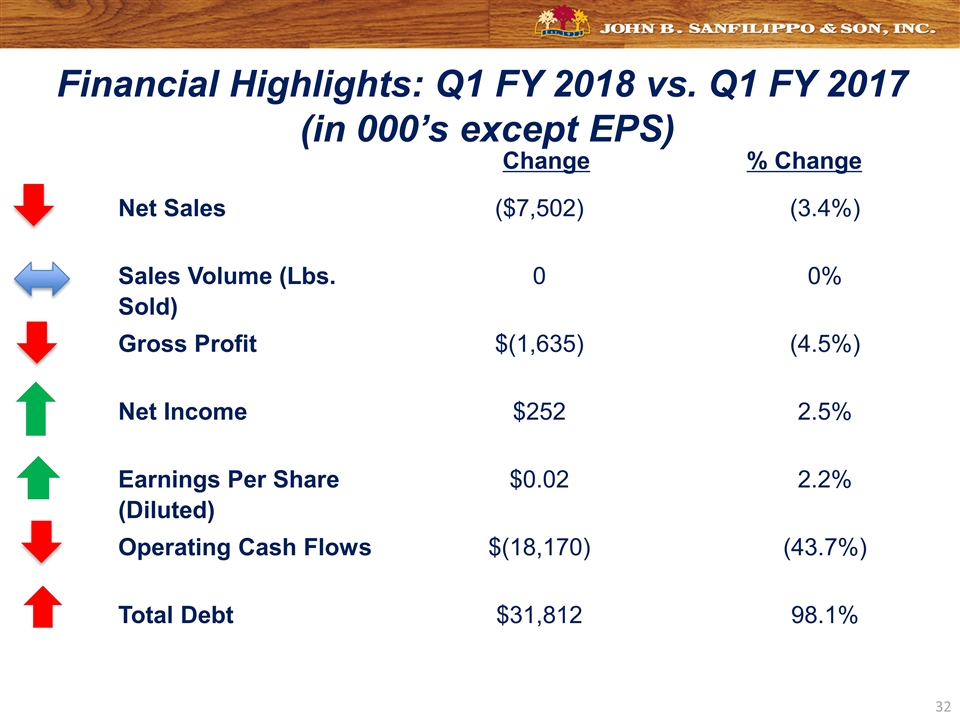

Net Sales ($7,502) (3.4%) Sales Volume (Lbs. Sold) 0 0% Gross Profit $(1,635) (4.5%) Net Income $252 2.5% Earnings Per Share (Diluted) $0.02 2.2% Operating Cash Flows $(18,170) (43.7%) Total Debt $31,812 98.1% Change % Change Financial Highlights: Q1 2018 vs. Q1 2017 (in 000’s except EPS) Financial Highlights: Q1 FY 2018 vs. Q1 FY 2017 (in 000’s except EPS)

Fy 2017 brand marketing overview

Snack Nuts Grow Brands Recipe Nuts

Recipe Nuts

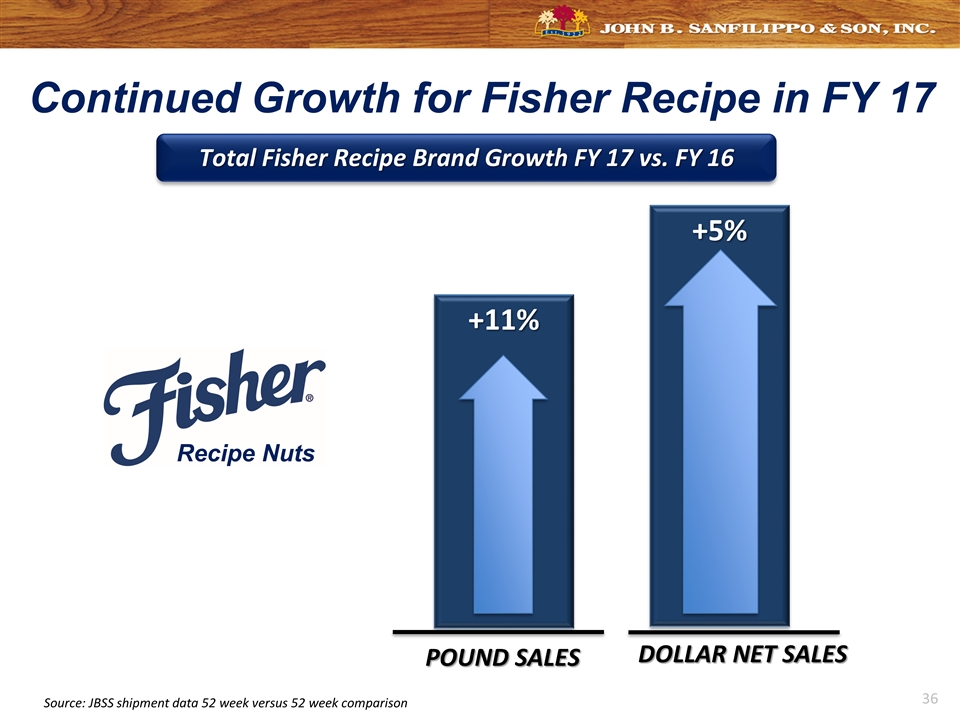

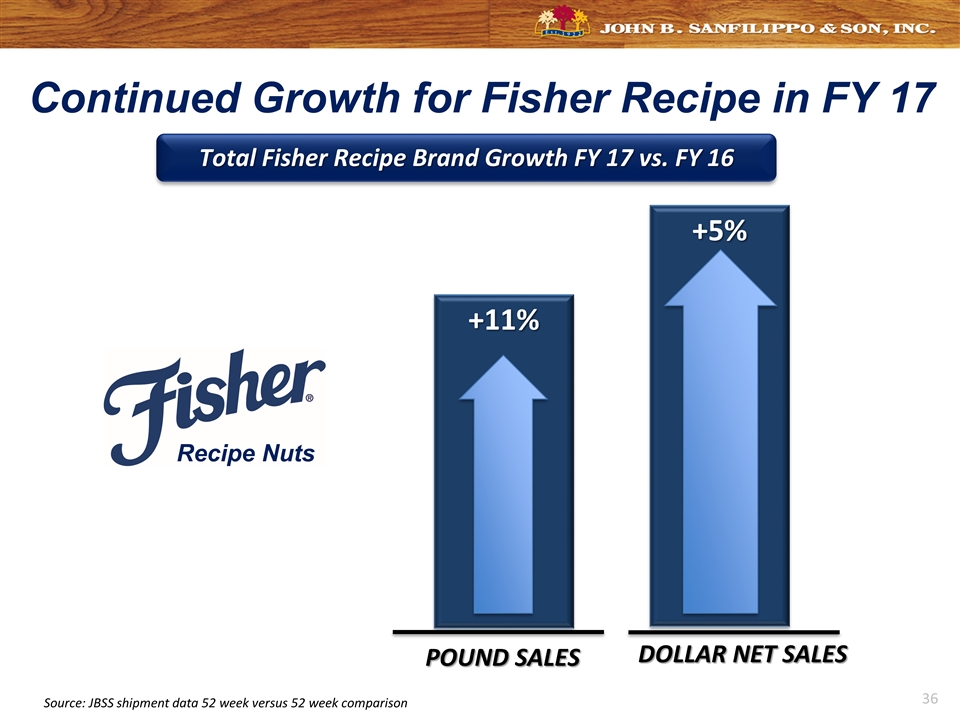

Continued Growth for Fisher Recipe in FY 17 Total Fisher Recipe Brand Growth FY 17 vs. FY 16 +11% +5% POUND SALES DOLLAR NET SALES Source: JBSS shipment data 52 week versus 52 week comparison Recipe Nuts

Fisher Recipe has Increased Market Share Source: IRI: Total Recipe Nut Category – Multi Outlet Geography – FY 2013 - 2017 Data Ending 6/25/17

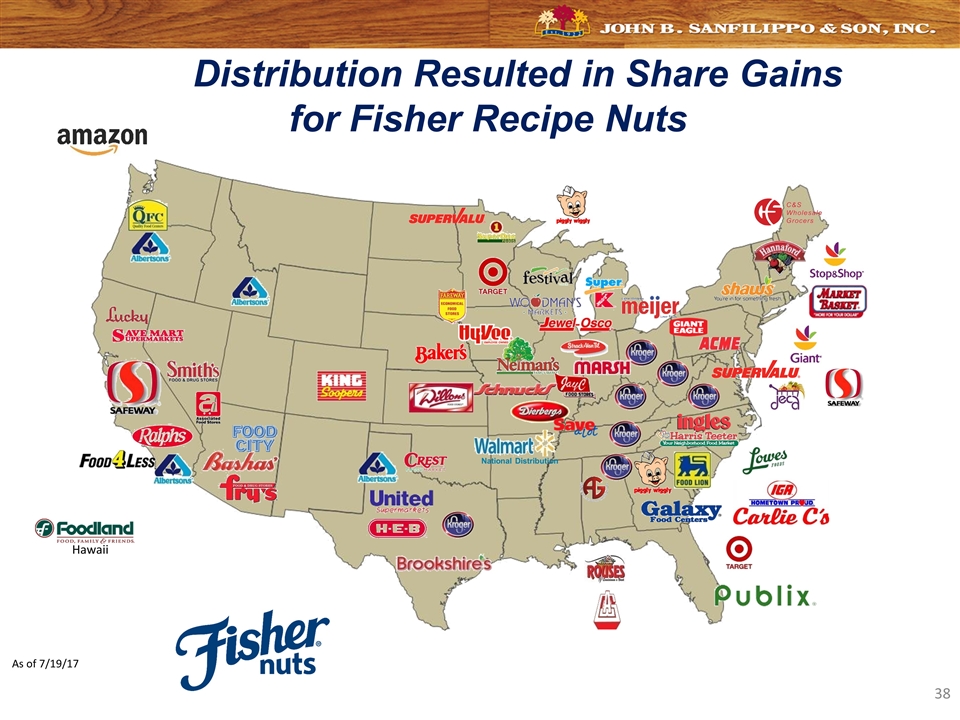

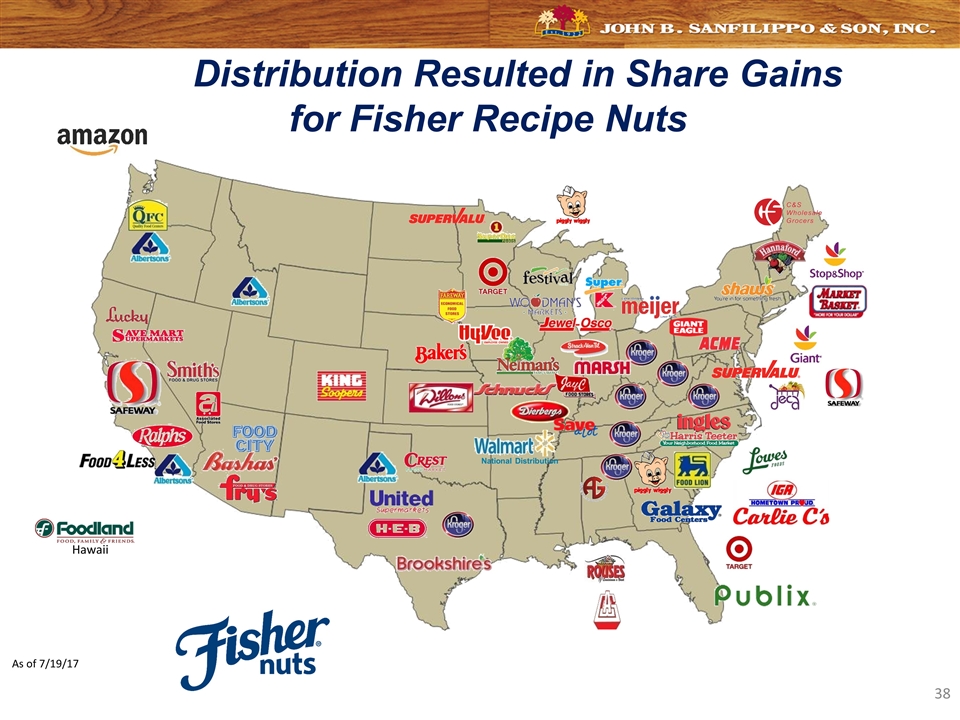

National Distribution Hawaii Distribution Resulted in Share Gains for Fisher Recipe Nuts As of 7/19/17

Continue to Build Fisher Brand Equity with Food Network Sponsorship

Integrated Marketing Key to Building Brand Equity Multi-Platform Food Network Partnership Influencer Marketing National Print In-Store Support Content: Social Media and Web Original PR photo content created and photographed by the Fisher Fresh Thinkers Influencer Network

Product Upsizing along with Improved Nut Variety and Size Communication

Snack Nuts

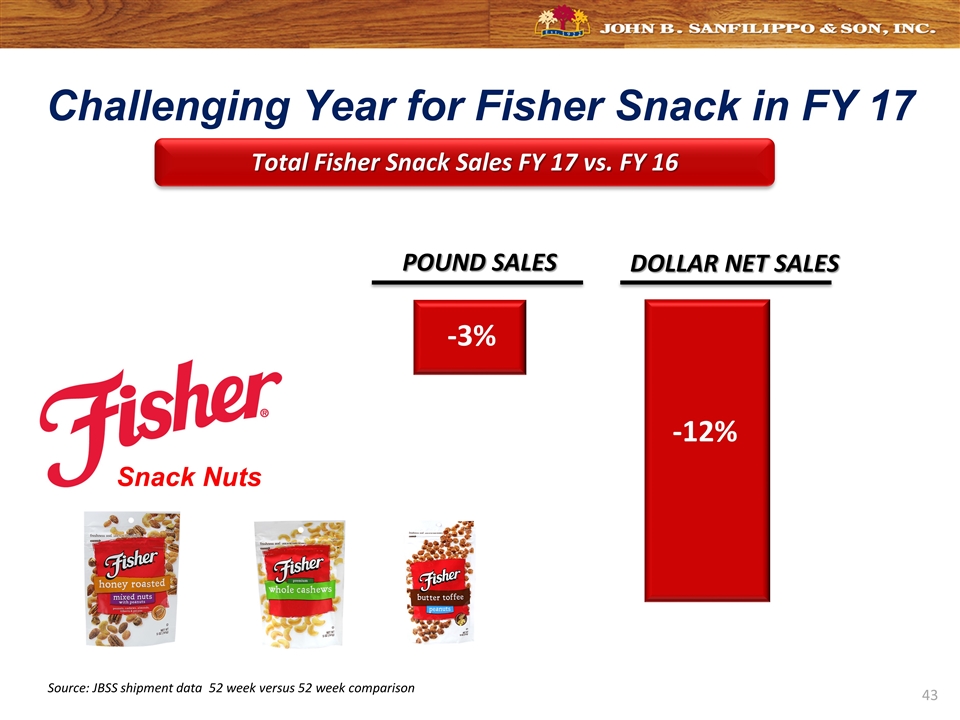

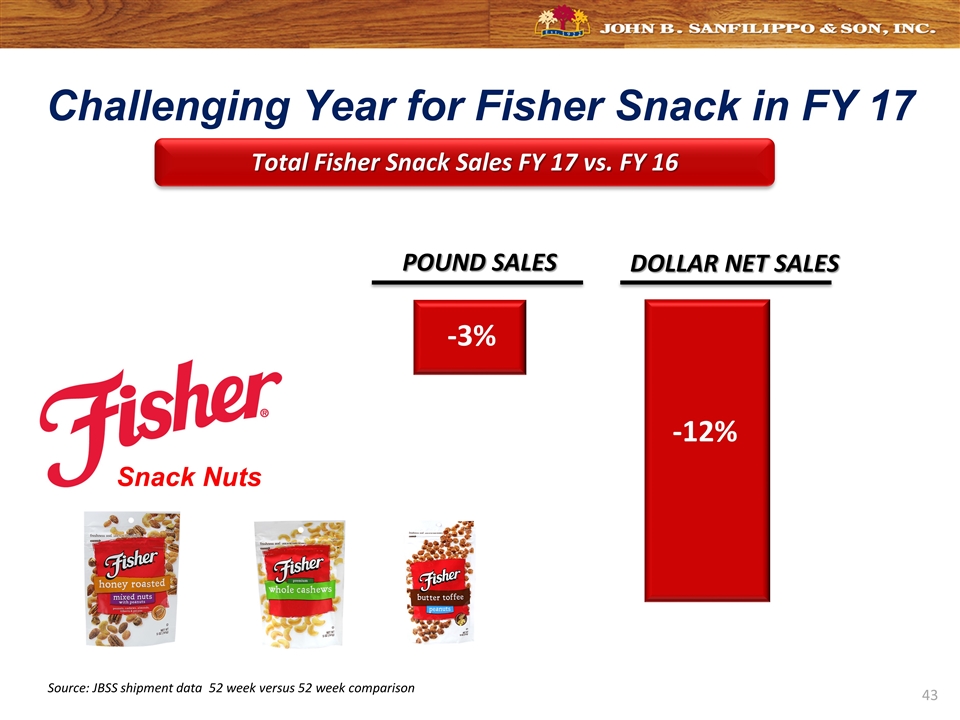

Challenging Year for Fisher Snack in FY 17 Total Fisher Snack Sales FY 17 vs. FY 16 Snack Nuts Source: JBSS shipment data 52 week versus 52 week comparison POUND SALES DOLLAR NET SALES -3% -12%

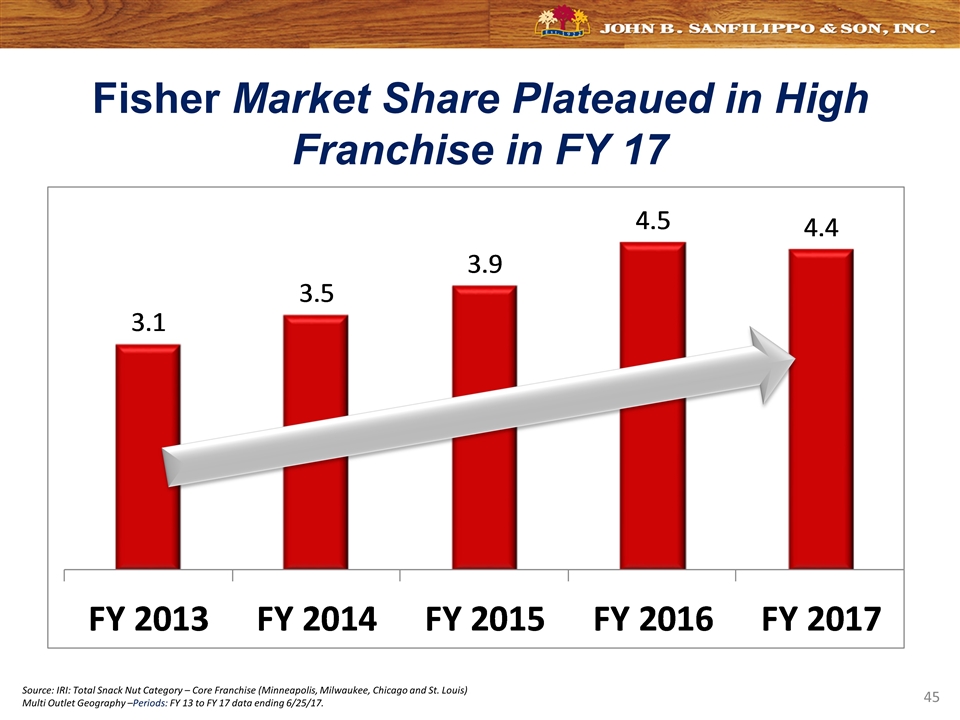

Fisher Snack Nut Strategy Focuses on Midwest High Franchise Markets Snack Nuts

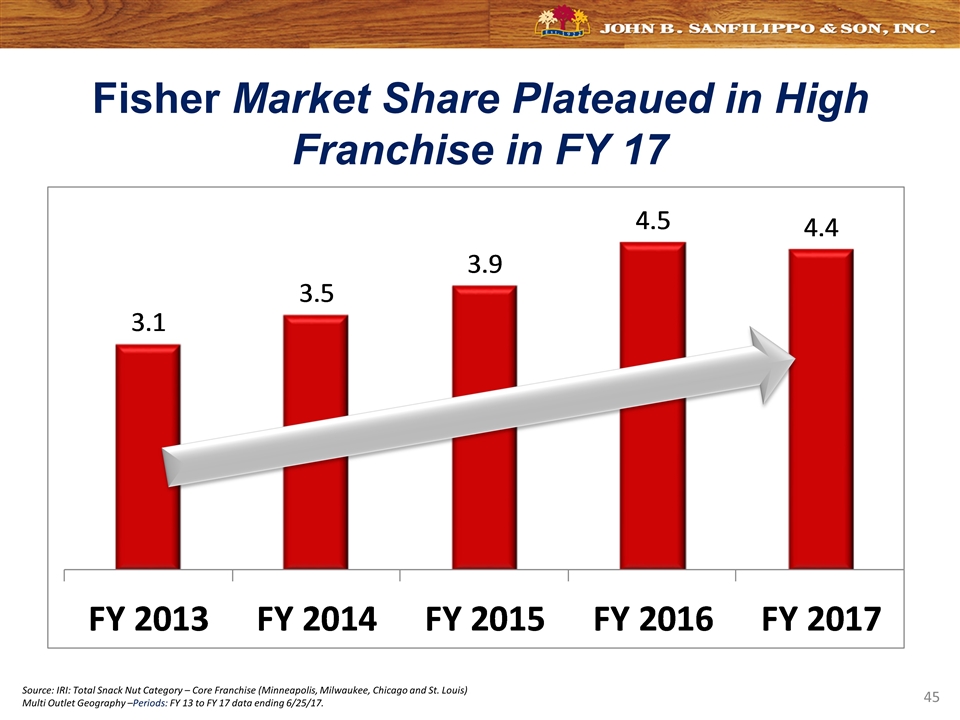

Fisher Market Share Plateaued in High Franchise in FY 17 Source: IRI: Total Snack Nut Category – Core Franchise (Minneapolis, Milwaukee, Chicago and St. Louis) Multi Outlet Geography –Periods: FY 13 to FY 17 data ending 6/25/17.

Core Dry Roast Peanut Business Remains Healthy

Pure and Simple Goodness

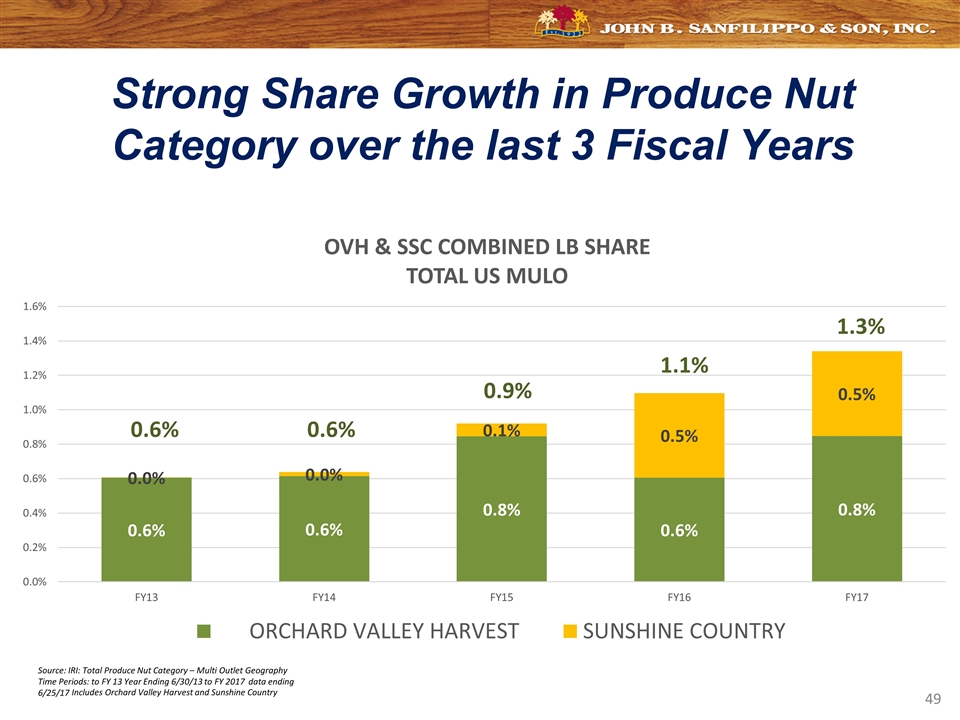

Strong Growth of Our Produce Brands Produce Brand Growth FY 17 vs. FY 16 +24% +29% DOLLAR NET SALES POUND SALES Source: JBSS shipment data 52 week versus 52 week comparison. Includes Orchard Valley Harvest brand and Sunshine Country brand

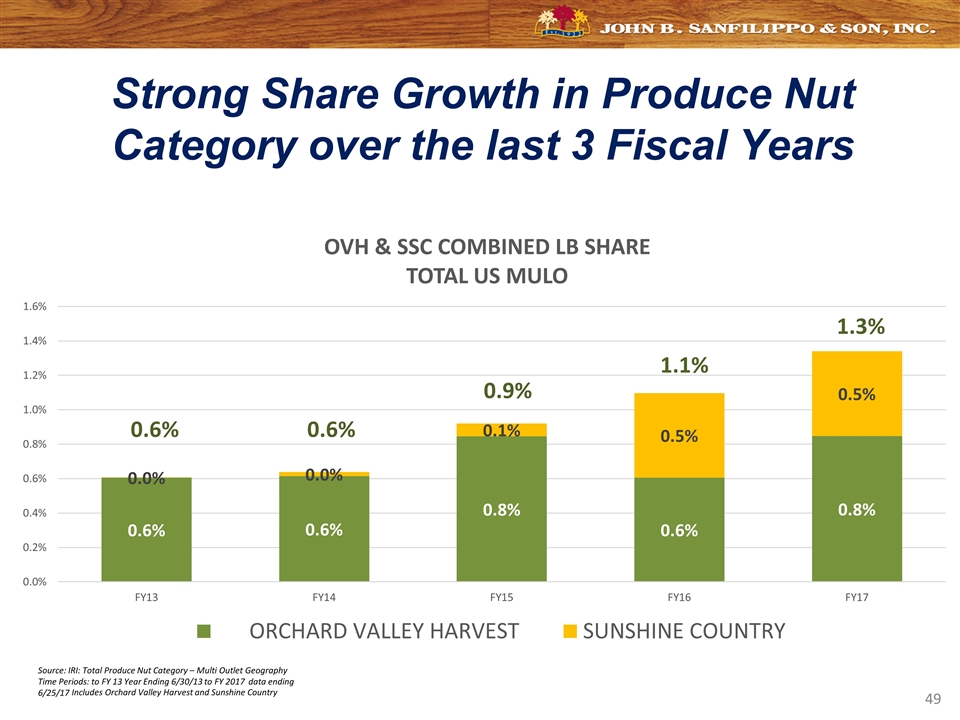

Strong Share Growth in Produce Nut Category over the last 3 Fiscal Years Source: IRI: Total Produce Nut Category – Multi Outlet Geography Time Periods: to FY 13 Year Ending 6/30/13 to FY 2017 data ending 6/25/17 Includes Orchard Valley Harvest and Sunshine Country 0.6% 0.6% 0.9% 1.1% 1.3%

BREAUX Markets 1 1 Distribution 2 National Distribution Updated 7.19.17 Updated as of 7.19.17

Consumers want healthy snacking options (3) (1) Source: Instantly poll of 4,200 people in the US between 9/15 and 9/21 2015 (2) Source: The Hartman Group, Reinventing health & nutrition study 2010/2013 (3) Source: Symphony IRI Group, 2013 Consumers want clean, simple ingredients (1,2) Consumers want portable snacking options (3) NO Artificial Ingredients Orchard Valley Harvest Delivers on Three Important Consumer Trends

New “Wellness Mixes” Help Meet Consumer Need for On-The-Go Goodness New in FY18

Salads are the #1 Usage Occasion for Nuts! Source: The NPD Group/NET In-Home Database, Indices for Seasonality of Total Nuts, Data for 10 Years Ending Nov 2011 We Have Expanded our Portfolio to Address Growing Usage of Nuts in Salads NO Artificial INGREDIENTS Multi Pack! 8 Individual Servings

Salad is the #1 Usage Occasion for Non-Snacking Nuts 22% of non-snacking nut usage is for Salads 19% of non-snacking nut usage is for Baking Indices for Seasonality of Total Nuts Data for 10 years ending Nov 2011; Measures % of Eating Source: The NPD Group/NET In-Home Database

Public Relations Shopkick Integrated Marketing Support

Fy 2018 strategy update

GROWTH DRIVERS Penetrate existing customers with current products Increase velocity of current products Gain new customers Launch new products Enter new channels Expand beyond core product portfolio M&A Form partnerships FY2018 Plan Consumer Commercial Ingredient Contract Manufacturing Resources & Structure Competitive Landscape Supply Chain Dynamics Consumption Trends HEADWINDS & TAILWINDS JBSS Strategies & Market Forces

Maintain Fisher Recipe #1 Share Position Nationally by Expanding Distribution New distribution at Meijer Stores New distribution at Publix Stores

Reposition Fisher Snack and Expand Distribution Nationally Gain new customers beyond core Midwest region

Launch Innovative Products Beyond Core Portfolio and Expand Distribution

Develop and Launch Sales in Alternative Channels Dollar Stores E-Commerce Non-Commercial Foodservice Club S tores

Expanding Consumer Reach Across All JBSS Brands Vending eCommerce Dollar Stores Non-Commercial Foodservice

Be Preferred Partner to Build Profitable Volume of Value-Added Nuts & Snacks

Establish Trust & Competitive Advantage Global Procurement Expertise Quality, Food Safety, Freshness Operational Excellence

“Hey this might be kind of random but I just wanted to say that I work here at Walmart and I stock your product and I just wanted to show my appreciation for your ready for sale display boxes they are the easiest most simple boxes to open and I can't tell you how many companies make horrid ready for sale boxes that end up getting ripped up and then can't be displayed. That's all and keep up the good work.” :) JM Feedback From A Customer

Closing comments

Source : A Strategy Worth Achieving Presentation from Kantar Retail, December 2016 Above Average Growth Projected for E-Commerce & Discounter 69

Food At Home (FAH) Food Away From Home (FAFH) WWII Source: Data through 2014 calculated by the Economic Research Service, USDA, from various data sets from the U.S. Census Bureau and the Bureau of Labor Statistics. 2015-2020 estimated based on previous 7 years data trend. Food Spending 70

“No problem is larger than a peanut and can be conquered with courage and persistence.” - Ulysses L. Baxter Colorado Springs Gazette July 17, 1966 Headwinds and Tailwinds Create Opportunities

This Team Will Drive Results

JBSS Mission To be the global leader of quality driven, innovative nut solutions that enhance the customer and consumer experience and achieve consistent, profitable growth for our shareholders. We will accomplish this through our commitment to a dynamic infrastructure that maximizes the potential of our brands, people and processes.

Thank You We Look Forward to a Successful FY 2018