FY 2019 Shareholder Meeting NASDAQ: JBSS October 30, 2019 Exhibit 99.1

JBSS Overview and Results - Jeffrey Sanfilippo Chairman & CEO FY 2019 Financial Milestones - Mike Valentine CFO & Group President Brand Marketing Overview - Howard Brandeisky Sr. V.P. Global Marketing Closing Remarks - Jeffrey Sanfilippo Chairman & CEO Agenda

Some of the statements in this presentation and any statements by management constitute “forward-looking statements” about John B. Sanfilippo & Son, Inc. Such statements include, in particular, statements about our plans, strategies, business prospects, changes and trends in our business and the markets in which we operate. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,” “potential” or “continue” or the negative of those terms or other comparable terminology. These statements represent our present expectations or beliefs concerning future events and are not guarantees. Such statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement. We caution that forward-looking statements are qualified by important factors, risks and uncertainties that could cause actual results to differ materially from those in the forward- looking statements. Our periodic reports filed with the Securities and Exchange Commission, including our Forms 10-K and 10-Q and any amendments thereto, describe some of these factors, risks and uncertainties. Forward-Looking Statements

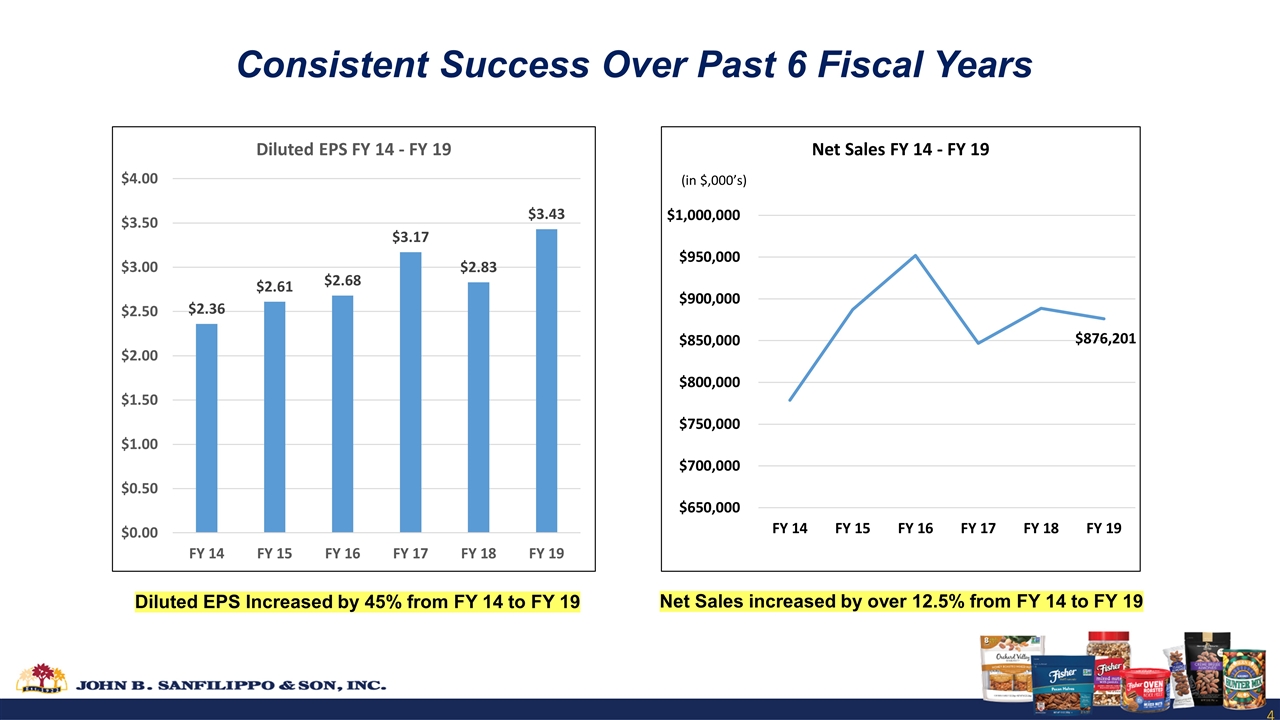

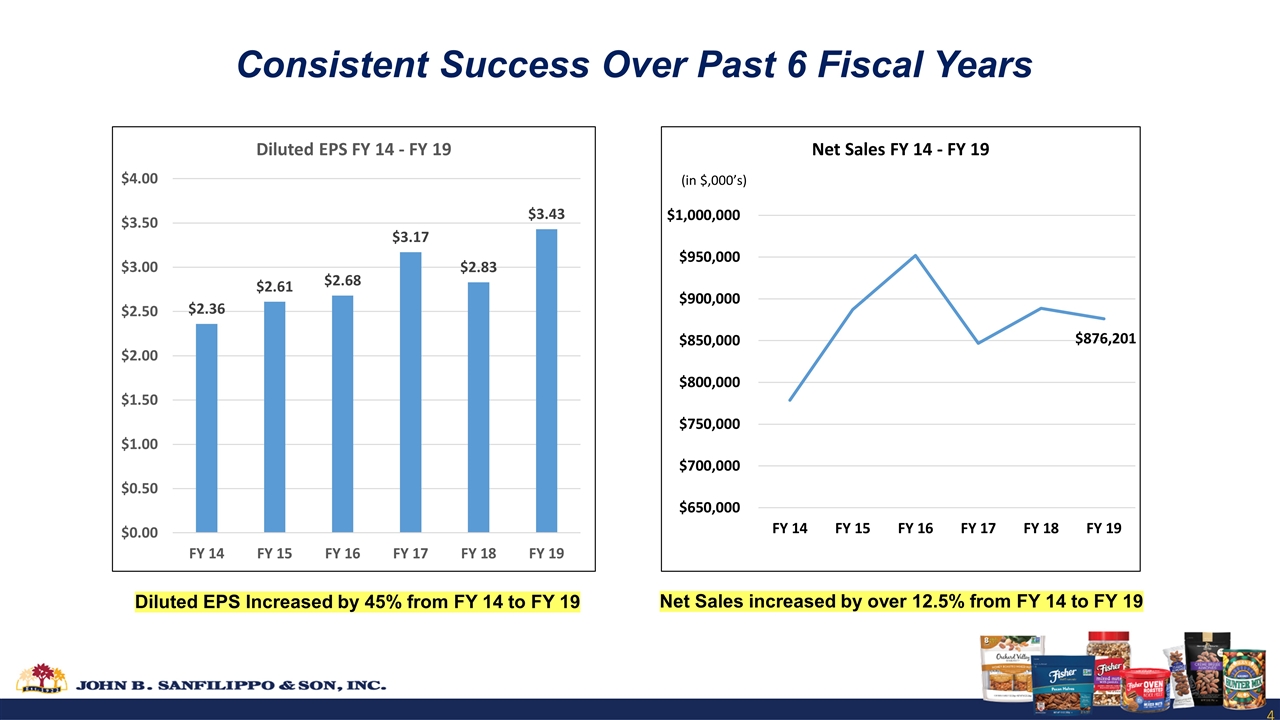

Consistent Success Over Past 6 Fiscal Years Diluted EPS Increased by 45% from FY 14 to FY 19 Net Sales increased by over 12.5% from FY 14 to FY 19

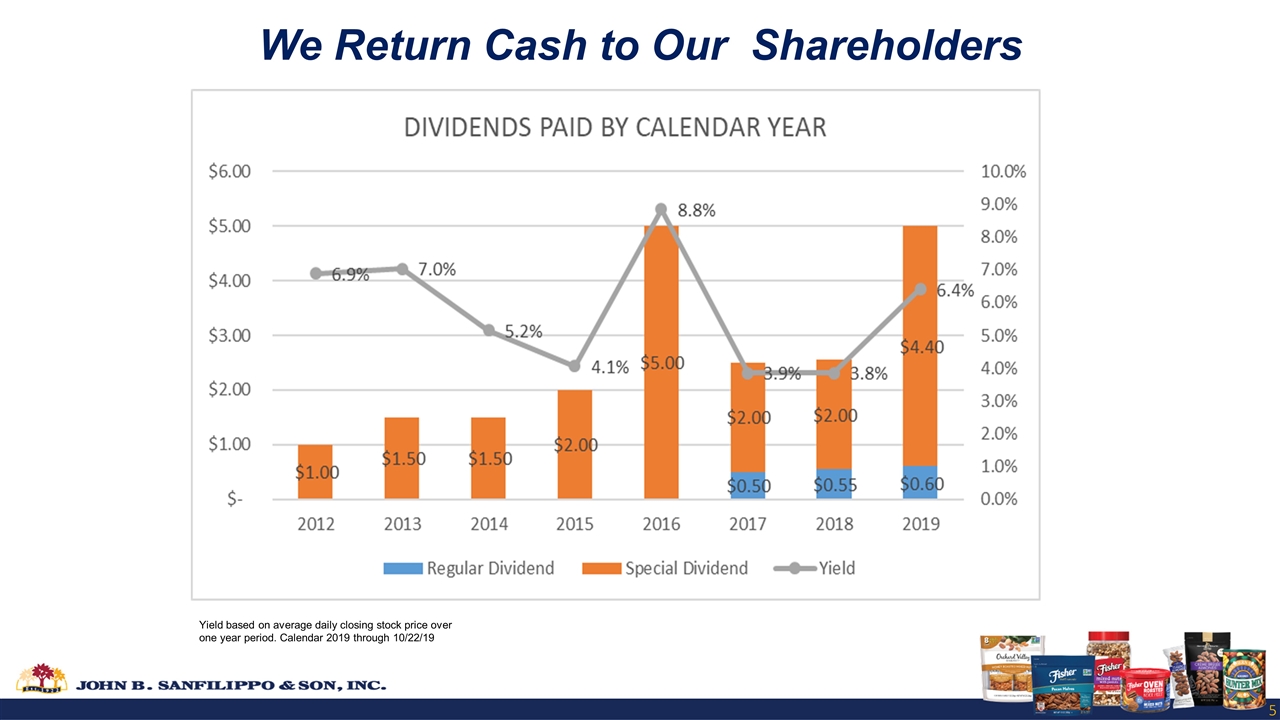

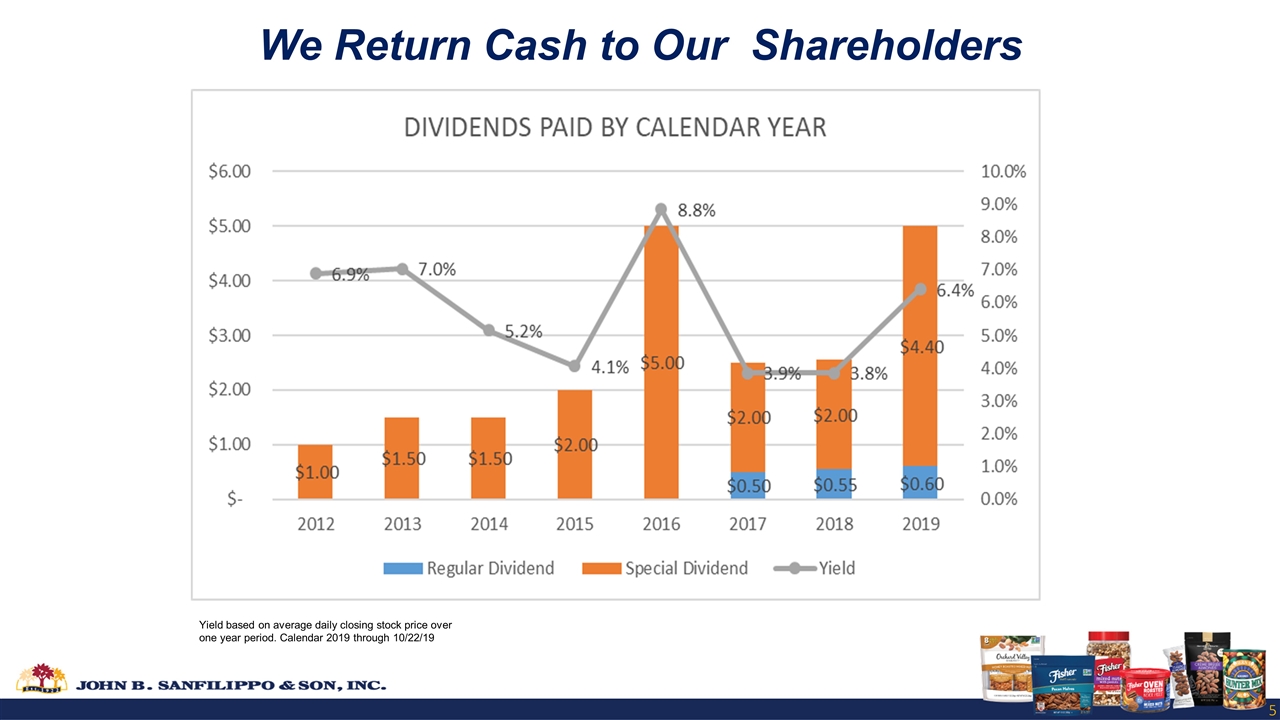

Yield based on average daily closing stock price over one year period. Calendar 2019 through 10/22/19 We Return Cash to Our Shareholders

FY 2019 Results 6

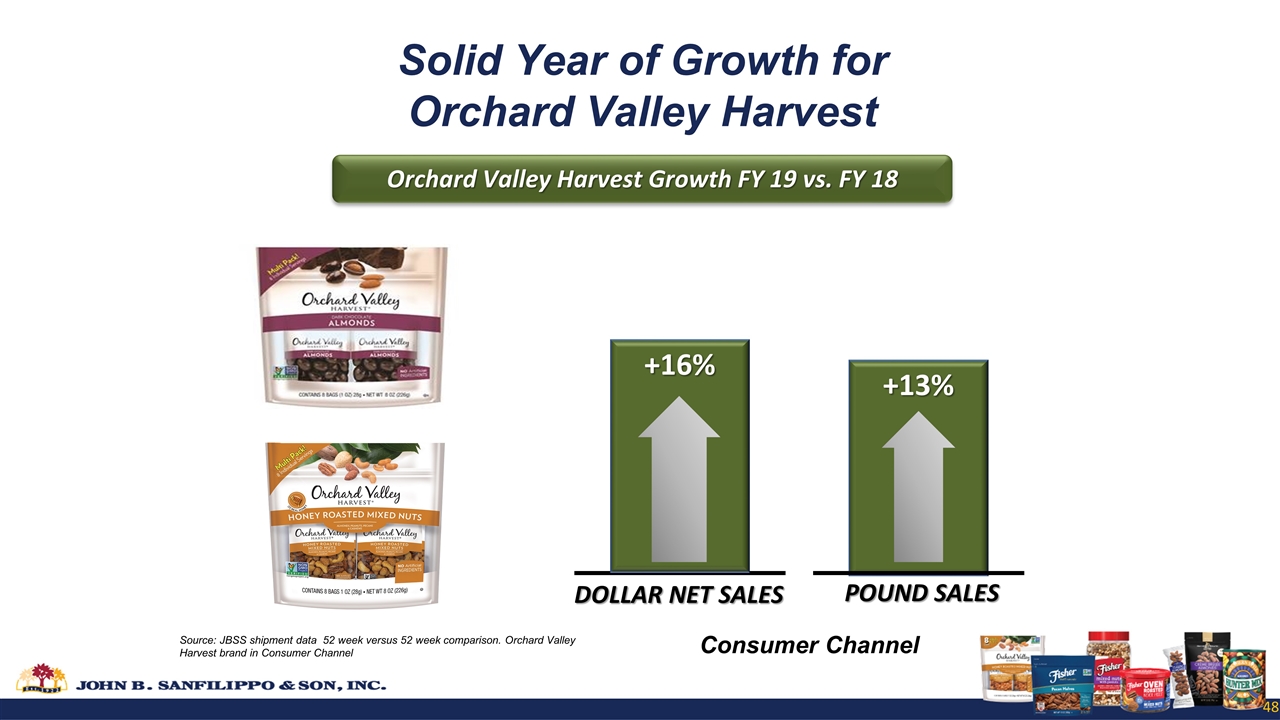

Orchard Valley Harvest net sales grew 16% in the consumer channel due to new product introductions, higher velocity and increased distribution Grew Fisher “Oven Roasted, Never Fried” snack nut line of products, with ACV* distribution up +16% versus prior year A challenging year for Fisher recipe due to private brand competition, but strong growth in traditional grocery FY 2019 Accomplishments 8 8 *ACV: All commodity volume as measured by IRI

Expanded product assortments at key retail private brand partners, particularly in value-added trail mix category Gained new “Top 20” private brand retail partners Despite challenges in Commercial Ingredient sector, we significantly expanded business with a key foodservice distributor FY 2019 Accomplishments 9 9

Expanded branded portfolio on Amazon with addition of Squirrel Brand and Hunter Mix Expanded branded distribution in airports, hotels, fitness centers and business & industry FY 2019 Accomplishments 10

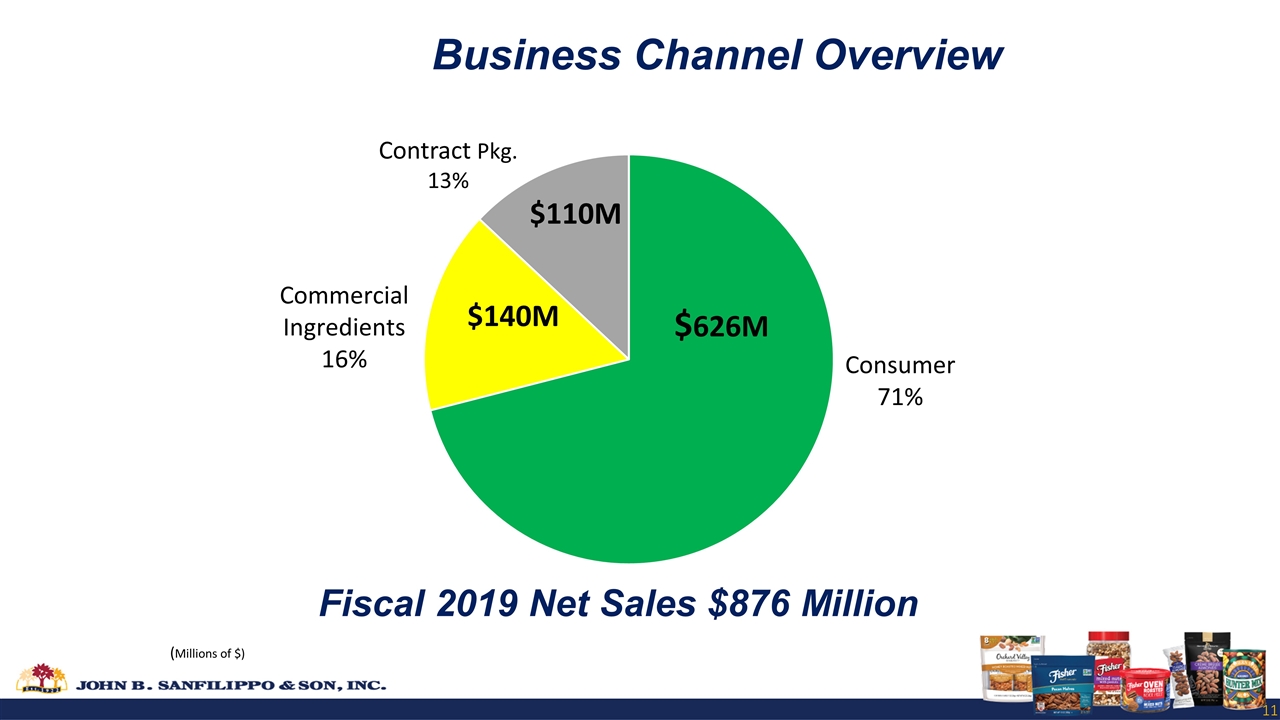

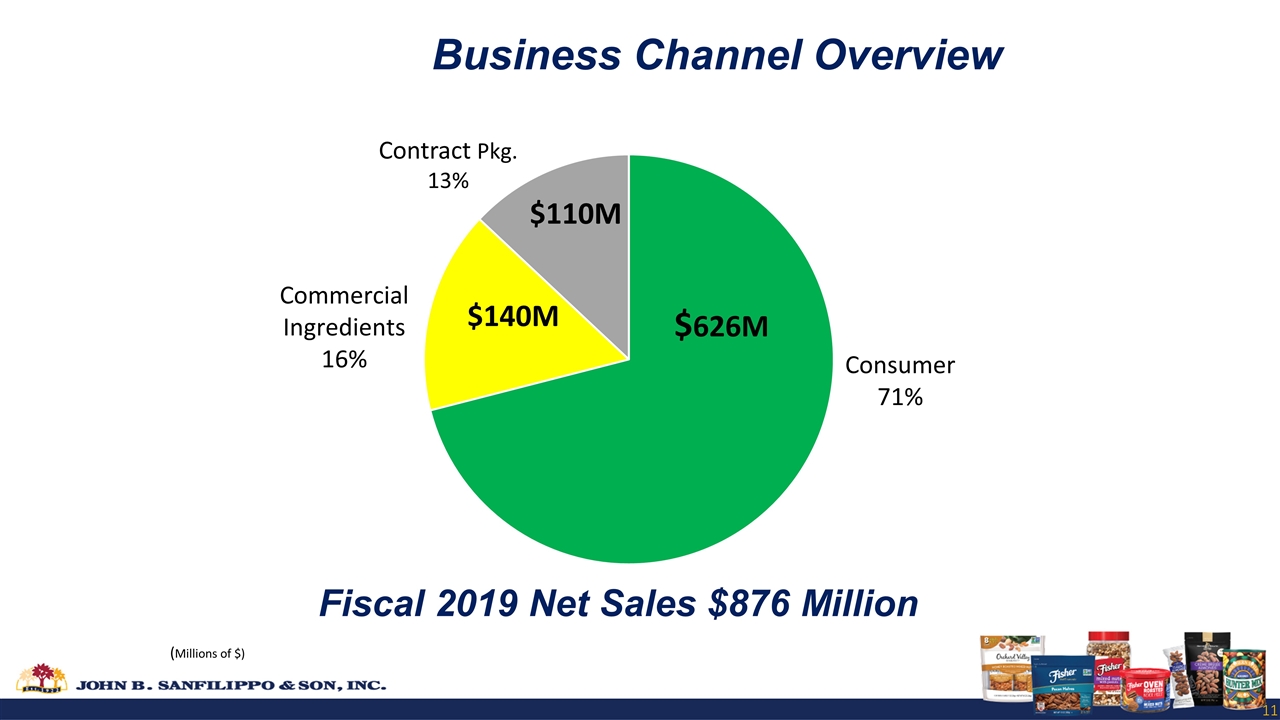

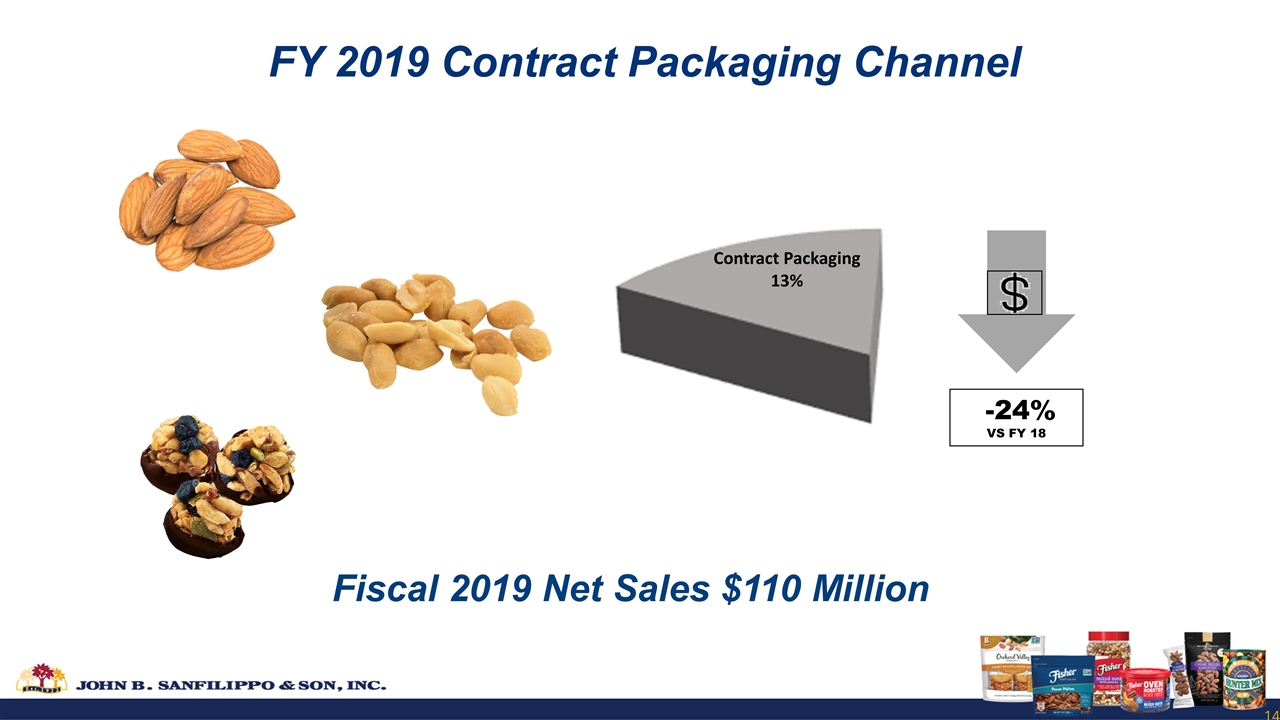

Fiscal 2019 Net Sales $876 Million Business Channel Overview (Millions of $) Contract Pkg. 13%

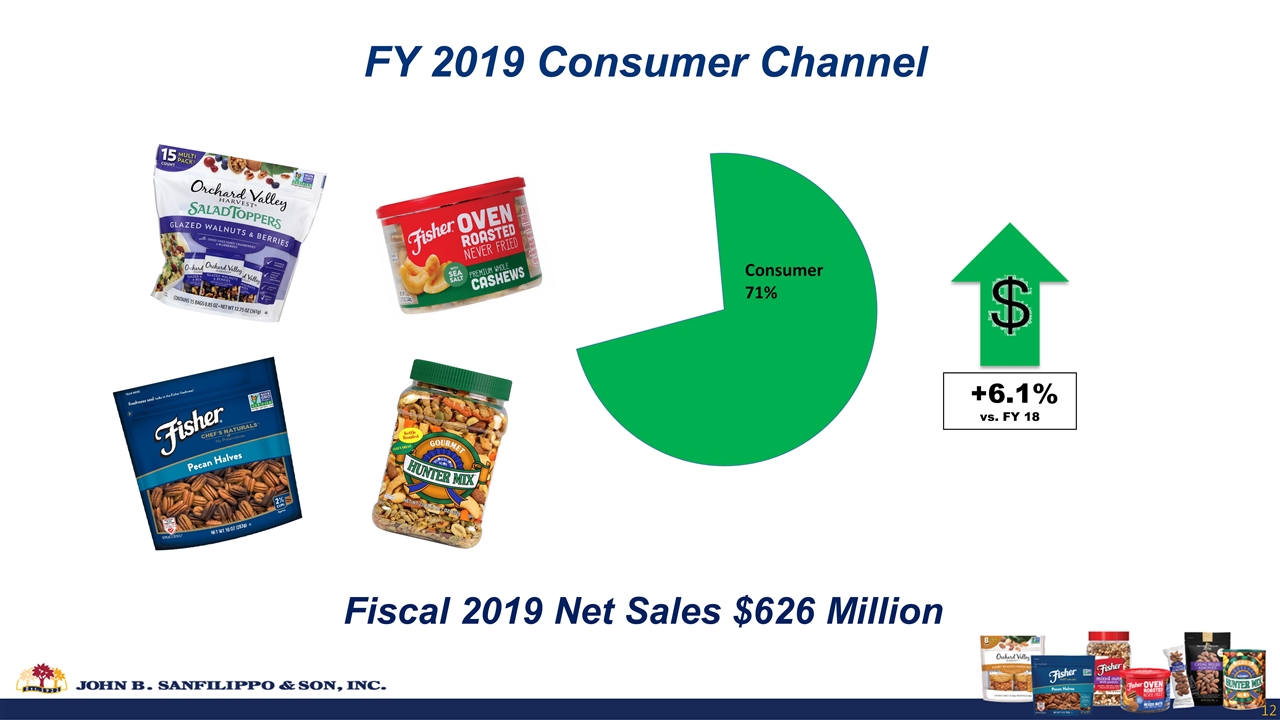

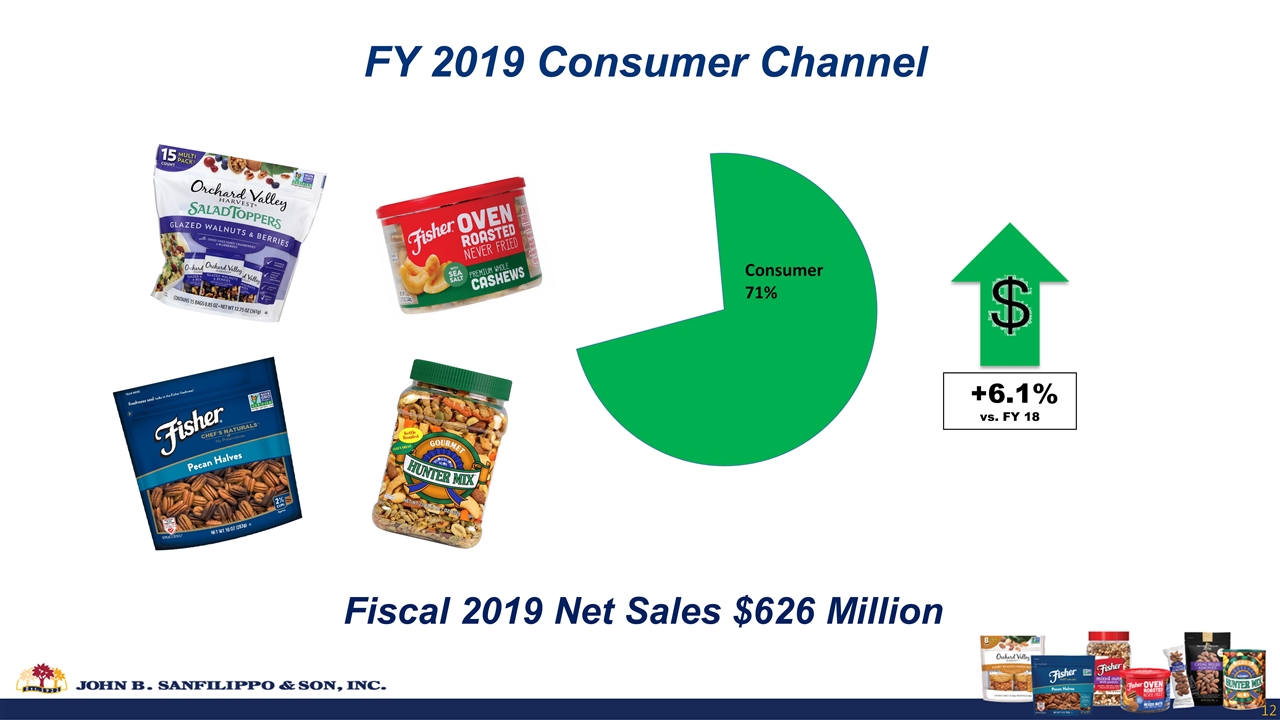

Fiscal 2019 Net Sales $626 Million FY 2019 Consumer Channel Consumer 71% +6.1% vs. FY 18

Fiscal 2019 Net Sales $140 Million FY 2019 Commercial Ingredients Channel -9.1% VS. FY 18 Commercial Ingredients 16%

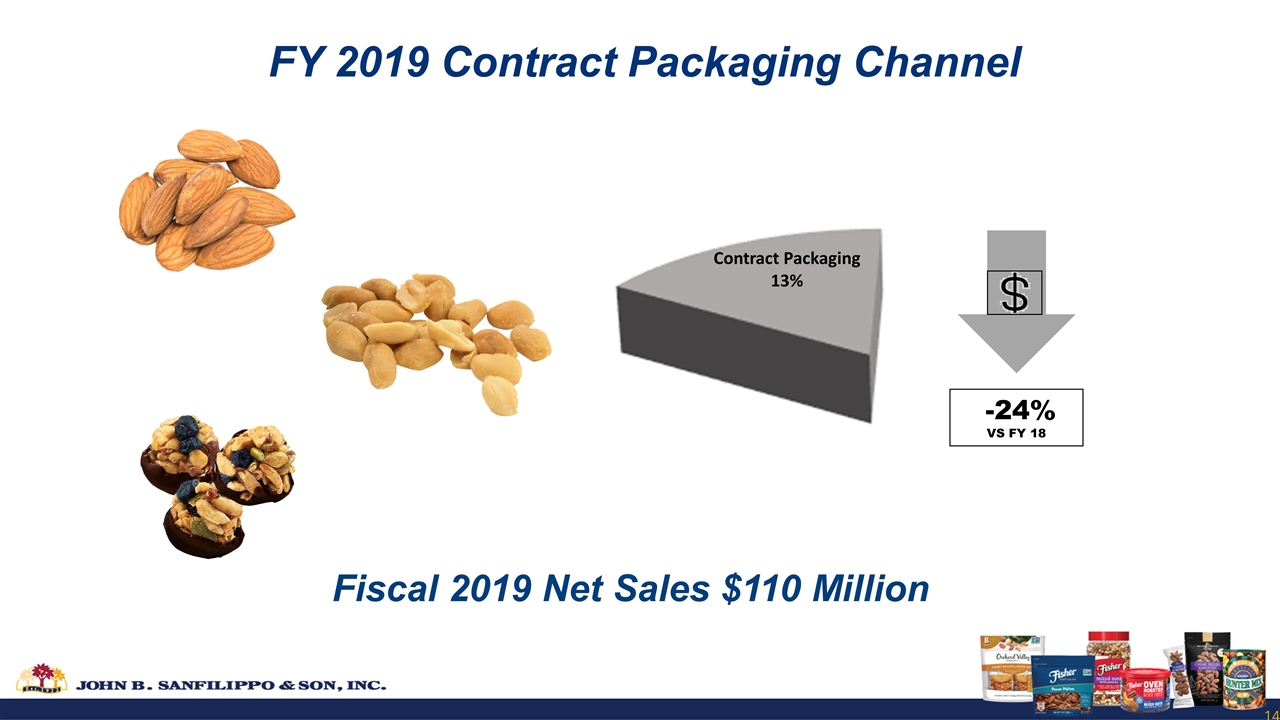

FY 2019 Contract Packaging Channel Fiscal 2019 Net Sales $110 Million -24% VS FY 18 Contract Packaging 13%

FY 2019 Nut Category Review 15

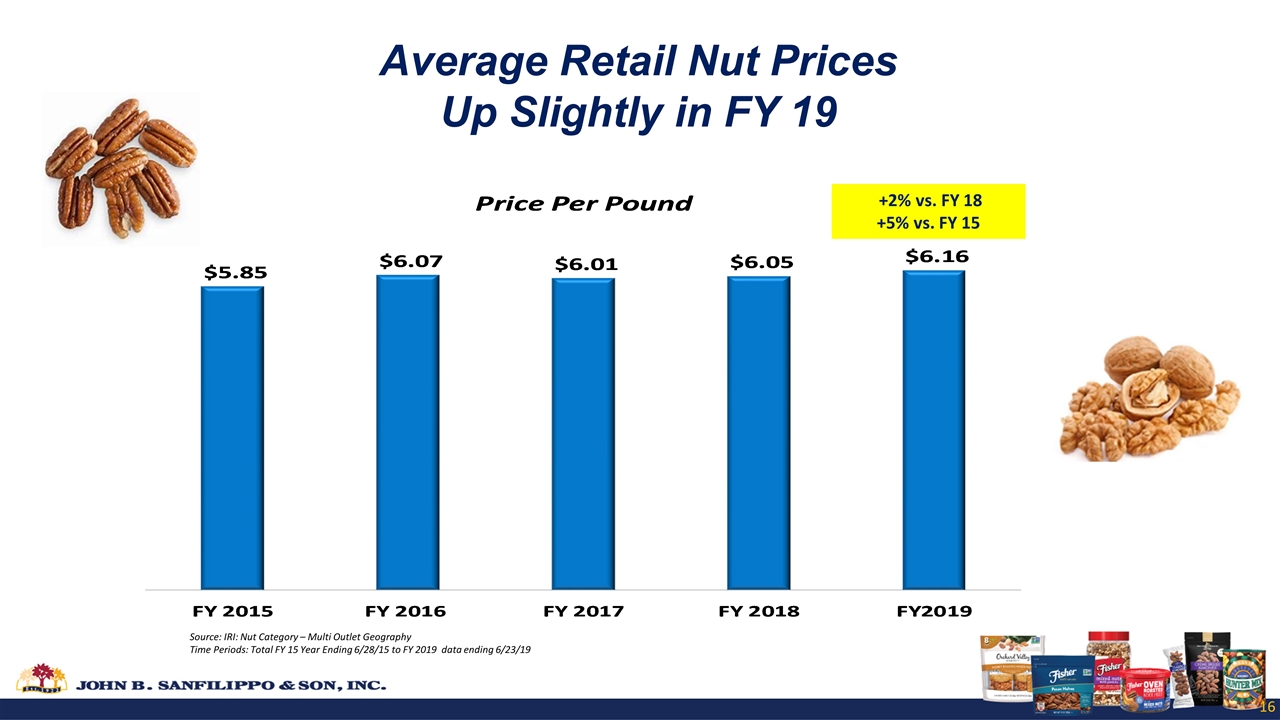

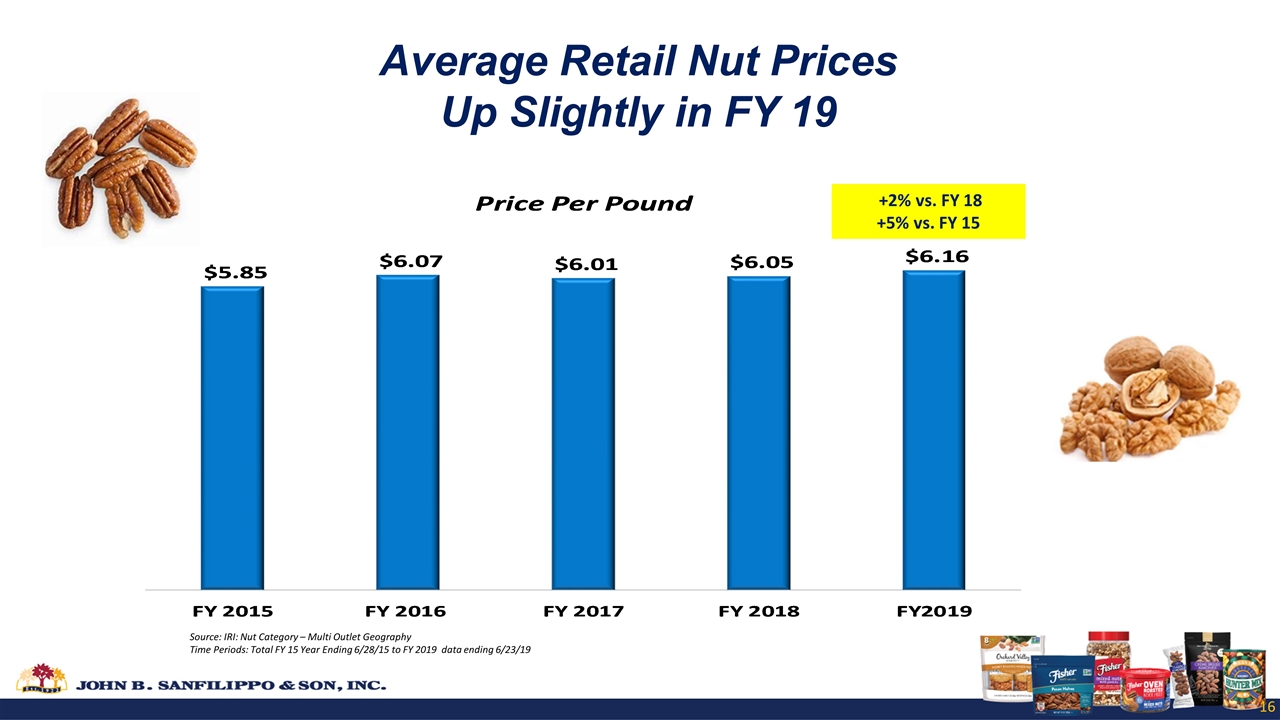

Average Retail Nut Prices Up Slightly in FY 19 Source: IRI: Nut Category – Multi Outlet Geography Time Periods: Total FY 15 Year Ending 6/28/15 to FY 2019 data ending 6/23/19 +2% vs. FY 18 +5% vs. FY 15

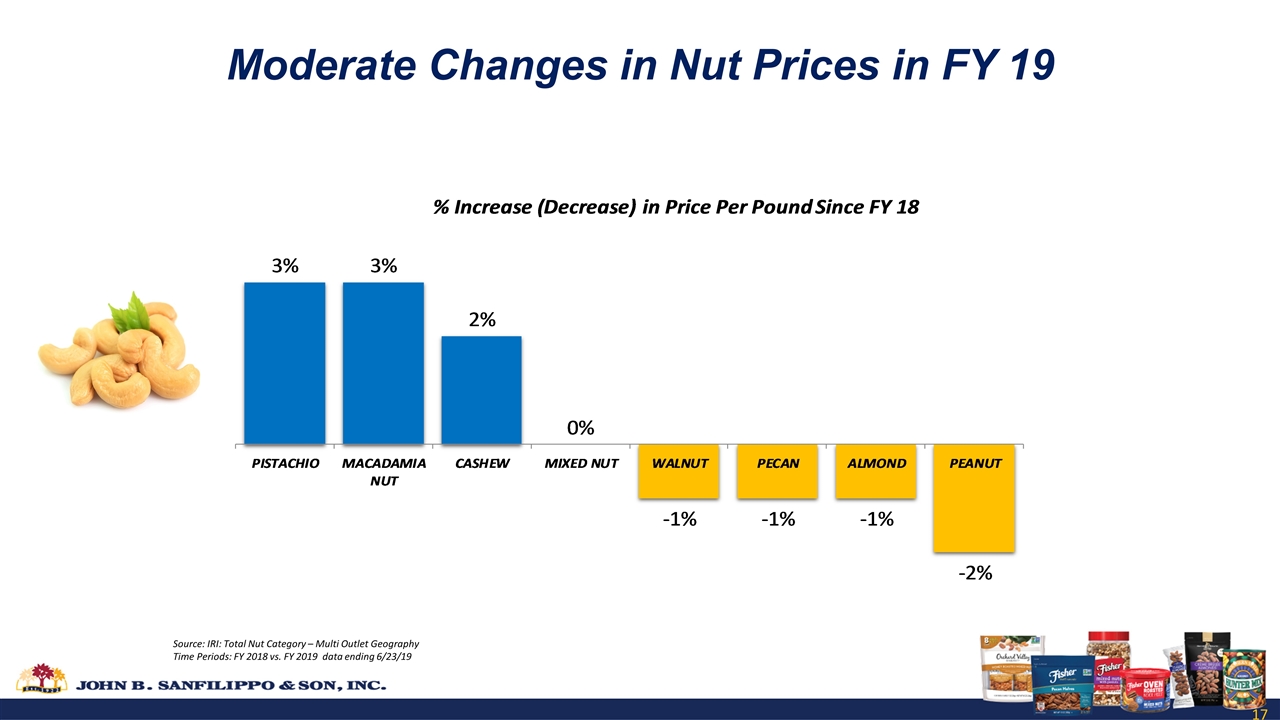

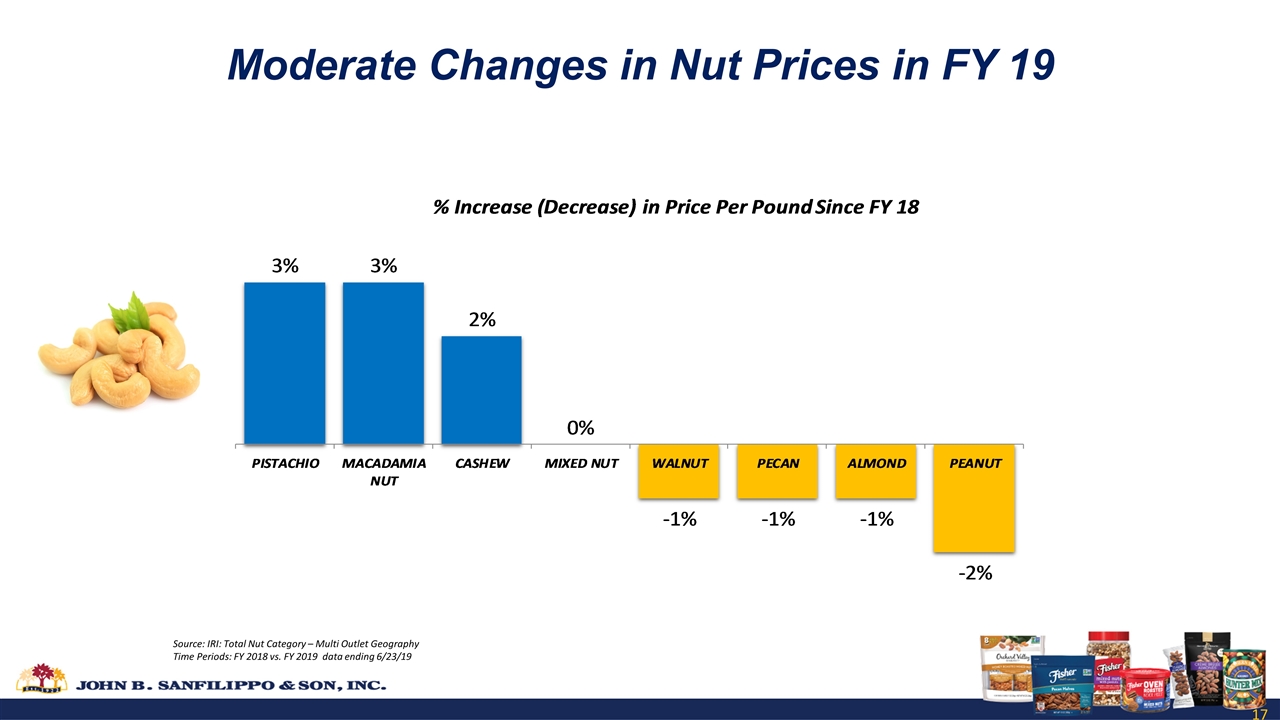

Moderate Changes in Nut Prices in FY 19 Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: FY 2018 vs. FY 2019 data ending 6/23/19

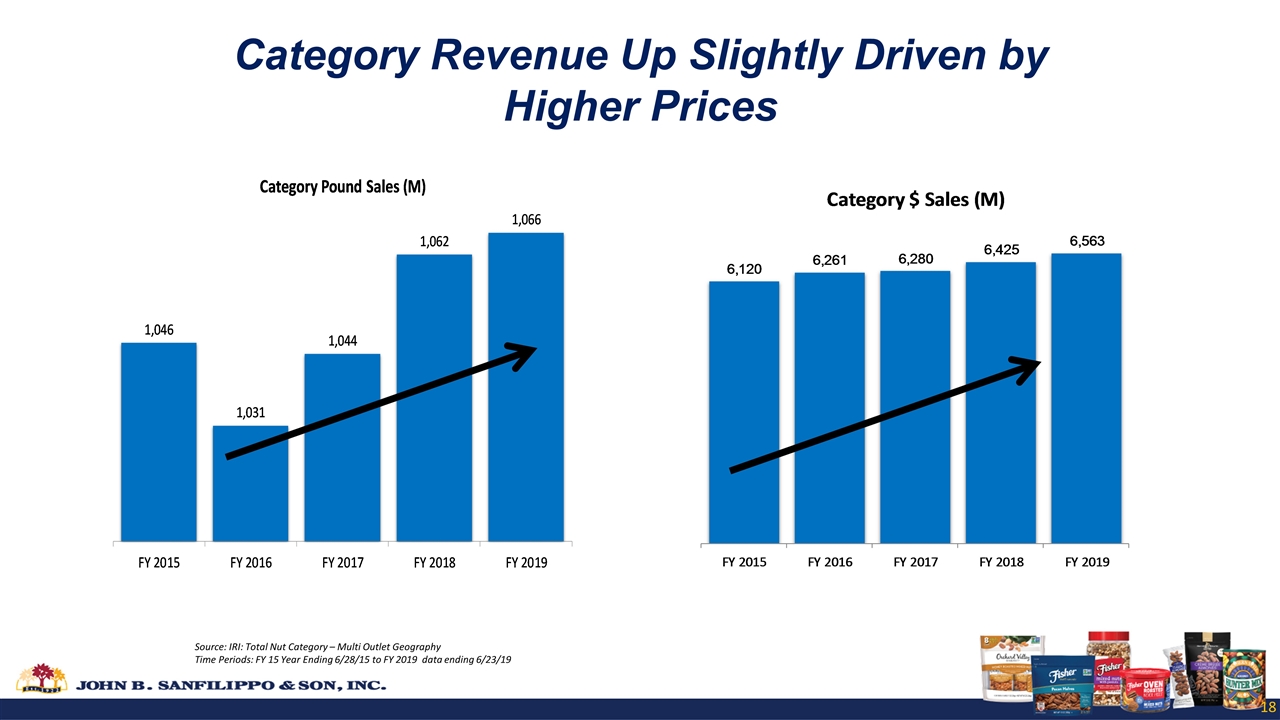

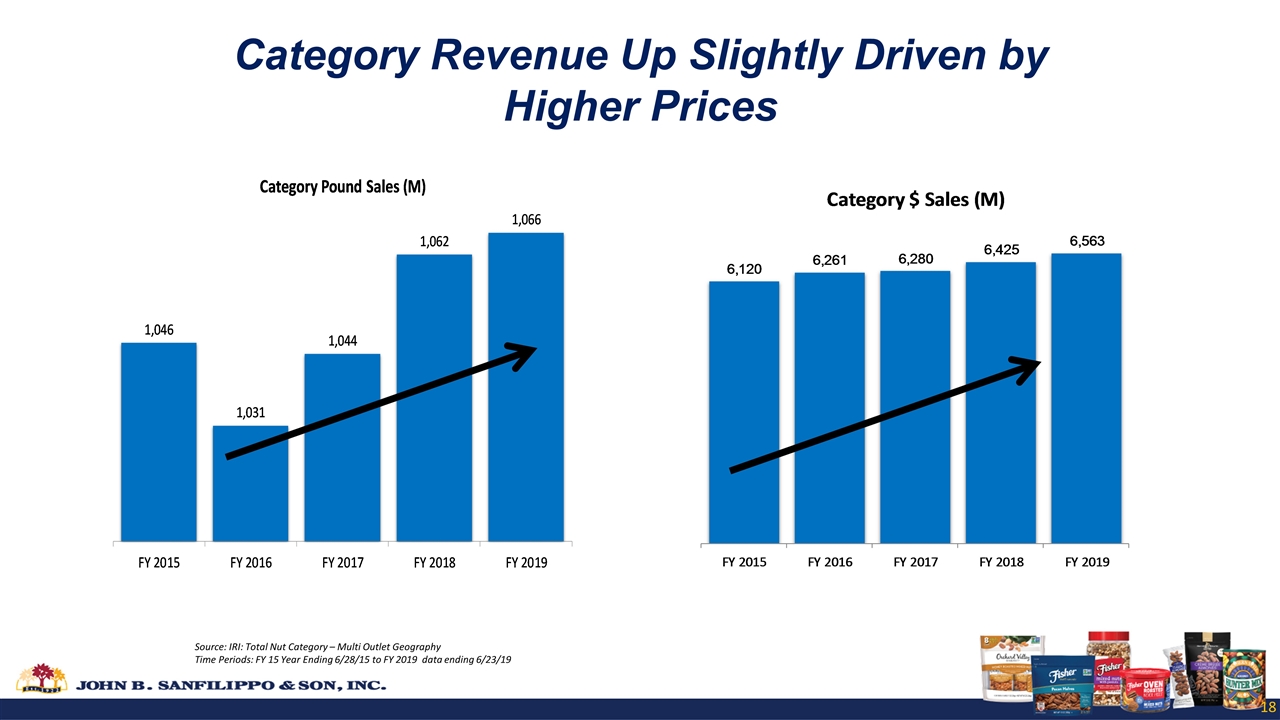

Category Revenue Up Slightly Driven by Higher Prices Source: IRI: Total Nut Category – Multi Outlet Geography Time Periods: FY 15 Year Ending 6/28/15 to FY 2019 data ending 6/23/19

Locally Grown

FY 2019 Financial Milestones 20

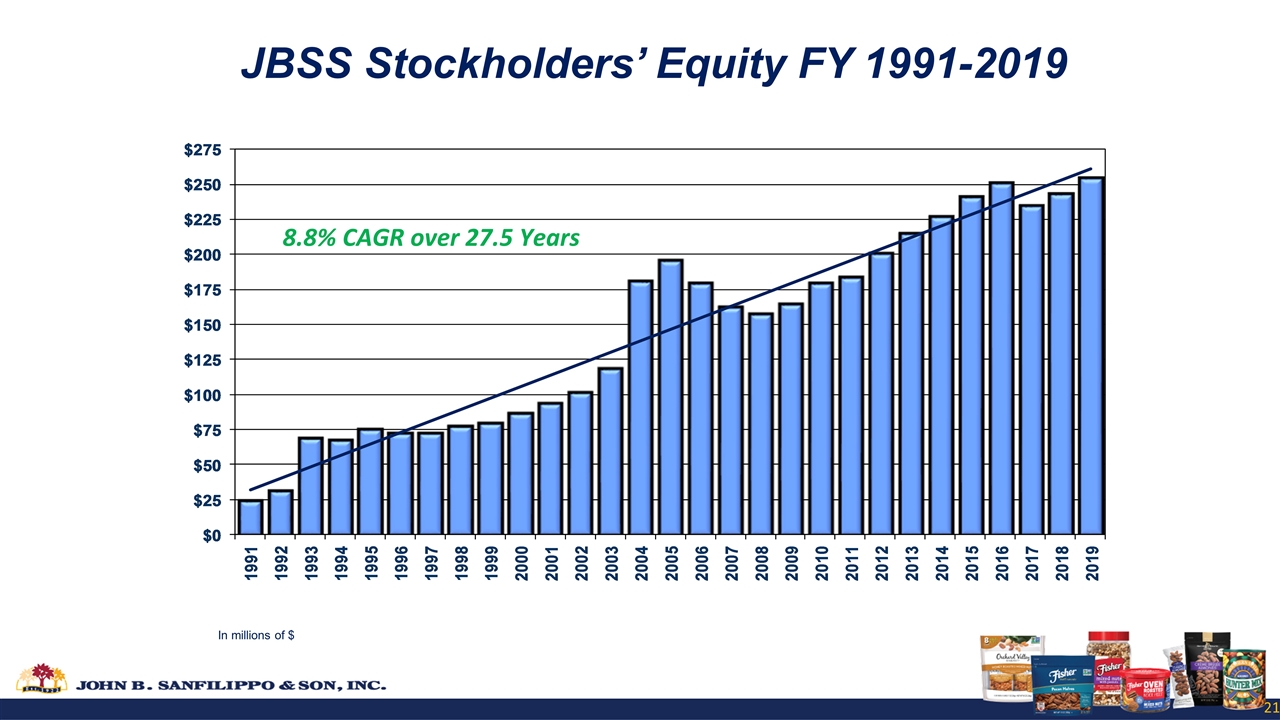

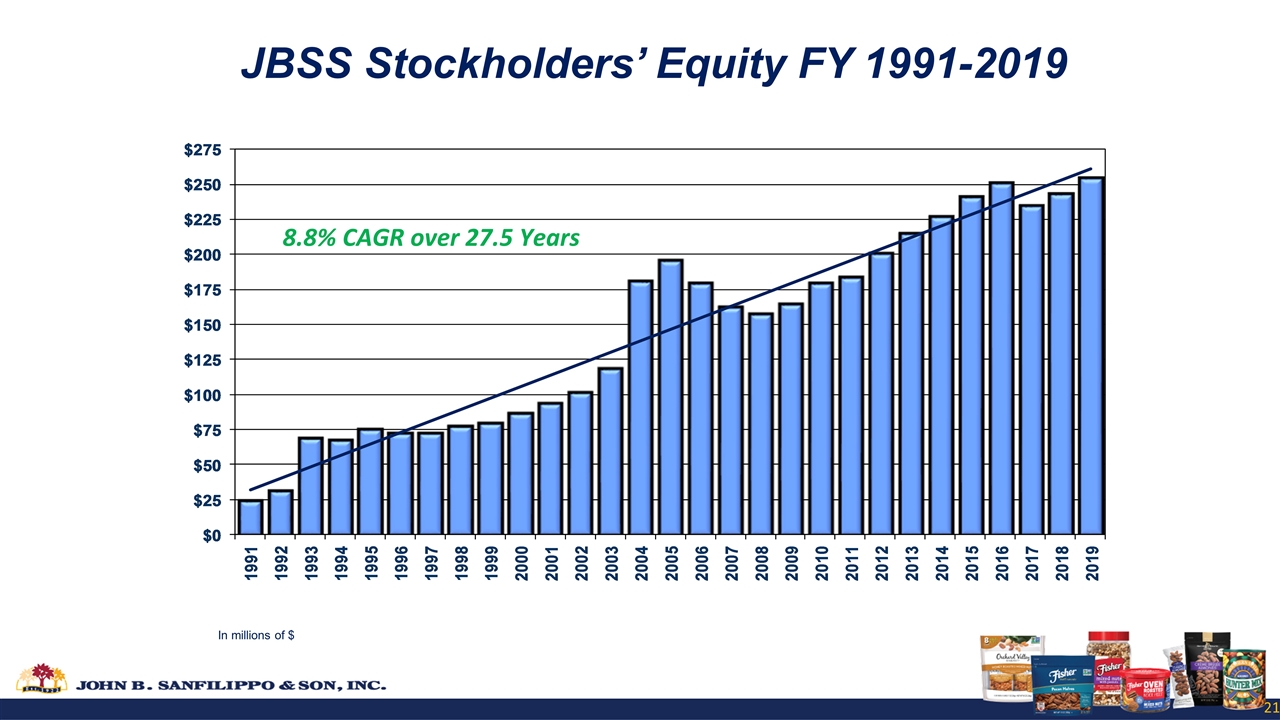

In millions of $ 8.8% CAGR over 27.5 Years JBSS Stockholders’ Equity FY 1991-2019

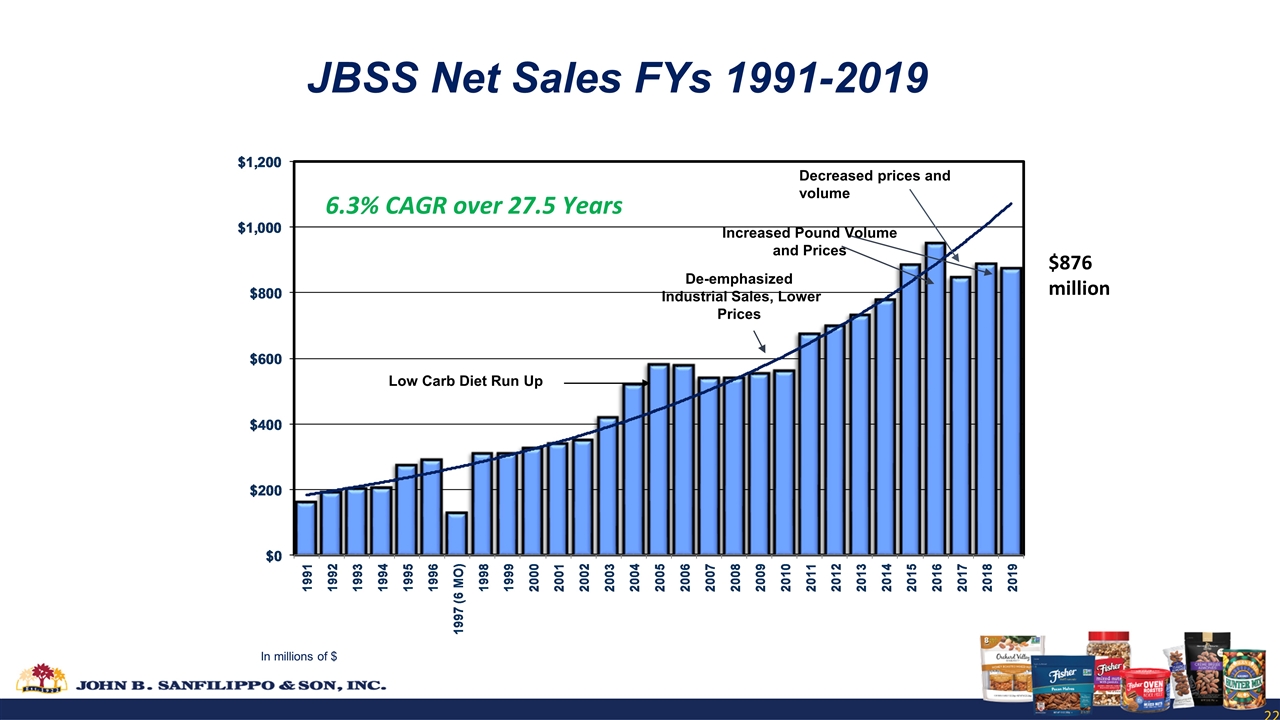

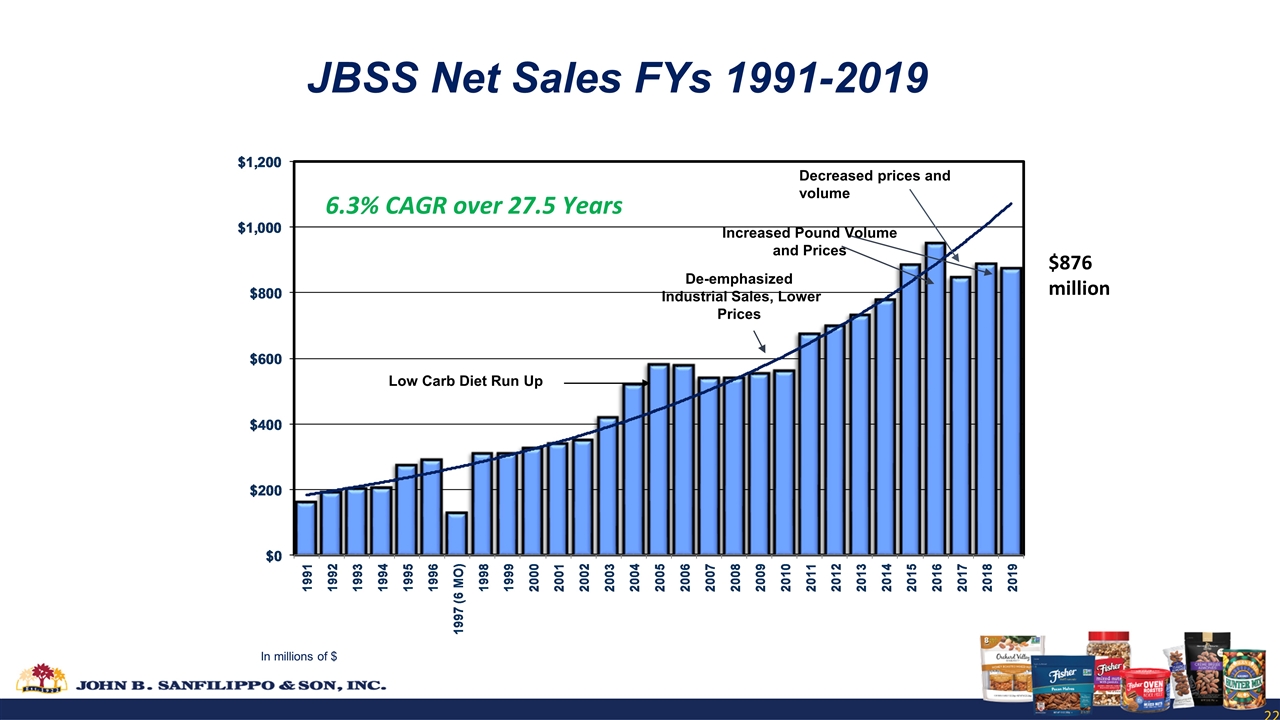

Increased Pound Volume and Prices De-emphasized Industrial Sales, Lower Prices Low Carb Diet Run Up $876 million In millions of $ Decreased prices and volume 6.3% CAGR over 27.5 Years JBSS Net Sales FYs 1991-2019

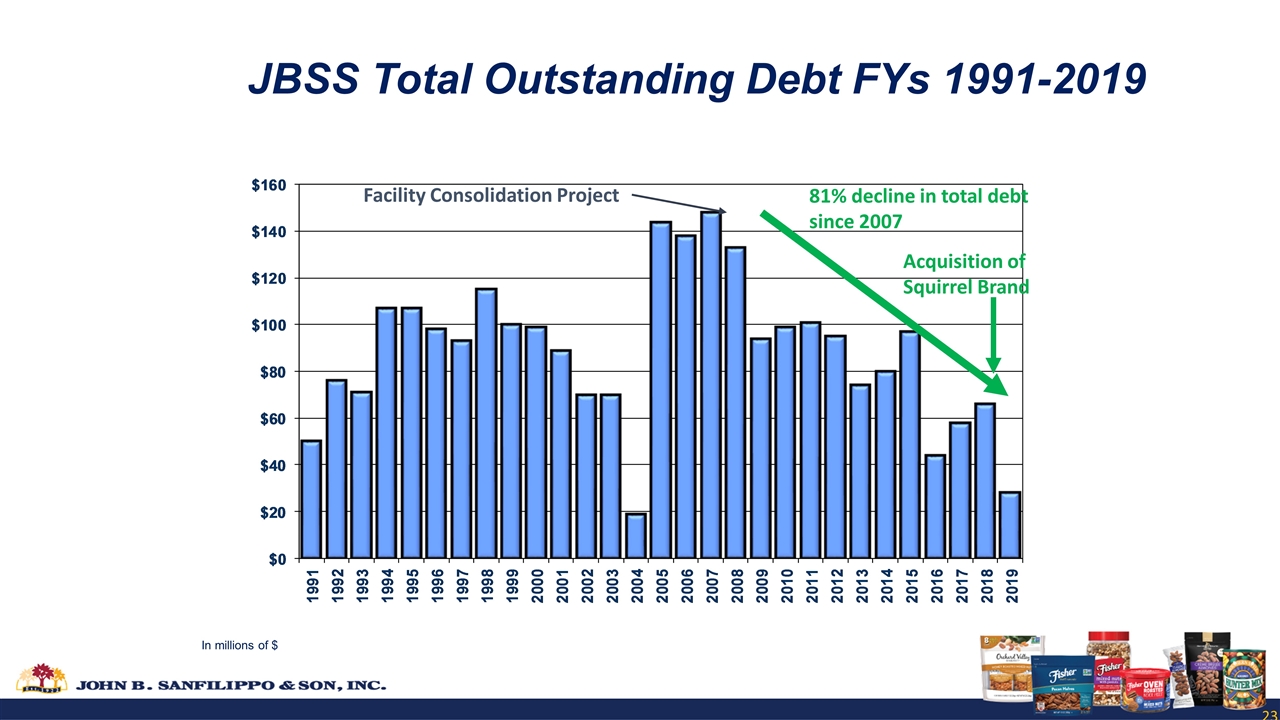

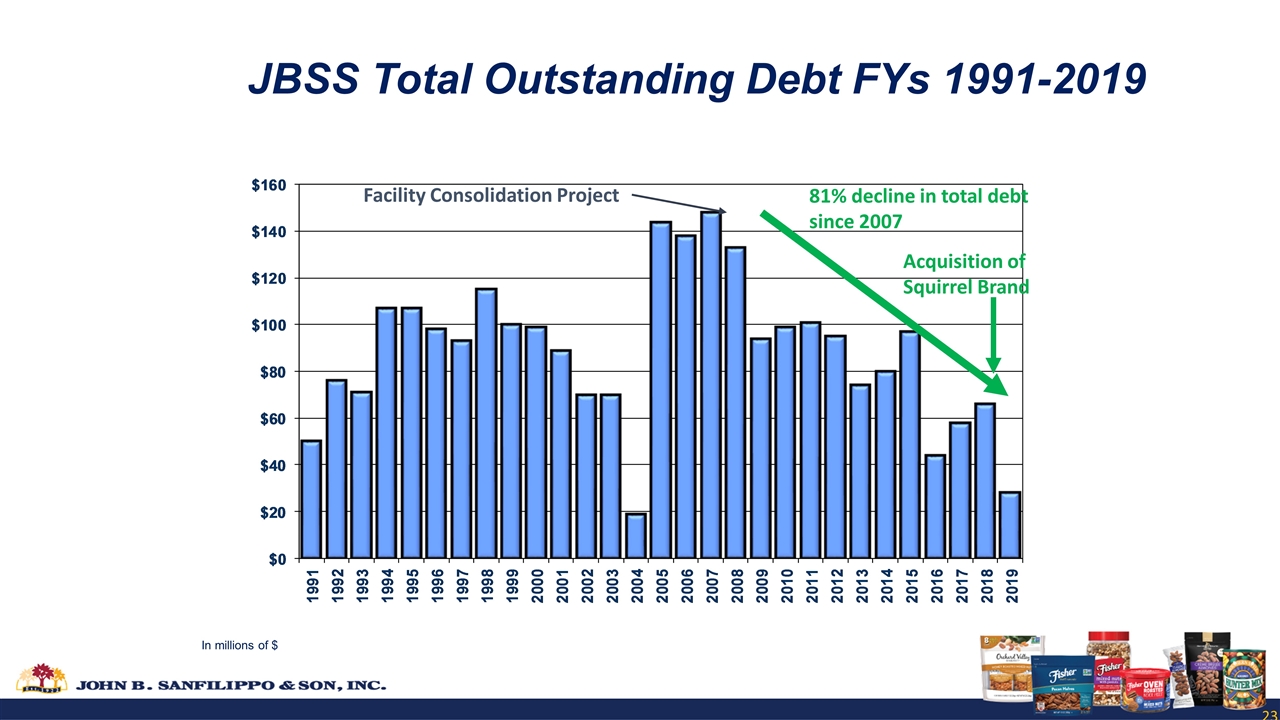

In millions of $ Facility Consolidation Project 81% decline in total debt since 2007 JBSS Total Outstanding Debt FYs 1991-2019 Acquisition of Squirrel Brand

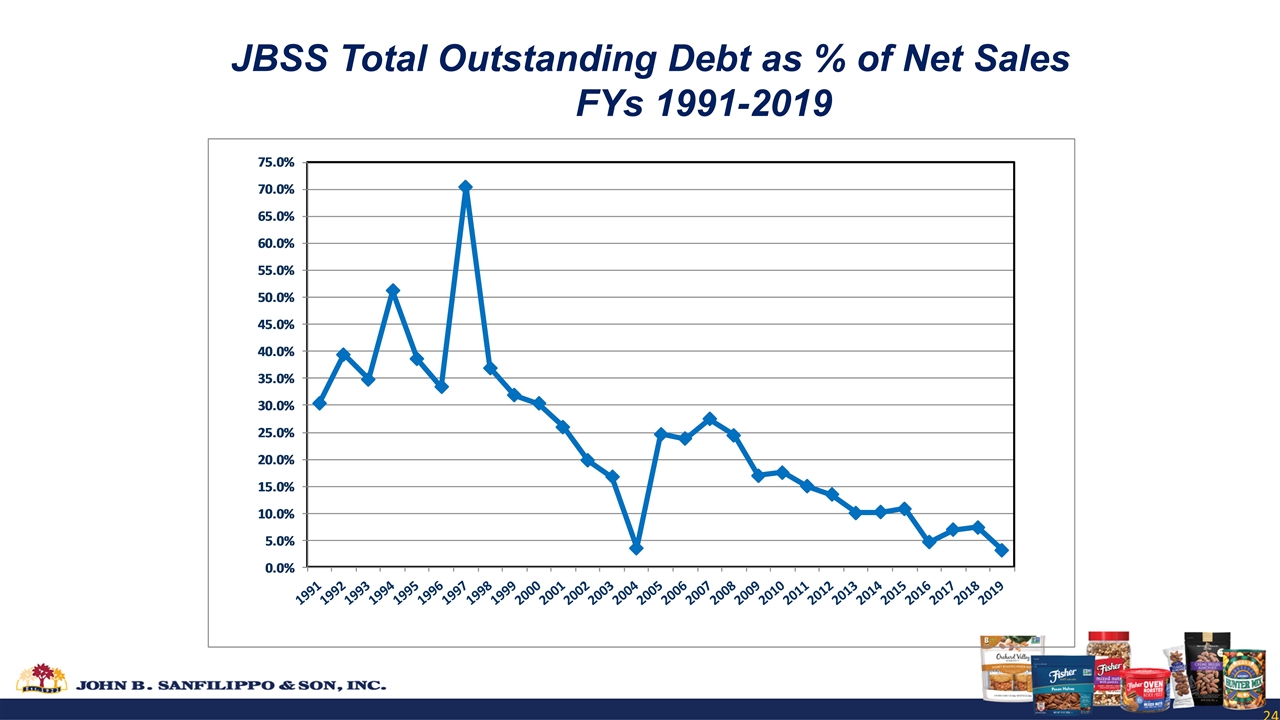

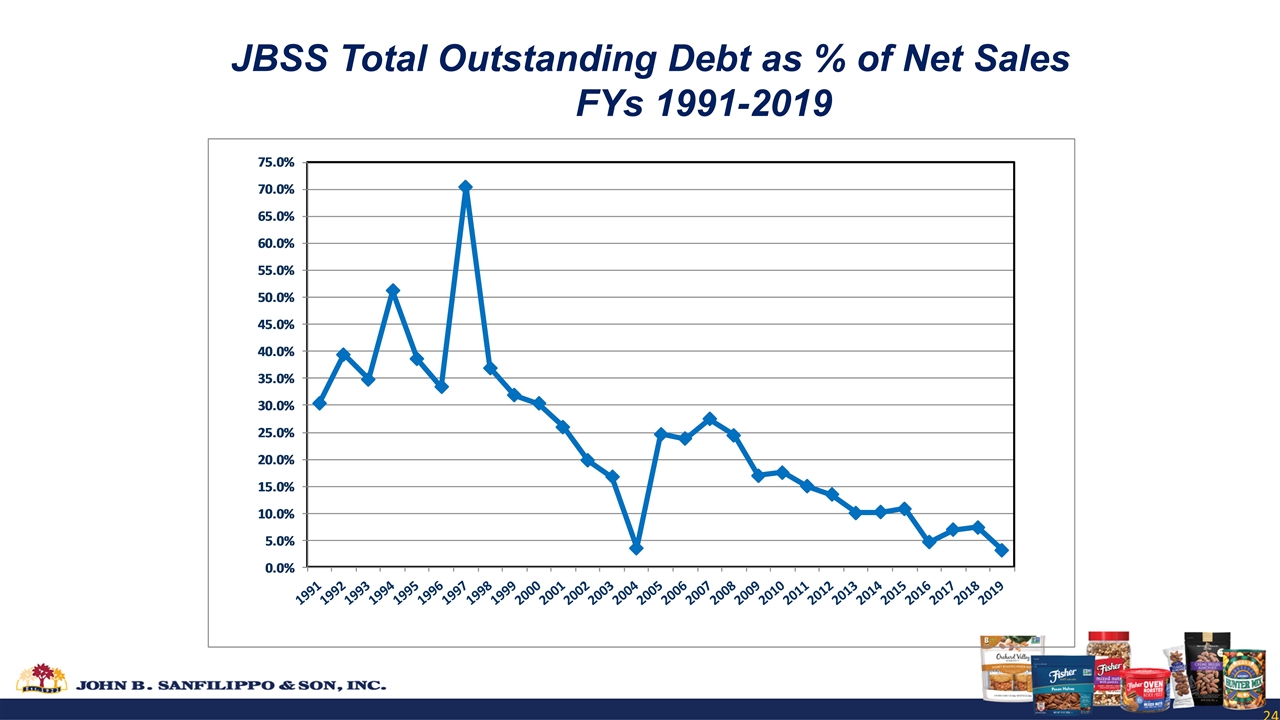

JBSS Total Outstanding Debt as % of Net Sales FYs 1991-2019

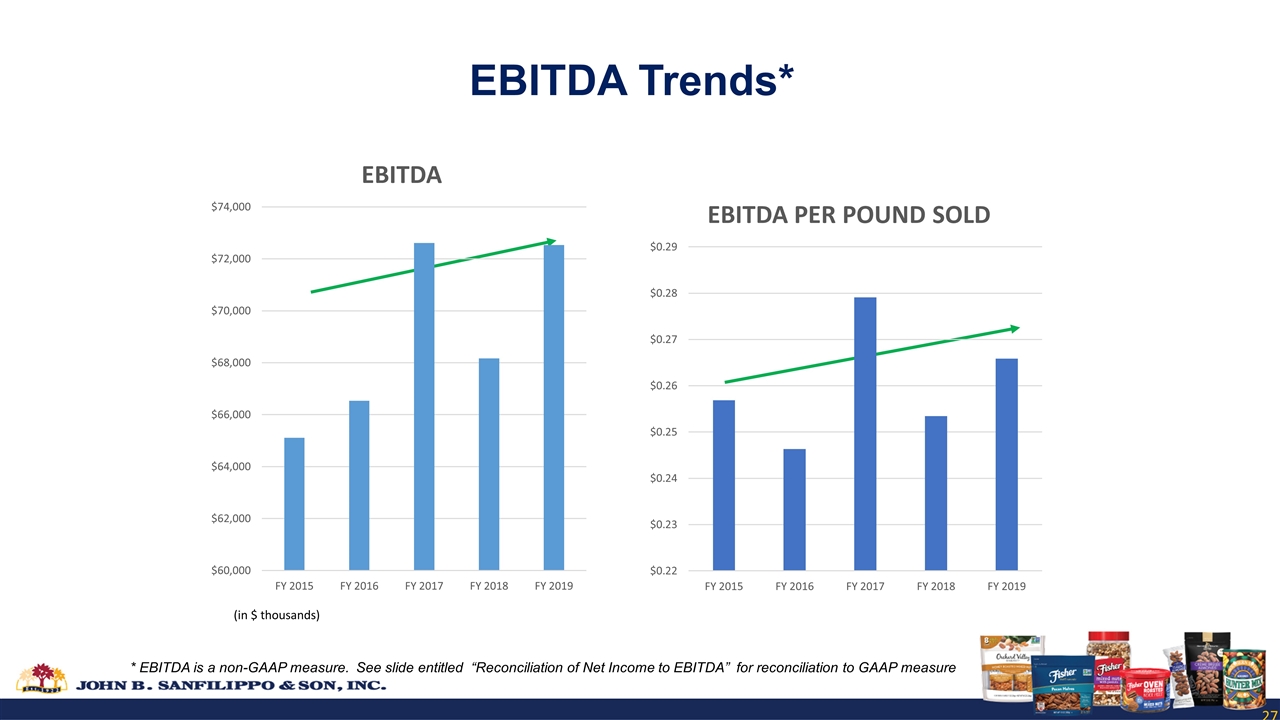

EBITDA EBITDA consists of earnings before interest, taxes, depreciation, amortization and noncontrolling interest. EBITDA is not a measurement of financial performance under accounting principles generally accepted in the United States of America ("GAAP"), and does not represent cash flow from operations. EBITDA is presented solely as a supplemental disclosure because management believes that it is important in evaluating JBSS's financial performance and market valuation. In conformity with Regulation G, a reconciliation of EBITDA to the most directly comparable financial measures calculated and presented in accordance with GAAP is presented in the following slide.

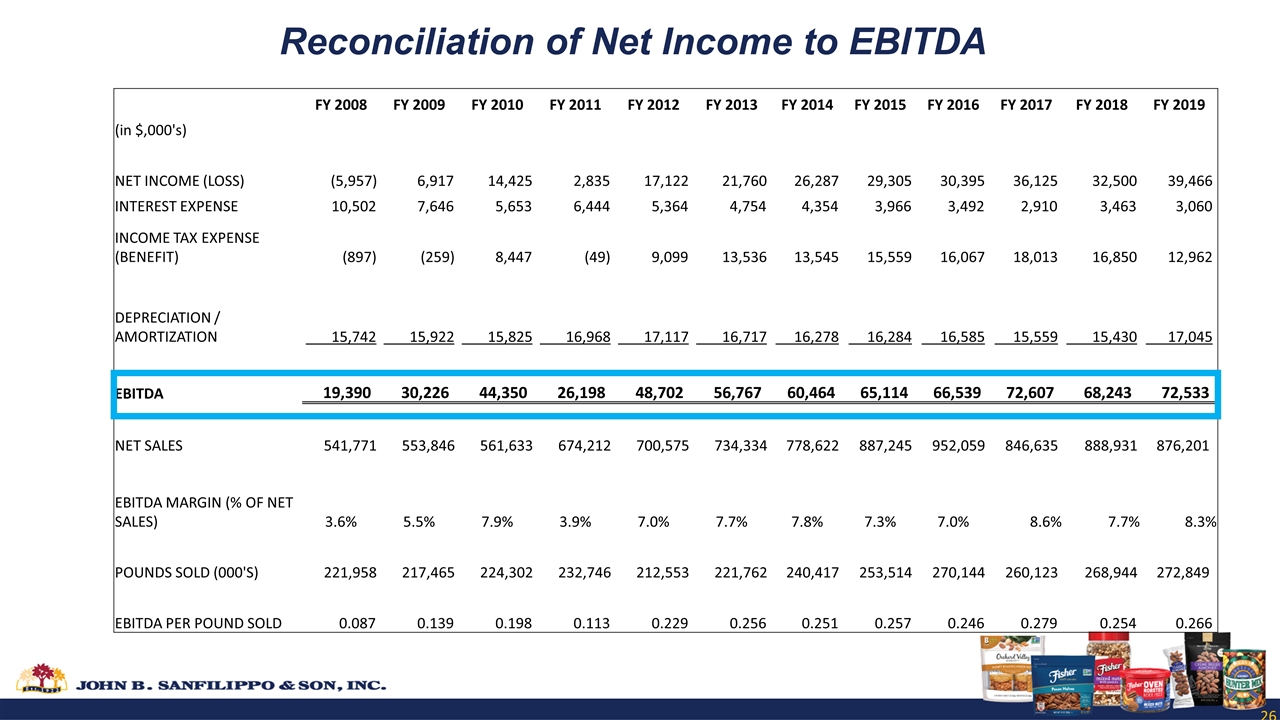

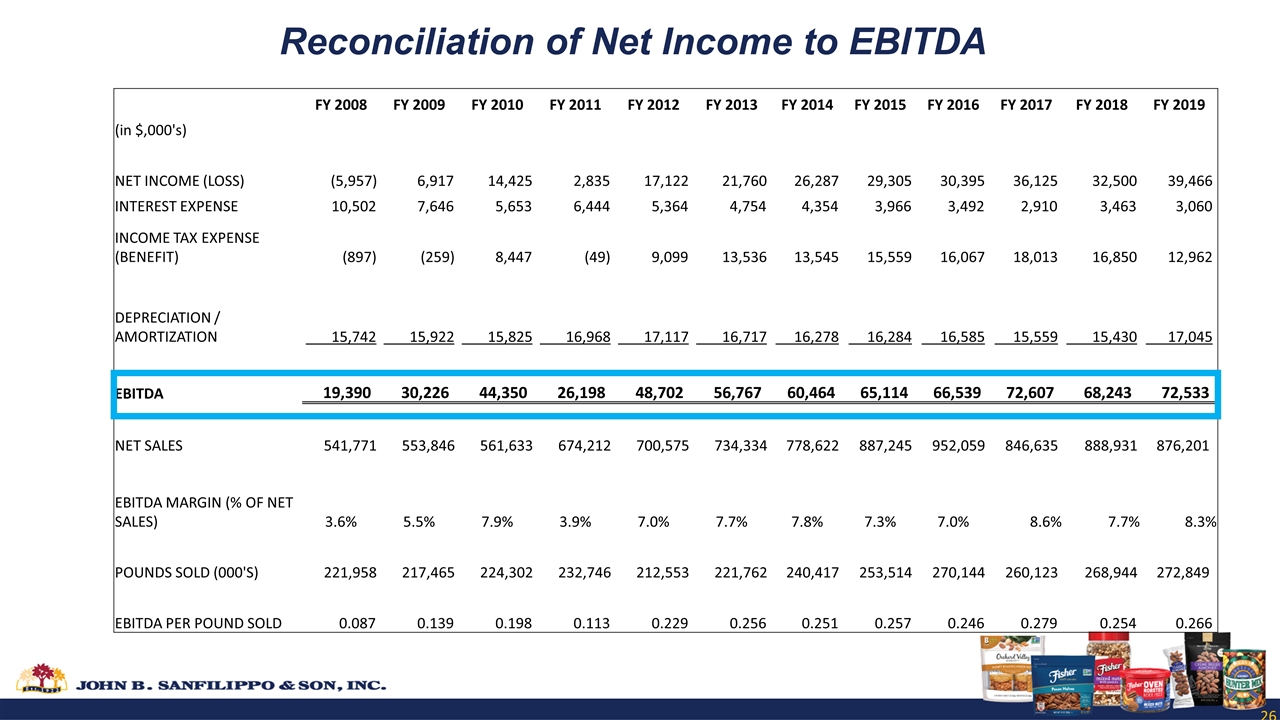

Reconciliation of Net Income to EBITDA FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 (in $,000's) NET INCOME (LOSS) (5,957) 6,917 14,425 2,835 17,122 21,760 26,287 29,305 30,395 36,125 32,500 39,466 INTEREST EXPENSE 10,502 7,646 5,653 6,444 5,364 4,754 4,354 3,966 3,492 2,910 3,463 3,060 INCOME TAX EXPENSE (BENEFIT) (897) (259) 8,447 (49) 9,099 13,536 13,545 15,559 16,067 18,013 16,850 12,962 DEPRECIATION / AMORTIZATION 15,742 15,922 15,825 16,968 17,117 16,717 16,278 16,284 16,585 15,559 15,430 17,045 EBITDA 19,390 30,226 44,350 26,198 48,702 56,767 60,464 65,114 66,539 72,607 68,243 72,533 NET SALES 541,771 553,846 561,633 674,212 700,575 734,334 778,622 887,245 952,059 846,635 888,931 876,201 EBITDA MARGIN (% OF NET SALES) 3.6% 5.5% 7.9% 3.9% 7.0% 7.7% 7.8% 7.3% 7.0% 8.6% 7.7% 8.3% POUNDS SOLD (000'S) 221,958 217,465 224,302 232,746 212,553 221,762 240,417 253,514 270,144 260,123 268,944 272,849 EBITDA PER POUND SOLD 0.087 0.139 0.198 0.113 0.229 0.256 0.251 0.257 0.246 0.279 0.254 0.266

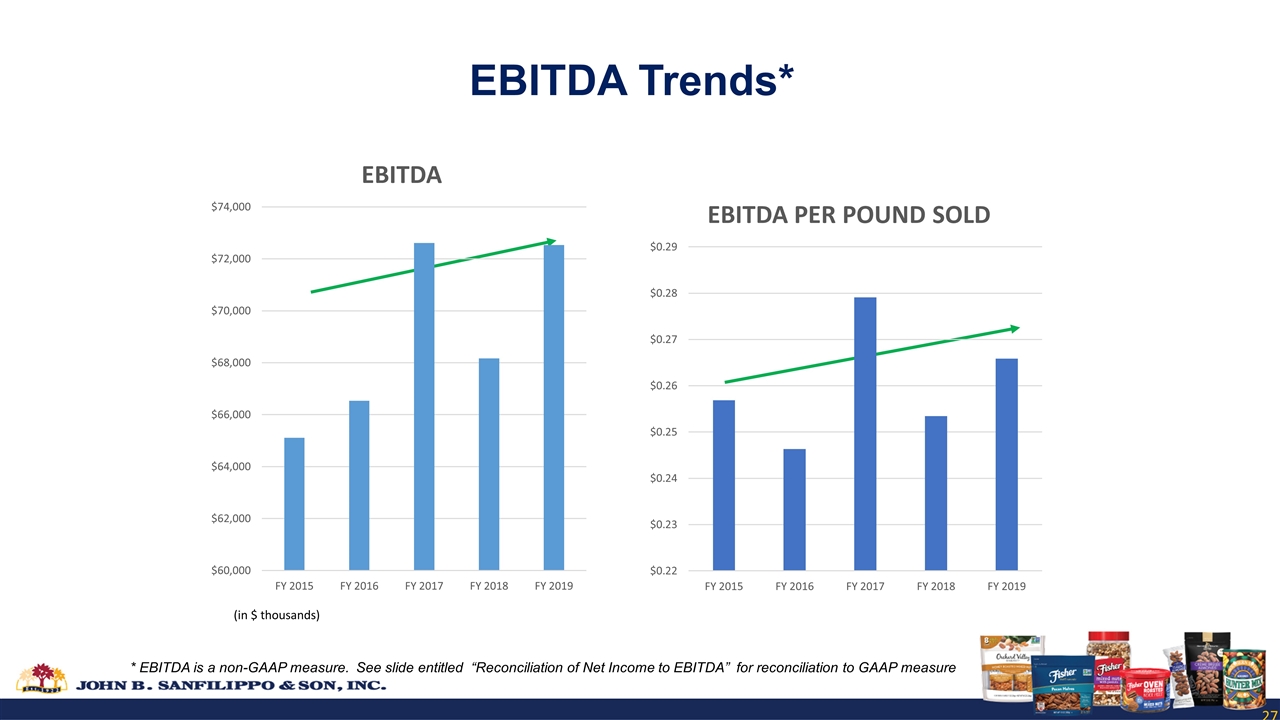

* EBITDA is a non-GAAP measure. See slide entitled “Reconciliation of Net Income to EBITDA” for reconciliation to GAAP measure (in $ thousands) EBITDA Trends*

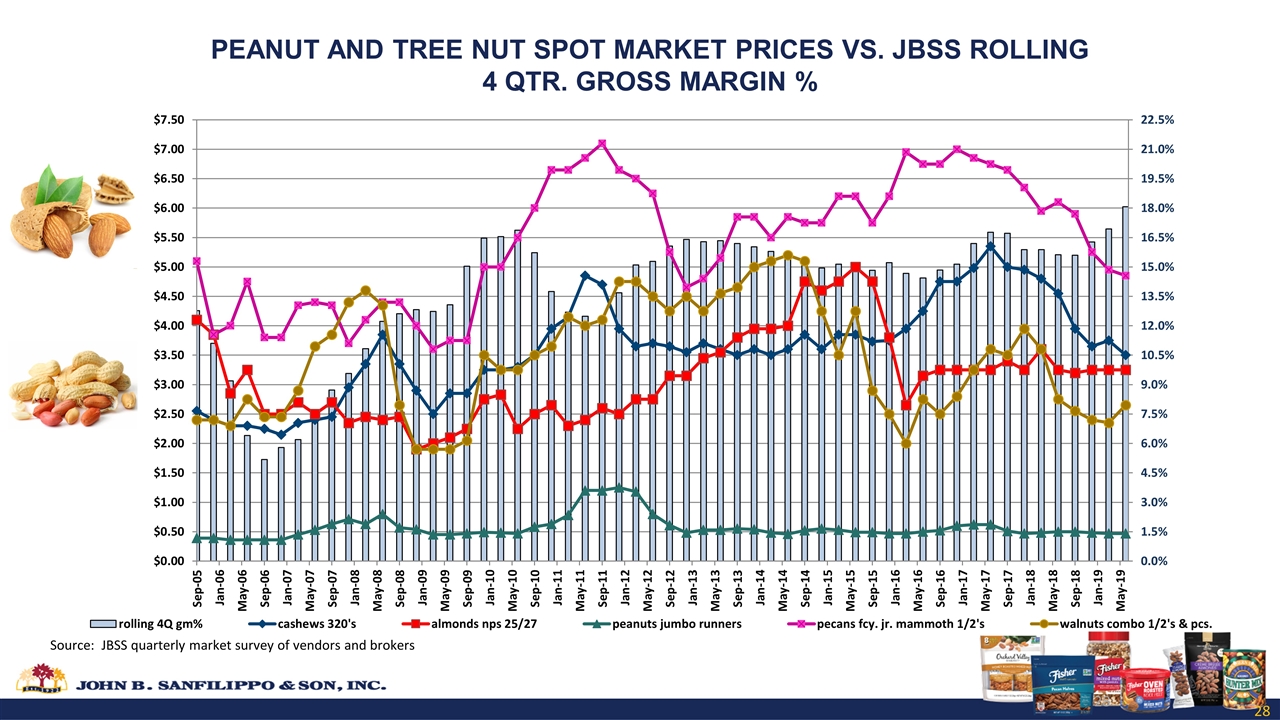

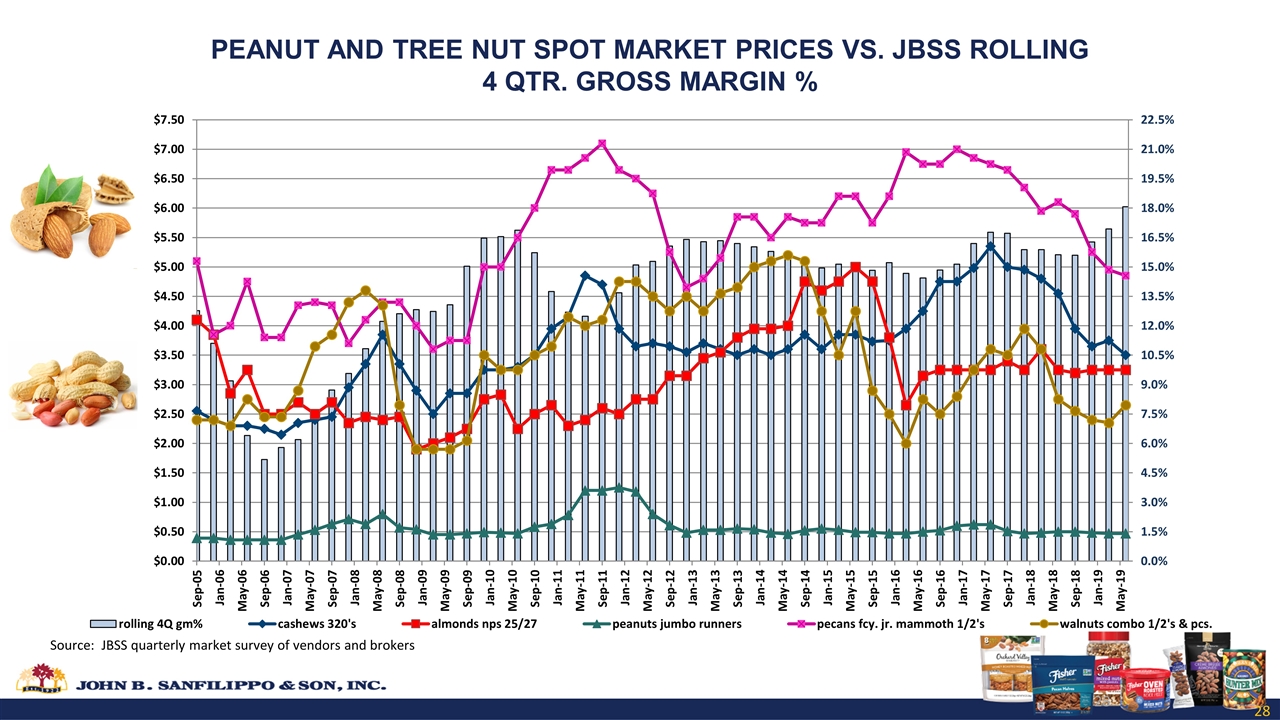

PEANUT AND TREE NUT SPOT MARKET PRICES VS. JBSS ROLLING 4 QTR. GROSS MARGIN % 28

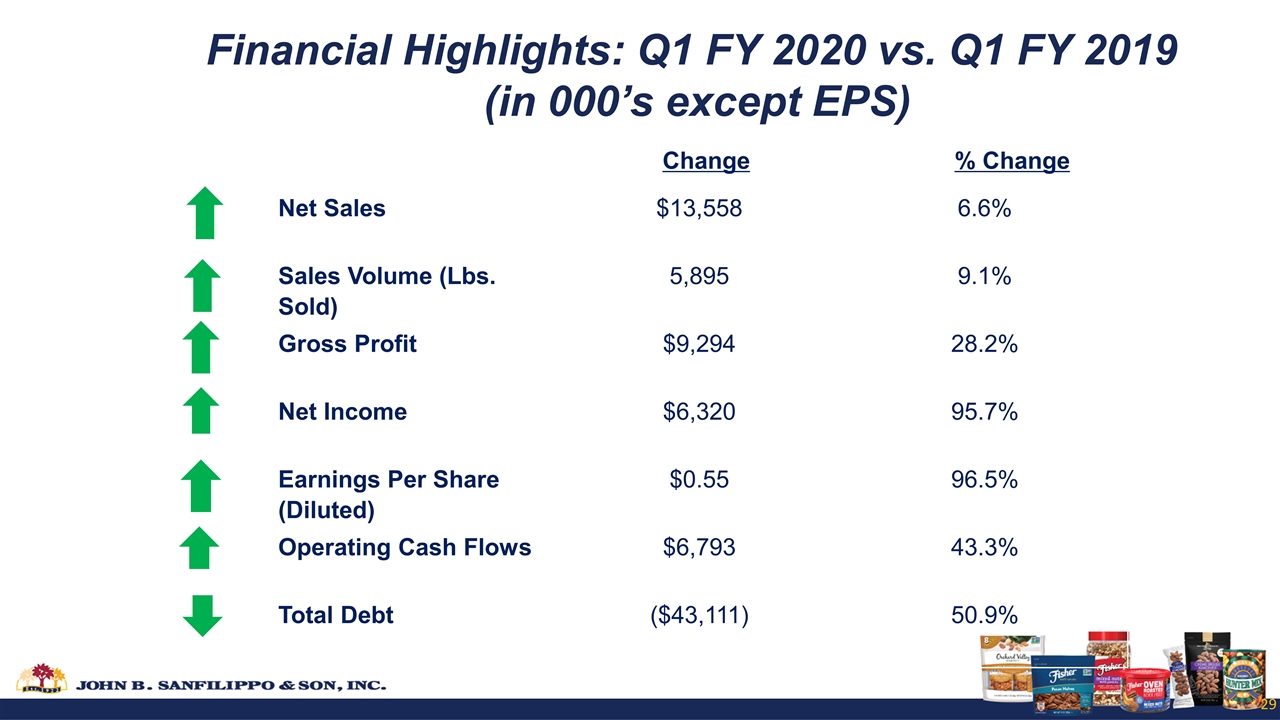

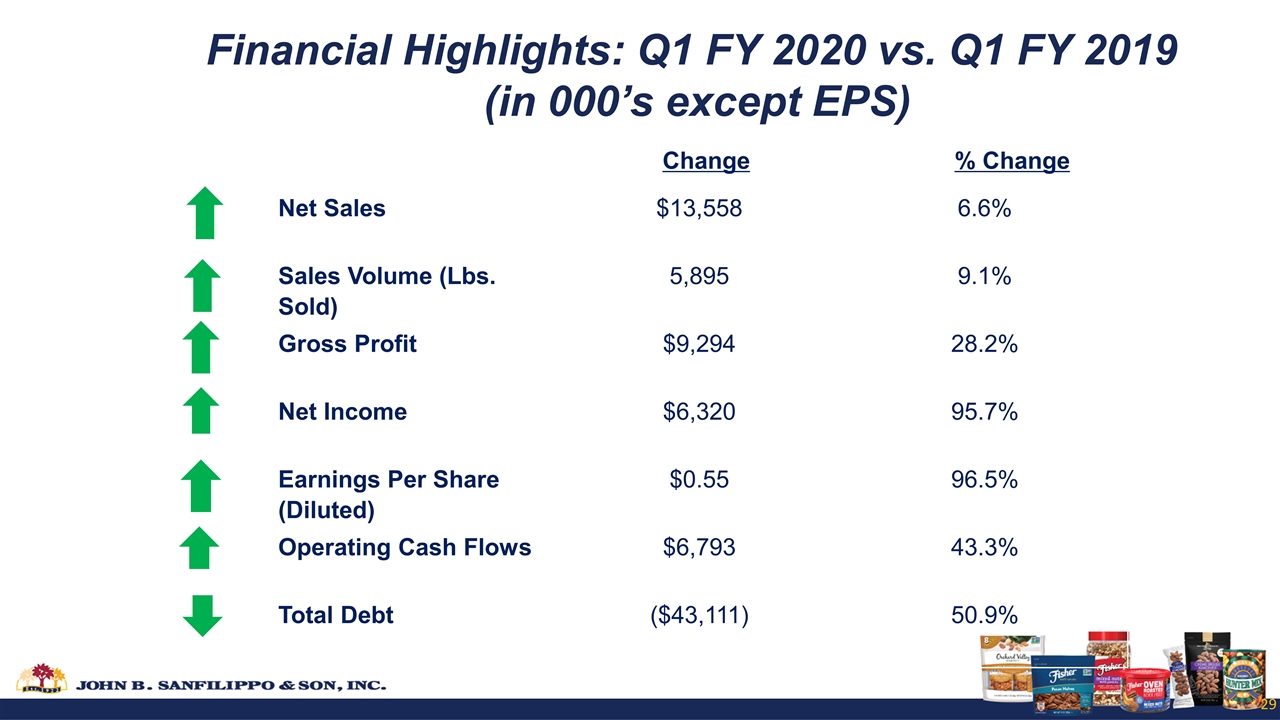

Net Sales $13,558 6.6% Sales Volume (Lbs. Sold) 5,895 9.1% Gross Profit $9,294 28.2% Net Income $6,320 95.7% Earnings Per Share (Diluted) $0.55 96.5% Operating Cash Flows $6,793 43.3% Total Debt ($43,111) 50.9% Change % Change Financial Highlights: Q1 FY 2020 vs. Q1 FY 2019 (in 000’s except EPS)

FY 2019 Brand Marketing Review 30

Snack Nuts Grow Brands Recipe Nuts

Recipe Nuts

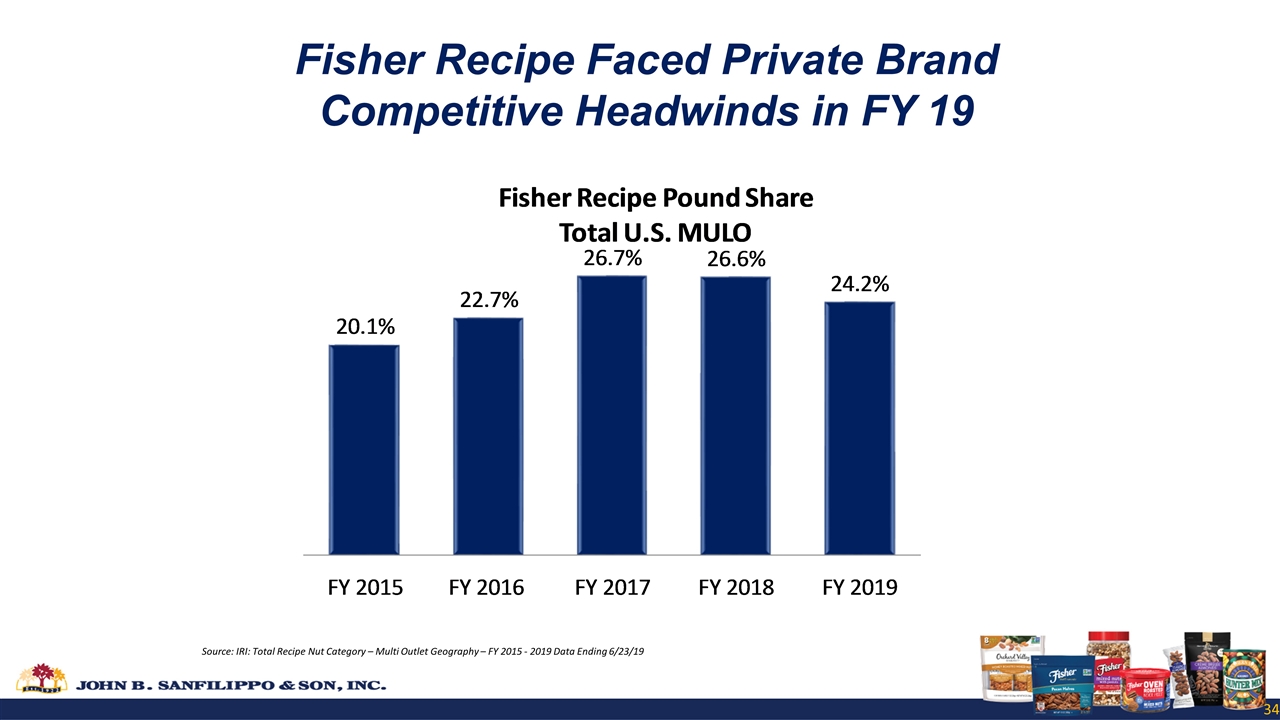

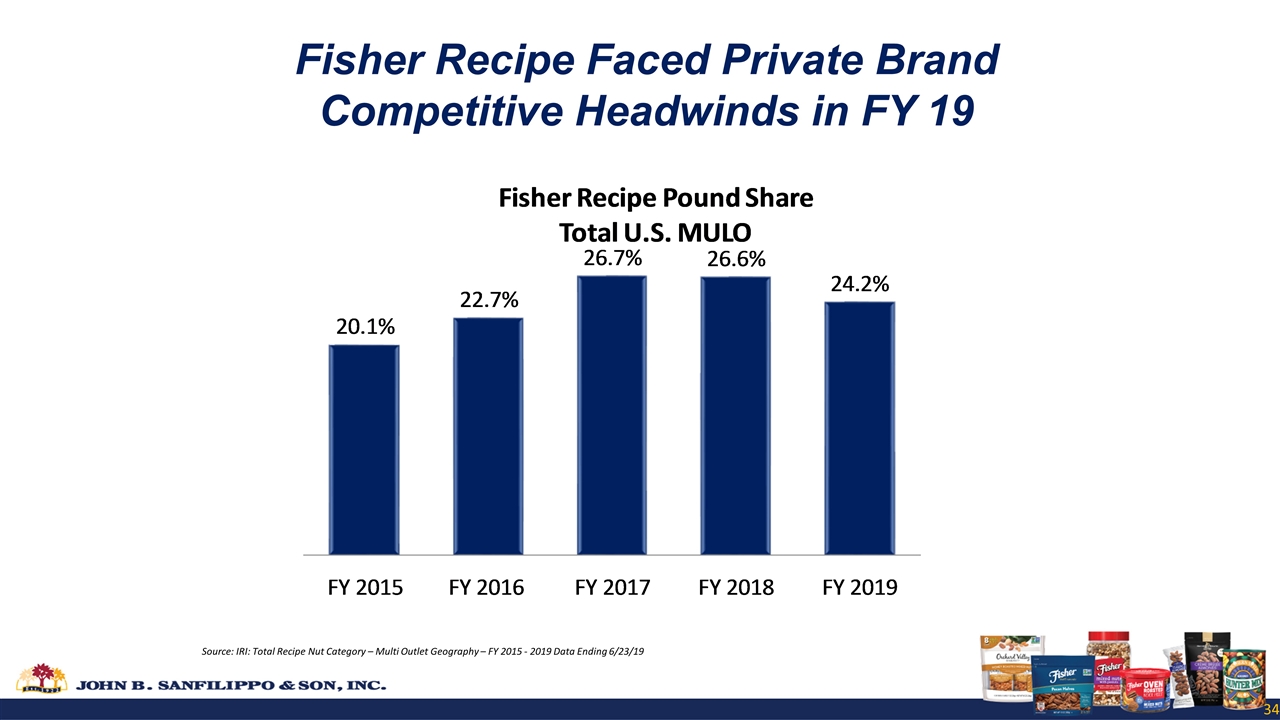

Total Fisher Recipe Brand Growth FY 19 vs. FY 18 DOLLAR NET SALES POUND SALES Source: JBSS shipment data 52 week versus 52 week comparison Fisher Recipe in the Consumer Channel Only Recipe Nuts (9)% (12)% Fisher Recipe Faced Private Brand Competitive Headwinds in FY 19 Consumer Channel

Fisher Recipe Faced Private Brand Competitive Headwinds in FY 19 Source: IRI: Total Recipe Nut Category – Multi Outlet Geography – FY 2015 - 2019 Data Ending 6/23/19

National Distribution 35 Fisher recipe distribution updated 6.20.19 Fisher Recipe has Strong Distribution Nationally

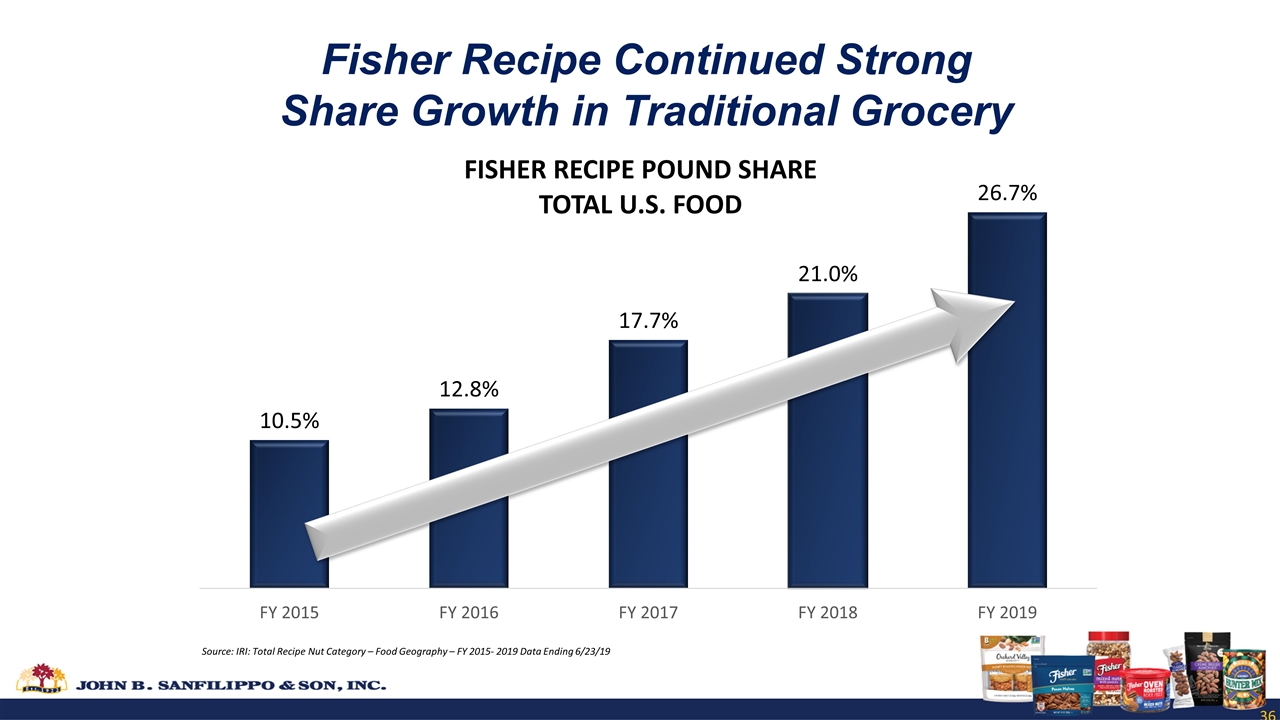

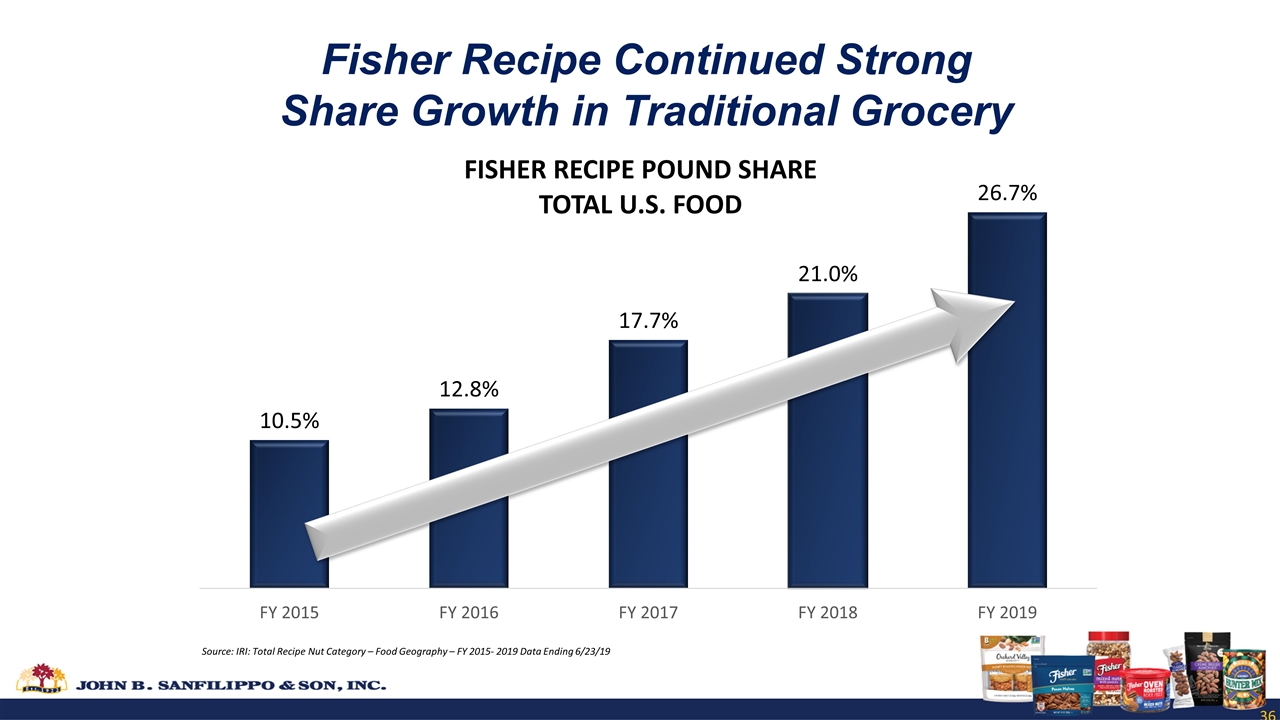

Fisher Recipe Continued Strong Share Growth in Traditional Grocery Source: IRI: Total Recipe Nut Category – Food Geography – FY 2015- 2019 Data Ending 6/23/19

Continued Partnership with the Food Network in FY 19

Engaging Consumers with Influencers on Social Media Original PR photo content created and photographed by the Fisher Fresh Thinkers Influencer Network

Snack Nuts

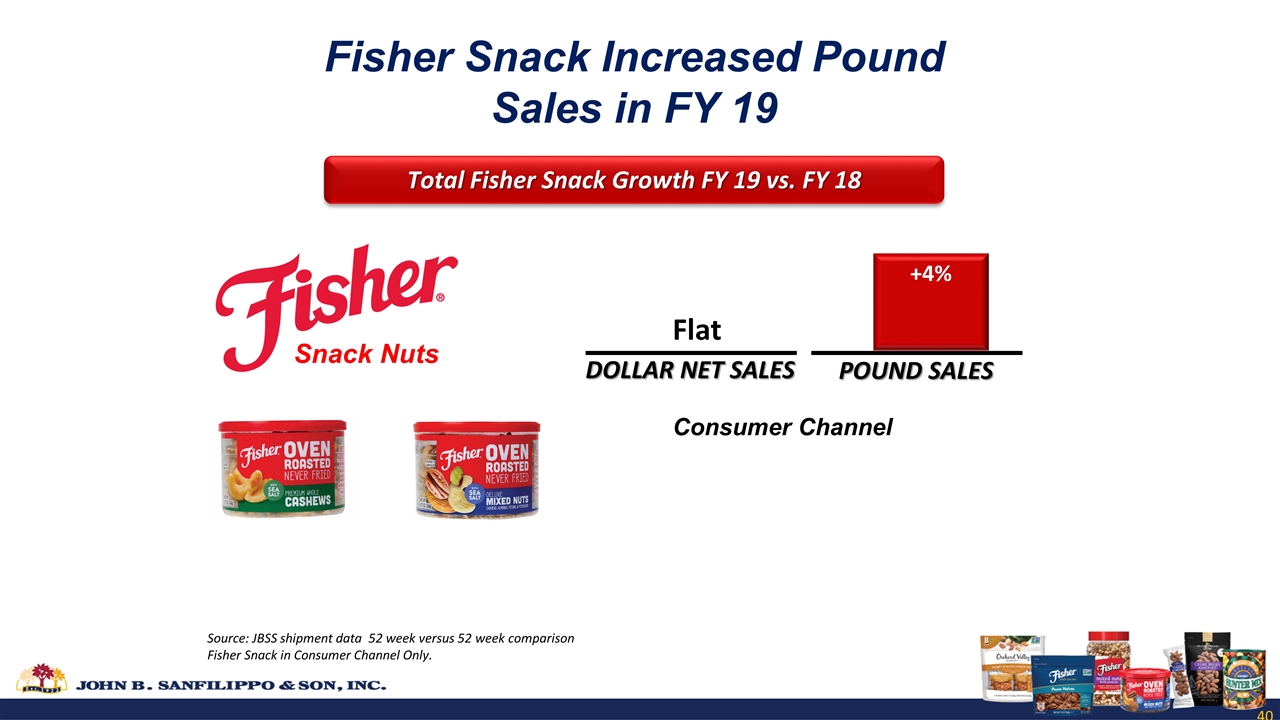

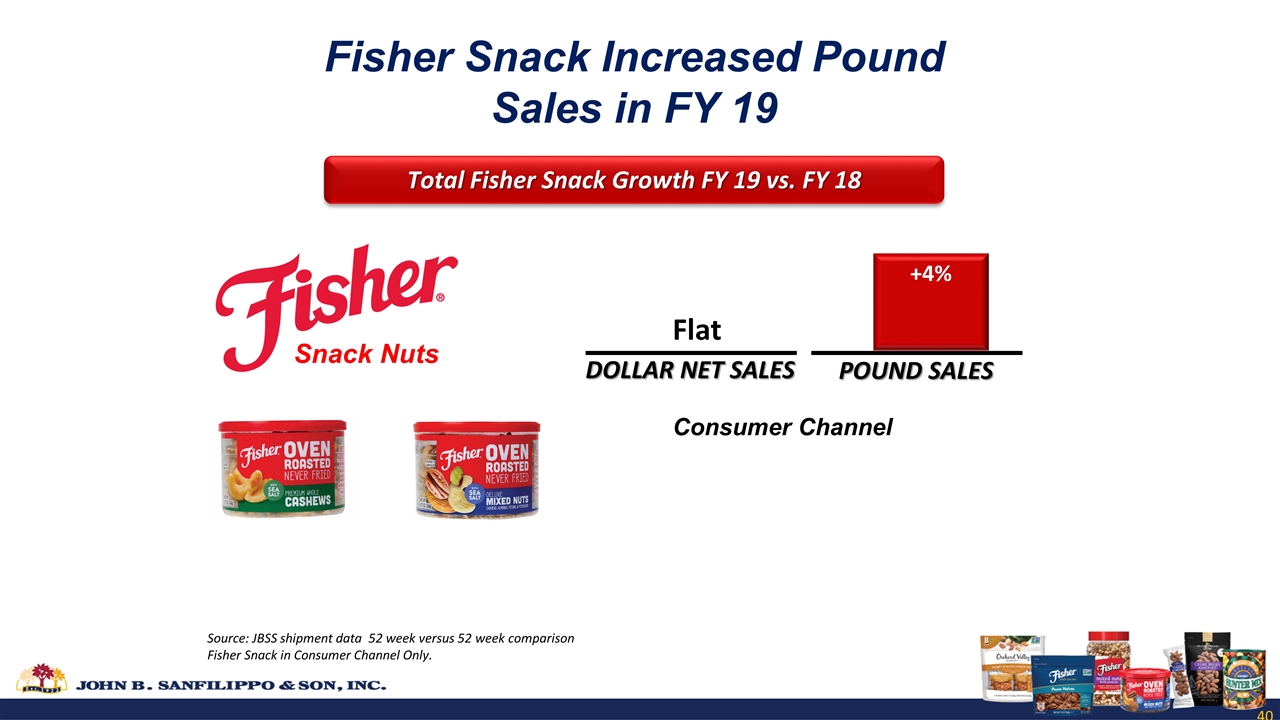

Fisher Snack Increased Pound Sales in FY 19 Total Fisher Snack Growth FY 19 vs. FY 18 Snack Nuts Source: JBSS shipment data 52 week versus 52 week comparison Fisher Snack in Consumer Channel Only. DOLLAR NET SALES Flat POUND SALES +4% Consumer Channel

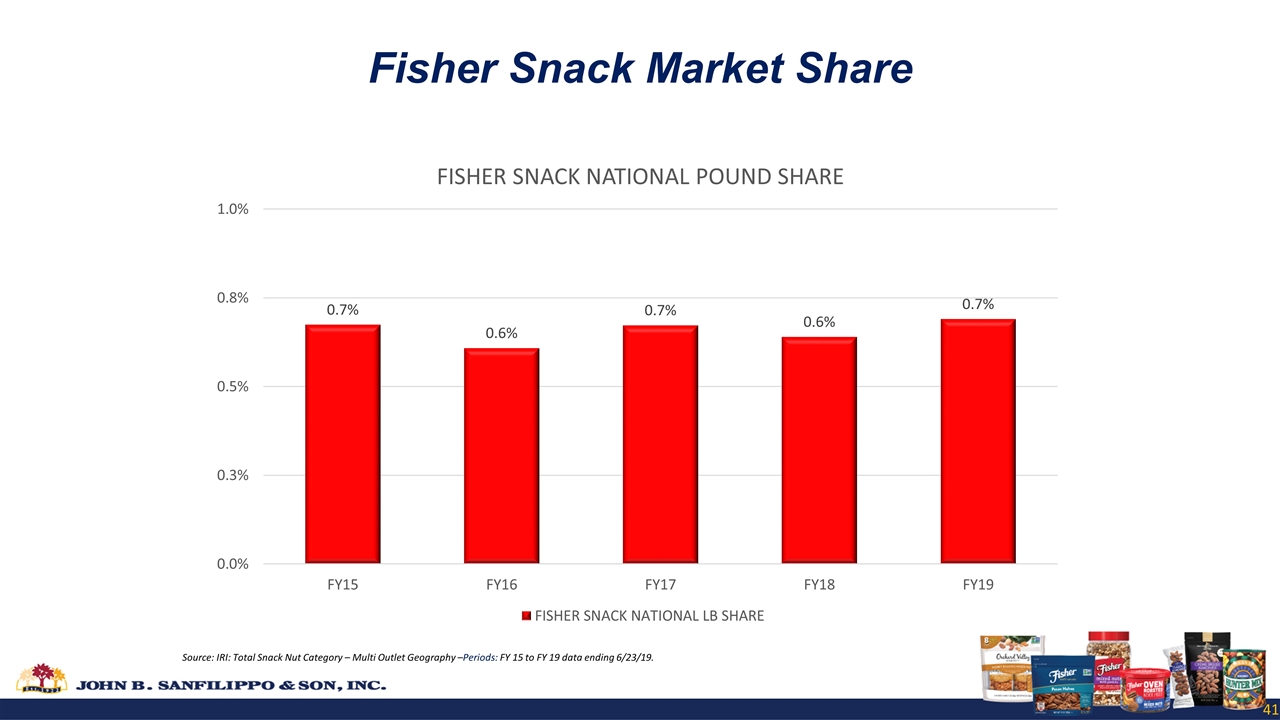

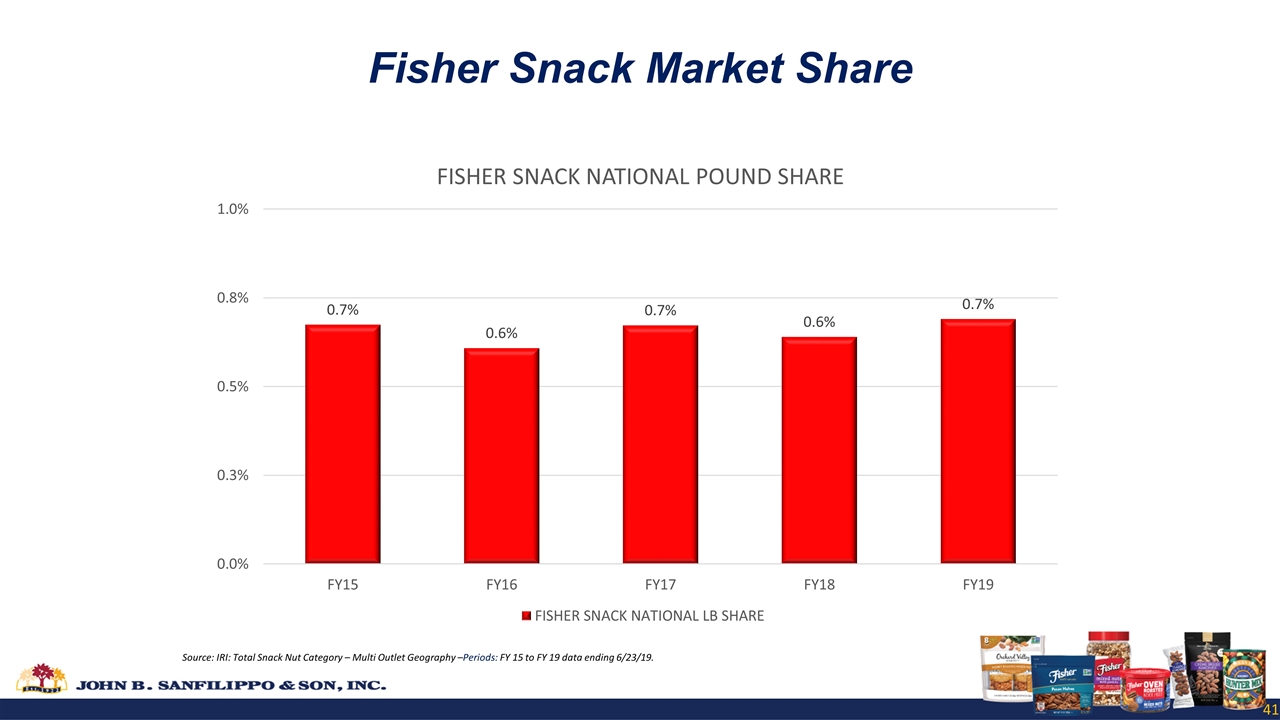

Fisher Snack Market Share Source: IRI: Total Snack Nut Category – Multi Outlet Geography –Periods: FY 15 to FY 19 data ending 6/23/19.

Oven Roasted Never Fried the Driver of Growth

Differentiated Offering in the Snack Nut Category

Strong Marketing Support to Communicate the Key Point of Difference Digital / Social & Print In Store Radio FSI Sampling

New Distribution!

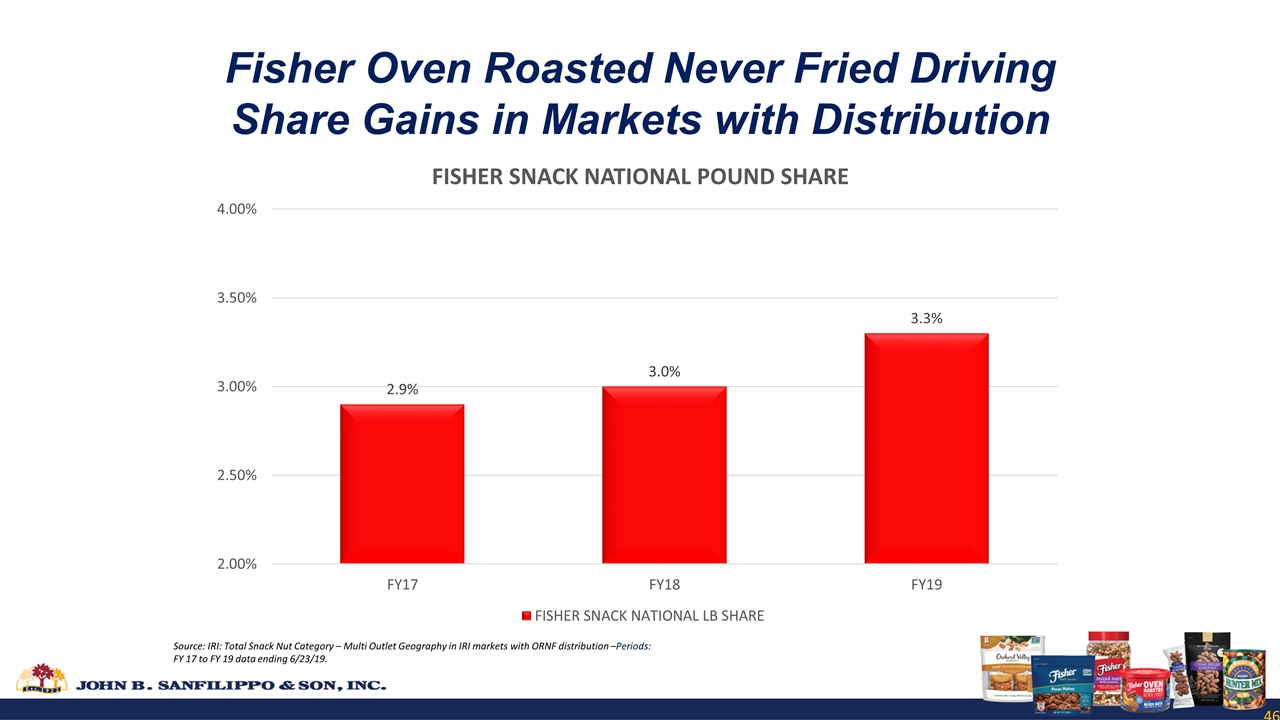

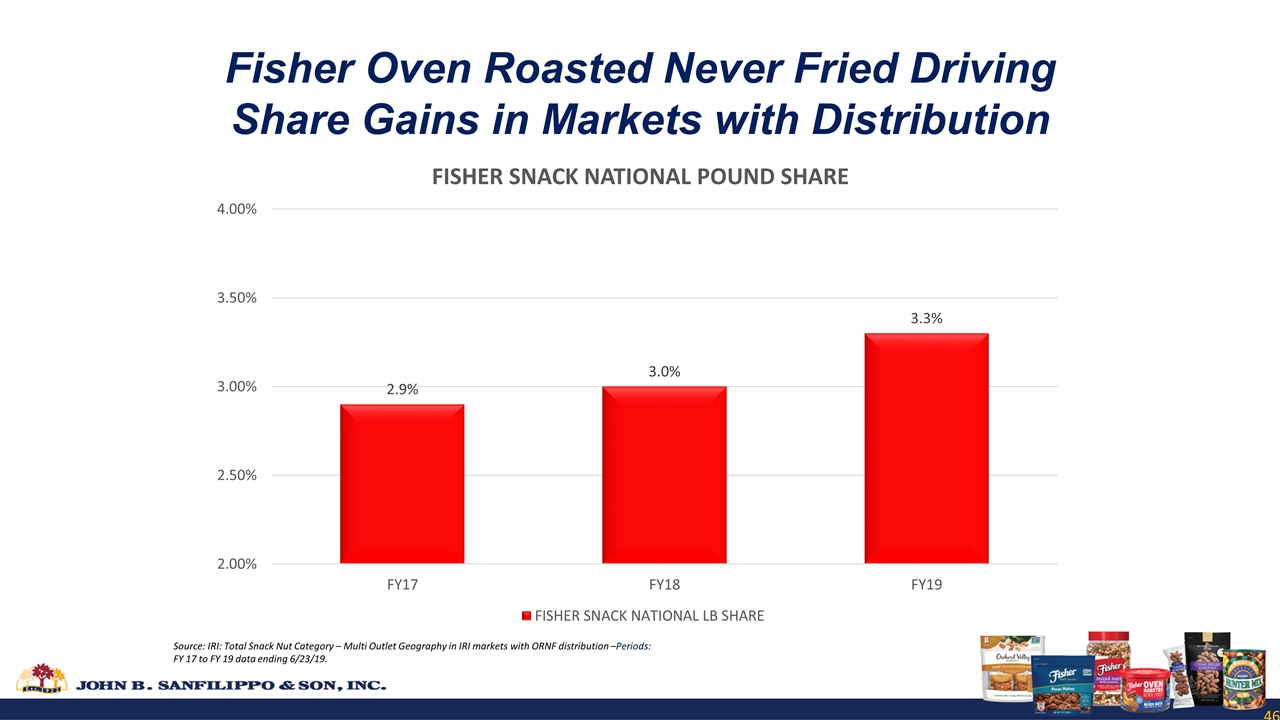

Fisher Oven Roasted Never Fried Driving Share Gains in Markets with Distribution Source: IRI: Total Snack Nut Category – Multi Outlet Geography in IRI markets with ORNF distribution –Periods: FY 17 to FY 19 data ending 6/23/19.

Pure and Simple Goodness

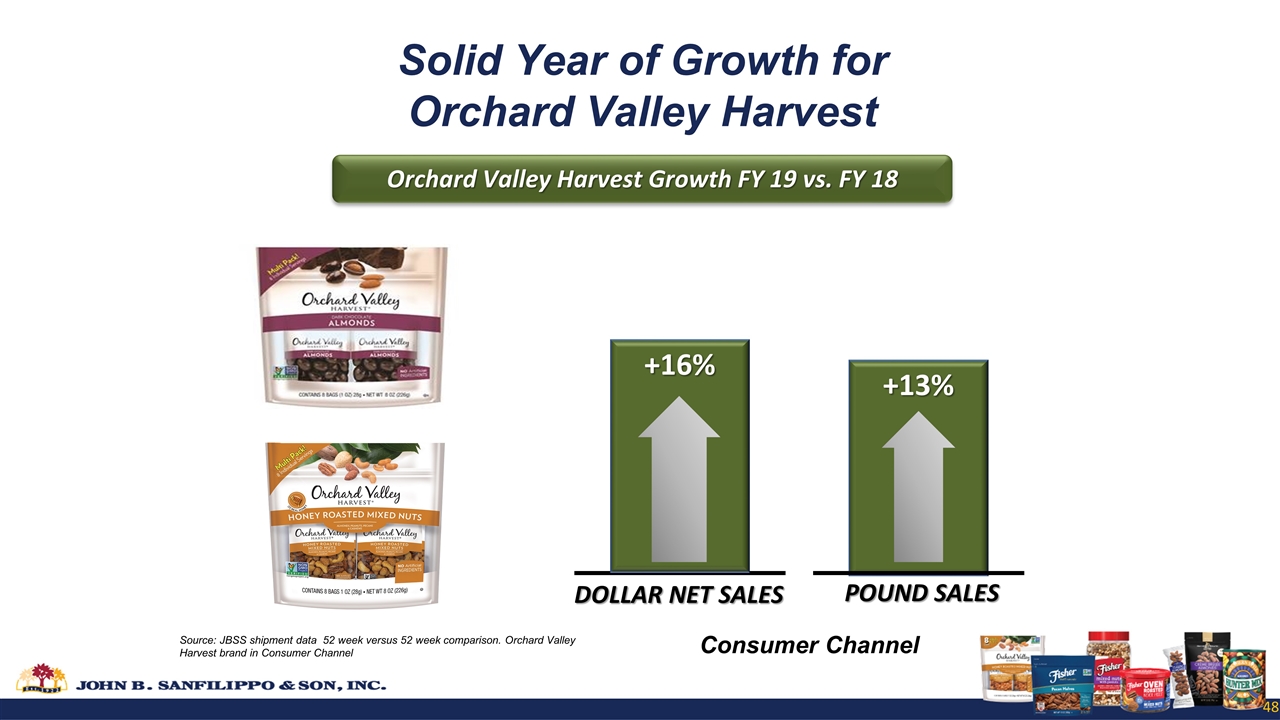

Solid Year of Growth for Orchard Valley Harvest +13% +16% DOLLAR NET SALES POUND SALES Source: JBSS shipment data 52 week versus 52 week comparison. Orchard Valley Harvest brand in Consumer Channel Orchard Valley Harvest Growth FY 19 vs. FY 18 Consumer Channel

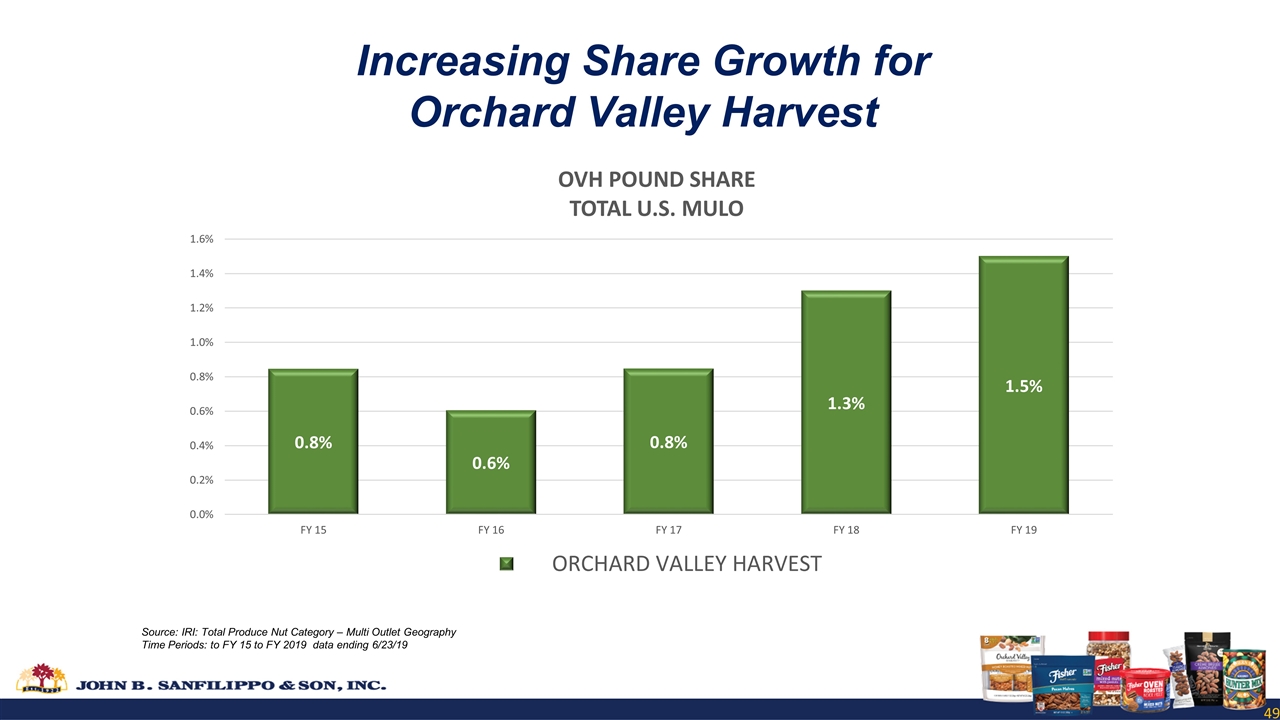

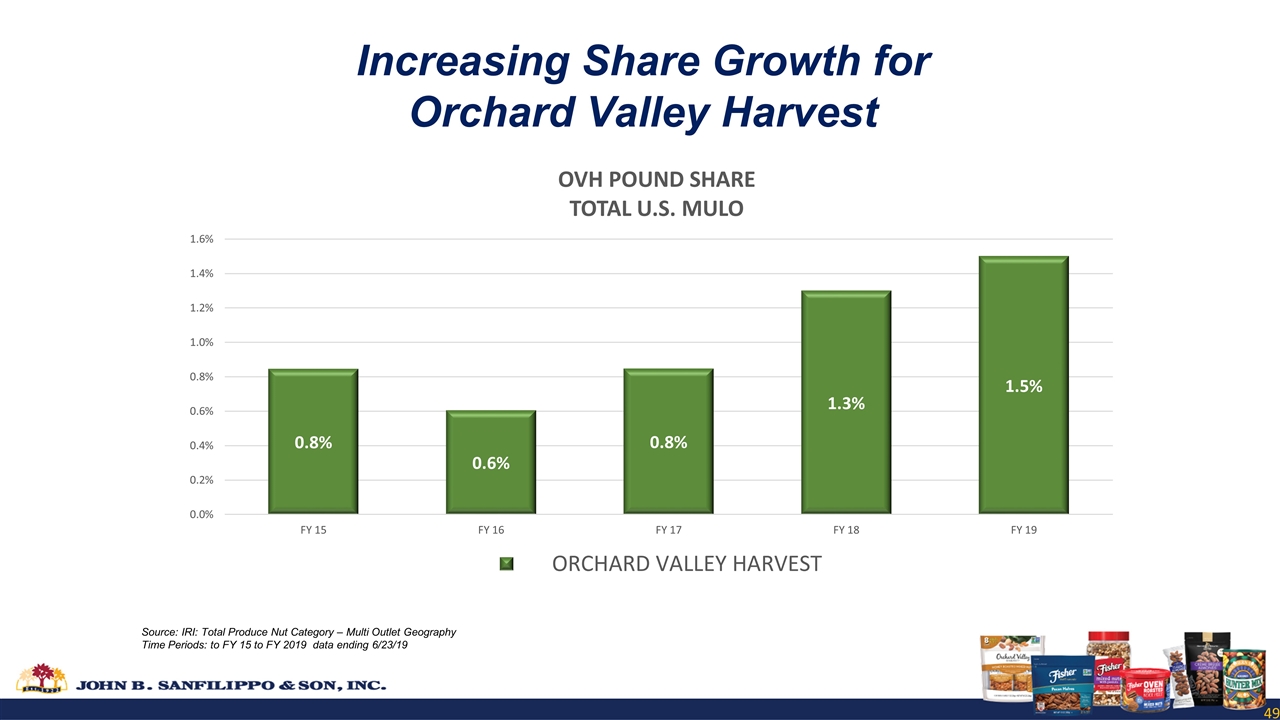

Increasing Share Growth for Orchard Valley Harvest Source: IRI: Total Produce Nut Category – Multi Outlet Geography Time Periods: to FY 15 to FY 2019 data ending 6/23/19

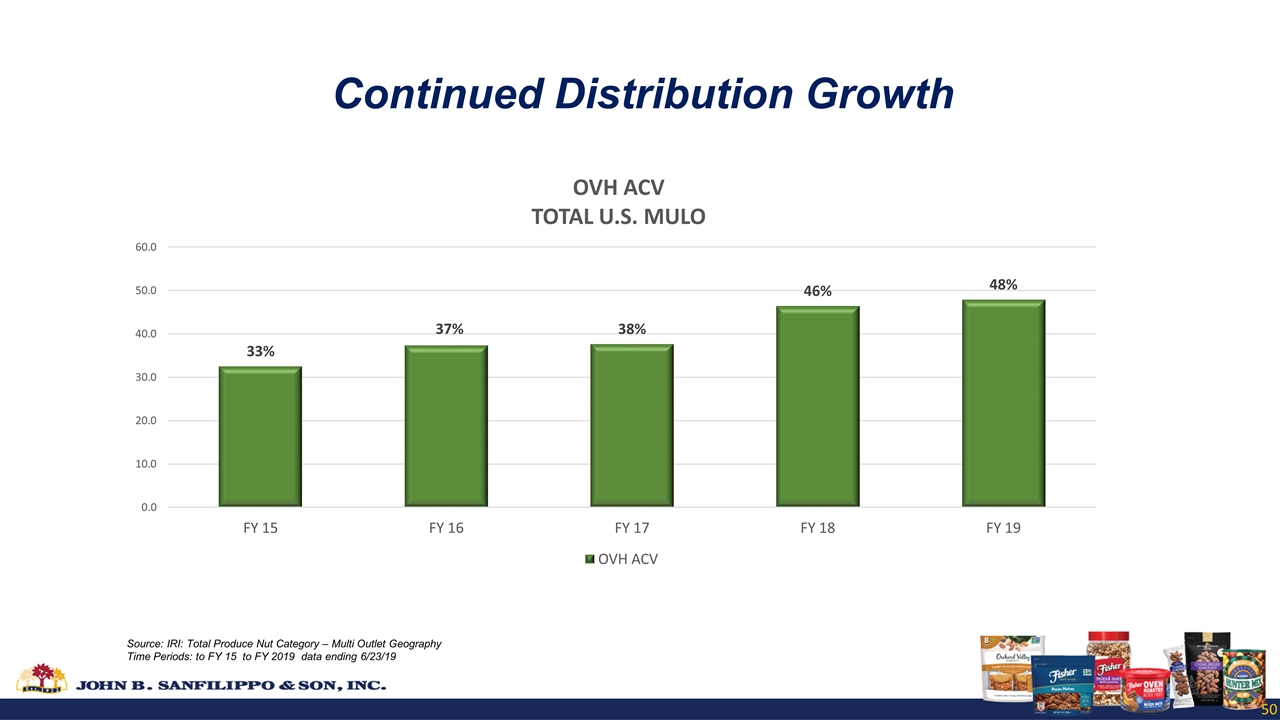

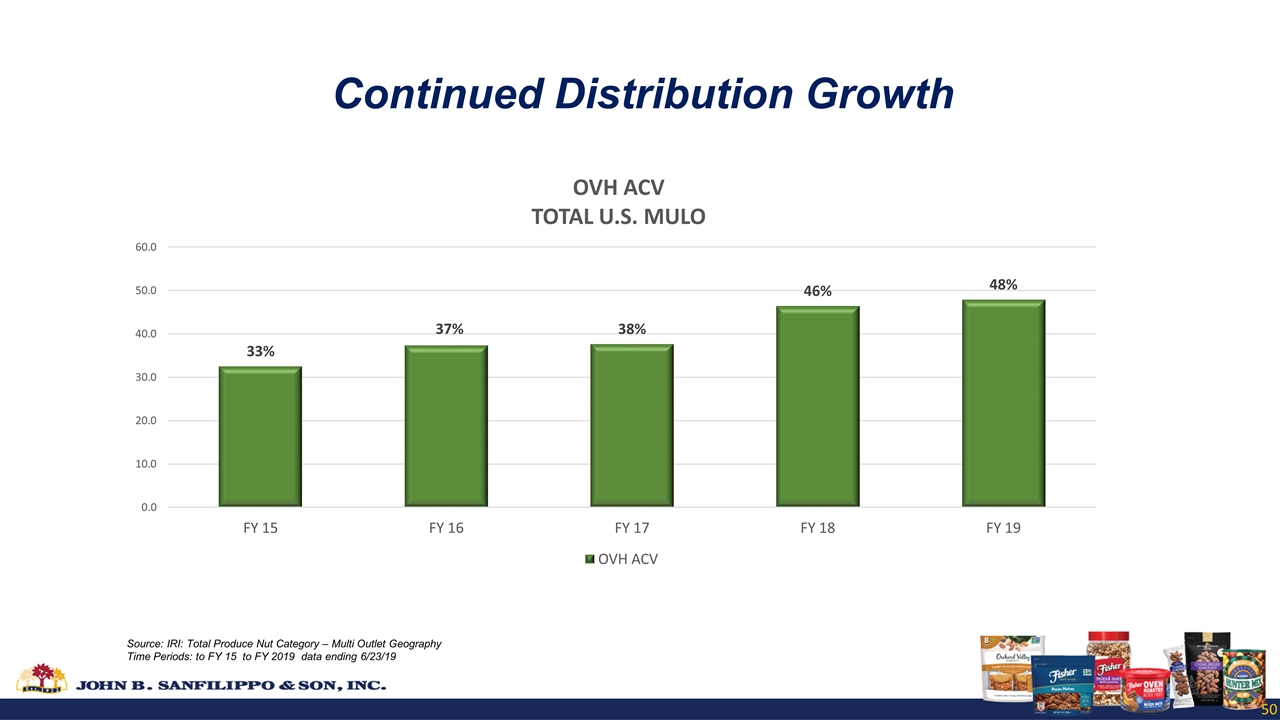

Source: IRI: Total Produce Nut Category – Multi Outlet Geography Time Periods: to FY 15 to FY 2019 data ending 6/23/19 Continued Distribution Growth

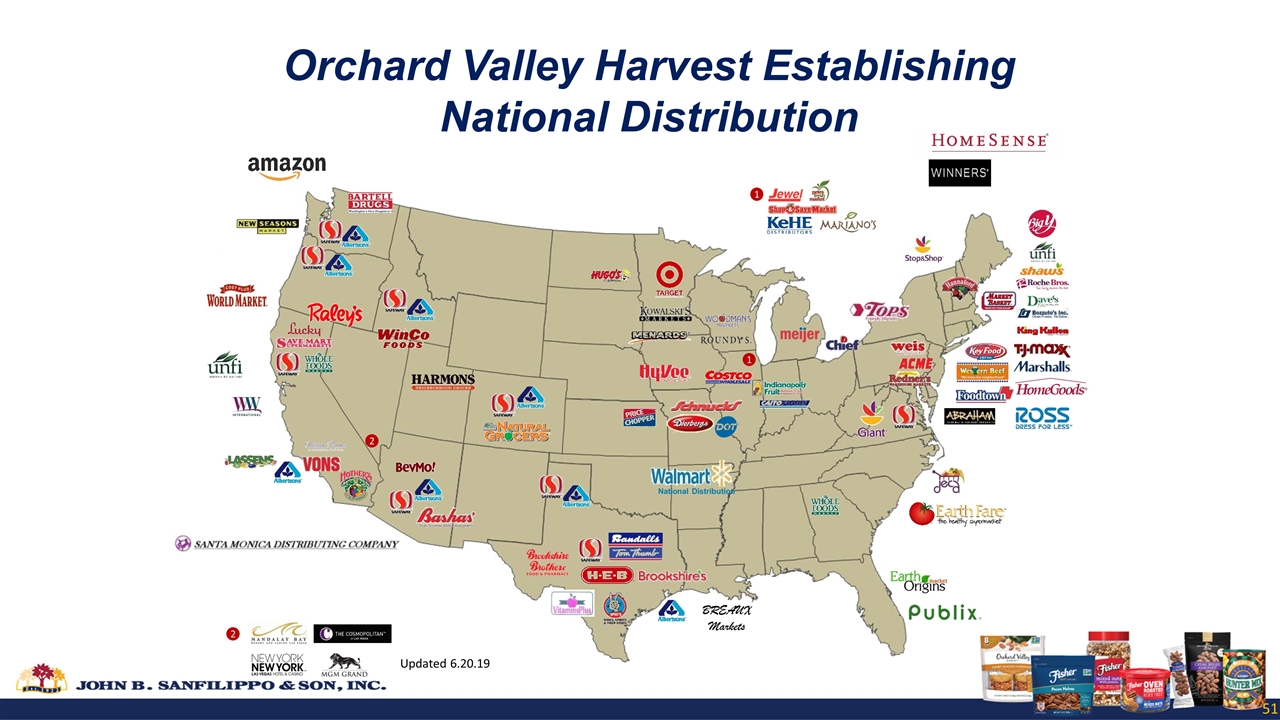

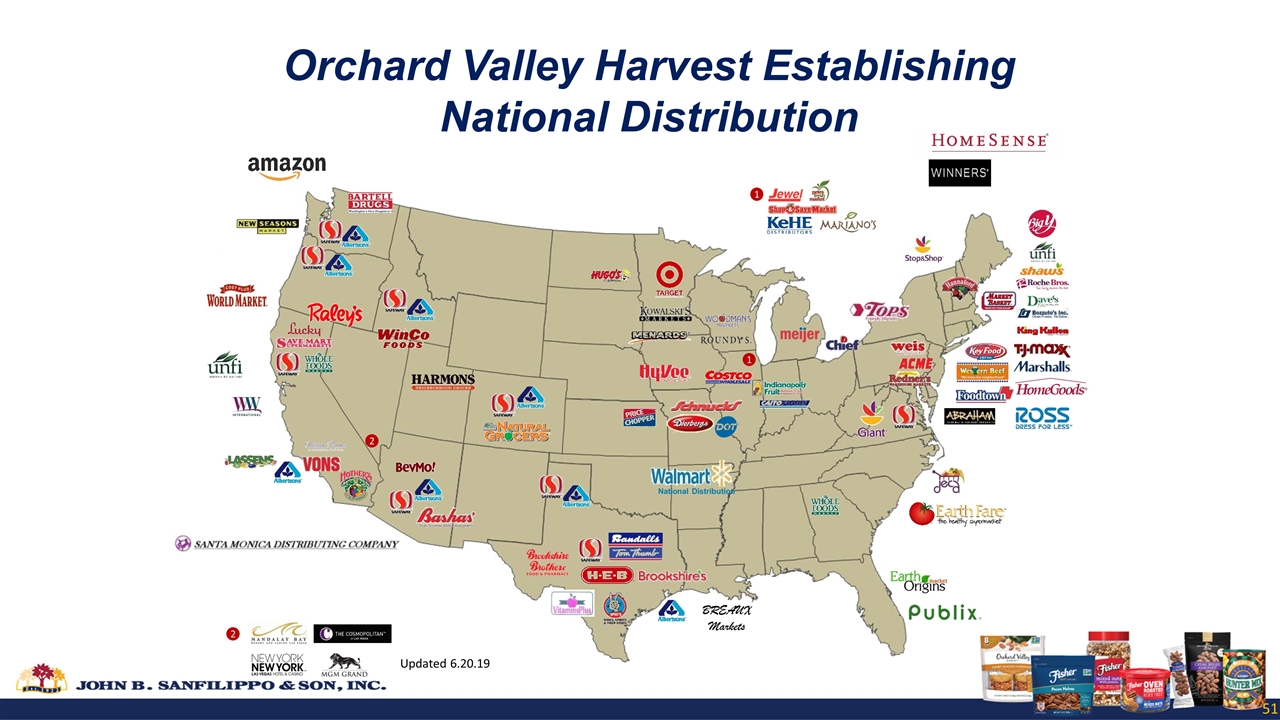

BREAUX Markets 1 1 2 2 National Distribution Updated 6.20.19 Orchard Valley Harvest Establishing National Distribution 51

Expanded Salad Topper Line 52

Social Media and Digital Support to Engage Consumers 53

54

Expanding Consumer Reach 55

Supporting Squirrel Brand through Social Media 56

57

Growing Southern Style Nuts with Expanded Distribution and New Items 58

FY 2019 Closing Comments 59

Snack Nuts Grow Brands Recipe Nuts How Unique consumer insights developed through custom IRI database Robust innovation pipeline Expand beyond nuts into other plant proteins – e.g. chickpea snacks

Porkless Rindz Sales Trial -Woodman’s Store 61

Expand Consumer Reach Across All JBSS Brands Foodservice Club Stores Alternative Stores Travel eCommerce

Club Channel VIRGINA COSTCO STORE WITH SQUIRREL CRÈME BRULE ALMONDS 63

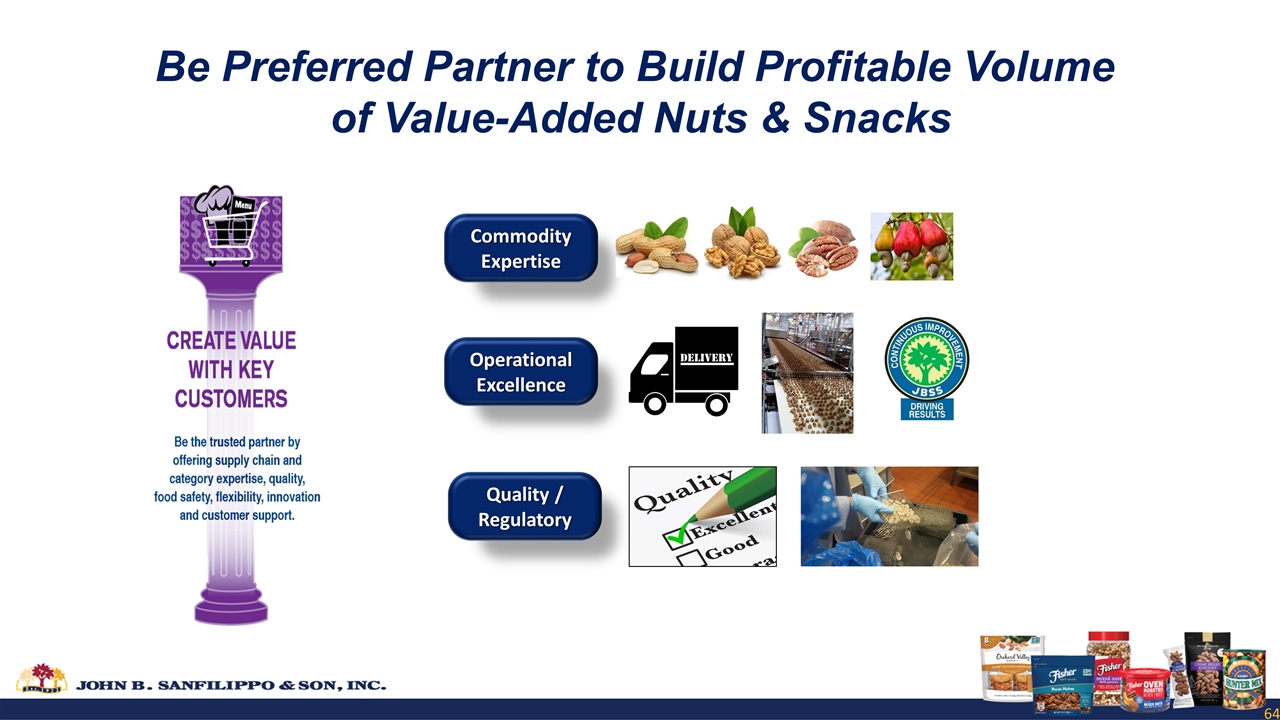

Operational Excellence Quality / Regulatory Commodity Expertise Be Preferred Partner to Build Profitable Volume of Value-Added Nuts & Snacks

Investments in Infrastructure Over $15 Million Dollars in FY 19 Warehouse Infrastructure Automation Equipment Upgrades Increased Capacity Food Safety

JBSS Mission To be the global leader of quality driven, innovative nut solutions that enhance the customer and consumer experience and achieve consistent, profitable growth for our shareholders. We will accomplish this through our commitment to a dynamic infrastructure that maximizes the potential of our brands, people and processes.

JBSS TEAMS WILL DRIVE RESULTS IN FY 20 Gustine, CA 67 Selma, TX

Bainbridge, GA 68 JBSS TEAMS WILL DRIVE RESULTS IN FY 20

Elgin, IL 69 JBSS TEAMS WILL DRIVE RESULTS IN FY 20

THANK YOU 70