UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6440

Fidelity Aberdeen Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | March 31 |

| |

Date of reporting period: | March 31, 2015 |

This report on Form N-CSR relates solely to the Registrant's Fidelity Freedom Index Income Fund, Fidelity Freedom Index 2005 Fund, Fidelity Freedom Index 2010 Fund, Fidelity Freedom Index 2015 Fund, Fidelity Freedom Index 2020 Fund, Fidelity Freedom Index 2025 Fund, Fidelity Freedom Index 2030 Fund, Fidelity Freedom Index 2035 Fund, Fidelity Freedom Index 2040 Fund, Fidelity Freedom Index 2045 Fund, Fidelity Freedom Index 2050 Fund, Fidelity Freedom Index 2055 Fund, Fidelity Freedom Index 2060 Fund, Fidelity Freedom Income Fund, Fidelity Freedom 2005 Fund, Fidelity Freedom 2010 Fund, Fidelity Freedom 2015 Fund, Fidelity Freedom 2020 Fund, Fidelity Freedom 2025 Fund, Fidelity Freedom 2030 Fund, Fidelity Freedom 2035 Fund, Fidelity Freedom 2040 Fund, Fidelity Freedom 2045 Fund, Fidelity Freedom 2050 Fund, Fidelity Freedom 2055 Fund, Fidelity Freedom 2060 Fund, Fidelity Freedom K® Income Fund, Fidelity Freedom K® 2005 Fund, Fidelity Freedom K® 2010 Fund, Fidelity Freedom K® 2015 Fund, Fidelity Freedom K® 2020 Fund, Fidelity Freedom K® 2025 Fund, Fidelity Freedom K® 2030 Fund, Fidelity Freedom K® 2035 Fund, Fidelity Freedom K® 2040 Fund, Fidelity Freedom K® 2045 Fund, Fidelity Freedom K® 2050 Fund, Fidelity Freedom K® 2055 Fund and Fidelity Freedom K® 2060 Fund series (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

ContentsPerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LinePerformance: The Bottom LineManagement's Discussion of Fund PerformanceShareholder Expense ExampleInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsInvestment Changes (Unaudited)Investments March 31, 2015Financial StatementsNotes to Financial StatementsReport of Independent Registered Public Accounting FirmTrustees and OfficersDistributions (Unaudited)1.

Fidelity Freedom K® Funds -

Income, 2005, 2010, 2015, 2020, 2025, 2030, 2035, 2040, 2045, 2050, 2055, 2060

Annual Report

March 31, 2015

(Fidelity Cover Art)

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

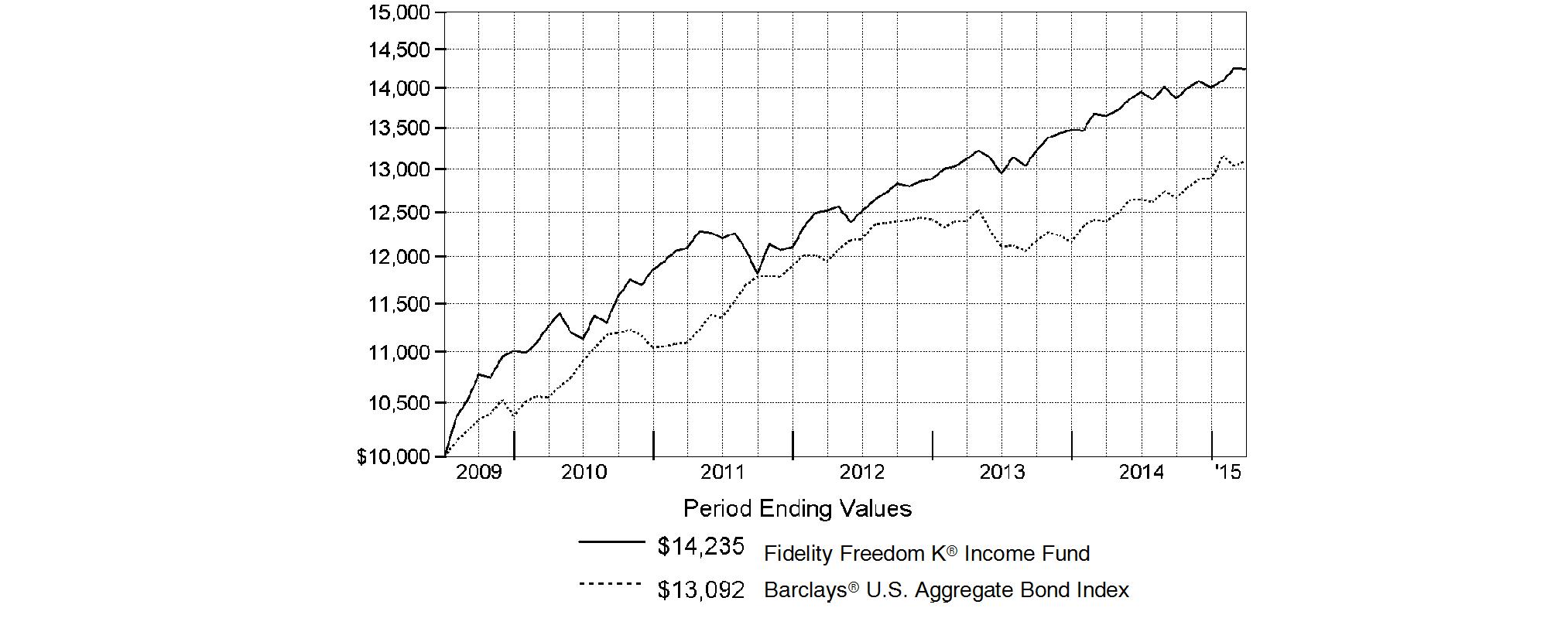

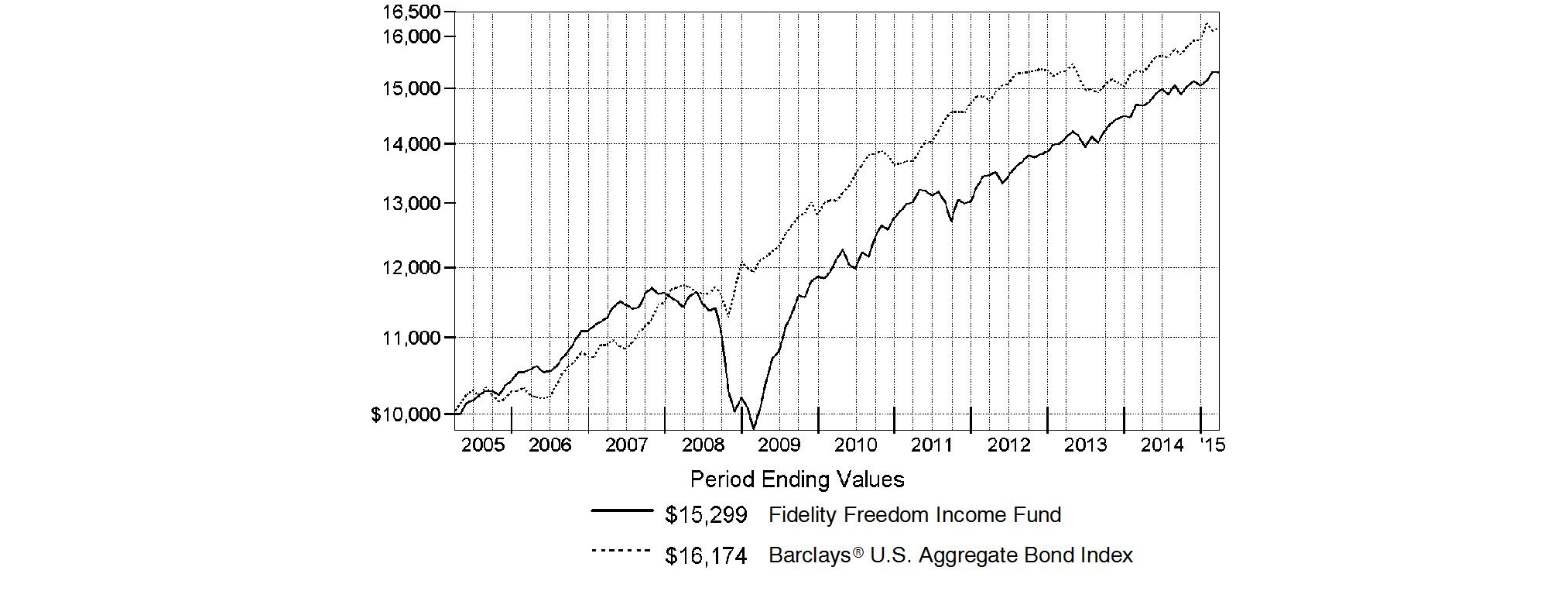

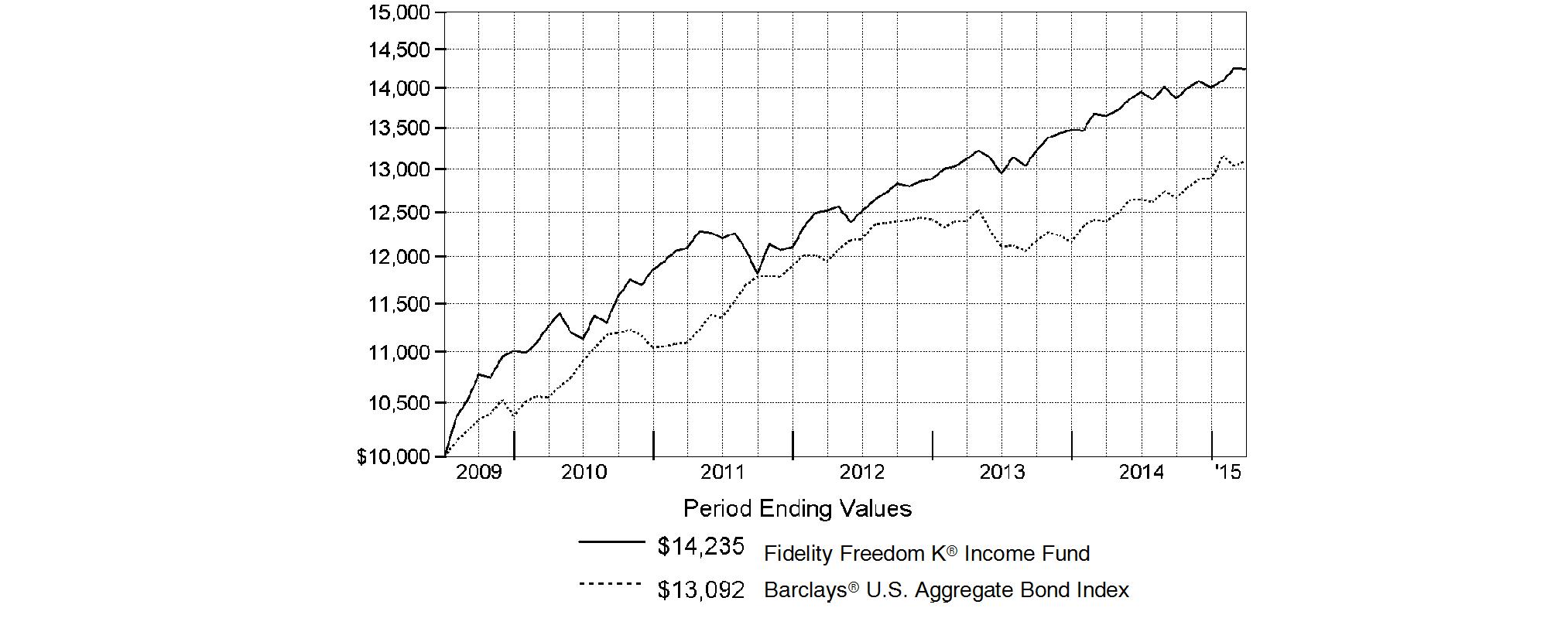

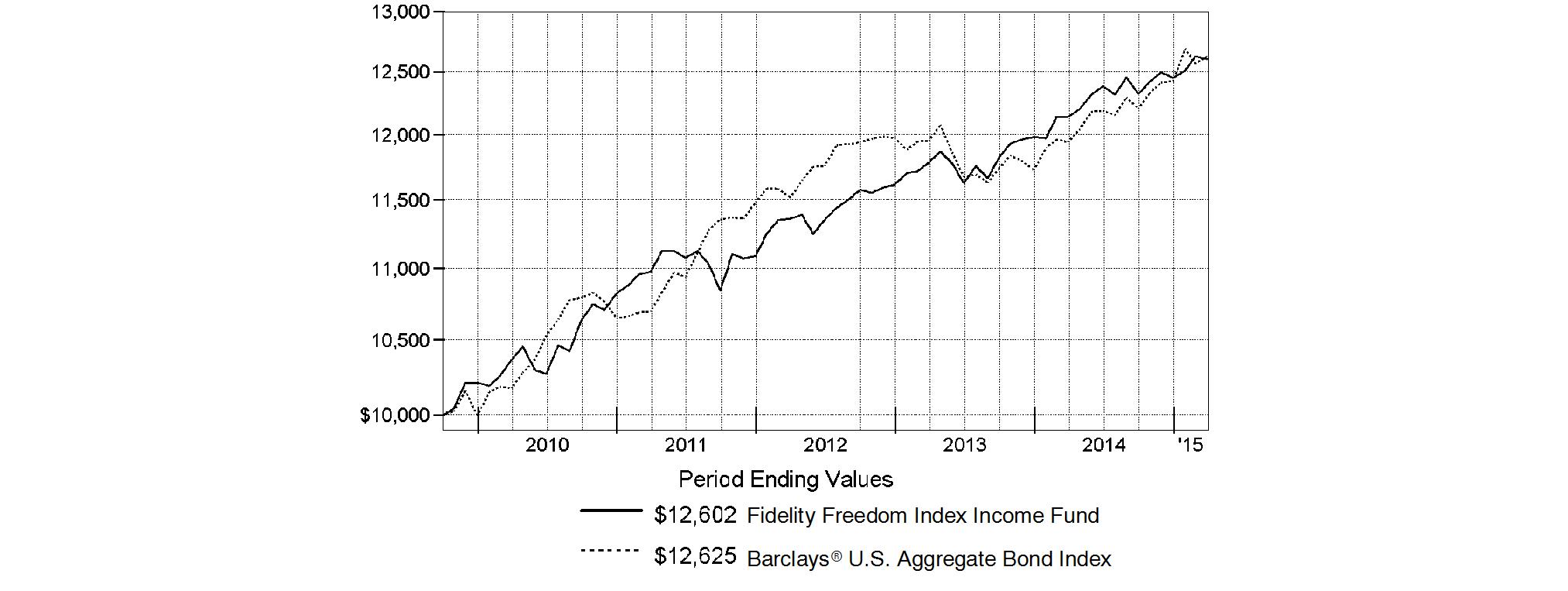

Fidelity Freedom K® Income Fund

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

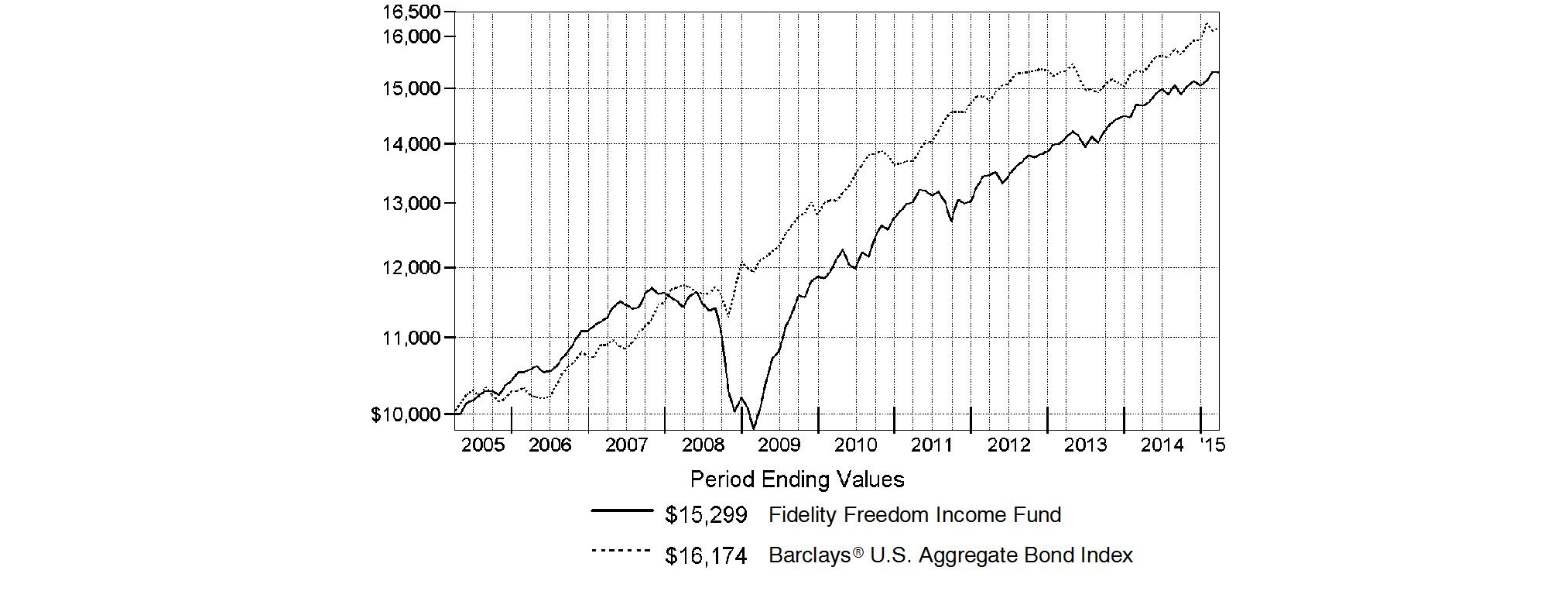

Fidelity Freedom K® Income Fund | 4.28% | 4.79% | 6.34% |

A From July 2, 2009.

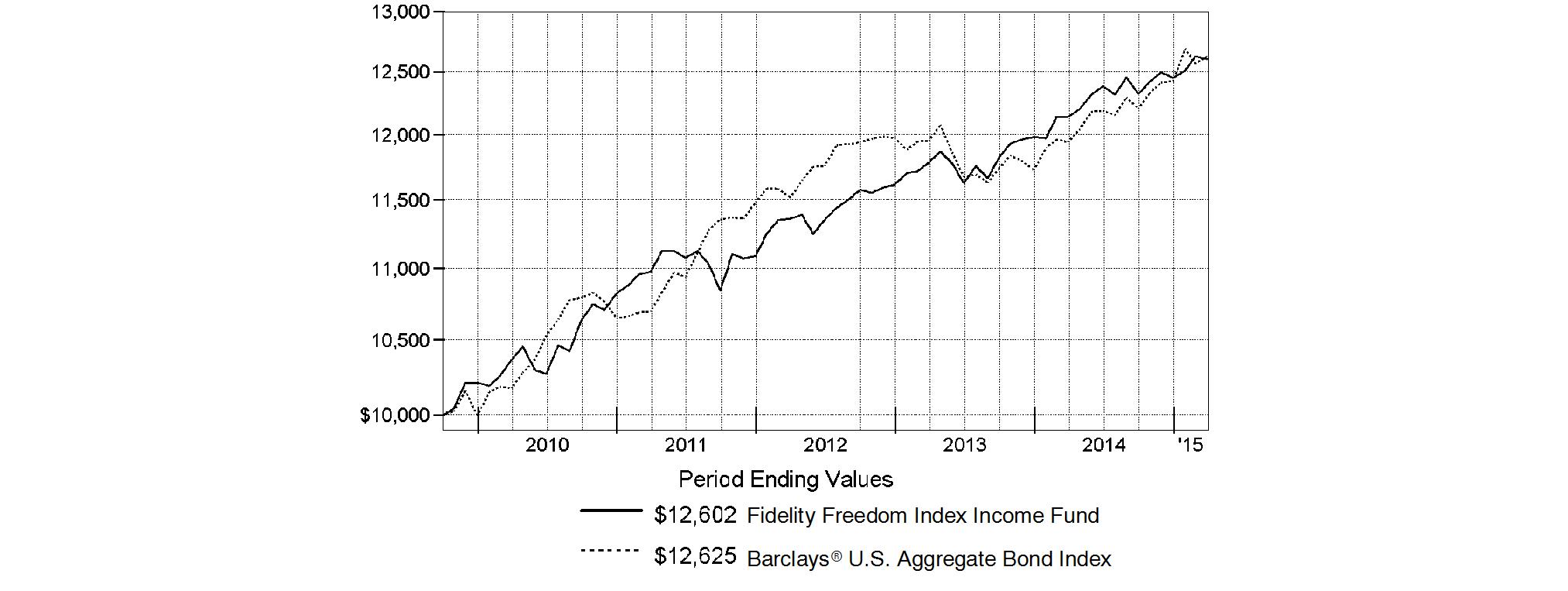

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® Income Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Barclays® U.S. Aggregate Bond Index performed over the same period.

Annual Report

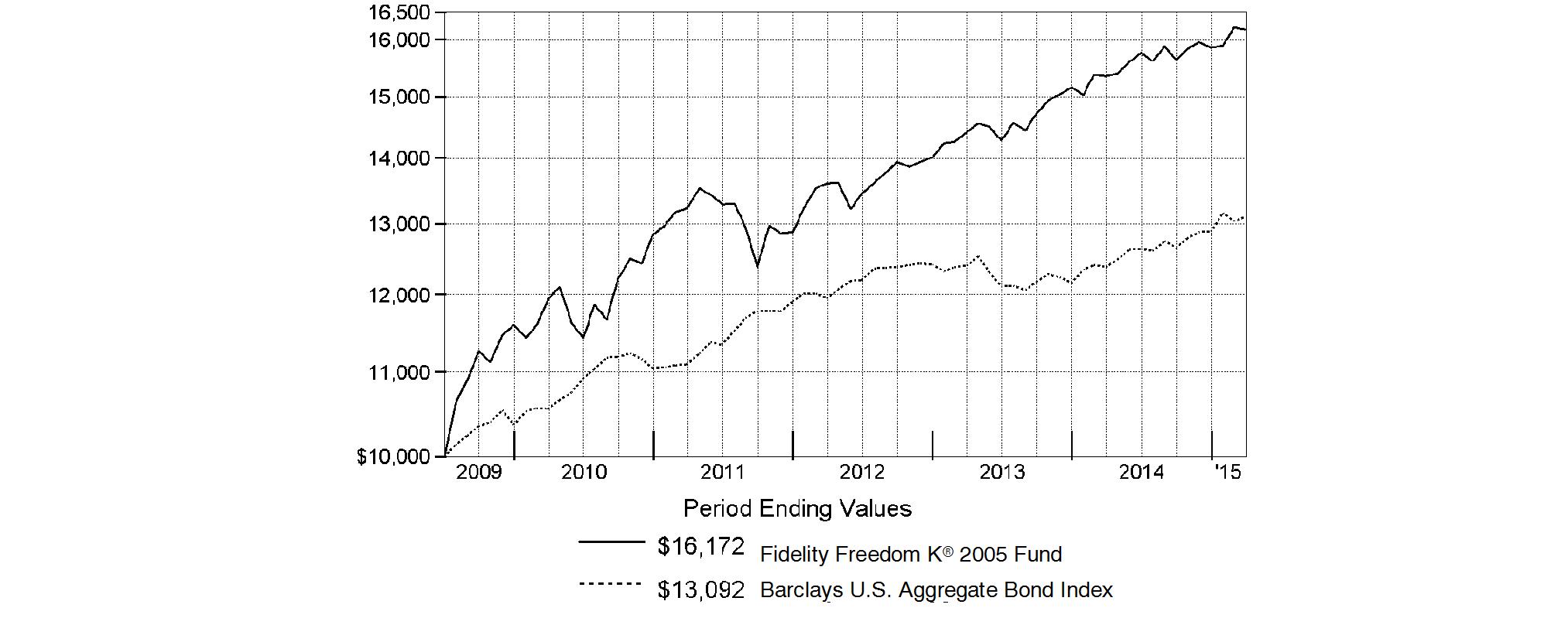

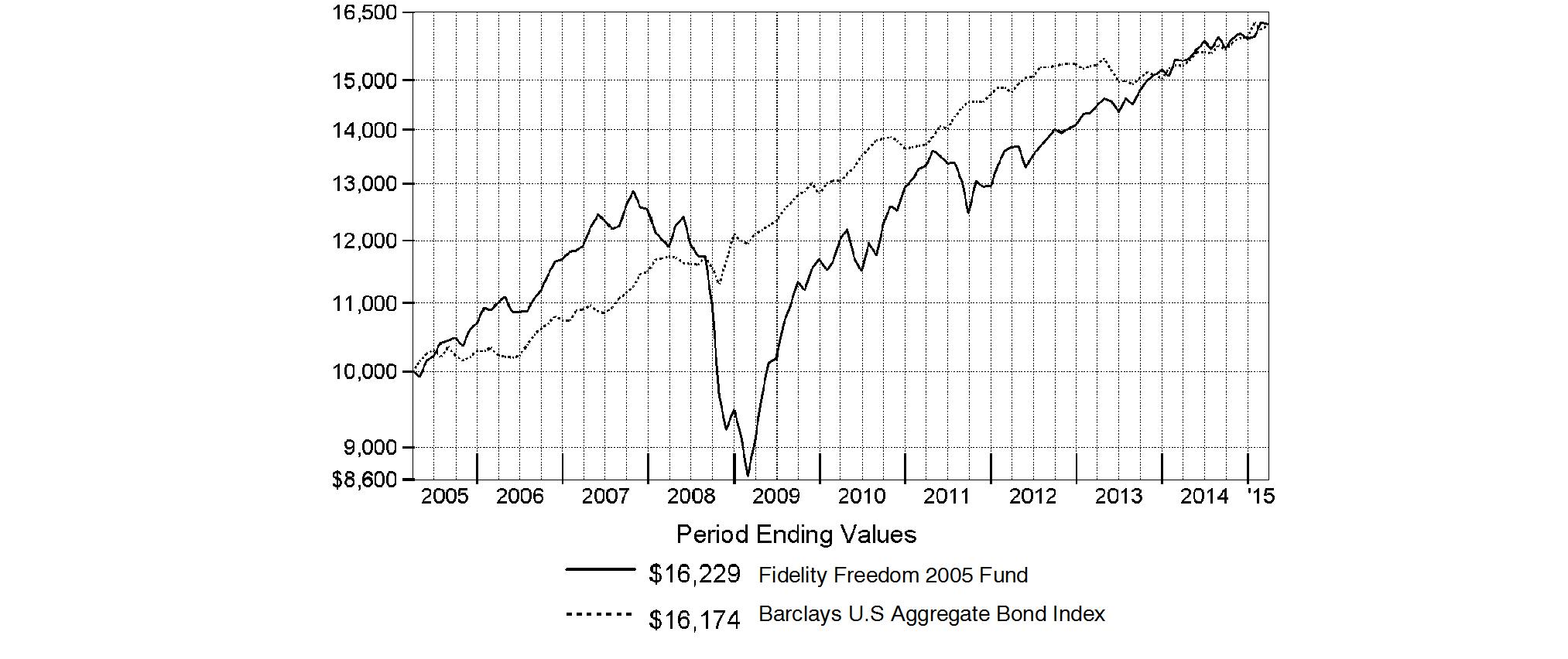

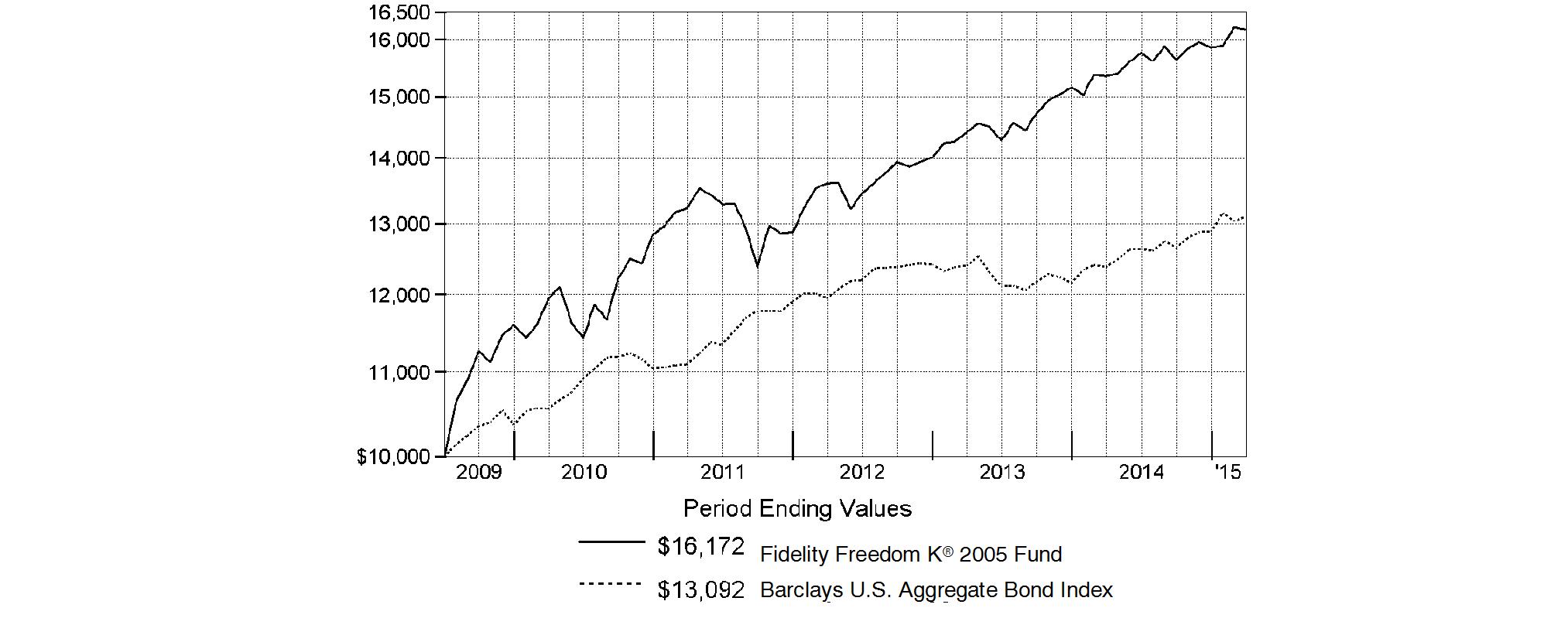

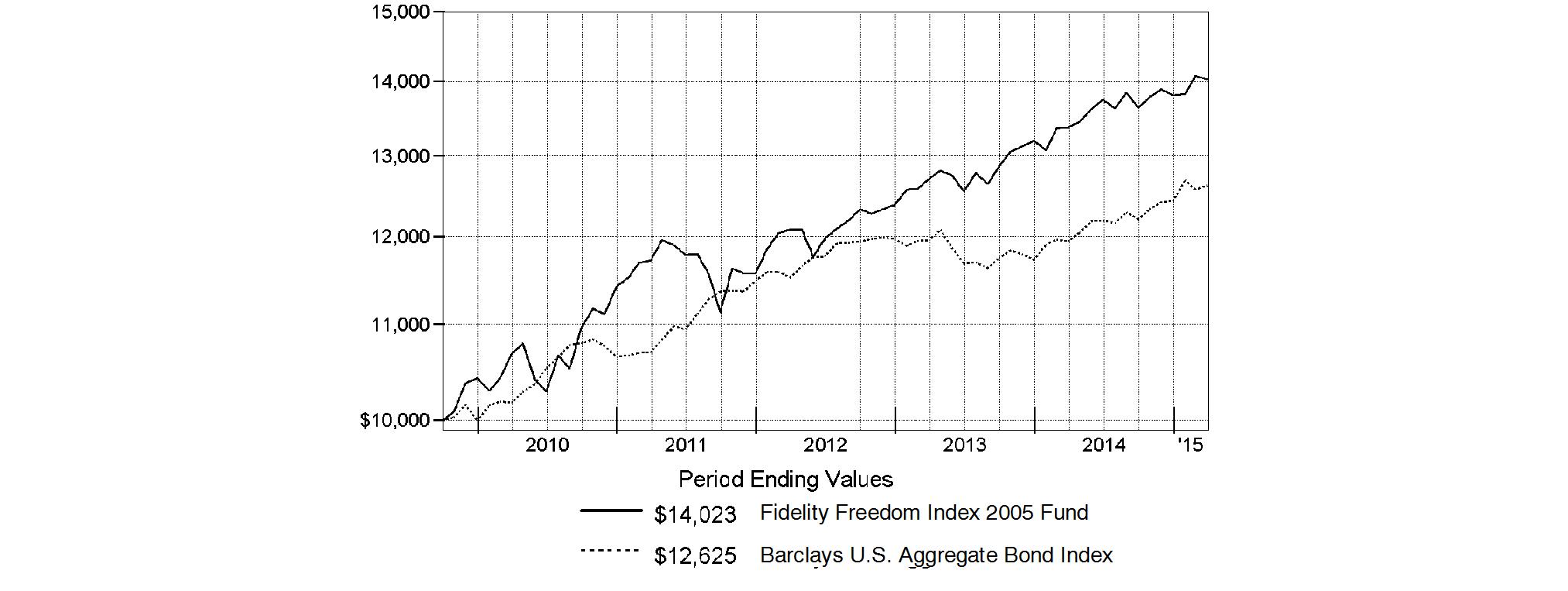

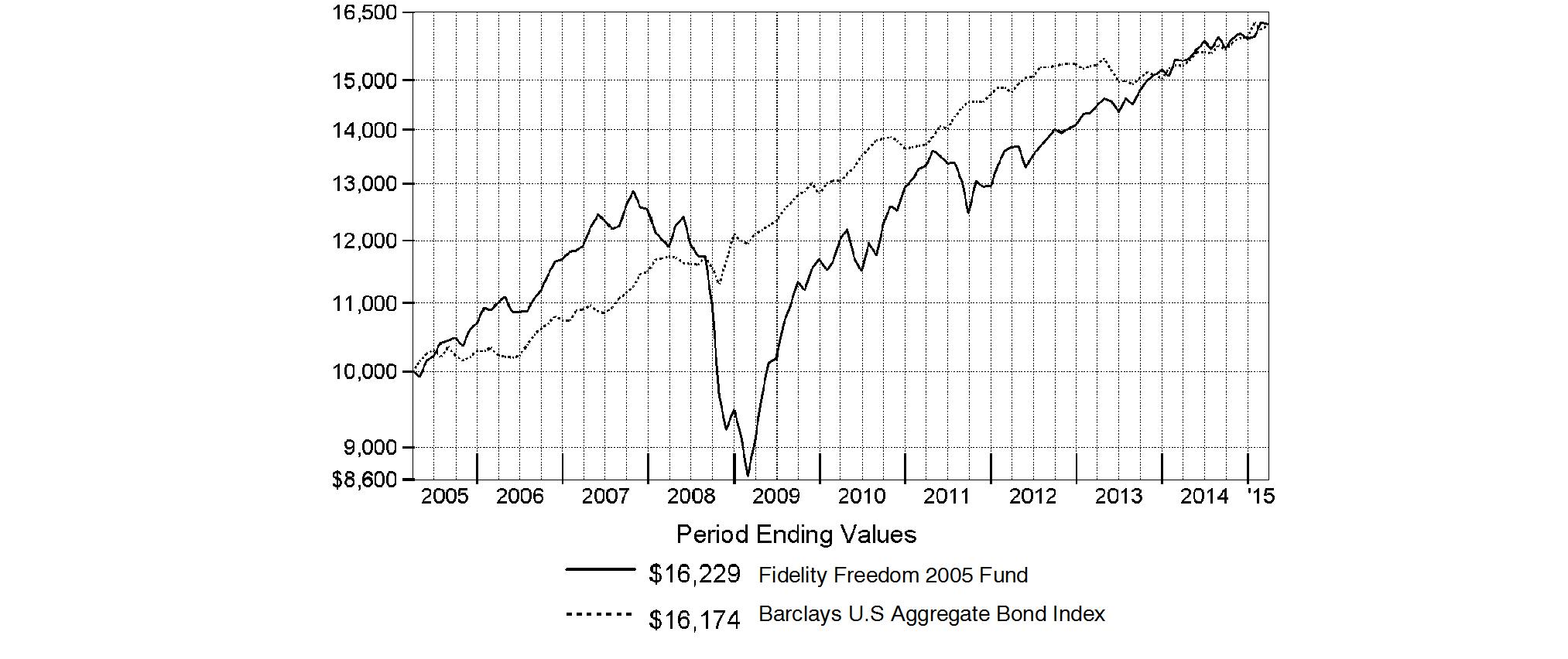

Fidelity Freedom K® 2005 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2005 Fund | 5.33% | 6.25% | 8.72% |

A From July 2, 2009.

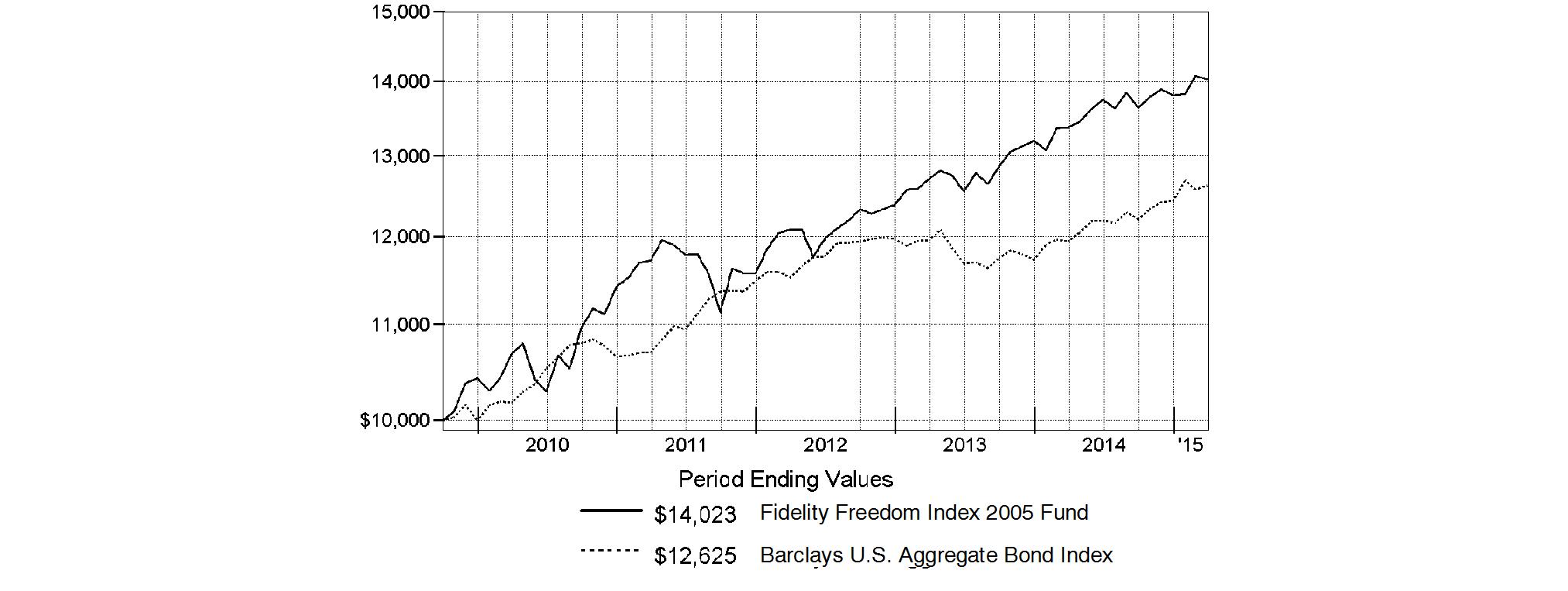

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2005 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Barclays U.S. Aggregate Bond Index performed over the same period.

Annual Report

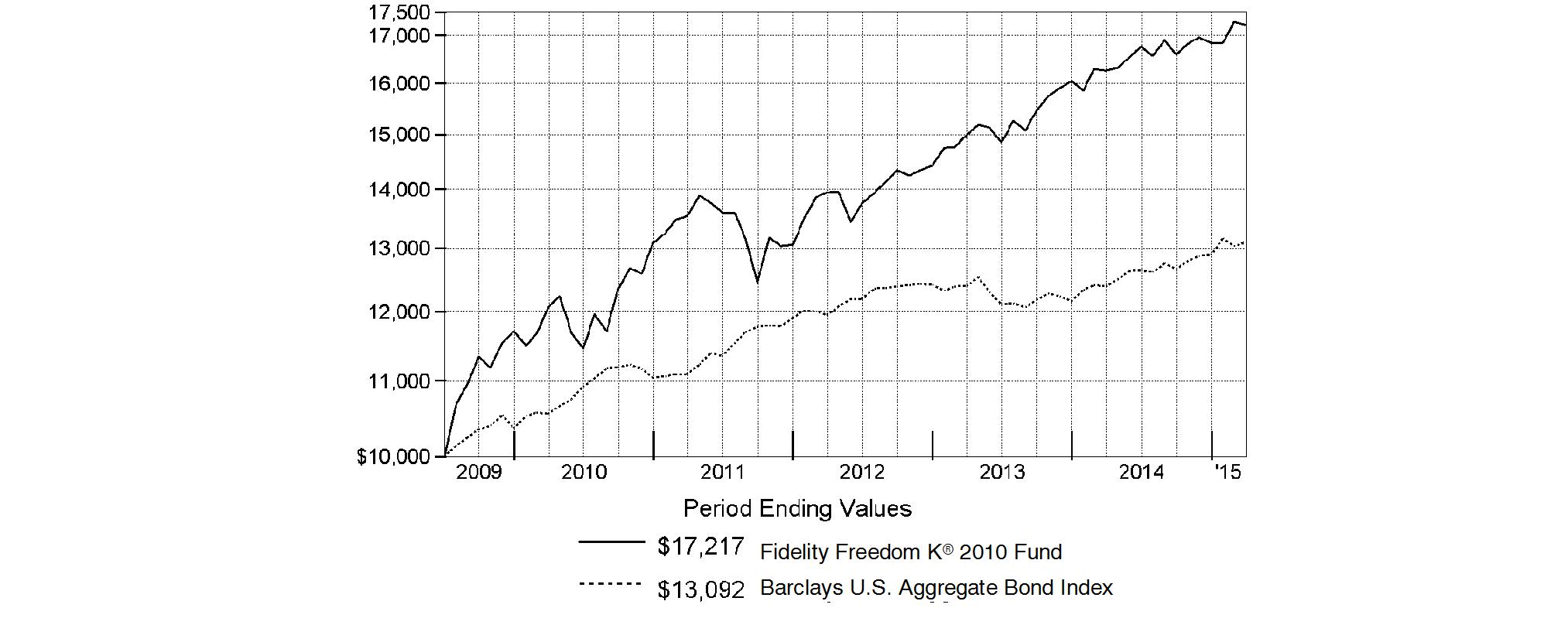

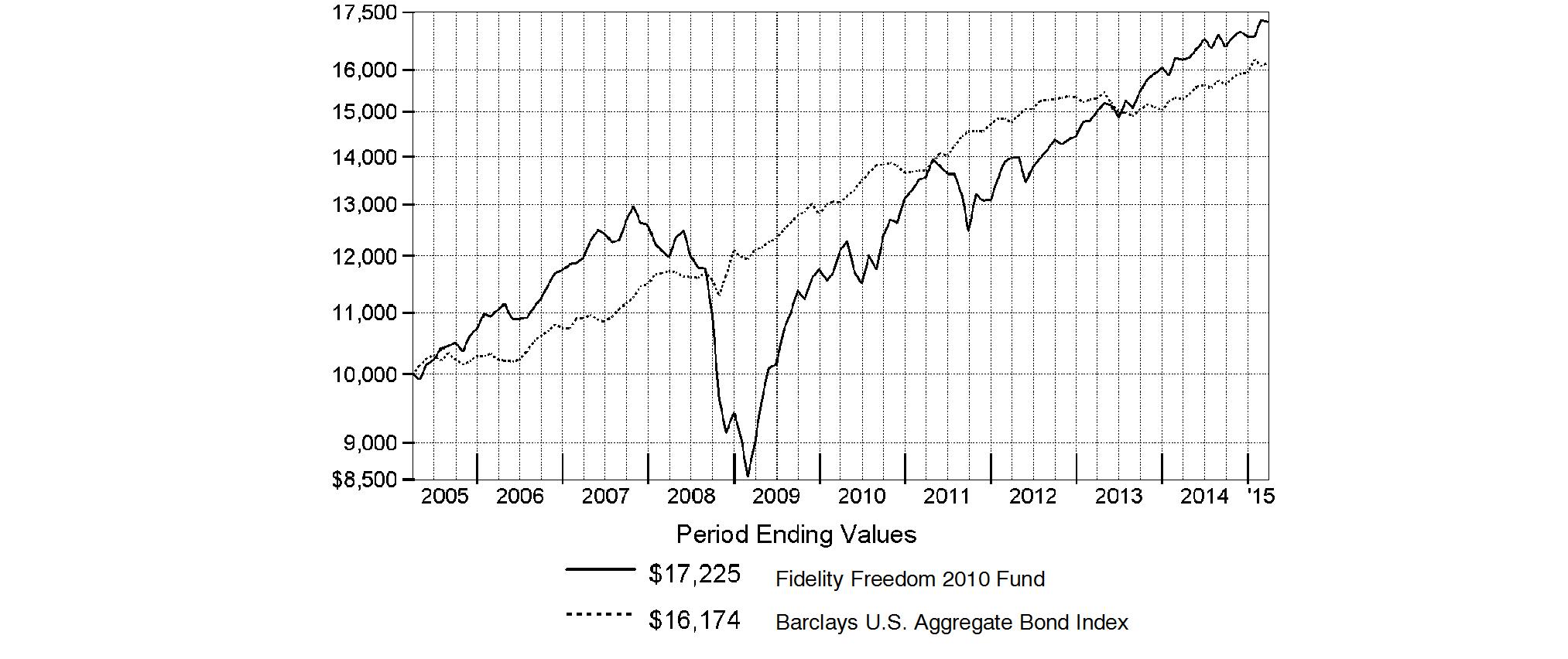

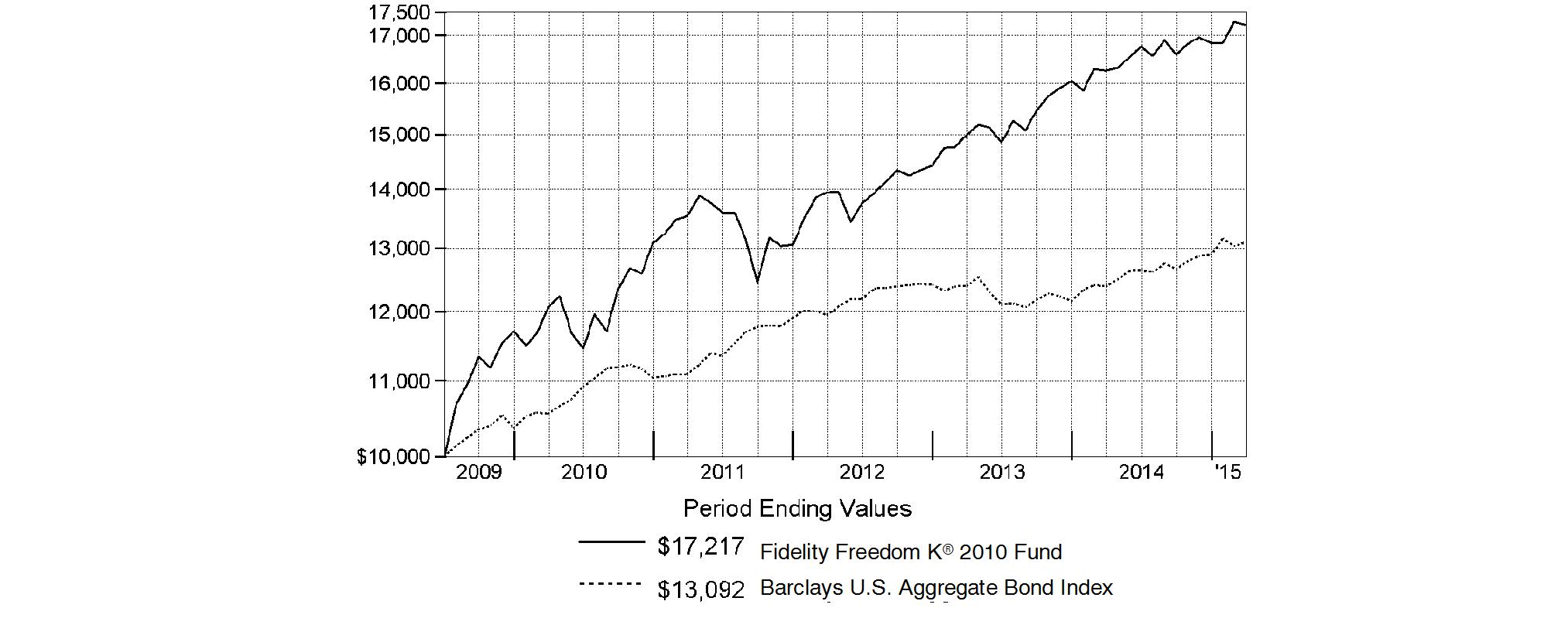

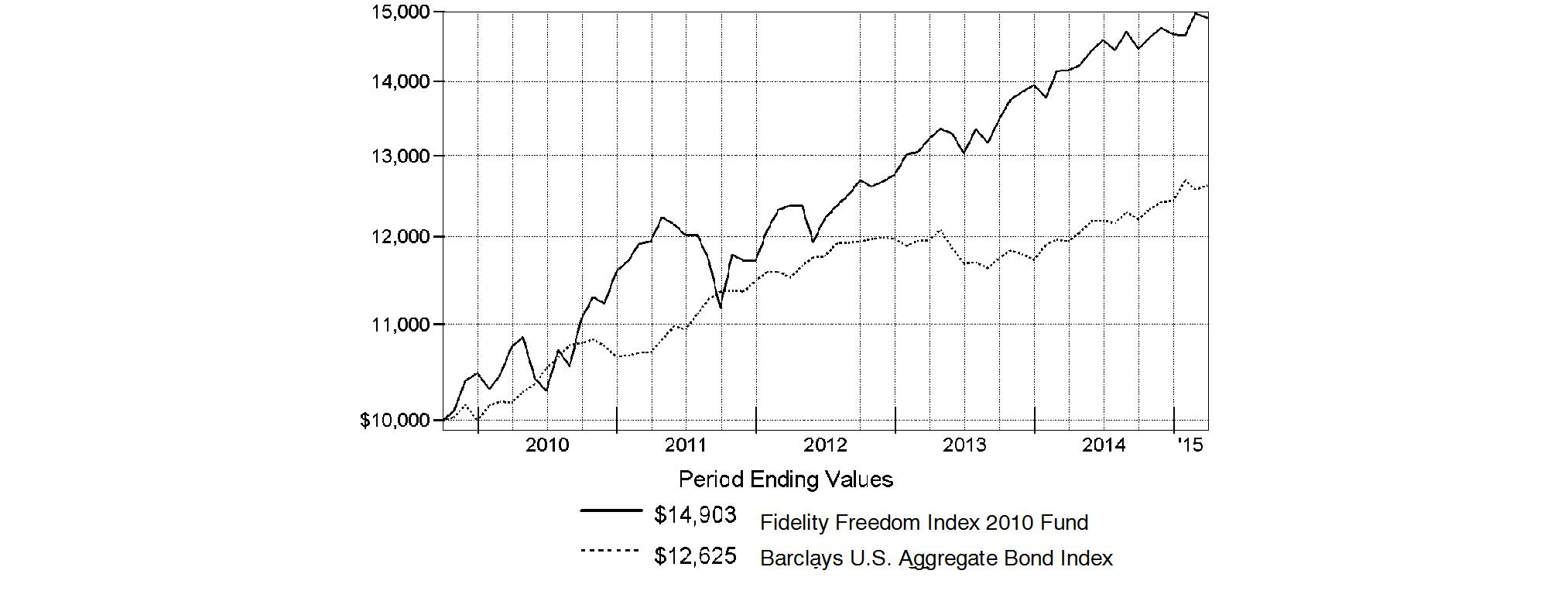

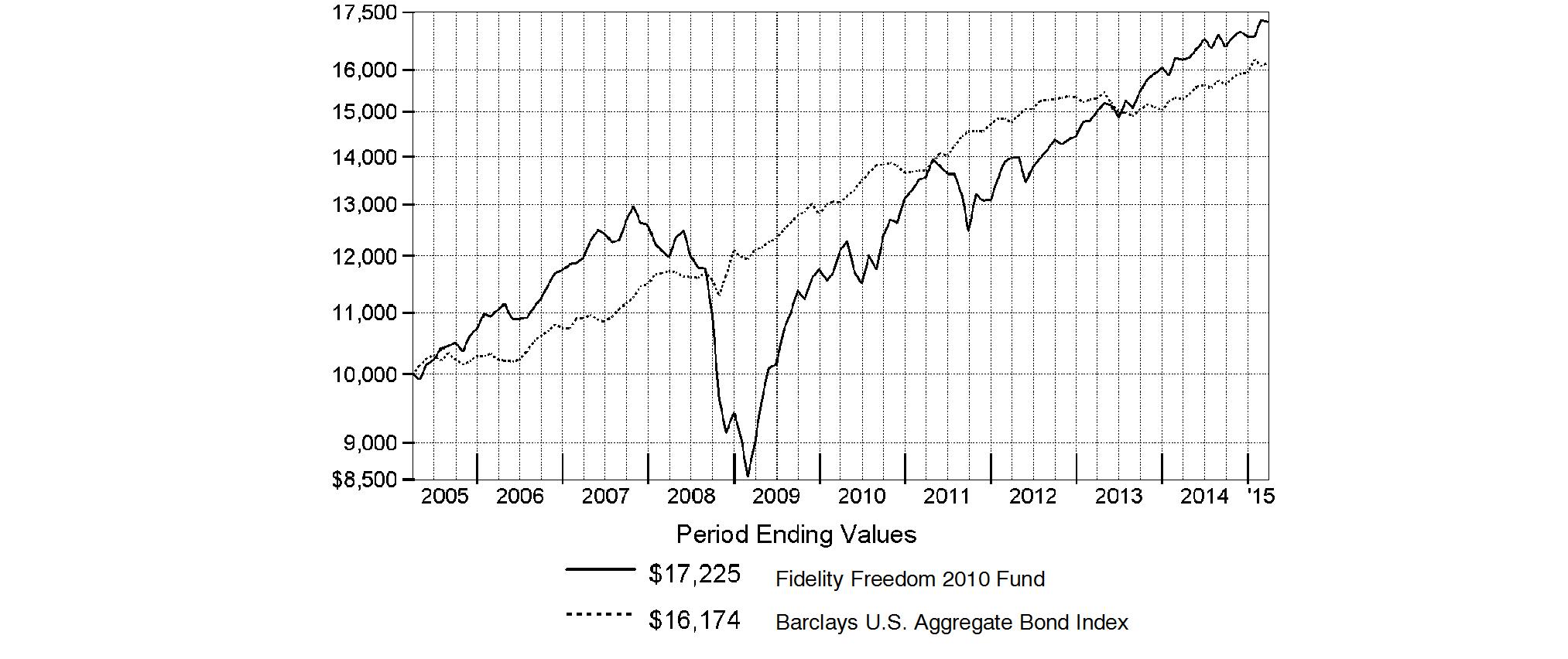

Fidelity Freedom K® 2010 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2010 Fund | 5.96% | 7.37% | 9.91% |

A From July 2, 2009.

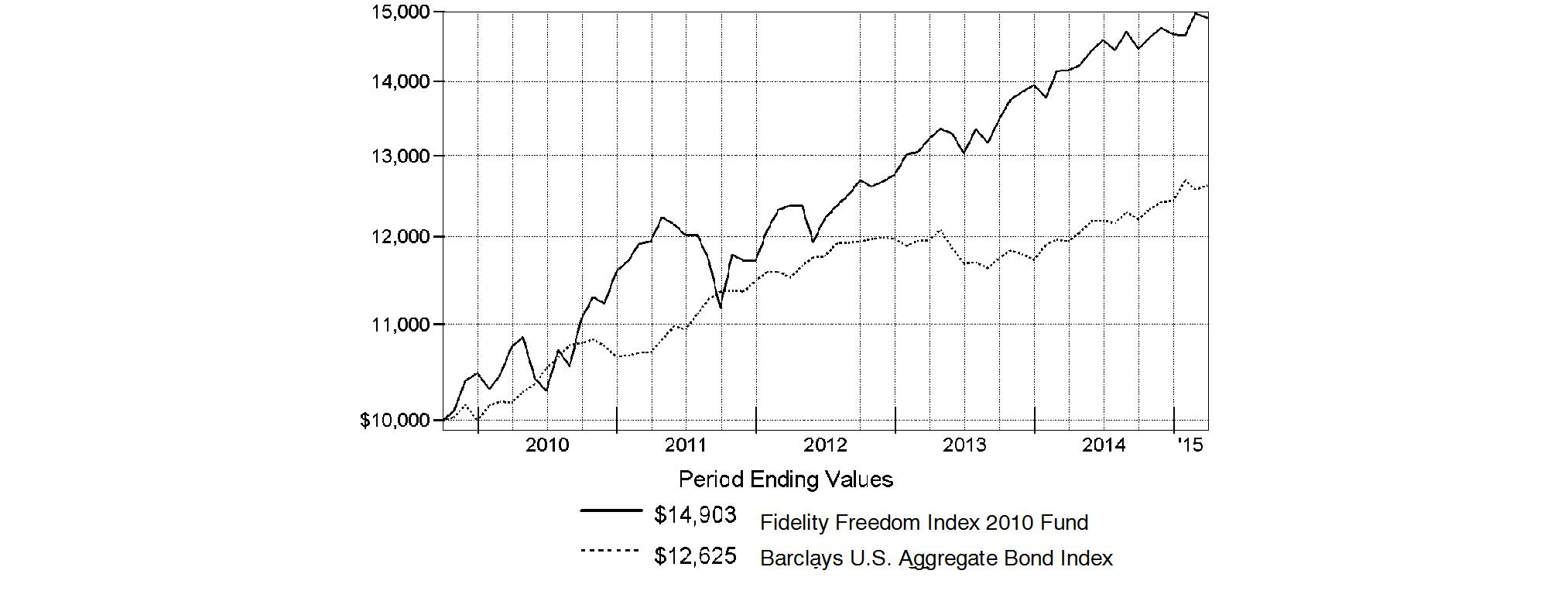

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2010 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Barclays U.S. Aggregate Bond Index performed over the same period.

Annual Report

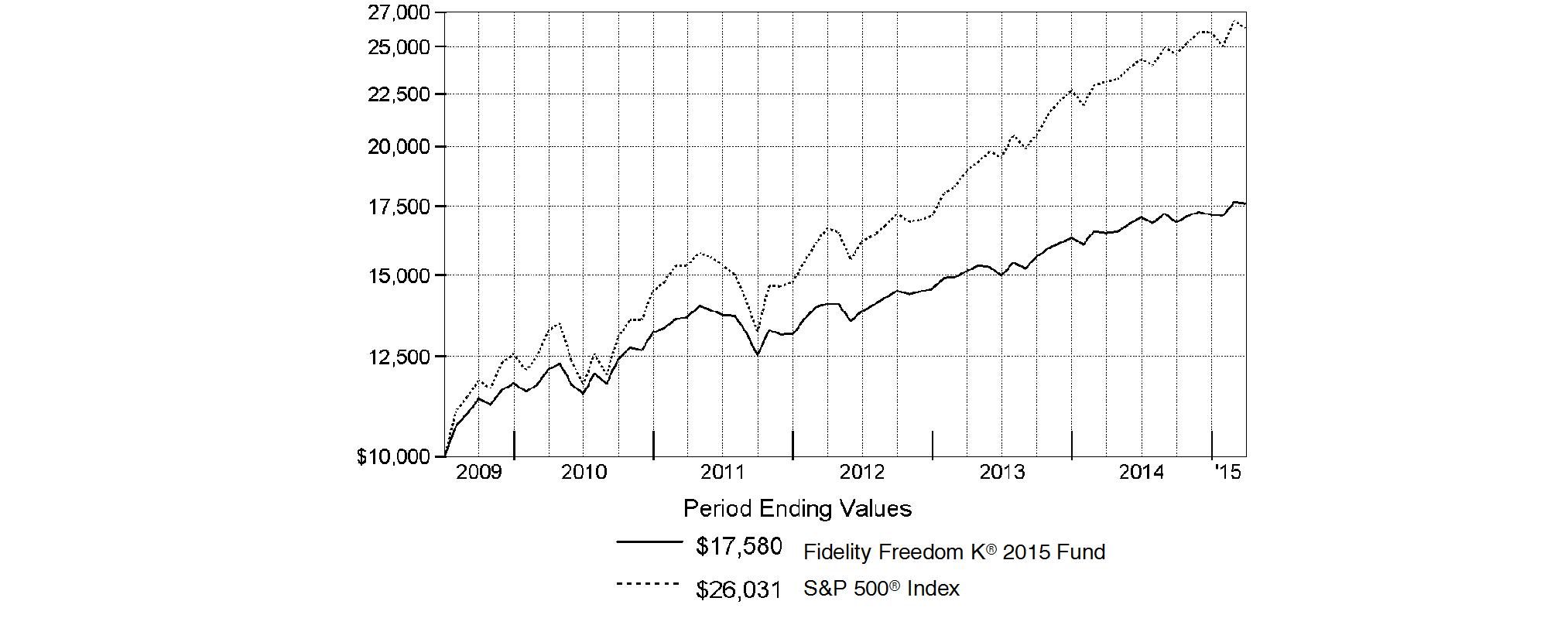

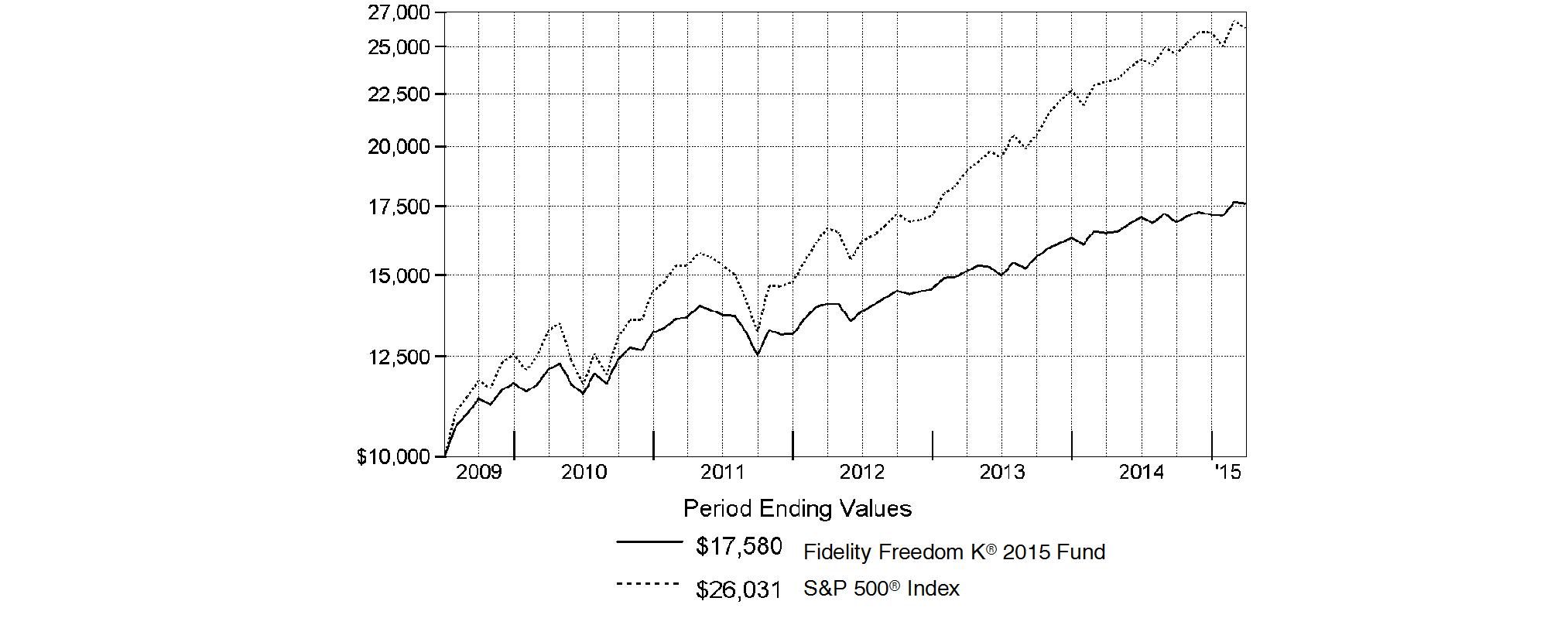

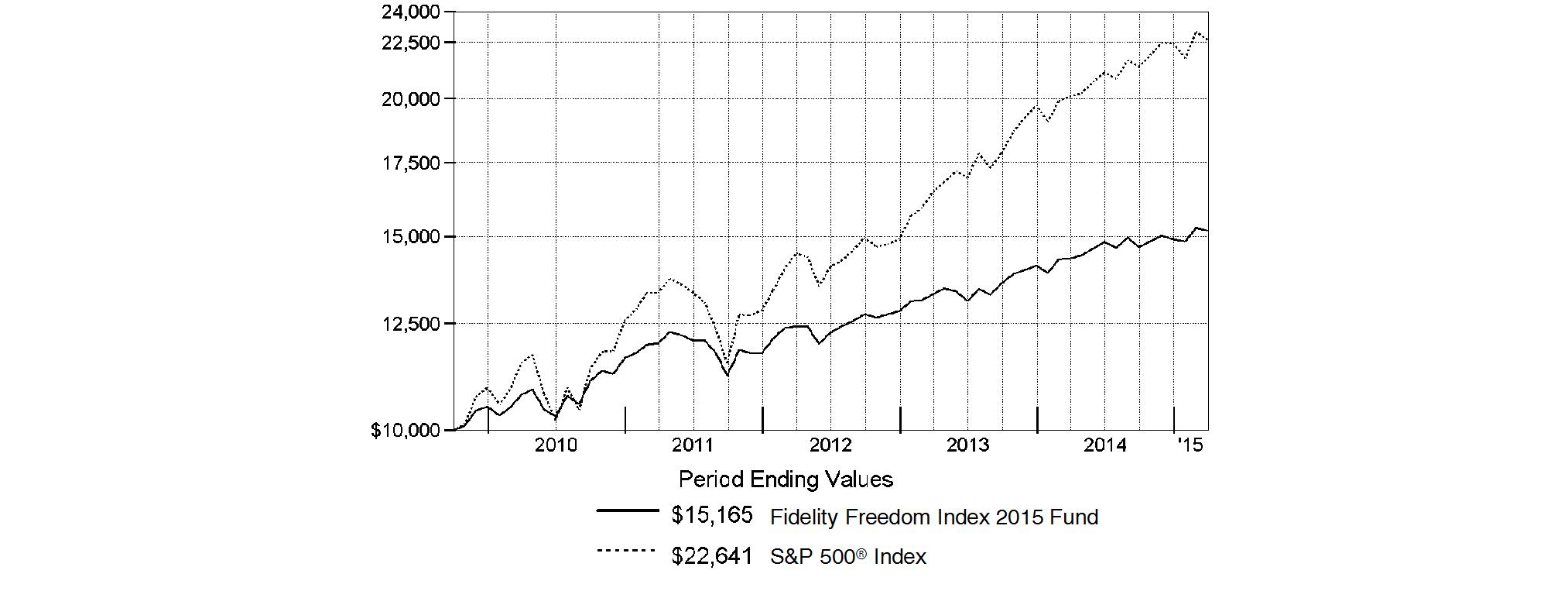

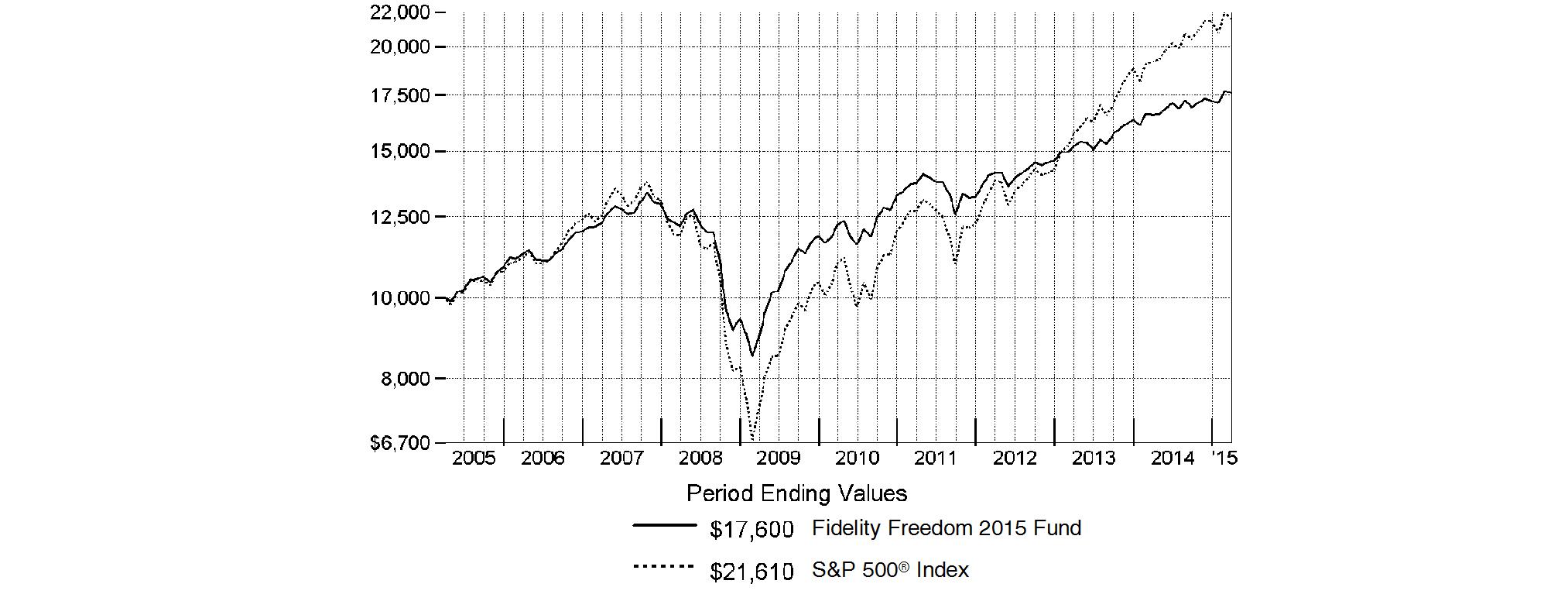

Fidelity Freedom K® 2015 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2015 Fund | 6.54% | 7.69% | 10.31% |

A From July 2, 2009.

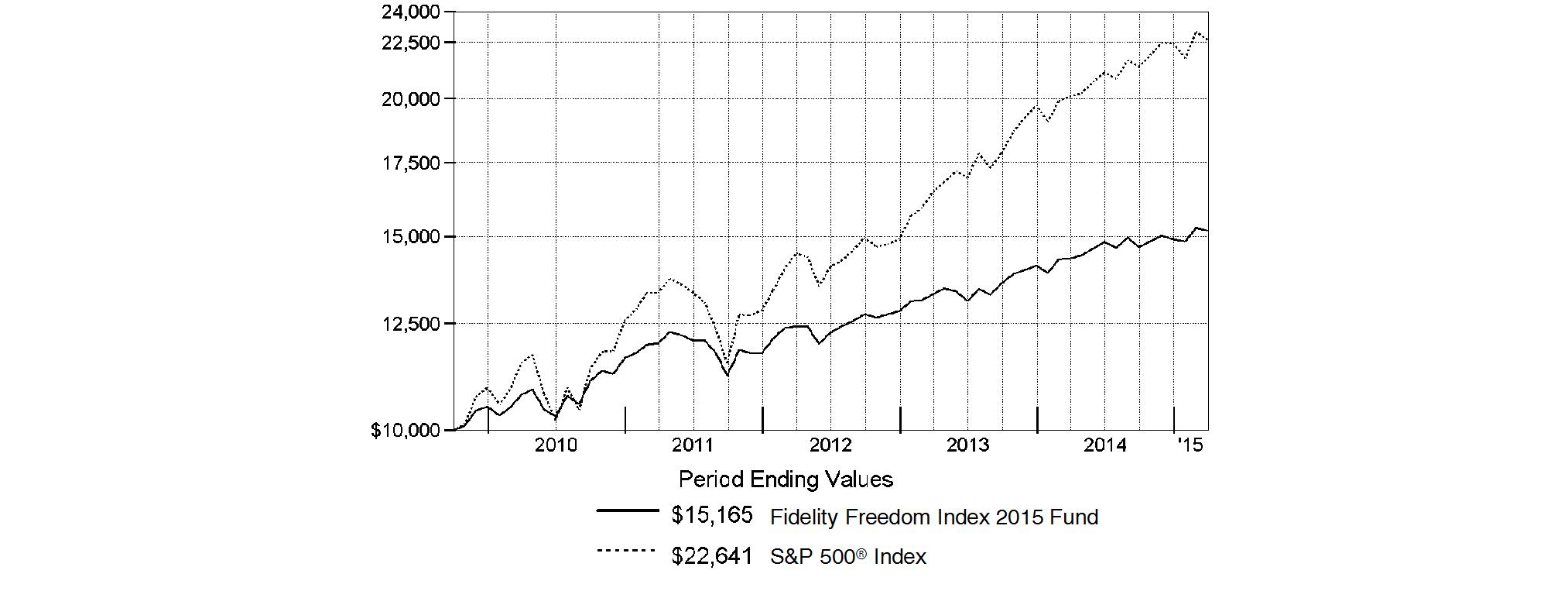

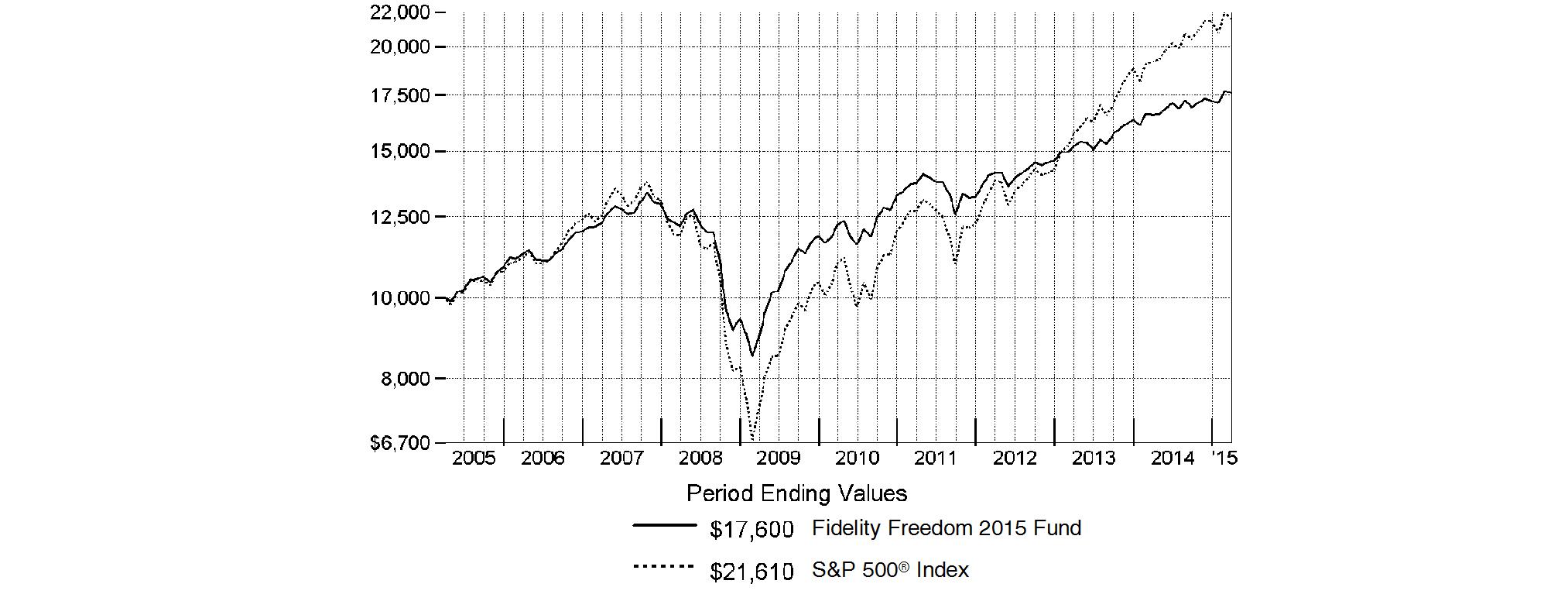

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2015 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

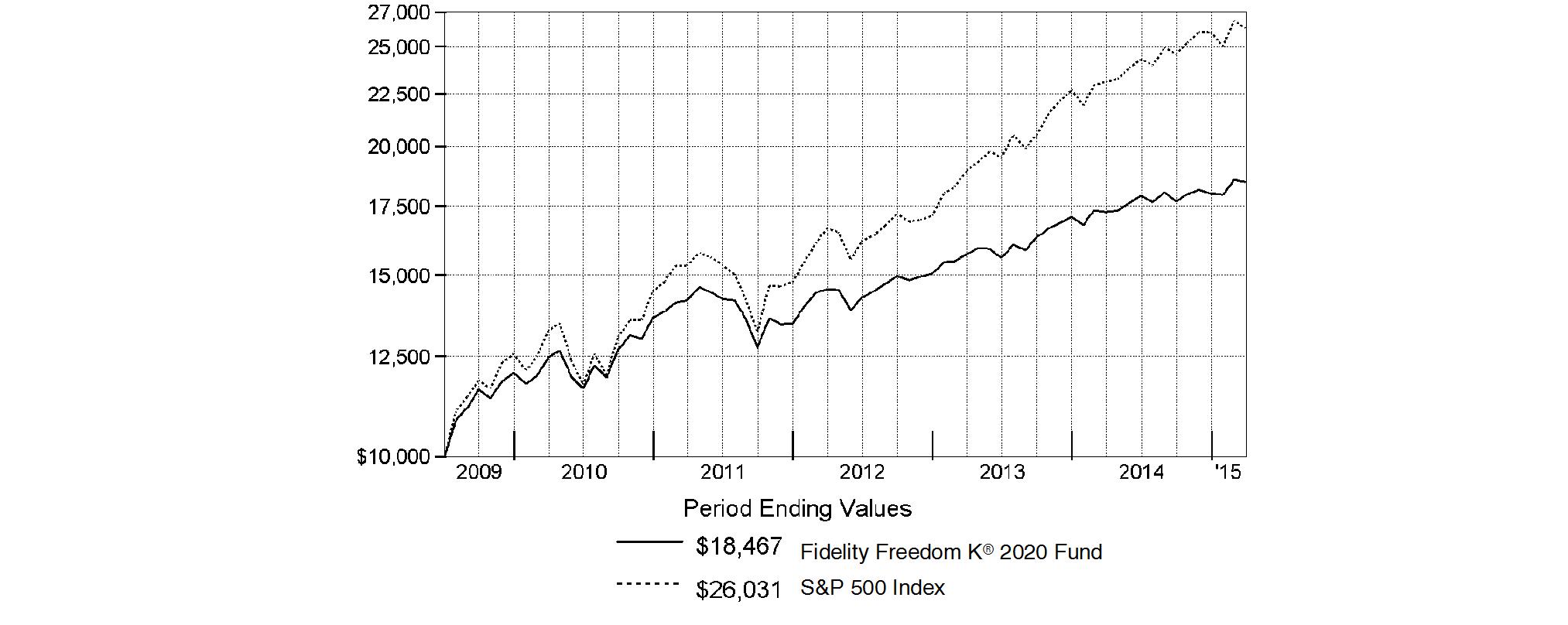

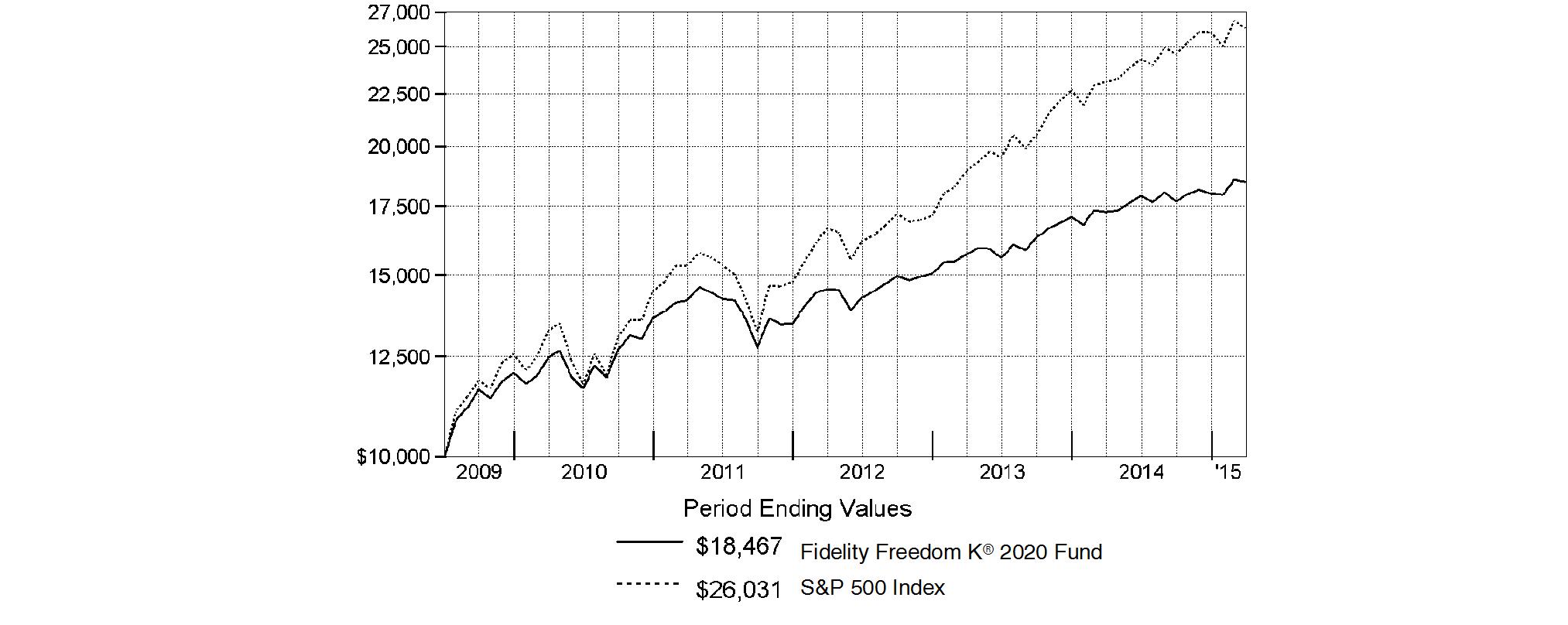

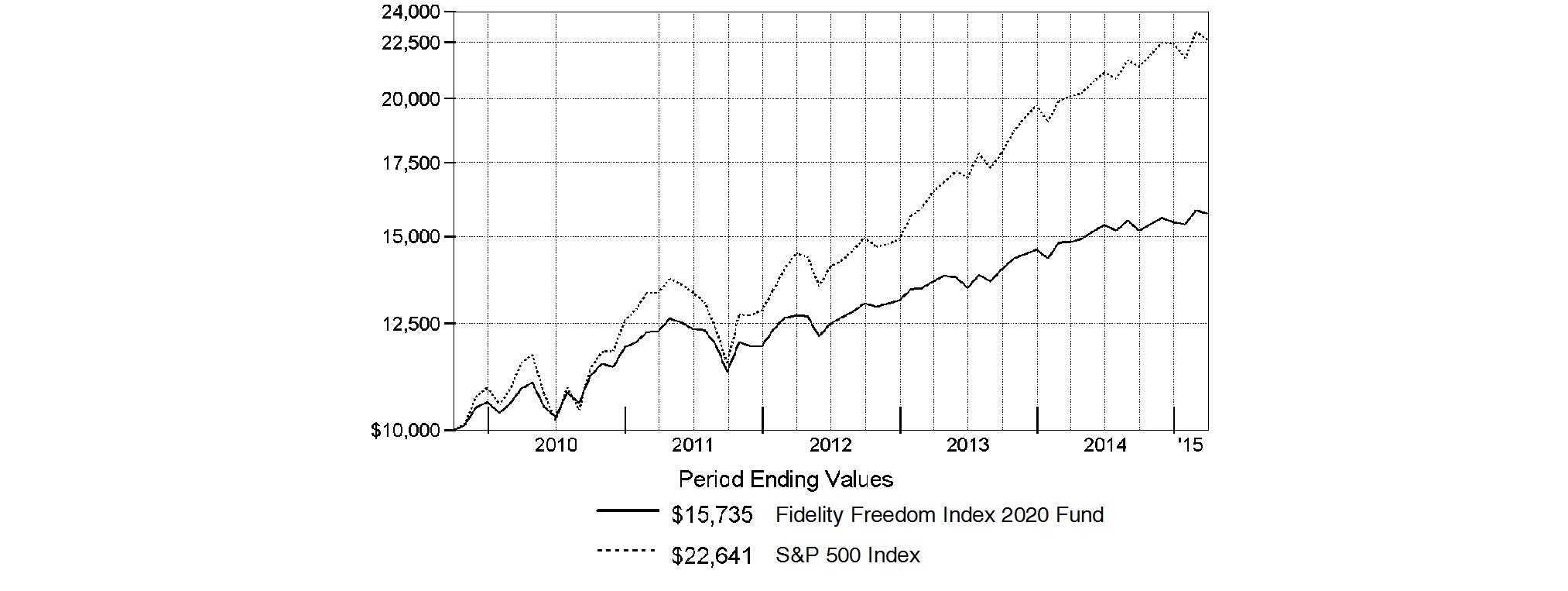

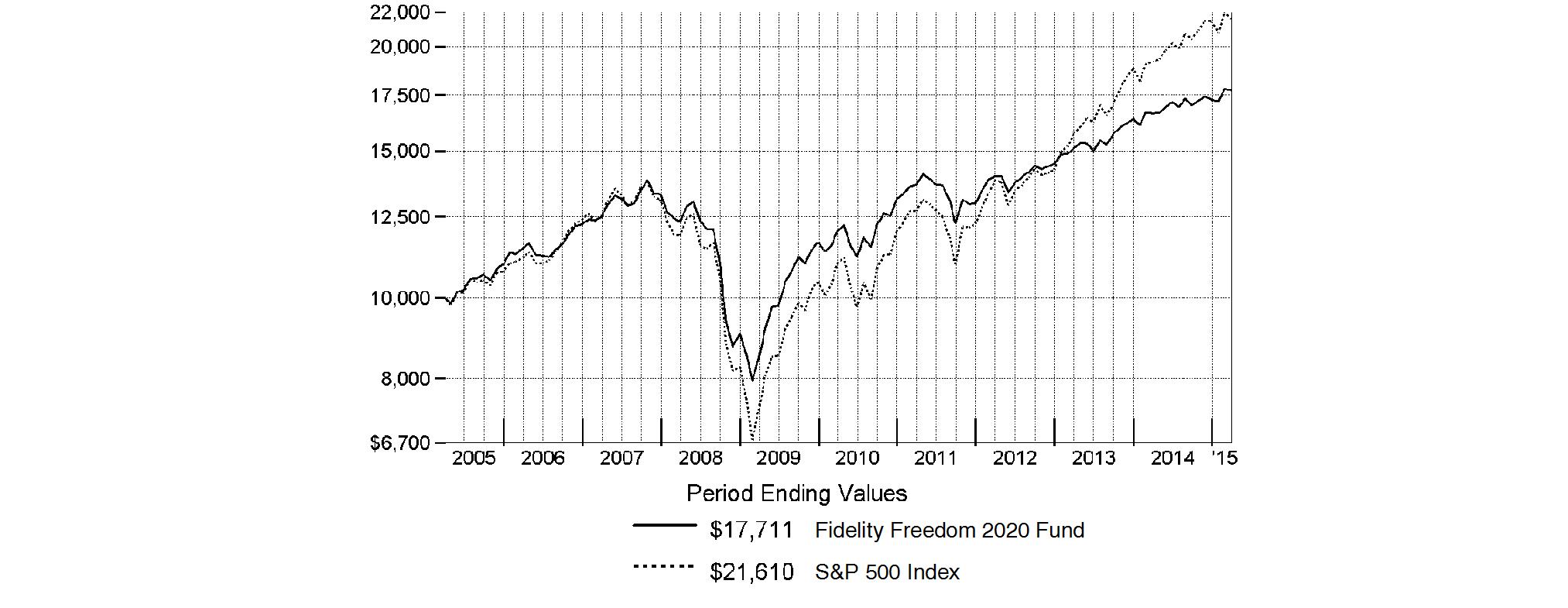

Fidelity Freedom K® 2020 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2020 Fund | 6.84% | 8.16% | 11.26% |

A From July 2, 2009.

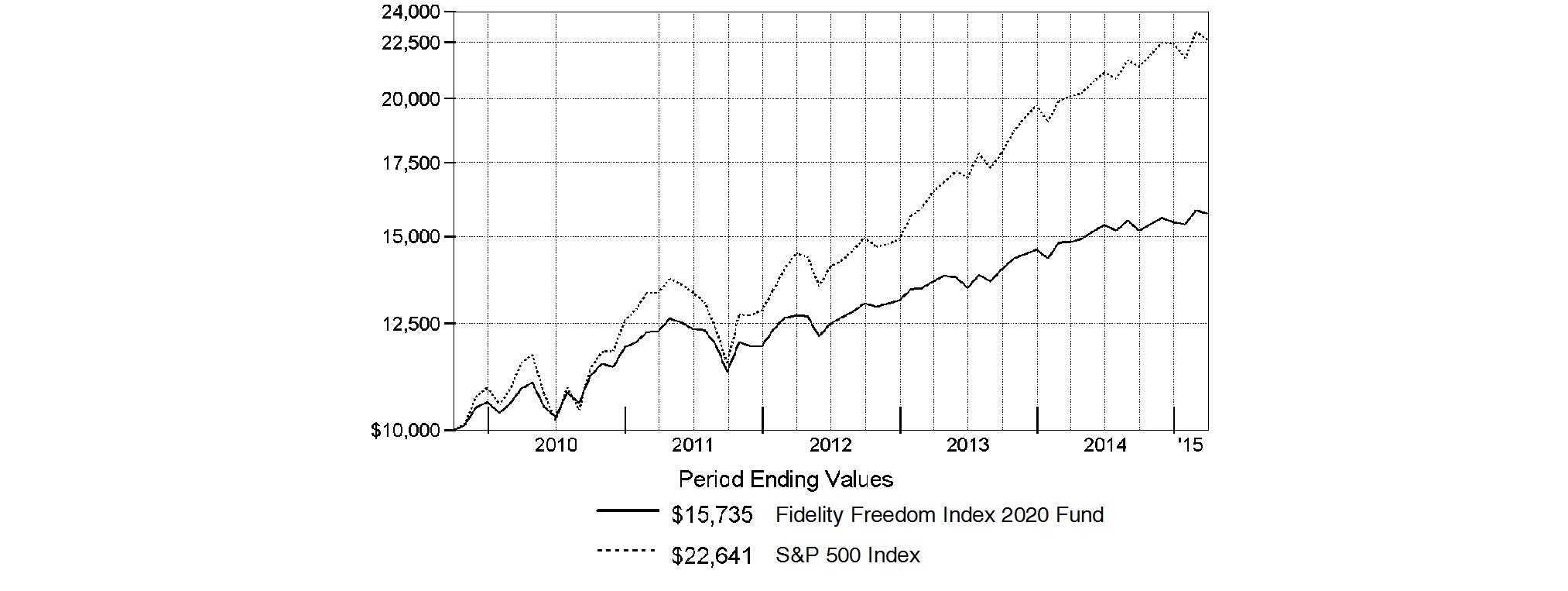

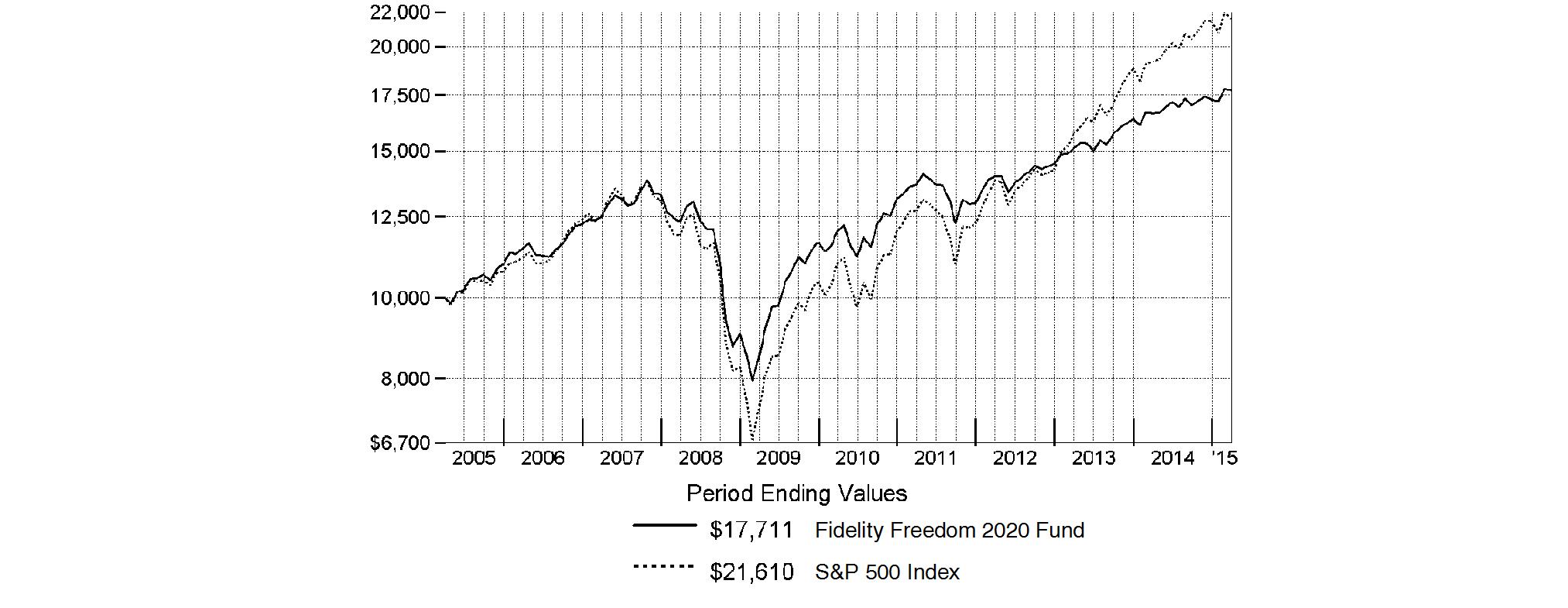

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2020 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

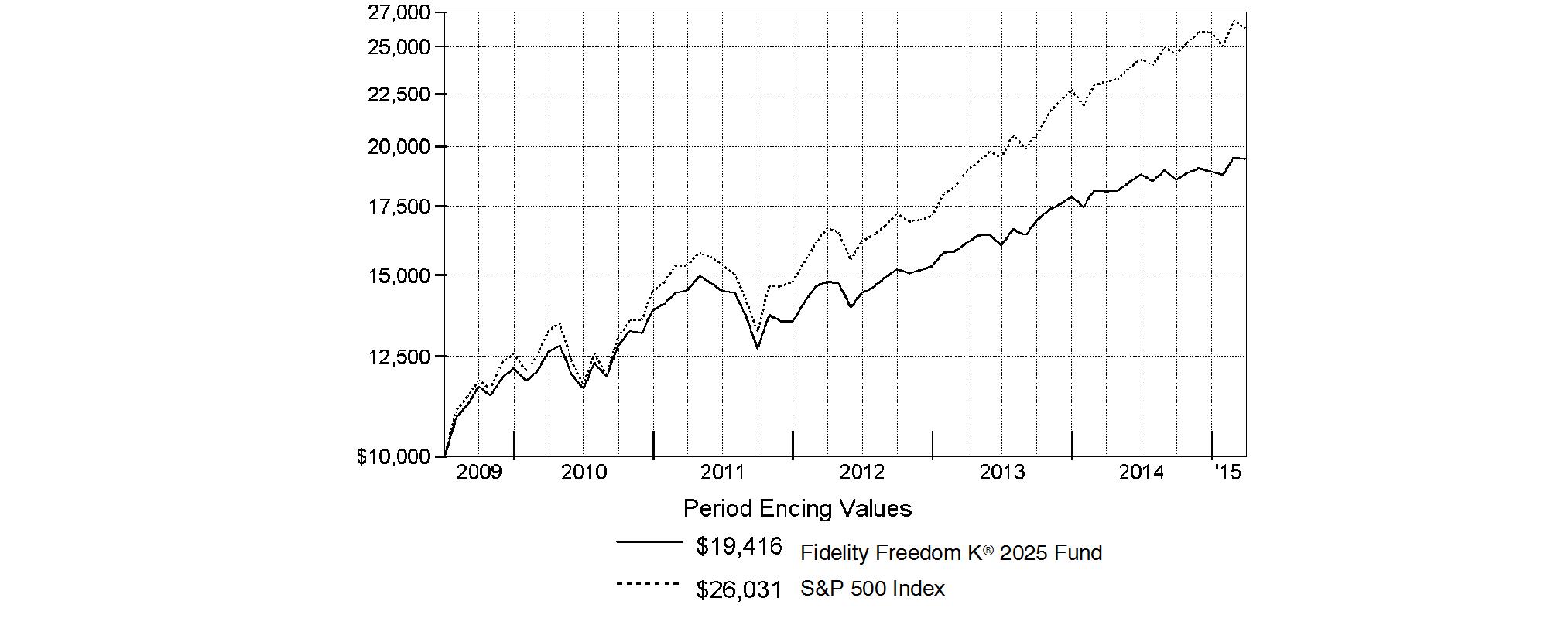

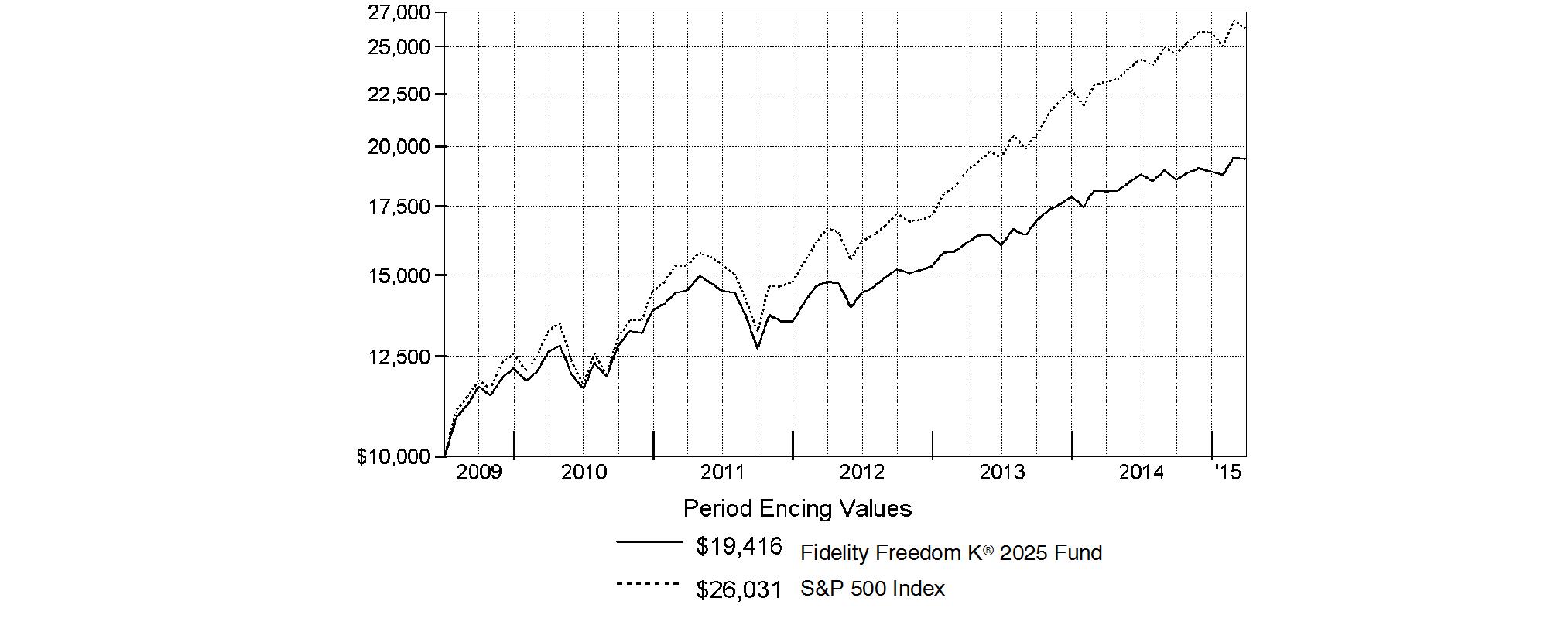

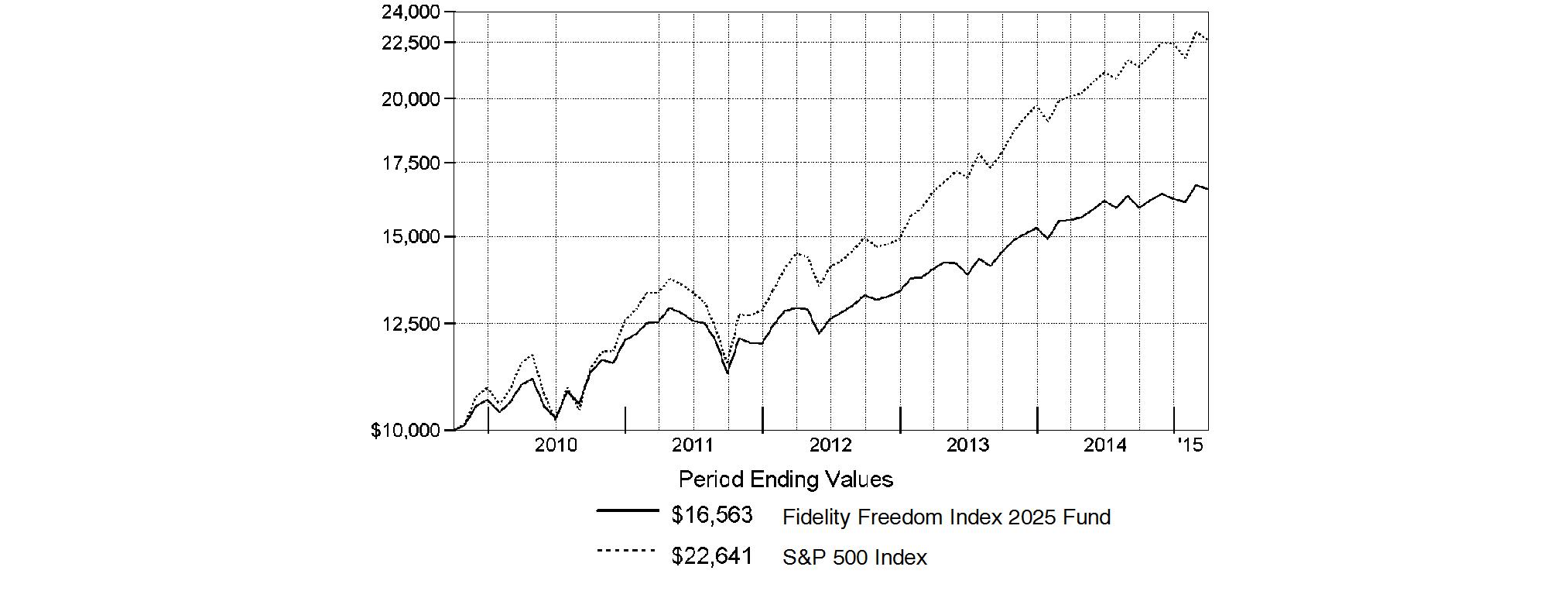

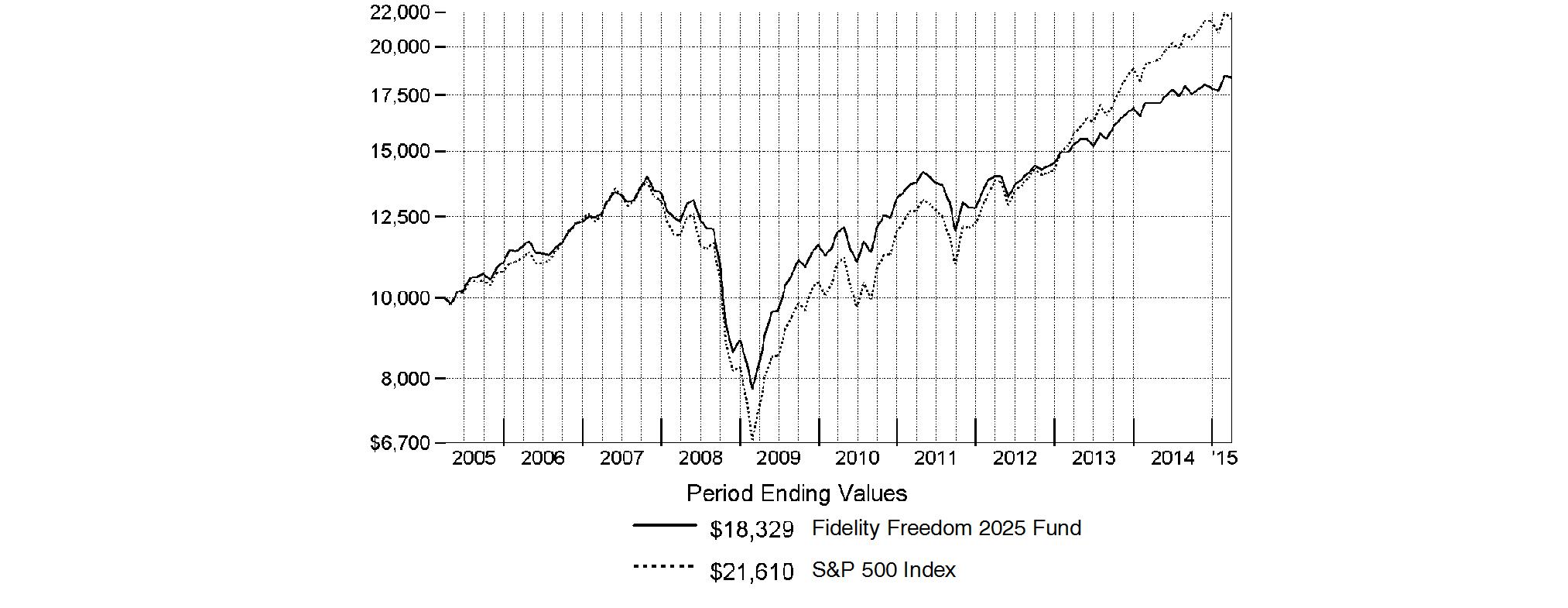

Fidelity Freedom K® 2025 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2025 Fund | 7.35% | 8.99% | 12.24% |

A From July 2, 2009.

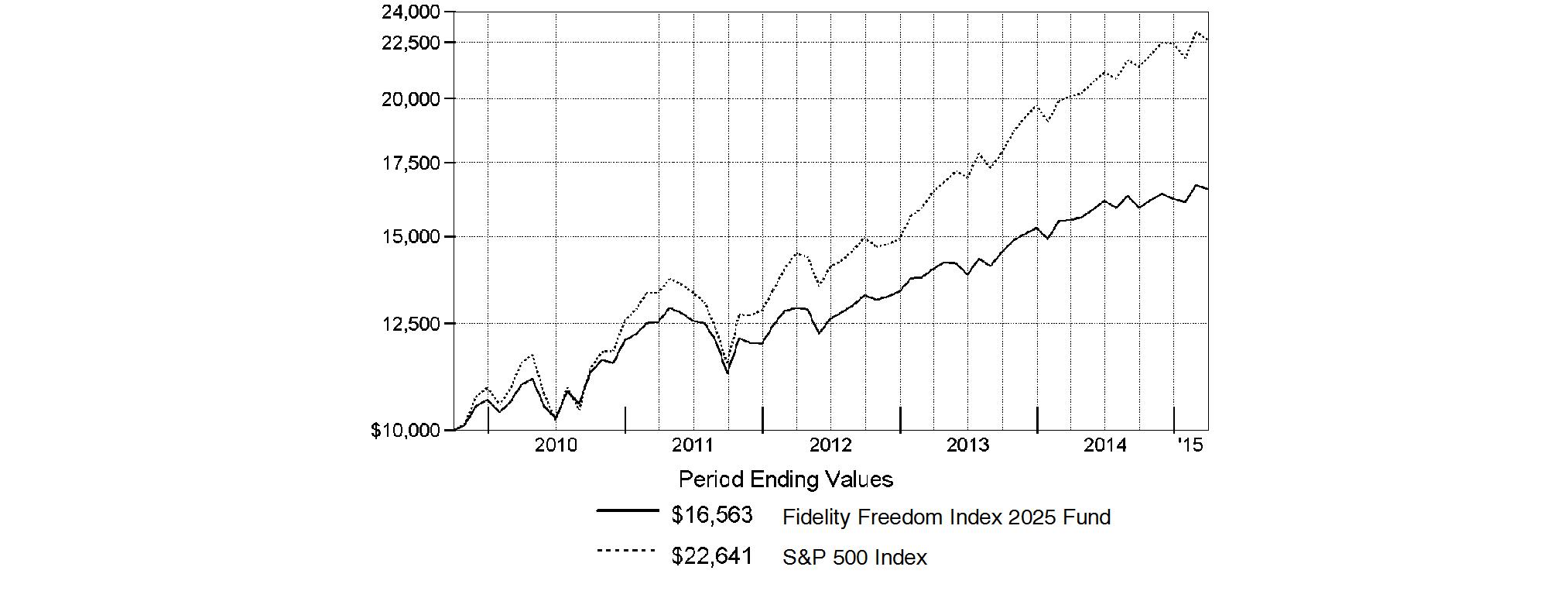

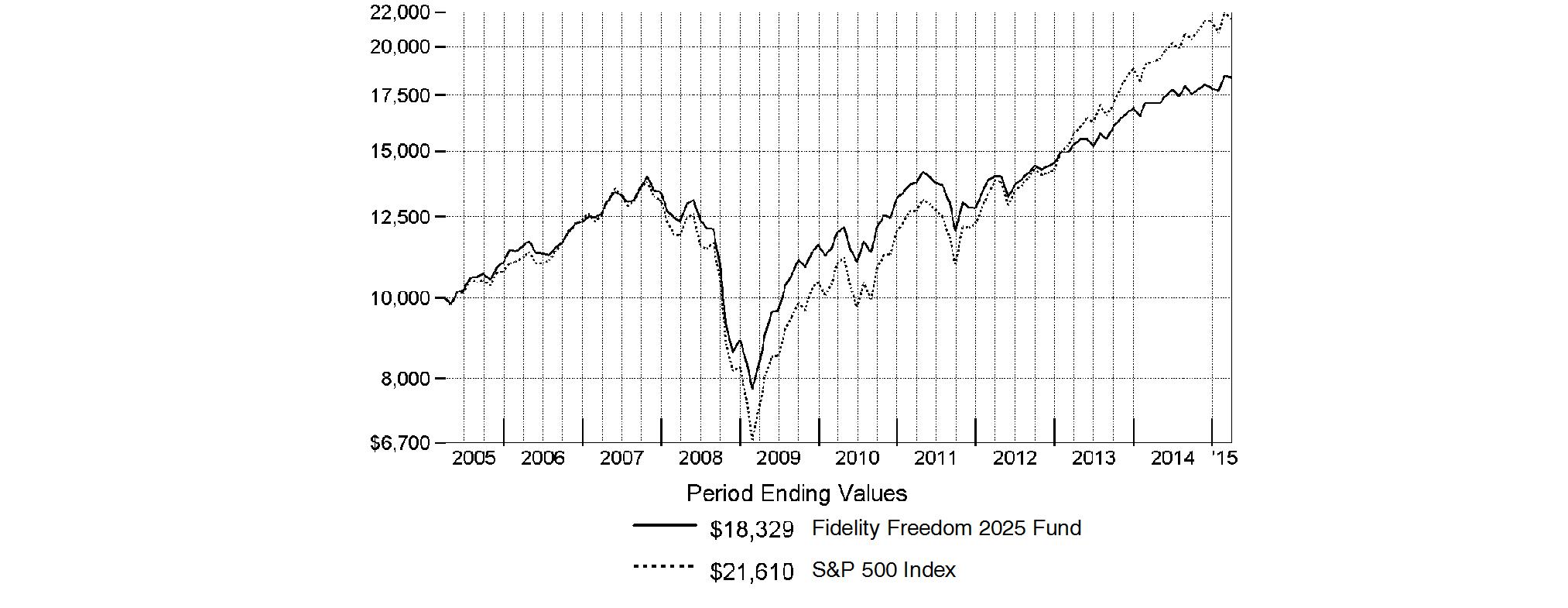

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2025 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

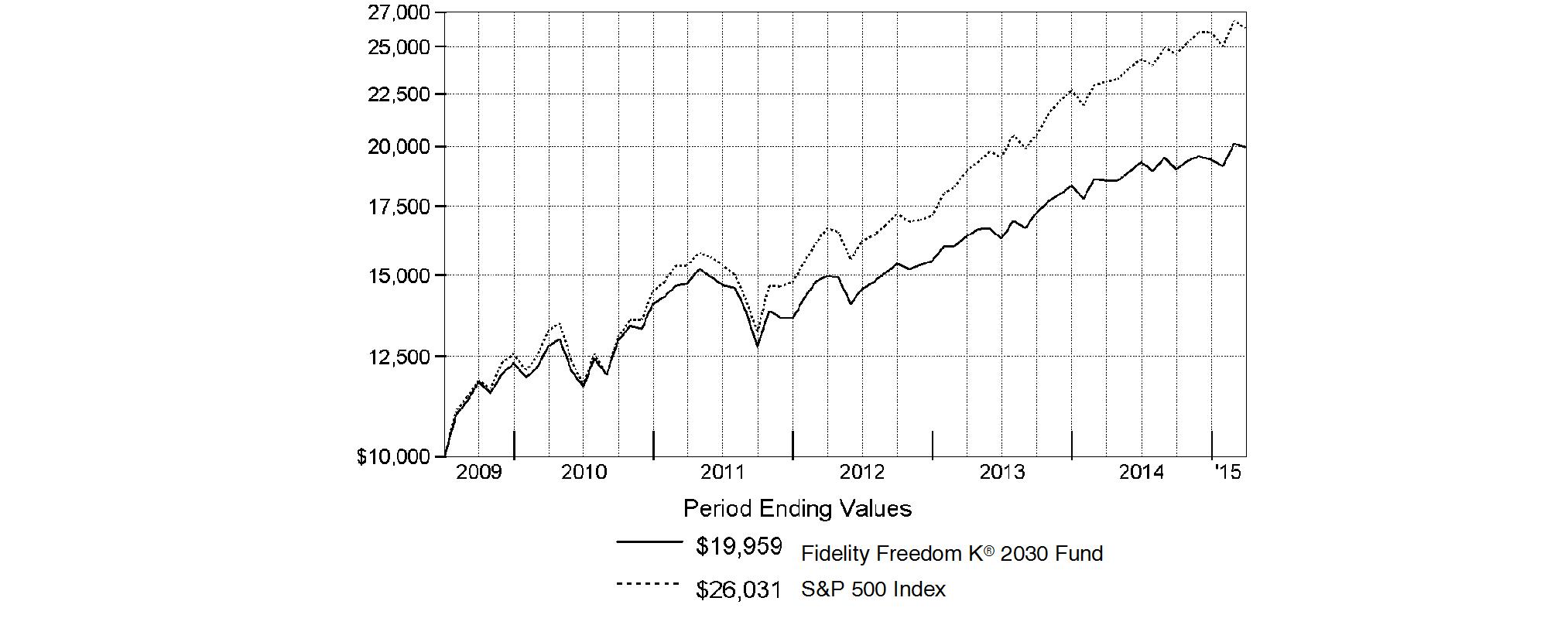

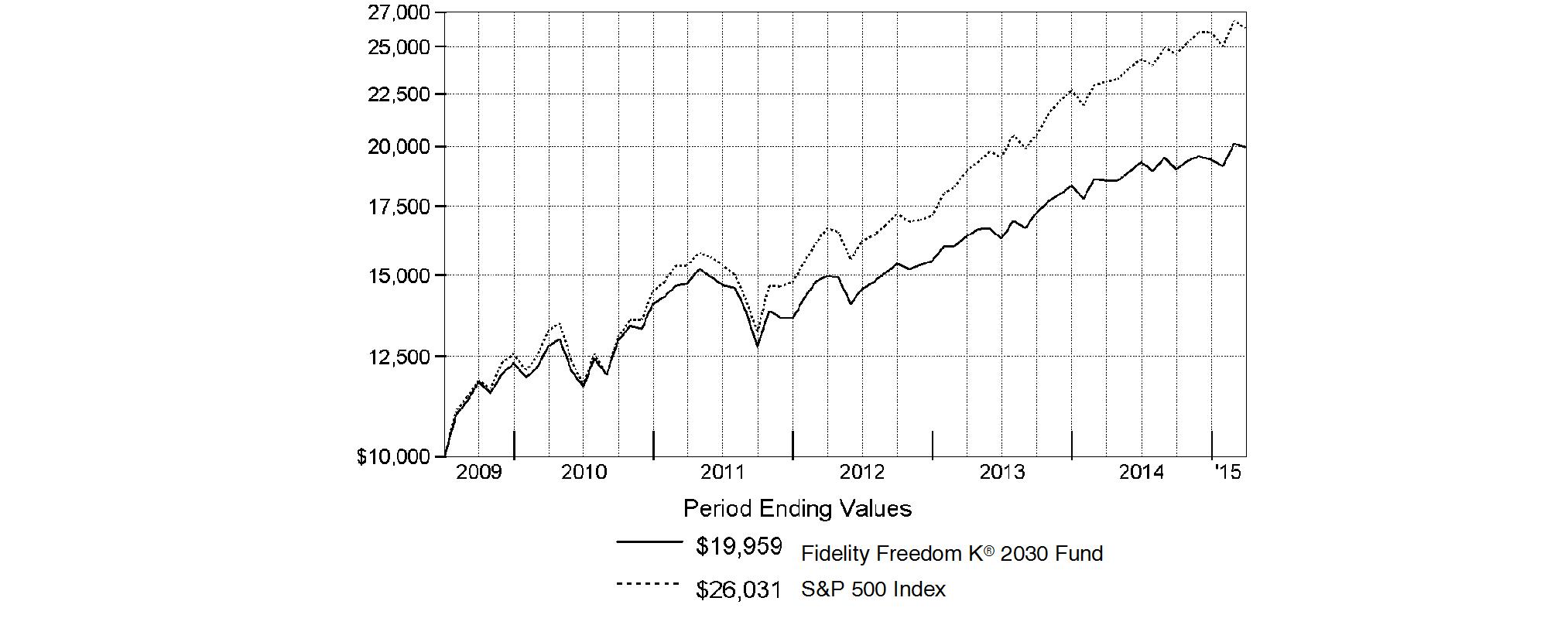

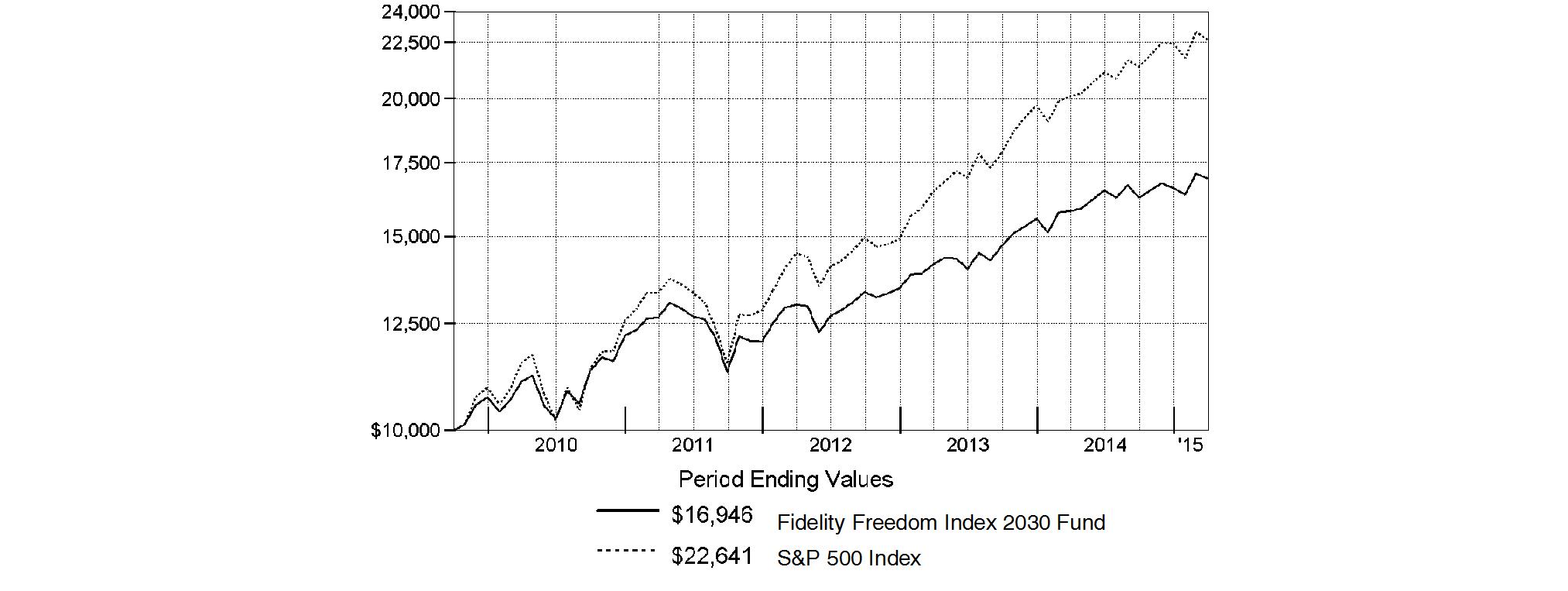

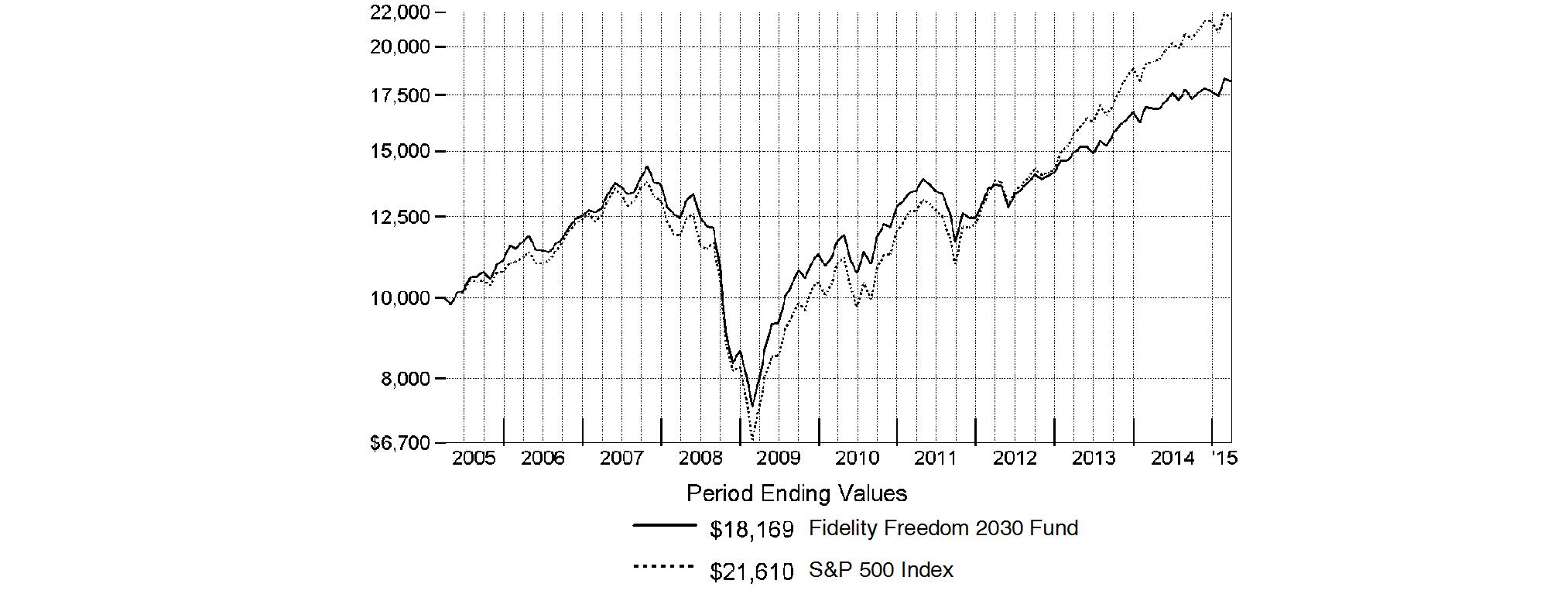

Fidelity Freedom K® 2030 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2030 Fund | 7.78% | 9.30% | 12.78% |

A From July 2, 2009.

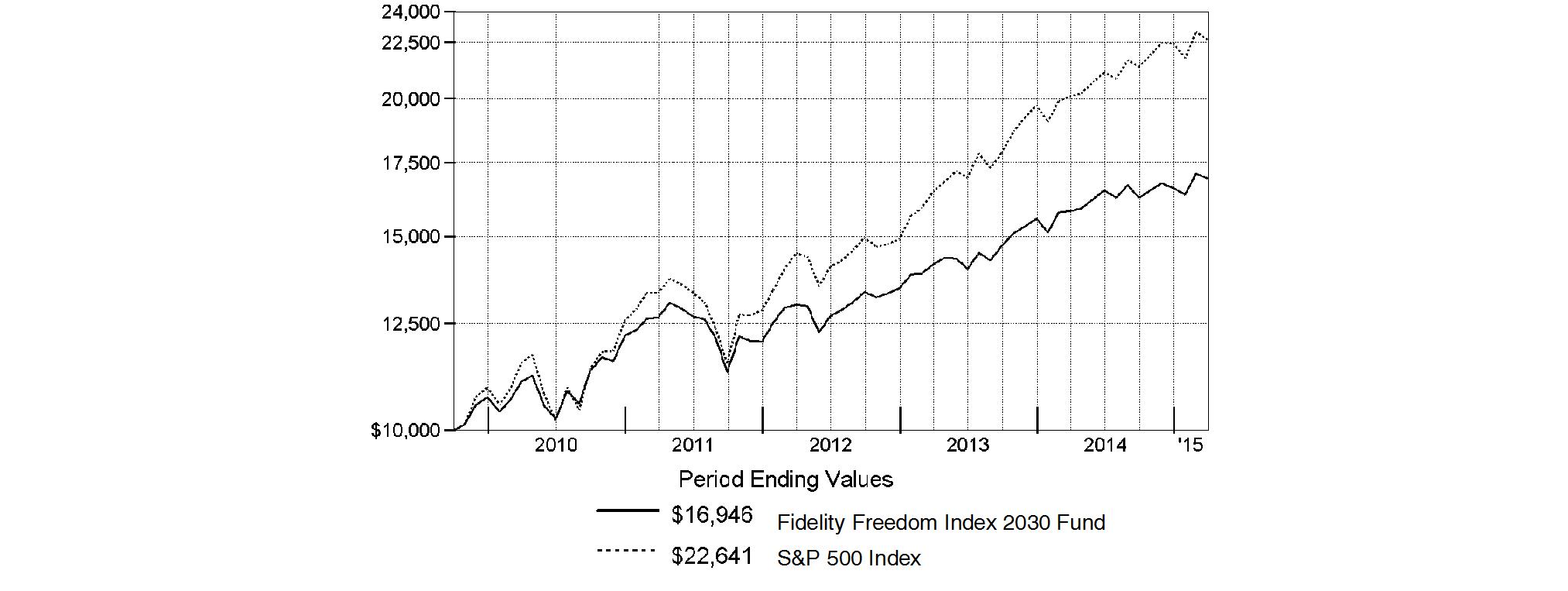

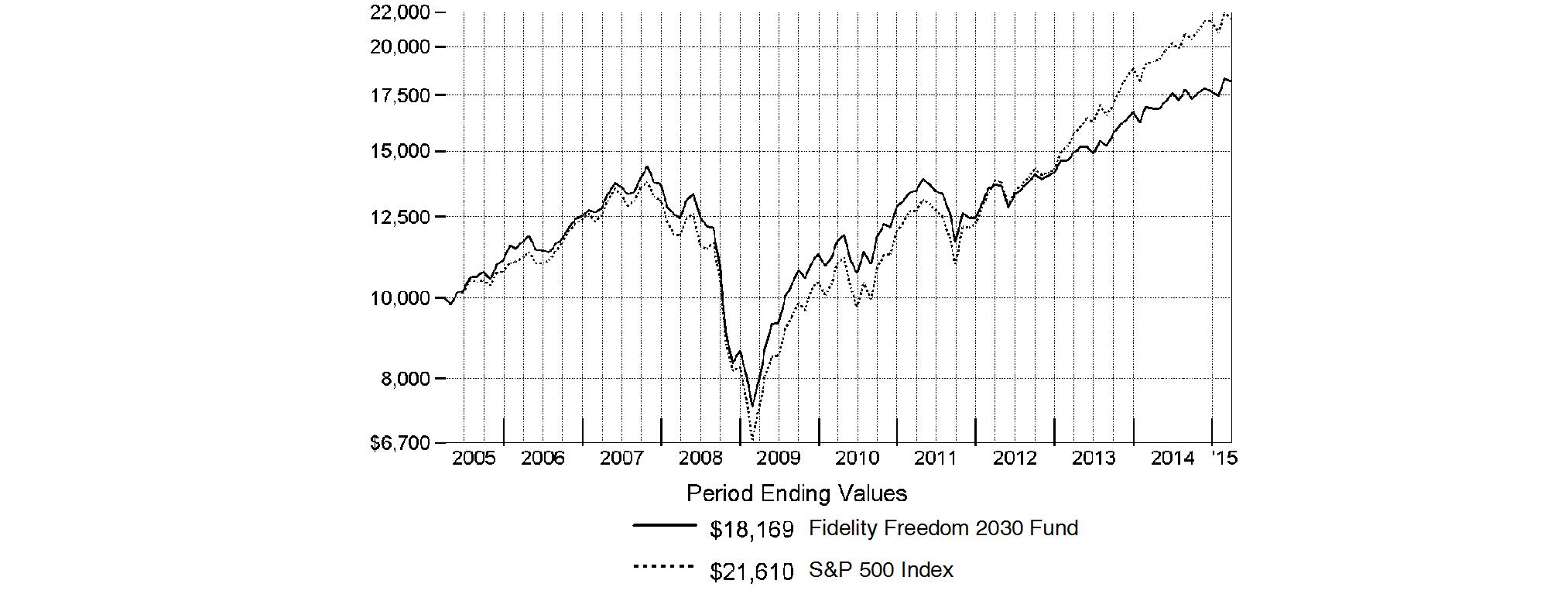

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2030 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

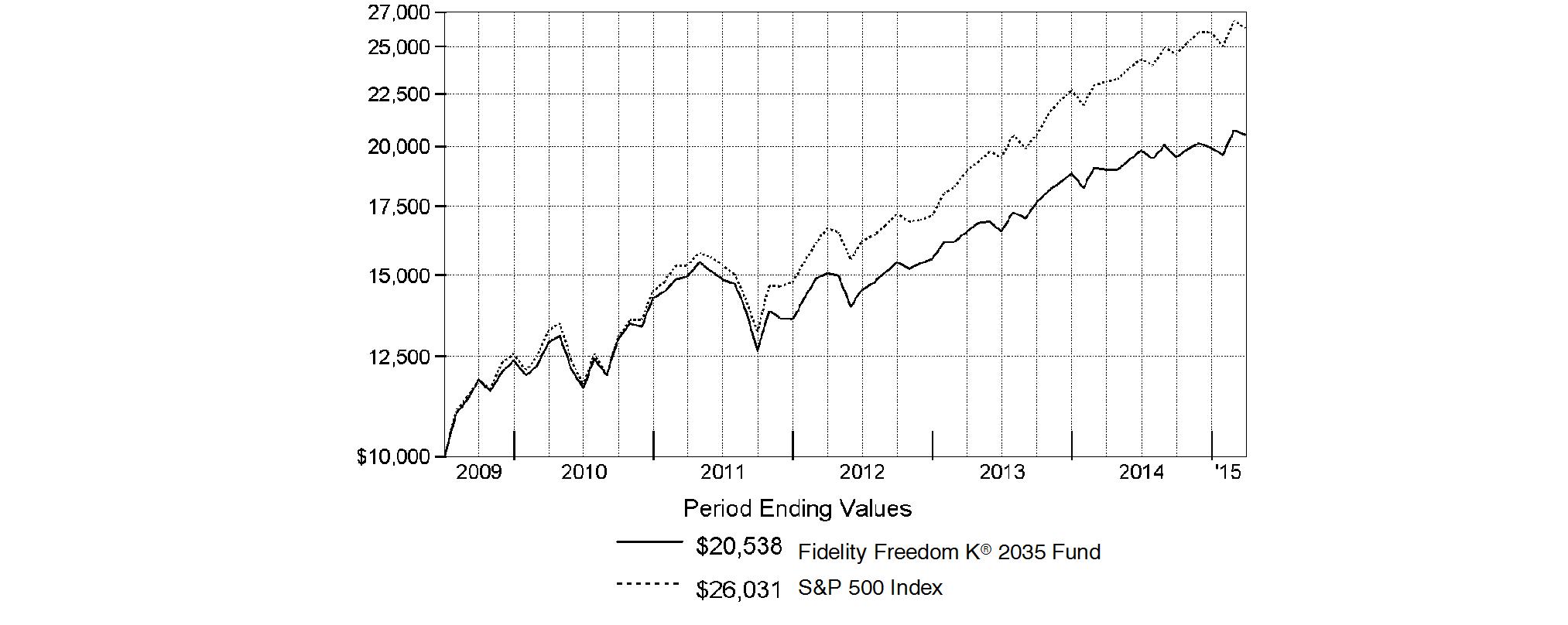

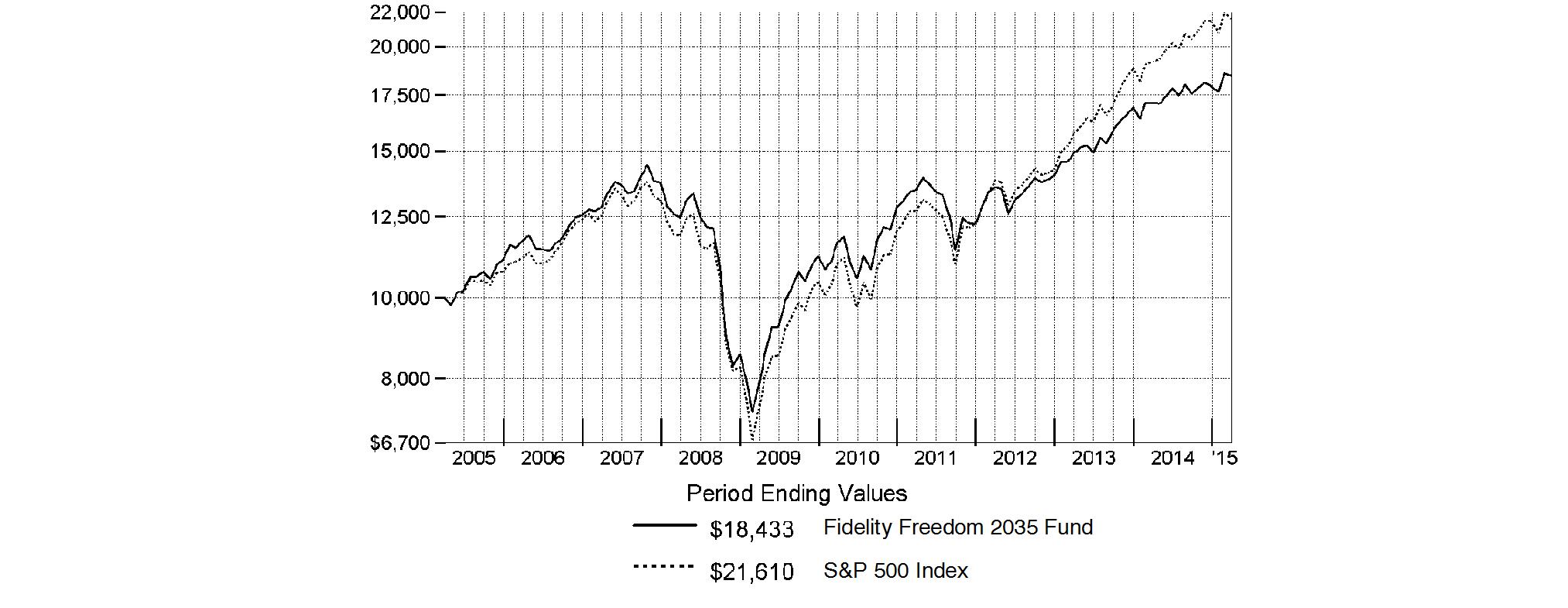

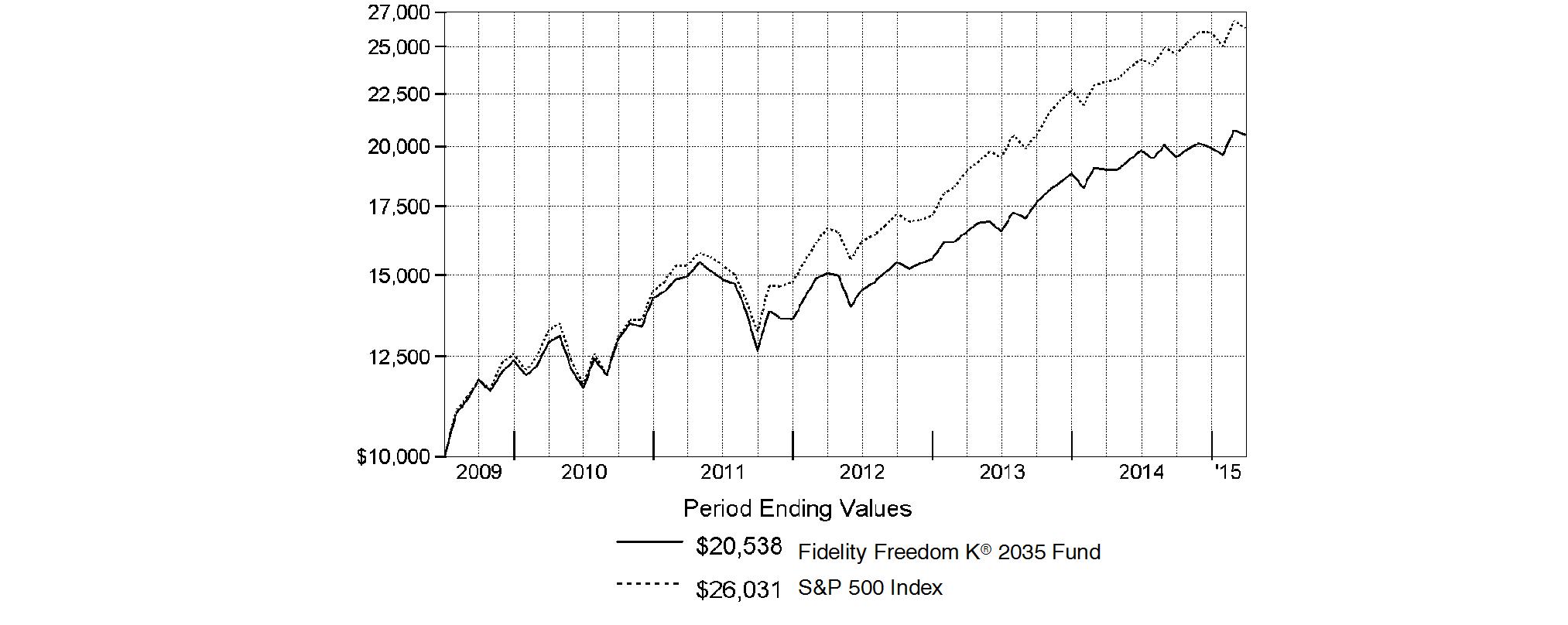

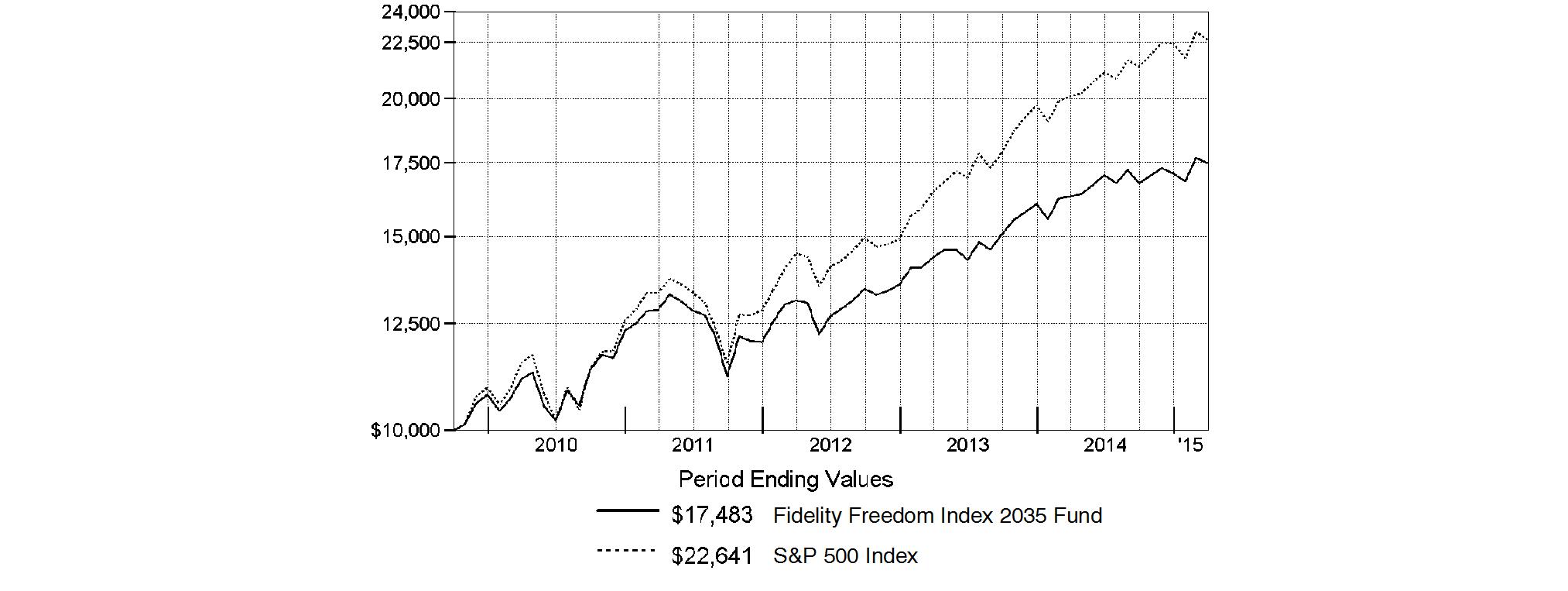

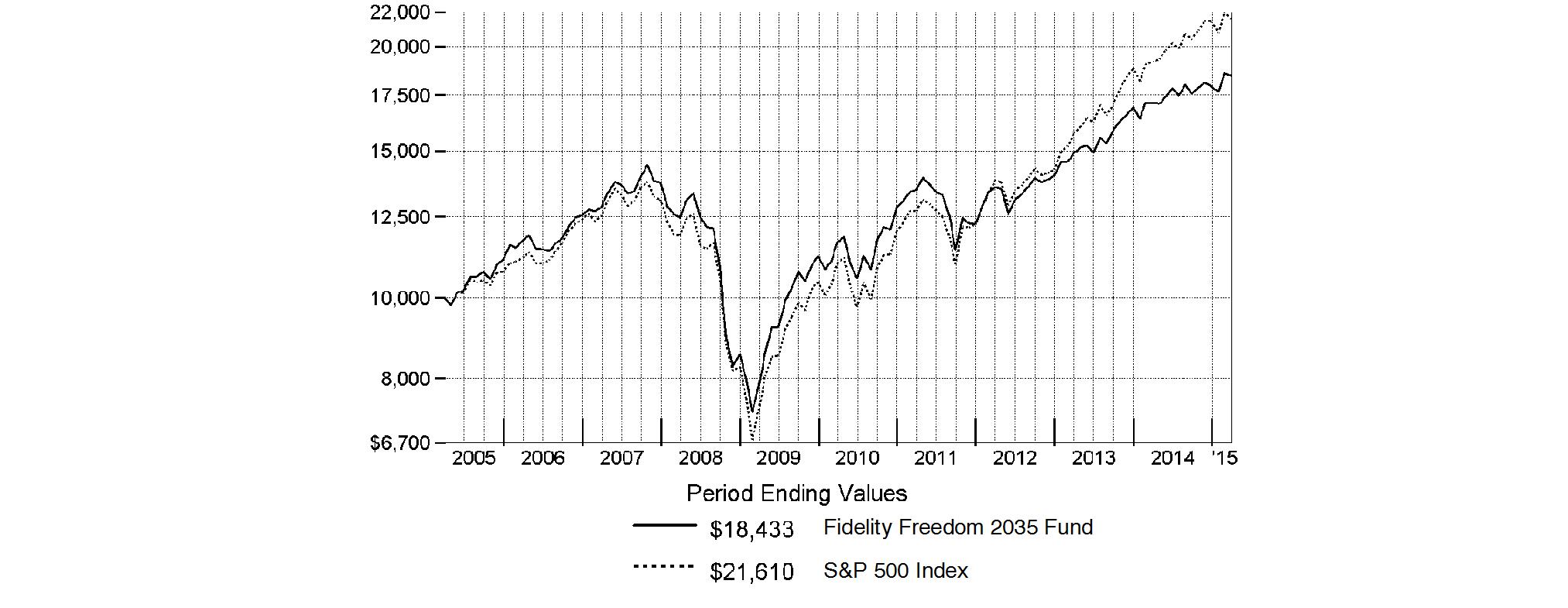

Fidelity Freedom K® 2035 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2035 Fund | 8.08% | 9.76% | 13.34% |

A From July 2, 2009.

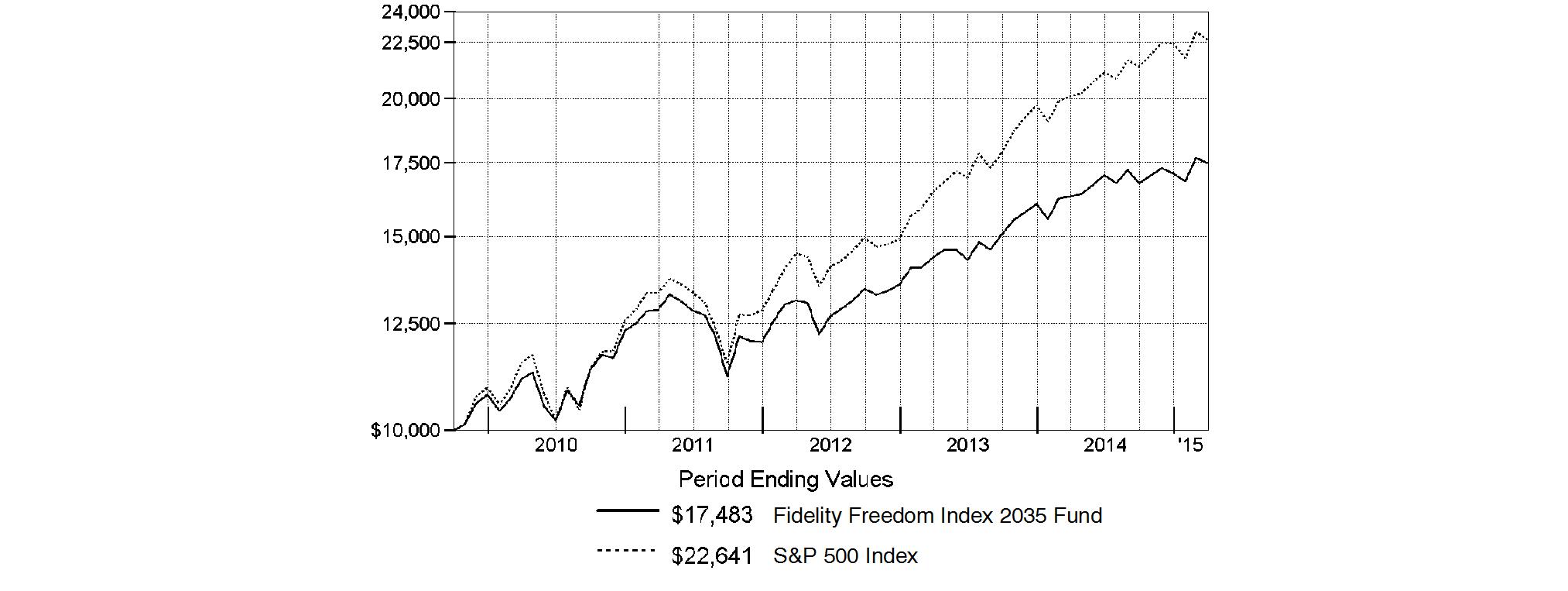

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2035 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

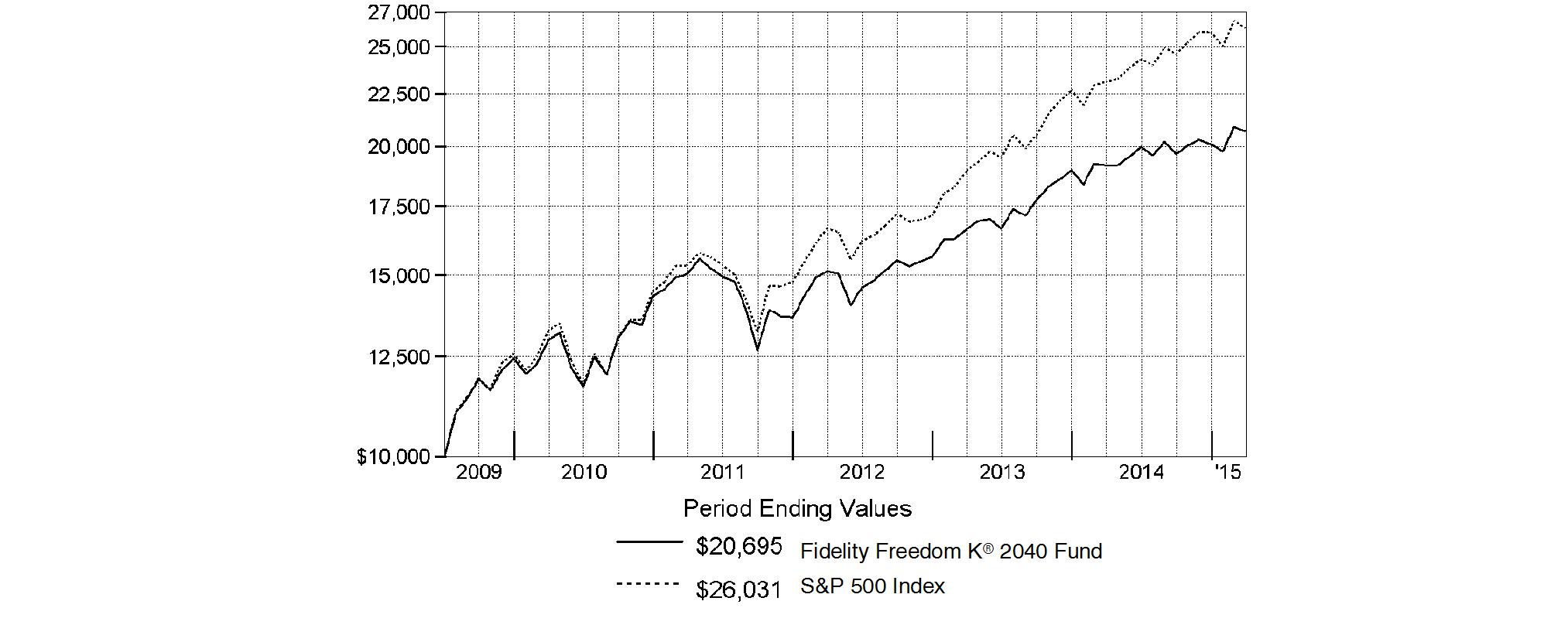

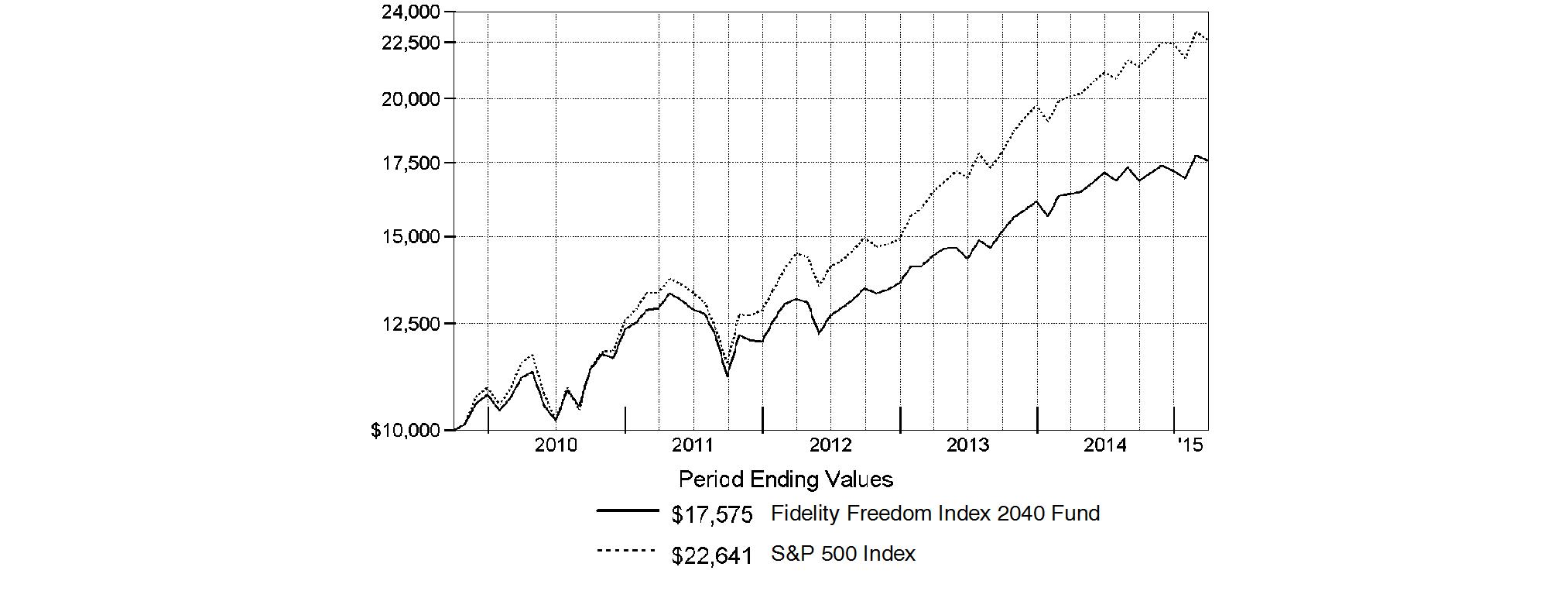

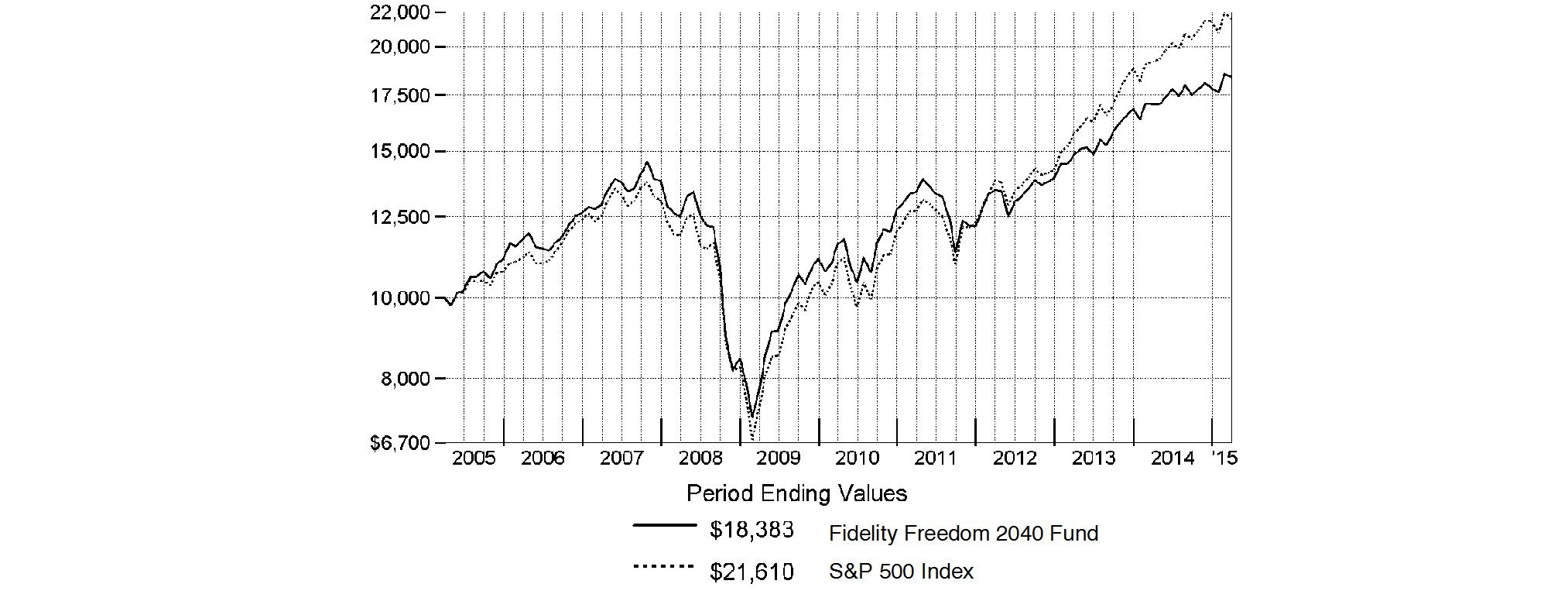

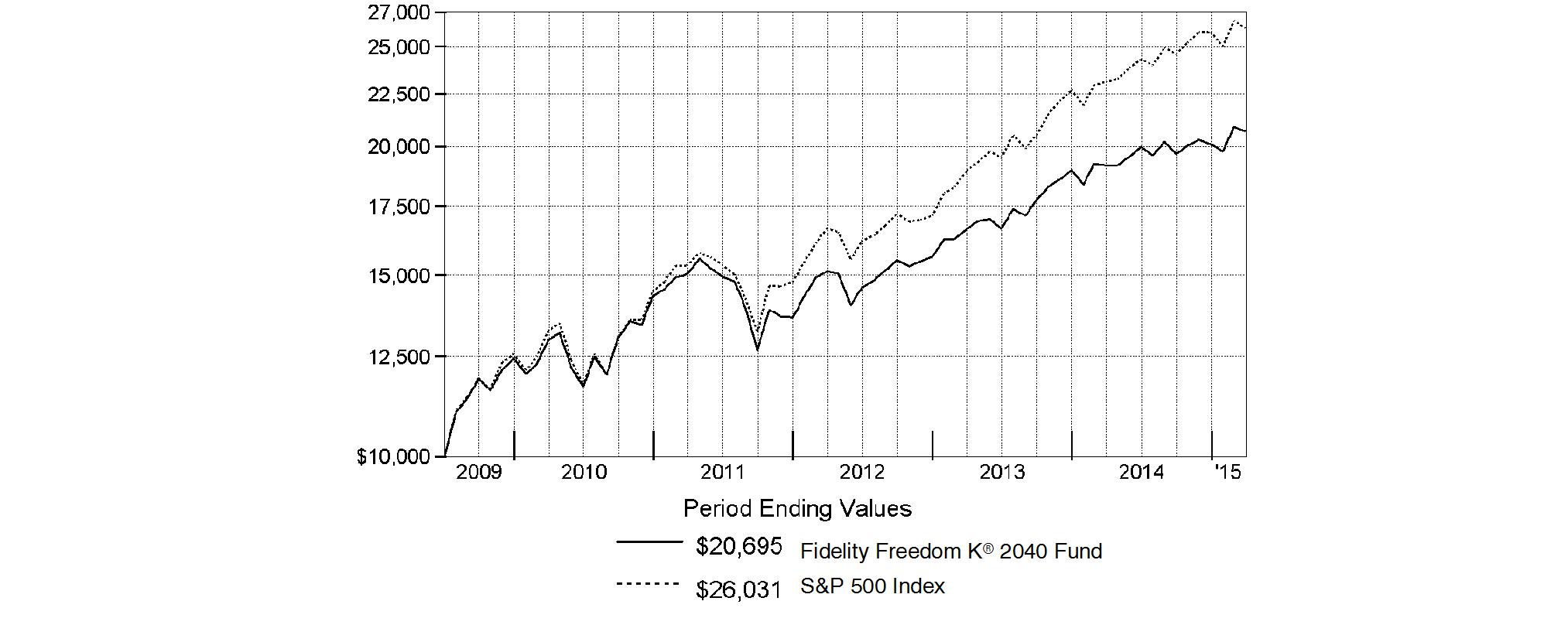

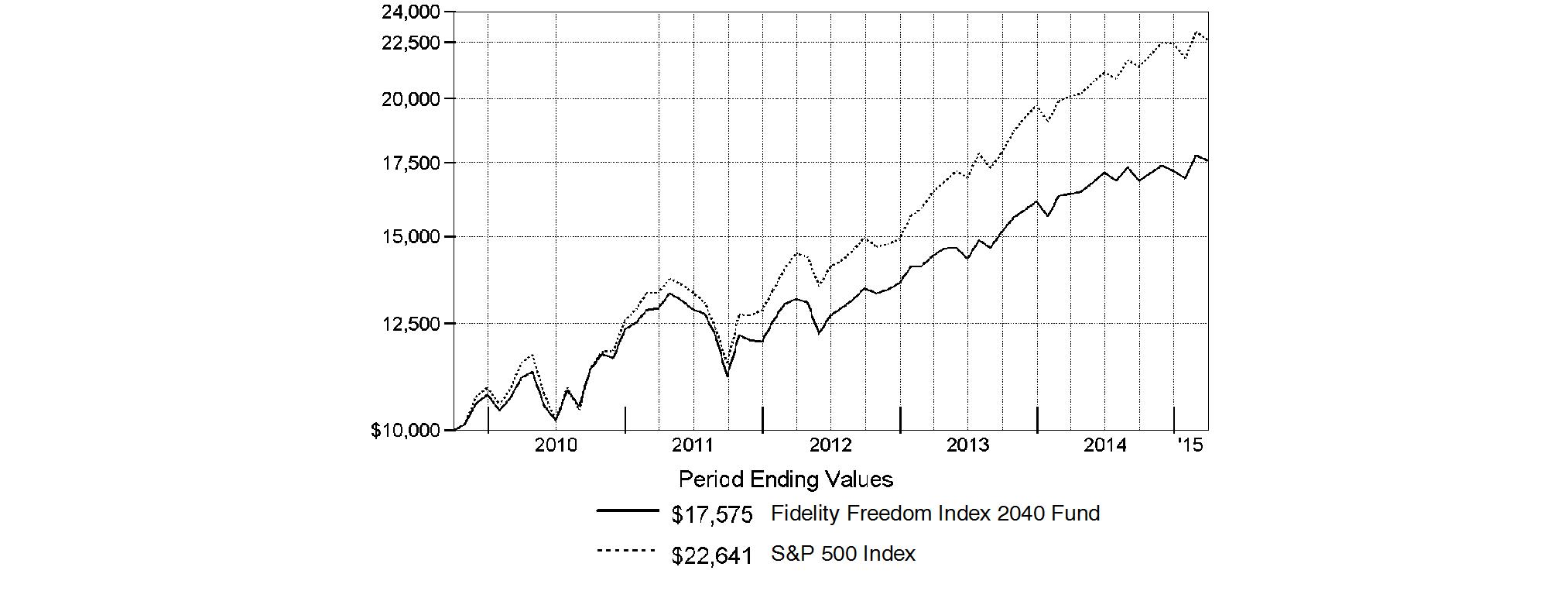

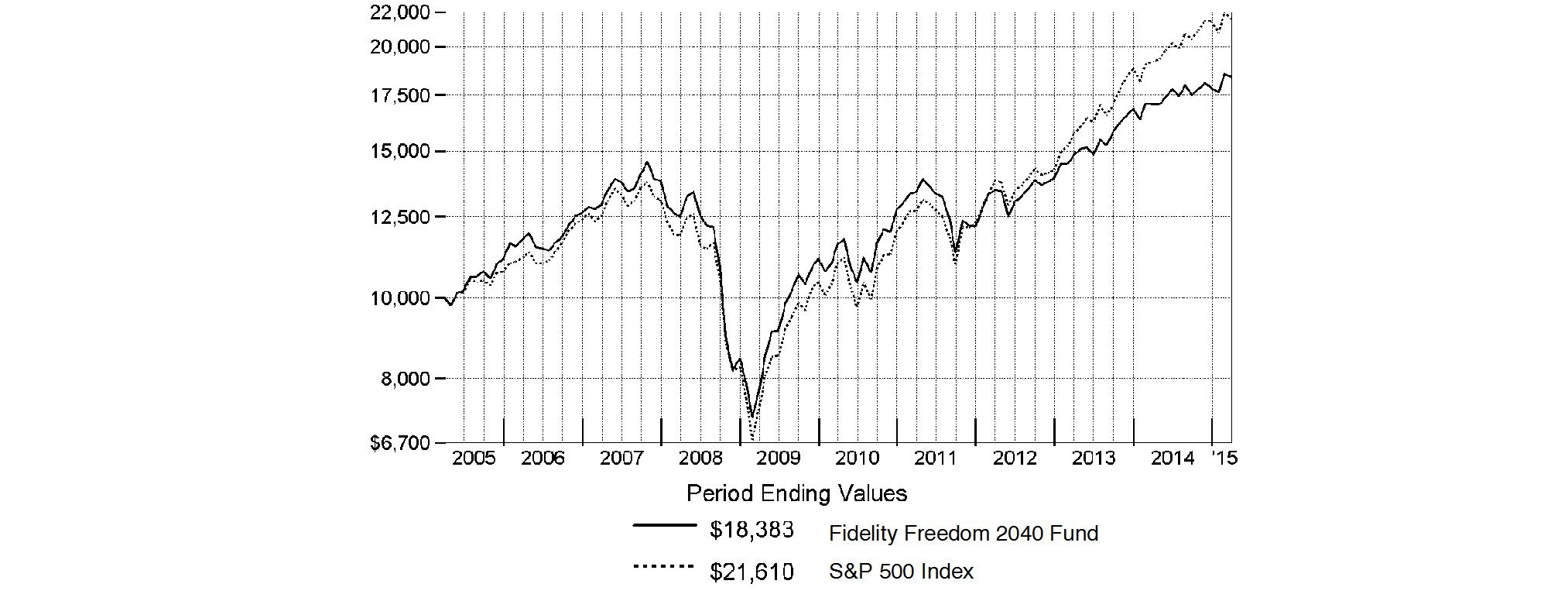

Fidelity Freedom K® 2040 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2040 Fund | 8.01% | 9.81% | 13.49% |

A From July 2, 2009.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2040 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

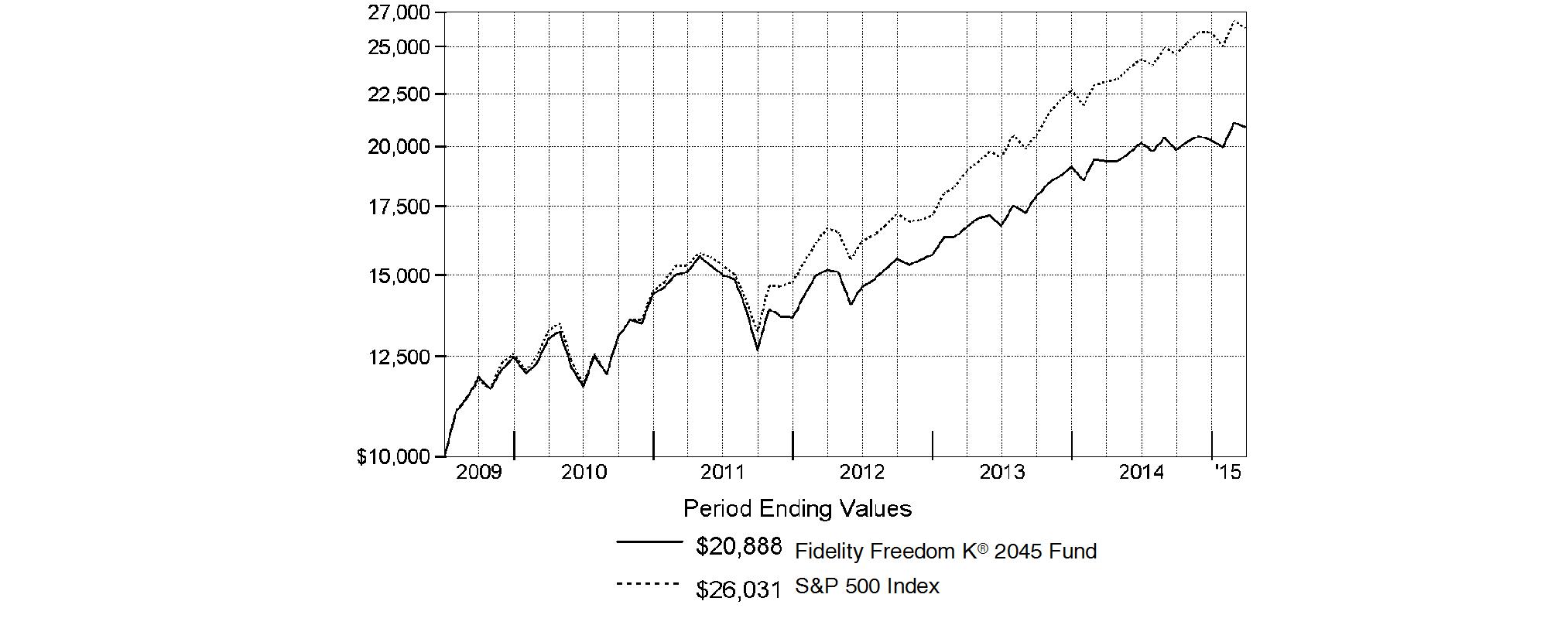

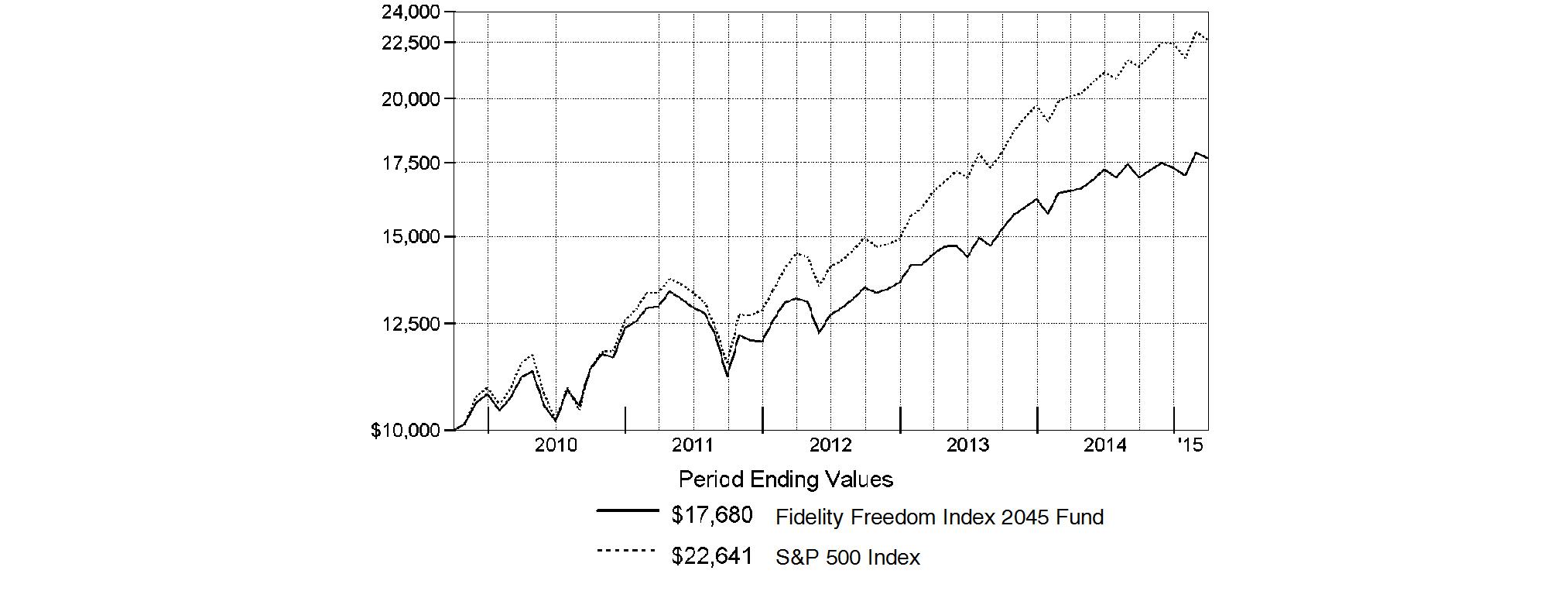

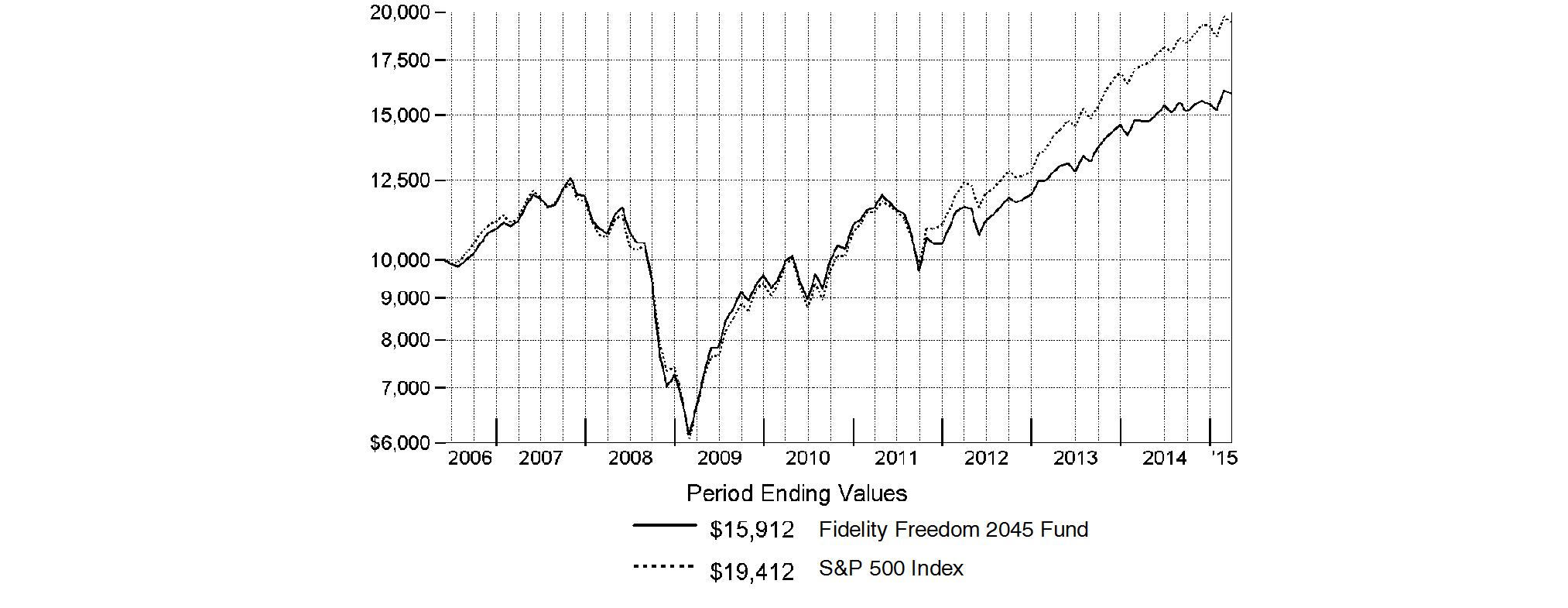

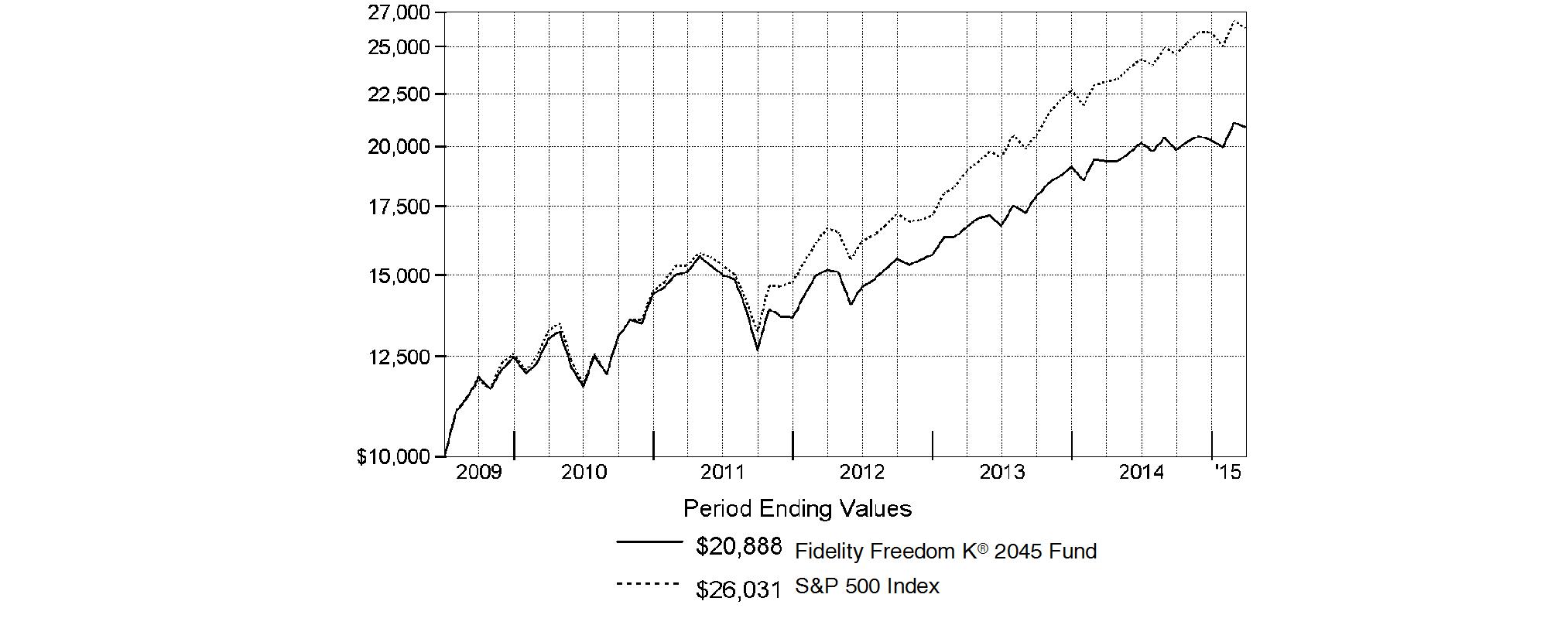

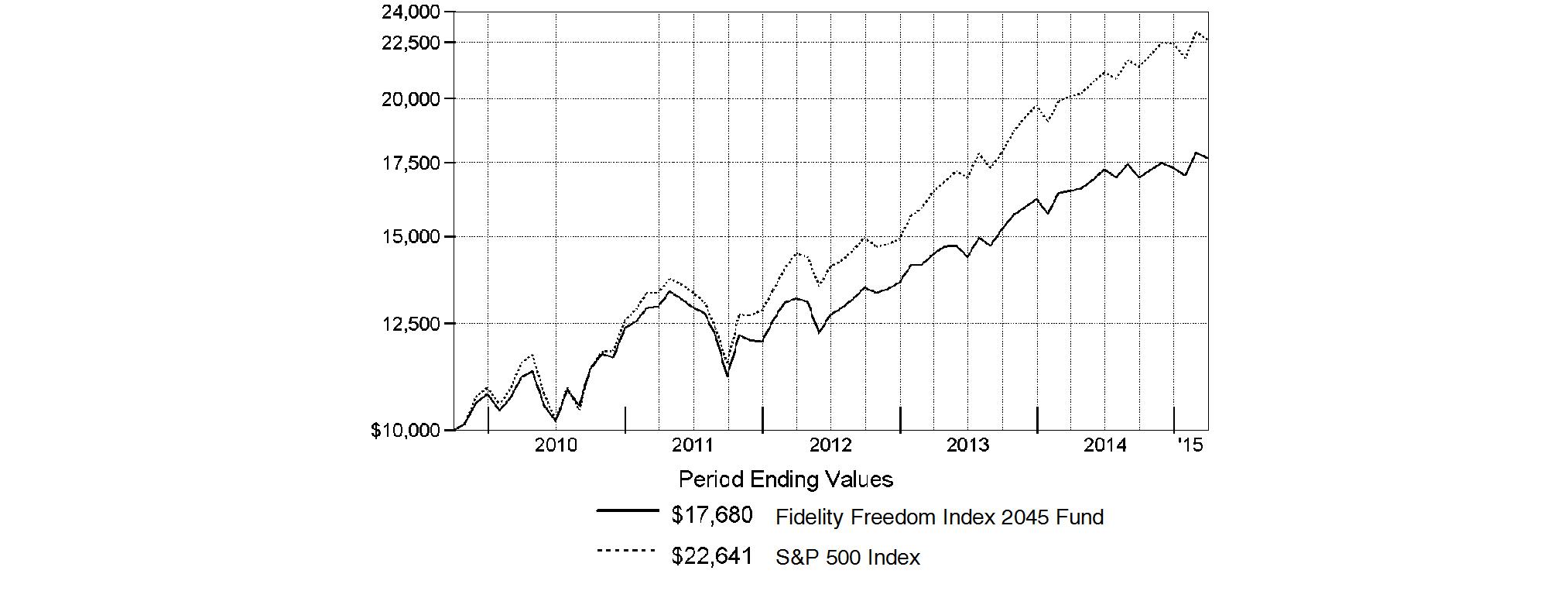

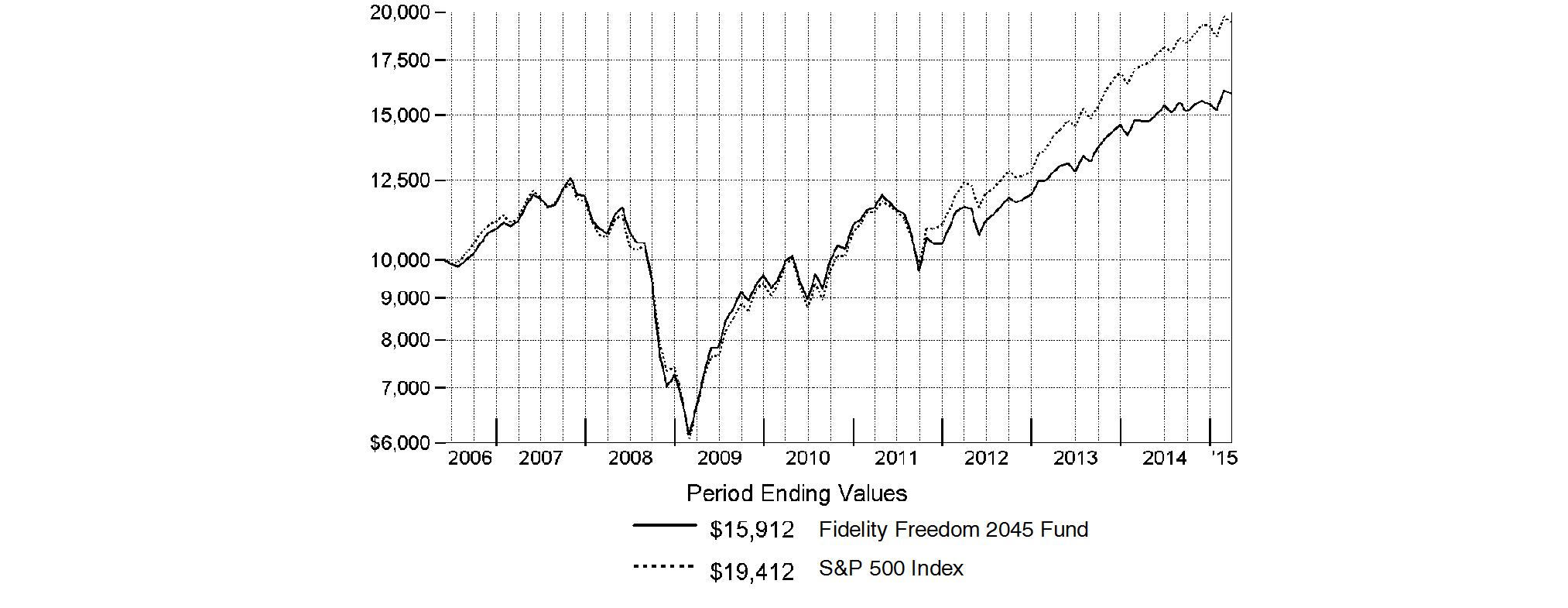

Fidelity Freedom K® 2045 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2045 Fund | 8.10% | 9.94% | 13.67% |

A From July 2, 2009.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2045 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

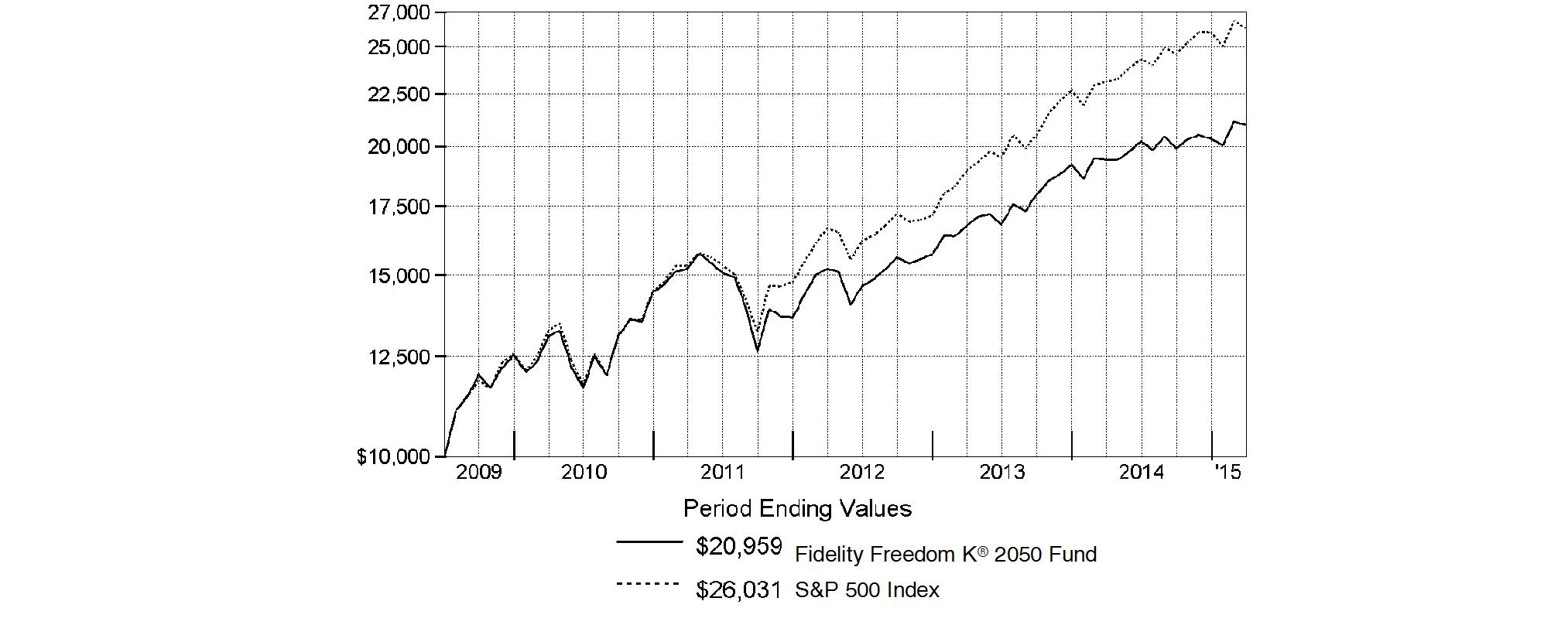

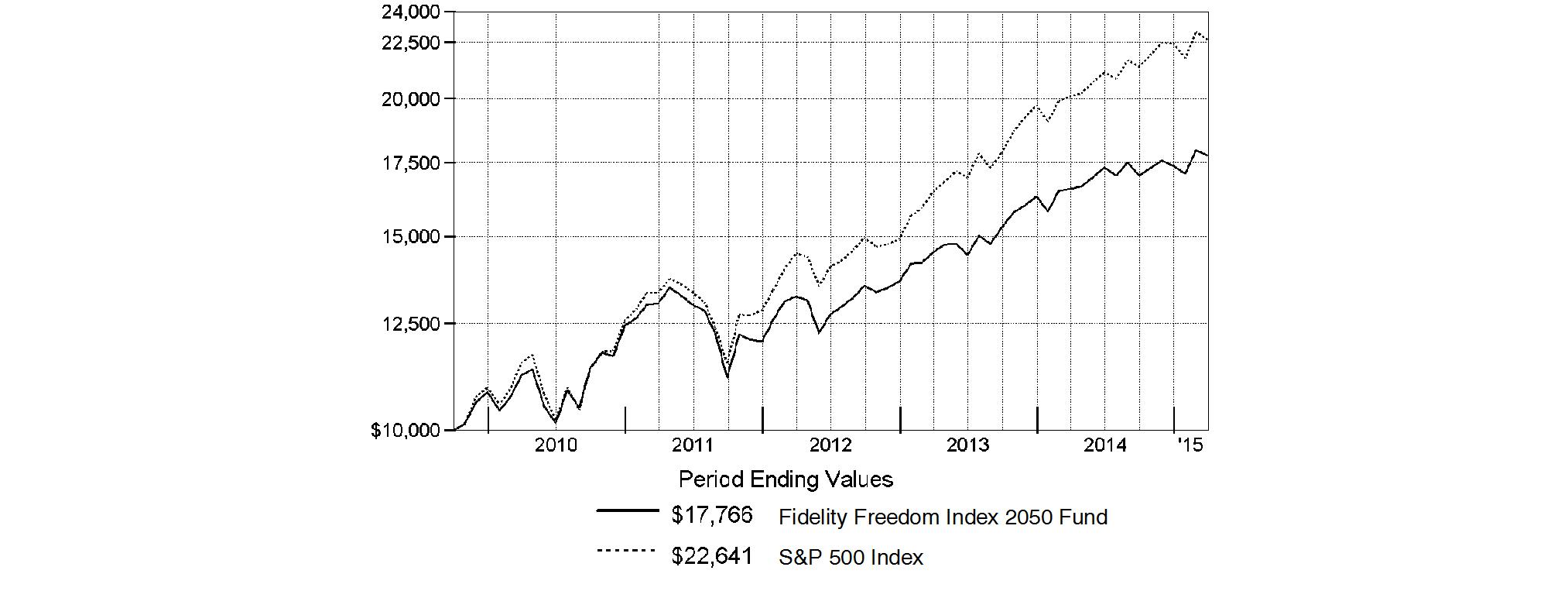

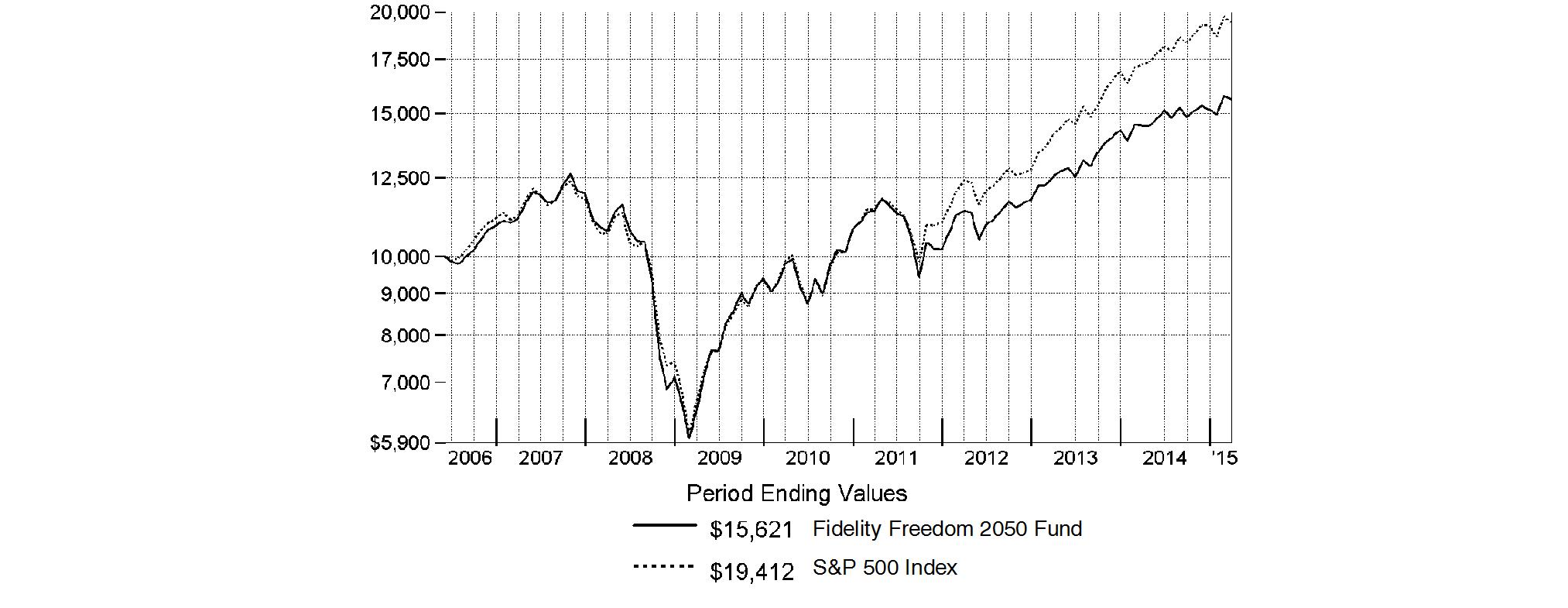

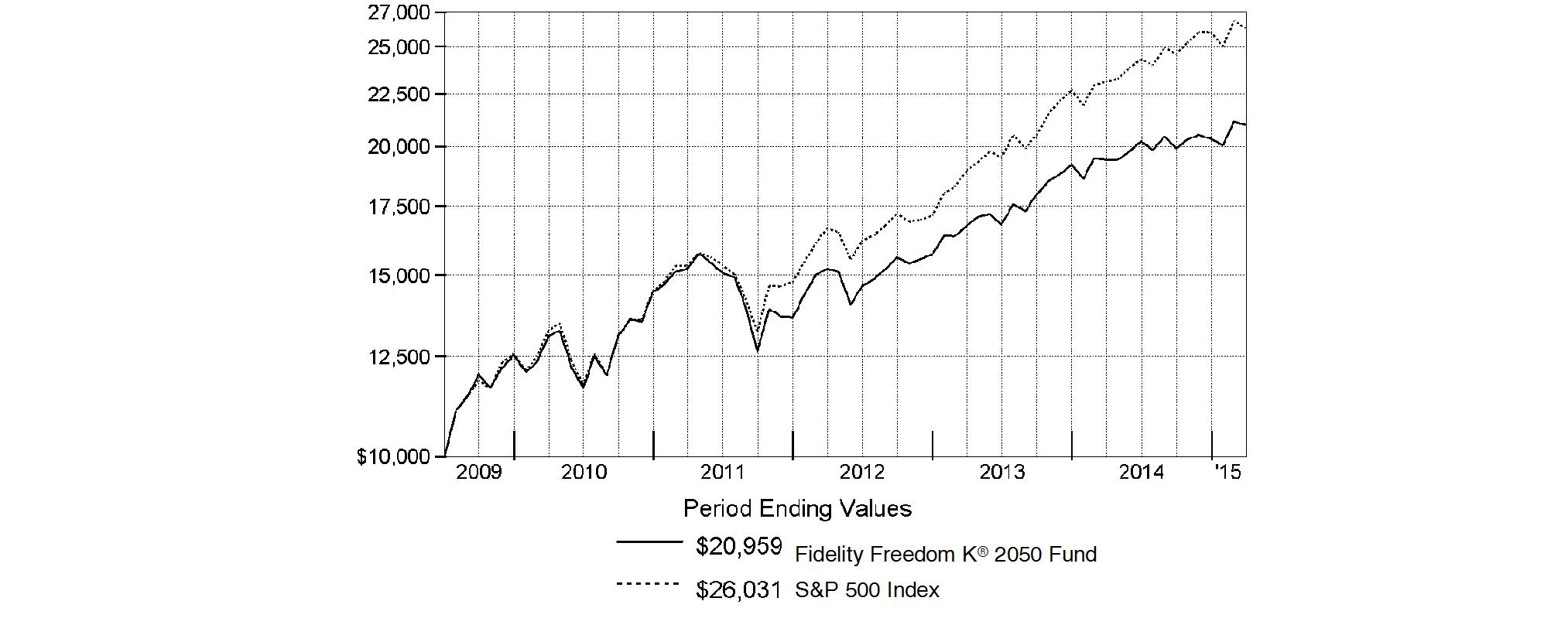

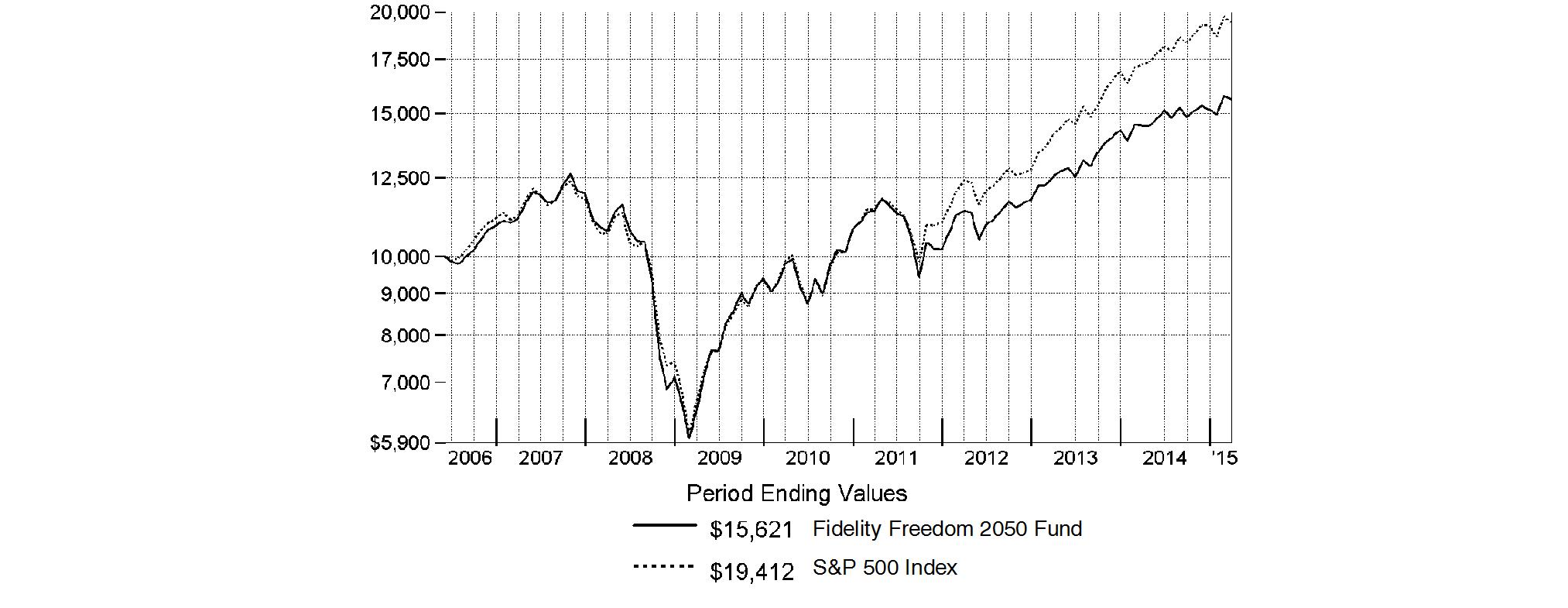

Fidelity Freedom K® 2050 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Past 5

years | Life of

fund A |

Fidelity Freedom K® 2050 Fund | 8.09% | 9.92% | 13.74% |

A From July 2, 2009.

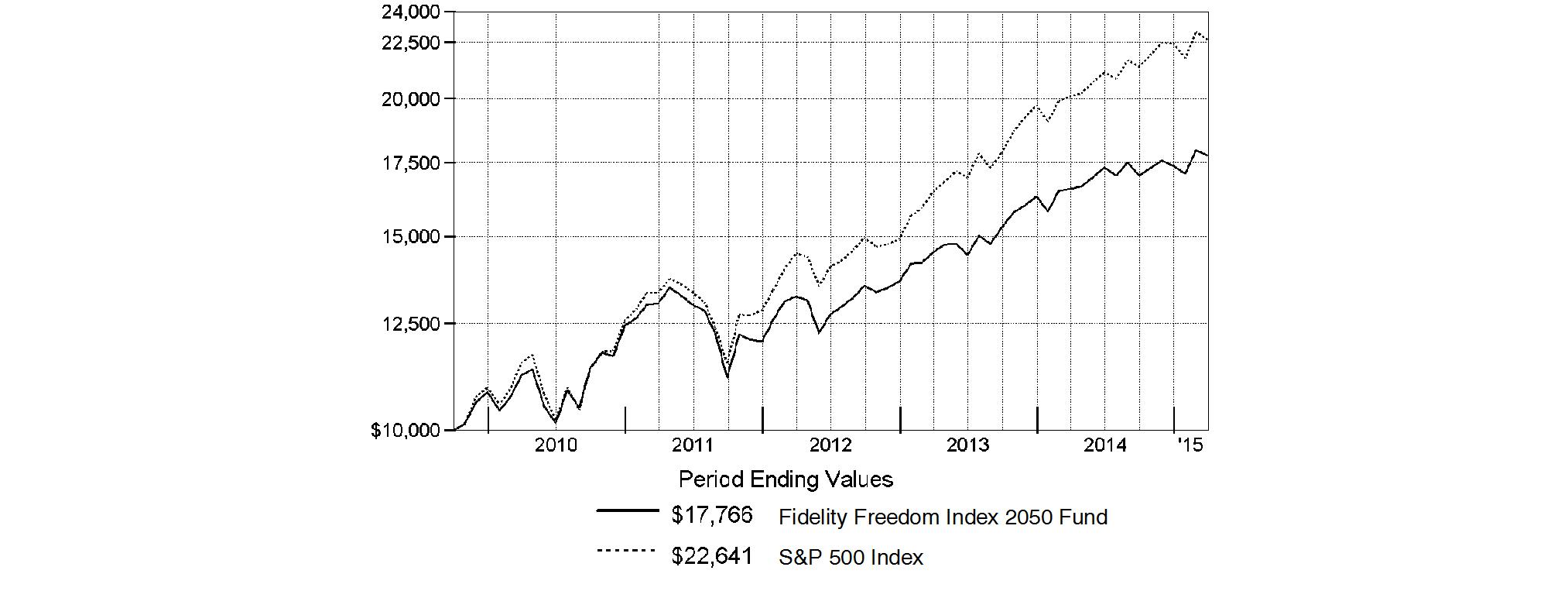

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2050 Fund on July 2, 2009, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

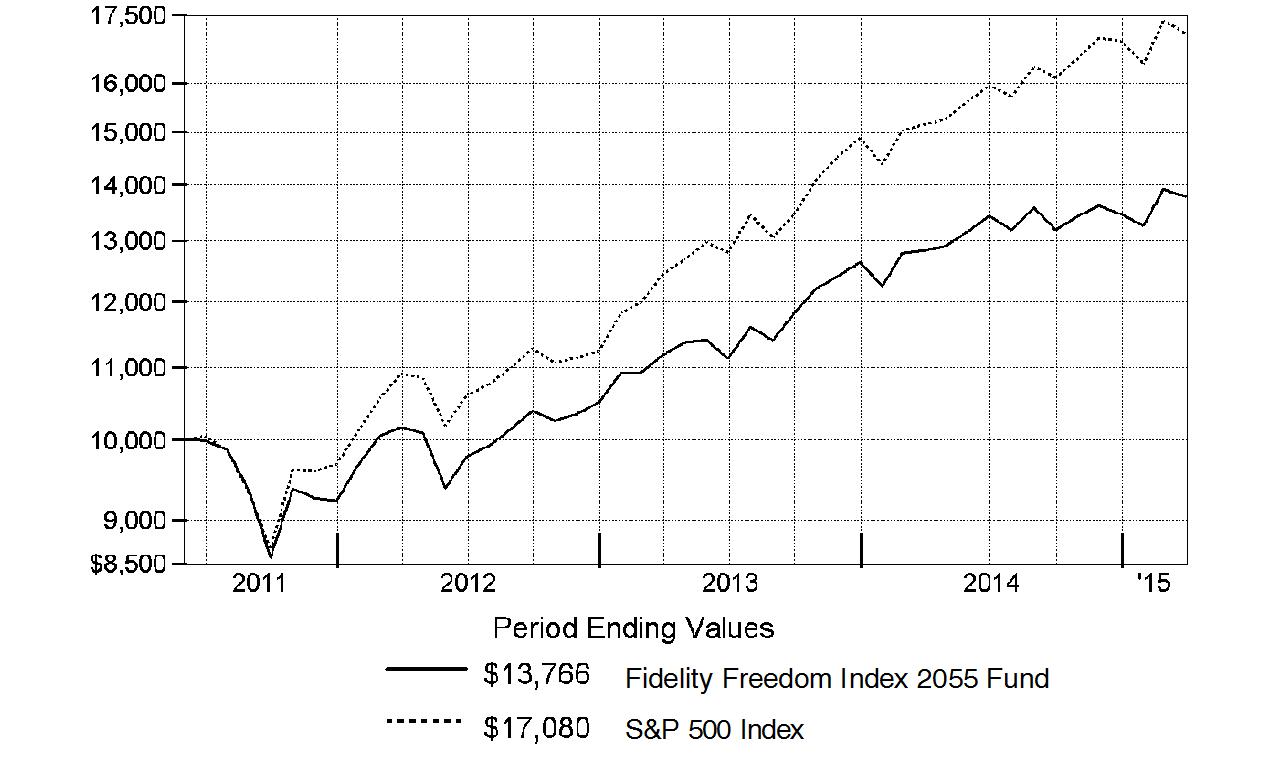

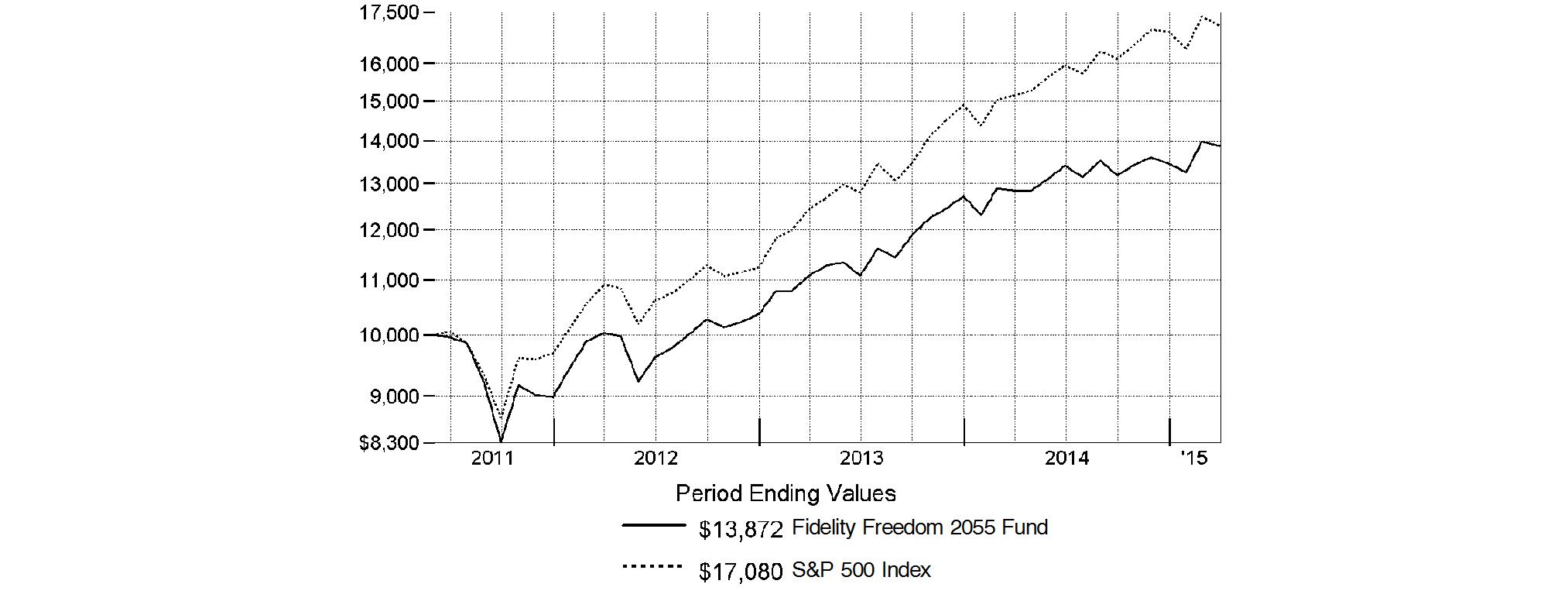

Fidelity Freedom K® 2055 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

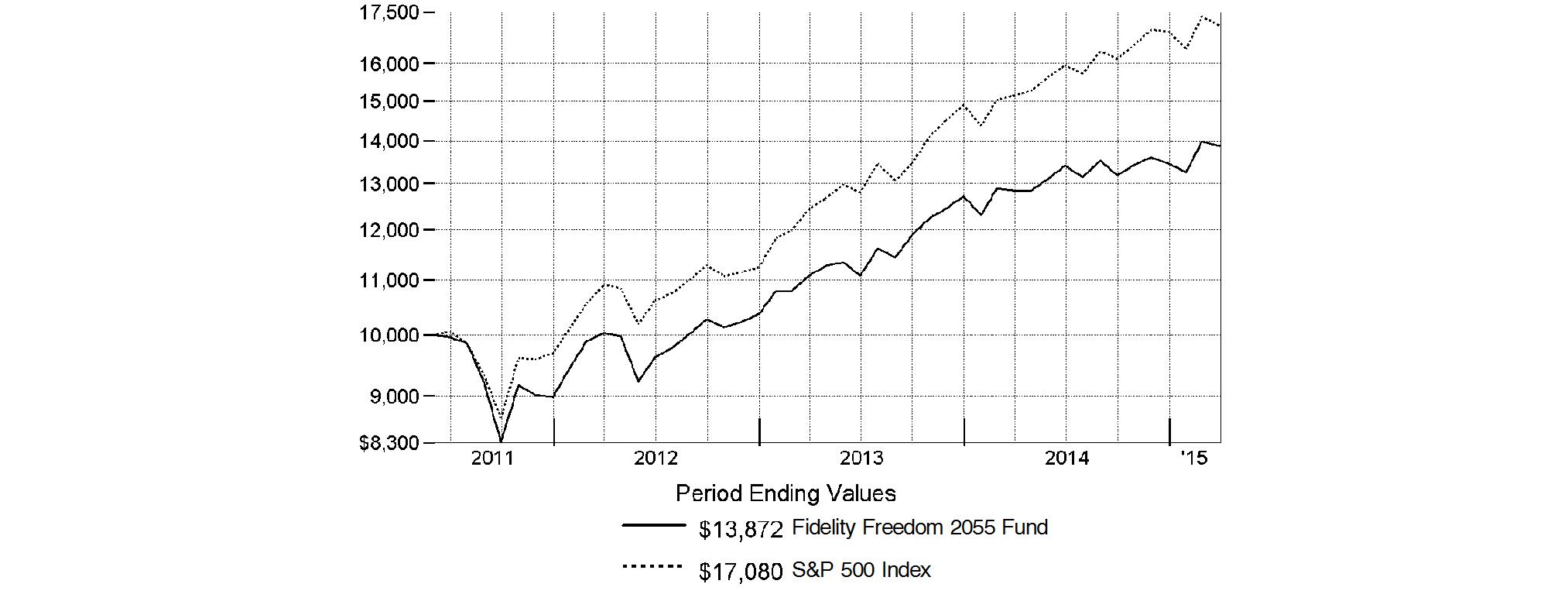

Average Annual Total Returns

Periods ended March 31, 2015 | Past 1

year | Life of

fund A |

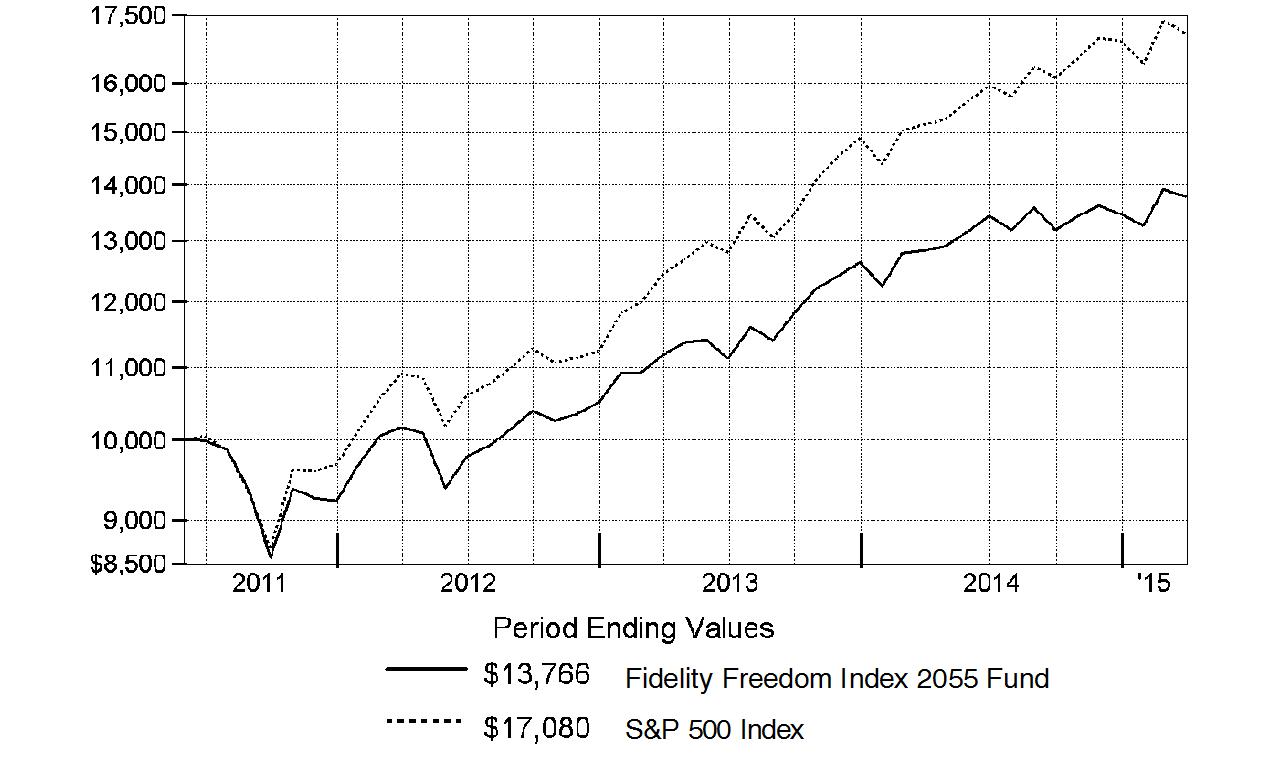

Fidelity Freedom K® 2055 Fund | 8.03% | 9.03% |

A From June 1, 2011.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2055 Fund on June 1, 2011, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

-

Annual Report

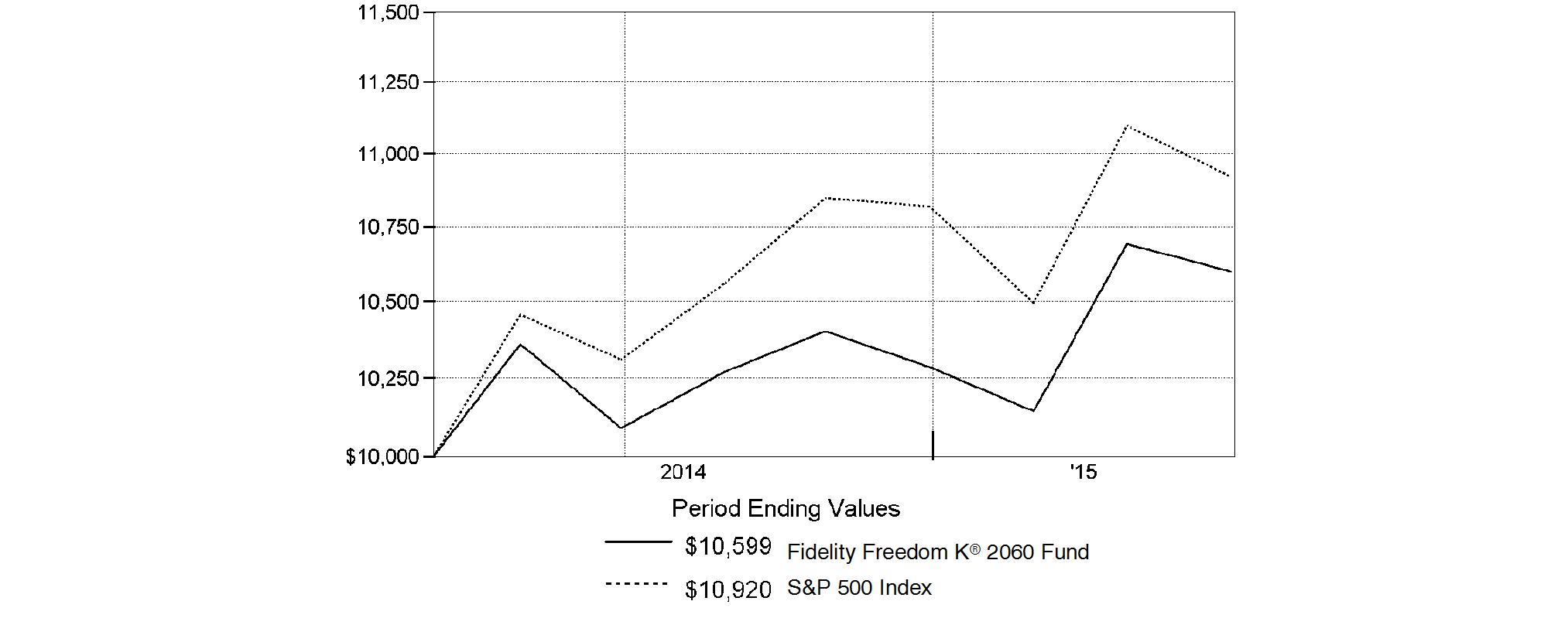

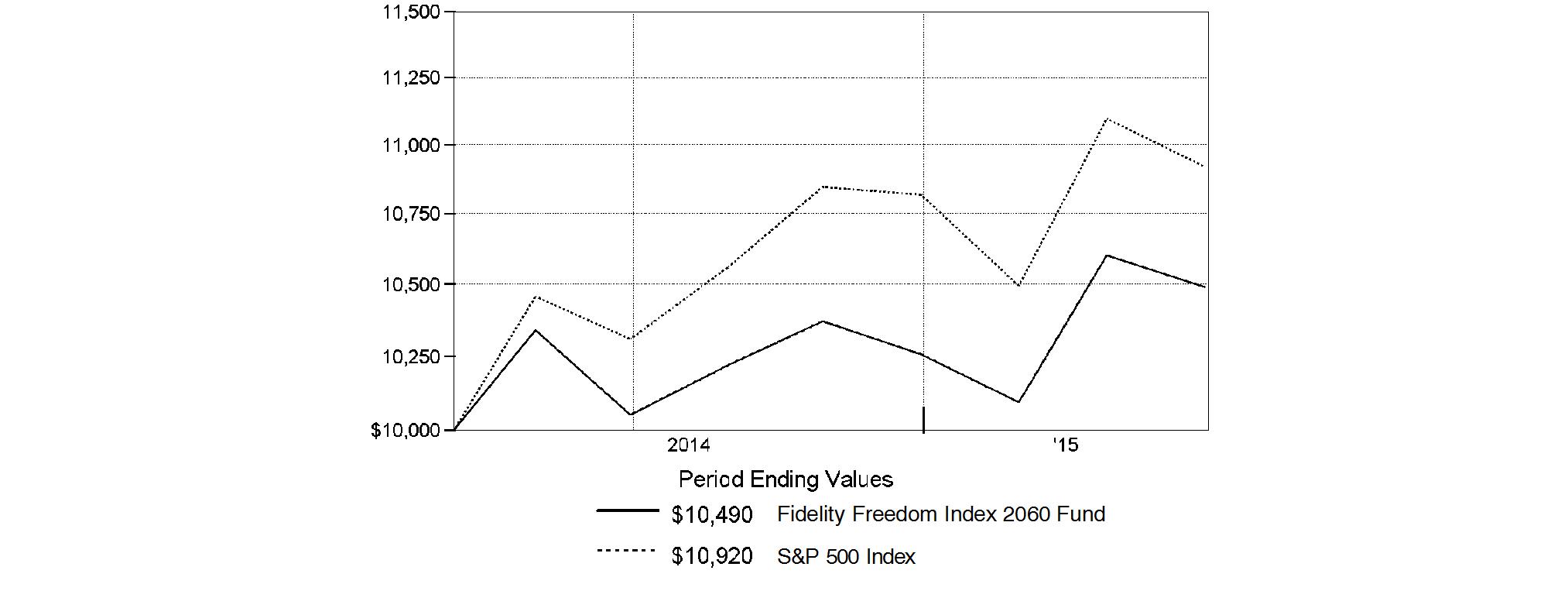

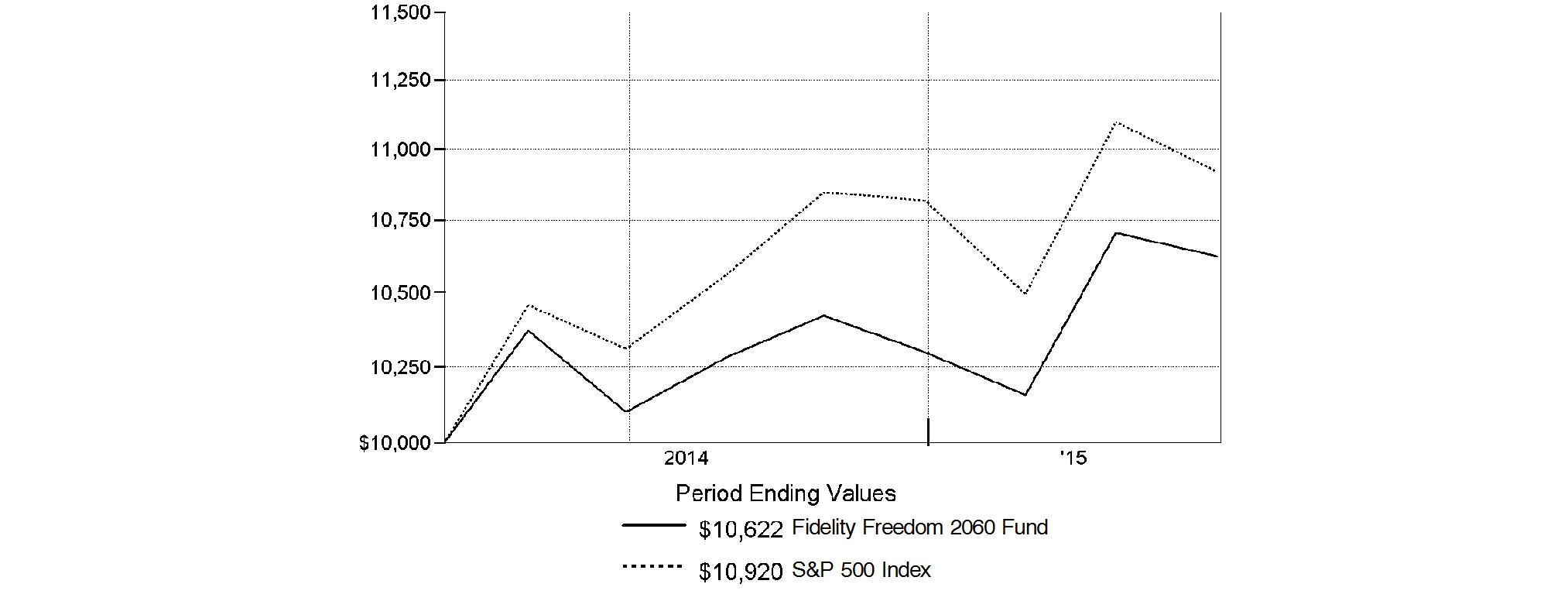

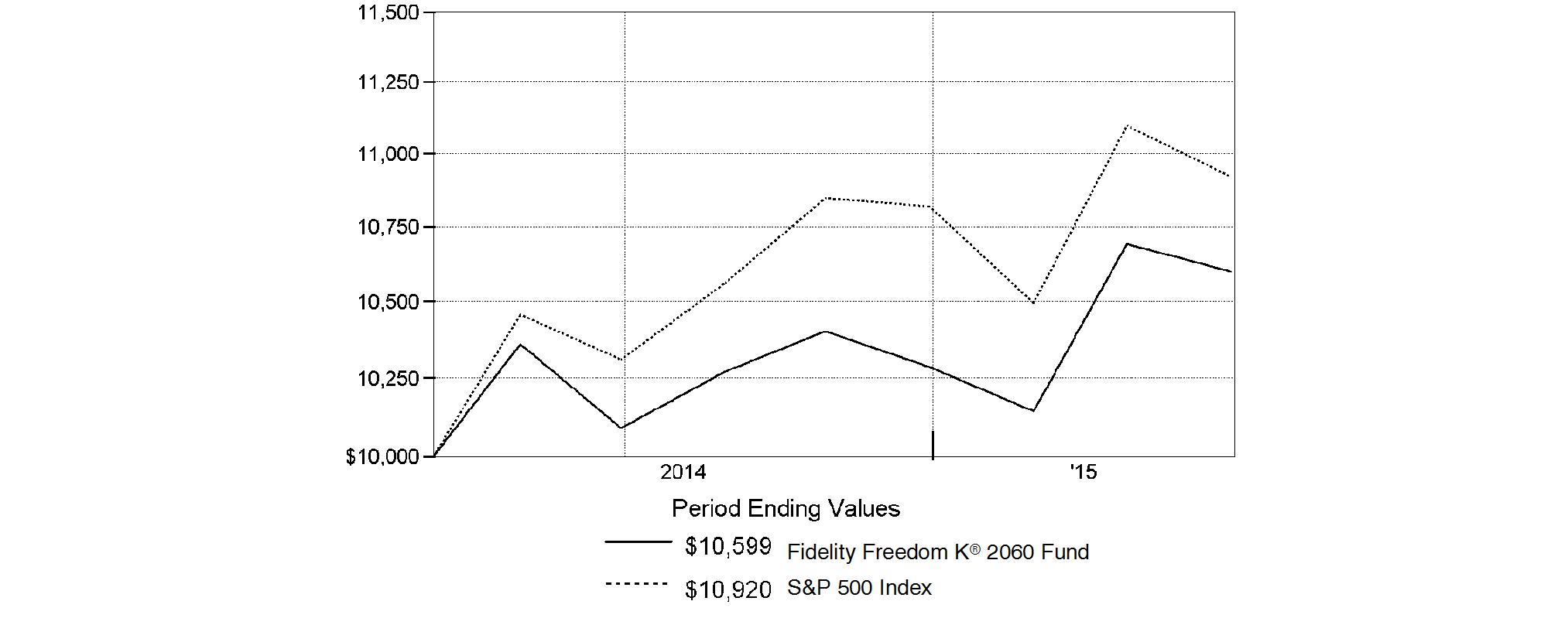

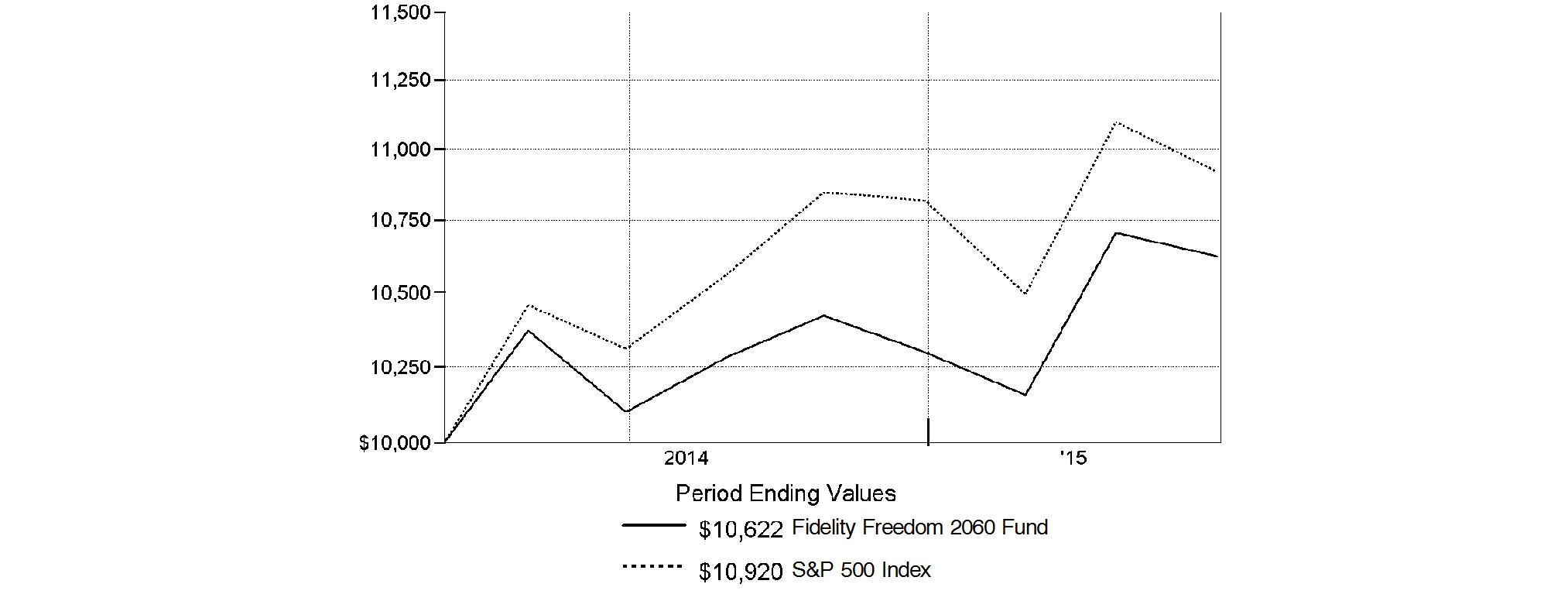

Fidelity Freedom K® 2060 Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

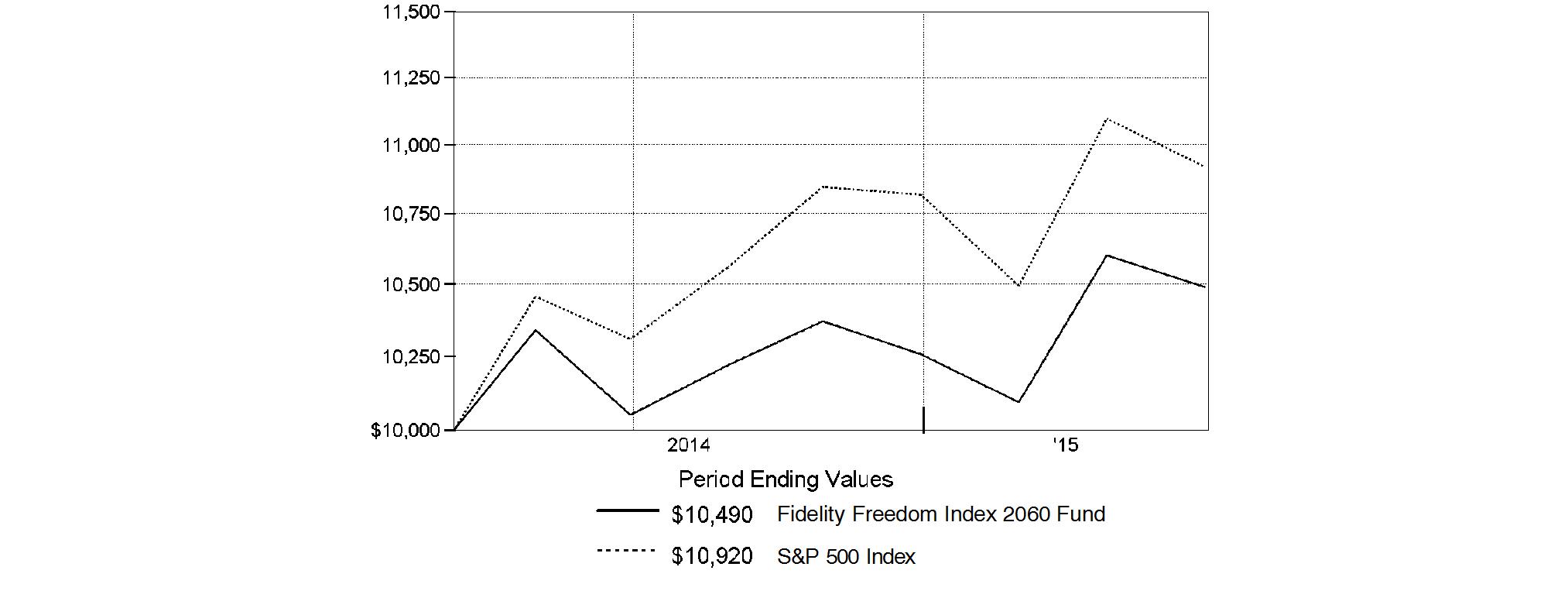

Average annual total returns take Fidelity Freedom K® 2060 Fund's cumulative total return and show you what would have happened if Fidelity Freedom K® 2060 Fund shares had performed at a constant rate each year. These numbers will be reported once the fund is a year old.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Freedom K® 2060 Fund on August 5, 2014, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Market Recap: The U.S. stock market closed slightly off recent all-time highs for the 12 months ending March 31, 2015, supported by the relative strength of the U.S. economy and dollar, as well as the appeal of stocks relative to bonds. The large-cap S&P 500® Index returned 12.73%. Growth stocks in the index handily outperformed value-oriented names; among sectors, all save energy notched a gain. The tech-heavy Nasdaq Composite Index® gained 18.12%, while the small-cap Russell 2000® Index advanced 8.21%, rallying after earlier weakness due to growth and valuation worries. International stocks, as measured by the MSCI ACWI (All Country World Index) ex USA Index, returned -0.88% amid recessionary pressure in parts of Asia, anemic economic growth in the eurozone and a rising U.S. dollar. Within the MSCI index, Europe (-4%) was hampered by late-period deflationary concerns and currency weakness. The U.K. (-5%) endured decelerating growth and a cooling housing market. Japan (+12%) fought encroaching recession by expanding its already-aggressive economic stimulus plan; Europe followed suit in January. Emerging markets (-1%) saw late-period outflows ahead of potential U.S. Federal Reserve tightening.

Turning to fixed income: U.S. taxable investment-grade bonds posted a positive return for the one-year period, despite a February price decline related to expectations of higher inflation and interest rates. For much of the period, investors in many parts of the world sought the perceived safe haven of U.S. bonds. The Barclays® U.S. Aggregate Bond Index rose 5.72%, well ahead of the negative return for international bonds, which struggled due to a surging U.S. dollar. Among sectors in the Barclays index, U.S. Treasuries rose roughly 5%, driven by this preference for conservative investments. Sentiment changed somewhat toward period end, however, when investors snapped up riskier assets amid a rally in higher-yielding bonds.

Comments from Co-Portfolio Managers Andrew Dierdorf and Brett Sumsion: For the 12 months ending March 31, 2015, each Freedom K® Fund posted a positive absolute return that was consistent with its investment goal. [Note: Freedom K® 2060 Fund has not marked a full year's performance; however, the comments here apply generally to its life-of-fund period.] Longer-dated Funds delivered higher returns, as we would expect given their greater exposure to underlying equities, which rose overall this period. On a relative basis, the Funds performed roughly in line with or modestly lagged their respective Composite indexes. (For specific Fund results, please refer to the performance section of this report.) Aggregate allocation decisions detracted from the Funds' relative results for the full year; however, underlying manager decisions proved additive overall. Security selection in the U.S. equity asset class helped most; positioning in non-U.S. equities also contributed. Conversely, allocations to asset classes such as high-yield debt and commodities hurt. Among the Funds' U.S. equity investments, favorable picks in health care and information technology aided overall results. Outside the U.S., decisions within the energy sector helped; among countries, U.K. stock picks contributed notably. Lastly, active asset allocation was implemented effective August 1, 2014; this allows portfolio managers to make incremental shifts - within predefined risk parameters - to Fund allocations relative to the strategic glide path.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2014 to March 31, 2015).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, each Fund, as a shareholder in underlying Fidelity Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Funds. These fees and expenses are not included in each Fund's annualized expense ratio used to calculate the expense estimates in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, each Fund, as a shareholder in underlying Fidelity Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Funds. These fees and expenses are not included in each Fund's annualized expense ratio used to calculate the expense estimates in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annualized

Expense Ratio B | Beginning

Account Value

October 1, 2014 | Ending

Account Value

March 31, 2015 | Expenses Paid

During Period*

October 1, 2014

to March 31, 2015 |

Fidelity Freedom K® Income Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,027.40 | $ .25 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2005 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,034.30 | $ .25 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2010 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,038.20 | $ .25 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2015 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,041.90 | $ .25 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2020 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,044.60 | $ .25 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2025 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,047.40 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2030 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,050.70 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2035 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,052.50 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2040 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,052.10 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

| Annualized

Expense Ratio B | Beginning

Account Value

October 1, 2014 | Ending

Account Value

March 31, 2015 | Expenses Paid

During Period*

October 1, 2014

to March 31, 2015 |

Fidelity Freedom K® 2045 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,052.60 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2050 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,052.80 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2055 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,051.80 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.68 | $ .25 |

Fidelity Freedom K® 2060 Fund | .05% | | | |

Actual | | $ 1,000.00 | $ 1,050.50 | $ .26 |

HypotheticalA | | $ 1,000.00 | $ 1,024.63 | $ .25 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Funds in which each Fund invests are not included in each Fund's annualized expense ratio.

Annual Report

Fidelity Freedom K® Income Fund

Investment Changes (Unaudited)

The information in the following tables is based on the direct investments of the Fund. |

Fund Holdings as of March 31, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Domestic Equity Funds | | |

Fidelity Series 100 Index Fund Class F | 0.6 | 0.6 |

Fidelity Series 1000 Value Index Fund Class F | 0.4 | 0.3 |

Fidelity Series All-Sector Equity Fund Class F | 2.0 | 2.0 |

Fidelity Series Blue Chip Growth Fund Class F | 1.6 | 1.8 |

Fidelity Series Commodity Strategy Fund Class F | 0.8 | 1.0 |

Fidelity Series Equity-Income Fund Class F | 2.7 | 2.7 |

Fidelity Series Growth & Income Fund Class F | 2.0 | 2.0 |

Fidelity Series Growth Company Fund Class F | 2.5 | 2.1 |

Fidelity Series Intrinsic Opportunities Fund Class F | 1.4 | 1.3 |

Fidelity Series Opportunistic Insights Fund Class F | 1.3 | 1.3 |

Fidelity Series Real Estate Equity Fund Class F | 0.2 | 0.2 |

Fidelity Series Small Cap Discovery Fund Class F | 0.4 | 0.3 |

Fidelity Series Small Cap Opportunities Fund Class F | 1.1 | 1.0 |

Fidelity Series Stock Selector Large Cap Value Fund Class F | 1.8 | 1.7 |

| 18.8 | 18.3 |

International Equity Funds | | |

Fidelity Series Emerging Markets Fund Class F | 2.7 | 1.7 |

Fidelity Series International Growth Fund Class F | 2.0 | 2.0 |

Fidelity Series International Small Cap Fund Class F | 0.4 | 0.4 |

Fidelity Series International Value Fund Class F | 2.0 | 2.4 |

| 7.1 | 6.5 |

Bond Funds | | |

Fidelity Series Emerging Markets Debt Fund Class F | 0.6 | 0.7 |

Fidelity Series Floating Rate High Income Fund Class F | 0.5 | 0.5 |

Fidelity Series High Income Fund Class F | 3.4 | 3.7 |

Fidelity Series Inflation-Protected Bond Index Fund Class F | 3.5 | 3.0 |

Fidelity Series Investment Grade Bond Fund Class F | 41.4 | 39.2 |

Fidelity Series Real Estate Income Fund Class F | 0.5 | 0.4 |

| 49.9 | 47.5 |

Short-Term Funds | | |

Fidelity Institutional Money Market Portfolio Class F | 13.5 | 15.3 |

Fidelity Series Short-Term Credit Fund Class F | 10.7 | 0.0 |

Fidelity Short-Term Bond Fund Class F | 0.0 | 12.4 |

| 24.2 | 27.7 |

Net Other Assets (Liabilities)* | 0.0 | 0.0 |

| 100.0 | 100.0 |

* Amount represents less than 0.1% |

Asset Allocation (% of fund's net assets) |

Period end |

| Domestic Equity Funds** | 18.8% | |

| International Equity Funds | 7.1% | |

| Bond Funds | 49.9% | |

| Short-Term Funds | 24.2% | |

Six months ago |

| Domestic Equity Funds** | 18.3% | |

| International Equity Funds | 6.5% | |

| Bond Funds | 47.5% | |

| Short-Term Funds | 27.7% | |

** Includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments. |

Annual Report

Fidelity Freedom K® Income Fund

Investments March 31, 2015

Showing Percentage of Net Assets

Domestic Equity Funds - 18.8% |

| Shares | | Value |

Fidelity Series 100 Index Fund Class F (c) | 946,913 | | $ 12,584,468 |

Fidelity Series 1000 Value Index Fund Class F (c) | 636,165 | | 7,125,049 |

Fidelity Series All-Sector Equity Fund Class F (c) | 2,887,028 | | 40,851,441 |

Fidelity Series Blue Chip Growth Fund Class F (c) | 2,476,840 | | 31,629,241 |

Fidelity Series Commodity Strategy Fund Class F (a)(c) | 2,649,823 | | 16,349,406 |

Fidelity Series Equity-Income Fund Class F (c) | 4,233,137 | | 53,464,522 |

Fidelity Series Growth & Income Fund Class F (c) | 3,005,358 | | 40,812,756 |

Fidelity Series Growth Company Fund Class F (c) | 3,974,018 | | 49,993,151 |

Fidelity Series Intrinsic Opportunities Fund Class F (c) | 1,814,963 | | 27,460,389 |

Fidelity Series Opportunistic Insights Fund Class F (c) | 1,719,767 | | 26,587,596 |

Fidelity Series Real Estate Equity Fund Class F (c) | 326,580 | | 4,905,231 |

Fidelity Series Small Cap Discovery Fund Class F (c) | 641,910 | | 7,253,584 |

Fidelity Series Small Cap Opportunities Fund Class F (c) | 1,581,352 | | 21,775,218 |

Fidelity Series Stock Selector Large Cap Value Fund Class F (c) | 2,752,445 | | 35,754,258 |

TOTAL DOMESTIC EQUITY FUNDS (Cost $312,688,085) |

376,546,310

|

International Equity Funds - 7.1% |

| | | |

Fidelity Series Emerging Markets Fund Class F (c) | 3,196,842 | | 54,474,185 |

Fidelity Series International Growth Fund Class F (c) | 2,754,849 | | 39,752,478 |

Fidelity Series International Small Cap Fund Class F (c) | 574,259 | | 9,130,712 |

Fidelity Series International Value Fund Class F (c) | 3,888,410 | | 39,467,365 |

TOTAL INTERNATIONAL EQUITY FUNDS (Cost $121,441,422) |

142,824,740

|

Bond Funds - 49.9% |

| Shares | | Value |

Fidelity Series Emerging Markets Debt Fund Class F (c) | 1,280,294 | | $ 12,431,653 |

Fidelity Series Floating Rate High Income Fund Class F (c) | 1,017,086 | | 9,977,614 |

Fidelity Series High Income Fund Class F (c) | 6,930,188 | | 67,915,841 |

Fidelity Series Inflation-Protected Bond Index Fund Class F (c) | 7,198,165 | | 70,254,093 |

Fidelity Series Investment Grade Bond Fund Class F (c) | 71,923,312 | | 832,152,723 |

Fidelity Series Real Estate Income Fund Class F (c) | 870,598 | | 9,846,461 |

TOTAL BOND FUNDS (Cost $994,411,122) |

1,002,578,385

|

Short-Term Funds - 24.2% |

| | | |

Fidelity Institutional Money Market Portfolio Class F 0.14% (b)(c) | 271,087,685 | | 271,087,685 |

Fidelity Series Short-Term Credit Fund Class F (c) | 21,398,526 | | 214,199,246 |

TOTAL SHORT-TERM FUNDS (Cost $485,072,946) |

485,286,931

|

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $1,913,613,575) | 2,007,236,366 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | | 79,600 |

NET ASSETS - 100% | $ 2,007,315,966 |

Legend |

(a) Non-income producing |

(b) The rate quoted is the annualized seven-day yield of the fund at period end. |

(c) Affiliated Fund |

Affiliated Underlying Funds |

Information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds and income earned by the Fund from investments in affiliated Underlying Funds is as follows: |

Affiliate | Value,

beginning of

period | Purchases | Sales

Proceeds | Dividend

Income | Value,

end of

period |

Fidelity Institutional Money Market Portfolio Class F | $ 246,990,533 | $ 24,307,675 | $ 104,851,552 | $ 277,337 | $ 271,087,685 |

Fidelity Series 100 Index Fund Class F | 7,486,906 | 3,498,979 | 2,542,306 | 273,628 | 12,584,468 |

Fidelity Series 1000 Value Index Fund Class F | 5,050,857 | 1,060,409 | 1,462,472 | 165,336 | 7,125,049 |

Fidelity Series All-Sector Equity Fund Class F | 29,534,883 | 10,562,577 | 12,093,854 | 484,595 | 40,851,441 |

Fidelity Series Blue Chip Growth Fund Class F | 23,833,744 | 10,886,443 | 19,395,555 | 130,759 | 31,629,241 |

Fidelity Series Commodity Strategy Fund Class F | 16,340,582 | 3,288,189 | 4,009,709 | - | 16,349,406 |

Fidelity Series Emerging Markets Debt Fund Class F | 9,163,332 | 2,634,238 | 2,951,851 | 741,206 | 12,431,653 |

Fidelity Series Emerging Markets Fund Class F | 21,684,123 | 28,916,614 | 5,355,002 | 424,546 | 54,474,185 |

Affiliate | Value,

beginning of

period | Purchases | Sales

Proceeds | Dividend

Income | Value,

end of

period |

Fidelity Series Equity-Income Fund Class F | $ 37,909,024 | $ 11,481,642 | $ 12,620,340 | $ 1,156,687 | $ 53,464,522 |

Fidelity Series Floating Rate High Income Fund Class F | 17,412,605 | 2,357,090 | 16,592,372 | 625,096 | 9,977,614 |

Fidelity Series Growth & Income Fund Class F | 28,302,817 | 8,487,693 | 10,125,134 | 697,063 | 40,812,756 |

Fidelity Series Growth Company Fund Class F | 29,487,542 | 3,836,994 | 4,023,264 | 176,518 | 49,993,151 |

Fidelity Series High Income Fund Class F | 75,535,231 | 11,807,289 | 42,509,676 | 4,315,416 | 67,915,841 |

Fidelity Series Inflation-Protected Bond Index Fund Class F | 43,504,752 | 20,404,375 | 11,375,734 | 178,116 | 70,254,093 |

Fidelity Series International Growth Fund Class F | 37,951,632 | 6,396,331 | 21,437,121 | 653,587 | 39,752,478 |

Fidelity Series International Small Cap Fund Class F | 9,102,058 | 1,054,343 | 4,455,353 | 108,122 | 9,130,712 |

Fidelity Series International Value Fund Class F | 38,113,298 | 6,214,342 | 16,487,369 | 1,950,450 | 39,467,365 |

Fidelity Series Intrinsic Opportunities Fund Class F | 18,154,142 | 5,543,827 | 6,136,901 | 440,065 | 27,460,389 |

Fidelity Series Investment Grade Bond Fund Class F | 542,389,512 | 167,993,395 | 133,578,115 | 19,692,338 | 832,152,723 |

Fidelity Series Opportunistic Insights Fund Class F | 17,651,876 | 6,992,238 | 8,205,710 | 23,695 | 26,587,596 |

Fidelity Series Real Estate Equity Fund Class F | 3,375,120 | 1,264,739 | 1,979,677 | 95,156 | 4,905,231 |

Fidelity Series Real Estate Income Fund Class F | 5,730,266 | 2,757,204 | 1,687,417 | 519,432 | 9,846,461 |

Fidelity Series Short-Term Credit Fund Class F | - | 214,538,736 | 554,015 | - | 214,199,246 |

Fidelity Series Small Cap Discovery Fund Class F | 4,478,629 | 2,471,888 | 2,473,220 | 22,869 | 7,253,584 |

Fidelity Series Small Cap Opportunities Fund Class F | 14,473,615 | 6,522,473 | 5,596,970 | 114,484 | 21,775,218 |

Fidelity Series Stock Selector Large Cap Value Fund Class F | 24,509,730 | 8,985,106 | 9,681,399 | 588,064 | 35,754,258 |

Fidelity Short-Term Bond Fund Class F | 202,495,760 | 30,092,519 | 319,019,515 | 2,272,892 | - |

Total | $ 1,510,662,569 | $ 604,357,348 | $ 781,201,603 | $ 36,127,457 | $ 2,007,236,366 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Freedom K® Income Fund

Statement of Assets and Liabilities

| March 31, 2015 |

| | |

Assets | | |

Investment in securities, at value (cost $1,913,613,575) - See accompanying schedule | | $ 2,007,236,366 |

Receivable for investments sold | | 8,134,719 |

Receivable for fund shares sold | | 1,250,485 |

Dividends receivable | | 175,745 |

Total assets | | 2,016,797,315 |

| | |

Liabilities | | |

Payable for investments purchased | $ 2,833,710 | |

Payable for fund shares redeemed | 6,567,229 | |

Transfer agent fees payable | 80,410 | |

Total liabilities | | 9,481,349 |

| | |

Net Assets | | $ 2,007,315,966 |

Net Assets consist of: | | |

Paid in capital | | $ 1,892,069,448 |

Undistributed net investment income | | 3,019,658 |

Accumulated undistributed net realized gain (loss) on investments | | 18,604,069 |

Net unrealized appreciation (depreciation) on investments | | 93,622,791 |

Net Assets, for 167,089,743 shares outstanding | | $ 2,007,315,966 |

Net Asset Value, offering price and redemption price per share ($2,007,315,966 ÷ 167,089,743 shares) | | $ 12.01 |

Statement of Operations

| Year ended March 31, 2015 |

| | |

Investment Income | | |

Income distributions from underlying funds | | $ 36,127,457 |

| | |

Expenses | | |

Transfer agent fees | $ 905,817 | |

Independent trustees' compensation | 8,709 | |

Total expenses | | 914,526 |

Net investment income (loss) | | 35,212,931 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | 10,494,155 | |

Capital gain distributions from underlying funds | 22,635,583 | |

Total net realized gain (loss) | | 33,129,738 |

Change in net unrealized appreciation (depreciation) on underlying funds | | 7,988,068 |

Net gain (loss) | | 41,117,806 |

Net increase (decrease) in net assets resulting from operations | | $ 76,330,737 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Freedom K® Income Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

March 31,

2015 | Year ended

March 31,

2014 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 35,212,931 | $ 22,059,734 |

Net realized gain (loss) | 33,129,738 | 37,501,808 |

Change in net unrealized appreciation (depreciation) | 7,988,068 | 1,228,266 |

Net increase (decrease) in net assets resulting from operations | 76,330,737 | 60,789,808 |

Distributions to shareholders from net investment income | (34,356,251) | (21,494,679) |

Distributions to shareholders from net realized gain | (49,781,478) | (13,588,645) |

Total distributions | (84,137,729) | (35,083,324) |

Share transactions

Proceeds from sales of shares | 646,904,316 | 647,109,876 |

Net asset value of shares issued in exchange for the net assets of Fidelity Freedom K® 2000 Fund (note 5) | 655,598,999 | - |

Reinvestment of distributions | 84,137,729 | 35,083,324 |

Cost of shares redeemed | (882,121,296) | (763,019,417) |

Net increase (decrease) in net assets resulting from share transactions | 504,519,748 | (80,826,217) |

Total increase (decrease) in net assets | 496,712,756 | (55,119,733) |

| | |

Net Assets | | |

Beginning of period | 1,510,603,210 | 1,565,722,943 |

End of period (including undistributed net investment income of $3,019,658 and undistributed net investment income of $2,162,978, respectively) | $ 2,007,315,966 | $ 1,510,603,210 |

Other Information Shares | | |

Sold | 54,158,762 | 54,544,970 |

Issued in exchange for the shares of Fidelity Freedom K® 2000 Fund (note 5) | 54,724,457 | - |

Issued in reinvestment of distributions | 7,090,115 | 2,955,331 |

Redeemed | (73,839,837) | (64,289,080) |

Net increase (decrease) | 42,133,497 | (6,788,779) |

Financial Highlights

Years ended March 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 12.09 | $ 11.88 | $ 11.66 | $ 11.64 | $ 11.10 |

Income from Investment Operations | | | | | |

Net investment income (loss) A | .22 | .17 | .16 | .19 | .20 |

Net realized and unrealized gain (loss) | .28 | .31 | .39 | .21 | .61 |

Total from investment operations | .50 | .48 | .55 | .40 | .81 |

Distributions from net investment income | (.21) | (.16) | (.16) | (.18) | (.18) |

Distributions from net realized gain | (.37) | (.10) | (.17) | (.19) | (.09) |

Total distributions | (.58) | (.27) E | (.33) | (.38) F | (.27) |

Net asset value, end of period | $ 12.01 | $ 12.09 | $ 11.88 | $ 11.66 | $ 11.64 |

Total Return | 4.28% | 4.07% | 4.77% | 3.50% | 7.37% |

Ratios to Average Net Assets B, C | | | | | |

Expenses before reductions | .05% | .05% | .05% | .05% | .05% |

Expenses net of fee waivers, if any | .05% | .05% | .05% | .05% | .05% |

Expenses net of all reductions | .05% | .05% | .05% | .05% | .05% |

Net investment income (loss) | 1.83% | 1.41% | 1.37% | 1.67% | 1.77% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 2,007,316 | $ 1,510,603 | $ 1,565,723 | $ 1,281,332 | $ 636,056 |

Portfolio turnover rate B | 32%D | 40% | 17% | 20% | 32% |

A Calculated based on average shares outstanding during the period.

B Amounts do not include the activity of the Underlying Funds.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund but do not include expenses of the underlying funds in which the Fund invests.

D The portfolio turnover rate does not include the assets acquired in the merger.

E Total distributions of $.27 per share is comprised of distributions from net investment income of $.164 and distributions from net realized gain of $.102 per share.

F Total distributions of $.38 per share is comprised of distributions from net investment income of $.182 and distributions from net realized gain of $.194 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Freedom K® 2005 Fund

Investment Changes (Unaudited)

The information in the following tables is based on the direct investments of the Fund. |

Fund Holdings as of March 31, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Domestic Equity Funds | | |

Fidelity Series 100 Index Fund Class F | 1.0 | 1.0 |

Fidelity Series 1000 Value Index Fund Class F | 0.6 | 0.6 |

Fidelity Series All-Sector Equity Fund Class F | 3.2 | 3.3 |

Fidelity Series Blue Chip Growth Fund Class F | 2.5 | 2.9 |

Fidelity Series Commodity Strategy Fund Class F | 0.8 | 1.0 |

Fidelity Series Equity-Income Fund Class F | 4.2 | 4.3 |

Fidelity Series Growth & Income Fund Class F | 3.2 | 3.3 |

Fidelity Series Growth Company Fund Class F | 3.6 | 3.5 |

Fidelity Series Intrinsic Opportunities Fund Class F | 2.1 | 2.1 |

Fidelity Series Opportunistic Insights Fund Class F | 2.1 | 2.2 |

Fidelity Series Real Estate Equity Fund Class F | 0.4 | 0.4 |

Fidelity Series Small Cap Discovery Fund Class F | 0.6 | 0.5 |

Fidelity Series Small Cap Opportunities Fund Class F | 1.7 | 1.6 |

Fidelity Series Stock Selector Large Cap Value Fund Class F | 2.8 | 2.9 |

| 28.8 | 29.6 |

International Equity Funds | | |

Fidelity Series Emerging Markets Fund Class F | 4.0 | 2.9 |

Fidelity Series International Growth Fund Class F | 3.5 | 3.5 |

Fidelity Series International Small Cap Fund Class F | 0.8 | 0.8 |

Fidelity Series International Value Fund Class F | 3.5 | 3.9 |

| 11.8 | 11.1 |

Bond Funds | | |

Fidelity Series Emerging Markets Debt Fund Class F | 0.6 | 0.6 |

Fidelity Series Floating Rate High Income Fund Class F | 0.5 | 0.5 |

Fidelity Series High Income Fund Class F | 3.5 | 4.3 |

Fidelity Series Inflation-Protected Bond Index Fund Class F | 3.0 | 2.2 |

Fidelity Series Investment Grade Bond Fund Class F | 36.5 | 33.5 |

Fidelity Series Real Estate Income Fund Class F | 0.5 | 0.5 |

| 44.6 | 41.6 |

Short-Term Funds | | |

Fidelity Institutional Money Market Portfolio Class F | 8.6 | 9.7 |

Fidelity Series Short-Term Credit Fund Class F | 6.2 | 0.0 |

Fidelity Short-Term Bond Fund Class F | 0.0 | 8.0 |

| 14.8 | 17.7 |

Net Other Assets (Liabilities)* | 0.0 | 0.0 |

| 100.0 | 100.0 |

* Amount represents less than 0.1% |

Asset Allocation (% of fund's net assets) |

Period end |

| Domestic Equity Funds** | 28.8% | |

| International Equity Funds | 11.8% | |

| Bond Funds | 44.6% | |

| Short-Term Funds | 14.8% | |

Six months ago |

| Domestic Equity Funds** | 29.6% | |

| International Equity Funds | 11.1% | |

| Bond Funds | 41.6% | |

| Short-Term Funds | 17.7% | |

** Includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments. |

Annual Report

Fidelity Freedom K® 2005 Fund

Investments March 31, 2015

Showing Percentage of Net Assets

Domestic Equity Funds - 28.8% |

| Shares | | Value |

Fidelity Series 100 Index Fund Class F (c) | 349,184 | | $ 4,640,658 |

Fidelity Series 1000 Value Index Fund Class F (c) | 235,851 | | 2,641,536 |

Fidelity Series All-Sector Equity Fund Class F (c) | 1,069,721 | | 15,136,546 |

Fidelity Series Blue Chip Growth Fund Class F (c) | 917,274 | | 11,713,591 |

Fidelity Series Commodity Strategy Fund Class F (a)(c) | 603,032 | | 3,720,710 |

Fidelity Series Equity-Income Fund Class F (c) | 1,568,531 | | 19,810,549 |

Fidelity Series Growth & Income Fund Class F (c) | 1,112,410 | | 15,106,529 |

Fidelity Series Growth Company Fund Class F (c) | 1,369,422 | | 17,227,330 |

Fidelity Series Intrinsic Opportunities Fund Class F (c) | 667,757 | | 10,103,160 |

Fidelity Series Opportunistic Insights Fund Class F (c) | 636,436 | | 9,839,302 |

Fidelity Series Real Estate Equity Fund Class F (c) | 121,359 | | 1,822,811 |

Fidelity Series Small Cap Discovery Fund Class F (c) | 238,711 | | 2,697,440 |

Fidelity Series Small Cap Opportunities Fund Class F (c) | 582,003 | | 8,014,177 |

Fidelity Series Stock Selector Large Cap Value Fund Class F (c) | 1,018,345 | | 13,228,304 |

TOTAL DOMESTIC EQUITY FUNDS (Cost $112,066,832) |

135,702,643

|

International Equity Funds - 11.8% |

| | | |

Fidelity Series Emerging Markets Fund Class F (c) | 1,091,987 | | 18,607,454 |

Fidelity Series International Growth Fund Class F (c) | 1,156,154 | | 16,683,302 |

Fidelity Series International Small Cap Fund Class F (c) | 238,328 | | 3,789,422 |

Fidelity Series International Value Fund Class F (c) | 1,611,077 | | 16,352,431 |

TOTAL INTERNATIONAL EQUITY FUNDS (Cost $46,875,195) |

55,432,609

|

Bond Funds - 44.6% |

| Shares | | Value |

Fidelity Series Emerging Markets Debt Fund Class F (c) | 305,763 | | $ 2,968,957 |

Fidelity Series Floating Rate High Income Fund Class F (c) | 237,151 | | 2,326,450 |

Fidelity Series High Income Fund Class F (c) | 1,661,485 | | 16,282,551 |

Fidelity Series Inflation-Protected Bond Index Fund Class F (c) | 1,462,232 | | 14,271,382 |

Fidelity Series Investment Grade Bond Fund Class F (c) | 14,834,597 | | 171,636,281 |

Fidelity Series Real Estate Income Fund Class F (c) | 201,822 | | 2,282,609 |

TOTAL BOND FUNDS (Cost $208,015,202) |

209,768,230

|

Short-Term Funds - 14.8% |

| | | |

Fidelity Institutional Money Market Portfolio Class F 0.14% (b)(c) | 40,706,365 | | 40,706,365 |

Fidelity Series Short-Term Credit Fund Class F (c) | 2,892,998 | | 28,958,911 |

TOTAL SHORT-TERM FUNDS (Cost $69,636,346) |

69,665,276

|

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $436,593,575) | | 470,568,758 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | | 5,375 |

NET ASSETS - 100% | $ 470,574,133 |

Legend |

(a) Non-income producing |

(b) The rate quoted is the annualized seven-day yield of the fund at period end. |

(c) Affiliated Fund |

Affiliated Underlying Funds |

Information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds and income earned by the Fund from investments in affiliated Underlying Funds is as follows: |

Affiliate | Value,

beginning of

period | Purchases | Sales

Proceeds | Dividend

Income | Value,

end of

period |

Fidelity Institutional Money Market Portfolio Class F | $ 51,961,906 | $ 7,740,604 | $ 18,996,147 | $ 42,883 | $ 40,706,365 |

Fidelity Series 100 Index Fund Class F | 4,172,909 | 1,336,977 | 1,241,621 | 94,779 | 4,640,658 |

Fidelity Series 1000 Value Index Fund Class F | 2,813,100 | 587,901 | 895,091 | 57,554 | 2,641,536 |

Fidelity Series All-Sector Equity Fund Class F | 15,334,718 | 4,990,734 | 5,328,208 | 161,305 | 15,136,546 |

Fidelity Series Blue Chip Growth Fund Class F | 13,505,714 | 4,023,128 | 8,057,826 | 46,736 | 11,713,591 |

Fidelity Series Commodity Strategy Fund Class F | 5,529,348 | 989,623 | 1,374,490 | - | 3,720,710 |

Fidelity Series Emerging Markets Debt Fund Class F | 2,992,990 | 801,189 | 676,862 | 177,200 | 2,968,957 |

Fidelity Series Emerging Markets Fund Class F | 12,030,943 | 8,811,568 | 2,017,960 | 139,692 | 18,607,454 |

Affiliate | Value,

beginning of

period | Purchases | Sales

Proceeds | Dividend

Income | Value,

end of

period |

Fidelity Series Equity-Income Fund Class F | $ 20,088,587 | $ 5,455,977 | $ 5,973,422 | $ 472,058 | $ 19,810,549 |

Fidelity Series Floating Rate High Income Fund Class F | 5,606,765 | 682,700 | 3,801,721 | 159,788 | 2,326,450 |

Fidelity Series Growth & Income Fund Class F | 15,957,846 | 3,545,817 | 5,129,836 | 294,724 | 15,106,529 |

Fidelity Series Growth Company Fund Class F | 15,907,241 | 895,698 | 2,155,281 | 60,983 | 17,227,330 |

Fidelity Series High Income Fund Class F | 26,401,733 | 3,861,673 | 12,408,126 | 1,169,398 | 16,282,551 |

Fidelity Series Inflation-Protected Bond Index Fund Class F | 10,542,477 | 6,774,639 | 2,868,825 | 35,076 | 14,271,382 |

Fidelity Series International Growth Fund Class F | 20,699,555 | 3,148,622 | 7,441,595 | 250,671 | 16,683,302 |

Fidelity Series International Small Cap Fund Class F | 4,656,665 | 661,922 | 1,425,225 | 41,575 | 3,789,422 |

Fidelity Series International Value Fund Class F | 21,001,598 | 3,653,954 | 6,655,572 | 712,561 | 16,352,431 |

Fidelity Series Intrinsic Opportunities Fund Class F | 10,396,106 | 2,245,225 | 3,392,265 | 159,637 | 10,103,160 |

Fidelity Series Investment Grade Bond Fund Class F | 146,053,367 | 53,839,656 | 32,441,877 | 4,120,568 | 171,636,281 |

Fidelity Series Opportunistic Insights Fund Class F | 9,909,787 | 2,553,783 | 3,644,149 | 8,009 | 9,839,302 |

Fidelity Series Real Estate Equity Fund Class F | 1,936,478 | 919,375 | 1,315,758 | 34,720 | 1,822,811 |

Fidelity Series Real Estate Income Fund Class F | 2,251,851 | 541,559 | 519,109 | 121,594 | 2,282,609 |

Fidelity Series Short-Term Credit Fund Class F | - | 28,968,668 | 38,724 | - | 28,958,911 |

Fidelity Series Small Cap Discovery Fund Class F | 2,689,594 | 851,624 | 1,101,921 | 9,103 | 2,697,440 |

Fidelity Series Small Cap Opportunities Fund Class F | 8,117,753 | 2,477,400 | 2,651,546 | 40,446 | 8,014,177 |

Fidelity Series Stock Selector Large Cap Value Fund Class F | 13,880,843 | 3,590,052 | 4,804,290 | 198,238 | 13,228,304 |

Fidelity Short-Term Bond Fund Class F | 42,559,093 | 5,583,727 | 48,203,414 | 360,555 | - |

Total | $ 486,998,967 | $ 159,533,795 | $ 184,560,861 | $ 8,969,853 | $ 470,568,758 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Freedom K® 2005 Fund

Statement of Assets and Liabilities

| March 31, 2015 |

| | |

Assets | | |

Investment in securities, at value (cost $436,593,575) - See accompanying schedule | | $ 470,568,758 |

Receivable for investments sold | | 1,248,330 |

Receivable for fund shares sold | | 330,126 |

Dividends receivable | | 23,706 |

Total assets | | 472,170,920 |

| | |

Liabilities | | |

Payable for investments purchased | $ 641,680 | |

Payable for fund shares redeemed | 937,089 | |

Transfer agent fees payable | 18,018 | |

Total liabilities | | 1,596,787 |

| | |

Net Assets | | $ 470,574,133 |

Net Assets consist of: | | |

Paid in capital | | $ 429,427,350 |

Undistributed net investment income | | 1,445,878 |

Accumulated undistributed net realized gain (loss) on investments | | 5,725,722 |

Net unrealized appreciation (depreciation) on investments | | 33,975,183 |

Net Assets, for 35,537,336 shares outstanding | | $ 470,574,133 |

Net Asset Value, offering price and redemption price per share ($470,574,133 ÷ 35,537,336 shares) | | $ 13.24 |

Statement of Operations

| Year ended March 31, 2015 |

| | |

Investment Income | | |

Income distributions from underlying funds | | $ 8,969,853 |

| | |

Expenses | | |

Transfer agent fees | $ 221,799 | |

Independent trustees' compensation | 2,053 | |

Total expenses | | 223,852 |

Net investment income (loss) | | 8,746,001 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | 3,074,497 | |

Capital gain distributions from underlying funds | 7,241,591 | |

Total net realized gain (loss) | | 10,316,088 |

Change in net unrealized appreciation (depreciation) on underlying funds | | 5,522,385 |

Net gain (loss) | | 15,838,473 |

Net increase (decrease) in net assets resulting from operations | | $ 24,584,474 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Freedom K® 2005 Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

March 31,

2015 | Year ended

March 31,

2014 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 8,746,001 | $ 7,008,293 |

Net realized gain (loss) | 10,316,088 | 19,974,058 |

Change in net unrealized appreciation (depreciation) | 5,522,385 | 3,662,079 |

Net increase (decrease) in net assets resulting from operations | 24,584,474 | 30,644,430 |

Distributions to shareholders from net investment income | (14,303,298) | (1,003,197) |

Distributions to shareholders from net realized gain | (23,376,590) | (7,138,132) |

Total distributions | (37,679,888) | (8,141,329) |

Share transactions

Proceeds from sales of shares | 173,718,310 | 199,302,150 |

Reinvestment of distributions | 37,679,888 | 8,141,329 |

Cost of shares redeemed | (214,708,998) | (239,030,129) |

Net increase (decrease) in net assets resulting from share transactions | (3,310,800) | (31,586,650) |

Total increase (decrease) in net assets | (16,406,214) | (9,083,549) |

| | |

Net Assets | | |

Beginning of period | 486,980,347 | 496,063,896 |

End of period (including undistributed net investment income of $1,445,878 and undistributed net investment income of $7,003,175, respectively) | $ 470,574,133 | $ 486,980,347 |

Other Information Shares | | |

Sold | 13,137,868 | 15,183,177 |

Issued in reinvestment of distributions | 2,909,900 | 629,160 |

Redeemed | (16,275,785) | (18,210,428) |

Net increase (decrease) | (228,017) | (2,398,091) |

Financial Highlights

Years ended March 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 13.62 | $ 13.00 | $ 12.65 | $ 12.82 | $ 11.85 |

Income from Investment Operations | | | | | |

Net investment income (loss) A | .24 | .19 | .19 | .21 | .21 |

Net realized and unrealized gain (loss) | .44 | .64 | .56 | .13 | 1.05 |

Total from investment operations | .68 | .83 | .75 | .34 | 1.26 |

Distributions from net investment income | (.41) | (.03) | (.18) | (.18) | (.17) |

Distributions from net realized gain | (.66) | (.19) | (.21) | (.33) | (.12) |

Total distributions | (1.06) D | (.21) E | (.40) F | (.51) | (.29) |

Net asset value, end of period | $ 13.24 | $ 13.62 | $ 13.00 | $ 12.65 | $ 12.82 |

Total Return | 5.33% | 6.48% | 6.03% | 2.83% | 10.75% |

Ratios to Average Net Assets B, C | | | | | |

Expenses before reductions | .05% | .05% | .05% | .05% | .05% |

Expenses net of fee waivers, if any | .05% | .05% | .05% | .05% | .05% |

Expenses net of all reductions | .05% | .05% | .05% | .05% | .05% |

Net investment income (loss) | 1.85% | 1.42% | 1.46% | 1.66% | 1.73% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 470,574 | $ 486,980 | $ 496,064 | $ 388,009 | $ 257,817 |

Portfolio turnover rate B | 34% | 55% | 29% | 37% | 47% |

A Calculated based on average shares outstanding during the period.

B Amounts do not include the activity of the Underlying Funds.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund but do not include expenses of the underlying funds in which the Fund invests.

D Total distributions of $1.06 per share is comprised of distributions from net investment income of $.406 and distributions from net realized gain of $.658 per share.

E Total distributions of $.21 per share is comprised of distributions from net investment income of $.026 and distributions from net realized gain of $.185 per share.

F Total distributions of $.40 per share is comprised of distributions from net investment income of $.182 and distributions from net realized gain of $.213 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Freedom K® 2010 Fund

Investment Changes (Unaudited)

The information in the following tables is based on the direct investments of the Fund. |

Fund Holdings as of March 31, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Domestic Equity Funds | | |

Fidelity Series 100 Index Fund Class F | 1.2 | 1.2 |

Fidelity Series 1000 Value Index Fund Class F | 0.7 | 0.7 |

Fidelity Series All-Sector Equity Fund Class F | 3.9 | 4.2 |

Fidelity Series Blue Chip Growth Fund Class F | 3.0 | 3.5 |

Fidelity Series Commodity Strategy Fund Class F | 0.8 | 1.0 |

Fidelity Series Equity-Income Fund Class F | 5.1 | 5.2 |

Fidelity Series Growth & Income Fund Class F | 3.9 | 4.0 |

Fidelity Series Growth Company Fund Class F | 4.7 | 4.3 |

Fidelity Series Intrinsic Opportunities Fund Class F | 2.6 | 2.6 |

Fidelity Series Opportunistic Insights Fund Class F | 2.5 | 2.6 |

Fidelity Series Real Estate Equity Fund Class F | 0.5 | 0.5 |

Fidelity Series Small Cap Discovery Fund Class F | 0.7 | 0.6 |

Fidelity Series Small Cap Opportunities Fund Class F | 2.0 | 2.0 |

Fidelity Series Stock Selector Large Cap Value Fund Class F | 3.4 | 3.5 |

| 35.0 | 35.9 |

International Equity Funds | | |

Fidelity Series Emerging Markets Fund Class F | 4.8 | 3.6 |

Fidelity Series International Growth Fund Class F | 4.5 | 4.5 |

Fidelity Series International Small Cap Fund Class F | 1.0 | 1.0 |

Fidelity Series International Value Fund Class F | 4.4 | 4.8 |

| 14.7 | 13.9 |

Bond Funds | | |

Fidelity Series Emerging Markets Debt Fund Class F | 0.7 | 0.7 |

Fidelity Series Floating Rate High Income Fund Class F | 0.5 | 0.5 |

Fidelity Series High Income Fund Class F | 3.4 | 4.3 |

Fidelity Series Inflation-Protected Bond Index Fund Class F | 2.4 | 1.7 |

Fidelity Series Investment Grade Bond Fund Class F | 33.4 | 30.4 |

Fidelity Series Real Estate Income Fund Class F | 0.5 | 0.5 |

| 40.9 | 38.1 |

Short-Term Funds | | |

Fidelity Institutional Money Market Portfolio Class F | 5.2 | 6.6 |

Fidelity Series Short-Term Credit Fund Class F | 4.2 | 0.0 |

Fidelity Short-Term Bond Fund Class F | 0.0 | 5.5 |

| 9.4 | 12.1 |

Net Other Assets (Liabilities)* | 0.0 | 0.0 |

| 100.0 | 100.0 |

* Amount represents less than 0.1% |

Asset Allocation (% of fund's net assets) |

Period end |

| Domestic Equity Funds** | 35.0% | |

| International Equity Funds | 14.7% | |

| Bond Funds | 40.9% | |

| Short-Term Funds | 9.4% | |

Six months ago |

| Domestic Equity Funds** | 35.9% | |

| International Equity Funds | 13.9% | |

| Bond Funds | 38.1% | |

| Short-Term Funds | 12.1% | |

** Includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments. |

Annual Report

Fidelity Freedom K® 2010 Fund

Investments March 31, 2015

Showing Percentage of Net Assets

Domestic Equity Funds - 35.0% |

| Shares | | Value |

Fidelity Series 100 Index Fund Class F (c) | 3,291,805 | | $ 43,748,084 |

Fidelity Series 1000 Value Index Fund Class F (c) | 2,201,097 | | 24,652,285 |

Fidelity Series All-Sector Equity Fund Class F (c) | 10,103,163 | | 142,959,754 |

Fidelity Series Blue Chip Growth Fund Class F (c) | 8,758,165 | | 111,841,765 |

Fidelity Series Commodity Strategy Fund Class F (a)(c) | 4,672,635 | | 28,830,156 |

Fidelity Series Equity-Income Fund Class F (c) | 14,793,059 | | 186,836,333 |

Fidelity Series Growth & Income Fund Class F (c) | 10,503,094 | | 142,632,022 |

Fidelity Series Growth Company Fund Class F (c) | 13,769,027 | | 173,214,356 |

Fidelity Series Intrinsic Opportunities Fund Class F (c) | 6,301,996 | | 95,349,205 |

Fidelity Series Opportunistic Insights Fund Class F (c) | 6,017,503 | | 93,030,589 |

Fidelity Series Real Estate Equity Fund Class F (c) | 1,136,230 | | 17,066,169 |

Fidelity Series Small Cap Discovery Fund Class F (c) | 2,184,888 | | 24,689,234 |

Fidelity Series Small Cap Opportunities Fund Class F (c) | 5,491,642 | | 75,619,907 |

Fidelity Series Stock Selector Large Cap Value Fund Class F (c) | 9,625,284 | | 125,032,437 |

TOTAL DOMESTIC EQUITY FUNDS (Cost $1,027,055,025) |

1,285,502,296

|

International Equity Funds - 14.7% |

| | | |

Fidelity Series Emerging Markets Fund Class F (c) | 10,195,495 | | 173,731,228 |

Fidelity Series International Growth Fund Class F (c) | 11,419,053 | | 164,776,932 |

Fidelity Series International Small Cap Fund Class F (c) | 2,355,304 | | 37,449,336 |

Fidelity Series International Value Fund Class F (c) | 15,955,224 | | 161,945,521 |

TOTAL INTERNATIONAL EQUITY FUNDS (Cost $445,200,909) |

537,903,017

|

Bond Funds - 40.9% |

| Shares | | Value |

Fidelity Series Emerging Markets Debt Fund Class F (c) | 2,437,358 | | $ 23,666,750 |

Fidelity Series Floating Rate High Income Fund Class F (c) | 1,849,560 | | 18,144,186 |

Fidelity Series High Income Fund Class F (c) | 12,793,230 | | 125,373,657 |

Fidelity Series Inflation-Protected Bond Index Fund Class F (c) | 9,045,970 | | 88,288,666 |

Fidelity Series Investment Grade Bond Fund Class F (c) | 106,051,244 | | 1,227,012,891 |

Fidelity Series Real Estate Income Fund Class F (c) | 1,579,678 | | 17,866,158 |

TOTAL BOND FUNDS (Cost $1,491,273,005) |

1,500,352,308

|

Short-Term Funds - 9.4% |

| | | |

Fidelity Institutional Money Market Portfolio Class F 0.14% (b)(c) | 192,026,291 | | 192,026,291 |

Fidelity Series Short-Term Credit Fund Class F (c) | 15,365,949 | | 153,813,150 |

TOTAL SHORT-TERM FUNDS (Cost $345,685,781) |

345,839,441

|

TOTAL INVESTMENT PORTFOLIO - 100.0% (Cost $3,309,214,720) | 3,669,597,062 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | | (34,867) |

NET ASSETS - 100% | $ 3,669,562,195 |

Legend |

(a) Non-income producing |

(b) The rate quoted is the annualized seven-day yield of the fund at period end. |

(c) Affiliated Fund |

Affiliated Underlying Funds |

Information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds and income earned by the Fund from investments in affiliated Underlying Funds is as follows: |

Affiliate | Value,

beginning of

period | Purchases | Sales

Proceeds | Dividend

Income | Value,

end of

period |

Fidelity Institutional Money Market Portfolio Class F | $ 334,962,376 | $ 8,755,524 | $ 151,691,609 | $ 249,312 | $ 192,026,291 |

Fidelity Series 100 Index Fund Class F | 45,182,420 | 7,546,763 | 12,965,301 | 982,316 | 43,748,084 |

Fidelity Series 1000 Value Index Fund Class F | 30,459,828 | 2,224,729 | 9,491,204 | 594,168 | 24,652,285 |

Fidelity Series All-Sector Equity Fund Class F | 187,718,960 | 22,901,446 | 70,121,245 | 1,678,209 | 142,959,754 |

Fidelity Series Blue Chip Growth Fund Class F | 142,099,487 | 26,450,085 | 80,154,942 | 490,848 | 111,841,765 |

Fidelity Series Commodity Strategy Fund Class F | 48,181,088 | 2,807,048 | 10,100,602 | - | 28,830,156 |

Fidelity Series Emerging Markets Debt Fund Class F | 27,244,103 | 3,988,143 | 6,283,795 | 1,540,913 | 23,666,750 |

Affiliate | Value,

beginning of

period | Purchases | Sales

Proceeds | Dividend

Income | Value,

end of

period |

Fidelity Series Emerging Markets Fund Class F | $ 131,220,990 | $ 67,119,478 | $ 22,238,839 | 1,486,093 | $ 173,731,228 |

Fidelity Series Equity-Income Fund Class F | 222,074,882 | 23,711,719 | 62,055,326 | 5,003,324 | 186,836,333 |

Fidelity Series Floating Rate High Income Fund Class F | 48,463,715 | 3,944,481 | 32,893,183 | 1,343,584 | 18,144,186 |

Fidelity Series Growth & Income Fund Class F | 168,310,715 | 15,778,233 | 48,961,157 | 3,056,679 | 142,632,022 |

Fidelity Series Growth Company Fund Class F | 175,859,579 | 2,624,101 | 32,231,181 | 626,672 | 173,214,356 |

Fidelity Series High Income Fund Class F | 244,241,991 | 19,956,631 | 125,061,584 | 10,325,035 | 125,373,657 |

Fidelity Series Inflation-Protected Bond Index Fund Class F | 76,857,501 | 36,534,203 | 24,020,134 | 238,613 | 88,288,666 |

Fidelity Series International Growth Fund Class F | 224,855,756 | 12,857,537 | 75,914,901 | 2,689,075 | 164,776,932 |

Fidelity Series International Small Cap Fund Class F | 52,103,797 | 2,175,586 | 15,685,600 | 446,792 | 37,449,336 |

Fidelity Series International Value Fund Class F | 227,777,669 | 18,776,719 | 67,447,407 | 7,643,687 | 161,945,521 |

Fidelity Series Intrinsic Opportunities Fund Class F | 108,238,903 | 10,371,587 | 32,032,628 | 1,630,943 | 95,349,205 |

Fidelity Series Investment Grade Bond Fund Class F | 1,157,213,539 | 294,840,138 | 257,432,611 | 31,637,446 | 1,227,012,891 |

Fidelity Series Opportunistic Insights Fund Class F | 107,650,969 | 11,834,110 | 37,147,338 | 82,053 | 93,030,589 |

Fidelity Series Real Estate Equity Fund Class F | 21,084,662 | 2,447,447 | 9,550,135 | 385,124 | 17,066,169 |

Fidelity Series Real Estate Income Fund Class F | 20,800,987 | 2,268,621 | 5,285,847 | 1,050,579 | 17,866,158 |

Fidelity Series Short-Term Credit Fund Class F | - | 153,893,916 | 234,651 | - | 153,813,150 |

Fidelity Series Small Cap Discovery Fund Class F | 27,383,990 | 1,816,850 | 6,786,851 | 88,458 | 24,689,234 |

Fidelity Series Small Cap Opportunities Fund Class F | 88,168,168 | 14,139,076 | 27,363,017 | 415,490 | 75,619,907 |

Fidelity Series Stock Selector Large Cap Value Fund Class F | 145,728,204 | 19,968,988 | 46,622,503 | 2,034,270 | 125,032,437 |

Fidelity Short-Term Bond Fund Class F | 274,250,140 | 16,726,510 | 291,313,348 | 2,142,900 | - |

Total | $ 4,338,134,419 | $ 806,459,669 | $ 1,561,086,939 | $ 77,862,583 | $ 3,669,597,062 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Freedom K® 2010 Fund

Statement of Assets and Liabilities

| March 31, 2015 |

| | |

Assets | | |

Investment in securities, at value (cost $3,309,214,720) - See accompanying schedule | | $ 3,669,597,062 |

Receivable for investments sold | | 10,561,824 |

Receivable for fund shares sold | | 1,995,620 |

Dividends receivable | | 126,065 |

Total assets | | 3,682,280,571 |

| | |

Liabilities | | |

Payable for investments purchased | $ 4,837,569 | |

Payable for fund shares redeemed | 7,732,814 | |

Transfer agent fees payable | 147,993 | |

Total liabilities | | 12,718,376 |

| | |

Net Assets | | $ 3,669,562,195 |

Net Assets consist of: | | |

Paid in capital | | $ 3,223,638,053 |

Undistributed net investment income | | 8,593,683 |

Accumulated undistributed net realized gain (loss) on investments | | 76,948,117 |

Net unrealized appreciation (depreciation) on investments | | 360,382,342 |

Net Assets, for 271,720,836 shares outstanding | | $ 3,669,562,195 |

Net Asset Value, offering price and redemption price per share ($3,669,562,195 ÷ 271,720,836 shares) | | $ 13.50 |

Statement of Operations

| Year ended March 31, 2015 |

| | |

Investment Income | | |

Income distributions from underlying funds | | $ 77,862,583 |

| | |

Expenses | | |

Transfer agent fees | $ 1,897,321 | |

Independent trustees' compensation | 17,728 | |

Total expenses | | 1,915,049 |

Net investment income (loss) | | 75,947,534 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | 65,143,711 | |

Capital gain distributions from underlying funds | 72,342,321 | |

Total net realized gain (loss) | | 137,486,032 |