UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06440

Fidelity Aberdeen Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | March 31 |

|

|

Date of reporting period: | September 30, 2022 |

Item 1.

Reports to Stockholders

Fidelity Advisor Freedom Funds®

Fidelity Advisor Freedom® Income Fund

Fidelity Advisor Freedom® 2005 Fund

Fidelity Advisor Freedom® 2010 Fund

Fidelity Advisor Freedom® 2015 Fund

Fidelity Advisor Freedom® 2020 Fund

Fidelity Advisor Freedom® 2025 Fund

Fidelity Advisor Freedom® 2030 Fund

Fidelity Advisor Freedom® 2035 Fund

Fidelity Advisor Freedom® 2040 Fund

Fidelity Advisor Freedom® 2045 Fund

Fidelity Advisor Freedom® 2050 Fund

Fidelity Advisor Freedom® 2055 Fund

Fidelity Advisor Freedom® 2060 Fund

Fidelity Advisor Freedom® 2065 Fund

Semi-Annual Report

September 30, 2022

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2022 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

The information in the following table is based on the direct Investments of the Fund.

Top Holdings (% of Fund's net assets) |

| |

| Fidelity Series Investment Grade Bond Fund | 39.1 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 20.0 | |

| Fidelity Series Government Money Market Fund 3.00% | 8.6 | |

| Fidelity Series Emerging Markets Opportunities Fund | 5.6 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 3.6 | |

| Fidelity Series Short-Term Credit Fund | 2.1 | |

| Fidelity Series Overseas Fund | 2.0 | |

| Fidelity Series International Value Fund | 2.0 | |

| Fidelity Series International Growth Fund | 1.9 | |

| | 88.9 | |

| |

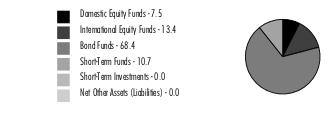

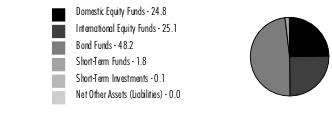

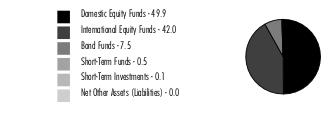

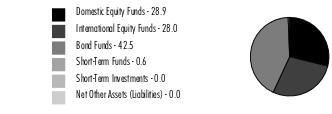

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

|

Domestic Equity Funds category includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments.

Fidelity Advisor Freedom® Income Fund

Showing Percentage of Net Assets

| U.S. Treasury Obligations - 0.0% |

| | | Principal Amount (a) | Value ($) |

U.S. Treasury Bills, yield at date of purchase 3.15% to 3.29% 12/15/22 to 12/29/22 (b) (Cost $99,263) | | 100,000 | 99,314 |

| | | | |

| Domestic Equity Funds - 7.5% |

| | | Shares | Value ($) |

| Fidelity Advisor Series Equity Growth Fund (c) | | 124,352 | 1,510,882 |

| Fidelity Advisor Series Growth Opportunities Fund (c) | | 121,228 | 1,063,167 |

| Fidelity Advisor Series Small Cap Fund (c) | | 62,367 | 652,981 |

| Fidelity Series All-Sector Equity Fund (c) | | 69,163 | 593,415 |

| Fidelity Series Commodity Strategy Fund (c) | | 1,048,930 | 2,192,264 |

| Fidelity Series Large Cap Stock Fund (c) | | 156,393 | 2,309,930 |

| Fidelity Series Large Cap Value Index Fund (c) | | 19,221 | 244,496 |

| Fidelity Series Opportunistic Insights Fund (c) | | 96,635 | 1,373,182 |

| Fidelity Series Small Cap Opportunities Fund (c) | | 71,362 | 769,286 |

| Fidelity Series Stock Selector Large Cap Value Fund (c) | | 131,142 | 1,464,857 |

| Fidelity Series Value Discovery Fund (c) | | 109,774 | 1,511,586 |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $13,203,383) | | | 13,686,046 |

| | | | |

| International Equity Funds - 13.4% |

| | | Shares | Value ($) |

| Fidelity Series Canada Fund (c) | | 125,527 | 1,556,533 |

| Fidelity Series Emerging Markets Fund (c) | | 149,137 | 1,079,755 |

| Fidelity Series Emerging Markets Opportunities Fund (c) | | 705,904 | 10,249,719 |

| Fidelity Series International Growth Fund (c) | | 281,160 | 3,604,471 |

| Fidelity Series International Small Cap Fund (c) | | 68,574 | 938,094 |

| Fidelity Series International Value Fund (c) | | 421,176 | 3,617,898 |

| Fidelity Series Overseas Fund (c) | | 381,732 | 3,637,909 |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $25,995,394) | | | 24,684,379 |

| | | | |

| Bond Funds - 68.4% |

| | | Shares | Value ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (c) | | 3,798,829 | 36,658,699 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (c) | | 20,960 | 167,471 |

| Fidelity Series Emerging Markets Debt Fund (c) | | 135,810 | 931,655 |

| Fidelity Series Emerging Markets Debt Local Currency Fund (c) | | 38,250 | 304,852 |

| Fidelity Series Floating Rate High Income Fund (c) | | 21,337 | 185,636 |

| Fidelity Series High Income Fund (c) | | 125,946 | 992,452 |

| Fidelity Series International Credit Fund (c) | | 14,078 | 110,793 |

| Fidelity Series International Developed Markets Bond Index Fund (c) | | 862,190 | 7,345,860 |

| Fidelity Series Investment Grade Bond Fund (c) | | 7,348,974 | 71,725,982 |

| Fidelity Series Long-Term Treasury Bond Index Fund (c) | | 1,113,111 | 6,645,271 |

| Fidelity Series Real Estate Income Fund (c) | | 49,430 | 470,569 |

| TOTAL BOND FUNDS (Cost $139,129,768) | | | 125,539,240 |

| | | | |

| Short-Term Funds - 10.7% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 3.10% (d) | | 53,195 | 53,206 |

| Fidelity Series Government Money Market Fund 3.00% (c)(e) | | 15,689,272 | 15,689,272 |

| Fidelity Series Short-Term Credit Fund (c) | | 403,896 | 3,828,932 |

| TOTAL SHORT-TERM FUNDS (Cost $19,744,466) | | | 19,571,410 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $198,172,274) | 183,580,389 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (2,900) |

| NET ASSETS - 100.0% | 183,577,489 |

| | |

| Futures Contracts |

| | Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) |

| Purchased | | | | | |

| | | | | | |

| Treasury Contracts | | | | | |

| CBOT 10-Year U.S. Treasury Note Contracts (United States) | 29 | Dec 2022 | 3,249,813 | (199,944) | (199,944) |

| CBOT Ultra Long Term U.S. Treasury Bond Contracts (United States) | 2 | Dec 2022 | 274,000 | (2,926) | (2,926) |

| | | | | | |

| TOTAL PURCHASED | | | | | (202,870) |

| | | | | | |

| Sold | | | | | |

| | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini S&P 500 Index Contracts (United States) | 4 | Dec 2022 | 720,300 | 18,378 | 18,378 |

| ICE E-mini MSCI EAFE Index Contracts (United States) | 7 | Dec 2022 | 581,210 | 58,885 | 58,885 |

| ICE E-mini MSCI Emerging Markets Index Contracts (United States) | 5 | Dec 2022 | 217,875 | 117 | 117 |

| | | | | | |

| TOTAL SOLD | | | | | 77,380 |

| | | | | | |

| TOTAL FUTURES CONTRACTS | | | | | (125,490) |

| The notional amount of futures purchased as a percentage of Net Assets is 1.9% |

| The notional amount of futures sold as a percentage of Net Assets is 0.8% |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $99,314. |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (e) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | %ownership, end of period |

| Fidelity Cash Central Fund 3.10% | 53,365 | 765,489 | 765,648 | 1,196 | - | - | 53,206 | 0.0% |

| Total | 53,365 | 765,489 | 765,648 | 1,196 | - | - | 53,206 | |

| | | | | | | | | |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Affiliated Underlying Funds

Fiscal year to date information regarding the Fund's investments in affiliated Underlying Funds is presented below. Exchanges between classes of the same affiliated Underlying Funds may occur. If an Underlying Funds changes its name, the name presented below is the name in effect at period end.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Advisor Series Equity Growth Fund | 1,730,921 | 417,979 | 266,358 | - | (16,418) | (355,242) | 1,510,882 |

| Fidelity Advisor Series Growth Opportunities Fund | 1,187,018 | 438,989 | 212,908 | - | (24,070) | (325,862) | 1,063,167 |

| Fidelity Advisor Series Small Cap Fund | 785,658 | 156,657 | 143,546 | - | (12,042) | (133,746) | 652,981 |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 34,146,354 | 9,628,616 | 5,601,677 | - | (87,396) | (1,427,198) | 36,658,699 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 211,922 | 1,680,400 | 1,687,471 | - | (16,667) | (20,713) | 167,471 |

| Fidelity Series All-Sector Equity Fund | 742,393 | 97,154 | 96,452 | - | (7,375) | (142,305) | 593,415 |

| Fidelity Series Canada Fund | 1,847,336 | 254,010 | 167,156 | - | (2,821) | (374,836) | 1,556,533 |

| Fidelity Series Commodity Strategy Fund | 3,167,711 | 1,914,381 | 1,077,677 | 1,542,273 | (244,555) | (1,567,596) | 2,192,264 |

| Fidelity Series Emerging Markets Debt Fund | 1,099,191 | 121,215 | 102,737 | 27,963 | (5,547) | (180,467) | 931,655 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 361,867 | 18,631 | 34,610 | - | (4,283) | (36,753) | 304,852 |

| Fidelity Series Emerging Markets Fund | 1,298,074 | 200,851 | 123,747 | - | (9,200) | (286,223) | 1,079,755 |

| Fidelity Series Emerging Markets Opportunities Fund | 11,695,185 | 2,222,628 | 1,108,505 | - | (71,786) | (2,487,803) | 10,249,719 |

| Fidelity Series Floating Rate High Income Fund | 216,914 | 16,336 | 36,639 | 5,377 | (2,888) | (8,087) | 185,636 |

| Fidelity Series Government Money Market Fund 3.00% | 21,517,858 | 1,393,121 | 7,221,707 | 111,476 | - | - | 15,689,272 |

| Fidelity Series High Income Fund | 1,284,707 | 90,722 | 221,880 | 30,708 | (19,140) | (141,957) | 992,452 |

| Fidelity Series Inflation-Protected Bond Index Fund | 4,270,619 | 54,593 | 4,250,090 | 19,406 | 126,753 | (201,875) | - |

| Fidelity Series International Credit Fund | 128,486 | 1,754 | - | 1,754 | - | (19,447) | 110,793 |

| Fidelity Series International Developed Markets Bond Index Fund | 6,624,405 | 2,132,470 | 752,625 | 11,070 | (38,704) | (619,686) | 7,345,860 |

| Fidelity Series International Growth Fund | 4,235,213 | 890,734 | 531,398 | - | (64,862) | (925,216) | 3,604,471 |

| Fidelity Series International Small Cap Fund | 1,169,533 | 158,947 | 111,261 | - | (11,880) | (267,245) | 938,094 |

| Fidelity Series International Value Fund | 4,278,116 | 782,182 | 482,217 | - | (29,633) | (930,550) | 3,617,898 |

| Fidelity Series Investment Grade Bond Fund | 85,065,499 | 5,715,304 | 10,317,247 | 1,130,473 | (598,752) | (8,138,822) | 71,725,982 |

| Fidelity Series Large Cap Stock Fund | 2,723,467 | 669,373 | 472,010 | 135,657 | 21,717 | (632,617) | 2,309,930 |

| Fidelity Series Large Cap Value Index Fund | 294,561 | 45,397 | 46,257 | - | 2,474 | (51,679) | 244,496 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 7,881,047 | 1,285,658 | 755,670 | 93,613 | (50,452) | (1,715,312) | 6,645,271 |

| Fidelity Series Opportunistic Insights Fund | 1,599,533 | 388,801 | 252,898 | - | (23,104) | (339,150) | 1,373,182 |

| Fidelity Series Overseas Fund | 4,258,859 | 929,802 | 460,812 | - | (39,678) | (1,050,262) | 3,637,909 |

| Fidelity Series Real Estate Income Fund | 783,758 | 67,063 | 273,953 | 36,304 | 11,219 | (117,518) | 470,569 |

| Fidelity Series Short-Term Credit Fund | 5,389,935 | 286,261 | 1,726,385 | 34,492 | (40,432) | (80,447) | 3,828,932 |

| Fidelity Series Small Cap Opportunities Fund | 969,997 | 117,935 | 116,707 | 36,170 | (10,950) | (190,989) | 769,286 |

| Fidelity Series Stock Selector Large Cap Value Fund | 1,738,355 | 295,616 | 272,682 | - | 2,255 | (298,687) | 1,464,857 |

| Fidelity Series Value Discovery Fund | 1,770,556 | 238,393 | 257,092 | - | 12,870 | (253,141) | 1,511,586 |

| | 214,475,048 | 32,711,973 | 39,182,374 | 3,216,736 | (1,255,347) | (23,321,431) | 183,427,869 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Purchases and Sales Proceeds in the table above include the value of shares purchased or redeemed through in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of September 30, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Other Short-Term Investments | 99,314 | - | 99,314 | - |

|

| Domestic Equity Funds | 13,686,046 | 13,686,046 | - | - |

|

| International Equity Funds | 24,684,379 | 24,684,379 | - | - |

|

| Bond Funds | 125,539,240 | 125,539,240 | - | - |

|

| Short-Term Funds | 19,571,410 | 19,571,410 | - | - |

| Total Investments in Securities: | 183,580,389 | 183,481,075 | 99,314 | - |

Derivative Instruments: | | | | |

|

| Assets | | | | |

Futures Contracts | 77,380 | 77,380 | - | - |

| Total Assets | 77,380 | 77,380 | - | - |

|

| Liabilities | | | | |

Futures Contracts | (202,870) | (202,870) | - | - |

| Total Liabilities | (202,870) | (202,870) | - | - |

| Total Derivative Instruments: | (125,490) | (125,490) | - | - |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of September 30, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

Primary Risk Exposure / Derivative Type | Value |

| Asset ($) | Liability ($) |

| Equity Risk | | |

Futures Contracts (a) | 77,380 | 0 |

| Total Equity Risk | 77,380 | 0 |

| Interest Rate Risk | | |

Futures Contracts (a) | 0 | (202,870) |

| Total Interest Rate Risk | 0 | (202,870) |

| Total Value of Derivatives | 77,380 | (202,870) |

(a)Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

Fidelity Advisor Freedom® Income Fund

| Statement of Assets and Liabilities |

| | | | September 30, 2022 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | $ | | | |

Unaffiliated issuers (cost $99,263) | | $99,314 | | |

Fidelity Central Funds (cost $53,206) | | 53,206 | | |

Other affiliated issuers (cost $198,019,805) | | 183,427,869 | | |

| | | | | |

| Total Investment in Securities (cost $198,172,274) | | | $ | 183,580,389 |

| Cash | | | | 30,922 |

| Receivable for investments sold | | | | 1,538,726 |

| Receivable for fund shares sold | | | | 355,814 |

| Distributions receivable from Fidelity Central Funds | | | | 297 |

| Receivable for daily variation margin on futures contracts | | | | 377 |

Total assets | | | | 185,506,525 |

| Liabilities | | | | |

| Payable for investments purchased | | $1,412,811 | | |

| Payable for fund shares redeemed | | 411,913 | | |

| Accrued management fee | | 72,346 | | |

| Distribution and service plan fees payable | | 29,645 | | |

| Payable for daily variation margin on futures contracts | | 2,321 | | |

| Total Liabilities | | | | 1,929,036 |

| Net Assets | | | $ | 183,577,489 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 198,535,897 |

| Total accumulated earnings (loss) | | | | (14,958,408) |

| Net Assets | | | $ | 183,577,489 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($62,983,660 ÷ 6,692,087 shares) (a) | | | $ | 9.41 |

| Maximum offering price per share (100/94.25 of $9.41) | | | $ | 9.98 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($26,942,185 ÷ 2,869,323 shares) (a) | | | $ | 9.39 |

| Maximum offering price per share (100/96.50 of $9.39) | | | $ | 9.73 |

| Class C : | | | | |

Net Asset Value and offering price per share ($4,947,838 ÷ 531,004 shares) (a) | | | $ | 9.32 |

| Class I : | | | | |

Net Asset Value , offering price and redemption price per share ($68,934,954 ÷ 7,295,081 shares) | | | $ | 9.45 |

| Class Z : | | | | |

Net Asset Value , offering price and redemption price per share ($6,849,269 ÷ 725,742 shares) | | | $ | 9.44 |

| Class Z6 : | | | | |

Net Asset Value , offering price and redemption price per share ($12,919,583 ÷ 1,368,573 shares) | | | $ | 9.44 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Six months ended September 30, 2022 (Unaudited) |

| Investment Income | | | | |

| Dividends: | | | | |

| Affiliated issuers | | | $ | 3,057,438 |

| Interest | | | | 919 |

| Income from Fidelity Central Funds | | | | 1,196 |

| Total Income | | | | 3,059,553 |

| Expenses | | | | |

| Management fee | $ | 454,777 | | |

| Distribution and service plan fees | | 187,995 | | |

| Independent trustees' fees and expenses | | 345 | | |

| Total expenses before reductions | | 643,117 | | |

| Expense reductions | | (55) | | |

| Total expenses after reductions | | | | 643,062 |

| Net Investment income (loss) | | | | 2,416,491 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 2 | | |

| Affiliated issuers | | (1,255,347) | | |

| Futures contracts | | (75,504) | | |

| Capital gain distributions from underlying funds: | | | | |

| Affiliated issuers | | 159,298 | | |

| Total net realized gain (loss) | | | | (1,171,551) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 52 | | |

| Affiliated issuers | | (23,321,431) | | |

| Futures contracts | | (168,825) | | |

| Total change in net unrealized appreciation (depreciation) | | | | (23,490,204) |

| Net gain (loss) | | | | (24,661,755) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (22,245,264) |

| Statement of Changes in Net Assets |

| |

| | Six months ended September 30, 2022 (Unaudited) | | Year ended March 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 2,416,491 | $ | 5,214,786 |

| Net realized gain (loss) | | (1,171,551) | | 7,224,171 |

| Change in net unrealized appreciation (depreciation) | | (23,490,204) | | (13,960,590) |

| Net increase (decrease) in net assets resulting from operations | | (22,245,264) | | (1,521,633) |

| Distributions to shareholders | | (5,460,009) | | (12,106,656) |

| Share transactions - net increase (decrease) | | (3,291,046) | | (10,275,204) |

| Total increase (decrease) in net assets | | (30,996,319) | | (23,903,493) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 214,573,808 | | 238,477,301 |

| End of period | $ | 183,577,489 | $ | 214,573,808 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity Advisor Freedom® Income Fund Class A |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.82 | $ | 11.49 | $ | 10.50 | $ | 10.76 | $ | 11.01 | $ | 10.94 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .12 | | .24 | | .09 | | .18 | | .20 | | .15 |

| Net realized and unrealized gain (loss) | | (1.25) | | (.34) | | 1.30 | | (.06) C | | .12 | | .34 |

| Total from investment operations | | (1.13) | | (.10) | | 1.39 | | .12 | | .32 | | .49 |

| Distributions from net investment income | | (.03) | | (.23) | | (.11) | | (.18) | | (.19) | | (.15) |

| Distributions from net realized gain | | (.24) | | (.34) | | (.30) | | (.20) | | (.38) | | (.26) |

| Total distributions | | (.28) D | | (.57) | | (.40) D | | (.38) | | (.57) | | (.42) D |

| Net asset value, end of period | $ | 9.41 | $ | 10.82 | $ | 11.49 | $ | 10.50 | $ | 10.76 | $ | 11.01 |

Total Return E,F,G | | (10.64)% | | (1.04)% | | 13.41% | | 1.04% C | | 3.14% | | 4.47% |

Ratios to Average Net Assets B,H,I | | | | | | | | | | | | |

| Expenses before reductions | | .72% J | | .72% | | .72% | | .72% | | .71% K | | .63% |

| Expenses net of fee waivers, if any | | .72% J | | .72% | | .72% | | .72% | | .71% K | | .63% |

| Expenses net of all reductions | | .72% J | | .72% | | .72% | | .72% | | .71% K | | .63% |

| Net investment income (loss) | | 2.35% J | | 2.11% | | .80% | | 1.64% | | 1.84% | | 1.38% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 62,984 | $ | 75,687 | $ | 73,935 | $ | 61,807 | $ | 69,817 | $ | 76,141 |

Portfolio turnover rate L | | 33% J | | 47% | | 29% | | 25% | | 36% | | 21% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been .93%.

D Total distributions per share do not sum due to rounding.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized

K On certain classes, the size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Freedom® Income Fund Class M |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.79 | $ | 11.47 | $ | 10.49 | $ | 10.74 | $ | 11.00 | $ | 10.93 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .11 | | .21 | | .06 | | .15 | | .17 | | .13 |

| Net realized and unrealized gain (loss) | | (1.24) | | (.34) | | 1.30 | | (.04) C | | .12 | | .33 |

| Total from investment operations | | (1.13) | | (.13) | | 1.36 | | .11 | | .29 | | .46 |

| Distributions from net investment income | | (.02) | | (.21) | | (.08) | | (.16) | | (.17) | | (.13) |

| Distributions from net realized gain | | (.24) | | (.34) | | (.30) | | (.20) | | (.38) | | (.26) |

| Total distributions | | (.27) D | | (.55) | | (.38) | | (.36) | | (.55) | | (.39) |

| Net asset value, end of period | $ | 9.39 | $ | 10.79 | $ | 11.47 | $ | 10.49 | $ | 10.74 | $ | 11.00 |

Total Return E,F,G | | (10.68)% | | (1.31)% | | 13.06% | | .90% C | | 2.78% | | 4.22% |

Ratios to Average Net Assets B,H,I | | | | | | | | | | | | |

| Expenses before reductions | | .97% J | | .97% | | .96% K | | .97% | | .96% K | | .89% |

| Expenses net of fee waivers, if any | | .97% J | | .97% | | .96% K | | .97% | | .96% K | | .89% |

| Expenses net of all reductions | | .97% J | | .97% | | .96% K | | .97% | | .96% K | | .89% |

| Net investment income (loss) | | 2.10% J | | 1.86% | | .55% | | 1.39% | | 1.59% | | 1.13% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 26,942 | $ | 31,925 | $ | 36,006 | $ | 36,147 | $ | 38,059 | $ | 38,204 |

Portfolio turnover rate L | | 33% J | | 47% | | 29% | | 25% | | 36% | | 21% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been .79%.

D Total distributions per share do not sum due to rounding.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized

K On certain classes, the size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Freedom® Income Fund Class C |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.72 | $ | 11.43 | $ | 10.47 | $ | 10.73 | $ | 10.98 | $ | 10.91 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .08 | | .15 | | .01 | | .10 | | .12 | | .07 |

| Net realized and unrealized gain (loss) | | (1.23) | | (.33) | | 1.29 | | (.06) C | | .12 | | .33 |

| Total from investment operations | | (1.15) | | (.18) | | 1.30 | | .04 | | .24 | | .40 |

| Distributions from net investment income | | - D | | (.20) | | (.04) | | (.10) | | (.11) | | (.07) |

| Distributions from net realized gain | | (.24) | | (.34) | | (.30) | | (.20) | | (.38) | | (.26) |

| Total distributions | | (.25) E | | (.53) E | | (.34) | | (.30) | | (.49) | | (.33) |

| Net asset value, end of period | $ | 9.32 | $ | 10.72 | $ | 11.43 | $ | 10.47 | $ | 10.73 | $ | 10.98 |

Total Return F,G,H | | (10.91)% | | (1.75)% | | 12.49% | | .30% C | | 2.35% | | 3.69% |

Ratios to Average Net Assets B,I,J | | | | | | | | | | | | |

| Expenses before reductions | | 1.47% K | | 1.47% | | 1.47% | | 1.46% L | | 1.46% L | | 1.39% |

| Expenses net of fee waivers, if any | | 1.47% K | | 1.47% | | 1.47% | | 1.46% L | | 1.46% B,L | | 1.39% |

| Expenses net of all reductions | | 1.47% K | | 1.47% | | 1.46% | | 1.46% L | | 1.46% L | | 1.39% |

| Net investment income (loss) | | 1.60% K | | 1.36% | | .05% | | .89% | | 1.09% | | .63% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 4,948 | $ | 6,378 | $ | 8,255 | $ | 7,918 | $ | 8,915 | $ | 13,727 |

Portfolio turnover rate M | | 33% K | | 47% | | 29% | | 25% | | 36% | | 21% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been .19%.

D Amount represents less than $.005 per share.

E Total distributions per share do not sum due to rounding.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Total returns do not include the effect of the contingent deferred sales charge.

I Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

J Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

K Annualized

L On certain classes, the size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

M Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Freedom® Income Fund Class I |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.86 | $ | 11.53 | $ | 10.53 | $ | 10.79 | $ | 11.05 | $ | 10.98 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .13 | | .27 | | .12 | | .21 | | .23 | | .18 |

| Net realized and unrealized gain (loss) | | (1.25) | | (.34) | | 1.31 | | (.06) C | | .11 | | .33 |

| Total from investment operations | | (1.12) | | (.07) | | 1.43 | | .15 | | .34 | | .51 |

| Distributions from net investment income | | (.05) | | (.26) | | (.13) | | (.21) | | (.22) | | (.18) |

| Distributions from net realized gain | | (.24) | | (.34) | | (.30) | | (.20) | | (.38) | | (.26) |

| Total distributions | | (.29) | | (.60) | | (.43) | | (.41) | | (.60) | | (.44) |

| Net asset value, end of period | $ | 9.45 | $ | 10.86 | $ | 11.53 | $ | 10.53 | $ | 10.79 | $ | 11.05 |

Total Return D,E | | (10.48)% | | (.80)% | | 13.72% | | 1.30% C | | 3.30% | | 4.70% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | .47% H | | .46% I | | .46% I | | .47% | | .46% I | | .39% |

| Expenses net of fee waivers, if any | | .47% H | | .46% I | | .46% I | | .47% | | .46% I | | .39% |

| Expenses net of all reductions | | .47% H | | .46% I | | .46% I | | .47% | | .46% I | | .39% |

| Net investment income (loss) | | 2.60% H | | 2.36% | | 1.05% | | 1.89% | | 2.09% | | 1.63% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 68,935 | $ | 79,536 | $ | 87,775 | $ | 83,215 | $ | 82,975 | $ | 83,723 |

Portfolio turnover rate J | | 33% H | | 47% | | 29% | | 25% | | 36% | | 21% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 1.19%.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I On certain classes, the size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Freedom® Income Fund Class Z |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 A |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.85 | $ | 11.52 | $ | 10.53 | $ | 10.79 | $ | 10.91 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) B,C | | .13 | | .28 | | .12 | | .21 | | .24 |

| Net realized and unrealized gain (loss) | | (1.24) | | (.34) | | 1.31 | | (.05) D | | .01 |

| Total from investment operations | | (1.11) | | (.06) | | 1.43 | | .16 | | .25 |

| Distributions from net investment income | | (.05) | | (.27) | | (.14) | | (.22) | | (.15) |

| Distributions from net realized gain | | (.24) | | (.34) | | (.30) | | (.20) | | (.22) |

| Total distributions | | (.30) E | | (.61) | | (.44) | | (.42) | | (.37) |

| Net asset value, end of period | $ | 9.44 | $ | 10.85 | $ | 11.52 | $ | 10.53 | $ | 10.79 |

Total Return F,G | | (10.44)% | | (.75)% | | 13.72% | | 1.36% D | | 2.47% |

Ratios to Average Net Assets C,H,I | | | | | | | | | | |

| Expenses before reductions | | .41% J,K | | .41% J | | .42% | | .42% | | .42% K |

| Expenses net of fee waivers, if any | | .41% J,K | | .41% J | | .42% | | .42% | | .42% K |

| Expenses net of all reductions | | .41% J,K | | .41% J | | .42% | | .42% | | .42% K |

| Net investment income (loss) | | 2.65% K | | 2.41% | | 1.10% | | 1.94% | | 4.60% K |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 6,849 | $ | 7,064 | $ | 8,919 | $ | 3,128 | $ | 765 |

Portfolio turnover rate L | | 33% K | | 47% | | 29% | | 25% | | 36% |

A For the period October 2, 2018 (commencement of sale of shares) through March 31, 2019.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

D Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 1.25%.

E Total distributions per share do not sum due to rounding.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J On certain classes, the size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

K Annualized

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Freedom® Income Fund Class Z6 |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 A |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.85 | $ | 11.52 | $ | 10.52 | $ | 10.78 | $ | 11.04 | $ | 11.09 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) B,C | | .14 | | .28 | | .13 | | .22 | | .23 | | .27 |

| Net realized and unrealized gain (loss) | | (1.25) | | (.34) | | 1.31 | | (.06) D | | .13 | | .03 |

| Total from investment operations | | (1.11) | | (.06) | | 1.44 | | .16 | | .36 | | .30 |

| Distributions from net investment income | | (.05) | | (.27) | | (.14) | | (.22) | | (.24) | | (.16) |

| Distributions from net realized gain | | (.24) | | (.34) | | (.30) | | (.20) | | (.38) | | (.19) |

| Total distributions | | (.30) E | | (.61) | | (.44) | | (.42) | | (.62) | | (.35) |

| Net asset value, end of period | $ | 9.44 | $ | 10.85 | $ | 11.52 | $ | 10.52 | $ | 10.78 | $ | 11.04 |

Total Return F,G | | (10.44)% | | (.71)% | | 13.87% | | 1.38% D | | 3.48% | | 2.69% |

Ratios to Average Net Assets C,H,I | | | | | | | | | | | | |

| Expenses before reductions | | .37% J,K | | .36% K | | .37% | | .36% K | | .37% | | .37% J |

| Expenses net of fee waivers, if any | | .37% J,K | | .36% K | | .37% | | .36% K | | .37% | | .37% J |

| Expenses net of all reductions | | .36% J,K | | .36% K | | .37% | | .36% K | | .37% | | .37% J |

| Net investment income (loss) | | 2.70% J | | 2.46% | | 1.15% | | 1.99% | | 2.19% | | 2.92% J |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 12,920 | $ | 13,984 | $ | 23,587 | $ | 21,248 | $ | 25,022 | $ | 1,693 |

Portfolio turnover rate L | | 33% J | | 47% | | 29% | | 25% | | 36% | | 21% |

A For the period June 6, 2017 (commencement of sale of shares) through March 31, 2018.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

D Amount includes a reimbursement from the investment adviser for an operational error which amounted to less than $.01 per share. Excluding this reimbursement, the total return would have been 1.27%.

E Total distributions per share do not sum due to rounding.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

J Annualized

K On certain classes, the size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

The information in the following table is based on the direct Investments of the Fund.

Top Holdings (% of Fund's net assets) |

| |

| Fidelity Series Investment Grade Bond Fund | 38.4 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 18.8 | |

| Fidelity Series Government Money Market Fund 3.00% | 8.2 | |

| Fidelity Series Emerging Markets Opportunities Fund | 5.8 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 3.7 | |

| Fidelity Series Overseas Fund | 2.1 | |

| Fidelity Series International Value Fund | 2.1 | |

| Fidelity Series International Growth Fund | 2.1 | |

| Fidelity Series Short-Term Credit Fund | 2.0 | |

| | 87.2 | |

| |

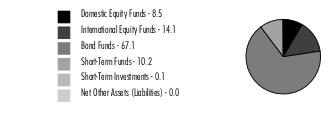

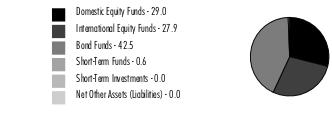

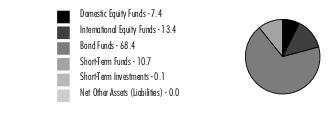

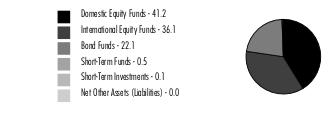

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

|

Domestic Equity Funds category includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments.

Fidelity Advisor Freedom® 2005 Fund

Showing Percentage of Net Assets

| U.S. Treasury Obligations - 0.1% |

| | | Principal Amount (a) | Value ($) |

U.S. Treasury Bills, yield at date of purchase 3.15% to 3.29% 12/15/22 to 12/29/22 (b) (Cost $59,587) | | 60,000 | 59,623 |

| | | | |

| Domestic Equity Funds - 8.5% |

| | | Shares | Value ($) |

| Fidelity Advisor Series Equity Growth Fund (c) | | 89,366 | 1,085,794 |

| Fidelity Advisor Series Growth Opportunities Fund (c) | | 87,105 | 763,914 |

| Fidelity Advisor Series Small Cap Fund (c) | | 44,801 | 469,069 |

| Fidelity Series All-Sector Equity Fund (c) | | 49,673 | 426,194 |

| Fidelity Series Commodity Strategy Fund (c) | | 649,925 | 1,358,344 |

| Fidelity Series Large Cap Stock Fund (c) | | 112,404 | 1,660,214 |

| Fidelity Series Large Cap Value Index Fund (c) | | 14,019 | 178,320 |

| Fidelity Series Opportunistic Insights Fund (c) | | 69,446 | 986,821 |

| Fidelity Series Small Cap Opportunities Fund (c) | | 51,981 | 560,354 |

| Fidelity Series Stock Selector Large Cap Value Fund (c) | | 94,245 | 1,052,719 |

| Fidelity Series Value Discovery Fund (c) | | 79,127 | 1,089,584 |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $8,888,553) | | | 9,631,327 |

| | | | |

| International Equity Funds - 14.1% |

| | | Shares | Value ($) |

| Fidelity Series Canada Fund (c) | | 83,081 | 1,030,207 |

| Fidelity Series Emerging Markets Fund (c) | | 95,542 | 691,727 |

| Fidelity Series Emerging Markets Opportunities Fund (c) | | 452,450 | 6,569,572 |

| Fidelity Series International Growth Fund (c) | | 186,026 | 2,384,859 |

| Fidelity Series International Small Cap Fund (c) | | 45,341 | 620,261 |

| Fidelity Series International Value Fund (c) | | 278,669 | 2,393,765 |

| Fidelity Series Overseas Fund (c) | | 252,584 | 2,407,125 |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $15,811,801) | | | 16,097,516 |

| | | | |

| Bond Funds - 67.1% |

| | | Shares | Value ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (c) | | 2,226,968 | 21,490,240 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (c) | | 87,128 | 696,156 |

| Fidelity Series Emerging Markets Debt Fund (c) | | 83,985 | 576,135 |

| Fidelity Series Emerging Markets Debt Local Currency Fund (c) | | 23,814 | 189,801 |

| Fidelity Series Floating Rate High Income Fund (c) | | 13,251 | 115,285 |

| Fidelity Series High Income Fund (c) | | 78,217 | 616,348 |

| Fidelity Series International Credit Fund (c) | | 13,379 | 105,296 |

| Fidelity Series International Developed Markets Bond Index Fund (c) | | 530,978 | 4,523,934 |

| Fidelity Series Investment Grade Bond Fund (c) | | 4,480,613 | 43,730,781 |

| Fidelity Series Long-Term Treasury Bond Index Fund (c) | | 700,152 | 4,179,906 |

| Fidelity Series Real Estate Income Fund (c) | | 30,674 | 292,018 |

| TOTAL BOND FUNDS (Cost $84,950,634) | | | 76,515,900 |

| | | | |

| Short-Term Funds - 10.2% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 3.10% (d) | | 81,922 | 81,939 |

| Fidelity Series Government Money Market Fund 3.00% (c)(e) | | 9,322,833 | 9,322,833 |

| Fidelity Series Short-Term Credit Fund (c) | | 239,459 | 2,270,068 |

| TOTAL SHORT-TERM FUNDS (Cost $11,779,176) | | | 11,674,840 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $121,489,751) | 113,979,206 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (1,815) |

| NET ASSETS - 100.0% | 113,977,391 |

| | |

| Futures Contracts |

| | Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) |

| Purchased | | | | | |

| | | | | | |

| Treasury Contracts | | | | | |

| CBOT 10-Year U.S. Treasury Note Contracts (United States) | 19 | Dec 2022 | 2,129,188 | (130,998) | (130,998) |

| CBOT Ultra Long Term U.S. Treasury Bond Contracts (United States) | 2 | Dec 2022 | 274,000 | (2,926) | (2,926) |

| | | | | | |

| TOTAL PURCHASED | | | | | (133,924) |

| | | | | | |

| Sold | | | | | |

| | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini S&P 500 Index Contracts (United States) | 3 | Dec 2022 | 540,225 | 11,857 | 11,857 |

| ICE E-mini MSCI EAFE Index Contracts (United States) | 5 | Dec 2022 | 415,150 | 35,096 | 35,096 |

| ICE E-mini MSCI Emerging Markets Index Contracts (United States) | 3 | Dec 2022 | 130,725 | 70 | 70 |

| | | | | | |

| TOTAL SOLD | | | | | 47,023 |

| | | | | | |

| TOTAL FUTURES CONTRACTS | | | | | (86,901) |

| The notional amount of futures purchased as a percentage of Net Assets is 2.1% |

| The notional amount of futures sold as a percentage of Net Assets is 1.0% |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $59,623. |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (e) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | %ownership, end of period |

| Fidelity Cash Central Fund 3.10% | 55,815 | 629,396 | 603,272 | 1,128 | - | - | 81,939 | 0.0% |

| Total | 55,815 | 629,396 | 603,272 | 1,128 | - | - | 81,939 | |

| | | | | | | | | |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Affiliated Underlying Funds

Fiscal year to date information regarding the Fund's investments in affiliated Underlying Funds is presented below. Exchanges between classes of the same affiliated Underlying Funds may occur. If an Underlying Funds changes its name, the name presented below is the name in effect at period end.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Advisor Series Equity Growth Fund | 1,435,837 | 223,414 | 282,107 | - | (16,126) | (275,224) | 1,085,794 |

| Fidelity Advisor Series Growth Opportunities Fund | 984,605 | 271,778 | 217,234 | - | (27,320) | (247,915) | 763,914 |

| Fidelity Advisor Series Small Cap Fund | 651,729 | 74,802 | 142,942 | - | (10,834) | (103,686) | 469,069 |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 20,907,595 | 5,530,599 | 4,066,421 | - | (48,959) | (832,574) | 21,490,240 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1,031,370 | 1,090,884 | 1,265,089 | - | (74,303) | (86,706) | 696,156 |

| Fidelity Series All-Sector Equity Fund | 615,810 | 34,338 | 106,039 | - | (8,193) | (109,722) | 426,194 |

| Fidelity Series Canada Fund | 1,362,090 | 106,948 | 179,279 | - | 2,963 | (262,515) | 1,030,207 |

| Fidelity Series Commodity Strategy Fund | 2,118,309 | 1,161,956 | 802,050 | 961,240 | (126,413) | (993,458) | 1,358,344 |

| Fidelity Series Emerging Markets Debt Fund | 731,304 | 63,604 | 100,752 | 17,727 | (18,063) | (99,958) | 576,135 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 241,705 | 7,561 | 33,180 | - | (6,006) | (20,279) | 189,801 |

| Fidelity Series Emerging Markets Fund | 908,970 | 98,964 | 120,715 | - | (8,338) | (187,154) | 691,727 |

| Fidelity Series Emerging Markets Opportunities Fund | 8,189,517 | 1,158,990 | 1,085,346 | - | (91,631) | (1,601,958) | 6,569,572 |

| Fidelity Series Floating Rate High Income Fund | 145,049 | 7,873 | 30,612 | 3,425 | (1,232) | (5,793) | 115,285 |

| Fidelity Series Government Money Market Fund 3.00% | 13,492,074 | 751,099 | 4,920,340 | 66,605 | - | - | 9,322,833 |

| Fidelity Series High Income Fund | 859,033 | 44,492 | 184,513 | 19,664 | (7,013) | (95,651) | 616,348 |

| Fidelity Series Inflation-Protected Bond Index Fund | 2,727,543 | 31,496 | 2,709,283 | 14,159 | 69,545 | (119,301) | - |

| Fidelity Series International Credit Fund | 122,111 | 1,667 | - | 1,667 | - | (18,482) | 105,296 |

| Fidelity Series International Developed Markets Bond Index Fund | 4,388,303 | 1,273,324 | 718,003 | 7,026 | (36,237) | (383,453) | 4,523,934 |

| Fidelity Series International Growth Fund | 3,109,470 | 471,654 | 511,790 | - | (72,298) | (612,177) | 2,384,859 |

| Fidelity Series International Small Cap Fund | 852,805 | 86,557 | 126,824 | - | (34,301) | (157,976) | 620,261 |

| Fidelity Series International Value Fund | 3,141,037 | 400,685 | 493,530 | - | (31,695) | (622,732) | 2,393,765 |

| Fidelity Series Investment Grade Bond Fund | 55,392,046 | 2,768,543 | 8,954,415 | 703,880 | (576,067) | (4,899,326) | 43,730,781 |

| Fidelity Series Large Cap Stock Fund | 2,259,110 | 362,722 | 495,008 | 100,504 | 79,946 | (546,556) | 1,660,214 |

| Fidelity Series Large Cap Value Index Fund | 244,343 | 21,100 | 49,010 | - | 9,029 | (47,142) | 178,320 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5,351,573 | 708,726 | 724,014 | 60,602 | (61,472) | (1,094,907) | 4,179,906 |

| Fidelity Series Opportunistic Insights Fund | 1,326,831 | 209,675 | 265,668 | - | (20,232) | (263,785) | 986,821 |

| Fidelity Series Overseas Fund | 3,126,870 | 498,202 | 463,976 | - | (54,940) | (699,031) | 2,407,125 |

| Fidelity Series Real Estate Income Fund | 522,278 | 33,368 | 197,563 | 21,836 | 11,181 | (77,246) | 292,018 |

| Fidelity Series Short-Term Credit Fund | 3,379,362 | 138,620 | 1,175,053 | 20,809 | (27,290) | (45,571) | 2,270,068 |

| Fidelity Series Small Cap Opportunities Fund | 804,665 | 52,830 | 140,884 | 26,398 | (8,038) | (148,219) | 560,354 |

| Fidelity Series Stock Selector Large Cap Value Fund | 1,441,992 | 150,705 | 313,762 | - | 28,983 | (255,199) | 1,052,719 |

| Fidelity Series Value Discovery Fund | 1,468,683 | 124,023 | 320,635 | - | 60,874 | (243,361) | 1,089,584 |

| | 143,334,019 | 17,961,199 | 31,196,037 | 2,025,542 | (1,104,480) | (15,157,057) | 113,837,644 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Purchases and Sales Proceeds in the table above include the value of shares purchased or redeemed through in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of September 30, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Other Short-Term Investments | 59,623 | - | 59,623 | - |

|

| Domestic Equity Funds | 9,631,327 | 9,631,327 | - | - |

|

| International Equity Funds | 16,097,516 | 16,097,516 | - | - |

|

| Bond Funds | 76,515,900 | 76,515,900 | - | - |

|

| Short-Term Funds | 11,674,840 | 11,674,840 | - | - |

| Total Investments in Securities: | 113,979,206 | 113,919,583 | 59,623 | - |

Derivative Instruments: | | | | |

|

| Assets | | | | |

Futures Contracts | 47,023 | 47,023 | - | - |

| Total Assets | 47,023 | 47,023 | - | - |

|

| Liabilities | | | | |

Futures Contracts | (133,924) | (133,924) | - | - |

| Total Liabilities | (133,924) | (133,924) | - | - |

| Total Derivative Instruments: | (86,901) | (86,901) | - | - |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of September 30, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

Primary Risk Exposure / Derivative Type | Value |

| Asset ($) | Liability ($) |

| Equity Risk | | |

Futures Contracts (a) | 47,023 | 0 |

| Total Equity Risk | 47,023 | 0 |

| Interest Rate Risk | | |

Futures Contracts (a) | 0 | (133,924) |

| Total Interest Rate Risk | 0 | (133,924) |

| Total Value of Derivatives | 47,023 | (133,924) |

(a)Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

Fidelity Advisor Freedom® 2005 Fund

| Statement of Assets and Liabilities |

| | | | September 30, 2022 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | $ | | | |

Unaffiliated issuers (cost $59,587) | | $59,623 | | |

Fidelity Central Funds (cost $81,939) | | 81,939 | | |

Other affiliated issuers (cost $121,348,225) | | 113,837,644 | | |

| | | | | |

| Total Investment in Securities (cost $121,489,751) | | | $ | 113,979,206 |

| Cash | | | | 21,697 |

| Receivable for investments sold | | | | 955,222 |

| Receivable for fund shares sold | | | | 56,378 |

| Distributions receivable from Fidelity Central Funds | | | | 284 |

| Receivable for daily variation margin on futures contracts | | | | 108 |

Total assets | | | | 115,012,895 |

| Liabilities | | | | |

| Payable for investments purchased | | 740,731 | | |

| Payable for fund shares redeemed | | 228,937 | | |

| Accrued management fee | | 45,102 | | |

| Distribution and service plan fees payable | | 18,889 | | |

| Payable for daily variation margin on futures contracts | | 1,845 | | |

| Total Liabilities | | | | 1,035,504 |

| Net Assets | | | $ | 113,977,391 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 121,615,591 |

| Total accumulated earnings (loss) | | | | (7,638,200) |

| Net Assets | | | $ | 113,977,391 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($45,587,164 ÷ 4,759,846 shares) (a) | | | $ | 9.58 |

| Maximum offering price per share (100/94.25 of $9.58) | | | $ | 10.16 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($19,143,921 ÷ 2,004,421 shares) (a) | | | $ | 9.55 |

| Maximum offering price per share (100/96.50 of $9.55) | | | $ | 9.90 |

| Class C : | | | | |

Net Asset Value and offering price per share ($748,584 ÷ 78,234 shares) (a) | | | $ | 9.57 |

| Class I : | | | | |

Net Asset Value , offering price and redemption price per share ($36,121,877 ÷ 3,738,472 shares) | | | $ | 9.66 |

| Class Z : | | | | |

Net Asset Value , offering price and redemption price per share ($6,080,283 ÷ 633,784 shares) | | | $ | 9.59 |

| Class Z6 : | | | | |

Net Asset Value , offering price and redemption price per share ($6,295,562 ÷ 654,544 shares) | | | $ | 9.62 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Six months ended September 30, 2022 (Unaudited) |

| Investment Income | | | | |

| Dividends: | | | | |

| Affiliated issuers | | | $ | 1,910,091 |

| Interest | | | | 553 |

| Income from Fidelity Central Funds | | | | 1,128 |

| Total Income | | | | 1,911,772 |

| Expenses | | | | |

| Management fee | $ | 291,606 | | |

| Distribution and service plan fees | | 122,621 | | |

| Independent trustees' fees and expenses | | 223 | | |

| Total expenses before reductions | | 414,450 | | |

| Expense reductions | | (61) | | |

| Total expenses after reductions | | | | 414,389 |

| Net Investment income (loss) | | | | 1,497,383 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 8 | | |

| Affiliated issuers | | (1,104,480) | | |

| Futures contracts | | (22,239) | | |

| Capital gain distributions from underlying funds: | | | | |

| Affiliated issuers | | 115,451 | | |

| Total net realized gain (loss) | | | | (1,011,260) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 37 | | |

| Affiliated issuers | | (15,157,057) | | |

| Futures contracts | | (128,070) | | |

| Total change in net unrealized appreciation (depreciation) | | | | (15,285,090) |

| Net gain (loss) | | | | (16,296,350) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (14,798,967) |

| Statement of Changes in Net Assets |

| |

| | Six months ended September 30, 2022 (Unaudited) | | Year ended March 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 1,497,383 | $ | 3,331,846 |

| Net realized gain (loss) | | (1,011,260) | | 6,843,136 |

| Change in net unrealized appreciation (depreciation) | | (15,285,090) | | (10,720,439) |

| Net increase (decrease) in net assets resulting from operations | | (14,798,967) | | (545,457) |

| Distributions to shareholders | | (3,733,968) | | (10,944,435) |

| Share transactions - net increase (decrease) | | (10,916,771) | | (7,545,903) |

| Total increase (decrease) in net assets | | (29,449,706) | | (19,035,795) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 143,427,097 | | 162,462,892 |

| End of period | $ | 113,977,391 | $ | 143,427,097 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity Advisor Freedom® 2005 Fund Class A |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 11.07 | $ | 11.99 | $ | 10.85 | $ | 11.36 | $ | 11.92 | $ | 11.84 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .12 | | .25 | | .10 | | .19 | | .21 | | .16 |

| Net realized and unrealized gain (loss) | | (1.31) | | (.33) | | 1.64 | | (.16) | | .14 | | .53 |

| Total from investment operations | | (1.19) | | (.08) | | 1.74 | | .03 | | .35 | | .69 |

| Distributions from net investment income | | (.01) | | (.26) | | (.11) | | (.20) | | (.22) | | (.17) |

| Distributions from net realized gain | | (.29) | | (.59) | | (.49) | | (.34) | | (.68) | | (.44) |

| Total distributions | | (.30) | | (.84) C | | (.60) | | (.54) | | (.91) C | | (.61) |

| Net asset value, end of period | $ | 9.58 | $ | 11.07 | $ | 11.99 | $ | 10.85 | $ | 11.36 | $ | 11.92 |

Total Return D,E,F | | (10.96)% | | (.90)% | | 16.31% | | .04% | | 3.24% | | 5.87% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | | | |

| Expenses before reductions | | .72% I | | .72% | | .72% | | .72% | | .73% | | .66% |

| Expenses net of fee waivers, if any | | .72% I | | .72% | | .72% | | .72% | | .73% | | .66% |

| Expenses net of all reductions | | .72% I | | .72% | | .71% | | .72% | | .73% | | .66% |

| Net investment income (loss) | | 2.29% I | | 2.07% | | .81% | | 1.62% | | 1.80% | | 1.34% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 45,587 | $ | 64,023 | $ | 76,060 | $ | 74,103 | $ | 86,981 | $ | 101,642 |

Portfolio turnover rate J | | 28% I | | 45% | | 31% | | 28% | | 28% | | 20% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Freedom® 2005 Fund Class M |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 11.05 | $ | 11.97 | $ | 10.83 | $ | 11.35 | $ | 11.91 | $ | 11.83 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .10 | | .22 | | .07 | | .16 | | .18 | | .13 |

| Net realized and unrealized gain (loss) | | (1.31) | | (.32) | | 1.64 | | (.17) | | .14 | | .53 |

| Total from investment operations | | (1.21) | | (.10) | | 1.71 | | (.01) | | .32 | | .66 |

| Distributions from net investment income | | - C | | (.23) | | (.08) | | (.17) | | (.19) | | (.14) |

| Distributions from net realized gain | | (.29) | | (.59) | | (.49) | | (.34) | | (.68) | | (.44) |

| Total distributions | | (.29) | | (.82) | | (.57) | | (.51) | | (.88) D | | (.58) |

| Net asset value, end of period | $ | 9.55 | $ | 11.05 | $ | 11.97 | $ | 10.83 | $ | 11.35 | $ | 11.91 |

Total Return E,F,G | | (11.11)% | | (1.13)% | | 16.06% | | (.31)% | | 2.98% | | 5.64% |

Ratios to Average Net Assets B,H,I | | | | | | | | | | | | |

| Expenses before reductions | | .97% J | | .96% K | | .97% | | .97% | | .98% | | .91% |

| Expenses net of fee waivers, if any | | .97% J | | .96% K | | .97% | | .97% | | .98% | | .91% |

| Expenses net of all reductions | | .97% J | | .96% K | | .97% | | .97% | | .98% | | .91% |

| Net investment income (loss) | | 2.04% J | | 1.82% | | .56% | | 1.37% | | 1.55% | | 1.08% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 19,144 | $ | 20,760 | $ | 21,606 | $ | 22,480 | $ | 24,132 | $ | 25,730 |

Portfolio turnover rate L | | 28% J | | 45% | | 31% | | 28% | | 28% | | 20% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Amount represents less than $.005 per share.

D Total distributions per share do not sum due to rounding.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized

K On certain classes, the size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Freedom® 2005 Fund Class C |

| |

| | Six months ended (Unaudited) September 30, 2022 | | Years ended March 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 11.09 | $ | 11.99 | $ | 10.85 | $ | 11.35 | $ | 11.91 | $ | 11.81 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .08 | | .16 | | .01 | | .10 | | .12 | | .07 |

| Net realized and unrealized gain (loss) | | (1.32) | | (.32) | | 1.64 | | (.16) | | .13 | | .54 |

| Total from investment operations | | (1.24) | | (.16) | | 1.65 | | (.06) | | .25 | | .61 |

| Distributions from net investment income | | - | | (.16) | | (.02) | | (.10) | | (.12) | | (.07) |

| Distributions from net realized gain | | (.28) | | (.59) | | (.49) | | (.34) | | (.68) | | (.44) |

| Total distributions | | (.28) | | (.74) C | | (.51) | | (.44) | | (.81) C | | (.51) |

| Net asset value, end of period | $ | 9.57 | $ | 11.09 | $ | 11.99 | $ | 10.85 | $ | 11.35 | $ | 11.91 |

Total Return D,E,F | | (11.34)% | | (1.55)% | | 15.42% | | (.70)% | | 2.35% | | 5.21% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | | | |

| Expenses before reductions | | 1.47% I | | 1.46% J | | 1.47% | | 1.47% | | 1.48% | | 1.41% |

| Expenses net of fee waivers, if any | | 1.47% I | | 1.46% J | | 1.47% | | 1.47% | | 1.48% | | 1.41% |

| Expenses net of all reductions | | 1.47% I | | 1.46% J | | 1.47% | | 1.47% | | 1.48% | | 1.41% |

| Net investment income (loss) | | 1.54% I | | 1.32% | | .06% | | .87% | | 1.05% | | .58% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 749 | $ | 1,051 | $ | 1,360 | $ | 1,642 | $ | 2,302 | $ | 5,867 |

Portfolio turnover rate K | | 28% I | | 45% | | 31% | | 28% | | 28% | | 20% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized