Searchable text section of graphics shown above

Enbridge Energy Partners

[LOGO]

Dan C. Tutcher

President, Enbridge Energy Partners

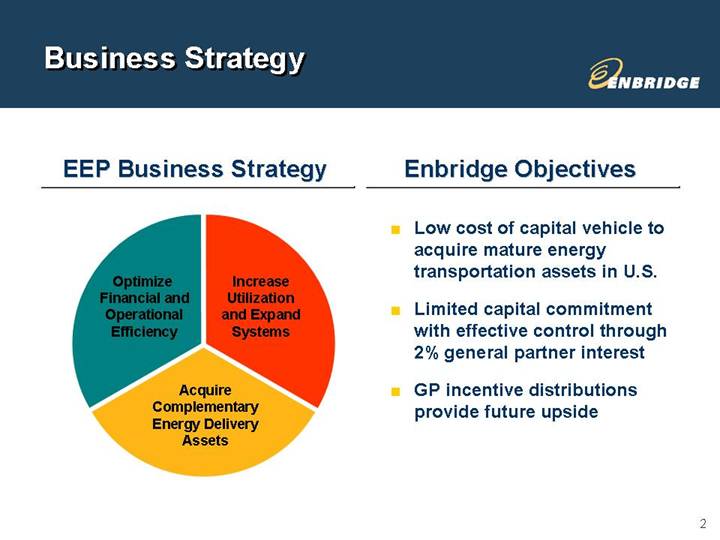

Business Strategy

EEP Business Strategy | | Enbridge Objectives |

| | |

[CHART] | | • Low cost of capital vehicle to acquire mature energy transportation assets in U.S. |

| |

| • Limited capital commitment with effective control through 2% general partner interest |

| |

| • GP incentive distributions provide future upside |

2

Investment in Growth Opportunities

• Disciplined Acquisition Program Spawns Additional Acquisitive and Organic Growth Opportunities

[CHART]

Note: Acquisitions shown as of date announced.

3

Spawning Growth

[GRAPHIC]

4

Spawning Growth:

Natural Gas Example

[GRAPHIC]

| ETX | NETX | | |

| | | ETX Transmission | |

| ANADARKO | ZYBACH | | |

PRODUCERS | | | | MARKETS |

| PALO DURO | | | |

| | | | |

| NTX1 | NTX2 | | |

| | | | |

| | NTX Link | | |

| | | | | |

Abbreviations: East Texas (ETX), Northeast Texas (NETX), North Texas (NTX)

5

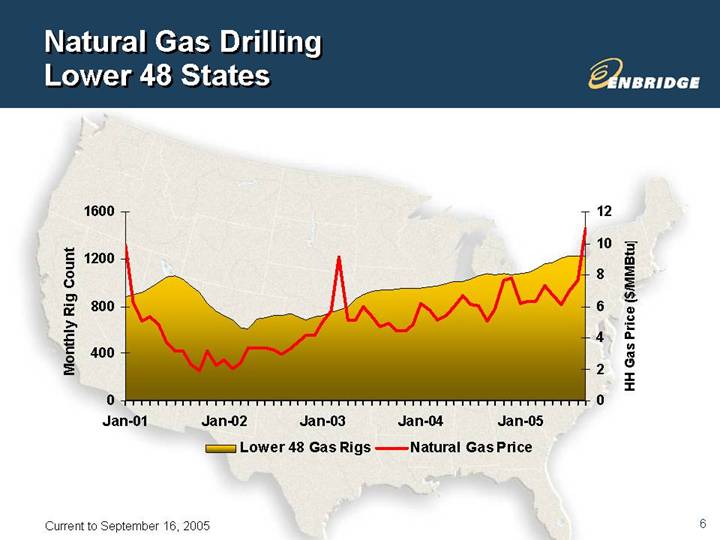

Natural Gas Drilling

Lower 48 States

[CHART]

Current to September 16, 2005

6

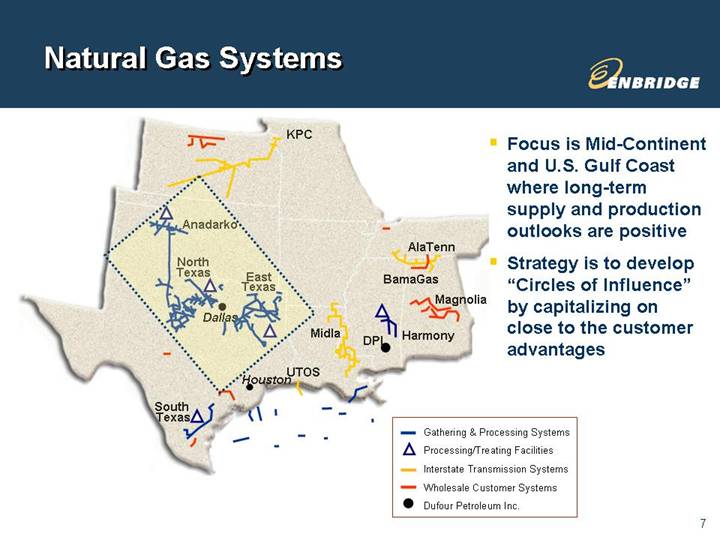

Natural Gas Systems

| | • Focus is Mid-Continent and U.S. Gulf Coast where long-term supply and production outlooks are positive |

[GRAPHIC] | | |

| | • Strategy is to develop “Circles of Influence” by capitalizing on close to the customer advantages |

7

Natural Gas

Access to Multiple Markets

[GRAPHIC]

8

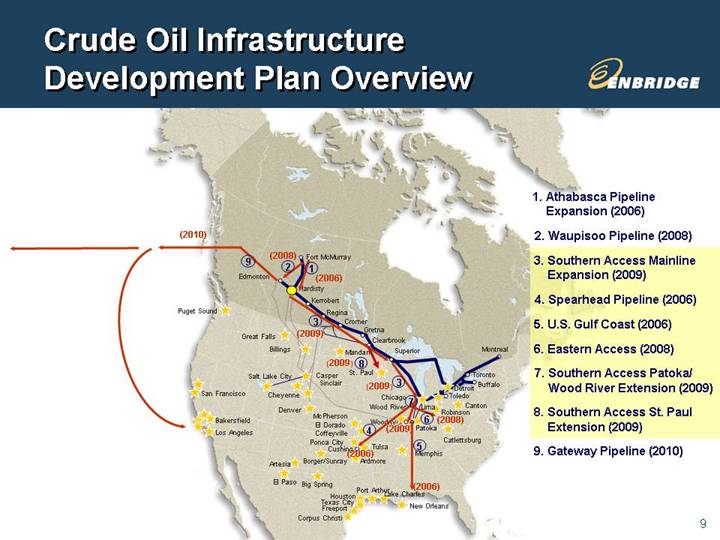

Crude Oil Infrastructure

Development Plan Overview

[GRAPHIC] | 1. Athabasca Pipeline Expansion (2006) |

|

2. Waupisoo Pipeline (2008) |

|

3. Southern Access Mainline Expansion (2009) |

|

4. Spearhead Pipeline (2006) |

|

5. U.S. Gulf Coast (2006) |

|

6. Eastern Access (2008) |

|

7. Southern Access Patoka/ Wood River Extension (2009) |

|

8. Southern Access St. Paul Extension (2009) |

|

9. Gateway Pipeline (2010) |

9

Southern Access Expansion & Extension Program

[GRAPHIC]

10

Stable Distributions

• Long-life Assets Underpin Stable Distributions to Partners

[CHART]

• Projected high level of capital expenditures on internal growth projects over the next few years is anticipated to limit distribution increase potential

Note: Annualized fourth quarter distribution, except 2005 is annualized current rate

11

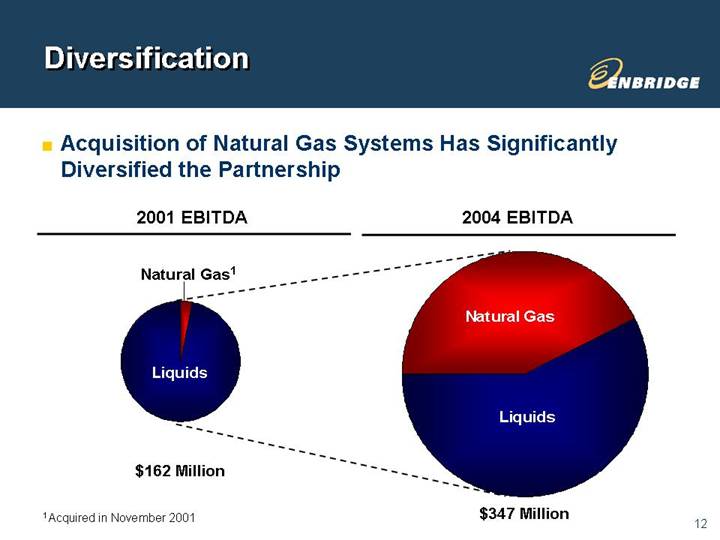

Diversification

• Acquisition of Natural Gas Systems Has Significantly Diversified the Partnership

2001 EBITDA | | 2004 EBITDA |

| | |

[CHART] | | [CHART] |

(1) Acquired in November 2001

12

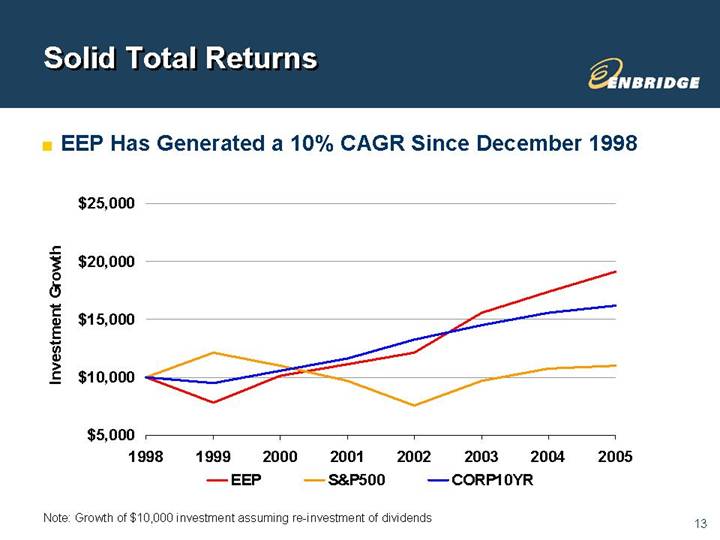

Solid Total Returns

• EEP Has Generated a 10% CAGR Since December 1998

[CHART]

Note: Growth of $10,000 investment assuming re-investment of dividends

13

Enbridge Energy Partners

[GRAPHIC]

Dan C. Tutcher

President, Enbridge Energy Partners

Appendix

MLP Structure

[CHART] | | • Enbridge is General Partner, through indirect subsidiary EECI, and has effective 11% interest in the Partnership |

| |

| • EEM is limited liability company - only asset is interest in EEP. EEM pays nontaxable in-kind quarterly distributions - sale of EEM shares taxed as capital gains |

| |

| • EEP is nontaxable master limited partnership - allocates taxable income to partners. EEP makes quarterly cash distributions - treated as reductions of tax cost basis |

A

Appendix

Natural Gas Demand & Supply

Source: Purvin & Gertz 2005 Market Outlook

B

Appendix

Commodity Price Exposure

• Cash Flow at Risk (CFaR) is Closely Monitored to Control Exposure Within Tolerance Limit

[CHART] | | • Major portion of cash flow derived from predictable fixed fee or cost of service revenue arrangements |

| |

| • Direct commodity price exposure is reduced through hedging program |

| |

| • Exposure to interest rate volatility is subject to conservative debt structure policy (0-20% floating debt target) |

| |

| • Largest exposure to non-controllable risk is commodity volumes |

C

Enbridge Energy Partners

[GRAPHIC]

Dan C. Tutcher

President, Enbridge Energy Partners