UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

LEGG MASON PARTNERS EQUITY TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

| | |

| | Your Proxy Vote is important! |

| |

| | And now you can submit your Proxy on thePHONEor theINTERNET. |

| |

| | It saves Money! Telephone and Internet voting saves postage costs. Savings which can help minimize expenses. |

| |

| | It saves Time! Telephone and Internet voting is instantaneous – 24 hours a day. |

| |

| | It’s Easy! Just follow these simple steps: |

| |

| | 1. Read your Proxy Statement and have it at hand. |

| |

| | 2. Call toll-free1-800-337-3503, or go to website:www.proxy-direct.com. |

| |

| | 3. Follow the recorded or on-screen directions. |

| |

| | 4. Donotmail your Proxy Card when you vote by phone or Internet. |

Please detach at perforation before mailing.

| | | | |

| PROXY | | LEGG MASON PARTNERS EQUITY TRUST | | PROXY |

LEGG MASON CLEARBRIDGE DIVIDEND STRATEGY FUND

PROXY FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 13, 2011

PROXY IS SOLICITED BY THE BOARD OF TRUSTEES.The undersigned holder of shares of Legg Mason ClearBridge Dividend Strategy Fund (the “Target Fund”), a series of Legg Mason Partners Equity Trust, hereby appoints Robert I. Frenkel, Thomas C. Mandia and Harris C. Goldblat as attorneys and proxies for the undersigned, each with full powers of substitution and revocation, to represent the undersigned and to vote on behalf of the undersigned all shares of the Target Fund that the undersigned is entitled to vote at the Special Meeting of Shareholders (the “Special Meeting”) of the Target Fund to be held on April 13, 2011, at the offices of Legg Mason Partners Fund Advisor, LLC, 620 Eighth Avenue, New York, New York 10018, at 10:00 a.m., Eastern Time, and any adjournments or postponements thereof. The undersigned hereby acknowledges receipt of the Notice of Special Meeting and Proxy Statement/Prospectus dated December 28, 2010 and hereby instructs said attorneys and proxies to vote said shares as indicated herein.In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Special Meeting or any adjournments or postponements thereof. A majority of the proxies present and acting at the Special Meeting in person or by substitute (or if only one shall be present, then that one) shall have and may exercise all of the power and authority of said proxies hereunder. The undersigned hereby revokes any proxy previously given.

This proxy, if properly executed, will be voted in the manner directed by the undersigned shareholder. If no direction is made, this proxy will be voted “FOR” approval of the Proposal.

| | | | | | | | |

| | VOTE VIA THE TELEPHONE: 1-800-337-3503 |

| | VOTE VIA THE INTERNET: www.proxy-direct.com |

| | | | | | | | |

| | 999 9999 9999 999 | | | | | | |

| | Note: Please sign exactly as your name appears on this Proxy. If joint owners, EITHER may sign this Proxy. When signing as attorney, executor, administrator, trustee, guardian, officer of an entity or in another representative capacity, please give your full title. Receipt of the Notice and the Proxy Statement/Prospectus, dated December 28, 2010 is hereby acknowledged. |

| | |

| | Signature(s) | | | | | | |

| | |

| | Title(s), if applicable | | | | | | |

| | |

| | Date | | | | | | LMP 22102B 010511 |

UNLESS VOTING BY TELEPHONE OR INTERNET, PLEASE SIGN, DATE AND MAIL THIS PROXY CARD

PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

PLEASE SIGN, DATE AND RETURN YOUR

PROXY TODAY

Please detach at perforation before mailing.

THIS PROXY IS SOLICITED ON BEHALF OF THE FUND’S BOARD OF TRUSTEES.

PLEASE MARK VOTE AS IN THIS EXAMPLE: n

| | | | | | | | | | | | |

1. To consider and vote upon the Agreement and Plan of Reorganization, providing for (i) the acquisition of all of the assets of the Target Fund, in exchange for the assumption of all of the liabilities of the Target Fund by Legg Mason ClearBridge Variable Equity Income Builder Portfolio (the “Acquiring Fund”) by the Acquiring Fund, a series of Legg Mason Partners Variable Equity Trust, and for shares of the Acquiring Fund to be distributed to the shareholders of the Target Fund and (ii) the subsequent termination of the Target Fund. | |

| FOR

¨ |

| |

| AGAINST

¨ |

| |

| ABSTAIN

¨ |

|

| | | | | | | | | | | | |

2. To transact any other business which may properly come before the Special Meeting or any adjournments or postponements thereof. | | | | | | | | | | | | |

| | |

| HAS YOUR ADDRESS CHANGED | | DO YOU HAVE ANY COMMENTS |

| |

| | |

| |

| | |

| |

| | |

YOUR VOTE IS IMPORTANT. UNLESS VOTING BY TELEPHONE OR INTERNET, PLEASE SIGN, DATE, AND MAIL THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

LMP_22102B_010511

| | |

| Q310 Product Profile | |  |

Share class (Symbol): A (SOPAX), B (SOPTX), C (SBPLX), I (SOPYX)

Legg Mason ClearBridge

Equity Income Builder Fund

There’s always a need for conservative income-oriented investments — particularly during retirement.Legg Mason ClearBridge Equity Income Builder Fund (SOPAX) offers the potential for attractive current income and capital appreciation by investing in securities of high-quality companies.

| | | | |

Emphasis on current income that could rise over time Invests in common stocks with relatively high dividend yields; may enhance yield and diversification by investing across capital structure | | Disciplined focus on attractively valued high-quality companies Selects high-quality, industry- leading companies with sound or improving balance sheets | | Flexible portfolio can adapt to changing market environments Owns U.S. and non-U.S. stocks of all market capitalizations; can buy corporate bonds on opportunistic basis |

The Fund may use the entire capital structure to enhance income and diversification

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average annual total returns and fund expenses (%) as of September 30, 2010 | |

| | | Without sales charges | | | With maximum sales charges | | | | | | | | | | | | | |

| | | | | Expenses (Gross)1 (Net)2 | | | | | | | |

| | | 1-yr | | | 3-yr | | | 5-yr | | | 10-yr | | | Since

inception | | | 1-yr | | | 3-yr | | | 5-yr | | | 10-yr | | | Since

inception | | | | 30-day

SEC yield | | | Inception

date | |

Class A | | | 11.99 | | | | -5.98 | | | | 0.20 | | | | 2.90 | | | | 7.34 | | | | 5.56 | | | | -7.82 | | | | -0.98 | | | | 2.30 | | | | 6.99 | | | | 1.21 | | | | 1.21 | | | | 3.07 | | | | 11/6/92 | |

Russell 3000 Value Index | | | 9.15 | | | | -9.04 | | | | -0.39 | | | | 2.96 | | | | – | | | | 9.15 | | | | -9.04 | | | | -0.39 | | | | 2.96 | | | | – | | | | – | | | | – | | | | – | | | | – | |

Performance shown represents past performance and is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than the original cost. For performance including sales charges, class A shares have a maximum front-end sales charge of 5.75%. Total returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Performance data does not reflect trade date adjustments made to the NAV at month-end. Performance would have been lower if fees had not been waived in various periods. For the most recent month-end information, please visit www.leggmason.com/individualinvestors.

| 1 | Gross expenses are the Fund’s total annual operating expenses for the share class indicated as of the date of the Fund’s most current prospectus and do not reflect fee waivers or reimbursements. These expenses include management fees, 12b-1 distribution and service fees, and other expenses. |

| 2 | Because the Fund does not currently have fee waivers or reimbursements, gross and net expense ratios are the same. |

This Product Profile for Legg Mason ClearBridge Equity Income Builder Fund is not part of the combined Proxy Statement for Legg Mason ClearBridge Dividend Strategy Fund and Prospectus for Legg Mason ClearBridge Equity Income Builder Fund dated December 28, 2010 (the “Proxy Statement/Prospectus”) and should be read in conjunction with the Proxy Statement/Prospectus.

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Legg Mason ClearBridge Equity Income Builder Fund

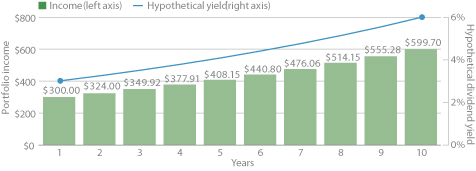

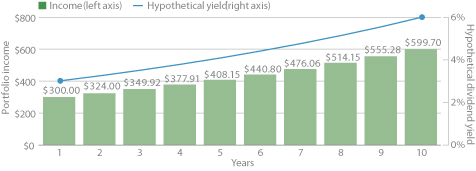

Hypothetical example for illustrative purposes only and does not represent any specific investment product. Assumes $10,000 initial investment, 3.00% dividend yield in Year 1 and 8.00% annualized dividend growth thereafter. Source: Legg Mason.

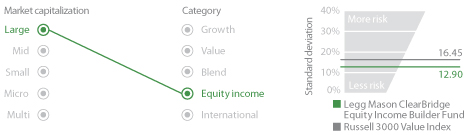

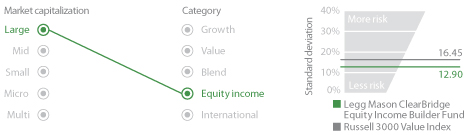

Style and risk profile(%)

Standard deviation measured on a 10-year period, as of 9/30/10. Benchmark: Russell 3000 Value Index. Standard deviation indicates the percentage by which a fund’s performance has varied from its average performance in any given month during the period indicated. The higher the standard deviation, the greater the range of performance, indicating greater volatility.

Meet ClearBridge Advisors

| | | | | | |

| |  | |  | | • Emphasizes selection of

high-quality companies

• Fundamental, research-

driven approach

• Heritage dating back

over 45 years |

Hersh Cohen

41 years’ experience | | Peter Vanderlee, CFA

11 years’ experience | | Michael Clarfeld, CFA

10 years’ experience | |

On December 7, 2009, the Fund’s investment objective, policies and strategies, along with its name, performance benchmarks and distribution policies changed. Prior to this date, the Fund was known as Legg Mason ClearBridge Capital and Income Fund. Please see the prospectus for more details.

The Russell 3000 Value Index measures the performance of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities. Please note an investor cannot invest directly in an index.

© 2011 Legg Mason Investor Services, LLC, member FINRA, SIPC. Legg Mason Investor Services, LLC and ClearBridge Advisors, LLC are subsidiaries of Legg Mason, Inc. 404927 LMFX012260 1/11 FN1012276

AN INVESTOR SHOULD CONSIDER A FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES CAREFULLY BEFORE INVESTING. FOR A FREE PROSPECTUS, WHICH CONTAINS THIS AND OTHER INFORMATION ON ANY LEGG MASON FUND, VISIT WWW.LEGGMASON.COM/INDIVIDUALINVESTORS. AN INVESTOR SHOULD READ THE PROSPECTUS CAREFULLY BEFORE INVESTING.

What should I know before investing?

Equity securities are subject to price fluctuation and possible loss of principal. Real estate investment trusts (REITs) are closely linked to the performance of the real estate markets. REITs are subject to illiquidity, credit and interest rate risks, and risks associated with small- and mid-cap investments. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Short selling is a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Dividends are not guaranteed, and a company may reduce or eliminate its dividend at any time. Investments in fixed-income securities involve risk, including possible loss of principal. These securities are subject to interest rate, credit, inflation and reinvestment risk. As interest rates rise, the value of fixed-income securities falls. Diversification does not assure a profit or protect against market loss.

Additional risks may include those risks associated with investing in high-yield securities. Please see the prospectus for more information.

Where can I find more information?

Talk to your financial advisor about the role Legg Mason ClearBridge Equity Income Builder Fund can play as a part of a well-diversified portfolio.

For more information, visit www. leggmason.com/individualinvestors.