Income Taxes

The provision for income taxes amounted to $2.5 million in 2019, $2.3 million in 2018, and $3.2 million in 2017. The increase in 2019 resulted from an increase in income. The decrease in 2018 resulted from the TCJA reducing the corporate statutory tax rate from 34% to 21%. The effective tax rate in 2019 and 2018 approximates 19%. The provision increase in 2017 included the TCJA income tax increase adjustment of $101 thousand resulting from the write down of a deferred tax asset of $109 thousand related to unrealized losses on securities, as the valuation rate on this future tax deduction was reduced from 34% to 21% in accordance with the TCJA.

FINANCIAL CONDITION

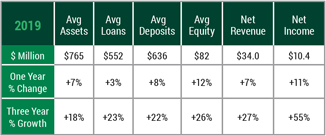

Total assets of the Company were $819 million at December 31, 2019, compared to $732 million at December 31, 2018, representing an increase of $87 million, or 12%. Net loans increased $2 million, or less than 1%, while investment securities increased $20 million, or 18%, and total cash and cash equivalents increased $56 million. Deposits increased $77 million and short-term borrowings increased $1 million, while other borrowings from the Federal Home Loan Bank (“FHLB”) decreased by $2 million, or 26%.

Securities

Total investment securities increased $20 million, or 18%, to $131 million atyear-end 2019. CSB’s portfolio is primarily comprised of agency mortgage-backed securities, obligations of state and political subdivisions, other government agencies’ debt, and corporate bonds. Restricted securities consist primarily of FHLB stock.

The Company has no exposure to government-sponsored enterprise preferred stocks, collateralized debt obligations, or trust preferred securities. The Company’s municipal bond portfolio consists oftax-exempt general obligation and revenue bonds. As of December 31, 2019, 96% of such bonds held an S&P or Moody’s investment grade rating and 4%, werenon-rated. The municipal portfolio includes a broad spectrum of counties, towns, universities, and school districts with 82% of the portfolio originating in Ohio, and 18% in Pennsylvania. Gross unrealized security losses within the portfolio were less than 1% of total securities at December 31, 2019, reflecting interest rate fluctuations, not credit downgrades.

One of the primary functions of the securities portfolio is to provide a source of liquidity and it is structured such that maturities and cash flows provide a portion of the Company’s liquidity needs and asset/liability management requirements.

Loans

Total loans increased $3 million, or less than 1%, during 2019 with increases in commercial real estate and1-4 family residential real estate. Volume increases were recognized as follows: commercial real estate loan increased $13 million, or 7%, and residential real estate loans increased $7 million, or 4%. Interest rates decreased during the third and fourth quarters of 2019, however, there was a slowing of commercial loan growth as business loan prepayments accelerated with increased competition from private lenders and several loan participations were repurchased by the originating banks.

The Company originated $47 million and $29 million of portfolio mortgage loans, which were predominately variable rate, in 2019 and 2018, respectively. Attractive interest rates in the secondary market also continued to drive consumer demand for longer-term1-4 family fixed rate residential mortgages as the Company sold $20 million of originated mortgages into the secondary market in 2019 as compared to $11 million in 2018. Demand for home equity loans improved in 2019, with balances increasing $2 million. Installment lending declined slightly with consumer loans decreasing from a slowdown in the origination of RV finance loans.

Management anticipates the Company’s local service areas will continue to exhibit modest economic growth in line with the past three years. Commercial and commercial real estate loans, in aggregate, comprise approximately 61% and 60% of the total loan portfolio atyear-end 2019 and 2018, respectively. Residential real estate loans increased to 32% in 2019 from 30% of the total loan portfolio. Construction and land development loans decreased to 4% of the portfolio as loans transferred to the commercial real estate portfolio for permanent financing. The Company is well within the respective regulatory guidelines for investment in construction, development, and investment property loans that are not owner occupied.

Most of the Company’s lending activity is with customers primarily located within Holmes, Stark, Tuscarawas, and Wayne counties in Ohio. Credit concentrations, including commitments, as determined using North American Industry Classification Codes (NAICS), to the four largest industries compared to total loans at December 31, 2019, included $48 million, or 9%, of total loans to lessors ofnon-residential buildings or dwellings; $32 million, or 6%, of total loans to borrowers in the hotel, motel, and lodging business; $30 million, or 5%, of total loans to logging, sawmills, and timber tract operations; and $29 million, or 5%, of total loans to assisted living facilities for the elderly. These loans are generally secured by real property and equipment, with repayment expected from operational cash flow. Credit evaluation is based on a review of cash flow coverage of principal, interest payments, and the adequacy of the collateral received.