UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2011

Commission File Number 1-10936

Orbital Corporation Limited

(Translation of registrant’s name into English)

4 Whipple Street Balcatta WA 6021

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x. Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l): ¨

Note: Regulation S-T Rule 10l(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No ¨

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

APPENDIX 4E

Preliminary Final Report

Orbital Corporation Limited

ABN 32 009 344 058

Financial year ended 30 June 2011

Results for announcement to the market

| | | | | | | | | | | | | | | | |

| | | | | A$’000 | | | | | | | | A$’000 | |

Total revenue | | DOWN | | | (627 | ) | | | -4 | % | | to | | | 16,638 | |

| | | | | |

Net profit from ordinary activities after tax attributable to members | | DOWN | | | (2,753 | ) | | | -61 | % | | to | | | 1,763 | |

| | | | | |

Net profit attributable to members | | DOWN | | | (2,753 | ) | | | -61 | % | | to | | | 1,763 | |

| | | | | |

| | | | | 2011 | | | | 2010 | | | | | | | |

| | | | | |

Net tangible assets per share (cents) | | | | | 35.70 | | | | 39.99 | | | | | | | |

There is no proposal to pay dividends for the year ended 30 june 2011

Commentary on results for the period

The Commentary on the results for the period is contained in the press release dated 24 August 2011 accompanying this statement.

Annual Meeting

The annual meeting will be held as follows:

| | |

Place: | | Rydges Hotel

Corner Hay and King Streets

Perth

Western Australia |

| |

Date: | | Wednesday 26 October 2011 |

| |

Time: | | 10.00 am |

Approximate date the annual report will be available: 23 September 2011

Audit

This report is based on accounts which have been audited. (see attached Annual Report)

ABN 32 009 344 058

ANNUAL REPORT

30 JUNE 2011

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

The Directors present their report together with the financial report of Orbital Corporation Limited (the Company or Orbital) and of the Group, being the Company, its subsidiaries and the Group’s interest in its associates for the year ended 30 June 2011 and the auditors’ report thereon.

| | | | | | | | | | |

Reference | | | | | | Contents of Directors’ Report | | Page | |

| 1. | | | | | | Directors | | | 2 | |

| 2. | | | | | | Company Secretary | | | 3 | |

| 3. | | | | | | Principal Activities | | | 3 | |

| 4. | | | | | | Consolidated Result | | | 3 | |

| 5. | | | | | | Directors’ Meetings | | | 3 | |

| 6. | | | | | | Directors’ Interests | | | 3 | |

| 7. | | | | | | Operating and Financial Review | | | 4 | |

| 8. | | | | | | Dividends | | | 9 | |

| 9. | | | | | | State of Affairs | | | 9 | |

| 10. | | | | | | Events Subsequent to Balance Date | | | 9 | |

| 11. | | | | | | Likely Developments and Expected Results | | | 9 | |

| 12. | | | | | | Share Options | | | 9 | |

| 13. | | | | | | Indemnification and Insurance of Officers | | | 10 | |

| 14. | | | | | | Non-Audit Services | | | 10 | |

| 15. | | | | | | Lead Auditor’s Independence Declaration | | | 10 | |

| 16. | | | | | | Rounding Off | | | 10 | |

| 17. | | | | | | Remuneration Report | | | 11 | |

1

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

The Directors of the Company at any time during or since the end of the financial year are:

Mr William Peter Day,LLB (Hons), MBA, FCPA, FCA, GAICD

Chairman, Independent Non-Executive Director

Joined the Board and appointed Chairman in August 2007. Mr Day retired as Chief Financial Officer of the global packaging group Amcor in 2007. He has a diversified background in finance and general management in mining, manufacturing, food and financial services industries.

He has held senior executive and director positions with Bonlac Foods, Rio Tinto, CRA and Comalco including Chief Financial Officer at Commonwealth Aluminum Corporation (USA) and Managing Director, CRA Business Services in Australia. He is a former Chairman of the Australian Accounting Standards Board, and was Deputy Chairman of the Australian Securities & Investments Commission.

Mr Day is a member of the Company’s Audit Committee and the Company’s Human Resources, Remuneration and Nomination Committee.

Mr Day is a non-executive director of Ansell Limited (appointed 20 August 2007), SAI Global Limited (appointed 15 August 2008) and Centro Retail Trust Limited (also Chairman appointed 01 October 2009). He is also involved in a number of public interest activities.

Mr Terry Dewayne Stinson, BBA (magna cum laude)

Managing Director and Chief Executive Officer

Joined the Board in June 2008. Mr Stinson has been a senior executive with Siemens VDO, Europe’s largest engineering conglomerate (recently purchased by Continental Corporation), with direct responsibility for sales in excess of US$300 million per annum in their Gasoline Systems, Fuel Systems and Fuel Components operations in the United States, Germany, Italy, China and support in many others. Mr Stinson has also served as a representative Director for Siemens VDO on the Synerject Board.

Prior to that, he held the position of VP Manufacturing for Outboard Marine Corporation, a privately held US$1 billion multinational outboard marine propulsion and boat company and executive positions with Synerject and Mercury Marine.

Mr Stinson was appointed a Member of the Australian Industry Innovation Council (AIIC) in 2009 and is Chairman of Sprint Gas (Aust) Pty Ltd.

Dr Mervyn Thomas Jones,B.E(Hons), Ph.D, DipBusStuds, CEng (UK), FIChemE (UK), FAICD, MIoD (NZ)

Independent Non-Executive Director

Joined the Board in March 2008. Dr Jones has more than 40 years experience as a consulting engineer and as a senior executive. He has specific expertise in the development and management of organic business growth in the Asia Pacific region, as well as acquisition experience in both Australia and China.

Dr Jones chairs the Company’s Audit Committee (since 28 February 2011) and is also a member of the Company’s Human Resources, Remuneration and Nomination Committee (Chairman until 28 February 2011).

Dr Jones is also a non-executive director of Pacific Environment Limited (appointed 3 July 2009, appointed Chairman 16 February 2010).

Dr Vijoleta Braach-Maksvytis,BSc (Hons), Ph.D, MAICD

Independent Non-Executive Director

Joined the Board in March 2008. Dr Braach-Maksvytis is an innovation strategist with more than 20 years experience in organisational change, formation of cross-sectoral and global partnerships, the commercialisation of technology, and intellectual property strategy. Previous roles include Head of the Office of the Chief Scientist of Australia, Science Executive and Director Global Development for CSIRO, and most recently, Deputy Vice Chancellor Innovation and Development at the University of Melbourne, and is currently an advisor in the area of social innovation.

Dr Braach-Maksvytis pioneered nanotechnology in Australia and holds over 20 patents in the field. Dr Braach-Maksvytis was a Member of the Australian Federal Government’s Green Car Innovation Fund Committee and on the advisory board of the Intellectual Property Research Institute of Australia, and is a member of a number of other public interest boards.

Dr Braach-Maksvytis chairs the Company’s Human Resources, Remuneration and Nomination Committee (since 28 February 2011) and is also a member of the Company’s Audit Committee.

Dr Braach-Maksvytis is also a non-executive director of AWE Limited (appointed 7 October 2010).

Mr John Grahame Young,LLB, FTIA, TEP

Independent Non-Executive Director

Mr Young retired from the Board on 28 February 2011. Joined the Board in November 1985. Mr Young is a lawyer with more than 30 years experience in corporate, revenue and intellectual property law. He has been a director of Cape Bouvard Investments Pty Ltd since 1998.

Mr Young chaired the Company’s Audit Committee and was also a member of the Company’s Human Resources, Remuneration and Nomination Committee.

2

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

Mr Ian G Veitch, B.Bus, GradDipACG, CA was appointed to the position of Company Secretary on 1 July 2009. He is a Chartered Accountant with over 17 years experience in corporate accounting and an Affiliate of Chartered Secretaries Australia.

Orbital is an international developer of innovative technical solutions for a cleaner world. Orbital provides innovation, design, product development and operational improvement services to the world’s producers, suppliers, regulators and end users of engines and engine management systems for applications in motorcycles, marine and recreational vehicles, automobiles and trucks.

There were no significant changes in the nature of the activities of the Group during the year.

The consolidated profit after income tax for the year attributable to the members of Orbital was $1,763,084 (2010:$4,515,451 profit)

The number of Directors’ meetings (including meetings of the committees of Directors) and the number of meetings attended by each of the Directors of the Company during the financial year are shown below.

| | | | | | | | | | | | | | | | | | | | | | | | |

Director | | Directors’ Meetings | | | Audit Committee Meetings | | | Human Resources, Remuneration

& Nomination Committee

Meetings | |

| | No. of

meetings

attended | | | No. of

meetings held* | | | No. of

meetings

attended | | | No. of

meetings held* | | | No. of

meetings

attended | | | No. of

meetings held* | |

W P Day | | | 11 | | | | 11 | | | | 4 | | | | 4 | | | | 3 | | | | 3 | |

T D Stinson | | | 11 | | | | 11 | | | | — | | | | — | | | | — | | | | — | |

M T Jones | | | 11 | | | | 11 | | | | 4 | | | | 4 | | | | 3 | | | | 3 | |

V Braach-Maksvytis | | | 10 | | | | 11 | | | | 4 | | | | 4 | | | | 3 | | | | 3 | |

J G Young | | | 8 | | | | 8 | | | | 3 | | | | 3 | | | | 2 | | | | 2 | |

| * | number of meetings held during the time the director held office during the year. |

The relevant interest of each Director in the share capital of the Company shown in the Register of Directors’ Shareholdings as at the date of this report is as follows: -

| | | | | | | | | | | | |

Director | | Ordinary Shares | | | ELTSP Rights | | | Performance

Rights | |

W P Day | | | 10,000 | | | | — | | | | — | |

T D Stinson | | | 375,690 | | | | 1,320,000 | | | | 1,150,000 | |

M T Jones | | | 18,000 | | | | — | | | | — | |

V Braach-Maksvytis | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

| | | 403,690 | | | | 1,320,000 | | | | 1,150,000 | |

3

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 7. | OPERATING AND FINANCIAL REVIEW |

The headline financial results for Orbital for the year ended 30 June 2011 are shown below.

| | | | | | | | |

| | | June 2011 $’000 | | | June 2010 $’000 | |

Alternative Fuels | | | | | | | | |

- Revenue | | | 5,847 | | | | 6,203 | |

- Contribution | | | (757 | ) | | | (1,727 | ) |

| | | | | | | | |

Consulting Services | | | | | | | | |

- Revenue | | | 9,492 | | | | 9,621 | |

- Contribution | | | 161 | | | | 1,031 | |

| | | | | | | | |

Licences & royalties | | | | | | | | |

- Revenue | | | 1,081 | | | | 1,199 | |

- Contribution | | | 610 | | | | 732 | |

| | | | | | | | |

Total Revenue | | | 16,420 | | | | 17,023 | |

Total Contribution | | | 14 | | | | 36 | |

| | | | | | | | |

| | |

Synerject | | | | | | | | |

| | | June 2011 | | | June 2010 | |

| | | US$m | | | US$m | |

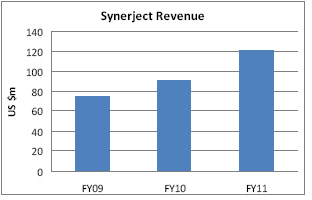

- Revenue (100%)(1) | | | 120.8 | | | | 90.4 | |

| | | | | | | | |

| | | | | | | | |

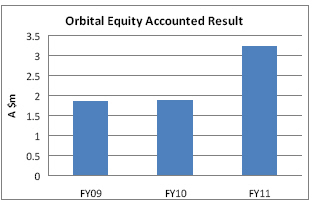

- Equity accounted profit | | | 3,233 | | | | 1,874 | |

| | |

Unallocated other income | | | 959 | | | | 644 | |

Unallocated other expenses | | | (2,809 | ) | | | (3,488 | ) |

Foreign exchange gain/(loss) | | | 79 | | | | (97 | ) |

Finance costs (net) | | | (353 | ) | | | (513 | ) |

Research and development | | | (1,158 | ) | | | (1,152 | ) |

Business development costs* | | | (205 | ) | | | (595 | ) |

Government grant on restructure of loan* | | | — | | | | 7,695 | |

Gain on sale of property* | | | 4,237 | | | | — | |

Write-off capitalised development costs* | | | (1,065 | ) | | | — | |

Provision for slow moving inventory* | | | (942 | ) | | | — | |

Terminations costs* | | | (417 | ) | | | (276 | ) |

| | | | | | | | |

Profit before tax | | | 1,573 | | | | 4,128 | |

Taxation | | | 190 | | | | 388 | |

| | | | | | | | |

Profit after tax | | | 1,763 | | | | 4,516 | |

| | | | | | | | |

Underlying profit/(loss) (excluding one off items*) | | | 155 | | | | (2,308 | ) |

| | | | | | | | |

| (1) | As reported by Synerject LLC. |

Detailed comments on Orbital’s four business streams are as follows:

4

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 7. | OPERATING AND FINANCIAL REVIEW (continued) |

Alternative Fuels

| | | | | | | | |

| | | June 2011 | | | June 2010 | |

| | | $’000 | | | $’000 | |

Revenue | | | 5,847 | | | | 6,203 | |

Contribution | | | (757 | ) | | | (1,727 | ) |

| | | | | | | | |

| | |

Write-off of capitalised development costs | | | (1,065 | ) | | | — | |

Provision for slow moving inventory | | | (942 | ) | | | — | |

| | | | | | | | |

Segment result | | | (2,764 | ) | | | (1,727 | ) |

| | | | | | | | |

Alternative fuel system development is core to Orbital’s growth strategy. Long term projections for increased crude oil prices, together with sovereign fuel security and requirements to reduce vehicle emissions, drive this strategy. The USA has announced major developments and sponsorship for use of CNG (Compressed Natural Gas). In the Asia Pacific region, the size of the CNG vehicle fleet increased by almost 16% to 6.7 million vehicle, with a global increase of 11%. In Europe there is a push for increasing use of CNG and LPG (Liquid Petroleum Gas) with European Automotive manufacturer’s now offering product using both of these fuels. In the LNG (Liquid Natural Gas) application the “Blue Corridor” (key road transport routes with LNG readily available) is being developed in Continental Europe. Orbital is already active in this space and plans to grow in each of these markets.

Revenue decreased by approximately 6% compared to last year due to Ford ceasing production of the previous generation LPG Falcon at the end of September 2010. Revenue was partly compensated by increased aftermarket sales including contribution from Sprint Gas Australia (SGA) which was acquired at the end of May 2011. Gross margins improved due to the stronger Australian dollar compared to the Euro. Operational efficiencies have also been introduced reducing overheads resulting in an overall year on year improvement in contribution of $970,000.

In conjunction with the acquisition of SGA, the Orbital Autogas Systems operation was also reviewed. The contraction in the LPG aftermarket prompted a write-down of previously capitalised development costs for Liquid LPi aftermarket kits ($1,065,000). In addition it was decided to provide for slow moving Liquid LPi aftermarket inventory ($942,000). In total these non-cash adjustments amounted to $2,007,000.

Ford Australia has recently released their “EcoLPi” Ford Falcon vehicle range equipped with Orbital’s Liquid LPG systems (Liquid LPi). The response from the motoring press has been very positive. Liquid LPi technology solves issues of emissions compliance, cold start and reduced power compared with previous LPG systems. Most importantly, fuel cost savings are approximately $1,000 year based on current fuel costs for a typical Australian family vehicle.

Orbital’s Liquid LPi systems were also introduced on Holden Special Vehicles in late 2010, confirming that the systems can meet the needs of Australia’s most prestigious and highest performance cars.

In May 2011, Orbital acquired the business of SGA for an initial investment of $2,000,000. SGA is a major LPG distributor in Victoria, with a presence in most capital cities in Australia. SGA offers a full range of LPG systems for the aftermarket, and will be an outlet for Orbital’s Liquid LPi systems. SGA also enables an Orbital presence in Victoria which is the centre of Australia’s auto LPG markets and the home of Australia’s automotive manufacturing businesses.

Orbital strategically invested in the LPG aftermarket at a time when the Australian market was under pressure. The Australian LPG aftermarket contracted throughout the year (approximately 50%), driven initially by the relatively lower differential between the cost of petrol and LPG, and reduction in the Government installation subsidy. However, LPG continues to offer a lower cost, cleaner alternative to petrol. We acquired a company that has a lead market share position in Australia. Orbital’s initial investment is effectively net asset value and we retain the support of the long standing owners. This positions Orbital for future recovery in LPG markets.

Looking forward, Orbital is undertaking research and development in the next generation of alternative fuels systems; for example direct injection of alternative fuels. In the case of CNG, direct injection can reclaim some of the performance typically lost with manifold injection applications of CNG. Orbital continues to support direct injection CNG projects for international customers.

5

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 7. | OPERATING AND FINANCIAL REVIEW (continued) |

Synerject

| | | | | | | | |

| | | June

2011 | | | June

2010 | |

| | | US$’000 | | | US$’000 | |

Revenue (100%) | | | 120,834 | | | | 90,375 | |

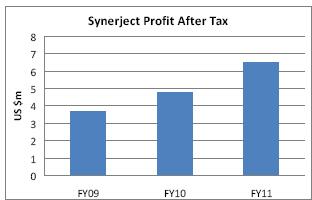

Profit after tax (100%) | | | 6,500 | | | | 4,744 | |

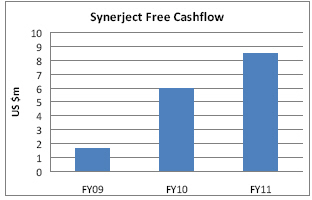

Operating cash flow, after capex (100%) | | | 8,517 | | | | 5,957 | |

| | | | | | | | |

| | |

| | | A$’000 | | | A$’000 | |

| | |

Orbital equity accounted contribution | | | 3,233 | | | | 1,874 | |

| | | | | | | | |

Synerject, Orbital’s 42:58% Joint Venture Partnership with Continental AG, is a key supplier of engine management systems to the non-automotive market, with small engine applications for scooters through to high performance motorcycles, outboards and snowmobiles.

Synerject revenue increased by 34% to US$120,834,000 with a corresponding increase in profit after tax.

The marine and recreational markets are still impacted by the ongoing effect of the global financial crisis however Synerject achieved growth with investment in new products which have been launched throughout the year. In particular, Synerject has expanded in the supply of systems to the high end market including snowmobiles and high performance motorcycles.

Taiwan, with its stringent in-field emission requirements remains a major market for Synerject, with 2 out of the 3 major Taiwanese motorcycle/scooter manufactures utilizing Synerject product. China is the largest motorcycle market in the world and has recently introduced motorcycle Euro III emissions standards. This remains Synerject’s primary growth target.

Synerject has also recently introduced new product into the high volume utility and small engine markets.

Notwithstanding the revenue growth Synerject kept tight control of working capital, generating increased cash flow year on year. Synerject had net cash on hand at 30 June 2011 of US$2,291,000 (2010: US$3,316,000 net debt). Orbital received dividends of A$1,208,000 from Synerject during the year (2010: A$677,000).

The Australian dollar has strengthened against the US dollar over recent years adversely impacting the translated equity accounted share of Synerject’s profit (FY2011: A$416,000 impact).

Synerject is well positioned in all of its markets and has a number of new product launches planned in the next 12 months. Synerject has a strong balance sheet and the active support of both parents.

6

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 7. | OPERATING AND FINANCIAL REVIEW (continued) |

Consulting Services

| | | | | | | | |

| | | June 2011 | | | June 2010 | |

| | | $’000 | | | $’000 | |

Revenue | | | 9,492 | | | | 9,621 | |

Contribution | | | 161 | | | | 1,031 | |

| | | | | | | | |

Orbital Consulting Services (OCS) provides engineering consulting services, design, development and testing in the areas of engine design, engine combustion, fuel systems, engine management systems, alternative fuels, engine and vehicle testing and certification. Orbital provides fuel economy and emissions solutions to a wide variety of vehicle applications, from small displacement utility engines to large transportation and power generation applications.

OCS revenue of $9,492,000 was marginally lower than FY2010. A significant portion of OCS customers are overseas and the strong Australian dollar has meant that OCS services are less competitive globally and margins are under pressure. Orbital continues to win new programs on a consistent basis due to the unique technology and services offered by Orbital, and the order book is higher now than this time last year.

Orbital’s new dual fuel LNG system development continues working with Western Australia’s Mitchell Corporation (recently acquired by Toll Transport). The initial pilot level fleet of three LNG system fitted prime movers has expanded to nine. Mitchell has achieved significant fuel cost savings compared to diesel fuel only operation and improved reliability. Orbital’s success with the Mitchell LNG program has generated interest from the broader transport industry. To expand significantly in this segment will require industry buy-in, expanded fuelling infrastructure and additional investment. We see this as a growth area; however we will continue to have a measured approach to limit Orbital’s future financial exposure without limiting the upside in LNG for transport.

Major work for OCS is the development of spark ignition heavy fuel engines for UAS (unmanned aerial systems) applications. Orbital’s proprietary FlexDITM systems enable a petrol type engine to run on heavy fuels and continue to deliver high performance. Orbital goes beyond FlexDITM offering engine design, development and prototype engine systems for various customer applications. We anticipate that this segment of our business will grow and strategically it is complementary to Orbital’s alternative fuels initiative.

The Changan program has been successfully completed, confirming the capability of the Orbital FlexDITM fuel system, which was integrated into Changan’s new Intelligent Compound Combustion system (ICCS). Orbital and Changan hit the target of 20% reduction for vehicle fuel consumption as measured on the European Drive Cycle. The improved performance of the engine was also demonstrated in the vehicle assessment. Changan are satisfied with the results and displayed the engine concept at the Shanghai Auto show in April 2011.

Orbital’s heavy duty engine test cell continues to be in high demand, with the test facility working extended hours during the year to match customer demand plus supporting Orbital’s large engine R&D. The heavy duty test facility has proven to be a worthwhile investment.

Orbital’s core engineering group provides engineering fee for service to external customers and creates new products for the Orbital group. The support ranges from advanced engine R&D through to development of LPG aftermarket kits and support for customer application programs.

At 31 July, 2011 Orbital had an order book of $4,630,000 (30 June 2010: $3,400,000)

7

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 7. | OPERATING AND FINANCIAL REVIEW (continued) |

Royalties and Licences

| | | | | | | | |

| | | June 2011 | | | June 2010 | |

| | | $’000 | | | $’000 | |

Revenue | | | 1,081 | | | | 1,199 | |

Contribution | | | 610 | | | | 732 | |

| | | | | | | | |

Orbital earns royalties and licenses from production using its FlexDITM systems and technology. The royalty bearing products today are in the recreational and scooter/motorcycle markets.

Orbital’s key royalty earning products, the Mercury Marine Optimax and the Tohatsu TLDI, achieved a slight increase in volume in a relatively flat global outboard engine market. As Orbital’s royalties are predominantly earned in US Dollars the volume increase was however offset by the strength of the Australian Dollar.

The recreational market growth is expected to remain flat, especially in the key North American market, due to financial insecurity and the general careful use of discretionary income.

Other

In February 2011 Orbital completed the sale and leaseback of its land and buildings in Balcatta for $8,650,000. The sale generated a net profit of approximately $4,237,000 and provides cash reserves for strategic acquisitions such as Sprint Gas and organic growth opportunities such as the launch of the new Ford EcoLPi Falcon range of vehicles. Orbital has entered into a lease agreement to rent the facilities for 10 years (plus two 5 year options) for an initial rent of $745,000 per annum.

In May 2011 Orbital acquired 55% of the business of Sprint Gas Australia for $2,000,000. Sprint Gas, founded in 1978, imports, assembles and distributes automotive LPG conversion kits in the Australian LPG aftermarket. Sprint Gas generated sales of approximately $7,300,000 in FY11 through distribution centres in Victoria, Queensland and Western Australia. The Sprint Gas business will compliment the recently developed range of Liquid LPi kits distributed by Orbital Autogas Systems. Put and call options are in place for the vendors remaining 45% holding of Sprint Gas which Orbital records as contingent (future) consideration. Orbital consolidates 100% of Sprint Gas. This business will be reported in the Alternative Fuels segment going forward.

Research and development investment of $1,158,000 (2010: $1,152,000) related primarily to applications of Orbital’s FlexDITM system in conjunction with the Changan project in China.

During the year management irrevocably waived their right to cash bonuses which were awarded and accrued in FY2010, resulting in a credit to the Income Statement of $407,000 in this year.

Other overhead expenses were managed closely and a range of savings were achieved including corporate costs, travel and accommodation, communication, insurance and patent costs.

| | | | | | | | |

| | | June 2011 | | | June 2010 | |

| | | $’000 | | | $’000 | |

Operating cash flows | | | (1,792 | ) | | | (5,049 | ) |

Synerject dividend | | | 1,208 | | | | 677 | |

| | | | | | | | |

| | | (584 | ) | | | (4,372 | ) |

Sale of Balcatta property | | | 8,557 | | | | — | |

Acquisition of Sprint Gas | | | (1,780 | ) | | | — | |

Other capital expenditures and development costs | | | (1,074 | ) | | | (2,478 | ) |

Financing cash flow | | | (1,848 | ) | | | 336 | |

| | | | | | | | |

Movement in cash/short term deposits | | | 3,271 | | | | (6,514 | ) |

| | | | | | | | |

Net cash used in operating activities (including the receipt of dividends from Synerject) was $584,000; an improvement of $3,788,000 compared to FY2010. Cash utilised for acquisition of plant and equipment and development costs decreased to $1,074,000 (FY2010: $2,478,000) as Orbital completed the investment in Liquid LPi retrofit fits and the heavy duty engine test facility. Orbital repaid $1,848,000 loans (2010: $336,000 net drawdown). At 30 June 2011 Orbital had cash and short term deposits of $6,874,000 (June 2010: $3,608,000).

8

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 7. | OPERATING AND FINANCIAL REVIEW (continued) |

Outlook

The Orbital Board targeted a return to underlying operating profits in FY2011. That has been achieved.

Year over year, changes in the exchange rate and markets impacted profitability. The strong Australian dollar has made our engineering services less competitive for overseas customers and the translation of royalty revenue and Orbital’s share of Synerject’s results were both negatively impacted. The launch of the Ford EcoLPi Falcon range was delayed which meant that OAGS sales of the newly developed Liquid LPi system to Ford were negligible in FY2011. The Australian LPG retrofit market is at record lows impacting the launch of the recently developed LLi retrofit kits.

Notwithstanding the impacts to the operating environment a $2,463,000 improvement in underlying operating result was achieved through cost reduction and efficiencies and the continuing growth of revenue and profits of Synerject.

Continued delivery on our strategy and the investments to date provides a solid foundation for targeted growth in the coming year:

| | • | | Ford has now launched the EcoLPi Falcon which is receiving excellent media coverage and positive feedback from the market. |

| | • | | Synerject has launched a number of new products in FY2011 and plans further product launches in FY2012. |

| | • | | Sprint Gas was acquired on 27th May 2011 and will contribute full year earnings in FY2012. Sprint Gas revenue was approximately $7,000,000 in FY2011. |

| | • | | OAGS has now developed approximately 50 Liquid LPi aftermarket kits and trained a national network of installers. OAGS will also distribute through Sprint Gas’s long established distribution channels. |

| | • | | Orbital’s UAS engine systems initiative is gaining momentum and FlexDITM provides Orbital with a unique position in this market. |

Orbital expects Royalties to be flat year on year and the Consulting Services business to provide some growth and a marginally improved contribution. As noted above the OCS order book at 31 July 2011 is $4,630,000.

The business efficiencies achieved in FY2011 will provide benefits in FY2012 with reduction in overheads (on a like for like basis). The integration of Sprint Gas will provide synergistic benefits for both Sprint Gas and OAGS.

As noted above the sale of property has provided a cash reserve for strategic growth. The Board will assess acquisitions opportunities as they arise and direct R&D investment in a number of alternative fuel application opportunities.

The Orbital Board looks forward to growth, improving our profitability and delivering sustainable operating cashflows.

No dividend has been paid or proposed in respect of the current financial year.

In May 2011, the Group acquired 55% of the voting shares of Sprint Gas (Aust) Pty Ltd, a new company incorporated to acquire the operating business of Sprint Gas, an Australian business specialising in the importation and wholesaling of LPG Fuel systems (refer note 38). There were no other significant changes in the state of affairs of the Group during the financial year, other than as reported elsewhere in the financial statements.

| 10. | EVENTS SUBSEQUENT TO BALANCE DATE |

On 11 August 2011 the Company announced that its American Depositary Shares will begin trading on the NYSE Amex on 25 August 2011.

There has not arisen in the interval between the end of the financial year and the date of this report any other item, transaction or event of a material and unusual nature likely, in the opinion of the directors of the Company, to affect significantly the operations of the Group, the results of those operations, or the state of affairs of the Group, in future years.

| 11. | LIKELY DEVELOPMENTS AND EXPECTED RESULTS |

Information as to the likely developments in the operations of the Group is set out in the review of operations above. Further information as to the likely developments in the operations of the Group and the expected results of those operations in subsequent financial years has not been included in this report because to include such information would be likely to result in unreasonable prejudice to the Group.

The Company has no unissued shares under option at the date of this report.

9

DIRECTORS’ REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 13. | INDEMNIFICATION AND INSURANCE OF OFFICERS |

To the extent permitted by law, the Company indemnifies every officer of the Company against any liability incurred by that person:

| (a) | in his or her capacity as an officer of the Company; and |

| (b) | to a person other than the Company or a related body corporate of the Company |

unless the liability arises out of conduct on the part of the officer which involves a lack of good faith.

During the year the Company paid a premium in respect of a contract insuring all Directors, Officers and employees of the Company (and/or any subsidiary companies of which it holds greater than 50% of the voting shares) against liabilities that may arise from their positions within the Company and its controlled entities, except where the liabilities arise out of conduct involving a lack of good faith. The Directors have not included details of the nature of the liabilities covered or the amount of the premium paid in respect of the insurance contract as disclosure is prohibited under the terms of the contract.

During the year Ernst & Young, the Company’s auditor, has performed certain other services in addition to their statutory duties.

The Board has considered the non-audit services provided during the year by the auditor and in accordance with advice provided by resolution of the Audit Committee is satisfied that the provision of those non-audit services by the auditor during the year is compatible with, and did not compromise, the auditor independence requirements of the Corporations Act 2001 for the following reasons:

| | • | | all non-audit services were subject to the corporate governance procedures adopted by the Company and have been reviewed by the Audit Committee to ensure that they do not impact the integrity and objectivity of the auditor; |

| | • | | the non-audit services do not undermine the general principles relating to auditor independence as set out in Professional Statement F1Professional Independence, as they did not involve reviewing or auditing the auditor’s own work, acting in a management or decision making capacity for the Company, acting as an advocate for the Company or jointly sharing risks and rewards. |

Details of the amounts paid to the auditor of the Company, Ernst & Young, and its related practices for audit and non-audit services provided during the year are shown in note 42 to the financial statements.

| 15. | LEAD AUDITOR’S INDEPENDENCE DECLARATION UNDER SECTION 307C OF THE CORPORATIONS ACT 2001 |

The directors received the following declaration from the auditor of Orbital Corporation Limited.

Auditor’s independence declaration to the Directors of Orbital Corporation Limited

In relation to our audit of the consolidated financial report of Orbital Corporation Limited and its controlled entities for the year ended 30 June 2011, to the best of my knowledge and belief, there have been no contraventions of the auditor independence requirements of theCorporations Act 2001or any applicable code of professional conduct.

Ernst & Young

G Lotter

Partner

Perth

23 August 2011

The Company is of a kind referred to in ASIC Class Order 98/100 dated 10 July 1998 and in accordance with that Class Order, amounts in the financial report and Directors’ Report have been rounded off to the nearest thousand dollars unless otherwise indicated.

10

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 17. | REMUNERATION REPORT—AUDITED |

Principles of compensation

This Remuneration Report for the year ended 30 June 2011 outlines the director and executive remuneration arrangements of the Company and the Group in accordance with the requirements of theCorporations Act 2001and its Regulations. For the purposes of this report Key Management Personnel (KMP) are defined as those persons having authority and responsibility for planning, directing and controlling the major activities of the Company and the Group, directly or indirectly, including any director (whether executive or otherwise) of the parent company, and the senior executives of the Group and Company. Remuneration disclosures for two senior managers of the Group who are not KMP but are within the 5 highest paid executives of the Company and the Group is also presented.

The remuneration report is presented under the following sections:

| 1. | Individual key management personnel and other executives’ disclosures |

| 2. | Remuneration at a glance |

| 3. | Board oversight of remuneration |

| 4. | Non-executive director remuneration arrangements |

| 5. | Executive remuneration arrangements |

| 6. | Company performance and the link to remuneration |

| 7. | Executive contractual arrangements |

| 9. | Equity instruments disclosures |

1. INDIVIDUAL KEY MANAGEMENT PERSONNEL AND OTHER EXECUTIVES DISCLOSURES

Details of KMP and the highest paid executives of the Company and the Group are set out below.

Key management personnel

(i) Directors

W Peter Day Chairman (Non-executive)

Mervyn T Jones (Non-executive)

Vijoleta Braach-Maksvytis (Non-executive)

J Grahame Young (Non-executive) – retired 28 February 2011

Terry D Stinson (Executive)

(ii) Executives

Keith A Halliwell – Chief Financial Officer

B Anthony Fitzgerald – Director, Orbital Autogas Systems – resigned 1 July 2011

Geoff P Cathcart – Director, Consulting Services & Engineering

Other than the resignation of B Anthony Fitzgerald, there were no other changes to KMP after reporting date and before the date the financial report was authorised for issue.

Other executives

David R Worth – Director, Business Development, Orbital Consulting Services (OCS)

Ian G Veitch – Company Secretary

2. REMUNERATION AT A GLANCE

Orbital’s remuneration strategy is designed to attract, motivate and retain employees and non-executive directors by identifying and rewarding high performers and recognising the contribution of each employee to the continued growth and success of the Group.

There have been no material changes to the medium-term incentive (MTI) bonus plan for the 2011 financial year. As in previous years, incentive payments are based on 1) Profit after tax, 2) Operating Cash Flow, and 3) Pro-rata Consolidated Sales.

Long-term incentive (LTI) awards consisting of shares that vest based on attainment of pre-determined performance goals are awarded to select executives. For the 2011 financial year, the Company used relative total shareholder return and earnings per share as the performance measures for the share awards. During the 2011 financial year, the performance hurdles for the 2008 grant of shares were not met and no shares were vested.

As a result of the one for ten share consolidation conducted by the Company during the financial year, all of the LTI targets impacted by the number of shares outstanding have been reset to maintain their relativity.

The remuneration of non-executive directors of the Company consists only of directors’ fees and committee fees. Director fees and committee fees were reviewed and adjusted during the year. The Chairman, Mr Peter Day, sacrificed a portion of his directors fee in the 2011 financial year.

Remuneration strategy

Orbital’s remuneration strategy is designed to attract, motivate and retain employees and non-executive directors by identifying and rewarding high performers and recognising the contribution of each employee to the continued growth and success of the Group.

To this end, key objectives of the Company’s reward framework are to ensure that remuneration practices:

| | • | | Are aligned to the Group’s business strategy |

| | • | | Offer competitive remuneration benchmarked against the external market |

| | • | | Provide strong linkage between individual and Group performance and rewards |

| | • | | Align the interests of executives with shareholders through measuring total shareholder return (TSR) |

11

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

3. BOARD OVERSIGHT OF REMUNERATION

Human Resources, Remuneration and Nomination Committee

The Human Resources, Remuneration and Nomination Committee reviews and makes recommendations to the Board on remuneration packages and policies applicable to directors, secretary and senior executives of the Company.

Data is obtained from independent surveys to ensure that compensation throughout the Group is set at market rates having regard to experience and performance. In this regard, formal performance appraisals are conducted at least annually for all employees. Compensation packages may include a mix of fixed compensation, performance-based compensation and equity-based compensation.

The Human Resources, Remuneration and Nomination Committee comprises three independent non-executive directors. Further information on the committee’s role, responsibilities and membership can be seen atwww.orbitalcorp.com.au.

Remuneration approval process

The Board approves the remuneration arrangements of the CEO and executives and all awards made under the long-term incentive (LTI) plan, following recommendations from the Human Resources, Remuneration and Nomination Committee. The Board also sets the aggregate remuneration of non-executive directors which is then subject to shareholder approval.

The Human Resources, Remuneration and Nomination Committee approves, having regard to the recommendations made by the CEO, the medium-term incentive (MTI) bonus plan.

Remuneration structure

In accordance with best practice corporate governance, the structure of non-executive directors and executive remuneration is separate and distinct.

4. NON-EXECUTIVE DIRECTOR REMUNERATION ARRANGEMENTS

Remuneration policy

The Board seeks to set aggregate remuneration at a level that provides the Company with the ability to attract and retain directors of the highest calibre, whilst incurring a cost that is acceptable to shareholders.

The amount of aggregate remuneration sought to be approved by shareholders and the fee structure is reviewed against fees paid to non-executive directors of comparable companies. The Board considers advice from external consultants when undertaking the review process.

The Company’s constitution and the ASX listing rules specify that the non-executive directors’ fee pool shall be determined from time to time by a general meeting. The latest determination was at the 2001 annual general meeting (AGM) held on 25 October 2001 when shareholders approved an aggregate fee pool of $400,000 per year.

The Board will not seek any increase for the non-executive director pool at the 2011 AGM.

Structure

The remuneration of non-executive directors consists of directors’ fees and committee fees. non-executive directors do not receive retirement benefits, nor do they participate in any incentive programs.

The Chairman of the Board receives a fee of $105,000 which also covers membership of Committees of the Board. The Chairman sacrificed a portion of his fee in the 2011 financial year. Each non-executive director receives a base fee of $55,000 for being a director of the Group. An additional fee of $3,500 is also paid for each Board committee on which a non-executive director sits or $8,000 if the director is the Chairman of a Board committee. The payment of additional fees for serving on a committee recognises the additional time commitment required by non-executive directors who serve on committees.

The remuneration of non-executive directors for the year ended 30 June 2011 and 30 June 2010 is detailed in Section 8 of this report.

5. EXECUTIVE REMUNERATION ARRANGEMENTS

Remuneration levels and mix

The Group aims to reward executives with a level and mix of remuneration commensurate with their position and responsibilities within the Group and aligned with market practice. The Group undertakes an annual remuneration review to determine the total remuneration positioning against the market.

The CEO’s target remuneration mix comprises 60% fixed remuneration, 20% target MTI opportunity and 20% LTI. The LTI value is the total accounting expense associated with the grant made during the financial year. Executives’ target remuneration mix ranges from 65-85% fixed remuneration, 8-20% target MTI opportunity and 7-15% LTI.

12

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 5. | EXECUTIVE REMUNERATION ARRANGEMENTS (continued) |

Structure

In the 2011 financial year, the executive remuneration framework consisted of the following components:

| | • | | Variable remuneration (MTI and LTI) |

The table below illustrates the structure of Orbital Corporation Limited’s executive remuneration arrangements:

| | | | | | |

Remuneration

component | | Vehicle | | Purpose | | Link to performance |

| Fixed compensation | | • Represented by total fixed remuneration (TFR). • Comprises base salary, Superannuation contributions and other benefits. | | • Set with reference to role, market and experience. • Executives are given the opportunity to receive their fixed remuneration in a variety of forms including cash and fringe benefits such as motor vehicles. It is intended that the manner of payment chosen will be optimal for the recipient without creating undue cost for the Group. | | • No link to company performance. |

| MTI component | | • Paid in cash. | | • Rewards executives for their contribution to achievement of Group outcomes. | | • Profit after tax. • Pro-rata Consolidated Sales. • Operating Cash Flows. |

| LTI component | | • Awards are made in the form of shares or performance rights. | | • Rewards executives for their contribution to the creation of shareholder value over the longer term. | | • Vesting of awards is dependent on Orbital Corporation Limited’s TSR performance relative to a peer group and its Earnings Per Share. |

Fixed compensation

Fixed compensation consists of base compensation (which is calculated on a total cost basis and includes any FBT charges related to employee benefits including motor vehicles), as well as employer contributions to superannuation funds.

Executive contracts of employment do not include any guaranteed base pay increases. TFR is reviewed annually by the remuneration committee. The process consists of a review of company, business unit and individual performance, relevant comparative remuneration internally and externally and, where appropriate, external advice independent of management.

The fixed component of executives’ remuneration is detailed in Section 8.

Variable remuneration — short-term incentive (STI)

Orbital does not provide a STI for KMP.

Variable remuneration — medium-term incentive (MTI)

The medium term incentive, replacing the short term incentive, was established in 2009 to incentivise executives to achieve stretch key performance indicators (KPI’s). The MTI plan is a target based plan rather than a time based plan.

Executive directors and senior executives may receive MTI bonuses based on the achievement of key performance indicators (“KPI’s”) related to the performance of the Group over the medium term. The three KPI’s chosen by the Human Resource, Remuneration and Nomination Committee in August 2009 relate to 1) Profit after tax, 2) Operating Cash Flow, and 3) Pro-rata Consolidated Sales. These three measures are chosen as they directly align the individual’s reward to the Group’s strategy and performance.

The KPI’s are summarised as follows:

| | | | | | | | | | | | |

Key Performance Indicator | | Proportion of MTI

award KPI applies to | | | Minimum KPI

$’000 | | | Stretch KPI

$’000 | |

Financial measure: | | | | | | | | | | | | |

• Profit after tax | | | 33 | % | | | 100 | | | | 9,000 | |

• Operating Cash Flow | | | 33 | % | | | 100 | | | | 2,700 | |

• Pro-rata Consolidated Sales | | | 33 | % | | | 100,000 | | | | 150,000 | |

Bonuses can only be paid if Orbital generates a profit after tax and also generates positive operating cash flow (before working capital movements). Abnormal one-off items influencing the KPIs may be excluded at the discretion of the Human Resources, Remuneration and Nomination Committee. No bonus will be paid unless the Board is satisfied that Orbital has sufficient cash reserves.

Bonuses are awarded when a target is achieved which is higher than that which has already been achieved and rewarded. The MTI earned accumulates over time as targets are achieved with any incremental MTI earned paid annually.

The total potential MTI available is set at a level so as to provide sufficient incentive to executives to achieve the operational targets and such that the cost to the Group is reasonable in the circumstances.

13

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 5. | EXECUTIVE REMUNERATION ARRANGEMENTS (continued) |

Variable remuneration — medium-term incentive (MTI)(continued)

The annual MTI payments for executives are subject to the approval of the Human Resources, Remuneration and Nomination Committee on an annual basis, after consideration of performance against KPIs. This process usually occurs within three months after the reporting date. Payments made are delivered as a cash bonus in the following reporting period.

MTI awards for 2010 and 2011 financial years

For the 2010 financial year, 100% of the MTI cash bonus of $406,645 as previously accrued in that period vested to executives, however all participants in the MTI scheme voluntarily and irrevocably waived their right to their MTI cash bonuses. The Group recorded a reversal of the MTI cash bonus of $406,645 during the current financial year.

The Human Resources, Remuneration and Nomination Committee has considered the MTI bonus for the 2011 financial year. The MTI cash bonus available for the 2011 financial year is nil. This amount has been determined on the basis that 1) the Group’s Profit after tax (after removing abnormal items) target for the year ended 30 June 2011 has been met, however 2) Positive Operating Cash Flows for the year ended 30 June 2011 were not achieved, and 3) the Consolidated Pro-rata Sales of the Group have not reached the minimum threshold of $100,000,000.

During the year the MTI bonus plan was altered so that Positive Operating Cash Flow (excluding working capital movements) is now a pre-requisite for the payment of any MTIs.

Estimates of the minimum and maximum possible total value of the award over time is as follows:

| | | | |

Name | | Position | | Amount (Min - Max) |

Terry Stinson | | Chief Executive Officer | | 0 - $630,000 |

Keith Halliwell | | Chief Financial Officer | | 0 - $359,478 |

Tony Fitzgerald | | Director, Orbital Autogas Systems | | 0 - $332,013 |

Geoff Cathcart | | Director, Consulting Services and Engineering | | 0 - $269,325 |

David Worth | | Director, Business Development, OCS | | 0 - $166,971 |

Ian Veitch | | Company Secretary | | 0 - $72,114 |

The maximum bonus is only payable if the stretch targets on all three of the KPI’s are achieved. No bonus is awarded where performance falls below minimum thresholds.

Variable remuneration — long-term incentives (LTI)

LTI awards are made annually to executives in order to align remuneration with the creation of shareholder value over the long-term. As such, LTI awards are only made to executives and other key talent who have an impact on the Group’s performance against the relevant long-term performance measure.

Employee Share Plan No.1

Senior executives (together with all other eligible employees) are each offered shares in the Company, at no cost to the employees, to the value of $1,000 per annum under the terms of the Company’s Employee Share Plan. There are no performance conditions, because the plan is designed to align the interests of participating employees with those of shareholders. Directors do not participate in Share Plan No.1.

Executive Long Term Share Plan

Executives may also be offered rights in the Company’s Executive Long Term Share Plan under which offered shares will vest for no consideration subject to the satisfaction of performance conditions over a 3 year period or subject to Board discretion for other qualifying reasons. The performance conditions, which are based 50% on the relative ranking of the Total Shareholder Return (“TSR”) of the Company to a group of selected peers, and 50% on Earnings Per Share (EPS) (FY2009: based 100% on TSR), apply to determine the number of shares (if any) that vest to the Executives.

TSR is the percentage increase in a company’s share price plus reinvested dividends over a given period and reflects the increase in value delivered to shareholders over that period. The peer group to which the Company’s TSR will be compared will comprise the 50 smallest companies, other than resource companies and property and investment trust companies, within the S&P / ASX 300 Index. These companies have a similar market capitalisation to the Company. The TSR performance criterion was chosen as it is widely accepted as one of the best indicators of shareholder wealth creation as it includes share price growth, dividends and other capital adjustments. In addition, this criterion provides a readily obtained objective means of measuring the Group’s performance against its peer group.

The Company’s TSR ranking at the end of the Performance Period, when compared to the TSR of the peer group will determine the percentage of shares originally offered which will vest to the Executive.

The following table sets out the relevant percentages of shares offered which will vest based on various percentile rankings of the Company:

| | |

Company Performance (TSR Ranking) | | % of offered shares issued to each executive |

Up to the 50th percentile | | 0% |

At or above the 50th percentile but below the 75th percentile | | 50% to 99% (on a straight line basis) |

At or above the 75th percentile but below the 90th percentile | | 100% |

At or above the 90th percentile | | 125% |

No shares will be granted under the FY2009 offer unless the Company’s TSR is at or above the 50th percentile.

14

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 5. | EXECUTIVE REMUNERATION ARRANGEMENTS (continued) |

Variable remuneration — long-term incentives (LTI) (continued)

No shares will be granted under the FY2011 and FY2010 offers unless the Company’s TSR is at or above the 50th percentile or the EPS for the years ended 30 June 2012 and 30 June 2013 is at or above 15 and 11 cents per share, respectively.

TSR Performance targets under the LTI offered in FY2008 were not met in FY2011 and as a result nil (2010: 911,400) shares were issued to KMPs.

Executive Long Term Share Plan (continued)

At the Company’s Annual General Meeting in October 2010, shareholders approved the above plan in relation to the ongoing remuneration of the Executive Director.

Performance Rights Plan

The Company also introduced a Performance Rights Plan in 2009 as part of the employment contact of Mr T D Stinson. The Performance Rights Plan was approved by shareholders in October 2008. The Board has no present intention to utilise the Performance Rights Plan for any other senior executives.

Under the Performance Rights Plan, performance rights will only be issued if the terms and conditions detailed below are satisfied.

A performance right is a right to acquire one fully paid ordinary share in the Company. Until they are exercised, performance rights:

| (a) | do not give the holder a legal or beneficial interest in shares of the Company; and |

| (b) | do not enable participating executives to receive dividends, rights on winding up, voting rights or other shareholder benefits. |

Performance rights issued under the Performance Rights Plan will be exercisable if:

| (a) | a performance hurdle is met over the periods specified by the Board; or |

| (b) | the Board allows early exercise on cessation of employment; or |

| (c) | it is determined by the Board in light of specific circumstances. |

The terms and conditions of the offer of Performance Rights made during the year ended 30 June 2009 are as follows:

| (a) | Mr T D Stinson will be awarded 1,150,000 performance rights; |

| (b) | the grant of performance rights will be in seven tranches, each tranche with a different specified share price target as set out below: |

| | | | | | | | |

Tranche | | Number of

performance rights | | | Share price target | |

1 | | | 200,000 | | | $ | 2.50 | |

2 | | | 200,000 | | | $ | 5.00 | |

3 | | | 200,000 | | | $ | 7.50 | |

4 | | | 200,000 | | | $ | 10.00 | |

5 | | | 125,000 | | | $ | 20.00 | |

6 | | | 125,000 | | | $ | 30.00 | |

7 | | | 100,000 | | | $ | 50.00 | |

The target share prices were chosen as they directly align the director’s reward with group strategy.

| (c) | the acquisition price and exercise price of the performance rights will be nil. |

| (d) | Mr T D Stinson will only be permitted to exercise a performance right if: |

| | • | | the Company attains the specified share price target (see table above) within eight years from the date of grant of the performance right; and |

| | • | | the specified share price target is also achieved at the end of two years from the date the target is first achieved (“Vesting Date”) based on the Company’s average closing share price over a 90 day period up to and including the Vesting Date; |

| (e) | If the specified share price target is either not achieved within eight years from the date of grant, or if so achieved, not also achieved at the end of the Vesting Date, the performance right will lapse. |

No performance rights were granted during the year ended 30 June 2011.

Termination and change of control provisions

Where a participant ceases employment prior to the vesting of their award, the unvested shares are forfeited unless the Board applies its discretion to allow vesting at or post cessation of employment in appropriate circumstances.

In the event of a change of control of the Group, the performance period end date will generally be brought forward to the date of the change of control and awards will vest subject to performance over this shortened period, subject to ultimate Board discretion.

LTI awards for 2011 financial year

Shares were granted under the Employee Share Plan No.1 to a number of executives on 17 January 2011. No Shares were granted under the Executive Long Term Share Plan or the Performance Rights Plan during the 2011 financial year.

Details in respect of the award are provided in Section 9.

15

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 6. | COMPANY PERFORMANCE AND THE LINK TO REMUNERATION |

Company performance and its link to medium-term incentives

Performance linked compensation includes both medium-term and long-term incentives and is designed to reward key management personnel for meeting or exceeding their financial and personal objectives. The medium-term incentive (MTI), which has replaced the short term incentive, is an “at risk” bonus provided in the form of cash, while the long-term incentive (LTI) is provided as ordinary shares of Orbital Corporation Limited under the rules of the various Share Plans.

In considering the Group’s performance and benefits for shareholders wealth the Human Resources, Remuneration and Nomination Committee has regard to the following indices in respect of the current financial year and the previous four financial years.

Profit after tax, Pro-rata Consolidated Sales and Operating Cash Flows are considered in setting the MTI as they are considered important medium term performance targets.

Company performance for the current year, the last 4 years and KPI targets are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

$’000 | | | 2008

$’000 | | | 2009

$’000 | | | 2010

$’000 | | | 2011

$’000 | | | Minimum KPI

$’000 | | | Stretch KPI

$’000 | |

Profit after tax | | | 1,333 | | | | 469 | | | | (2,451 | ) | | | 4,516 | | | | 1,763 | | | | positive | | | | 9,000 | |

Operating Cash Flow | | | (182 | ) | | | 73 | | | | (856 | ) | | | (4,372 | ) | | | (584 | ) | | | positive | | | | 2,700 | |

Pro-rata Consolidated Sales | | | 65,004 | | | | 59,875 | | | | 63,867 | | | | 61,081 | | | | 65,889 | | | | 100,000 | | | | 150,000 | |

Operating Cash Flow (before working capital movements)* | | | (250 | ) | | | 901 | | | | (2,372 | ) | | | (2,934 | ) | | | (833 | ) | | | positive | | | | Not applicable | |

| * | A positive operating cash flow (before working capital movements) must be achieved as a pre-condition for the payment of any MTI. |

Company performance and its link to long-term incentives

The performance measure which drives LTI vesting is the Company’s TSR performance relative to the companies within its peer group and earnings per share (EPS). The table below show the performance of the Group as measured by the Group’s total shareholder return (TSR) to the median of the TSR for peer group and also the Group’s earnings per share for the past five years (including the current period) to 30 June 2011. The earnings per share values in the table below have been adjusted to reflect the share consolidation undertaken during the reporting period.

Company performance for the current year and last 4 years is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012

Minimum | | | 2013

Minimum | |

TSR ranking (percentile) | | | * | | | | 76th | | | | 70th | | | | 56th | | | | * | | | | 50th | | | | 50th | |

Earnings per share (cents) | | | 3.00 | | | | 1.00 | | | | (5.10 | ) | | | 9.39 | | | | 3.65 | | | | 15.00 | | | | 11.00 | |

| * | The Company did not measure its TSR ranking in 2007 or 2011 as the Board determined that Orbital’s TSR would be below the median TSR of the peer group. |

As a result of the Company’s performance over the last five years, LTIs offered during 2005, 2006 and 2007 were fully vested in financial year 2008 and partially vested in financial years 2009 and 2010 respectively. The performance target for the LTIs offered in 2008 were not met during the financial year 2011 and as such no shares were vested.

16

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 7. | EXECUTIVE CONTRACTUAL ARRANGEMENTS |

Remuneration arrangements for KMP are formalised in employment agreements. Details of these contracts are provided below.

The CEO, Mr. Stinson, is employed under a rolling contract.

Under the terms of the present contract as disclosed to the ASX on 14 September 2007:

| | • | | The CEO receives fixed remuneration of $350,000 per annum |

| | • | | The CEO’s target MTI opportunity per annum is 20% of annual TEC and his maximum MTI opportunity per annum is 60% of TEC |

| | • | | The CEO is eligible to participate in Orbital Corporation Limited’s LTI plan on terms determined by the Board, subject to receiving any required or appropriate shareholder approval |

The CEO’s termination provisions are as follows:

| | | | | | | | | | |

| | | Notice Period | | Payment in lieu of

notice | | Treatment of MTI

on termination | | Treatment of LTI

on termination | | Termination

payments |

Employer

initiated

termination | | 12 months | | 12 months | | Pro-rated for

time and

performance | | Board discretion | | None |

| | | | | |

Termination for

serious

misconduct | | None | | None | | Unvested awards

forfeited | | Unvested awards

forfeited | | None |

| | | | | |

Employee-

initiated

termination | | 3 months | | 3 months | | Unvested awards

forfeited | | Unvested awards

forfeited subject

to Board

discretion | | None |

Other KMP

All other KMP have rolling contracts.

Standard KMP termination provisions are as follows:

| | | | | | | | | | |

| | | Notice

Period | | Payment in lieu

of notice | | Treatment of MTI

on termination | | Treatment of LTI

on termination | | Termination payments |

Employer

initiated

termination | | 1 months | | 1 months | | Pro-rated for

time and performance | | Board discretion | | 4 weeks pay, plus 2 weeks pay for each completed year of service, plus for each completed year of service beyond 10, an additional 1/2 weeks pay, plus a pro-rata payment for each completed month of service in the final year. The maximum entitlement to termination pay is limited to 65 weeks pay. |

| | | | | |

Termination for serious

misconduct | | None | | None | | Unvested awards forfeited | | Unvested awards forfeited | | None |

| | | | | |

Employee

- initiated

termination | | 1 months | | 1 months | | Unvested awards forfeited | | Unvested awards forfeited subject to Board

discretion | | None |

Payments applicable to outgoing executives

The following arrangements applied to outgoing executives in office during the 2011 financial year:

| | • | | Mr Fitzgerald received a termination payment of $288,241, in accordance with the Company’s policy on termination payments, after over 29 years of service to the Group; |

| | • | | In accordance with the terms of the Company’s Executive Long Term Share Plan, Mr Fitzgerald’s Executive Long Term Share Plan rights that had not reached their vesting date were forfeited. |

Other than the termination of Mr Fitzgerald, there were no changes to the KMP of the Group for the year ended 30 June 2011 or subsequent to 30 June 2011.

17

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 8 | DIRECTORS’ AND EXECUTIVE OFFICERS’ REMUNERATION COMPANY AND GROUP |

Details of the nature and amount of each major element of remuneration of each director of the Company and each of the five named Company executives, and relevant group executives who receive the highest remuneration are:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Short Term | | | Post Employment | | | Share Based Payments | | | Termination

Payments $ | | | Total $ | | | Proportion of

remuneration

performance

related

% (g) | |

| | | Year | | | Salary

and

Director’s

Fees

$ | | | Cash

Bonuses

$ (a) | | | Total

$ | | | Employer

Superannuation

Contributions

$ | | | Employee

Share

Plans

$ (b)(c) | | | Performance

Rights Plan

$ (d) | | | | |

Non-executive Directors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

W Peter Day | | | 2011 | | | | 63,075 | | | | — | | | | 63,075 | | | | 5,676 | | | | — | | | | — | | | | — | | | | 68,751 | | | | — | |

Chairman (Non-executive) | | | 2010 | | | | 96,376 | | | | — | | | | 96,376 | | | | 8,674 | | | | — | | | | — | | | | — | | | | 105,050 | | | | — | |

Mervyn T Jones | | | 2011 | | | | 60,827 | | | | — | | | | 60,827 | | | | 5,475 | | | | — | | | | — | | | | — | | | | 66,302 | | | | — | |

Director (Non-executive) | | | 2010 | | | | 55,092 | | | | — | | | | 55,092 | | | | 4,958 | | | | — | | | | — | | | | — | | | | 60,050 | | | | — | |

Vijoleta Braach-Maksvytis | | | 2011 | | | | 57,955 | | | | — | | | | 57,955 | | | | 5,216 | | | | — | | | | — | | | | — | | | | 63,171 | | | | — | |

Director (Non-executive) | | | 2010 | | | | 50,505 | | | | — | | | | 50,505 | | | | 4,545 | | | | — | | | | — | | | | — | | | | 55,050 | | | | — | |

J Grahame Young | | | 2011 | | | | 41,949 | | | | — | | | | 41,949 | | | | 3,775 | | | | — | | | | — | | | | — | | | | 45,724 | | | | — | |

Director (Non-executive) | | | 2010 | | | | 52,358 | | | | — | | | | 52,358 | | | | 4,712 | | | | — | | | | — | | | | — | | | | 57,070 | | | | — | |

| | | 2011 | | | | 223,806 | | | | — | | | | 223,806 | | | | 20,142 | | | | — | | | | — | | | | — | | | | 243,948 | | | | — | |

Total Consolidated, all non-executive directors | | | 2010 | | | | 254,331 | | | | — | | | | 254,331 | | | | 22,889 | | | | — | | | | — | | | | — | | | | 277,220 | | | | — | |

Executive Director | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Terry D Stinson | | | 2011 | | | | 322,892 | | | | (140,000 | ) | | | 182,892 | | | | 36,144 | | | | 113,800 | | | | 49,283 | | | | — | | | | 382,119 | | | | 31.2 | % |

Director and Chief Executive Officer | | | 2010 | | | | 321,101 | | | | 140,000 | | | | 461,101 | | | | 38,532 | | | | 58,383 | | | | 49,283 | | | | — | | | | 607,299 | | | | 40.8 | % |

Total Consolidated, all specified directors | |

| 2011

2010 |

| |

| 546,698

575,432 |

| |

| (140,000

140,000 | )

| |

| 406,698

715,432 |

| |

| 56,286

61,421 |

| |

| 113,800

58,383 |

| |

| 49,283

49,283 |

| |

| —

— |

| |

| 626,067

884,519 |

| |

| 21.3

28.0 | %

% |

| | | | | | | |

| | | | | | Short Term | | | Post Employment | | | Share Based Payments | | | Termination

Payments

$ | | | Total

$ | | | Proportion of

remuneration

performance

related

% (g) | |

| | | Year | | | Salary

and

Director’s

Fees $ | | | Cash

Bonuses

$ (a) | | | Total

$ | | | Employer

Superannuation

Contributions

$ | | | Employee

Share

Plans

$ (b)(c) | | | Performance

Rights Plan

$ (d) | | | | |

Executives | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Keith A Halliwell | | | 2011 | | | | 256,694 | | | | (79,884 | ) | | | 176,810 | | | | 28,757 | | | | 59,542 | | | | — | | | | — | | | | 265,109 | | | | 17.3 | % |

Chief Financial Officer | | | 2010 | | | | 245,701 | | | | 79,884 | | | | 325,585 | | | | 27,439 | | | | 46,982 | | | | — | | | | — | | | | 400,006 | | | | 31.7 | % |

B Anthony Fitzgerald (e) | | | 2011 | | | | 230,593 | | | | (73,781 | ) | | | 156,812 | | | | 27,671 | | | | (41,647 | ) | | | — | | | | 288,241 | | | | 431,077 | | | | -8.2 | % |

Director, Orbital Autogas Systems | | | 2010 | | | | 225,629 | | | | 73,781 | | | | 299,410 | | | | 27,076 | | | | 39,917 | | | | — | | | | — | | | | 366,403 | | | | 31.0 | % |

Geoff P Cathcart | | | 2011 | | | | 196,340 | | | | (59,850 | ) | | | 136,490 | | | | 18,841 | | | | 42,427 | | | | — | | | | — | | | | 197,758 | | | | 16.5 | % |

Director, Consulting Services & Engineering | | | 2010 | | | | 186,998 | | | | 59,850 | | | | 246,848 | | | | 16,669 | | | | 31,172 | | | | — | | | | — | | | | 294,689 | | | | 30.9 | % |

Other executives | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

David R Worth (f) | | | 2011 | | | | 174,288 | | | | (37,105 | ) | | | 137,183 | | | | 20,915 | | | | 17,571 | | | | — | | | | — | | | | 175,669 | | | | 8.3 | % |

Director, Business Development OCS | | | 2010 | | | | 170,203 | | | | 37,105 | | | | 207,308 | | | | 20,424 | | | | 16,002 | | | | — | | | | — | | | | 243,734 | | | | 21.8 | % |

Ian G Veitch (f) | | | 2011 | | | | 155,268 | | | | (16,025 | ) | | | 139,243 | | | | 12,985 | | | | 14,033 | | | | — | | | | — | | | | 166,261 | | | | 7.7 | % |

Company Secretary | | | 2010 | | | | 147,926 | | | | 16,025 | | | | 163,951 | | | | 12,325 | | | | 11,448 | | | | — | | | | — | | | | 187,724 | | | | 14.6 | % |

Total Consolidated, all specified executives | |

| 2011

2010 |

| |

| 1,013,183

976,457 |

| |

| (266,645

266,645 | )

| |

| 746,538

1,243,102 |

| |

| 109,169

103,933 |

| |

| 91,926

145,521 |

| |

| —

— |

| |

| 288,241

— |

| |

| 1,235,874

1,492,556 |

| |

| 6.1

27.6 | %

% |

Notes in relation to the table of directors’ and executive officers remuneration

| (a) | Bonuses are those paid or accrued as payable in relation to the year reported. For the 2010 financial year, 100% of the MTI cash bonus of $406,645 as previously accrued in that period vested to executives, however all participants in the MTI scheme voluntarily and irrevocably waived their right to their MTI cash bonuses. The Group recorded a reversal of the MTI cash bonus of $406,645 during the current financial year. |

| (b) | The fair value of the Employee Share Plan #1 is based upon the market value (at offer date) of shares offered. |

| (c) | The fair value of the Executive Long Term Share plan (“ELTSP”) is calculated at the date of grant through utilisation of the assumptions underlying the Black-Scholes methodology to produce a Monte-Carlo simulation model and is allocated to each reporting period evenly over the period from grant date to vesting date. The value disclosed is the portion of the fair value of the rights recognised in this reporting period. In valuing the rights the market based hurdles that must be met before the executive long term share plan rights vest in the holder have been taken into account. |

18

DIRECTORS’ REPORT

REMUNERATION REPORT FOR THE YEAR ENDED 30 JUNE 2011

| 8. | DIRECTORS’ AND EXECUTIVE OFFICERS’ REMUNERATION COMPANY AND GROUP (continued) |

The following factors and assumptions were used in determining the fair value of TSR related rights issued under the ELTSP on grant date:

TSR related rights

| | | | | | | | | | | | | | | | | | | | | | | | |

Grant Date | | Life | | | Fair Value

per right | | | Exercise

Price | | | Market Price

of shares on

grant date | | | Expected

volatility | | | Risk free

interest rate | |

31-Aug-08 | | | 3 years | | | | 58 cents | | | | nil | | | | 79 cents | | | | 62.70 | % | | | 5.68 | % |

31-Aug-09 | | | 3 years | | | | 38 cents | | | | nil | | | | 55 cents | | | | 65.00 | % | | | 5.03 | % |

31-Aug-10 | | | 3 years | | | | 33 cents | | | | nil | | | | 34 cents | | | | 60.00 | % | | | 4.27 | % |

The following factors and assumptions were used in determining the fair value of EPS related rights issued under the ELTSP on grant date:

EPS related rights

| | | | | | | | | | | | | | | | |

Grant Date | | Life | | | Fair Value

per right | | | Exercise

Price | | | Market price

of shares on

grant date | |

31-Aug-09 | | | 3 years | | | | 55 cents | | | | nil | | | | 55 cents | |

31-Aug-10 | | | 3 years | | | | 34 cents | | | | nil | | | | 34 cents | |

The fair value of the EPS related rights is equal to the market price of shares on the grant date.

| (d) | The fair value of the Performance Rights is calculated at the date of grant through utilisation of the assumptions underlying the Black-Scholes methodology to produce a Monte-Carlo simulation model and allocated to each reporting period evenly over the period from grant date to vesting date. The value disclosed is the portion of the fair value of the performance rights recognised in this reporting period. In valuing the performance rights the hurdles that must be met before the executive long term share plan shares vest in the holder have been taken into account. |

| | | | | | | | | | | | | | | | | | | | | | | | |

Grant Date | | Life | | | Fair Value

per right | | | Target

price | | | Market price

of shares on

grant date | | | Expected

volatility | | | Risk free