UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2012

Commission File Number 1-10936

Orbital Corporation Limited

(Translation of registrant’s name into English)

4 Whipple Street Balcatta WA 6021

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x. Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l): ¨

Note: Regulation S-T Rule 10l(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No ¨

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

| | |

| | 4 WHIPPLE STREET BALCATTA WA 6021 AUSTRALIA TELEPHONE: +61 8 9441 2311 FACSIMILE: +61 8 9441 2133 http://www.orbitalcorp.com.au |

| | ASX Code: OEC |

| |

| | NYSE AMEX Code: OBT |

FOR IMMEDIATE RELEASE: 24 February 2012

ORBITAL HALF YEAR RESULTS

PERTH, AUSTRALIA:24 February 2012 - Orbital Corporation Limited today reports results for the half year ended 31 December 2011.

Key Features of the Half Year

“We are pleased to see revenue growth right across Orbital’s business segments” commented Managing Director and CEO, Terry Stinson, “Growth has been a key strategic objective and recent investments are now bearing fruit”

| | • | | Net profit after tax of $103,000 compared to a profit of $29,000 last year. |

| | • | | Consolidated revenue increased by 75% to $13.01 million |

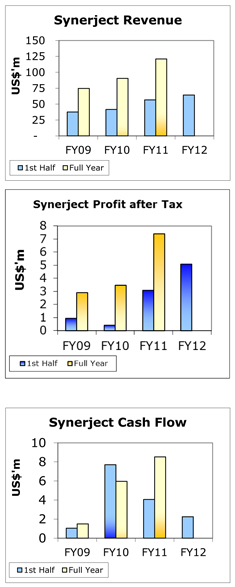

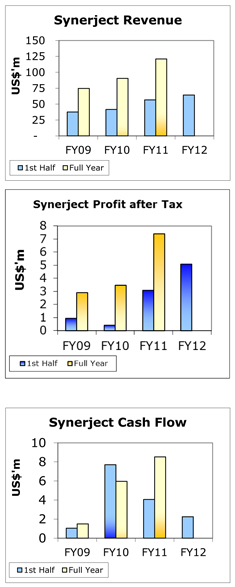

| | • | | Synerject increased revenue to US$66.42 million (+17%) and profit after tax to US$5.07 million (+65%) |

| | • | | The recently launched Ford EcoLPi Falcon incorporating Orbital Autogas Systems “Liquid” LPG injection system won Best Large Car under $60,000 at the Australian Best Car Awards. |

| | • | | AAI unveiled the latest Aerosonde small unmanned air vehicle featuring a heavy fuel engine built by Orbital, and planned to be included in bids for major US military contracts. |

| | • | | Integration of recently acquired Sprint Gas Australia one of the largest distributors in the Australian LPG aftermarket. Sprint Gas contributed $3.14 million revenue and positive EBITDA in line with the acquisition plan. |

| | • | | Net cash used in operations was $3.02 million including $2.39 million increase in inventory primarily to support the Ford EcoLPi launch. |

“Synerject achieved another great result including a record profit after tax in the half year and we look forward to continuing growth of this important and successful investment” added Mr Stinson.

1

Financial Overview (1)

| | | | | | | | | | | | | | | | |

| | | | | | | | | Dec 2011

$’000 | | | Dec 2010

$’000 | |

| Alternative Fuels | | | | | | | Revenue | | | | 7,028 | | | | 2,717 | |

| | | | | | | Segment result | | | | 137 | | | | (396 | ) |

| | | | | | | | | | | | | | | | |

| Consulting Services | | | | | | | Revenue | | | | 5,372 | | | | 4,202 | |

| | | | | | | Segment result | | | | (889 | ) | | | 36 | |

| | | | | | | | | | | | | | | | |

| Royalties and Licences | | | | Revenue | | | | 438 | | | | 463 | |

| | | | | | | Segment result | | | | 220 | | | | 273 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | Revenue | | | | 12,838 | | | | 7,382 | |

| | | | | | | Segment result | | | | (532 | ) | | | (87 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

| Synerject | | Dec 2011

US$’000 | | | Dec 2010 US$’000 | | | | | | | |

Revenue (100%) | | | 66,419 | | | | 56,608 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | equity accounted profit | | | | 2,154 | | | | 1,466 | |

Other income | | | | | | | | | | | 692 | | | | 564 | |

Foreign exchange loss | | | | | | | | | | | (22 | ) | | | (88 | ) |

Finance costs (net) | | | | | | | | | | | (171 | ) | | | (248 | ) |

Research and development | | | | | | | | | | | (232 | ) | | | (716 | ) |

Other expenses | | | | | | | | | | | (1,759 | ) | | | (1,087 | ) |

| | | | | | | | | | | | | | | | |

Profit/(Loss) before tax | | | | | | | | 130 | | | | (196 | ) |

Taxation | | | | | | | | | | | (27 | ) | | | 225 | |

| | | | | | | | | | | | | | | | |

Profit after tax | | | | | | | | | | | 103 | | | | 29 | |

| | | | | | | | | | | | | | | | |

| 1. | The information above has not been audited or reviewed, but has been extracted from Orbital’s interim financial report which has been subject to review by the external auditors. This information is presented to assist in making appropriate comparisons with prior periods and to assess the operating performance of the business. |

2

Detailed comments on Orbital’s four business streams are as follows:

Alternative Fuels

| | | | | | | | |

| | | Dec 2011 | | | Dec 2010 | |

| | | $’000 | | | $’000 | |

Revenue | | | 7,028 | | | | 2,717 | |

Segment result | | | 137 | | | | (396 | ) |

Development and supply of Alternative Fuel engine management systems remains key to Orbital’s growth strategy. Globally there is increased demand for alternative fuels, driven by fuel costs, fuel security and reduced greenhouse gas emissions. In USA and Europe, there is considerable Government policy to support development and growth. In USA shale gas is becoming a major source of natural gas with potential to reduce the reliance on imported crude oils. In Australia, Government support for alternative fuels has reduced with the introduction of the LPG fuel excise and continued reduction in direct support of the LPG Vehicle rebate scheme. This is a concern and Orbital will continue to promote Government support for LPG and other clean, low cost gaseous fuels which will provide Australia with improved fuel security.

Orbital’s initiatives in the Alternative Fuels market are in several key areas: Liquid LPG systems, LPG system aftermarket distribution and the development of Dual Fuel LNG (Liquid Natural Gas) and diesel for heavy duty transport.

Orbital Autogas Systems (OAS) developed, and is the supplier to Ford Australia of Liquid LPG systems for the Ford “EcoLPi” Falcon range of passenger cars and utilities. The Ford EcoLPi Falcon offers performance of a big family car with fuel running costs better than many mid/small sized cars. In November 2011, the EcoLPi Falcon was awarded “Best Large Car Under $60,000” by the peak motoring body the Australian Automobile Association (AAA) in conjunction with the seven major state and territory motorists’ clubs. The commercial release in this half year of the EcoLPi vehicles has boosted OAS’s revenues compared to the same period last year.

Sprint Gas Australia (SGA) is a major nationwide distributor of LPG systems for the aftermarket. SGA offers a wide range of systems from the older generation “vapouriser” systems through to sequential injection systems and the Orbital Liquid LPG systems.

Whilst the LPG aftermarket has remained at relatively low levels, both OAS and SGA are achieving positive results for the group. Both businesses have been able to carefully control their operating costs to suit the market conditions, and both are well positioned for an increase in the domestic LPG market.

The LNG dual fuel system fleet trial started with Mitchell Corporation (now Toll Corporation) has continued, with additional trucks added to the test fleet. Results have been positive to date. Whilst further commercialisation and system development will be required to make this into a mature product, there is potential for this product both in Australia and globally in the longer term.

3

Synerject

| | | | | | | | |

| | | Dec 2011 | | | Dec 2010 | |

| | | US$’000 | | | US$’000 | |

Synerject (100%) | | | | | | | | |

| | |

Revenue | | | 66,419 | | | | 56,608 | |

Profit after tax | | | 5,066 | | | | 3,078 | |

Operating cashflow, including capex | | | 2,248 | | | | 4,053 | |

| | | | | | | | |

| | |

| | | A$’000 | | | A$’000 | |

Equity accounted contribution | | | 2,154 | | | | 1,466 | |

| | | | | | | | |

Synerject, Orbital’s 42:58% Joint Venture Partnership with Continental AG, is a key supplier of engine management systems to the non-automotive market. Original equipment products using Synerject’s engine management systems range from the high performance motorcycle/recreational vehicles to the high volume scooter and small engine applications.

Synerject reported a 17% increase in revenue compared to the same period last year due partly to increased product offerings, together with post global financial crisis market recovery, primarily the marine market. Synerject has invested in new technology for a number of years; for example low cost engine management systems for motorcycle applications, which have underpinned the significant and regular growth over a number of years. As reported previously the Taiwanese motorcycle and European and North American snowmobile markets feature strongly in Synerject’s recent growth and these together with the low end motorcycle market in China and continuing recovery in non-automotive markets will be important in the future.

The increased revenue and tight cost control has resulted in a record half year profit after tax of US$5.07 million for Synerject an improvement of 65% over the previous corresponding period.

Notwithstanding an investment of US$2.87 million in working capital to support the business growth Synerject generated US$2.25 million positive cash flow. The cash was utilised in the payment of dividends and debt repayment. At 31 December 2011, Synerject held cash of US$5.29 million and borrowings of US$2.52 million (June 2011: net cash of US$2.29 million).

4

Consulting Services

| | | | | | | | |

| | | Dec 2011 | | | Dec 2010 | |

| | | $’000 | | | $’000 | |

Revenue | | | 5,372 | | | | 4,202 | |

Contribution | | | (389 | ) | | | 36 | |

| | | | | | | | |

Provision for doubtful debts | | | (500 | ) | | | — | |

Segment Result | | | (889 | ) | | | 36 | |

| | | | | | | | |

Orbital Consulting Services (OCS) provides engineering consulting services in engine design, development and specialised market supply of combustion, fuel and engine management systems, along with engine and vehicle testing and certification. Orbital provides fuel economy and emission solutions to a wide variety of engine and vehicle applications, from 150 tonne line haul trucks through to small industrial engines.

OCS revenue for the half year was $5.37 million compared to $4.20 million in the same period last year.

A major part of the engineering and consulting work carried out during the half year was the development and supply of heavy fuel engines for AAI Unmanned Aircraft Systems, an operating unit of Textron Systems, a Textron Inc. (NYSE: TXT) company. The engine is incorporated in the latest Aerosonde® small unmanned aerial vehicle (UAV). This new UAV was recently previewed in a Flight Global article, dated 11 January 2012. The engine is a 3kW (4hp) heavy fuel engine built by Orbital to meet US military requirements. The Unmanned Aerial Systems (UAS) market is an emerging market for OCS. Many UAS applications around the world are calling for “one fuel” policy. For small reconnaissance UAS applications, engine size and weight are critical. Orbital’s FlexDITM systems, coupled to purpose designed light weight two-stroke engines enable a spark-ignition engine package that can operate independently on heavy fuels such as kerosene, JP5 and JP8.

The development and supply of engines for AAI offset a reduction in Orbital’s traditional consulting service revenue. Continued softness in customer demand coupled with the continuing high value of the Australian dollar has impacted on OCS’s ability to win consulting engineering from overseas customers and achieve historical margins.

During the half year Orbital fully provided for a long outstanding customer debt ($0.49 million). Orbital continues to negotiate payment in full.

In addition to providing fee for service consulting work for customers, Orbital’s engineering group provide key services across the Orbital group supporting existing product and development of new products, along with research and development aligned with Orbital’s strategic growth strategies.

At 31 January 2011, the OCS order book stood at $1.19 million (30 June 2011 $3.87 million). The team has been working to secure several key contracts, which have the potential to deliver on our strategic plans. As it stands today, the reduced order book will result in a trading loss for the year for the OCS business. We will continue to control costs throughout the balance of the year while protecting key resources that enable delivery on key projects and strategic plans.

5

Royalties and Licensing

| | | | | | | | |

| | | Dec 2011

$’000 | | | Dec 2010

$’000 | |

Revenue | | | 438 | | | | 463 | |

Segment result | | | 220 | | | | 273 | |

Orbital earns royalties from product using its FlexDITM systems and technology. The royalty bearing products today are in the marine and the scooter/motorcycle markets.

FlexDITM product volumes reduced marginally compared to the same period last year. This, together with the strong Australian Dollar, has resulted in a 9% reduction in revenue for the half year.

Typically the second half of the financial year is the more active half for royalty revenue aligned with the North American spring and early summer recreational product build and peak sales period.

Other

Unallocated other expenses increased by $0.67 million to $1.76 million. Occupancy expenses increased by $0.28 million due to the sale and leaseback of the engineering facility in Perth and in the prior corresponding period a bonus provision was reversed resulting in a credit to the income statement of $0.40 million.

Cash Flow

| | | | | | | | |

| | | Dec 2011

$’000 | | | Dec 2010

$’000 | |

Operating cash flow | | | (3,733 | ) | | | (481 | ) |

Synerject dividend | | | 709 | | | | 737 | |

| | | | | | | | |

| | | (3,024 | ) | | | 256 | |

Other capital expenditure and development costs | | | (407 | ) | | | (394 | ) |

Proceeds/(repayment) of borrowings | | | 1,916 | | | | (1,509 | ) |

| | | | | | | | |

Movement in cash/term deposits | | | (1,515 | ) | | | (1,647 | ) |

| | | | | | | | |

Net cash used in operations (including the Synerject dividend of $0.71 million) was $3.02 million (2010:+$0.26 million). This included an increase in working capital of $2.60 million due primarily to an increase in inventory levels required to support the launch of the Ford EcoLPi Falcon. The net cash used in operations, including the Synerject dividend, but before working capital movements was $0.42 million (2010: $0.31 million). The operating cash flow in this half year included $0.37 million operating lease payments for the engineering facility (2010: $nil).

During the half year $1.92 million was drawn from a trade finance facility and at 31 December 2011 Orbital had borrowings of $2.50 million and cash (including short term deposits) of $5.36 million.

As disclosed in note 13 of the interim financial report, subsequent to balance date, the Company renegotiated the terms of the financing facilities provided by its banker to reduce the amount of the security provided by a short term deposit from $3.36 million to $1.36 million. This change provides Orbital with increased financial flexibility.

6

Outlook

It is anticipated that the alternative fuels business will see further revenue growth in the 2nd half both for OAS, in line with Ford production, and SGA as the LPG aftermarket goes through the typically stronger cycle of the year. Although the EcoLPi volumes are below expectations the increased revenue will flow through to improved results for this business segment.

Synerject has achieved significant growth in this reporting period (including 47% improvement in equity accounted result) continuing a number of successful growth years. Synerject is targeting further aggressive growth in the future however due to the timing of customer build schedules it is not anticipated to be realised in Orbital’s second half. Synerject will continue to be profitable and cash flow positive but the strong Australian dollar and timing issues noted above will likely result in a reduced equity accounted contribution from Synerject in the second half.

As noted above, the OCS international business is affected by the strong Australian dollar, and as a result the order book at 31 December 2011 is lower than historical levels and internal targets. This will result in a decline in consulting services revenue in the 2nd half compared with both the 1st half and the same period last year. The anticipated reduction in OCS revenue will also put pressure on cash resources. Orbital is however confident that the unique technology and services offered by OCS will result in a recovery of the order intake, particularly in the prospective UAS market and on-going FlexDITMapplication engineering contracts.

The outcome of the business environment outlined above, is that at this time, the Orbital Board anticipates a loss in the 2nd half and overall year. Orbital will focus on cash management and manage costs appropriately to minimise overheads during this period while protecting resources for future growth. Despite the expected short term impact to the OCS business Orbital’s strategic plans are delivering growth and diversification. Orbital is targeting a return to profits in the financial year ending 30 June 2013.

| | | | |

| CONTACTS | | Mr. Terry Stinson Chief Executive Officer Mr. Keith Halliwell Chief Financial Officer Tel: +61 8 9441 2311 | | Email Info@orbitalcorp.com.au Website www.orbitalcorp.com.au |

About Orbital

Orbital is an international developer of innovative technical solutions for a cleaner world. Orbital provides innovation, design, product development and operational improvement services to the world’s producers, suppliers, regulators and end users of engines and engine management systems for application in motorcycles, marine and recreational vehicles, automobiles and trucks. Orbital’s principal operations in Perth, Western Australia, provide a world class facility with capabilities in design, manufacturing, development and testing of engines and engine management systems. Headquartered in Perth, Western Australia, Orbital stock is traded on the Australian Stock Exchange (OEC) NYSE Amex (OBT).

Forward Looking Statements

This release includes forward-looking statements that involve risks and uncertainties. These forward-looking statements are based upon management’s expectations and beliefs concerning future events. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of the Company, which could cause actual results to differ materially from such statements. Actual results and events may differ significantly from those projected in the forward-looking statements as a result of a number of factors including, but not limited to, those detailed from time to time in the Company’s Form 20-F filings with the US Securities and Exchange Commission. Orbital makes no undertaking to subsequently update or revise the forward-looking statements made in this release to reflect events or circumstances after the date of this release.

7

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | ORBITAL CORPORATION LIMITED |

| | (Registrant) |

| | |

| Date: 24 February, 2012 | | By | | /S/ IAN VEITCH |

| | | | (Signature)* |

| | | | Ian Veitch Company Secretary |