UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-00642

Deutsche DWS International Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code:(212) 454-4500

Diane Kenneally

One International Place

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 10/31 |

| | |

| Date of reporting period: | 10/31/2019 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

October 31, 2019

Annual Report

to Shareholders

DWS Global Macro Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s Web site (dws.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank), or if you are a direct investor, by calling (800) 728-3337 or sending an email request to service@dws.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call (800) 728-3337 or send an email request to service@dws.com to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with DWS if you invest directly with the Fund.

Contents

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| | | | | | |

| 2 | | | | | DWS Global Macro Fund | | |

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Investments in mutual funds involve risk. Stocks may decline in value. Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. The Fund’s use of forward currency contracts may not be successful in hedging currency exchange rates changes and could eliminate some or all of the benefit of an increase in the value of a foreign currency versus the US dollar. Because Exchange Traded Funds (ETFs) trade on a securities exchange, their shares may trade at a premium or discount to their net asset value. ETFs also incur fees and expenses so they may not fully match the performance of the indexes they are designed to track. Fund management could be wrong in its analysis of industries, companies, economic trends and favor a security that underperforms the market. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Market price movements or regulatory and economic changes will have a significant impact on the Fund’s performance. The Fund may lend securities to approved institutions. A counterparty with whom the Fund does business may decline in financial health and become unable to honor its commitments, which could cause losses for the Fund. In certain situations, it may be difficult or impossible to sell an investment at an acceptable price. Although allocation among different asset categories generally limits risk, fund management may favor an asset category that underperforms other assets or markets as a whole. Any fund that focuses in a particular segment of the market or region of the world will generally be more volatile than a fund that invests more broadly. Investments inlower-quality (“junk bonds”) andnon-rated securities present greater risk of loss than investments in higher-quality securities. Companies in the infrastructure, transportation, energy and utility industries may be affected by a variety of factors, including, but not limited to, high interest costs, energy prices, high degrees of leverage, environmental and other government regulations, the level of government spending on infrastructure projects, intense competition and other factors. As interest rates change, issuers of higher (or lower) interest debt obligations may pay off the debts earlier (or later) than expected causing the Fund to reinvest proceeds at lower yields (or be tied up in lower interest debt obligations). Please read the prospectus for details.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 3 | |

Letter to Shareholders

Dear Shareholder:

The markets, both domestic and global, have been increasingly influenced by geopolitical concerns in recent months — most notably the trade conflict between China and the United States and uncertainty around the implementation of Britain’s exit from the European Union (“Brexit”). The result has been increased volatility and continued efforts by central banks to bolster economic growth through monetary policy.

Against this backdrop, our Americas Chief Investment Officer (“CIO”) remains constructive, albeit more cautious than at the beginning of the year. In our view, while tariffs raise concerns, particularly for commodity producing and manufacturing industries, including the world’s regional economies tilted toward such industries and still suffering from their own weak internal recoveries, a robust labor market and other key metrics suggest the underpinnings of the U.S. economy remain intact.

Of course, these issues and their potential implications bear close watching. Our CIO Office and global network of analysts diligently monitor these matters to determine when and what, if any, strategic or tactical adjustments may be warranted.

We invite you to access these views to better understand the changing landscape and, most important, what it may mean for you. The “Insights” section of our web site, dws.com, is home to our CIO View, which integrates theon-the-ground views of our worldwide network of economists, research analysts and investment professionals. This truly global perspective guides our strategic investment approach.

As always, we thank you for trusting DWS to help serve your investment needs.

Best regards,

| | |

| |

Hepsen Uzcan President, DWS Funds |

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

| | | | | | |

| 4 | | | | | DWS Global Macro Fund | | |

| | |

| Portfolio Management Review | | (Unaudited) |

Market Overview and Fund Performance

All performance information below is historical and does not guarantee future results. Returns shown are for Class A shares, unadjusted for sales charges. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the most recentmonth-end performance of all share classes. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had. Please refer to pages 10 through 12 for more complete performance information.

Investment Process

Portfolio management constructs the fund’s portfolio using a combination oftop-down macro views andbottom-up research along with risk management strategies. Based on thetop-down macro views, the portfolio management team outlines a strategic allocation among asset classes for the portfolio which is a reflection of the team’s broad market view. The portfolio management team further takes into consideration news flows, market sentiment and technical factors and then decides on a targeted level of risk. Idea generation, allocation by regions and sectors as well as position sizing are important features of the strategic allocation process during which exposures to different asset classes are determined. Selection of investments is then made usingbottom-up fundamental analysis. The portfolio management team evaluates the strategic allocations and fund investments on an ongoing basis from a risk/return perspective.

The fund invests in equities (common and preferred), bonds, structured notes, money market instruments, exchange traded funds (ETFs), and cash. There are no limits on asset class exposures, provided that risk parameters are met. The fund may also invest in alternative asset classes (such as real estate, REITs, infrastructure, convertibles, commodities and currencies). The fund may achieve exposure to commodities by investing in commodities-linked derivatives. In addition, the Fund may invest in ETFs, other registered investment companies or exchange-traded notes (ETNs) to gain exposure to certain asset classes, including commodities. The fund’s allocation to different global markets and to different investment instruments will vary depending on the overall economic cycle and assessment by portfolio management.

Currencies are considered an asset class in their own right by portfolio management and form an integral part of the strategic allocation and the investment selection process. Currencies are actively managed and portfolio management attempts to hedge against undesired currency risk. Portfolio management views currency as an important additional source of alpha-generation. Active currency positions may be taken across developed and emerging market currencies to exploit under- and/or over-valued currencies and to benefit from currency fluctuations. Portfolio management also views currency management as a beneficial source of risk diversification. Completely or partially applied currency hedges may also impact overall fund performance.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 5 | |

DWS Global Macro Fund returned 6.65% during the12-month period ended October 31, 2019, outperforming the 2.40% return of the ICE Bank of America Merrill Lynch U.S.3-Month Treasury Bill Index.

We continued to use a multi-asset strategy that strives for positive absolute returns. The foundation of our approach is our view that in an ever-changing investment environment that is increasingly driven by divergent factors across sectors, regions, currencies, and asset classes, inefficiencies can emerge and shift rapidly. Our strategy focuses on recognizing these investment opportunities in a timely fashion, and then selecting the optimal means of exploiting them to generate a positive absolute return. The Fund typically has a core exposure to assets that can provide capital preservation and/or steady income, with a disciplined tactical component designed to capitalize on opportunities as they arise. This approach helped the Fund deliver a gain over the past 12 months and build on its outperformance of the previous annual period.

Market Overview

The world financial markets delivered healthy, broad-based gains in the past year, with positive returns for both equities and bonds. The favorable backdrop largely reflected the shift in U.S. Federal Reserve (Fed) policy. In late 2018 and early 2019, the Fed began to indicate that it was likely finished raising interest rates and was set to adopt a more accommodative posture. The Fed indeed cut interest by a quarter point on three occasions from August to October, and investors appeared hopeful that more reductions could be on the way in the year ahead. Global central banks generally followed suit, highlighted by the European Central Bank’s pledge to restart its quantitative easing policy. Investors were further encouraged by the fact that the world economy — while slowing from its pace of 2018 — remained in positive territory. Corporate profits continued to expand as well, allaying the fears of an “earnings recession” that weighed on market sentiment in late 2018. Together, these factors outweighed the periodic stretches of volatility associated with the trade dispute between the United States and China. Financial assets responded very well to these developments. Global developed-market equities posted double-digit gains, with the United States outpacing its international peers. Bonds also delivered an impressive performance thanks to a strong showing for both rate- and credit-sensitive investments.

| | | | | | |

| 6 | | | | | DWS Global Macro Fund | | |

Fund Performance

The Fund firmly outpaced its cash benchmark, with its allocations to both equities and bonds adding value. On the equity side, the Fund’s holdings in the communications services sector performed well and provided a boost to results. The bond portfolio also generated a healthy absolute return, led by positions in U.S. Treasuries and emerging-markets corporate issues. High-yield bonds, while not keeping pace with the overall fixed-income market, nonetheless contributed to performance versus the cash benchmark.

“The Fund firmly outpaced its cash benchmark, with its allocations to both equities and bonds adding value.”

Although the Fund achieved its objectives of outperformance and positive total returns, it trailed the equity and fixed-income markets. This shortfall was the result of two key factors. First, we maintained an elevated cash position throughout the course of the year. At its peak in November 2018, the cash weighting reached as high as 25.7% of net assets. This strategy reflected our generally cautious view, as well as our desire to have “dry powder” on hand to take advantage of volatility. The high cash weighting did not have an effect on benchmark-relative performance, and it helped cushion downside risk in thesell-off of late 2018. However, it also played a role in the Fund’s inability to keep pace with the gains for both stocks and bonds in the subsequent rally. The Fund’s cash weighting stood at 13.4% of assets at the end of October 2019.

Second, we used derivatives to make shorter-term adjustments to the portfolio’s positioning without making major changes to the Fund’s core holdings. This aspect of our approach detracted from performance by preventing the Fund from fully capitalizing on the rally in stocks. On the positive side, the use of derivatives helped mitigate the volatility in the broader market.

The Fund also used derivatives to help us fine-tune our positioning with regard to interest rates and currencies. The use of derivatives for these purposes was a net detractor in the annual period.

Outlook and Positioning

We adopted a more defensive posture early in the period, and we maintained this stance thereafter. We saw a number of issues that had

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 7 | |

the potential to derail the markets, including the slowdown in global growth and the headlines regarding the trade conflict. This element of defensiveness limited the extent of the Fund’s gain, as stocks and higher-risk segments of the bond market continued to post gains despite these headwinds. Still, we don’t think it’s appropriate to move far out the risk spectrum following an extended, broad-based rally in financial assets. We therefore maintained a somewhat defensive approach as of the end of October.

In the equity portfolio, this translated to a focus on larger, stable growers with high free cash flows and solid dividend yields. The majority of Fund’s equity holdings are domiciled in the developed markets, primarily the United States and Europe. At the sector level, we saw the best opportunities in communication services, health care, and information technology.

On the bond side, we sought to maintain a low duration (interest-rate sensitivity) to manage the risk that bond yields could rise from theultra-low levels they reached in the late summer. The fixed-income portfolio continued to feature of mix of corporate bonds, emerging-markets debt, and U.S. Treasuries. We believe Treasuries, while offering low yields, should continue to find support from their sizable yield advantage over other developed markets.

More broadly speaking, we think our defensive, multifaceted strategy can help the Fund continue to capitalize on potential opportunities while also guarding against the possibility of an unfavorable shift in market conditions.

| | | | | | |

| 8 | | | | | DWS Global Macro Fund | | |

Portfolio Management Team

Henning Potstada, Managing Director

Portfolio Manager of the Fund. Began managing the Fund in 2017.

| – | Portfolio Manager for Multi Asset: Frankfurt. |

| – | MBA, University of Bayreuth, Germany. |

Christoph-Arend Schmidt, CFA, Director

Portfolio Manager of the Fund. Began managing the Fund in 2017.

| – | Portfolio Manager for Multi Asset: Frankfurt. |

| – | MBA, University of Bayreuth, Germany. |

Stefan Flasdick, Vice President

Portfolio Manager of the Fund. Began managing the Fund in 2017.

| – | Joined DWS in 2004 with 11 years of industry experience. Prior to his current role, he served as a portfolio manager in Deutsche Bank Private Wealth Management. Previously, he served in Futures & Options Sales for Germany & Austria at JP Morgan in London and Frankfurt. He began his career as a Trainee in Treasury and F&O Sales at BfG Bank / Credit Lyonnais. |

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

Anexchange-traded fund (ETF) is a security that tracks an index, a commodity or a basket of assets like an index fund but that trades like a stock on an exchange.

ICE Bank of America Merrill Lynch US 3-Month Treasury Bill Index tracks the performance of the US dollar denominated US Treasury Bills publicly issued in the US domestic market with a remaining term to final maturity of less than three months.

Index returns do not reflect fees or expenses and it is not possible to invest directly into an index.

Derivatives are contracts whose values can be based on a variety of instruments including indices, currencies or securities. They can be utilized for a variety of reasons including for hedging purposes; for risk management; fornon-hedging purposes to seek to enhance potential gains; or as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 9 | |

| | |

| Performance Summary | | October 31, 2019 (Unaudited) |

| | | | | | | | | | | | |

| Class A | | 1-Year | | | 5-Year | | | 10-Year | |

|

| Average Annual Total Returnsas of 10/31/19 | |

| Unadjusted for Sales Charge | | | 6.65% | | | | 5.03% | | | | 6.15% | |

Adjusted for the Maximum Sales Charge

(max 5.75% load) | | | 0.52% | | | | 3.79% | | | | 5.52% | |

ICE Bank of America Merrill Lynch

U.S.3-Month Treasury Bill Index† | | | 2.40% | | | | 1.02% | | | | 0.56% | |

| | | |

| Class C | | 1-Year | | | 5-Year | | | 10-Year | |

|

| Average Annual Total Returnsas of 10/31/19 | |

| Unadjusted for Sales Charge | | | 5.85% | | | | 4.22% | | | | 5.35% | |

Adjusted for the Maximum Sales Charge

(max 1.00% CDSC) | | | 5.85% | | | | 4.22% | | | | 5.35% | |

ICE Bank of America Merrill Lynch

U.S.3-Month Treasury Bill Index† | | | 2.40% | | | | 1.02% | | | | 0.56% | |

| | | |

| Class R | | 1-Year | | | 5-Year | | | 10-Year | |

|

| Average Annual Total Returnsas of 10/31/19 | |

| No Sales Charges | | | 6.35% | | | | 4.77% | | | | 5.89% | |

ICE Bank of America Merrill Lynch

U.S.3-Month Treasury Bill Index† | | | 2.40% | | | | 1.02% | | | | 0.56% | |

| | | |

| Class S | | 1-Year | | | 5-Year | | | 10-Year | |

|

| Average Annual Total Returnsas of 10/31/19 | |

| No Sales Charges | | | 7.04% | | | | 5.27% | | | | 6.36% | |

ICE Bank of America Merrill Lynch

U.S.3-Month Treasury Bill Index† | | | 2.40% | | | | 1.02% | | | | 0.56% | |

| | | |

| Institutional Class | | 1-Year | | | 5-Year | | | 10-Year | |

|

| Average Annual Total Returnsas of 10/31/19 | |

| No Sales Charges | | | 6.98% | | | | 5.30% | | | | 6.46% | |

ICE Bank of America Merrill Lynch

U.S.3-Month Treasury Bill Index† | | | 2.40% | | | | 1.02% | | | | 0.56% | |

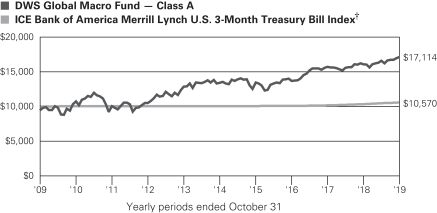

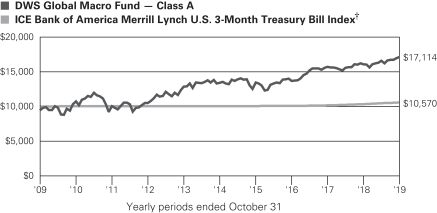

Performance in the Average Annual Total Returns table(s) above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the Fund’s most recentmonth-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

| | | | | | |

| 10 | | | | | DWS Global Macro Fund | | |

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated February 1, 2019 (July 1, 2019 for Class R6) are 2.60%, 3.34%, 2.82%, 2.14%, 2.34% and 2.19% for Class A, Class C, Class R, Class R6, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Prior to May 8, 2017, this Fund was known as Deutsche Global Equity Fund. The Fund’s investment objective, strategy and portfolio management team also changed on that date. All returns, rankings and ratings prior to May 8, 2017 were achieved with a different objective, strategy and portfolio management. Please see the prospectus for details.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

|

Growth of an Assumed $10,000 Investment

(Adjusted for Maximum Sales Charge) |

The Fund’s growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial investment of $9,425.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

| † | ICE Bank of America Merrill Lynch U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than three months. |

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class R | | | Class R6 | | | Class S | | | Institutional

Class | |

| | | | | | |

| Net Asset Value | | | | | | | | | | | | | | | | | | | | | | | | |

| 10/31/19 | | $ | 10.16 | | | $ | 9.48 | | | $ | 9.77 | | | $ | 9.98 | | | $ | 9.95 | | | $ | 9.97 | |

| 7/1/19 (commencement of operations of Class R6) | | $ | — | | | $ | — | | | $ | — | | | $ | 9.70 | | | $ | — | | | $ | — | |

| 10/31/18 | | $ | 10.15 | | | $ | 9.48 | | | $ | 9.77 | | | $ | — | | | $ | 9.93 | | | $ | 9.96 | |

| | | | |

| Distribution Informationas on 10/31/2019 | | | | | | | | | | | | | | | | | |

| Income Dividends, Twelve Months | | $ | .42 | | | $ | .32 | | | $ | .38 | | | $ | — | | | $ | .43 | | | $ | .44 | |

| Capital Gain Distributions, Twelve Months | | $ | .18 | | | $ | .18 | | | $ | .18 | | | $ | — | | | $ | .18 | | | $ | .18 | |

| | | | | | |

| 12 | | | | | DWS Global Macro Fund | | |

| | |

| Portfolio Summary | | (Unaudited) |

| | | | | | | | |

| | |

Asset Allocation (As a % of Investment Portfolio excluding

Securities Lending Collateral) | | 10/31/19 | | | 10/31/18 | |

| Common Stocks | | | 50% | | | | 36% | |

| Corporate Bonds | | | 15% | | | | 17% | |

U.S. Treasury Obligations | | | 11% | | | | 3% | |

| Cash Equivalents | | | 11% | | | | 33% | |

| Sovereign Bonds | | | 8% | | | | 5% | |

| Fixed Income Exchange-Traded Funds | | | 4% | | | | 5% | |

| Convertible Bonds | | | 1% | | | | 1% | |

| | | | 100% | | | | 100% | |

| | |

Geographical Diversification (As a % of Investment

Portfolio excluding Exchange Traded Funds, Cash Equivalents

and Securities Lending Collateral) | | 10/31/19 | | | 10/31/18 | |

| United States | | | 41% | | | | 35% | |

| Germany | | | 13% | | | | 12% | |

| France | | | 11% | | | | 13% | |

| Netherlands | | | 7% | | | | 9% | |

| Turkey | | | 6% | | | | 6% | |

| United Kingdom | | | 5% | | | | 3% | |

| Russia | | | 4% | | | | 4% | |

| Switzerland | | | 4% | | | | 6% | |

| Taiwan | | | 2% | | | | 3% | |

| China | | | 2% | | | | 2% | |

| Japan | | | 2% | | | | 1% | |

| Mexico | | | 1% | | | | 2% | |

| Other | | | 2% | | | | 4% | |

| | | | 100% | | | | 100% | |

| | |

Sector Diversification (As a % of Common Stocks,

Corporate Bonds and Convertible Bonds) | | 10/31/19 | | | 10/31/18 | |

| Health Care | | | 19% | | | | 12% | |

| Communication Services | | | 18% | | | | 22% | |

| Financials | | | 18% | | | | 23% | |

| Energy | | | 12% | | | | 10% | |

| Information Technology | | | 11% | | | | 12% | |

| Industrials | | | 9% | | | | 9% | |

| Consumer Staples | | | 5% | | | | 5% | |

| Consumer Discretionary | | | 3% | | | | 1% | |

Materials | | | 3% | | | | 6% | |

| Utilities | | | 2% | | | | — | |

| | | | 100% | | | | 100% | |

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 13 | |

| | | | | | | | | | |

Five Largest Equity Holdings at October 31, 2019

(10.6% of Net Assets) | | Country | | Percent | |

| | 1 | | | Vonovia SE | | Germany | | | 2.7 | % |

| | | | | Provider of real estate services | | | | | | |

| | 2 | | | Vodafone Group PLC | | United Kingdom | | | 2.0 | % |

| | | | | Provider of mobile telecommunication services | | | | | | |

| | 3 | | | Royal Dutch Shell PLC | | Netherlands | | | 2.0 | % |

| | | | | Explores, produces and refines petroleum | | | | | | |

| | 4 | | | Alphabet, Inc. | | United States | | | 2.0 | % |

| | | | | ProvidesWeb-based search, maps, hardware products and various software applications | | | | | | |

| | 5 | | | AT&T, Inc. | | United States | | | 1.9 | % |

| | | | | An integrated telecommunications company | | | | | | |

| | | | | | | | | | |

Five Largest Fixed-Income Long-Term Securities at

October 31, 2019 (11.1% of Net Assets) | | Country | | Percent | |

| | 1 | | | U.S. Treasury Notes | | United States | | | 4.9 | % |

| | | | | 2.375%, 5/15/2029 | | | | | | |

| | 2 | | | U.S. Treasury Notes | | United States | | | 2.0 | % |

| | | | | 2.75%, 4/30/2023 | | | | | | |

| | 3 | | | U.S. Treasury Notes | | United States | | | 1.4 | % |

| | | | | 2.875%, 10/31/2020 | | | | | | |

| | 4 | | | U.S. Treasury Notes | | United States | | | 1.4 | % |

| | | | | 1.75%, 10/31/2020 | | | | | | |

| | 5 | | | U.S. Treasury Notes | | United States | | | 1.4 | % |

| | | | | 1.375%, 9/30/2020 | | | | | | |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 15. A quarterly Fact Sheet is available on dws.com or upon request. Please see the Account Management Resources section on page 63 for contact information.

| | | | | | |

| 14 | | | | | DWS Global Macro Fund | | |

| | |

| Investment Portfolio | | as of October 31, 2019 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| Common Stocks 48.0% | |

| Austria 0.2% | |

Lenzing AG (Cost $72,903) | | | 750 | | | | 79,019 | |

|

| Belgium 0.3% | |

bpost SA (Cost $133,105) | | | 8,908 | | | | 101,692 | |

|

| China 1.4% | |

| | |

Alibaba Group Holding Ltd. (ADR)* | | | 1,498 | | | | 264,651 | |

| | |

Tencent Holdings Ltd. | | | 5,600 | | | | 227,710 | |

| | | | | | | | |

(Cost $535,860) | | | | 492,361 | |

|

| France 6.1% | |

| | |

Airbus SE | | | 1,268 | | | | 181,559 | |

| | |

AXA SA | | | 14,115 | | | | 372,516 | |

| | |

Bureau Veritas SA | | | 2,705 | | | | 69,012 | |

| | |

Capgemini SE | | | 888 | | | | 99,978 | |

| | |

Cie de Saint-Gobain | | | 5,660 | | | | 230,239 | |

| | |

EssilorLuxottica SA | | | 691 | | | | 105,345 | |

| | |

LVMH Moet Hennessy Louis Vuitton SE | | | 170 | | | | 72,500 | |

| | |

Sanofi | | | 3,246 | | | | 298,886 | |

| | |

TOTAL SA | | | 9,867 | | | | 519,083 | |

| | |

Veolia Environnement SA | | | 5,526 | | | | 145,242 | |

| | | | | | | | |

(Cost $1,993,043) | | | | 2,094,360 | |

|

| Germany 10.4% | |

| | |

Allianz SE (Registered) | | | 560 | | | | 136,768 | |

| | |

BASF SE | | | 3,172 | | | | 241,284 | |

| | |

Bayer AG (Registered) | | | 5,270 | | | | 409,453 | |

| | |

Deutsche Post AG (Registered) | | | 1,937 | | | | 68,553 | |

| | |

Deutsche Telekom AG (Registered) | | | 11,369 | | | | 199,888 | |

| | |

E.ON SE | | | 36,460 | | | | 367,336 | |

| | |

Evonik Industries AG | | | 13,809 | | | | 364,155 | |

| | |

Fresenius SE & Co. KGaA | | | 5,468 | | | | 287,457 | |

| | |

Infineon Technologies AG | | | 6,181 | | | | 119,867 | |

| | |

SAP SE | | | 1,307 | | | | 172,951 | |

| | |

TUI AG | | | 11,357 | | | | 148,218 | |

| | |

Vonovia SE | | | 17,547 | | | | 933,982 | |

| | |

Wirecard AG | | | 955 | | | | 120,972 | |

| | | | | | | | |

(Cost $3,451,939) | | | | 3,570,884 | |

|

| Japan 1.4% | |

| | |

Murata Manufacturing Co., Ltd. | | | 1,400 | | | | 76,080 | |

| | |

Panasonic Corp. | | | 35,200 | | | | 295,824 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 15 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Secom Co., Ltd.

| | | 1,200 | | | | 111,306 | |

| | | | | | | | |

(Cost $512,425) | | | | 483,210 | |

|

| Korea 0.2% | |

Samsung Electronics Co., Ltd. (Cost $66,542) | | | 1,629 | | | | 70,114 | |

|

| Netherlands 3.5% | |

| | |

ING Groep NV | | | 28,192 | | | | 318,483 | |

| | |

Koninklijke Ahold Delhaize NV | | | 7,460 | | | | 185,777 | |

| | |

Royal Dutch Shell PLC “A” | | | 24,113 | | | | 700,580 | |

| | | | | | | | |

(Cost $1,289,985) | | | | 1,204,840 | |

|

| Russia 1.2% | |

| | |

Gazprom PJSC (ADR) | | | 24,127 | | | | 193,318 | |

| | |

Sberbank of Russia PJSC (ADR) | | | 14,661 | | | | 215,553 | |

| | | | | | | | |

(Cost $349,895) | | | | 408,871 | |

|

| Singapore 0.1% | |

Singapore Exchange Ltd. (Cost $26,212) | | | 5,000 | | | | 32,837 | |

|

| Spain 0.4% | |

Banco Santander SA (Cost $198,179) | | | 33,554 | | | | 134,663 | |

|

| Switzerland 3.0% | |

| | |

Nestle SA (Registered) | | | 2,791 | | | | 297,868 | |

| | |

Novartis AG (Registered) | | | 2,551 | | | | 222,383 | |

| | |

Roche Holding AG (Genusschein) | | | 1,640 | | | | 493,668 | |

| | | | | | | | |

(Cost $737,521) | | | | 1,013,919 | |

|

| Taiwan 1.5% | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Cost $380,603) | | | 53,000 | | | | 515,467 | |

|

| United Kingdom 2.8% | |

| | |

Compass Group PLC | | | 6,961 | | | | 185,524 | |

| | |

Reckitt Benckiser Group PLC | | | 1,045 | | | | 80,672 | |

| | |

Vodafone Group PLC | | | 345,357 | | | | 703,907 | |

| | | | | | | | |

(Cost $841,644) | | | | 970,103 | |

|

| United States 15.5% | |

| | |

AbbVie, Inc. | | | 7,929 | | | | 630,752 | |

| | |

Allergan PLC | | | 1,233 | | | | 217,144 | |

| | |

Alphabet, Inc. “A”* | | | 550 | | | | 692,340 | |

| | |

American Express Co. | | | 1,444 | | | | 169,352 | |

| | |

Amgen, Inc. | | | 413 | | | | 88,072 | |

| | |

AT&T, Inc. | | | 16,739 | | | | 644,284 | |

| | |

Cisco Systems, Inc. | | | 7,275 | | | | 345,635 | |

| | |

CVS Health Corp. | | | 5,066 | | | | 336,332 | |

| | |

Elanco Animal Health, Inc.* | | | 6,450 | | | | 174,279 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 16 | | | | | DWS Global Macro Fund | | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| | |

Johnson & Johnson | | | 4,376 | | | | 577,807 | |

| | |

MasterCard, Inc. “A” | | | 689 | | | | 190,722 | |

| | |

Microsoft Corp. | | | 741 | | | | 106,237 | |

| | |

Mohawk Industries, Inc.* | | | 427 | | | | 61,223 | |

| | |

Pfizer, Inc. | | | 10,572 | | | | 405,648 | |

| | |

Schlumberger Ltd. | | | 1,570 | | | | 51,323 | |

| | |

Walt Disney Co. | | | 3,979 | | | | 516,952 | |

| | |

Wells Fargo & Co. | | | 2,293 | | | | 118,388 | |

| | | | | | | | |

(Cost $4,656,244) | | | | 5,326,490 | |

Total Common Stocks(Cost $15,246,100) | | | | 16,498,830 | |

| | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| Bonds 33.4% | |

| France 3.1% | |

| | |

BNP Paribas SA, REG S,3-month EURIBOR + 0.850%, 0.454%**, 9/22/2022 | | EUR | 357,000 | | | | 403,548 | |

|

CMA CGM SA: | |

| | |

REG S, 5.25%, 1/15/2025 | | | 345,000 | | | | 259,725 | |

| | |

REG S, 6.5%, 7/15/2022 | | | 224,000 | | | | 184,248 | |

| | |

REG S, 7.75%, 1/15/2021 | | | 250,000 | | | | 230,666 | |

| | | | | | | | |

(Cost $1,271,673) | | | | 1,078,187 | |

|

| Germany 0.3% | |

Hapag-Lloyd AG, REG S, 5.125%, 7/15/2024

(Cost $113,916) | | EUR | 100,000 | | | | 117,385 | |

|

| Ireland 0.6% | |

GE Capital International Funding Co. Unlimited Co., 2.342%, 11/15/2020 (Cost $198,394) | | | 200,000 | | | | 199,875 | |

|

| Mexico 0.9% | |

Petroleos Mexicanos, 6.5%, 3/13/2027 (Cost $312,017) | | | 294,000 | | | | 311,640 | |

|

| Netherlands 2.0% | |

|

Petrobras Global Finance BV: | |

| | |

5.375%, 1/27/2021 | | | 330,000 | | | | 341,138 | |

| | |

8.375%, 5/23/2021 (b) | | | 308,000 | | | | 336,105 | |

| | | | | | | | |

(Cost $656,822) | | | | 677,243 | |

|

| Oman 0.6% | |

Oman Government International Bond, REG S, 5.625%, 1/17/2028 (Cost $198,000) | | | 200,000 | | | | 197,750 | |

|

| Russia 1.9% | |

|

Russian Federal Bond — OFZ: | |

| | |

7.0%, 8/16/2023 | | RUB | 20,382,000 | | | | 328,032 | |

| | |

7.6%, 4/14/2021 | | RUB | 20,710,000 | | | | 330,510 | |

| | | | | | | | |

(Cost $660,122) | | | | 658,542 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 17 | |

| | | | | | | | |

| | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

|

| Turkey 5.1% | |

|

Republic of Turkey: | |

| | |

3.25%, 6/14/2025 | | | 200,000 | | | | 216,368 | |

| | |

4.35%, 11/12/2021 | | | 250,000 | | | | 292,069 | |

| | |

5.125%, 5/18/2020 | | | 208,000 | | | | 237,096 | |

| | |

5.125%, 3/25/2022 | | | 200,000 | | | | 202,000 | |

| | |

5.625%, 3/30/2021 | | | 208,000 | | | | 212,511 | |

| | |

6.25%, 9/26/2022 | | | 200,000 | | | | 206,794 | |

| | |

7.0%, 6/5/2020 | | | 300,000 | | | | 306,018 | |

| | |

7.375%, 2/5/2025 | | | 80,000 | | | | 85,800 | |

| | | | | | | | |

(Cost $1,687,086) | | | | 1,758,656 | |

|

| United Kingdom 1.2% | |

HSBC Holdings PLC, REG S,3-month EURIBOR + 0.700%, 0.29%**, 9/27/2022 (Cost $397,978) | | EUR | 356,000 | | | | 399,270 | |

|

| United States 17.7% | |

| | |

Anheuser-Busch InBev Worldwide, Inc., 4.0%, 4/13/2028 | | | 170,000 | | | | 187,657 | |

| | |

Arconic, Inc., 5.125%, 10/1/2024 | | | 350,000 | | | | 375,375 | |

| | |

Coty, Inc., 144A, 6.5%, 4/15/2026 (b) | | | 300,000 | | | | 307,374 | |

| | |

DISH DBS Corp., 7.75%, 7/1/2026 | | | 40,000 | | | | 40,354 | |

|

Netflix, Inc.: | |

| | |

144A, 4.625%, 5/15/2029 | | | 185,000 | | | | 225,599 | |

| | |

144A, 6.375%, 5/15/2029 | | | 30,000 | | | | 33,675 | |

|

T-Mobile U.S.A., Inc.: | |

| | |

6.0%, 3/1/2023 | | | 321,000 | | | | 327,420 | |

| | |

6.375%, 3/1/2025 | | | 250,000 | | | | 259,428 | |

| | |

The Goldman Sachs Group, Inc., REG S,3-month EURIBOR + 1.000%, 0.596%**, 7/27/2021 | | EUR | 352,000 | | | | 397,669 | |

| | |

Transocean, Inc., 6.5%, 11/15/2020 | | | 79,000 | | | | 80,383 | |

|

U.S. Treasury Notes: | |

| | |

1.375%, 9/30/2020 | | | 466,000 | | | | 464,962 | |

| | |

1.75%, 10/31/2020 | | | 466,000 | | | | 466,637 | |

| | |

2.375%, 5/15/2029 | | | 1,600,000 | | | | 1,696,562 | |

| | |

2.75%, 4/30/2023 | | | 650,000 | | | | 676,965 | |

| | |

2.875%, 10/31/2020 | | | 466,000 | | | | 471,716 | |

| | |

VeriSign, Inc., 5.25%, 4/1/2025 | | | 55,000 | | | | 60,225 | |

| | | | | | | | |

(Cost $5,920,802) | | | | 6,072,001 | |

Total Bonds(Cost $11,416,810) | | | | 11,470,549 | |

|

| Convertible Bonds 0.6% | |

| Mexico 0.3% | |

America Movil SAB de CV, REG S, 0.00%, 5/28/2020* (Cost $109,563) | | EUR | 100,000 | | | | 111,277 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 18 | | | | | DWS Global Macro Fund | | |

| | | | | | | | |

| | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

|

| United States 0.3% | |

Twitter, Inc., 1.0%, 9/15/2021 (Cost $92,845) | | | 96,000 | | | | 92,905 | |

Total Convertible Bonds(Cost $202,408) | | | | 204,182 | |

| | |

| | | Shares | | | Value ($) | |

| Exchange-Traded Funds 3.6% | |

| | |

iShares Floating Rate Bond ETF | | | 14,613 | | | | 745,117 | |

| | |

SPDR Bloomberg Barclays1-3 MonthT-Bill ETF | | | 5,423 | | | | 496,746 | |

| |

Total Exchange-Traded Funds(Cost $1,239,585) | | | | 1,241,863 | |

|

| Securities Lending Collateral 0.3% | |

DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares”,

1.72% (c) (d) (Cost $125,775) | | | 125,775 | | | | 125,775 | |

|

| Cash Equivalents 10.3% | |

DWS Central Cash Management Government Fund,

1.82% (c) (Cost $3,541,267) | | | 3,541,267 | | | | 3,541,267 | |

| | |

| | | % of Net

Assets | | | Value ($) | |

| Total Investment Portfolio(Cost $31,771,945) | | | 96.2 | | | | 33,082,466 | |

| Other Assets and Liabilities, Net | | | 3.8 | | | | 1,290,937 | |

| |

| Net Assets | | | 100.0 | | | | 34,373,403 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 19 | |

A summary of the Fund’s transactions with affiliated investments during the year ended October 31, 2019 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value ($)

at

10/31/2018 | | | Pur-

chases

Cost

($) | | | Sales

Proceeds

($) | | | Net

Real-

ized

Gain/

(Loss)

($) | | | Net

Change

in

Unrealized

Appreci-

ation

(Depreci-

ation)

($) | | | Income

($) | | | Capital

Gain

Distri-

butions

($) | | | Number of

Shares at

10/31/2019 | | | Value ($)

at

10/31/2019 | |

| | Securities Lending Collateral 0.3% | |

| DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares”,

1.72% (c) (d) |

|

| | — | | | | 125,775 (e) | | | | — | | | | — | | | | — | | | | 3,547 | | | | — | | | | 125,775 | | | | 125,775 | |

| | Cash Equivalents 10.3% | |

| | DWS Central Cash Management Government Fund, 1.82% (c) | |

| | 8,108,844 | | | | 14,771,473 | | | | 19,339,050 | | | | — | | | | — | | | | 193,619 | | | | — | | | | 3,541,267 | | | | 3,541,267 | |

| | 8,108,844 | | | | 14,897,248 | | | | 19,339,050 | | | | — | | | | — | | | | 197,166 | | | | — | | | | 3,667,042 | | | | 3,667,042 | |

| * | Non-income producing security. |

| ** | Variable or floating rate security. These securities are shown at their current rate as of October 31, 2019. For securities based on a published reference rate and spread, the reference rate and spread are indicated within the description above. Certain variable rate securities are not based on a published reference rate and spread but adjust periodically based on current market conditions, prepayment of underlying positions and/or other variables. |

| (a) | Principal amount stated in U.S. dollars unless otherwise noted. |

| (b) | All or a portion of these securities were on loan. In addition, “Other Assets and Liabilities, Net” may include pending sales that are also on loan. The value of securities loaned at October 31, 2019 amounted to $119,371, which is 0.3% of net assets. |

| (c) | Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualizedseven-day yield at period end. |

| (d) | Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. |

| (e) | Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested in cash collateral for the year ended October 31, 2019. |

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

ADR: American Depositary Receipt

EURIBOR: Euro Interbank Offered Rate

OFZ: Obigatyi Federal novo Zaima (Federal Loan Obligations)

PJSC: Public Joint Stock Company

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

S&P: Standard & Poor’s

SPDR: Standard & Poor’s Depositary Receipt

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 20 | | | | | DWS Global Macro Fund | | |

At October 31, 2019, open futures contracts sold were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Futures | | Currency | | | Expiration

Date | | | Contracts | | | Notional

Amount ($) | | | Notional

Value ($) | | | Unrealized

Depreciation ($) | |

| Mini-DAX Index | | | EUR | | | | 12/20/2019 | | | | 24 | | | | 1,650,231 | | | | 1,725,614 | | | | (75,383 | ) |

| NASDAQ 100E-Mini Index | | | USD | | | | 12/20/2019 | | | | 5 | | | | 778,964 | | | | 809,025 | | | | (30,061 | ) |

| S&P 500E-Mini Index | | | USD | | | | 12/20/2019 | | | | 13 | | | | 1,950,945 | | | | 1,973,269 | | | | (22,324 | ) |

| Total unrealized depreciation | | | | | | | | | | | | | | | | (127,768 | ) |

As of October 31, 2019, the Fund had the following open forward foreign currency contracts:

| | | | | | | | | | | | | | | | | | | | |

Contracts to

Deliver | | | In Exchange For | | | Settlement

Date | | | Unrealized

Depreciation ($) | | | Counterparty |

| HKD | | | 2,988,650 | | | USD | | | 381,256 | | | | 11/29/2019 | | | | (80 | ) | | Royal Bank of Canada |

| EUR | | | 9,244,528 | | | USD | | | 10,295,326 | | | | 11/29/2019 | | | | (34,426 | ) | | Royal Bank of Canada |

| Total unrealized depreciation | | | | | | | | (34,506 | ) | | |

|

| Currency Abbreviations |

| EUR Euro |

| HKD Hong Kong Dollar |

| RUB Russian Ruble |

| USD United States Dollar |

For information on the Fund’s policy and additional disclosures regarding futures contracts and forward foreign currency contracts, please refer to the Derivatives section of Note B in the accompanying Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 21 | |

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2019 in valuing the Fund’s investments. For information on the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

Austria | | $ | — | | | $ | 79,019 | | | $ | — | | | $ | 79,019 | |

Belgium | | | — | | | | 101,692 | | | | — | | | | 101,692 | |

China | | | 264,651 | | | | 227,710 | | | | — | | | | 492,361 | |

France | | | — | | | | 2,094,360 | | | | — | | | | 2,094,360 | |

Germany | | | — | | | | 3,570,884 | | | | — | | | | 3,570,884 | |

Japan | | | — | | | | 483,210 | | | | — | | | | 483,210 | |

Korea | | | — | | | | 70,114 | | | | — | | | | 70,114 | |

Netherlands | | | — | | | | 1,204,840 | | | | — | | | | 1,204,840 | |

Russia | | | 408,871 | | | | — | | | | — | | | | 408,871 | |

Singapore | | | — | | | | 32,837 | | | | — | | | | 32,837 | |

Spain | | | — | | | | 134,663 | | | | — | | | | 134,663 | |

Switzerland | | | — | | | | 1,013,919 | | | | — | | | | 1,013,919 | |

Taiwan | | | — | | | | 515,467 | | | | — | | | | 515,467 | |

United Kingdom | | | — | | | | 970,103 | | | | — | | | | 970,103 | |

United States | | | 5,326,490 | | | | — | | | | — | | | | 5,326,490 | |

| Bonds | | | — | | | | 11,470,549 | | | | — | | | | 11,470,549 | |

| Convertible Bonds | | | — | | | | 204,182 | | | | — | | | | 204,182 | |

| Exchange-Traded Funds | | | 1,241,863 | | | | — | | | | — | | | | 1,241,863 | |

| Short-Term Investments (f) | | | 3,667,042 | | | | — | | | | — | | | | 3,667,042 | |

| Total | | $ | 10,908,917 | | | $ | 22,173,549 | | | $ | — | | | $ | 33,082,466 | |

| | | | |

| Liabilities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Derivatives (g) | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (127,768 | ) | | $ | — | | | $ | — | | | $ | (127,768 | ) |

Forward Foreign Currency Contracts | | | — | | | | (34,506 | ) | | | — | | | | (34,506 | ) |

| Total | | $ | (127,768 | ) | | $ | (34,506 | ) | | $ | — | | | $ | (162,274 | ) |

| (f) | See Investment Portfolio for additional detailed categorizations. |

| (g) | Derivatives include unrealized appreciation (depreciation) on open futures contracts and forward foreign currency contracts. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 22 | | | | | DWS Global Macro Fund | | |

Statement of Assets and Liabilities

| | | | |

| as of October 31, 2019 | | | | |

| | | | |

| |

| Assets | | | | |

| Investments innon-affiliated securities, at value (cost $28,104,903) — including $119,371 of securities loaned | | $ | 29,415,424 | |

| Investment in DWS Government & Agency Securities Portfolio (cost $125,775)* | | | 125,775 | |

| Investment in DWS Central Cash Management Government Fund (cost $3,541,267) | | | 3,541,267 | |

| Foreign currency, at value (cost $1,270,676) | | | 1,272,919 | |

| Deposit with broker for futures contracts | | | 242,420 | |

| Receivable for investments sold | | | 205,678 | |

| Receivable for Fund shares sold | | | 38,198 | |

| Dividends receivable | | | 29,827 | |

| Interest receivable | | | 118,223 | |

| Receivable for variation margin on futures contracts | | | 13,852 | |

| Foreign taxes recoverable | | | 16,388 | |

| Due from Advisor | | | 10,573 | |

| Other assets | | | 31,862 | |

| Total assets | | | 35,062,406 | |

|

| Liabilities | |

| Cash overdraft | | | 13,465 | |

| Payable upon return of securities loaned | | | 125,775 | |

| Payable for investments purchased | | | 345,433 | |

| Payable for Fund shares redeemed | | | 52,871 | |

| Unrealized depreciation on forward foreign currency contracts | | | 34,506 | |

| Accrued Director’s fees | | | 767 | |

| Other accrued expenses and payables | | | 116,186 | |

| Total liabilities | | | 689,003 | |

| Net assets, at value | | $ | 34,373,403 | |

|

| Net Assets Consist of | |

| Distributable earnings (loss) | | | 1,849,008 | |

| Paid-in capital | | | 32,524,395 | |

| Net assets, at value | | $ | 34,373,403 | |

| * | Represents collateral on securities loaned. |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 23 | |

| | |

| Statement of Assets and Liabilitiesas of October 31, 2019 (continued) | | |

| | | | |

|

| Net Asset Value | |

| | | | |

Class A | | | | |

| |

Net Asset Value and redemption price per share

($10,397,782 ÷ 1,023,848 shares of capital stock outstanding,

$.01 par value, 50,000,000 shares authorized) | | $ | 10.16 | |

| |

| Maximum offering price per share (100 ÷ 94.25 of $10.16) | | $ | 10.78 | |

Class C | | | | |

| |

Net Asset Value, offering and redemption price

(subject to contingent deferred sales charge) per share

($2,164,826 ÷ 228,301 shares of capital stock outstanding,

$.01 par value, 50,000,000 shares authorized) | | $ | 9.48 | |

Class R | | | | |

| |

Net Asset Value, offering and redemption price per share

($290,179 ÷ 29,698 shares of capital stock outstanding,

$.01 par value, 50,000,000 shares authorized) | | $ | 9.77 | |

Class R6 | | | | |

| |

Net Asset Value,offering and redemption price per share

($10,291 ÷ 1,031 shares of capital stock outstanding,

$.01 par value, 50,000,000 shares authorized) | | $ | 9.98 | |

Class S | | | | |

| |

Net Asset Value,offering and redemption price per share

($5,358,182 ÷ 538,664 shares of capital stock outstanding,

$.01 par value, 50,000,000 shares authorized) | | $ | 9.95 | |

Institutional Class | | | | |

| |

Net Asset Value, offering and redemption price per share

($16,152,143 ÷ 1,619,832 shares of capital stock outstanding,

$.01 par value, 50,000,000 shares authorized) | | $ | 9.97 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 24 | | | | | DWS Global Macro Fund | | |

Statement of Operations

| | | | |

| for the year ended October 31, 2019 | | | | |

| | | | |

| |

| Investment Income | | | | |

| Income: | |

| |

| Dividends (net of foreign taxes withheld of $41,952) | | $ | 373,184 | |

| Interest | | | 369,239 | |

Income distributions — DWS Central Cash Management

Government Fund | | | 193,619 | |

| Securities lending income, net of borrower rebates | | | 3,547 | |

| Total income | | | 939,589 | |

| Expenses: | |

| |

| Management fee | | | 183,923 | |

| Administration fee | | | 30,654 | |

| Services to shareholders | | | 46,585 | |

| Distribution and service fees | | | 45,662 | |

| Custodian fee | | | 42,920 | |

| Professional fees | | | 92,473 | |

| Reports to shareholders | | | 38,868 | |

| Registration fees | | | 76,746 | |

| Directors’ fees and expenses | | | 3,837 | |

| Other | | | 27,300 | |

| Total expenses before expense reductions | | | 588,968 | |

| Expense reductions | | | (236,037 | ) |

| Total expenses after expense reductions | | | 352,931 | |

| Net investment income | | | 586,658 | |

|

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) from: | |

| |

| Investments | | | 128,975 | |

| Futures | | | (241,793 | ) |

| Forward foreign currency contracts | | | 375,725 | |

| Foreign currency | | | 9,468 | |

| | | | 272,375 | |

| Change in net unrealized appreciation (depreciation) on: | |

| |

| Investments | | | 1,428,393 | |

| Futures | | | (143,695 | ) |

| Forward foreign currency contracts | | | (99,997 | ) |

| Foreign currency | | | 7,287 | |

| | | | 1,191,988 | |

| Net gain (loss) | | | 1,464,363 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 2,051,021 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 25 | |

Statements of Changes in Net Assets

| | | | | | | | |

| Increase (Decrease) in Net Assets | | Years Ended October 31, | |

| | | 2019 | | | 2018 | |

| | | | | | | | |

| Operations: | |

| | |

| Net investment income (loss) | | $ | 586,658 | | | $ | 285,603 | |

| Net realized gain (loss) | | | 272,375 | | | | 1,225,198 | |

| Change in net unrealized appreciation (depreciation) | | | 1,191,988 | | | | (1,156,491 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 2,051,021 | | | | 354,310 | |

| Distributions to shareholders: | |

| | |

Class A | | | (590,792 | ) | | | — | |

Class C | | | (97,035 | ) | | | — | |

Class R | | | (23,266 | ) | | | — | |

Class S | | | (342,233 | ) | | | — | |

Institutional Class | | | (622,882 | ) | | | — | |

| Total distributions | | | (1,676,208 | ) | | | — | |

| Fund share transactions: | |

| | |

| Proceeds from shares sold | | | 15,038,005 | | | | 10,949,811 | |

| Reinvestment of distributions | | | 1,619,898 | | | | — | |

| Payments for shares redeemed | | | (8,402,578 | ) | | | (4,811,839 | ) |

| Net increase (decrease) in net assets from Fund share transactions | | | 8,255,325 | | | | 6,137,972 | |

| Increase (decrease) in net assets | | | 8,630,138 | | | | 6,492,282 | |

| Net assets at beginning of period | | | 25,743,265 | | | | 19,250,983 | |

| | |

| Net assets at end of period | | $ | 34,373,403 | | | $ | 25,743,265 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 26 | | | | | DWS Global Macro Fund | | |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended October 31, | |

| Class A | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.15 | | | $ | 9.92 | | | $ | 8.61 | | | $ | 8.49 | | | $ | 8.47 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)a | | | .17 | | | | .15 | | | | .06 | | | | .00 | * | | | .00 | * |

Net realized and unrealized gain (loss) | | | .44 | | | | .08 | | | | 1.25 | | | | .12 | | | | .02 | |

Total from investment operations | | | .61 | | | | .23 | | | | 1.31 | | | | .12 | | | | .02 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (.42 | ) | | | — | | | | — | | | | — | | | | — | |

Net realized gains | | | (.18 | ) | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (.60 | ) | | | — | | | | — | | | | — | | | | — | |

| Redemption fees | | | — | | | | — | | | | .00 | * | | | .00 | * | | | — | |

| Net asset value, end of period | | $ | 10.16 | | | $ | 10.15 | | | $ | 9.92 | | | $ | 8.61 | | | $ | 8.49 | |

| Total Return (%)b,c | | | 6.65 | | | | 2.32 | | | | 15.21 | e | | | 1.41 | d | | | .24 | |

|

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 10 | | | | 10 | | | | 10 | | | | 11 | | | | 15 | |

| Ratio of expenses before expense reductions (%) | | | 2.08 | | | | 2.58 | | | | 2.63 | | | | 2.32 | | | | 2.06 | |

Ratio of expenses after expense

reductions (%) | | | 1.30 | | | | 1.02 | | | | 1.20 | | | | 1.40 | | | | 1.44 | |

| Ratio of net investment income (%) | | | 1.76 | | | | 1.49 | | | | .66 | | | | .02 | | | | .02 | |

| Portfolio turnover rate (%) | | | 41 | | | | 80 | | | | 121 | | | | 42 | | | | 88 | |

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. |

| c | Total return would have been lower had certain expenses not been reduced. |

| d | The Fund’s total return includes a reimbursement by the Advisor for a realized loss on a trade executed incorrectly. Excluding this reimbursement, total return would have been 0.35% lower. |

| e | The Fund’s total return includes a reimbursement for commissions paid on trades for portfolio rebalancing related to implementing a new investment strategy. Excluding this reimbursement, total return would have been 0.33% lower. |

| * | Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 27 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Years Ended October 31, | |

| Class C | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | | | | $ | 9.48 | | | $ | 9.34 | | | $ | 8.17 | | | $ | 8.12 | | | $ | 8.16 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)a | | | | .09 | | | | .07 | | | | (.01 | ) | | | (.06 | ) | | | (.06 | ) |

Net realized and unrealized gain (loss) | | | | | | | .41 | | | | .07 | | | | 1.18 | | | | .11 | | | | .02 | |

Total from investment operations | | | | .50 | | | | .14 | | | | 1.17 | | | | .05 | | | | (.04 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | | (.32 | ) | | | — | | | | — | | | | — | | | | — | |

Net realized gains | | | | (.18 | ) | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | | (.50 | ) | | | — | | | | — | | | | — | | | | — | |

| Redemption fees | | | | — | | | | — | | | | .00 | * | | | .00 | * | | | — | |

| Net asset value, end of period | | | $ | 9.48 | | | $ | 9.48 | | | $ | 9.34 | | | $ | 8.17 | | | $ | 8.12 | |

| Total Return (%)b,c | | | | 5.85 | | | | 1.50 | | | | 14.32 | e | | | .62 | d | | | (.49 | ) |

|

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | | 2 | | | | 2 | | | | 3 | | | | 3 | | | | 3 | |

| Ratio of expenses before expense reductions (%) | | | | 2.82 | | | | 3.32 | | | | 3.34 | | | | 3.01 | | | | 2.79 | |

| Ratio of expenses after expense reductions (%) | | | | 2.05 | | | | 1.77 | | | | 1.95 | | | | 2.15 | | | | 2.19 | |

| Ratio of net investment income (loss) (%) | | | | 1.02 | | | | .74 | | | | (.10 | ) | | | (.76 | ) | | | (.73 | ) |

| Portfolio turnover rate (%) | | | | 41 | | | | 80 | | | | 121 | | | | 42 | | | | 88 | |

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. |

| c | Total return would have been lower had certain expenses not been reduced. |

| d | The Fund’s total return includes a reimbursement by the Advisor for a realized loss on a trade executed incorrectly. Excluding this reimbursement, total return would have been 0.35% lower. |

| e | The Fund’s total return includes a reimbursement for commissions paid on trades for portfolio rebalancing related to implementing a new investment strategy. Excluding this reimbursement, total return would have been 0.33% lower. |

| * | Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 28 | | | | | DWS Global Macro Fund | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended October 31, | |

| Class R | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.77 | | | $ | 9.57 | | | $ | 8.33 | | | $ | 8.24 | | | $ | 8.23 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)a | | | .14 | | | | .11 | | | | .04 | | | | (.02 | ) | | | (.02 | ) |

Net realized and unrealized gain (loss) | | | .42 | | | | .09 | | | | 1.20 | | | | .11 | | | | .03 | |

Total from investment operations | | | .56 | | | | .20 | | | | 1.24 | | | | .09 | | | | .01 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (.38 | ) | | | — | | | | — | | | | — | | | | — | |

Net realized gains | | | (.18 | ) | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (.56 | ) | | | — | | | | — | | | | — | | | | — | |

| Redemption fees | | | — | | | | — | | | | .00 | * | | | .00 | * | | | — | |

| Net asset value, end of period | | $ | 9.77 | | | $ | 9.77 | | | $ | 9.57 | | | $ | 8.33 | | | $ | 8.24 | |

| Total Return (%)b | | | 6.35 | | | | 2.09 | | | | 14.89 | d | | | 1.09 | c | | | .12 | |

|

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | .3 | | | | .4 | | | | 1 | | | | 1 | | | | 1 | |

| Ratio of expenses before expense reductions (%) | | | 2.45 | | | | 2.80 | | | | 2.94 | | | | 2.63 | | | | 2.32 | |

| Ratio of expenses after expense reductions (%) | | | 1.53 | | | | 1.27 | | | | 1.44 | | | | 1.65 | | | | 1.69 | |

| Ratio of net investment income (%) | | | 1.51 | | | | 1.13 | | | | .44 | | | | (.21 | ) | | | (.20 | ) |

| Portfolio turnover rate (%) | | | 41 | | | | 80 | | | | 121 | | | | 42 | | | | 88 | |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | The Fund’s total return includes a reimbursement by the Advisor for a realized loss on a trade executed incorrectly. Excluding this reimbursement, total return would have been 0.35% lower. |

| d | The Fund’s total return includes a reimbursement for commissions paid on trades for portfolio rebalancing related to implementing a new investment strategy. Excluding this reimbursement, total return would have been 0.33% lower. |

| * | Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 29 | |

| | | | |

| | | Period

Ended | |

| Class R6 | | 10/31/19a | |

|

| Selected Per Share Data | |

| Net asset value, beginning of period | | | $9.70 | |

| Income (loss) from investment operations: | | | | |

| |

Net investment incomeb | | | .05 | |

Net realized and unrealized gain | | | .23 | |

Total from investment operations | | | .28 | |

| Net asset value, end of period | | | $9.98 | |

| Total Return (%)c | | | 2.89 | ** |

|

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ thousands) | | | 10 | |

| Ratio of expenses before expense reductions (%) | | | 1.82 | * |

| Ratio of expenses after expense reductions (%) | | | .98 | * |

| Ratio of net investment income (%) | | | 1.55 | * |

| Portfolio turnover rate (%) | | | 41 | d |

| a | For the period from July 1, 2019 (commencement of operations) to October 31, 2019. |

| b | Based on average shares outstanding during the period. |

| c | Total return would have been lower had certain expenses not been reduced. |

| d | Represents the Fund’s portfolio turnover rate for the year ended October 31, 2019. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 30 | | | | | DWS Global Macro Fund | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended October 31, | |

| Class S | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.93 | | | $ | 9.69 | | | $ | 8.39 | | | $ | 8.26 | | | $ | 8.22 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)a | | | .20 | | | | .17 | | | | .09 | | | | .02 | | | | .01 | |

Net realized and unrealized gain (loss) | | | .43 | | | | .07 | | | | 1.21 | | | | .11 | | | | .03 | |

Total from investment operations | | | .63 | | | | .24 | | | | 1.30 | | | | .13 | | | | .04 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (.43 | ) | | | — | | | | — | | | | — | | | | — | |

Net realized gains | | | (.18 | ) | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (.61 | ) | | | — | | | | — | | | | — | | | | — | |

| Redemption fees | | | — | | | | — | | | | .00 | * | | | .00 | * | | | — | |

| Net asset value, end of period | | $ | 9.95 | | | $ | 9.93 | | | $ | 9.69 | | | $ | 8.39 | | | $ | 8.26 | |

| Total Return (%)b | | | 7.04 | | | | 2.48 | | | | 15.49 | d | | | 1.57 | c | | | .49 | |

|

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 5 | | | | 5 | | | | 4 | | | | 3 | | | | 4 | |

| Ratio of expenses before expense reductions (%) | | | 1.86 | | | | 2.32 | | | | 2.41 | | | | 2.11 | | | | 1.79 | |

Ratio of expenses after expense

reductions (%) | | | .94 | | | | .82 | | | | .96 | | | | 1.19 | | | | 1.29 | |

| Ratio of net investment income (%) | | | 2.12 | | | | 1.72 | | | | .94 | | | | .22 | | | | .13 | |

| Portfolio turnover rate (%) | | | 41 | | | | 80 | | | | 121 | | | | 42 | | | | 88 | |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | The Fund’s total return includes a reimbursement by the Advisor for a realized loss on a trade executed incorrectly. Excluding this reimbursement, total return would have been 0.35% lower. |

| d | The Fund’s total return includes a reimbursement for commissions paid on trades for portfolio rebalancing related to implementing a new investment strategy. Excluding this reimbursement, total return would have been 0.33% lower. |

| * | Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 31 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended October 31, | |

| Institutional Class | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.96 | | | $ | 9.72 | | | $ | 8.41 | | | $ | 8.28 | | | $ | 8.23 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)a | | | .20 | | | | .18 | | | | .08 | | | | .02 | | | | .02 | |

Net realized and unrealized gain (loss) | | | .43 | | | | .06 | | | | 1.23 | | | | .11 | | | | .03 | |

Total from investment operations | | | .63 | | | | .24 | | | | 1.31 | | | | .13 | | | | .05 | |

| Less distributions from: | |

| | | | | |

Net investment income | | | (.44 | ) | | | — | | | | — | | | | — | | | | — | |

Net realized gains | | | (.18 | ) | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (.62 | ) | | | — | | | | — | | | | — | | | | — | |

| Redemption fees | | | — | | | | — | | | | .00 | * | | | .00 | * | | | — | |

| Net asset value, end of period | | $ | 9.97 | | | $ | 9.96 | | | $ | 9.72 | | | $ | 8.41 | | | $ | 8.28 | |

| Total Return (%)b | | | 6.98 | | | | 2.47 | | | | 15.58 | d | | | 1.57 | c | | | .61 | |

|

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 16 | | | | 8 | | | | 2 | | | | 2 | | | | 7 | |

| Ratio of expenses before expense reductions (%) | | | 1.67 | | | | 2.17 | | | | 2.25 | | | | 1.90 | | | | 1.61 | |

Ratio of expenses after expense

reductions (%) | | | .97 | | | | .77 | | | | .94 | | | | 1.15 | | | | 1.19 | |

| Ratio of net investment income (%) | | | 2.10 | | | | 1.84 | | | | .93 | | | | .24 | | | | .27 | |

| Portfolio turnover rate (%) | | | 41 | | | | 80 | | | | 121 | | | | 42 | | | | 88 | |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | The Fund’s total return includes a reimbursement by the Advisor for a realized loss on a trade executed incorrectly. Excluding this reimbursement, total return would have been 0.35% lower. |

| d | The Fund’s total return includes a reimbursement for commissions paid on trades for portfolio rebalancing related to implementing a new investment strategy. Excluding this reimbursement, total return would have been 0.33% lower. |

| * | Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 32 | | | | | DWS Global Macro Fund | | |

| | |

| Notes to Financial Statements | | |

A. Organization and Significant Accounting Policies

DWS Global Macro Fund (the “Fund”) is a diversified series of Deutsche DWS International Fund, Inc. (the “Corporation”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as anopen-end management investment company organized as a Maryland corporation.

The Fund offers multiple classes of shares which provide investors with different purchase options. Class A shares are subject to an initial sales charge. Class C shares are not subject to an initial sales charge but are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions within one year of purchase. Class C shares automatically convert to Class A shares in the same fund after 10 years, provided that the fund or the financial intermediary through which the shareholder purchased the Class C shares has records verifying that the Class C shares have been held for at least 10 years. Class R shares are not subject to initial or contingent deferred sales charges and are generally available only to certain retirement plans. Class R6 shares commenced operations on July 1, 2019. Class R6 shares are not subject to initial or contingent deferred sales charges and are generally available only to certain retirement plans. Class S shares are not subject to initial or contingent deferred sales charges and are only available to a limited group of investors. Institutional Class shares are not subject to initial or contingent deferred sales charges and are generally available only to qualified institutions.

Investment income, realized and unrealized gains and losses, and certainfund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class such as distribution and service fees, services to shareholders and certain otherclass-specific expenses. Differences inclass-level expenses may result in payment of different per share dividends by class. All shares of the Fund have equal rights with respect to voting subject toclass-specific arrangements.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of their financial statements.

| | | | | | | | |

| | DWS Global Macro Fund | | | | | | 33 | |

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.