UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00642

Deutsche DWS International Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 8/31 |

| Date of reporting period: | 8/31/2024 |

| Item 1. | Reports to Stockholders. |

| (a) |

DWS CROCI International Fund

Class A: SUIAX

Annual Shareholder Report—August 31, 2024

This annual shareholder report contains important information about DWS CROCI International Fund ("the Fund") for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/mutualreports. You can also request this information by contacting us at (800) 728-3337.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

|---|---|---|

| Class A | $131 | 1.22% |

Gross expense ratio as of the latest prospectus: 1.21%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher.

How did the Fund perform last year and what affected its performance?

Class A shares of the Fund returned 15.16% (unadjusted for sales charges) for the period ended August 31, 2024. The Fund's broad-based index, the MSCI EAFE Index, returned 19.40% for the same period, while the Fund's additional, more narrowly based index, the MSCI EAFE® Value Index, returned 20.38%.

Stock selection was the primary reason for the Fund’s underperformance. The weakest results occurred in the information technology sector, primarily due to poor performance for the Netherlands-based semiconductor producer STMicroelectronics NV.* The stock lagged its industry peers for much of the period due to weakness in its auto and industrial end markets, and it further declined in August 2024 after missing earnings expectations and reducing its forward guidance. Infineon Technologies AG (3.0%), which was hurt by a slow inventory recovery cycle, weakening electric vehicle sales, and declining market share, was also a notable laggard in technology.

The industrials sector was another area of weakness. The German chemicals producer Brenntag SE (1.4%) was the largest detractor. Profits came in below expectations due to the combination of weaker demand and intensifying pricing headwinds, and management reduced guidance to the low end of the previous range. The Dutch human resources consulting firm Randstad NV,* which was hurt by a slowdown in hiring trends, was a further detractor in industrials. The Fund’s stock picks in healthcare underperformed, as well. Japan-based Ono Pharmaceutical Co., Ltd. (3.4%), which announced the acquisition of a company without meaningful current revenues, was the largest detractor. Shionogi & Co., Ltd. (4.6%) also lost ground after the trial results of its anti-obesity drug did not meet expectations. In addition, its pill-based COVID-19 treatment did not clear a late stage trial.

On the other hand, the Fund outperformed in the materials sector. Shares of the Swiss building materials producer Holcim AG (3.2%) rose on the strength of robust cash flows, growth related to the global decarbonization trend, and a cyclical recovery in its U.S. roofing business. Nitto Denko Corp. (0.7%), a Japanese maker of adhesives and building products, was also a top contributor in materials. The stock was boosted by improving earnings growth visibility and the company’s proactive stance on shareholder returns. Shin Etsu Chemical, Ltd.,* whose products are used in the fabrication of semiconductors, was another contributor of note. Stock selection in the consumer discretionary sector also added value, led by positions in Sekisui House Ltd. (2.8%) and Pandora A/S (0.3%).

* Not held at August 31, 2024

Percentages in parentheses are based on the Fund's net assets as of August 31, 2024.

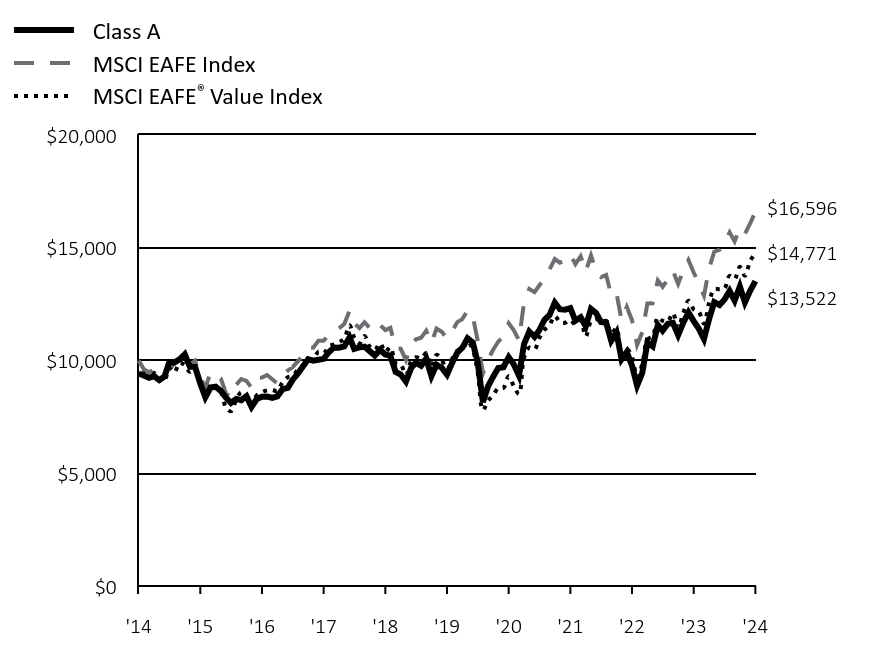

Fund Performance

Cumulative Growth of an Assumed $10,000Investment

(Adjusted for Maximum Sales Charge)

MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI EAFE Index is a broad-based index that represents the fund’s overall equity market.

MSCI EAFE® Value Index captures large and mid-capitalization securities exhibiting overall value style characteristics across developed markets countries around the world, excluding the U.S. and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The MSCI EAFE® Value Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

| Class A | MSCI EAFE Index | MSCI EAFE® Value Index | |

|---|---|---|---|

| '14 | $9,425 | $10,000 | $10,000 |

| '14 | $9,336 | $9,616 | $9,588 |

| '14 | $9,233 | $9,476 | $9,394 |

| '14 | $9,309 | $9,605 | $9,447 |

| '14 | $9,127 | $9,272 | $9,122 |

| '15 | $9,285 | $9,317 | $9,097 |

| '15 | $9,921 | $9,874 | $9,666 |

| '15 | $9,915 | $9,724 | $9,477 |

| '15 | $10,049 | $10,122 | $9,896 |

| '15 | $10,273 | $10,070 | $9,800 |

| '15 | $9,725 | $9,784 | $9,497 |

| '15 | $9,711 | $9,988 | $9,662 |

| '15 | $8,983 | $9,253 | $8,936 |

| '15 | $8,372 | $8,783 | $8,379 |

| '15 | $8,802 | $9,470 | $8,996 |

| '15 | $8,838 | $9,322 | $8,773 |

| '15 | $8,649 | $9,197 | $8,604 |

| '16 | $8,344 | $8,532 | $7,904 |

| '16 | $8,118 | $8,375 | $7,751 |

| '16 | $8,296 | $8,920 | $8,262 |

| '16 | $8,240 | $9,179 | $8,588 |

| '16 | $8,418 | $9,095 | $8,451 |

| '16 | $7,945 | $8,790 | $8,032 |

| '16 | $8,292 | $9,235 | $8,454 |

| '16 | $8,395 | $9,242 | $8,591 |

| '16 | $8,397 | $9,355 | $8,674 |

| '16 | $8,337 | $9,164 | $8,694 |

| '16 | $8,403 | $8,982 | $8,640 |

| '16 | $8,725 | $9,289 | $9,036 |

| '17 | $8,787 | $9,558 | $9,258 |

| '17 | $9,139 | $9,695 | $9,322 |

| '17 | $9,417 | $9,962 | $9,583 |

| '17 | $9,736 | $10,215 | $9,784 |

| '17 | $10,059 | $10,590 | $10,010 |

| '17 | $9,990 | $10,571 | $10,040 |

| '17 | $10,029 | $10,876 | $10,376 |

| '17 | $10,072 | $10,872 | $10,311 |

| '17 | $10,364 | $11,143 | $10,630 |

| '17 | $10,570 | $11,312 | $10,712 |

| '17 | $10,563 | $11,431 | $10,808 |

| '17 | $10,621 | $11,614 | $10,974 |

| '18 | $11,028 | $12,197 | $11,566 |

| '18 | $10,512 | $11,646 | $11,016 |

| '18 | $10,582 | $11,436 | $10,751 |

| '18 | $10,612 | $11,697 | $11,082 |

| '18 | $10,416 | $11,434 | $10,602 |

| '18 | $10,221 | $11,295 | $10,467 |

| '18 | $10,470 | $11,573 | $10,768 |

| '18 | $10,267 | $11,349 | $10,376 |

| '18 | $10,210 | $11,448 | $10,591 |

| '18 | $9,495 | $10,537 | $9,888 |

| '18 | $9,375 | $10,523 | $9,833 |

| '18 | $9,066 | $10,012 | $9,352 |

| '19 | $9,670 | $10,670 | $9,978 |

| '19 | $9,905 | $10,942 | $10,144 |

| '19 | $9,765 | $11,011 | $10,092 |

| '19 | $10,082 | $11,321 | $10,327 |

| '19 | $9,303 | $10,777 | $9,729 |

| '19 | $9,808 | $11,417 | $10,248 |

| '19 | $9,679 | $11,272 | $10,017 |

| '19 | $9,369 | $10,980 | $9,606 |

| '19 | $9,883 | $11,294 | $10,069 |

| '19 | $10,351 | $11,700 | $10,433 |

| '19 | $10,566 | $11,832 | $10,474 |

| '19 | $10,982 | $12,217 | $10,856 |

| '20 | $10,797 | $11,961 | $10,464 |

| '20 | $9,929 | $10,880 | $9,474 |

| '20 | $8,160 | $9,428 | $7,795 |

| '20 | $8,844 | $10,037 | $8,212 |

| '20 | $9,285 | $10,474 | $8,462 |

| '20 | $9,663 | $10,831 | $8,764 |

| '20 | $9,700 | $11,083 | $8,781 |

| '20 | $10,144 | $11,653 | $9,295 |

| '20 | $9,833 | $11,350 | $8,868 |

| '20 | $9,327 | $10,897 | $8,511 |

| '20 | $10,725 | $12,586 | $10,123 |

| '20 | $11,278 | $13,171 | $10,571 |

| '21 | $11,046 | $13,031 | $10,489 |

| '21 | $11,337 | $13,323 | $10,988 |

| '21 | $11,804 | $13,630 | $11,358 |

| '21 | $12,015 | $14,040 | $11,575 |

| '21 | $12,565 | $14,498 | $11,976 |

| '21 | $12,271 | $14,335 | $11,700 |

| '21 | $12,250 | $14,442 | $11,671 |

| '21 | $12,318 | $14,697 | $11,804 |

| '21 | $11,761 | $14,271 | $11,587 |

| '21 | $11,915 | $14,622 | $11,772 |

| '21 | $11,515 | $13,941 | $11,064 |

| '21 | $12,289 | $14,655 | $11,723 |

| '22 | $12,095 | $13,947 | $11,845 |

| '22 | $11,704 | $13,700 | $11,684 |

| '22 | $11,670 | $13,788 | $11,762 |

| '22 | $10,869 | $12,896 | $11,167 |

| '22 | $11,245 | $12,993 | $11,441 |

| '22 | $10,054 | $11,787 | $10,302 |

| '22 | $10,376 | $12,375 | $10,517 |

| '22 | $9,767 | $11,787 | $10,162 |

| '22 | $8,885 | $10,684 | $9,251 |

| '22 | $9,460 | $11,259 | $9,848 |

| '22 | $10,800 | $12,527 | $10,930 |

| '22 | $10,628 | $12,537 | $11,068 |

| '23 | $11,573 | $13,552 | $11,922 |

| '23 | $11,322 | $13,269 | $11,755 |

| '23 | $11,629 | $13,598 | $11,725 |

| '23 | $11,669 | $13,982 | $12,103 |

| '23 | $11,124 | $13,391 | $11,451 |

| '23 | $11,664 | $14,000 | $12,095 |

| '23 | $12,128 | $14,453 | $12,645 |

| '23 | $11,743 | $13,899 | $12,270 |

| '23 | $11,413 | $13,424 | $12,166 |

| '23 | $10,949 | $12,880 | $11,631 |

| '23 | $11,824 | $14,076 | $12,552 |

| '23 | $12,588 | $14,824 | $13,165 |

| '24 | $12,460 | $14,909 | $13,157 |

| '24 | $12,695 | $15,182 | $13,181 |

| '24 | $13,085 | $15,681 | $13,755 |

| '24 | $12,653 | $15,280 | $13,615 |

| '24 | $13,282 | $15,871 | $14,151 |

| '24 | $12,577 | $15,615 | $13,757 |

| '24 | $13,088 | $16,073 | $14,402 |

| '24 | $13,522 | $16,596 | $14,771 |

Yearly periods ended August 31

The Fund's growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial invesment of $9,425.

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|---|---|---|

| Class A Unadjusted for Sales Charge | 15.16% | 7.62% | 3.68% |

| Class A Adjusted for the Maximum Sales Charge (max 5.75% load) | 8.54% | 6.35% | 3.06% |

| MSCI EAFE Index | 19.40% | 8.61% | 5.20% |

MSCI EAFE® Value Index | 20.38% | 8.99% | 3.98% |

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please visit dws.com/en-us/products/mutual-funds for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had reflected sales charges.

Key Fund Statistics

| Net Assets ($) | 438,521,810 |

| Number of Portfolio Holdings | 61 |

| Portfolio Turnover Rate (%) | 60 |

| Total Net Advisory Fees Paid ($) | 2,409,224 |

What did the Fund invest in?

Asset Allocation

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Preferred Stocks | 0% |

| Cash Equivalents | 0% |

| Other Assets and Liabilities, Net | 1% |

| Total | 100% |

Holdings-based data is subject to change.

Sector Allocation

| Sector | % of Net Assets |

| Health Care | 23% |

| Financials | 23% |

| Consumer Discretionary | 14% |

| Materials | 10% |

| Industrials | 8% |

| Communication Services | 6% |

| Information Technology | 5% |

| Utilities | 4% |

| Consumer Staples | 4% |

| Energy | 2% |

Ten Largest Equity Holdings

| Holdings | 35.9% of Net Assets |

|---|---|

| Oversea-Chinese Banking Corp., Ltd. | 4.8% |

| Shionogi & Co., Ltd | 4.6% |

| Lloyds Banking Group PLC | 3.8% |

| ArcelorMittal SA | 3.7% |

| Volvo AB | 3.4% |

| Ono Pharmaceutical Co., Ltd. | 3.4% |

| Holcim AG | 3.2% |

| Otsuka Holdings Co., Ltd. | 3.0% |

| Infineon Technologies AG | 3.0% |

| Nintendo Co., Ltd. | 3.0% |

Geographical Diversification

| Country | % of Net Assets |

| Japan | 27% |

| United Kingdom | 15% |

| Switzerland | 10% |

| France | 9% |

| Singapore | 9% |

| Germany | 6% |

| Luxembourg | 5% |

| Sweden | 3% |

| Spain | 3% |

| Netherlands | 3% |

| Other | 10% |

Additional Information

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/mutualreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Householding

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report and prospectus to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your financial representative or call DWS toll free at (800) 728-3337.

Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Stocks may decline in value. The Fund will be managed using the CROCI® Investment Process, which is based on portfolio management’s belief that, over time, stocks which display more favorable financial metrics (for example, the CROCI® Economic P/E Ratio) as generated by this process may outperform stocks which display less favorable metrics. This premise may not prove to be correct and prospective investors should evaluate this assumption prior to investing in the Fund. The Fund may lend securities to approved institutions. Please read the prospectus for details.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/mutualreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2024 DWS Group GmbH&Co. KGaA. All rights reserved

DCIF-TSRA-A

R-102572-1 (10/24)

DWS CROCI International Fund

Class C: SUICX

Annual Shareholder Report—August 31, 2024

This annual shareholder report contains important information about DWS CROCI International Fund ("the Fund") for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/mutualreports. You can also request this information by contacting us at (800) 728-3337.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

|---|---|---|

| Class C | $210 | 1.96% |

Gross expense ratio as of the latest prospectus: 1.98%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher.

How did the Fund perform last year and what affected its performance?

Class C shares of the Fund returned 14.30% (unadjusted for sales charges) for the period ended August 31, 2024. The Fund's broad-based index, the MSCI EAFE Index, returned 19.40% for the same period, while the Fund's additional, more narrowly based index, the MSCI EAFE® Value Index, returned 20.38%.

Stock selection was the primary reason for the Fund’s underperformance. The weakest results occurred in the information technology sector, primarily due to poor performance for the Netherlands-based semiconductor producer STMicroelectronics NV.* The stock lagged its industry peers for much of the period due to weakness in its auto and industrial end markets, and it further declined in August 2024 after missing earnings expectations and reducing its forward guidance. Infineon Technologies AG (3.0%), which was hurt by a slow inventory recovery cycle, weakening electric vehicle sales, and declining market share, was also a notable laggard in technology.

The industrials sector was another area of weakness. The German chemicals producer Brenntag SE (1.4%) was the largest detractor. Profits came in below expectations due to the combination of weaker demand and intensifying pricing headwinds, and management reduced guidance to the low end of the previous range. The Dutch human resources consulting firm Randstad NV,* which was hurt by a slowdown in hiring trends, was a further detractor in industrials. The Fund’s stock picks in healthcare underperformed, as well. Japan-based Ono Pharmaceutical Co., Ltd. (3.4%), which announced the acquisition of a company without meaningful current revenues, was the largest detractor. Shionogi & Co., Ltd. (4.6%) also lost ground after the trial results of its anti-obesity drug did not meet expectations. In addition, its pill-based COVID-19 treatment did not clear a late stage trial.

On the other hand, the Fund outperformed in the materials sector. Shares of the Swiss building materials producer Holcim AG (3.2%) rose on the strength of robust cash flows, growth related to the global decarbonization trend, and a cyclical recovery in its U.S. roofing business. Nitto Denko Corp. (0.7%), a Japanese maker of adhesives and building products, was also a top contributor in materials. The stock was boosted by improving earnings growth visibility and the company’s proactive stance on shareholder returns. Shin Etsu Chemical, Ltd.,* whose products are used in the fabrication of semiconductors, was another contributor of note. Stock selection in the consumer discretionary sector also added value, led by positions in Sekisui House Ltd. (2.8%) and Pandora A/S (0.3%).

* Not held at August 31, 2024

Percentages in parentheses are based on the Fund's net assets as of August 31, 2024.

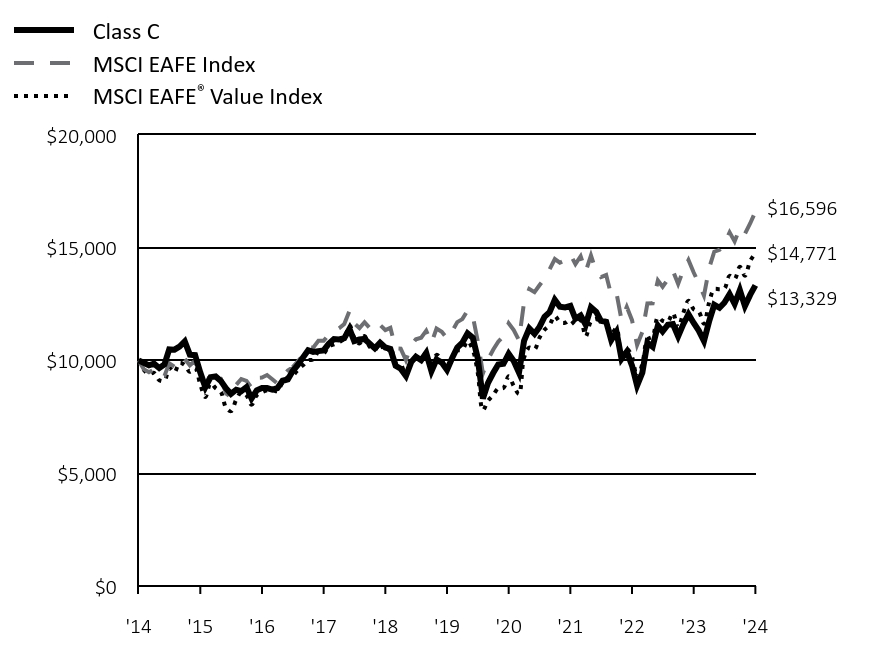

Fund Performance

Cumulative Growth of an Assumed $10,000Investment

MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI EAFE Index is a broad-based index that represents the fund’s overall equity market.

MSCI EAFE® Value Index captures large and mid-capitalization securities exhibiting overall value style characteristics across developed markets countries around the world, excluding the U.S. and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The MSCI EAFE® Value Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

| Class C | MSCI EAFE Index | MSCI EAFE® Value Index | |

|---|---|---|---|

| '14 | $10,000 | $10,000 | $10,000 |

| '14 | $9,901 | $9,616 | $9,588 |

| '14 | $9,784 | $9,476 | $9,394 |

| '14 | $9,860 | $9,605 | $9,447 |

| '14 | $9,663 | $9,272 | $9,122 |

| '15 | $9,825 | $9,317 | $9,097 |

| '15 | $10,491 | $9,874 | $9,666 |

| '15 | $10,478 | $9,724 | $9,477 |

| '15 | $10,612 | $10,122 | $9,896 |

| '15 | $10,842 | $10,070 | $9,800 |

| '15 | $10,257 | $9,784 | $9,497 |

| '15 | $10,235 | $9,988 | $9,662 |

| '15 | $9,465 | $9,253 | $8,936 |

| '15 | $8,814 | $8,783 | $8,379 |

| '15 | $9,261 | $9,470 | $8,996 |

| '15 | $9,293 | $9,322 | $8,773 |

| '15 | $9,089 | $9,197 | $8,604 |

| '16 | $8,762 | $8,532 | $7,904 |

| '16 | $8,522 | $8,375 | $7,751 |

| '16 | $8,703 | $8,920 | $8,262 |

| '16 | $8,640 | $9,179 | $8,588 |

| '16 | $8,819 | $9,095 | $8,451 |

| '16 | $8,317 | $8,790 | $8,032 |

| '16 | $8,677 | $9,235 | $8,454 |

| '16 | $8,777 | $9,242 | $8,591 |

| '16 | $8,775 | $9,355 | $8,674 |

| '16 | $8,708 | $9,164 | $8,694 |

| '16 | $8,771 | $8,982 | $8,640 |

| '16 | $9,101 | $9,289 | $9,036 |

| '17 | $9,160 | $9,558 | $9,258 |

| '17 | $9,518 | $9,695 | $9,322 |

| '17 | $9,803 | $9,962 | $9,583 |

| '17 | $10,128 | $10,215 | $9,784 |

| '17 | $10,455 | $10,590 | $10,010 |

| '17 | $10,379 | $10,571 | $10,040 |

| '17 | $10,413 | $10,876 | $10,376 |

| '17 | $10,446 | $10,872 | $10,311 |

| '17 | $10,744 | $11,143 | $10,630 |

| '17 | $10,948 | $11,312 | $10,712 |

| '17 | $10,935 | $11,431 | $10,808 |

| '17 | $10,988 | $11,614 | $10,974 |

| '18 | $11,402 | $12,197 | $11,566 |

| '18 | $10,863 | $11,646 | $11,016 |

| '18 | $10,929 | $11,436 | $10,751 |

| '18 | $10,954 | $11,697 | $11,082 |

| '18 | $10,745 | $11,434 | $10,602 |

| '18 | $10,538 | $11,295 | $10,467 |

| '18 | $10,788 | $11,573 | $10,768 |

| '18 | $10,575 | $11,349 | $10,376 |

| '18 | $10,509 | $11,448 | $10,591 |

| '18 | $9,767 | $10,537 | $9,888 |

| '18 | $9,636 | $10,523 | $9,833 |

| '18 | $9,311 | $10,012 | $9,352 |

| '19 | $9,928 | $10,670 | $9,978 |

| '19 | $10,164 | $10,942 | $10,144 |

| '19 | $10,014 | $11,011 | $10,092 |

| '19 | $10,334 | $11,321 | $10,327 |

| '19 | $9,528 | $10,777 | $9,729 |

| '19 | $10,040 | $11,417 | $10,248 |

| '19 | $9,905 | $11,272 | $10,017 |

| '19 | $9,580 | $10,980 | $9,606 |

| '19 | $10,098 | $11,294 | $10,069 |

| '19 | $10,573 | $11,700 | $10,433 |

| '19 | $10,785 | $11,832 | $10,474 |

| '19 | $11,202 | $12,217 | $10,856 |

| '20 | $11,006 | $11,961 | $10,464 |

| '20 | $10,116 | $10,880 | $9,474 |

| '20 | $8,308 | $9,428 | $7,795 |

| '20 | $8,999 | $10,037 | $8,212 |

| '20 | $9,442 | $10,474 | $8,462 |

| '20 | $9,822 | $10,831 | $8,764 |

| '20 | $9,853 | $11,083 | $8,781 |

| '20 | $10,298 | $11,653 | $9,295 |

| '20 | $9,977 | $11,350 | $8,868 |

| '20 | $9,459 | $10,897 | $8,511 |

| '20 | $10,867 | $12,586 | $10,123 |

| '20 | $11,422 | $13,171 | $10,571 |

| '21 | $11,181 | $13,031 | $10,489 |

| '21 | $11,468 | $13,323 | $10,988 |

| '21 | $11,935 | $13,630 | $11,358 |

| '21 | $12,140 | $14,040 | $11,575 |

| '21 | $12,690 | $14,498 | $11,976 |

| '21 | $12,384 | $14,335 | $11,700 |

| '21 | $12,355 | $14,442 | $11,671 |

| '21 | $12,417 | $14,697 | $11,804 |

| '21 | $11,848 | $14,271 | $11,587 |

| '21 | $11,995 | $14,622 | $11,772 |

| '21 | $11,586 | $13,941 | $11,064 |

| '21 | $12,356 | $14,655 | $11,723 |

| '22 | $12,153 | $13,947 | $11,845 |

| '22 | $11,756 | $13,700 | $11,684 |

| '22 | $11,714 | $13,788 | $11,762 |

| '22 | $10,903 | $12,896 | $11,167 |

| '22 | $11,273 | $12,993 | $11,441 |

| '22 | $10,072 | $11,787 | $10,302 |

| '22 | $10,387 | $12,375 | $10,517 |

| '22 | $9,772 | $11,787 | $10,162 |

| '22 | $8,885 | $10,684 | $9,251 |

| '22 | $9,455 | $11,259 | $9,848 |

| '22 | $10,789 | $12,527 | $10,930 |

| '22 | $10,607 | $12,537 | $11,068 |

| '23 | $11,544 | $13,552 | $11,922 |

| '23 | $11,285 | $13,269 | $11,755 |

| '23 | $11,585 | $13,598 | $11,725 |

| '23 | $11,618 | $13,982 | $12,103 |

| '23 | $11,069 | $13,391 | $11,451 |

| '23 | $11,598 | $14,000 | $12,095 |

| '23 | $12,052 | $14,453 | $12,645 |

| '23 | $11,661 | $13,899 | $12,270 |

| '23 | $11,326 | $13,424 | $12,166 |

| '23 | $10,859 | $12,880 | $11,631 |

| '23 | $11,720 | $14,076 | $12,552 |

| '23 | $12,470 | $14,824 | $13,165 |

| '24 | $12,335 | $14,909 | $13,157 |

| '24 | $12,561 | $15,182 | $13,181 |

| '24 | $12,939 | $15,681 | $13,755 |

| '24 | $12,504 | $15,280 | $13,615 |

| '24 | $13,116 | $15,871 | $14,151 |

| '24 | $12,413 | $15,615 | $13,757 |

| '24 | $12,907 | $16,073 | $14,402 |

| '24 | $13,329 | $16,596 | $14,771 |

Yearly periods ended August 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|---|---|---|

| Class C Unadjusted for Sales Charge | 14.30% | 6.83% | 2.92% |

| Class C Adjusted for the Maximum Sales Charge (max 1.00% CDSC) | 13.30% | 6.83% | 2.92% |

| MSCI EAFE Index | 19.40% | 8.61% | 5.20% |

MSCI EAFE® Value Index | 20.38% | 8.99% | 3.98% |

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please visit dws.com/en-us/products/mutual-funds for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions.

Key Fund Statistics

| Net Assets ($) | 438,521,810 |

| Number of Portfolio Holdings | 61 |

| Portfolio Turnover Rate (%) | 60 |

| Total Net Advisory Fees Paid ($) | 2,409,224 |

What did the Fund invest in?

Asset Allocation

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Preferred Stocks | 0% |

| Cash Equivalents | 0% |

| Other Assets and Liabilities, Net | 1% |

| Total | 100% |

Holdings-based data is subject to change.

Sector Allocation

| Sector | % of Net Assets |

| Health Care | 23% |

| Financials | 23% |

| Consumer Discretionary | 14% |

| Materials | 10% |

| Industrials | 8% |

| Communication Services | 6% |

| Information Technology | 5% |

| Utilities | 4% |

| Consumer Staples | 4% |

| Energy | 2% |

Ten Largest Equity Holdings

| Holdings | 35.9% of Net Assets |

|---|---|

| Oversea-Chinese Banking Corp., Ltd. | 4.8% |

| Shionogi & Co., Ltd | 4.6% |

| Lloyds Banking Group PLC | 3.8% |

| ArcelorMittal SA | 3.7% |

| Volvo AB | 3.4% |

| Ono Pharmaceutical Co., Ltd. | 3.4% |

| Holcim AG | 3.2% |

| Otsuka Holdings Co., Ltd. | 3.0% |

| Infineon Technologies AG | 3.0% |

| Nintendo Co., Ltd. | 3.0% |

Geographical Diversification

| Country | % of Net Assets |

| Japan | 27% |

| United Kingdom | 15% |

| Switzerland | 10% |

| France | 9% |

| Singapore | 9% |

| Germany | 6% |

| Luxembourg | 5% |

| Sweden | 3% |

| Spain | 3% |

| Netherlands | 3% |

| Other | 10% |

Additional Information

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/mutualreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Householding

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report and prospectus to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your financial representative or call DWS toll free at (800) 728-3337.

Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Stocks may decline in value. The Fund will be managed using the CROCI® Investment Process, which is based on portfolio management’s belief that, over time, stocks which display more favorable financial metrics (for example, the CROCI® Economic P/E Ratio) as generated by this process may outperform stocks which display less favorable metrics. This premise may not prove to be correct and prospective investors should evaluate this assumption prior to investing in the Fund. The Fund may lend securities to approved institutions. Please read the prospectus for details.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/mutualreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2024 DWS Group GmbH&Co. KGaA. All rights reserved

DCIF-TSRA-C

R-102572-1 (10/24)

DWS CROCI International Fund

Class R6: SUIRX

Annual Shareholder Report—August 31, 2024

This annual shareholder report contains important information about DWS CROCI International Fund ("the Fund") for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/mutualreports. You can also request this information by contacting us at (800) 728-3337.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

|---|---|---|

| Class R6 | $85 | 0.79% |

Gross expense ratio as of the latest prospectus: 0.79%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher.

How did the Fund perform last year and what affected its performance?

Class R6 shares of the Fund returned 15.67% for the period ended August 31, 2024. The Fund's broad-based index, the MSCI EAFE Index, returned 19.40% for the same period, while the Fund's additional, more narrowly based index, the MSCI EAFE® Value Index, returned 20.38%.

Stock selection was the primary reason for the Fund’s underperformance. The weakest results occurred in the information technology sector, primarily due to poor performance for the Netherlands-based semiconductor producer STMicroelectronics NV.* The stock lagged its industry peers for much of the period due to weakness in its auto and industrial end markets, and it further declined in August 2024 after missing earnings expectations and reducing its forward guidance. Infineon Technologies AG (3.0%), which was hurt by a slow inventory recovery cycle, weakening electric vehicle sales, and declining market share, was also a notable laggard in technology.

The industrials sector was another area of weakness. The German chemicals producer Brenntag SE (1.4%) was the largest detractor. Profits came in below expectations due to the combination of weaker demand and intensifying pricing headwinds, and management reduced guidance to the low end of the previous range. The Dutch human resources consulting firm Randstad NV,* which was hurt by a slowdown in hiring trends, was a further detractor in industrials. The Fund’s stock picks in healthcare underperformed, as well. Japan-based Ono Pharmaceutical Co., Ltd. (3.4%), which announced the acquisition of a company without meaningful current revenues, was the largest detractor. Shionogi & Co., Ltd. (4.6%) also lost ground after the trial results of its anti-obesity drug did not meet expectations. In addition, its pill-based COVID-19 treatment did not clear a late stage trial.

On the other hand, the Fund outperformed in the materials sector. Shares of the Swiss building materials producer Holcim AG (3.2%) rose on the strength of robust cash flows, growth related to the global decarbonization trend, and a cyclical recovery in its U.S. roofing business. Nitto Denko Corp. (0.7%), a Japanese maker of adhesives and building products, was also a top contributor in materials. The stock was boosted by improving earnings growth visibility and the company’s proactive stance on shareholder returns. Shin Etsu Chemical, Ltd.,* whose products are used in the fabrication of semiconductors, was another contributor of note. Stock selection in the consumer discretionary sector also added value, led by positions in Sekisui House Ltd. (2.8%) and Pandora A/S (0.3%).

* Not held at August 31, 2024

Percentages in parentheses are based on the Fund's net assets as of August 31, 2024.

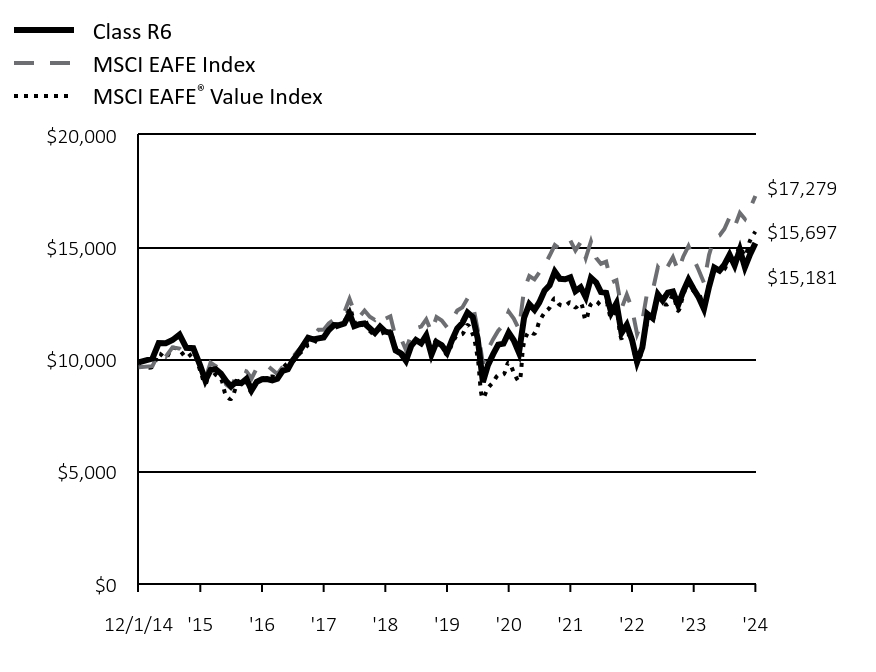

Fund Performance

Cumulative Growth of an Assumed $10,000Investment

MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI EAFE Index is a broad-based index that represents the fund’s overall equity market.

MSCI EAFE® Value Index captures large and mid-capitalization securities exhibiting overall value style characteristics across developed markets countries around the world, excluding the U.S. and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The MSCI EAFE® Value Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

| Class R6 | MSCI EAFE Index | MSCI EAFE® Value Index | |

|---|---|---|---|

| 12/1/14 | $9,870 | $9,654 | $9,694 |

| 1/31/15 | $10,041 | $9,701 | $9,667 |

| 2/28/15 | $10,728 | $10,281 | $10,272 |

| 3/31/15 | $10,722 | $10,125 | $10,071 |

| 4/30/15 | $10,867 | $10,538 | $10,516 |

| 5/31/15 | $11,109 | $10,484 | $10,414 |

| 6/30/15 | $10,518 | $10,187 | $10,092 |

| 7/31/15 | $10,505 | $10,399 | $10,268 |

| 8/31/15 | $9,723 | $9,634 | $9,496 |

| 9/30/15 | $9,062 | $9,145 | $8,904 |

| 10/31/15 | $9,530 | $9,860 | $9,560 |

| 11/30/15 | $9,571 | $9,706 | $9,323 |

| 12/31/15 | $9,372 | $9,575 | $9,143 |

| 1/31/16 | $9,044 | $8,883 | $8,399 |

| 2/29/16 | $8,804 | $8,720 | $8,237 |

| 3/31/16 | $8,999 | $9,288 | $8,780 |

| 4/30/16 | $8,943 | $9,557 | $9,126 |

| 5/31/16 | $9,136 | $9,470 | $8,981 |

| 6/30/16 | $8,626 | $9,152 | $8,535 |

| 7/31/16 | $9,006 | $9,616 | $8,984 |

| 8/31/16 | $9,120 | $9,622 | $9,129 |

| 9/30/16 | $9,125 | $9,741 | $9,218 |

| 10/31/16 | $9,064 | $9,541 | $9,239 |

| 11/30/16 | $9,140 | $9,351 | $9,182 |

| 12/31/16 | $9,493 | $9,671 | $9,602 |

| 1/31/17 | $9,563 | $9,952 | $9,839 |

| 2/28/17 | $9,948 | $10,094 | $9,906 |

| 3/31/17 | $10,256 | $10,372 | $10,183 |

| 4/30/17 | $10,606 | $10,636 | $10,397 |

| 5/31/17 | $10,961 | $11,026 | $10,638 |

| 6/30/17 | $10,891 | $11,007 | $10,670 |

| 7/31/17 | $10,938 | $11,324 | $11,027 |

| 8/31/17 | $10,982 | $11,320 | $10,958 |

| 9/30/17 | $11,306 | $11,602 | $11,296 |

| 10/31/17 | $11,533 | $11,778 | $11,383 |

| 11/30/17 | $11,528 | $11,901 | $11,485 |

| 12/31/17 | $11,598 | $12,092 | $11,661 |

| 1/31/18 | $12,046 | $12,699 | $12,291 |

| 2/28/18 | $11,485 | $12,126 | $11,707 |

| 3/31/18 | $11,567 | $11,907 | $11,425 |

| 4/30/18 | $11,603 | $12,179 | $11,777 |

| 5/31/18 | $11,390 | $11,905 | $11,266 |

| 6/30/18 | $11,184 | $11,760 | $11,124 |

| 7/31/18 | $11,459 | $12,049 | $11,443 |

| 8/31/18 | $11,241 | $11,817 | $11,027 |

| 9/30/18 | $11,181 | $11,919 | $11,255 |

| 10/31/18 | $10,405 | $10,970 | $10,507 |

| 11/30/18 | $10,276 | $10,957 | $10,449 |

| 12/31/18 | $9,940 | $10,425 | $9,938 |

| 1/31/19 | $10,605 | $11,110 | $10,603 |

| 2/28/19 | $10,866 | $11,393 | $10,779 |

| 3/31/19 | $10,719 | $11,465 | $10,725 |

| 4/30/19 | $11,071 | $11,787 | $10,975 |

| 5/31/19 | $10,216 | $11,221 | $10,339 |

| 6/30/19 | $10,774 | $11,887 | $10,890 |

| 7/31/19 | $10,637 | $11,736 | $10,645 |

| 8/31/19 | $10,298 | $11,432 | $10,208 |

| 9/30/19 | $10,866 | $11,760 | $10,701 |

| 10/31/19 | $11,387 | $12,182 | $11,087 |

| 11/30/19 | $11,626 | $12,319 | $11,130 |

| 12/31/19 | $12,088 | $12,720 | $11,537 |

| 1/31/20 | $11,887 | $12,454 | $11,120 |

| 2/29/20 | $10,938 | $11,328 | $10,067 |

| 3/31/20 | $8,991 | $9,816 | $8,284 |

| 4/30/20 | $9,749 | $10,450 | $8,727 |

| 5/31/20 | $10,239 | $10,905 | $8,993 |

| 6/30/20 | $10,660 | $11,277 | $9,313 |

| 7/31/20 | $10,703 | $11,540 | $9,331 |

| 8/31/20 | $11,196 | $12,133 | $9,878 |

| 9/30/20 | $10,856 | $11,818 | $9,424 |

| 10/31/20 | $10,301 | $11,346 | $9,044 |

| 11/30/20 | $11,849 | $13,105 | $10,757 |

| 12/31/20 | $12,465 | $13,714 | $11,234 |

| 1/31/21 | $12,213 | $13,568 | $11,146 |

| 2/28/21 | $12,539 | $13,872 | $11,677 |

| 3/31/21 | $13,062 | $14,191 | $12,070 |

| 4/30/21 | $13,299 | $14,618 | $12,301 |

| 5/31/21 | $13,911 | $15,095 | $12,727 |

| 6/30/21 | $13,591 | $14,925 | $12,433 |

| 7/31/21 | $13,572 | $15,037 | $12,403 |

| 8/31/21 | $13,654 | $15,302 | $12,544 |

| 9/30/21 | $13,041 | $14,858 | $12,313 |

| 10/31/21 | $13,217 | $15,224 | $12,510 |

| 11/30/21 | $12,775 | $14,515 | $11,757 |

| 12/31/21 | $13,641 | $15,259 | $12,457 |

| 1/31/22 | $13,428 | $14,521 | $12,587 |

| 2/28/22 | $13,001 | $14,264 | $12,416 |

| 3/31/22 | $12,965 | $14,356 | $12,499 |

| 4/30/22 | $12,081 | $13,427 | $11,867 |

| 5/31/22 | $12,505 | $13,528 | $12,159 |

| 6/30/22 | $11,183 | $12,273 | $10,948 |

| 7/31/22 | $11,545 | $12,884 | $11,176 |

| 8/31/22 | $10,871 | $12,272 | $10,799 |

| 9/30/22 | $9,894 | $11,124 | $9,831 |

| 10/31/22 | $10,537 | $11,723 | $10,465 |

| 11/30/22 | $12,034 | $13,043 | $11,615 |

| 12/31/22 | $11,845 | $13,053 | $11,762 |

| 1/31/23 | $12,906 | $14,110 | $12,670 |

| 2/28/23 | $12,628 | $13,816 | $12,492 |

| 3/31/23 | $12,977 | $14,158 | $12,460 |

| 4/30/23 | $13,025 | $14,558 | $12,861 |

| 5/31/23 | $12,421 | $13,942 | $12,169 |

| 6/30/23 | $13,028 | $14,577 | $12,853 |

| 7/31/23 | $13,550 | $15,048 | $13,437 |

| 8/31/23 | $13,125 | $14,472 | $13,039 |

| 9/30/23 | $12,762 | $13,977 | $12,928 |

| 10/31/23 | $12,248 | $13,411 | $12,360 |

| 11/30/23 | $13,232 | $14,655 | $13,339 |

| 12/31/23 | $14,092 | $15,434 | $13,991 |

| 1/31/24 | $13,954 | $15,523 | $13,981 |

| 2/29/24 | $14,219 | $15,807 | $14,007 |

| 3/31/24 | $14,663 | $16,327 | $14,618 |

| 4/30/24 | $14,186 | $15,909 | $14,468 |

| 5/31/24 | $14,893 | $16,525 | $15,038 |

| 6/30/24 | $14,107 | $16,258 | $14,620 |

| 7/31/24 | $14,687 | $16,735 | $15,305 |

| 8/31/24 | $15,181 | $17,279 | $15,697 |

Yearly periods ended August 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | Since Inception 12/1/14 |

|---|---|---|---|

| Class R6 No Sales Charge | 15.67% | 8.07% | 4.38% |

| MSCI EAFE Index | 19.40% | 8.61% | 5.77% |

MSCI EAFE® Value Index | 20.38% | 8.99% | 4.73% |

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please visit dws.com/en-us/products/mutual-funds for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions.

Key Fund Statistics

| Net Assets ($) | 438,521,810 |

| Number of Portfolio Holdings | 61 |

| Portfolio Turnover Rate (%) | 60 |

| Total Net Advisory Fees Paid ($) | 2,409,224 |

What did the Fund invest in?

Asset Allocation

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Preferred Stocks | 0% |

| Cash Equivalents | 0% |

| Other Assets and Liabilities, Net | 1% |

| Total | 100% |

Holdings-based data is subject to change.

Sector Allocation

| Sector | % of Net Assets |

| Health Care | 23% |

| Financials | 23% |

| Consumer Discretionary | 14% |

| Materials | 10% |

| Industrials | 8% |

| Communication Services | 6% |

| Information Technology | 5% |

| Utilities | 4% |

| Consumer Staples | 4% |

| Energy | 2% |

Ten Largest Equity Holdings

| Holdings | 35.9% of Net Assets |

|---|---|

| Oversea-Chinese Banking Corp., Ltd. | 4.8% |

| Shionogi & Co., Ltd | 4.6% |

| Lloyds Banking Group PLC | 3.8% |

| ArcelorMittal SA | 3.7% |

| Volvo AB | 3.4% |

| Ono Pharmaceutical Co., Ltd. | 3.4% |

| Holcim AG | 3.2% |

| Otsuka Holdings Co., Ltd. | 3.0% |

| Infineon Technologies AG | 3.0% |

| Nintendo Co., Ltd. | 3.0% |

Geographical Diversification

| Country | % of Net Assets |

| Japan | 27% |

| United Kingdom | 15% |

| Switzerland | 10% |

| France | 9% |

| Singapore | 9% |

| Germany | 6% |

| Luxembourg | 5% |

| Sweden | 3% |

| Spain | 3% |

| Netherlands | 3% |

| Other | 10% |

Additional Information

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/mutualreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Householding

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report and prospectus to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your financial representative or call DWS toll free at (800) 728-3337.

Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Stocks may decline in value. The Fund will be managed using the CROCI® Investment Process, which is based on portfolio management’s belief that, over time, stocks which display more favorable financial metrics (for example, the CROCI® Economic P/E Ratio) as generated by this process may outperform stocks which display less favorable metrics. This premise may not prove to be correct and prospective investors should evaluate this assumption prior to investing in the Fund. The Fund may lend securities to approved institutions. Please read the prospectus for details.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/mutualreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2024 DWS Group GmbH&Co. KGaA. All rights reserved

DCIF-TSRA-R6

R-102572-1 (10/24)

DWS CROCI International Fund

Class S: SCINX

Annual Shareholder Report—August 31, 2024

This annual shareholder report contains important information about DWS CROCI International Fund ("the Fund") for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/mutualreports. You can also request this information by contacting us at (800) 728-3337.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

|---|---|---|

| Class S | $100 | 0.93% |

Gross expense ratio as of the latest prospectus: 0.93%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher.

How did the Fund perform last year and what affected its performance?

Class S shares of the Fund returned 15.50% for the period ended August 31, 2024. The Fund's broad-based index, the MSCI EAFE Index, returned 19.40% for the same period, while the Fund's additional, more narrowly based index, the MSCI EAFE® Value Index, returned 20.38%.

Stock selection was the primary reason for the Fund’s underperformance. The weakest results occurred in the information technology sector, primarily due to poor performance for the Netherlands-based semiconductor producer STMicroelectronics NV.* The stock lagged its industry peers for much of the period due to weakness in its auto and industrial end markets, and it further declined in August 2024 after missing earnings expectations and reducing its forward guidance. Infineon Technologies AG (3.0%), which was hurt by a slow inventory recovery cycle, weakening electric vehicle sales, and declining market share, was also a notable laggard in technology.

The industrials sector was another area of weakness. The German chemicals producer Brenntag SE (1.4%) was the largest detractor. Profits came in below expectations due to the combination of weaker demand and intensifying pricing headwinds, and management reduced guidance to the low end of the previous range. The Dutch human resources consulting firm Randstad NV,* which was hurt by a slowdown in hiring trends, was a further detractor in industrials. The Fund’s stock picks in healthcare underperformed, as well. Japan-based Ono Pharmaceutical Co., Ltd. (3.4%), which announced the acquisition of a company without meaningful current revenues, was the largest detractor. Shionogi & Co., Ltd. (4.6%) also lost ground after the trial results of its anti-obesity drug did not meet expectations. In addition, its pill-based COVID-19 treatment did not clear a late stage trial.

On the other hand, the Fund outperformed in the materials sector. Shares of the Swiss building materials producer Holcim AG (3.2%) rose on the strength of robust cash flows, growth related to the global decarbonization trend, and a cyclical recovery in its U.S. roofing business. Nitto Denko Corp. (0.7%), a Japanese maker of adhesives and building products, was also a top contributor in materials. The stock was boosted by improving earnings growth visibility and the company’s proactive stance on shareholder returns. Shin Etsu Chemical, Ltd.,* whose products are used in the fabrication of semiconductors, was another contributor of note. Stock selection in the consumer discretionary sector also added value, led by positions in Sekisui House Ltd. (2.8%) and Pandora A/S (0.3%).

* Not held at August 31, 2024

Percentages in parentheses are based on the Fund's net assets as of August 31, 2024.

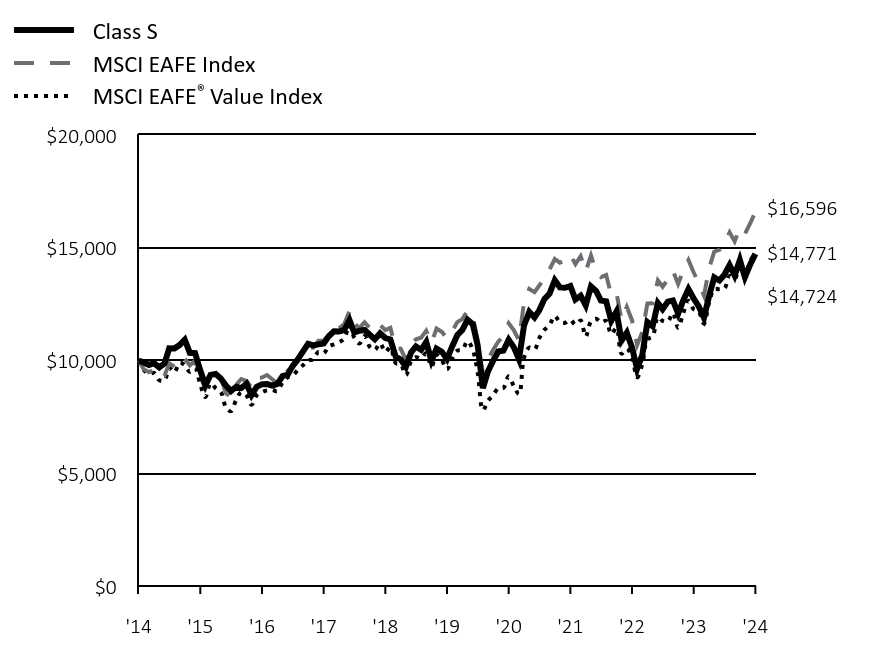

Fund Performance

Cumulative Growth of an Assumed $10,000Investment

MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI EAFE Index is a broad-based index that represents the fund’s overall equity market.

MSCI EAFE® Value Index captures large and mid-capitalization securities exhibiting overall value style characteristics across developed markets countries around the world, excluding the U.S. and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The MSCI EAFE® Value Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

| Class S | MSCI EAFE Index | MSCI EAFE® Value Index | |

|---|---|---|---|

| '14 | $10,000 | $10,000 | $10,000 |

| '14 | $9,908 | $9,616 | $9,588 |

| '14 | $9,802 | $9,476 | $9,394 |

| '14 | $9,884 | $9,605 | $9,447 |

| '14 | $9,694 | $9,272 | $9,122 |

| '15 | $9,864 | $9,317 | $9,097 |

| '15 | $10,541 | $9,874 | $9,666 |

| '15 | $10,536 | $9,724 | $9,477 |

| '15 | $10,680 | $10,122 | $9,896 |

| '15 | $10,921 | $10,070 | $9,800 |

| '15 | $10,340 | $9,784 | $9,497 |

| '15 | $10,325 | $9,988 | $9,662 |

| '15 | $9,553 | $9,253 | $8,936 |

| '15 | $8,903 | $8,783 | $8,379 |

| '15 | $9,362 | $9,470 | $8,996 |

| '15 | $9,402 | $9,322 | $8,773 |

| '15 | $9,203 | $9,197 | $8,604 |

| '16 | $8,881 | $8,532 | $7,904 |

| '16 | $8,642 | $8,375 | $7,751 |

| '16 | $8,833 | $8,920 | $8,262 |

| '16 | $8,776 | $9,179 | $8,588 |

| '16 | $8,966 | $9,095 | $8,451 |

| '16 | $8,462 | $8,790 | $8,032 |

| '16 | $8,837 | $9,235 | $8,454 |

| '16 | $8,949 | $9,242 | $8,591 |

| '16 | $8,951 | $9,355 | $8,674 |

| '16 | $8,889 | $9,164 | $8,694 |

| '16 | $8,962 | $8,982 | $8,640 |

| '16 | $9,307 | $9,289 | $9,036 |

| '17 | $9,375 | $9,558 | $9,258 |

| '17 | $9,750 | $9,695 | $9,322 |

| '17 | $10,050 | $9,962 | $9,583 |

| '17 | $10,393 | $10,215 | $9,784 |

| '17 | $10,741 | $10,590 | $10,010 |

| '17 | $10,671 | $10,571 | $10,040 |

| '17 | $10,714 | $10,876 | $10,376 |

| '17 | $10,757 | $10,872 | $10,311 |

| '17 | $11,073 | $11,143 | $10,630 |

| '17 | $11,293 | $11,312 | $10,712 |

| '17 | $11,289 | $11,431 | $10,808 |

| '17 | $11,355 | $11,614 | $10,974 |

| '18 | $11,790 | $12,197 | $11,566 |

| '18 | $11,243 | $11,646 | $11,016 |

| '18 | $11,320 | $11,436 | $10,751 |

| '18 | $11,353 | $11,697 | $11,082 |

| '18 | $11,145 | $11,434 | $10,602 |

| '18 | $10,940 | $11,295 | $10,467 |

| '18 | $11,208 | $11,573 | $10,768 |

| '18 | $10,994 | $11,349 | $10,376 |

| '18 | $10,936 | $11,448 | $10,591 |

| '18 | $10,172 | $10,537 | $9,888 |

| '18 | $10,046 | $10,523 | $9,833 |

| '18 | $9,717 | $10,012 | $9,352 |

| '19 | $10,367 | $10,670 | $9,978 |

| '19 | $10,621 | $10,942 | $10,144 |

| '19 | $10,474 | $11,011 | $10,092 |

| '19 | $10,817 | $11,321 | $10,327 |

| '19 | $9,983 | $10,777 | $9,729 |

| '19 | $10,527 | $11,417 | $10,248 |

| '19 | $10,391 | $11,272 | $10,017 |

| '19 | $10,060 | $10,980 | $9,606 |

| '19 | $10,612 | $11,294 | $10,069 |

| '19 | $11,119 | $11,700 | $10,433 |

| '19 | $11,354 | $11,832 | $10,474 |

| '19 | $11,802 | $12,217 | $10,856 |

| '20 | $11,607 | $11,961 | $10,464 |

| '20 | $10,677 | $10,880 | $9,474 |

| '20 | $8,774 | $9,428 | $7,795 |

| '20 | $9,514 | $10,037 | $8,212 |

| '20 | $9,989 | $10,474 | $8,462 |

| '20 | $10,399 | $10,831 | $8,764 |

| '20 | $10,442 | $11,083 | $8,781 |

| '20 | $10,922 | $11,653 | $9,295 |

| '20 | $10,589 | $11,350 | $8,868 |

| '20 | $10,046 | $10,897 | $8,511 |

| '20 | $11,554 | $12,586 | $10,123 |

| '20 | $12,154 | $13,171 | $10,571 |

| '21 | $11,907 | $13,031 | $10,489 |

| '21 | $12,223 | $13,323 | $10,988 |

| '21 | $12,732 | $13,630 | $11,358 |

| '21 | $12,961 | $14,040 | $11,575 |

| '21 | $13,557 | $14,498 | $11,976 |

| '21 | $13,244 | $14,335 | $11,700 |

| '21 | $13,223 | $14,442 | $11,671 |

| '21 | $13,302 | $14,697 | $11,804 |

| '21 | $12,701 | $14,271 | $11,587 |

| '21 | $12,872 | $14,622 | $11,772 |

| '21 | $12,442 | $13,941 | $11,064 |

| '21 | $13,282 | $14,655 | $11,723 |

| '22 | $13,073 | $13,947 | $11,845 |

| '22 | $12,655 | $13,700 | $11,684 |

| '22 | $12,621 | $13,788 | $11,762 |

| '22 | $11,758 | $12,896 | $11,167 |

| '22 | $12,168 | $12,993 | $11,441 |

| '22 | $10,880 | $11,787 | $10,302 |

| '22 | $11,229 | $12,375 | $10,517 |

| '22 | $10,575 | $11,787 | $10,162 |

| '22 | $9,623 | $10,684 | $9,251 |

| '22 | $10,247 | $11,259 | $9,848 |

| '22 | $11,702 | $12,527 | $10,930 |

| '22 | $11,519 | $12,537 | $11,068 |

| '23 | $12,546 | $13,552 | $11,922 |

| '23 | $12,275 | $13,269 | $11,755 |

| '23 | $12,611 | $13,598 | $11,725 |

| '23 | $12,658 | $13,982 | $12,103 |

| '23 | $12,069 | $13,391 | $11,451 |

| '23 | $12,658 | $14,000 | $12,095 |

| '23 | $13,165 | $14,453 | $12,645 |

| '23 | $12,748 | $13,899 | $12,270 |

| '23 | $12,395 | $13,424 | $12,166 |

| '23 | $11,894 | $12,880 | $11,631 |

| '23 | $12,847 | $14,076 | $12,552 |

| '23 | $13,683 | $14,824 | $13,165 |

| '24 | $13,547 | $14,909 | $13,157 |

| '24 | $13,802 | $15,182 | $13,181 |

| '24 | $14,230 | $15,681 | $13,755 |

| '24 | $13,765 | $15,280 | $13,615 |

| '24 | $14,452 | $15,871 | $14,151 |

| '24 | $13,689 | $15,615 | $13,757 |

| '24 | $14,247 | $16,073 | $14,402 |

| '24 | $14,724 | $16,596 | $14,771 |

Yearly periods ended August 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|---|---|---|

| Class S No Sales Charge | 15.50% | 7.92% | 3.94% |

| MSCI EAFE Index | 19.40% | 8.61% | 5.20% |

MSCI EAFE® Value Index | 20.38% | 8.99% | 3.98% |

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please visit dws.com/en-us/products/mutual-funds for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions.

Key Fund Statistics

| Net Assets ($) | 438,521,810 |

| Number of Portfolio Holdings | 61 |

| Portfolio Turnover Rate (%) | 60 |

| Total Net Advisory Fees Paid ($) | 2,409,224 |

What did the Fund invest in?

Asset Allocation

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Preferred Stocks | 0% |

| Cash Equivalents | 0% |

| Other Assets and Liabilities, Net | 1% |

| Total | 100% |

Holdings-based data is subject to change.

Sector Allocation

| Sector | % of Net Assets |

| Health Care | 23% |

| Financials | 23% |

| Consumer Discretionary | 14% |

| Materials | 10% |

| Industrials | 8% |

| Communication Services | 6% |

| Information Technology | 5% |

| Utilities | 4% |

| Consumer Staples | 4% |

| Energy | 2% |

Ten Largest Equity Holdings

| Holdings | 35.9% of Net Assets |

|---|---|

| Oversea-Chinese Banking Corp., Ltd. | 4.8% |

| Shionogi & Co., Ltd | 4.6% |

| Lloyds Banking Group PLC | 3.8% |

| ArcelorMittal SA | 3.7% |

| Volvo AB | 3.4% |

| Ono Pharmaceutical Co., Ltd. | 3.4% |

| Holcim AG | 3.2% |

| Otsuka Holdings Co., Ltd. | 3.0% |

| Infineon Technologies AG | 3.0% |

| Nintendo Co., Ltd. | 3.0% |

Geographical Diversification

| Country | % of Net Assets |

| Japan | 27% |

| United Kingdom | 15% |

| Switzerland | 10% |

| France | 9% |

| Singapore | 9% |

| Germany | 6% |

| Luxembourg | 5% |

| Sweden | 3% |

| Spain | 3% |

| Netherlands | 3% |

| Other | 10% |

Additional Information

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/mutualreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Householding

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report and prospectus to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your financial representative or call DWS toll free at (800) 728-3337.

Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Stocks may decline in value. The Fund will be managed using the CROCI® Investment Process, which is based on portfolio management’s belief that, over time, stocks which display more favorable financial metrics (for example, the CROCI® Economic P/E Ratio) as generated by this process may outperform stocks which display less favorable metrics. This premise may not prove to be correct and prospective investors should evaluate this assumption prior to investing in the Fund. The Fund may lend securities to approved institutions. Please read the prospectus for details.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/mutualreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2024 DWS Group GmbH&Co. KGaA. All rights reserved

DCIF-TSRA-S

R-102572-1 (10/24)

DWS CROCI International Fund

Institutional Class: SUIIX

Annual Shareholder Report—August 31, 2024

This annual shareholder report contains important information about DWS CROCI International Fund ("the Fund") for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/mutualreports. You can also request this information by contacting us at (800) 728-3337.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

|---|---|---|

| Institutional Class | $95 | 0.88% |

Gross expense ratio as of the latest prospectus: 0.87%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher.

How did the Fund perform last year and what affected its performance?

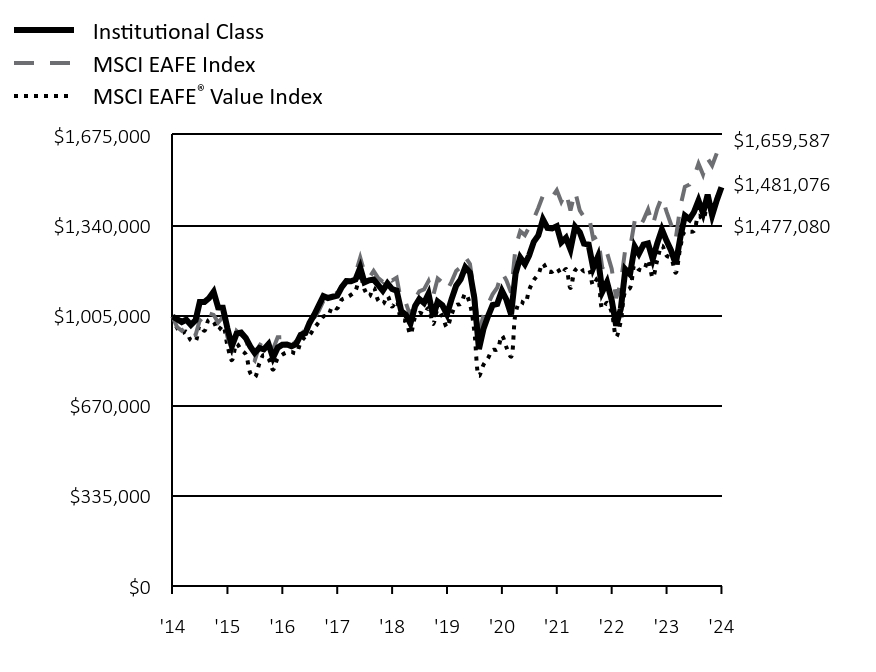

Institutional Class shares of the Fund returned 15.55% for the period ended August 31, 2024. The Fund's broad-based index, the MSCI EAFE Index, returned 19.40% for the same period, while the Fund's additional, more narrowly based index, the MSCI EAFE® Value Index, returned 20.38%.

Stock selection was the primary reason for the Fund’s underperformance. The weakest results occurred in the information technology sector, primarily due to poor performance for the Netherlands-based semiconductor producer STMicroelectronics NV.* The stock lagged its industry peers for much of the period due to weakness in its auto and industrial end markets, and it further declined in August 2024 after missing earnings expectations and reducing its forward guidance. Infineon Technologies AG (3.0%), which was hurt by a slow inventory recovery cycle, weakening electric vehicle sales, and declining market share, was also a notable laggard in technology.

The industrials sector was another area of weakness. The German chemicals producer Brenntag SE (1.4%) was the largest detractor. Profits came in below expectations due to the combination of weaker demand and intensifying pricing headwinds, and management reduced guidance to the low end of the previous range. The Dutch human resources consulting firm Randstad NV,* which was hurt by a slowdown in hiring trends, was a further detractor in industrials. The Fund’s stock picks in healthcare underperformed, as well. Japan-based Ono Pharmaceutical Co., Ltd. (3.4%), which announced the acquisition of a company without meaningful current revenues, was the largest detractor. Shionogi & Co., Ltd. (4.6%) also lost ground after the trial results of its anti-obesity drug did not meet expectations. In addition, its pill-based COVID-19 treatment did not clear a late stage trial.

On the other hand, the Fund outperformed in the materials sector. Shares of the Swiss building materials producer Holcim AG (3.2%) rose on the strength of robust cash flows, growth related to the global decarbonization trend, and a cyclical recovery in its U.S. roofing business. Nitto Denko Corp. (0.7%), a Japanese maker of adhesives and building products, was also a top contributor in materials. The stock was boosted by improving earnings growth visibility and the company’s proactive stance on shareholder returns. Shin Etsu Chemical, Ltd.,* whose products are used in the fabrication of semiconductors, was another contributor of note. Stock selection in the consumer discretionary sector also added value, led by positions in Sekisui House Ltd. (2.8%) and Pandora A/S (0.3%).

* Not held at August 31, 2024

Percentages in parentheses are based on the Fund's net assets as of August 31, 2024.

Fund Performance

Cumulative Growth of an Assumed $1,000,000Investment

MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI EAFE Index is a broad-based index that represents the fund’s overall equity market.

MSCI EAFE® Value Index captures large and mid-capitalization securities exhibiting overall value style characteristics across developed markets countries around the world, excluding the U.S. and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The MSCI EAFE® Value Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

| Institutional Class | MSCI EAFE Index | MSCI EAFE® Value Index | |

|---|---|---|---|

| '14 | $1,000,000 | $1,000,000 | $1,000,000 |

| '14 | $990,991 | $961,559 | $958,756 |

| '14 | $980,257 | $947,597 | $939,350 |

| '14 | $988,691 | $960,486 | $944,675 |

| '14 | $969,878 | $927,214 | $912,222 |

| '15 | $986,890 | $931,747 | $909,675 |

| '15 | $1,054,724 | $987,448 | $966,648 |

| '15 | $1,054,299 | $972,447 | $947,671 |

| '15 | $1,068,759 | $1,012,151 | $989,575 |

| '15 | $1,092,788 | $1,006,970 | $980,009 |

| '15 | $1,034,735 | $978,439 | $949,709 |

| '15 | $1,033,460 | $998,755 | $966,233 |

| '15 | $956,269 | $925,284 | $893,597 |

| '15 | $891,199 | $878,302 | $837,917 |

| '15 | $937,344 | $946,958 | $899,588 |

| '15 | $941,171 | $932,226 | $877,268 |

| '15 | $921,191 | $919,665 | $860,369 |

| '16 | $889,031 | $853,160 | $790,381 |

| '16 | $865,461 | $837,530 | $775,100 |

| '16 | $884,405 | $892,026 | $826,221 |

| '16 | $878,898 | $917,851 | $858,800 |

| '16 | $898,062 | $909,513 | $845,145 |

| '16 | $847,839 | $878,983 | $803,191 |

| '16 | $885,066 | $923,531 | $845,399 |

| '16 | $896,300 | $924,187 | $859,082 |

| '16 | $896,741 | $935,540 | $867,387 |

| '16 | $890,573 | $916,404 | $869,412 |

| '16 | $898,062 | $898,153 | $864,045 |

| '16 | $932,412 | $928,865 | $903,599 |

| '17 | $939,274 | $955,809 | $925,849 |

| '17 | $977,019 | $969,477 | $932,179 |

| '17 | $1,007,215 | $996,165 | $958,251 |

| '17 | $1,041,529 | $1,021,512 | $978,356 |

| '17 | $1,076,300 | $1,059,006 | $1,001,013 |

| '17 | $1,069,437 | $1,057,133 | $1,004,037 |

| '17 | $1,074,012 | $1,087,627 | $1,037,622 |

| '17 | $1,078,130 | $1,087,217 | $1,031,148 |

| '17 | $1,109,927 | $1,114,268 | $1,062,950 |

| '17 | $1,132,116 | $1,131,188 | $1,071,182 |

| '17 | $1,131,659 | $1,143,053 | $1,080,783 |

| '17 | $1,138,320 | $1,161,400 | $1,097,350 |

| '18 | $1,182,201 | $1,219,655 | $1,156,601 |

| '18 | $1,127,291 | $1,164,605 | $1,101,640 |

| '18 | $1,135,035 | $1,143,614 | $1,075,098 |

| '18 | $1,138,320 | $1,169,726 | $1,108,218 |

| '18 | $1,117,436 | $1,143,433 | $1,060,187 |

| '18 | $1,097,021 | $1,129,463 | $1,046,743 |

| '18 | $1,124,006 | $1,157,265 | $1,076,792 |

| '18 | $1,102,652 | $1,134,915 | $1,037,625 |

| '18 | $1,096,786 | $1,144,765 | $1,059,077 |

| '18 | $1,020,288 | $1,053,651 | $988,758 |

| '18 | $1,007,616 | $1,052,323 | $983,256 |

| '18 | $974,583 | $1,001,239 | $935,182 |

| '19 | $1,039,896 | $1,067,041 | $997,773 |

| '19 | $1,065,486 | $1,094,241 | $1,014,366 |

| '19 | $1,050,863 | $1,101,141 | $1,009,208 |

| '19 | $1,085,226 | $1,132,100 | $1,032,722 |

| '19 | $1,001,635 | $1,077,730 | $972,942 |

| '19 | $1,055,981 | $1,141,667 | $1,024,779 |

| '19 | $1,042,334 | $1,127,171 | $1,001,733 |

| '19 | $1,008,946 | $1,097,971 | $960,582 |

| '19 | $1,064,267 | $1,129,434 | $1,006,936 |

| '19 | $1,115,202 | $1,170,014 | $1,043,264 |

| '19 | $1,138,598 | $1,183,204 | $1,047,392 |

| '19 | $1,183,546 | $1,221,658 | $1,085,639 |

| '20 | $1,163,883 | $1,196,140 | $1,046,382 |

| '20 | $1,070,611 | $1,088,012 | $947,358 |

| '20 | $880,034 | $942,797 | $779,511 |

| '20 | $954,399 | $1,003,704 | $821,233 |

| '20 | $1,002,296 | $1,047,410 | $846,214 |

| '20 | $1,043,386 | $1,083,074 | $876,386 |

| '20 | $1,047,671 | $1,108,319 | $878,087 |

| '20 | $1,096,324 | $1,165,299 | $929,490 |

| '20 | $1,063,049 | $1,135,021 | $886,809 |

| '20 | $1,008,598 | $1,089,701 | $851,099 |

| '20 | $1,159,850 | $1,258,619 | $1,012,275 |

| '20 | $1,220,190 | $1,317,140 | $1,057,115 |

| '21 | $1,195,278 | $1,303,107 | $1,048,873 |

| '21 | $1,227,124 | $1,332,335 | $1,098,840 |

| '21 | $1,278,233 | $1,362,970 | $1,135,817 |

| '21 | $1,301,605 | $1,403,981 | $1,157,504 |

| '21 | $1,361,445 | $1,449,766 | $1,197,591 |

| '21 | $1,329,856 | $1,433,451 | $1,170,003 |

| '21 | $1,328,058 | $1,444,244 | $1,167,146 |

| '21 | $1,336,020 | $1,469,719 | $1,180,365 |

| '21 | $1,275,922 | $1,427,066 | $1,158,700 |

| '21 | $1,292,872 | $1,462,165 | $1,177,178 |

| '21 | $1,249,725 | $1,394,110 | $1,106,353 |

| '21 | $1,334,054 | $1,465,494 | $1,172,250 |

| '22 | $1,313,489 | $1,394,676 | $1,184,466 |

| '22 | $1,271,291 | $1,370,016 | $1,168,367 |

| '22 | $1,267,819 | $1,378,822 | $1,176,162 |

| '22 | $1,181,285 | $1,289,620 | $1,116,657 |

| '22 | $1,222,415 | $1,299,288 | $1,144,146 |

| '22 | $1,093,150 | $1,178,730 | $1,030,224 |

| '22 | $1,128,404 | $1,237,466 | $1,051,680 |

| '22 | $1,062,436 | $1,178,693 | $1,016,194 |

| '22 | $966,822 | $1,068,430 | $925,089 |

| '22 | $1,029,852 | $1,125,884 | $984,757 |

| '22 | $1,175,944 | $1,252,699 | $1,092,994 |

| '22 | $1,157,333 | $1,253,706 | $1,106,802 |

| '23 | $1,260,735 | $1,355,227 | $1,192,236 |

| '23 | $1,233,641 | $1,326,948 | $1,175,529 |

| '23 | $1,267,647 | $1,359,835 | $1,172,487 |

| '23 | $1,272,347 | $1,398,227 | $1,210,269 |

| '23 | $1,213,181 | $1,339,057 | $1,145,095 |

| '23 | $1,272,624 | $1,399,997 | $1,209,473 |

| '23 | $1,323,496 | $1,445,296 | $1,264,470 |

| '23 | $1,281,748 | $1,389,923 | $1,226,981 |

| '23 | $1,246,082 | $1,342,446 | $1,216,570 |

| '23 | $1,195,763 | $1,288,021 | $1,163,062 |

| '23 | $1,291,701 | $1,407,572 | $1,255,230 |

| '23 | $1,375,613 | $1,482,355 | $1,316,547 |

| '24 | $1,362,143 | $1,490,886 | $1,315,662 |

| '24 | $1,387,936 | $1,518,176 | $1,318,054 |

| '24 | $1,431,210 | $1,568,108 | $1,375,539 |

| '24 | $1,384,210 | $1,527,951 | $1,361,472 |

| '24 | $1,453,277 | $1,587,136 | $1,415,116 |

| '24 | $1,376,472 | $1,561,514 | $1,375,721 |

| '24 | $1,432,930 | $1,607,323 | $1,440,212 |

| '24 | $1,481,076 | $1,659,587 | $1,477,080 |

Yearly periods ended August 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|---|---|---|

| Institutional Class No Sales Charge | 15.55% | 7.98% | 4.01% |

| MSCI EAFE Index | 19.40% | 8.61% | 5.20% |

MSCI EAFE® Value Index | 20.38% | 8.99% | 3.98% |

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please visit dws.com/en-us/products/mutual-funds for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions.

Key Fund Statistics

| Net Assets ($) | 438,521,810 |

| Number of Portfolio Holdings | 61 |

| Portfolio Turnover Rate (%) | 60 |

| Total Net Advisory Fees Paid ($) | 2,409,224 |

What did the Fund invest in?

Asset Allocation

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Preferred Stocks | 0% |

| Cash Equivalents | 0% |

| Other Assets and Liabilities, Net | 1% |

| Total | 100% |

Holdings-based data is subject to change.

Sector Allocation

| Sector | % of Net Assets |

| Health Care | 23% |

| Financials | 23% |

| Consumer Discretionary | 14% |

| Materials | 10% |

| Industrials | 8% |

| Communication Services | 6% |

| Information Technology | 5% |

| Utilities | 4% |

| Consumer Staples | 4% |

| Energy | 2% |

Ten Largest Equity Holdings

| Holdings | 35.9% of Net Assets |

|---|---|

| Oversea-Chinese Banking Corp., Ltd. | 4.8% |

| Shionogi & Co., Ltd | 4.6% |

| Lloyds Banking Group PLC | 3.8% |

| ArcelorMittal SA | 3.7% |

| Volvo AB | 3.4% |

| Ono Pharmaceutical Co., Ltd. | 3.4% |

| Holcim AG | 3.2% |

| Otsuka Holdings Co., Ltd. | 3.0% |

| Infineon Technologies AG | 3.0% |

| Nintendo Co., Ltd. | 3.0% |

Geographical Diversification

| Country | % of Net Assets |

| Japan | 27% |

| United Kingdom | 15% |

| Switzerland | 10% |

| France | 9% |

| Singapore | 9% |

| Germany | 6% |

| Luxembourg | 5% |

| Sweden | 3% |

| Spain | 3% |

| Netherlands | 3% |

| Other | 10% |

Additional Information

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/mutualreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Householding

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report and prospectus to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your financial representative or call DWS toll free at (800) 728-3337.

Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Stocks may decline in value. The Fund will be managed using the CROCI® Investment Process, which is based on portfolio management’s belief that, over time, stocks which display more favorable financial metrics (for example, the CROCI® Economic P/E Ratio) as generated by this process may outperform stocks which display less favorable metrics. This premise may not prove to be correct and prospective investors should evaluate this assumption prior to investing in the Fund. The Fund may lend securities to approved institutions. Please read the prospectus for details.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/mutualreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2024 DWS Group GmbH&Co. KGaA. All rights reserved

DCIF-TSRA-I

R-102572-1 (10/24)

| (b) Not applicable | |

| Item 2. | Code of Ethics. |

As of the end of the period covered by this report, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR that applies to its Principal Executive Officer and Principal Financial Officer.

There have been no amendments to, or waivers from, a provision of the code of ethics during the period covered by this report that would require disclosure under Item 2.

A copy of the code of ethics is filed as an exhibit to this Form N-CSR. | |

| Item 3. | Audit Committee Financial Expert. |