As Filed Electronically with the Securities and Exchange Commission on November 16, 2004

Securities Act File No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ¨

Post-Effective Amendment No. ¨

SCUDDER INTERNATIONAL FUND, INC.

(Exact Name of Registrant as Specified in Charter)

Two International Place

Boston, Massachusetts 02110-4103

(Address of Principal Executive Offices) (Zip Code)

617-295-2572

(Registrant’s Area Code and Telephone Number)

John Millette

Deutsche Investment Management Americas Inc.

Two International Place

Boston, Massachusetts 02110-4103

(Name and Address of Agent for Service)

With copies to:

| | |

| John W. Gerstmayr, Esq. | | Cathy G. O’Kelly, Esq. |

| Thomas R. Hiller, Esq. | | David A. Sturms, Esq. |

| Ropes & Gray LLP | | Vedder, Price, Kaufman & Kammholz, P.C. |

| One International Place | | 222 North LaSalle Street |

| Boston, Massachusetts 02110-2624 | | Chicago, Illinois 60601 |

TITLE OF SECURITIES BEING REGISTERED:

Shares of the Scudder Greater Europe Growth Fund Series of the Registrant

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Questions & Answers

Scudder New Europe Fund

Scudder New Europe Fund, Inc.

Q&A

Q What is happening?

A Deutsche Asset Management (“DeAM”), the investment manager for the Scudder funds, has initiated a program to reorganize and merge selected funds within the Scudder fund family.

Q What issue am I being asked to vote on?

A You are being asked to vote on a proposal to merge Scudder New Europe Fund into Scudder Greater Europe Growth Fund. Both funds are managed by the same portfolio management team and seek to achieve substantially the same investment objective through similar types of investments.

After carefully reviewing the proposal, your fund’s Board has determined that this action is in the best interest of the fund. The Board recommends that you vote for this proposal.

Q Why has this proposal been made for my fund?

A The merger of the two funds is intended to create a more streamlined lineup of Scudder funds, which DeAM believes may help enhance performance and increase the efficiency of DeAM’s operations. The combined fund will pay a lower management fee than Scudder New Europe Fund. In addition, combining the two funds means that the costs of operating the fund are anticipated to be spread across a larger asset base, which may result in greater cost efficiencies and the potential for greater economies of scale.

Q&A continued

Finally, DeAM has agreed to cap the expenses of the combined fund at levels equal to or lower than the expenses currently paid by Scudder New Europe Fund for approximately three years following the merger. Consequently, the combined fund will have the same or lower total operating expenses than Scudder New Europe Fund.

Q Will I have to pay taxes as a result of the merger?

A The merger is expected to be a tax-free transaction for federal income tax purposes and will not take place unless special tax counsel provides an opinion to that effect. As a result of the merger, however, your fund may lose the benefit of certain tax losses that could have been used to offset or defer future gains.

If you choose to redeem or exchange your shares before or after the merger, the redemption or exchange will generate taxable gain or loss; therefore, you may wish to consult a tax advisor before doing so. Of course, you may also be subject to capital gains or losses as a result of the normal operations of your fund whether or not the transaction occurs.

Q Upon merger, will I own the same number of shares?

A The aggregate value of your shares will not change as a result of the merger. It is likely, however, that the number of shares you own will change as a result of the merger because your shares will be exchanged at the net asset value per share of Scudder Greater Europe Growth Fund, which will probably be different from the net asset value per share of Scudder New Europe Fund.

Q Will any fund pay for the proxy solicitation and legal costs associated with this solicitation?

A No. DeAM will bear these costs.

Q When would the merger take place?

A If approved, the merger would occur on or about March 14, 2005 or as soon as reasonably practicable after shareholder approval is obtained. Shortly after completion of

Q&A continued

the merger, shareholders whose accounts are affected by the merger will receive a confirmation statement reflecting their new account number and number of shares owned.

Q How can I vote?

A You can vote in any one of four ways:

| n | | Through the Internet by going to the website listed on your proxy card; |

| n | | By telephone, with a toll-free call to the number listed on your proxy card; |

| n | | By mail, by sending the enclosed proxy card, signed and dated, to us in the enclosed envelope; or |

| n | | In person, by attending the special meeting. |

We encourage you to vote over the Internet or by telephone, following the instructions that appear on your proxy card. Whichever method you choose, please take the time to read the full text of the proxy statement before you vote.

Q If I send my proxy in now as requested, can I change my vote later?

A You may revoke your proxy at any time before it is voted by: (1) sending a written revocation to the Secretary of the fund as explained in the proxy statement; or (2) forwarding a later-dated proxy that is received by the fund at or prior to the special meeting; or (3) attending the special meeting and voting in person. Even if you plan to attend the special meeting, we ask that you return the enclosed proxy. This will help us ensure that an adequate number of shares are present for the special meeting to be held.

Q Will I be able to continue to track my fund’s performance in the newspaper, on the Internet or through the voice response system (ScudderACCESS)?

A Yes. You will be able to continue to track your fund’s performance through all these means.

Q Whom should I call for additional information about this proxy statement?

A Please call Georgeson Shareholder, your fund’s proxy solicitor, at 1-888-288-5518.

SCUDDER NEW EUROPE FUND

A Message from the Fund’s Chief Executive Officer

December , 2004

Dear Shareholder:

I am writing to you to ask for your vote on an important matter that affects your investment in Scudder New Europe Fund (“New Europe Fund”). While you are, of course, welcome to join us at New Europe Fund’s special meeting, most shareholders cast their vote by filling out and signing the enclosed proxy card, or by voting by telephone or through the Internet.

We are asking for your vote on the following matter:

| | |

| Proposal: | | Approval of a proposed merger of New Europe Fund into Scudder Greater Europe Growth Fund (“Greater Europe Growth Fund”). In this merger, your shares of New Europe Fund would, in effect, be exchanged, on a tax-free basis, for shares of Greater Europe Growth Fund with an equal aggregate net asset value. |

The proposed merger is part of a program initiated by Deutsche Asset Management (“DeAM”), the investment manager for the Scudder funds. This program is intended to provide a more streamlined selection of investment options that is consistent with the changing needs of investors. If approved by fund shareholders, this program will enable DeAM to:

| | • | | Eliminate redundancies within the Scudder fund family by reorganizing and combining certain funds; and |

| | • | | Focus its investment resources on a core set of mutual funds that best meets investor needs. |

In determining to recommend approval of the merger, the Directors of Scudder New Europe Fund, Inc. considered the following factors, among others:

| | • | | DeAM’s overall program to reorganize and combine selected funds within the Scudder fund family gives the portfolio management team the opportunity to focus its efforts on managing the combined Fund and offers a uniform distribution platform for the combined Fund; |

| | • | | New Europe Fund shareholders will have the opportunity to continue to invest in a substantially larger Fund with similar investment policies; |

| | • | | Shareholders will have the potential for economies of scale; |

| | • | | DeAM’s agreement to pay all costs associated with the merger; and |

| | • | | The merger would be a tax-free reorganization for the shareholders. |

The investment objective and policies of Greater Europe Growth Fund are substantially similar to those of New Europe Fund. If the merger is approved, the Board expects that the proposed changes will take effect during the first calendar quarter of 2005.

Included in this booklet is information about the upcoming shareholders’ meeting:

| | • | | A Notice of a Special Meeting of Shareholders, which summarizes the issue for which you are being asked to provide voting instructions; and |

| | • | | A Prospectus/Proxy Statement, which provides detailed information on Greater Europe Growth Fund, the specific proposal being considered at the shareholders’ meeting, and why the proposal is being made. |

Although we would like very much to have each shareholder attend the special meeting, we realize this may not be possible. Whether or not you plan to be present, however, we need your vote. We urge you to review the enclosed materials thoroughly. Once you’ve determined how you would like your interests to be represented, please promptly complete, sign, date and return the enclosed proxy card, vote by telephone or record your voting instructions on the Internet. A postage-paid envelope is enclosed for mailing, and telephone and Internet voting instructions are listed at the top of your proxy card.

I’m sure that you, like most people, lead a busy life and are tempted to put this proxy aside for another day. Please don’t. Your prompt return of the enclosed proxy card (or your voting by telephone or through the Internet) may save the necessity and expense of further solicitations.

Your vote is important to us. We appreciate the time and consideration I am sure you will give this important matter. If you have questions about the proposal, please call Georgeson Shareholder, New Europe Fund’s proxy solicitor, at 1-888-288-5518, or contact your financial advisor. Thank you for your continued support of Scudder Investments.

Sincerely yours,

Julian F. Sluyters

Chief Executive Officer

Scudder New Europe Fund, Inc.

SCUDDER NEW EUROPE FUND

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

This is the formal agenda for your Fund’s shareholder special meeting. It tells you what matter will be voted on and the time and place of the special meeting, in the event you choose to attend in person.

To the Shareholders of Scudder New Europe Fund:

A Special Meeting of Shareholders of Scudder New Europe Fund (“New Europe Fund”) will be held February 24, 2005 at [ ] [a.m./p.m.] Eastern time, at the offices of Deutsche Investment Management Americas Inc., 345 Park Avenue, 27th Floor, New York, New York 10154 (the “Meeting”), to consider the following:

| | |

| Proposal: | | Approving an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of New Europe Fund to Scudder Greater Europe Growth Fund (“Greater Europe Growth Fund”), in exchange for shares of Greater Europe Growth Fund and the assumption by Greater Europe Growth Fund of all liabilities of New Europe Fund, and the distribution of such shares, on a tax-free basis, to the shareholders of New Europe Fund in complete liquidation of New Europe Fund. |

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting or any adjournments or postponements thereof.

Holders of record of shares of New Europe Fund at the close of business on December 2, 2004 are entitled to vote at the Meeting and at any adjournments or postponements thereof.

In the event that the necessary quorum to transact business or the vote required to approve the merger is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting in accordance with applicable law to permit such further solicitation of proxies as may be deemed necessary or advisable. Any adjournment requires the affirmative vote of a majority of the shareholders entitled to vote at the Meeting that are present in person or by proxy at the session of the Meeting to be adjourned. The persons named as proxies will vote FOR any such adjournment those proxies which they are entitled to vote in favor of the proposal and will vote AGAINST any such adjournment those proxies to be voted against the proposal.

By order of the Board of Directors

John Millette

Secretary

December , 2004

WE URGE YOU TO MARK, SIGN, DATE AND MAIL THE ENCLOSED PROXY IN THE POSTAGE-PAID ENVELOPE PROVIDED OR RECORD YOUR VOTING INSTRUCTIONS BY TELEPHONE OR THROUGH THE INTERNET SO THAT YOU WILL BE REPRESENTED AT THE MEETING.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| | |

Registration

| | Valid Signature

|

Corporate Accounts | | |

(1) ABC Corp. | | ABC Corp.,

John Doe, Treasurer |

(2) ABC Corp. | | John Doe, Treasurer |

(3) ABC Corp. c/o John Doe, Treasurer | | John Doe |

(4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| |

Partnership Accounts | | |

(1) The XYZ Partnership | | Jane B. Smith, Partner |

(2) Smith and Jones, Limited Partnership | | Jane B. Smith, General

Partner |

| |

Trust Accounts | | |

(1) ABC Trust Account | | Jane B. Doe, Trustee |

(2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

| |

Custodial or Estate Accounts | | |

(1) John B. Smith, Cust. f/b/o John B. Smith Jr.

UGMA/UTMA | | John B. Smith |

(2) Estate of John B. Smith | | John B. Smith, Jr., Executor |

IMPORTANT INFORMATION

FOR SHAREHOLDERS OF

SCUDDER NEW EUROPE FUND

This document contains a prospectus/proxy statement and a proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how to vote on your behalf on an important issue relating to your fund. If you complete and sign the proxy (or tell us how you want to vote by voting by telephone or through the Internet), we’ll vote exactly as you tell us. If you simply sign the proxy, we’ll vote it in accordance with the Directors’ recommendation on page [ ].

We urge you to review the prospectus/proxy statement carefully and either fill out your proxy card and return it to us by mail, vote by telephone or record your voting instructions via the Internet. You may receive more than one proxy card since several shareholder special meetings are being held as part of the broader restructuring program of the Scudder fund family. If so, please vote each one. Your prompt return of the enclosed proxy card (or your voting by telephone or through the Internet) may save the necessity and expense of further solicitations.

We want to know how you would like to vote and welcome your comments. Please take a few minutes to read these materials and return your proxy to us. If you have any questions, please call Georgeson Shareholder, New Europe Fund’s proxy solicitor, at the special toll-free number we have set up for you (1-888-288-5518) or contact your financial advisor.

PROSPECTUS/PROXY STATEMENT

[ ], 2004

| | |

Acquisition of the assets of:

| | By and in exchange for shares of:

|

| |

| Scudder New Europe Fund, Inc. | | Scudder Greater Europe Growth Fund a series of Scudder International Fund, Inc. |

| |

222 South Riverside Plaza Chicago, IL 60606 (617) 295-2572 | | Two International Place Boston, MA 02110 (617) 295-3986 |

This Prospectus/Proxy Statement is being furnished in connection with the proposed merger of Scudder New Europe Fund, Inc. (“New Europe Fund”) into Scudder Greater Europe Growth Fund (“Greater Europe Growth Fund”). Greater Europe Growth Fund and New Europe Fund are referred to herein collectively as the “Funds,” and each is referred to herein individually as a “Fund.” As a result of the proposed merger, each shareholder of New Europe Fund will receive a number of full and fractional shares of the corresponding class of Greater Europe Growth Fund equal in value as of the date of the merger to the total value of such shareholder’s New Europe Fund shares.

This Prospectus/Proxy Statement is being mailed on or about December , 2004. It explains concisely what you should know before voting on the matter described in this Prospectus/Proxy Statement or investing in Greater Europe Growth Fund, a non-diversified series of an open-end management investment company. Please read it carefully and keep it for future reference.

The securities offered by this Prospectus/Proxy Statement have not been approved or disapproved by the Securities and Exchange Commission (“SEC”), nor has the SEC passed upon the accuracy or adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

The following documents have been filed with the SEC and are incorporated into this Prospectus/Proxy Statement by reference:

| | (i) | | the joint prospectus of Greater Europe Growth Fund (Classes A, B and C) and New Europe Fund (Classes A, B and C), dated March 1, 2004, as supplemented from time to time, a copy of which, if applicable, is included with this Prospectus/Proxy Statement; |

| | (ii) | | the prospectus of Greater Europe Growth Fund, dated December 1, 2004, as supplemented from time to time, relating to Institutional Class shares, a copy of which, if applicable, is included with this Prospectus/Proxy Statement; |

| | (iii) | | the prospectus of New Europe Fund, dated March 1, 2004, as supplemented from time to time, relating to Institutional Class shares; |

| | (iv) | | the statement of additional information of New Europe Fund, dated March 1, 2004, as supplemented from time to time, relating to Class A, Class B, Class C and Institutional Class shares; |

| | (v) | | the statement of additional information relating to the proposed merger, dated [ ], 2004 (the “Merger SAI”); and |

1

| | (vi) | | the financial statements and related report of independent registered public accounting firm included in New Europe Fund’s Annual Report to Shareholders for the fiscal year ended October 31, 2003 and the financial statements included in New Europe Fund’s Semiannual Report to Shareholders for the six-month period ended April 30, 2004. |

The updated financial highlights for the Greater Europe Growth Fund contained in the Semiannual Report to Shareholders for the six-month period ended April 30, 2004 are attached to this Prospectus/Proxy Statement. See Exhibit B.

Shareholders may receive free copies of the Funds’ annual reports, semiannual reports, prospectuses, statements of additional information or the Merger SAI, request other information about a Fund, or make shareholder inquiries, by contacting their financial advisor or by calling the corresponding Fund at 1-800-621-1048 for Class A, Class B and Class C shares and 1-800-730-1313 for Institutional Class shares.

Like shares of New Europe Fund, shares of Greater Europe Growth Fund are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

This document is designed to give you the information you need to vote on the proposal. Much of the information is required disclosure under rules of the SEC; some of it is technical. If there is anything you don’t understand, please contact Georgeson Shareholder, New Europe Fund’s proxy solicitor, at 1-888-288-5518, or contact your financial advisor.

Greater Europe Growth Fund is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith files reports and other information with the SEC. You may review and copy information about the Funds, including the prospectuses and the statements of additional information, at the SEC’s public reference room at 450 Fifth Street, NW, Washington, D.C. You may call the SEC at 1-202-942-8090 for information about the operation of the public reference room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549-0102. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

2

I. Synopsis

The responses to the questions that follow provide an overview of key points typically of concern to shareholders considering a proposed merger between mutual funds. These responses are qualified in their entirety by the remainder of this Prospectus/Proxy Statement, which you should read carefully because it contains additional information and further details regarding the proposed merger.

| 1. | | What is being proposed? |

The Board of Directors of New Europe Fund is recommending that the shareholders approve the transactions contemplated by the Agreement and Plan of Reorganization (as described below in Part IV and a form of which is attached hereto as Exhibit A), which we refer to as a merger of New Europe Fund with and into Greater Europe Growth Fund. If approved by shareholders, all of the assets of New Europe Fund will be transferred to Greater Europe Growth Fund solely in exchange for (a) the issuance and delivery to New Europe Fund of Class A, Class B, Class C and Institutional Class shares of Greater Europe Growth Fund (“Merger Shares”) with a value equal to the value of New Europe Fund’s assets net of liabilities, and (b) the assumption by Greater Europe Growth Fund of all liabilities of New Europe Fund. Immediately following the transfer, the appropriate class of Merger Shares received by New Europe Fund will be distributed pro rata, on a tax-free basis, to each of its shareholders of record.

DeAM proposed this combination as part of its overall product rationalization program to reorganize and combine selected funds within the Scudder fund family. The Scudder fund family is made up of a group of funds that were managed by different investment advisors over the years and that have come together as a result of various corporate transactions that have taken place over time. As a result of these corporate transactions, there are a number of redundant funds within the Scudder fund family. In addition, the funds in the Scudder fund family do not currently have the same share class structure. DeAM’s overall program is designed to reorganize and combine funds in order to, among other reasons, eliminate redundant funds. DeAM’s program also is designed to expand product offerings across more share classes and to adjust or eliminate share classes in order to implement the same share class structure across the Scudder fund family. DeAM believes this program may help enhance investment performance and increase the efficiency of its operations.

| 2. | | What will happen to my shares of New Europe Fund as a result of the merger? |

Your shares of New Europe Fund will, in effect, be exchanged on a tax-free basis for shares of the same class of Greater Europe Growth Fund with an equal aggregate net asset value on the date of the merger.

| 3. | | Why has the Board of Directors of New Europe Fund recommended that I approve the merger? |

The Directors considered the following factors in determining to recommend that shareholders of New Europe Fund approve the merger:

| | • | | DeAM’s overall program to reorganize and combine selected funds in the Scudder fund family as described above. |

3

| | • | | The merger offers New Europe Fund shareholders the opportunity to continue to invest in a substantially larger fund with similar investment policies. |

| | • | | Deutsche Investment Management Americas Inc. (“DeIM”), New Europe Fund’s investment advisor, has advised the Directors that New Europe Fund and Greater Europe Growth Fund have substantially similar investment objectives, policies and strategies. In addition, DeIM has advised the Directors that both Funds have the same portfolio management team. |

| | • | | The merger is intended to create a more streamlined line-up of Scudder funds, which DeAM believes may help enhance investment performance and increase the efficiency of DeAM’s operations. The merger may also result in greater cost efficiencies and the potential for economies of scale for the combined Fund and its shareholders. |

| | • | | DeAM’s agreement to pay all costs associated with the merger. |

| | • | | The merger is structured as a tax-free reorganization for federal income tax purposes. Shareholders are not expected to recognize any gain or loss for federal income tax purposes directly as a result of the merger. |

The Board of Directors of New Europe Fund has concluded that: (1) the merger is in the best interests of New Europe Fund, and (2) the interests of the existing shareholders of New Europe Fund will not be diluted as a result of the merger. Accordingly, the Board of Directors of New Europe Fund recommends approval of the Agreement and Plan of Reorganization (as defined below) and the merger as contemplated thereby.

| 4. | | How do the investment goals, policies and restrictions of the two Funds compare? |

While not identical, the investment objectives, policies and restrictions of the Funds are substantially similar. New Europe Fund seeks long-term capital appreciation. Greater Europe Growth Fund seeks long-term growth of capital. Under normal circumstances, both Greater Europe Growth Fund and New Europe Fund invest at least 80% of total assets (or, in the case of New Europe Fund, 80% of net assets, plus the amount of any borrowings for investment purposes) in European common stocks and other equities (equities that are traded mainly on European markets, issued by companies organized and based in Europe or doing more than half of their business there). Both Greater Europe Growth Fund and New Europe Fund may invest up to 20% of total (or, in the case of New Europe Fund, net) assets in European debt securities of any credit quality, including junk bonds (grade BB and below). New Europe Fund is a non-diversified open-end management investment company and Greater Europe Growth Fund is a non-diversified series of an open-end management investment company. Non-diversified funds may invest in the securities of relatively few issuers, which means that the performance of one or a small number of holdings can affect overall performance more than if such funds invested in a larger number of issuers. Please also see Part II—Investment Strategies and Risk Factors—below for a more detailed comparison of the Funds’ investment policies and restrictions.

4

The following table sets forth a summary of the composition of the investment portfolio of each Fund as of April 30, 2004, and of Greater Europe Growth Fund on a pro forma combined basis, giving effect to the proposed merger:

Portfolio Composition (as a % of Fund)

(excludes cash equivalents)

| | | | | | | | | |

Country

| | New

Europe Fund

| | | Greater Europe

Growth Fund

| | | Greater Europe

Growth Fund— Pro Forma

Combined(1)

| |

United Kingdom | | 32 | % | | 33 | % | | 33 | % |

Switzerland | | 16 | % | | 16 | % | | 16 | % |

France | | 14 | % | | 15 | % | | 15 | % |

Germany | | 14 | % | | 14 | % | | 14 | % |

Netherlands | | 6 | % | | 6 | % | | 6 | % |

Spain | | 5 | % | | 5 | % | | 5 | % |

Italy | | 5 | % | | 4 | % | | 4 | % |

Sweden | | 2 | % | | 2 | % | | 2 | % |

Finland | | 2 | % | | 2 | % | | 2 | % |

Other | | 4 | % | | 3 | % | | 3 | % |

| | |

|

| |

|

| |

|

|

| | | 100 | % | | 100 | % | | 100 | % |

| (1) | | Reflects the blended characteristics of New Europe Fund and Greater Europe Growth Fund as of April 30, 2004. The portfolio composition and characteristics of the combined fund will change consistent with its stated investment objective and policies. |

5

| 5. | | How do the management fees and expense ratios of the two Funds compare, and what are they estimated to be following the merger? |

The following tables summarize the fees and expenses you may pay when investing in the Funds, the expenses that each of the Funds incurred for the 12-month period ended April 30, 2004, and the pro forma estimated expense ratios of Greater Europe Growth Fund assuming consummation of the merger as of that date.

Shareholder Fees

(fees that are paid directly from your investment)

| | | | | | | | | | | |

| | | Class A

| | | Class B

| | | Class C

| | | Institutional

Class

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of the offering price) | | | | | | | | | | | |

New Europe Fund | | 5.75 | % | | None | | | None | | | None |

Greater Europe Growth Fund | | 5.75 | % | | None | | | None | | | None |

Maximum Contingent Deferred Sales Charge (Load) (as a percentage of redemption proceeds) | | | | | | | | | | | |

New Europe Fund | | None | (1) | | 4.00 | % | | 1.00 | % | | None |

Greater Europe Growth Fund | | None | (1) | | 4.00 | % | | 1.00 | % | | None |

Redemption Fee(2) (as a percentage of total redemption proceeds) | | | | | | | | | | | |

New Europe Fund | | None | | | None | | | None | | | None |

Greater Europe Growth Fund | | None | | | None | | | None | | | None |

| (1) | | The redemption of shares purchased at net asset value under the Large Order NAV Purchase Privilege may be subject to a contingent deferred sales charge of 1.00% if redeemed within 12 months following purchase and 0.50% if redeemed within the next six months following purchase. Please see the applicable Fund’s prospectus for more details. |

| (2) | | Effective February 1, 2005, each Fund will impose a redemption fee of 2% of the total redemption amount on all Fund shares redeemed or exchanged within 30 days of buying them (either by purchase or exchange). |

The table below compares the annual management fee schedules of the Funds, expressed as a percentage of net assets. The management fee schedule of Greater Europe Growth Fund reflects reductions that will be effective upon the consummation of the merger. As of April 30, 2004, Greater Europe Growth Fund and New Europe Fund had net assets of $360,781,155 and $127,558,404, respectively.

| | | | | | | | |

Greater Europe Growth Fund

| | | New Europe Fund

| |

Average Daily Net Assets

| | Management Fee

| | | Average Daily Net Assets

| | Management Fee

| |

| $0 - $250 million | | 0.75 | % | | $0 - $250 million | | 0.75 | % |

| $250 million -$750 million | | 0.72 | % | | $250 million - $1 billion | | 0.72 | % |

| $750 million - $1.5 billion | | 0.70 | % | | $1 billion - $2.5 billion | | 0.70 | % |

| $1.5 billion - $2.5 billion | | 0.68 | % | | $2.5 billion - $5 billion | | 0.68 | % |

| $5 billion - $7.5 billion | | 0.65 | % | | $5 billion - $7.5 billion | | 0.65 | % |

| $7.5 billion - $10 billion | | 0.64 | % | | $7.5 billion - $10 billion | | 0.64 | % |

| $10 billion - $12.5 billion | | 0.63 | % | | $10 billion - $12.5 billion | | 0.63 | % |

| Over $12.5 billion | | 0.62 | % | | Over $12.5 billion | | 0.62 | % |

6

As shown below, the merger is expected to result in a lower management fee ratio and in the same or a lower total expense ratio for shareholders of New Europe Fund. However, there can be no assurance that the merger will result in expense savings.

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

| | | | | | | | | | | | | | | | | | |

| | | Management

Fee

| | | Distribution/

Service

(12b-1)

Fees

| | | Other

Expenses(1)

| | | Total

Annual

Fund

Operating

Expenses

| | | Less Expense

Waiver/

Reimbursements

| | | Net

Annual

Fund

Operating

Expenses

(after

Waiver)

| |

New Europe Fund | | | | | | | | | | | | | | | | | | |

Class A | | 0.75 | % | | 0.24 | % | | 0.61 | % | | 1.60 | %(2) | | — | | | 1.60 | % |

Class B | | 0.75 | % | | 0.98 | % | | 0.85 | % | | 2.58 | %(2) | | 0.08 | % | | 2.50 | % |

Class C | | 0.75 | % | | 0.98 | % | | 0.72 | % | | 2.45 | %(2) | | — | | | 2.45 | % |

Institutional Class | | 0.75 | % | | 0.00 | % | | 0.63 | % | | 1.38 | %(2) | | 0.26 | % | | 1.12 | % |

| | | | | | |

Greater Europe Growth Fund | | | | | | | | | | | | | | | | | | |

Class A | | 1.00 | % | | 0.16 | % | | 0.34 | % | | 1.50 | %(3) | | — | | | 1.50 | % |

Class B | | 1.00 | % | | 0.97 | % | | 0.65 | % | | 2.62 | %(3) | | 0.16 | % | | 2.46 | % |

Class C | | 1.00 | % | | 0.99 | % | | 0.52 | % | | 2.51 | %(3) | | 0.04 | % | | 2.47 | % |

Institutional Class | | 1.00 | % | | 0.00 | % | | 0.44 | %(4) | | 1.44 | % | | — | | | 1.44 | % |

| | | | | | |

Greater Europe Growth Fund (pro forma combined)(5) | | | | | | | | | | | | | | | | | | |

Class A | | 0.73 | % | | 0.24 | % | | 0.41 | %(6) | | 1.38 | % | | — | | | 1.38 | % |

Class B | | 0.73 | % | | 0.98 | % | | 0.66 | %(6) | | 2.37 | % | | — | | | 2.37 | % |

Class C | | 0.73 | % | | 0.98 | % | | 0.53 | %(6) | | 2.24 | % | | — | | | 2.24 | % |

Institutional Class | | 0.73 | % | | 0.00 | % | | 0.44 | %(6) | | 1.17 | % | | 0.06 | % | | 1.11 | % |

| (1) | | Restated and estimated to reflect the termination of the fixed rate administrative fee effective March 31, 2004 for Greater Europe Growth Fund. |

| (2) | | Through September 30, 2005, the investment advisor of New Europe Fund has contractually agreed to waive all or a portion of its management fee and/or reimburse or pay operating expenses of the Fund to the extent necessary to maintain the Fund’s total operating expenses at 1.50% for Class A, Class B and Class C shares and at 1.10% for Institutional Class shares, excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest, Rule 12b-1 distribution and/or service fees, director and director counsel fees and organizational and offering expenses. |

| (3) | | Through September 30, 2005, the investment advisor for Greater Europe Growth Fund has contractually agreed to waive all or a portion of its management fee and/ or to reimburse or pay operating expenses of the Fund to the extent necessary to |

7

| | maintain the Fund’s total operating expenses at 1.465%, 1.480% and 1.470% for Class A, Class B and Class C shares, respectively, excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest, Rule 12b-1 distribution and/or service fees, director and director counsel fees and organizational and offering expenses. |

| (4) | | The Institutional share class of Greater Europe Growth Fund was not operational during the prior fiscal year because it is being created in connection with the proposed merger. Therefore, the other expenses listed in the table for that Fund are based on estimates for the coming fiscal year. |

| (5) | | Through March 1, 2009, the investment advisor of Greater Europe Growth Fund has contractually agreed to waive all or a portion of its management fee and/or to reimburse or pay operating expenses of the combined fund to the extent necessary to maintain the combined fund’s total operating expenses at 1.17%, 1.45%, 1.29% and 1.10% for Class A, Class B, Class C and Institutional Class shares, respectively, excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest, Rule 12b-1 distribution and/or service fees, shareholder servicing fees, director and director counsel fees, and organizational and offering expenses. |

| (6) | | Other expenses are estimated, accounting for the effect of the merger. |

The tables are provided to help you understand the expenses of investing in the Funds and your share of the operating expenses that each Fund incurs and that DeAM expects the combined Fund to incur in the first year following the merger.

Examples:

The following examples translate the expenses shown in the preceding table into dollar amounts. By doing this, you can more easily compare the costs of investing in the Funds. The examples make certain assumptions. They assume that you invest $10,000 in a Fund for the time periods shown and reinvest all dividends and distributions. They also assume a 5% return on your investment each year and that a Fund’s operating expenses remain the same. This is only an example; actual expenses will be different.

| | | | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

|

New Europe Fund | | | | | | | | | | | | |

Class A | | $ | 728 | | $ | 1051 | | $ | 1396 | | $ | 2366 |

Class B(1)(3) | | $ | 653 | | $ | 1095 | | $ | 1563 | | $ | 2449 |

Class B(2)(3) | | $ | 348 | | $ | 764 | | $ | 1306 | | $ | 2786 |

Class C(1) | | $ | 248 | | $ | 764 | | $ | 1306 | | $ | 2786 |

Class C(2) | | $ | 248 | | $ | 764 | | $ | 1306 | | $ | 2786 |

Institutional Class(3) | | $ | 114 | | $ | 411 | | $ | 730 | | $ | 1635 |

| | | | |

Greater Europe Growth Fund | | | | | | | | | | | | |

Class A | | $ | 719 | | $ | 1022 | | $ | 1346 | | $ | 2263 |

Class B(1)(3) | | $ | 649 | | $ | 1099 | | $ | 1576 | | $ | 2417 |

Class B(2)(3) | | $ | 249 | | $ | 799 | | $ | 1376 | | $ | 2417 |

Class C(1)(3) | | $ | 350 | | $ | 778 | | $ | 1332 | | $ | 2843 |

Class C(2)(3) | | $ | 250 | | $ | 778 | | $ | 1332 | | $ | 2843 |

Institutional Class | | $ | 147 | | $ | 456 | | $ | 787 | | $ | 1724 |

8

| | | | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

|

Greater Europe Growth Fund

(pro forma combined) | | | | | | | | | | | | |

Class A | | $ | 707 | | $ | 987 | | $ | 1287 | | $ | 2137 |

Class B(1) | | $ | 640 | | $ | 1039 | | $ | 1465 | | $ | 2232 |

Class B(2) | | $ | 240 | | $ | 739 | | $ | 1265 | | $ | 2232 |

Class C(1) | | $ | 327 | | $ | 700 | | $ | 1200 | | $ | 2575 |

Class C(2) | | $ | 227 | | $ | 700 | | $ | 1200 | | $ | 2575 |

Institutional Class(4) | | $ | 113 | | $ | 353 | | $ | 625 | | $ | 1407 |

| (1) | | Assuming you sold your shares at the end of each period. |

| (2) | | Assuming you kept your shares. |

| (3) | | Includes one year of capped expenses in each period. |

| (4) | | Includes one year of capped expenses in the “1 year” period and three years of capped expenses in the “3 years,” “5 years,” and “10 years” periods. |

| 6. | | What are the federal income tax consequences of the proposed merger? |

For federal income tax purposes, no gain or loss is expected to be recognized by New Europe Fund or its shareholders as a direct result of the merger. For a discussion of taxes that you may incur indirectly as a result of the merger (e.g., due to differences in the Funds’ portfolio turnover rates and net investment income), please see “Information about the Proposed Merger—Federal Income Tax Consequences,” below.

| 7. | | Will my dividends be affected by the merger? |

The merger will not result in a change in dividend policy.

| 8. | | Do the procedures for purchasing, redeeming and exchanging shares of the two Funds differ? |

No. The procedures for purchasing and redeeming shares of each Fund, and for exchanging shares of each Fund for shares of other Scudder funds, are identical.

| 9. | | How will I be notified of the outcome of the merger? |

If the proposed merger is approved by shareholders, you will receive confirmation after the merger is completed, indicating your new account number and the number of Merger Shares you are receiving. Otherwise, you will be notified in the next shareholder report of New Europe Fund.

| 10. | | Will the number of shares I own change? |

Yes, the number of shares you own will most likely change. However, the total value of the shares of Greater Europe Growth Fund you receive will equal the total value of the shares of New Europe Fund that you hold at the time of the merger. Even though the net asset value per share of each Fund is likely to be different, the total value of each shareholder’s holdings will not change as a result of the merger.

| 11. | | What percentage of shareholders’ votes is required to approve the merger? |

Approval of the merger will require the affirmative vote of a majority of the votes entitled to be cast on the matter at the special meeting.

9

The Board of Directors of New Europe Fund believes that the proposed merger is in the best interest of New Europe Fund. Accordingly, the Board of Directors recommends that shareholders vote FOR approval of the proposed merger.

II. Investment Strategies and Risk Factors

What are the main investment strategies and related risks of Greater Europe Growth Fund and how do they compare with those of New Europe Fund?

Investment Objectives and Strategies. As noted above, the Funds have similar investment objectives and are managed by the same portfolio management team. Greater Europe Growth Fund seeks long-term growth of capital. New Europe Fund seeks long-term capital appreciation. Under normal circumstances, both Greater Europe Growth Fund and New Europe Fund invest at least 80% of total assets (or, for New Europe Fund, net assets, plus the amount of any borrowings for investment purposes) in European common stocks and other equities (equities that are traded mainly on European markets, issued by companies organized and based in Europe or doing more than half of their business there). Greater Europe Growth Fund tends to focus on common stocks of multinational companies in industrialized western and southern European countries, such as France, Italy, Germany, the Netherlands and the United Kingdom. New Europe Fund generally focuses on common stocks of companies in the more established markets of western and southern Europe, such as Finland, Germany, France, Italy, Spain and Portugal.

The portfolio managers of both funds use a combination of three analytical disciplines: bottom-up research, growth orientation and analysis of regional themes. The portfolio managers of Greater Europe Growth Fund look for individual companies with a history of above-average growth, strong competitive positioning, attractive prices relative to potential growth, sound financial strength and effective management, among other factors. Additionally, they look for companies that they believe have above-average potential for sustainable growth of revenue or earnings and whose market value appears reasonable in light of their business prospects. Also, they look for significant social, economic, industrial and demographic changes, seeking to identify stocks that may benefit from them. The portfolio managers of New Europe Fund look for individual companies with new or dominant products or technologies, among other factors. Additionally, they look for stocks that seem to offer the potential for sustainable above-average growth of revenues or earnings relative to each stock’s own market and whose market prices appear reasonable in light of their potential growth. Also, they consider the outlook for economic, political, industrial and demographic trends and how they may affect various countries, sectors and industries.

For both Funds, the portfolio managers will normally sell a stock when they believe its price is unlikely to go much higher, its fundamentals have deteriorated or other investments offer better opportunities, or in the course of adjusting its exposure to a given country.

In addition, both Funds may (but are not required to) use various types of derivative instruments (contracts whose value is based on, for example, indices, currencies or securities) in circumstances when the managers believe that they offer an economical

10

means of gaining exposure to a particular asset class or to keep cash on hand to meet shareholder redemptions or other needs while maintaining exposure to the market. Furthermore, both Funds may invest up to 20% of their total (or, in the case of New Europe Fund, net) assets in European debt securities, including junk bonds (grade BB and below), which pay higher yields and have higher volatility and risk of default on payments as compared to investment-grade bonds. New Europe Fund may lend its investment securities up to 25% of its total assets to approved institutional borrowers who need to borrow securities in order to complete certain transactions. Greater Europe Growth Fund may lend its investment securities up to 33 1/3% of its total assets to approved institutional borrowers who need to borrow securities in order to complete certain transactions.

New Europe Fund is a non-diversified open-end management investment company and Greater Europe Growth Fund is a non-diversified series of an open-end management investment company. Non-diversified funds are subject to non-diversification risk, as discussed below.

DeAM believes that Greater Europe Growth Fund should provide a comparable investment opportunity for shareholders of New Europe Fund. It is anticipated that there will be a pre-merger liquidation by New Europe Fund of all investments that are not consistent with the current investment objectives, policies and restrictions of Greater Europe Growth Fund.

For a more detailed description of the investment techniques used by Greater Europe Growth Fund and New Europe Fund, please see the applicable Fund’s prospectus and statement of additional information.

Primary Risks. As with any mutual fund, you may lose money by investing in Greater Europe Growth Fund. Certain risks associated with an investment in Greater Europe Growth Fund are summarized below. Subject to limited exceptions, the risks of an investment in Greater Europe Growth Fund are substantially similar to the risks of an investment in New Europe Fund. More detailed descriptions of the risks associated with an investment in Greater Europe Growth Fund can be found in the current prospectus and statement of additional information for Greater Europe Growth Fund.

The value of your investment in Greater Europe Growth Fund will change with changes in the values of the investments held by Greater Europe Growth Fund. A wide array of factors can affect those values. In this summary, we describe the principal risks that may affect Greater Europe Growth Fund’s investments as a whole. Greater Europe Growth Fund could be subject to additional principal risks because the types of investments it makes can change over time.

There are several risk factors that could hurt the performance of Greater Europe Growth Fund, cause you to lose money or cause the performance of Greater Europe Growth Fund to trail that of other investments.

Stock Market Risk. As with most stock funds, an important factor with Greater Europe Growth Fund is how stock markets perform—in this case, the European markets. When European stock prices fall, you should expect the value of your investment to fall as well. For example, European companies could be hurt by such factors as regional

11

economic downturns or difficulties with the European Economic and Monetary Union (EMU). Eastern European companies can be very sensitive to political and economic developments. To the extent that Greater Europe Growth Fund invests in smaller-sized companies, it will be more susceptible to these risks as smaller-sized companies have limited business lines and financial resources, making them especially vulnerable to business risks and economic downturns. An investment in New Europe Fund also is subject to this risk.

Foreign Investment Risk. Foreign markets often exhibit more volatility than those in the US. Investing in foreign securities involves greater risk than investing in US securities for various reasons, including:

| | • | | Political Risk. Some foreign governments have limited the outflow of profits to investors abroad, extended diplomatic disputes to include trade and financial relations, and imposed high taxes on corporate profits. |

| | • | | Information Risk. Financial reporting standards for companies based in foreign markets are often less stringent than those applicable to US companies and may present an incomplete or misleading picture of a foreign company. |

| | • | | Liquidity Risk. Securities that trade less can be more difficult or more costly to buy, or to sell, than more liquid or active securities. This liquidity risk is a factor of the trading volume of a particular security, as well as the size and liquidity of the entire local market. On the whole, foreign markets are smaller and less liquid than the US market. This can make buying and selling certain shares more difficult and costly. Relatively small transactions in some instances can have a disproportionately large effect on the price and supply of securities. In certain situations, it may become virtually impossible to sell a security in an orderly fashion at a price that approaches the managers’ estimate of its value. |

| | • | | Regulatory Risk. There is generally less government regulation of foreign markets, companies and securities dealers than in the US. |

| | • | | Currency Risk. Greater Europe Growth Fund invests in foreign securities denominated in foreign currencies. To the extent that the Fund is exposed to non-dollar currencies, if these currencies decline in value relative to the dollar, it may reduce gains or increase losses. |

An investment in New Europe Fund also is subject to all of these risks.

Emerging Markets Risk. To the extent that Greater Europe Growth Fund does invest in emerging markets to enhance overall returns, it may face higher political, information, and stock market risks. In addition, profound social changes and business practices that depart from norms in developed countries’ economies have hindered the orderly growth of emerging economies and their stock markets in the past. High levels of debt tend to make emerging economies heavily reliant on foreign capital and vulnerable to capital flight. An investment in New Europe Fund also is subject to this risk.

Regional Focus Risk. Focusing on a single country or region involves increased currency, political, regulatory and other risks. To the extent Greater Europe Growth Fund concentrates its investments in a particular country or region, market swings in

12

such a targeted country or region will be likely to have a greater effect on Fund performance than they would in a more geographically diversified equity fund. An investment in New Europe Fund also is subject to this risk.

Pricing Risk. At times, market conditions might make it hard to value some investments. For example, if Greater Europe Growth Fund has valued its securities too highly, you may end up paying too much for Fund shares when you buy into the Fund. If the Fund underestimates their price, you may not receive the full market value for your Fund shares when you sell. An investment in New Europe Fund also is subject to this risk.

Non-Diversification Risk. Greater Europe Growth Fund is classified as “non-diversified.” This means that it may invest in securities of relatively few issuers. Thus, the performance of one or a small number of Fund holdings can affect overall performance more than if the Fund invested in a larger number of issuers. An investment in New Europe Fund also is subject to this risk.

Securities Lending Risk. Any loss in the market price of securities loaned by Greater Europe Growth Fund that occurs during the term of the loan would be borne by the Fund and would adversely affect the Fund’s performance. Also, there may be delays in recovery of securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially while the loan is outstanding. However, loans will be made only to borrowers selected by the Fund’s delegate after a review of relevant facts and circumstances, including the creditworthiness of the borrower. An investment in New Europe Fund also is subject to this risk.

Other factors that could affect performance include:

| | • | | the managers could be incorrect in their analysis of industries, companies, economic trends, the relative attractiveness of different sizes of stocks, geographical trends or other matters; |

| | • | | a bond could fall in credit quality or go into default; this risk is greater with junk bonds and foreign bonds; and |

| | • | | derivatives could produce disproportionate losses due to a variety of factors, including the unwillingness or inability of the counterparty to meet its obligations or unexpected price or interest rate movements. |

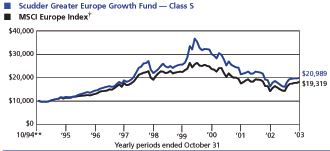

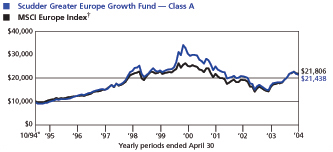

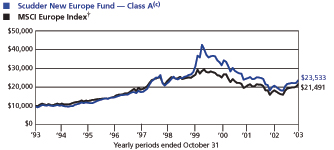

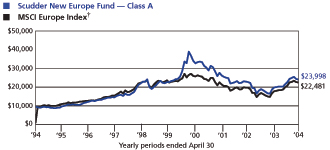

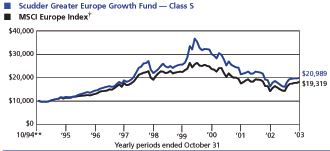

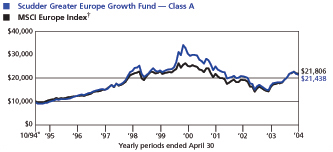

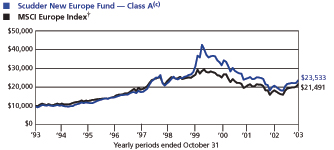

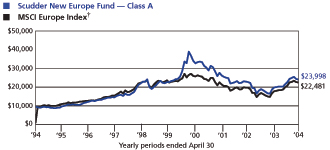

Performance Information. The following information provides some indication of the risks of investing in the Funds. The bar charts show year-to-year changes in the performance of each Fund’s Class A shares. The bar charts do not reflect sales loads; if they did, total returns would be lower than those shown. The table following the charts shows how each Fund’s performance compares to that of a broad-based market index (which, unlike a Fund, does not have any fees or expenses). Because the inception date for Classes A, B and C of Greater Europe Growth Fund was March 19, 2001, the performance figures for each such class of Greater Europe Growth Fund before that date are based on the historical performance of the Fund’s original share class (Class S), adjusted to reflect the higher gross total annual operating expenses and the current applicable sales charges of Class A, Class B or Class C. Institutional Class shares of Greater Europe Growth Fund have not yet begun operations as of the date of this Prospectus/Proxy Statement. Class A shares are invested in the same portfolio as

13

Institutional Class shares, and their annual total returns would differ from Institutional Class shares only to the extent that Class A shares have higher gross total annual operating expenses. Because the inception date for Classes A, B and C of New Europe Fund was September 3, 1999, the performance figures for each such class of New Europe Fund before that date are based on the historical performance of New Europe Fund’s original share class (Class M), adjusted to reflect the higher gross total annual operating expenses and the current applicable sales charges of Class A, Class B or Class C. The performance of the Funds and the index varies over time. Of course, a Fund’s past performance is not an indication of future performance.

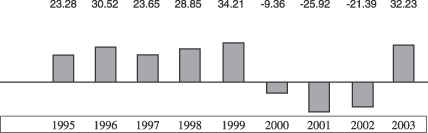

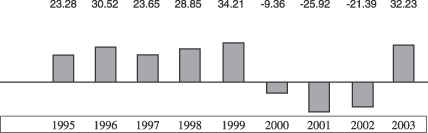

Calendar Year Total Returns (%)

Greater Europe Growth Fund

| | |

Annual Total Returns (%) as of 12/31 each year | | Class A |

For the periods included in the bar chart:

Best Quarter: 30.83%, Q4, 1999 Worst Quarter: -25.08%, Q3, 2002

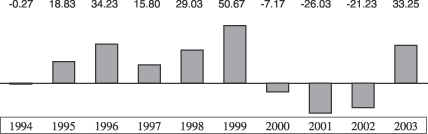

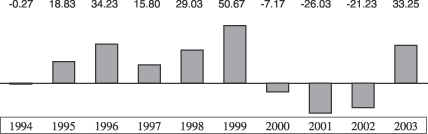

New Europe Fund

| | |

Annual Total Returns (%) as of 12/31 each year | | Class A |

For the periods included in the bar chart:

Best Quarter: 37.57%, Q4, 1999 Worst Quarter: -25.25%, Q3, 2002

14

Class A year-to-date performance through September 30, 2004 was 1.34% for New Europe Fund and 1.38% for Greater Europe Growth Fund.

Average Annual Total Returns (for periods ending 12/31/03)

| | | | | | | | | |

| | | Past

1 year

| | | Past

5 years

| | | Past 10 years/

Since

Inception(1)

| |

Greater Europe Growth Fund | | | | | | | | | |

Class A (return before taxes) | | 24.63 | % | | -2.46 | % | | 8.76 | % |

Class A (return after taxes on distributions) | | 24.89 | % | | -2.53 | % | | 8.10 | % |

Class A (return after taxes on distributions

and sale of Fund shares) | | 14.68 | % | | -2.17 | % | | 7.35 | % |

Class B (return before taxes) | | 28.24 | % | | -2.26 | % | | 8.60 | % |

Class C (return before taxes) | | 31.17 | % | | -2.06 | % | | 8.62 | % |

Index* (reflects no deductions for fees,

expenses or taxes) | | 38.54 | % | | -0.78 | % | | 8.87 | % |

| | | |

New Europe Fund | | | | | | | | | |

Class A (return before taxes) | | 25.59 | % | | 0.60 | % | | 9.91 | % |

Class A (return after taxes on distributions) | | 25.75 | % | | -8.26 | % | | 4.33 | % |

Class A (return after taxes on distributions

and sale of Fund shares) | | 15.29 | % | | -6.90 | % | | 4.13 | % |

Class B (return before taxes) | | 28.92 | % | | 0.73 | % | | 9.63 | % |

Class C (return before taxes) | | 31.90 | % | | 0.83 | % | | 9.57 | % |

Institutional Class (return before taxes) | | 33.38 | % | | N/A | | | 15.38 | %(2) |

Index** (reflects no deductions for fees,

expenses or taxes) | | 38.54 | % | | -0.78 | % | | 8.71 | % |

Index*: The unmanaged Morgan Stanley Capital International (MSCI) Europe Index consists of a capitalization-weighted measure of 15 stock markets in Europe.

Index**: The unmanaged Morgan Stanley Capital International Europe Equity Index is generally representative of the equity securities of the European markets.

| (1) | | Class S shares of Greater Europe Growth Fund commenced operations October 10, 1994. The index comparison for Greater Europe Growth Fund begins October 31, 1994. |

| (2) | | Average annual total return since inception. New Europe Fund’s Institutional Class shares commenced operations on August 19, 2002. |

Current performance may be higher or lower than the performance data quoted above. For more recent performance information, call your financial representative or 1-800-621-1048 or visit the Scudder website at www.scudder.com for Class A, Class B or Class C shares, or call 1-800-730-1313 for Institutional Class shares.

The table shows returns on a before-tax and after tax-basis. After-tax returns are estimates based on the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and are likely to differ from those shown. After-tax returns are shown for Class A shares of each Fund only and will vary for Class B, Class C and Institutional Class shares. After-tax returns are not relevant to those investing through 401(k) plans, IRAs or other tax-deferred arrangements.

15

III. Other Comparisons Between the Funds

Advisor and Portfolio Managers. DeIM is the investment advisor for each Fund. Under the supervision of the Board of Directors, DeIM, with headquarters at 345 Park Avenue, New York, NY 10154, or a subadvisor, makes each Fund’s investment decisions, buys and sells securities for each Fund and conducts research that leads to these purchase and sale decisions. DeIM and its predecessors have more than 80 years of experience managing mutual funds and DeIM provides a full range of investment advisory services to institutional and retail clients. DeIM or a subadvisor is also responsible for selecting brokers and dealers and for negotiating brokerage commissions and dealer charges.

Deutsche Asset Management Investment Services Ltd. (“DeAMIS”), an affiliate of DeIM, with offices at One Appold Street, London, England, is the subadvisor for each Fund and is responsible for managing each Fund’s assets. DeAMIS provides a full range of international investment advisory services to institutional and retail clients. DeIM compensates DeAMIS out of the management fee it receives from each Fund.

DeIM and DeAMIS are each a part of DeAM and are indirect wholly owned subsidiaries of Deutsche Bank AG. Deutsche Bank AG is a major global banking institution that is engaged in a wide range of financial services, including investment management, mutual fund, retail, private and commercial banking, investment banking and insurance.

Piers Hillier, Managing Director of DeAM, is a Portfolio Manager of each Fund. Mr. Hillier joined the Funds in 2004, and has 11 years of experience as a European equities portfolio manager.

Paras Anand, Vice President of DeAM, is a Portfolio Manager of each Fund. Mr. Anand joined the Funds in 2004, and has 8 years of investment industry experience.

Distribution and Service Fees. Pursuant to separate Underwriting and Distribution Services Agreements, Scudder Distributors, Inc. (“SDI”), 222 South Riverside Plaza, Chicago, Illinois 60606, an affiliate of DeIM, is the principal underwriter, distributor and administrator for the Class A, Class B, Class C and Institutional Class shares of both Greater Europe Growth Fund and New Europe Fund, and acts as agent of each Fund in the continuous offering of such shares.

Greater Europe Growth Fund has adopted a plan on behalf of the Class A, Class B and Class C shares in accordance with Rule 12b-1 under the 1940 Act that is substantially identical to the plan adopted by New Europe Fund. This plan allows the Fund to pay distribution fees for the sale and distribution of its Class B and Class C shares and service fees with respect to Class A, Class B and Class C shares. Because these fees are paid out of the Fund’s assets on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than other types of investments. Rule 12b-1 plans have not been adopted for Institutional Class shares of either Fund.

Pursuant to the Shareholder Services Agreement with Greater Europe Growth Fund, which is substantially identical to the Shareholder Services Agreement with New Europe

16

Fund, SDI receives a service fee of up to 0.25% per year with respect to the Class A, Class B and Class C shares of Greater Europe Growth Fund. SDI uses the fee to compensate financial services firms for providing personal services and maintaining accounts for their customers that hold these classes of shares of Greater Europe Growth Fund, and may retain any portion of the fee not paid to such firms to compensate itself for administrative functions performed for Greater Europe Growth Fund. All amounts are payable monthly and are based on the average daily net assets of the Fund attributable to the relevant class of shares. Neither Fund’s Institutional Class shares have a service fee.

For its services under the Distribution Agreement, which is substantially similar to the Underwriting Agreement with New Europe Fund, SDI receives a fee from Greater Europe Growth Fund under its Rule 12b-1 plan, payable monthly, at the annual rate of 0.75% of the average daily net assets of each Fund attributable to its Class B and Class C shares. This fee is accrued daily as an expense of Class B and Class C shares. SDI also receives any contingent deferred sales charges paid with respect to Class B or Class C shares. Neither Fund’s Institutional Class shares have a distribution fee.

Directors and Officers. The Directors of Scudder International Fund, Inc. (of which Greater Europe Growth Fund is a series) are different from those of New Europe Fund. As more fully described in the statement of additional information for Greater Europe Growth Fund, which is available upon request, the following individuals comprise the Board of Directors of Scudder International Fund, Inc.: Dawn-Marie Driscoll (Chair), Henry P. Becton, Jr., Keith R. Fox, Louis E. Levy, Jean Gleason Stromberg, Jean C. Tempel, and Carl W. Vogt. In addition the officers of Scudder International Fund, Inc. are different than those of New Europe Fund. Please see the Merger SAI for further details.

Independent Registered Public Accounting Firms (“Auditors”). PricewaterhouseCoopers LLP serves as Auditor for Greater Europe Growth Fund, and Ernst & Young LLP serves as Auditor for New Europe Fund.

Charter Documents. New Europe Fund is organized as a Maryland corporation entitled Scudder New Europe Fund, Inc., and is governed by Maryland law. Greater Europe Growth Fund is a series of Scudder International Fund, Inc., a Maryland corporation governed by Maryland law. New Europe Fund is governed by Articles of Amendment and Restatement dated July 12, 2002, as amended from time to time. Greater Europe Growth Fund is governed by Articles of Amendment and Restatement dated January 24, 1991, as amended from time to time. Each charter document is referred to herein as Articles of Incorporation. These charter documents are similar but not identical to one another, and therefore shareholders of the Funds may have different rights. Additional information about each Fund’s Articles of Incorporation is provided below.

Shareholders of New Europe Fund and Greater Europe Growth Fund have a number of rights in common. Shares of each Fund entitle their holders to one vote per share, with fractional shares voting proportionally; however, a separate vote will be taken by the applicable Fund or class of shares on matters affecting that particular Fund or class when so required by Maryland General Corporation Law or the Investment Company Act of 1940 (“1940 Act”), except that (i) in the case of New Europe Fund,

17

when the Board of Directors determines that a matter does not affect a certain class of shares, that class shall not be entitled to vote on the matter and (ii) in the case of Greater Europe Growth Fund, if a matter does not affect a certain class of shares, that class shall not be entitled to vote on the matter. For example, a change in a fundamental investment policy for Greater Europe Growth Fund would be voted upon only by shareholders of the Fund, and adoption of a distribution plan of either Fund relating to a particular class of either Fund and requiring shareholder approval would be voted upon only by shareholders of that class. Annual meetings of the shareholders of either Fund must be called when required by the 1940 Act to elect Directors. Meetings of the shareholders of either Fund also may be called by the Board of Directors, the Chairman or the President, and must be called upon written request of a majority of the Directors. The President, Chairman or Board of Directors (or, in the case of New Europe Fund, the President or Secretary) also is required to call a meeting of shareholders at the written request of the holders of at least 50% of the outstanding shares entitled to vote at such meeting.

Neither Fund’s shares have preemptive rights. Shares of each Fund are entitled to dividends as declared by Directors, and if a Fund were liquidated, each class of shares of that Fund is entitled to receive the net assets of the Fund attributable to said class. Greater Europe Growth Fund has the right to redeem, at the then current net asset value, the shares of any shareholder, to the extent it has funds or other property legally available therefore and subject to such reasonable conditions as the Directors of Scudder International Fund, Inc. may determine. New Europe Fund has the right to redeem, at the then current net asset value, the shares of any shareholder whose account does not exceed a minimum balance designated from time to time by the Directors of Scudder New Europe Fund, Inc.

Pursuant to Maryland law, shareholders are generally not personally liable for the debts of their respective Fund (or, in the case of Greater Europe Growth Fund, any other series of Scudder International Fund, Inc.).

All consideration received by Greater Europe Growth Fund for the issue or sale of shares of the Fund, together with all assets in which such consideration is invested or reinvested, and all income, earnings, profits and proceeds, including proceeds from the sale, exchange or liquidation of assets, are held and accounted for separately from the other assets of Scudder International Fund. Inc., subject only to the rights of creditors of the Fund, and belong irrevocably to the Fund for all purposes.

The assets and liabilities and the income and expenses attributable to each class of either Fund’s stock shall be determined separately from those of each other class of such Fund’s stock.

The charter documents for neither Scudder International Fund, Inc. nor New Europe Fund specify the mechanics by which the corporation or any of its series may be liquidated; however, Maryland law provides that liquidation of a corporation requires the affirmative vote of the holders of two-thirds of the votes entitled to be cast on the matter.

The Articles of Incorporation governing Greater Europe Growth Fund and New Europe Fund may be amended in the manner now or hereafter prescribed by the laws of the State of Maryland.

18

The voting powers of shareholders of each Fund with respect to the election of Directors are similar. Except as required by the 1940 Act or as described above, the Directors of Scudder International Fund, Inc. need not call meetings of the shareholders for the election or reelection of Directors, or to fill vacancies that do not cause the total number of Directors to fall below three. Subject to the limits of the 1940 Act, such vacancies may be filled by a majority of the standing Directors. Subject to the limits of the 1940 Act, any Director of Scudder International Fund, Inc. may be removed with or without cause by (a) a majority of the Board of Directors; (b) a committee of the Board appointed for such purpose; or (c) vote of a majority of the outstanding shares of the Corporation. Directors of New Europe Fund are elected at the annual or special meeting of stockholders held for that purpose, or if no annual meeting is required by the 1940 Act in a particular year, Directors are elected at the next annual meeting held. Subject to the limits of the 1940 Act, vacancies in the Board of Directors of New Europe Fund may be filled by a majority of the standing Directors. Any Director of New Europe Fund may be removed from office with or without cause at any time by a vote of a majority of the votes entitled to be cast for the election of Directors.

Quorum for a shareholder meeting of both New Europe Fund and Scudder International Fund, Inc. is the presence in person or by proxy of one-third of the shares outstanding (or, in the case of New Europe Fund, entitled to be cast) or, when a matter requires a separate vote by class, then one-third of the shares outstanding and entitled to vote of that class shall constitute a quorum as to the matter being voted upon by that class.

The foregoing is a very general summary of certain provisions of the Articles of Incorporation governing New Europe Fund and Greater Europe Growth Fund. It is qualified in its entirety by reference to the charter documents themselves.

IV. Information About the Proposed Merger

General. The shareholders of New Europe Fund are being asked to approve a merger between New Europe Fund and Greater Europe Growth Fund pursuant to an Agreement and Plan of Reorganization between the Funds, the form of which is attached to this Prospectus/Proxy Statement as Exhibit A.

The merger is structured as a transfer of all of the assets of New Europe Fund to Greater Europe Growth Fund in exchange for the assumption by Greater Europe Growth Fund of all of the liabilities of New Europe Fund and for the issuance and delivery to New Europe Fund of Merger Shares equal in aggregate value to the net value of the assets transferred to Greater Europe Growth Fund.

After receipt of the Merger Shares, New Europe Fund will distribute the Merger Shares to its shareholders, in proportion to their existing shareholdings, in complete liquidation and termination of New Europe Fund, and the legal existence of New Europe Fund will be terminated. Each shareholder of New Europe Fund will receive a number of full and fractional Merger Shares of the same class(es) as, and equal in value at the date of the exchange to, the aggregate value of the shareholder’s New Europe Fund shares.

19

Prior to the date of the merger, New Europe Fund will sell all investments that are not consistent with the current investment objective, policies and restrictions of Greater Europe Growth Fund, if any, and declare a taxable distribution that, together with all previous distributions, will have the effect of distributing to shareholders all of its net investment income and net realized capital gains, if any, through the date of the merger. The sale of such investments may increase the taxable distribution to shareholders of the New Europe Fund occurring prior to the merger above that which they would have received absent the merger. DeIM has represented that as of [ ], 2004, New Europe Fund did not have any investments that were not consistent with the current investment objective, policies and restrictions of Greater Europe Growth Fund.

The Directors of New Europe Fund have voted to approve the Agreement and the proposed merger and to recommend that shareholders also approve the merger. The actions contemplated by the Agreement and the related matters described therein will be consummated only if approved by the affirmative vote of the shareholders of New Europe Fund entitled to vote a majority of the votes entitled to be cast on the matter at the special meeting.

In the event that the merger does not receive the required shareholder approval, each Fund will continue to be managed as a separate Fund in accordance with its current investment objectives and policies, and the Directors of New Europe Fund and of Scudder International Fund, Inc. may consider such alternatives as may be in the best interests of each Fund’s respective shareholders.

Background and Directors’ Considerations Relating to the Proposed Merger. DeAM discussed the proposed merger with the Directors of New Europe Fund at a meeting held in February 2004. The merger was presented to the Directors and considered by them as part of a broader program initiated by DeAM to consolidate its mutual fund lineup. DeAM advised the Directors that this initiative was intended to:

| | • | | Eliminate redundancies within the Scudder fund family by reorganizing and combining certain funds; and |

| | • | | Focus DeAM’s investment resources on a core set of mutual funds that best meet investor needs. |

The Directors of New Europe Fund, including all Directors who are not “interested persons” of the Fund (as defined by the 1940 Act) (the “Disinterested Directors”), conducted a thorough review of the potential implications of the merger on New Europe Fund’s shareholders as well as the various other funds for which they serve as trustee or director. The Disinterested Directors were assisted in this review by their independent legal counsel. Following the February 2004 meeting, the Disinterested Directors met on several occasions to review and discuss the merger, both among themselves and with representatives of DeAM. In the course of their review, the Directors requested and received substantial additional information and negotiated changes to DeAM’s initial proposal.

Following the conclusion of this process, the Directors of New Europe Fund, the directors and trustees of other funds involved and DeAM reached general agreement on the elements of a restructuring plan as it affects shareholders of various funds, and, when required, agreed to submit elements of the plan for approval to shareholders of those funds.

20

On September 24, 2004, the Directors of New Europe Fund, including all Disinterested Directors, approved the terms of the merger. The Directors have also agreed to recommend that the merger be approved by New Europe Fund shareholders. In making this determination, the Directors examined all factors that they considered relevant, including information regarding comparative expense ratios, management fees and the tax consequences of the merger to New Europe Fund and its shareholders.

In determining to recommend that the shareholders of New Europe Fund approve the merger, the Directors considered, among other factors:

| | • | | The fees and expense ratios of the Funds, including comparisons between the expense ratio of New Europe Fund and the estimated operating expense ratio of the combined Fund, and between the estimated operating expense ratio of the combined Fund and other mutual funds with similar investment objectives, and in particular noted that the combined Fund’s total operating expense ratio was anticipated to be equal to or lower than that of New Europe Fund currently; |

| | • | | That DeAM agreed to cap the combined Fund’s operating expense ratios for approximately a three-year period at levels at or below New Europe Fund’s current operating expense ratios; |