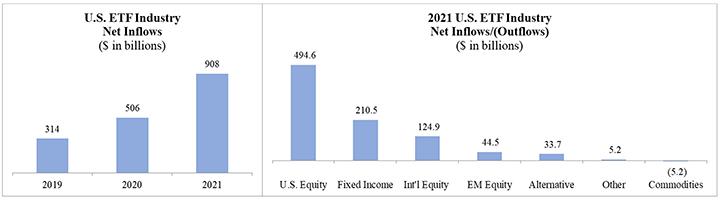

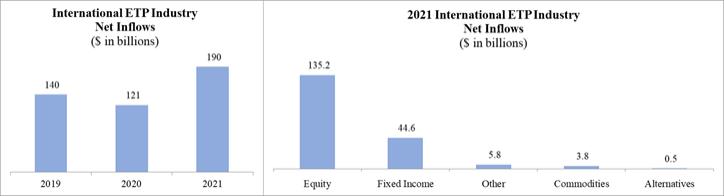

The asset management industry is highly competitive and we face substantial competition in virtually all aspects of our business. Factors affecting our business include fees for our products, our offerings and investment performance, brand recognition, business reputation, quality of service and the continuity of our financial advisor and platform relationships. We compete directly with other ETP sponsors and mutual fund companies and indirectly against other investment management firms, insurance companies, banks, brokerage firms and other financial institutions. Many of the firms we compete with are subsidiaries of large diversified financial companies and many others are much larger in terms of AUM, years in operations and revenues and, accordingly, have much larger sales organizations and budgets. In addition, these larger competitors may attract business through means that are not available to us, including retail bank offices, investment banking, insurance agencies and broker-dealers.

The ETP industry is becoming significantly more competitive. ETPs are now available for virtually every asset class including equities, fixed income, commodities, alternative strategies, leveraged-and inverse, currencies and cryptocurrencies (with greater access to markets outside of the U.S.). Existing players have broadened their suite of products offering strategies that are, in some cases, similar to ours and large traditional asset managers are also launching ETPs, some with similar strategies as well. There remain substantial areas for sponsors to continue to innovate, including with respect to cryptocurrency, liquid alternative, thematic and ESG strategies.

Price competition exists in not only commoditized product categories such as traditional, market capitalization weighted index exposures and commodities, but also in

non-market

capitalization weighted or factor-based exposures and commodities. Fee reductions by certain of our competitors has been a trend over the last few years and continues to persist and many of our competitors are well positioned to benefit from this trend. Certain larger competitors are able to offer products at lower price points or otherwise as loss leaders due to other revenue sources available within such competitors that are currently unavailable to us. Newer players have also been entering the ETP industry and frequently seek to differentiate by offering ETPs at a lower price point. Funds are being offered with fees of 20 basis points or less, which have attracted approximately 72% of the net flows globally during the last three years. However, while these

low-cost

products have accumulated a significant amount of AUM recently, we estimate that these same funds represent only approximately 31% of global revenues.

Being a first mover, or one of the first providers of ETPs in a particular asset class, can be a significant advantage, as the first ETP in a category to attract scale in AUM and trading liquidity is generally viewed as the most attractive product. We believe that our early launch of products in a number of asset classes or strategies, including fundamental weighting and currency hedging, along with commodities including gold, certain fixed income, alternative and thematic categories and our ESG offerings, positions us well to maintain our standing as one of the leaders of the ETP industry. Additionally, we believe our affiliated indexing or “self-indexing” model, as well as our more recent active ETFs, enable us to launch proprietary products that do not have direct competition and are positioned to generate alpha versus benchmarks. As investors increasingly become more comfortable with the product structure, we believe there will be a greater focus on

after-fee

performance rather than using ETPs primarily as

low-cost

market access vehicles. While we have selectively lowered fee rates on certain products that have yet to attain scale, and there is no assurance that we will not lower fee rates on certain products in the future, our strategy continues to include launching new funds in the same category with a differentiated exposure at a lower fee rate, rather than reducing fees on existing products with a significant amount of AUM, long performance track records, and secondary market liquidity, which continue to remain competitively priced for the value provided, among other factors. We generally believe we are well positioned from a product pricing perspective.

We also have been positioning ourselves to expand beyond our existing ETP business by leveraging blockchain technology, digital assets and principles of DeFi to deliver transparency, choice and inclusivity to customers and consumers around the world. Our products are expanding to include asset tokenization and blockchain enabled funds, leveraging federal and state regulated entities, and we are planning to launch a dollar token, gold token and digital short term treasury fund which we are developing with the ability to be recorded and/or transferred on multiple public and/or permissioned blockchains with interoperability between blockchains. We believe this expansion will complement our core competencies in a holistic manner, diversify our revenue streams and contribute to our growth. Competition in the digital assets industry on a global basis is increasing, ranging from large, established financial incumbents to smaller, early-stage financial technology providers and companies. There are jurisdictions with more stringent and robust regulatory and compliance requirements than others which could impact the ability of a company to compete in the digital assets industry. We are embracing a concept we refer to as “responsible DeFi” for our anticipated and expanded products and services which we believe upholds the foundational principles of regulation in this innovative and quickly evolving space. We remain committed to being a trusted provider of innovative products and services guided by proactive engagement and continued collaboration with current and new regulators.

Our ability to successfully compete will depend largely on offering innovative products through traditional ETPs and digital asset exposures, generating strong

after-fee

performance and track records, embracing regulation, developing distribution relationships, promoting thought leadership and a differentiated solutions program, building upon our brand and attracting and retaining talented sales professionals and other employees.