UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

Form 10-Q

________________________

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from____to____.

Commission File Number 001-10932

________________________

WisdomTree, Inc.

(Exact name of registrant as specified in its charter)

________________________

| | |

| Delaware | 13-3487784 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| | |

250 West 34th Street 3rd Floor New York, New York | 10119 |

| (Address of principal executive offices) | (Zip Code) |

212-801-2080

(Registrant’s telephone number, including area code)

________________________

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value Preferred Stock Purchase Rights | WT | The New York Stock Exchange The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 2, 2024, there were 151,816,951 shares of the registrant’s Common Stock, $0.01 par value per share, outstanding.

WISDOMTREE, INC.

Form 10-Q

For the Quarterly Period Ended March 31, 2024

TABLE OF CONTENTS

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree, Inc. and its subsidiaries.

WisdomTree®, WisdomTree Prime® and Modern Alpha® are trademarks of WisdomTree, Inc. in the United States and in other countries. All other trademarks are the property of their respective owners.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, or Report, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission, or the SEC, as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report may include statements about:

| ● | anticipated trends, conditions and investor sentiment in the global markets and exchange-traded products, or ETPs; |

| ● | anticipated levels of inflows into and outflows out of our ETPs; |

| ● | our ability to deliver favorable rates of return to investors; |

| ● | competition in our business; |

| ● | whether we will experience future growth; |

| ● | our ability to develop new products and services and their potential for success; |

| ● | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| ● | our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including WisdomTree Prime, and achieve its objectives; |

| ● | our ability to successfully operate and expand our business in non-U.S. markets; |

| ● | the effect of laws and regulations that apply to our business; and |

| ● | actions of activist stockholders. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

PART I: FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

WisdomTree, Inc. and Subsidiaries

Consolidated Balance Sheets

(In Thousands, Except Per Share Amounts)

| | | March 31, 2024 | | December 31,

2023 |

| Assets | | (unaudited) | | | | |

| Current assets: | | | | | | | | |

| Cash, cash equivalents and restricted cash (including $5,061 and $5,007 invested in the WisdomTree Government Money Market Digital Fund at March 31, 2024 and December 31, 2023, respectively) (Note 3) | | $ | 116,926 | | | $ | 129,305 | |

| Financial instruments owned, at fair value (including $48,353 and $47,559 invested in WisdomTree products at March 31, 2024 and December 31, 2023, respectively) (Note 5) | | | 58,301 | | | | 58,722 | |

| Accounts receivable (including $31,178 and $28,511 due from related parties at March 31, 2024 and December 31, 2023, respectively) | | | 40,020 | | | | 35,473 | |

| Prepaid expenses | | | 6,491 | | | | 5,258 | |

| Other current assets | | | 1,284 | | | | 1,036 | |

| Total current assets | | | 223,022 | | | | 229,794 | |

| Fixed assets, net | | | 436 | | | | 427 | |

| Securities held-to-maturity | | | 224 | | | | 230 | |

| Deferred tax assets, net (Note 21) | | | 5,477 | | | | 11,057 | |

| Investments (Note 7) | | | 9,606 | | | | 9,684 | |

| Right of use assets—operating leases (Note 13) | | | 243 | | | | 563 | |

| Goodwill (Note 23) | | | 86,841 | | | | 86,841 | |

| Intangible assets, net (Note 23) | | | 605,347 | | | | 605,082 | |

| Other noncurrent assets | | | 456 | | | | 459 | |

| Total assets | | $ | 931,652 | | | $ | 944,137 | |

| Liabilities and stockholders’ equity | | | | | | | | |

| Liabilities | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Fund management and administration payable | | $ | 32,665 | | | $ | 30,085 | |

| Compensation and benefits payable | | | 9,624 | | | | 38,111 | |

| Payable to Gold Bullion Holdings (Jersey) Limited (“GBH”) (Note 12) | | | 14,804 | | | | 14,804 | |

| Income taxes payable | | | 1,140 | | | | 3,866 | |

| Operating lease liabilities (Note 13) | | | 251 | | | | 578 | |

| Accounts payable and other liabilities | | | 17,105 | | | | 15,772 | |

| Total current liabilities | | | 75,589 | | | | 103,216 | |

| Convertible notes (Note 10) | | | 275,263 | | | | 274,888 | |

| Payable to GBH (Note 12) | | | 24,994 | | | | 24,328 | |

| Total liabilities | | | 375,846 | | | | 402,432 | |

| Preferred stock—Series A Non-Voting Convertible, par value $0.01; 14.750 shares authorized, issued and outstanding; redemption value of $123,108 and $96,869 at March 31, 2024 and December 31, 2023, respectively) (Note 11) | | | 132,569 | | | | 132,569 | |

| Contingencies (Note 14) | | | | | | | | |

| Stockholders’ equity | | | | | | | | |

| Preferred stock, par value $0.01; 2,000 shares authorized | | | — | | | | — | |

| Common stock, par value $0.01; 400,000 shares authorized; issued and outstanding: 151,819 and 150,330 at March 31, 2024 and December 31, 2023, respectively | | | 1,518 | | | | 1,503 | |

| Additional paid-in capital | | | 309,768 | | | | 312,440 | |

| Accumulated other comprehensive loss | | | (907 | ) | | | (548 | ) |

| Retained earnings | | | 112,858 | | | | 95,741 | |

| Total stockholders’ equity | | | 423,237 | | | | 409,136 | |

| Total liabilities and stockholders’ equity | | $ | 931,652 | | | $ | 944,137 | |

The accompanying notes are an integral part of these consolidated financial statements.

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Operations

(In Thousands, Except Per Share Amounts)

(Unaudited)

| | | Three Months Ended March 31, |

| | | 2024 | | 2023 |

| Operating Revenues: | | | | | | | | |

| Advisory fees | | $ | 92,501 | | | $ | 77,637 | |

| Other income | | | 4,337 | | | | 4,407 | |

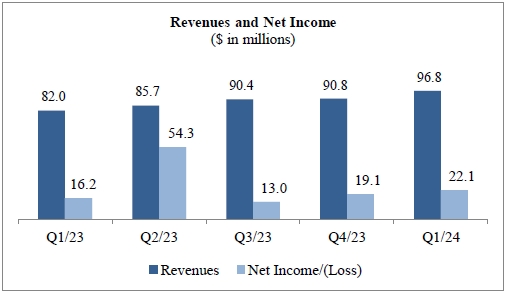

| Total revenues | | | 96,838 | | | | 82,044 | |

| Operating Expenses: | | | | | | | | |

| Compensation and benefits | | | 31,054 | | | | 27,398 | |

| Fund management and administration | | | 19,962 | | | | 17,153 | |

| Marketing and advertising | | | 4,408 | | | | 4,007 | |

| Sales and business development | | | 3,611 | | | | 2,994 | |

| Contractual gold payments (Note 9) | | | — | | | | 4,486 | |

| Professional fees | | | 3,630 | | | | 3,715 | |

| Occupancy, communications and equipment | | | 1,210 | | | | 1,101 | |

| Depreciation and amortization | | | 383 | | | | 109 | |

| Third-party distribution fees | | | 2,307 | | | | 2,253 | |

| Other | | | 2,323 | | | | 2,257 | |

| Total operating expenses | | | 68,888 | | | | 65,473 | |

| Operating income | | | 27,950 | | | | 16,571 | |

| Other Income/(Expenses): | | | | | | | | |

| Interest expense | | | (4,128 | ) | | | (4,002 | ) |

| Gain on revaluation/termination of deferred consideration—gold payments (Note 9) | | | — | | | | 20,592 | |

| Interest income | | | 1,398 | | | | 1,083 | |

| Impairments (Note 25) | | | — | | | | (4,900 | ) |

| Loss on extinguishment of convertible notes (Note 10) | | | — | | | | (9,721 | ) |

| Other gains and losses, net | | | 2,592 | | | | (2,007 | ) |

| Income before income taxes | | | 27,812 | | | | 17,616 | |

| Income tax expense | | | 5,701 | | | | 1,383 | |

| Net income | | $ | 22,111 | | | $ | 16,233 | |

| Earnings per share—basic | | $ | 0.14 | | | $ | 0.10 | |

| Earnings per share—diluted | | $ | 0.13 | | | $ | 0.10 | |

| Weighted-average common shares—basic | | | 146,464 | | | | 143,862 | |

| Weighted-average common shares—diluted | | | 165,268 | | | | 159,887 | |

| Cash dividends declared per common share | | $ | 0.03 | | | $ | 0.03 | |

The accompanying notes are an integral part of these consolidated financial statements.

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In Thousands)

(Unaudited)

| | | Three Months Ended March 31, |

| | | 2024 | | 2023 |

| Net income | | $ | 22,111 | | | $ | 16,233 | |

| Other comprehensive (loss)/income | | | | | | | | |

| Foreign currency translation adjustment, net of income taxes | | | (359 | ) | | | 466 | |

| Other comprehensive (loss)/income | | | (359 | ) | | | 466 | |

| Comprehensive income | | $ | 21,752 | | | $ | 16,699 | |

The accompanying notes are an integral part of these consolidated financial statements.

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Changes in Stockholders’ Equity

(In Thousands)

(Unaudited)

| | | Three Months Ended March 31, 2024 |

| | | Common Stock | | Additional

| | Accumulated

Other | | | | | |

| | | Shares

Issued | | Par

Value | | Paid-In

Capital | | Comprehensive

Loss | | | Retained

Earnings | | Total |

| Balance—January 1, 2024 | | | 150,330 | | | $ | 1,503 | | | $ | 312,440 | | | $ | (548 | ) | | $ | 95,741 | | | $ | 409,136 | |

| Restricted stock issued and vesting of restricted stock units, net | | | 2,585 | | | | 26 | | | | (26 | ) | | | — | | | | — | | | | — | |

| Shares repurchased | | | (1,096 | ) | | | (11 | ) | | | (7,809 | ) | | | — | | | | — | | | | (7,820 | ) |

| Stock-based compensation | | | — | | | | — | | | | 5,163 | | | | — | | | | — | | | | 5,163 | |

| Other comprehensive loss | | | — | | | | — | | | | — | | | | (359 | ) | | | — | | | | (359 | ) |

| Dividends | | | — | | | | — | | | | — | | | | — | | | | (4,994 | ) | | | (4,994 | ) |

| Net income | | | — | | | | — | | | | — | | | | — | | | | 22,111 | | | | 22,111 | |

| Balance—March 31, 2024 | | | 151,819 | | | $ | 1,518 | | | $ | 309,768 | | | $ | (907 | ) | | $ | 112,858 | | | $ | 423,237 | |

| | | Three Months Ended March 31, 2023 |

| | | Common Stock | | Additional | | Accumulated

Other | | | | | | |

| | | Shares

Issued | | Par

Value | | Paid-In

Capital | | Comprehensive

Loss | | Retained

Earnings | | Total |

| Balance—January 1, 2023 | | | 146,517 | | | $ | 1,465 | | | $ | 291,847 | | | $ | (1,420 | ) | | $ | 13,719 | | | $ | 305,611 | |

| Restricted stock issued and vesting of restricted stock units, net | | | 3,379 | | | | 34 | | | | (34 | ) | | | — | | | | — | | | | — | |

| Shares repurchased | | | (605 | ) | | | (6 | ) | | | (3,378 | ) | | | — | | | | — | | | | (3,384 | ) |

| Stock-based compensation | | | — | | | | — | | | | 4,536 | | | | — | | | | — | | | | 4,536 | |

| Other comprehensive income | | | — | | | | — | | | | — | | | | 466 | | | | — | | | | 466 | |

| Dividends | | | — | | | | — | | | | — | | | | — | | | | (4,924 | ) | | | (4,924 | ) |

| Net income | | | — | | | | — | | | | — | | | | — | | | | 16,233 | | | | 16,233 | |

| Balance—March 31, 2023 | | | 149,291 | | | $ | 1,493 | | | $ | 292,971 | | | $ | (954 | ) | | $ | 25,028 | | | $ | 318,538 | |

The accompanying notes are an integral part of these consolidated financial statements.

WisdomTree, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

| | | Three Months Ended March 31, |

| | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | | |

| Net income | | $ | 22,111 | | | $ | 16,233 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | | | | | | |

| Advisory and license fees paid in gold, other precious metals and cryptocurrency | | | (11,727 | ) | | | (12,760 | ) |

| Deferred income taxes | | | 5,640 | | | | 4,783 | |

| Stock-based compensation | | | 5,163 | | | | 4,536 | |

| Gains on financial instruments owned, at fair value | | | (2,063 | ) | | | (1,954 | ) |

| Imputed interest on payable to GBH | | | 666 | | | | — | |

| Depreciation and amortization | | | 383 | | | | 109 | |

| Amortization of issuance costs—convertible notes | | | 375 | | | | 579 | |

| Amortization of right of use asset | | | 324 | | | | 319 | |

| Gains on investments | | | (123 | ) | | | 3,919 | |

| Gain on revaluation/termination of deferred consideration—gold payments | | | — | | | | (20,592 | ) |

| Loss on extinguishment of convertible notes | | | — | | | | 9,721 | |

| Impairments | | | — | | | | 4,900 | |

| Contractual gold payments | | | — | | | | 4,486 | |

| Other | | | — | | | | (452 | ) |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (4,243 | ) | | | (4,791 | ) |

| Prepaid expenses | | | (1,247 | ) | | | (1,161 | ) |

| Gold and other precious metals | | | 11,561 | | | | 8,332 | |

| Other assets | | | (79 | ) | | | 167 | |

| Fund management and administration payable | | | 2,659 | | | | 3,638 | |

| Compensation and benefits payable | | | (28,386 | ) | | | (27,271 | ) |

| Income taxes payable | | | (2,723 | ) | | | (3,418 | ) |

| Operating lease liabilities | | | (332 | ) | | | (326 | ) |

| Accounts payable and other liabilities | | | 1,003 | | | | 5,606 | |

| Net cash used in operating activities | | | (1,038 | ) | | | (5,397 | ) |

| Cash flows from investing activities: | | | | | | | | |

| Purchase of financial instruments owned, at fair value | | | (2,500 | ) | | | (20,278 | ) |

| Cash paid—software development | | | (592 | ) | | | — | |

| Purchase of fixed assets | | | (66 | ) | | | (26 | ) |

| Proceeds from the sale of financial instruments owned, at fair value | | | 5,180 | | | | 18,290 | |

| Proceeds from held-to-maturity securities maturing or called prior to maturity | | | 6 | | | | 6 | |

| Net cash provided by/(used in) investing activities | | | 2,028 | | | | (2,008 | ) |

| Cash flows from financing activities: | | | | | | | | |

| Dividends paid | | | (4,997 | ) | | | (4,821 | ) |

| Shares repurchased | | | (7,820 | ) | | | (3,384 | ) |

| Repurchase of convertible notes (Note 10) | | | — | | | | (124,317 | ) |

| Issuance costs—convertible notes | | | — | | | | (3,548 | ) |

| Proceeds from the issuance of convertible notes (Note 10) | | | — | | | | 130,000 | |

| Net cash used in financing activities | | | (12,817 | ) | | | (6,070 | ) |

| (Decrease)/increase in cash flow due to changes in foreign exchange rate | | | (552 | ) | | | 473 | |

| Net decrease in cash, cash equivalents and restricted cash | | | (12,379 | ) | | | (13,002 | ) |

| Cash, cash equivalents and restricted cash—beginning of year | | | 129,305 | | | | 132,101 | |

| Cash, cash equivalents and restricted cash—end of period | | $ | 116,926 | | | $ | 119,099 | |

| Supplemental disclosure of cash flow information: | | | | | | | | |

| Cash paid for income taxes | | $ | 2,769 | | | $ | 1,422 | |

| Cash paid for interest | | $ | 3,738 | | | $ | 801 | |

The accompanying notes are an integral part of these consolidated financial statements.

WisdomTree, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(In Thousands, Except Share and Per Share Amounts)

1. Organization and Description of Business

WisdomTree, Inc., through its global subsidiaries (collectively, “WisdomTree” or the “Company”), is a global financial innovator, offering a well-diversified suite of exchange-traded products (“ETPs”), models, solutions and products leveraging blockchain technology. Building on its heritage of innovation, the Company is also developing and has launched next-generation digital products, services and structures, including digital or blockchain-enabled mutual funds (“Digital Funds”) and tokenized assets, as well as its blockchain-native digital wallet, WisdomTree Prime. The Company has the following wholly-owned operating subsidiaries:

| ● | WisdomTree Asset Management, Inc. is a New York based investment adviser registered with the SEC, providing investment advisory and other management services to the WisdomTree Trust (“WTT”) and WisdomTree exchange-traded funds (“ETFs”). The WisdomTree ETFs are issued in the U.S. by WTT. WTT is a non-consolidated Delaware statutory trust registered with the SEC as an open-end management investment company. The Company has licensed to WTT the use of certain of its own indexes on an exclusive basis for the WisdomTree ETFs in the U.S. |

| ● | WisdomTree Management Jersey Limited (“ManJer”) is a Jersey based management company providing management services to seven issuers (the “ManJer Issuers”) in respect of the ETPs issued and listed by the ManJer Issuers covering commodity, currency, cryptocurrency and leveraged-and-inverse strategies. |

| ● | WisdomTree Multi Asset Management Limited (“WTMAML”) is a Jersey based management company providing management services to WisdomTree Multi Asset Issuer PLC (“WMAI”) in respect of the ETPs issued by WMAI. WMAI is a non-consolidated public limited company domiciled in Ireland. |

| ● | WisdomTree Management Limited (“WML”) is an Ireland based management company providing management services to WisdomTree Issuer ICAV (“WTICAV”) in respect of the WisdomTree UCITS ETFs issued by WTICAV. WTICAV is a non-consolidated public limited company domiciled in Ireland. |

| ● | WisdomTree UK Limited (“WTUK”) is a U.K. based company registered with the Financial Conduct Authority currently providing distribution and support services to ManJer, WTMAML and WML. |

| ● | WisdomTree Europe Limited is a U.K. based company which is the legacy distributor of the WMAI ETPs and WisdomTree UCITS ETFs. These services are now provided directly by WTUK. WisdomTree Europe Limited is no longer regulated and does not provide any regulated services. |

| ● | WisdomTree Ireland Limited is an Ireland based company authorized by the Central Bank of Ireland providing distribution services to ManJer, WTMAML and WML. |

| ● | WisdomTree Digital Commodity Services, LLC is a New York based company that serves as the sponsor of the WisdomTree Bitcoin Fund, which is currently effective with the SEC. The WisdomTree Bitcoin Fund is an exchange-traded fund that issues common shares of beneficial interest and is listed on the Cboe BZX Exchange, Inc. The WisdomTree Bitcoin Fund provides exposure to the spot price of bitcoin. |

| ● | WisdomTree Digital Management, Inc. (“WT Digital Management”) is a New York based investment adviser registered with the SEC, providing investment advisory and other management services to the WisdomTree Digital Trust (“WTDT”) and WisdomTree Digital Funds. The WisdomTree Digital Funds are issued in the U.S. by WTDT. WTDT is a non-consolidated Delaware statutory trust registered with the SEC as an open-end management investment company. Each Digital Fund uses blockchain technology to maintain a secondary record of its shares on one or more blockchains (e.g., Stellar or Ethereum), but does not directly or indirectly invest in any assets that rely on blockchain technology, such as cryptocurrencies. |

| ● | WisdomTree Digital Movement, Inc. (“WT Digital Movement”) is a New York based company operating as a money services business registered with the Financial Crimes Enforcement Network. WT Digital Movement has obtained and is seeking additional state money transmitter licenses to operate a platform for the purchase, sale and exchange of tokenized assets, while also providing blockchain-native digital wallet services through WisdomTree Prime to facilitate such activity. |

| ● | WisdomTree Securities, Inc. is a New York based limited purpose broker-dealer (i.e., mutual fund retailer), facilitating transactions in WisdomTree Digital Funds. |

| ● | WisdomTree Transfers, Inc. is a New York based transfer agent registered with the SEC, providing transfer agency and registrar services for the WisdomTree Digital Funds. The transfer agent maintains the official record of share ownership in book entry form and reconciles the official record with the secondary record of ownership of shares on one or more blockchains. |

| ● | WisdomTree Digital Trust Company, LLC is a New York based limited liability trust company chartered by the New York State Department of Financial Services to provide certain digital asset products and services (e.g., custody) via the WisdomTree Prime mobile application. |

2. Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and in the opinion of management reflect all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentation of the financial statements. The consolidated financial statements include the accounts of the Company’s wholly-owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Consolidation

The Company consolidates entities in which it has a controlling financial interest. The Company determines whether it has a controlling financial interest in an entity by first evaluating whether the entity is a voting interest entity (“VOE”) or a variable interest entity (“VIE”). The usual condition for a controlling financial interest in a VOE is ownership of a majority voting interest. If the Company has a majority voting interest in a VOE, the entity is consolidated. The Company has a controlling financial interest in a VIE when the Company has a variable interest that provides it with (i) the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance and (ii) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could potentially be significant to the VIE.

The Company reassesses its evaluation of whether an entity is a VOE or VIE when certain reconsideration events occur.

Segment and Geographic Information

The Company, through its subsidiaries in the U.S. and Europe, is a global financial innovator, offering a well-diversified suite of ETPs, models, solutions and products leveraging blockchain technology. The Company conducts business as a single operating segment as an ETP sponsor and asset manager, which is based upon the Company’s current organizational and management structure, as well as information used by the Company’s Chief Executive Officer (the chief operating decision maker, or CODM) to allocate resources and other factors.

Foreign Currency Translation

Assets and liabilities of subsidiaries whose functional currency is not the U.S. dollar are translated based on the end of period exchange rates from local currency to U.S. dollars. Results of operations are translated at the average exchange rates in effect during the period. The impact of the foreign currency translation adjustment is included in the Consolidated Statements of Comprehensive Income as a component of other comprehensive (loss)/income.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the balance sheet dates and the reported amounts of revenues and expenses for the periods presented. Actual results could differ materially from those estimates.

Revenue Recognition

The Company earns substantially all of its revenue in the form of advisory fees from its ETPs and recognizes this revenue over time, as the performance obligation is satisfied. Advisory fees are based on a percentage of the ETPs’ average daily net assets. Progress is measured using the practical expedient under the output method resulting in the recognition of revenue in the amount for which the Company has a right to invoice.

Contractual Gold Payments

Contractual gold payments were measured and paid monthly based upon the average daily spot price of gold. The Company’s obligation to continue making these payments terminated on May 10, 2023.

Marketing and Advertising

Marketing and advertising costs, including media advertising and production costs, are expensed when incurred.

Depreciation and Amortization

Depreciation and amortization is provided for using the straight-line method over the estimated useful lives of the related assets as follows:

| Equipment | | 3 to 5 years |

| Internally-developed software | | 3 years |

The assets listed above are recorded at cost less accumulated depreciation and amortization.

Stock-Based Awards

Accounting for stock-based compensation requires the measurement and recognition of compensation expense for all equity awards based on estimated fair values. Stock-based compensation is measured based on the grant-date fair value of the award and is amortized over the relevant service period. Forfeitures are recognized when they occur.

Third-Party Distribution Fees

The Company pays a percentage of its advisory fee revenues based on incremental growth in assets under management (“AUM”), subject to caps or minimums, to marketing agents to sell WisdomTree ETPs and for including WisdomTree ETPs on third-party customer platforms and recognizes these expenses as incurred.

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly liquid investments with an original maturity of 90 days or less at the time of purchase to be classified as cash equivalents. The Company maintains deposits with financial institutions in an amount that is in excess of federally insured limits. Restricted cash is required to be maintained in a separate account with withdrawal and usage restrictions.

Accounts Receivable

Accounts receivable are customer and other obligations due under normal trade terms. The Company measures credit losses, if any, by applying historical loss rates, adjusted for current conditions and reasonable and supportable forecasts to amounts outstanding using the aging method.

Impairment of Long-Lived Assets

The Company performs a review for the impairment of long-lived assets when events or changes in circumstances indicate that the estimated undiscounted future cash flows expected to be generated by the assets are less than their carrying amounts or when other events occur which may indicate that the carrying amount of an asset may not be recoverable.

Financial Instruments Owned and Financial Instruments Sold, but Not yet Purchased (at Fair Value)

Financial instruments owned and financial instruments sold, but not yet purchased are financial instruments classified as either trading or available-for-sale (“AFS”). These financial instruments are recorded on their trade date and are measured at fair value. All equity instruments that have readily determinable fair values are classified by the Company as trading. Debt instruments are classified based primarily on the Company’s intent to hold or sell the instrument. Changes in the fair value of debt instruments classified as trading and AFS are reported in other income/(expenses) and other comprehensive income, respectively, in the period the change occurs. Debt instruments classified as AFS are assessed for impairment on a quarterly basis and an estimate for credit loss is provided when the fair value of the AFS debt instrument is below its amortized cost basis. Credit-related impairments are recognized in earnings with a corresponding adjustment to the instrument’s amortized cost basis if the Company intends to sell the impaired AFS debt instrument or it is more likely than not the Company will be required to sell the instrument before recovering its amortized cost basis. Other credit-related impairments are recognized as an allowance with a corresponding adjustment to earnings. Impairments resulting from noncredit-related factors are recognized in other comprehensive income. Amounts recorded in other comprehensive income are reclassified into earnings upon sale of the AFS debt instrument using the specific identification method.

Securities Held-to-Maturity

The Company accounts for certain of its securities as held-to-maturity on a trade date basis, which are recorded at amortized cost. For held-to-maturity securities, the Company has the intent and ability to hold these securities to maturity and it is not more-likely-than-not that the Company will be required to sell these securities before recovery of their amortized cost bases, which may be maturity. Held-to-maturity securities are placed on non-accrual status when the Company is in receipt of information indicating collection of interest is doubtful. Cash received on held-to-maturity securities placed on non-accrual status is recognized on a cash basis as interest income if and when received.

The Company reviews its portfolio of held-to-maturity securities for impairment on a quarterly basis, recognizing an allowance, if any, by applying an estimated loss rate after consideration for the nature of collateral securing the financial asset as well as potential future changes in collateral values and historical loss information for financial assets secured with similar collateral.

Investments in pass-through government-sponsored enterprises (“GSEs”) are determined to have an estimated loss rate of zero due to an implicit U.S. government guarantee.

Investments

The Company accounts for equity investments that do not have a readily determinable fair value under the measurement alternative prescribed in Accounting Standards Codification (“ASC”) Topic 321, Investments – Equity Securities (“ASC 321”), to the extent such investments are not subject to consolidation or the equity method. Under the measurement alternative, these financial instruments are carried at cost, less any impairment (assessed quarterly), plus or minus changes resulting from observable price changes in orderly transactions for an identical or similar investment of the same issuer. In addition, income is recognized when dividends are received only to the extent they are distributed from net accumulated earnings of the investee. Otherwise, such distributions are considered returns of investment and are recorded as a reduction of the cost of the investment.

Investments in debt instruments are accounted for at fair value, with changes in fair value reported in other income/(expenses).

Goodwill

Goodwill is the excess of the purchase price over the fair values of the identifiable net assets at the acquisition date. The Company tests goodwill for impairment at least annually and at the time of a triggering event requiring re-evaluation, if one were to occur. Goodwill is considered impaired when the estimated fair value of the reporting unit that was allocated the goodwill is less than its carrying value. If the estimated fair value of such reporting unit is less than its carrying value, goodwill impairment is recognized based on that difference, not to exceed the carrying amount of goodwill. A reporting unit is an operating segment or a component of an operating segment provided that the component constitutes a business for which discrete financial information is available and management regularly reviews the operating results of that component.

Goodwill is allocated to the Company’s U.S. business and European business components. For impairment testing purposes, these components are aggregated as a single reporting unit as they fall under the same operating segment and have similar economic characteristics.

Goodwill is assessed for impairment annually on November 30th. When performing its goodwill impairment test, the Company considers a qualitative assessment, when appropriate, and a quantitative assessment using the market approach and its market capitalization when determining the fair value of the reporting unit.

Intangible Assets

Indefinite-lived intangible assets are tested for impairment at least annually and are also reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Indefinite-lived intangible assets are impaired if their estimated fair values are less than their carrying values.

Finite-lived intangible assets, if any, are amortized over their estimated useful life, which is the period over which the assets are expected to contribute directly or indirectly to the future cash flows of the Company. These intangible assets are tested for impairment at the time of a triggering event, if one were to occur. Finite-lived intangible assets may be impaired when the estimated undiscounted future cash flows generated from the assets are less than their carrying amounts.

The Company may rely on a qualitative assessment when performing its intangible asset impairment test. Otherwise, the impairment evaluation is performed at the lowest level of reasonably identifiable cash flows independent of other assets. The annual impairment testing date for all of the Company’s intangible assets is November 30th.

Software Development Costs

Software development costs incurred after the preliminary project stage is complete are capitalized if it is probable that the project will be completed and the software will be used as intended. Capitalized costs consist of employee compensation costs and fees paid to third parties who are directly involved in the application development efforts and are included in intangible assets, net in the Consolidated Balance Sheets. Such costs are amortized over the estimated useful life of the software on a straight-line basis and are included in depreciation and amortization in the Consolidated Statements of Operations. Once the application development stage is complete, additional costs are expensed as incurred.

Leases

The Company accounts for its lease obligations in accordance with ASC Topic 842, Leases (“ASC 842”), which requires the recognition of both (i) a lease liability equal to the present value of the remaining lease payments and (ii) an offsetting right-of-use asset. The remaining lease payments are discounted using the rate implicit in the lease, if known, or otherwise the Company’s incremental borrowing rate. After lease commencement, right-of-use assets are assessed for impairment and otherwise are amortized over the remaining lease term on a straight-line basis. These recognition requirements are not applied to short-term leases, which are those with a lease term of 12 months or less. Instead, lease payments associated with short-term leases are recognized as an expense on a straight-line basis over the lease term.

ASC 842 also provides a practical expedient which allows for consideration in a contract to be accounted for as a single lease component rather than allocated between lease and non-lease components. The Company has elected to apply this practical expedient to all lease contracts, where applicable.

Deferred Consideration—Gold Payments

Deferred consideration—gold payments represented the present value of an obligation to pay gold to a third party into perpetuity and was measured using forward-looking gold prices observed on the CMX exchange, a selected discount rate and perpetual growth rate (Note 9). Changes in the fair value of this obligation were reported as gain on revaluation/termination of deferred consideration—gold payments in the Consolidated Statements of Operations.

Convertible Notes

Convertible notes are carried at amortized cost, net of issuance costs. The Company accounts for convertible instruments as a single liability (applicable to the convertible notes) or equity with no separate accounting for embedded conversion features unless the conversion feature meets the criteria for accounting under the substantial premium model or does not qualify for a derivative scope exception. Interest expense is recognized using the effective interest method and includes amortization of issuance costs over the life of the debt.

Contingencies

The Company may be subject to reviews, inspections and investigations by regulatory authorities as well as legal proceedings arising in the ordinary course of business. The Company evaluates the likelihood of an unfavorable outcome of all legal or regulatory proceedings to which it is a party and accrues a loss contingency when the loss is probable and reasonably estimable.

Contingent Payments

The Company recognizes a gain on contingent payments when the contingency is resolved and the gain is realized.

Earnings per Share

Basic earnings per share (“EPS”) is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding for the period. Net income available to common stockholders represents net income of the Company reduced by an allocation of earnings to participating securities. The Series A non-voting convertible preferred stock (Note 11) and unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are participating securities and are included in the computation of EPS pursuant to the two-class method. Share-based payment awards that do not contain such rights are not deemed participating securities and are included in diluted shares outstanding (if dilutive).

Diluted EPS is calculated under the treasury stock method and the two-class method. The calculation that results in the lowest diluted EPS amount for the common stock is reported in the Company’s consolidated financial statements. The treasury stock method includes the dilutive effect of potential common shares including unvested stock-based awards, the Series A non-voting convertible preferred stock and the convertible notes, if any. Potential common shares associated with the Series A non-voting convertible preferred stock and the convertible notes are computed under the if-converted method. Potential common shares associated with the conversion option embedded in the convertible notes are dilutive when the Company’s average stock price exceeds the conversion price.

Income Taxes

The Company accounts for income taxes using the liability method, which requires the determination of deferred tax assets and liabilities based on the differences between the financial and tax bases of assets and liabilities using the enacted tax rates in effect for the year in which differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance if, based on the weight of available evidence, it is more-likely-than-not that some portion or all the deferred tax assets will not be realized.

Tax positions are evaluated utilizing a two-step process. The Company first determines whether any of its tax positions are more-likely-than-not to be sustained upon examination, based solely on the technical merits of the position. Once it is determined that a position meets this recognition threshold, the position is measured as the largest amount of benefit that is greater than 50% likely of being realized upon ultimate settlement. The Company records interest expense and penalties related to tax expenses as income tax expense.

The Global Intangible Low-Taxed Income (“GILTI”) provisions of the Tax Reform Act requires the Company to include in its U.S. income tax return foreign subsidiary earnings in excess of an allowable return on the foreign subsidiary’s tangible assets. An accounting policy election is available to either account for the tax effects of GILTI in the period that is subject to such taxes or to provide deferred taxes for book and tax basis differences that upon reversal may be subject to such taxes. The Company accounts for the tax effects of these provisions in the period that is subject to such tax.

Non-income based taxes are recorded as part of other liabilities and other expenses.

Recently Issued Accounting Pronouncements

On December 14, 2023, the Financial Accounting Standards Board (“FASB”) issued ASU 2023-09, Improvements to Income Tax Disclosures, which establishes new income tax disclosure requirements in addition to modifying and eliminating certain existing requirements. Under the new guidance, entities must consistently categorize and provide greater disaggregation of information in the rate reconciliation. They must also further disaggregate income taxes paid. The standard is intended to benefit stockholders by providing more detailed income tax disclosures that would be useful in making capital allocation decisions. The guidance applies to all entities subject to income taxes and is effective for annual periods beginning after December 15, 2024. The guidance will be applied on a prospective basis with the option to apply the standard retrospectively. Early adoption is permitted. The Company is considering early adoption of this standard in connection with the filing of its Annual Report on Form 10-K for the year ending December 31, 2024.

Recently Adopted Accounting Pronouncements

On January 1, 2024, the Company adopted ASU 2023-07, Segment Reporting—Improvements to Reportable Segment Disclosures, which requires public entities to provide disclosures of significant segment expenses and other segment items. The guidance requires public entities to provide in interim periods all disclosures about a reportable segment’s profit or loss and assets that are currently required annually and also applies to public entities with a single reportable segment. Entities are permitted to disclose more than one measure of a segment’s profit or loss if such measures are used by the CODM to allocate resources and assess performance, as long as at least one of those measures is determined in a way that is most consistent with the measurement principles used to measure the corresponding amounts in the consolidated financial statements. The guidance is applied retrospectively to all periods presented in financial statements, unless it is impracticable, and is effective for fiscal years beginning after December 15, 2023, and for interim periods beginning after December 15, 2024. See Note 26 for additional information.

On January 1, 2024, the Company early adopted ASU 2023-08, Accounting for and Disclosure of Crypto Assets, which contains final guidance requiring all entities to measure certain crypto assets at fair value each reporting period and to reflect changes from remeasurement in net income. Entities are required to present crypto assets measured at fair value separately from other intangible assets on the balance sheet and present changes from the remeasurement of crypto assets separately from changes in the carrying amounts of other intangible assets in the income statement. Entities are required to provide interim and annual disclosures about the types of crypto assets they hold and any changes in their holdings of crypto assets. The guidance is effective for fiscal years beginning after December 15, 2024, including interim periods within those fiscal years. The adoption of this standard did not have a material impact on the Company’s financial statements.

3. Cash, Cash Equivalents and Restricted Cash

Of the total cash, cash equivalents and restricted cash of $116,926 and $129,305 at March 31, 2024 and December 31, 2023, respectively, $107,956 and $116,895 were held at three financial institutions. At March 31, 2024 and December 31, 2023, cash equivalents were approximately $13,795 and $50,226, respectively.

Certain of the Company’s subsidiaries are required to maintain a minimum level of regulatory capital, generally satisfied by cash on hand, which was $42,058 and $29,156 at March 31, 2024 and December 31, 2023, respectively. Of these amounts, $13,083 and $0, at March 31, 2024 and December 31, 2023, respectively, was restricted cash, which is required to be maintained in a separate account with withdrawal and usage restrictions in compliance with regulatory obligations.

4. Fair Value Measurements

The fair value of financial instruments is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., “the exit price”) in an orderly transaction between market participants at the measurement date. ASC 820, Fair Value Measurement, establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability developed based on market data obtained from independent sources. Unobservable inputs reflect assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The hierarchy is broken down into three levels based on the transparency of inputs as follows:

Level 1 – Quoted prices for identical instruments in active markets.

Level 2 – Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 – Instruments whose significant drivers are unobservable.

The availability of observable inputs can vary from product to product and is affected by a wide variety of factors, including, for example, the type of product, whether the product is new and not yet established in the marketplace, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by management in determining fair value is greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The tables below summarize the categorization of the Company’s assets and liabilities measured at fair value. During the three months ended March 31, 2024 and 2023, there were no transfers between Levels 2 and 3.

| | | March 31, 2024 |

| | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | | |

| Recurring fair value measurements: | | | | | | | | |

| Cash equivalents | | $ | 13,795 | | | $ | 13,795 | | | $ | — | | | $ | — | |

| Financial instruments owned, at fair value: | | | | | | | | | | | | | | | | |

| ETFs | | | 34,058 | | | | 34,058 | | | | — | | | | — | |

| Pass-through GSEs | | | 9,948 | | | | — | | | | 9,948 | | | | — | |

| Other assets—seed capital (WisdomTree Digital Funds): | | | | | | | | | | | | | | | | |

| U.S. treasuries | | | 5,261 | | | | — | | | | 5,261 | | | | — | |

| Equities | | | 7,095 | | | | 7,095 | | | | — | | | | — | |

| Fixed income | | | 1,939 | | | | 1,014 | | | | 925 | | | | — | |

| Total | | $ | 72,096 | | | $ | 55,962 | | | $ | 16,134 | | | $ | — | |

| | | |

| | | December 31, 2023 |

| | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | | |

| Recurring fair value measurements: | | | | | | | | | | | | | | | | |

| Cash equivalents | | $ | 50,226 | | | $ | 50,226 | | | $ | — | | | $ | — | |

| Financial instruments owned, at fair value | | | | | | | | | | | | | | | | |

| ETFs | | | 35,181 | | | | 35,181 | | | | — | | | | — | |

| Pass-through GSEs | | | 10,240 | | | | — | | | | 10,240 | | | | — | |

| Other assets—seed capital (WisdomTree Digital Funds) | | | | | | | | | | | | | | | | |

| U.S. treasuries | | | 5,007 | | | | — | | | | 5,007 | | | | — | |

| Equities | | | 6,337 | | | | 6,337 | | | | — | | | | — | |

| Fixed income | | | 1,957 | | | | 1,008 | | | | 949 | | | | — | |

| Total | | $ | 108,948 | | | $ | 92,752 | | | $ | 16,196 | | | $ | — | |

| | | | | | | | | | | | | | | | | |

| Non-recurring fair value measurements: | | | | | | | | | | | | | | | | |

| Fnality International Limited—Series B-1 Preference Shares0F(1) | | | 9,684 | | | | — | | | | — | | | | 9,684 | |

| Other investments(1F1F2) | | | — | | | | — | | | | — | | | | — | |

| Total | | $ | 9,684 | | | $ | — | | | $ | — | | | $ | 9,684 | |

_____________________________

(1) Fair value determined on October 31, 2023

(2) Fair value determined on September 30, 2023

Recurring Fair Value Measurements – Methodology

Cash Equivalents (Note 3) – These financial assets represent cash invested in highly liquid investments with original maturities of less than 90 days. These investments are valued at par, which approximates fair value, and are classified as Level 1 in the fair value hierarchy.

Financial instruments owned (Note 5) – Financial instruments owned are investments in ETFs, pass-through GSEs, U.S. treasuries, equities and fixed income. ETFs and equities are generally traded in active, quoted and highly liquid markets and are therefore classified as Level 1 in the fair value hierarchy. Pricing of U.S. treasuries, pass-through GSEs and fixed income includes consideration given to date of issuance, collateral characteristics and market assumptions related to yields, credit risk and timing of prepayments and may be classified as either Level 1 or Level 2.

5. Financial instruments owned

These instruments consist of the following:

| | | March 31,

2024 | | December 31,

2023 |

| Financial instruments owned | | | | | | | | |

| Trading securities | | $ | 44,006 | | | $ | 45,421 | |

| Other assets—seed capital (WisdomTree Digital Funds) | | | 14,295 | | | | 13,301 | |

| Total | | $ | 58,301 | | | $ | 58,722 | |

The Company recognized net trading gains on financial instruments owned that were still held at the reporting dates of $1,904 and $4,722 during the three months ended March 31, 2024 and 2023, respectively, which were recorded in other gains and losses, net, in the Consolidated Statements of Operations.

6. Securities Held-to-Maturity

The following table is a summary of the Company’s securities held-to-maturity:

| | | March 31, 2024 | | December 31, 2023 |

| Debt instruments: Pass-through GSEs (amortized cost) | | $ | 224 | | | $ | 230 | |

During each of the three months ended March 31, 2024 and 2023, the Company received proceeds of $6 from held-to-maturity securities maturing or being called prior to maturity.

The following table summarizes unrealized losses, gains and fair value (classified as Level 2 within the fair value hierarchy) of securities held-to-maturity:

| | | March 31, 2024 | | December 31, 2023 |

| Cost/amortized cost | | $ | 224 | | | $ | 230 | |

| Gross unrealized losses | | | (19 | ) | | | (15 | ) |

| Fair value | | $ | 205 | | | $ | 215 | |

An allowance for credit losses was not provided on the Company’s held-to-maturity securities as all securities are investments in pass-through GSEs which are determined to have an estimated loss rate of zero due to an implicit U.S. government guarantee.

The following table sets forth the maturity profile of the securities held-to-maturity; however, these securities may be called prior to the maturity date:

| | | March 31, 2024 | | December 31, 2023 |

| Due within one year | | $ | — | | | $ | — | |

| Due one year through five years | | | — | | | | — | |

| Due five years through ten years | | | 21 | | | | 22 | |

| Due over ten years | | | 203 | | | | 208 | |

| Total | | $ | 224 | | | $ | 230 | |

7. Investments

The following table sets forth the Company’s investments:

| | | March 31, 2024 | | December 31, 2023 |

| | | Carrying Value | | Cost | | Carrying Value | | Cost |

| | | | | | | | | | | | |

| Fnality International Limited—Series B-1 Preference Shares | | $ | 9,606 | | | $ | 8,091 | | | $ | 9,684 | | | $ | 8,091 | |

| Total | | $ | 9,606 | | | $ | 8,091 | | | $ | 9,684 | | | $ | 8,091 | |

Fnality International Limited

The Company owns approximately 5.4% (or 4.8% on a fully-diluted basis) of capital stock of Fnality International Limited (“Fnality”), a company incorporated in England and Wales and focused on creating a peer-to-peer digital wholesale settlement ecosystem comprised of a consortium of financial institutions, offering real time cross-border payments from a single pool of liquidity. The Company’s ownership interest is represented by 2,340,378 Series B-1 Preference Shares, resulting from the conversion of its investment of £6,000 ($8,091) in convertible notes upon Fnality’s qualified equity financing which occurred in October 2023. The Series B-1 Preference Shares carry a 1.0x liquidation preference, are convertible into ordinary shares at the option of the Company and contain various rights and protections.

This investment is accounted for under the measurement alternative prescribed in ASC 321, as it does not have a readily determinable fair value and is otherwise not subject to the equity method of accounting. The investment is assessed for impairment and similar observable transactions on a quarterly basis. During the three months ended March 31, 2024, the Company recognized a loss of $78 due to changes in the British pound to U.S. dollar exchange rate. There was no impairment recognized on this investment during the three months ended March 31, 2024 based upon a qualitative assessment.

During the three months ended March 31, 2023, the Company recognized a gain of $530 when re-measuring its previously held convertible notes to fair value.

8. Fixed Assets, net

The following table summarizes fixed assets:

| | | March 31, 2024 | | December 31, 2023 |

| Equipment | | $ | 998 | | | $ | 1,097 | |

| Less: accumulated depreciation | | | (562 | ) | | | (670 | ) |

| Total | | $ | 436 | | | $ | 427 | |

9. Deferred Consideration—Gold Payments

Deferred consideration—gold payments represented an obligation the Company assumed in connection with its acquisition of the European exchange-traded commodity, currency and leveraged-and-inverse business of ETFS Capital Limited (“ETFS Capital”) which occurred on April 11, 2018. The obligation was for fixed payments to ETFS Capital of physical gold bullion equating to 9,500 ounces of gold per year through March 31, 2058 and then subsequently reduced to 6,333 ounces of gold per year continuing into perpetuity (“contractual gold payments”). ETFS Capital continued to pass through the payments to other parties to meet its payment obligations under prior royalty agreements, including to Gold Bullion Holdings (Jersey) Limited (“GBH”), a subsidiary of the World Gold Council (“WGC”), Graham Tuckwell (“GT”), and Rodber Investments Limited (“RIL”), an entity controlled by GT, who is also the Chairman of ETFS Capital.

On May 10, 2023, the Company terminated its contractual gold payments obligation for aggregate consideration totaling $136,903 pursuant to a Sale, Purchase and Assignment Deed (the “SPA Agreement”) with WisdomTree International Holdings Ltd, Electra Target HoldCo Limited, ETFS Capital, WGC, GBH, GT and RIL. Under the terms of the transaction, GBH received approximately $4,371 in cash and 13,087 shares of Series C Non-Voting Convertible Preferred Stock of the Company, $0.01 par value per share convertible into 13,087,000 shares of the Company’s common stock (see Note 12 for additional information), and RIL received approximately $45,634 in cash.

During the three months ended March 31, 2024 and 2023, the Company recognized the following in respect of deferred consideration—gold payments:

| | | Three Months Ended March 31, |

| | | 2024 | | 2023 |

| | | | | | | |

| Contractual gold payments | | $ | — | | | $ | 4,486 | |

| Contractual gold payments—gold ounces paid | | | — | | | | 2,375 | |

| Gain on revaluation/termination of deferred consideration—gold payments | | $ | — | | | $ | 20,592 | |

10. Convertible Notes

On February 14, 2023, the Company issued and sold $130,000 in aggregate principal amount of 5.75% Convertible Senior Notes due 2028 (the “2023 Notes”) pursuant to an indenture dated February 14, 2023, between the Company and U.S. Bank Trust Company, National Association, as trustee (or its successor in interest, the “Trustee”), in a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (“Rule 144A”).

On June 14, 2021, the Company issued and sold $150,000 in aggregate principal amount of 3.25% Convertible Senior Notes due 2026 (the “2021 Notes”) pursuant to an indenture dated June 14, 2021, between the Company and the Trustee, in a private offering to qualified institutional buyers pursuant to Rule 144A.

On June 16, 2020, the Company issued and sold $150,000 in aggregate principal amount of 4.25% Convertible Senior Notes due 2023 (the “June 2020 Notes”) pursuant to an indenture dated June 16, 2020, between the Company and the Trustee, in a private offering to qualified institutional buyers pursuant to Rule 144A. On August 13, 2020, the Company issued and sold $25,000 in aggregate principal amount of 4.25% Convertible Senior Notes due 2023 at a price equal to 101% of the principal amount thereof, plus interest deemed to have accrued since June 16, 2020, which constitute a further issuance of, and form a single series with, the Company’s June 2020 Notes (the “August 2020 Notes” and together with the June 2020 Notes, the “2020 Notes”).

In connection with the issuance of the 2023 Notes, the Company repurchased $115,000 in aggregate principal amount of the 2020 Notes. As a result of this repurchase, the Company recognized a loss on extinguishment of approximately $9,721 during the three months ended March 31, 2023. The remainder of the 2020 Notes matured on June 15, 2023 and were settled for $59,955 in cash and 1,037,288 shares of common stock, as the conversion option was in the money.

After the repurchase and settlement at maturity of the 2020 Notes and the issuance of the 2023 Notes (and together with the 2021 Notes, the “Convertible Notes”), the Company had $280,000 in aggregate principal amount of Convertible Notes outstanding.

Key terms of the Convertible Notes are as follows:

| | | 2023 Notes | | 2021 Notes |

| Principal outstanding | | $130,000 | | | $150,000 | |

| Maturity date (unless earlier converted, repurchased or redeemed) | | August 15, 2028 | | | June 15, 2026 | |

| Interest rate | | 5.75% | | | 3.25% | |

| Conversion price | | $9.54 | | | $11.04 | |

| Conversion rate | | 104.8658 | | | 90.5797 | |

| Redemption price | | $12.40 | | | $14.35 | |

| ● | Interest rate: Payable semiannually in arrears on February 15 and August 15 of each year for the 2023 Notes and on June 15 and December 15 of each year for the 2021 Notes. |

| ● | Conversion price: Convertible at an initial conversion rate into shares of the Company’s common stock, per $1,000 principal amount of notes (equivalent to an initial conversion price set forth in the table above), subject to adjustment. |

| ● | Conversion: Holders may convert at their option at any time prior to the close of business on the business day immediately preceding May 15, 2028 and March 15, 2026 for the 2023 Notes and 2021 Notes, respectively, only under the following circumstances: (i) if the last reported sale price of the Company’s common stock for at least 20 trading days during a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price for the respective Convertible Notes on each applicable trading day; (ii) during the five business day period after any ten consecutive trading day period (the “measurement period”) in which the trading price per $1,000 principal amount of the Convertible Notes for each trading day of the measurement period was less than 98% of the product of the last reported sales price of the Company’s common stock and the conversion rate on each such trading day; (iii) upon a notice of redemption delivered by the Company in accordance with the terms of the indentures but only with respect to the Convertible Notes called (or deemed called) for redemption; or (iv) upon the occurrence of specified corporate events. On or after May 15, 2028 and March 15, 2026 in respect of the 2023 Notes and the 2021 Notes, respectively, until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert their Convertible Notes at any time, regardless of the foregoing circumstances. |

| ● | Cash settlement of principal amount: Upon conversion, the Company will pay cash up to the aggregate principal amount of the Convertible Notes to be converted. At its election, the Company will also settle its conversion obligation in excess of the aggregate principal amount of the Convertible Notes being converted in either cash, shares of its common stock or a combination of cash and shares of its common stock. |

| ● | Redemption price: The Company may redeem for cash all or any portion of the Convertible Notes, at its option, on or after August 20, 2025 and June 20, 2023 in respect of the 2023 Notes and the 2021 Notes, respectively, and on or prior to the 55th scheduled trading day immediately preceding the maturity date, if the last reported sale price of the Company’s common stock has been at least 130% of the conversion price for the respective Convertible Notes then in effect for at least 20 trading days, including the trading day immediately preceding the date on which the Company provides notice of redemption, during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which the Company provides notice of redemption, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding the redemption date. No sinking fund is provided for the Convertible Notes. |

| ● | Limited investor put rights: Holders of the Convertible Notes have the right to require the Company to repurchase for cash all or a portion of their notes at 100% of their principal amount, plus any accrued and unpaid interest, upon the occurrence of certain change of control transactions or liquidation, dissolution or common stock delisting events. |

| ● | Conversion rate increase in certain customary circumstances: In certain circumstances, conversions in connection with a “make-whole fundamental change” (as defined in the indentures) or conversions of Convertible Notes called (or deemed called) for redemption may result in an increase to the conversion rate, provided that the conversion rate will not exceed 167.7853 shares and 144.9275 shares of the Company’s common stock per $1,000 principal amount of the 2023 Notes and the 2021 Notes, respectively (the equivalent of 43,551,214 shares of the Company’s common stock), subject to adjustment. |

| ● | Seniority and Security: The 2023 Notes and 2021 Notes rank equal in right of payment, and are the Company’s senior unsecured obligations, but are subordinated in right of payment to the Company’s obligations to make certain redemption payments (if and when due) in respect of its Series A Non-Voting Convertible Preferred Stock (Note 11). |

The indentures contain customary terms and covenants, including that upon certain events of default occurring and continuing, either the Trustee or the respective holders of not less than 25% in aggregate principal amount of the respective series of Convertible Notes outstanding may declare the entire principal amount of all such respective Convertible Notes to be repurchased, plus any accrued special interest, if any, to be immediately due and payable.

The following table provides a summary of the Convertible Notes at March 31, 2024 and December 31, 2023:

| | | March 31, 2024 | | December 31, 2023 |

| | | 2023 Notes | | 2021 Notes | | Total | | 2023 Notes | | 2021 Notes | | Total |

| Principal amount | | $ | 130,000 | | | $ | 150,000 | | | $ | 280,000 | | | $ | 130,000 | | | $ | 150,000 | | | $ | 280,000 | |

| Plus: Premium | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Gross proceeds | | | 130,000 | | | | 150,000 | | | | 280,000 | | | | 130,000 | | | | 150,000 | | | | 280,000 | |

| Less: Unamortized issuance costs | | | (2,827 | ) | | | (1,910 | ) | | | (4,737 | ) | | | (2,987 | ) | | | (2,125 | ) | | | (5,112 | ) |

| Carrying amount | | $ | 127,173 | | | $ | 148,090 | | | $ | 275,263 | | | $ | 127,013 | | | $ | 147,875 | | | $ | 274,888 | |

| Effective interest rate(5F1) | | | 6.25% | | | | 3.83% | | | | 4.96% | | | | 6.25% | | | | 3.83% | | | | 4.96% | |

_____________________________

(1) Includes amortization of the issuance costs and premium.

Interest expense on the Convertible Notes during the three months ended March 31, 2024 and 2023 was $3,462 and $4,002, respectively. Interest payable of $2,391 and $3,041 at March 31, 2024 and December 31, 2023, respectively, is included in accounts payable and other liabilities on the Consolidated Balance Sheets.

The fair value of the Convertible Notes (classified as Level 2 in the fair value hierarchy) was $308,487 and $281,897 at March 31, 2024 and December 31, 2023, respectively. The if-converted value of the Convertible Notes did not exceed the principal amount at March 31, 2024 and December 31, 2023.

11. Series A Preferred Stock

On April 10, 2018, the Company filed a Certificate of Designations of Series A Non-Voting Convertible Preferred Stock (the “Series A Certificate of Designations”) with the Secretary of State of the State of Delaware establishing the rights, preferences, privileges, qualifications, restrictions, and limitations relating to the Series A Preferred Stock (defined below). The Series A Preferred Stock is intended to provide ETFS Capital with economic rights equivalent to the Company’s common stock on an as-converted basis. The Series A Preferred Stock has no voting rights, is not transferable and has the same priority with regard to dividends, distributions and payments as the common stock.

As described in the Series A Certificate of Designations, the Company will not issue, and ETFS Capital does not have the right to require the Company to issue, any shares of common stock upon conversion of the Series A Preferred Stock, if, as a result of such conversion, ETFS Capital (together with certain attribution parties) would beneficially own more than 9.99% of the Company’s outstanding common stock immediately after giving effect to such conversion.

In connection with the completion of the acquisition of the European exchange-traded commodity, currency and leveraged-and-inverse business of ETFS Capital (the “ETFS Acquisition”), the Company issued 14,750 shares of Series A Non-Voting Convertible Preferred Stock (the “Series A Preferred Stock”), which are convertible into an aggregate of 14,750,000 shares of common stock. The fair value of this consideration was $132,750, based on the closing price of the Company’s common stock on April 10, 2018 of $9.00 per share, the trading day prior to the closing of the acquisition.

The following is a summary of the Series A Preferred Stock balance:

| | | March 31, 2024 | | December 31, 2023 |

| Issuance of Series A Preferred Stock | | $ | 132,750 | | | $ | 132,750 | |

| Less: Issuance costs | | | (181 | ) | | | (181 | ) |

| Series A Preferred Stock—carrying value | | $ | 132,569 | | | $ | 132,569 | |

| Cash dividends declared per share (quarterly) | | $ | 0.03 | | | $ | 0.03 | |

Temporary equity classification is required for redeemable instruments for which redemption triggers are outside of the issuer’s control. ETFS Capital has the right to redeem all the Series A Preferred Stock specified to be converted during the period of time specified in the Series A Certificate of Designations in the event that: (a) the number of shares of the Company’s common stock authorized by its certificate of incorporation is insufficient to permit the Company to convert all of the Series A Preferred Stock requested by ETFS Capital to be converted; or (b) ETFS Capital does not, upon completion of a change of control of the Company, receive the same amount per share of Series A Preferred Stock as it would have received had each outstanding share of Series A Preferred Stock been converted into common stock immediately prior to the change of control. However, the Company will not be obligated to make any such redemption payments to the extent such payments would be a breach of any covenant or obligation the Company owes to any of its secured creditors or is otherwise prohibited by applicable law.

Any such redemption will be at a price per share of Series A Preferred Stock equal to the dollar volume-weighted average price for a share of common stock for the 30-trading day period ending on the date of such attempted conversion or change of control, as applicable, multiplied by 1,000. Such redemption payment will be made in one payment no later than 10 business days following the last day of the Company’s first fiscal quarter that begins on a date following the date ETFS Capital exercises such redemption right. The redemption value of the Series A Preferred Stock was $123,108 and $96,869 at March 31, 2024 and December 31, 2023, respectively.

The carrying amount of the Series A Preferred Stock was not adjusted as it was not probable that such shares would become redeemable.

12. Payable to Gold Bullion Holdings (Jersey) Limited (“GBH”)

On November 20, 2023, the Company repurchased its Series C Non-Voting Convertible Preferred Stock, par value $0.01 per share (the “Series C Preferred Stock”) which was convertible into 13,087,000 shares of the Company’s common stock, from GBH, a subsidiary of WGC, for aggregate cash consideration of approximately $84,411. Under the terms of the transaction, the Company paid GBH $40,000 on the closing date, with the remainder of the purchase price payable in equal, interest-free installments on the first, second and third anniversaries of the closing date. The implied price per share was $6.02 when considering the interest-free financing element of the transaction. The investor rights agreement that the Company and GBH entered into in May 2023 in connection with the issuance of the Series C Preferred Stock, which provided GBH with certain rights and obligations with respect to the shares, including registration rights, was terminated in this transaction.

Under U.S. GAAP, the obligation was recorded at its present value utilizing a market rate of interest on the closing date of 7.0% and the corresponding discount is being amortized as interest expense pursuant to the effective interest method of accounting over the life of the obligation. The aggregate consideration payable was valued at $38,835 on the closing date and the carrying value of this obligation is as follows:

| | | | March 31, 2024 | | December 31, 2023 |

| Current: | | | $ | 14,804 | | | $ | 14,804 | |

| Long-term | | | | 24,994 | | | | 24,328 | |

| Total | | | $ | 39,798 | | | $ | 39,132 | |

Interest expense recognized during the three months ended March 31, 2024 and 2023 was $666 and $0, respectively, and is included as a component of total interest expense recognized on the Consolidated Statements of Operations.

13. Leases

The Company has entered into operating leases for its office facilities (including its corporate headquarters) and equipment. The Company has no finance leases.

The following table provides additional information regarding the Company’s leases:

| | | Three Months Ended March 31, |

| | | 2024 | | 2023 |

| Lease cost | | | | | | | | |

| Operating lease cost | | $ | 324 | | | $ | 319 | |

| Short-term lease cost | | | 93 | | | | 56 | |

| Total lease cost | | $ | 417 | | | $ | 375 | |

| Other information | | | | | | | | |

Cash paid for amounts included in the measurement of operating

liabilities (operating leases) | | $ | 332 | | | $ | 326 | |

Right-of-use assets obtained in exchange for new operating lease

liabilities | | | n/a | | | | n/a | |

| Weighted-average remaining lease term (in years)—operating leases | | | 0.2 | | | | 1.0 | |

| Weighted-average discount rate—operating leases | | | 5.8 | % | | | 6.5 | % |

None of the Company’s leases include variable payments, residual value guarantees or any restrictions or covenants relating to the Company’s ability to pay dividends or incur additional financing obligations.

The following table discloses future minimum lease payments at March 31, 2024 with respect to the Company’s operating lease liabilities:

| Remainder of 2024 | | $ | 251 | |