UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EAGLE FINANCIAL SERVICES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

EAGLE FINANCIAL SERVICES, INC.

2 East Main Street

P.O. Box 391

Berryville, Virginia 22611

NOTICE OF 2004 ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Eagle Financial Services, Inc. (the “Company”) will be held on Wednesday, April 21, 2004, at Noon at the John H. Enders Fire Company Social Hall, Berryville, Virginia. The purpose of the meeting shall be as follows:

1. To elect four (4) Directors for a term of three (3) years.

2. To transact such other business as shall properly come before the Annual Meeting or any adjournment thereof.

The Board of Directors has fixed the close of business on March 19, 2004, as the record date for determining the shareholders of the Company entitled to notice of and to vote at the Annual Meeting and any adjournments thereof.

|

| By order of the Board of Directors, |

|

/s/ JAMES W. MCCARTY, JR. |

|

James W. McCarty, Jr. |

Vice President, Chief Financial Officer, and Secretary-Treasurer |

Berryville, Virginia

March 30, 2004

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED. PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED. THE ENCLOSED PROXY, WHEN RETURNED PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED IN THE PROXY.

EAGLE FINANCIAL SERVICES, INC.

2 East Main Street

P.O. Box 391

Berryville, Virginia 22611

PROXY STATEMENT

2004 ANNUAL MEETING OF SHAREHOLDERS

April 21, 2004

This Proxy Statement is being furnished to the shareholders of Eagle Financial Services, Inc. (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting of Shareholders to be held on April 21, 2004, at Noon at the John H. Enders Fire Company Social Hall, Berryville, Virginia, and at any adjournment thereof.

The cost of solicitation of proxies and preparation of proxy materials will be borne by the Company. Solicitations of proxies will be made by use of the United States mail and may be made by direct or telephone contact by employees of the Company. Brokerage houses and nominees will be requested to forward the proxy materials to the beneficial holders of the shares held of record by these persons, and the Company will reimburse them for their reasonable charges in this connection. Shares represented by duly executed proxies in the accompanying form received by the Company prior to the meeting and not subsequently revoked will be voted at the meeting. The approximate date on which this proxy statement, the accompanying proxy card and Annual Report to Shareholders (which is not part of the Company’s soliciting materials) are being mailed to the Company’s shareholders is March 30, 2004.

The purposes of the meeting are to elect Directors and vote on such other business, if any, that may properly come before the meeting or any adjournment. The Company does not know of any other matters that are to come before the meeting. If any other matters are properly presented for action, the persons named in the accompanying form of proxy will vote the proxy in accordance with their best judgment. Each outstanding share of the Company’s Common Stock is entitled to one vote on all matters submitted to shareholders at the meeting. There are no cumulative voting rights.

Where a shareholder directs in the proxy a choice with respect to any matter that is to be voted on, that direction will be followed. If no direction is made, proxies will be voted in favor of the election of the Directors and in the best judgment of Messrs. Thomas T. Byrd, Randall G. Vinson, and Lewis M. Ewing on such other business, if any, that may properly come before the meeting or any adjournment. Any person who has returned a proxy has the power to revoke it at any time before it is exercised by submitting a subsequently dated proxy, by giving notice in writing to the Secretary of the Company, or by voting in person at the meeting.

The close of business on March 19, 2004, has been fixed as the record date for the meeting and any adjournment. As of that date, there were approximately 1,500,089 shares of Common Stock outstanding. As of the record date, and on the date hereof, no person was known by the Company to own beneficially more than 5% of the outstanding shares of the Company’s Common Stock. The Directors and executive officers of the Company beneficially own in the aggregate 186,599 shares of the Company’s Common Stock, representing 12.44% of the amount outstanding on the date hereof.

PROPOSAL ONE - ELECTION OF DIRECTORS

The Board of Directors of the Company is structured into three classes (I, II, and III) with one class elected each year to serve a three-year term. The term of Class I Directors will expire at the Annual Meeting. The persons named below, all of whom are currently members of the Board, will be nominated to serve as Class I Directors. If elected, the Class I nominees will serve until the 2007 Annual Meeting of Shareholders. All nominees have consented to be named and have indicated their intent to serve if elected. Those nominees receiving the greatest number of votes shall be deemed elected even though they may not receive a majority. Abstentions and broker non-votes will not be considered a vote for, or a vote against, a Director.

1

The Board of Directors recommends a vote FOR the Directors nominated to serve as Class I Directors.

Information Concerning Directors and Nominees

Certain information concerning the nominees for election at the Annual Meeting as Class I Directors is set forth below, as well as certain information about the Class II and III Directors, who will continue in office until the 2005 and 2006 Annual Meetings of Shareholders, respectively. The following biographical information discloses each Director’s age, principal occupation during the last five years and the year that each individual was first elected to the Board of Directors of the Company or previously to the Board of Directors of Bank of Clarke County (the “Bank”), the predecessor to and now a wholly owned subsidiary of the Company.

Class I (Nominees) (Directors to be Elected to Serve until the 2007 Annual Meeting):

Thomas T. Gilpin, 50, has been a Director since 1986.

Mr. Gilpin is President of Lenoir City Company, a real estate development company in Winchester, Virginia.

John R. Milleson, 47, has been a Director since 1999.

Mr. Milleson has been the President and Chief Executive Officer of both the Company and the Bank since 1999. From 1997 to 1999, he was Executive Vice President and Secretary-Treasurer of the Company and Executive Vice President and Chief Administrative Officer of the Bank.

Robert W. Smalley, Jr., 52, has been a Director since 1989.

Mr. Smalley is President and Chief Executive Officer of Smalley Package Co., Inc., a pallet manufacturing company in Berryville, Virginia.

James T. Vickers, 51, has been a Director since 2001.

Mr. Vickers is Chief Executive Officer of Oakcrest Companies, a family of real estate-related companies in Winchester, Virginia.

Class II (Directors Serving until the 2005 Annual Meeting):

Thomas T. Byrd, 57, has been a Director since 1995.

Mr. Byrd is President and Publisher of Winchester Evening Star, Inc., a newspaper publishing company headquartered in Winchester, Virginia.

Lewis M. Ewing, 69, has been a Director since 1984.

Mr. Ewing retired as President and Chief Executive Officer of the Company and as President and Chief Executive Officer of the Bank in 1999.

John D. Hardesty, 72, has been a Director since 1963.

Mr. Hardesty is Partner/Manager of John O. Hardesty & Son, a dairy operation in Berryville, Virginia. Mr. Hardesty is the Chairman of the Board of both the Company and the Bank.

Class III (Directors Serving until the 2006 Annual Meeting):

Mary Bruce Glaize, 48, has been a Director since 1998.

Mrs. Glaize is a homemaker and local volunteer of the Shenandoah Valley Discovery Museum.

James R. Wilkins, Jr., 58, has been a Director since 1998.

Mr. Wilkins is President of Wilkins ShoeCenter, Inc., a footwear retailer in Winchester, Virginia.

Randall G. Vinson, 57, has been a Director since 1985.

Mr. Vinson is Pharmacist and Owner of Berryville Pharmacy in Berryville, Virginia.

2

Executive Officers who are not Directors

Jeffrey S. Boppe, 39, has served as Senior Vice President and Senior Loan Officer of the Bank since 1998.

James W. McCarty, Jr., 34, has served as Vice President and Chief Financial Officer of the Company since 1997. Mr. McCarty has served as Senior Vice President and Chief Financial Officer of the Bank since 2000.

Elizabeth M. Pendleton, 55, has served as Senior Vice President and Trust Officer of the Bank since 2000. Mrs. Pendleton served as Vice President and Trust Officer of the Bank from 1998 until 2000.

3

SECURITY OWNERSHIP

Ownership of Company Stock

The following table sets forth, as of March 1, 2004, certain information with respect to beneficial ownership of shares of Common Stock by each of the members of the Board of Directors, by each of the executive officers named in the “Summary Compensation Table” below (the “named executive officers”) and by all Directors and executive officers as a group. The Company is not aware of any person who is the beneficial owner of more than 5% of the Company’s Common Stock.

| | | | | |

Name

| | Number of

Shares

| | | Percent of Class (%)

|

Jeffrey S. Boppe | | 1,378 | (1)(2)(3) | | * |

Thomas T. Byrd | | 10,808 | (4) | | * |

Lewis M. Ewing | | 13,332 | (1) | | * |

Thomas T. Gilpin | | 44,211 | (1) | | 2.95 |

Mary Bruce Glaize | | 561 | | | * |

John D. Hardesty | | 11,834 | (1) | | * |

James W. McCarty, Jr. | | 1,996 | (1)(2)(3) | | * |

John R. Milleson | | 20,431 | (1)(2)(3) | | 1.36 |

Elizabeth M. Pendleton | | 2,307 | (1)(2)(3) | | * |

Robert W. Smalley, Jr. | | 6,747 | (1) | | * |

James T. Vickers | | 3,430 | | | * |

Randall G. Vinson | | 12,278 | (1) | | * |

James R. Wilkins, Jr. | | 57,282 | (1) | | 3.82 |

| | |

|

| |

|

Directors and executive officers as a group (13 persons) | | 186,599 | | | 12.44 |

| | |

|

| |

|

| * | Percentage of ownership is less than one percent of the outstanding shares of Common Stock. |

| (1) | Amounts include shares held jointly with spouse and/or as custodian under the Virginia Uniform Gifts to Minors Act and/or as trustee under the terms of certain trusts. |

| (2) | Amounts include shares of the Company’s Common Stock allocated to participants and held in trust under the Bank of Clarke County Employee 401(k) Savings and Stock Ownership Plan as of December 31, 2003. As of such date, the KSOP Plan held 59,738 shares of Common Stock, or 3.98% of the total number of such shares outstanding. Of the shares of Common Stock held in the KSOP Plan, 7,556 shares were held for the accounts of executive officers. Each participant in the KSOP Plan has the right to vote the shares allocated to his or her account. |

| (3) | Amounts disclosed include shares of Restricted Stock which vest over a three-year period on the anniversary of the grant date which was October 1, 2003. The shares were granted as follows: Mr. Boppe, 420 shares; Mr. McCarty, 420 shares; Mr. Milleson, 900 shares; and Mrs. Pendleton, 420 shares |

| (4) | Amount includes 2,800 shares held by Winchester Evening Star, Inc., where the Director is an executive officer of that Corporation. |

4

Section 16(a) Beneficial Ownership Reporting Compliance

Under Section 16(a) of the Securities Exchange Act of 1934, as amended, Directors and executive officers of the Company and beneficial owners of more than 10% of the Company’s Common Stock are required to file reports with the Securities and Exchange Commission and the Company of their beneficial ownership and changes in ownership of Common Stock or written representations that no other reports were required. The Company believes that, during the fiscal year ended December 31, 2003, all filing requirements applicable to its officers and Directors were complied with. The Company is not aware of any person having beneficial ownership of more than 10% of the Company’s Common Stock.

CORPORATE GOVERNANCE AND

THE BOARD OF DIRECTORS

General

The business and affairs of the Company are managed under the direction of the Board of Directors in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Bylaws. Members of the Board are kept informed of the Company’s business through discussions with the Chairman of the Board, the President and Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees.

Independence of the Directors

The Board of Directors has determined that the following nine individuals of its total ten members are independent as defined by the listing standards of the NASDAQ Stock Market (“NASDAQ”): Mrs. Glaize and Messrs. Byrd, Ewing, Gilpin, Hardesty, Smalley, Vickers, Vinson, and Wilkins. The only Director not considered independent is Mr. Milleson, who serves as the President and Chief Executive Officer of the Company.

Board and Committee Meeting Attendance

During 2003, the Board of Directors of the Company held eight meetings. The Directors of the Company also serve as Directors of its wholly-owned subsidiary, Bank of Clarke County (the “Bank”). The Bank’s Board held fourteen meetings in 2003. During 2003 each Director attended greater than 75% of the aggregate number of meetings of both Boards of Directors and meetings of committees on which he or she was a member.

Executive Sessions

Independent Directors meet periodically outside of regularly scheduled Board meetings. The Company has scheduled four executive sessions that include only independent Directors for 2004.

Committees of the Board

The Company’s only standing committee is the Audit Committee. The Compensation Committee is a committee of the Bank’s Board of Directors. Neither the Company’s nor the Bank’s Board of Directors has a nominating committee. The following sections discuss each of these committees.

5

Audit Committee. The Audit Committee met four times in 2003. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibility to the shareholders relating to the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements and the qualifications, independence and the performance of the internal audit function. During 2003, the Company outsourced its internal audit function to an independent public accounting firm that specializes in financial institutions. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of the independent auditor engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attestation services for the Company. The Audit Committee and the Board of Directors have adopted a written charter for the Audit Committee, which is included as Attachment A to this Proxy Statement.

This committee consists of Messrs. Vinson, Byrd and Wilkins and Mrs. Glaize. Each of the members of the Audit Committee is independent as that term is defined in the listing standards of the NASDAQ Stock Market (“NASDAQ”). The Company does not have an “audit committee financial expert” as defined by Securities and Exchange Commission regulations. The Board of Directors, however, believes that the members of the Audit Committee have the ability to understand financial statements and generally accepted accounting principles, the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves, an understanding of internal controls and procedures for financial reporting and an understanding of audit committee functions. For additional information regarding the Audit Committee, see the section titled “Audit Information – Audit Committee Report” within this Proxy Statement.

Compensation Committee. The Compensation Committee met five times in 2003. The Compensation Committee reviews the CEO’s performance and compensation and reviews and sets guidelines for compensation of the other executive officers. All decisions by the Compensation Committee relating to the compensation of the Company’s executive officers are reported to the full Board of Directors. The Compensation Committee consists of Messrs. Smalley, Vickers and Vinson, all of whom are independent as that term is defined by the listing standards of NASDAQ. For additional information regarding the Compensation Committee, see the section titled “Executive Compensation and Related Party Transactions – Compensation Committee Report on Executive Compensation” within this Proxy Statement.

Nominating Committee. There is no nominating committee of the Board of Directors. The entire Board performs the functions of a nominating committee. The Board has chosen not to have a separate nominating committee because it is comprised primarily of independent Directors and has the time and resources to perform the function of selecting board nominees. When the Board performs its nominating function, the Board acts in accordance with the Company’s Articles of Incorporation and Bylaws but does not have a separate charter related to the nomination process.

Shareholders may submit candidates for consideration by the Company if timely written notice is received, in proper form, for each such recommended Director nominee. If the notice is not timely and in proper form, the nominee will not be considered by the Company. To be timely for the 2005 Annual Meeting, the notice must be received within the time frame set forth in the section titled “Shareholder Proposals for the 2005 Annual Meeting” within this Proxy Statement. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and information about the shareholder making the nomination and the person nominated for election.

In considering Director nominees, including any nominee that a shareholder may submit, the Board of Directors considers, at a minimum, the following factors for new Directors, or the continued service of existing Directors:

| | • | the ability of the prospective nominee to represent the interests of the shareholders of the Corporation; |

| | • | the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; |

| | • | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; and |

| | • | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board. |

6

Annual Meeting Attendance

The Company has not adopted a formal policy on Director attendance at its Annual Meeting of Shareholders, although all Directors are encouraged to attend and historically most have done so. All Directors attended the Company’s 2003 Annual Meeting of Shareholders.

Shareholder Communication

Shareholders may communicate with all or any member of the Board of Directors by addressing correspondence to “Board of Directors” or to the individual Director. Such correspondence should be addressed to the Secretary of the Company, P.O. Box 391, Berryville, Virginia 22611. All communications so addressed will be forwarded promptly, without screening, to the Chairman of the Board of Directors (in the case of correspondence addressed to “Board of Directors”) or to the individual Director.

Director Compensation

In 2003 the Chairman of the Board received an $8,000 annual retainer and $200 per Bank Board meeting attended as compensation for services as a Director plus a per meeting fee of $100 for each Bank committee meeting attended. All other Directors in 2003 each received a $5,000 annual retainer and $200 per Bank Board meeting attended as compensation for services as Director plus a per meeting fee of $100 for each Bank committee meeting attended. The Company’s Chief Executive Officer, John R. Milleson, does not receive fees for committee meetings of the Bank.

EXECUTIVE COMPENSATION AND

RELATED PARTY TRANSACTIONS

Compensation Committee Report on Executive Compensation

The Compensation Committee, which is composed of the independent Directors listed below, recommends to the Board of Directors the annual salary levels and any bonuses to be paid to the executive officers of the Bank. The Committee also makes recommendations to the Board regarding the issuance of equity compensation and other compensation related matters. Currently, the individuals serving as the Chief Executive Officer and the Chief Financial Officer of the Company also serve in the same capacities, respectively, for the Bank. These officers are presently compensated by the Bank for services rendered, but not by the Company.

The primary objective of the Company’s executive compensation program is to attract and retain highly skilled and motivated executive officers who will manage the Company in a manner to promote its growth and profitability and advance the interest of the Company’s shareholders. As such, the compensation program is designed to provide levels of compensation that are reflective of both the individual’s and the Company’s performance in achieving its goals and objectives.

The elements of the Company’s compensation program include base annual salary, short-term incentive compensation under the Bank’s Executive Bonus Plan, and long-term incentives through equity compensation under the Company’s 2003 Stock Incentive Plan.

Compensation for the President and Chief Executive Officer of the Company is determined by the Board of Directors, excluding the President and Chief Executive Officer, based on the recommendation of the Compensation Committee of the Board. The Compensation Committee annually reviews and approves corporate goals and objectives relevant to the Chief Executive Officer’s compensation, evaluates his performance in light of these goals and objectives, and recommends to the Board his compensation level based on this evaluation. In determining the long-term incentive component of his compensation, the Committee considers the Company’s performance and relative shareholder return, the value of similar incentive awards to Chief Executive Officers at comparable companies and the awards given to the Chief Executive Officer in past years.

7

Compensation for executive officers other than the President and Chief Executive Officer is determined by the Board of Directors based on the recommendation of the Compensation Committee, with the input of the President and Chief Executive Officer. Compensation levels for all executive officers are determined based on the performance of the Company, performance judgments as to the past and future contributions of the individual officers and compensation paid to executives in similar positions in the industry.

Short-term incentive compensation for executive officers under the Executive Bonus Plan is related to the financial performance of the Company, namely return on equity. The Board establishes return on equity goals and sets the incentive amount as a percentage of annual salary. The amount of short-term incentive compensation increases when financial performance exceeds the approved goals.

Each year, the Committee also considers the desirability of granting long-term incentive awards under the Company’s 2003 Stock Incentive Plan. The Committee believes that equity compensation focuses the Company’s executive officers on building profitability and shareholder value by offering them ownership in the Company. In fixing the grants of equity compensation to executive officers, the Committee reviews recommended individual awards with the Chief Executive Officer, taking into account the respective scope of accountability and contributions of each executive officer.

The Board and the Compensation Committee establish overall compensation using both objective and subjective criteria based on the factors noted above. With respect to the objective portion of the performance evaluation, the Compensation Committee specifically considers the growth in earnings per share and the relative level of return on equity. The subjective component focuses on the Committee’s perception of the performance by the executive officer of his or her individual responsibilities as defined by the Committee and in comparison to the compensation paid to persons in comparable positions within the industry.

Compensation Committee

Robert W. Smalley, Jr., Chairman

James T. Vickers

Randall G. Vinson

Compensation Committee Interlocks and Insider Participation

All members of the Compensation Committee are Directors of the Bank. No member of the Compensation Committee is a current or former officer of the Company or any of its subsidiaries. In addition, there are no compensation committee interlocks with other entities with respect to any such member.

8

Executive Compensation

The following table shows the cash compensation paid by the Bank, as well as certain other compensation paid or accrued, for the years ended December 31, 2003, 2002 and 2001 to each of the named executive officers in all capacities in which he or she served:

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term

Compensation

| | | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual Compensation ($)(1)

| | Restricted Stock Award(s) ($)(2)

| | Securities Underlying Options/ SARs (#)

| | All Other

Compensation

($)

| |

John R. Milleson President and Chief Executive Officer | | 2003

2002

2001 | | 150,000

112,000

105,000 | | 71,026

25,116

1,713 | | —

—

— | | 41,220

—

— | | 2,000

—

— | | 4,499

6,234

3,231 | (3)

|

| | | | | | | |

Jeffrey S. Boppe Senior Vice President and Senior Loan Officer, Bank of Clarke County | | 2003

2002

2001 | | 120,000

90,000

82,000 | | 23,449

21,974

8,987 | | —

—

— | | 19,236

—

— | | 1,000

—

— | | 2,460

2,459

2,454 | (3)

|

| | | | | | | |

Elizabeth M. Pendleton Senior Vice President and Trust Officer, Bank of Clarke County | | 2003

2002

2001 | | 100,000

91,000

85,000 | | 23,722

22,218

9,313 | | —

—

— | | 19,236

—

— | | 1,000

—

— | | 3,000

2,730

2,550 | (3)

|

| | | | | | | |

James W. McCarty, Jr. Vice President and Chief Financial Officer | | 2003

2002

2001 | | 93,000

77,500

71,500 | | 20,197

18,921

7,825 | | —

—

— | | 19,236

—

— | | 1,000

—

— | | 2,790

2,145

2,097 | (3)

|

| (1) | The aggregate of this compensation does not exceed the lesser of $50,000 or 10% of the total salary and bonus for the named executive. |

| (2) | On December 31, 2003 Mr. Milleson held 900 shares and Mr. Boppe, Mrs. Pendleton and Mr. McCarty each held 420 shares of restricted stock. The amount of restricted stock awards was calculated by multiplying the number of restricted shares held by the closing price of a share of Common Stock as reported on the Over-the-Counter Bulletin Board on December 31, 2003. Restricted shares vest in one-third installments commencing on October 1, 2004. All restricted shares of the Company’s Common Stock have voting rights and are entitled to dividends at the same rate as unrestricted shares of the Company’s Common Stock. |

| (3) | Amount of matching contributions to the 401(k) Savings Plan for 2003. |

9

Option Grants

The following table sets forth for the year ended December 31, 2003 the grants of stock options to the named executive officers:

Option Grants in Last Fiscal Year

| | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted(#)(1)

| | Percent of Total

Options Granted

to Employees in

2003(%)(2)

| | Exercise

or Base

Price ($/

Share)

| | Expiration

Date

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Price

Appreciation for

Option Term

|

| | | | | | 5%($)

| | 10%($)

|

John R. Milleson | | 2,000 | | 30.77 | | 43.26 | | 10/1/2013 | | 54,412 | | 137,890 |

Jeffrey S. Boppe | | 1,000 | | 15.38 | | 43.26 | | 10/1/2013 | | 27,206 | | 68,945 |

Elizabeth M. Pendleton | | 1,000 | | 15.38 | | 43.26 | | 10/1/2013 | | 27,206 | | 68,945 |

James W. McCarty, Jr. | | 1,000 | | 15.38 | | 43.26 | | 10/1/2013 | | 27,206 | | 68,945 |

| (1) | Stock options were granted at or above the fair market value of the shares of Common Stock at the date of award. Each grant becomes exercisable as follows: one-third of the shares on the first, second and third anniversaries of the date of grant. |

| (2) | Options to purchase 6,500 shares of Common Stock were granted to employees during the year ended 12/31/03. |

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year End Option Values

| | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized

($)

| | Number of Securities Underlying

Unexercised Options at

Fiscal Year End (#)

| | Value of Unexercised In-the-Money Options at

Fiscal Year End ($)(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

John R. Milleson | | — | | — | | — | | 2,000 | | — | | 5,080 |

Jeffrey S. Boppe | | — | | — | | — | | 1,000 | | — | | 2,540 |

Elizabeth M. Pendleton | | — | | — | | — | | 1,000 | | — | | 2,540 |

James W. McCarty, Jr. | | — | | — | | — | | 1,000 | | — | | 2,540 |

| (1) | The value of in-the-money options at fiscal year end was calculated by determining the difference between the closing price of a share of Common Stock as reported on the Over-the-Counter Bulletin Board on December 31, 2003 and the exercise price of the options. |

10

Equity Compensation Plans

The following table sets forth information as of December 31, 2003, with respect to compensation plans under which shares of Common Stock are authorized for issuance.

| | | | | | | |

Plan Category

| | Number of Securities to

Be Issued upon

Exercise of

Outstanding Options,

Warrants and Rights

| | | Weighted Average Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Remaining Available for Future Issuance Under Equity Compensation Plans (1)

|

Equity Compensation Plans Approved by Shareholders: | | | | | | | |

2003 Stock Incentive Plan(2) | | 6,500 | (4) | | 43.26 | | 140,620 |

Equity Compensation Plans Not Approved by Shareholders(3) | | — | | | — | | — |

| | |

|

| |

| |

|

Total | | 6,500 | | | 43.26 | | 140,620 |

| | |

|

| |

| |

|

| (1) | Amounts exclude any securities to be issued upon exercise of outstanding options, warrants and rights, and restricted shares issued. |

| (2) | During the 2003 Annual Meeting of Shareholders, the Eagle Financial Services, Inc. Stock Incentive Plan (the “2003 Stock Incentive Plan”) was adopted, as approved by the Board of Directors on February 28, 2003. The 2003 Stock Incentive Plan authorizes the issuance of up to 150,000 shares of Common Stock and no shares may issued under this plan after February 27, 2013. |

| (3) | The Company does not have any equity compensation plans that have not been approved by shareholders. |

| (4) | This amount does not include 2,880 restricted shares issued under the 2003 Stock Incentive Plan. |

Employment Agreements

Certain named executive officers are parties to employment agreements effective January 1, 2004 that provide for service at their respective positions with the Bank. John R. Milleson’s contract is for an initial two-year term. However, on January 1, 2004 and each day thereafter the term of the agreement is renewed and extended by one year. Mr. Milleson’s employment contract provides for an initial base salary of $150,000, and he is eligible for base salary increases and bonuses as determined by the Executive Committee of the Board of Directors. Mr. Milleson’s employment may be terminated by the Bank with or without cause. If he resigns for “good reason” or is terminated “without cause” (as those terms are defined in the employment agreement), then the Company will be obligated to continue to provide the compensation and benefits specified in the agreement until the expiration of its term. The employment agreement also contains covenants not to compete for a specified period after he is no longer employed by the Company. The employment agreement will terminate in the event there is a change in control of the Company. If during the twelve months following the change in control, he is terminated “without cause” or resigns for “good reason”, he will receive an amount equal to 299% of his base salary, annual bonus and equivalent benefits.

The employment agreements for James W. McCarty, Jr., and Elizabeth M. Pendleton each have one year terms effective January 1, 2004. These contracts are for an initial term of one year and automatically extend by one year on December 31 of each year beginning in 2004. These agreements have substantially the same terms and conditions as Mr. Milleson’s, excluding the base salary amount and renewal term.

11

Retirement Benefits

Employee Pension Plan. The Company has a noncontributory pension plan that conforms to the Employee Retirement Income Security Act of 1974, as amended (ERISA). Under its current terms, benefits are based on the an employee’s average compensation during his or her employment. The pension plan provides for 20% vesting after three years of service and 20% for each additional year of service. An employee is 100% vested in the pension plan after seven years of service. The pension plan provides full benefits under normal retirement at age sixty-five and partial benefits for early retirement at age fifty-five with ten years of service. The benefits are payable in single or joint/survivor annuities, as well as a lump sum payment option upon retirement or separation of service (subject to limitations as described in the pension plan’s adoption agreement).

The following table shows the estimated annual benefits payable upon retirement based on the specified final annual salary and years of credited service classifications, assuming continuation of the present pension plan and retirement at age sixty-five.

| | | | | | | | | | |

| | | Years of Service

|

Final Annual Salary

| | 15

| | 20

| | 25

| | 30

| | 35

|

$ 50,000 | | $ 9,881 | | $12,303 | | $14,403 | | $16,394 | | $18,243 |

75,000 | | 16,438 | | 20,407 | | 23,898 | | 27,127 | | 30,045 |

100,000 | | 23,200 | | 28,835 | | 33,763 | | 38,232 | | 42,220 |

125,000 | | 29,962 | | 37,262 | | 43,627 | | 49,335 | | 54,391 |

150,000 | | 36,725 | | 45,690 | | 53,491 | | 60,437 | | 66,561 |

200,000 and above | | 49,379 | | 61,674 | | 72,348 | | 81,773 | | 90,036 |

Compensation under the plan is limited to $205,000 in 2004 by the Internal Revenue Code of 1986, as amended. The table below provides the estimated annual benefit payable under the pension plan upon retirement for the Company’s named executives as of December 31, 2003.

| | | | | |

Name

| | Estimated

Annual

Benefits

Payable

| | Vested Years of Service

|

John R. Milleson | | $ | 92,360 | | 19 |

Jeffrey S. Boppe | | | 75,528 | | 9 |

Elizabeth M. Pendleton | | | 32,586 | | 5 |

James W. McCarty, Jr. | | | 67,990 | | 11 |

Employee 401(k) Savings and Stock Ownership Plan. The Company sponsors a 401(k) savings and stock ownership plan (“KSOP”) under which eligible employees may choose to save up to 15% of their salary on a pretax basis, subject to certain IRS limits. The Company matches 50% (up to 6% of the employee’s salary) of employee contributions with the Company’s Common Stock or cash, as elected by each employee. The shares required for the matched contributions are provided by authorized but unissued Common Stock. The Board of Directors may, at its discretion, make contributions to the KSOP which will be used to purchase shares of the Company’s Common Stock. These shares are also provided by authorized but unissued Common Stock.

Transactions with Management

The officers, Directors, their immediate families and affiliated companies in which they are shareholders maintain normal relationships with the Company and the Bank. Loans made by the Bank are made in the ordinary course of business on the same terms, including interest rate and collateral, as those prevailing at the time for comparable transactions with others, and do not involve more than normal risks of collectibility or present other unfavorable features. On December 31, 2003, these persons and firms were indebted to the Bank for loans totaling $1,693,496.

12

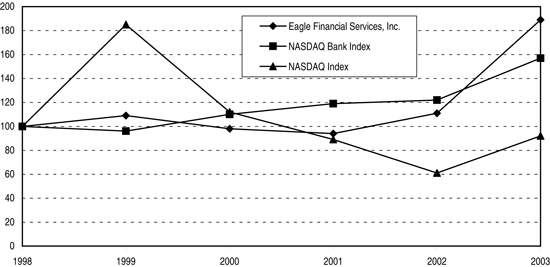

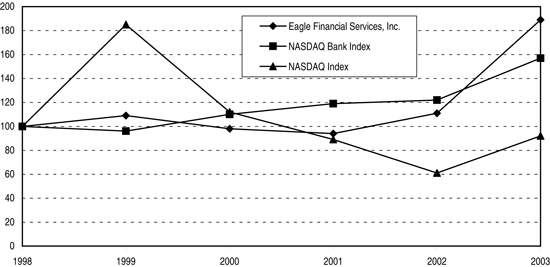

STOCK PERFORMANCE GRAPH

The following line graph compares the cumulative total return to the shareholders of the Company to the returns of the NASDAQ Bank Index and the NASDAQ Index for the last five years. The amounts in the table represent the value of the investment on December 31st of the year specified, assuming $100 was initially invested on December 31, 1998.

| | | | | | | | | | | | | | | | | | |

Index

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

Eagle Financial Services, Inc. | | $ | 100 | | $ | 109 | | $ | 98 | | $ | 94 | | $ | 111 | | $ | 189 |

NASDAQ Bank Index | | | 100 | | | 96 | | | 110 | | | 119 | | | 122 | | | 157 |

NASDAQ Index | | | 100 | | | 185 | | | 112 | | | 89 | | | 61 | | | 92 |

13

RELATIONSHIP WITH INDEPENDENT PUBLIC ACCOUNTANTS

The firm of Yount, Hyde & Barbour, P.C. has been selected by the Board of Directors as the independent accountants for the Company for the year 2004.

The firm of Yount, Hyde & Barbour, P.C. has served the Company, and the Bank prior to the establishment of the Company, since 1979. The independent accountants have no direct or indirect financial interest in the Company. Representatives of the firm of Yount, Hyde & Barbour, P.C. are expected to be present at the Annual Meeting, will have the opportunity to make a statement, if they desire to do so, and are expected to be available to respond to appropriate questions from the shareholders.

AUDIT INFORMATION

Audit Committee Report

The Audit Committee’s Report to the Shareholders, which follows, was approved and adopted by the Committee on March 9, 2004.

The Audit Committee has reviewed and discussed the audited financial statements with management and discussed the matters required by SAS 61 with the independent auditors. In addition, the Audit Committee has received from the independent auditors the written disclosures required by Independence Standards Board Standard No. 1 and discussed with them their independence from the Company and its management. Based on such reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Form 10-K filed by the Company.

During 2003 the Audit Committee approved a Communications Policy to enact Sections 301 and 806 of the Sarbanes-Oxley Act of 2002. This policy was adopted by the Board of Directors as a section of the Bank’s Personnel Policy. The Communications Policy provides guidance to all employees on reporting concerns regarding accounting or auditing matters directly to the Audit Committee. Further, the policy notifies employees that the Company is prohibited from retaliating against an employee who reports a concern and/or assists with the investigation of that concern.

Audit Committee

Randall G. Vinson, Chairman

Thomas T. Byrd

Mary Bruce Glaize

James R. Wilkins, Jr.

Fees of Independent Public Accountants

Audit Fees. The aggregate fees billed by Yount, Hyde & Barbour, P.C. for professional services rendered for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 2003 and 2002, and for the review of the financial statements included in the Quarterly Reports on Form 10-Q for those fiscal years were $47,250 for 2003 and $44,167 for 2002.

Audit Related Fees. The aggregate fees billed by Yount, Hyde & Barbour, P.C. for professional services for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and not reported under the heading “Audit Fees” above for the fiscal years ended December 31, 2003 and December 31, 2002 were $34,239 and $18,377, respectively. During 2003, these services included an Information Technology systems audit, a FHLB collateral verification audit, agreed-upon procedures related to the Trust Department’s Regulation 9 examination, agreed-upon procedures for the Bank’s

14

ACH function as required by NACHA, agreed upon procedures for Public Funds as required by the Commonwealth of Virginia and consultation concerning financial accounting and reporting standards and other related issues. During 2002, these services included a FHLB collateral verification audit, agreed-upon procedures related to the Trust Department’s Regulation 9 examination, agreed-upon procedures for the Bank’s ACH function as required by NACHA, agreed upon procedures for Public Funds as required by the Commonwealth of Virginia and consultation concerning financial accounting and reporting standards and other related issues.

Tax Fees. The aggregate fees billed by Yount, Hyde & Barbour, P.C. for professional services for tax compliance, tax advice and tax planning for the fiscal years ended December 31, 2003 and December 31, 2002 were $4,850 and $4,620, respectively. During 2003 and 2002, these services included preparation of federal and state income tax returns.

All Other Fees. The aggregate fees billed by Yount, Hyde & Barbour, P.C. for all other services rendered to the Company for the fiscal year ended December 31, 2002 totaled $17,850. During 2002, these other services represented agreed-upon procedures for the internal audit function. There were no other fees billed by Yount, Hyde & Barbour, P.C. during the fiscal year ended December 31, 2003.

Audit Committee Pre-Approval Policy

The Audit Committee is responsible for the appointment, compensation and oversight of the work performed by the Company’s independent auditor. The Audit Committee, or a designated member of the committee, must pre-approve all audit (including audit related) and non-audit services performed by the independent auditor in order to ensure that the provisions of such services does not impair the auditor’s independence. Any interim pre-approval of permitted non-audit services is required to be reported to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent auditor to management.

SHAREHOLDER PROPOSALS FOR 2005 ANNUAL MEETING

Under the regulations of the Securities and Exchange Commission, any shareholder desiring to make a proposal to be acted upon at the 2005 Annual Meeting of Shareholders must cause such proposal to be delivered, in proper form, to the Secretary of the Company, whose address is P.O. Box 391, Berryville, Virginia 22611, no later than November 30, 2004, in order for the proposal to be considered for inclusion in the Company’s Proxy Statement. The Company anticipates holding the 2005 Annual Meeting on April 20, 2005.

The Company’s Bylaws also prescribe the procedure a shareholder must follow to nominate Directors or to bring other business before shareholders’ meetings. For a shareholder to nominate a candidate for Director or to bring other business before a meeting, written notice must be received by the Company not less than 60 days and not more than 90 days prior to the date of the meeting. Based on an anticipated meeting date of April 20, 2005 for the 2005 Annual Meeting of Shareholders, the Company must receive such notice no later than February 19, 2005 and no earlier than January 20, 2005. If shareholders receive notice less than 70 days prior to the meeting or public disclosure of the meeting date is made less than 70 days prior to the meeting, written notice must be received by the Company not later than the close of business on the tenth day following the day on which such notice of the date of the Annual Meeting was made or such public disclosure was made.

Notice of a nomination for Director must describe various matters regarding the nominee and the shareholder giving notice. Notice of other business to be brought before the meeting must include a description of the proposed business, the reasons therefor, and other specific matters.

15

ANNUAL REPORT AND FINANCIAL STATEMENTS

THE COMPANY’S 2003 ANNUAL REPORT TO SHAREHOLDERS (THE “ANNUAL REPORT”), WHICH INCLUDES A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2003 (EXCLUDING EXHIBITS) AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, IS BEING MAILED TO SHAREHOLDERS WITH THIS PROXY STATEMENT. A COPY OF THE ANNUAL REPORT MAY ALSO BE OBTAINED WITHOUT CHARGE BY WRITING TO JAMES W. McCARTY, JR., SECRETARY OF THE COMPANY, WHOSE ADDRESS IS P.O. BOX 391, BERRYVILLE, VIRGINIA 22611. THE ANNUAL REPORT IS NOT PART OF THE PROXY SOLICITATION MATERIALS.

OTHER MATTERS

Management is not aware of any matters to be presented for action at the meeting other than as set forth herein. If any other matters properly come before the meeting, or any adjournment thereof, the person or persons voting the proxies will vote them in accordance with their best judgment.

By Order of the Board of Directors

James W. McCarty, Jr.

Vice President, Chief Financial Officer and Secretary-Treasurer

March 30, 2004

16

ATTACHMENT A

Eagle Financial Services, Inc.

Audit Committee Charter

I. AUTHORITY AND MEMBERSHIP

The Committee shall be a joint committee of the Boards of Directors of Eagle Financial Services, Inc. (the “Company”) and of Bank of Clarke County, an Virginia banking Company (the “Bank”). The members of the Committee are appointed annually by the Chairman of the Board of Directors of the Company. The members shall serve until their successors are duly elected and qualified by the Board. The Board determines the number of members in the Committee from time to time, but the number will not be less than three (3). Committee members must fully satisfy independence and experience requirements as prescribed by Section 10A of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules and regulations of the Securities and Exchange Commission (“SEC”). No member of the Committee may be an “affiliated person” of the Company or any of its subsidiaries (as defined in the federal securities laws) nor may any member of the Committee simultaneously serve on the audit committee of more than two other public companies or on the audit committee of any financial institution not affiliated with the Bank.

Director’s fees are the only compensation that a Committee member may receive directly or indirectly from or on behalf of the Company.

The Chairman will appoint one of the members of the Committee to serve as Committee Chair. The Committee may also appoint a Secretary, who need not be a Director.

In addition to the Company, the Committee is the audit committee for the Bank and has the responsibility, fiduciary duty and authority to oversee the management, financial statements and audit functions of the Bank. In that capacity, the Committee will receive official reports of management and the internal and external auditors regarding financial reporting, internal controls and other matters as discussed herein of the Bank as well as the Company.

The Committee has the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other advisors. The Committee shall also have the authority, to the extent it deems necessary or appropriate, to ask the Company to provide the Committee with the support of one or more Company employees to assist it in carrying out its duties. The Company shall provide for appropriate funding, as determined solely by the Committee, for payment of the ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties, as well as compensation to the independent auditors for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company and compensation to independent counsel or any other advisors employed by the Committee. The Committee may request any officer or employee of the Company or the Company’s outside counsel, independent auditors or other advisors to attend a meeting of the Committee or to meet with any members of, or consultant to, the Committee.

The Committee is directly and solely responsible for the appointment, compensation, and oversight of the work of the independent auditor (including resolution of disagreements between management and the auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The independent auditors shall report directly to the Committee.

The Committee is also responsible for the appointment, compensation, and oversight of the Company’s internal audit function.

17

II. PURPOSES OF THE COMMITTEE

The Committee’s primary purposes are to:

| | • | Oversee the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. |

| | • | Provide assistance to the Company’s Board of Directors by monitoring: |

| | • | the integrity of the financial statements of the Company, |

| | • | the independent auditors’ qualifications and independence, |

| | • | the performance of the Company’s and its subsidiaries’ internal audit function and independent auditors, |

| | • | the Company’s system of internal controls, and |

| | • | the Company’s financial reporting and system of disclosure controls. |

| | • | Provide assistance to the Bank’s Board by monitoring: |

| | • | the integrity of the financial statements of the Bank, |

| | • | the Bank’s system of internal controls, |

| | • | the Bank’s financial reporting, and |

| | • | the compliance by the Bank with applicable legal and regulatory requirements. |

| | • | Prepare the Committee report required by the rules of the SEC to be included in the Company’s annual proxy statement. |

With respect to joint sessions of the Committee:

| | • | The Committee may meet simultaneously as a committee of the Company and the Bank, though it should hold separate sessions if necessary to address issues that are relevant to one entity but not the other(s) or to consider transactions between the entities or other matters where the Company and its subsidiary may have different interests; and |

| | • | The Committee should consult with outside counsel if, in the opinion of the Committee, any matter under consideration by the Committee has the potential for any conflict between the interests of the Company and its subsidiary in order to ensure that appropriate procedures are established for addressing any such potential conflict and for ensuring compliance with the Company’s policies regarding Sections 23A and 23B of the Federal Reserve Act. |

The Committee’s job is one of oversight as set forth in this charter. It is not the duty of the Committee to prepare the Company’s or the Bank’s financial statements, to plan or conduct audits, or to determine that the Company’s or the Bank’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles (“GAAP”). The Company’s and the Bank’s management are responsible for preparing such financial statements and for maintaining internal controls, and the independent auditors are responsible for auditing the financial statements. Nor is it the duty of the Committee to conduct investigations or to assure compliance with laws and regulations and the Company’s Code of Ethics.

III. RESPONSIBILITIES OF THE COMMITTEE

A. Charter Review

| | • | Review and reassess the adequacy of this charter at least annually and recommend to the Board any proposed changes to this charter; and |

| | • | Publicly disclose the charter and any such amendments at the times and in the manner as required by the SEC and/or any other regulatory body or stock exchange having authority over the Company, and in all events post such charter and amendments to the Company’s website. |

18

B. Company Financial Reporting / Internal Controls

| | • | Review and discuss with the internal auditors and the independent auditors their respective annual audit plans, reports and the results of their respective audits; |

| | • | Review and discuss with management and the independent auditors the Company’s quarterly financial statements and its Form 10-Q (prior to filing the same as required by the Exchange Act), including disclosures made in the section regarding management’s discussion and analysis, the results of the independent auditors’ reviews of the quarterly financial statements, and determine whether the quarterly financial statements should be included in the Company’s Form 10-Q; |

| | • | Review and discuss with management and the independent auditors the Company’s annual audited financial statements and its Form 10-K (prior to filing the same as required by the Exchange Act), including disclosures made in the section regarding management’s discussion and analysis, and recommend to the Board whether the audited financial statements should be included in the Company’s Form 10-K; |

| | • | Review and discuss with management and, where appropriate, the independent auditors, the Company’s financial disclosures in its registration statements, press releases, earnings releases, current reports, real time disclosures, call reports or other public disclosures before the same are filed, posted, disseminated or released (including the use of “pro forma” or “adjusted” non-GAAP information and all related reconciliations to GAAP information) and any earnings guidance, as well as all financial information provided to rating agencies and/or securities analysts including presentations at industry, investor or other conferences; |

| | • | Review and discuss with the Company’s Chief Executive Officer and Chief Financial Officer all matters such officers are required to certify in connection with the Company’s Form 10-Q and 10-K or other filings or reports; |

| | • | Discuss with management and the independent auditors significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements, including any significant changes in the Company’s selection or application of accounting principles, the development, selection and disclosure of critical accounting estimates and principles and the use thereof, and analyses of the effect of alternative assumptions, estimates, principles or generally accepted accounting principles (“GAAP”) methods on the Company’s financial statements; |

| | • | Discuss with management and the independent auditors the effect of regulatory and accounting initiatives and off-balance sheet transactions on the Company’s financial statements, conditions or results and any necessary disclosures related thereto; |

| | • | Discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies; |

| | • | Discuss with the independent auditors the matters required to be discussed by Statement of Auditing Standards No. 90, Audit Committee Communications; |

| | • | Ensure that the Company’s independent auditors report to the Committee all of the Company’s critical accounting policies and procedures and alternative accounting treatments of financial information within GAAP that have been discussed with management, including the ramifications of the use of such alternative treatments and disclosures and the treatment preferred by the independent auditors; |

| | • | Ensure that the Company’s independent auditors share with the Committee all material written communication between the auditors and management; |

| | • | Discuss with the Company’s independent auditors, internal auditors, and management their assessments of the adequacy of the Company’s internal controls and disclosure controls and procedures; |

| | • | Assess whether management is resolving any significant internal control weaknesses diligently; |

| | • | Discuss with the Company’s independent auditors, internal auditors and management, as appropriate, any significant weaknesses or deficiencies that any of the foregoing have identified relating to financial reporting, internal controls or other related matters and their proposals for rectifying such weaknesses or deficiencies; |

| | • | Monitor the Company’s progress in promptly addressing and correcting any significant identified weaknesses or deficiencies in financial reporting, internal controls or related matters; |

19

| | • | Receive periodic reports from the independent auditors and appropriate officers of the Company on significant accounting or reporting developments proposed by the Financial Accounting Standards Board or the SEC that may impact the Company; and |

| | • | Receive periodic reports from independent auditors and appropriate officers of the Company on significant financial reporting, internal controls or other related matters of the Company’s subsidiaries. |

C. Bank Financial Reporting / Internal Controls

| | • | Review, discuss with management (and, if deemed necessary, the internal and external auditors) and approve the Bank’s financial statements, any reports required by the Bank’s State of incorporation, and the Bank’s representations made to the Company regarding the same; |

| | • | Discuss with management (and, if deemed necessary, the internal and external auditors) significant financial reporting issues and significant accounting policies and judgments made in connection with the preparation of the Bank’s financial statements and call reports, including any significant changes in the Bank’s selection or application of accounting principles; |

| | • | Discuss with management and the internal auditors the effect of regulatory and accounting initiatives and off-balance sheet transactions on the Bank’s financial statements and any necessary disclosures related thereto; |

| | • | Review all material written communication between the independent auditors and Bank management; |

| | • | Discuss with the Bank’s internal auditors and management their assessments of the adequacy of the Bank’s internal controls, including an assessment of whether management is diligently resolving any internal control weaknesses; |

| | • | Discuss with the Bank’s internal auditors and management any weaknesses or deficiencies that any of the foregoing have identified relating to financial reporting, internal controls or other related matters and management’s proposals for rectifying such weaknesses or deficiencies; |

| | • | Monitor the Bank’s progress in promptly addressing and correcting any and all identified weaknesses or deficiencies in financial reporting, internal controls or related matters; and |

| | • | Discuss with management and the internal auditors the Bank’s compliance with applicable laws and regulations and from time to time advise the Board of Directors with respect to the same. |

D. Bank Trust Department Audit

| | • | Direct and oversee the annual fiduciary audit of the Bank’s Trust Department; |

| | • | Receive and review reports of management regarding the Bank’s controls for transaction, reputation, and compliance risks as they relate to the Bank’s Trust Department; and |

| | • | Perform any other duties required to be performed by an audit committee for the Bank’s Trust Department in the manner required by applicable laws and regulations. |

E. Independent Auditors

| | • | Hire, fire, compensate, review and oversee the work of the independent auditors (including resolution of disagreements between management and the auditors regarding financial reporting); |

| | • | Review the experience, rotation and qualifications of the senior members of the independent auditors’ team; |

| | • | Monitor the independence, qualifications and performance of the independent auditors by, among other things: |

| | • | Obtaining and reviewing a report from the independent auditors at least annually regarding (a) the independent auditors’ internal quality-control procedures, (b) any material issues raised by the most recent quality-control review, or peer review, of the independent auditors, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the same, (c) any steps taken to deal with any such issues, and (d) all relationships between the independent auditors and the Company; |

20

| | • | Evaluating the qualifications, performance and independence of the independent auditors, including considering whether the auditors’ quality controls are adequate and whether the provision of any non-audit services is compatible with maintaining the auditors’ independence, and taking into account the opinions of management and the internal auditors; |

| | • | Establishing and overseeing restrictions on the actions of directors, officers, or employees of the Company in illegally influencing, coercing, manipulating or misleading the Company’s independent auditors including violations of Rule 13b2-2 promulgated under the Exchange Act; and |

| | • | If so determined by the Committee, taking additional action to satisfy itself of the qualifications, performance and independence of the auditors. |

| | • | Meet with the independent auditors prior to each annual audit to discuss the planning and staffing of the audit; |

| | • | Review and approve the independent annual audit plan as well as material changes thereto quarterly; |

| | • | Pre-approve all audit services, audit-related services and permitted non-audit services to be performed for the Company by the independent auditors. In no event shall the independent auditors perform any non-audit services for the Company which are prohibited by Section 10A(g) of the Exchange Act or the rules of the SEC or the Public Company Accounting Oversight Board (or other similar body as may be established from time to time). The Committee shall establish general guidelines for the permissible scope and nature of any permitted non-audit services in connection with its annual review of the independent auditors’ audit plan and shall review such guidelines with the Board. Pre-approval may be granted by action of the full Committee or, in the absence of such Committee action, by the Committee Chair whose action shall be considered to be that of the entire Committee. Approvals of a non-audit service to be performed by the auditors and, if applicable, the guidelines pursuant to which such services were approved, shall be disclosed when required as promptly as practicable in the Company’s quarterly or annual reports required by Section 13(a) of the Exchange Act; |

| | • | Oversee the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit at least once every five years and considering whether, in order to assure continuing auditor independence, it is appropriate to rotate the auditing firm itself from time to time; |

| | • | Recommend to the Board policies for the Company’s hiring of employees or former employees of the independent auditors who participated in any capacity in an audit of the Company, including in particular the prohibition on employment under Section 10A(1) of the Exchange Act as chief executive officer, controller, chief financial officer, chief accounting officer, or any person serving in an equivalent position for the Company, during the preceding one-year period; and |

| | • | Ensure that the independent auditors have access to all necessary Company personnel, records or other resources. |

F. Internal Audit Function

| | • | Review and approve the Internal Audit Policy, as well as any material changes thereto annually; |

| | • | Review and approve the annual risk assessment, as well as material changes thereto quarterly; |

| | • | Review and approve the internal annual audit plan, as well as any material changes to the internal audit plan quarterly; |

| | • | Receive and review internal audit reports regarding: |

| | • | execution of the internal audit plan quarterly; |

| | • | achievement of annual audit plan; |

| | • | issues that result in a less than satisfactory audit rating, along with management’s proposed corrective actions and the status of that corrective action at each meeting, until the issue is closed by the internal audit department; |

| | • | outstanding audit findings and/or issues by rating, as well as those which are past-due or have been re-aged, systemic issues which are pervasive or persistent across audits and over time, as well as trends in issues (volume, ratings, by line of business, etc); |

| | • | significant trends of risk exposures and control matters; |

| | • | significant governance issues that arise in the course of performing audits; |

21

| | • | any unwarranted restriction on access by internal auditors to all Company activities, records, property, and personnel; |

| | • | any potential fraud involving management or employees who are significantly involved in the internal controls of the Company as necessary; |

| | • | materials relative to significant industry, accounting, risk management or internal control matters that impact audit scope or emphasis. |

| | • | Ensure that the internal auditors have access to all necessary Company resources. |

G. Compliance Oversight

| | • | Review procedures designed to identify related party transactions that are material to the financial statements or otherwise require disclosure; |

| | • | Establish procedures and require the Company to obtain or provide the necessary resources and mechanisms for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters; |

| | • | Discuss with management and the independent auditors any correspondence with regulators or governmental agencies and any employee complaints or published reports which raise material issues regarding the Company’s financial statements or accounting policies; and |

| | • | Discuss legal matters that may have a material impact on the financial statements and that may have an impact on the Company’s compliance policies with the Company’s attorney. |

H. General

| | • | Meet as often as the Committee or the Committee Chair determines, but not less frequently than quarterly; |

| | • | On a regular basis, as appropriate, meet separately with management, the internal auditors, and with the independent auditors; |

| | • | Report to the Board on the Committee’s activities at each Board meeting; |

| | • | Maintain minutes or other records of the Committee’s meetings and activities; |

| | • | Review and assess the quality and clarity of the information provided to the Committee and make recommendations to management, the internal auditors and the independent auditors as the Committee deems appropriate from time to time for improving such materials; |

| | • | Form and delegate authority to subcommittees or members when appropriate; |

| | • | Prepare the audit committee report to be included in the Company’s proxy statement when and as required by the rules of the SEC; and |

| | • | Annually review the performance of the Committee. |

In performing their duties and responsibilities, Committee members are entitled to rely in good faith on information, opinions, reports or statements prepared or presented by:

| | • | One or more officers or employees of the Company whom the Committee member reasonably believes to be reliable and competent in the matters presented; |

| | • | Counsel, independent auditors, or other persons as to matters which the Committee member reasonably believes to be within the professional or expert competence of such person; or |

| | • | Another committee of the Board as to matters within its designated authority which committee the Committee member reasonably believes to merit confidence. |

22

ANNUAL MEETING OF SHAREHOLDERS OF

EAGLE FINANCIAL SERVICES, INC.

April 21, 2004

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

¯ Please detach along perforated line and mail in the envelope provided.¯

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF DIRECTORS.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x

| | | | |

1. Election of Directors: a) For a Three (3) Year Term | | 2. To vote in accordance with their best judgment on such other business, if any, that may properly come before the meeting. |

| | |

¨ FOR ALL NOMINEES ¨ WITHHOLD AUTHORITY FOR ALL NOMINEES ¨ FOR ALL EXCEPT (See instructions below) | | NOMINEES: ¨ THOMAS T. GILPIN ¨ ROBERT W. SMALLEY, JR. ¨ JAMES T. VICKERS ¨ JOHN R. MILLESON | | This proxy when properly executed will be voted in the manner directed herein by the shareholder. If no direction is made, this proxy will be voted for the nominees for election of directors listed in item 1. PLEASE SIGN AND DATE BELOW. PLEASE RETURN PROMPTLY IN THE ENCLOSED POSTAGE PAID ENVELOPE. |

| | | | |

INSTRUCTION: | | To withhold authority to vote for any individual nominee(s), mark“FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: · | | |

| | | | | | |

| | | |

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered names(s) on the account may not be submitted via this method. | | ¨ | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Signature of Shareholder | | _______________________ | | Date: | | __________ | | Signature of Shareholder | | ___________ | | Date: | | _____ |

| | | | | | | | | | | | | | | | | | | | |

Note: | | Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holders should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |

EAGLE FINANCIAL SERVICES, INC.

Proxy for 2004 Annual Meeting of Shareholders Solicited on behalf of the Board of Directors

The undersigned hereby constitutes and appoints Messrs. Thomas T. Byrd, Lewis M. Ewing and Randall G. Vinson, or any one of them, attorneys and proxies, with the power of substitution in each, to act for the undersigned, as designated below, with respect to all of the Corporation’s Common Stock of the undersigned at the Annual Meeting of Shareholders to be held at the John H. Enders Fire Company Social Hall on Wednesday, April 21, 2004 at Noon, and at any adjournment thereof.

(Continued and to be signed on the reverse side)