UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06453

Fidelity Court Street Trust II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | November 30 |

|

|

Date of reporting period: | May 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity® New Jersey Municipal Money Market Fund

Semi-Annual Report

May 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544, or for Institutional, call 1-877-208-0098, to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

| Current 7-Day Yields |

| | | |

| Fidelity® New Jersey Municipal Money Market Fund | 2.88% | |

| Institutional Class | 3.10% | |

| Premium Class | 3.00% | |

| | | |

Yield refers to the income paid by the Fund over a given period. Yield for money market funds is usually for seven-day periods, as it is here, though it is expressed as an annual percentage rate. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending May 31, 2023, the most recent period shown in the table, would have been 3.05% for Institutional Class. | |

| Effective Maturity Diversification (% of Fund's Investments) |

| Days |

| 1 - 7 | 72.1 | |

| 8 - 30 | 9.9 | |

| 31 - 60 | 2.3 | |

| 61 - 90 | 2.3 | |

| 91 - 180 | 3.0 | |

| > 180 | 10.4 | |

| Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

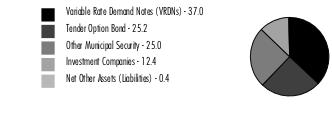

Asset Allocation (% of Fund's net assets) |

|

|

Showing Percentage of Net Assets

| Variable Rate Demand Note - 37.0% |

| | | Principal Amount (a) | Value ($) |

| Alabama - 1.0% | | | |

| Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 4% 6/7/23, VRDN (b)(c) | | 900,000 | 900,000 |

| West Jefferson Indl. Dev. Board Solid Waste Disp. Rev. (Alabama Pwr. Co. Miller Plant Proj.) Series 2008, 4.15% 6/1/23, VRDN (b)(c) | | 7,735,000 | 7,735,000 |

TOTAL ALABAMA | | | 8,635,000 |

| Arizona - 0.3% | | | |

| Maricopa County Poll. Cont. Rev.: | | | |

| (Arizona Pub. Svc. Co. Palo Verde Proj.) Series 2009 A, 3.63% 6/7/23, VRDN (b) | | 400,000 | 400,000 |

| Series 2009 C, 3.65% 6/7/23, VRDN (b) | | 1,900,000 | 1,900,000 |

TOTAL ARIZONA | | | 2,300,000 |

| Arkansas - 0.0% | | | |

| Blytheville Indl. Dev. Rev. (Nucor Corp. Proj.) Series 1998, 4.07% 6/7/23, VRDN (b)(c) | | 300,000 | 300,000 |

| Georgia - 0.1% | | | |

| Bartow County Dev. Auth. (Georgia Pwr. Co. Plant Bowen Proj.) Series 2022, 4.2% 6/1/23, VRDN (b)(c) | | 1,200,000 | 1,200,000 |

| Kansas - 0.3% | | | |

| Burlington Envir. Impt. Rev. (Kansas City Pwr. and Lt. Co. Proj.): | | | |

| Series 2007 A, 3.48% 6/7/23, VRDN (b) | | 100,000 | 100,000 |

| Series 2007 B, 3.48% 6/7/23, VRDN (b) | | 300,000 | 300,000 |

| St. Mary's Kansas Poll. Cont. Rev. (Kansas Gas and Elec. Co. Proj.) Series 1994, 3.45% 6/7/23, VRDN (b) | | 1,100,000 | 1,100,000 |

| Wamego Kansas Poll. Cont. Rfdg. Rev.: | | | |

| (Kansas Gas & Elec. Co. Proj.) Series 1994, 3.45% 6/7/23, VRDN (b) | | 100,000 | 100,000 |

| (Western Resources, Inc. Proj.) Series 1994, 3.45% 6/7/23, VRDN (b) | | 500,000 | 500,000 |

TOTAL KANSAS | | | 2,100,000 |

| Kentucky - 0.2% | | | |

| Daviess County Exempt Facilities Rev. (Kimberly-Clark Tissue Co. Proj.) Series 1999, 3.45% 6/7/23 (Kimberly-Clark Corp. Guaranteed), VRDN (b)(c) | | 1,800,000 | 1,800,000 |

| Louisiana - 0.7% | | | |

| Saint James Parish Gen. Oblig. (Nucor Steel Louisiana LLC Proj.) Series 2010 B1, 3.75% 6/7/23, VRDN (b) | | 6,400,000 | 6,400,000 |

| Nebraska - 0.0% | | | |

| Stanton County Indl. Dev. Rev. Series 1998, 4.07% 6/7/23, VRDN (b)(c) | | 100,000 | 100,000 |

| New Jersey - 31.2% | | | |

| New Jersey Econ. Dev. Auth. Natural Gas Facilities Rev. (South Jersey Gas Co. Proj.) Series 2006-1, 3.25% 6/7/23, LOC JPMorgan Chase Bank, VRDN (b)(c) | | 23,700,000 | 23,700,000 |

| New Jersey Econ. Dev. Auth. Rev. (Cooper Health Sys. Proj.) Series 2008 A, 3.5% 6/7/23, LOC TD Banknorth, NA, VRDN (b) | | 43,650,000 | 43,650,000 |

| New Jersey Health Care Facilities Fing. Auth. Rev.: | | | |

| (AHS Hosp. Corp. Proj.): | | | |

Series 2008 B, 3.38% 6/7/23, LOC Bank of America NA, VRDN (b) | | 39,940,000 | 39,940,000 |

Series 2008 C, 3.38% 6/7/23, LOC JPMorgan Chase Bank, VRDN (b) | | 22,160,000 | 22,160,000 |

| (Virtua Health Proj.): | | | |

Series 2004, 2.95% 6/7/23, LOC Wells Fargo Bank NA, VRDN (b) | | 28,090,000 | 28,090,000 |

Series 2009 D, 3.25% 6/7/23, LOC TD Banknorth, NA, VRDN (b) | | 7,275,000 | 7,275,000 |

Series 2009 E, 2.75% 6/7/23, LOC TD Banknorth, NA, VRDN (b) | | 8,050,000 | 8,050,000 |

| New Jersey Hsg. & Mtg. Fin. Agcy. Multi-family Rev. Series 2013 5, 3.52% 6/7/23, LOC Citibank NA, VRDN (b)(c) | | 42,475,000 | 42,475,000 |

| Union County Poll. Cont. Fing. Auth. Poll. Cont. Rev.: | | | |

| (Exxon Mobil Proj.) Series 1994, 3.93% 6/1/23 (Exxon Mobil Corp. Guaranteed), VRDN (b) | | 19,930,000 | 19,930,000 |

| (ExxonMobil Proj.) Series 1989, 3.88% 6/1/23 (Exxon Mobil Corp. Guaranteed), VRDN (b) | | 22,140,000 | 22,140,000 |

| FHLMC Essex County Impt. Auth. Multi-family Hsg. Rev. (Fern Sr. Hsg. Proj.) Series 2010, 3.41% 6/7/23, LOC Freddie Mac, VRDN (b) | | 11,300,000 | 11,300,000 |

TOTAL NEW JERSEY | | | 268,710,000 |

| New York And New Jersey - 2.9% | | | |

| Port Auth. of New York & New Jersey: | | | |

| Series 1992 2, 3.46% 6/30/23, VRDN (b)(d) | | 6,400,000 | 6,400,000 |

| Series 1995 3, 3.49% 6/30/23, VRDN (b)(c)(d) | | 4,800,000 | 4,800,000 |

| Series 1995 4, 3.49% 6/30/23, VRDN (b)(c)(d) | | 6,600,000 | 6,600,000 |

| Series 1997 1, 3.46% 6/30/23, VRDN (b)(d) | | 4,400,000 | 4,400,000 |

| Series 1997 2, 3.46% 6/30/23, VRDN (b)(d) | | 3,100,000 | 3,100,000 |

TOTAL NEW YORK AND NEW JERSEY | | | 25,300,000 |

| South Carolina - 0.3% | | | |

| Berkeley County Indl. Dev. Rev. (Nucor Corp. Proj.): | | | |

| Series 1995, 4.07% 6/7/23, VRDN (b)(c) | | 100,000 | 100,000 |

| Series 1997, 4.07% 6/7/23, VRDN (b)(c) | | 2,100,000 | 2,100,000 |

TOTAL SOUTH CAROLINA | | | 2,200,000 |

| Tennessee - 0.0% | | | |

| Memphis-Shelby County Indl. Dev. Board Facilities Rev. Series 2007, 4.07% 6/7/23, VRDN (b)(c) | | 50,000 | 50,000 |

| TOTAL VARIABLE RATE DEMAND NOTE (Cost $319,095,000) | | | 319,095,000 |

| | | | |

| Tender Option Bond - 25.2% |

| | | Principal Amount (a) | Value ($) |

| Colorado - 0.0% | | | |

| Denver City & County Arpt. Rev. Bonds Series G-114, 3.66%, tender 6/1/23 (Liquidity Facility Royal Bank of Canada) (b)(c)(d)(e)(f) | | 100,000 | 100,000 |

| Connecticut - 0.3% | | | |

| Connecticut Gen. Oblig. Participating VRDN Series Floaters 016, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 1,500,000 | 1,500,000 |

| Connecticut Spl. Tax Oblig. Trans. Infrastructure Rev. Bonds Series Floaters G 110, 3.59%, tender 10/2/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 600,000 | 600,000 |

TOTAL CONNECTICUT | | | 2,100,000 |

| District Of Columbia - 0.0% | | | |

| Metropolitan Washington DC Arpts. Auth. Sys. Rev. Participating VRDN Series Floaters XF 06 94, 3.53% 6/7/23 (Liquidity Facility Bank of America NA) (b)(c)(e)(f) | | 55,000 | 55,000 |

| Florida - 0.0% | | | |

| Greater Orlando Aviation Auth. Arpt. Facilities Rev. Bonds Series Floaters G 25, 3.66%, tender 10/2/23 (Liquidity Facility Royal Bank of Canada) (b)(c)(d)(e)(f) | | 100,000 | 100,000 |

| South Miami Health Facilities Auth. Hosp. Rev. Participating VRDN Series XM 08 68, 3.61% 6/7/23 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 100,000 | 100,000 |

| Tampa-Hillsborough County Expressway Auth. Rev. Bonds Series G-113, 3.61%, tender 7/3/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 100,000 | 100,000 |

TOTAL FLORIDA | | | 300,000 |

| Kentucky - 0.0% | | | |

| CommonSpirit Health Participating VRDN Series MIZ 90 21, 3.51% 6/7/23 (Liquidity Facility Mizuho Cap. Markets LLC) (b)(e)(f) | | 200,000 | 200,000 |

| Maryland - 0.1% | | | |

| Baltimore Proj. Rev. Bonds Series Floaters G 28, 3.61%, tender 1/2/24 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 100,000 | 100,000 |

| Maryland Stadium Auth. Rev. Bonds Series 2023, 3.61%, tender 11/1/23 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 400,000 | 400,000 |

TOTAL MARYLAND | | | 500,000 |

| New Jersey - 18.9% | | | |

| Hudson County Impt. Auth. Participating VRDN Series Floaters XG 02 22, 3.46% 6/7/23 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 2,130,000 | 2,130,000 |

| New Jersey Econ. Dev. Auth. Participating VRDN: | | | |

| Series 2022 YX 12 56, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 6,065,000 | 6,065,000 |

| Series XF 28 65, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 4,500,000 | 4,500,000 |

| Series XL 03 95, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 3,750,000 | 3,750,000 |

| New Jersey Econ. Dev. Auth. Lease Participating VRDN Series XF 23 57, 3.44% 6/7/23 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(e)(f) | | 7,375,000 | 7,375,000 |

| New Jersey Econ. Dev. Auth. Lease Rev. Participating VRDN Series Floaters XF 25 25, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 2,100,000 | 2,100,000 |

| New Jersey Econ. Dev. Auth. Natural Gas Facilities Rev. Participating VRDN Series XG 04 57, 3.51% 6/1/23 (Liquidity Facility Toronto-Dominion Bank) (b)(c)(e)(f) | | 1,835,000 | 1,835,000 |

| New Jersey Econ. Dev. Auth. Rev. Participating VRDN: | | | |

| Series Floaters XF 10 48, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 8,985,000 | 8,985,000 |

| Series Floaters XF 23 93, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 2,600,000 | 2,600,000 |

| Series Floaters XF 25 38, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 2,810,000 | 2,810,000 |

| Series Floaters XL 00 52, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 1,900,000 | 1,900,000 |

| Series YX 12 87, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 8,165,000 | 8,165,000 |

| New Jersey Edl. Facilities Auth. Rev. Participating VRDN Series 15 XF0149, 3.43% 6/7/23 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 8,000,000 | 8,000,000 |

| New Jersey Edl. Facility Participating VRDN Series Floaters XF 27 56, 3.44% 6/7/23 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 3,400,000 | 3,400,000 |

| New Jersey Health Care Facilities Fing. Auth. Rev. Participating VRDN: | | | |

| Series 2022 043, 4.16% 6/1/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 5,325,000 | 5,325,000 |

| Series 2022 ZL 03 42, 3.44% 6/7/23 (Liquidity Facility Wells Fargo Bank NA) (b)(e)(f) | | 2,015,000 | 2,015,000 |

| Series XF 27 02, 3.44% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 4,140,000 | 4,140,000 |

| New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev. Participating VRDN Series Floaters XG 01 78, 3.49% 6/7/23 (Liquidity Facility Bank of America NA) (b)(c)(e)(f) | | 2,810,000 | 2,810,000 |

| New Jersey Hsg. & Mtg. Fin. Agcy. Rev. Participating VRDN Series Floaters XG 02 28, 3.44% 6/7/23 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 6,325,000 | 6,325,000 |

| New Jersey Tpk. Auth. Tpk. Rev.: | | | |

| Bonds Series G 119, 3.59%, tender 1/2/24 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 1,000,000 | 1,000,000 |

| Participating VRDN: | | | |

Series 2022 XF 04 09, 3.44% 6/7/23 (Liquidity Facility Wells Fargo Bank NA) (b)(e)(f) | | 14,600,000 | 14,600,000 |

Series 2022 YX 12 46, 3.47% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 3,040,000 | 3,040,000 |

Series XM 10 96, 3.46% 6/7/23 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 18,600,000 | 18,600,000 |

| New Jersey Trans. Trust Fund Auth. Participating VRDN: | | | |

| Series Floaters XG 02 05, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 1,235,000 | 1,235,000 |

| Series Floaters XX 10 93, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 6,800,000 | 6,800,000 |

| Series XX 11 40, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 4,140,000 | 4,140,000 |

| Series YX 12 68, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 8,300,000 | 8,300,000 |

| Series YX 12 70, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 9,295,000 | 9,295,000 |

| Series YX 12 83, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 5,245,000 | 5,245,000 |

| Union County Impt. Auth. Rev. Participating VRDN Series Floaters XG 02 21, 3.45% 6/7/23 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 800,000 | 800,000 |

| Union County Util. Auth. Solid Waste Facilities Lease Rev. Participating VRDN Series ZF 24 79, 3.44% 6/7/23 (Liquidity Facility Citibank NA) (b)(e)(f) | | 5,845,000 | 5,845,000 |

TOTAL NEW JERSEY | | | 163,130,000 |

| Pennsylvania, New Jersey - 1.4% | | | |

| Delaware River Port Auth. Pennsylvania & New Jersey Rev. Participating VRDN Series YX 12 14, 3.45% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 12,265,000 | 12,265,000 |

| New York And New Jersey - 4.3% | | | |

| Port Auth. of New York & New Jersey Participating VRDN: | | | |

| Series 15 ZF0203, 3.48% 6/7/23 (Liquidity Facility JPMorgan Chase Bank) (b)(c)(e)(f) | | 1,675,000 | 1,675,000 |

| Series 2023 G, 3.47% 6/7/23 (Liquidity Facility Royal Bank of Canada) (b)(c)(e)(f) | | 1,800,000 | 1,800,000 |

| Series BC 22 023, 3.22% 6/1/23 (Liquidity Facility Barclays Bank PLC) (b)(c)(e)(f) | | 2,175,000 | 2,175,000 |

| Series Floaters XF 06 97, 3.44% 6/7/23 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 2,285,000 | 2,285,000 |

| Series Floaters XF 26 00, 3.44% 6/7/23 (Liquidity Facility Toronto-Dominion Bank) (b)(e)(f) | | 5,260,000 | 5,260,000 |

| Series MS 3321, 3.48% 6/7/23 (Liquidity Facility Toronto-Dominion Bank) (b)(c)(e)(f) | | 4,970,000 | 4,970,000 |

| Series ROC 14086, 3.46% 6/7/23 (Liquidity Facility Citibank NA) (b)(c)(e)(f) | | 200,000 | 200,000 |

| Series ROC II R 14077, 3.44% 6/7/23 (Liquidity Facility Citibank NA) (b)(e)(f) | | 6,000,000 | 6,000,000 |

| Series X3 03 37, 3.48% 6/7/23 (Liquidity Facility Bank of America NA) (b)(c)(e)(f) | | 2,800,000 | 2,800,000 |

| Series XF 31 09, 3.46% 6/7/23 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(c)(e)(f) | | 1,400,000 | 1,400,000 |

| Series XG 03 94, 3.48% 6/7/23 (Liquidity Facility Bank of America NA) (b)(c)(e)(f) | | 1,500,000 | 1,500,000 |

| Series XG 04 71, 4.03% 6/1/23 (Liquidity Facility JPMorgan Chase Bank) (b)(c)(e)(f) | | 3,940,000 | 3,940,000 |

| Series YX 11 78, 3.48% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(c)(e)(f) | | 400,000 | 400,000 |

| Series ZL 02 55, 3.48% 6/7/23 (Liquidity Facility Bank of America NA) (b)(c)(e)(f) | | 2,000,000 | 2,000,000 |

| Series ZL 02 56, 3.44% 6/7/23 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 370,000 | 370,000 |

| Series ZL 02 70, 3.48% 6/7/23 (Liquidity Facility Barclays Bank PLC) (b)(c)(e)(f) | | 600,000 | 600,000 |

TOTAL NEW YORK AND NEW JERSEY | | | 37,375,000 |

| Ohio - 0.0% | | | |

| Cuyahoga County Ctfs. of Prtn. Participating VRDN Series Floaters XG 02 06, 3.51% 6/7/23 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 100,000 | 100,000 |

| Ohio Univ. Gen. Receipts Athens Bonds Series Floaters G 27, 3.61%, tender 6/1/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 200,000 | 200,000 |

TOTAL OHIO | | | 300,000 |

| Pennsylvania - 0.1% | | | |

| Lehigh County Gen. Purp. Hosp. Rev. Participating VRDN Series BAML 23 50 39, 3.66% 7/5/23 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 400,000 | 400,000 |

| South Carolina - 0.0% | | | |

| South Carolina Trans. Infrastructure Bank Rev. Bonds Series Floaters G 109, 3.61%, tender 10/2/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 100,000 | 100,000 |

| Texas - 0.1% | | | |

| El Paso Wtr. & Swr. Rev. Bonds Series G 124, 3.61%, tender 9/1/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f)(g) | | 300,000 | 300,000 |

| North Texas Tollway Auth. Rev. Bonds Series G-112, 3.61%, tender 7/3/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 100,000 | 100,000 |

TOTAL TEXAS | | | 400,000 |

| Virginia - 0.0% | | | |

| Virginia Pub. Bldg. Auth. Pub. Facilities Rev. Bonds Series Floaters G 40, 3.61%, tender 8/1/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 100,000 | 100,000 |

| Washington - 0.0% | | | |

| Central Puget Sound Reg'l. Trans. Auth. Sales & Use Tax Rev. Bonds Series G 123, 3.61%, tender 11/1/23 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | | 200,000 | 200,000 |

| TOTAL TENDER OPTION BOND (Cost $217,525,000) | | | 217,525,000 |

| | | | |

| Other Municipal Security - 25.0% |

| | | Principal Amount (a) | Value ($) |

| Michigan - 0.1% | | | |

| Kent Hosp. Fin. Auth. Hosp. Facilities Rev. Bonds (Spectrum Health Sys. Proj.) Series 2015 A, SIFMA Municipal Swap Index + 0.250% 3.66%, tender 12/27/23 (b)(g) | | 400,000 | 400,000 |

| New Jersey - 23.8% | | | |

| Avalon Borough Gen. Oblig. BAN Series 2023, 5% 2/8/24 | | 5,800,000 | 5,855,780 |

| Bergen County Gen. Oblig. BAN: | | | |

| Series 2022 A, 4% 6/8/23 | | 1,090,000 | 1,090,082 |

| Series 2022, 4% 10/19/23 | | 1,000,000 | 1,004,023 |

| Bergen County Impt. Auth. Rev. Bonds Series 2023, 4.5% 5/31/24 (Bergen County Gen. Oblig. Guaranteed) (h) | | 2,000,000 | 2,019,320 |

| Berkely Township BAN Series 2023 A, 4.5% 3/22/24 | | 145,000 | 146,132 |

| Camden County BAN Series 2023 A, 4.5% 5/22/24 | | 10,000,000 | 10,122,503 |

| Cedar Grove Township Gen. Oblig. BAN Series 2022, 4% 7/10/23 | | 10,900,000 | 10,909,672 |

| Cherry Hill Township Gen. Oblig. BAN Series 2022, 5% 10/23/23 | | 245,000 | 246,043 |

| Closter Gen. Oblig. BAN Series 2022, 3% 6/1/23 | | 3,695,000 | 3,695,000 |

| East Brunswick Township Gen. Oblig. BAN Series 2022, 3.5% 7/18/23 | | 730,000 | 729,986 |

| Essex County Gen. Oblig. Bonds Series 2022, 4% 8/15/23 | | 125,000 | 125,253 |

| Essex County Impt. Auth. Proj. Rev. Bonds: | | | |

| Series 2006, 5.25% 12/15/23 (Essex County Gen. Oblig. Guaranteed) | | 3,635,000 | 3,677,130 |

| Series 2017, 2% 12/15/23 (Essex County Gen. Oblig. Guaranteed) | | 325,000 | 323,927 |

| Evesham Township BAN Series 2022 B, 4% 9/20/23 | | 8,100,000 | 8,126,553 |

| Galloway Township BAN Series 2022, 4% 8/8/23 | | 7,325,000 | 7,341,188 |

| Hopewell Township Gen. Oblig. BAN Series 2022, 4% 9/27/23 | | 300,000 | 300,869 |

| Hudson County Impt. Auth. Bonds (Hudson County Courthouse Proj.) Series 2020, 4% 10/1/23 | | 330,000 | 330,746 |

| Hudson County Impt. Auth. Rev. BAN Series 2022 B1, 3% 8/4/23 | | 10,690,000 | 10,693,449 |

| Long Branch Gen. Oblig. BAN Series 2023, 5.5% 1/30/24 | | 4,300,000 | 4,372,472 |

| Lyndhurst Township Gen. Oblig. Bonds Series 2013, 3.5% 8/15/23 | | 400,000 | 399,955 |

| Mercer County Gen. Oblig. BAN Series 2022 A, 4% 6/5/23 | | 1,125,000 | 1,125,108 |

| Monmouth County Bonds: | | | |

| Series 2017, 5% 7/15/23 | | 150,000 | 150,286 |

| Series 2019, 5% 7/15/23 | | 275,000 | 275,698 |

| Monmouth County Impt. Auth. Rev.: | | | |

| BAN Series 2023, 4% 3/15/24 (Monmouth County Guaranteed) | | 10,000,000 | 10,072,047 |

| Bonds Series 2016 B, 4% 8/1/23 (Monmouth County Guaranteed) | | 100,000 | 100,190 |

| Monroe Township Middlesex County Gen. Oblig.: | | | |

| BAN Series 2023, 5% 6/4/24 (h) | | 1,500,000 | 1,520,940 |

| Bonds Series 2015, 4% 8/1/23 | | 525,000 | 525,823 |

| New Jersey Econ. Dev. Auth. Bonds Series QQQ, 5% 6/15/23 | | 840,000 | 840,545 |

| New Jersey Econ. Dev. Auth. Lease Bonds: | | | |

| (College Avenue Redev. Proj.) Series 2013 5% 6/15/23 (Pre-Refunded to 6/15/23 @ 100) | | 190,000 | 190,147 |

| College Avenue Redev. Proj. Series 2013, 5% 6/15/23 (Pre-Refunded to 6/15/23 @ 100) | | 25,840,000 | 25,865,299 |

| Series 2007 E, 5% 6/15/23 (Pre-Refunded to 6/15/23 @ 100) | | 1,455,000 | 1,456,161 |

| New Jersey Econ. Dev. Auth. Rev. Bonds: | | | |

| Series 2005 N1, 5.5% 9/1/23 | | 850,000 | 854,210 |

| Series 2014 UU, 5% 6/15/23 | | 265,000 | 265,122 |

| Series 2015 XX, 5% 6/15/23 | | 150,000 | 150,127 |

| Series 2016 BBB, 5% 6/15/23 | | 2,000,000 | 2,001,174 |

| Series 2023, 3.1% tender 6/15/23, CP mode | | 3,245,000 | 3,245,000 |

| New Jersey Edl. Facility Bonds: | | | |

| Series 2014, 5% 6/15/23 | | 380,000 | 380,208 |

| Series 2016 B, 5% 7/1/23 | | 100,000 | 100,176 |

| Series 2017 B, 5% 7/1/23 | | 4,285,000 | 4,292,767 |

| Series 2017 I, 5% 7/1/23 | | 200,000 | 200,275 |

| New Jersey Gen. Oblig. Bonds Series 2020 A, 4% 6/1/23 | | 205,000 | 205,000 |

| New Jersey Health Care Facilities Fing. Auth. Rev. Bonds: | | | |

| (Greystone Park Psychiatric Hosp. Proj.) Series 2013 B, 5% 9/15/23 | | 750,000 | 752,967 |

| (Hosp. Asset Transformation Prog.) Series 2017, 5% 10/1/23 | | 700,000 | 703,977 |

| Series 2021 A, 5% 7/1/23 | | 1,175,000 | 1,176,682 |

| New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev. Bonds: | | | |

| Series 2016 1A, 5% 12/1/23 (c) | | 4,475,000 | 4,502,876 |

| Series 2017 1A, 5% 12/1/23 (c) | | 4,125,000 | 4,158,371 |

| Series 2020 A, 5% 12/1/23 (c) | | 500,000 | 502,841 |

| Series 2021 A, 5% 12/1/23 (c) | | 200,000 | 201,226 |

| Series 2021 B, 5% 12/1/23 (c) | | 300,000 | 301,839 |

| New Jersey Hsg. & Mtg. Fin. Agcy. Rev. Bonds Series 2019 D, 4% 10/1/23 (c) | | 1,415,000 | 1,417,725 |

| New Jersey Sports & Exposition Auth. Contract Rev. Bonds Series 2018 A, 5% 9/1/23 | | 410,000 | 412,151 |

| New Jersey Trans. Trust Fund Auth. Bonds: | | | |

| Series 2004 A, 5.75% 6/15/23 | | 300,000 | 300,264 |

| Series 2006 A, 5.5% 12/15/23 | | 2,725,000 | 2,753,519 |

| Series 2010 D, 5.25% 12/15/23 | | 420,000 | 423,783 |

| Series 2014 AA, 5% 6/15/23 | | 500,000 | 500,200 |

| Series 2015 AA, 4% 6/15/24 | | 100,000 | 99,998 |

| North Bergen Township Gen. Oblig. BAN Series 2023, 4% 4/24/24 | | 265,000 | 266,013 |

| North Brunswick Township Gen. Oblig. BAN Series 2022 A, 4% 7/12/23 | | 100,000 | 100,014 |

| Oradell BAN Series 2023, 4% 3/29/24 | | 8,967,450 | 9,021,168 |

| Somerville BAN Series 2023 A, 5% 1/30/24 | | 6,660,000 | 6,748,522 |

| Southampton BAN Series 2022 A, 4% 6/27/23 | | 5,145,395 | 5,148,773 |

| Stafford Township Gen. Oblig. BAN Series 2022 B, 5% 10/24/23 | | 210,000 | 211,288 |

| Tenafly BAN Series 2023, 4.25% 5/24/24 | | 3,000,000 | 3,024,121 |

| Union County Gen. Oblig.: | | | |

| BAN Series 2022, 3.5% 6/15/23 | | 18,675,000 | 18,679,337 |

| Bonds Series 2018, 3% 3/1/24 | | 745,000 | 743,479 |

| Verona Township Gen. Oblig. BAN Series 2023, 5% 3/1/24 | | 9,031,200 | 9,126,521 |

| West Milford Township Gen. Oblig. BAN Series 2022, 3.75% 9/15/23 | | 500,000 | 500,097 |

| Wood-Ridge Gen. Oblig. BAN Series 2023, 5.5% 2/27/24 | | 2,000,000 | 2,026,207 |

| Woolwich Township BAN Series 2023, 5% 5/23/24 | | 6,000,000 | 6,099,178 |

TOTAL NEW JERSEY | | | 205,229,523 |

| New York And New Jersey - 1.1% | | | |

| Port Auth. of New York & New Jersey Bonds: | | | |

| Series 185, 5% 9/1/23 (c) | | 2,220,000 | 2,230,834 |

| Series 2015 194, 5% 10/15/23 | | 365,000 | 367,206 |

| Series 2018 209, 5% 7/15/23 | | 115,000 | 115,206 |

| Series 2020, 5% 7/15/23 (c) | | 140,000 | 140,378 |

| Series 2021 226, 5% 10/15/23 (c) | | 2,710,000 | 2,727,417 |

| Series 207, 5% 9/15/23 (c) | | 3,760,000 | 3,777,982 |

| Series 223, 5% 7/15/23 (c) | | 500,000 | 501,215 |

TOTAL NEW YORK AND NEW JERSEY | | | 9,860,238 |

| TOTAL OTHER MUNICIPAL SECURITY (Cost $215,489,761) | | | 215,489,761 |

| | | | |

| Investment Company - 12.4% |

| | | Shares | Value ($) |

Fidelity Municipal Cash Central Fund 3.74% (i)(j) (Cost $106,702,413) | | 106,682,253 | 106,702,413 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 99.6% (Cost $858,812,174) | 858,812,174 |

NET OTHER ASSETS (LIABILITIES) - 0.4% | 3,703,852 |

| NET ASSETS - 100.0% | 862,516,026 |

| | |

Security Type Abbreviations

| BAN | - | BOND ANTICIPATION NOTE |

| CP | - | COMMERCIAL PAPER |

| VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (c) | Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

| (d) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $28,300,000 or 3.3% of net assets. |

| (e) | Provides evidence of ownership in one or more underlying municipal bonds. |

| (f) | Coupon rates are determined by re-marketing agents based on current market conditions. |

| (g) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (h) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (i) | Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund. |

| (j) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Additional information on each restricted holding is as follows: |

| Security | Acquisition Date | Cost ($) |

| Baltimore Proj. Rev. Bonds Series Floaters G 28, 3.61%, tender 1/2/24 (Liquidity Facility Royal Bank of Canada) | 1/03/23 | 100,000 |

| | | |

| Central Puget Sound Reg'l. Trans. Auth. Sales & Use Tax Rev. Bonds Series G 123, 3.61%, tender 11/1/23 (Liquidity Facility Royal Bank of Canada) | 2/09/23 | 200,000 |

| | | |

| Connecticut Spl. Tax Oblig. Trans. Infrastructure Rev. Bonds Series Floaters G 110, 3.59%, tender 10/2/23 (Liquidity Facility Royal Bank of Canada) | 4/01/21 - 12/20/22 | 600,000 |

| | | |

| Denver City & County Arpt. Rev. Bonds Series G-114, 3.66%, tender 6/1/23 (Liquidity Facility Royal Bank of Canada) | 12/01/22 | 100,000 |

| | | |

| El Paso Wtr. & Swr. Rev. Bonds Series G 124, 3.61%, tender 9/1/23 (Liquidity Facility Royal Bank of Canada) | 2/09/23 | 300,000 |

| | | |

| Greater Orlando Aviation Auth. Arpt. Facilities Rev. Bonds Series Floaters G 25, 3.66%, tender 10/2/23 (Liquidity Facility Royal Bank of Canada) | 4/01/21 | 100,000 |

| | | |

| New Jersey Tpk. Auth. Tpk. Rev. Bonds Series G 119, 3.59%, tender 1/2/24 (Liquidity Facility Royal Bank of Canada) | 1/03/23 | 1,000,000 |

| | | |

| North Texas Tollway Auth. Rev. Bonds Series G-112, 3.61%, tender 7/3/23 (Liquidity Facility Royal Bank of Canada) | 1/03/23 | 100,000 |

| | | |

| Ohio Univ. Gen. Receipts Athens Bonds Series Floaters G 27, 3.61%, tender 6/1/23 (Liquidity Facility Royal Bank of Canada) | 12/01/22 | 200,000 |

| | | |

| Port Auth. of New York & New Jersey Series 1992 2, 3.46% 6/30/23, VRDN | 2/14/92 | 6,400,000 |

| | | |

| Port Auth. of New York & New Jersey Series 1995 3, 3.49% 6/30/23, VRDN | 9/15/95 | 4,800,000 |

| | | |

| Port Auth. of New York & New Jersey Series 1995 4, 3.49% 6/30/23, VRDN | 8/09/02 | 6,600,000 |

| | | |

| Port Auth. of New York & New Jersey Series 1997 1, 3.46% 6/30/23, VRDN | 8/09/02 | 4,400,000 |

| | | |

| Port Auth. of New York & New Jersey Series 1997 2, 3.46% 6/30/23, VRDN | 9/15/97 | 3,100,000 |

| | | |

| South Carolina Trans. Infrastructure Bank Rev. Bonds Series Floaters G 109, 3.61%, tender 10/2/23 (Liquidity Facility Royal Bank of Canada) | 4/01/21 | 100,000 |

| | | |

| Tampa-Hillsborough County Expressway Auth. Rev. Bonds Series G-113, 3.61%, tender 7/3/23 (Liquidity Facility Royal Bank of Canada) | 1/03/23 | 100,000 |

| | | |

| Virginia Pub. Bldg. Auth. Pub. Facilities Rev. Bonds Series Floaters G 40, 3.61%, tender 8/1/23 (Liquidity Facility Royal Bank of Canada) | 2/01/21 | 100,000 |

| | | |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Municipal Cash Central Fund 3.74% | 78,880,419 | 318,307,000 | 290,485,006 | 1,260,422 | - | - | 106,702,413 | 5.3% |

| Fidelity Tax-Free Cash Central Fund 3.73% | 14,346,741 | - | 14,349,092 | 588 | 2,351 | - | - | 0.0% |

| Total | 93,227,160 | 318,307,000 | 304,834,098 | 1,261,010 | 2,351 | - | 106,702,413 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in these securities. For more information on valuation inputs, refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Statement of Assets and Liabilities |

| | | | May 31, 2023 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $752,109,761) | $ | 752,109,761 | | |

Fidelity Central Funds (cost $106,702,413) | | 106,702,413 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $858,812,174) | | | $ | 858,812,174 |

| Cash | | | | 1,085 |

| Receivable for fund shares sold | | | | 1,793,741 |

| Interest receivable | | | | 7,407,148 |

| Distributions receivable from Fidelity Central Funds | | | | 288,779 |

| Receivable from investment adviser for expense reductions | | | | 14,818 |

| Other receivables | | | | 3,087 |

Total assets | | | | 868,320,832 |

| Liabilities | | | | |

| Payable for investments purchased on a delayed delivery basis | $ | 3,540,260 | | |

| Payable for fund shares redeemed | | 1,897,295 | | |

| Distributions payable | | 161,477 | | |

| Accrued management fee | | 142,579 | | |

| Other affiliated payables | | 56,127 | | |

| Other payables and accrued expenses | | 7,068 | | |

| Total Liabilities | | | | 5,804,806 |

| Net Assets | | | $ | 862,516,026 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 862,515,338 |

| Total accumulated earnings (loss) | | | | 688 |

| Net Assets | | | $ | 862,516,026 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Fidelity New Jersey Municipal Money Market Fund : | | | | |

Net Asset Value , offering price and redemption price per share ($4,025,194 ÷ 4,025,092 shares) | | | $ | 1.00 |

| Institutional Class : | | | | |

Net Asset Value , offering price and redemption price per share ($376,774,375 ÷ 376,374,714 shares) | | | $ | 1.00 |

| Premium Class : | | | | |

Net Asset Value , offering price and redemption price per share ($481,716,457 ÷ 481,564,250 shares) | | | $ | 1.00 |

| Statement of Operations |

| | | | Six months ended May 31, 2023 (Unaudited) |

| Investment Income | | | | |

| Interest | | | $ | 10,605,713 |

| Income from Fidelity Central Funds | | | | 1,261,010 |

| Total Income | | | | 11,866,723 |

| Expenses | | | | |

| Management fee | $ | 828,976 | | |

| Transfer agent fees | | 331,133 | | |

| Independent trustees' fees and expenses | | 1,397 | | |

| Total expenses before reductions | | 1,161,506 | | |

| Expense reductions | | (91,531) | | |

| Total expenses after reductions | | | | 1,069,975 |

| Net Investment income (loss) | | | | 10,796,748 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 65,186 | | |

| Fidelity Central Funds | | 2,351 | | |

| Total net realized gain (loss) | | | | 67,537 |

| Net increase in net assets resulting from operations | | | $ | 10,864,285 |

| Statement of Changes in Net Assets |

| |

| | Six months ended May 31, 2023 (Unaudited) | | Year ended November 30, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 10,796,748 | $ | 4,467,707 |

| Net realized gain (loss) | | 67,537 | | (6,831) |

Net increase in net assets resulting from operations | | 10,864,285 | | 4,460,876 |

| Distributions to shareholders | | (10,792,672) | | (4,528,349) |

| Share transactions - net increase (decrease) | | 77,452,669 | | 447,596,368 |

| Total increase (decrease) in net assets | | 77,524,282 | | 447,528,895 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 784,991,744 | | 337,462,849 |

| End of period | $ | 862,516,026 | $ | 784,991,744 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity New Jersey Municipal Money Market Fund |

| |

| | Six months ended (Unaudited) May 31, 2023 | | Years ended November 30, 2022 A |

Selected Per-Share Data | | | | |

| Net asset value, beginning of period | $ | 1.00 | $ | 1.00 |

| Income from Investment Operations | | | | |

Net investment income (loss) B | | .014 | | .003 |

Net realized and unrealized gain (loss) C | | - | | - |

| Total from investment operations | | .014 | | .003 |

| Distributions from net investment income | | (.014) | | (.003) |

| Total distributions | | (.014) | | (.003) |

| Net asset value, end of period | $ | 1.00 | $ | 1.00 |

Total Return D,E | | 1.23% | | .32% |

Ratios to Average Net Assets B,F,G | | | | |

| Expenses before reductions | | .42% H | | .42% H |

| Expenses net of fee waivers, if any | | .42% H | | .42% H |

| Expenses net of all reductions | | .42% H | | .42% H |

| Net investment income (loss) | | 2.45% H | | 1.61% H |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $ | 4,025 | $ | 1,614 |

A For the period September 22, 2022 (commencement of sale of shares) through November 30, 2022.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Amount represents less than $.0005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized.

| Fidelity® New Jersey Municipal Money Market Fund Institutional Class |

| |

| | Six months ended (Unaudited) May 31, 2023 | | Years ended November 30, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A | | .015 | | .008 | | - B | | .005 | | .013 | | .012 |

Net realized and unrealized gain (loss) B | | - | | - | | - | | - | | - | | - |

| Total from investment operations | | .015 | | .008 | | - B | | .005 | | .013 | | .012 |

| Distributions from net investment income | | (.015) | | (.008) | | - B | | (.005) | | (.013) | | (.012) |

| Distributions from net realized gain | | - | | - | | - | | - | | - | | - B |

| Total distributions | | (.015) | | (.008) | | - B | | (.005) | | (.013) | | (.012) |

| Net asset value, end of period | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 |

Total Return C,D | | 1.34% | | .79% | | .01% | | .52% | | 1.31% | | 1.21% |

Ratios to Average Net Assets A,E,F | | | | | | | | | | | | |

| Expenses before reductions | | .25% G | | .25% | | .25% | | .25% | | .25% | | .25% |

| Expenses net of fee waivers, if any | | .20% G | | .18% | | .10% | | .20% | | .20% | | .20% |

| Expenses net of all reductions | | .20% G | | .18% | | .10% | | .20% | | .20% | | .20% |

| Net investment income (loss) | | 2.67% G | | 1.01% | | .01% | | .54% | | 1.30% | | 1.21% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 376,774 | $ | 290,546 | $ | 209,900 | $ | 260,192 | $ | 308,793 | $ | 270,195 |

A Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Annualized.

| Fidelity® New Jersey Municipal Money Market Fund Premium Class |

| |

| | Six months ended (Unaudited) May 31, 2023 | | Years ended November 30, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A | | .014 | | .007 | | - B | | .004 | | .012 | | .011 |

Net realized and unrealized gain (loss) B | | - | | - | | - | | - | | - | | - |

| Total from investment operations | | .014 | | .007 | | - B | | .004 | | .012 | | .011 |

| Distributions from net investment income | | (.014) | | (.007) | | - B | | (.004) | | (.012) | | (.011) |

| Distributions from net realized gain | | - | | - | | - | | - | | - | | - B |

| Total distributions | | (.014) | | (.007) | | - B | | (.004) | | (.012) | | (.011) |

| Net asset value, end of period | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 |

Total Return C,D | | 1.29% | | .72% | | .01% | | .44% | | 1.21% | | 1.11% |

Ratios to Average Net Assets A,E,F | | | | | | | | | | | | |

| Expenses before reductions | | .30% G | | .30% | | .30% | | .30% | | .30% | | .30% |

| Expenses net of fee waivers, if any | | .30% G | | .27% | | .10% | | .27% | | .30% | | .30% |

| Expenses net of all reductions | | .30% G | | .27% | | .10% | | .27% | | .30% | | .30% |

| Net investment income (loss) | | 2.57% G | | .92% | | .01% | | .47% | | 1.20% | | 1.11% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 481,716 | $ | 492,831 | $ | 127,495 | $ | 139,392 | $ | 172,947 | $ | 185,546 |

A Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Annualized.

For the period ended May 31, 2023

1. Organization.

Fidelity New Jersey Municipal Money Market Fund (the Fund) is a fund of Fidelity Court Street Trust II (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust. The Fund offers Fidelity New Jersey Municipal Money Market Fund, Institutional Class and Premium Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Shares of the Fund are only available for purchase by retail shareholders. The Fund may be affected by economic and political developments in the state of New Jersey.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies . The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Investment Transactions and Income. The net asset value per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Security transactions, including the Fund's investment activity in the Fidelity Central Funds, are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to market discount and capital loss carryforwards.

The Fund purchases municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

As of period end, the cost and unrealized appreciation (depreciation) in securities for federal income tax purposes were as follows:

| Gross unrealized appreciation | $- |

| Gross unrealized depreciation | - |

| Net unrealized appreciation (depreciation) | $- |

| Tax cost | $858,812,174 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of prior fiscal period end and is subject to adjustment.

Short-term | $(67,846) |

| Total capital loss carryforward | $(67,846) |

Delayed Delivery Transactions and When-Issued Securities. During the period, certain Funds transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. Securities purchased on a delayed delivery or when-issued basis are identified as such in the Schedule of Investments. Compensation for interest forgone in the purchase of a delayed delivery or when-issued debt security may be received. With respect to purchase commitments, each applicable Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Payables and receivables associated with the purchases and sales of delayed delivery securities having the same coupon, settlement date and broker are offset. Delayed delivery or when-issued securities that have been purchased from and sold to different brokers are reflected as both payables and receivables in the Statement of Assets and Liabilities under the caption "Delayed delivery", as applicable. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

4. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee that is based on an annual rate of .20% of the Fund's average net assets. Under the management contract, the investment adviser pays all other fund-level expenses, except the compensation of the independent Trustees and certain other expenses such as interest expense. The management fee is reduced by an amount equal to the fees and expenses paid by the Fund to the independent Trustees.

In addition, under the expense contract, the investment adviser pays class-level expenses for Premium Class so that the total expenses do not exceed .35%, expressed as a percentage of class average net assets, with certain exceptions such as interest expense.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for the Fund. FIIOC receives asset-based fees with respect to each account. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets A |

| Fidelity New Jersey Municipal Money Market Fund | $2,793 | .22 |

| Institutional Class | 85,626 | .05 |

| Premium Class | 242,714 | .10 |

| | $331,133 | |

A Annualized

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss) ($) |

| Fidelity New Jersey Municipal Money Market Fund | 20,873,220 | 6,030,000 | - |

Other. During the period, the investment adviser reimbursed the Fund for certain losses as follows:

| | Amount ($) |

| Fidelity New Jersey Municipal Money Market Fund | 5,757 |

5. Expense Reductions.

The investment adviser contractually agreed to reimburse Institutional Class to the extent annual operating expenses, expressed as a percentage of average net assets, exceed .20%. Some expenses, for example the compensation of the independent Trustees, and certain other expenses such as interest expense, are excluded from this reimbursement. During the period, this reimbursement reduced Institutional Class expenses by $86,739.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, custodian credits reduced the Fund's expenses by $4,792.

6. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended May 31, 2023 | Year ended November 30, 2022 A |

| Fidelity New Jersey Municipal Money Market Fund | | |

| Distributions to shareholders | | |

| Fidelity New Jersey Municipal Money Market Fund | $31,369 | $2,894 |

| Institutional Class | 4,557,240 | 2,227,665 |

| Premium Class | 6,204,063 | 2,297,678 |

| Service Class | - | 112 |

Total | $10,792,672 | $4,528,349 |

A Distributions for Fidelity New Jersey Municipal Money Market Fund are for the period September 22, 2022 (commencement of sale of shares) through November 30, 2022.

7. Share Transactions.

Share transactions for each class of shares at a $1.00 per share were as follows and may contain in-kind transactions, automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended May 31, 2023 | Year ended November 30, 2022 A | Six months ended May 31, 2023 | Year ended November 30, 2022 A |

| Fidelity New Jersey Municipal Money Market Fund | | | | |

| Fidelity New Jersey Municipal Money Market Fund | | | | |

| Shares sold | 5,241,957 | 1,815,410 | $5,241,957 | $1,815,410 |

| Reinvestment of distributions | 27,295 | 2,432 | 27,295 | 2,432 |

| Shares redeemed | (2,858,469) | (203,533) | (2,858,469) | (203,533) |

| Net increase (decrease) | 2,410,783 | 1,614,309 | $2,410,783 | $1,614,309 |

| Institutional Class | | | | |

| Shares sold | 279,481,019 | 298,849,601 | $279,481,019 | $298,849,601 |

| Reinvestment of distributions | 4,081,426 | 2,063,870 | 4,081,426 | 2,063,870 |

| Shares redeemed | (197,423,976) | (220,261,729) | (197,423,976) | (220,261,729) |

| Net increase (decrease) | 86,138,469 | 80,651,742 | $86,138,469 | $80,651,742 |

| Premium Class | | | | |

| Shares sold | 136,518,708 | 97,754,118 | $136,518,707 | $97,219,691 |

| Issued in exchange for the shares of the Target Fund(s) | - | 375,676,671 | - | 376,211,162 |

| Reinvestment of distributions | 5,827,247 | 2,163,396 | 5,827,247 | 2,163,396 |

| Shares redeemed | (153,442,537) | (110,195,569) | (153,442,537) | (110,195,569) |

| Net increase (decrease) | (11,096,582) | 365,398,616 | $(11,096,583) | $365,398,680 |

| Service Class | | | | |

| Reinvestment of distributions | - | 83 | - | 83 |

| Shares redeemed | - | (68,382) | - | (68,446) |

| Net increase (decrease) | - | (68,299) | $- | $(68,363) |

A Share transactions for Fidelity New Jersey Municipal Money Market Fund are for the period September 22, 2022 (commencement of sale of shares) through November 30, 2022.

8. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

9. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer. Significant concentrations in security types, issuers, industries, sectors, and geographic locations may magnify the factors that affect a fund's performance.

10. Merger Information

On September 16, 2022, Fidelity New Jersey Municipal Money Market Fund (formerly Fidelity New Jersey AMT Tax-Free Money Market Fund) acquired all of the assets and assumed all of the liabilities of Fidelity New Jersey Municipal Money Market Fund ("Target Fund") pursuant to an Agreement and Plan of Reorganization ("Agreements") approved by the Board of Trustees ("The Board"). The securities held by the Target Fund were the primary assets acquired by Fidelity New Jersey Municipal Money Market Fund. The acquisition was accomplished by an exchange of Premium Class (formerly Fidelity New Jersey AMT Tax-Free Money Market Fund) of Fidelity New Jersey Municipal Money Market Fund for shares outstanding of the Target Fund at its respective net asset value on the acquisition date. The reorganization provides shareholders of the Target Fund access to a larger portfolio with a similar investment objective and lower projected expenses. For financial reporting purposes, the assets and liabilities of the Target Fund and shares issued by Fidelity New Jersey Municipal Money Market Fund were recorded at fair value; however, the cost basis of the investments received from the Target Fund were carried forward and will be utilized for purposes of Fidelity New Jersey Municipal Money Market Fund ongoing reporting of realized and unrealized gains and losses to more closely align subsequent reporting of realized gains with amounts distributable to shareholders for tax purposes. The reorganization qualified as a tax-free reorganization for federal income tax purposes with no gain or loss recognized to the funds or their shareholders.

| Target Fund | Investments | Unrealized appreciation (depreciation)$ | Net Assets | Shares Exchanged | Shares Exchanged Ratio |

| Fidelity New Jersey Municipal Money Market Fund | 377,936,406 | 0 | 376,211,162 | 375,676,671 | 1.0000 |

| Surviving Fund | Net Assets$ | Total net assets after the acquisition$ |

| Fidelity New Jersey Municipal Money Market Fund (formerly Fidelity New Jersey AMT Tax-Free Money Market Fund) | 426,276,573 | 802,487,735 |

Pro forma results of operations of the combined entity for the entire period ended November 30, 2022, as though the acquisition had occurred as of the beginning of the year (rather than on the actual acquisition date, are as follows:

| Net investment income (loss) | $5,801,069 |

| Total net realized gain (loss) | (61,908) |

| Total change in net unrealized appreciation (depreciation) | - |

| Net increase (decrease) in net assets resulting from operations | $5,739,161 |

Because the combined investment portfolios have been managed as a single portfolio since the acquisition was completed, it is not practicable to separate the amounts of revenue and earnings of the acquired fund that have been included in the Fund's Statement of Operations since September 16, 2022.

As a shareholder, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or redemption proceeds, as applicable and (2) ongoing costs, which generally include management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (December 1, 2022 to May 31, 2023). |

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class/Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If any fund is a shareholder of any underlying mutual funds or exchange-traded funds (ETFs) (the Underlying Funds), such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses incurred presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. If any fund is a shareholder of any Underlying Funds, such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses as presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | Annualized Expense Ratio- A | | Beginning Account Value December 1, 2022 | | Ending Account Value May 31, 2023 | | Expenses Paid During Period- C December 1, 2022 to May 31, 2023 |

| Fidelity® New Jersey Municipal Money Market Fund | | | | | | | | | | |

| Fidelity® New Jersey Municipal Money Market Fund | | | | .42% | | | | | | |

| Actual | | | | | | $ 1,000 | | $ 1,012.30 | | $ 2.11 |

Hypothetical- B | | | | | | $ 1,000 | | $ 1,022.84 | | $ 2.12 |

| Institutional Class | | | | .20% | | | | | | |

| Actual | | | | | | $ 1,000 | | $ 1,013.40 | | $ 1.00 |

Hypothetical- B | | | | | | $ 1,000 | | $ 1,023.93 | | $ 1.01 |

| Premium Class | | | | .30% | | | | | | |

| Actual | | | | | | $ 1,000 | | $ 1,012.90 | | $ 1.51 |

Hypothetical- B | | | | | | $ 1,000 | | $ 1,023.44 | | $ 1.51 |

| |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B 5% return per year before expenses

C Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/ 365 (to reflect the one-half year period). The fees and expenses of any Underlying Funds are not included in each annualized expense ratio.

1.850774.116

SNJ-SANN-0723

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Court Street Trust II’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Court Street Trust II’s (the “Trust”) disclosure controls and procedures (as

defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Item 12.

Disclosure of Securities Lending Activities for Closed-End Management

Investment Companies

Not applicable.

Item 13.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Court Street Trust II

| |

By: | /s/Laura M. Del Prato |

| Laura M. Del Prato |

| President and Treasurer |

|

|

Date: | July 20, 2023 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| |

By: | /s/Laura M. Del Prato |

| Laura M. Del Prato |

| President and Treasurer |

|

|

Date: | July 20, 2023 |

| |

By: | /s/John J. Burke III |

| John J. Burke III |

| Chief Financial Officer |

|

|

Date: | July 20, 2023 |