Premiere Global Services, Inc.

3280 Peachtree Road, NE

The Terminus Building

Suite 1000

Atlanta, Georgia 30305

April 27, 2015

Dear Fellow Shareholders:

On behalf of the board of directors and management of Premiere Global Services, Inc., or PGi, you are cordially invited to our 2015 annual meeting of shareholders to be held on Wednesday, June 17, 2015 at 8:30 a.m., MDT, at the Antlers Hilton Hotel, 4 South Cascade Avenue, Colorado Springs, Colorado 80903.

As described in the accompanying notice of annual meeting and proxy statement, at this year’s annual meeting, in addition to the election of all of our directors and ratification of our independent auditors for 2015, you will be asked to approve, on a non-binding advisory basis, the compensation of our named executive officers, which is commonly referred to as a “say-on-pay” proposal. Our board’s recommendation on these items is set forth in the proposals in our accompanying proxy statement, and your support is important.

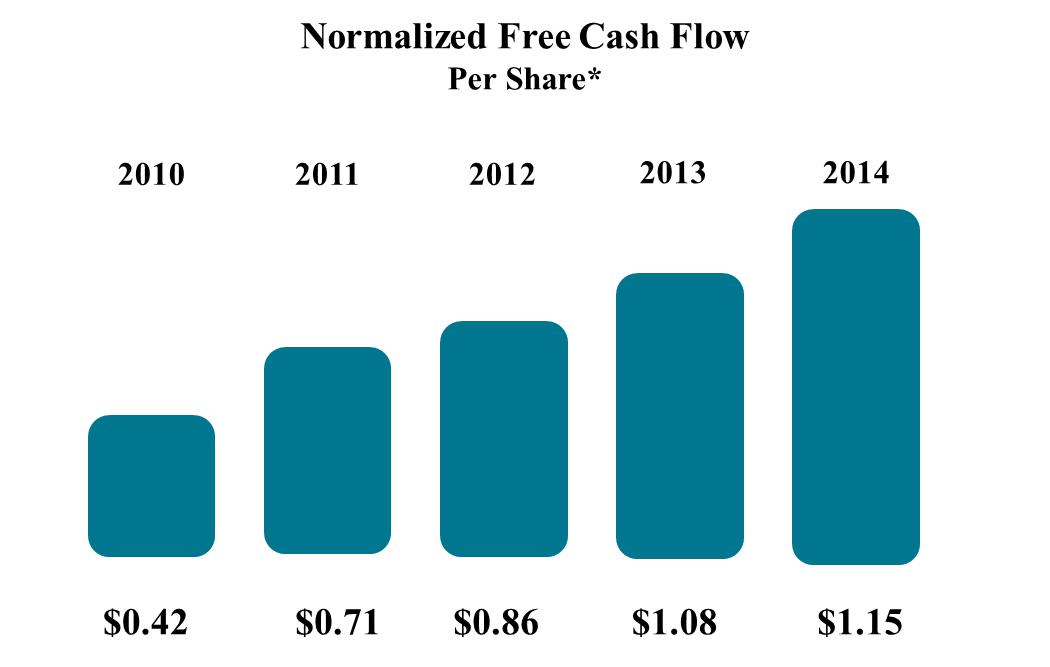

In 2014, we continued to accelerate our transition toward a software model, generating 58% year-over-year SaaS revenue growth and exiting the year with more than 12% of our total revenue from these high value, high-margin products. In addition, through our internal development efforts and our strategic acquisitions, we expanded our portfolio of unified communications and collaboration (UC&C) products to increase our total addressable market opportunity to approximately $28 billion in aggregate in 2018. We made these achievements while continuing to deliver solid financial results against all of our key operating metrics, including generating double digit growth in adjusted EBITDA and non-GAAP EPS, generating normalized free cash flow of $1.15 per share for the year and improving our gross margin by almost two percentage points. While 2014 proved to be a more challenging year for our stock price, we remain confident that our ability to execute on our long-term strategy will deliver higher value to our shareholders and further strengthen our company’s position as the world’s largest dedicated provider of collaboration software and services.

We believe that our proxy statement demonstrates our ongoing commitment to effectively communicate with our shareholders by describing the matters to be considered at our upcoming annual meeting in a format that is easy to follow. Because we value your input, we continued our shareholder outreach efforts in 2014 to better understand shareholder views on a variety of corporate governance topics, particularly in the executive compensation area. Our compensation committee also worked closely with its independent compensation consultant in evaluating our executive compensation program to continue to enhance our pay-for-performance philosophy. When casting your say-on-pay vote this year, we encourage you to consider the significant changes we have made in recent years to our executive compensation program, which we believe reflect the shareholder feedback we received.

Your vote is important to us. Whether or not you plan to attend the meeting in person, we encourage you to vote so that your shares will be represented at our annual meeting. Please take the time to vote over the Internet, by telephone or by mail (if you received paper copies of our proxy materials). You may also vote in person at our annual meeting.Even if you plan to attend the meeting, we encourage you to vote your shares prior to the meeting. Additional information about voting your shares is included in our proxy statement.

Thank you for your continuing support and your investment in our company.

Sincerely,

Boland T. Jones

Chairman of the Board and Chief Executive Officer

Premiere Global Services, Inc.

3280 Peachtree Road, NE

The Terminus Building

Suite 1000

Atlanta, Georgia 30305

_________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

_________________

To be held on June 17, 2015

TO OUR SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the 2015 annual meeting of shareholders of Premiere Global Services, Inc. will be held at the Antlers Hilton Hotel, 4 South Cascade Avenue, Colorado Springs, Colorado 80903, on Wednesday, June 17, 2015, at 8:30 a.m., MDT, for the purposes of:

| 1. | electing all seven members of our board of directors each for a one-year term; |

| 2. | holding an advisory vote to approve the compensation of our named executive officers; |

| 3. | ratifying the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2015; and |

| 4. | transacting such other business as may properly come before the annual meeting or any adjournments thereof. |

Information relating to the foregoing matters is set forth in the attached proxy statement. Shareholders of record at the close of business on April 9, 2015 are entitled to receive notice of and to vote at our annual meeting and any adjournments thereof.

By Order of the Board of Directors,

Scott Askins Leonard

Secretary

Atlanta, Georgia

April 27, 2015

This proxy statement and our 2014 annual report are available atar2014.pgi.com.

PLEASE READ OUR PROXY STATEMENT AND PROMPTLY VOTE OVER THE INTERNET OR BY TELEPHONE. IF YOU RECEIVED A PAPER COPY OF PROXY MATERIALS, YOU MAY SUBMIT YOUR PROXY BY COMPLETING, SIGNING, DATING AND RETURNING YOUR PROXY CARD OR VOTING INSTRUCTION FORM IN THE PRE-ADDRESSED ENVELOPE PROVIDED. IF YOU VOTE OVER THE INTERNET OR BY TELEPHONE, PLEASE DO NOT RETURN YOUR PROXY CARD OR VOTING INSTRUCTION FORM. YOU CAN SPARE US THE EXPENSE OF FURTHER PROXY SOLICITATION BY PROMPTLY VOTING OVER THE INTERNET OR BY TELEPHONE OR BY RETURNING YOUR PROXY CARD OR VOTING INSTRUCTION FORM. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU SO DESIRE.

TABLE OF CONTENTS

| PROXY STATEMENT SUMMARY | 1 |

| GENERAL INFORMATION | 3 |

| CORPORATE GOVERNANCE MATTERS | 8 |

| Independent Directors | 8 |

| Board Leadership Structure | 10 |

| Risk Oversight | 10 |

| Meetings of the Board of Directors | 11 |

| Committees of the Board of Directors | 11 |

| Shareholder Director Nominations | 15 |

| Code of Conduct and Ethics and Corporate Governance Guidelines | 15 |

| Communications with the Board of Directors | 15 |

| Director Compensation | 16 |

| Director Compensation for Fiscal Year 2014 | 18 |

| CERTAIN TRANSACTIONS | 19 |

| PROPOSAL 1 – ELECTION OF DIRECTORS | 19 |

| Nominees | 19 |

| Information Regarding Nominee Directors and Executive Officers | 20 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 25 |

| Officers and Directors | 25 |

| Principal Shareholders | 26 |

| COMPENSATION COMMITTEE REPORT | 27 |

| COMPENSATION DISCUSSION AND ANALYSIS | 28 |

| Executive Summary | 28 |

| Impact of 2014 Business Results on Executive Compensation | 33 |

| Consideration of Say-on-Pay Votes on Executive Compensation and Shareholder Outreach Efforts | 33 |

| Compensation Practices that Benefit Our Shareholders | 34 |

| Executive Compensation Program Objectives | 35 |

| Executive Compensation Determinations and Assessments | 35 |

| Elements of Our Executive Compensation Program | 37 |

| Other Compensation Considerations | 46 |

| EXECUTIVE COMPENSATION | 47 |

| Summary Compensation Table | 47 |

| Supplemental Realized Compensation Table | 48 |

| Grants of Plan-Based Awards in Fiscal Year 2014 | 50 |

| Outstanding Equity Awards at Fiscal Year-End 2014 | 52 |

| Stock Vested in Fiscal Year 2014 | 53 |

| Potential Payments upon Termination or Change in Control | 54 |

| Individual Severance Agreements | 57 |

| PROPOSAL 2 – ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 58 |

| AUDIT COMMITTEE REPORT | 58 |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 59 |

| AUDIT MATTERS AND FEES | 59 |

| PROPOSAL 3 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 60 |

| EQUITY COMPENSATION PLAN INFORMATION | 61 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 61 |

| OTHER MATTERS | 61 |

| APPENDIX A - RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | A-1 |

| i |

PROXY STATEMENT SUMMARY

This summary highlights certain key disclosures in our proxy statement. It does not contain all of the information that you should consider carefully before voting. You should read this entire proxy statement and our 2014 annual report on Form 10-K available atar2014.pgi.com for more complete information.

Annual Meeting of Shareholders(page 3)

| Date: | Wednesday, June 17, 2015 |

| Time: | 8:30 a.m., MDT |

| Location: | Antlers Hilton Hotel 4 South Cascade Avenue Colorado Springs, Colorado 80903 |

| Record Date: | April 9, 2015 |

Proposals and Board Recommendation

| Proposal | Recommendation |

| Election of Directors (page 19) | FOR ALL NOMINEES |

| Advisory Vote to Approve the | FOR |

| Compensation of our Named | |

| Executive Officers (page 58) | |

| Ratification of KPMG LLP as | FOR |

| 2015 Auditors (page 60) |

Executive Compensation(page 27)

Company Performance:

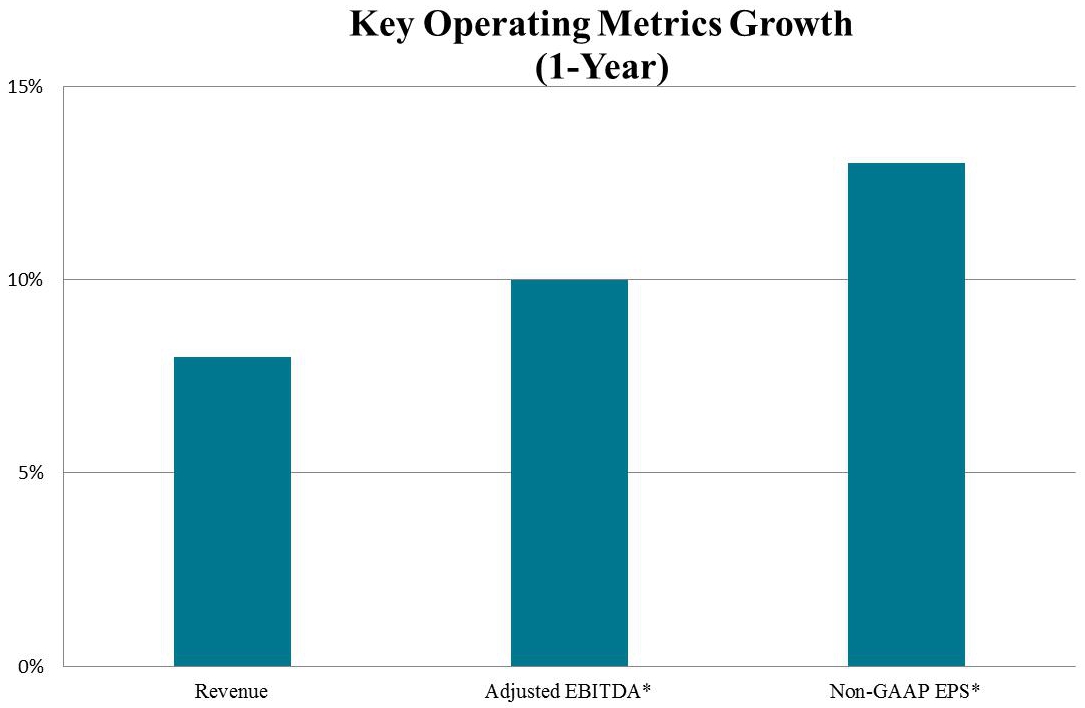

| · | Delivered on all key operating metrics tied to compensation program performance targets: |

| o | Grew net revenue by approximately 8% over 2013 |

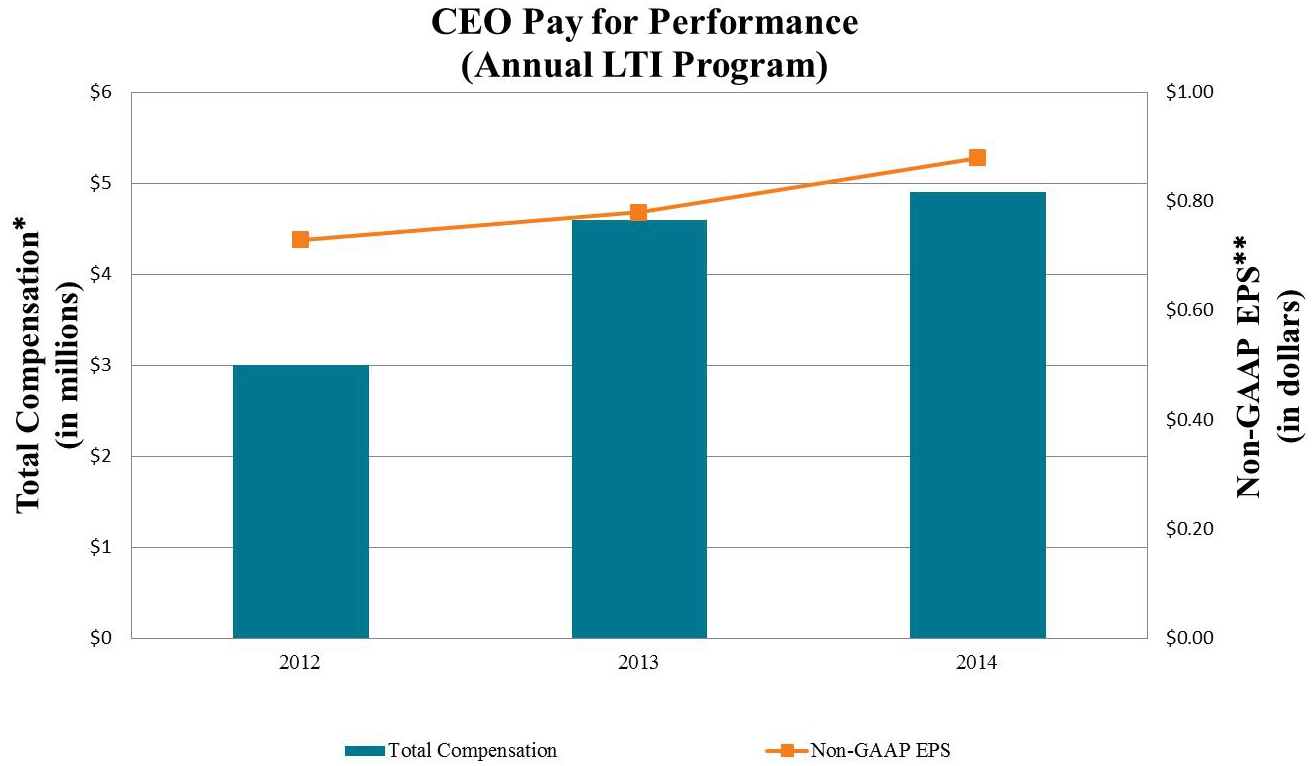

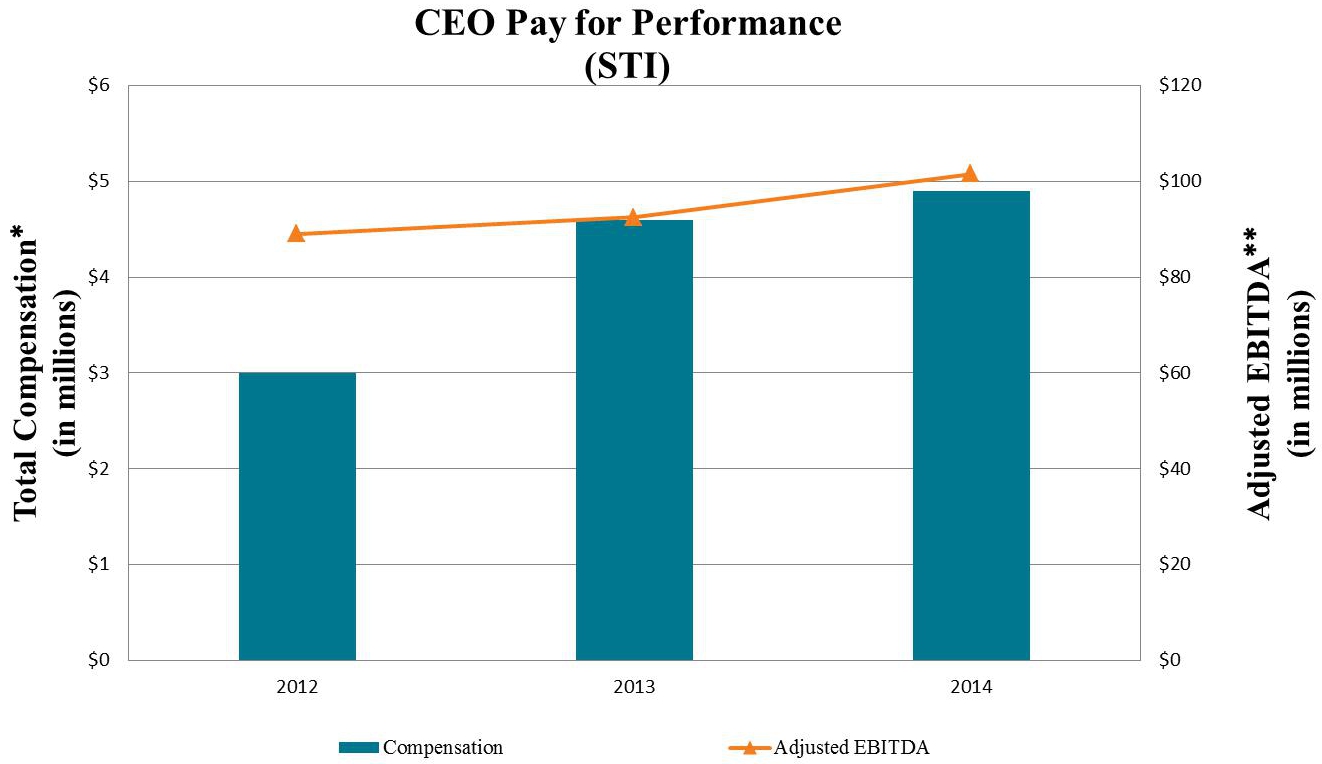

| o | Generated double digit growth over 2013 of approximately: |

| Ø | 10% in adjusted EBITDA* |

| Ø | 13% in non-GAAP EPS* |

| o | Grew SaaS revenue by approximately 58% over 2013 and exited 2014 with more than 12% of our total revenue from UC&C SaaS products |

| o | Generated significant normalized free cash flow of $1.15 per share* |

| · | Improved our annual gross margin by almost two percentage points |

| · | Expanded our UC&C product portfolio and increased our total addressable market opportunity |

_______

* See Appendix A

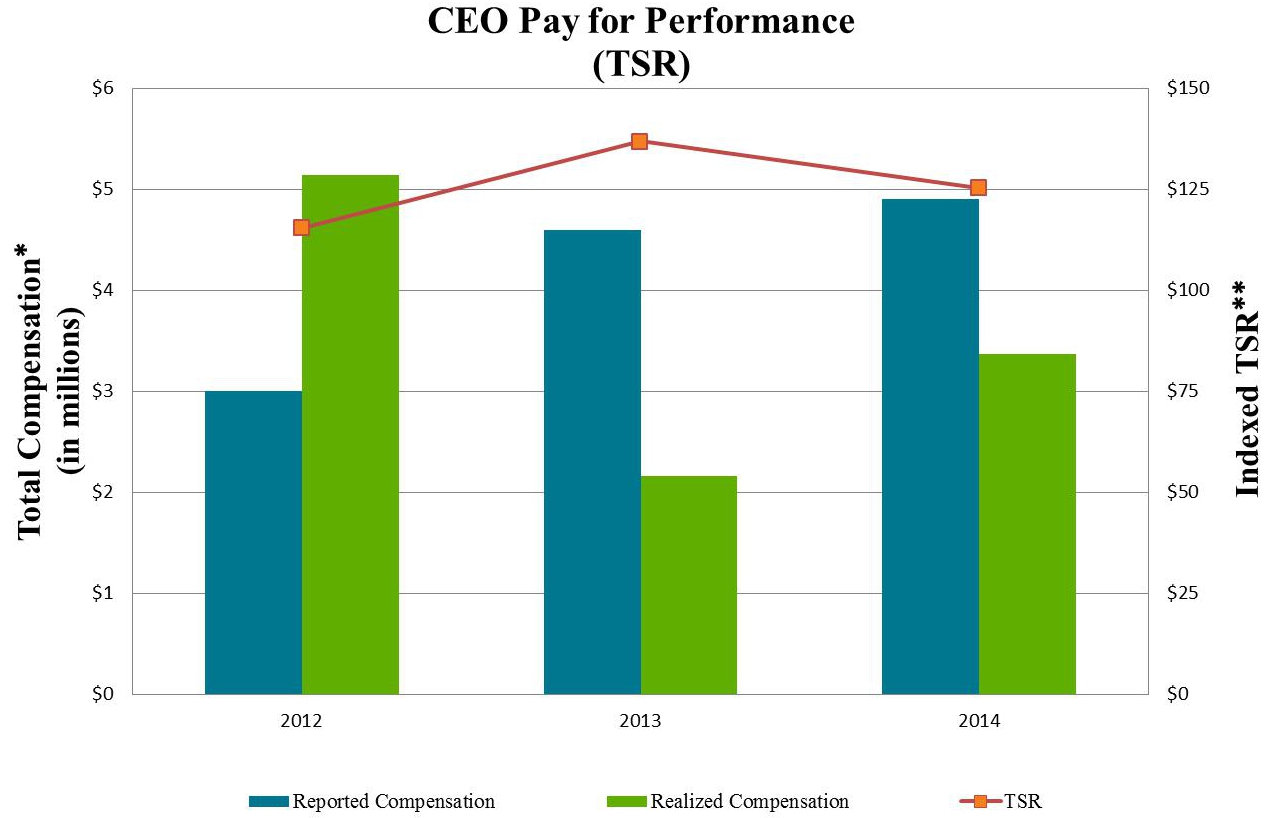

Total Shareholder Return:

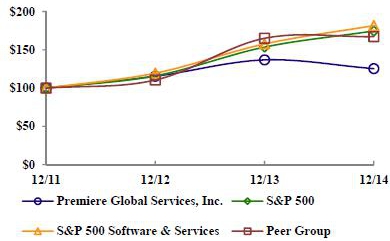

| · | Delivered 25.4% and 28.7% three- and five-year cumulative TSR, respectively, despite volatility in our stock price and decline in our one-year TSR in 2014 |

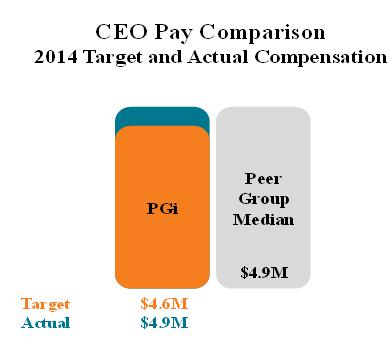

CEO Total Compensation:

| · | 80% of CEO pay “at risk” and 60% equity-based |

| · | No increases in base salaries, target bonus opportunities, perquisites or severance amounts for our CEO since 2005 |

Consideration of Say-on-Pay Votes:

| · | Ongoing shareholder outreach efforts |

| · | Annual executive compensation study |

| · | No use of employment agreements |

| · | Annual LTI program |

| · | Elimination of automatic “single trigger” vesting acceleration upon a change in control for equity awards |

| · | No overlap of performance targets for short- and long-term incentive awards |

1

Corporate Governance(page 8)

| Governance Highlights | |

| Supermajority of independent directors | P |

| Presiding independent director | P |

| Annual election of all directors | P |

| Board committees consist entirely of independent directors | P |

| Independent directors meet regularly in executive session | P |

| All directors attended at least 75% of meetings held | P |

| Significant portion of compensation is “at risk” | P |

| Corporate governance guidelines | P |

| Code of conduct and ethics and anonymous hotline | P |

| Board education | P |

| Annual board and committee self-evaluations | P |

| CEO succession planning | P |

| Annual advisory approval of executive compensation | P |

| Utilize independent compensation consultant | P |

| Robust stock ownership guidelines | P |

| Compensation clawback policy | P |

| Anti-pledging and hedging policies | P |

| Poison pill | X |

Corporate Governance Materials(page 15):

pgi.investorroom.com/governance

Board Communications(page 15):

Premiere Global Services, Inc.

c/o Secretary

3280 Peachtree Road, NE

The Terminus Building

Suite 1000

Atlanta, Georgia 30305

Certain Transactions(page 19):

None

| Director Nominees(page 20) | Committee Memberships | |||||

| Name | Age | Position | Independent | AC | CC | NG |

| Boland T. Jones | 55 | Chairman of the Board and Chief Executive Officer, Premiere Global Services, Inc. | ||||

| John F. Cassidy | 60 | Senior Advisor, Blackstone Capital Partners | P | |||

| K. Robert Draughon | 55 | Chief Operating Officer, Hospital Solutions, Health Grades, Inc. | P | C, F | M | |

| John R. Harris | 66 | Operating Partner, glendonTodd Capital LLC | P* | C | C | |

| W. Steven Jones | 63 | Professor of Strategy and Organizational Behavior, Kenan-Flagler Business School of the University of North Carolina at Chapel Hill | P | M, F | ||

| Raymond H. Pirtle, Jr. | 73 | Chief Manager, Claridge Company, LLC | P | M, F | ||

| J. Walker Smith, Jr. | 59 | Global Executive Chairman, The Futures Company | P | M | ||

______________

* Presiding Independent Director

| AC = Audit Committee | CC = Compensation Committee | NG = Nominating and Governance Committee | C = Chairman |

| ** Messrs. Cassidy and Harris also qualify as financial experts | M = Member | ||

| F** = Financial Expert | |||

2

PREMIERE GLOBAL SERVICES, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 17, 2015

This proxy statement is furnished to our shareholders in connection with the solicitation of proxies by our board of directors for use at our annual meeting of shareholders and at any adjournments thereof. Our annual meeting will be held on Wednesday, June 17, 2015, at 8:30 a.m., MDT, at the Antlers Hilton Hotel, 4 South Cascade Avenue, Colorado Springs, Colorado 80903.

The approximate date on which we are first mailing the Notice of Internet Availability of Proxy Materials or our proxy materials to our shareholders is May 4, 2015.

GENERAL INFORMATION

Why am I receiving the proxy materials?

You have received the proxy materials because our board of directors is soliciting your proxy to vote your shares at our 2015 annual meeting. This proxy statement includes information that we are required to provide you under Securities and Exchange Commission, or SEC, rules and is designed to assist you in voting your shares.

What is included in the proxy materials?

The proxy materials include this proxy statement for our 2015 annual meeting of shareholders and our 2014 annual report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2014. If you receive a paper copy of these materials by mail, they also include a proxy card or voting instruction form.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

We are utilizing the SEC rule that allows us to furnish our proxy materials over the Internet rather than sending a full set of materials by mail. All shareholders receiving the Notice of Internet Availability of Proxy Materials will have the ability to access the proxy materials and vote over the Internet, by phone or request to receive a paper copy of the proxy materials by mail by following the instructions in the notice. In addition, instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the Notice of Internet Availability of Proxy Materials and below. We believe electronic delivery will expedite your receipt of our proxy materials while also lowering costs of delivery and reducing the environmental impact of our annual meeting.

How can I access the proxy materials over the Internet or obtain a paper copy?

This proxy statement and our 2014 annual report are available atar2014.pgi.com. You may obtain a paper copy of this proxy statement and our 2014 annual report without charge upon written request to Investor Relations, Premiere Global Services, Inc., 3280 Peachtree Road, NE, Suite 1000, Atlanta, Georgia 30305 or via the Internet atpgi.investorroom.com/materials_request.

What is a shareholder of record and a beneficial owner?

If your shares are registered directly in your name with our registrar and transfer agent, American Stock Transfer & Trust Company, you are considered a registered shareholder of record with respect to your shares. If your shares are held in a brokerage account, bank or with another nominee, your shares are considered held in street name, and you are considered the beneficial owner of your shares.

| 3 |

What is householding?

Only one copy of the Notice of Internet Availability of Proxy Materials is being delivered to shareholders sharing an address unless we have received contrary instructions from you and you do not participate in the electronic delivery of proxy materials. This process, known as “householding,” reduces the volume of duplicate information shareholders receive and helps reduce our printing and mailing expenses. We will deliver promptly upon oral or written request a separate copy of the Notice of Internet Availability of Proxy Materials, this proxy statement and our 2014 annual report, as applicable, to any shareholder residing at an address to which only one copy was mailed. If you prefer to receive a separate copy, please contact us by phone at 1-800-749-9111, extension 8462, or write to us at the address set forth under “Corporate Governance Matters – Communications with the Board of Directors,” and a separate copy will be promptly sent to you. If you are the beneficial owner but not the shareholder of record of our stock, please contact your broker, bank or other nominee who holds the shares directly. If you are currently receiving multiple copies and wish to receive one copy of the proxy materials, please write to us at the address set forth under “Corporate Governance Matters – Communications with the Board of Directors.”

What should I do if I receive more than one Notice of Internet Availability of Proxy Materials or more than one paper copy of the proxy materials?

You may receive more than one Notice of Internet Availability of Proxy Materials or more than one paper copy of the proxy materials, including multiple proxy cards or voting instruction forms. For example, if you hold your shares in more than one brokerage account, you may receive a separate Notice of Internet Availability of Proxy Materials or a separate proxy card or voting instruction form for each account in which you hold your shares. If you are a shareholder of record and your shares are registered in more than one name, you may receive more than one Notice of Internet Availability of Proxy Materials or more than one proxy card or voting instruction form. To vote all of your shares by proxy, you must vote over the Internet the shares represented by each Notice of Internet Availability of Proxy Materials that you receive or complete, sign, date and return each proxy card or voting instruction form that you receive.

How do I sign up for electronic delivery service of proxy materials?

Instead of receiving future copies of our annual report and proxy statement by mail, shareholders of record and most beneficial owners of our shares can elect to receive an e-mail that provides electronic links to our proxy materials. Opting to receive these materials online will give you an electronic link to the proxy voting site and save us the cost of printing and mailing these materials. If you vote over the Internet, follow the prompts for enrolling in the electronic delivery service of proxy materials.

What am I voting on?

You will be voting on the following items:

| • | election of the seven nominees named in “Election of Directors” to our board of directors, each for a one-year term; |

| • | an advisory vote to approve the compensation of our named executive officers; |

| • | ratification of the appointment of KPMG LLP, or KPMG, as our independent registered public accounting firm for the year ending December 31, 2015; and |

| • | any other business properly brought before the meeting or any adjournments thereof. |

Our board of directors is not aware of any other matters to be brought before the meeting. If other matters are properly raised at the meeting, the persons named as proxies may vote any shares represented by proxy in their discretion.

| 4 |

What are the board’s vote recommendations?

Our board recommends that you vote your shares:

| • | “FOR” all of the nominees for election as directors; |

| • | “FOR” the advisory vote to approve the compensation of our named executive officers; and |

| • | “FOR” the ratification of the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 2015. |

Who is entitled to vote?

You may vote if you owned shares of our common stock as of the close of business on April 9, 2015, the record date for the meeting. Each share of common stock is entitled to one vote on each matter presented for a vote of the shareholders. On the record date, 46,475,974 shares of our common stock were outstanding and eligible to be voted at the meeting.

How do I vote before the meeting?

If you are a registered shareholder, you have three options for voting before the meeting:

| • | over the Internet atwww.proxyvote.com by following the instructions on the Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form; |

| • | if you received a paper copy of proxy materials and a proxy card or voting instruction form, you may vote by telephone, by calling 1-800-690-6903; or |

| • | by completing, dating, signing and returning a proxy card or voting instruction form by mail. |

If you vote over the Internet or by telephone, please do not return your proxy card or voting instruction form.

If you are the beneficial owner and your shares are held in street name through an account with a broker or bank, your ability to vote over the Internet or by telephone depends on the voting procedures of your broker or bank. Please follow the directions that your broker or bank provides on the Notice of Internet Availability of Proxy Materials and proxy card or voting instruction form.

May I vote at the meeting?

Only shareholders of record as of the record date may attend the meeting. If you are a registered shareholder, you may vote your shares at the meeting if you attend in person. If you hold your shares through an account with a broker or bank, you must obtain instructions from the broker or bank in order to vote at the meeting. You must have photo identification and proof of ownership of your shares. Even if you plan to attend the meeting, we encourage you to vote your shares before the meeting. Participants in our 401(k) plan may instruct the trustee of that plan as to how to vote their plan shares on their behalf and cannot vote their plan shares in person at the meeting.

May I revoke my proxy and/or change my vote?

Yes, except that any change to your voting instructions for our 401(k) plan must be provided by 11:59 p.m., Eastern Time, on June 15, 2015. Otherwise, you may revoke your proxy and/or change your vote at any time before the polls close at the conclusion of voting at the meeting. You may do this by:

| • | signing another proxy card or voting instruction form with a later date and delivering it to us before the meeting; |

| • | voting again over the Internet or by telephone prior to 11:59 p.m., Eastern Time, on June 16, 2015; |

| 5 |

| • | voting at the meeting if you are a registered shareholder or have obtained instructions from your broker or bank if you are a beneficial owner; or |

| • | notifying the company’s Secretary in writing before the meeting. |

What if I sign and return my proxy but do not provide voting instructions?

Proxy cards or voting instruction forms that are signed, dated and returned but do not contain voting instructions will be voted:

| • | “FOR” all of the nominees for election as directors; |

| • | “FOR” the advisory vote to approve the compensation of our named executive officers; |

| • | “FOR” the ratification of the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 2015; and |

| • | on any other matters properly brought before the meeting, in accordance with the discretion of the named proxies. |

If your shares are held through an account with a broker or bank, see “—Will my shares be voted if I do not provide my proxy or voting instruction form”below.

Will my shares be voted if I do not provide my proxy or voting instruction form?

If you are a registered shareholder and do not provide a proxy by voting over the Internet, by telephone or by signing and returning a proxy card or voting instruction form, you must attend the meeting in order to vote.

If you hold shares through an account with a broker, the voting of the shares by the broker when you do not provide voting instructions is governed by the rules of the New York Stock Exchange, or NYSE. These rules allow brokers to vote shares in their discretion on “routine” matters for which their customers do not provide voting instructions. On matters considered “non-routine,” brokers may not vote shares without your instruction. Shares that brokers are not authorized to vote are referred to as “broker non-votes.” To ensure your shares are voted at the meeting, we encourage you to return your proxy.

The ratification of KPMG as our independent registered public accounting firm for 2015 is considered a routine matter. Accordingly, brokers may vote shares on this proposal without your instructions, and there will be no broker non-votes with respect to this proposal.

The election of directors and say-on-pay proposals are considered non-routine matters; therefore, brokers cannot vote shares on those proposals without your instructions. Please note that if you want your vote to be counted on these proposals, you must instruct your broker how to vote your shares. If you do not provide voting instructions, no votes will be cast on your behalf with respect to those proposals.

How many shares must be present to hold the meeting?

In order for us to conduct the meeting, holders of a majority of our outstanding shares of common stock as of the close of business on our record date of April 9, 2015 must be present at the meeting in person or by proxy, which is referred to as a “quorum.” Your shares are counted as present if you attend the meeting and vote in person or if you properly return a proxy or vote over the Internet, by telephone or by mail. Abstentions and broker non-votes will be counted for purposes of establishing a quorum. If a quorum is not present at the meeting, the meeting may be adjourned from time to time until a quorum is present.

| 6 |

How many votes are needed to approve the proposals?

With respect to the election of directors, each director must be elected by a plurality of the votes cast by the shares entitled to vote and present at the meeting, which means that the nominees who receive the highest number of affirmative votes cast will be elected. Shareholders may vote “for” all of the director nominees, ‘‘withhold’’ authority to vote for all of the nominees or “withhold” authority to vote for any individual nominee but vote for other nominees.

The ratification of KPMG as our independent registered public accounting firm and the advisory vote to approve the compensation of our named executive officers require a majority of votes cast to be approved, which means that the number of “for” votes exceeds the number of “against” votes. While the say-on-pay vote is advisory in nature and is not binding on us even if approved by the majority of votes cast, our compensation committee and board will consider the results of the voting on this proposal in formulating future executive compensation policies and practices. Shareholders may vote “for,” “against” or “abstain” from voting on these proposals.

A proxy marked “abstain” with respect to any proposal will not have any effect on the outcome of the vote on that proposal. Similarly, broker non-votes will not be counted as votes cast with respect to any proposal and, therefore, will not have any effect on the outcome of the vote on that proposal.

How will the company solicit proxies?

In addition to soliciting proxies directly, we have requested brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record by them. We also may solicit proxies through our directors, officers and employees in person and by telephone, facsimile and electronic means, without payment of additional compensation to such persons. All expenses incurred in connection with the solicitation of proxies will be borne by us. We have retained Innisfree M&A Incorporated in the solicitation of proxies for a fee of approximately $12,500 plus expenses.

Where and when will I be able to find the voting results?

You can find the official results of voting of our annual meeting in our current report on Form 8-K to be filed within four business days after the meeting. If the official results are not available at that time, we will provide preliminary voting results in our Form 8-K and will provide the final results in an amendment to our Form 8-K as soon as they become available.

How do I submit a proposal for inclusion in the company’s proxy statement for the 2016 annual meeting?

Under Rule 14a-8(e) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, proposals of shareholders intended to be presented at the 2016 annual meeting of shareholders must be received by us on or before January 5, 2016 to be eligible for inclusion in our proxy statement and proxy card related to that meeting. Only proper proposals under Rule 14a-8 of the Exchange Act that are timely received will be included in the proxy statement and proxy card for our 2016 annual meeting of shareholders.

Our bylaws provide that shareholders seeking to bring business before a meeting of shareholders must provide notice thereof not less than 120 nor more than 150 calendar days before the first anniversary of the date of our notice of annual meeting sent to shareholders in connection with the previous year’s annual meeting, and, in such notice, provide to us certain information relating to the proposal. Any shareholder proposal received at our principal executive offices before November 29, 2015 or after December 29, 2015 will be considered untimely and, if presented at the 2016 annual meeting of shareholders, the proxy holders will be able to exercise discretionary authority to vote on any such proposal to the extent authorized by Rule 14a-4(c) promulgated under the Exchange Act.

For information regarding a shareholder’s submission of a director nominee candidate to the nominating and governance committee or a shareholder’s director nomination for election at an annual meeting, see “Corporate Governance Matters – Shareholder Director Nominations.”

| 7 |

CORPORATE GOVERNANCE MATTERS

Our board believes that good corporate governance practices contribute to successful business performance. Our corporate governance practices are designed to align the interests of our board and management with those of our shareholders and to promote integrity throughout our company. Some highlights of our corporate governance practices include the following:

| · | Six of our seven board members are independent, and all of our board committee members are independent, as defined by SEC rules and NYSE listing standards and our more exacting independence guidelines; |

| · | Our board appointed a presiding independent director to chair executive sessions of independent directors without management present and to function as a liaison between independent directors and our Chairman of the Board and other members of management; |

| · | Our board is declassified, with all of our directors elected annually for one-year terms; |

| · | Our board has adopted corporate governance guidelines and a code of conduct and ethics that apply to our directors, officers and employees; |

| · | We maintain a compliance hotline available to all of our employees, and our audit committee has procedures in place for the confidential, anonymous submission of employee concerns relating to accounting, internal controls over financial reporting or audit matters; |

| · | Our internal audit function maintains critical oversight over the key areas of our business and financial processes and controls and reports directly to our audit committee; |

| · | To assist our board in remaining current with their board duties, committee responsibilities and the many important developments affecting our business and our company, we offer training opportunities to our board, as well as participation in the National Association of Corporate Directors and the Board Leadership Program by NYSE Governance Services, which offer our directors access to a wide range of in-person, peer-based and webinar educational programs on corporate governance, committee duties, board leadership and industry developments; |

| · | Our board conducts annual self-evaluations as part of an ongoing process designed to achieve high levels of board and committee performance; |

| · | Our board reviews our CEO succession planning procedures at least twice annually at regularly scheduled board meetings and has approved contingency procedures to enable us to respond to an unexpected vacancy in this position; and |

| · | We do not have a shareholder rights plan, or poison pill. |

Independent Directors

The members of our board of directors who qualify as independent under SEC rules and NYSE listing standards meet in executive session at least twice a year in conjunction with regularly scheduled board meetings. In 2014, the independent members of our board met four times in executive session without management present. Ourboard of directors has affirmatively determined that all of our board members, except our Chairman and CEO, Boland T. Jones, are independent directors under SEC rules and NYSE listing standards, which constitutes a supermajority of our board members. Any independent director may call an executive session of independent directors at any time upon not less than five days’ prior notice duly given. Our independent directors have appointed a presiding independent director, John R. Harris, who has served in this capacity since November 2014. Wilkie S. Colyer previously served as the presiding independent director prior to his untimely death in November 2014.

| 8 |

John F. Cassidy was appointed to our board of directors on April 21, 2015. Our board undertook a thorough review process before filling the vacancy left by the death of Wilkie S. Colyer in November 2014. The board recognizes and appreciates the contributions of Mr. Colyer during his years of service on our board as our former presiding independent director, chairman of our compensation committee and a member of our audit committee and welcomes the experience and skills Mr. Cassidy brings to our board.

Our board has established guidelines to assist it in determining director independence that are more exacting than the independence requirements under SEC rules and NYSE listing standards, and which we refer to in this proxy statement as our “independence guidelines.” Under our independence guidelines, a director will not be independent if:

| · | The director is, or has been within the last three years, employed by us, or an immediate family member is, or has served within the last three years, as one of our executive officers; |

| · | The director has received during any 12-month period within the last three years any direct compensation from us in excess of $100,000, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| · | An immediate family member of the director has received during any 12-month period within the last three years more than $100,000 in direct compensation from us; |

| · | (1) The director or an immediate family member is a current partner of a firm that is our internal or external auditor; (2) The director is a current employee of such a firm; (3) An immediate family member is a current employee of such a firm and participates in the firm’s audit, assurance or tax compliance (but not tax planning) practice; or (4) The director or an immediate family member was within the last three years (but is no longer) a partner or employee of such firm and personally worked on our audit within that time; |

| · | The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of our current executive officers serves or has served on that company’s compensation committee; |

| · | The director is a current employee or executive officer, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, us for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1.0 million or two percent of such other company’s consolidated gross revenues; |

| · | At the time of the independence determination, the director is an employee or executive officer, or an immediate family member is an executive officer, of another company that is indebted to us, or to which we are indebted, and the total amount of either company’s indebtedness to the other at the end of the last completed fiscal year is more than one percent of the other company’s total consolidated assets; or |

| · | The director serves as an officer, director or trustee of a charitable, tax exempt organization and, within the preceding three years, our discretionary charitable contributions to that organization in any single fiscal year are greater than $1.0 million or two percent of that organization’s total annual charitable receipts. |

These independence guidelines are part of our corporate governance guidelines, which are available on our website atpgi.investorroom.com/governance_guidelines(or by following the “Investors” link to “Corporate Governance,” “Corporate Governance Guidelines” on our website atpgi.com). In addition to applying these independence guidelines, our board considers all relevant facts and circumstances when making a determination of independence, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. Our board considers the issue not merely from the standpoint of a director, but also from that of persons or organizations with which the director has a significant affiliation. We believe an independent director should be

| 9 |

free of any relationship with us or our management that is reasonably likely to impair the director’s ability to make independent judgments. If our board determines that a director who satisfies SEC rules and NYSE listing standards is independent even though they do not satisfy all of our independence guidelines, we will disclose and explain that determination in our proxy statement.

After the review and recommendation of our nominating and governance committee, our board of directors has affirmatively determined that all of our non-employee directors, John F. Cassidy, K. Robert Draughon, John R. Harris, W. Steven Jones, Raymond H. Pirtle, Jr. and J. Walker Smith, Jr., are independent members of our board under SEC rules, NYSE listing standards and our independence guidelines. In reaching this determination, our board considered other companies with which our directors may be affiliated to which we provided our services in the ordinary course of business in 2014 and determined that the revenue related to these customers was immaterial. All of these relationships fell below the thresholds under our independence guidelines, SEC rules and NYSE listing standards and for disclosure in “Certain Transactions” in this proxy statement. Our board has determined that none of these relationships constituted material relationships that would impair the independence of our directors or violate our independence guidelines.

Board Leadership Structure

Our board has determined that having a combined Chairman and CEO, board committees comprised entirely of independent directors and a presiding independent director currently provides the leadership structure most appropriate for our company and is in the best interests of our company and shareholders at this time. Our Chairman and CEO is also the founder of our company and has contributed to our success since our inception, by providing our strategic vision and serving as the primary voice of our company. We believe our CEO possesses valuable knowledge of and insight into our company’s strategy and operations and is currently in the best position to focus the independent directors’ attention on the issues of greatest importance to our company and shareholders.

As required by our corporate governance guidelines, our independent directors have appointed a presiding independent director. The presiding independent director chairs executive sessions of the independent directors without management present and functions as a liaison between the independent directors and our Chairman and other members of management.

We believe this leadership structure, together with our other strong corporate governance practices, provides robust independent oversight of management while ensuring clear strategic alignment throughout our company by allowing one person to speak for and lead our company and board. In addition, we believe that it allows efficient communication between management and the board and a clear delineation of our Chairman and CEO’s strategic and day-to-day management operational role from the board’s oversight role. Our overall corporate governance practices combined with the strength of our independent directors minimizes the potential for conflicts that may result from combining the roles of Chairman and CEO. In addition, splitting these roles could potentially make our management and governance processes less effective through undesirable duplication of roles or a blurring of lines of accountability and responsibility without any clear offsetting benefits.

Risk Oversight

Our senior management is responsible for assessing and managing our risk exposures on a day-to-day basis, including the creation of appropriate risk management programs and policies. Our board has delegated oversight of our company’s risk assessment and risk management function to our audit committee. As a result, ouraudit committee has principal responsibility for oversight of our risk management processes and for understanding the overall risk profile of our company. At least quarterly in connection with a regularly scheduled audit committee meeting, executive management reviews and discusses with our audit committee our key financial, compliance, strategic and operational risks. For each of these risks, our audit committee discusses management’s efforts to mitigate such risks. Our audit committee then regularly reports to our board on its risk oversight activities. By receiving a regular report of our key risks and the status of efforts to address and mitigate those risks, our board maintains a practical understanding of our risk philosophy, as well as the key risks our company is facing. In addition, our board discusses with management specific business risks as part of strategy reviews at regularly scheduled board meetings and has regular access to executive management outside of formal board meetings. Through this regular and consistent risk communication, our board has reasonable assurance that all of our material risks are being addressed and that we are

| 10 |

instilling a risk-aware culture into the foundation of our business. In addition, pursuant to our audit committee charter, our company’s independent auditors report directly to the audit committee, which also oversees the objectives, activities and staffing of our internal auditors. Our compensation committee also oversees our compensation policies and practices to ensure that they do not encourage excessive risk taking.

Meetings of the Board of Directors

Our board encourages all board members to attend each of our annual meetings of shareholders. Where a director is unable to attend an annual meeting in person but is able to do so by video or audio conference, we will arrange for the director’s participation by these means. All of our directors attended last year’s annual meeting, either in person or via conference through our iMeet®solution.

Our board conducts its business through meetings and unanimous written consents and through committees of our board. During the year ended December 31, 2014, our board held seven meetings and took action by unanimous written consent on one occasion. Each of our directors attended 75% or more of all of the meetings of the board and committees on which they served, with overall attendance at board and committee meetings during 2014 averaging approximately 97% for our directors as a group. In addition to regularly scheduled meetings, our board members have regular access to our senior executives, and a number of our directors were involved in informal meetings with our executive management team offering advice and suggestions on a broad range of corporate matters.

Committees of the Board of Directors

We have three standing committees to which directors are appointed: our audit, compensation and nominating and governance committees. Each committee’s charter is available on our website at the links set forth below (follow the “Investors” link to “Corporate Governance,” “Board Committees”) and in print to any shareholder who requests it in writing to our Secretary at the address provided under the heading, “— Communications with the Board of Directors.”

Members of our board currently serve on the committees indicated below:

| Director | Audit | Compensation | Nominating and Governance |

| Boland T. Jones | |||

| John F. Cassidy | |||

| K. Robert Draughon | Chairman | Member | |

| John R. Harris | Chairman | Chairman | |

| W. Steven Jones | Member | ||

| Raymond H. Pirtle, Jr. | Member | ||

| J. Walker Smith, Jr. | Member |

Wilkie S. Colyer previously served as presiding independent director, chairman of our compensation committee and our audit committee member until his death in November 2014.

Audit Committee

Current Members |

Primary Responsibilities | Number ofMeetings |

K. Robert Draughon (Chairman) W. Steven Jones Raymond H. Pirtle, Jr. | · reviewing our financial statements, reports and other financial information;

· appointing and overseeing our independent auditors, who report directly to our audit committee; | 9 |

| 11 |

Current Members |

Primary Responsibilities | Number ofMeetings |

· overseeing the integrity of our financial reporting processes and the annual audit of our financial statements;

· reviewing with our auditors our internal controls and procedures for financial reporting;

· reviewing the quality and appropriateness of our accounting principles and underlying estimates;

· pre-approving all audit and permitted non-audit services;

· overseeing our company’s processes for identifying and managing risk;

· overseeing the performance of our internal audit function;

· establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential anonymous submission of concerns regarding questionable accounting or auditing matters; and

· approving and reviewing on an ongoing basis our related party transactions. |

These duties and responsibilities are set forth in our amended and restated audit committee charter, a copy of which is available on our website atpgi.investorroom.com/audit_committee_charter.

At least quarterly in connection with a regularly scheduled meeting, our audit committee meets separately in executive session with our external auditors and also with our internal auditors without management present.

Our board of directors has determined that each of our audit committee members qualifies as an audit committee financial expert under SEC rules and NYSE listing standards, and each is financially literate and independent, as independence for audit committee members is defined in our independence guidelines, SEC rules and NYSE listing standards. Effective immediately following the filing of this proxy statement, Mr. Cassidy will become a member of our audit committee. Our board has also determined that Mr. Cassidy qualifies as an audit committee financial expert and is financially literate and independent under our independence guidelines, SEC rules and NYSE listing standards.

Compensation Committee

Current Members |

Primary Responsibilities | Number ofMeetings |

John R. Harris (Chairman) K. Robert Draughon | · setting and approving the compensation goals regarding our CEO and evaluating our CEO’s performance in light of those goals;

· reviewing and evaluating the compensation of our other executive officers and our compensation programs as a whole;

· determining and approving the compensation of our CEO and our other executive officers;

· reviewing and evaluating the compensation of our directors and recommending changes in director compensation to our board;

· administering stock award grants to our directors, executive officers and other employees under our equity-based plans; and | 9 |

| 12 |

Current Members |

Primary Responsibilities | Number ofMeetings |

· making recommendations to the board regarding our incentive compensation plans and equity-based plans. |

These duties and responsibilities are set forth in our amended and restated compensation committee charter, a copy of which is available on our website atpgi.investorroom.com/compensation_committee_charter.

Messrs. Harris and Draughon are independent under our independence guidelines, SEC rules and NYSE listing standards. Mr. Harris was appointed the chairman of our compensation committee, and Mr. Draughon was appointed a member of our compensation committee, in December 2014 to fill the vacancy created by Mr. Colyer’s death.

Our compensation committee’s charter provides that the committee has authority to delegate any of its responsibilities to subcommittees as it may deem appropriate. Ourcompensation committee’s charter complies with the new SEC and NYSE standards relating to independence of compensation committee members, the authority of compensation committee members to retain compensation advisers and the requirement to consider any compensation adviser’s independence.If an independent compensation consultant is retained to assist in evaluating the amount or form of director or executive compensation or make recommendations about such compensation, our compensation committee has the sole authority to retain, at our expense, and terminate the compensation consultant, including sole authority to approve the consultant’s fees and other retention terms. For example, our compensation committee generally retains an independent compensation consultant to complete a study of our executive compensation on an annual basis and our director compensation on a biennial basis, to review and comment on our existing compensation programs and to assist us with the design of future programs that enhance our pay-for-performance philosophy and align our compensation practices with shareholder value. For more information regarding our compensation committee’s process and procedures for considering and determining executive compensation, including the role of compensation consultants and executive officers in determining executive compensation, see “Compensation Discussion and Analysis.”

Compensation Committee Interlocks and Insider Participation

No member of our compensation committee had a relationship that requires disclosure as a compensation committee interlock.

Nominating and Governance Committee

Current Members |

Primary Responsibilities | Number ofMeetings |

John R. Harris (Chairman) J. Walker Smith, Jr. | · identifying individuals qualified to serve on our board, consistent with criteria approved by our board;

· recommending to our board director nominees for election by our shareholders at the annual meeting;

· developing and recommending to our board a set of corporate governance principles applicable to us as may be required or appropriate for our effective governance;

· reviewing annually our corporate governance guidelines and board committee charters;

· overseeing the annual evaluation of our management, board and committees of the board; and | 3 |

| 13 |

Current Members |

Primary Responsibilities | Number ofMeetings |

· reporting the results of these reviews and evaluations to our board, committees and management, along with any recommendations for improvements. |

These duties and responsibilities are set forth in our nominating and governance committee charter, a copy of which is available on our website atpgi.investorroom.com/nominating_and_governance_committee_charter.

Messrs. Harris and Smith are independent under our independence guidelines, SEC rules and NYSE listing standards.

Our nominating and governance committee evaluates and recommends nominees for election to our board based on a number of qualifications, including, but not limited to, level of education and business experience, independence and the absence of a conflict of interest that would interfere with performance as a director, character and integrity, financial literacy, sufficient time to devote to board matters and a commitment to represent the long-term interests of our shareholders.

Our corporate governance guidelines provide that our nominating and governance committee annually review the appropriate experience, skills and qualifications expected of board members in the context of the current membership of the board. These guidelines provide that this assessment should include, among other relevant factors, in the context of the perceived needs of our board at that time, issues of experience, reputation, judgment, diversity and skills. In selecting candidates for nomination, these guidelines also provide that our nominating and governance committee consider such criteria as it deems appropriate, which may include current or recent experience as a senior executive officer, business expertise currently desired on the board, with specific attention to the requirements for membership on the audit committee, industry experience and the general ability to enhance the overall composition of our board. Although we do not currently have a formal diversity policy, diversity is among the factors considered, and we believe that these guidelines will result in board members with a complementary mix of background, viewpoints, professional and educational experience and skills.

Our nominating and governance committee identifies potential director nominees through a variety of business contacts, including our current executive officers, directors, community leaders and shareholders, as a source for potential board candidates. Our nominating and governance committee may, to the extent it deems appropriate, retain a professional search firm and other advisors to identify potential nominees for directors.

Our nominating and governance committee evaluates candidates to our board by reviewing their biographical information and qualifications. If our nominating and governance committee determines that a candidate is qualified to serve on our board, at least one member of this committee seeks to interview such candidate. All members of our board also have an opportunity to interview qualified candidates. Our nominating and governance committee may provide for additional screening criteria, including independent background checks, as this committee deems appropriate to evaluate a candidate. The nominating and governance committee then determines, based on the background information and the information obtained in any interviews, whether to recommend to our board that a candidate is nominated for approval by the shareholders to fill a directorship. With respect to an incumbent director, our nominating and governance committee reviews and considers the incumbent director’s service to us during his or her term, including the number of meetings attended, level of participation and overall contribution to us, in addition to such person’s biographical information and qualifications. The manner inwhich our nominating and governance committee evaluates a potential nominee will not differ based on whether the candidate is recommended by one of our shareholders.

Our nominating and governance committee seeks to ensure that the composition of our board at all times adheres to the requirements of our independence guidelines, SEC rules and NYSE listing standards and reflects a variety of complementary experiences and backgrounds, particularly in the areas of leadership and management, which are sufficient to provide sound and prudent guidance with respect to our operations and interests.

| 14 |

Shareholder Director Nominations

Our nominating and governance committee will consider written recommendations from shareholders for nominees to our board of directors. A shareholder who wishes to recommend a person to our nominating and governance committee for nomination to our board must submit a written notice by mail to the committee at the address provided under the heading “— Communications with the Board of Directors.” The written recommendation to this committee should include:

| · | the candidate’s name, age, business addresses and other contact information; |

| · | a complete description of the candidate’s qualifications, experience, background and affiliations, as would be required to be disclosed in our proxy statement pursuant to Regulation 14A of the Exchange Act; |

| · | a sworn or certified statement by the candidate in which he or she consents to being named in the proxy statement as a nominee and to serve as a director if elected; and |

| · | the name and address of the shareholder(s) of record making such a recommendation. |

In addition to the above procedures, our bylaws provide that a shareholder may propose a director candidate to be considered and voted on at an annual meeting of shareholders by providing notice thereof to our Secretary not less than 120 calendar days nor more than 150 calendar days before the first anniversary of the date of our notice of annual meeting sent to shareholders in connection with the previous year’s annual meeting; however, our board will determine whether information regarding such a director candidate will be included in our proxy statement to shareholders for the annual meeting. This notice provided by a shareholder to our Secretary must set forth certain information relating to the proposed nominee as required by our bylaws.

Code of Conduct and Ethics and Corporate Governance Guidelines

We have adopted a code of conduct and ethics that applies to all employees, directors and officers, including our principal executive officer and principal financial and accounting officer. We have also adopted corporate governance guidelines that provide a framework within which our board and management can effectively pursue our governance objectives for the benefit of our shareholders.

Our code of conduct and ethics and our corporate governance guidelines are each posted on our website, copies of which are available atpgi.investorroom.com/conductandpgi.investorroom.com/governance_guidelines,respectively (or follow the “Investors” link to “Corporate Governance,” “Code of Conduct and Ethics” and “Corporate Governance Guidelines,” respectively, on our websitepgi.com). Our code and guidelines are available in print to any shareholder who requests it by writing to our Secretary at the same address under “—Communications with the Board of Directors.” We will post any amendments to, or waivers from, any provision of our code of conduct and ethics with respect to our principal executive officer and principal financial and accounting officer or any other persons performing similar functions by disclosing the nature of such amendment or waiver at the above-referenced location on our website.

Communications with the Board of Directors

Our board accepts communications sent to the board (or to specified individual directors) by our shareholders or other interested third parties. Shareholders and other interested third parties may communicate with our board (or with our presiding independent director, our non-management directors as a group or specified individual directors) by writing to us at Premiere Global Services, Inc., c/o Secretary, 3280 Peachtree Road, NE, The Terminus Building, Suite 1000, Atlanta, Georgia 30305. All written communications received in such manner will be compiled by our Secretary and forwarded promptly to the board or appropriate director(s) prior to or at the next regularly scheduled meeting of the board.

| 15 |

Director Compensation

Our compensation committee reviews and evaluates the cash and equity compensation of our directors and recommends any changes in director compensation to our board. Our CEO, who also serves as Chairman of the Board, does not receive compensation for his service as a director.

Our compensation committee generally retains an independent compensation consultant to complete a study of our non-employee director compensation on a biennial basis. In the fall of each of 2012 and 2014, our compensation committee retained Aon Hewitt to provide an analysis of relevant market data based on non-employee director compensation derived from a peer group of comparable companies and recommended changes consistent with market practices for similarly-situated directors. Our peer group is the same for executive and director compensation and is discussed under “Compensation Discussion and Analysis – Executive Compensation Determinations and Assessments.”

Aon Hewitt reviewed our peer group’s total compensation paid to non-employee directors, which includes retainers, board fees, committee fees and equity awards as part of our 2012 and 2014 comprehensive compensation studies.

Our board’s last revision to our overall non-employee director compensation became effective on January 1, 2013. Our 2012 compensation study concluded that the proposed total director compensation for 2013 was at the 50th percentile of our peer group and that the equity-to-cash ratio of approximately 70%/30% was competitive with market practice. In addition, our compensation study found that our stock ownership guidelines requiring our non-employee directors to hold five times the annual board cash retainer was competitive with our peer group, which only requires a median multiple of three times. Although our 2014 compensation study concluded that our total director compensation was somewhat below market, our compensation committee decided not to recommend any overall changes at this time.

The chart below sets forth the elements of our non-employee director compensation for 2014:

Cash Retainers

| Board Fees: | ($) |

| Annual cash retainer(1) | 50,000 |

| Attendance at all quarterly, regularly scheduled board meetings(2) | 10,000 |

| Attendance at special board meeting | 1,000 |

| Per diem for authorized special projects and director training | 1,250 |

| Committee Annual Cash Retainers: | |

| Chairman of audit committee | 10,000 |

| Member of audit committee | 5,000 |

| Chairman of compensation committee | 10,000 |

| Member of compensation committee | 5,000 |

| Chairman of nominating and governance committee | 5,000 |

| Member of nominating and governance committee | 2,500 |

| Presiding independent director fee(3) | 20,000 |

| 16 |

Equity Awards

| Board Awards: | ($) |

| Base equity retainer | 160,000 |

| Committee Annual Equity Retainers: | |

| Chairman of audit committee | 10,000 |

| Member of audit committee | 5,000 |

| Chairman of compensation committee | 10,000 |

| Member of compensation committee | 5,000 |

| Chairman of nominating and governance committee | 5,000 |

| Member of nominating and governance committee | 2,500 |

_____________

| (1) | Our stock ownership guidelines require our non-employee directors to hold five times our annual cash retainer, representing $250,000 worth of our common stock. |

| (2) | Board years run from annual shareholders’ meeting to annual shareholders’ meeting. |

| (3) | Our board increased the presiding independent director fee to $50,000, effective January 1, 2015, in consideration of the duties, additional time commitment and responsibilities of our presiding independent director. |

We pay annual cash retainers in four quarterly installments, and we grant 25% of the board and committee annual equity retainers in fair market value of restricted stock to each non-employeedirector in arrears on the last day of each calendar quarter; provided that the director remains in that position on our board on such dates. The shares granted on such dates vest immediately in recognition of service for the prior quarter. Upon a change in control of our company (as defined in our amended and restated 2000 directors stock plan, as amended, or directors stock plan), each of our non-employee directors would receive a grant equal to the annual equity grants for the prospective year. We determine the number of shares to be granted by dividing the dollar amount of the applicable award by our common stock’s trailing 20-day average closing price on the grant date and pay any fractional shares in cash. One-half of the shares held by each director are subject to a holding period until such director meets our stock ownership guidelines. Directors joining the board or a committee during a board year receive pro-rated cash retainers and equity awards.

In addition, each director may elect to defer the equity component of his compensation for Board service. Messrs. Colyer and Harris elected to defer the equity component of their compensation for Board service for 2014. Mr. Colyer’s deferral date accelerated upon his death.

Miscellaneous

We pay or reimburse directors for travel and accommodation expenses to attend meetings and other corporate functions. In addition, we encourage directors to visit our facilities, participate in executive management meetings and director education programs and to attend our annual company sales incentive trip, and we pay their expenses related to such events (including expenses for their spouse or a guest if they attend our annual sales incentive trip).

| 17 |

Director Compensation for Fiscal Year 2014

| Name (1) | Fees Earned or Paid in Cash ($) (2) | Stock Awards ($) (3)(4) | Total ($) |

| Wilkie S. Colyer | 74,781 | 129,321 | 204,102 |

| K. Robert Draughon | 72,212 | 168,936 | 241,148 |

| John R. Harris | 74,277 | 168,936 | 243,213 |

| W. Steven Jones | 67,026 | 163,774 | 230,800 |

| Raymond H. Pirtle, Jr. | 67,026 | 163,774 | 230,800 |

| J. Walker Smith, Jr. | 64,525 | 161,294 | 225,819 |

| (1) | Mr. Boland Jones does not receive compensation in any form for his service on our board as he is considered an inside director, and his compensation as our CEO is described under “Compensation Discussion and Analysis– Elements of Our Executive Compensation Program” and in our Summary Compensation Table. |

| (2) | Cash retainers and fees per board year are paid in arrears and in quarterly installments. Payments in 2014 for each non-employee director included: (a) an annual retainer of $50,000; (b) $10,000 if the director attended all quarterly, regularly scheduled board meetings during the board year, which all of our directors received; (c) $2,000 for attendance at two special meetings, which all of our directors received; (d) additional cash retainers for committee chairs and members, for which Mr. Colyer received $7,500, Mr. Draughon received $5,190, Mr. Harris received $10,190, Mr. Steve Jones received $5,000, Mr. Pirtle received $5,000 and Mr. Smith received $2,500 (with Messrs. Colyer, Draughon and Harris receiving a pro rata amount based on Mr. Colyer’s death on November 25, 2014, Mr. Harris’ appointment as presiding independent director and chairman of our compensation committee effective November 25, 2014 and December 18, 2014, respectively, and Mr. Draughon’s appointment as compensation committee member effective December 18, 2014); and (e) $20,000 for services as the presiding independent director, of which Mr. Colyer received $15,000 and Mr. Harris received $2,065. |

| (3) | Amounts shown reflect the aggregate fair value of the awards on the date they were granted, computed in accordance with Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, or ASC 718. The grant date fair value of the stock awards is based on the fair market value of the underlying shares on the date of grant. The table below sets forth the grant date, the number of shares and the grant date fair value of each stock award during 2014. The dollar values reflected do not equal the amount reflected in the Stock Awards column above because the amounts shown in the Stock Awards column above include certain de minimis amounts (less than $20) for each quarterly award that were paid in cash in lieu of fractional shares. Stock awards granted in 2014 were as follows: |

| Stock Awards | ||||||||

| March 31, 2014 | June 30, 2014 | September 30, 2014 | December 31, 2014 | |||||

Name | Shares (#) | Value ($) | Shares (#) | Value ($) | Shares (#) | Value ($) | Shares (#) | Value ($) |

| Wilkie S. Colyer | 3,642 | 43,923 | 3,316 | 44,269 | 3,436 | 41,129 | — | — |

| K. Robert Draughon | 3,538 | 42,668 | 3,222 | 43,014 | 3,338 | 39,956 | 4,077 | 43,298 |

| John R. Harris | 3,538 | 42,668 | 3,222 | 43,014 | 3,338 | 39,956 | 4,077 | 43,298 |

| W. Steven Jones | 3,434 | 41,414 | 3,127 | 41,745 | 3,240 | 38,783 | 3,939 | 41,832 |

| Raymond H. Pirtle, Jr. | 3,434 | 41,414 | 3,127 | 41,745 | 3,240 | 38,783 | 3,939 | 41,832 |

| J. Walker Smith, Jr. | 3,382 | 40,787 | 3,079 | 41,105 | 3,191 | 38,196 | 3,880 | 41,206 |

| (4) | None of our outside directors have any unvested stock awards. Please see “Security Ownership of Certain Beneficial Owners and Management” for a description of the common stock holdings of each director. |

| 18 |

CERTAIN TRANSACTIONS

Our board has adopted a statement of policy with respect to related person transactions, which sets forth in writing the policies and procedures for the review, approval or ratification of any transaction (or any series of similar transactions) in which our company was, is or will be a participant and the amount involved exceeds $5,000, and in which any related person had, has or will have a direct or indirect material interest. For purposes of the policy, a “related person” is:

| · | any person who is, or at any time since the beginning of our last fiscal year was, our executive officer or director or a nominee to become one of our directors; |

| · | any shareholder owning in excess of five percent of our company; |

| · | any immediate family member of any of the foregoing persons; or |

| · | any firm, corporation or other entity in which any of the foregoing persons is employed or is a partner or principal or in a similar position or in which such person has a five percent or greater beneficial ownership interest. |

Our board of directors has determined that our audit committee is best suited to review and approve related person transactions. Prior to the consummation of, or material amendment to, a related person transaction, our audit committee reviews the transaction and considers all relevant facts and circumstances, including, but not limited to:

| · | the benefits to us from the transaction; |

| · | the impact on a director’s independence, if applicable; |

| · | the availability of other sources for comparable products or services; |

| · | the terms of the transaction; and |

| · | the terms available to unrelated third parties or employees generally. |

Our audit committee approves only those related person transactions that are in, or are not inconsistent with, the best interests of our company and our shareholders. Other than a transaction involving compensation that is approved by our compensation committee, we will consummate or continue a related person transaction only if our audit committee has approved or ratified it in accordance with the guidelines set forth in the policy and the transaction is on terms comparable to those that could be obtained in arm’s length dealings in the ordinary course with unrelated third parties. Based on the conclusions reached, our audit committee would evaluate all feasible options, including but not limited to, ratification, amendment, rescission or termination of the related person transaction.

In 2014, no related party transactions required approval by our audit committee, and there are no transactions or currently proposed transactions in which our company is or will be a participant and the amount involved exceeds $120,000 and in which any related person has or will have a direct or indirect material interest.

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees

Pursuant to our bylaws, the number of our directors may not be less than three or more than ten, with the precise number to be determined by resolution of our board of directors from time to time. Currently, seven directors serve on our board. Our board is declassified, with each of our directors

| 19 |

elected each year by our shareholders for one-year terms until successors are elected and qualified or until such director’s death, resignation or removal. All of our nominees, except Mr. Cassidy, were elected to the board at our annual meeting last year, with each of our directors receiving well over a majority vote, and our board as a whole garnering significant shareholder support with an average of approximately 90.8% of votes cast in favor of our nominees. Mr. Cassidy was elected to the board by our then-current board members on April 21, 2015. All of the nominees have consented to being named and to serve if elected.

If any of the nominees should be unavailable to serve for any reason (which is not anticipated), our board may designate a substitute nominee or nominees (in which case the persons named as proxies on the proxy card or voting instruction form will vote the shares represented by all valid proxy cards or voting instruction forms for the election of such substitute nominee or nominees), allow the vacancy or vacancies to remain open until a suitable candidate or candidates are located and nominated by resolution of our board. The board may also decide to reduce the size of the board by resolution.

Our board unanimously recommends a vote “FOR” all of the nominees listed below for election as directors.

Information Regarding Nominee Directors and Executive Officers

We believe that our directors’ executive leadership, finance, global business, technology, academic and marketing experiences represent a range of perspectives that provide collaborative and candid discussions relevant to our company’s operations. Our directors’ varied experiences include CEO positions with domestic and international companies with operations inside and outside of the United States and leadership positions at leading investment banking firms, academic institutions and global marketing research companies, as well as service on other public, private and non-profit company boards. The following table summarizes the primary qualifications that our nominees for director bring to our board. The lack of a mark in the table does not mean that the director does not possess that experience or skill; rather a mark indicates a specific area of focus or expertise on which our board relies most heavily and were most relevant to the decision to nominate the director to serve on our board.

Summary of Director Qualifications

| John F. Cassidy | K. Robert Draughon | John R.Harris | Boland T. Jones | W. StevenJones | RaymondH. Pirtle | J. WalkerSmith | |

| Public company CEO/leadership experience | P | P | P | P | P | P | P |

| Financial expertise | P | P | P | P | P | P | |

| Global business experience | P | P | P | P | P | P | |

| M&A experience | P | P | P | P | P | ||

| Public company board service and governance | P | P | P | P | P | ||

| Technology industry experience | P | P | P | P | P | P | |

| Academic/education experience | P | P | P | P | |||

| Brand/marketing expertise | P | P | P | P |

Each director’s biographical information below describes certain key business experiences and skills regarding our nominees for director and our current executive officers in more detail.

Director Nominees

Boland T. Jones, Chairman of the Board and Chief Executive Officer, Premiere Global Services, Inc.

Director since July 1991

As our company’s founder, Mr. Jones’ nearly two decades of experience leading our company provides an in-depth understanding of our history and complexity and adds a valuable perspective for board decision making, which supports his nomination to our board.

| 20 |

Mr. Jones, 55, our founder, has served as Chief Executive Officer since our inception in July 1991. Since September 1993, Mr. Jones has also served as Chairman of the Board. From February 1993 until August 1998, Mr. Jones was our President.

Former Directorships:

HSW International, Inc.

WebMD, Inc.

John F. Cassidy, Senior Advisor, Blackstone Capital Partners