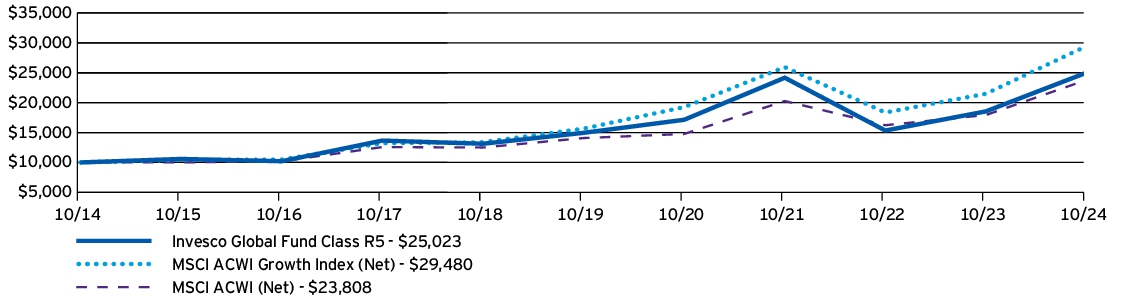

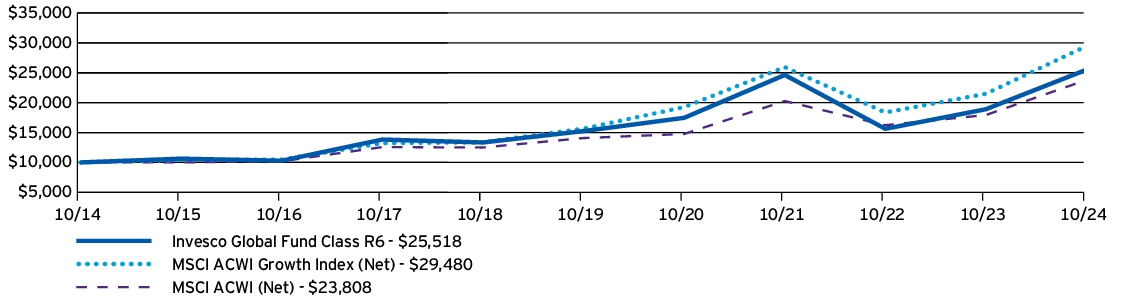

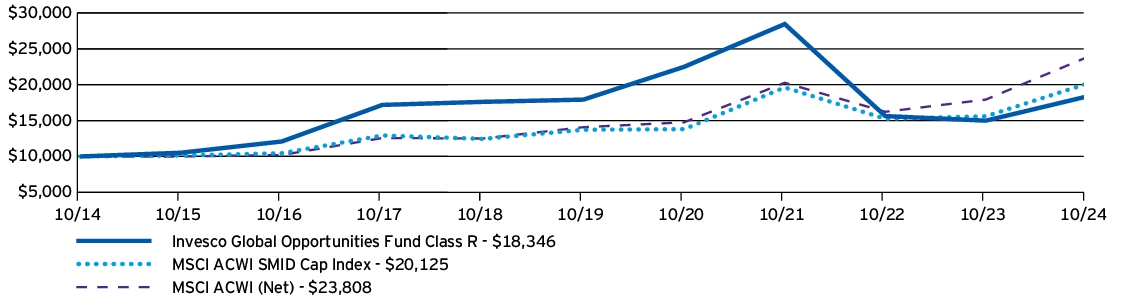

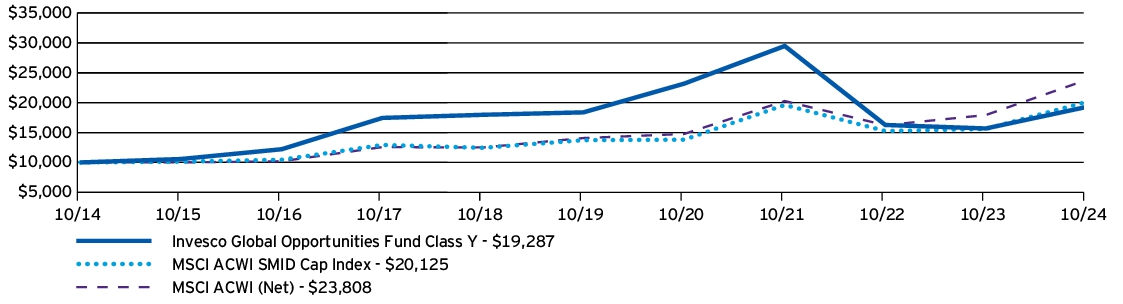

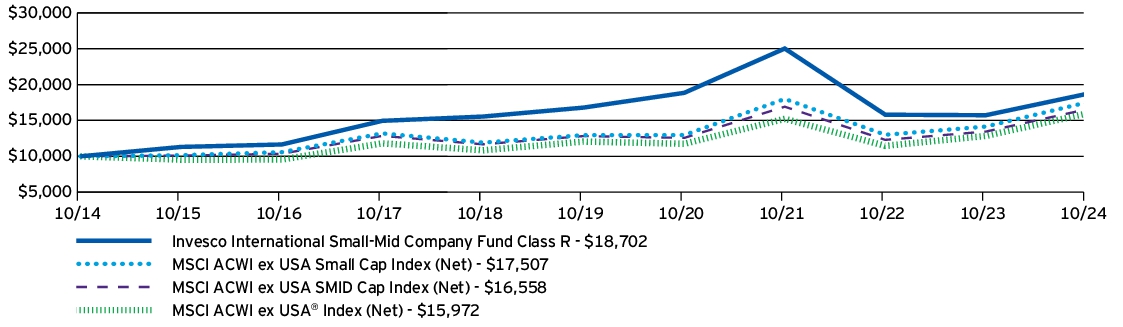

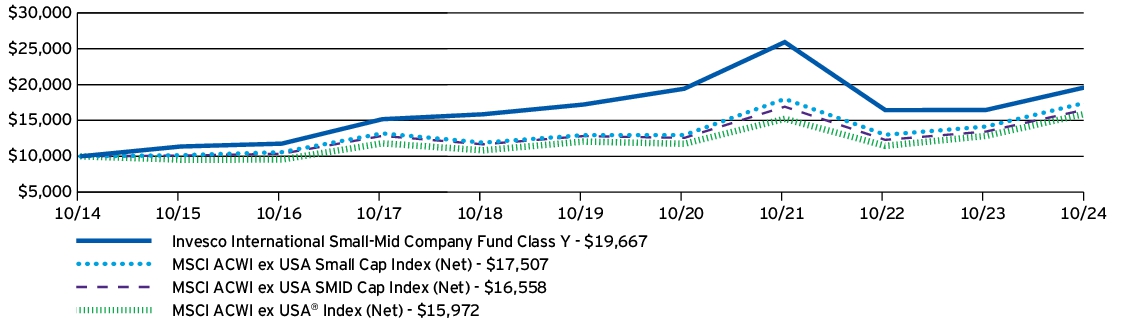

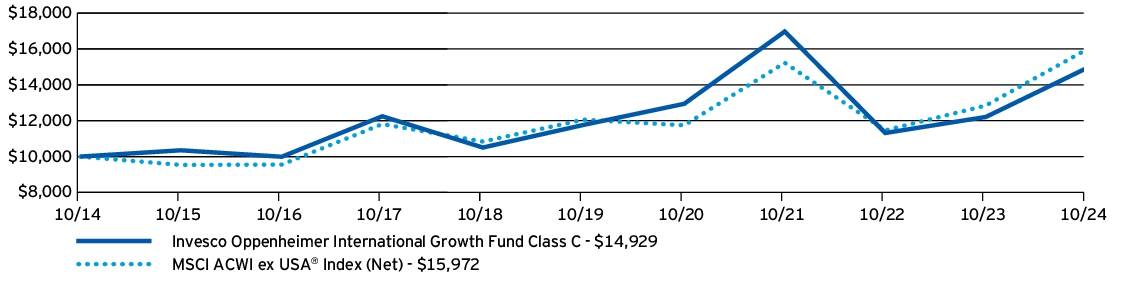

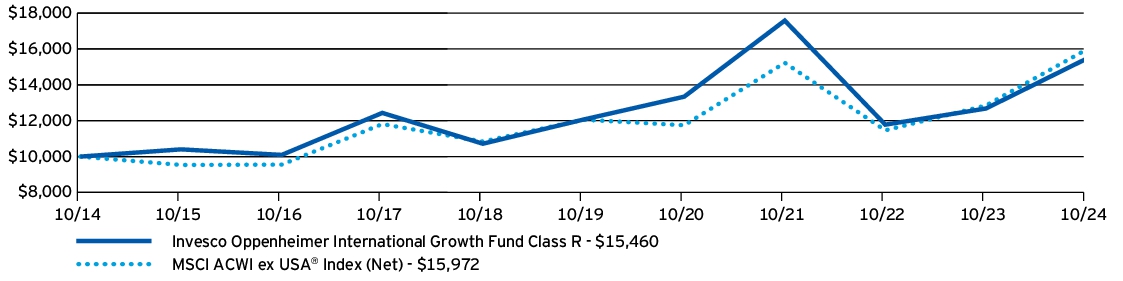

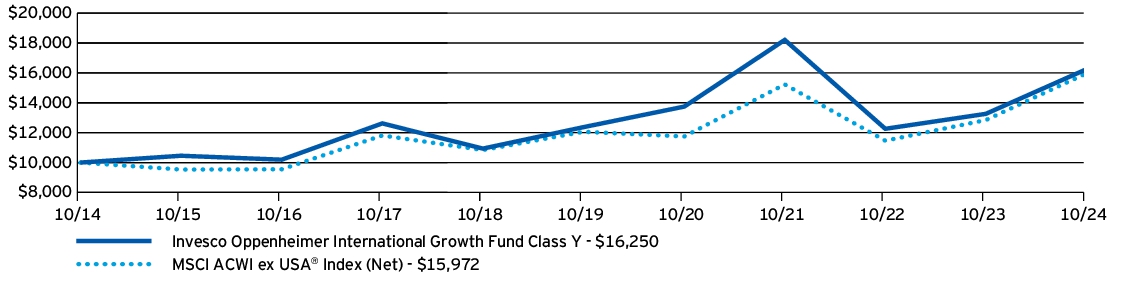

0000880859 aimimf:C000209200Member oef:MaterialsSectorMember 2024-10-31

UNITED STATES

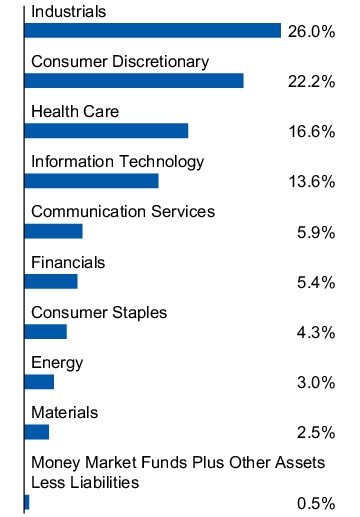

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

AIM International Mutual Funds (Invesco International Mutual Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Glenn Brightman, Principal Executive Officer

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders.

(a) The Registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") is as follows:

Invesco Advantage International Fund

Class A: QMGAX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Advantage International Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Advantage International Fund

(Class A) | $114 | 1.06%† |

† | Reflects fee waivers and /or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• The global monetary easing cycle finally arrived, with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets. Throughout the fiscal year, monetary policy remained a key market driver, with dovish central bank comments boosting market sentiment and expectations of further rate cuts.

• For the fiscal year ended October 31, 2024, Class A shares of the Fund, excluding sales charge, returned 15.61%. For the same time period, the MSCI ACWI ex USA® Index (Net) (“Benchmark Index") returned 24.33%.

What contributed to performance?

Diversified International Stock Portfolio | The Fund's exposure to a diversified portfolio of international stocks, designed to have low tracking error relative to the Benchmark Index, provided growth over the year and performed in line with the Benchmark Index.

What detracted from performance?

Factor tilts to low volatility stocks | The Fund's exposure to low volatility stocks helped to reduce the impact of market volatility and drawdowns relative to the Benchmark Index. However, due to the more defensive nature of the investments, this exposure dragged on overall relative performance as equity markets generally trended upwards over the year.

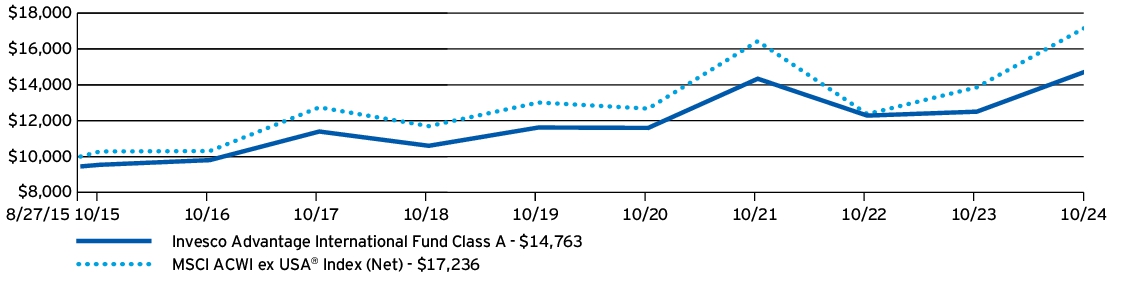

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since

Inception

(8/27/15) |

| Invesco Advantage International Fund (Class A) —including sales charge | 9.32% | 3.32% | 4.34% |

| Invesco Advantage International Fund (Class A) —excluding sales charge | 15.61% | 4.48% | 4.98% |

| MSCI ACWI ex USA® Index (Net) | 24.33% | 5.78% | 6.11% |

Effective after the close of business on May 24, 2019, Class A shares of Oppenheimer Global Multi-Asset Growth Fund, (the predecessor fund), were reorganized into Class A shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class A shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $31,998,953% |

| Total number of portfolio holdings | $453% |

| Total advisory fees paid | $0% |

| Portfolio turnover rate | $156% |

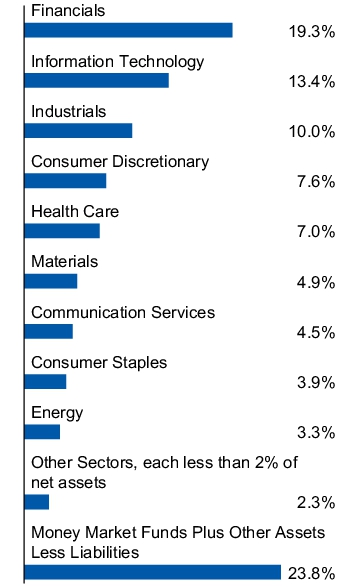

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 4.23% |

| China Construction Bank Corp., H Shares | 1.36% |

| Novo Nordisk A/S, Class B | 1.34% |

| Novartis AG | 1.27% |

| ASML Holding N.V. | 1.08% |

| PDD Holdings, Inc., ADR | 1.08% |

| Roche Holding AG | 0.97% |

| Hitachi Ltd. | 0.97% |

| Samsung Electronics Co. Ltd. | 0.92% |

| Industrial & Commercial Bank of China Ltd., H Shares | 0.91% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective March 1, 2024, the expense limitation for Class A shares changed from 0.85% to 1.18% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on February 28, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Advantage International Fund

Class C: QMGCX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Advantage International Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Advantage International Fund

(Class C) | $194 | 1.81%† |

† | Reflects fee waivers and /or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• The global monetary easing cycle finally arrived, with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets. Throughout the fiscal year, monetary policy remained a key market driver, with dovish central bank comments boosting market sentiment and expectations of further rate cuts.

• For the fiscal year ended October 31, 2024, Class C shares of the Fund, excluding sales charge, returned 14.79%. For the same time period, the MSCI ACWI ex USA® Index (Net) (“Benchmark Index") returned 24.33%.

What contributed to performance?

Diversified International Stock Portfolio | The Fund's exposure to a diversified portfolio of international stocks, designed to have low tracking error relative to the Benchmark Index, provided growth over the year and performed in line with the Benchmark Index.

What detracted from performance?

Factor tilts to low volatility stocks | The Fund's exposure to low volatility stocks helped to reduce the impact of market volatility and drawdowns relative to the Benchmark Index. However, due to the more defensive nature of the investments, this exposure dragged on overall relative performance as equity markets generally trended upwards over the year.

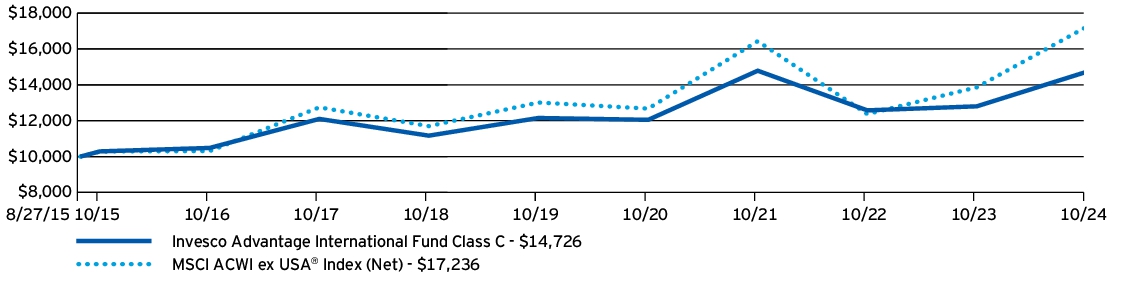

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since

Inception

(8/27/15) |

| Invesco Advantage International Fund (Class C) —including sales charge | 13.91% | 3.74% | 4.31% |

| Invesco Advantage International Fund (Class C) —excluding sales charge | 14.79% | 3.74% | 4.31% |

| MSCI ACWI ex USA® Index (Net) | 24.33% | 5.78% | 6.11% |

Effective after the close of business on May 24, 2019, Class C shares of Oppenheimer Global Multi-Asset Growth Fund, (the predecessor fund), were reorganized into Class C shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class C shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $31,998,953% |

| Total number of portfolio holdings | $453% |

| Total advisory fees paid | $0% |

| Portfolio turnover rate | $156% |

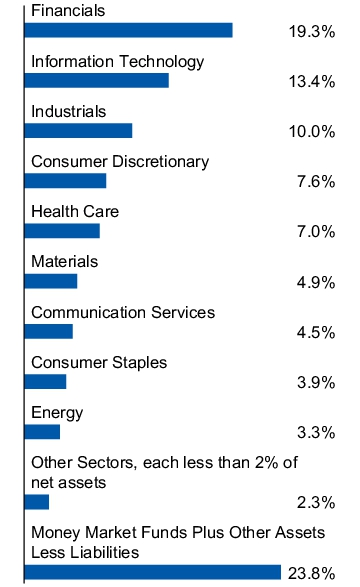

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 4.23% |

| China Construction Bank Corp., H Shares | 1.36% |

| Novo Nordisk A/S, Class B | 1.34% |

| Novartis AG | 1.27% |

| ASML Holding N.V. | 1.08% |

| PDD Holdings, Inc., ADR | 1.08% |

| Roche Holding AG | 0.97% |

| Hitachi Ltd. | 0.97% |

| Samsung Electronics Co. Ltd. | 0.92% |

| Industrial & Commercial Bank of China Ltd., H Shares | 0.91% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective March 1, 2024, the expense limitation for Class C shares changed from 1.60% to 1.93% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on February 28, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Advantage International Fund

Class R: QMGRX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Advantage International Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Advantage International Fund

(Class R) | $141 | 1.31%† |

† | Reflects fee waivers and /or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• The global monetary easing cycle finally arrived, with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets. Throughout the fiscal year, monetary policy remained a key market driver, with dovish central bank comments boosting market sentiment and expectations of further rate cuts.

• For the fiscal year ended October 31, 2024, Class R shares of the Fund returned 15.31%. For the same time period, the MSCI ACWI ex USA® Index (Net) (“Benchmark Index") returned 24.33%.

What contributed to performance?

Diversified International Stock Portfolio | The Fund's exposure to a diversified portfolio of international stocks, designed to have low tracking error relative to the Benchmark Index, provided growth over the year and performed in line with the Benchmark Index.

What detracted from performance?

Factor tilts to low volatility stocks | The Fund's exposure to low volatility stocks helped to reduce the impact of market volatility and drawdowns relative to the Benchmark Index. However, due to the more defensive nature of the investments, this exposure dragged on overall relative performance as equity markets generally trended upwards over the year.

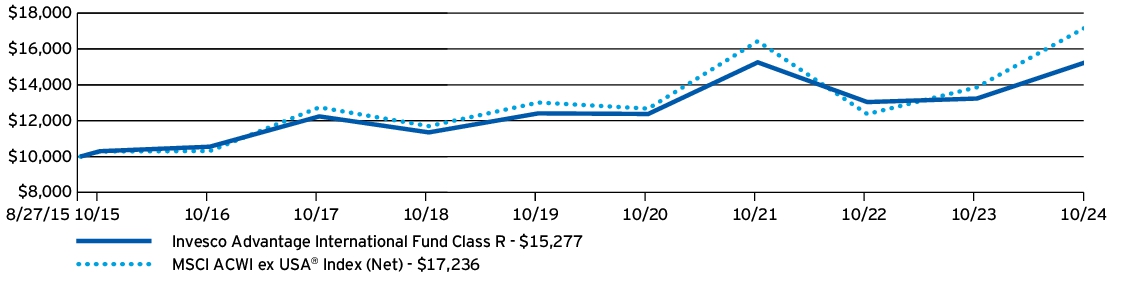

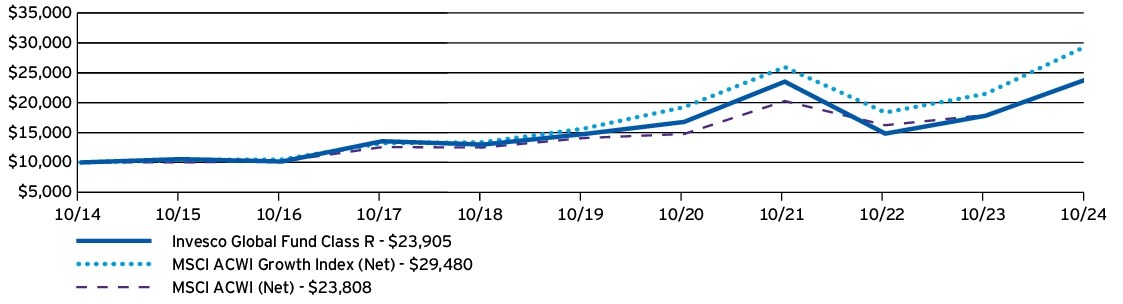

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since

Inception

(8/27/15) |

| Invesco Advantage International Fund (Class R) | 15.31% | 4.25% | 4.73% |

| MSCI ACWI ex USA® Index (Net) | 24.33% | 5.78% | 6.11% |

Effective after the close of business on May 24, 2019, Class R shares of Oppenheimer Global Multi-Asset Growth Fund, (the predecessor fund), were reorganized into Class R shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class R shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $31,998,953% |

| Total number of portfolio holdings | $453% |

| Total advisory fees paid | $0% |

| Portfolio turnover rate | $156% |

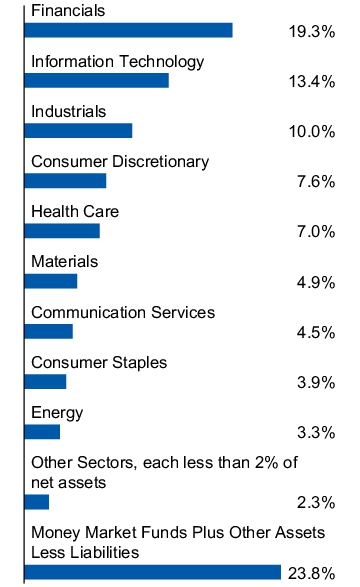

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 4.23% |

| China Construction Bank Corp., H Shares | 1.36% |

| Novo Nordisk A/S, Class B | 1.34% |

| Novartis AG | 1.27% |

| ASML Holding N.V. | 1.08% |

| PDD Holdings, Inc., ADR | 1.08% |

| Roche Holding AG | 0.97% |

| Hitachi Ltd. | 0.97% |

| Samsung Electronics Co. Ltd. | 0.92% |

| Industrial & Commercial Bank of China Ltd., H Shares | 0.91% |

| * Excluding money market fund holdings, if any. | |

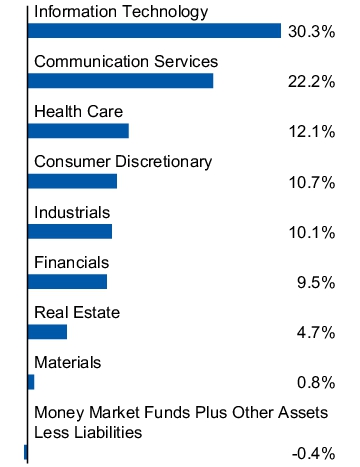

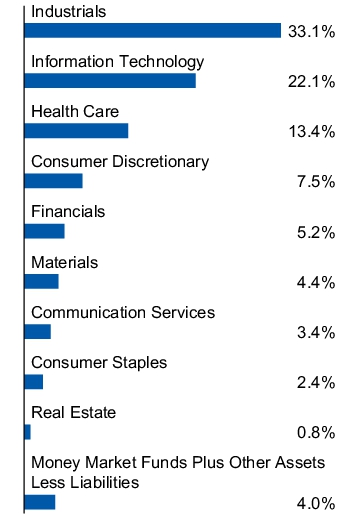

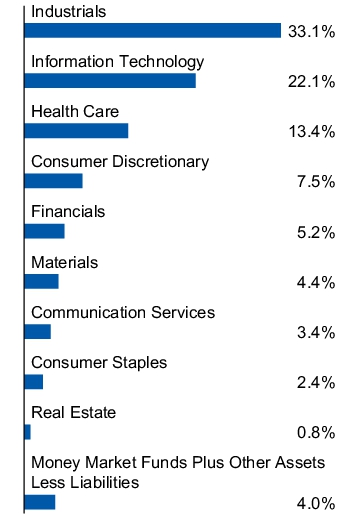

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective March 1, 2024, the expense limitation for Class R shares changed from 1.10% to 1.43% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on February 28, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Advantage International Fund

Class Y: QMGYX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Advantage International Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Advantage International Fund

(Class Y) | $85 | 0.79%† |

† | Reflects fee waivers and /or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• The global monetary easing cycle finally arrived, with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets. Throughout the fiscal year, monetary policy remained a key market driver, with dovish central bank comments boosting market sentiment and expectations of further rate cuts.

• For the fiscal year ended October 31, 2024, Class Y shares of the Fund returned 15.81%. For the same time period, the MSCI ACWI ex USA® Index (Net) (“Benchmark Index") returned 24.33%.

What contributed to performance?

Diversified International Stock Portfolio | The Fund's exposure to a diversified portfolio of international stocks, designed to have low tracking error relative to the Benchmark Index, provided growth over the year and performed in line with the Benchmark Index.

What detracted from performance?

Factor tilts to low volatility stocks | The Fund's exposure to low volatility stocks helped to reduce the impact of market volatility and drawdowns relative to the Benchmark Index. However, due to the more defensive nature of the investments, this exposure dragged on overall relative performance as equity markets generally trended upwards over the year.

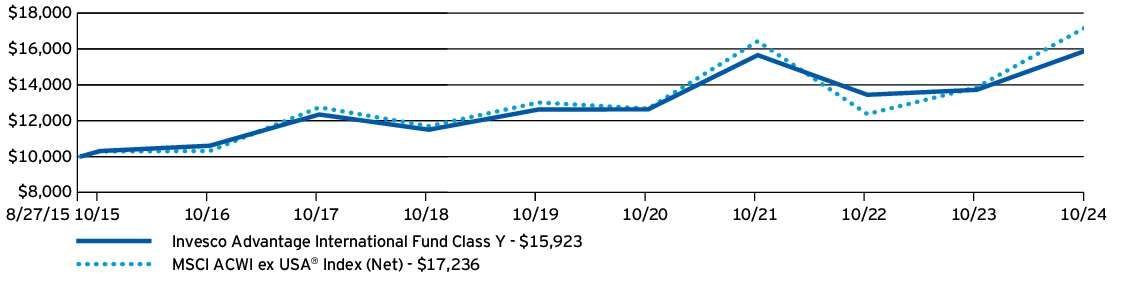

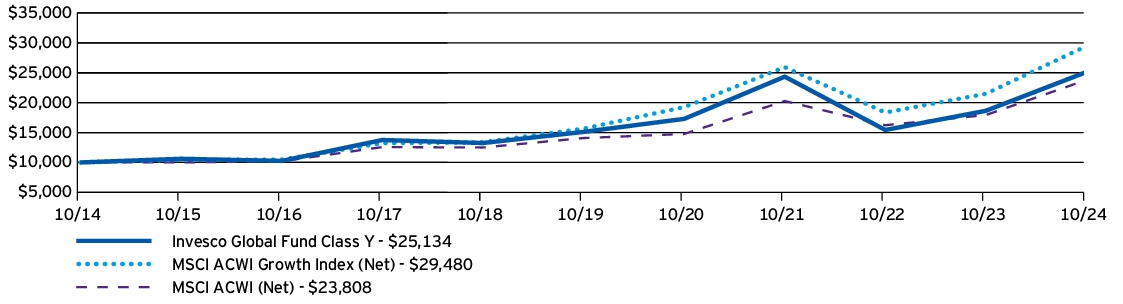

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since

Inception

(8/27/15) |

| Invesco Advantage International Fund (Class Y) | 15.81% | 4.76% | 5.20% |

| MSCI ACWI ex USA® Index (Net) | 24.33% | 5.78% | 6.11% |

Effective after the close of business on May 24, 2019, Class Y shares of Oppenheimer Global Multi-Asset Growth Fund, (the predecessor fund), were reorganized into Class Y shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class Y shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $31,998,953% |

| Total number of portfolio holdings | $453% |

| Total advisory fees paid | $0% |

| Portfolio turnover rate | $156% |

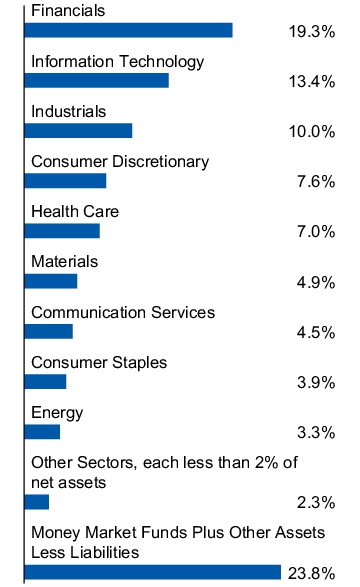

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 4.23% |

| China Construction Bank Corp., H Shares | 1.36% |

| Novo Nordisk A/S, Class B | 1.34% |

| Novartis AG | 1.27% |

| ASML Holding N.V. | 1.08% |

| PDD Holdings, Inc., ADR | 1.08% |

| Roche Holding AG | 0.97% |

| Hitachi Ltd. | 0.97% |

| Samsung Electronics Co. Ltd. | 0.92% |

| Industrial & Commercial Bank of China Ltd., H Shares | 0.91% |

| * Excluding money market fund holdings, if any. | |

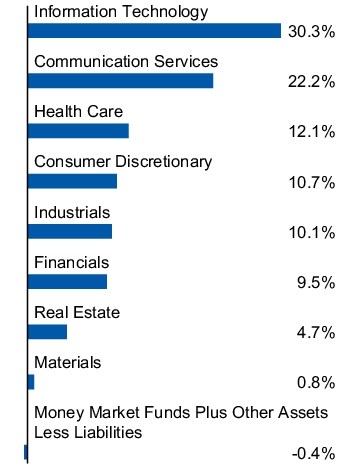

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective March 1, 2024, the expense limitation for Class Y shares changed from 0.60% to 0.93% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on February 28, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Advantage International Fund

Class R5: GMAGX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Advantage International Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Advantage International Fund

(Class R5) | $89 | 0.82%† |

† | Reflects fee waivers and /or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• The global monetary easing cycle finally arrived, with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets. Throughout the fiscal year, monetary policy remained a key market driver, with dovish central bank comments boosting market sentiment and expectations of further rate cuts.

• For the fiscal year ended October 31, 2024, Class R5 shares of the Fund returned 15.88%. For the same time period, the MSCI ACWI ex USA® Index (Net) (“Benchmark Index") returned 24.33%.

What contributed to performance?

Diversified International Stock Portfolio | The Fund's exposure to a diversified portfolio of international stocks, designed to have low tracking error relative to the Benchmark Index, provided growth over the year and performed in line with the Benchmark Index.

What detracted from performance?

Factor tilts to low volatility stocks | The Fund's exposure to low volatility stocks helped to reduce the impact of market volatility and drawdowns relative to the Benchmark Index. However, due to the more defensive nature of the investments, this exposure dragged on overall relative performance as equity markets generally trended upwards over the year.

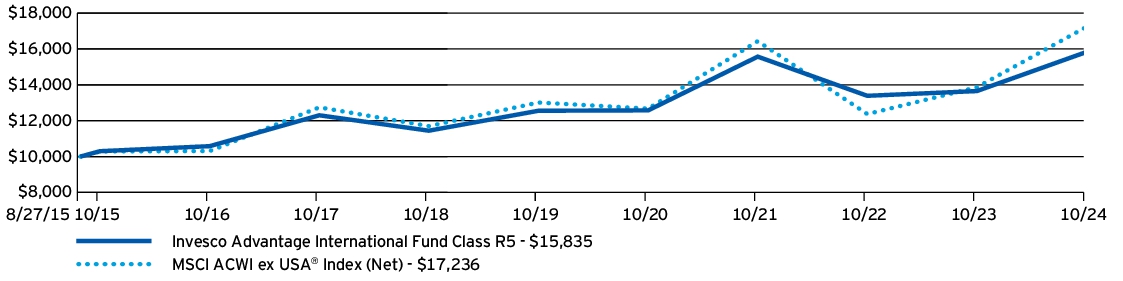

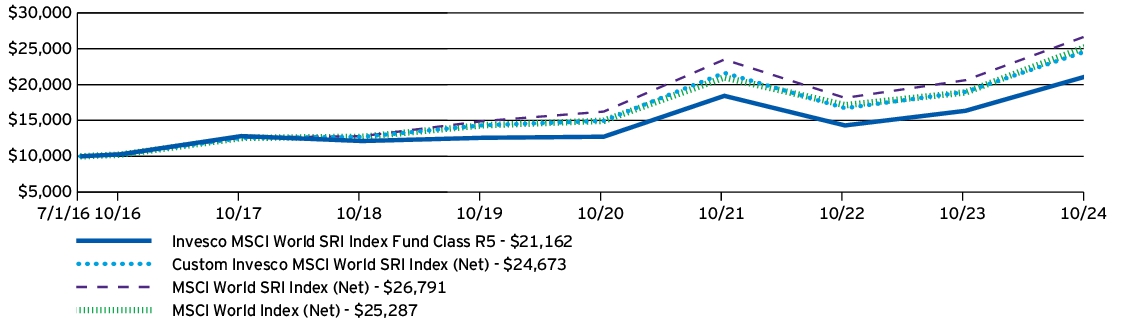

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since

Inception

(8/27/15) |

| Invesco Advantage International Fund (Class R5) | 15.88% | 4.75% | 5.14% |

| MSCI ACWI ex USA® Index (Net) | 24.33% | 5.78% | 6.11% |

Class R5 shares incepted on May 24, 2019. Performance shown on and prior to that date is that of Oppenheimer Global Multi-Asset Growth Fund's (the predecessor fund) Class A shares at net asset value and includes 12b-1 fees applicable to Class A shares. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $31,998,953% |

| Total number of portfolio holdings | $453% |

| Total advisory fees paid | $0% |

| Portfolio turnover rate | $156% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 4.23% |

| China Construction Bank Corp., H Shares | 1.36% |

| Novo Nordisk A/S, Class B | 1.34% |

| Novartis AG | 1.27% |

| ASML Holding N.V. | 1.08% |

| PDD Holdings, Inc., ADR | 1.08% |

| Roche Holding AG | 0.97% |

| Hitachi Ltd. | 0.97% |

| Samsung Electronics Co. Ltd. | 0.92% |

| Industrial & Commercial Bank of China Ltd., H Shares | 0.91% |

| * Excluding money market fund holdings, if any. | |

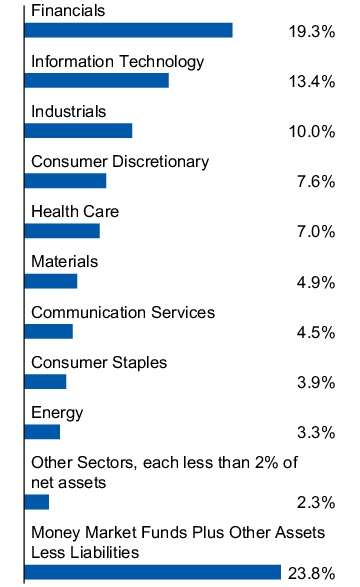

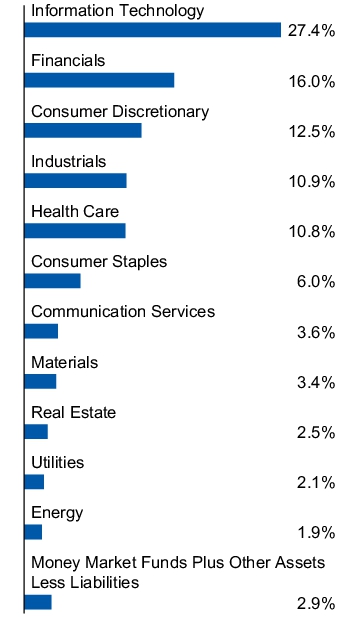

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective March 1, 2024, the expense limitation for Class R5 shares changed from 0.60% to 0.93% of the Fund's average daily net assest. Unless Invesco continues the fee waiver agreement, it will terminate on February 28, 2025.

Effective after the close of business on September 30, 2024, the Fund has limited public sales of its Class R5 shares to certain investors who were previously invested in Class R5 shares of the Fund.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Advantage International Fund

Class R6: QMGIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Advantage International Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Advantage International Fund

(Class R6) | $89 | 0.82%† |

† | Reflects fee waivers and /or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• The global monetary easing cycle finally arrived, with several central banks cutting interest rates. Despite some volatility, global growth and disinflationary progress continued, leading to robust gains for global equity markets. Throughout the fiscal year, monetary policy remained a key market driver, with dovish central bank comments boosting market sentiment and expectations of further rate cuts.

• For the fiscal year ended October 31, 2024, Class R6 shares of the Fund returned 15.89%. For the same time period, the MSCI ACWI ex USA® Index (Net) (“Benchmark Index") returned 24.33%.

What contributed to performance?

Diversified International Stock Portfolio | The Fund's exposure to a diversified portfolio of international stocks, designed to have low tracking error relative to the Benchmark Index, provided growth over the year and performed in line with the Benchmark Index.

What detracted from performance?

Factor tilts to low volatility stocks | The Fund's exposure to low volatility stocks helped to reduce the impact of market volatility and drawdowns relative to the Benchmark Index. However, due to the more defensive nature of the investments, this exposure dragged on overall relative performance as equity markets generally trended upwards over the year.

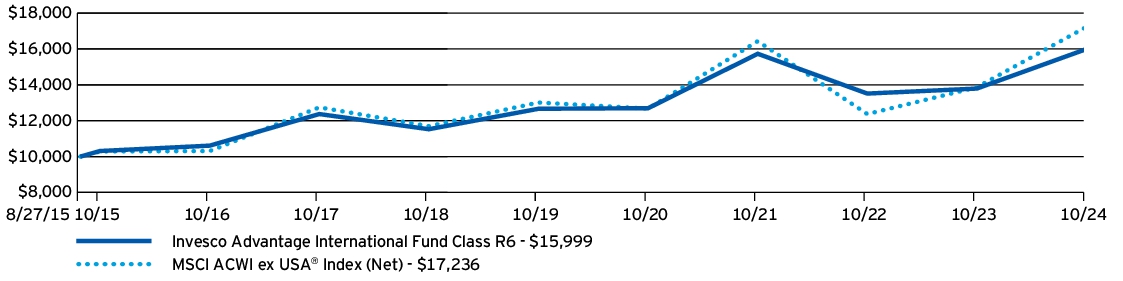

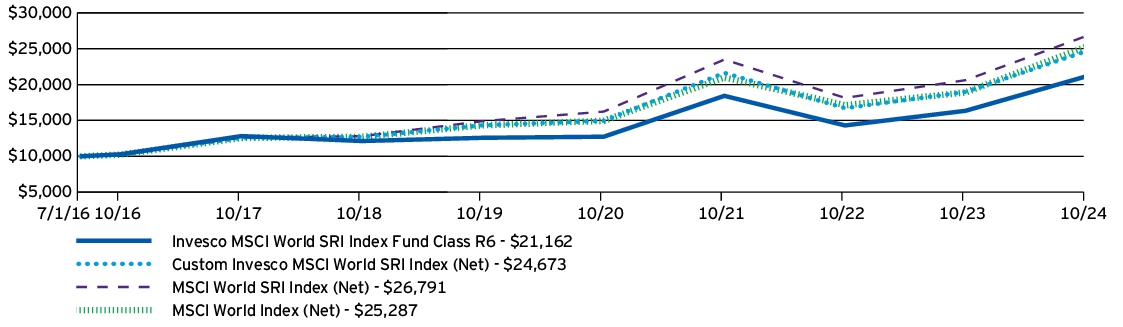

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since

Inception

(8/27/15) |

| Invesco Advantage International Fund (Class R6) | 15.89% | 4.79% | 5.25% |

| MSCI ACWI ex USA® Index (Net) | 24.33% | 5.78% | 6.11% |

Effective after the close of business on May 24, 2019, Class I shares of Oppenheimer Global Multi-Asset Growth Fund, (the predecessor fund), were reorganized into Class R6 shares of the Fund. Returns shown above for periods ending on or prior to May 24, 2019 are those of Class I shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $31,998,953% |

| Total number of portfolio holdings | $453% |

| Total advisory fees paid | $0% |

| Portfolio turnover rate | $156% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 4.23% |

| China Construction Bank Corp., H Shares | 1.36% |

| Novo Nordisk A/S, Class B | 1.34% |

| Novartis AG | 1.27% |

| ASML Holding N.V. | 1.08% |

| PDD Holdings, Inc., ADR | 1.08% |

| Roche Holding AG | 0.97% |

| Hitachi Ltd. | 0.97% |

| Samsung Electronics Co. Ltd. | 0.92% |

| Industrial & Commercial Bank of China Ltd., H Shares | 0.91% |

| * Excluding money market fund holdings, if any. | |

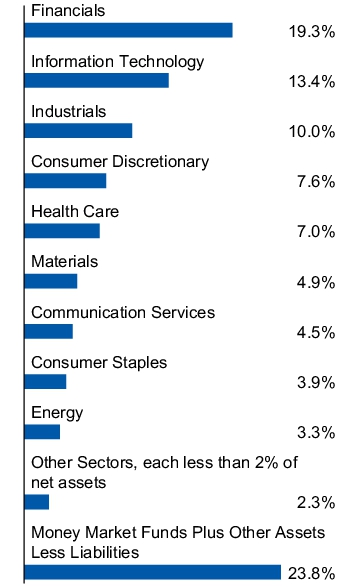

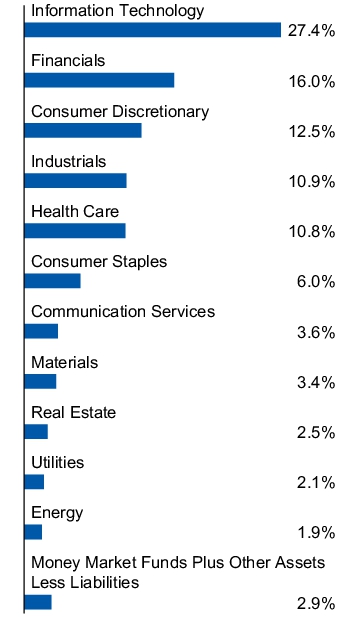

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective March 1, 2024, the expense limitation for Class R6 shares changed from 0.60% to 0.93% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on February 28, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV Asia Pacific Equity Fund

Class A: ASIAX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco EQV Asia Pacific Equity Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV Asia Pacific Equity Fund

(Class A) | $167 | 1.51% |

How Did The Fund Perform During The Period?

• Emerging market equities in the Asia Pacific ex Japan region performed very well during the fiscal year ended October 31, 2024. News of fiscal stimulus by the Chinese government drove better sentiment towards the region, with robust returns in China and Taiwan. Indian equities also performed very well during the fiscal year, as well as Australia on the developed markets side.

• For the fiscal year ended October 31, 2024, Class A shares of the Fund, excluding sales charge, returned 20.85%, lagging the MSCI All Country Asia Pacific ex-Japan Index return of 28.15%. The Fund's underperformance for the fiscal year was primarily driven by stock selection in consumer staples, financials and China and overweight exposures to consumer staples and Indonesia.

What contributed to performance?

Taiwan Semiconductor Manufacturing Co. Ltd. | The company's technology roadmap and financial performance have remained strong and TSMC has continued to benefit from increased artificial intelligence (AI) demand and a better pricing outlook.

Broadcom, Inc. | Semiconductor products manufacturer Broadcom’s generative AI demand has been, in our view, better-than-expected. The newly acquired VMware software business has generated better-than-expected revenue, and the company has been executing on cost synergies as planned.

Tencent Holdings Ltd. | A Chinese technology conglomerate. Tencent’s newer online advertising products have boosted growth and market share, and we believe the outlook for online games may improve given its solid pipeline. Profit margins have risen faster-than-expected as the company focuses on higher value revenue streams.

What detracted from performance?

Yum China Holdings, Inc. | A Chinese fast-food company that we exited during the fiscal year due to increased competition in the restaurant channel that negatively affected same store sales.

China Mengniu Dairy Co. Ltd. | A leading producer of milk and dairy products in China. Consumption has remained weak, and with raw milk in oversupply, promotional activity began to increase, leading to weaker profitability for the company. We trimmed the Fund's position during the fiscal year.

China Resources Beer Holdings Co. Ltd. | A large beer producer in China that has been impacted by weak sentiment amid macro softness.

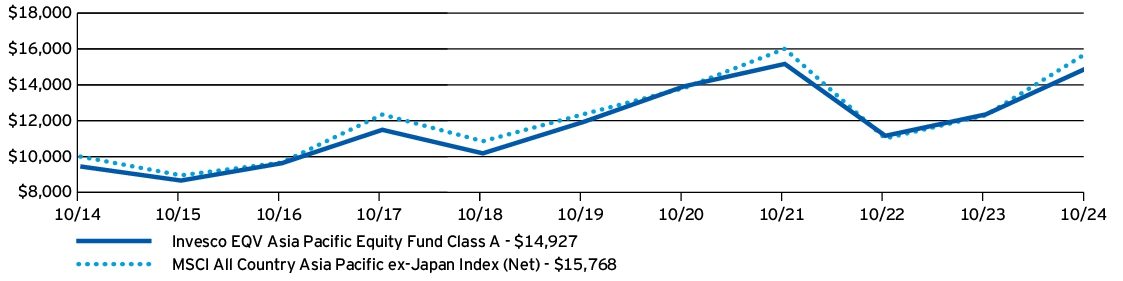

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV Asia Pacific Equity Fund (Class A) —including sales charge | 14.19% | 3.41% | 4.09% |

| Invesco EQV Asia Pacific Equity Fund (Class A) —excluding sales charge | 20.85% | 4.59% | 4.68% |

| MSCI All Country Asia Pacific ex-Japan Index (Net) | 28.15% | 4.99% | 4.66% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $400,589,205% |

| Total number of portfolio holdings | $50% |

| Total advisory fees paid | $3,740,026% |

| Portfolio turnover rate | $15% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. | 8.14% |

| Tencent Holdings Ltd. | 5.37% |

| HDFC Bank Ltd., ADR | 4.14% |

| Broadcom, Inc. | 3.52% |

| Aristocrat Leisure Ltd. | 3.37% |

| Tongcheng Travel Holdings Ltd. | 3.10% |

| BDO Unibank, Inc. | 3.06% |

| Techtronic Industries Co. Ltd. | 3.01% |

| Central Pattana PCL, Foreign Shares | 2.99% |

| Fuyao Glass Industry Group Co. Ltd., H Shares | 2.90% |

| * Excluding money market fund holdings, if any. | |

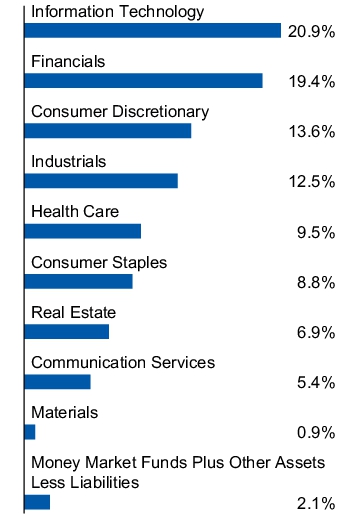

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

At a meeting held on September 9-11, 2024, the Board of Trustees of Invesco Greater China Fund (the "Target Fund") unanimously approved an Agreement and Plan of Reorganization (the "Agreement") pursuant to which the Fund would acquire all or substantially all of the assets and liabilities of the Target Fund in exchange for shares of the Fund. The reorganization is expected to be consummated at the close of business on or about February 21, 2025 (unless otherwise agreed by the parties to account for any delay for any reason). In connection with the reorganization, the Board of Trustees approved a reduction in the Fund's advisory fee schedule and also approved changing Class A's compensation styled Rule 12b-1 plan with a reimbursement styled Rule 12b-1 plan; such changes will become effective upon the closing of the reorganization.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV Asia Pacific Equity Fund

Class C: ASICX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco EQV Asia Pacific Equity Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV Asia Pacific Equity Fund

(Class C) | $249 | 2.26% |

How Did The Fund Perform During The Period?

• Emerging market equities in the Asia Pacific ex Japan region performed very well during the fiscal year ended October 31, 2024. News of fiscal stimulus by the Chinese government drove better sentiment towards the region, with robust returns in China and Taiwan. Indian equities also performed very well during the fiscal year, as well as Australia on the developed markets side.

• For the fiscal year ended October 31, 2024, Class C shares of the Fund, excluding sales charge, returned 19.97%, lagging the MSCI All Country Asia Pacific ex-Japan Index return of 28.15%. The Fund's underperformance for the fiscal year was primarily driven by stock selection in consumer staples, financials and China and overweight exposures to consumer staples and Indonesia.

What contributed to performance?

Taiwan Semiconductor Manufacturing Co. Ltd. | The company's technology roadmap and financial performance have remained strong and TSMC has continued to benefit from increased artificial intelligence (AI) demand and a better pricing outlook.

Broadcom, Inc. | Semiconductor products manufacturer Broadcom’s generative AI demand has been, in our view, better-than-expected. The newly acquired VMware software business has generated better-than-expected revenue, and the company has been executing on cost synergies as planned.

Tencent Holdings Ltd. | A Chinese technology conglomerate. Tencent’s newer online advertising products have boosted growth and market share, and we believe the outlook for online games may improve given its solid pipeline. Profit margins have risen faster-than-expected as the company focuses on higher value revenue streams.

What detracted from performance?

Yum China Holdings, Inc. | A Chinese fast-food company that we exited during the fiscal year due to increased competition in the restaurant channel that negatively affected same store sales.

China Mengniu Dairy Co. Ltd. | A leading producer of milk and dairy products in China. Consumption has remained weak, and with raw milk in oversupply, promotional activity began to increase, leading to weaker profitability for the company. We trimmed the Fund's position during the fiscal year.

China Resources Beer Holdings Co. Ltd. | A large beer producer in China that has been impacted by weak sentiment amid macro softness.

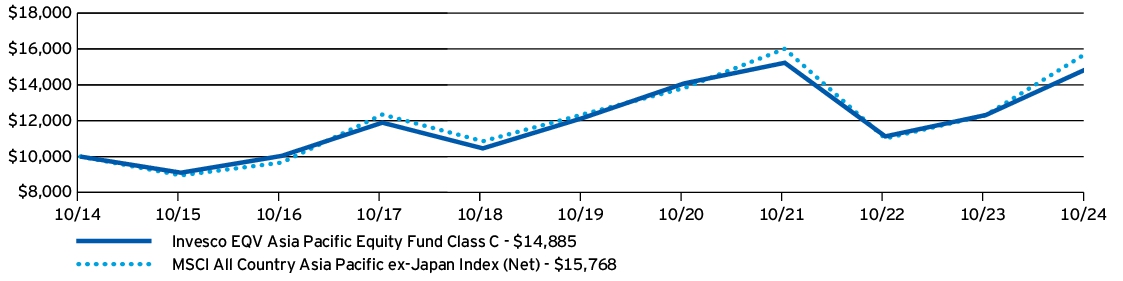

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV Asia Pacific Equity Fund (Class C) —including sales charge | 18.97% | 3.81% | 4.06% |

| Invesco EQV Asia Pacific Equity Fund (Class C) —excluding sales charge | 19.97% | 3.81% | 4.06% |

| MSCI All Country Asia Pacific ex-Japan Index (Net) | 28.15% | 4.99% | 4.66% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $400,589,205% |

| Total number of portfolio holdings | $50% |

| Total advisory fees paid | $3,740,026% |

| Portfolio turnover rate | $15% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. | 8.14% |

| Tencent Holdings Ltd. | 5.37% |

| HDFC Bank Ltd., ADR | 4.14% |

| Broadcom, Inc. | 3.52% |

| Aristocrat Leisure Ltd. | 3.37% |

| Tongcheng Travel Holdings Ltd. | 3.10% |

| BDO Unibank, Inc. | 3.06% |

| Techtronic Industries Co. Ltd. | 3.01% |

| Central Pattana PCL, Foreign Shares | 2.99% |

| Fuyao Glass Industry Group Co. Ltd., H Shares | 2.90% |

| * Excluding money market fund holdings, if any. | |

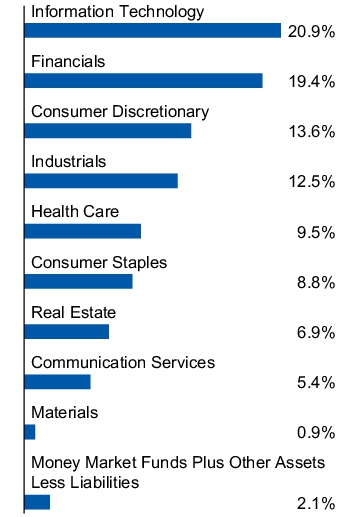

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

At a meeting held on September 9-11, 2024, the Board of Trustees of Invesco Greater China Fund (the "Target Fund") unanimously approved an Agreement and Plan of Reorganization (the "Agreement") pursuant to which the Fund would acquire all or substantially all of the assets and liabilities of the Target Fund in exchange for shares of the Fund. The reorganization is expected to be consummated at the close of business on or about February 21, 2025 (unless otherwise agreed by the parties to account for any delay for any reason). In connection with the reorganization, the Board of Trustees approved a reduction in the Fund's advisory fee schedule and also approved changing Class C's compensation styled Rule 12b-1 plan with a reimbursement styled Rule 12b-1 plan; such changes will become effective upon the closing of the reorganization.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

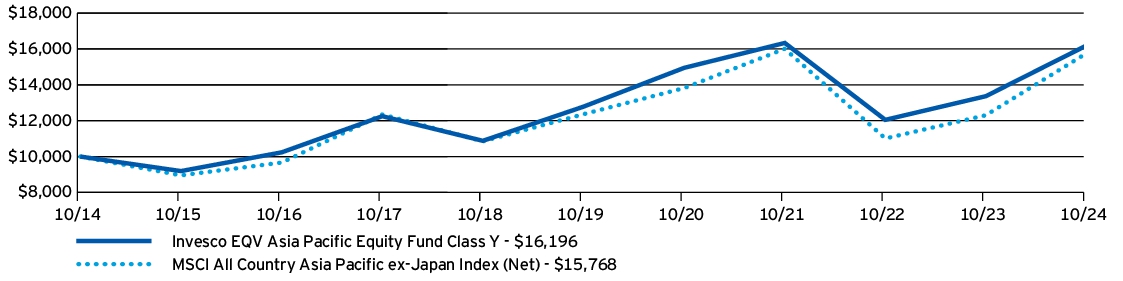

Invesco EQV Asia Pacific Equity Fund

Class Y: ASIYX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco EQV Asia Pacific Equity Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV Asia Pacific Equity Fund

(Class Y) | $139 | 1.26% |

How Did The Fund Perform During The Period?

• Emerging market equities in the Asia Pacific ex Japan region performed very well during the fiscal year ended October 31, 2024. News of fiscal stimulus by the Chinese government drove better sentiment towards the region, with robust returns in China and Taiwan. Indian equities also performed very well during the fiscal year, as well as Australia on the developed markets side.

• For the fiscal year ended October 31, 2024, Class Y shares of the Fund returned 21.17%, lagging the MSCI All Country Asia Pacific ex-Japan Index return of 28.15%. The Fund's underperformance for the fiscal year was primarily driven by stock selection in consumer staples, financials and China and overweight exposures to consumer staples and Indonesia.

What contributed to performance?

Taiwan Semiconductor Manufacturing Co. Ltd. | The company's technology roadmap and financial performance have remained strong and TSMC has continued to benefit from increased artificial intelligence (AI) demand and a better pricing outlook.

Broadcom, Inc. | Semiconductor products manufacturer Broadcom’s generative AI demand has been, in our view, better-than-expected. The newly acquired VMware software business has generated better-than-expected revenue, and the company has been executing on cost synergies as planned.

Tencent Holdings Ltd. | A Chinese technology conglomerate. Tencent’s newer online advertising products have boosted growth and market share, and we believe the outlook for online games may improve given its solid pipeline. Profit margins have risen faster-than-expected as the company focuses on higher value revenue streams.

What detracted from performance?

Yum China Holdings, Inc. | A Chinese fast-food company that we exited during the fiscal year due to increased competition in the restaurant channel that negatively affected same store sales.

China Mengniu Dairy Co. Ltd. | A leading producer of milk and dairy products in China. Consumption has remained weak, and with raw milk in oversupply, promotional activity began to increase, leading to weaker profitability for the company. We trimmed the Fund's position during the fiscal year.

China Resources Beer Holdings Co. Ltd. | A large beer producer in China that has been impacted by weak sentiment amid macro softness.

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV Asia Pacific Equity Fund (Class Y) | 21.17% | 4.85% | 4.94% |

| MSCI All Country Asia Pacific ex-Japan Index (Net) | 28.15% | 4.99% | 4.66% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $400,589,205% |

| Total number of portfolio holdings | $50% |

| Total advisory fees paid | $3,740,026% |

| Portfolio turnover rate | $15% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. | 8.14% |

| Tencent Holdings Ltd. | 5.37% |

| HDFC Bank Ltd., ADR | 4.14% |

| Broadcom, Inc. | 3.52% |

| Aristocrat Leisure Ltd. | 3.37% |

| Tongcheng Travel Holdings Ltd. | 3.10% |

| BDO Unibank, Inc. | 3.06% |

| Techtronic Industries Co. Ltd. | 3.01% |

| Central Pattana PCL, Foreign Shares | 2.99% |

| Fuyao Glass Industry Group Co. Ltd., H Shares | 2.90% |

| * Excluding money market fund holdings, if any. | |

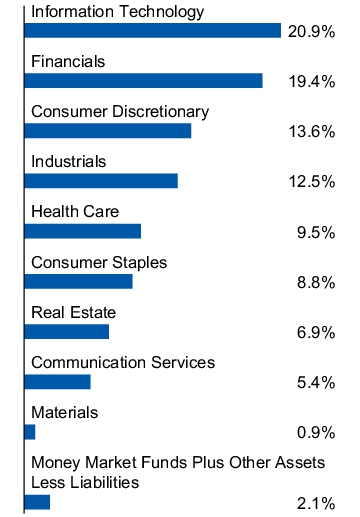

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

At a meeting held on September 9-11, 2024, the Board of Trustees of Invesco Greater China Fund (the "Target Fund") unanimously approved an Agreement and Plan of Reorganization (the "Agreement") pursuant to which the Fund would acquire all or substantially all of the assets and liabilities of the Target Fund in exchange for shares of the Fund. The reorganization is expected to be consummated at the close of business on or about February 21, 2025 (unless otherwise agreed by the parties to account for any delay for any reason). In connection with the reorganization, the Board of Trustees approved a reduction in the Fund's advisory fee schedule effective upon the closing of the reorganization.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

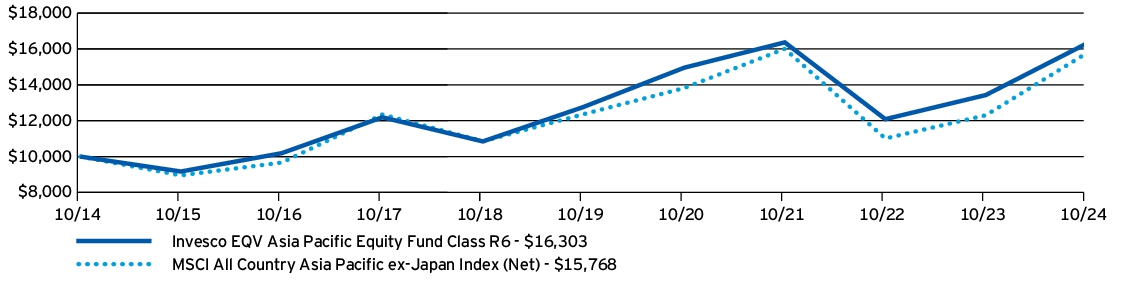

Invesco EQV Asia Pacific Equity Fund

Class R6: ASISX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco EQV Asia Pacific Equity Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV Asia Pacific Equity Fund

(Class R6) | $118 | 1.07% |

How Did The Fund Perform During The Period?

• Emerging market equities in the Asia Pacific ex Japan region performed very well during the fiscal year ended October 31, 2024. News of fiscal stimulus by the Chinese government drove better sentiment towards the region, with robust returns in China and Taiwan. Indian equities also performed very well during the fiscal year, as well as Australia on the developed markets side.

• For the fiscal year ended October 31, 2024, Class R6 shares of the Fund returned 21.39%, lagging the MSCI All Country Asia Pacific ex-Japan Index return of 28.15%. The Fund's underperformance for the fiscal year was primarily driven by stock selection in consumer staples, financials and China and overweight exposures to consumer staples and Indonesia.

What contributed to performance?

Taiwan Semiconductor Manufacturing Co. Ltd. | The company's technology roadmap and financial performance have remained strong and TSMC has continued to benefit from increased artificial intelligence (AI) demand and a better pricing outlook.

Broadcom, Inc. | Semiconductor products manufacturer Broadcom’s generative AI demand has been, in our view, better-than-expected. The newly acquired VMware software business has generated better-than-expected revenue, and the company has been executing on cost synergies as planned.

Tencent Holdings Ltd. | A Chinese technology conglomerate. Tencent’s newer online advertising products have boosted growth and market share, and we believe the outlook for online games may improve given its solid pipeline. Profit margins have risen faster-than-expected as the company focuses on higher value revenue streams.

What detracted from performance?

Yum China Holdings, Inc. | A Chinese fast-food company that we exited during the fiscal year due to increased competition in the restaurant channel that negatively affected same store sales.

China Mengniu Dairy Co. Ltd. | A leading producer of milk and dairy products in China. Consumption has remained weak, and with raw milk in oversupply, promotional activity began to increase, leading to weaker profitability for the company. We trimmed the Fund's position during the fiscal year.

China Resources Beer Holdings Co. Ltd. | A large beer producer in China that has been impacted by weak sentiment amid macro softness.

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV Asia Pacific Equity Fund (Class R6) | 21.39% | 5.02% | 5.01% |

| MSCI All Country Asia Pacific ex-Japan Index (Net) | 28.15% | 4.99% | 4.66% |

Class R6 shares incepted on April 4, 2017. Performance shown prior to that date is that of Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares. Class R6 shares' returns of the Fund will be different from Class A shares' returns of the Fund as they have different expenses.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $400,589,205% |

| Total number of portfolio holdings | $50% |

| Total advisory fees paid | $3,740,026% |

| Portfolio turnover rate | $15% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. | 8.14% |

| Tencent Holdings Ltd. | 5.37% |

| HDFC Bank Ltd., ADR | 4.14% |

| Broadcom, Inc. | 3.52% |

| Aristocrat Leisure Ltd. | 3.37% |

| Tongcheng Travel Holdings Ltd. | 3.10% |

| BDO Unibank, Inc. | 3.06% |

| Techtronic Industries Co. Ltd. | 3.01% |

| Central Pattana PCL, Foreign Shares | 2.99% |

| Fuyao Glass Industry Group Co. Ltd., H Shares | 2.90% |

| * Excluding money market fund holdings, if any. | |

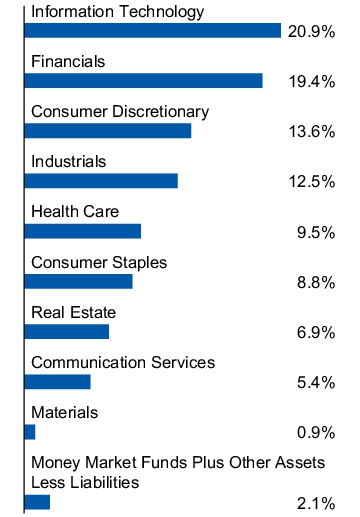

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

At a meeting held on September 9-11, 2024, the Board of Trustees of Invesco Greater China Fund (the "Target Fund") unanimously approved an Agreement and Plan of Reorganization (the "Agreement") pursuant to which the Fund would acquire all or substantially all of the assets and liabilities of the Target Fund in exchange for shares of the Fund. The reorganization is expected to be consummated at the close of business on or about February 21, 2025 (unless otherwise agreed by the parties to account for any delay for any reason). In connection with the reorganization, the Board of Trustees approved a reduction in the Fund's advisory fee schedule effective upon the closing of the reorganization.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

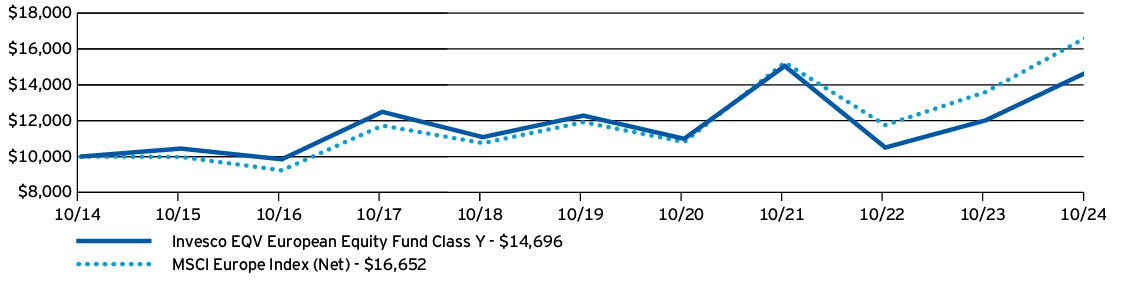

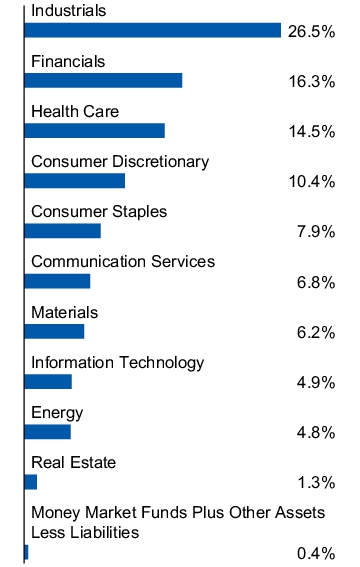

Invesco EQV European Equity Fund

Class A: AEDAX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco EQV European Equity Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV European Equity Fund

(Class A) | $158 | 1.42% |

How Did The Fund Perform During The Period?

• European equities delivered robust returns for the fiscal year ended October 31, 2024, but underperformed those of other regions, including the US and emerging markets. In a market environment where the European Central Bank and the Bank of England cut interest rates, European value stocks outperformed European growth stocks, with the financials sector being the best performing sector for the fiscal year.

• For the fiscal year ended October 31, 2024, Class A shares of the Fund, excluding sales charge, returned 21.96%, slightly lagging the MSCI Europe Index return of 22.43%. The Fund's performance for the fiscal year benefited from positive stock selection in consumer discretionary, materials, the UK and Sweden and was hampered by weaker stock selection in information technology, consumer staples, France and Switzerland.

What contributed to performance?

Investor AB | A Swedish investment holding company. The holding company combines a portfolio of, what we believe to be, high-performing blue-chip publicly listed companies with a group of structurally growing private healthcare and technology businesses. Investor AB benefited from strong performance of the company’s underlying equity stakes.

Schneider Electric SE | A French industrials company that specializes in digital automation and energy management. The company has seen robust growth driven by demand in the energy management sector and recovery signs in industrials automation in China.

CRH PLC | A construction materials company that has benefited from solid exposure to growth trends such as reshoring/onshoring and infrastructure spending in the US and Europe. We believe CRH has plenty of opportunity for mergers and acquisitions in its key markets.

What detracted from performance?

STMicroelectronics N.V. | A large European semiconductor chipmaker. The company's shares have lagged due to challenges in automotive and industrial end markets. We believe STMicroelectronics is a good quality semiconductor company that is going through a cyclical correction but remains exposed to robust long-term growth trends.

Pernod Ricard S.A. | A French international spirits company that has been negatively affected by weak demand in China and slowing US trends. We believe that Pernod has strong brand equity and structural advantages.

Edenred SE | A French payment service provider that specializes in pre-paid benefits such as tax advantaged employee meal vouchers or fuel cards. The stock fell due to concerns about the visibility and duration of its profitable growth algorithm. After reviewing regulatory risk, the competitive landscape, and the impact of moderating interest rates, we believe Edenred is likely to continue a path of profitable growth.

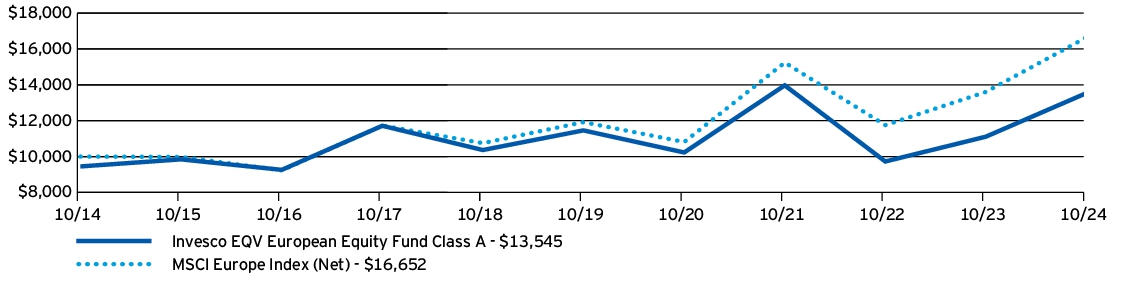

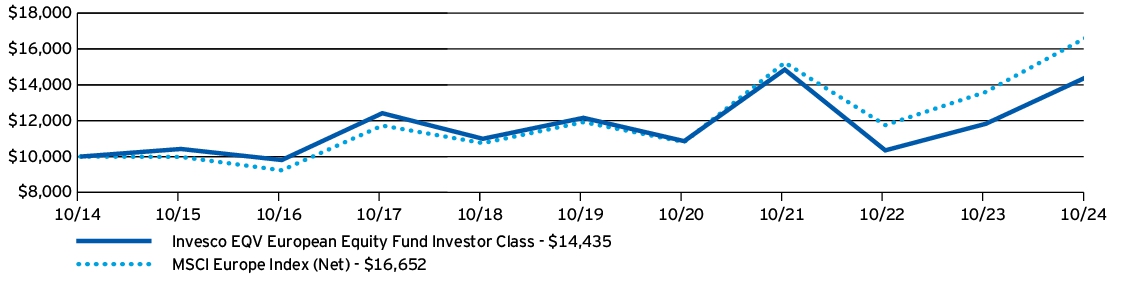

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV European Equity Fund (Class A) —including sales charge | 15.23% | 2.23% | 3.08% |

| Invesco EQV European Equity Fund (Class A) —excluding sales charge | 21.96% | 3.40% | 3.67% |

| MSCI Europe Index (Net) | 22.43% | 6.91% | 5.23% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $451,231,722% |

| Total number of portfolio holdings | $60% |

| Total advisory fees paid | $4,431,176% |

| Portfolio turnover rate | $19% |

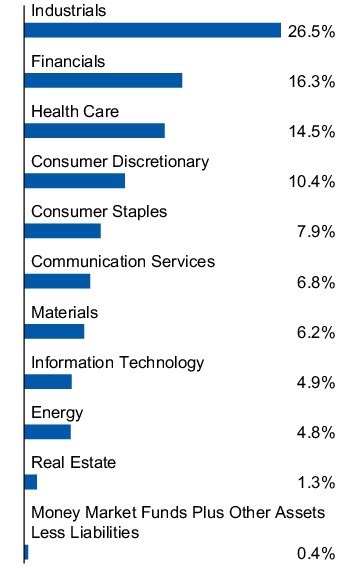

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Novo Nordisk A/S, Class B | 3.95% |

| Investor AB, Class B | 3.62% |

| RELX PLC | 3.42% |

| Deutsche Boerse AG | 2.97% |

| IG Group Holdings PLC | 2.78% |

| CRH PLC | 2.67% |

| Nestle S.A. | 2.61% |

| Haleon PLC | 2.51% |

| Richter Gedeon Nyrt | 2.51% |

| Bollore SE | 2.42% |

| * Excluding money market fund holdings, if any. | |

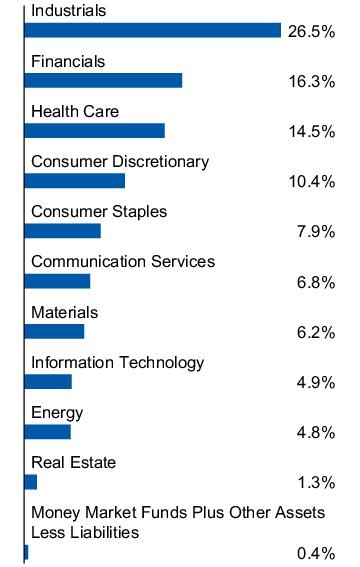

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV European Equity Fund

Class C: AEDCX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco EQV European Equity Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV European Equity Fund

(Class C) | $240 | 2.17% |

How Did The Fund Perform During The Period?

• European equities delivered robust returns for the fiscal year ended October 31, 2024, but underperformed those of other regions, including the US and emerging markets. In a market environment where the European Central Bank and the Bank of England cut interest rates, European value stocks outperformed European growth stocks, with the financials sector being the best performing sector for the fiscal year.

• For the fiscal year ended October 31, 2024, Class C shares of the Fund, excluding sales charge, returned 21.01%, slightly lagging the MSCI Europe Index return of 22.43%. The Fund's performance for the fiscal year benefited from positive stock selection in consumer discretionary, materials, the UK and Sweden and was hampered by weaker stock selection in information technology, consumer staples, France and Switzerland.

What contributed to performance?

Investor AB | A Swedish investment holding company. The holding company combines a portfolio of, what we believe to be, high-performing blue-chip publicly listed companies with a group of structurally growing private healthcare and technology businesses. Investor AB benefited from strong performance of the company’s underlying equity stakes.

Schneider Electric SE | A French industrials company that specializes in digital automation and energy management. The company has seen robust growth driven by demand in the energy management sector and recovery signs in industrials automation in China.

CRH PLC | A construction materials company that has benefited from solid exposure to growth trends such as reshoring/onshoring and infrastructure spending in the US and Europe. We believe CRH has plenty of opportunity for mergers and acquisitions in its key markets.

What detracted from performance?

STMicroelectronics N.V. | A large European semiconductor chipmaker. The company's shares have lagged due to challenges in automotive and industrial end markets. We believe STMicroelectronics is a good quality semiconductor company that is going through a cyclical correction but remains exposed to robust long-term growth trends.

Pernod Ricard S.A. | A French international spirits company that has been negatively affected by weak demand in China and slowing US trends. We believe that Pernod has strong brand equity and structural advantages.

Edenred SE | A French payment service provider that specializes in pre-paid benefits such as tax advantaged employee meal vouchers or fuel cards. The stock fell due to concerns about the visibility and duration of its profitable growth algorithm. After reviewing regulatory risk, the competitive landscape, and the impact of moderating interest rates, we believe Edenred is likely to continue a path of profitable growth.

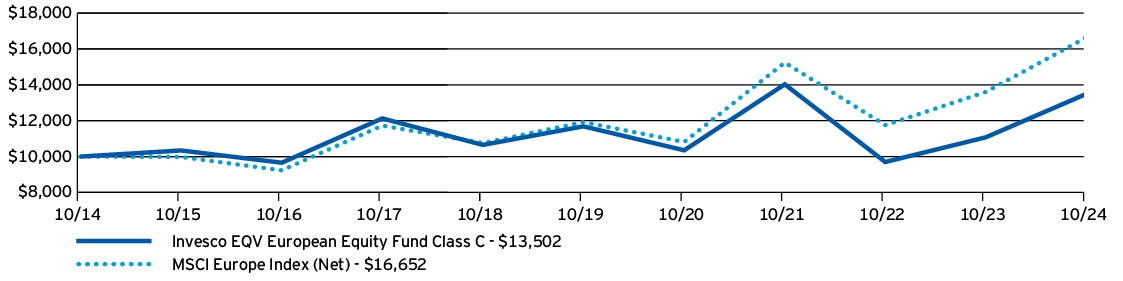

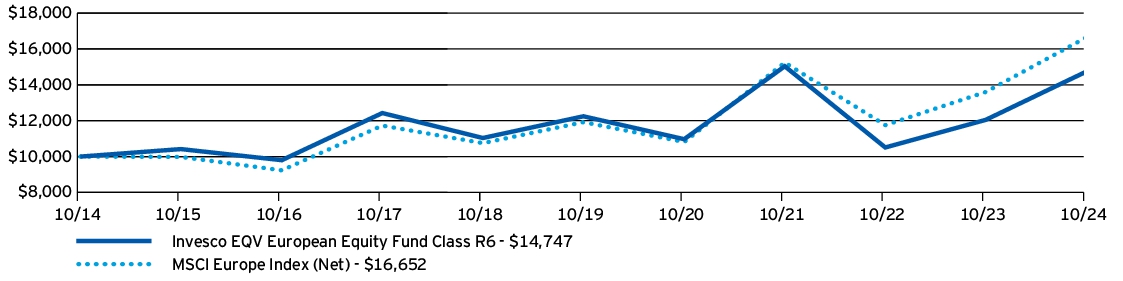

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV European Equity Fund (Class C) —including sales charge | 20.01% | 2.62% | 3.05% |

| Invesco EQV European Equity Fund (Class C) —excluding sales charge | 21.01% | 2.62% | 3.05% |

| MSCI Europe Index (Net) | 22.43% | 6.91% | 5.23% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $451,231,722% |

| Total number of portfolio holdings | $60% |

| Total advisory fees paid | $4,431,176% |

| Portfolio turnover rate | $19% |

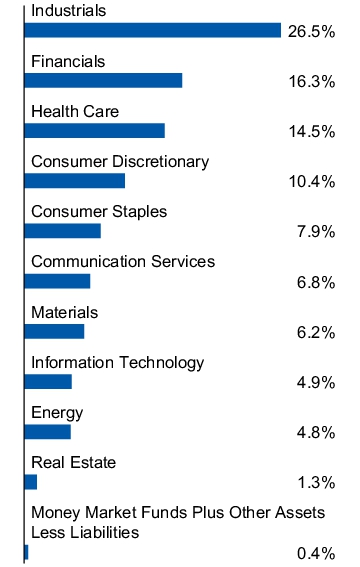

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Novo Nordisk A/S, Class B | 3.95% |

| Investor AB, Class B | 3.62% |

| RELX PLC | 3.42% |

| Deutsche Boerse AG | 2.97% |

| IG Group Holdings PLC | 2.78% |

| CRH PLC | 2.67% |

| Nestle S.A. | 2.61% |

| Haleon PLC | 2.51% |

| Richter Gedeon Nyrt | 2.51% |

| Bollore SE | 2.42% |

| * Excluding money market fund holdings, if any. | |

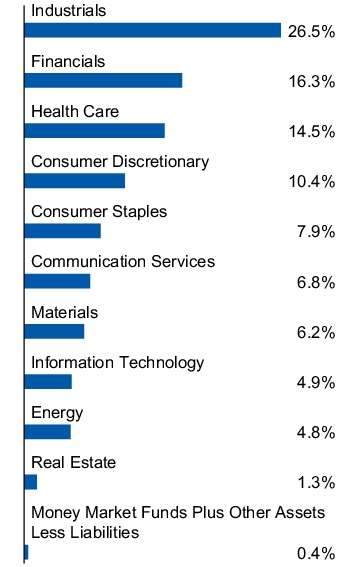

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

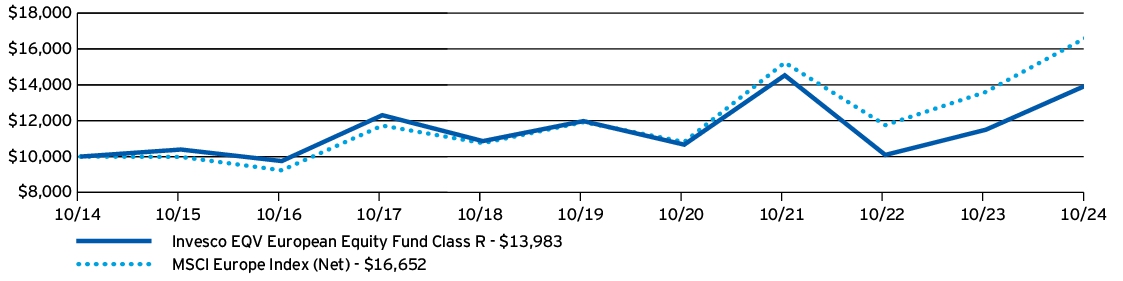

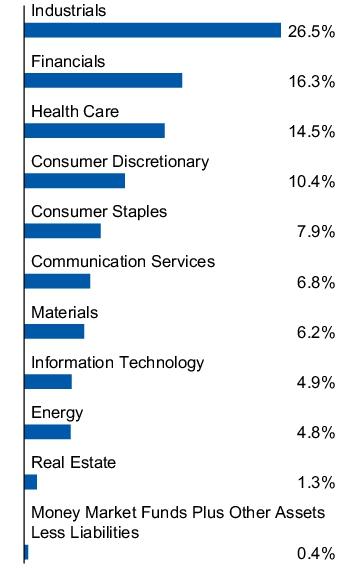

Invesco EQV European Equity Fund

Class R: AEDRX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco EQV European Equity Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV European Equity Fund

(Class R) | $185 | 1.67% |

How Did The Fund Perform During The Period?

• European equities delivered robust returns for the fiscal year ended October 31, 2024, but underperformed those of other regions, including the US and emerging markets. In a market environment where the European Central Bank and the Bank of England cut interest rates, European value stocks outperformed European growth stocks, with the financials sector being the best performing sector for the fiscal year.

• For the fiscal year ended October 31, 2024, Class R shares of the Fund returned 21.66%, slightly lagging the MSCI Europe Index return of 22.43%. The Fund's performance for the fiscal year benefited from positive stock selection in consumer discretionary, materials, the UK and Sweden and was hampered by weaker stock selection in information technology, consumer staples, France and Switzerland.

What contributed to performance?

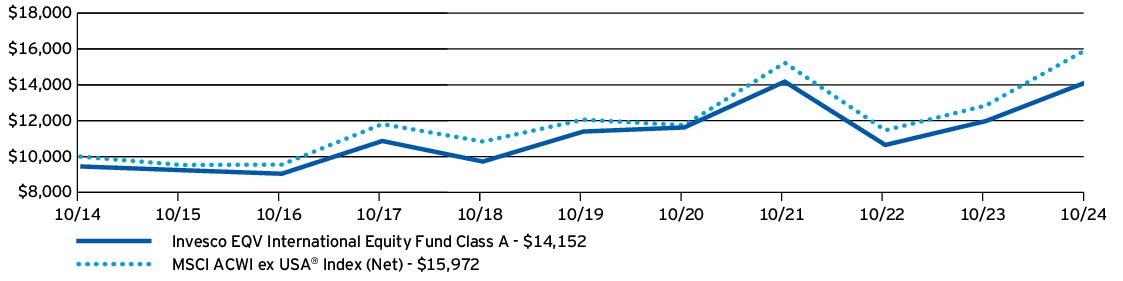

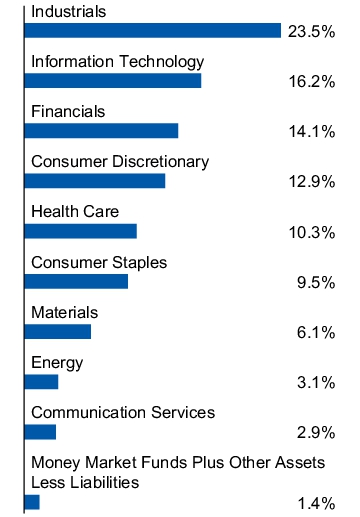

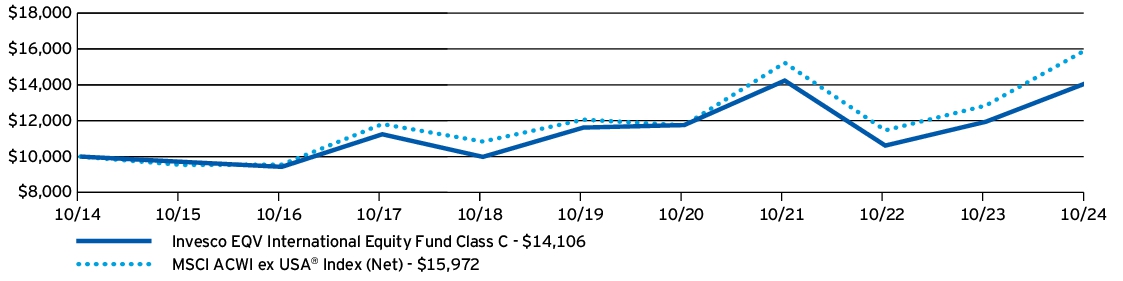

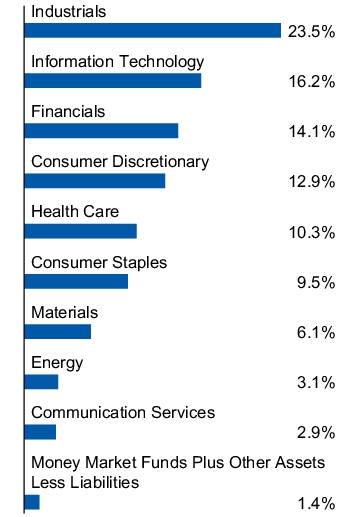

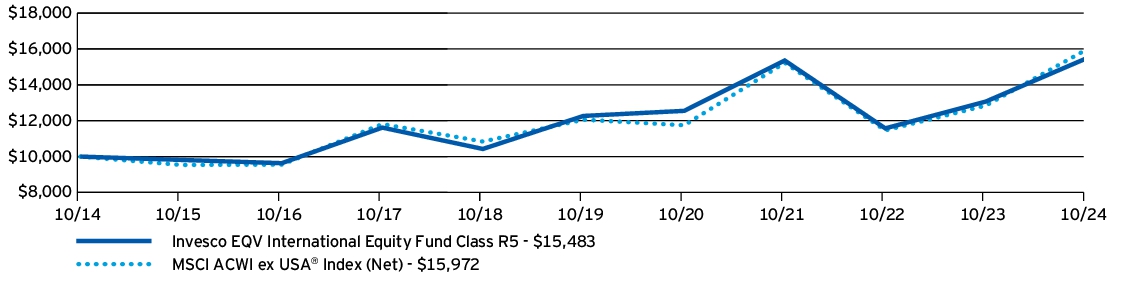

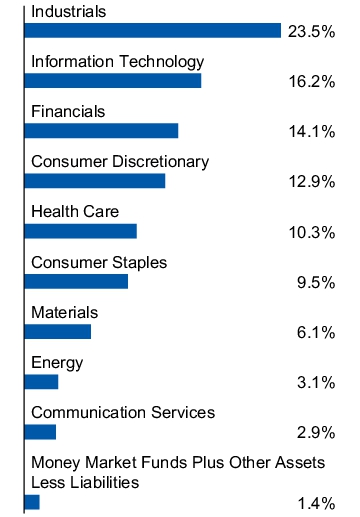

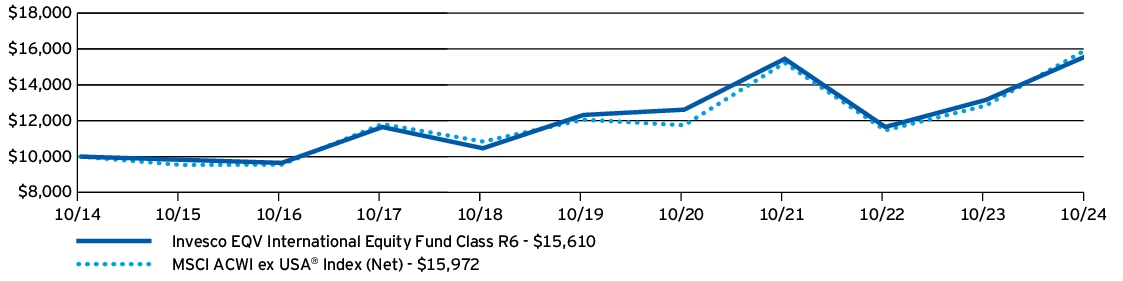

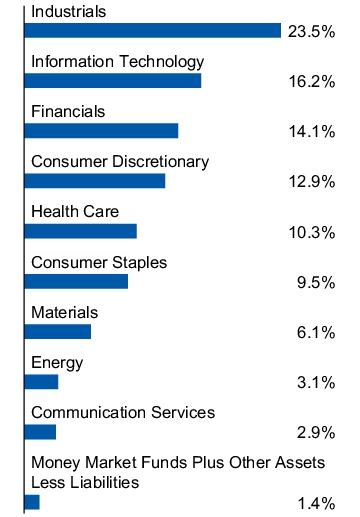

Investor AB | A Swedish investment holding company. The holding company combines a portfolio of, what we believe to be, high-performing blue-chip publicly listed companies with a group of structurally growing private healthcare and technology businesses. Investor AB benefited from strong performance of the company’s underlying equity stakes.