UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06463

AIM International Mutual Funds (Invesco International Mutual Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

| | |

Date of fiscal year end: | | 10/31 |

| |

Date of reporting period: | | 10/31/19 |

| Item 1. | Reports to Stockholders. |

| | | | |

| | |

| | Annual Report to Shareholders | | October 31, 2019 |

| | |

| | Invesco Asia Pacific Growth Fund |

| | Nasdaq: A: ASIAX∎ C: ASICX∎ Y: ASIYX∎ R6: ASISX |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco.com/edelivery. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call (800)959-4246 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all funds held with the fund complex if you invest directly with the Fund. 2 Letters to Shareholders 4 Management’s Discussion 4 Performance Summary 6 Long-Term Fund Performance 8 Supplemental Information 10 Schedule of Investments 12 Financial Statements 15 Financial Highlights 16 Notes to Financial Statements 22 Report of Independent Registered Public Accounting Firm 23 Fund Expenses 24 Approval of Investment Advisory andSub-Advisory Contracts 26 Tax InformationT-1 Trustees and Officers

Letters to Shareholders

| | |

Andrew Schlossberg | | Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. Despite marked market volatility along the way, most global equity markets produced solid gains for the reporting period. As the reporting period unfolded in the final months of 2018, global equities were reeling from a sharpsell-off. The catalyst for thesell-off was a combination of ongoing trade concerns between the US and China, fears of a global economic slowdown and lower oil prices from a supply glut. Gains posted earlier in 2018 for global equities were erased, while US Treasury bonds, along with government and municipal bonds, rallied as investors fled to “safe haven” assets. |

At the start of 2019, global equity markets rebounded strongly buoyed by more policy from central banks and optimism about a potentialUS-China trade deal. In May,US-China trade concerns and slowing global growth led to a global equitysell-off and rally in US Treasuries. Despite the Maysell-off, domestic equity markets rallied in June in anticipation of a US Federal Reserve (the Fed) interest rate cut and closed the second quarter with modest gains. ContinuedUS-China trade worries and signs of slowing global economic growth left global equity markets largely flat for the third quarter. As the reporting period came to a close in October 2019, a raft of upbeat positive corporate earnings results and a US interest rate cut buoyed domestic equity results with some domestic indices recording record highs.

The Fed, in fact, both raised and lowered the federal funds rate during the reporting period. Given signs of a strong economy, the Fed raised rates in December 2018. In 2019, however, the Fed altered its outlook on further rate hikes leaving rates unchanged for the first half of the year. In July, the Fed lowered interest rates for the first time in 11 years. It again lowered rates in September and once again in October. As the year continues to unfold, we’ll see how the interplay of interest rates, economic data, geopolitics and a host of other factors affect US and overseas equity and fixed income markets.

Investor uncertainty and market volatility, such as we witnessed during the reporting period, are unfortunate facts of life when it comes to investing. That’s why Invesco encourages investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan. A financial adviser who knows your unique financial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. He or she can offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. To do so, select “Log In” on the right side of the homepage, and then select “Register for Individual Account Access.”

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets and the economy by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I’m pleased to share with you Invesco’s commitment to both the Principles for Responsible Investment and to considering environmental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Andrew Schlossberg

Head of the Americas,

Senior Managing Director, Invesco Ltd.

2 Invesco Asia Pacific Growth Fund

| | |

Bruce Crockett | | Dear Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: ∎ Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. ∎ Monitoring how the portfolio management teams of the Invesco funds are performing in light of |

changing economic and market conditions.

| ∎ | Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| ∎ | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory andsub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3 Invesco Asia Pacific Growth Fund

Management’s Discussion of Fund Performance

| | | | |

Performance summary | |

For the fiscal year ended October 31, 2019, Class A shares of Invesco Asia Pacific Growth Fund (the Fund), at net asset value (NAV), outperformed the MSCI All Country Asia Pacificex-Japan Index, the Fund’s broad market/style-specific benchmark. Your Fund’s long-term performance appears later in this report. | |

Fund vs. Indexes | |

Total returns, October 31, 2018 to October 31, 2019, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) orfront-end sales charges, which would have reduced performance. | |

Class A Shares | | | 17.17 | % |

Class C Shares | | | 16.29 | |

Class Y Shares | | | 17.48 | |

Class R6 Shares | | | 17.70 | |

MSCI All Country Asia Pacificex-Japan Indexq (Broad Market/ Style-Specific Index) | | | 13.89 | |

Lipper Pacific Regionex-Japan Funds Index⬛ (Peer Group Index) | | | 16.71 | |

Source(s):qRIMES Technologies Corp.;⬛Lipper Inc. | | | | |

Market conditions and your Fund

The fiscal year began with global equity markets, particularly the US, declining sharply at the end of 2018 amid rising interest rates, a flattening US Treasury yield curve, signaling a possible recession, and concerns that higher inflation could result in a more restrictive monetary policy. Investors also had concerns over the Brexit negotiations, ongoing trade tensions between the US and China, declining oil prices and fears of slowing economic growth, particularly in the eurozone.

After a relatively calm start at the beginning of 2019, global equity markets faced greater volatility in the second quarter, hampered by ongoing US and China trade issues, potential for new tariffs and slowing global economic growth. Global equity markets, particularly China, declined sharply in May 2019, ending a four-month rally. Trade and tariff issues, which were not limited to the US and China, clouded the outlook for many

global economies. Disagreement within the UK about its withdrawal from the European Union increased uncertainty for the UK and eurozone economies. Following better performance in June, most global equity markets managed modest positive returns for the second quarter of 2019, with developed markets generally outperforming emerging markets. China was an exception, declining during the second quarter.

Weakening global economic data and the ongoing US and China trade conflict contributed to higher market volatility in the third quarter of 2019. During the third quarter, data released showed slowing manufacturing activity and declining business investment, which was evidence that trade tensions were stifling economic growth across both developed and emerging markets. Global recession concerns caused a sharp equitysell-off in August 2019 as investors crowded into asset classes perceived as safe havens, including US Treasuries and gold. In

September 2019, both the US Federal Reserve and European Central Bank cut interest rates, providing a measure of support for risk assets. Growing optimism about a potential trade deal between the US and China also boosted equities in September. However, except for the US and Japan, performance in most regions declined during the third quarter. Uncertainty about the UK’s withdrawal from the European Union continued to weigh on UK and European equities, while political and trade issues affected areas of Latin America and Asia.

Global equity markets gained in October 2019 amid several positive catalysts, including a US interest rate cut, optimism surrounding US and China trade negotiations, and a raft of upbeat corporate results. The UK equity market provided a flat return during October and while domestic politics continued to dominate the region, European markets made modest gains. October was also a positive month for emerging equity markets with all regions recording gains. Despite increased market volatility, global equity indexes, in both developed and emerging markets, ended the fiscal year in positive territory.

Regardless of the macroeconomic environment, we remain focused on ourbottom-up investment approach of identifying attractive companies that fit our earnings, quality and valuation (EQV) process.

The Fund’s relative outperformance versus the MSCI All Country Asia Pacificex-Japan Index during the fiscal year was primarily driven by stock selection and meaningful overweight exposure to the consumer staples sector. Within the sector, China-based spirits producersWu-liangye YibinandKweichow Moutaicontributed to both the Fund’s absolute and relative performance. The companies benefited from the consumption upgrade

| | | | |

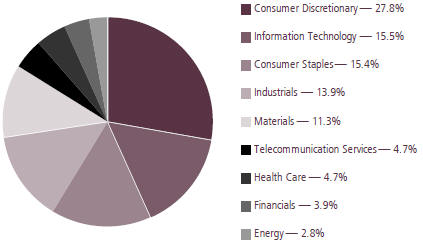

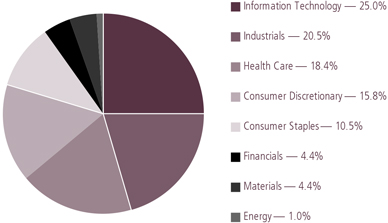

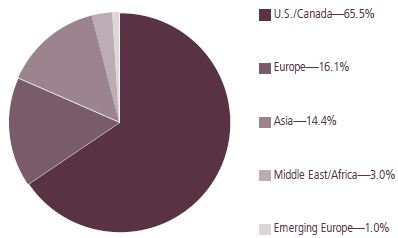

Portfolio Composition | | | | |

By sector % of total net assets | |

| |

Financials | | | 20.21 | % |

Information Technology | | | 15.41 | |

Real Estate | | | 15.35 | |

Consumer Discretionary | | | 12.86 | |

Consumer Staples | | | 12.47 | |

Communication Services | | | 5.36 | |

Industrials | | | 3.77 | |

Other Sectors, Each Less than 2% of Net Assets | | | 3.77 | |

Money Market Funds Plus Other Assets Less Liabilities | | | 10.80 | |

| | | | |

Top 10 Equity Holdings* | | | | |

% of total net assets | |

| |

1. PT Bank Central Asia Tbk | | | 4.45 | % |

2. United Overseas Bank Ltd. | | | 4.17 | |

3. Sunny Optical Technology Group Co., Ltd. | | | 3.92 | |

4. Yum China Holdings, Inc. | | | 3.75 | |

5. Broadcom, Inc. | | | 3.73 | |

6. Swire Properties Ltd. | | | 3.71 | |

7. Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3.64 | |

8. Samsung Electronics Co., Ltd. | | | 3.59 | |

9. PT Telekomunikasi Indonesia (Persero) Tbk | | | 3.41 | |

10. CK Asset Holdings Ltd. | | | 3.39 | |

| | | | |

Total Net Assets | | $ | 731.3 million | |

| |

Total Number of Holdings* | | | 41 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

*Excluding money market fund holdings, if any.

Data presented here are as of October 31, 2019.

4 Invesco Asia Pacific Growth Fund

cycle in China with the popularity of its premium Baiju brands. Strong stock selection in the information technology sector also contributed to the Fund’s relative results. Strength was seen inSunny Optical TechnologyandBroad-com. An underweight exposure to the energy sector relative to the broad market/style-specific index added to the Fund’s relative return. On a geographic basis, strong stock selection in China was the largest contributor to the Fund’s relative performance. The Fund’s holdings in Indonesia and South Korea outperformed those of the broad market/style-specific index and also contributed to relative results. Overweight exposure to Indonesia and underweight exposure to South Korea benefited the Fund’s relative performance as well.

In contrast, stock selection in the real estate sector detracted from the Fund’s relative performance during the fiscal year. Hong Kong-based companySwire Propertieswas one of the Fund’s largest individual detractors from Fund results during the fiscal year. The Fund’s holdings in the financials sector underperformed those of the broad market/style-specific index and hampered relative results. Thailand-basedKasikornbankwas a notable detractor within the sector. We trimmed our position in the bank during the fiscal year due to concerns about increased structural and cyclical pressures. Geographically, stock selection in Hong Kong was a key detractor from the Fund’s relative performance. Stock selection and overweight exposure in the weaker Malaysian market was a drag on the Fund’s relative return. In a rising market environment, the Fund’s cash exposure (which averaged around 11% during the fiscal year) detracted from the Fund’s performance relative to the broad market/ style-specific benchmark. It is important to note that cash is a residual of ourbottom-up investment process and not the result of anytop-down tactical asset allocation or risk-management allocation decision.

During the fiscal year, we continued to look for opportunities to improve the growth potential and quality of the Fund’s portfolio by adding companies based on our EQV outlook for each company. We added several new holdings, including China-basede-commerce companyAlibaba, online provider of consumer services including food deliveryMeituan Dianpingand Philippines-based banking companyBDO Unibank. We also added to several existing holdings, including China-based companiesYum China

and Sunny Optical Technology. We sold several holdings, includingChina Mobile,Want Want ChinaandLee & Man Paper Manufacturingdue to deteriorating fundamentals. We also reduced our existing positions in Broadcom and Kweichow Moutai during the fiscal year.

As always, we continue to look for high-quality growth companies that we believe exhibit the following characteristics: strong organic revenue growth; high returns on capital; pricing power; strong balance sheets; cash generation; and reasonable valuations. In addition, we continue to favor companies that we believe are able to consistently generate cash during weak economic environments. We believe that this balancedEQV-focused approach may help deliver attractive returns over the long term.

We thank you for your continued investment in Invesco Asia Pacific Growth Fund.

Portfolio managers:

Brent Bates

Shuxin (Steve) Cao

Mark Jason

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

5 Invesco Asia Pacific Growth Fund

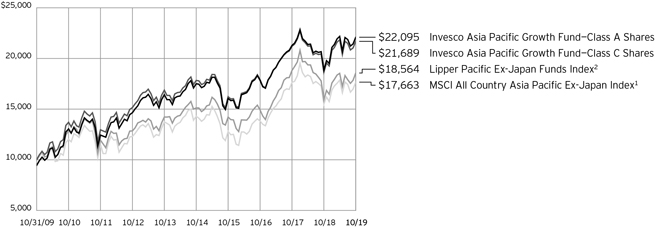

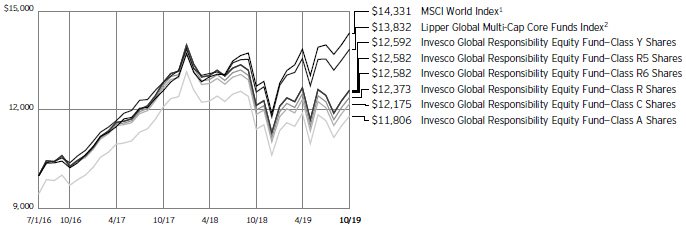

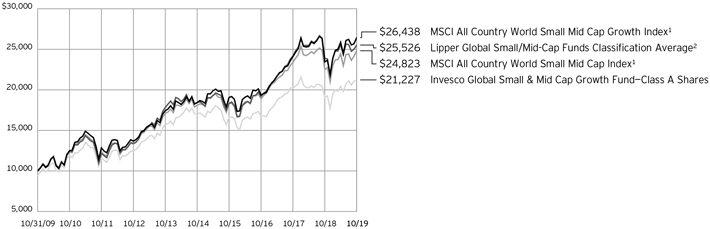

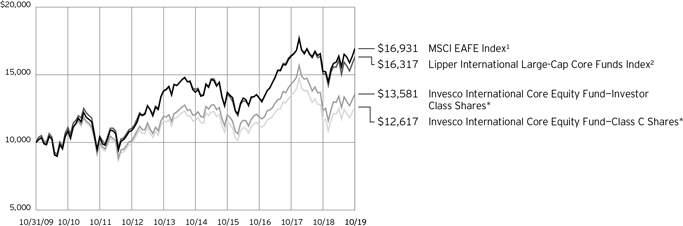

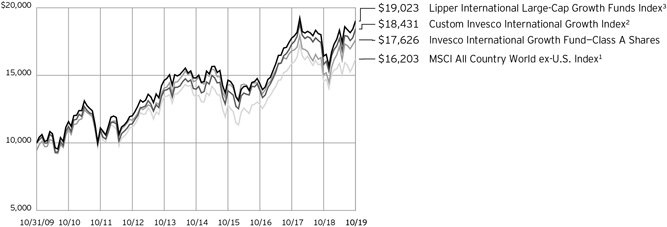

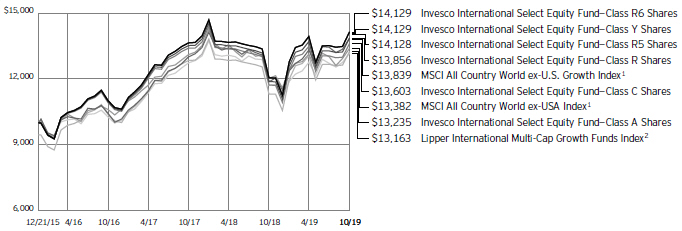

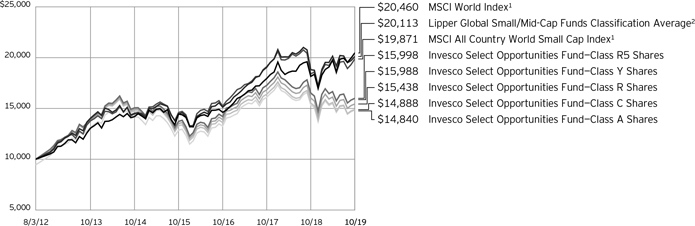

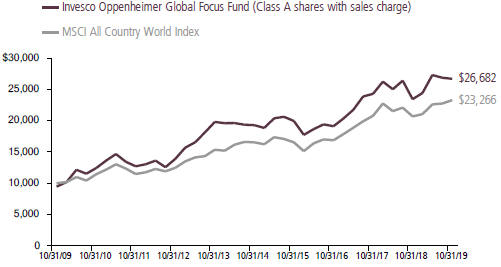

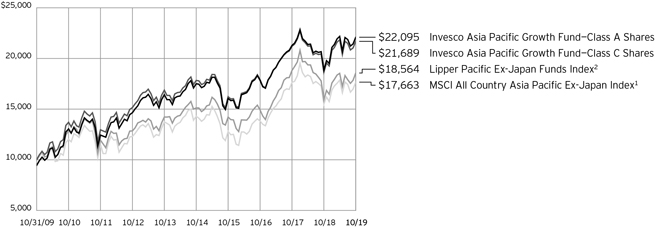

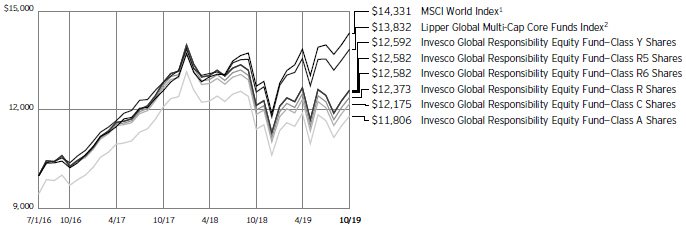

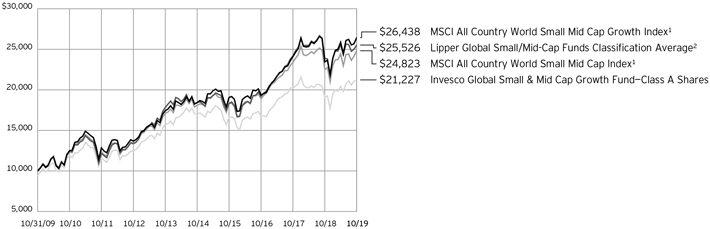

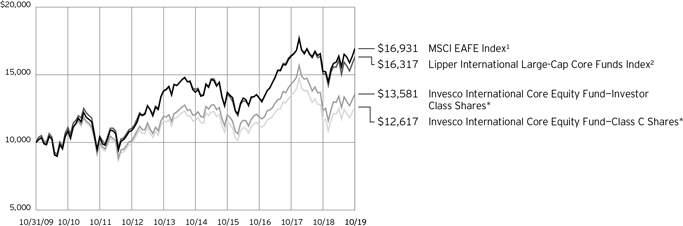

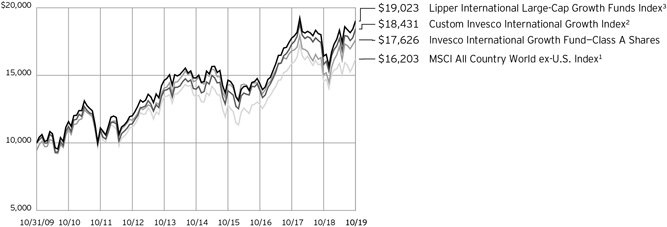

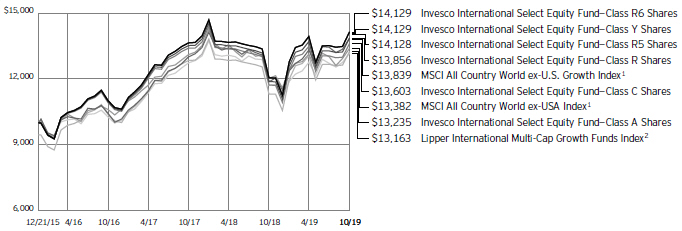

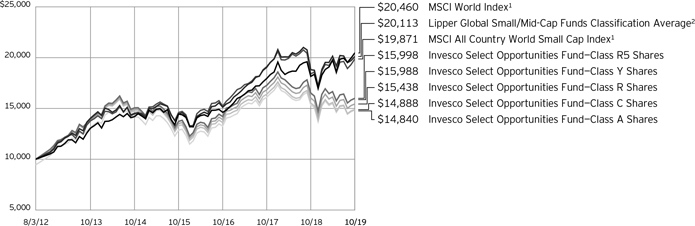

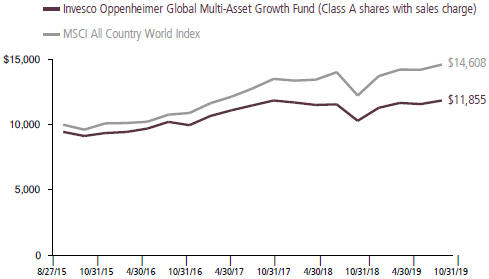

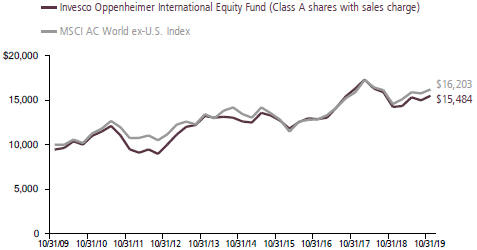

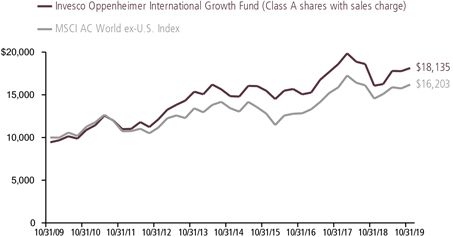

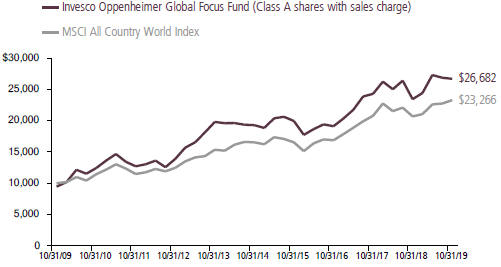

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 10/31/09

1 Source: RIMES Technologies Corp.

2 Source: Lipper Inc.

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including

management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees; performance

of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

6 Invesco Asia Pacific Growth Fund

| | | | | | |

| | | Average Annual Total Returns | |

| | As of 10/31/19, including maximum applicable sales charges | |

| | |

| | | Class A Shares | | | | |

| | | Inception (11/3/97) | | | 8.49% | |

| | | 10 Years | | | 8.25 | |

| | | 5 Years | | | 3.59 | |

| | | 1 Year | | | 10.74 | |

| | |

| | | Class C Shares | | | | |

| | | Inception (11/3/97) | | | 8.41% | |

| | | 10 Years | | | 8.05 | |

| | | 5 Years | | | 3.99 | |

| | | 1 Year | | | 15.29 | |

| | |

| | | Class Y Shares | | | | |

| | | Inception (10/3/08) | | | 10.88% | |

| | | 10 Years | | | 9.14 | |

| | | 5 Years | | | 5.03 | |

| | | 1 Year | | | 17.48 | |

| | |

| | | Class R6 Shares | | | | |

| | | 10 Years | | | 8.98% | |

| | | 5 Years | | | 5.00 | |

| | 1 Year | | | 17.70 | |

| | | | | | |

| | | Average Annual Total Returns | |

| | As of 9/30/19, the most recent calendar quarter end, including maximum applicable sales charges | |

| | |

| | | Class A Shares | | | | |

| | | Inception (11/3/97) | | | 8.37% | |

| | | 10 Years | | | 7.92 | |

| | | 5 Years | | | 3.45 | |

| | | 1 Year | | | –2.01 | |

| | |

| | | Class C Shares | | | | |

| | | Inception (11/3/97) | | | 8.29% | |

| | | 10 Years | | | 7.72 | |

| | | 5 Years | | | 3.84 | |

| | | 1 Year | | | 1.97 | |

| | |

| | | Class Y Shares | | | | |

| | | Inception (10/3/08) | | | 10.65% | |

| | | 10 Years | | | 8.80 | |

| | | 5 Years | | | 4.88 | |

| | | 1 Year | | | 3.96 | |

| | |

| | | Class R6 Shares | | | | |

| | | 10 Years | | | 8.65% | |

| | | 5 Years | | | 4.84 | |

| | 1 Year | | | 4.17 | |

Class R6 shares incepted on April 4, 2017. Performance shown prior to that date is that of Class A shares and includes the12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recentmonth-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The net annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, Class Y and Class R6 shares was 1.46%, 2.21%, 1.21% and 1.03%, respectively.1 The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, Class Y and Class R6 shares was 1.48%, 2.23%, 1.23% and 1.05%, respectively. The expense ratios presented above may vary from the expense

ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class Y shares and Class R6 shares do not have afront-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| 1 | Total annual Fund operating expenses after any contractual fee waivers and/or expense reimbursements by the adviser in effect through at least June 30, 2021. See current prospectus for more information. |

7 Invesco Asia Pacific Growth Fund

Invesco Asia Pacific Growth Fund’s investment objective is long-term growth of capital.

| ∎ | Unless otherwise stated, information presented in this report is as of October 31, 2019, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About share classes

| ∎ | Class Y sharesare available only to certain investors. Please see the prospectus for more information. |

| ∎ | Class R6 sharesare available for use by retirement plans that meet certain standards and for institutional investors. Class R6 shares are also available through intermediaries that have established an agreement with Invesco Distributors, Inc. to make such shares available for use in retail omnibus accounts. Please see the prospectus for more information. |

Principal risks of investing in the Fund

| ∎ | Asia pacific region risk(ex-Japan). The level of development of the economies of countries in the Asia Pacific region varies greatly. Furthermore, since the economies of the countries in the region are largely intertwined, if an economic recession is experienced by any of these countries, it will likely adversely impact the economic performance of other countries in the region. Certain economies in the region may be adversely affected by increased competition, high inflation rates, undeveloped financial services sectors, currency fluctuations or restrictions, political and social instability and increased economic volatility. |

| | Investments in companies located or operating in China involve risks not associated with investments in Western nations, such as nationalization, expropriation, or confiscation of property; difficulty in obtaining and/or enforcing judgments; alteration or discontinuation of economic reforms; military conflicts, either internal or with other countries; inflation, currency fluctuations and fluctuations in inflation and interest rates that may have negative effects on the economy and securities markets of China; and China’s dependency on the economies of other Asian countries, many of which are developing countries. |

| | Export growth continues to be a major driver of China’s rapid economic growth. As a result, a reduction in spending on Chinese products and services, the institution of additional tariffs or other trade barriers, including as a result of heightened trade tensions between China and the United States, or a downturn in any of the economies of China’s key trading partners may have an adverse impact on the Chinese economy. In addition, certain securities issued by companies located or operating in China, such as ChinaA-shares, are subject to trading restrictions, quota limitations, and clearing and settlement risks. |

| ∎ | Depositary receipts risk.Investing in depositary receipts involves the same risks as direct investments in foreign securities. In addition, the underlying issuers of certain depositary receipts are under no obligation to distribute shareholder communications or pass through any voting rights with respect to the deposited securities to the holders of such receipts. The Fund may therefore receive less timely information or have less control than if it invested directly in the foreign issuer. |

| ∎ | Derivatives risk.The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset (each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise perform under the derivative contract. Derivatives create leverage risk because they do not require payment up front equal to the economic exposure created by holding a position in the derivative. As a result, an adverse change in the value of the |

| | underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in the derivative or the anticipated value of the underlying asset, which may make the Fund’s returns more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Derivatives strategies may not always be successful. For example, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions. |

| ∎ | Emerging markets securities risk. Emerging markets (also referred to as developing markets) are generally subject to greater market volatility, political, social and economic instability, uncertain trading markets and more governmental limitations on foreign investment than more developed markets. In addition, companies operating in emerging markets may be subject to lower trading volume and greater price fluctuations than companies in more developed markets. Securities law and the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably. In addition, investments in emerging markets securities may be subject to additional transaction costs, delays in settlement procedures, and lack of timely information. |

| ∎ | Foreign securities risk.The Fund’s foreign investments may be adversely affected by political and social instability, changes in economic or taxation |

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

8 Invesco Asia Pacific Growth Fund

| | policies, difficulty in enforcing obligations, decreased liquidity or increased volatility. Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire investments in a certain market) and the possible adoption of foreign governmental restrictions such as exchange controls. Unless the Fund has hedged its foreign securities risk, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. |

| ∎ | Geographic focus risk. The Fund may from time to time invest a substantial amount of its assets in securities of issuers located in a single country or a limited number of countries. Adverse economic, political or social conditions in those countries may therefore have a significant negative impact on the Fund’s investment performance. |

| ∎ | Growth investing risk. Growth stocks tend to be more expensive relative to the issuing company’s earnings or assets compared with other types of stock. As a result, they tend to be more sensitive to changes in, or investors’ expectations of, the issuing company’s earnings and can be more volatile. |

| ∎ | Management risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its investment objective. |

| ∎ | Market risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section of the economy, or it may affect the market as a whole. Individual stock |

| | prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. During a general downturn in the financial markets, multiple asset classes may decline in value. When markets perform well, there can be no assurance that specific investments held by the Fund will rise in value. |

| ∎ | Preferred securities risk. Preferred securities are subject to issuer-specific and market risks applicable generally to equity securities. Preferred securities also may be subordinated to bonds or other debt instruments, subjecting them to a greater risk ofnon-payment, may be less liquid than many other securities, such as common stocks, and generally offer no voting rights with respect to the issuer. |

| ∎ | Sector focus risk. The Fund may from time to time invest a significant amount of its assets (i.e. over 25%) in one market sector or group of related industries. In this event, the Fund’s performance will depend to a greater extent on the overall condition of the sector or group of industries and there is increased risk that the Fund will lose significant value if conditions adversely affect that sector or group of industries. |

| ∎ | Small- andmid-capitalization companies risks. Small- andmid-capitalization companies tend to be more vulnerable to changing market conditions, may have little or no operating history or track record of success, and may have more limited product lines and markets, less experienced management and fewer financial resources than larger companies. These companies’ securities may be more volatile and less liquid than those of more established companies, and their returns may vary, sometimes significantly, from the overall securities market. |

About indexes used in this report

| ∎ | TheMSCI All Country Asia Pacificex-Japan Indexis an unmanaged index considered representative of Asia Pacific region stock markets, excluding Japan. The index is computed using the net return, which withholds applicable taxes fornon-resident investors. |

| ∎ | TheLipper Pacific Regionex-Japan Funds Indexis an unmanaged index considered representative of Pacific regionex-Japan funds tracked by Lipper. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| ∎ | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

| ∎ | Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

9 Invesco Asia Pacific Growth Fund

Schedule of Investments

October 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| |

Common Stocks & Other Equity Interests-89.20% | |

Australia-2.34% | | | | | | | | |

Computershare Ltd. | | | 348,886 | | | $ | 3,797,093 | |

| |

CSL Ltd. | | | 75,544 | | | | 13,296,577 | |

| |

| | | | | | | 17,093,670 | |

| |

| | |

China-26.78% | | | | | | | | |

Alibaba Group Holding Ltd., ADR(a) | | | 84,980 | | | | 15,013,417 | |

| |

Angel Yeast Co., Ltd., A Shares | | | 2,554,150 | | | | 10,944,024 | |

| |

China Mengniu Dairy Co. Ltd.(a) | | | 6,031,000 | | | | 24,099,576 | |

| |

Henan Shuanghui Investment & Development Co., Ltd., A Shares | | | 3,278,084 | | | | 13,842,271 | |

| |

Industrial & Commercial Bank of China Ltd., H Shares | | | 10,736,000 | | | | 7,716,366 | |

| |

Kweichow Moutai Co., Ltd., A Shares | | | 33,927 | | | | 5,682,695 | |

| |

Meituan Dianping, B Shares(a) | | | 1,371,400 | | | | 16,385,362 | |

| |

Minth Group Ltd. | | | 1,286,000 | | | | 4,539,756 | |

| |

New Oriental Education & Technology Group, Inc., ADR(a) | | | 69,138 | | | | 8,438,984 | |

| |

Qingdao Port International Co., Ltd., H Shares(b) | | | 6,409,000 | | | | 3,664,497 | |

| |

Sunny Optical Technology Group Co., Ltd. | | | 1,807,100 | | | | 28,664,766 | |

| |

Weibo Corp., ADR(a) | | | 137,381 | | | | 6,757,771 | |

| |

Wuliangye Yibin Co., Ltd., A Shares | | | 1,212,460 | | | | 22,667,403 | |

| |

Yum China Holdings, Inc. | | | 645,384 | | | | 27,428,820 | |

| |

| | | | | | | 195,845,708 | |

| |

| | |

Hong Kong-11.30% | | | | | | | | |

CK Asset Holdings Ltd. | | | 3,560,160 | | | | 24,772,345 | |

| |

CK Hutchison Holdings Ltd. | | | 1,409,160 | | | | 13,012,681 | |

| |

Hongkong Land Holdings Ltd. | | | 3,222,100 | | | | 17,680,239 | |

| |

Swire Properties Ltd. | | | 8,678,600 | | | | 27,167,009 | |

| |

| | | | | | | 82,632,274 | |

| |

| | |

Indonesia-12.28% | | | | | | | | |

PT Bank Central Asia Tbk | | | 14,538,400 | | | | 32,505,768 | |

| |

PT Bank Mandiri (Persero) Tbk | | | 41,342,500 | | | | 20,634,137 | |

| |

PT Pakuwon Jati Tbk | | | 264,401,600 | | | | 11,735,752 | |

| |

PT Telekomunikasi Indonesia (Persero) Tbk | | | 85,773,000 | | | | 24,941,294 | |

| |

| | | | | | | 89,816,951 | |

| |

| | |

Macau-2.45% | | | | | | | | |

Galaxy Entertainment Group Ltd. | | | 2,629,000 | | | | 17,948,619 | |

| |

| | |

Malaysia-4.37% | | | | | | | | |

Bursa Malaysia Bhd. | | | 11,494,850 | | | | 16,622,001 | |

| |

Public Bank Bhd | | | 3,158,700 | | | | 15,324,673 | |

| |

| | | | | | | 31,946,674 | |

| |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Philippines-5.15% | | | | | | | | |

BDO Unibank, Inc. | | | 4,628,990 | | | $ | 14,083,853 | |

| |

Metro Pacific Investments Corp. | | | 56,295,300 | | | | 5,303,881 | |

| |

SM Investments Corp. | | | 537,066 | | | | 10,875,221 | |

| |

SM Prime Holdings, Inc. | | | 9,593,000 | | | | 7,364,135 | |

| |

| | | | | | | 37,627,090 | |

| |

| | |

Singapore-7.39% | | | | | | | | |

Keppel REIT | | | 26,543,700 | | | | 23,562,638 | |

| |

United Overseas Bank Ltd. | | | 1,549,300 | | | | 30,500,430 | |

| |

| | | | | | | 54,063,068 | |

| |

| | |

South Korea-4.62% | | | | | | | | |

NAVER Corp. | | | 53,315 | | | | 7,504,795 | |

| |

Samsung Electronics Co., Ltd. | | | 608,392 | | | | 26,295,373 | |

| |

| | | | | | | 33,800,168 | |

| |

| | |

Taiwan-3.64% | | | | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 2,742,464 | | | | 26,643,806 | |

| |

| | |

Thailand-1.28% | | | | | | | | |

Kasikornbank PCL, Foreign Shares | | | 1,107,000 | | | | 5,113,724 | |

| |

Thai Stanley Electric PCL, Foreign Shares | | | 818,700 | | | | 4,269,785 | |

| |

| | | | | | | 9,383,509 | |

| |

| | |

United States-5.69% | | | | | | | | |

Amcor PLC, CDI | | | 1,502,055 | | | | 14,301,705 | |

| |

Broadcom, Inc. | | | 93,153 | | | | 27,279,856 | |

| |

| | | | | | | 41,581,561 | |

| |

| | |

Vietnam-1.91% | | | | | | | | |

Vietnam Dairy Products JSC | | | 2,494,692 | | | | 13,939,528 | |

| |

Total Common Stocks & Other Equity Interests

(Cost $463,702,569) | | | | 652,322,626 | |

| |

| | |

Money Market Funds-10.58% | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class, 1.71%(c) | | | 27,069,917 | | | | 27,069,917 | |

| |

Invesco Liquid Assets Portfolio, Institutional Class, 1.90%(c) | | | 19,334,982 | | | | 19,342,717 | |

| |

Invesco Treasury Portfolio, Institutional Class, 1.66%(c) | | | 30,937,048 | | | | 30,937,048 | |

| |

Total Money Market Funds (Cost $77,344,060) | | | | | | | 77,349,682 | |

| |

TOTAL INVESTMENTS IN SECURITIES-99.78%

(Cost $541,046,629) | | | | 729,672,308 | |

| |

OTHER ASSETS LESS LIABILITIES-0.22% | | | | 1,638,973 | |

| |

NET ASSETS–100.00% | | | | | | $ | 731,311,281 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco Asia Pacific Growth Fund

Investment Abbreviations:

| | | | |

| ADR | | - American Depositary Receipt | | |

| CDI | | - CREST Depository Interest | | |

| REIT | | - Real Estate Investment Trust | | |

Notes to Schedule of Investments:

| (a) | Non-income producing security. |

| (b) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The value of this security at October 31, 2019 represented less than 1% of the Fund’s Net Assets. |

| (c) | The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the7-day SEC standardized yield as of October 31, 2019. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco Asia Pacific Growth Fund

Statement of Assets and Liabilities

October 31, 2019

| | | | |

Assets: | | | | |

| |

Investments in securities, at value

(Cost $463,702,569) | | $ | 652,322,626 | |

| |

Investments in affiliated money market funds, at value (Cost $77,344,060) | | | 77,349,682 | |

| |

Foreign currencies, at value

(Cost $1,906,291) | | | 1,918,645 | |

| |

Receivable for: | | | | |

Investments sold | | | 709,505 | |

| |

Dividends | | | 521,267 | |

| |

Fund shares sold | | | 216,966 | |

| |

Investment for trustee deferred compensation and retirement plans | | | 137,609 | |

| |

Other assets | | | 25,667 | |

| |

Total assets | | | 733,201,967 | |

| |

| |

Liabilities: | | | | |

Payable for: | | | | |

Fund shares reacquired | | | 474,391 | |

| |

Accrued foreign taxes | | | 649,558 | |

| |

Accrued fees to affiliates | | | 488,832 | |

| |

Accrued trustees’ and officers’ fees and benefits | | | 1,869 | |

| |

Accrued other operating expenses | | | 127,103 | |

| |

Trustee deferred compensation and retirement plans | | | 148,933 | |

| |

Total liabilities | | | 1,890,686 | |

| |

Net assets applicable to shares outstanding | | $ | 731,311,281 | |

| |

| |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 495,072,301 | |

| |

Distributable earnings | | | 236,238,980 | |

| |

| | $ | 731,311,281 | |

| |

| | | | |

Net Assets: | | | | |

Class A | | $ | 433,120,307 | |

| |

Class C | | $ | 31,408,966 | |

| |

Class Y | | $ | 170,249,272 | |

| |

Class R6 | | $ | 96,532,736 | |

| |

|

Shares outstanding, no par value, with an unlimited number of shares authorized: | |

Class A | | | 13,063,704 | |

| |

Class C | | | 1,038,200 | |

| |

Class Y | | | 5,119,538 | |

| |

Class R6 | | | 2,901,516 | |

| |

Class A: | | | | |

Net asset value per share | | $ | 33.15 | |

| |

Maximum offering price per share

(Net asset value of $33.15 ÷ 94.50%) | | $ | 35.08 | |

| |

Class C: | | | | |

Net asset value and offering price per share | | $ | 30.25 | |

| |

Class Y: | | | | |

Net asset value and offering price per share | | $ | 33.25 | |

| |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 33.27 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco Asia Pacific Growth Fund

Statement of Operations

For the year ended October 31, 2019

| | | | |

Investment income: | | | | |

Dividends (net of foreign withholding taxes of $1,115,104) | | $ | 16,955,886 | |

| |

Dividends from affiliated money market funds | | | 1,774,968 | |

| |

Total investment income | | | 18,730,854 | |

| |

| |

Expenses: | | | | |

Advisory fees | | | 6,787,064 | |

| |

Administrative services fees | | | 118,574 | |

| |

Custodian fees | | | 156,788 | |

| |

Distribution fees: | | | | |

| |

Class A | | | 1,077,149 | |

| |

Class C | | | 399,236 | |

| |

Transfer agent fees - A, C and Y | | | 1,372,752 | |

| |

Transfer agent fees - R6 | | | 8,390 | |

| |

Trustees’ and officers’ fees and benefits | | | 28,931 | |

| |

Registration and filing fees | | | 79,038 | |

| |

Reports to shareholders | | | 81,667 | |

| |

Professional services fees | | | 64,991 | |

| |

Other | | | 15,595 | |

| |

Total expenses | | | 10,190,175 | |

| |

Less: Fees waived and/or expense offset arrangement(s) | | | (98,908 | ) |

| |

Net expenses | | | 10,091,267 | |

| |

Net investment income | | | 8,639,587 | |

| |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Investment securities (net of foreign taxes of $642,201) | | | 40,057,832 | |

| |

Foreign currencies | | | (226,126 | ) |

| |

| | | 39,831,706 | |

| |

Change in net unrealized appreciation of: Investment securities (net of foreign taxes of $1,984,454) | | | 67,973,561 | |

| |

Foreign currencies | | | 22,147 | |

| |

| | | 67,995,708 | |

| |

Net realized and unrealized gain | | | 107,827,414 | |

| |

Net increase in net assets resulting from operations | | $ | 116,467,001 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 Invesco Asia Pacific Growth Fund

Statement of Changes in Net Assets

For the years ended October 31, 2019 and 2018

| | | | | | | | |

| | | 2019 | | | 2018 | |

| |

| | |

Operations: | | | | | | | | |

| | |

Net investment income | | $ | 8,639,587 | | | $ | 9,891,947 | |

| |

Net realized gain | | | 39,831,706 | | | | 38,916,398 | |

| |

Change in net unrealized appreciation (depreciation) | | | 67,995,708 | | | | (141,623,811 | ) |

| |

Net increase (decrease) in net assets resulting from operations | | | 116,467,001 | | | | (92,815,466 | ) |

| |

| | |

Distributions to shareholders from distributable earnings: | | | | | | | | |

| | |

Class A | | | (26,750,392 | ) | | | (37,717,459 | ) |

| |

Class B | | | – | | | | (143,824 | ) |

| |

Class C | | | (3,425,301 | ) | | | (5,230,928 | ) |

| |

Class Y | | | (12,016,731 | ) | | | (20,892,067 | ) |

| |

Class R6 | | | (6,512,306 | ) | | | (9,802,768 | ) |

| |

Total distributions from distributable earnings | | | (48,704,730 | ) | | | (73,787,046 | ) |

| |

| | |

Share transactions–net: | | | | | | | | |

| | |

Class A | | | (1,605,418 | ) | | | (10,135,034 | ) |

| |

Class B | | | – | | | | (2,153,316 | ) |

| |

Class C | | | (25,531,581 | ) | | | (4,250,596 | ) |

| |

Class Y | | | (18,397,911 | ) | | | (53,967,485 | ) |

| |

Class R6 | | | 881,498 | | | | (13,134,106 | ) |

| |

Net increase (decrease) in net assets resulting from share transactions | | | (44,653,412 | ) | | | (83,640,537 | ) |

| |

Net increase (decrease) in net assets | | | 23,108,859 | | | | (250,243,049 | ) |

| |

| | |

Net assets: | | | | | | | | |

| | |

Beginning of year | | | 708,202,422 | | | | 958,445,471 | |

| |

End of year | | $ | 731,311,281 | | | $ | 708,202,422 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco Asia Pacific Growth Fund

Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset

value,

beginning

of period | | | Net

investment

income(a) | | | Net gains

(losses)

on securities

(both

realized and

unrealized) | | | Total from

investment

operations | | | Dividends

from net

investment

income | | | Distributions

from net

realized

gains | | | Total

distributions | | | Net asset

value, end

of period | | | Total

return (b) | | | Net assets,

end of period

(000’s omitted) | | | Ratio of

expenses

to average

net assets

with fee waivers

and/or

expenses

absorbed | | | Ratio of

expenses

to average net

assets without

fee waivers

and/or

expenses

absorbed | | | Ratio of net

investment

income

to average

net assets | | | Portfolio

turnover (c) | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/19 | | | $30.30 | | | | $0.35 | | | | $4.60 | | | | $4.95 | | | | $(0.34 | ) | | | $(1.76 | ) | | | $(2.10 | ) | | | $33.15 | | | | 17.17 | % | | | $433,120 | | | | 1.43 | %(d) | | | 1.44 | %(d) | | | 1.08 | %(d) | | | 17 | % |

Year ended 10/31/18 | | | 36.95 | | | | 0.36 | | | | (4.21 | ) | | | (3.85 | ) | | | (0.28 | ) | | | (2.52 | ) | | | (2.80 | ) | | | 30.30 | | | | (11.39 | ) | | | 395,319 | | | | 1.44 | | | | 1.46 | | | | 1.04 | | | | 21 | |

Year ended 10/31/17 | | | 31.60 | | | | 0.28 | | | | 5.69 | | | | 5.97 | | | | (0.30 | ) | | | (0.32 | ) | | | (0.62 | ) | | | 36.95 | | | | 19.32 | | | | 495,214 | | | | 1.45 | | | | 1.47 | | | | 0.85 | | | | 18 | |

Year ended 10/31/16 | | | 29.35 | | | | 0.31 | | | | 2.83 | | | | 3.14 | | | | (0.89 | ) | | | – | | | | (0.89 | ) | | | 31.60 | | | | 11.15 | | | | 467,191 | | | | 1.45 | | | | 1.47 | | | | 1.06 | | | | 9 | |

Year ended 10/31/15 | | | 33.43 | | | | 0.83 | (e) | | | (3.54 | ) | | | (2.71 | ) | | | (0.41 | ) | | | (0.96 | ) | | | (1.37 | ) | | | 29.35 | | | | (8.32 | ) | | | 468,366 | | | | 1.44 | | | | 1.45 | | | | 2.63 | (e) | | | 23 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/19 | | | 27.77 | | | | 0.10 | | | | 4.21 | | | | 4.31 | | | | (0.07 | ) | | | (1.76 | ) | | | (1.83 | ) | | | 30.25 | | | | 16.29 | | | | 31,409 | | | | 2.18 | (d) | | | 2.19 | (d) | | | 0.33 | (d) | | | 17 | |

Year ended 10/31/18 | | | 34.08 | | | | 0.09 | | | | (3.86 | ) | | | (3.77 | ) | | | (0.02 | ) | | | (2.52 | ) | | | (2.54 | ) | | | 27.77 | | | | (12.05 | ) | | | 53,201 | | | | 2.19 | | | | 2.21 | | | | 0.29 | | | | 21 | |

Year ended 10/31/17 | | | 29.17 | | | | 0.03 | | | | 5.27 | | | | 5.30 | | | | (0.07 | ) | | | (0.32 | ) | | | (0.39 | ) | | | 34.08 | | | | 18.44 | | | | 70,146 | | | | 2.20 | | | | 2.22 | | | | 0.10 | | | | 18 | |

Year ended 10/31/16 | | | 27.10 | | | | 0.08 | | | | 2.63 | | | | 2.71 | | | | (0.64 | ) | | | – | | | | (0.64 | ) | | | 29.17 | | | | 10.34 | | | | 72,872 | | | | 2.20 | | | | 2.22 | | | | 0.31 | | | | 9 | |

Year ended 10/31/15 | | | 30.96 | | | | 0.55 | (e) | | | (3.27 | ) | | | (2.72 | ) | | | (0.18 | ) | | | (0.96 | ) | | | (1.14 | ) | | | 27.10 | | | | (9.02 | ) | | | 79,991 | | | | 2.19 | | | | 2.20 | | | | 1.88 | (e) | | | 23 | |

Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/19 | | | 30.41 | | | | 0.43 | | | | 4.60 | | | | 5.03 | | | | (0.43 | ) | | | (1.76 | ) | | | (2.19 | ) | | | 33.25 | | | | 17.44 | | | | 170,249 | | | | 1.18 | (d) | | | 1.19 | (d) | | | 1.33 | (d) | | | 17 | |

Year ended 10/31/18 | | | 37.07 | | | | 0.45 | | | | (4.23 | ) | | | (3.78 | ) | | | (0.36 | ) | | | (2.52 | ) | | | (2.88 | ) | | | 30.41 | | | | (11.17 | ) | | | 172,297 | | | | 1.19 | | | | 1.21 | | | | 1.29 | | | | 21 | |

Year ended 10/31/17 | | | 31.69 | | | | 0.36 | | | | 5.71 | | | | 6.07 | | | | (0.37 | ) | | | (0.32 | ) | | | (0.69 | ) | | | 37.07 | | | | 19.66 | | | | 267,942 | | | | 1.20 | | | | 1.22 | | | | 1.10 | | | | 18 | |

Year ended 10/31/16 | | | 29.45 | | | | 0.39 | | | | 2.82 | | | | 3.21 | | | | (0.97 | ) | | | – | | | | (0.97 | ) | | | 31.69 | | | | 11.42 | | | | 329,748 | | | | 1.20 | | | | 1.22 | | | | 1.31 | | | | 9 | |

Year ended 10/31/15 | | | 33.55 | | | | 0.91 | (e) | | | (3.55 | ) | | | (2.64 | ) | | | (0.50 | ) | | | (0.96 | ) | | | (1.46 | ) | | | 29.45 | | | | (8.12 | ) | | | 268,833 | | | | 1.19 | | | | 1.20 | | | | 2.88 | (e) | | | 23 | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 10/31/19 | | | 30.43 | | | | 0.49 | | | | 4.61 | | | | 5.10 | | | | (0.50 | ) | | | (1.76 | ) | | | (2.26 | ) | | | 33.27 | | | | 17.70 | | | | 96,533 | | | | 0.98 | (d) | | | 0.99 | (d) | | | 1.53 | (d) | | | 17 | |

Year ended 10/31/18 | | | 37.10 | | | | 0.51 | | | | (4.22 | ) | | | (3.71 | ) | | | (0.44 | ) | | | (2.52 | ) | | | (2.96 | ) | | | 30.43 | | | | (11.00 | ) | | | 87,386 | | | | 1.01 | | | | 1.03 | | | | 1.47 | | | | 21 | |

Year ended 10/31/17(f) | | | 32.81 | | | | 0.27 | | | | 4.02 | | | | 4.29 | | | | – | | | | – | | | | – | | | | 37.10 | | | | 13.08 | | | | 122,996 | | | | 1.01 | (g) | | | 1.03 | (g) | | | 1.29 | (g) | | | 18 | |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (d) | Ratios are based on average daily net assets (000’s omitted) of $430,860, $39,924, $181,658 and $93,272 for Class A, Class C, Class Y and Class R6 shares, respectively. |

| (e) | Net investment income per share and the ratio of net investment income to average net assets include significant dividends received during the fiscal year ended October 31, 2015. Net investment income per share and the ratio of net investment income to average net assets excluding the significant dividends are $0.38 and 1.18%, $0.10 and 0.43% and $0.46 and 1.43% for Class A, Class C and Class Y shares, respectively. |

| (f) | Commencement date of April 4, 2017. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 Invesco Asia Pacific Growth Fund

Notes to Financial Statements

October 31, 2019

NOTE 1–Significant Accounting Policies

Invesco Asia Pacific Growth Fund (the “Fund”) is a series portfolio of AIM International Mutual Funds (Invesco International Mutual Funds) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as anopen-end series management investment company authorized to issue an unlimited number of shares of beneficial interest. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of the Fund or each class.

The Fund’s investment objective is long-term growth of capital.

The Fund currently consists of four different classes of shares: Class A, Class C, Class Y and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with afront-end sales charge unless certain waiver criteria are met. Under certain circumstances, load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class Y and Class R6 shares are sold at net asset value. Class C shares held for ten years after purchase are eligible for automatic conversion into Class A shares of the same Fund (the “Conversion Feature”). The automatic conversion pursuant to the Conversion Feature will generally occur at the end of the month following the tenth anniversary after a purchase of Class C shares.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946,Financial Services - Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations– Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in theover-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments inopen-end andclosed-end registered investment companies that do not trade on an exchange are valued at theend-of-day net asset value per share. Investments inopen-end andclosed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such asinstitution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the investment adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates

16 Invesco Asia Pacific Growth Fund

depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

B. Securities Transactions and Investment Income– Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on theex-dividend date.

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

C. Country Determination– For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted.

D. Distributions– Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on theex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes.

E. Federal Income Taxes –The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

F. Expenses– Fees provided for under the Rule12b-1 plan of a particular class of the Fund are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R6 are charged to such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets.

G. Accounting Estimates –The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after theperiod-end date and before the date the financial statements are released to print.

H. Indemnifications- Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote.

I. Foreign Currency Translations– Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net

17 Invesco Asia Pacific Growth Fund

unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| J. | Forward Foreign Currency Contracts– The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical settlement of the two currencies, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards). The Fund will set aside liquid assets in an amount equal to the dailymark-to-market obligation for forward foreign currency contracts.

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

NOTE 2–Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund accrues daily and pays monthly an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| | |

| Average Daily Net Assets | | Rate |

First $250 million | | 0.935% |

Next $250 million | | 0.910% |

Next $500 million | | 0.885% |

Next $1.5 billion | | 0.860% |

Next $2.5 billion | | 0.835% |

Next $2.5 billion | | 0.810% |

Next $2.5 billion | | 0.785% |

Amount over $10 billion | | 0.760% |

For the year ended October 31, 2019, the effective advisory fee rate incurred by the Fund was 0.91%.