UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006 | Commission file number 0-19771 |

ACORN FACTOR, INC.

(Exact name of registrant as specified in charter)

Delaware | 22-2786081 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

200 Route 17, Mahwah, New Jersey | 07430 |

(Address of principal executive offices) | (Zip Code) |

(201) 529-2026

Registrant’s telephone number, including area code

_______________________

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of last day of the second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $23 million based on the closing sale price on that date as reported on the Over-the-Counter Bulletin Board.

As of April 10, 2007 there were 9,561,659 shares of Common Stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

TABLE OF CONTENTS

| PART I | | PAGE |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 5 |

| Item 1B. | Unresolved Staff Comments | 10 |

| Item 2. | Properties | 10 |

| Item 3. | Legal Proceedings. | 11 |

| Item 4. | Submission of Matters to a Vote of Security Holders. | 11 |

| | | |

| PART II | | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters | |

| | and Issuer Purchases of Equity Securities. | 12 |

| Item 6. | Selected Financial Data. | 12 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 27 |

| Item 8. | Financial Statements and Supplementary Data. | 27 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. | Controls and Procedures | 28 |

| Item 9B. | Other Information | 28 |

| | | |

| PART III | | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 29 |

| Item 11. | Executive Compensation | 31 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships, Related Transactions and Director Independence | 42 |

| Item 14. | Principal Accounting Fees and Services | 44 |

| | | |

| Part IV | | |

| | | |

| Item 15. | Exhibits and Financial Statement Schedules. | 45 |

Certain statements contained in this report are forward-looking in nature. These statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should” or “anticipates”, or the negatives thereof, or comparable terminology, or by discussions of strategy. You are cautioned that our business and operations are subject to a variety of risks and uncertainties and, consequently, our actual results may materially differ from those projected by any forward-looking statements. Certain of such risks and uncertainties are discussed below under the heading “Item 1A. Risk Factors.”

EasyBillTM, OncosoftTM and OncoProTM are trademarks of our dsIT Solutions Ltd subsidiary. Maingate® is a registered trademark and PowerCampTM is a trademark of Comverge, Inc.

PART I

ITEM 1. BUSINESS

OVERVIEW

Acorn Factor is a holding company that currently maintains majority ownership or primarily controlling equity positions in the three companies described below. Our principal business strategy is to identify, develop, acquire and operate majority-owned subsidiaries and primarily-controlled companies by seeking to acquire new technologies or existing businesses that (i) are led by proven entrepreneurs, (ii) have strong growth potential and (iii) are approaching profitability and positive cash flow. We seek to identify and acquire companies possessing new business models that can speed adoption of proven technologies, with a particular focus on “power systems” that offer solutions for managing knowledge, asset protection and intelligent delivery systems for our increasingly scarce natural resources. We also seek strategic partner companies outside the “power systems” area, which we believe would otherwise substantially fulfill the objectives of our business strategy.

We presently hold majority or significant equity interests in the following companies:

| | (a) | Comverge, Inc. — a leading demand response company enabling utilities, industry and consumers to better manage peak electricity usage; |

| | (b) | Paketeria GmbH — the innovator of Germany's first "Super Service Market"; and |

| | (c) | dsIT Solutions Ltd. — a provider of software consulting and development services and software/hardware solutions in the areas of port security, oncology treatment and billing services. |

During 2006, we had operations in two reportable segments: RT Solutions and IT Solutions, both conducted through our dsIT subsidiary.

| | · | RT Solutions whose activities are focused on two areas - naval solutions and other real-time and embedded hardware & software development. |

| | · | IT Solutions, whose activities are comprised of the Company’s Oncosoft™ solution state of the art chemotherapy package for oncology and hematology departments and EasyBill™, an easy-to-use, end-to-end, modular customer care and billing system designed especially for small and medium-sized enterprises with large and expanding customer bases. |

SALES BY ACTIVITY

The following table shows, for the years indicated, the dollar amount and the percentage of the sales attributable to each of the segments of our operations.

| | | 2004 | | 2005 | | 2006 | |

| | | Amount | | % | | Amount | | % | | Amount | | % | |

| RT Solutions | | $ | 1,988 | | | 59 | | $ | 2,844 | | | 68 | | $ | 2,729 | | | 66 | |

| IT Solutions | | | 1,312 | | | 39 | | | 1,314 | | | 31 | | | 1,125 | | | 27 | |

| Other | | | 64 | | | 2 | | | 29 | | | 1 | | | 263 | | | 7 | |

| Total | | $ | 3,364 | | | 100 | % | $ | 4,187 | | | 100 | % | $ | 4,117 | | | 100 | % |

RT SOLUTIONS

Products and Services

dsIT’s RT Solutions activities are focused on two areas - naval solutions and other real-time and embedded hardware & software development. Our naval solutions include a full range of sonar and acoustic-related solutions to the commercial, defense and homeland security markets. These solutions include:

| | · | Diver Detection Sonar (DDS) - a system that guards ports and shore installations from underwater threats; |

| | · | Mobile Acoustic Range (MAR); - a mobile system that accurately measures the radiated noise of submarines and surface vessels, thus assisting to reduce their noise level; |

| | · | Generic Sonar Simulator (GSS) - a PC based sonar simulator for the rapid and comprehensive training of ASW, submarine, and mine detection sonar operators; |

| | · | Harbor Surveillance System (HSS) - a system that incorporates DDS sensors with above-water surveillance sensors to create a comprehensive above and below water security system; and |

| | · | Underwater Acoustic Signal Analysis system (UASA) - a system that processes, analyzes and classifies all types of acoustic signals radiated by various sources and received by naval sonar systems. |

Our other real-time and embedded hardware & software development solutions areas of development and production include:

| | · | Computerized vision for the Semiconductor industry; |

| | · | Operation control consoles and HMI applications; and |

| | · | Command & control applications |

During 2004, 2005 and 2006, sales from our RT solutions activities were $2.0 million, $2.8 million and $2.7 million, respectively, accounting for approximately 59%, 68% and 66% of company sales for 2004, 2005 and 2006, respectively.

We generally provide our RT solutions on a fixed-price basis. When working on a fixed-price basis, we undertake to deliver software or hardware/software solutions to a customer’s specifications or requirements for a particular project, accounting for these services on the percentage-of-completion method. Since the profit margins on these projects are primarily determined by our success in controlling project costs, the margins on these projects may vary as a result of various factors, including underestimating costs, difficulties associated with implementing new technologies and economic and other changes that may occur during the term of the contract.

dsIT has initiated discussions for strategic alliances for marketing its sonar technology. We hope that some of these discussions will come to fruition before the end of 2007.

Customers and Markets

All of this segment’s operations and most sales took place in Israel in 2004, 2005 and 2006. We expect to generate significant revenues from naval solutions outside of Israel in 2007. We have created significant relationships with some of Israel’s largest companies in its defense and electronics industries. dsIT is continuing to invest considerable effort to penetrate European, Asian and other markets in order to broaden its geographic sales base with respect to our sonar technology solutions. Two customers accounted for 63% of segment sales in 2006 (32% and 31%, respectively) while in 2005 three customers accounted for 72% (33%, 22%, and 17%, respectively) of segment sales. (See Risks Related to the RT and IT Solutions segments - “We Are Substantially Dependent On A Small Number Of Customers And The Loss Of One Or More Of These Customers May Cause Revenues And Cash Flow To Decline” for more information.)

Competition

Our RT Solutions activity faces competition from numerous competitors, both large and small, operating in the Israeli and United States markets, some with substantially greater financial and marketing resources. We believe that our wide range of experience and long-term relationships with large corporations as well as the strategic partnerships we are developing will enable us to compete successfully and obtain future business.

IT SOLUTIONS

Products and Services

Through dsIT, we also provide globally oriented solutions in the area of information technology (“IT”). dsIT’s IT solutions includes OncoPro™, a state of the art chemotherapy package for oncology and hematology departments, based on experience gained in the largest cancer center in Israel. OncoPro™ integrates patient data with medical knowledge bases and enables the simplified management of daily ward functions as well as the creation of complex protocols. We also offer EasyBillTM, an easy-to-use, end-to-end, modular customer care and billing system designed especially for small and medium-sized enterprises with large and expanding customer bases.

Sales from our IT solutions activities were $1.3 million, $1.3 million and $1.1 million, respectively, accounting for approximately 39%, 31% and 27% of company sales for 2004, 2005 and 2006, respectively.

We recently received a letter of intent from a major chain of hospitals in the U.S., which will allow us to install our OncoPro™ solutions package as a beta site. We expect to finalize this arrangement in the near future. In addition, we continue to have discussions with respect to potential strategic partners, investors and alliances for our OncoPro™ solutions package.

Customers and Markets

All of this segment’s operations and sales took place in Israel in 2004, 2005 and 2006. We expect to begin to generate revenues from our OncoPro™ solutions outside of Israel in 2007. We have created a significant relationship with Israel’s largest HMO organization (the Clalit Health Fund or “Clalit”) and are continuing to invest considerable effort to penetrate the US and European markets in order to broaden our geographic sales base. Two customers accounted for 83% (61% (Clalit) and 22%, respectively) of segment sales in 2006 (three customers accounted for 94% of segment sales in 2005 (54% (Clalit), 25% and 15%, respectively)). (See Item 1A. Risk Factors - Risks Related to the RT and IT Solutions Segments - “We are substantially dependent on a small number of customers and the loss of one or more of these customers may cause revenues and cash flow to decline” for more information.)

Proprietary Rights

The customer, for whom the services are performed, generally owns the intellectual property rights resulting from our consulting and development services. We own two proprietary software packages described above - Easybill™ and OncoPro™. These packages are licensed for use by customers, while we retain ownership of the intellectual property.

DEMAND RESPONSE SOLUTIONS - COMVERGE INC.

We are engaged in the business of providing demand response solutions, through Comverge Inc. Comverge is North America's leading provider of clean and low-cost peak electric capacity reduction, achieved through Demand Response solutions and technologies, including its patent pending fully outsourced Virtual Peaking Capacity(TM) offering. As North America's leader in Demand Response, Comverge serves over 500 clients in the electric utility industry, implementing both integrated and outsourced solution-based models for direct and price responsive load management, remote meter reading, and distributed generation monitoring. We currently have an approximate 23% equity interest in Comverge and are Comverge’s single largest stockholder. Comverge’s stockholders include Nth Power, EnerTech Capital, E.ON Venture Partners GmbH, Ridgewood Capital, Easton Hunt Capital Partners, L.P., Norsk Hydro Technology Ventures, Rockport Capital Partners, Partners for Growth, the Shell Internet Ventures affiliate of Royal Dutch/Shell Group, and Air Products and Chemicals, Inc.

Comverge designs, develops and markets a full spectrum of products, services and turnkey solutions to electric utilities and transmission and distribution companies that provide capacity during periods of peak electricity demand and allow their residential and commercial customers to conserve energy. These Demand Response solutions allow Comverge’s customers to reduce usage or “shed load” during peak usage periods, such as the summer air conditioning season, thereby reducing or eliminating the need to buy costly additional power on the spot market, or invest in new peaking generation capacity. Demand Response solutions are cost-effective and environmentally superior to building new generation capabilities.

In addition to Demand Response solutions, Comverge also offers a combination of intelligent hardware and a suite of software products, which, together or separately, help customers address energy usage issues through data communications and analysis, real-time pricing and integrated billing and reporting. Comverge’s two-way data communications solutions allow utilities to gather, transmit, verify and analyze real-time usage information, and can be used for automated meter reading, support time-of-use metering, theft detection, remote connect/disconnect and other value-added services.

Comverge’s principal offices are located in East Hanover, New Jersey and Atlanta, Georgia. In addition, Comverge operates satellite offices in Newark, California, Pensacola, Florida and Tel Aviv, Israel.

SUPER SERVICES MARKET - PAKETERIA GmbH

We are engaged in the “Super Services Market” business through our 33% equity interest in Paketeria GmbH. In August 2006, we made our first investment (€600,000 or approximately $776.000) in Paketeria GmbH followed by a second investment (€320,000 or approximately $419,000) in October 2006. As a result of these investments, we currently own approximately 33% of Paketeria with options to acquire a controlling interest by August 2007.

Paketeria GmbH, a company registered in Germany and headquartered in Berlin, is a retail chain store operating in a unique “Super Services Market” format. The stores provide eBay drop shop, post and parcels, office supplies, photo processing, photocopy, printer cartridge refilling, and Internet pharmacy services in Germany. Paketeria was established to take advantage of the privatization and subsequent substantial reduction in retail outlets of the German post office, which has stranded many communities without convenient access to postal services. Since the beginning of 2006, Paketeria has doubled in size to four company owned stores and 60 franchised stores.

Paketeria’s principal offices are located in Berlin, Germany. Paketeria’s stores and franchises are located throughout Germany with a concentration in the area in and around Berlin.

BACKLOG

As of December 31, 2006, our backlog of work to be completed was $1.9 million, $1.4 million of which related to our RT segment and $0.5 million of which related to our IT segment. We estimate that we will perform our entire backlog in both of our reporting segments in 2007.

EMPLOYEES

At December 31, 2006, we employed a total of 70 people, including 53 in engineering and technical support, 1 in marketing and sales, and 16 in management, administration and finance. A total of 69 of our employees are employed by dsIT and are based in Israel. Our only employee in the United States is our CEO and President. We consider our relationship with our employees to be satisfactory.

We have no collective bargaining agreements with any of our employees. However, with regard to our Israeli activities, certain provisions of the collective bargaining agreements between the Israeli Histadrut (General Federation of Labor in Israel) and the Israeli Coordination Bureau of Economic Organizations (including the Industrialists Association) are applicable by order of the Israeli Ministry of Labor. These provisions mainly concern the length of the workday, contributions to a pension fund, insurance for work-related accidents, procedures for dismissing employees, determination of severance pay and other conditions of employment. We generally provide our Israeli employees with benefits and working conditions beyond the required minimums. Israeli law generally requires severance pay upon the retirement or death of an employee or termination of employment without due cause. Furthermore, Israeli employees and employers are required to pay specified amounts to the National Insurance Institute, which administers Israel’s social security programs. The payments to the National Insurance Institute include health tax and are approximately 5% of wages (up to a specified amount), of which the employee contributes approximately 70% and the employer approximately 30%.

SEGMENT INFORMATION

For additional financial information regarding our operating segments, foreign and domestic operations and sales, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 19 to our Consolidated Financial Statements included in this Annual Report.

ITEM 1A. RISK FACTORS

We may from time to time make written or oral statements that contain forward-looking information. However, our actual results may differ materially from our expectations, statements or projections. The following risks and uncertainties could cause actual results to differ from our expectations, statements or projections.

GENERAL FACTORS

We have a history of operating losses and decreasing cash available for operations.

We have a history of operating losses, and have used increasing amounts of cash to fund our operating activities over the years. In 2004, 2005 and 2006, we had operating losses of $2.5 million, $2.3 million and $3.6 million, respectively. Cash used in operations in 2004, 2005 and 2006 was $0.1 million, $1.7 million and $1.6 million, respectively.

Although we raised $3.2 million ($2.5 million net of transaction costs) in 2006 from the private placement of our securities, we have invested a significant portion of those funds in Paketeria. At December 31, 2006, we did not have sufficient cash available to fund our US operations for the next 12 months. As described under the caption “Recent Developments” in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” we recently raised an additional $6.9 million (approximately $6.0 after transaction costs) in a private placement of convertible debentures and warrants. While this provides us with enough cash to finance our US operations for the next 12 months, we may need additional funds to fund our operating activities and acquisitions over the longer term. Should we be unsuccessful in completing additional timely transactions providing necessary liquidity, we may not have sufficient funds to finance our future US activities and strategic acquisitions over the long-term. In such event, we might need to sell some of our assets to finance these activities.

For additional discussion of our liquidity position and factors that may affect our future liquidity, see the discussion under the captions “Recent Developments” and “Liquidity and Capital Resources” in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Loss of the services of a few key employees could harm our operations.

We depend on our key management, technical employees and sales personnel. The loss of certain managers could diminish our ability to develop and maintain relationships with customers and potential customers. The loss of certain technical personnel could harm our ability to meet development and implementation schedules. The loss of certain sales personnel could have a negative effect on sales to certain current customers. Most of our significant employees are bound by confidentiality and non-competition agreements. Our future success also depends on our continuing ability to identify, hire, train and retain other highly qualified technical and managerial personnel. If we fail to attract or retain highly qualified technical and managerial personnel in the future, our business could be disrupted.

A failure to integrate our new management may adversely affect us.

We appointed a new chief financial officer and chief accounting officer in December 2005 and appointed a new president and chief executive officer in March 2006. Any failure to effectively integrate our new management and any new management controls, systems and procedures they may implement, could materially adversely affect our business, results of operations and financial condition.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent registered public accounting firm.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring public companies to include a report of management on internal control over financial reporting in their annual reports. In addition, the independent registered public accounting firm auditing a public company’s financial statements must attest to and report on management’s assessment of the effectiveness of the company’s internal control over financial reporting as well as the operating effectiveness of the company’s internal controls over financial reporting. Our management is currently required to report on our internal controls as a required part of our annual report beginning with fiscal year 2007 and to allow our independent registered public accounting firm to attest to our internal controls as a required part of our annual report beginning with fiscal year 2008.

We may have to expend significant resources during fiscal years 2007 and 2008 in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, and there is a risk that we will not comply with all of the requirements.

If we identify material weaknesses in our internal controls over financial reporting that we cannot remediate in a timely manner or we receive an adverse opinion from our independent registered public accounting firm with respect to our internal controls over financial reporting, investors and others may lose confidence in the reliability of our financial statements and our ability to obtain equity or debt financing could be adversely affected.

Compliance with changing regulation of corporate governance, public disclosure and financial accounting standards may result in additional expenses and affect our reported results of operations.

Keeping informed of, and in compliance with, changing laws, regulations and standards relating to corporate governance, public disclosure and accounting standards, including the Sarbanes-Oxley Act, as well as new and proposed SEC regulations and accounting standards, has required an increased amount of management attention and external resources. Compliance with such requirements may result in increased general and administrative expenses and an increased allocation of management time and attention to compliance activities.

RISKS RELATED TO THE RT AND IT SOLUTIONS SEGMENTS

Failure to accurately forecast costs of fixed-priced contracts could reduce our margins.

When working on a fixed-price basis, we undertake to deliver software or integrated hardware/software solutions to a customer’s specifications or requirements for a particular project. The profits from these projects are primarily determined by our success in correctly estimating and thereafter controlling project costs. Costs may in fact vary substantially as a result of various factors, including underestimating costs, difficulties with new technologies and economic and other changes that may occur during the term of the contract. If, for any reason, our costs are substantially higher than expected, we may incur losses on fixed-price contracts.

Hostilities in the Middle East region may slow down the Israeli hi-tech market and may harm our Israeli operations; our Israeli operations may be negatively affected by the obligations of our personnel to perform military service.

Our software consulting and development services segment is currently conducted in Israel. Accordingly, political, economic and military conditions in Israel may directly affect this segment of our business. Any increase in hostilities in the Middle East involving Israel could weaken the Israeli hi-tech market, which may result in a significant deterioration of the results of our Israeli operations. In addition, an increase in hostilities in Israel could cause serious disruption to our Israeli operations if acts associated with such hostilities result in any serious damage to our offices or those of our customers or harm to our personnel.

Many of our employees in Israel are obligated to perform military reserve duty. In the event of severe unrest or other conflict, one or more of our key employees could be required to serve in the military for extended periods of time. In the past, there were numerous call-ups of military reservists to active duty, and it is possible that there will be additional call-ups in the future. Our Israeli operations could be disrupted as a result of such call-ups for military service.

Exchange rate fluctuations could increase the cost of our Israeli operations.

The sales in this segment stem from our Israeli operations and a significant portion of those sales are in New Israeli Shekels (“NIS”). In addition, many transactions that are linked to the dollar are settled in NIS. The dollar value of the revenues of our operations in Israel will decrease if the dollar is devalued in relation to the NIS during the period from the invoicing of a transaction to its settlement. In addition, significant portions of our expenses in those operations are in NIS, so that if the dollar is devalued in relation to the NIS, the dollar value of these expenses will increase.

One of our major customers has a history of operating deficits and may implement cost-cutting measures that may have a material adverse effect on us.

In 2006, 17% of dsIT’s sales (17% and 13% in 2005 and 2004, respectively) and 24% of its billed receivables at December 31, 2006 (10% at December 31, 2005) were related to Clalit. Clalit has a history of running at a deficit, which in the past has required numerous cost cutting plans and periodic assistance from the Israeli government. Should Clalit have to institute additional cost cutting measures in the future, which may include restructuring of its terms of payment, this could have a material adverse effect on the performance of dsIT.

We are substantially dependent on a small number of customers and the loss of one or more of these customers may cause revenues and cash flow to decline

In 2006, 58% of dsIT’s sales (51% and 59% in 2005 and 2004, respectively) were concentrated in three customers (Applied Materials Israel Ltd., RAFAEL Armament Development Authority Ltd. and Clalit). A significant reduction of orders from any of these customers could have a material adverse effect on the performance of dsIT.

We have sold our outsourcing business, which in the past provided our Israeli operations with a steady cash flow; our Israeli operations may be hindered by future cash flow problems.

In August 2005, we sold our outsourcing business, which in the past provided our Israeli operations with a steady cash flow stream, and, in conjunction with bank lines of credit, helped to finance our Israeli operations. Our present operations, as we are currently structured, places a greater reliance on our meeting project milestones in order to generate cash flow to finance our operations. Should we encounter difficulties in meeting significant project milestones, resulting cash flow difficulties could have a material adverse effect on our operations.

If we are unable to keep pace with rapid technological change, our results of operations, financial condition and cash flows may suffer.

Some of our RT and IT solutions are characterized by rapidly changing technologies and industry standards and technological obsolescence. Our competitiveness and future success depends on our ability to keep pace with changing technologies and industry standards on a timely and cost-effective basis. A fundamental shift in technologies in could have a material adverse effect on our competitive position. Our failure to react to changes in existing technologies could materially delay our development of new products, which could result in technological obsolescence, decreased revenues, and/or a loss of market share to competitors. To the extent that we fail to keep pace with technological change, our revenues and financial condition could be materially adversely affected.

RISKS RELATED TO OUR PAKETERIA INVESTMENT

Paketeria’s business plan is predicated on projected rapid growth in its network of franchised stores. If Paketeria fails to effectively manage this growth, its business and operating results could be harmed. Additionally they could be forced to incur significant expenditures to address the additional operational and control requirements of this growth.

Paketeria’s business plan is predicated on projected rapid growth in its operations, which will place significant demands on its management, operational and financial infrastructure. If Paketeria does not effectively manage this growth, the quality of its services could suffer, which could negatively affect its operating results. To effectively manage this growth, Paketeria will need to continue to improve its operational, financial, and management controls and its reporting systems and procedures. These system enhancements and improvements could require Paketeria to make significant capital expenditures and an allocation of valuable management resources. If the improvements are not implemented successfully, Paketeria’s ability to manage growth may be impaired and could force it to make significant additional expenditures to address these issues, expenditures that could harm its financial position.

Paketeria will need to raise funds to finance its planned activities.

Paketeria does not currently have enough cash to finance its planned activities in 2007. In the event that it is unable raise these funds from new investors, we may need to make loans or additional equity investments in Paketeria from our limited financial resources to help fund its activities. (See “Recent Developments”.)

RISKS RELATED TO OUR SECURITIES

There is only a limited trading market for our Common Stock.

There is currently only a limited market for our Common Stock. Our Common Stock trades on the OTC Bulletin Board under the symbol “ ACFN“ with, until recently, very limited trading volume. We cannot assure you that a substantial trading market will be sustained for our Common Stock.

Our share price may decline due to the large number of shares of our Common Stock eligible for future sale in the public market including the shares of the selling security holders.

A substantial number of shares of our Common Stock are, or could upon exercise of options or warrants, become eligible for sale in the public market as described below. Sales of substantial amounts of shares of ourCommon Stock in the public market, or the possibility of these sales, may adversely affect our stock price.

As of December 31, 2006 there were 614,039 warrants with a weighted average exercise price of $2.79 and 1,626,157 options with a weighted average exercise price of $2.46 per share, presently exercisable, which if exercised for cash would result in the issuance of an additional 2,240,196 shares of Common Stock. In addition, there were 482,668 options and 190,000 warrants that expire on or before December 31, 2007 all of which are in-the-money at December 31, 2006.

The market price of our Common Stock will likely be affected by fluctuations in the market price of the common stock of Comverge.

As described below under “Recent Developments,” shares of Comverge common stock have commenced trading on the Nasdaq Global Market. Due to the substantial position we hold in Comverge, the market price of our Common Stock is likely to be affected by fluctuations in the market price of the common stock of Comverge.

We may be deemed to be an investment company under the Investment Company Act of 1940; if we were deemed to be an investment company we could be forced to sell our shares in Comverge at prices lower than we might otherwise obtain.

Under the Investment Company Act of 1940, as amended, and the rules thereunder we would be deemed to be an investment company if it is determined that the value of investment securities we own account for more than 45% of the total value of our assets. The Investment Company Act and the rules thereunder exclude from the definition of investment securities shares in companies which are majority-owned or “controlled primarily” by the issuer.

Our equity holdings in Comverge currently account for substantially more than 45% of the value of our assets on a fair market value basis. We believe that until the recent Comverge initial public offering we had primary control over Comverge for purposes of application of the Investment Company Act and our Comverge holdings were therefore excluded from the definition of investment securities. However, as a result of the offering and the termination of our voting agreement with the other major Comverge shareholders, it is likely that Comverge will no longer be controlled primarily by us for Investment Company Act purposes. If we were no longer deemed to primarily control Comverge, we would no longer be excluded from the definition of an Investment Company effective June 30, 2007 since the value of our investment securities, which would now include our Comverge shares, would be in excess of 45% of our assets.

Were we to be deemed an investment company as a result of the Comverge IPO, we believe that we would be eligible for relief from the application of the Investment Company Act as a transient investment company under Rule 3a-2. Under Rule 3a-2, we would not be subject to the Investment Company Act provided that we have a bona fide intent to be engaged primarily, as soon as is reasonably possible (in any event within a one year period), in a business other than that of investing, reinvesting, owning, holding or trading in securities.

Our management and Board of Directors is formulating its plans for compliance with Rule 3a-2. These plans would include the acquisition of one or more wholly-owned, majority-owned, or primarily-controlled operating businesses. Steps in effectuating these plans may include the sale and or distribution to our shareholders of all or a portion of our Comverge shares, and/or a merger or other acquisition transaction.

We are subject to a lock-up period that would prevent us from being able to sell Comverge shares for six months following the completion of the Comverge initial public offering. To the extent that effectuating our plan to remain exempt from the Investment Company Act requires us to sell significant number of Comverge shares, we may have only a six month period in which to make such sales. Being forced to sell a significant portion of our Comverge shares during a relatively short time period could result in our selling Comverge shares sooner than we otherwise would have, at prices lower than we might otherwise have obtained. We may also find that we are not able to identify and acquire during the one year period a suitable operating business or businesses on terms acceptable to us. While we could request an order from the SEC to give us additional time beyond the year period allowed by Rule 3a-2 to sell and/or distribute Comverge shares and take any other action necessary to come into compliance with the Act, there is no assurance that such an order would be granted.

If we are unable to come into compliance with the Investment Company Act during the one year period (or any extension thereof granted to us by the SEC), we would be in violation of the Investment Company Act. Companies which fall under the Act are subject to substantial regulation concerning management, operations, transactions with affiliated persons, portfolio composition, including restrictions with respect to diversification and industry concentration, and other matters. We would be required to file reports with the SEC regarding various aspects of our business. The cost of such compliance would result in the Company incurring additional annual expenses. In addition, compliance with the Investment Company Act may not be consistent with the Company’s current strategy of holding primarily controlling interest in companies in which it holds interests.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Prior to the consummation of the sale of our Databit computer hardware subsidiary, our corporate headquarters and the principal offices for our computer hardware sales segment were located in Mahwah, New Jersey in approximately 5,000 square feet of office space, at a rate of $85,000 per year (plus annual CPI adjustments), under a lease that expired in September 2006.

As part of the sale of our Databit computer hardware subsidiary, we assigned all of the US leases to Databit. The landlords of the properties have not yet consented to the assignments and we therefore continue to be contingently liable on these leases. Databit has agreed to indemnify us for any liability in connection with these leases.

In November 2006, we signed a lease for office space in Wilmington, Delaware. The annual rent is approximately $32,000 and the lease is to expire in November 2009.

Our Israeli activities are conducted in approximately 18,000 square feet of office space in the Tel Aviv metropolitan area under a lease that expires in August 2009. The annual rent is approximately $288,000. These facilities are used for the Israeli operations of our RT Solutions and IT Solutions segments.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock is currently traded on the OTC Bulletin Board (“OTCBB”) under the symbol “ ACFN.OB”. Prior to January 26, 2005, our Common Stock traded on The Nasdaq SmallCap Market. The following table sets forth, for the periods indicated, the high and low reported sales prices per share of our Common Stock on The Nasdaq SmallCap Market and the OTCBB (as applicable).

| | | High | | Low | |

| 2005: | | | | | |

| First Quarter | | $ | 1.30 | | $ | 0.64 | |

| Second Quarter | | | 1.32 | | | 0.95 | |

| Third Quarter | | | 1.74 | | | 1.05 | |

| Fourth Quarter | | | 1.80 | | | 1.20 | |

| | | | | | | | |

| 2006: | | | | | | | |

| First Quarter | | $ | 2.80 | | $ | 1.43 | |

| Second Quarter | | | 3.20 | | | 2.50 | |

| Third Quarter | | | 3.39 | | | 2.85 | |

| Fourth Quarter | | $ | 3.47 | | $ | 3.14 | |

As of April 10, 2007, the last reported sales price of our Common Stock on the OTCBB was $4.80, there were 106 record holders of our Common Stock and we estimate that there were approximately 1,100 beneficial owners of our Common Stock.

We paid no dividends in 2005 or 2006 and do not intend to pay any dividends in 2007.

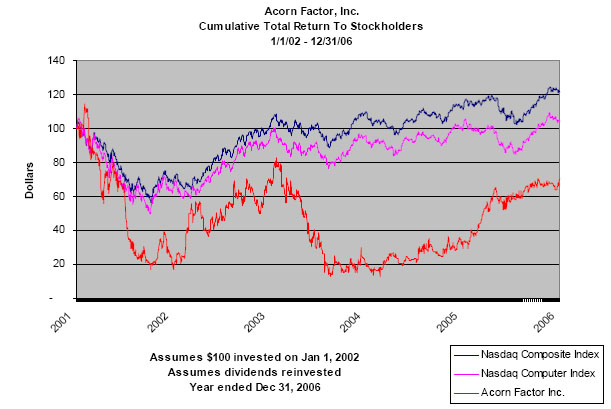

PERFORMANCE GRAPH

The following stock price performance graph compares the cumulative total return of the Company’s Common Stock, during the period December 31, 2001 to December 30, 2006, to the cumulative total return during such period of (i) the NASDAQ Composite Index and (ii) the NASDAQ Computer Index. The graph assumes that the value of the investment in our Common Stock and each index (including reinvestment of dividends) was $100.00 on December 31, 2001.

ITEM 6. SELECTED FINANCIAL DATA

The selected consolidated statement of operations data for the years ended December 31, 2004, 2005 and 2006 and consolidated balance sheet data as of December 31, 2005 and 2006 has been derived from our audited Consolidated Financial Statements included in this Annual Report. The selected consolidated statement of operations data for the years ended December 31, 2002 and 2003 and the selected consolidated balance sheet data as of December 31, 2002, 2003 and 2004 has been derived from our unaudited consolidated financial statements not included herein.

This data should be read in conjunction with our Consolidated Financial Statements and related notes included herein and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Selected Consolidated Statement of Operations Data:

| | | | For the Years Ended December 31, | |

| | | | 2002** (unaudited) | | | 2003** (unaudited) | | | 2004* | | | 2005* | | | 2006 | |

| | | | (in thousands, except per share data) | |

| Sales | | $ | 24,295 | | $ | 8,874 | | $ | 3,364 | | $ | 4,187 | | $ | 4,117 | |

| Cost of sales | | | 17,910 | | | 6,833 | | | 2,491 | | | 2,945 | | | 2,763 | |

| Gross profit | | | 6,385 | | | 2,041 | | | 873 | | | 1,242 | | | 1,354 | |

| Research and development expenses | | | 1,526 | | | 153 | | | 30 | | | 53 | | | 324 | |

| Selling, marketing, general and administrative expenses | | | 12,591 | | | 7,422 | | | 3,374 | | | 3,464 | | | 4,658 | |

| Impairment of investment | | | 90 | | | -- | | | -- | | | -- | | | -- | |

| Operating loss | | | (7,822 | ) | | (5,534 | ) | | (2,531 | ) | | (2,275 | ) | | (3,628 | ) |

| Finance expense, net | | | (429 | ) | | (534 | ) | | (33 | ) | | (12 | ) | | (30 | ) |

| Other income, net | | | -- | | | -- | | | 148 | | | -- | | | 330 | |

| Loss from operations before taxes on income | | | (8,251 | ) | | (6,068 | ) | | (2,416 | ) | | (2,287 | ) | | (3,328 | ) |

| Taxes on income | | | 46 | | | 48 | | | (27 | ) | | 37 | | | (183 | ) |

| Loss from operations of the Company and its consolidated subsidiaries | | | (8,205 | ) | | (6,020 | ) | | (2,443 | ) | | (2,250 | ) | | (3,511 | ) |

| Share of losses in Comverge | | | -- | | | (1,752 | ) | | (1,242 | ) | | (380 | ) | | (210 | ) |

| Gain on sale of shares in Comverge | | | -- | | | -- | | | 705 | | | -- | | | -- | |

| Share of losses in Paketeria | | | -- | | | -- | | | -- | | | -- | | | (424 | ) |

| Minority interests, net of tax | | | 880 | | | 264 | | | (90 | ) | | (73 | ) | | -- | |

| Loss from continuing operations | | | (7,325 | ) | | (7,508 | ) | | (3,070 | ) | | (2,703 | ) | | (4,145 | ) |

| Gain (loss) on sale of discontinued operations and contract settlement (in 2006), net of income taxes | | | -- | | | -- | | | -- | | | 541 | | | (2,069 | ) |

| Income (loss) from discontinued operations, net of income taxes | | | (819 | ) | | 1,226 | | | 1,898 | | | 844 | | | 78 | |

| Net loss | | $ | (8,144 | ) | $ | (6,282 | ) | $ | (1,172 | ) | $ | (1,318 | ) | $ | (6,136 | ) |

| Basic and diluted net income (loss) per share: | | | | | | | | | | | | | | | | |

| Loss from continuing operations | | $ | (1.00 | ) | $ | (0.97 | ) | $ | (0.39 | ) | $ | (0.26 | ) | $ | (0.48 | ) |

| Discontinued operations | | | (0.11 | ) | | 0.16 | | | 0.24 | | | 0.10 | | | (0.23 | ) |

| Net loss per share (basic and diluted) | | $ | (1.11 | ) | $ | (0.81 | ) | $ | (0.15 | ) | $ | (0.16 | ) | $ | (0.71 | ) |

Weighted average number of shares Outstanding - basic and diluted | | | 7,349 | | | 7,738 | | | 7,976 | | | 8,117 | | | 8,689 | |

___________

* Results have been restated for the discontinued operations of our Israel based consulting business, which was sold in August 2005. Results have been restated for the discontinued operations of our US-based computer VAR business, which was sold in March 2006.

** The selected consolidated statements of operations data for the years ended December 31, 2002 and 2003 have been restated for the discontinued operations of our US-based computer VAR business and our Israel and US-based consulting businesses and are unaudited.

Selected Consolidated Balance Sheet Data:

| | | As of December 31, | |

| | | 2002 (unaudited) | | 2003 (unaudited) | | 2004 (unaudited) | | 2005 | | 2006 | |

| | | (in thousands) | |

| Working capital | | | 2,845 | | $ | 729 | | $ | 874 | | $ | 1,458 | | $ | 259 | |

| Total assets | | | 33,347 | | | 17,784 | | | 17,025 | | | 10,173 | | | 7,258 | |

| Short-term and long-term debt | | | 10,033 | | | 2,259 | | | 1,396 | | | 365 | | | 488 | |

| Minority interests | | | 1,609 | | | 1,367 | | | 1,471 | | | -- | | | -- | |

| Total shareholders’ equity (deficit) | | | 7,128 | | | 3,200 | | | 2,125 | | | 820 | | | (461 | ) |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RECENT DEVELOPMENTS

Private Placement of Debentures and Warrants

On April 11, 2007, we completed a private placement of $6.9 million of principal amount of 10% Convertible Redeemable Subordinated Debentures (the “Debentures”), resulting in gross proceeds of the same amount. The Debentures, subject to certain restrictions, are convertible into our common stock at a conversion price of $3.80 per share and mature on March 30, 2011.

In connection with the offering, we entered into subscription agreements with certain accredited investors. By the terms of the subscription agreements each subscriber in addition to the Debentures purchased, received a warrant exercisable for the purchase of 25% of the number of shares obtained by dividing the principal amount of a given Debenture by the conversion price of $3.80 per share, resulting in the issuance of warrants to purchase 453,047 shares. The warrants are exercisable for shares of Common Stock for a period of five years at an exercise price of $4.50 per share. Both the Debentures and the warrants are redeemable by us in certain circumstances.

In connection with the offering, we retained a registered broker-dealer to serve as placement agent. In accordance with the terms of our agreement with the placement agent, the agent received a 7% selling commission, 3% management fee, and 2% non-accountable expense allowance out of the gross proceeds of the offering.

Out of the gross proceeds of the offering, we paid the placement agent commissions and expenses of approximately $0.9 million. In addition, we issued to the placement agent warrants to purchase 181,211 shares of common stock on substantially the same terms as those issued to the subscribers.

Comverge IPO

On April 13, 2007, Comverge priced its initial public offering of 5,300,000 shares of its common shares, at $18.00 a share. The shares sold in the offering (which reflect a one for two reverse stock split made immediately prior to the offering) represent an approximate 28% interest in Comverge. The underwriters of the offering are Citigroup Global Markets Inc., sole book-running manager of the offering, and Cowen and Company, LLC, RBC Capital Markets Corporation and Pacific Growth Equities, LLC as co-managers. In addition, certain selling shareholders granted the underwriters a 30-day option to purchase up to 795,000 additional shares of common stock. We did not sell any of our shares of Comverge common stock in the offering. On April 13, 2007, shares of Comverge common stock commenced trading on the Nasdaq Global Market under the symbol "COMV".

As a result of the offeringall shares of preferred stock of Comverge will be converted to common stock of Comverge and as a result we will own 2,786,021 shares of Comverge common stock, representing 15.9% of the issued and outstanding capital stock of Comverge following the offering.

In connection with the offering, we (and all of Comverge’s executive officers, directors and certain of other major stockholders of Comverge), entered into a lock-up agreement under which we agreed, subject to limited exceptions, not to transfer or otherwise dispose of any of our shares of Comverge common stock for a period of at least 180 days from the date of effetiveness of the offering without the prior written consent of lead manager of the offering.

Paketeria

In January and March, we provided Paketeria with approximately $200,000 of loans in order to provide them with additional short-term financing to help it support its current expansion and operating activities.

Dilution of Our Holdings in dsIT

In February 2007, certain senior managers and other employees of dsIT exercised their options. These exercises reduced our holdings in dsIT from 80% to 58%.

OVERVIEW AND TREND INFORMATION

The following discussion includes statements that are forward-looking in nature. Whether such statements ultimately prove to be accurate depends upon a variety of factors that may affect our business and operations. Certain of these factors are discussed in “Item 1. Business-Risk Factors Which May Affect Future Results.”

We operate in two reportable segments: RT Solutions and IT Solutions. As we sold our Databit computer hardware sales in March 2006, the information provided below does not include the results from those activities as they have been reclassified and consolidated on one line as net income from discontinued operations, after tax.

The following analysis should be read together with the segment information provided in Note 19 to our Consolidated Financial Statements included in this report.

RT Solutions

Segment revenues decreased by $0.1 million or 4% in 2006 as compared to 2005. The decrease in sales was the result of our near completion of a significant Naval solutions project in 2005, which was nearly offset by increases in sales from our embedded hardware and software development products. Segment gross profit, however, increased by $0.1 million or 16% in 2006 as compared to 2005. Segment gross profit percentage also increased (from 28% in 2005 to 34% in 2006) as we completed a number of relatively high margin embedded hardware and software development projects during the year.

Our projected growth in sales in 2007 is expected to come primarily from our Naval solutions projects with our embedded hardware and software development projects expected to remain relatively stable. Due to the sale of our outsourcing business in August 2005, our segment overhead currently is a heavier burden to the segment and we must generate a higher level of sales to reach profitability. We anticipate our sales to increase in the second half 2007 with the expected receipt of a number of significant Naval solutions contracts, with the segment reaching profitability towards the end of the year.

IT Solutions

Segment revenues decreased by $0.2 million or 14% in 2006 as compared to 2005. The decrease in sales was primarily the result of the decreased revenues from sales of our EasyBill™ billing system. OncoPro™ sales were not significantly changed in 2006 from 2005. Segment gross profit also decreased by $0.1 million or 19% in 2006 as compared to 2005 with segment gross profit percentage also decreasing (from 31% in 2005 to 28% in 2006).

Our projected growth in sales in 2007 is expected to come primarily from sales of our OncoPro™ solutions with revenues from our EasyBill™ billing system continuing to decline. We expect to successfully complete our beta-site work in the second half of 2007 and begin sales of OncoPro™ in the United States in the second half of 2007. As with our RT Solutions segment, due to the sale of our outsourcing business in August 2005, our segment overhead currently is a heavier burden to the segment and we must generate a higher level of sales to reach profitability. Though we anticipate our sales to increase in the second half 2007, we also anticipate significantly higher development costs associated with the beta-site work and do not expect this segment to reach profitability until 2008.

Comverge

We account for Comverge on the equity method; however since our losses to date exceed our investment, Comverge’s losses no longer affect our consolidated results.

As described above under “Recent Developments”, on April 13, 2007 Comverge priced its initial public offering. Comverge plans to use the net proceeds from the offering to finance current and future capital requirements of its VPC™ contracts, to finance research and development, to repay indebtedness, to fund any cash consideration for future acquisitions and for other general corporate purposes.

Paketeria

We account for our Paketeria investment the equity method and, as such, currently record approximately 33% of its income or loss in our consolidated results.

Paketeria was established to take advantage of the privatization and subsequent substantial reduction in retail outlets of the German post office. Since the beginning of 2006, Paketeria has doubled in size to four company owned stores and 60 franchised stores. In 2007, Paketeria is planning to continue its expansion of stores. In addition, Paketeria is planning to add additional services to its unique “Super Services Market” format. Planned additions to its services menu include an Internet pharmacy and telecommunication services in cooperation with The Phone House, Europe’s largest independent mobile phone retailer. In addition, Paketeria will be seeking additional capital investment to help fund its activities and expansion.

In 2007 to date, we lent Paketeria approximately $200,000 to help it finance its ongoing activities and expansion.

Corporate

In March 2006, we appointed John Moore as our President and CEO to succeed George Morgenstern, our founder and President and CEO since 1986. Mr. Morgenstern continues to serve on the board of directors and as Chairman of the Board focusing on efforts to grow our projects and solutions activities in Israel. Though our cash corporate expenses have been relatively stable in 2006 as compared to 2005, we have expended and will continue to expend in the future, significant amounts of funds on professional fees and other costs in connection with our strategy to seek out and invest in companies that fit our target business model.

We raised approximately $2.5 million, net, in private placements in 2006 and continue to raise funds in this way in 2007. For disclosure regarding our recently announced private placement, see “Recent Developments” above.

CRITICAL ACCOUNTING POLICIES

The Securities and Exchange Commission (“SEC”) defines “critical accounting policies” as those that require application of management's most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain and may change in subsequent periods.

The following discussion of critical accounting policies represents our attempt to report on those accounting policies, which we believe are critical to our consolidated financial statements and other financial disclosure. It is not intended to be a comprehensive list of all of our significant accounting policies, which are more fully described in Note 2 of the Notes to the Consolidated Financial Statements included in this Annual Report. In many cases, the accounting treatment of a particular transaction is specifically dictated by generally accepted accounting principles, with no need for management's judgment in their application. There are also areas in which the selection of an available alternative policy would not produce a materially different result.

We have identified the following as critical accounting policies affecting our company: principles of consolidation and investments in associated companies; revenue recognition; foreign currency transactions; income taxes; and stock-based compensation.

Principles of Consolidation and Investments in Associated Companies

Our consolidated financial statements include the accounts of all majority-owned subsidiaries. All intercompany balances and transactions have been eliminated. Minority interests in net losses are limited to the extent of their equity capital. Losses in excess of minority interest equity capital are charged against us in our consolidated statements of operations.

Investments in associated companies are accounted for by the equity method.

Our Comverge investment is comprised of both common and preferred stock. As of December 31, 2006 the balance of our investment was a net liability of $1.8 million comprised of our negative investment in common shares of $1.8 million and our investment in preferred shares of $3.8 million which we have written down to zero value as a result of accumulated equity losses against our preferred investment. We currently no longer record equity losses in Comverge. Should we begin to record equity income on our investment in Comverge, we would record that equity income to our preferred investment up to our original $3.8 million preferred share investment in Comverge, and thereafter to our investment in Comverge’s common shares, of which we currently own approximately 66% (we currently own a weighted average of approximately 23% of common and preferred shares). As at December 31, 2006, we had a provision for unrecognized losses in Comverge of $381,000. We will record equity income from our preferred investment in Comverge, if and when Comverge records net income in excess of approximately $5.7 million. As described above under “Recent Developments,” as a result of the Comverge IPO all shares of preferred stock will be converted into common stock. If as a result of Comverge’s public offering, we may be precluded from accounting for our investment in Comverge on the equity method and may account for our investment in Comverge on the cost method.

Our Paketeria investment is comprised of an initial investment of $877,000 (including transaction costs) for approximately 23% of Paketeria and a subsequent investment of approximately $461,000 (including transaction costs), which increased our holdings in Paketeria to approximately 33%. Our investment in Paketeria was allocated as follows:

| | · | $69,000 to the net value of various options in the initial investment; |

| | · | $281,000 to the value of the non-compete agreement given to Paketeria’s founder and managing director; |

| | · | $185,000 to the value of the franchise agreements acquired at the date of our investment; |

| | · | $446,000 to the value of the Paketeria brand name; and |

Since we account for our investment in Paketeria under the equity method, we have, in 2006, reduced our investment in Paketeria by $127,000, which represents our share of Paketeria’s losses during the period since our investment. In addition, we have included in our equity loss the amortization of the value of the acquired non-compete agreement and the franchise agreements, which in 2006 totaled $52,000 during the period since our investment. These reductions in our investment were partially offset by the $20,000 change in value of the put option we acquired.

The options that we have in Paketeria allow us to increase our holdings in Paketeria from our current 33% to just over 50% and would allow us to control the company.

Revenue Recognition

Revenue from time-and-materials service contracts, maintenance agreements and other services is recognized as services are provided.

In 2006, we derived $1.8 million of revenues from fixed-price type contracts, in both our RT Solutions and IT Solutions segments, representing approximately 43% of consolidated sales in 2006 ($1.9 million and 46%, and $1.8 million and 55%, in 2005 and 2004, respectively), which require the accurate estimation of the cost, scope and duration of each engagement. Revenue and the related costs for these projects are recognized for a particular period, using the percentage-of-completion method as costs (primarily direct labor) are incurred, with revisions to estimates reflected in the period in which changes become known. If we do not accurately estimate the resources required or the scope of work to be performed, or do not manage our projects properly within the planned periods of time or satisfy our obligations under the contracts, then future revenue and consulting margins may be significantly and negatively affected and losses on existing contracts may need to be recognized. Any such resulting changes in revenues and reductions in margins or contract losses could be material to our results of operations.

Foreign Currency Transactions

The currency of the primary economic environment in which our corporate headquarters and our U.S. subsidiaries operate is the United States dollar (“dollar”). Accordingly, the Company and all of its U.S. subsidiaries use the dollar as their functional currency.

In March 2006, we sold our Databit subsidiary. As a result, the results from Databit’s operations for the years ended December 31, 2004, 2005 and 2006 are reflected as discontinued operations. Consequently, our dsIT Israeli subsidiary accounts for all of our net revenues for the years ended December 31, 2004, 2005 and 2006. In addition, dsIT accounts for 64% of our assets and 52% of our total liabilities as of December 31, 2006 (45% of our assets and 42% of our total liabilities as of December 31, 2005). dsIT’s functional currency is the New Israeli Shekel (“NIS”) and its financial statements have been translated using the exchange rates in effect at the balance sheet date. Statements of operations amounts have been translated using the exchange rate at date of transaction. All exchange gains and losses denominated in non-functional currencies are reflected in finance expense, net in the consolidated statement of operations when they arise.

Income Taxes

We have a history of unprofitable operations due to losses incurred in a number of our operations. These losses generated sizeable state, federal and foreign tax net operating loss (“NOL”) carryforwards, which as of December 31, 2006 were approximately $14.7 million, $12.1 million and $0.8 million, respectively.

Generally accepted accounting principles require that we record a valuation allowance against the deferred income tax asset associated with these NOL carryforwards and other deferred tax assets if it is “more likely than not” that we will not be able to utilize them to offset future income taxes. Due to our history of unprofitable operations, we only recognize net deferred tax assets in those subsidiaries in which we believe that it is “more likely than not” that we will be able to utilize them to offset future income taxes in the future. We currently provide for income taxes only to the extent that we expect to pay cash taxes on current income or disallowed expenses.

It is possible, however, that we could be profitable in the future at levels which cause management to conclude that it is more likely than not that we will realize all or a portion of the NOL carryforwards and other deferred tax assets. Upon reaching such a conclusion, we would immediately record the estimated net realizable value of the deferred tax assets at that time and would then provide for income taxes at a rate equal to our combined federal and state effective rates or foreign rates. Subsequent revisions to the estimated net realizable value of the deferred tax assets could cause our provision for income taxes to vary significantly from period to period.

Stock-based Compensation

For the year ending December 31, 2006, we incurred stock compensation expense of approximately $1.8 million. We account for all stock-based compensation in accordance with the fair value recognition provisions of SFAS No. 123R, Share-Based Payment. Under these provisions, stock-based compensation cost is measured at the grant date based on the value of the award and is recognized as expense over the vesting period. Under SFAS No. 123R, we are required to use judgment in estimating the amount of stock-based awards that are expected to be forfeited. If actual forfeitures differ significantly from the original estimate, stock-based compensation expense and our results of operations could be materially impacted.

The following table sets forth a comparison of the per share effect of our adoption of SFAS 123R for the years ended December 31, 2004, 2005 and 2006.

| | | Year ended December 31, | |

| | | 2004 | | 2005 | | 2006 | |

| Basic and diluted net income (loss) per share as reported: | | | | | | | |

| Loss per share from continuing operations | | $ | (0.39 | ) | $ | (0.26 | ) | $ | (0.48 | ) |

| Discontinued operations | | | 0.24 | | | 0.10 | | | (0.23 | ) |

| Net loss per share - basic and diluted | | $ | (0.15 | ) | $ | (0.16 | ) | $ | (0.71 | ) |

| Basic and diluted net income (loss) per share had we not adopted SFAS 123R: | | | | | | | | | | |

| Loss per share from continuing operations | | $ | (0.39 | ) | $ | (0.26 | ) | $ | (0.29 | ) |

| Discontinued operations | | | 0.24 | | | 0.10 | | | (0.19 | ) |

| Net loss per share - basic and diluted | | $ | (0.15 | ) | $ | (0.16 | ) | $ | (0.48 | ) |

See Note 14 to the condensed consolidated financial statements for information on the impact of our adoption of SFAS 123R and the assumptions used to calculate the fair value of share-based employee compensation.

Prior to the adoption of SFAS No. 123-R, we accounted for stock-based employee compensation plans in accordance with Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees and its related interpretations (APB No. 25), and followed the pro forma net income, pro forma income per share, and stock-based compensation plan disclosure requirements set forth in SFAS No. 123, Accounting for Stock-Based Compensation.

The fair values of all stock options granted were estimated using the Black-Scholes-Merton option-pricing model. The Black-Scholes-Merton model requires the input of highly subjective assumptions such as risk-free interest rates, volatility factor of the expected market price of our Common Stock and the weighted-average expected option life. The expected volatility factor used to value stock options in 2006 was based on the historical volatility of the market price of the Company’s Common Stock over a period equal to the estimated weighted average life of the options. The weighted average life of the options was estimated based management’s estimates based on an evaluation of the vesting term, contractual life, and expected exercise behavior since our history of option exercises is too brief to have established historical rates. The risk-free interest rate used is based upon U.S. Treasury yields for a period consisted with the expected term of the options.

We account for stock-based compensation issued to non-employees on a fair value basis in accordance with SFAS No. 123 and EITF Issue No. 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in conjunction with Selling, Goods or Services” and related interpretations. We use the Black-Scholes valuation method to estimate the fair value of warrants.

RESULTS OF OPERATIONS

The following table sets forth selected consolidated statement of operations data as a percentage of our total sales:

| | | Year Ended December 31, | |

| | | 2002 (unaudited) | | 2003 (unaudited) | | 2004 | | 2005 | | 2006 | |

| Sales | | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| Cost of sales | | | 74 | | | 77 | | | 74 | | | 70 | | | 67 | |

| Gross profit | | | 26 | | | 23 | | | 26 | | | 30 | | | 33 | |

| Research and development expenses | | | 6 | | | 2 | | | 1 | | | 1 | | | 8 | |

| Selling, marketing, general and administrative expenses | | | 52 | | | 84 | | | 100 | | | 83 | | | 113 | |

| Impairment of investment | | | 0 | | | -- | | | -- | | | -- | | | -- | |

| Operating loss | | | (33 | ) | | (62 | ) | | (75 | ) | | (54 | ) | | (88 | ) |

| Finance expense, net | | | (2 | ) | | (6 | ) | | (1 | ) | | 0 | | | (1 | ) |

| Other income, net | | | -- | | | -- | | | 4 | | | -- | | | 8 | |

| Loss from operations before taxes on income | | | (34 | ) | | (68 | ) | | (71 | ) | | (55 | ) | | (81 | ) |

| Taxes on income | | | 0 | | | (1 | ) | | 1 | | | (1 | ) | | 4 | |

| Loss from operations of the Company and its consolidated subsidiaries | | | (34 | ) | | (68 | ) | | (72 | ) | | (54 | ) | | (85 | ) |

| Share of losses in Comverge | | | -- | | | (20 | ) | | (37 | ) | | (9 | ) | | (5 | ) |

| Gain on sale of shares in Comverge | | | -- | | | -- | | | 21 | | | -- | | | -- | |

| Share of losses in Paketeria | | | -- | | | -- | | | -- | | | -- | | | (10 | ) |

| Minority interests, net of tax | | | 4 | | | 3 | | | (3 | ) | | (2 | ) | | -- | |

| Loss from continuing operations | | | (30 | ) | | (85 | ) | | (91 | ) | | (65 | ) | | (101 | ) |

| Gain (loss) on sale of discontinued operations and contract settlement (in 2006), net of income taxes | | | -- | | | -- | | | -- | | | 13 | | | (50 | ) |

| Income (loss) from discontinued operations, net of income taxes | | | (3 | ) | | 14 | | | 56 | | | 20 | | | 2 | |

| Net loss | | | (34 | )% | | (71 | )% | | (35 | )% | | (31 | )% | | (149 | )% |

The following table sets forth certain information with respect to revenues and profits of our reportable business segments for the years ended December 31, 2004, 2005 and 2006, including the percentages of revenues attributable to such segments. (See Note 18 to our consolidated financial statements for the definitions of our reporting segments.) Segment information excludes the discontinued results of our US based consulting activities, which were discontinued in 2004, and our Israel based outsourcing activities, which were discontinued in 2005 as well as the results of our former Databit subsidiary which was sold in March 2006 (see Note 3 to our consolidated financial statements). The column marked “Other” aggregates information relating to miscellaneous operating segments, which may be combined for reporting under applicable accounting principles.

| | | RT Solutions | | IT Solutions | | Other | | Total | |

| | | (in thousands) | |

| Year ended December 31, 2006: | | | | | | | | | |

| Revenues from external customers | | $ | 2,729 | | $ | 1,125 | | $ | 264 | | $ | 4,117 | |

| Percentage of total revenues from external customers | | | 66 | % | | 27 | % | | 7 | % | | 100 | % |

| Gross profit | | | 936 | | | 330 | | | 88 | | | 1,354 | |

| Segment income (loss) before income taxes | | | (159 | ) | | (281 | ) | | 29 | | | (411 | ) |

| Year ended December 31, 2005: | | | | | | | | | | | | | |

| Revenues from external customers | | $ | 2,844 | | $ | 1,314 | | $ | 29 | | $ | 4,187 | |

| Percentage of total revenues from external customers | | | 68 | % | | 31 | % | | 1 | % | | 100 | % |

| Gross profit | | | 805 | | | 408 | | | 29 | | | 1,242 | |

| Segment income before income taxes | | | 34 | | | 48 | | | 19 | | | 102 | |

| Year ended December 31, 2004: | | | | | | | | | | | | | |

| Revenues from external customers | | $ | 1,988 | | $ | 1,312 | | $ | 64 | | $ | 3,364 | |

| Percentage of total revenues from external customers | | | 59 | % | | 39 | % | | 2 | % | | 100 | % |

| Gross profit | | | 479 | | | 330 | | | 64 | | | 873 | |

| Segment income (loss) before income taxes | | | (175 | ) | | (49 | ) | | 38 | | | (186 | ) |

2006 COMPARED TO 2005

Sales. Sales in 2006 decreased marginally as compared to 2005 with slight decreases in both of our reporting segments being partially offset by an increase in sales in our “Other” miscellaneous segment.

Gross profit. Gross profits increased in 2006 by $112,000 or 9%, primarily due to an increase in gross profits from our RT Solutions segment which more than offset the decrease in gross profits from our IT Solutions segment. The increase in gross profit in our RT Solutions segment was primarily attributable to a number of specific projects with particularly high profit margins, which offset the decrease in sales. The decrease in gross profit in our IT Solutions segment was attributable to a combination of reduced sales and a reduced gross margin.

Research and development expenses (“R&D”). Research and development expenses increased by $271,000, which was primarily attributable to an increase in development costs associated with our OncoProTM solution package in our IT Solutions segment.

Selling, marketing, general and administrative expenses (“SMG&A”). SMG&A increased in 2006 by approximately $1.2 million or 34%. This increase is entirely attributable to the $1.2 million of stock-compensation expense we recorded as a result of our adoption of FAS 123(R) in 2006 that is included in SMG&A. Excluding the stock-compensation expense, our corporate SMG&A was relatively unchanged in 2006 compared to 2005 whereas dsIT’s SMG&A in 2006 was approximately $90,000 less in 2006 as compared to 2005.

Other income, net. In the first quarter of 2006, we reached a settlement agreement with an Israeli bank with respect to our claims against the bank and the bank’s counterclaim against us. As a result of the settlement agreement, we recorded income of $330,000, net of legal expenses.

Taxes on income. The increase in taxes on income in 2006 is due to the increase in a tax provision previously made with respect to a transaction in a previous year.

Share of Losses in Comverge. In the first quarter of 2006, the carrying value of our investment in Comverge's common stock and preferred stock was reduced to zero. As such, Comverge has had no effect on our results since the first quarter of 2006. Our share of Comverge's net losses in 2006 was $210,000. In the future, when Comverge begins to show profit, after it has reached the level of equity at which we ceased recording equity losses, we will record 7% of that income as equity income to our preferred investment up to our original $3.9 million preferred share investment in Comverge, and thereafter to our investment in Comverge’s common shares, of which we currently own approximately 66%.

Share of losses in Paketeria. In the third quarter of 2006, we acquired 23% of Paketeria and increased our investment in the fourth quarter of 2006 to approximately 33%. Our share of Paketeria’s net losses plus amortization of the purchase price allocated to intangibles during the period since our acquisition was $159,000.

Net income from discontinued operations, net of tax. Under applicable accounting principles, as a result of our sale of Databit in the first quarter of 2006, the results of Databit have been reclassified in the current period and for all prior periods as a discontinued operation. The condensed results of this business are presented in each of the current and comparative period as net income from discontinued operations.