QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month ofOctober, 2003

MERANT plc

ABBEY VIEW, EVERARD CLOSE, ST. ALBANS, HERTFORDSHIRE, AL1 2PS

UNITED KINGDOM

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F]

Form 20-F X Form 40-F

[Indicated by check mark whether the registrant by furnishing the information contained in this Form is also hereby furnishing the information to the Commission pursuant to Rule 12g3 - 2(b) under the Securities Exchange Act of 1934.]

Yes No X

EXPLANATORY NOTE:

Attached hereto (and furnished as part of this report) are the following items:

- 1.

- Annual Report and Accounts for the fiscal year ended April 30, 2003 as distributed to shareholders and filed with the U.K. Listing Authority

- 2.

- Explanatory letter and Notice of Meeting for the 2003 Annual Meeting of Shareholders to be held December 4, 2003 as distributed to shareholders and filed with the U.K. Listing Authority

- 3.

- Form of Proxy for use by shareholders in connection with the 2003 Annual Meeting of Shareholders as distributed to shareholders and filed with the U.K. Listing Authority

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Merant plc |

| | | | | |

|

|

By: |

|

/s/ STEPHEN M. GOING

|

| | | Name: | | Stephen M. Going |

| | | Title: | | Vice President, General Counsel & Secretary |

2003 ANNUAL REPORT AND ACCOUNTS

www.merant.com

MERANT plc

TABLE OF CONTENTS

| Letter to Our Shareholders | | 1 |

Financial Review |

|

3 |

Directors' Report |

|

5 |

Report on Corporate Governance |

|

9 |

Directors' Remuneration Report |

|

13 |

Statement of Directors' Responsibilities |

|

18 |

Independent Auditors' Report |

|

19 |

Consolidated Profit and Loss Account |

|

21 |

Consolidated Balance Sheet |

|

22 |

Consolidated Cash Flow Statement |

|

23 |

Notes to the Consolidated Cash Flow Statement |

|

24 |

Company Balance Sheet |

|

25 |

Consolidated Statement of Total Recognised Gains and Losses |

|

26 |

Reconciliations of Movements in Shareholders' Funds |

|

27 |

Notes to the Consolidated Financial Statements |

|

28 |

Five Year Record |

|

44 |

Further Information for Shareholders |

|

45 |

In this report, "the Company" means Merant plc and

"Merant" or "the Group" means Merant plc and all of its subsidiary undertakings

Merant plc, Registered office: Abbey View, Everard Close, St. Albans, Hertfordshire, AL1 2PS, U.K.

Registered in England No. 01709998.

MERANT plc

YEAR ENDED 30 APRIL 2003

Letter to Our Shareholders

Merant has made significant progress during fiscal year 2003. In our last annual report it was outlined that our goal for fiscal 2003 was to continue our focus on increasing value to our shareholders by returning to profitability and establishing a strategic direction for the Group moving forward. We made good progress on these goals as illustrated by the following accomplishments:

- •

- Operating earnings before interest and taxes (excluding charges for goodwill amortisation and fundamental restructuring) in fiscal 2003 (year ended 30 April 2003) increased to £2.8m compared to the £12.1m loss from continuing operations (net of £5.9m goodwill amortisation related to discontinued operations—see note 3) reported in fiscal 2002 (year ended 30 April 2002).

- •

- Fiscal 2003 revenue from continuing operations declined 9.7% from fiscal 2002 due to continued difficult economic conditions. In the face of this economic downturn, we trimmed operating expenses by £64m or 46.7% compared to fiscal 2002.

- •

- During this fiscal year, Merant returned an additional £11.8m to shareholders through market repurchases of our ordinary shares. The Group has now completed its return of capital through share buybacks originally announced in December of 2001, with a total share repurchase of approximately £35m or 32.2m shares, representing 24% of the outstanding issued share capital at the commencement of repurchases.

- •

- Notwithstanding very difficult economic and market conditions, Merant continued its investment in new and updated products, spending 23% of total revenue on research and development in fiscal 2003 compared with 20% in fiscal 2002.

- •

- The Group's fiscal 2003 ending balance sheet continued to be very strong, including £45.5m in cash and marketable securities and no debt.

Merant's ability to perform relatively well this year in difficult economic conditions underscores the advantages of having a broad, strong and diverse customer base and a business model that includes a diverse mix of transaction sizes.

Looking forward to fiscal 2004 (year ending 30 April 2004), while the Group maintains a cautious outlook regarding revenue and earnings performance, as global recessionary pressures continue to limit information technology and software development spending, we will continue striving to develop our business through the delivery of high caliber SCM solutions with our Professional and Dimensions products. In addition, growth initiatives aimed at driving incremental revenue beyond our current core client server (distributed) SCM market are currently focused in the following areas:

- 1.

- Enterprise-wide Software Configuration Management: The Group plans to grow market share in the overall SCM market through enhancements to its current Dimensions product, as well as through the extension of Dimensions into the mainframe environment.

- 2.

- Web Content Management: We have not been as successful as we had hoped with Collage, our web content management product. However, the Group plans to continue to enhance the Merant Collage product offering, a business content management solution that delivers enterprise-class capability and seamless integration with SCM solutions for a fraction of the price of competitive offerings.

- 3.

- Configuration Management: The Group plans to move beyond software development into new markets requiring robust, high-end configuration management tools. By enriching its strong Dimensions product feature set, the Group is increasing its investment in new market segments.

1

Over the longer term, once the economic conditions begin to improve and key additional product revenues emerge from its increased growth investments, the Group's goal continues to be the generation of sustainable 15 percent operating margins on sales. While we have made significant strides over this last year, there is much left to do. We are confident that when we report to you again next year we will have made further progress in developing the business of Merant.

J. Michael Gullard

Chairman of the Board

Gerald Perkel

President and Chief Executive Officer

15 October 2003

2

MERANT plc

FINANCIAL REVIEW

YEAR ENDED 30 APRIL 2003

For the year ended 30 April 2003, our operating loss on continuing business improved significantly to £10.7m before interest, tax and exceptional items (2002: loss of £42.0m). After adding back goodwill amortisation from the operating performance the Group made a profit of £2.8m (2002: loss of £12.1m on continuing business—net of £5.9m amortisation of goodwill related to discontinued operations) or 3.4% (2002: -8.5%) of total revenue.

Total revenue for continuing business in the year ended 30 April 2003 decreased by £8.5m to £78.6m. The weakening of the US dollar to the pound sterling from an average rate of 1.43 in the year ended 30 April 2002 to a rate of 1.55 in the year ended 30 April 2003 accounted for approximately £4.5m of the decrease.

Licence fees accounted for approximately 38% (2002: 38%) of total revenue for continuing business and declined by 11% when compared to the year ended 30 April 2002. Maintenance Subscription Services accounted for 49% (2002: 46%) of total revenue. The remaining 13% (2002: 16%) consisted of consulting and training fees.

Gross margins from continuing operations were 79% (2002: 76%). Total expenses reduced by 31% in the year to £89.3m, compared to £129.0m in 2002 (excluding discontinued operations and exceptional items). This decline is a direct result of the aggressive restructuring actions and general spending controls initiated over the year.

Research and development expenditure totalled £17.8m compared to £24.2m last year. This represents 23% of total turnover (2002: 20%), emphasising the Group's continued commitment to product development.

During the year the Group recorded fundamental restructuring charges of £3.5m. £2.4m arose in the first half and £1.1m arose in the second half of the year. The amounts were all related to the Group's previously announced restructuring programme with the aim of re-focusing the Group into the software configuration management market, plus growth initiatives, and to return the Group to profitability.

The year ended 30 April 2003 also saw the finalisation of the disposal of two business units, Micro Focus (the Group's Application Creation and Transformation (ACT) business unit) and Data Direct (the Group's Enterprise Data Connectivity (EDC) business unit). The disposal of these business units occurred in the year ended 30 April 2002 however final settlement of all post closing contractual adjustments was not reached until 2003, resulting in an exceptional gain of £0.6m being recorded in the year.

The Group's policy is to write off acquired goodwill over a five year period, resulting in a charge of £13.4m (2002: £35.3m).

The Group recorded a £0.3m (2002: £nil) tax credit relating to the net favourable release of previously accrued tax liabilities in the fourth quarter. The Group believes that its effective rate will be near zero throughout 2004, due primarily to the availability of tax losses brought forward from prior years.

The Board considers the most relevant measure of earnings/(loss) per share (EPS) to be basic EPS. Basic EPS is calculated by dividing profits/(losses) after tax and goodwill amortisation by the weighted average number of shares in issue. EPS calculated on this basis resulted in a loss per share of 12.4p (2002: loss of 49.6p).

Ending cash balance was £45.5m (2002: £71.6m). Cash outflow from operating activities was £8.2m (2002: £22.8m). Non operating cash outflows totalled £12.8m, the most significant elements of which were:

- •

- Purchase of own shares—return of £11.7m to shareholders through the market re-purchase of 11,991,229 shares

- •

- Purchase of shares for the Merant Employee Benefit Trust 1994 and Employee Benefit Trust 2003 at an aggregate cost £2.2m

3

- •

- Proceeds from the sale of shares to employees under the Employee Share Purchase Plan scheme—£1.2m

- •

- Tax payments of £0.5m

The Group's treasury seeks to reduce financial risk, to ensure sufficient liquidity is available to meet foreseeable needs and to invest cash assets safely and profitably. It operates within policies and procedures approved by the Board. The Group does not undertake any trading activity in financial instruments.

During the year the class action suit against the Company was settled and all payments made under the settlement agreement were paid by the Company's insurance carrier. In December 2002 the settlement was approved and the case dismissed (see note 22).

Scott Hildebrandt

Chief Financial Officer

15 October 2003

4

MERANT plc

DIRECTORS' REPORT

YEAR ENDED 30 APRIL 2003

The directors of Merant plc ("the Company") present their report together with the audited financial statements of the Company and its subsidiary undertakings (collectively "Merant" or "the Group") for the year ended 30 April 2003.

Principal activities

Merant plc is the parent company of a group of companies whose principal activities are the design, development and marketing of software products and services. Specifically, following the sale of the Group's ACT and EDC businesses in the year ended 30 April 2002, Merant has since focused its resources on delivering the industry's most flexible and comprehensive enterprise change management solutions. Already in use at thousands of organizations across the globe, including 90 of the Fortune 100, Merant's products and services dramatically enhance the productivity, quality and ROI of customers' technology initiatives by allowing them to quickly and cost-effectively track, manage and control modifications in business-critical information assets.

Dividend

The directors will not be recommending payment of a dividend in respect of the year ended 30 April 2003 (2002: £nil).

Purchase of own shares

During the prior year, the Company began a process of returning excess capital to shareholders through the purchase for cancellation of its ordinary shares on the open market. This activity continued in the year ended 30 April 2003.

Between 11 June 2002 and 15 January 2003 the Company purchased for cancellation 11,991,229 ordinary shares (having a nominal value of £240,000), representing approximately 10% of the Company's issued share capital at the time the authority was granted. The aggregate consideration was £11,777,000, representing an average price of approximately £0.98 per ordinary share. Authority to make these purchases was granted by shareholders at an extraordinary general meeting on 6 June 2002. The shares were purchased on the London Stock Exchange and were cancelled immediately. The authority expired, however, on 6 June 2003 and as such Merant has no further buy back authority.

The Company provides loans to Merant Trustees Limited to enable it to purchase ordinary shares in the Company. These purchases are made primarily to ensure that the Company can fulfil its obligations under its Employee Share Purchase Plan ("ESPP") and to provide shares against which stock options can be issued under the 2003 Merant Share Incentive Plan ("2003 Plan"). During fiscal year 2003, Merant Trustees Limited received loans from the Company in the amount of £2,750,000 with which it purchased 300,000 shares in the Employee Benefit Trust 1994 for use under the ESPP and 1,550,000 ordinary shares in the Employee Benefit Trust 2003 for use under the 2003 Plan. For more information on the ESPP, see note 23 to the financial statements.

Future prospects

A review of the business and an indication of future prospects are provided in the Letter to our Shareholders on page 1 and the Financial Review on page 3.

5

Directors

The following served as directors of the Company during the year ended 30 April 2003:

| Non-executive directors: | | J Michael Gullard, Chairman (a) (c)

Harold Hughes (a)

Michel Berty (b) (c)

Barry X Lynn (b)

Don C Watters (a) (b) |

Chief Executive Officer:

(Executive director) |

|

Gerald Perkel (c) |

Notes: |

|

(a) Member of audit committee

(b) Member of remuneration committee

(c) Member of nomination committee |

Executive Director

Mr. Perkel, who is 48, joined Merant on 20 September 2001 as the Company's President and Chief Executive Officer, and was appointed an executive director on the same date. He joined Merant from Xerox Corporation in the U.S.A., where he served as Senior Vice President and President of the Office Printing Business. He joined Xerox in January 2000 when Xerox acquired the Color Printing and Imaging Division of Tektronix, Inc., where he served as president. Mr. Perkel serves as Board President for the Juvenile Diabetes Research Foundation. He holds a Bachelor of Science degree in System Science Engineering from the University of California, Los Angeles.

Non-Executive Directors

The Company's chairman, Mr. Gullard, is 58. He was appointed a non-executive director in May 1995 and was elected Chairman in March 1996. He is general partner of Cornerstone Management, a California, U.S.A. based venture capital and consulting firm that provides strategic focus and direction for technology companies primarily in the software and data communications industries. He is also a director of JDA Software Group, Inc. and Celeritek, Inc., and is Chairman of Netsolve, Inc., each a publicly-traded U.S. company. Mr. Gullard's 28 years in the technology industry includes a number of executive and management posts at Telecommunications Technology Inc. and Intel Corporation. He holds a Master of Business Administration and a Bachelor of Arts degree from Stanford University in California.

Mr. Hughes, who is 57, was appointed a non-executive director in December 1993. Mr. Hughes worked for 26 years with Intel Corporation, where he held senior positions in financial and operational management. He is currently a director of the London Pacific Group Ltd., a publicly-traded financial services company, Xilinx, Inc., a publicly traded provider of programmable logic solutions, Atsana Semiconductor Corp., a U.S based venture-backed semiconductor company, eVineyard, a privately-held U.S. company and Remec Inc., a publicly traded communications company.

Mr. Berty, who is 64, was appointed a non-executive director of the Company following the acquisition of Intersolv, Inc. in September 1998. He had been a non-executive director of Intersolv, Inc. since 1997. In July, 2003, Mr. Berty commenced service as CEO and Chairman of Security Biometrics Inc., a U.S. company publicly traded on the over-the-counter market. He is also on the boards of directors of Sapiens International Corporation N.V., a publicly-traded software solutions provider based in the Netherlands Antilles. He is also a director of iGate Corporation, a U.S. publicly traded company listed on NASDAQ, and Dataraid, e-Vantage Solutions, Inc., and NetGain, all of which are privately-owned U.S. based corporations. From 1972 until 1997 he was an executive of the Cap Gemini Group and served as Chairman of Cap Gemini America from 1993 to 1997.

Mr. Lynn, who is 52, was appointed a non-executive director in September 1999. He is President and CEO of Be eXceL Management, Inc. and Director/General Partner of Shoreline Venture Management. Prior to founding Be eXceL Management, Inc, Mr. Lynn was with Wells Fargo for 16 years, his last position being President of Wells Fargo Technology Services. Previously, he served as the company's Chief Information Officer (CIO). Before that, he ran Wells Fargo's Private Banking Operations and their Investment Operations. Mr. Lynn founded and became the first President of Wells Fargo Securities.

6

Mr. Watters, who is 60, was appointed a non-executive director in December 1999. He retired from McKinsey & Co in 1997 after 28 years service, most recently as a director. He continues to act as a consultant and as a member of the McKinsey Advisory Board.

All of the Company's board members are U.S. citizens.

The directors' remuneration report on page 13 sets out details of the Company's policy on the retirement of directors, the remuneration of the directors, their beneficial and non-beneficial interests in the share capital of the Company, and options they have been granted to acquire ordinary shares in the Company under the Merant share option plans.

No director has or has had a material interest in any contract involving the Company, other than their service contracts where applicable, subsisting during or at the end of the financial year ended 30 April 2003 which was significant to the Group's business.

Substantial shareholders

At 1 October 2003 the following interests of 3% or more in the share capital of the Company have been reported:

| | Ordinary

shares held

| | Percentage

holding

| |

|---|

| Schroder Investment Management Limited | | 19,462,891 | | 18.49 | % |

| Merant Trustees Limited | | 7,324,930 | | 6.96 | % |

| UBS Asset Management Limited | | 5,747,161 | | 5.46 | % |

| D3 Family Fund LP | | 4,626,383 | | 4.39 | % |

| Legal & General Investment Management Limited | | 3,431,637 | | 3.26 | % |

At 30 April 2003 The Bank of New York, acting as Depositary Bank, held approximately 14% of the Company's ordinary shares in respect of which American Depositary Shares ("ADSs") have been issued, evidenced by American Depositary Receipts ("ADRs"). The ADRs are traded in the United States on the Nasdaq National Market. On 13 March 1998 the Company split its ordinary shares on a 5-for-1 basis, but the Company's ADSs did not split and, consequently, each ADS now represents five ordinary shares. Some of the holdings reported above may be held in the form of ADSs, but for the purposes of the table, numbers of ADSs have been converted to numbers of ordinary shares.

Research and development

Merant continues to invest in research and development, and continues to develop new products whilst updating and improving its existing products.

Branches

During the year ended 30 April 2003 Merant has operated branches in Denmark, Italy, Japan, Korea and Norway. During the fiscal year, the Korean branch was established and the Norwegian branch was closed.

Employee involvement

The directors acknowledge their responsibilities in communicating relevant information to the Group's employees. Merant operates a number of initiatives designed to develop the Group's arrangement for employee information and consultation, and to increase its employees' understanding of critical business factors, which affect the performance of the Group. It maintains regular communication through group meetings and team briefings.

Most employees are eligible to become Merant shareholders through the ownership of options to acquire ordinary shares in the Company under the Merant share option plans. Employees are also eligible to invest in the Company through the Employee Share Purchase Plan. Details of these employee benefit plans are set out in note 23 to the financial statements.

Disabled employees

Merant gives full and fair consideration to applications for employment from disabled persons where a handicapped or disabled person may adequately cover the requirements of the job with

7

reasonable accommodation. If necessary Merant reasonably accommodates and endeavours to retrain any member of staff who develops disability during employment with Merant and to provide career development and promotion opportunities wherever appropriate.

Donations and political contributions

Merant's policy is to concentrate support on projects related to the communities in which its employees and offices are located. During the year Merant donated approximately £1,000 (2002: £3,000) to U.K. charities and approximately £21,000 (2002: £19,000) to U.S. charities for total worldwide donations of £22,000 (2002: £22,000). No political contributions were made during the year (2002: £nil).

Environment

Merant recognises its responsibilities for the environment, and the possible effects of its activities on the environment are given due consideration. As a software company, Merant believes its activities should have a minor effect on the environment. Merant has taken steps to reduce environmental impacts in such areas as minimisation of waste and energy conservation.

Supplier payment policy and practice

The Group does not follow any code or standard on payment practices. It is, however, Group policy to agree payment terms with suppliers when negotiating the terms of transactions, to ensure that suppliers are made aware of the terms of payment, and to comply with those contractual arrangements. At the year end, there were 16 days (2002: 20 days) purchases in Group trade creditors.

Approval of Directors' Remuneration Report

An ordinary resolution will be put to shareholders at the forthcoming Annual General Meeting to approve the Directors' Remuneration Report.

Auditors

In accordance with Section 384 of the Companies Act 1985, a resolution for the reappointment of KPMG Audit Plc as auditors of the Company and the Group is to be proposed at the forthcoming Annual General Meeting.

By Order of the Board

Stephen M. Going

Company Secretary

15 October 2003

8

MERANT plc

REPORT ON CORPORATE GOVERNANCE

YEAR ENDED 30 APRIL 2003

Background

The Board supports the principles of the Combined Code relating to Good Governance and the Code of Best Practice, which was issued in June 1998. The Board considers that the Company complied fully throughout the year with the recommendations of the Combined Code, except as noted below.

Applying the principles of good governance

The Board:

The Company is managed by a Board of Directors which meets at least once a quarter to review trading results and discuss operational, financial, legal and other business issues. In particular it deals with those matters reserved to it for decision, according to the schedule of responsibilities and authorities, which stipulates clear requirements for matters which exceed delegated authorities to be dealt with by the Board. These include:

- •

- business strategy

- •

- annual operating plans

- •

- business acquisitions and disposals

- •

- approval of financial statements

- •

- internal controls

The Board deals with other matters as appropriate, and regularly receives presentations from senior management on issues such as sales and marketing initiatives, technological developments, human resources matters, information technology requirements, business processes and investor relations. The Board is supplied, in a timely manner, with information in a form and of a quality appropriate to enable it to discharge its duties.

The board members are based in the U.S.A., and the board is generally constituted in line with U.S. practice. It consists of a non-executive Chairman, four other non-executive directors (all of whom are considered independent) and one executive director, the Chief Executive Officer. Senior management reports to the Board through the Chief Executive Officer, whose role is separate and distinct from that of the Chairman. Biographies of the directors are set out in the Directors' Report commencing on page 5. A list of the senior management is set out on the inside back cover page of this report. Each of the non-executive directors has senior executive experience in other companies. The non-executive directors are independent of management and, other than as noted below, free from any business or other relationship which could materially interfere with the exercise of the independent judgment that they offer on Board matters. None has previously served in an executive capacity with Merant. The senior non-executive director is Harold Hughes.

The proportion of non-executive directors complies with the Code, and the Board considers that the balance achieved between executive and non-executive directors is appropriate and effective for the control and direction of the business.

There are procedures for Board members to receive appropriate induction and training and to solicit independent professional advice, at the Company's expense, where specific expertise is required in the course of exercising their duties. All directors have access to the Company Secretary, who is responsible for ensuring compliance with appropriate statutes and regulations.

Directors are subject to re-election by shareholders at the first opportunity after their appointment and thereafter at intervals of no more than three years, with one third of directors being required to submit for re-election by rotation each year.

Sub-committees of the Board:

The Board is assisted by committees which have been established with written terms of reference. Their roles and composition are set out below.

9

The audit committee consists of Mr. Hughes (Chairman), Mr. Gullard and Mr. Watters, all of whom are non executive directors. The role of the audit committee is explained under "Accountability and audit" below.

The remuneration committee consists of three non-executive directors, Mr. Berty (Chairman), Mr. Lynn and Mr. Watters. Mr. Berty has been a member of the committee since 1999, and was appointed committee chairman in December 2000. Mr. Watters was appointed a member of the committee in December 2000, and Mr. Lynn was appointed a member of the committee in April 2002. None of the committee members has any personal financial interests (other than as shareholders and/or option holders of the Company), conflicts of interests arising from cross-directorships or day-to-day involvement in running the business.

The committee is responsible for recommending to the Board the framework of executive remuneration and then determining individual terms of employment. Those responsibilities cover salary and bonus arrangements, benefits, contracts of employment and share option grants. The committee operates in accordance with written terms of reference and is authorised to seek appropriate professional advice if it considers this necessary. It ensures that remuneration is appropriate to the executive director's responsibilities, taking into consideration the overall financial and business position of the Company, the highly competitive industry of which Merant is part, salary scales within the Company, and the importance of recruiting and retaining management of the appropriate calibre.

The directors' remuneration report on page 13 provides full disclosure of the remuneration policy and the amounts of remuneration and benefits earned by the directors.

The nomination committee consists of Mr. Gullard (Chairman), Mr. Perkel and Mr. Berty. The committee meets from time to time when required to do so, and makes recommendations to the Board on all proposed new appointments of directors. Such appointments are subject to subsequent confirmation by the shareholders.

Relations with shareholders

Merant conducts regular dialogue with shareholders to ensure mutual understanding of objectives and divulges such information as is consistent with the guidelines of the Listing Rules of the Financial Services Authority and U.S. law.

Merant's website includes an investors section, which includes an investor calendar, access to current and historical market prices of the Company's shares, financial reports and announcements, other information of interest to corporate and individual shareholders, as well as offering an e-mail alert service.

All shareholders are invited to participate in the annual general meeting, where the Chief Executive Officer will be available to answer any questions. Each matter to be dealt with at the annual general meeting is addressed by a separate resolution. Proxy votes received are disclosed to the meeting after each resolution has been dealt with on a show of hands.

Accountability and audit

The audit committee meets at least quarterly to consider the adequacy of the Group's system of internal controls, policies and procedures and the outcome of the external audit, and to review the group's annual and quarterly reports and accounts. It also involves the Group's auditors in that process, focusing particularly on compliance with legal requirements, accounting standards and the requirements of the U.K. Financial Services Authority and NASDAQ, and on an ongoing basis reviews the effectiveness of our systems of internal financial controls. It also advises the Board on the appointment of the Group's auditors together with their remuneration for both audit and non-audit work. The committee is authorised to investigate any activity within its terms of reference, to seek any information it requires from any employee and to obtain independent professional advice if it considers this necessary. Members of senior management and the external auditor normally attend its meetings. The committee regularly meets in private sessions to confer with the auditors without the attendance of executive officers and other members of the Group's management. The ultimate responsibility for reviewing and approving our annual and quarterly reports and accounts remains with the Board.

Management prepares a comprehensive system of budgets with monthly reporting of actual results against targets, and provides directors with regular updates on the financial performance of the Group.

10

At its quarterly meetings, the Board is provided with an analysis of financial information which includes key performance and risk indicators. The Group's auditors are engaged to review the Group's reported results and balance sheet at each quarter end, and to audit the annual results and balance sheet which are included in this report. The Board is responsible for reviewing and approving for publication the financial results for the previous quarter.

The Group does not currently have an internal audit function. The Board has reviewed the need for an internal audit function but has decided that the current control mechanisms are sufficient for the size of the Group. The Board has agreed to review the situation on an annual basis.

Risk management

The directors have overall responsibility for ensuring that the Group maintains a system of internal control. This provides them with reasonable assurance that the assets are safe-guarded and therefore, shareholders investment is protected.

The Board has established an ongoing process for identifying, evaluating and managing the significant risks faced by the Group. This process has been in place for the year under review and continues up until the date of this Annual Report. The processes are reviewed regularly by the Directors and accords with the Combined Code and Turnbull guidance.

Internal control is designed to manage, rather than eliminate the risk of failure to achieve the business' objectives. There are limitations in any system of internal control and, accordingly, even the most effective system can provide only reasonable, and not absolute, assurance with respect to the preparation of financial information and the safeguarding of assets and can only provide reasonable and not absolute assurance against material misstatement or loss.

The Board has performed a review of the effectiveness of the internal controls in operation at the date of this report. They have reviewed, in detail, the significant risks identified that are faced by the Group along with the controls and communication process in place to manage the risks. The Board reviews the secondary risks on an exception basis and also reviews the embedded controls that exist within the organisation. Following the review the internal controls being operated by the Group to mitigate risk, are being re-examined and enhanced as appropriate.

The Board regularly reviews the following key procedures that were established to provide effective internal control and risk assessment:

- •

- Annual budgets are prepared with input from executive managers responsible for the different business disciplines. Budgets are updated through a system of monthly and quarterly forecasts;

- •

- An ongoing process for identifying, evaluating and managing the significant risks faced by the Group;

- •

- Management accounts are produced each month and the financial results are measured against the budget and forecasts to identify and investigate any significant variations;

- •

- The Board continues to review the major risks to the business. These are assessed and responsibility allocated to minimise them;

- •

- Maintenance of a control environment directed towards the proper management of risk;

- •

- The Group appoints staff of the necessary calibre to fulfil their allotted responsibilities.

Going concern

In compliance with the recommendation of the Combined Code to report that the business is a going concern, after making enquiries, the directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future and the financial statements will be prepared on the going concern basis. The directors believe this to be appropriate for the following reasons.

The Group made an operating profit before amortisation of goodwill and exceptional items in the year ended 30 April 2003 of £2.8m and incurred exceptional restructuring costs of £3.5m. At 30 April 2003 the Group had net cash balances of £45.5m. The directors have prepared their budgets for the year ended 30 April 2004 and these projections show that the Group will generate sufficient cash to enable the Group to meet its liabilities as they fall due.

11

Communications

Communications with shareholders are given a high priority. The Annual Report is sent to shareholders and the 20-F is available on request. In addition, at the half year, an interim report is produced and sent to shareholders and the quarterly results are published via the London Stock Exchange and by press release.

Compliance with Best Practice

The Group is required to report on its compliance with the provisions of Section 1 of the Combined Code throughout the year ended 30 April 2003. Except as detailed below, the directors consider that the Company has complied throughout the period under review with the provisions of Section 1 of the Combined Code.

In prior years, Merant's non-executive directors have been granted share options in accordance with a resolution passed by shareholders at the 1999 annual general meeting. Provision A.3.2 of the Combined Code requires that non-executive directors should be independent of management and free from any business or other relationship which could materially interfere with the exercise of their independent judgment. While the Company has maintained that the numbers of options granted to the non-executive directors are de minimis in terms of their own personal wealth and therefore does not compromise their independence; the existence of these option grants has caused the Company to be out of compliance with Provision A.3.2 of the Combined Code. Effective 1 April 2003, each of the Company's non-executive directors agreed to cancel and terminate all outstanding options to acquire Company shares and therefore no non-executive director held options as of 30 April 2003. For more information, please see the directors' remuneration report commencing on page 13.

J Michael Gullard

Chairman of the Board

15 October 2003

12

MERANT plc

DIRECTORS' REMUNERATION REPORT

YEAR ENDED 30 APRIL 2003

Directors' remuneration is determined by recommendations from the remuneration committee, whose composition and terms of reference are set out in the Report on Corporate Governance commencing on page 9.

Directors' remuneration policy is in line with the Group's overall practice on pay and benefits. This is, to reward employees competitively, taking into account individual performance, Group performance, market comparisons and the competitive pressures in the software industry. External comparisons are made looking at comparable roles in our industry. During fiscal year 2003, the remuneration committee appointed Andrew White from Sellbourne Inc to review the compensation and benefits packages to ensure alignment to market standards. Neither Andrew White or Sellbourne Inc provided any other services to the Group in the year. At this stage it is believed the same policy will be continued in subsequent fiscal years.

Executive Director's Remuneration Policy

The remuneration package for Merant's executive director is designed to attract, motivate, and retain individuals of the necessary calibre. It is determined by reference to relevant market data for the countries in which the director performs his duties, and recognises the continuing competitive market in the sectors in which Merant operates. It is intended that the executive director's remuneration is positioned in the upper quartile of the market place. The chief components of the executive director's remuneration, as they applied to the holder of that office, Mr Perkel, during the year ended 30 April 2003, are as follows:

Basic salary: the salary rate for the executive director is reviewed annually, taking into account the performance of the Group, the individual job performance, market trends and data relating to executive director compensation of companies in comparable circumstances.

Performance-related bonus: the executive director is eligible for an annual performance-related bonus. The philosophy is to offer greater than market opportunities in terms of bonus compensation, scaling upwards if Merant's performance exceeds the targets set. The bonus is based on fixed formulae measuring Merant's performance against targets set at the beginning of the financial year. In the case of Mr. Perkel, the annual target bonus was based on a plan presented to and approved by the Board of Directors prior to the commencement of the fiscal year.

Pension contributions: the Group does not operate a pension scheme for its directors. The executive director is eligible to participate in Merant's retirement plan for U.S.-based employees (401(k) plan), whereby Merant will partially match employee contributions to the plan, subject to the rules of the U.S. Internal Revenue Service.

Other benefits: the executive director is entitled to participate in all welfare plans and policies provided to other senior executives, including tax and financial planning, medical, dental, disability, life, accidental death and travel insurance.

Compensation for loss of office: the level of compensation offered by the Group is determined by the need to provide the executive director with a competitive package in accordance with the criteria described above. In the case of Mr. Greenfield, the Company's former Chief Executive Officer and executive director who was replaced by Mr Perkel in September 2001, this entitlement did not exceed the equivalent of two years' pay and consisted of a maximum of one year's salary and bonus as severance and an additional one year's salary and bonus for services rendered to the Group for twelve months following termination and as consideration for certain non-compete covenants. In addition, his welfare benefits would continue for eighteen months. In the event that Mr. Perkel's employment is terminated without cause or he resigns under certain defined circumstances, Mr. Perkel will be entitled to receive twelve monthly severance payments equal to his monthly base salary, plus a proportion of his bonus. The bonus amount due in each month will be the greater of one-twelfth of (i) his annualised actual bonus over the twelve months preceding the termination, or (ii) 50% of the annual target bonus. In addition, his welfare benefits would continue for the duration of the severance period. Mr. Perkel has agreed to a 12-month non-competition covenant on termination preventing him from engaging in

13

competition with the Group. If Mr. Perkel is terminated without cause or resigns for good reason, at any time, from the date the Board of Directors approves a transaction which, if consummated, will result in a change of control and continuing for 12 months following the effective date of the change of control, Mr. Perkel is entitled to receive, for a period of 24 consecutive months following the termination or resignation, an amount equal to the sum of monthly base salary plus one twelfth of his annual target bonus.

Share plans: the executive director is eligible to participate in the Merant share option plans. Option prices are set at the market price at date of grant, and are not offered at a discount. The grant of share options to the executive director, vesting over four years, is designed to ensure that an element of his remuneration is directly related to long-term growth in shareholder value. The options are not subject to any performance conditions. The Company does not impose specific Group performance thresholds or criteria for the vesting of options, choosing instead to manage directly the performance of each employee and take corrective actions as necessary. The executive director is also eligible to participate in the Company's Employee Share Purchase Plan on the same terms as apply to all employees. Under the plan, employees may purchase shares at discounted rates. Details of these employee benefit plans are set out in note 23 to the financial statements.

Long term incentives: the executive director is not eligible for any other long-term incentive payments.

Remuneration for non-executive directors

Remuneration for non-executive directors is determined by the Board as a whole. The Remuneration committee appointed an independent advisor to review the compensation and benefits packages to ensure alignment to market standards. Non-executive directors receive an annual retainer and earn additional fees for attendance at Board meetings and for time spent on other Company-related business. Fees are set within the limits stipulated in the Company's Articles of Association.

Non-executive directors are eligible to participate in the Merant 1998 share option plan, details of which are set out in note 23 to the financial statements. However the Board of directors has elected to suspend the use of stock options as a means of compensating non-executive directors and, effective 1 April 2003, each non-executive director agreed to terminate and cancel all then outstanding options in exchange for certain cash consideration. See information under "Directors Share Options" on page 16.

Service agreements

Mr. Perkel was appointed Chief Executive Officer on 20 September 2001. His appointment is at will, and may be terminated by him or by the Company at any time for any reason. Upon termination for other than death, disability, or cause, or if he resigns under certain defined circumstances, he is entitled to compensation as set out above. Mr. Perkel has agreed to devote all of his business time and attention to the business of the Company. The terms of Mr. Perkel's service contract relating to compensation for loss of office were determined by the Board in the reasonable exercise of its discretion based on U.S.-based market practices for similar positions.

None of the non-executive directors has a letter of appointment.

Each of the Company's non-executive directors are free to accept other appointments, directorships and positions to the extent consistent with the periodic obligations to the Company and subject to applicable legal and ethical standards relating to conflict of interest.

The Company's Articles of Association require that one third of the directors should retire by rotation each year and submit for re-election. Mr. Perkel and Mr. Watters will therefore retire at the 2003 annual general meeting and, being eligible, will offer themselves for re-election. Mr. Watters does not have a service agreement with the Company. Mr. Perkel's service agreement is terminable at will by the Company.

14

Directors' Remuneration (audited)

The following table analyses the remuneration earned by each director in the year ended 30 April 2003 and discloses summary information for the year ended 30 April 2002:

| | Salary

£'000

| | Performance

related pay

£'000

| | Fees

£'000

| | Benefits-

in-kind

£'000

| | 2003(1)

£'000

| | 2002

£'000

|

|---|

| J Michael Gullard | | — | | — | | 102 | | — | | 102 | | 101 |

| Michel Berty | | — | | — | | 24 | | — | | 24 | | 31 |

| Harold Hughes | | — | | — | | 26 | | — | | 26 | | 29 |

| Barry X Lynn | | — | | — | | 23 | | — | | 23 | | 24 |

| Gerald Perkel | | 288 | | 474 | | — | | 11 | | 773 | | 560 |

| Don C Watters | | — | | — | | 27 | | — | | 27 | | 29 |

| Gary Greenfield (resigned 31 October 2001) | | — | | — | | — | | — | | — | | *2,645 |

| | |

| |

| |

| |

| |

| |

|

| | | 288 | | 474 | | 202 | | 11 | | 975 | | 3,419 |

| | |

| |

| |

| |

| |

| |

|

- (1)

- Excludes one-time cash payments of £116,000 made to directors in exchange for cancellation of all outstanding stock options. See Directors' share options below.

- *

- includes £844,000 in respect of compensation for loss of office

Directors' shareholdings (audited)

The beneficial and non-beneficial interests in the ordinary shares of the Company of the directors holding office at 30 April 2003 are as follows:

| | 30 April 2003

| | 30 April 2002

|

|---|

| J Michael Gullard,Chairman | | 126,774 | | 64,361 |

| Michel Berty | | 24,758 | | 6,861 |

| Harold Hughes | | 134,758 | | 116,861 |

| Barry X Lynn | | 24,758 | | 6,861 |

| Gerald Perkel | | 34,865 | | — |

| Don C Watters | | 24,758 | | 6,861 |

There have been no changes to the above shareholdings since the year-end.

15

Directors' share options (audited)

The following table sets out the numbers of options to acquire ordinary shares or ADSs held during the year by each director in office at 30 April 2003 and the changes in their holdings during the year. All options granted to directors vest over a period of four years from the date of grant and are not offered at a discount.

| |

| |

| | Numbers of options

| |

| |

|

|---|

| | Date of

option grant

| | Exercise price

(in GBP)

| | At 30 April

2002

| | Granted in

the year

| | Lapsed in

the year

| | Cancelled in

the year

| | At April 30

2003

| | Earliest

exercise date

| | Latest

exercise date

|

|---|

| J Michael Gullard | | 21 Jun 1996

16 Sep 1999

30 Nov 2000

14 Dec 2001 | | 1.67

2.87

0.78

1.02 | | 100,000

20,000

20,000

20,000 | | —

—

—

— | | —

—

—

— | | (100,000

(20,000

(20,000

(20,000 | )

)

)

) | —

—

—

— | | 21 Jun 1997

16 Sep 1999

30 Nov 2000

14 Dec 2001 | | 21 Jun 2006

16 Sep 2009

30 Nov 2010

14 Dec 2011 |

Michel Berty |

|

30 Nov 2000

14 Dec 2001 |

|

0.78

1.02 |

|

10,000

10,000 |

|

—

— |

|

—

— |

|

(10,000

(10,000 |

)

) |

—

— |

|

30 Nov 2000

14 Dec 2001 |

|

30 Nov 2010

14 Dec 2011 |

Harold Hughes |

|

19 Aug 1992

16 Jun 1994

16 Sep 1999

30 Nov 2000

14 Dec 2001 |

|

3.00

2.40

2.87

0.78

1.02 |

|

50,000

10,000

10,000

10,000

10,000 |

|

—

—

—

— |

|

(50,000

—

—

—

— |

)

|

(10,000

(10,000

(10,000

(10,000 |

)

)

)

) |

—

—

—

—

— |

|

19 Aug 1993

16 Jun 1995

16 Sep 1999

30 Nov 2000

14 Dec 2001 |

|

19 Aug 2002

16 Jun 2004

16 Sep 2009

30 Nov 2010

14 Dec 2011 |

Barry X Lynn |

|

16 Sep 1999

30 Nov 2000

14 Dec 2001 |

|

2.87

0.78

1.02 |

|

10,000

10,000

10,000 |

|

—

—

— |

|

—

—

— |

|

(10,000

(10,000

(10,000 |

)

)

) |

—

—

— |

|

16 Sep 1999

30 Nov 2000

14 Dec 2001 |

|

16 Sep 2009

30 Nov 2010

14 Dec 2011 |

Gerald Perkel(1) |

|

20 Sep 2001

24 Sep 2002 |

|

0.69

0.84 |

|

2,750,000

— |

|

—

687,500 |

|

—

— |

|

|

|

2,750,000

687,500 |

|

20 Sep 2002

24 Sep 2003 |

|

20 Sep 2011

24 Sep 2012 |

Don C Watters |

|

8 Dec 1999

30 Nov 2000

14 Dec 2001 |

|

4.59

0.78

1.02 |

|

10,000

10,000

10,000 |

|

—

—

— |

|

—

—

— |

|

(10,000

(10,000

(10,000 |

)

)

) |

—

—

— |

|

8 Dec 1999

30 Nov 2000

14 Dec 2001 |

|

8 Dec 2009

30 Nov 2010

14 Dec 2011 |

- (1)

- On 2 October 2003, Mr. Perkel was granted an additional option to acquire 687,500 shares at an exercise price of £1.42.

The directors did not exercise any options during the year. On 1 April 2003 each non-executive director agreed to cancel and terminate all outstanding options held in exchange for a one-time cash payment based on the spread of the market value over the exercise price, given some assumed share appreciation over the remaining period of exercisability. The total cash payment to all the directors was £116,000.

The market price of the shares at 30 April 2003 was £1.21 and the range during the year was £0.70 to £1.23.

16

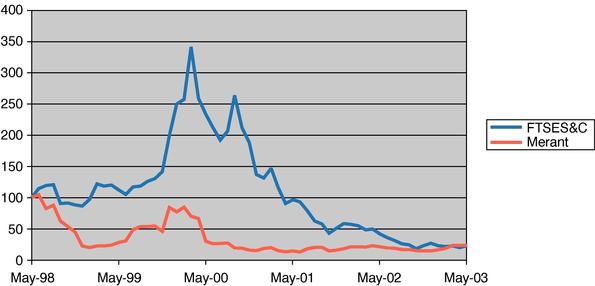

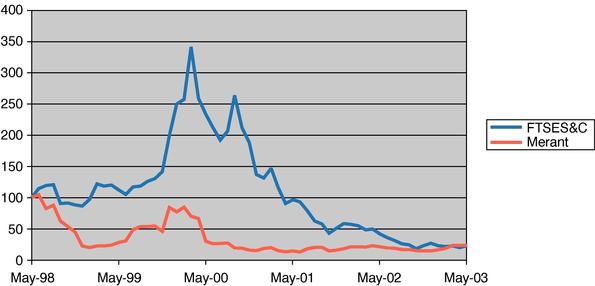

Merant share price performance (not subject to audit)

This following 5 year graph illustrates Merant total shareholder return compared to the UK software and computer services sector (FTSES&C) between 1 May 1998 and 30 April 2003. This sector has been chosen as appropriate for comparison due to the specific circumstances that have affected this industry over the past three years which have not equally impacted the wider market.

(1 May 1998 = 100)

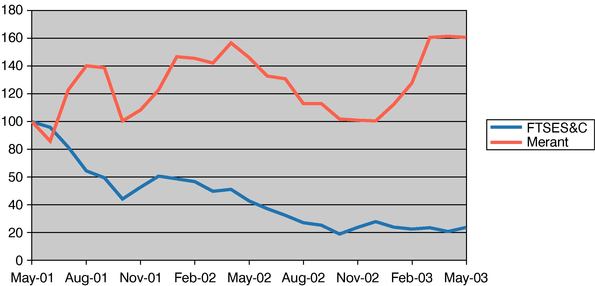

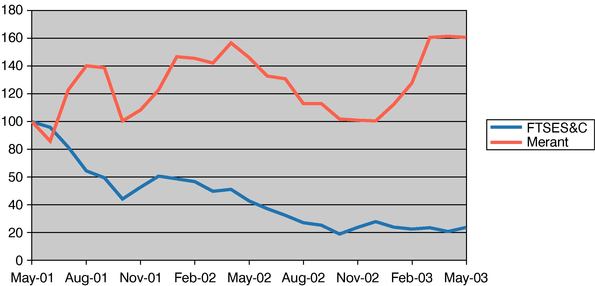

This graph illustrates Merant total shareholder return compared to the UK software and computer services sector between 1 May 2001 and 30 April 2003. This time period was chosen as 1 May 2001 was the commencement of the fiscal year during which the Company sold its ACT and EDC business units and brought in a new management team.

(1 May 2001 = 100)

On behalf of the Board

Michel Berty

Chairman of the Remuneration Committee

15 October 2003

17

MERANT plc

FINANCIAL STATEMENTS

STATEMENT OF DIRECTORS' RESPONSIBILITIES

IN RESPECT OF THE FINANCIAL STATEMENTS

Company law requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the Company and of the Group and of the profit or loss for that period. In preparing those financial statements the directors are required to:

- (a)

- select suitable accounting policies and then apply them consistently;

- (b)

- make judgements and estimates that are reasonable and prudent;

- (c)

- state whether applicable accounting standards have been followed, subject to any material departures disclosed and explained in the financial statements.

- (d)

- prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Company and Group will continue in business.

The directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial position of the Company and to enable them to ensure that the financial statements comply with the Companies Act 1985. They have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the Group and to prevent and detect fraud and other irregularities.

18

MERANT plc

FINANCIAL STATEMENTS 2003

INDEPENDENT AUDITORS' REPORT TO THE MEMBERS OF MERANT PLC

We have audited the financial statements on pages 21 to 43. We have also audited the information in the Directors' Remuneration Report that is described as having been audited.

This report is made solely to the Company's members, as a body, in accordance with section 235 of the Companies Act 1985. Our audit work has been undertaken so that we might state to the Company's members those matters we are required to state to them in an auditors' report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company's members as a body, for our audit work, for this report, or for the opinions we have formed.

Respective responsibilities of directors and auditors

The directors are responsible for preparing the Annual Report and the Directors' Remuneration Report. As described on page 18, this includes responsibility for preparing the financial statements in accordance with applicable United Kingdom law and accounting standards. Our responsibilities, as independent auditors, are established in the United Kingdom by statute, the Auditing Practices Board, the Listing Rules of the Financial Services Authority, and by our profession's ethical guidance.

We report to you our opinion as to whether the financial statements give a true and fair view and whether the financial statements and part of the Directors' Remuneration Report to be audited have been properly prepared in accordance with the Companies Act 1985. We also report to you if, in our opinion, the directors' report is not consistent with the financial statements, if the company has not kept proper accounting records, if we have not received all the information and explanations we require for our audit, or if information specified by law regarding directors' remuneration and transactions with the Group is not disclosed.

We review whether the statement on page 9 reflects the Company's compliance with the seven provisions of the Combined Code specified for our review by the Listing Rules, and we report if it does not. We are not required to consider whether the Board's statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the Group's corporate governance procedures or its risk and control procedures.

We read the other information contained in the Annual Report, including the Corporate Governance Statement and the unaudited part of the Directors' Remuneration Report, and consider whether it is consistent with the audited financial statements. We consider the implications for our report if we become aware of any apparent misstatements or material inconsistencies with the financial statements.

Basis of audit opinion

We conducted our audit in accordance with Auditing Standards issued by the Auditing Practices Board. An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements and the part of the Directors' Remuneration Report to be audited. It also includes an assessment of the significant estimates and judgments made by the directors in the preparation of the financial statements, and of whether the accounting policies are appropriate to the Group's circumstances, consistently applied and adequately disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered necessary in order to provide us with sufficient evidence to give reasonable assurance that the financial statements and the part of the Directors' Remuneration Report to be audited are free from material misstatement, whether caused by fraud or other irregularity or error. In forming our opinion we also evaluated the overall adequacy of the presentation of information in the financial statements and the part of the Directors' Remuneration Report to be audited.

Opinion

In our opinion:

- •

- The financial statements give a true and fair view of the state of affairs of the Company and the Group as at 30 April 2003 and of the loss of the Group for the year then ended; and

19

- •

- The financial statements and the part of the Directors' Remuneration Report to be audited have been properly prepared in accordance with the Companies Act 1985.

KPMG Audit Plc

Chartered Accountants

Registered Auditor

St Albans

23 October 2003

20

MERANT plc

FINANCIAL STATEMENTS 2003

CONSOLIDATED PROFIT AND LOSS ACCOUNT

| |

| | Years ended 30 April

| |

|---|

| | Notes

| | 2003

£'000

| | 2002

£'000

| |

|---|

| Turnover: continuing business | | | | | | | |

| Licence fees | | | | 29,636 | | 33,387 | |

| Maintenance subscriptions | | | | 38,902 | | 39,779 | |

| Training and consulting | | | | 10,054 | | 13,902 | |

| | | | |

| |

| |

| | | | | 78,592 | | 87,068 | |

| Turnover: discontinued business | | 3 | | — | | 31,207 | |

| | | | |

| |

| |

| Total turnover | | 2 | | 78,592 | | 118,275 | |

| | | | |

| |

| |

| Cost of sales: continuing business | | | | | | | |

| Cost of licence fees | | | | 1,852 | | 1,429 | |

| Cost of maintenance revenue | | | | 5,179 | | 5,855 | |

| Cost of service revenue | | | | 9,172 | | 13,832 | |

| | | | |

| |

| |

| | | | | 16,203 | | 21,116 | |

| | | | |

| |

| |

| Cost of sales: discontinued business | | 3 | | — | | 5,510 | |

| | | | |

| |

| |

| Total cost of sales | | | | 16,203 | | 26,626 | |

| | | | |

| |

| |

| Gross profit | | | | 62,389 | | 91,649 | |

| | | | |

| |

| |

| Operating expenses | | | | | | | |

| Research and development | | | | 17,792 | | 24,187 | |

| Sales and marketing | | | | 32,158 | | 58,922 | |

| Amortization of goodwill and other intangibles | | | | 13,485 | | 35,896 | |

| Other general and administrative | | | | 9,646 | | 18,042 | |

| | | | |

| |

| |

| Total general and administrative | | | | 23,131 | | 53,938 | |

| Total operating expenses | | | | 73,081 | | 137,047 | |

| | | | |

| |

| |

| Operating (loss): | | | | | | | |

| Continuing business | | | | (10,692 | ) | (41,953 | ) |

| Discontinued business | | | | — | | (3,445 | ) |

| | | | |

| |

| |

| Total operating (loss) | | 4 | | (10,692 | ) | (45,398 | ) |

| | | | |

| |

| |

| Exceptional items: | | | | | | | |

| Continuing operations: | | | | | | | |

| Fundamental restructuring costs | | 18 | | (3,515 | ) | (13,342 | ) |

| Loss on disposal of fixed assets | | | | — | | (1,761 | ) |

| Discontinued operations: | | | | | | | |

| Gain/(loss) on termination of business operation | | 3 | | 594 | | (3,139 | ) |

| | | | |

| |

| |

| (Loss) on ordinary activities before interest | | | | (13,613 | ) | (63,640 | ) |

| | | | |

| |

| |

| Other interest receivable and similar income | | 7 | | 843 | | 1,751 | |

| Interest payable and similar charges | | 8 | | (28 | ) | (137 | ) |

| | | | |

| |

| |

| (Loss) on ordinary activities before taxation | | | | (12,798 | ) | (62,026 | ) |

| | | | |

| |

| |

| Taxation | | 9 | | 300 | | — | |

| | | | |

| |

| |

| Retained (loss) for the year | | 20 | | (12,498 | ) | (62,026 | ) |

| | | | |

| |

| |

| (Loss) per share: basic | | 10 | | (12.4 | )p | (49.6 | )p |

| (Loss) per share: diluted | | 10 | | (12.4 | )p | (49.6 | )p |

The notes on pages 28 to 43 form part of these financial statements.

21

MERANT plc

FINANCIAL STATEMENTS 2003

CONSOLIDATED BALANCE SHEET

| |

| | 30 April

2003

£'000

| | 30 April

2002

Restated

£'000

| |

|---|

| Fixed assets | | | | | | | |

| Intangible fixed assets | | 11 | | 8,606 | | 21,782 | |

| Tangible fixed assets | | 12 | | 1,970 | | 3,255 | |

| Investments | | 13 | | 6,993 | | 5,858 | |

| | | | |

| |

| |

| Total fixed assets | | | | 17,569 | | 30,895 | |

| | | | |

| |

| |

| Current assets | | | | | | | |

| Stocks | | | | 90 | | 94 | |

| Debtors | | 14 | | 19,458 | | 25,176 | |

| Cash and bank deposits | | | | 45,538 | | 71,620 | |

| | | | |

| |

| |

| Total current assets | | | | 65,086 | | 96,890 | |

| | | | |

| |

| |

| Creditors: amounts falling due within one year | | 15 | | 44,860 | | 58,271 | |

| | | | |

| |

| |

| Net current assets | | | | 20,226 | | 38,619 | |

| | | | |

| |

| |

| Total assets less current liabilities | | | | 37,795 | | 69,514 | |

| | | | |

| |

| |

| Provisions for liabilities and charges | | 18 | | 4,479 | | 10,299 | |

| | | | |

| |

| |

| Net assets | | | | 33,316 | | 59,215 | |

| | | | |

| |

| |

| Capital and reserves | | | | | | | |

| Called up share capital | | 19 | | 2,078 | | 2,300 | |

| Share premium account | | 20 | | 201,741 | | 200,865 | |

| Capital redemption reserve | | 20 | | 937 | | 697 | |

| Profit and loss account | | 20 | | (171,440 | ) | (144,647 | ) |

| | | | |

| |

| |

| Equity shareholders' funds | | | | 33,316 | | 59,215 | |

| | | | |

| |

| |

The financial statements on pages 21 to 43 were approved by the Board of Directors and signed on its behalf by:

J. Michael Gullard

Director

15 October 2003

The notes on pages 28 to 43 form part of these financial statements.

22

MERANT plc

FINANCIAL STATEMENTS 2003

CONSOLIDATED CASH FLOW STATEMENT

| | Years ended 30 April

| |

|---|

| | 2003

£'000

| | 2002

£'000

| |

|---|

| Net cash (outflow) from operating activities | | (8,225 | ) | (22,752 | ) |

| | |

| |

| |

| Returns on investments and servicing of finance: | | | | | |

| Interest received | | 843 | | 1,751 | |

| Interest paid | | (28 | ) | (137 | ) |

| | |

| |

| |

| Net cash inflow from returns on investments and servicing of finance | | 815 | | 1,614 | |

| | |

| |

| |

| Taxation | | (475 | ) | (2,026 | ) |

| | |

| |

| |

| Capital expenditure and financial investment: | | | | | |

| Purchases of tangible fixed assets | | (1,395 | ) | (2,592 | ) |

| Investment in own shares | | (2,250 | ) | — | |

| Proceeds from sale of own shares | | 1,370 | | 1,316 | |

| Disposal of tangible fixed assets | | — | | 11,594 | |

| | |

| |

| |

| Net cash (outflow)/inflow from capital expenditure and financial investment: | | (2,275 | ) | 10,318 | |

| | |

| |

| |

| Acquisitions and disposals: | | | | | |

| Proceeds from sale of subsidiary undertakings | | — | | 50,106 | |

| Net cash (sold) with subsidiary undertakings | | — | | (5,122 | ) |

| | |

| |

| |

| Net cash inflow from acquisitions and disposals | | — | | 44,984 | |

| | |

| |

| |

| Cash (outflow)/inflow before financing | | (10,160 | ) | 32,138 | |

| Issue of ordinary shares | | 897 | | 161 | |

| Cancellation of ordinary shares | | (11,659 | ) | (23,052 | ) |

| Expenses attributable to issue/cancellation of ordinary shares | | (118 | ) | (403 | ) |

| Bank loan | | — | | (1,404 | ) |

| | |

| |

| |

| Net cash outflow from financing | | (10,880 | ) | (24,698 | ) |

| | |

| |

| |

| (Decrease)/increase in cash in the year | | (21,040 | ) | 7,440 | |

| | |

| |

| |

The notes on pages 28 to 43 form part of these financial statements.

23

MERANT plc

FINANCIAL STATEMENTS 2002

NOTES TO CONSOLIDATED CASH FLOW STATEMENT

| | Years ended 30 April

| |

|---|

| | 2003

£'000

| | 2002

Restated

£'000

| |

|---|

| (i) Reconciliation of operating (loss) to Net cash (outflow) from operating activities | | | | | |

| Operating (loss) | | (10,692 | ) | (45,398 | ) |

| Depreciation charges | | 2,257 | | 10,661 | |

| Amortisation charges | | 13,485 | | 35,896 | |

| Employee benefit trust costs | | 250 | | — | |

| Loss on sale of tangible fixed assets | | — | | (1,761 | ) |

| Exceptional items | | (2,921 | ) | (8,854 | ) |

| (Increase)/decrease in stocks | | (3 | ) | 56 | |

| Decrease/(increase) in debtors | | 4,296 | | (5,149 | ) |

| Decrease in creditors | | (14,897 | ) | (8,203 | ) |

| | |

| |

| |

| | | (8,225 | ) | (22,752 | ) |

| | |

| |

| |

(ii) Reconciliation to net funds |

|

|

|

|

|

| (Decrease)/increase in cash during the year | | (21,040 | ) | 7,440 | |

| Cash inflow from movement in debt | | — | | 1,404 | |

| | |

| |

| |

| | | (21,040 | ) | 8,844 | |

| | |

| |

| |

| Translation difference | | (5,042 | ) | 2,977 | |

| | | (26,082 | ) | 11,821 | |

| Net funds, beginning of year | | 71,620 | | 59,799 | |

| | |

| |

| |

| Net funds, end of year | | 45,538 | | 71,620 | |

| | |

| |

| |

| | Balances at 30 April

2002

£'000

| | Cash flow

£'000

| | Exchange

differences

£'000

| | Balances at 30 April

2003

£'000

|

|---|

| (iii) Analysis of net funds | | | | | | | | |

| Cash | | 71,620 | | (21,040 | ) | (5,042 | ) | 45,538 |

| | |

| |

| |

| |

|

The notes on pages 28 to 43 form part of these financial statements.

24

MERANT plc

FINANCIAL STATEMENTS 2003

COMPANY BALANCE SHEET

| | Notes

| | 30 April

2003

£'000

| | 30 April

2002

£'000

|

|---|

| Fixed assets | | | | | | |

| Investments | | 13 | | 217,628 | | 216,493 |

| | | | |

| |

|

| Total fixed assets | | | | 217,628 | | 216,493 |

| | | | |

| |

|

| Current assets | | | | | | |

| Amounts owed by subsidiary undertakings | | | | 2,615 | | 5,546 |

| Other debtors | | | | 5 | | 181 |

| Cash and bank deposits | | | | 188 | | 227 |

| | | | |

| |

|

| Total current assets | | | | 2,808 | | 5,954 |

| | | | |

| |

|

| Creditors: amounts falling due within one year | | | | | | |

| Amounts owed to subsidiary undertakings | | | | 9,479 | | — |

| Accrued expenses | | | | 180 | | 384 |

| | | | |

| |

|

| | | | | 9,659 | | 384 |

| | | | |

| |

|

| Net current (liabilities)/assets | | | | (6,851 | ) | 5,570 |

| | | | |

| |

|

| Net assets | | | | 210,777 | | 222,063 |

| | | | |

| |

|

| Capital and reserves | | | | | | |

| Called up share capital | | 19 | | 2,078 | | 2,300 |

| Share premium account | | 20 | | 201,741 | | 200,865 |

| Capital redemption reserve | | 20 | | 937 | | 697 |

| Profit and loss account | | 20 | | 6,021 | | 18,201 |

| | | | |

| |

|

| Equity shareholders' funds | | | | 210,777 | | 222,063 |

| | | | |

| |

|

The financial statements on pages 21 to 43 were approved by the Board of directors and signed on its behalf by:

J. Michael Gullard

Director

15 October 2003

The notes on pages 28 to 43 form part of these financial statements.

25

MERANT plc

FINANCIAL STATEMENTS 2003

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

Years ended 30 April

| | 2003

£'000

| | 2002

£'000

| |

|---|

| (Loss) for the year | | (12,498 | ) | (62,026 | ) |

| Currency translation adjustment | | (2,518 | ) | 4,252 | |

| | |

| |

| |

| Total recognised gains and losses for the year | | (15,016 | ) | (57,774 | ) |

| | |

| |

| |

The notes on pages 28 to 43 form part of these financial statements.

26

MERANT plc

FINANCIAL STATEMENTS 2003

RECONCILIATIONS OF MOVEMENTS IN SHAREHOLDERS' FUNDS

| | Group

2003

£'000

| | Group

2002

£'000

| | Company

2003

£'000

| | Company

2002

£'000

| |

|---|

| (Loss)/profit for the year | | (12,498 | ) | (62,026 | ) | (403 | ) | 25,026 | |

| Share buy back | | (11,777 | ) | (23,455 | ) | (11,777 | ) | (23,455 | ) |

| Share options exercised | | 894 | | 246 | | 894 | | 246 | |

| Goodwill taken to profit and loss account on disposal | | — | | 11,732 | | — | | — | |

| Currency translation adjustment | | (2,518 | ) | 4,252 | | — | | — | |

| | |

| |

| |

| |

| |

| Net (reduction in)/addition to shareholders' funds | | (25,899 | ) | (69,251 | ) | (11,286 | ) | 1,817 | |

| Opening shareholders' funds | | 59,215 | | 128,466 | | 222,063 | | 220,246 | |

| | |

| |

| |

| |

| |

| Closing shareholders' funds | | 33,316 | | 59,215 | | 210,777 | | 222,063 | |

| | |

| |

| |

| |

| |

The notes on pages 28 to 43 form part of these financial statements.

27

MERANT plc

FINANCIAL STATEMENTS 2003

NOTES TO THE FINANCIAL STATEMENTS

Note 1 Significant accounting policies

The following accounting policies have been applied consistently in dealing with items that are considered material in relation to the Group's financial statements.

Basis of preparation

The financial statements have been prepared in accordance with applicable accounting standards under the historical cost accounting rules and the provisions of the Companies Act 1985.

Basis of consolidation

The consolidated financial statements include the financial statements of Merant Plc (the Company) and its subsidiary undertakings made up to 30 April 2003. The acquisition method of accounting has been adopted. Under this method, the results of subsidiary undertakings acquired or disposed of in the year are included in the consolidated profit and loss account from the date of acquisition or up to the date of disposal.

Under section 230(4) of the Companies Act 1985 the Company is exempt from the requirement to present its own profit and loss account.

Turnover

Turnover represents the amounts (excluding value added tax) derived from the provision of goods and services to customers.

The Group's revenue recognition policies are in accordance with the principles of AICPA's Statement of Position 97-2 (SOP 97-2) Software Revenue Recognition, amendments to SOP 97-2 in SOP 98-4 and 98-9 Software Revenue Recognition with respect to Certain Transactions, and the associated AICPA Technical Practice Aids.

License fees: the standard end user licence agreement for the Group's products provides for an initial fee to use the product in perpetuity up to a maximum number of users. We also enter into other types of licence arrangements, typically with major end user customers, which allow for the use of our products, usually restricted by the number of employees, the number of users, or the licence term. Licence fees are recognized as revenues upon product shipment, provided a signed agreement is in place, fees are fixed or determinable, no significant vendor obligations remain and collection of the resulting debt is deemed probable. Fees from licences sold together with consulting services are generally recognized upon shipment if the above criteria have been met and payment of the licence fees is not dependent upon the performance of the consulting services. Where these criteria have not been met, both the licence and consulting fees are recognized as the services are performed.

Maintenance subscriptions: maintenance agreements generally call for the Group to provide technical support and software updates to customers. Revenue on technical support and software update rights is recognised over the term of the support agreement on a pro-rata basis. Payments for maintenance fees are generally made in advance and are non-refundable.

Training and consulting: the Group recognises revenue from consulting and education as the services are performed.

Software product assets

Costs related to the initial development and design of new software products prior to the establishment of technological feasibility are written off to research and development costs when incurred. Purchased software assets are amortised using the straight line method over the useful economic life, which is no more than five years.

28

Goodwill

Purchased goodwill arising on business combination in respect of acquisitions before 1 February 1998, when FRS 10Goodwill and intangible assets was adopted, was written off to reserves in the year of acquisition. In the event of a subsequent disposition, any related goodwill previously written off to reserves is written back through the profit and loss account as part of the profit or loss on disposal.